Framework for Deterministic Assessment of Risk-Averse Participation in Local Flexibility Markets † †

Abstract

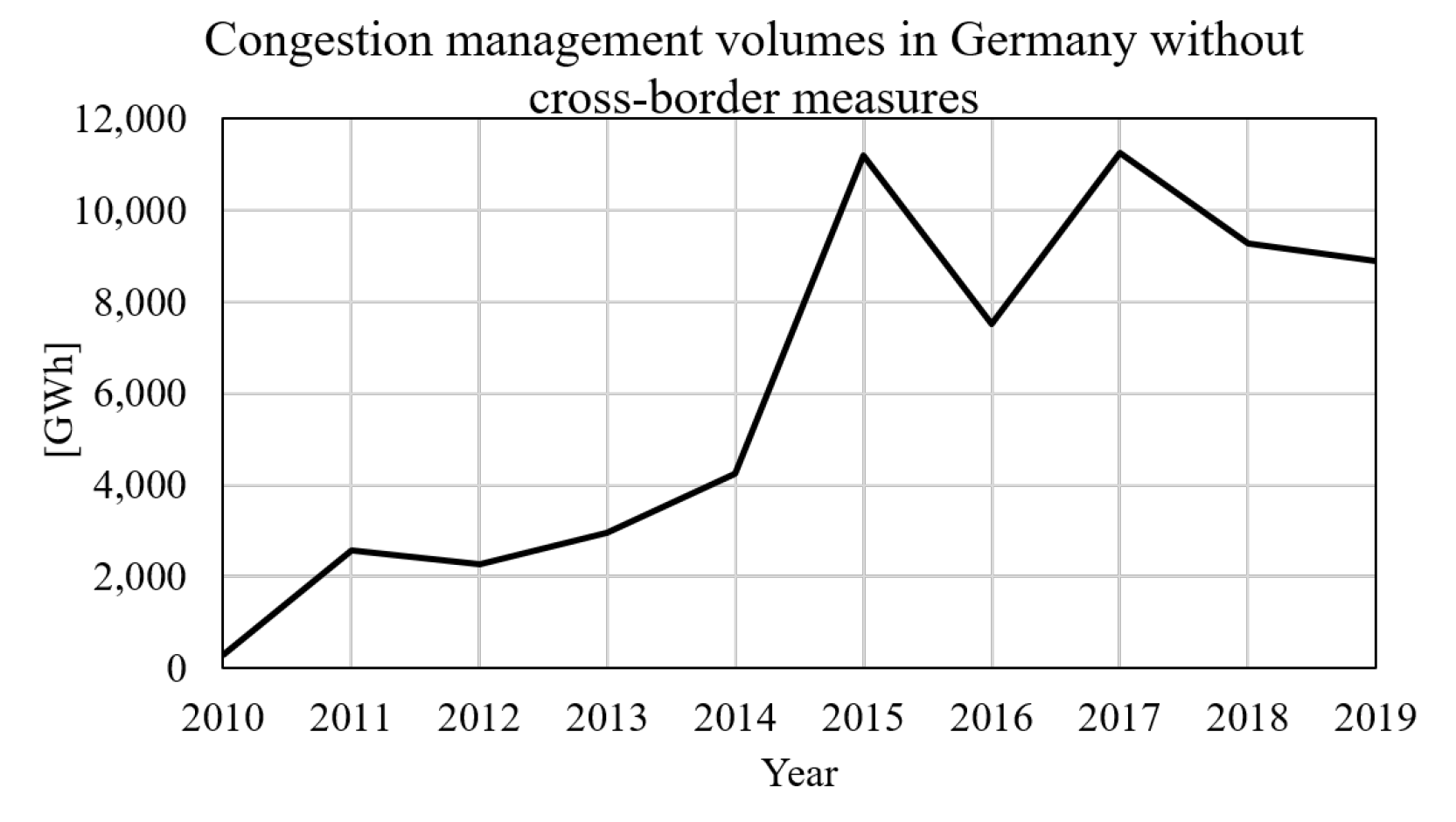

1. Introduction

1.1. LFM Pricing and Inc-Dec-Gaming in LFMs

1.2. Deterministic Assessment of Risk-Averse Behavior by LFM Participants

