Abstract

The article deals with the problem of adaptation of the Russian oil and gas company (Novatek, Russia) to the rapidly changing external environment, the avalanche of data from competitors, and the need to filter important information for business development and the prosperity of the industry as a whole. The approach is based on the system of integrated software monitoring of key business processes at the enterprise developed by the authors—from the formation of the idea of a new product to its implementation to paying customers. The scientific novelty lies in the use of an optimization model that allows for minimizing the maximum losses of the investor at all levels of decision-making, from the distribution of capital between companies, to the optimization of internal reserves to increase the competitiveness of the company. The toolkit is a minimax model that allows you to redistribute the shares of investor influence at the portfolio level, and then within the business processes of each company selected by investors, in order to achieve the optimal solution in accordance with the selected estimated indicators. Application of the well-known portfolio investment models of Markowitz, Tobin, Sharp, etc. is not possible due to the lack of necessary data on the basis of which the probabilistic parameters involved in the model are estimated. Even if we get them, it is necessary to take into account the level of correlation influence of the technological process in the composition of each subsystem, which is unacceptable for the data used, as it leads to a strong increase in errors. Using minimax and a systematic approach allows you to minimize such errors by choosing a balanced concentration of distributed assets for both the investor and the buyer. To this end, a three-way analysis of the company’s development was carried out and a technology for comprehensive improvement of the company’s activities was developed in the following areas: the company’s rating in the industry, financial condition, and interaction with counterparties using merchandising technologies. Tools for optimal image zoning at the Novatek site using the minimax approximation criterion have been developed. The technology provides a procedure for creating a comfortable mode of image perception based on high-tech visualization of merchandising, zoning of the screen area, and a mathematical approach that allows you to develop a calculation algorithm.

1. Introduction

The distribution of investments in the oil and gas sector is particularly relevant. This is due to the huge capital involved in this industry. A competent resource-saving strategy can be achieved only by applying a comprehensive analysis of internal and external business development prospects. The least researched and most popular problems lie in the application of optimization models in visual marketing solutions based on online technologies (attracting customers for each company of interest), as well as portfolio structuring. This problem is an important and urgent task of investment analysis [1,2,3]. However, for the oil and gas sector, the initial indicators are not enough, and a serious modification is needed based on important criteria of fundamental analytics. Turning to the history of the issue of investment analysis and modeling, it should be noted that the first model for optimizing the capital distributed among the investor’s assets was proposed by [4]. Currently, many approaches based on the solution of the Markowitz problem and its development allow us to achieve an optimal share structure of investments distributed among several investment entities. However, despite the high accuracy of forecasting by statistical indicators, in practice, models of this kind are little used, since their application requires a wide array of constantly updated statistical information about the dynamics of profitability, which is necessary for the construction (evaluation of real coefficients) of the covariance matrix [5,6]. In addition, the work is based on the specifics of key models for analyzing the external environment of an industrial enterprise, such as strategic matrix models or the business models of A. Osterwalder and I. Pinier [7].

With modern high-tech business projects and high-speed decision-making systems, the use of traditional investment portfolio optimization models is associated with difficulties associated with obtaining quantitative risk estimates used in the model [8]. In particular, it is not possible to form the covariance matrix of returns on capital invested in business projects required for the Markowitz model, since the development of each high-tech project in an enterprise requires some time and a set of resources mobilized at this enterprise. Therefore, such a process is almost impossible to perform in real time.

In view of the above, the current direction of research is the development of a procedure for the shared distribution of investments between high-tech projects, based on the revision of the set of quantitative indicators of the model and the use of new mathematical methods and models. Such a construction is advisable to perform in a hierarchical mode, and the minimax model makes it possible to expand the range of indicators used and consider the requirements of the investor for various criteria of financial analysis.

The difficulties faced by industrial entities include significant changes in the business environment and the influence of its factors on the results of their activities. Today, the business environment of oil and gas companies is subject to a high degree of volatility (risk, volatility). With the advent of new technologies of the digital economy, the company’s website has become the most important area of activity. Activity, therefore, the optimization of merchandising technology (“optimal display of goods on the showcase”) has moved into the sphere of optimizing the company’s website in terms of improving the technological profile of virtual ideas about the specifics of the company’s work [9].

One of the objectives of the article is to develop economic and mathematical tools to justify the modernization of an oil and gas company from a technological point of view.

Research hypothesis: A comprehensive toolkit for improving market position, increasing profitability, and making Novatek more attractive to investment: the main mechanism in a short period is the visual presentation of their services based on high-tech digital technologies, in the average (from one month to two years) period, the revision of the capital structure in favor of increasing equity capital, and reducing the borrowed capital to the maximum allowable limits (without reducing the total amount of borrowed and equity capital) has a stronger effect.

In a long (more than two years) period, one should be guided by the integral rating of Novatek among other industries.

In this context, it is obvious that Russian industrial entities must engage in thorough research, both practical and theoretical.

The issue of timely response to changes is especially acute. At the same time, it is necessary to pay attention to the fact that the concept of adaptation and the system that implements it in the practice is new and little studied, since their experience in the market is not long. In this context, it is obvious that the issues of adaptation of domestic industrial enterprises to changes in the business environment require in-depth research both in theoretical and practical terms.

