A Wind Energy Supplier Bidding Strategy Using Combined EGA-Inspired HPSOIFA Optimizer and Deep Learning Predictor

Abstract

1. Introduction

1.1. Non-Game Approach

1.2. Traditional Game Approach

1.3. Evolutionary Game Approach (EGA)

1.4. Purposes and Contributions of the Paper

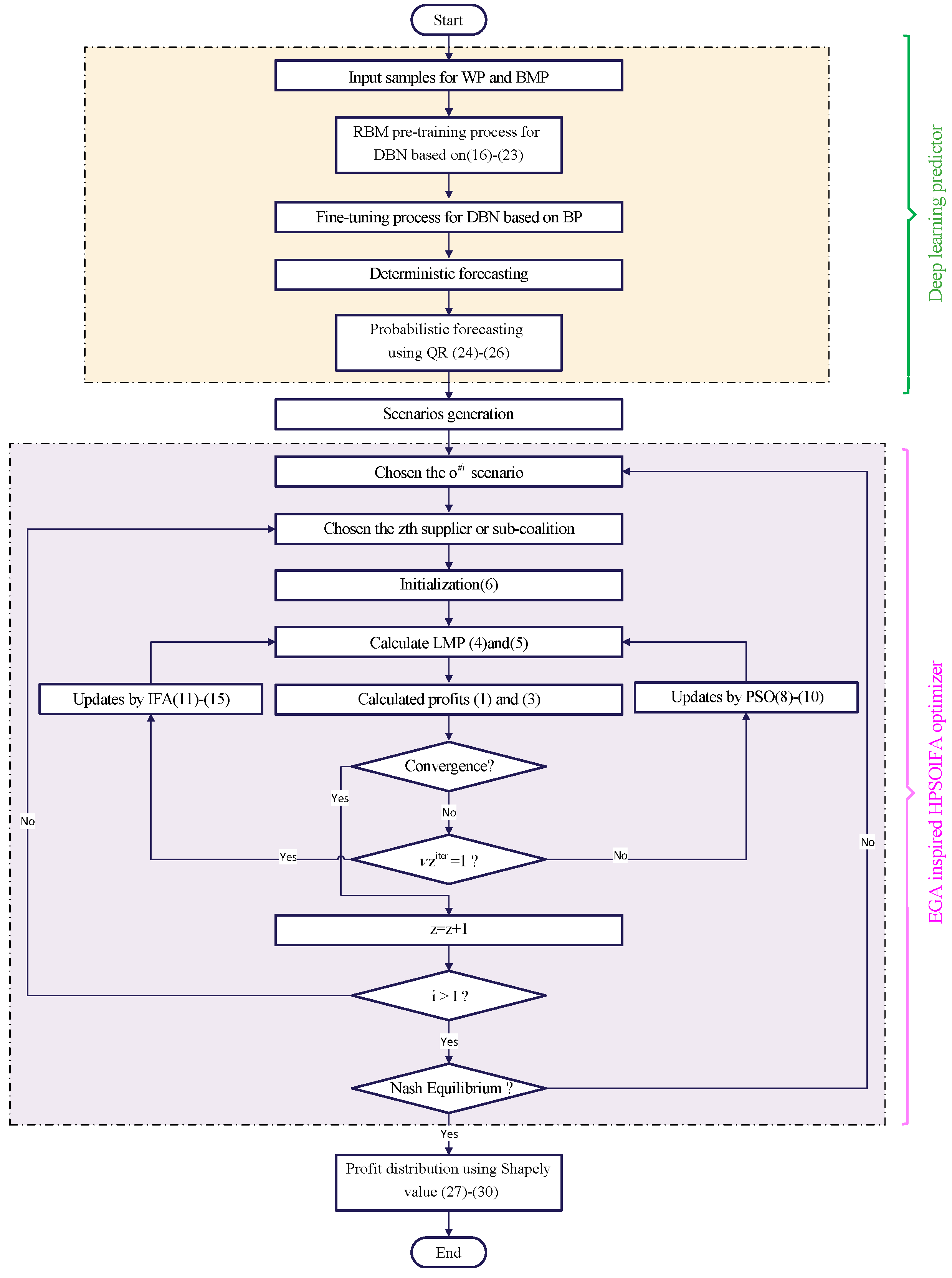

- Another bi-layer enhancement model for the wind power makers is proposed here. The top layer depicts the helpful connection between customary power providers and a wind provider with the vulnerability of WP and BMP, and the lower-layer model is the independent system operator’s (ISO) improvement considering losses in the network. The model is targeted for enhancing the profits of the wind power producers;

- An evolutionary game approach based on a hybrid particle swarm optimization and improved firefly algorithm (HPSOIFA) is newly proposed to tackle the bi-layer bidding model. The methodology can produce a more solid balance arrangement contrasted with conventional techniques;