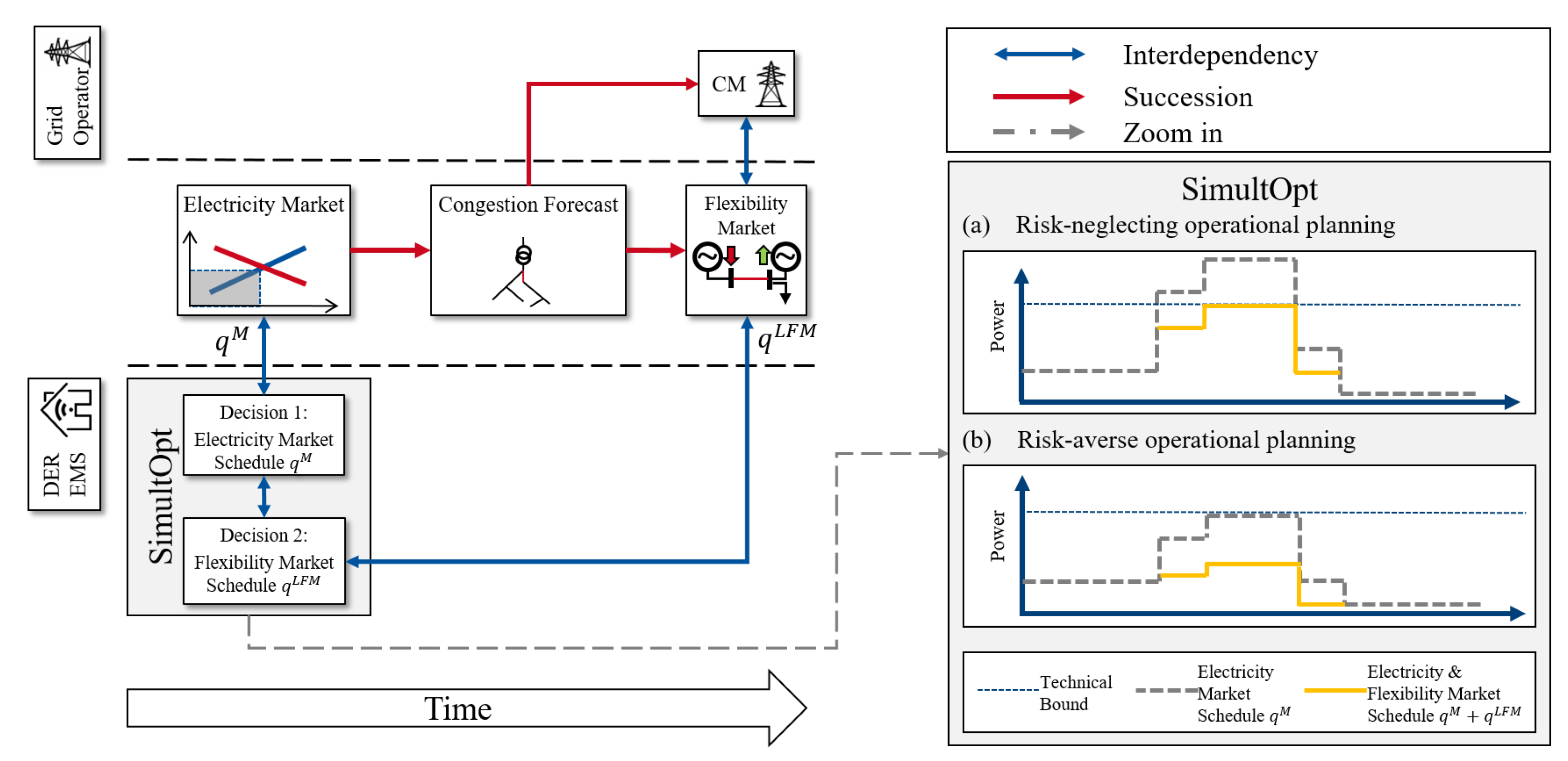

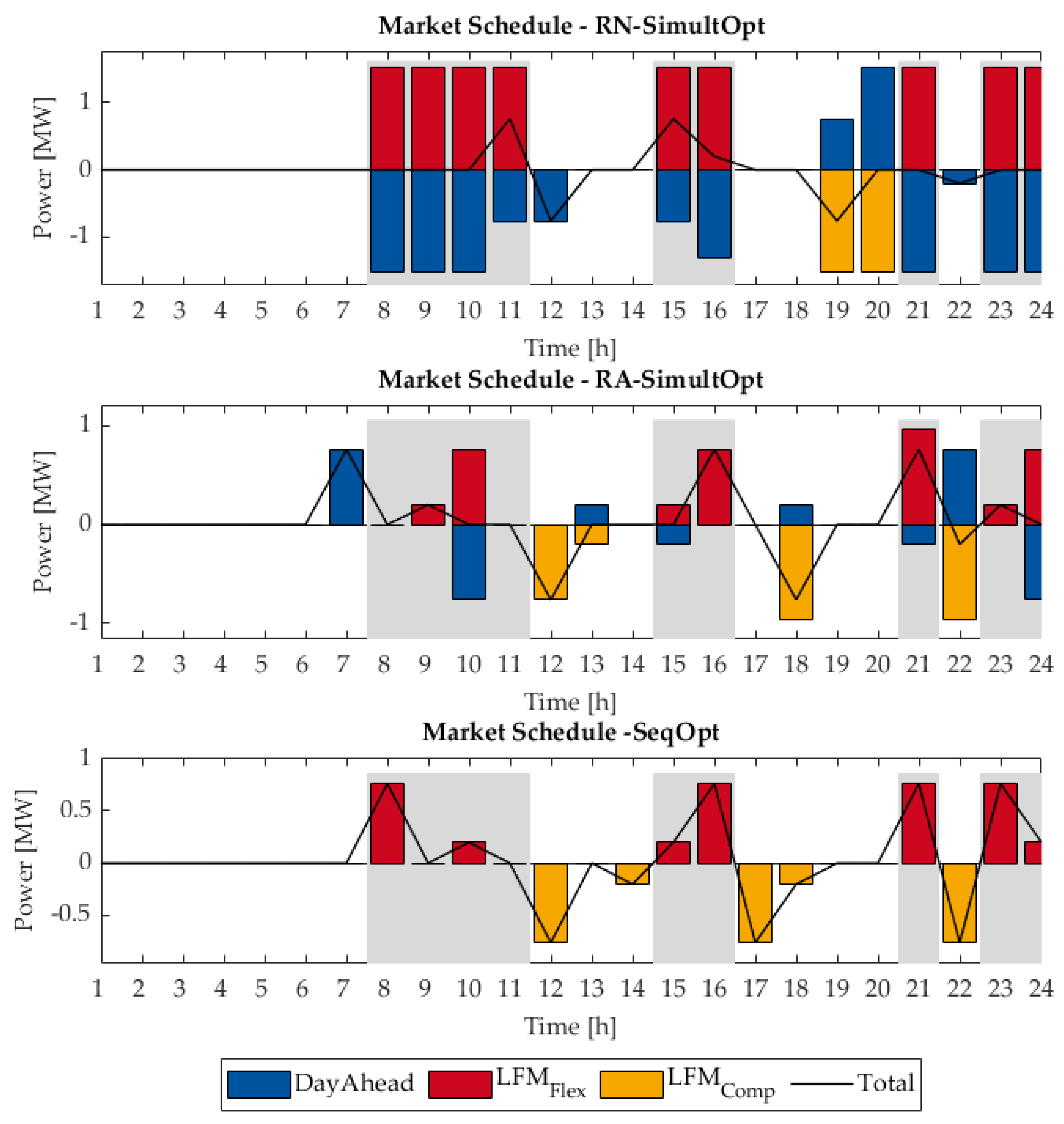

- SeqOpt: Sequential optimization in electricity markets and LFMs (as depicted in Figure 2), i.e., no anticipation of LFMs when determining electricity market schedules.