In real-world practice, the adaptation of industrial entities to changes in the external environment involves the introduction of certain changes in the internal systems and processes of business entities in order to ensure that their functioning corresponds to the state of the business environment and, ultimately, to achieve efficiency in general. This is realized by accelerating the release of new, high-quality, competitive products, replacing physically and morally obsolete fixed assets, taking into account the latest achievements of science and technology, and introducing energy and resource-saving technologies into the production process [10,11,12].

A mature, well-build change management process, tailored for the organization, is required if an industrial entity expects to be successful in modernizing their internal processes and procedures.

The concept of adaptation is quite broad and dialectically related to many socio-economic spheres, as a result of which it has a wide meaning and is the subject of independent research.

The view of adaptation as an adaptation is the most common, characterizes its very essence and can be used in any field of science. However, according to the author, such a definition and understanding is most acceptable when it comes to general issues, without going into the essence of the problem.

We can also note a more structured, complex approach to the interpretation of the concept of “adaptation”, which is understood as the mechanism of economic and social adjustments that allow the system to maintain (change) the direction and pace of development regardless of the influence of external factors [13,14,15]. It seems that this approach should be used in the case when the enterprise is able to develop the very mechanism of economic and social adjustments and in the event that the influence of external factors is not significant and does not threaten the existence of the enterprise itself.

Organizational and managerial contour structurally consists of objects, subjects, and tasks. At the same time, we consider it necessary to pay attention to the fact that this circuit should be designed and created on the basis of the theory and practice of project management. All possible organizational structures, according to this theory, are based on the division of labor—vertical (functionally-administrative) and horizontal (project-oriented) [16,17,18,19].

The basic principles of adaptation include: complexity, consistency, economic, and environmental feasibility [20,21,22].

The establishment of resource constraints precedes the implementation of the adaptation system and its corresponding mechanisms in the economic activity of the enterprise. The last elements of the algorithm for the formation of the adaptation system are control over its implementation and assessment of the effectiveness of the measures taken.

The identification of the key elements of the adaptation system and the formalization of the algorithm for its formation make it possible to implement a holistic and systematic approach to its construction and structuring. J. Shaughnessy notes that “in order to understand how the system performs its function, it is necessary to know how all its elements are interconnected with each other and how it is connected with a system that forms its external environment” [23].

2. Literature Foundations

2.1. Management Decision-Making System

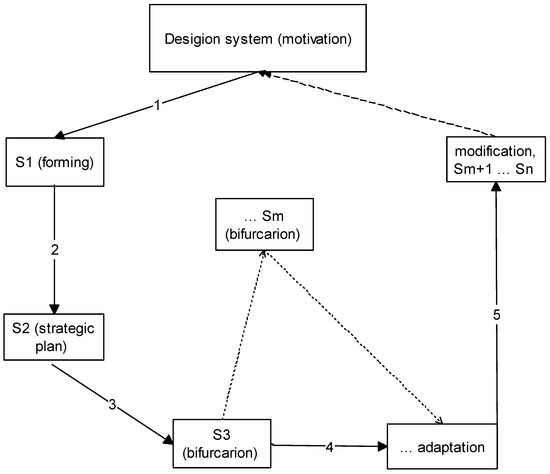

The scheme of strategic development of a large industrial enterprise considered as an open stationary socio-economic system, and the action of the mechanisms of its adaptation to the disturbances of the business environment is shown in Figure 1.

Figure 1.

Scheme of strategic development and adaptation of the enterprise to changes in the business environment (Bifurcation-restructuring). Where: S1—the initial state of the industrial holding as an open stationary system; S2, S3, Sn, Sm—the state of the holding after the application of adaptation mechanisms and tools; MDMS—is a management decision making system.

Let us analyze the circuit shown in Figure 1 in more detail. A large enterprise, which is an open stationary system, is in its initial state (S1) under the influence of external and internal environmental factors. Based on the available indicators (characteristics of the S1 system), the management makes a strategic decision on further development and applies the appropriate adaptation mechanisms.

As a result of the implementation of transformational evolutionary adaptation mechanisms, the S1 system adapts to changes in the external environment, while maintaining its fundamental (significant) distinctive signs (integrity), or is transformed into a new state S2, S3, Sn, or Sm, which provides for the nature of changes, in which an open stationary system loses its initial fundamental characteristic features and passes into a new qualitative state, while maintaining a hereditary connection with the previous state.

An important point in the process of using transformational adaptation mechanisms is a clear understanding of the level of socio-economic development of an enterprise for the correct determination of the bifurcation point, which is critical. A. Kusakina and E. Skiperskaya argue that at this point the system becomes unstable with respect to fluctuations and uncertainty of further development arises: the system remains unstable and it collapses or acquires a new, higher level of order. [24,25]

Let us now consider in more detail the specific practical aspects of adapting domestic industrial holdings to the dynamic changes of the modern business environment, which is under the strong influence and pressure of the accelerating digital transformation.

Thus, the hypothesis of the study, subject to mathematical justification, will be confirmed. Namely, MDMS (management decision making system) as a comprehensive toolkit for solving the problem of reducing the competitiveness, profitability, and investment attractiveness of Novatek consists in the competent distribution of leverage from the initial state (S1) in the short and long period:

The main mechanism in a short period is the visual presentation of their services based on high-tech digital technologies (Sm, Sm−1, …, S3), in the average (from one month to two years) period, the revision of the capital structure in favor of increasing equity capital, and reducing the borrowed capital to the maximum allowable limits (without reducing the total amount of borrowed and equity capital) has a stronger effect (S3, S2, S1) [26,27].