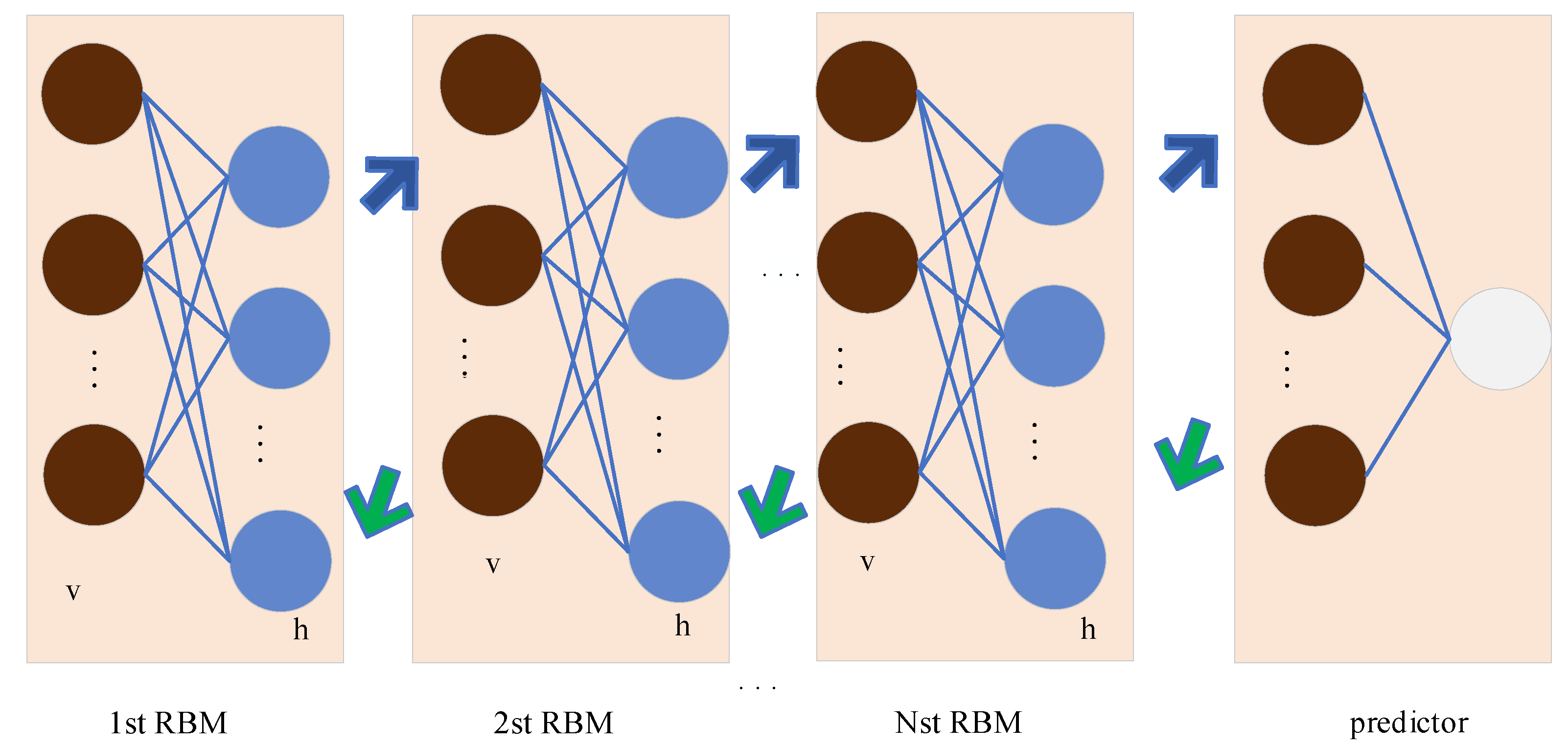

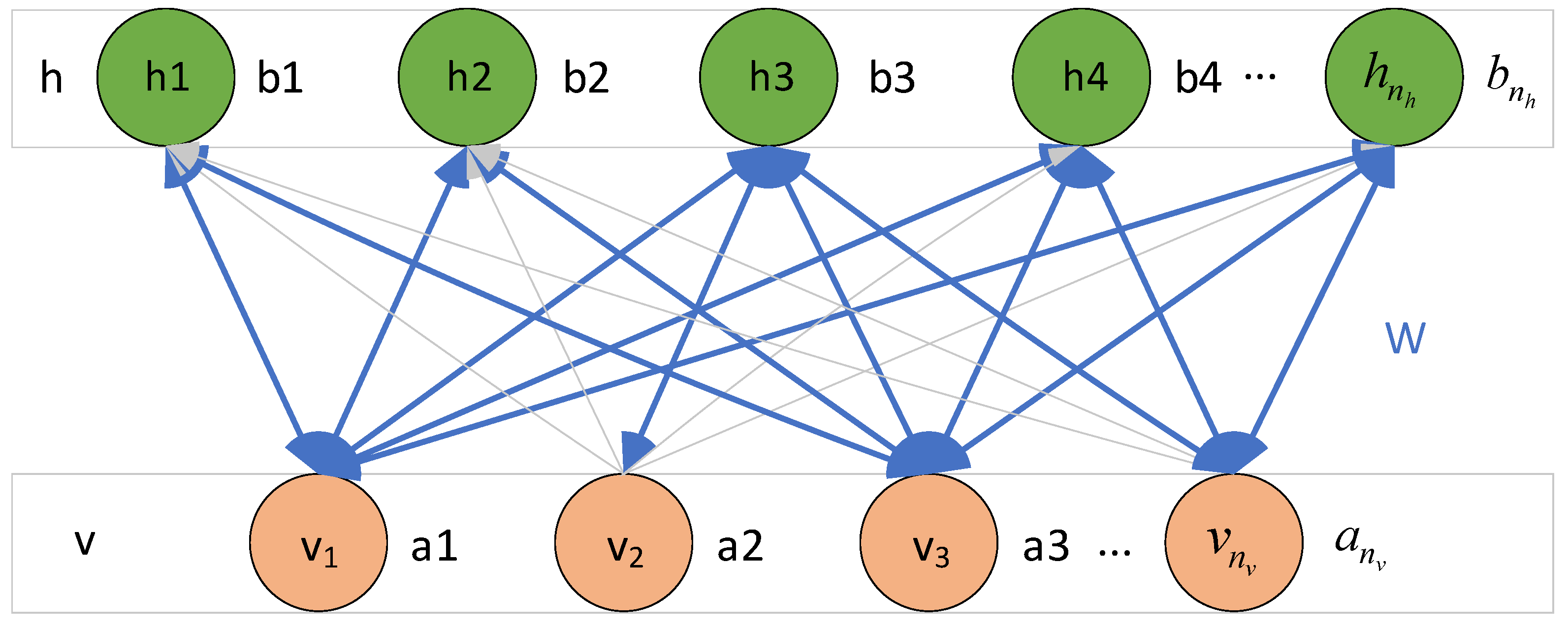

- A deep belief network (DBN) is introduced and adjusted to comprehensively extract nonlinear features for the WP and BMP. And the uncertainty in the WP and BMP is probabilistically formulated based on the quantile regression (QR).

