Scaling up Renewable Energy Assets: Issuing Green Bond via Structured Public-Private Collaboration for Managing Risk in an Emerging Economy

Abstract

1. Introduction

1.1. Challenges in Scaling up Renewable Energy Assets

1.2. Impetus in Developing and Financing Wind Power under China’s Market Socialism

2. Materials and Methods

2.1. Policy and Practice Review

2.1.1. Green Bond Development for Global Sustainability

2.1.2. Green Financing Policy under a Political Economy

2.1.3. China’s Emerging Green Financial System

| Elements | Products and Services | Policy Tools | Pertinent Stakeholders |

|---|---|---|---|

| Green Credit | Commercial banks providing financing for ecological protection, ecological construction, a low-carbon economy and green industry through a credit mode | In 2012, the China Banking Regulatory Commission (CBRC) issued the Green Credit Guidelines for the key evaluation indicators for the implementation of green credits; and the green credit policies formulated by commercial banks themselves. | Commercial banks, business enterprises |

| Green Bonds | Corporate bonds issued specifically to support green projects | In 2015, the People’s Bank of China (PBOC) issued the “Green Bond Support Project Catalog”. In 2015, the National Development and Reform Commission (NDRC) issued the guidelines on the issuance of green bonds. | Commercial banks, state banks, |

| Green Stock Index | Stock price index for green stock selection among listed companies according to specific criteria | In 2015, the Shanghai Stock Exchange officially released a Carbon Efficiency Index. | Listed companies, individual and institutional investors |

| Green Funds | Special investment funds established for energy savings and emissions reduction strategies, low-carbon economic development and environmental optimization and transformation projects | In 2015/16, the Ministry of Finance, PBOC and other ministries jointly released the Guidelines for Establishing the Green Financial System. | Local governments, business enterprises, investment funds, private capital |

| Green Insurance | Also known as environmental pollution liability insurance, targeting the risk of enterprise pollution and related accidents caused by damage to third parties in accordance with the law to bear such liability | In 2017, the Ministry of Environmental Protection and the China Insurance Regulatory Commission (CIRC) jointly released the “Guidance on Environmental Pollution Liability Insurance” and the “Guiding Opinions on the Pilot Work of Compulsory Liability Insurance for Environmental Pollution”. The administrative measures on compulsory liability insurance for environmental pollution were issued as a draft. | Insurance companies, business enterprises |