2.2. Expert Opinion on the Rating of an Industry Enterprise

Table 1 and Table 2 show the average results of expert assessments of the influence of the factors of the modern business environment on the activities of PJSC NOVATEK.

Table 1.

Analysis of the influence of macroenvironmental factors on the activities of PJSC “NOVATEK”.

Table 2.

Analysis of the influence of microenvironment factors on the activities of PJSC “NOVATEK”.

That is, the general influence of macroenvironmental factors has a negative impact (5.4 points out of 10 possible) on the functioning and development prospects of an industrial holding. This can be explained by economic turbulence, the complexity of the legal framework, and the unstable international situation. At the same time, special attention should be paid to the fact that the digital divide between the industrial sectors of Russia and the leading countries of the world, the obsolescence of equipment and technology, as well as the obvious delay in the introduction of breakthrough innovations have a significant negative impact.

The cumulative influence of microenvironment factors is also negative, although the situation is somewhat better compared to the influence of macroenvironmental factors (4.2 points out of 10 possible).

At the next stage of the study, we will analyze the compliance of the goals set as priorities by PJSC NOVATEK with the current business conditions. The assessment will be carried out using the SMART Russia toolkit. It seems expedient to analyze the initial system of the holding’s goals by the main levels of strategic management: corporate strategy, business strategy, functional strategy, and operational strategy (Table 3).

Table 3.

Results of SMART-assessment of the goals of PJSC NOVATEK, maximum assessment—10 points.

The results of evaluating the system of goals of PJSC NOVATEK by the main levels of strategic management indicate a fairly high level of its balance. High marks according to the criterion “Time constraints” reflect the understanding of the holding’s management of the need to determine the planning horizons in the process of formulating goals. Low scores on the criterion “measurable” indicate the qualitative nature of the goals, which cannot always be assessed using a system of quantitative indicators.

However, since assessments of the impact of exogenous changes showed negative results, it is advisable for the holding to adapt its functioning program and development strategy in accordance with the dynamics of the business environment and digital transformations.

The realities of today clearly indicate that the intensification of business activities of economic entities, especially in foreign markets, presupposes an increase in the degree of their openness and interaction with partners. The complication, versatility, and complexity of such interaction illustrates of the expediency and effectiveness of the network approach in the process of PJSC NOVATEK’s adaptation to the dynamics of the external environment.

2.3. Marketing Strategy of the Enterprise: Network Technologies

In fact, the network approach is a response to the challenges, including changes in the operating environment of enterprises and their expectations in an uncertain economic space saturated with threats and information while undergoing significant transformations in the digital age. In fact, the network approach provides for the use of one of the types of horizontal integration, which will maximize the attraction of available resources; mastering innovations; and build up competencies, competitive advantages, innovation, production, information, and intellectual potential within the framework of a single multipolar information and communication space [28,29].

The logic of the network approach includes: decentralization, synergy, community, free access, maximization of innovation, multidimensional space, lack of discontinuity, ratio of technologies, and expansion of the space of innovative opportunities [30].

Among the most significant advantages of the network approach are: highlight increased organizational ability, more efficient use of resources and digital opportunities, expanding the horizon of tools and mechanisms that allow solving complex business problems, and improving the quality of services and the complexity of services and services for consumers.

According to the author, the use of the network approach of PJSC NOVATEK, which should replace linear interactions, will contribute to the formation of an additional source of value creation for the holding, since it will:

- -

- Initiate design and production with a priority on optimal functionality;

- -

- Intensify technological and product innovations by obtaining new previously disjointed data about the external environment and a better understanding of production processes, supplier capabilities and consumer needs.

The high potential of the network approach is confirmed by the successful functioning of a number of well-known global corporations, for example, Apple, Intel, Samsung, Exxon Mobil, Procter and Gamble, Tata Motors Ltd., Shougang Steel, etc. At the same time, according to experts, the greatest opportunities when using the network approach open up to reduce the time of the research and production cycle (from the development of new products to its introduction to the market) (by 20–50%), reduce equipment downtime (by 30–50%), reducing the cost of maintenance of machines and mechanisms (by 10–40%), and the cost of maintaining inventories (by 20–50%), thus increasing labor productivity by automating its mental component (by 45–55%) [31].

It is obvious that the introduction of a network approach into the activities of PJSC NOVATEK as a tool for adapting its systems to the business environment should be reflected at the strategic and tactical levels.

The strategic nature provides for the solution of development tasks in dynamic market conditions over a long time period, and the issue of restructuring structures and systems in accordance with the current market conditions in the short and medium term. Of course, the tactical aspect of adaptation should be addressed regarding the strategic directions of the holding’s development in the market environment.

According to the authors, when drawing up a strategic adaptation plan for PJSC NOVATEK based on a network approach and considering digital transformation, it is necessary to solve several fundamental technological issues:

- -

- Expedite business and production processes via automation and virtualization;

- -

- Ensure the transparency, maturity and reliability of organizational processes at all levels. This will require a distributed architecture for analytics and industrial internet of things solutions;

- -

- Improve production speeds, product quality and reduce operational expenses.