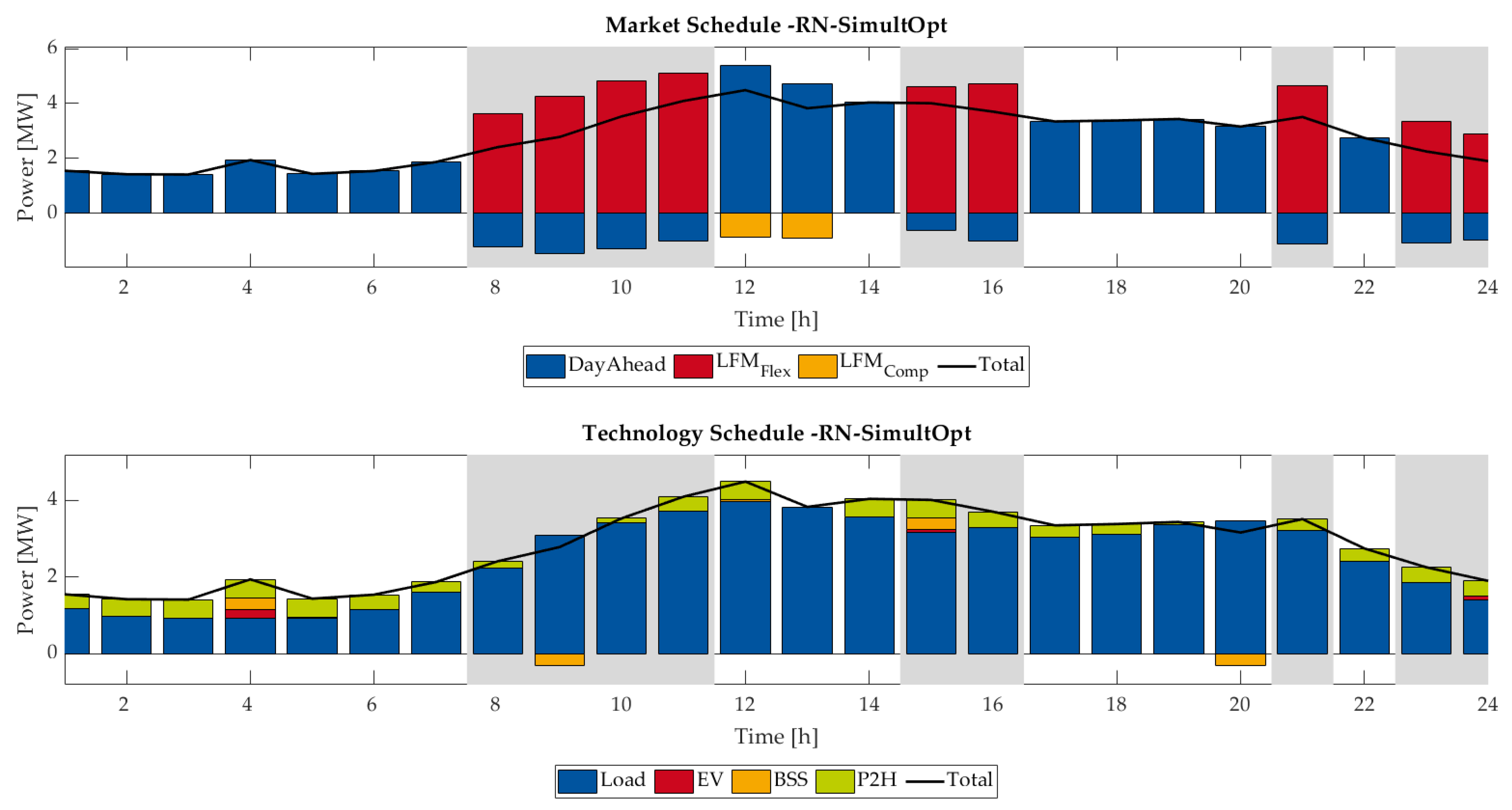

- RN-SimultOpt: Risk-neglecting anticipation of LFMs through simultaneous optimization of electricity market and LFM participation (as depicted in Figure 4a), allowing for short-selling of flexibility.

- RA-SimultOpt: Risk-averse anticipation of LFMs through simultaneous optimization of electricity and LFM participation with additional constraints for technical feasibility of the electricity market schedules (as depicted in Figure 4b), without short-selling of flexibility.