2.1.4. Green Bond Characteristics

2.1.5. Knowledge Gap

2.2. Case Study

3. Results

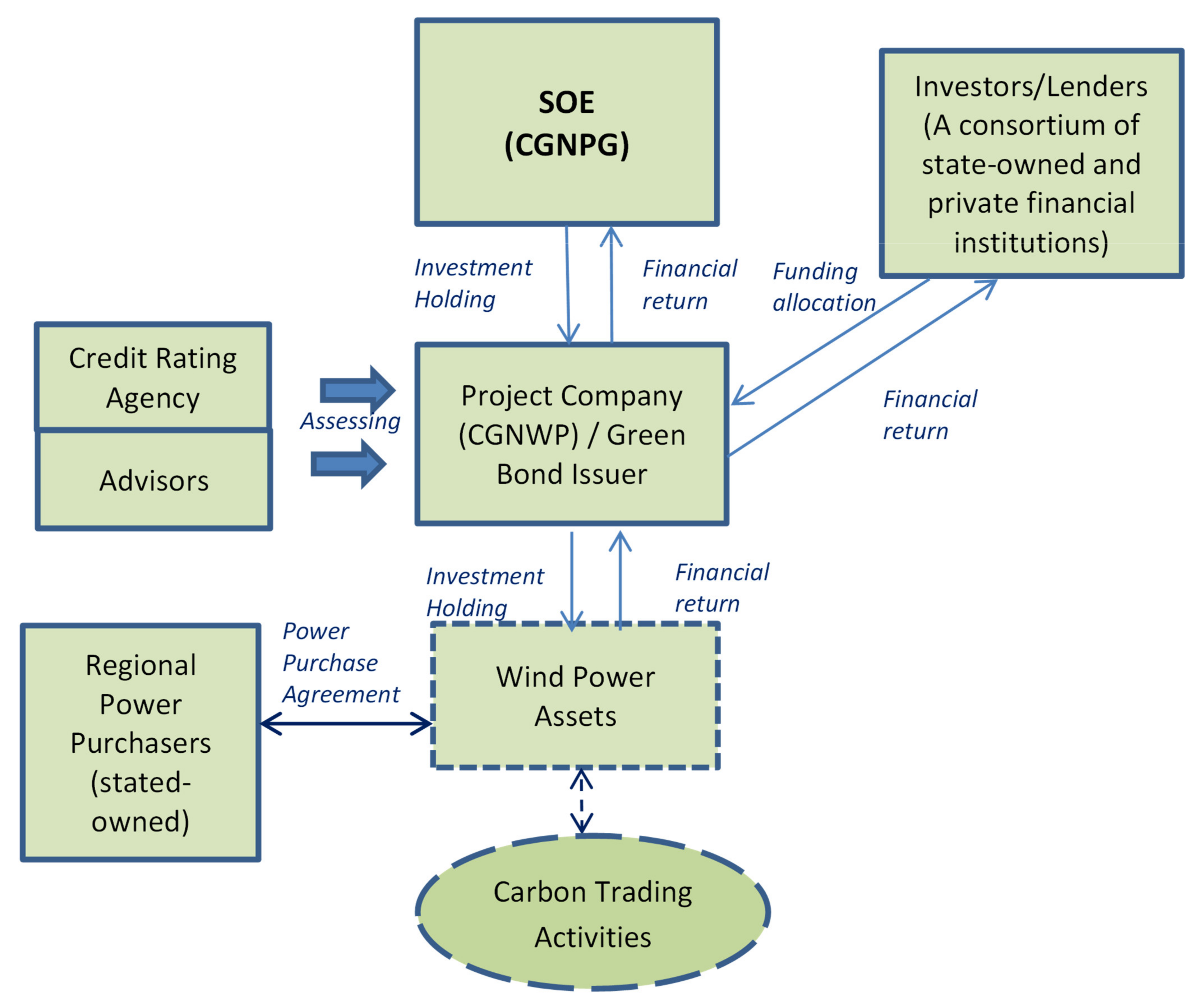

3.1. Pioneering Public-Private Initiative

3.2. Structured Financial Arrangement

3.3. Bundled Wind Power Assets

3.4. Generating Carbon Trading Income from Wind Power Projects

4. Discussion

4.1. Leveraging on a Strong Credit Rating

4.2. Investor Risk Protection and Incentives

4.3. Financing Renewable Energy in Scale to Reduce Carbon Emissions

4.4. Work in Progress

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Barbosa, J.P.; Saraiva, J.D.; Seixas, J. Solar energy policy to boost Brazilian power sector. Int. J. Clim. Chang. Strat. Manag. 2020, 12, 349–367. [Google Scholar] [CrossRef]

- Nathwani, J.; Ng, A. A “cap and invest” strategy for managing the intergenerational burden of financing energy transitions. In Handbook of Green Finance; Sachs, J., Thye, W., Yoshino, N., Taghizadeh-Hesary, F., Eds.; Springer: Singapore, 2019; pp. 63–80. [Google Scholar]

- International Renewable Energy Agency (IRENA). Renewable Energy Prospects: China. 2014. Available online: https://www.irena.org/publications/2014/Nov/Renewable-Energy-Prospects-China (accessed on 30 April 2021).

- Umamaheswaran, S.; Rajiv, S. Financing large scale wind and solar projects—A review of emerging experiences in the Indian context. Renew. Sustain. Energy Rev. 2015, 48, 166–177. [Google Scholar] [CrossRef]

- Ng, A.W.; Nathwani, J. Sustainable energy infrastructure for Asia: Policy framework for responsible financing and investment. In Routledge Handbook of Energy in Asia; Bhattacharyya, S.C., Ed.; Routledge: London, UK, 2018; pp. 284–295. [Google Scholar]

- Lam, P.T.; Law, A.O. Financing for renewable energy projects: A decision guide by developmental stages with case studies. Renew. Sustain. Energy Rev. 2018, 90, 937–944. [Google Scholar] [CrossRef]

- Donastorg, A.; Renukappa, S.; Suresh, S. Financing Renewable Energy Projects in Developing Countries: A Critical Review. IOP Conf. Series: Earth Environ. Sci. 2017, 83, 12012. [Google Scholar] [CrossRef]