1.5. Structure of the Paper

2. Wind Energy Suppliers’ Coalition Model

2.1. Problem Description

2.2. The Top-Layer Model

2.3. The Lower-Layer Model

3. Solution Method–Novel Hybrid Optimization Model

3.1. Evolutionary Game Approach (EGA)

3.2. Hybrid Particle Swarm Optimization and Improved Firefly Algorithm (HPSOIFA)

3.2.1. Halton Initialization

3.2.2. Selected Operator

3.2.3. PSO Updation

3.2.4. IFA Updation

3.3. DBN-Based Deterministic and Probabilistic Forecasting of WP and BMP

3.3.1. DBN-Based Deterministic Forecasting of WP and BMP

3.3.2. DBN-Based Probabilistic Forecasting of WP and BMP

3.4. Shapley Value

3.5. Proposed Solution Model

4. Empirical Results and Discussion

4.1. Experimental Settings

| Algorithm 1 Pseudocode of the wind power producers’ market bidding algorithm |

DBN

|

4.2. Case 1: Performance Evaluation of Prediction Model and Optimization Algorithm

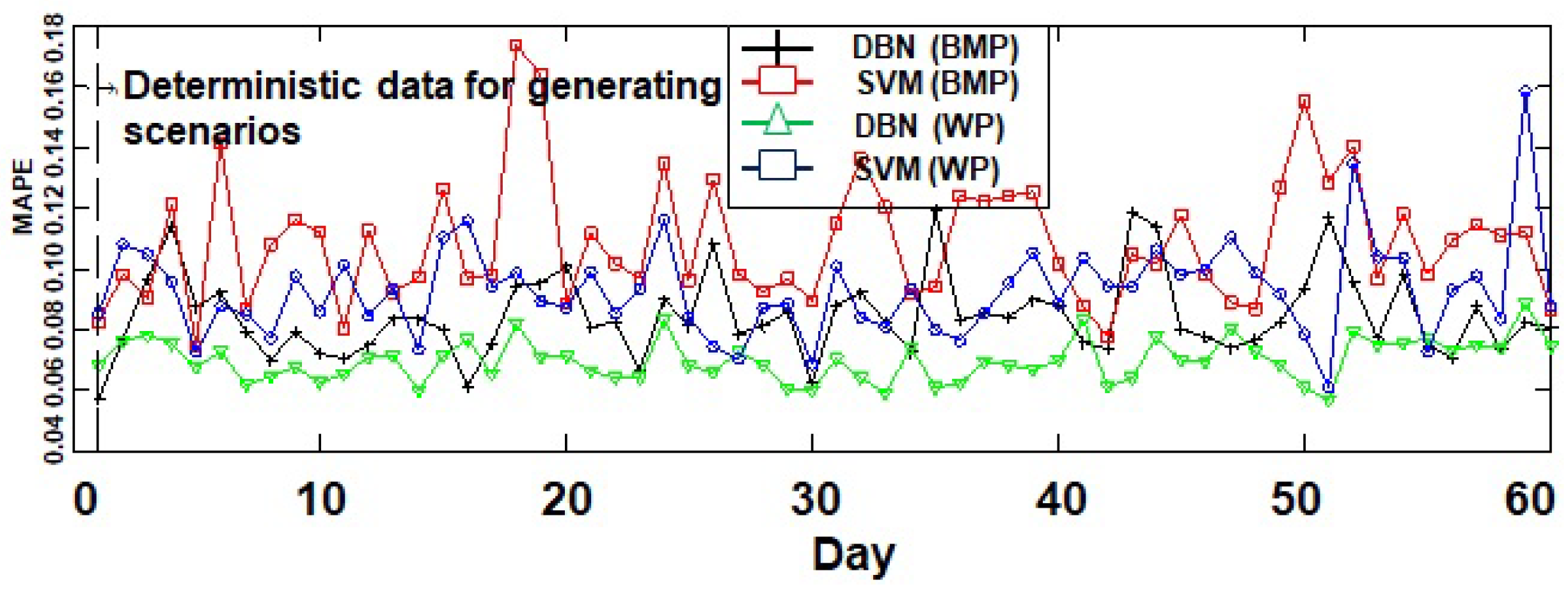

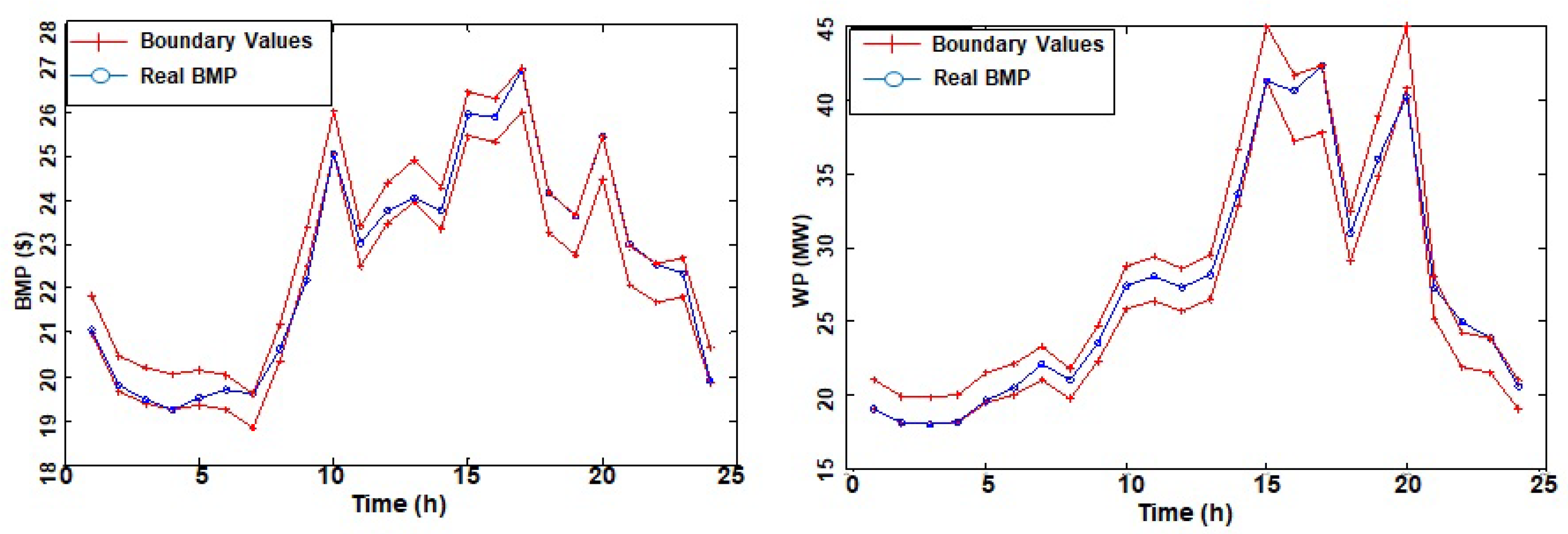

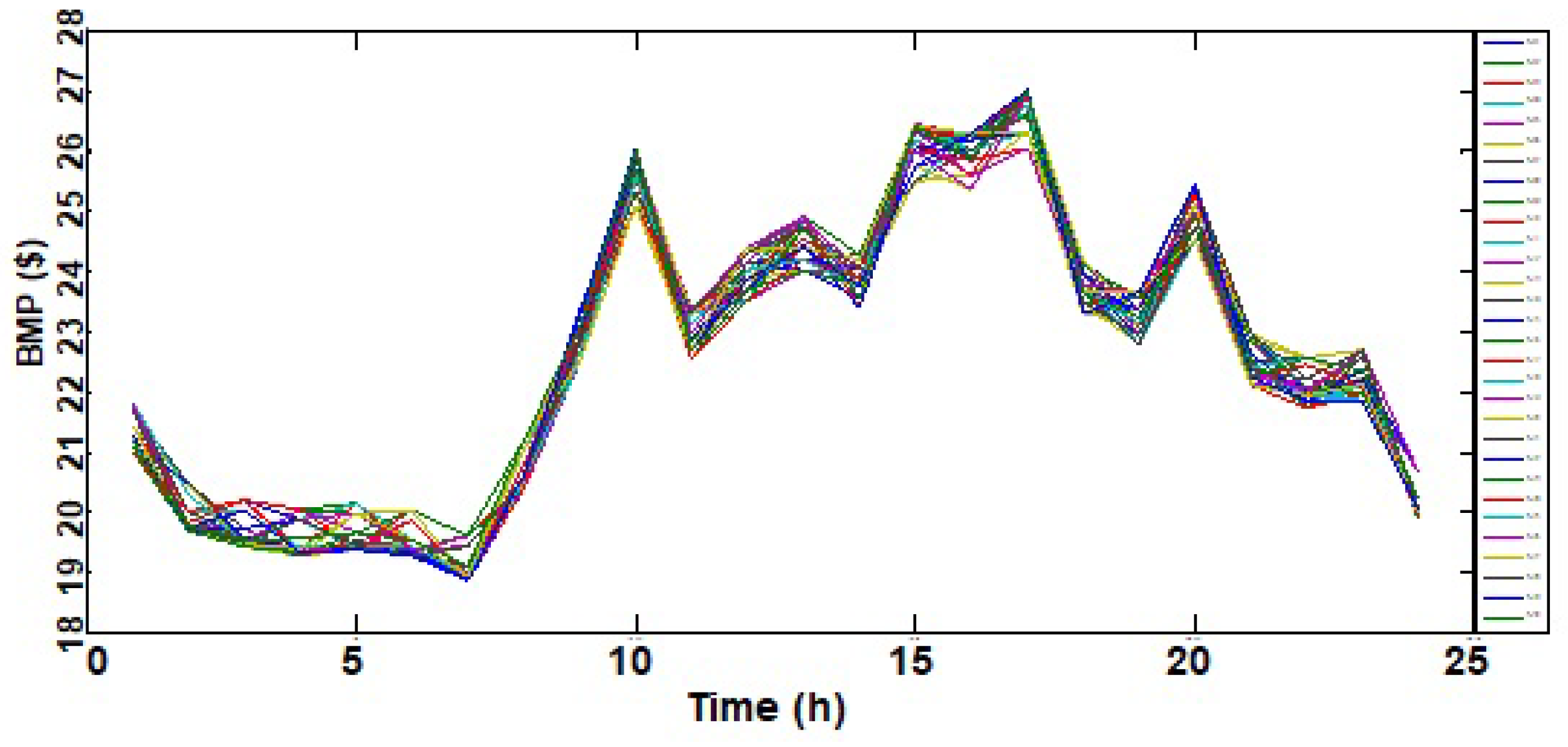

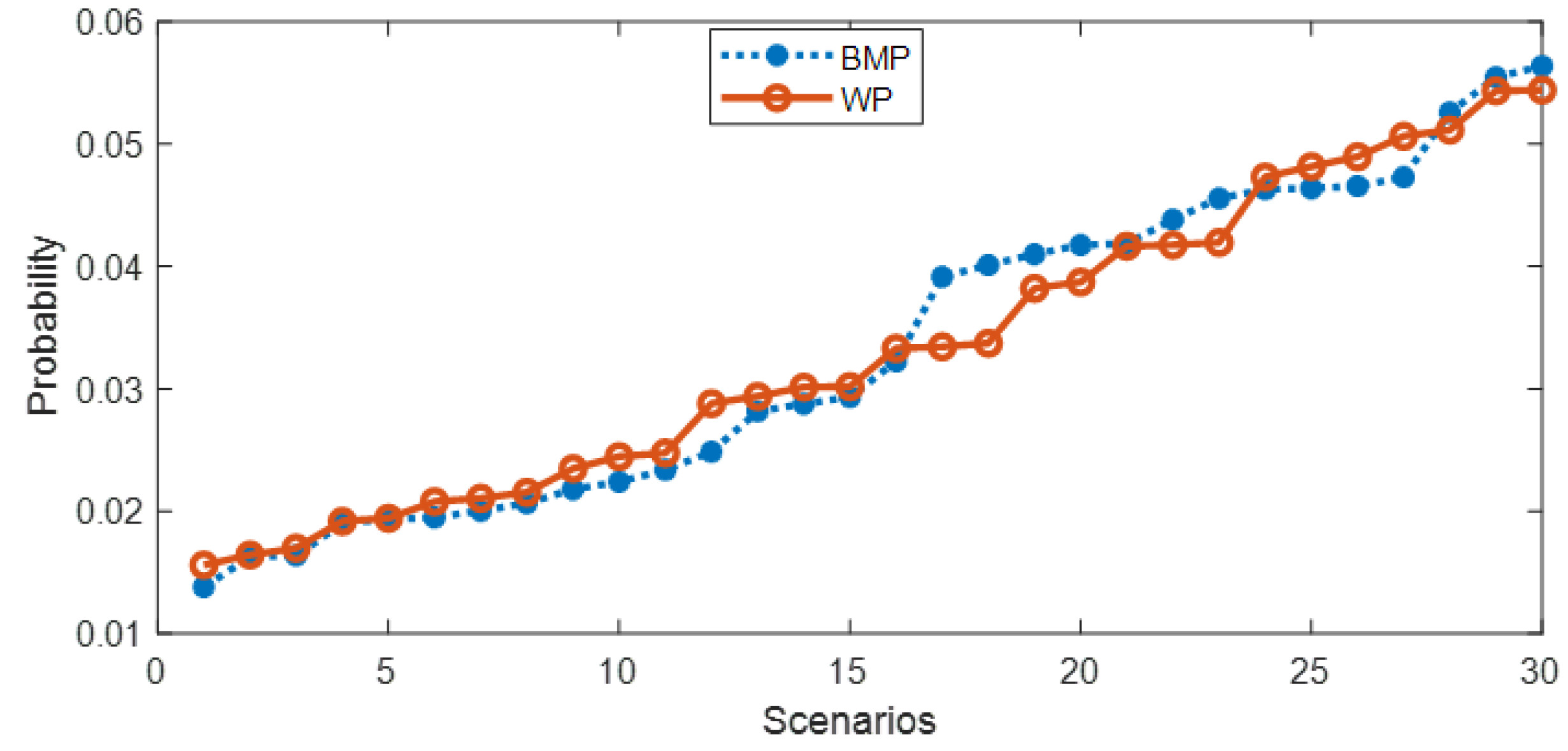

4.2.1. Forecasting Performance Evaluation and Scenarios Generation

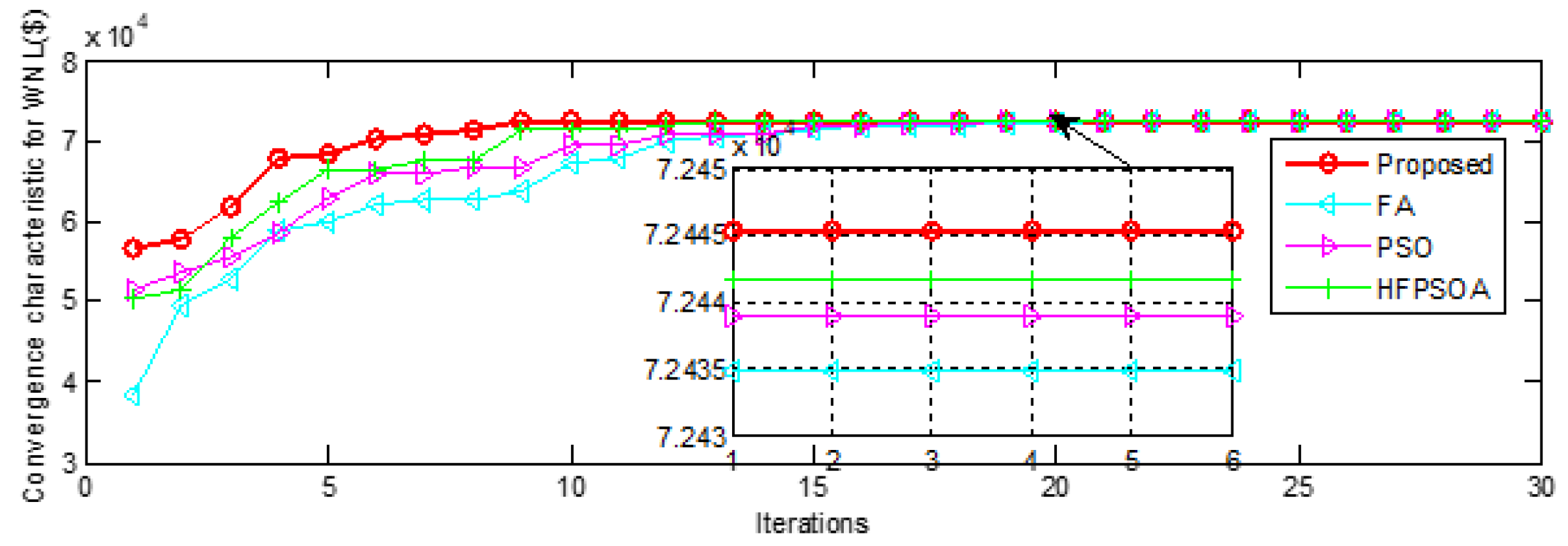

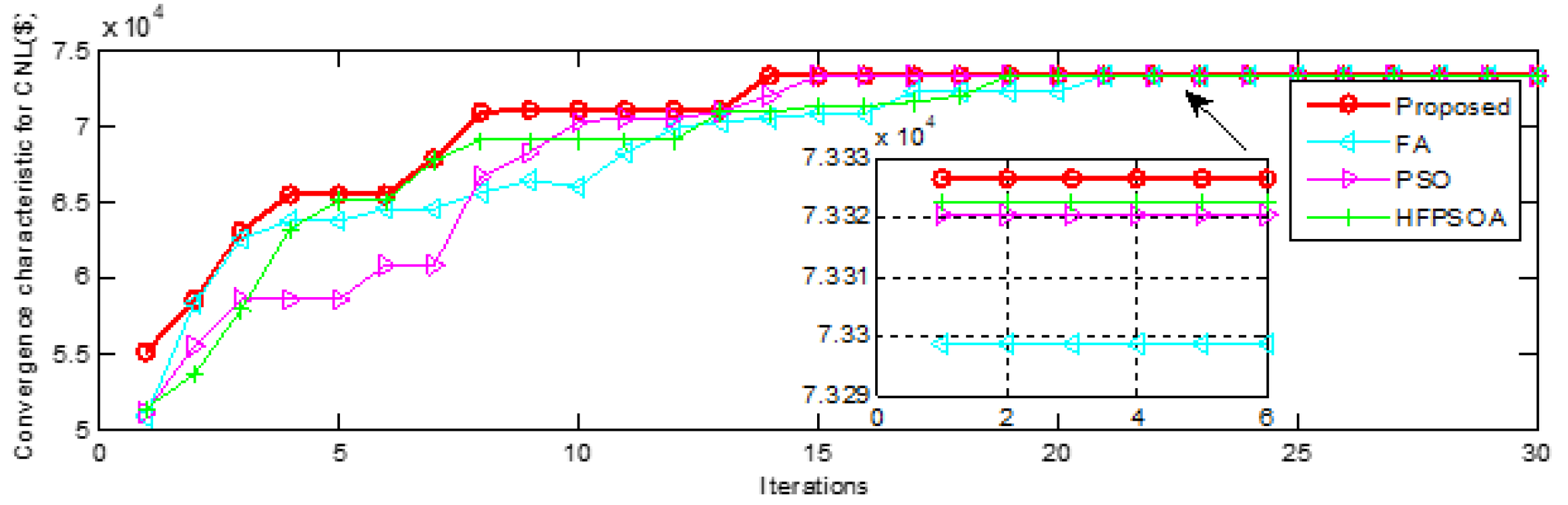

4.2.2. Optimal Performance Evaluation of an HPSOIFA

4.3. Case 2: Investigations of CB Results