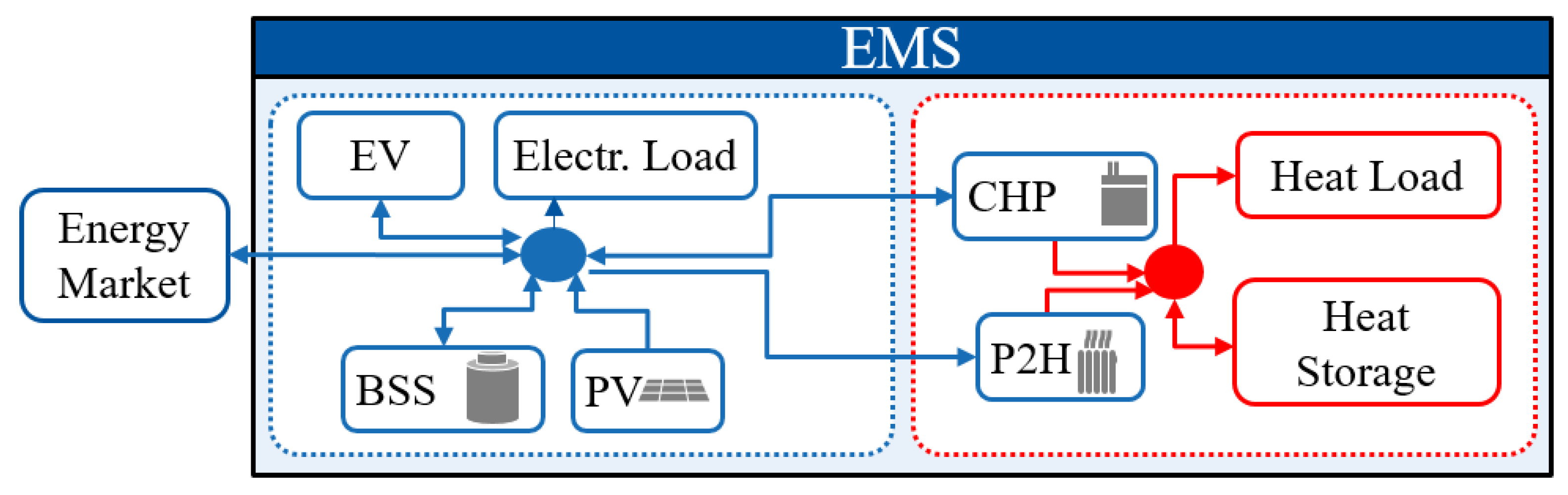

2. Energy Management System Model

2.1. PV and Wind Power Plant Technology Models

2.2. BSS Model

2.3. P2H and Combined-Heat-and-Power Technology Model

2.4. EV Model

2.5. Electrical Load Model

2.6. General EMS Operational Planning

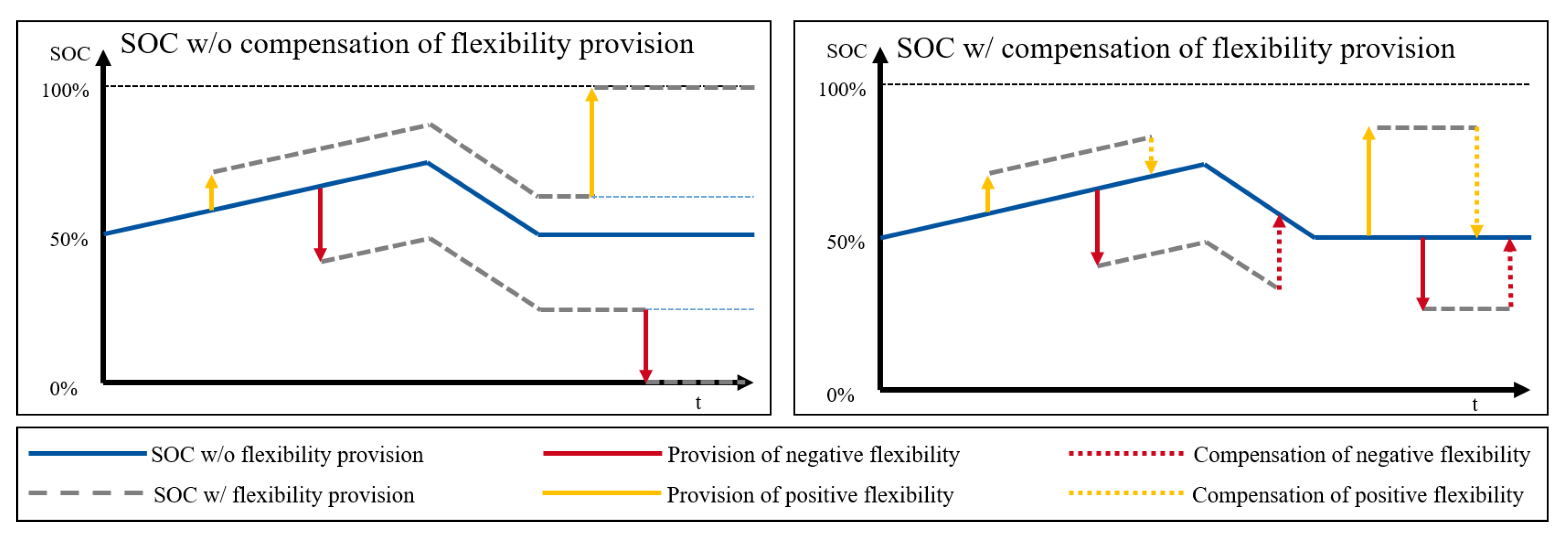

3. LFM Participation Modeling

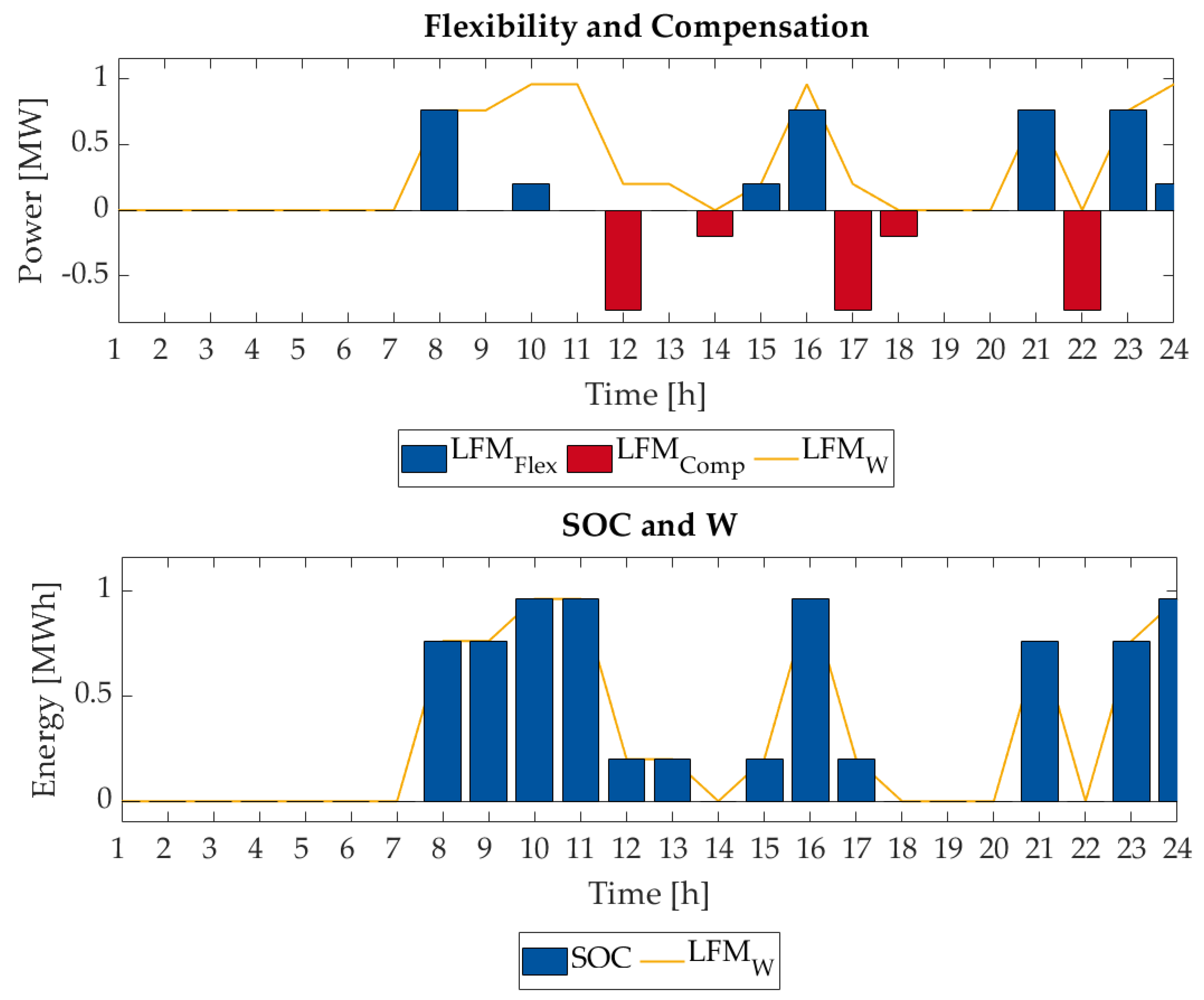

3.1. LFM Operational Planning Variables and Bid Formulation

- Positive, non-storage-based flexibility:

- Positive, storage-based bids:

- Negative, non-storage-based flexibility:

- Negative, storage-based bids:

- Positive, non-time-coupled flexibility bids :

- Negative, non-time-coupled flexibility bids :

- Positive, time-coupled flexibility bids :

- Negative, time-coupled flexibility bids :

3.2. EMS LFM Operational Planning

3.3. Risk-Averse Operational Planning for LFMs

- : no LFM consideration

- : only positive LFM participation

- : only negative LFM participation

- : both positive and negative LFM participation

4. LFM Clearing Formulation

5. Integrated Modeling Framework of Operational Planning and LFM Operation

- the benchmark case without LFMs;

- sequential decision making in electricity and LFMs (SeqOpt );

- anticipation of the LFM with negligence of LFM risks of non-activation (Risk-neglecting RN-SimultOpt );

- anticipation of the LFMs with risk-averse operational planning (Risk-averse RA-SimultOpt )

6. Case Study

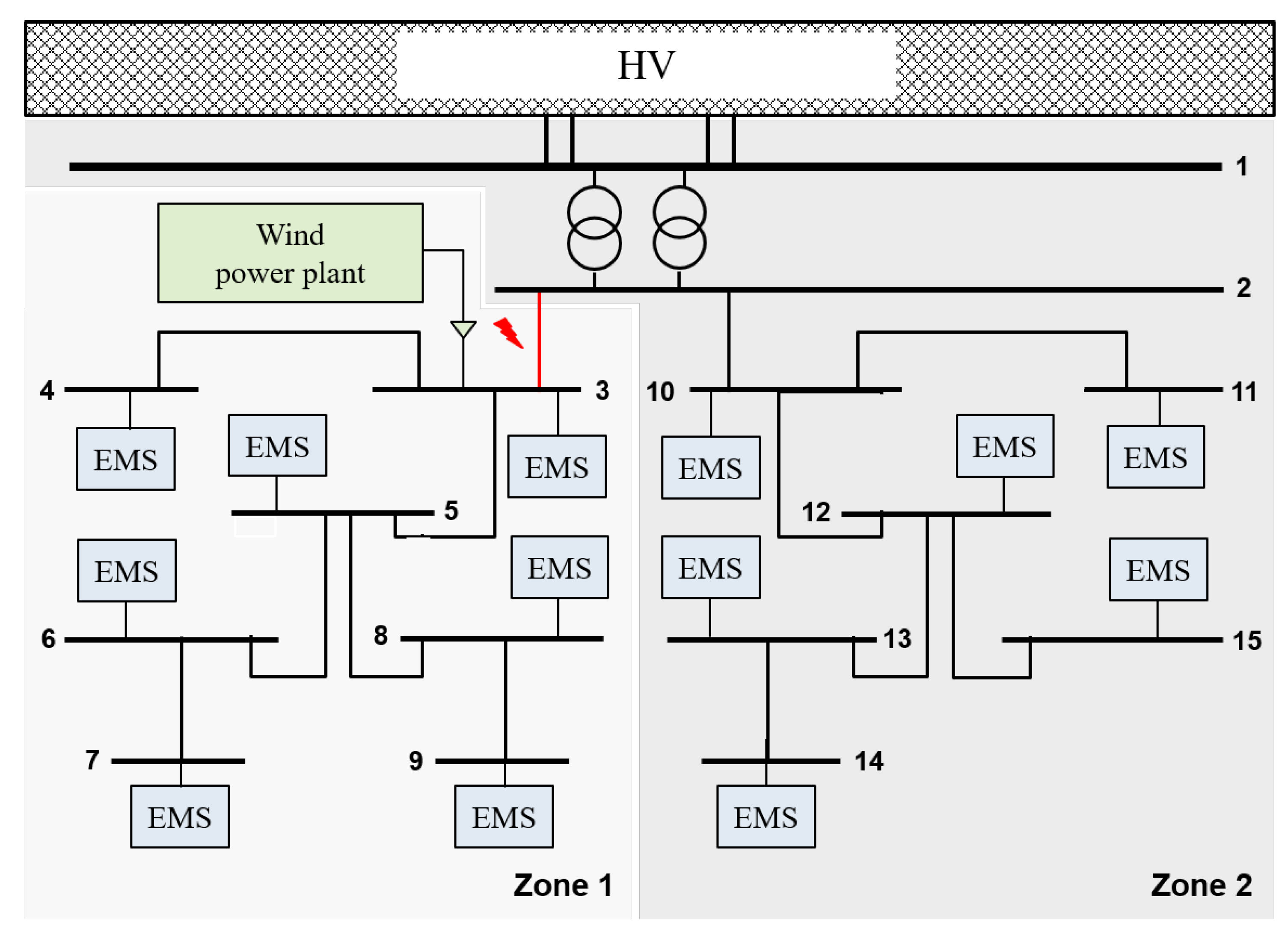

6.1. 2-Node Demonstration System

6.2. 15-Node System

7. Conclusions and Outlook

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| BSS | Battery Storage System |