At the same time, information security is a key element of any digital transformation, especially industrial holdings that have unique production processes, flow charts, and other intellectual property at their disposal. If information protection issues are not given due attention, the business entity may lose all potential benefits.

Organizations should prepare for a significant shift in ideology, business process, and communication strategy when introducing new technology to internal and external stakeholders.

During the first stage of digital transformation of PJSC NOVATEK’s organizational mechanisms, the following actions will be required:

- -

- Introduce unified programs for use in various departments;

- -

- Unify operational processes in the corporate center and at production units;

- -

- Carry out a pilot implementation of certain digital control technologies.

The next stage of the holding’s adaptation to digital transformations should be the development of organizational processes in all structural divisions. A fast, unified, secure, and comfortable shared information exchange system is essential to drive innovation, especially for agile decision-making, flexibility and operational efficiency. At this stage, these key areas of adaptation of organizational mechanisms are considered:

- -

- Technological automation of business processes;

- -

- Automation of business communications;

- -

- Deep development of IT infrastructure;

- -

- Introduction of a budgeting system and unified electronic document management;

- -

- Providing offices and divisions of the holding with modern IT tools and mechanisms, new communication channels, networks, data centers, and servers;

- -

- Transition to cloud server space.

PJSC NOVATEK is actively engaged with global business partners. Protective measures must be taken to ensure the holding remains competitive in the domestic market in addition to the global market.

Table 4 presents the key aspects of the impact of integration processes on the activities of PJSC NOVATEK.

Table 4.

Positive and negative aspects of the impact of integration on the international markets of PJSC NOVATEK.

The opportunities and threats indicated in Table 4 make it possible to highlight the following areas of PJSC NOVATEK’s adaptation:

- Harmonization of the quality system to world standards;

- Implementation of modern environmental protection systems;

- Product certification;

- Regulation of production in accordance with the demand in the world market;

- Creation of a positive image;

- Development of an improved model of product entry to world markets.

Taking into account the fact that today the Fourth Industrial Revolution, which was named Industry 4.0, is taking place in the world, it seems appropriate to pay attention to the mechanisms and directions of adaptation of industrial holdings in Russia, in particular PJSC NOVATEK, to radical changes in industry.

Industry 4.0 “indicates the transition to the 4, 5 and 6 technological order, within which both high technologies and computerized approaches to the optimal solution of the problem are developing”. Due to the gradual decline in the cost of these technologies, they are becoming available, that is, they are increasingly used by industry and business, which ultimately affects existing business models or even creates new business formats.

In this context, it seems that the process of increasing the adaptability of energy holdings should include four key vectors.

1. Replacement and modernization of equipment. To increase the flexibility of production, industrial holdings need to have universal equipment that will allow switching from the production of one product to another on existing production lines. However, it should be noted that the cost of such equipment is an order of magnitude higher than that of narrow-profile machines and mechanisms, and given the economy mode and limited budgetary funds, as well as investor investments, it is obvious that holding companies will have to cover these costs at their own expense. Therefore, it is necessary to carefully analyze the feasibility of purchasing universal equipment in each specific case, for example, such equipment will be advisable in the automotive industry, where the parameters of the goods need to be changed quite often to meet the requirements of consumers. Domestic machine-building holdings have the nature of mass production; therefore, additional costs for such equipment will be justified, and in such industries as the production of missiles, it is more expedient to have highly specialized equipment, since products are manufactured using technologies that have not changed for many years.

2. Implementation of new solutions for the organization of world-class production. It should be noted that a key characteristic of Industry 4.0 is Horizontal and Vertical System Integration. Modern information and communication tools and technologies make it possible to combine and integrate all its subdivisions into a single information space within one enterprise, within one supply chain of all its participants, etc. However, in domestic practice, even subdivisions of one enterprise do not always work in a single information system, not to mention the horizontal structures of individual economic units. Industry 4.0 technologies make it possible to combine various structures, enterprises, and participants in the value chain and the division of labor into a single information circuit. In addition, the existing rigid hierarchical system of access to information at enterprises or between enterprises in the conditions of Industry 4.0 will be destroyed: objects connected to the industrial Internet of things will be able to receive any information they need directly, regardless of their information level and position in the production hierarchy.

3. Adaptation of personnel to working conditions in conditions of uncertainty, continuous technological updates, increasing the amount of information, and new breakthrough technologies generated by Industry 4.0. When introducing innovative work systems, it will be necessary not only to train workers on how to use new equipment and use network forms of interaction, but also to pay attention to the psychological aspect of work. The average age of those employed in the industrial sector in Russia is 55 years, which means that changes in work will create a strong psychological stress and cause a resistant reaction, which will significantly reduce the efficiency of activities, because the main driving factor in the implementation of any plan is the employees. Special attention should be paid to the psychological aspects of personnel adaptation; therefore, the management of domestic industrial holdings should consider the costs of personnel adaptation and, above all, workers at production sites.