4.3.1. Impact Analysis on Network Loss and Profit Distribution by Shapley Value

4.3.2. Cooperative Bidding Results for a Wind Power Supplier

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| LMP | locational marginal price |

| WP | wind production |

| BM | balancing market |

| BMP | balancing market price |

| BS | bidding strategy |

| EGA | evolutionary game approach |

| PSO | particle swarm optimization |

| FA | firefly algorithm |

| HPSOIFA | hybrid particle swarm optimization and improved firefly algorithm |

| QR | quantile regression |

| SV | Shapley value |

| ISO | independent system operator’s |

| DBN | deep belief network |

References

- Wang, H.; Liu, Y.; Zhou, B.; Li, C.; Cao, G.; Voropai, N.; Barakhtenko, E. Taxonomy research of artificial intelligence for deterministic solar power forecasting. Energy Convers. Manag. 2020, 214, 112909. [Google Scholar] [CrossRef]

- Aziz, S.; Wang, H.; Liu, Y.; Peng, J.; Jiang, H. Variable universe fuzzy logic-based hybrid LFC control with real-time implementation. IEEE Access 2019, 7, 25535–25546. [Google Scholar] [CrossRef]

- Zhang, H.; Liu, X.; Ji, H.; Hou, Z.; Fan, L. Multi-Agent-Based Data-Driven Distributed Adaptive Cooperative Control in Urban Traffic Signal Timing. Energies 2019, 12, 1402. [Google Scholar] [CrossRef]