| CHP | Combined-Heat-and-Power plant |

| CM | Congestion Management |

| DER | Distributed Energy Resource |

| DSO | Distribution System Operator |

| EMS | Energy Management System |

| EV | Electric Vehicle |

| GWh | Gigawatt hours |

| LFM | Local Flexibility Market |

| P2H | Power-To-Heat |

| PV | PhotoVoltaic power plant |

| SO | System Operator |

| SOC | State of Charge |

| TSO | Transmission System Operator |

| WPP | Wind Power Plant |

| Indices and Sets: | |

| t | index of time period |

| index and set of DER asset | |

| set of non-storage-based DER assets | |

| set of storage-based DER assets | |

| set of PV plants | |

| set of WPPs | |

| set of BSSs | |

| set of CHPs | |

| set of P2H systems | |

| set of EV (pools) | |

| index and set of EV cars | |

| set of electrical demands | |

| N | index of non-storage-based variables |

| S | index of storage-based variables |

| index of limit scenarios of LFM bid activation | |

| index and set of EMS | |

| index and set of grid nodes | |

| index and set of grid lines | |

| index and set of LFM bids | |

| set of LFM bids at node n | |

| index and set of flexibility for cost-based CM | |

| set of cost-based flexibility at node n | |

| Parameters and Constants: | |

| maximum generation of PV or WPP i in t | |

| charging efficiency of DER i | |

| discharging efficiency of DER i | |

| maximum charging capacity of DER i | |

| maximum discharging capacity of DER i | |

| minimum SOC of DER i | |

| minimum SOC of DER i | |

| coupling factor of electricity and heat of base (b) and peak (p) heat technologies | |

| heat demand of DER i in t | |

| maximum electrical input/output of base (b) | |

| and peak (p) heat technologies of DER i | |

| fuel cost of base and peak heat technologies | |

| binary parameter indicating if car c is at charging station in t | |

| arrival energy of car c in t | |

| departure energy of car c in t | |

| electrical demand of load i in t | |

| electricity market purchase price in t | |

| electricity market sale price in t | |

| LFM price at node n in t | |

| maximum flexibility offered by EMS in LFM | |

| maximum compensation offered by EMS in LFM | |

| maximum of accounting variable as part of LFM bid | |

| feasible space of LFM bid | |

| activation cost function of LFM bid | |

| LFM participation problem formulation | |

| fixed electricity market schedule | |

| thermal limit of line l | |

| power flow forecast on line l in t based on electricity market schedules | |

| power transfer distribution factor for generation at node n on line l | |

| dual variable of CM balance constraint in t | |

| dual variable of CM line constraint l in t | |

| electricity market schedule of cost-based flexibility p in t | |

| maximum generation of cost-based flexibility p | |

| cost of positive and negative activation of cost-based flexibility p | |

| Variables: | |

| generic load of DER i in t | |

| generic generation of DER i in t | |

| generation cost of DER i in t | |

| charging of DER (BSS or EV) i in t | |

| discharging of DER (BSS or EV) i in t | |

| SOC of DER i in t | |

| base and peak demand/supply of heat DER i | |

| exhaust heat of DER i | |

| electricity market sale variable of EMS in t | |

| electricity market purchase variable of EMS in t | |

| self-supply (between DERs) of EMS in t | |

| positive and negative flexibility offer operational planning variable of EMS in t | |

| positive and negative compensation offer | |

| operational planning variable of EMS in t | |

| positive and negative accounting variable of EMS in t | |

| auxiliary variable to increase inc-dec-potential | |

| of non-storage technologies in t | |

| positive activation of cost-based flexibility p in t for CM | |

| negative activation of cost-based flexibility p in t for CM | |

| flexibility activation of LFM bid f in t | |

| compensation activation of LFM bid f in t | |

| activation of auxiliary variable of LFM bid f in t within CM/ LFM clearing |

Appendix A. Bid Structure

Appendix B. Installed Capacities for the 15 Node Case

| Node ID | Load | PV | WPP | BSS , | EV | CHP | P2H |

|---|---|---|---|---|---|---|---|

| 3 | 3.96 | 0 | 15 | 0.3, 0.33 | 0.43 | 0 | 0.48 |

| 4 | 0.52 | 0 | 0 | 0, 0 | 0.39 | 0 | 0.5 |

| 5 | 1.58 | 0 | 0 | 0, 0 | 0.42 | 0.31 | 0.2 |

| 6 | 1.73 | 0.3 | 0 | 0, 0 | 0.12 | 0 | 0.08 |

| 7 | 0.43 | 0 | 0 | 0, 0 | 0.4 | 0 | 0.05 |

| 8 | 0.69 | 0 | 0 | 0, 0 | 0.39 | 0 | 0.09 |

| 9 | 0.14 | 0.1 | 0 | 0.1, 0.11 | 0.41 | 0 | 0.01 |

| 10 | 0.54 | 0 | 0 | 0, 0 | 0.37 | 0 | 0.06 |

| 11 | 0 | 6 | 0 | 0, 0 | 0 | 0 | 0 |

| 12 | 1.04 | 0 | 0 | 0, 0 | 0.43 | 0.21 | 0.12 |

| 13 | 0.89 | 0 | 0 | 0, 0 | 0.17 | 0 | 0.1 |

| 14 | 0.29 | 0 | 0 | 0, 0 | 0.41 | 0 | 0.03 |

| 15 | 0.34 | 0 | 0 | 0, 0 | 0.4 | 0 | 0.06 |

References

- Consentec. Quantitative Analysen zu Beschaffungskonzepten für Redispatch. In Sammlung Verschiedener Berichte und Kurzpapiere aus dem Vorhaben “Untersuchung zur Beschaffung von Redispatch” (Projekt 055/17) im Auftrag des Bundesministeriums für Wirtschaft und Energie. 2019. Available online: https://www.bmwi.de/Redaktion/DE/Publikationen/Studien/untersuchung-zur-beschaffung-von-redispatch.pdf (accessed on 20 May 2021).

- BDEW, “Redispatch in Deutschland: Auswertung der Transparenzdaten April 2013 bis Einschließlich September 2020”, Berlin. November 2020. Available online: https://www.bdew.de/media/documents/2020_Q3_Bericht_Redispatch_GOQPsvY.pdf (accessed on 25 February 2021).

- Nodes, E-Bridge, Pöyry, “Marktbasiertes Engpassmanagement als Notwendige Ergänzung zum Regulierten Redispatch in Deutschland”. 2019. Available online: https://www.e-bridge.de/wp-content/uploads/2019/09/20190904_NODES_Marktbasierter_RD_DEUTSCH_v10_sent.pdf (accessed on 30 March 2021).