4. Introduction of research and development. To date, government support in this area is insufficient. Therefore, industrial holdings are forced to carry out research mainly at their own expense. In the current situation, it will be expedient only for science-intensive holdings, for example, manufacturers of spacecraft or heavy engineering products. In many industrial sectors, advanced research and development is extremely necessary, since the vast majority of the technologies used are obsolete and do not meet modern market demands, but conducting fundamental research is too expensive an undertaking, which also has a very indefinite payback period. One of the ways out in this situation may be the unification of scientific departments of several holdings to conduct research in which all participants are interested and can lead to a significant economic effect. In this way, research costs will be shared among several stakeholders.

A study of high-tech companies—global giants showed that 97% of competitive failures are associated with insufficient attention to market changes or an inability to respond to vital information [32,33].

Considering that the amount of information circulating today in the market, in the environment and internal divisions of modern business entities has increased significantly, in order for domestic industrial holdings to quickly respond to changes and adapt to them in time, they must be properly informed. In this case, it becomes necessary to constantly update the information flow by using special, innovative methods of collecting and processing information.

It seems that in the process of adapting to a dynamic information environment, domestic industrial holdings should use the following methods of collecting and analyzing information.

Scanning the environment is one of the areas of analytical and predictive work, which is rapidly developing and is widely used in strategic management systems [34,35]. The purpose of the scan is to collect, evaluate and predict the significance to the subject management of important changes. Scanning is usually carried out in the following areas:

- -

- Economic scanning—research of changes in macro- and microeconomic indicators;

- -

- Industry indicators and competition in it;

- -

- The state of financial markets;

- -

- Technical scanning—the study of scientific and technical progress;

- -

- Fundamental technical and technological innovations;

- -

- Political scanning—assessment of the political situation at the level of the country, region;

- -

- Risk assessment of financial investments, etc.

1. When scanning, a variety of tools are used: expert methods, scenarios, comparison, modeling, morphological, and functional-cost analysis.

2. Monitoring the environment is the constant tracking of current and new information. For industrial holdings that use strategic management technology, it is advisable to create a special tracking system. Within the framework of this system, it is possible to conduct not only regular, but also special observations on critical factors of influence.

3. Forecasting is the formation of an idea of the future state of environmental factors. This tool is an integral component of the strategic planning process.

3. Results

3.1. Digital Transformation: Site Improvement Solution (S3)

When improving information technologies of high-performance computing in the field of electronic merchandising, it is necessary to adapt the graphic images on the web page of the official website of the enterprise to the avalanche-like growth of the flow of information about the company. In this section, a digital technology is created for transforming the visual perception of images on the NOVATEK website in the optimal mathematical screen zoning mode to attract interested parties (partners, investors, and buyers) to the site.

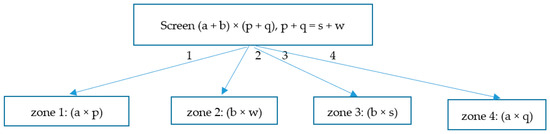

Mathematical method. Consider a minimax model that allows you to optimally place in different images on the web page of a company website [36,37,38].

Risk indicators (positive quantitative indicators,

monthly click-through rates of images) will be denoted by V1, …., Vn.

Let, for definiteness, V1< … <Vn. We calculate

the proportions of the screen area using the task:

In case (1), it is required to find the portions of

the image space on the web page of the NOVATEK website, allocated for placing

illustrations in order to attract the attention of contractors.

The solution to case (1) is determined by the

formulas:

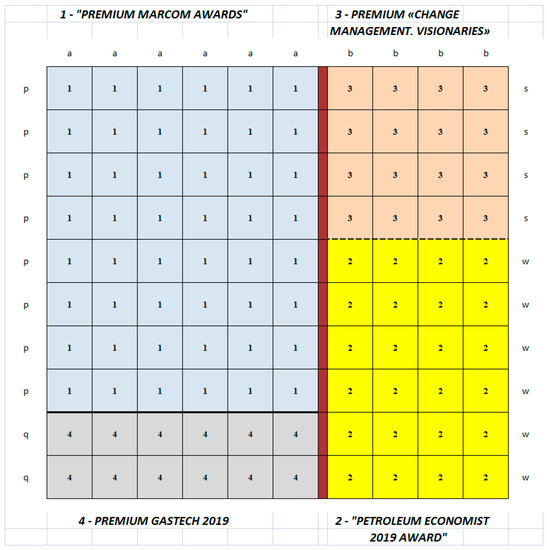

Computational experiment. The study examined n = 4

positions from the NOVATEK website, of the following functional groups:

- MARCOM AWARDS;

- PETROLEUM ECONOMIST 2019 AWARD;

- GASTECH 2019 AWARD;

- “CHANGE MANAGEMENT. VISIONERS“ AWARD.

Risk indicators associated with the lack of interest of clients in the image of each structural element—ranks, from the best “1” to the most risky “4”, therefore V1 = 1,…, V4 = 4. The calculation of the zoning parameters was carried out according to the formulas (2).

Table 5.

Data for analysis.

Figure 2.

Zoning scheme.

Table 6.

Screen zoning.

Table 7.

Financial analysis of companies (important ratios and ratings).

Figure 3.

Screen zoning layout for images 1, 2, 3, and 4 (descending rank).

3.2. Company Rating among Oil and Gas Companies (S2)

To build an integral rating, three indicators are used (assets, revenue, equity), after which the coefficients are analyzed.