- Ng, A.W. From sustainability accounting to a green financing system: Institutional legitimacy and market heterogeneity in a global financial centre. J. Clean. Prod. 2018, 195, 585–592. [Google Scholar] [CrossRef]

- Sahu, B.K. Wind energy developments and policies in China: A short review. Renew. Sustain. Energy Rev. 2018, 81, 1393–1405. [Google Scholar] [CrossRef]

- Dai, J.; Yang, X.; Wen, L. Development of wind power industry in China: A comprehensive assessment. Renew. Sustain. Energy Rev. 2018, 97, 156–164. [Google Scholar] [CrossRef]

- Li, L.; Ren, X.; Yang, Y.; Zhang, P.; Chen, X. Analysis and recommendations for onshore wind power policies in China. Renew. Sustain. Energy Rev. 2018, 82, 156–167. [Google Scholar] [CrossRef]

- Choi, J.J.; Powers, M.R.; Zhang, X.T. The Political Economy of Chinese Finance. Int. Financ. Rev. 2016, 17, 411. [Google Scholar]

- Ji, Q.; Zhang, D. How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 2019, 128, 114–124. [Google Scholar] [CrossRef]

- Zhang, H. Regulating green bond in China: Definition divergence and implications for policy making. J. Sustain. Finance Invest. 2020, 10, 141–156. [Google Scholar] [CrossRef]

- Tolliver, C.; Keeley, A.R.; Managi, S. Drivers of green bond market growth: The importance of Nationally Determined Contributions to the Paris Agreement and implications for sustainability. J. Clean. Prod. 2020, 244, 118643. [Google Scholar] [CrossRef]

- Banga, J. The green bond market: A potential source of climate finance for developing countries. J. Sustain. Finance Invest. 2018, 9, 17–32. [Google Scholar] [CrossRef]

- Azhgaliyeva, D.; Liddle, B. Introduction to the special issue: Scaling Up Green Finance in Asia. J. Sustain. Finance Invest. 2020, 10, 83–91. [Google Scholar] [CrossRef]

- IPCC. Summary for policymakers. In Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H., Roberts, D., Skea, J., Shukla, P., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; IPCC: Geneva, Switzerland, 2018; pp. 3–24. [Google Scholar]

- Joint Report on Multilateral Development Banks’: Climate Finance 2018 (English); World Bank Group: Washington, DC, USA; Available online: http://documents.worldbank.org/curated/en/247461561449155666/Joint-Report-on-Multilateral-Development-Banks-Climate-Finance-2018 (accessed on 2 May 2019).

- Croce, R.; Kaminker, C.; Stewart, F. The Role of Pension Funds in Financing Green Growth Initiatives; OECD Working Papers on Finance Insurance & Private Pensions; OECD Publishing: Paris, France, 2011. [Google Scholar]

- Kaminker, C.; Stewart, F. The Role of Institutional Investors in Financing Clean Energy; OECD Working Papers on Finance, Insurance and Private Pensions; No. 23; OECD Publishing: Paris, France, 2012. [Google Scholar]

- Climate Bonds Initiative. Green Bond Market Summary 2018. 2019. Available online: https://www.climatebonds.net/resources/reports/2018-green-bond-market-highlights (accessed on 30 December 2020).

- Pagano, M. The Political Economy of Finance. Oxf. Rev. Econ. Policy 2001, 17, 502–519. [Google Scholar] [CrossRef]

- Andrianova, S.; Demetriades, P.; Xu, C. Political Economy Origins of Financial Markets in Europe and Asia. World Dev. 2011, 39, 686–699. [Google Scholar] [CrossRef]

- Haber, S.; Perotti, E. The Political Economy of Financial Systems; Tinbergen Institute Discussion Papers 08-045/2; Tinbergen Institute: Amsterdam, The Netherlands, 2008. [Google Scholar]

- National Development and Reform Commission (NDRC). Guidance on Green Bond Issuance; National Development and Reform Commission (NDRC): Beijing, China, 2015. [Google Scholar]

- People’s Bank of China and UNEP. Establishing China’s Green Financial System: Final Report of the Green Finance Task Force; People’s Bank of China and UNEP: Beijing, China, 2015. [Google Scholar]

- Kuo, L.; Yu, H.-C.; Chang, B.-G. The signals of green governance on mitigation of climate change—Evidence from Chinese firms. Int. J. Clim. Chang. Strat. Manag. 2015, 7, 154–171. [Google Scholar] [CrossRef]