- Ramos, A.; De Jonghe, C.; Gómez, V.; Belmans, R. Realizing the smart grid’s potential: Defining local markets for flexibility. Util. Policy 2016, 40, 26–35. [Google Scholar] [CrossRef]

- European Commission. Clean Energy Package: Ensure Wholesale-Retail Integration; Electricity Directive Article; European Commission: Luxembourg, 2019; p. 32. [Google Scholar]

- Jin, X.; Wu, Q.; Jia, H. Local flexibility markets: Literature review on concepts, models and clearing methods. Appl. Energy 2020, 40, 114387. [Google Scholar] [CrossRef]

- Buchmann, M. How decentralization drives a change of the institutional framework on the distribution grid level in the electricity sector—The case of local congestion markets. Energy Policy 2020, 145, 111725. [Google Scholar] [CrossRef]

- Radecke, J.; Hefele, J.; Hirth, L. Markets for Local Flexibility in Distribution Networks. ZBW-Leibniz Inform. Centre Econ. 2019. Available online: http://hdl.handle.net/10419/204559 (accessed on 20 May 2021).

- Heilmann, E.; Klempp, N.; Wetzel, H. Design of regional flexibility markets for electricity: A product classification framework for and application to German pilot projects. Util. Policy 2020, 67, 101133. [Google Scholar] [CrossRef]

- Dronne, T.; Roques, F.; Saguan, M. Local Flexibility Markets for Distribution Network Congestion-Management: Which Design for Which Needs? Chaire European Electricity Markets/Working Paper #47. December 2020. Available online: http://www.ceem-dauphine.org/working/en/LOCAL-FLEXIBILITY-MARKETS-FOR-DISTRIBUTION-NETWORK-CONGESTION-MANAGEMENT-WHICH-DESIGN-FOR-WHICH-NEEDS (accessed on 20 May 2021).

- Anaya, K.L.; Pollitt, M.G. Milestone 1: A Review of International Experience in the use of Smart Electricity Platformes for the Procurement of Flexibility Services (Part 1). Merlin Project Report. 2020. Available online: https://project-merlin.co.uk/wp-content/uploads/2020/05/SSEN_Cambridge_V5b_pages.pdf (accessed on 20 May 2021).

- Schittekatte, T.; Meeus, L. Flexibility markets: Q&A with project pioneers. Util. Policy 2020, 63, 101017. [Google Scholar] [CrossRef]

- ENERA Consortium. Using Enera’s Experience to Complement the Upcoming Redispatch Regime with Flexibility from Load & Other Non-Regulated Assets. 2020. Available online: https://projekt-enera.de/wp-content/uploads/enera-Improving-redispatch-thanks-to-flexibility-platform-experience.pdf (accessed on 20 May 2021).

- Correa-Florez, C.A.; Michiorri, A.; Kariniotakis, G. Optimal Participation of Residential Aggregators in Energy and Local Flexibility Markets. IEEE Trans. Smart Grid 2020, 11, 1644–1656. [Google Scholar] [CrossRef]

- Esmat, A.; Usaola, J.; Moreno, M.A. Distribution-level flexibility market for congestion management. Energies 2018, 11, 1056. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Lloret-Gallego, P.; Munné-Collado, Í.; Villafafila-Robles, R.; Sumper, A.; Ottessen, S.Ø.; Rajasekharan, J.; Bremdal, B.A. Local Flexibility Market Design for Aggregators Providing Multiple Flexibility Services at Distribution Network Level. Energies 2018, 11, 822. [Google Scholar] [CrossRef]

- Torbaghan, S.S.; Blaauwbroek, N.; Kuiken, D.; Gibescu, M.; Hajighasemi, M.; Nguyen, P.; Smit, G.J. M; Roggenkamp, M.; Hurink, J. A market-based framework for demand side flexibility scheduling and dispatching. Sustain. Energy Grids Netw. 2018, 14, 47–61. [Google Scholar] [CrossRef]

- Zhang, C.; Ding, Y.; Nordentoft, N.C.; Pinson, P.; Østergaard, J. FLECH: A Danish market solution for DSO congestion management through DER flexibility services. J. Mod. Power Syst. Clean Energy 2014, 2, 126–133. [Google Scholar] [CrossRef]

- Kulms, T.; Meinerzhagen, A.; Koopmann, S.; Schnettler, A. Development of an agent-based model for assessing the market and grid oriented operation of distributed energy resources. Energy Procedia 2017, 135, 294–303. [Google Scholar] [CrossRef]

- Coninx, K.; Deconinck, G.; Holvoet, T. Who gets my flex? An evolutionary game theory analysis of flexibility market dynamics. Appl. Energy 2018, 218, 104–113. [Google Scholar] [CrossRef]

- Li, R.; Wu, Q.; Oren, S.S. Distribution locational marginal pricing for optimal electric vehicle charging management. IEEE Trans. Power Syst. 2013, 29, 203–211. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Bullich-Massagué, E.; Aragüés-Peñalba, M.; Sumper, A.; Ottesen, S.Ø.; Vidal-Clos, J.A.; Villafáfila-Robles, R. Optimization problem for meeting distribution system operator requests in local flexibility markets with distributed energy resources. Appl. Energy 2018, 210, 881–895. [Google Scholar] [CrossRef]

- Brunekreeft, G.; Buchmann, M.; Höckner, J.; Palovic, M.; Voswinkel, S.; Weber, C. Thesenpapier: Ökonomische und regulatorische Fragestellungen zum enera-FlexMarkt. In EWL Working Papers; University of Duisburg-Essen, Chair for Management Science and Energy Economics: Essen, Germany; Bremen, Germany, 2020. [Google Scholar]

- Meißner, A.C.; Dreher, A.; Knorr, K.; Vogt, M.; Zarif, H.; Jürgens, L.; Grasenack, M. A co-simulation of flexibility market based congestion management in Northern Germany. In Proceedings of the 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019. [Google Scholar]

- Schmitt, C.; Sous, T.; Blank, A.; Gaumnitz, F.; Moser, A. A Linear Programing Formulation of Time-Coupled Flexibility Market Bids by Storage Systems. In Proceedings of the 2020 55th International Universities Power Engineering Conference (UPEC), Torino, Italy, 1–4 September 2020; pp. 1–6. [Google Scholar] [CrossRef]

- Schweppe, F.C.; Caramanis, M.C.; Tabors, R.D.; Bohn, R.E. Spot Pricing of Electricity; Springer Science & Business Media: Boston, MA, USA, 1988. [Google Scholar]