Financial leverage ratio equal to the ratio of borrowed capital (the amount of short-term and long-term borrowings) to the company’s own funds (in the liabilities “capital and reserves”, the ratio is considered normal to be less than 1), return on equity ratio equal to the ratio of net profit to equity, and the normal value is more than 0.2.

The results are presented in Table 7.

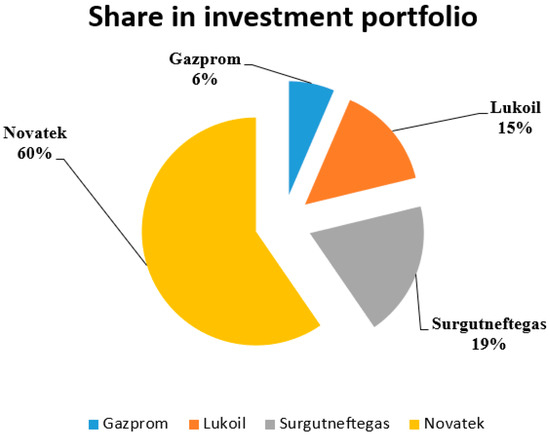

3.3. Financial Portfolio by Minimax Approximation Criterion (S1)

In addition to Novatek, companies are considered

the best link in the oil and gas industry according to the rating for the

investor.

Step 1. Now risk V is financial leverage, we use

the solution to the case (1) to form an investment portfolio. Portfolio shares θ—the

distribution of the investor’s capital between the companies.

The case is considered (1) and the solution of the

case is:

Step 2. The rate of return characterizes the return

on equity. It is believed that the results of the activities of the enterprise

make a profit, therefore .

Let the portfolio profitability be the minimum

acceptable for the investor .

The solution is corrected:

If , then

(3) is the desired solution. If not, the asset with the minimum return is

excluded from the portfolio, and problem (1)–(3) is solved again. The algorithm

is finite, the extreme situation is the presence of the only asset in the

portfolio, the return of which is maximum.

Table 8.

Financial analysis of companies (shares in the portfolio).

Figure 4.

Shares of companies’ shares in the investor’s portfolio.

4. Discussion

The understanding and analysis of adaptation processes make it possible to establish that the formation of the theory of adaptation is objectively conditioned by changes in environmental factors that act as determinants and driving forces for the development of relations between business entities and their environment. During the study of terminological apparatus revealed the ambiguity of the interpretation of the concept of “adaptation” and on this basis, clarified its content. Under the adaptation of an industrial holding to the modern business environment, the author proposes to understand its ability to determine goals and means of achieving them with the anticipation of future changes using situational (adaptive) analysis to enhance competitive advantages and ensure its sustainable functioning, which implies an analysis of economic, industrial, scientific and technical, financial, and social spheres of activity (taking into account industry characteristics). The structural composition of the adaptation system has also been formalized, which includes: organizational and managerial contour; means, methods, and tools for the implementation of adaptation measures, as well as the functions and key principles of their implementation; management models that allow coordinating the processes of interaction with an unstable environment; and a mechanism for providing adaptation procedures.

Clarification of these elements of the adaptation system made it possible to implement an integrated approach to the selection and substantiation of methods for adapting Russian industrial holdings to changes in the business environment, as well as to highlight the criteria for choosing a management model during the adaptation period.

There is no doubt that the proper organization of adaptation processes at domestic industrial holdings requires the formation of an appropriate system and the use of an adaptive algorithm for its implementation. In the course of the study, the authors have developed a holistic algorithm for the formation of a system for adapting an industrial holding to changes in the business environment, which allows for the implementation of an integrated approach to the implementation and implementation of adaptation measures, which, in turn, will contribute to improving the efficiency of management, ensuring the sustainable functioning and development of the holding in long term.

In considering the practical aspects of adapting domestic industrial holdings to changes in the business environment, special attention was paid to the need to take into account the dynamics and rapid trends in the development of the digital economy, which are occurring at an exponential rate, radically changing the essence of business and transforming all sectors of the national economy.

In this context, the authors proposed to use a network approach, which involves the use of one of the types of horizontal integration, which contributes to the maximum attraction of available resources, the development of innovations, the building of competencies, competitive advantages, innovation, production, information, and intellectual potential within the framework of a single multipolar information and communication space.

Additionally, special emphasis is placed on the need to introduce modern tools for collecting, analyzing, and processing information, which make it possible to form an information flow in real time and track the dynamics of disturbances in the internal and external environment of an industrial holding.

In addition, the expediency and necessity of including in the adaptation system mechanisms and tools for the formation of digital alternatives for manufactured products and services, transformation of the organizational architecture of industrial holdings using modern information, and communication technologies has been substantiated.

5. Conclusions

A marketing system and a quantitative analysis of the strategic change plan within Novatek were developed. The dynamic factors of the external environment were taken into account, a digital merchandising technology for the company was developed, and recommendations on the capital structure were given.

The article deals with a fundamentally new problem: the problem of adapting a large Russian oil and gas company (Novatek) to a rapidly changing external environment, subject to an avalanche of data from competitors, and the need to filter important information for business development as well as the prosperity of the industry as a whole. The authors have developed a system for adapting data flows using mathematical and graphical tools, an optimization model, and criteria for selecting risk values to improve the company’s development and develop a technological solution for complex improvement of activities in the following areas: the company’s rating in the industry, financial condition, and work with counterparties using merchandising technologies. Computational experiments confirming the theoretical basis of the instrumental solution based on software-oriented technologies are performed.