- Monk, A.; Perkins, R. What explains the emergence and diffusion of green bonds? Energy Policy 2020, 145, 111641. [Google Scholar] [CrossRef]

- Price Waterhouse Coopers (PWC). Exploring Green Finance Incentives in China. Final Report; Price Waterhouse Coopers (PWC): Beijing, China, 2013. [Google Scholar]

- People’s Bank of China. Guidelines for Establishing the Green Financial System, Jointly Issued by the People’s Bank of China, Ministry of Finance, National Development and Reform Commission, Ministry of Environmental Protection, China Banking Regulatory Commission, China Securities Regulatory Commission and the China Insurance Regulatory Commission. Available online: http://www.pbc.gov.cn/english/130721/3133045/index.html (accessed on 2 May 2019).

- Securities and Futures Commission (SFC), 2018. Strategic framework for green finance. Available online: https://www.sfc.hk/web/EN/files/ER/PDF/SFCs%20Strategic%20Framework%20for%20Green%20Finance%20-%20Final%20Report%20(21%20Sept%202018.pdf (accessed on 2 May 2019).

- Weber, O. The financial sector’s impact on sustainable development. J. Sustain. Finance Invest. 2014, 4, 1–8. [Google Scholar] [CrossRef]

- Weber, O. Corporate sustainability and financial performance of Chinese banks. Sustain. Accounting Manag. Policy J. 2017, 8, 358–385. [Google Scholar] [CrossRef]

- Yin, R. Case Study Research: Design and Methods; Sage: Thousand Oaks, CA, USA, 1994. [Google Scholar]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Cai, Y.; Aoyama, Y. Fragmented authorities, institutional misalignments, and challenges to renewable energy transition: A case study of wind power curtailment in China. Energy Res. Soc. Sci. 2018, 41, 71–79. [Google Scholar] [CrossRef]

- Timilsina, G.R.; Shah, K.U. Filling the gaps: Policy supports and interventions for scaling up renewable energy development in Small Island Developing States. Energy Policy 2016, 98, 653–662. [Google Scholar] [CrossRef]

- China General Nuclear Power Group (CGNPG). Report on Issuing Carbon Bond. 2018. Available online: http://www.cs.com.cn/sylm/jsbd/201405/t20140513_4388739.html (accessed on 6 March 2019).

- China Emission Exchange. Issuance of Carbon Bond by China General Nuclear Power Group. 2018. Available online: http://www.cerx.cn/Inews/1689.htm (accessed on 6 March 2019).

- Busch, J.; Engelmann, J. Cost-effectiveness of reducing emissions from tropical deforestation, 2016–2050. Environ. Res. Lett. 2017, 13, 015001. [Google Scholar] [CrossRef]

- Busch, J.; Engelmann, J.; Cook-Patton, S.C.; Griscom, B.W.; Kroeger, T.; Possingham, H.; Shyamsundar, P. Potential for low-cost carbon dioxide removal through tropical reforestation. Nature Clim. Chang. 2019, 9, 463–466. [Google Scholar] [CrossRef]

- Austin, K.G.; Baker, J.S.; Sohngen, B.L.; Wade, C.M.; Daigneault, A.; Ohrel, S.B.; Ragnauth, S.; Bean, A. The economic costs of planting, preserving, and managing the world’s forests to mitigate climate change. Nat. Commun. 2020, 11, 1–9. [Google Scholar] [CrossRef]

- Cheng, W.; Yang, Z.; Pan, X.; Baležentis, T.; Chen, X. Evolution of Carbon Shadow Prices in China’s Industrial Sector during 2003–2017: A By-Production Approach. Sustainability 2020, 12, 722. [Google Scholar] [CrossRef]

- Dai, S.; Zhou, X.; Kuosmanen, T. Forward-looking assessment of the GHG abatement cost: Application to China. Energy Econ. 2020, 88. [Google Scholar] [CrossRef]

- International Capital Market Association (ICMA). The Green Bond Principles 2016: Voluntary Process Guidelines for Issuing Green Bonds; International Capital Market Association (ICMA): Beijing, China, 2016. [Google Scholar]

- International Capital Market Association (ICMA). The Green Bond Principles 2018: Voluntary Process Guidelines for Issuing Green Bonds; International Capital Market Association (ICMA): Paris, France, 2018. [Google Scholar]