- Yang, W.; Wang, M.; Aziz, S.; Kharal, A.Y. Magnitude-Reshaping Strategy for Harmonic Suppression of VSG-Based Inverter Under Weak Grid. IEEE Access 2020, 8, 184399–184413. [Google Scholar] [CrossRef]

- Baringo, L.; Conejo, A.J. Strategic Offering for a Wind Power Producer. IEEE Trans. Power Syst. 2013, 28, 4645–4654. [Google Scholar] [CrossRef]

- The Gansu Power Trading Center Official Website. Available online: https://pmos.gs.sgcc.com.cn (accessed on 14 September 2020).

- The ERCOT Website. Available online: https://www.tklaw.com/services/ercot (accessed on 21 September 2020).

- The PJM Official Website. Available online: https://www.pjm.com/markets-and-operations/data-dictionary.aspx/ (accessed on 11 September 2020).

- Zugno, M.; Morales, J.M.; Pinson, P.; Madsen, H. Pool Strategy of a Price-Maker Wind Power Producer. IEEE Trans. Power Syst. 2013, 28, 3440–3450. [Google Scholar] [CrossRef]

- Xiao, Y.; Wang, X.; Wang, X.; Dang, C.; Lu, M. Behavior analysis of wind power producer in electricity market. Appl. Energy 2016, 171, 325–335. [Google Scholar] [CrossRef]

- de la Nieta, A.A.S.; Contreras, J.; Muñoz, J.I.; O’Malley, M. Modeling the Impact of a Wind Power Producer as a Price-Maker. IEEE Trans. Power Syst. 2014, 29, 2723–2732. [Google Scholar] [CrossRef]

- Li, Y.; Xue, W.; Wu, T.; Wang, H.; Zhou, B.; Aziz, S.; He, Y. Intrusion detection of cyber physical energy system based on multivariate ensemble classification. Energy 2021, 218, 119505. [Google Scholar] [CrossRef]