Recent events have clearly demonstrated the scientific and practical significance of research devoted to accelerating the economic development of any country, which is based on the use of rapidly developing digital platforms [39]. The development of these platforms poses new challenges not only for business processes, but also for their analysis systems, including financial ones. Traditional methods of financial analysis no longer correspond to the changing business environment and require the creation of computer technologies based on mathematical models.

The computer technology proposed by the authors, based on mathematical models, will allow the financial analyst to predict the financial condition of the company based on the analysis of historical information accumulated in the database.

The authors developed a marketing system and conducted a quantitative analysis of the strategic change plan of Novatek. Dynamic factors of the external environment were taken into account, digital merchandising technology was developed for the company, and recommendations on the capital structure were given. The article systematizes the features of the influence of the main formal and informal socio-economic institutions on the effectiveness of the formation and implementation of the financial strategy of modern companies. In addition, the specifics of the key models for analyzing the external environment of the energy sector, such as strategic matrix models, business models, the balanced scorecard model, etc., are highlighted. The limitations of the use of such methods and models of business environment analysis in the practice of financial and economic activities of modern companies are systematized. The implementation of the proposed methodological approaches to improving the efficiency of financial strategy development in the practical activities of the energy holding will allow to identify the state of its external environment, taking into account the level of influence of turbulence factors; to determine the type of stability; and to make an informed choice of financial strategy. For further research, it is proposed to consider algorithms and models that make it possible to form a system for adapting an energy holding to dynamic environmental disturbances, and to improve its internal systems and procedures in accordance with market requirements and consumer requests.

The implementation of the results of the assessment, analysis and forecasting of the factors of the external and internal environment of the holding company using improved tools based on the theory of fuzzy sets will increase the validity of management decisions regarding the choice of financial strategy and will contribute to improving the efficiency of the holding company as a whole.

Author Contributions

Conceptualization, M.T.; methodology, A.B.; software, I.V.; formal analysis, M.S.; writing—original draft preparation, A.K.; writing—review and editing, N.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Vygodchikova, I. Model of optimal investment portfolio based at minimax approachhikova. Vestn. Sseu 2018, 3, 170–174. [Google Scholar]

- Pham, H. Smooth solutions to optimal investment models with stochastic volatilities and portfolio constraints. Appl. Math. Optim. 2002, 46, 55–78. [Google Scholar] [CrossRef]

- Streimikiene, D. Ranking of Baltic States on progress towards the main energy security goals of European energy union strategy. J. Int. Stud. 2020, 13, 24–37. [Google Scholar] [CrossRef]

- Markovitz, H. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Ledoit, O.; Wolf, M. Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. J. Empir. Financ. 2003, 10, 603–621. [Google Scholar] [CrossRef]

- Zhang, W.; Wang, J. Nonlinear stochastic exclusion financial dynamics modeling and complexity behaviors. Nonlinear Dyn. 2017, 88, 921–935. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pinye, I. Building business models. In Table Book of the Strategist and Innovator. M; Albina Publisher: Durham, NC, SUA, 2019; p. 112. [Google Scholar]

- Khalikov, M.; Maksimov, D. Multi-step optimization of the portfolio of financial assets of a non-institutional investor. Entrep. Guide 2017, 33, 211–219. [Google Scholar]

- Jaakkola, H. Is integration and enterprise migration—Adaptation in global context. Int. J. Intell. Def. Support Syst. 2010, 3, 78–89. [Google Scholar] [CrossRef]

- Shindina, T.; Streimikis, J.; Sukhareva, Y.; Nawrot, Ł. Social and Economic Properties of the Energy Markets. Econ. Sociol. 2018, 11, 334–344. [Google Scholar] [CrossRef]

- Borodin, A.; Mityushina, I.; Streltsova, E.; Kulikov, A.; Yakovenko, I.; Namitulina, A. Mathematical Modeling for Financial Analysis of an Enterprise: Motivating of Not Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 79. [Google Scholar] [CrossRef]

- Zollo, M.; Bettinazzi, E.L.; Neumann, K.; Snoeren, P. Toward a Comprehensive Model of Organizational Evolution: Dynamic Capabilities for Innovation and Adaptation of the Enterprise Model. Glob. Strat. J. 2016, 6, 225–244. [Google Scholar] [CrossRef]

- Stavytskyy, A.; Kharlamova, G.; Giedraitis, V.; Šumskis, V. Estimating the interrelation between energy security and macroeconomic factors in European countries. J. Int. Stud. 2018, 11, 217–238. [Google Scholar] [CrossRef]

- Repina, E.; Shiryaeva, L.; Fedorova, E. The Study of Dependence Structure between Small Business Development and Microfinance Security of Russian Regions. Ekon. I Mat. Metod. 2019, 55, 41–57. [Google Scholar] [CrossRef]

- Murray, S. The Adaptation Industry: The Cultural ECONOMY of Contemporary Literary Adaptation; Routledge: London, UK, 2012; p. 272. [Google Scholar]