- Climate Bonds Initiative and China Central Depository & Clearing Company (CBI and CCDCC). China Green Bond Market 2017; Climate Bonds Initiative and China Central Depository & Clearing Company (CBI and CCDCC): Beijing, China, 2018. [Google Scholar]

- Hong Kong Stock Exchange (HKEX). The Green Bond Trend: Global, Mainland China and Hong Kong; Hong Kong Exchange and Clearing Limited: Hong Kong, China, 2018. [Google Scholar]

- China Development Bank. Green Bond Framework; China Development Bank: Beijing, China, 2017. [Google Scholar]

- Gallagher, K.P. China’s global energy finance: Poised to lead. Energy Res. Soc. Sci. 2018, 40, 89–90. [Google Scholar] [CrossRef]

- Asian Development Bank. Green Finance Strategies for Post-COVID-19 Economic Recovery in Southeast Asia: Greening Recoveries for Planet and People. 2020. Available online: https://www.adb.org/publications/green-finance-post-covid-19-economic-recovery-southeast-asia. (accessed on 16 May 2021).

- Fears, R.; Gillett, W.; Haines, A.; Norton, M.; Ter Meulen, V. Post-pandemic recovery: Use of scientific advice to achieve social equity, planetary health, and economic benefits. Lancet Planet. Health 2020, 4, e383–e384. [Google Scholar] [CrossRef]

| Issuer | China-Guangzhou Nuclear Wind Power Co., Ltd. (CGNWP) |

|---|---|

| Release time | 12 May 2014 |

| Release size | 1 billion yuan |

| Term | 5 years |

| Interest rate | 5.65% (fixed), plus 5–20 bp (floating) |

| Release method | Public offerings |

| Principal underwriter/co-principal underwriter | Pudong Development Bank/China Development Bank |

| Rating agency | United Credit Evaluation Co., Ltd. |

| Financial advisors | China-Guangzhou Nuclear Financial Co., Ltd.; Shenzhen Emission Rights Exchange |

| Basic assets | Issuer’s subordinate project company, sales revenue and income from carbon assets generated from 5 wind power projects |

| Issue pricing mechanism | The pricing method of fixed interest plus additional income is used, in which the sales revenue generated from the wind power project is used to repay the principal and fixed interest of the asset-backed instruments, and the income from the carbon assets generated by the wind power project is used to pay the additional benefits attributable to the investors with reference to the asset support notes. |

| Geographical Location of Wind Power Assets | Installed Capacity | Annual Power Supply | Online Electricity Tariff | Regional Power Purchasers |

|---|---|---|---|---|

| Inner Mongolia | 49.3 MW | 110,751 MWh | 0.51 yuan/kwh | Inner Mongolia Electric Power (Group) Company |

| Inner Mongolia | 49.5 MW | 131,564 MWh | 0.51 yuan/kwh | Inner Mongolia Electric Power (Group) Company |

| Xinjiang | 49.5 MW | 122,364 MWh | 0.58 yuan/kwh | Xinjiang Electric Power Company |

| Gansu | 49.5 MW | 91,130 MWh | 0.58 yuan/kwh | Gansu Electric Power Company |

| Guangdong | 35.7 MW | 61,740 MWh | 0.61 yuan/kWh | Jiangmen Power Supply Bureau of Guangdong Grid Company |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fu, J.; Ng, A.W. Scaling up Renewable Energy Assets: Issuing Green Bond via Structured Public-Private Collaboration for Managing Risk in an Emerging Economy. Energies 2021, 14, 3076. https://doi.org/10.3390/en14113076

Fu J, Ng AW. Scaling up Renewable Energy Assets: Issuing Green Bond via Structured Public-Private Collaboration for Managing Risk in an Emerging Economy. Energies. 2021; 14(11):3076. https://doi.org/10.3390/en14113076

Chicago/Turabian StyleFu, Jingyan, and Artie W. Ng. 2021. "Scaling up Renewable Energy Assets: Issuing Green Bond via Structured Public-Private Collaboration for Managing Risk in an Emerging Economy" Energies 14, no. 11: 3076. https://doi.org/10.3390/en14113076

APA StyleFu, J., & Ng, A. W. (2021). Scaling up Renewable Energy Assets: Issuing Green Bond via Structured Public-Private Collaboration for Managing Risk in an Emerging Economy. Energies, 14(11), 3076. https://doi.org/10.3390/en14113076