- Banaei, M.; Buygi, M.O.; Zareipour, H. Impacts of Strategic Bidding of Wind Power Producers on Electricity Markets. IEEE Trans. Power Syst. 2016, 31, 4544–4553. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, D.; Zhang, H.; Zhang, K. Optimal Bidding of Price-Maker Retailers With Demand Price Quota Curves Under Price Uncertainty. IEEE Access 2020, 8, 120746–120756. [Google Scholar] [CrossRef]

- Wang, J.; Zhou, Z.; Botterud, A. An evolutionary game approach to analyzing bidding strategies in electricity markets with elastic demand. Energy 2011, 36, 3459–3467. [Google Scholar] [CrossRef]

- Shafie-Khah, M.; Heydarian-Forushani, E.; Golshan, M.E.H.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Catalao, J.P.S. Strategic Offering for a Price-Maker Wind Power Producer in Oligopoly Markets Considering Demand Response Exchange. IEEE Trans. Ind. Inform. 2015, 11, 1542–1553. [Google Scholar] [CrossRef]

- Dai, T.; Wei, Q. Optimal Bidding Strategy of a Strategic Wind Power Producer in the Short-Term Market. IEEE Trans. Sustain. Energy 2017, 6, 707–719. [Google Scholar] [CrossRef]

- Stanford Encyclopedia of Philosophy. Available online: http://plato.stanford.edu/entries/game-evolutionary/ (accessed on 6 September 2019).