- Uchenov, A. Research of Russian and foreign experience of state support of inductrial enterprises for the subseqient adaptation of best practices. Financ. Econ. 2019, 3, 413–418. [Google Scholar]

- Bessarabova, Y.; Evtushenko-Mulukaeva, N. Architectural adaptation of an industrial enterprise to a new function. Caspain Eng. Construst. Bull. 2019, 2, 28–33. [Google Scholar]

- Ruzakova, O.; Kurdyumov, A. Restructuring and adaptation of enterprises in the conditions of information economy development. In Proceedings of the 4th International Scientific Conference on Social Sciences and Arts, Albena, Bulgaria, 24–30 August 2017; p. 795. [Google Scholar]

- Keruenbaeva, D. Formation of the concept of enterprise adaptation to environmental conditions. Econ. Soc. 2020, 1, 482–484. [Google Scholar]

- Vo, H.D. Sustainable agriculture & energy in the U.S.: A link between ethanol production and the acreage for corn. Econ. Sociol. 2020, 13, 259–268. [Google Scholar] [CrossRef]

- Shan, S.; Luo, Y.; Zhou, Y.; Wei, Y. Big data analysis adaptation and enterprises’ competitive advantages: The perspective of dynamic capability and resource-based theories. Technol. Anal. Strateg. Manag. 2019, 31, 406–420. [Google Scholar] [CrossRef]

- Hnatyshyn, M. Decomposition analysis of the impact of economic growth on ammonia and nitrogen oxides emissions in the European Union. J. Int. Stud. 2018, 11, 201–209. [Google Scholar] [CrossRef] [PubMed]

- O´ Shaughnessy, J. Principles of Organization of Company Management, 1st ed.; Routledge: London, UK, 2013. [Google Scholar]

- Kusakina, O. Methodological Aooroaches to Assessing the Socio-Economic Efficiency of Integration. Available online: http://www.sworld.com.ua/konfer29/958.pdf (accessed on 15 May 2021).

- Borodin, A.; Mityushina, I. Evaluating the effectiveness of companies using the DEA method. Nauk. Visnyk Natsionalnoho Hirnychoho Universytetu 2020, 6, 193–197. [Google Scholar] [CrossRef]

- Mokhova, N.; Zinecker, M.; Meluzín, T. Internal factors influencing the cost of equity capital. Entrep. Sustain. Issues 2018, 5, 827–845. [Google Scholar] [CrossRef]

- Ogiugo, H.U.; Adesuyi, I.; Ogbeide, S.O. Empirical test of capital asset pricing model on securities return of listed firms in Nigeria. Insights Into Reg. Dev. 2020, 825–836. [Google Scholar] [CrossRef]

- Štreimikienė, D. Externalities of power generation in Visegrad countries and their integration through support of renewables. Econ. Sociol. 2021, 14, 89–102. [Google Scholar] [CrossRef] [PubMed]

- Goltyapin, V. Network approach. Agro-Bus. 2019, 3, 120–125. [Google Scholar]

- Qian, Y. Modelling industry interdependency dynamics in a network context. Stud. Econ. Financ. 2020, 37, 50–70. [Google Scholar] [CrossRef]

- Demircan Keskin, F. A two-stage fuzzy approach for Industry 4.0 project portfolio selection within criteria and project interdependencies context. J. Multi-Criteria Decis. Anal. 2020, 27, 65–83. [Google Scholar] [CrossRef]

- Joseph, A.J. Health, Safety, and Environmental Data Analysis: A Business Approach; CRC Press: Boca Raton, FL, USA, 2020; p. 386. [Google Scholar]

- Svazas, M.; Navickas, V.; Krajnakova, E.; Nakonieczny, J. Sustainable supply chain of the biomass cluster as a factor for preservation and enhancement of forests. J. Int. Stud. 2019, 12, 309–321. [Google Scholar] [CrossRef]

- Plenkina, V.; Andronova, I.; Deberdieva, E.; Lenkova, O.; Osinovskaya, I. Specifics of strategic managerial decisions-making in Russian oil companies. Entrep. Sustain. Issues 2018, 5, 858–874. [Google Scholar] [CrossRef]

- Vygodchikova, I. Toolkit for making decisions on investing in large Russian companies using a hierarchical ranking procedure and minimax approach. Appl. Inform. 2019, 14, 123–137. [Google Scholar]

- 36. Szczepankiewicz., E.I.; Mućko, P. CSR reporting practices of Polish energy and mining companies. Sustainability 2016, 8, 126. [Google Scholar] [CrossRef]

- Hąbek, P.; Wolniak, R. Assessing the quality of corporate social responsibility reports: The case of reporting practices in selected European Union member states. Qual. Quant. 2020, 50, 399–420. [Google Scholar] [CrossRef] [PubMed]

- Raufflet, E.; Cruz, L.B.; Bres, L. An assessment of corporate social responsibility practices in the mining and oil and gas industries. J. Clean Prod. 2014, 84, 256–270. [Google Scholar] [CrossRef]

- Tvaronavičienė, M.; Prakapienė, D.; Garškaitė-Milvydienė, K.; Prakapas, R.; Nawrot, Ł. Energy Efficiency in the Long-Run in the Selected European Countries. Econ. Sociol. 2018, 11, 245–254. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).