- Wang, D.; Li, B. Behavioral Selection Strategies of Members of Enterprise Community of Practice—An Evolutionary Game Theory Approach to the Knowledge Creation Process. IEEE Access 2020, 8, 153322–153333. [Google Scholar] [CrossRef]

- Wen, X.; Peng, J.; Aziz, S.; Jiang, H. PCC Voltage Compensation Scheme of MMC-MTDC System for Transient Stability Enhancement Under Communication Delay. IEEE Access 2020, 8, 187713–187720. [Google Scholar] [CrossRef]

- Niknam, T.; Sharifinia, S.; Azizipanah-Abarghooee, R. A new enhanced bat-inspired algorithm for finding linear supply function equilibrium of GENCOs in the competitive electricity market. Energy Convers. Manag. 2013, 76, 1015–1028. [Google Scholar] [CrossRef]

- Peng, X.; Tao, X. Cooperative game of electricity retailers in China’s spot electricity market. Energy 2018, 145, 152–170. [Google Scholar] [CrossRef]

- Soliman, M.A.; Hasanien, H.M.; Azazi, H.Z.; El-Kholy, E.E.; Mahmoud, S.A. Hybrid ANFIS-GA-based control scheme for performance enhancement of a grid-connected wind generator. IET Renew. Power Gener. 2018, 12, 832–843. [Google Scholar] [CrossRef]

- Li, T.; Shahidehpour, M. Strategic Bidding of Transmission-Constrained GENCOs with Incomplete Information. IEEE Trans-Actions Power Syst. 2005, 20, 437–447. [Google Scholar] [CrossRef]

- Litvinov, E.; Zheng, T.; Rosenwald, G.; Shamsollahi, P. Marginal Loss Modeling in LMP Calculation. IEEE Trans. Power Syst. 2004, 19, 880–888. [Google Scholar] [CrossRef]

- Stern, A.; Tettenhorst, A. Hodge decomposition and the Shapley value of a cooperative game. Games Econ. Behav. 2019, 113, 186–198. [Google Scholar] [CrossRef]

- Ma, Z.; Guo, S.; Xu, G.; Aziz, S. Meta Learning-Based Hybrid Ensemble Approach for Short-Term Wind Speed Forecasting. IEEE Access 2020, 8, 172859–172868. [Google Scholar] [CrossRef]

- Jana, B.; Mitra, S.; Acharyya, S. Repository and Mutation based Particle Swarm Optimization (RMPSO): A new PSO variant applied to reconstruction of Gene Regulatory Network. Appl. Soft Comput. 2019, 74, 330–355. [Google Scholar] [CrossRef]

- Aydilek, İ.B. A Hybrid Firefly and Particle Swarm Optimization Algorithm for Computationally Expensive Numerical Problems. Appl. Soft Comput. 2018, 66, S1568494618300. [Google Scholar] [CrossRef]

- Ruan, J.; Wang, H.; Aziz, S.; Wang, G.; Zhou, B.; Fu, X. Interval state estimation based defense mechanism against cyber attack on power systems. In Proceedings of the 2017 IEEE Conference on Energy Internet and Energy System Integration (EI2), Beijing, China, 26–28 November 2017; pp. 1–5. [Google Scholar]

- Kiran, M.S.; Gunduz, M. A recombination-based hybridization of particle swarm optimization and artificial bee colony al-gorithm for continuous optimization problems. Appl. Soft Comput. 2013, 13, 2188–2203. [Google Scholar] [CrossRef]

- Aziz, S.; Peng, J.; Wang, H.; Jiang, H. ADMM-Based Distributed Optimization of Hybrid MTDC-AC Grid for Determining Smooth Operation Point. IEEE Access 2019, 7, 74238–74247. [Google Scholar] [CrossRef]

- Yang, X.S.; He, X. Firefly Algorithm: Recent Advances and Applications. Int. J. Swarm Intell. 2013, 1, 36–50. [Google Scholar] [CrossRef]

- Wang, H.; Cai, R.; Zhou, B.; Aziz, S.; Qin, B.; Voropai, N.; Gan, L.; Barakhtenko, E. Solar irradiance forecasting based on direct explainable neural network. Energy Convers. Manag. 2020, 226, 113487. [Google Scholar] [CrossRef]

- Wang, H.; Wang, W.; Zhou, X.; Sun, H.; Zhao, J.; Yu, X.; Cui, Z. Firefly algorithm with neighborhood attraction. Inform. Sci. 2017, 382–383, 374–879. [Google Scholar] [CrossRef]

- Caponetto, R.; Fortuna, L.; Fazzino, S.; Xibilia, M. Chaotic sequences to improve the performance of evolutionary algorithms. IEEE Trans. Evol. Comput. 2003, 7, 289–304. [Google Scholar] [CrossRef]

- Liu, Y.; Jiang, H.; Peng, J.; Aziz, S. A Grouping-Based Frequency Support Scheme for Wind Farm Under Cyber Uncertainty. IEEE Access 2020, 8, 178044–178054. [Google Scholar] [CrossRef]

- Xiang, L.; Deng, Z.; Hu, A. Forecasting Short-Term Wind Speed Based on IEWT-LSSVM Model Optimized by Bird Swarm Algorithm. IEEE Access 2019, 7, 59333–59345. [Google Scholar] [CrossRef]

- Marir, N.; Wang, H.; Feng, G.; Li, B.; Jia, M. Distributed Abnormal Behavior Detection Approach Based on Deep Belief Network and Ensemble SVM Using Spark. IEEE Access 2018, 6, 59657–59671. [Google Scholar] [CrossRef]

- Awange, J.L.; Paláncz, B.; Lewis, R.H.; Völgyesi, L. Quantile Regression; Springer: Cham, Switzerland; New York, NY, USA, 2018. [Google Scholar]

- Le Roux, N.; Bengio, Y. Representational Power of Restricted Boltzmann Machines and Deep Belief Networks. Neural Comput. 2008, 20, 1631–1649. [Google Scholar] [CrossRef] [PubMed]

- Hinton, G.E.; Osindero, S.; Teh, Y.W. A Fast Learning Algorithm for Deep Belief Nets. Neural Comput. 2006, 18, 1527–1554. [Google Scholar] [CrossRef]

- Lei, Z.; Wang, H.; Wen, X.; Meng, A.; Aziz, S. Wind Power Forecasting Based on Echo State Network. In Proceedings of the 2019 IEEE Sustainable Power and Energy Conference (iSPEC), Beijing, China, 21–23 November 2019; pp. 268–272. [Google Scholar]

- Sun, S.; Fu, J.; Wei, L.; Li, A. Multi-Objective Optimal Dispatching for a Grid-Connected Micro-Grid Considering Wind Power Forecasting Probability. IEEE Access 2020, 8, 46981–46997. [Google Scholar] [CrossRef]

- Zhang, R.; Li, G.; Ma, Z. A Deep Learning Based Hybrid Framework for Day-Ahead Electricity Price Forecasting. IEEE Access 2020, 8, 143423–143436. [Google Scholar] [CrossRef]

- Shahidehpour, M.; Wang, Y. Appendix C: IEEE-30 Bus System Data. In Communication and Control in Electric Power Systems; Wiley-IEEE Press: Hoboken, NJ, USA, 2005. [Google Scholar]

- Wang, H.; Zhang, R.; Peng, J.; Wang, G.; Liu, Y.; Jiang, H.; Liu, W. GPNBI-inspired MOSFA for Pareto operation optimization of integrated energy system. Energy Convers. Manag. 2017, 151, 524–537. [Google Scholar] [CrossRef]

- Camal, S.; Teng, F.; Michiorri, A.; Kariniotakis, G.; Badesa, L. Scenario generation of aggregated Wind, Photovoltaics and small Hydro production for power systems applications. Appl. Energy 2019, 242, 1396–1406. [Google Scholar] [CrossRef]

- Li, T.; Shahidehpour, M.; Li, Z. Risk-Constrained Bidding Strategy With Stochastic Unit Commitment. IEEE Trans. Power Syst. 2007, 22, 449–458. [Google Scholar] [CrossRef]

| Kind | Algorithms | Best (USD) | Worst (USD) | Mean (USD) | Var. |

|---|---|---|---|---|---|

| WNL | Proposed | 72,445.37 | 72,442.65 | 72,444.89 | 0.6821 |

| FA | 72,434.88 | 72,429.67 | 72,432.99 | 2.5027 | |

| PSO | 72,438.93 | 72,432.29 | 72,435.61 | 4.6050 | |

| HFPSOA | 72,441.67 | 72,438.11 | 72,439.89 | 1.1685 | |

| CNL | Proposed | 73,326.38 | 73,324.28 | 73,325.26 | 0.4213 |

| FA | 73,298.79 | 73,292.32 | 73,295.34 | 3.9833 | |

| PSO | 73,320.25 | 73,313.41 | 73,316.60 | 4.4631 | |

| HFPSOA | 73,322.34 | 73,319.56 | 73,320.86 | 0.7394 |

| Type | No | G1 | G2 | G3 | G4 | G5 | G6 |

|---|---|---|---|---|---|---|---|

| WNL | K | 0.97 | 1.60 | 0.86 | 1.40 | 0.66 | 2.00 |

| Sv(USD) | 611.9 | 64.8 | 474.0 | −1066.1 | 895.5 | 1011.3 | |

| CNL | k | 1.53 | 1.60 | 1.32 | 1.25 | 1.49 | 1.98 |

| Sv (USD) | 440.53 | 582.4 | 243.6 | −888.4 | 682.7 | 1072 |

| Combinations | T1(USD) | T2(USD) | T3(USD) | T4(USD) | T4(USD) |

|---|---|---|---|---|---|

| Profit without coalition for G1 | 11,389 | 11,389 | 11,389 | 11,389 | 11,389 |

| Profit considering coalition for G1 | 10,238 | 11,956 | 9685 | 11,772 | 14,792 |

| Extra profit for G1 | −1976 | 567 | −1704 | 383 | 3403 |

| Profit without coalition for Gc | 10,083 | 7330 | 3828 | 8843 | 19,567 |

| Profit considering coalition for Gc | 15,861 | 9140 | 2556 | 9335 | 22,565 |

| Extra profit for Gc | 5778 | 1810 | −1272 | 492 | 2998 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, R.; Aziz, S.; Farooq, M.U.; Hasan, K.N.; Mohammed, N.; Ahmad, S.; Ibadah, N. A Wind Energy Supplier Bidding Strategy Using Combined EGA-Inspired HPSOIFA Optimizer and Deep Learning Predictor. Energies 2021, 14, 3059. https://doi.org/10.3390/en14113059

Zhang R, Aziz S, Farooq MU, Hasan KN, Mohammed N, Ahmad S, Ibadah N. A Wind Energy Supplier Bidding Strategy Using Combined EGA-Inspired HPSOIFA Optimizer and Deep Learning Predictor. Energies. 2021; 14(11):3059. https://doi.org/10.3390/en14113059

Chicago/Turabian StyleZhang, Rongquan, Saddam Aziz, Muhammad Umar Farooq, Kazi Nazmul Hasan, Nabil Mohammed, Sadiq Ahmad, and Nisrine Ibadah. 2021. "A Wind Energy Supplier Bidding Strategy Using Combined EGA-Inspired HPSOIFA Optimizer and Deep Learning Predictor" Energies 14, no. 11: 3059. https://doi.org/10.3390/en14113059

APA StyleZhang, R., Aziz, S., Farooq, M. U., Hasan, K. N., Mohammed, N., Ahmad, S., & Ibadah, N. (2021). A Wind Energy Supplier Bidding Strategy Using Combined EGA-Inspired HPSOIFA Optimizer and Deep Learning Predictor. Energies, 14(11), 3059. https://doi.org/10.3390/en14113059