- Franco, J.F.; Rider, M.J.; Lavorato, M.; Romero, R. A mixed-integer LP model for the reconfiguration of radial electric distribution systems considering distributed generation. Electr. Power Syst. Res. 2013, 97, 51–60. [Google Scholar] [CrossRef]

- Franken, M.S.; Barrios, H.; Schrief, A.B.; Moser, A. Transmission expansion planning via power flow controlling technologies. IET Gener. Transm. Distrib. 2020, 14, 3530–3538. [Google Scholar] [CrossRef]

- Linnemann, C.; Echternacht, D.; Breuer, C.; Moser, A. Modeling optimal redispatch for the european transmission grid. In Proceedings of the 2011 IEEE Trondheim PowerTech, Trondheim, Norway, 19–23 June 2011. [Google Scholar]

- Schermeyer, H.; Vergara, C.; Fichtner, W. Renewable energy curtailment: A case study on today’s and tomorrow’s congestion management. Energy Policy 2018, 112, 427–436. [Google Scholar] [CrossRef]

- Hirth, L.; Schlecht, I. Redispatch Markets in Zonal Electricity Markets: Inc-Dec Gaming as a Consequence of Inconsistent Power Market Design (Not Market Power). 2019. Available online: http://hdl.handle.net/10419/194292 (accessed on 20 May 2021).

- Cramton, P. Local Flexibility Market. University of Cologne and University of Maryland Working Paper. 2019. Available online: www.cramton.umd.edu/papers2015-2019/cramton-local-flexibility-market.pdf (accessed on 20 May 2021).

- Hogan, W. Restructuring the Electricity Market: Institutions for Network Systems; Harvard University: Cambridge, MA, USA, 1999. [Google Scholar]

- Brunekreeft, G.; Pechan, A.; Palovic, M.; Meyer, R.; Brandstätt, C.; Buchmann, M. Kurzgutachten zum Thema ‘Risiken Durch Strategisches Verhalten von Lasten auf Flexibilitäts- und anderen Energiemärkten’; Report; Deutsche Energie-Agentur (dena): Bremen, Germany, 2020. [Google Scholar]

- Nodes AS; DNV-GL. Market-Based Redispatch—Why It Works! 2020. Available online: https://nodesmarket.com/publications/ (accessed on 20 May 2021).

- ENKO consortium. Scheinflexibilität–Eine beherrschbare Herausforderung für ENKO. Whitepaper. 2020. Available online: https://www.enko.energy/wp-content/uploads/ENKO-White-Paper-Scheinflexibilität.pdf (accessed on 20 May 2021).

- Kulms, T.; Meinerzhagen, A.; Koopmann, S.; Schnettler, A. A simulation framework for assessing the market and grid driven value of flexibility options in distribution grids. J. Energy Storage 2018, 17, 203–212. [Google Scholar] [CrossRef]

- Geschermann, K.; Moser, A. Evaluation of market-based flexibility provision for congestion management in distribution grids. In Proceedings of the 2017 IEEE Power & Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017. [Google Scholar]

- Thie, T.; Vasconcelos, M.; Schnettler, A.; Kloibhofer, L. Influence of European Market Frameworks on Market Participation and Risk Management of Virtual Power Plants. In Proceedings of the 2018 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; pp. 1–5. [Google Scholar] [CrossRef]

- Thie, N. Risikomanagement in der Direktvermarktung erneuerbarer Energien. Ph.D. Thesis, RWTH Aachen University, Aachen, Germany, 2020. [Google Scholar] [CrossRef]

- Vertgewall, C.M.; Trageser, M.; Kurth, M. Modeling of Location and Time Dependent Charging Profiles of Electric Vehicles Based on Historic User Behavior. Unpublished work, 2021. [Google Scholar]

- Gils, H.C. Economic potential for future demand response in Germany—Modelling approach and case study. Appl. Energy 2016, 162, 401–415. [Google Scholar] [CrossRef]

- Carrion, M.; Arroyo, J.M. A computationally efficient mixed-integer linear formulation for the thermal unit commitment problem. IEEE Trans. Power Syst. 2006, 21, 1371–1378. [Google Scholar] [CrossRef]

- Ventosa, M.; Baıllo, A.; Ramos, A.; Rivier, M. Electricity market modeling trends. Energy Policy 2005, 33, 897–913. [Google Scholar] [CrossRef]

- NEMO Committee. EUPHEMIA Public Description—Single Price Coupling Algortithm. 2019. Available online: http://www.nemo-committee.eu/assets/files/190410_Euphemia%20Public%20Description%20version%20NEMO%20Committee.pdf (accessed on 20 May 2021).

- Meinecke, S.; Sarajlić, D.; Drauz, S.R.; Klettke, A.; Lauven, L.-P.; Rehtanz, C.; Moser, A.; Braun, M. SimBench—A Benchmark Dataset of Electric Power Systems to Compare Innovative Solutions Based on Power Flow Analysis. Energies 2020, 13, 3290. [Google Scholar] [CrossRef]

- Bundesnetzagentur für Elektrizität, Gas, Telekommunikation, Post und Eisenbahnen (BNetzA). Genehmigung des Szenariorahmens 2019–2030. 2018. Available online: https://www.netzentwicklungsplan.de/sites/default/files/paragraphs-files/Szenariorahmen_2019-2030_Genehmigung_0_0.pdf (accessed on 30 March 2021).

- Müller, C.; Hoffrichter, A.; Wyrwoll, L.; Schmitt, C.; Trageser, M.; Kulms, T.; Beulertz, D.; Metzger, M.; Duckheim, M.; Huber, M.; et al. Modeling framework for planning and operation of multi-modal energy systems in the case of Germany. Appl. Energy 2019, 250, 1132–1146. [Google Scholar] [CrossRef]

| CM Case | Status Quo | Benchmark (all Flexibility at Marginal Cost) | SeqOpt | RA-SimultOpt | RN-SimultOpt |

|---|---|---|---|---|---|

| CM costs [EUR] | 878.96 | 37.06 | 813.69 | 870.71 | 1460.8 |

| Total Overload [MWh] | 12.55 | 12.55 | 12.55 | 19.71 | 99.27 |

| Curtailment volume [MWh] | 12.55 | 0.11 | 9.06 | 6.70 | 11.78 |

| Offered Flexibility [MWh] (% activation) | - | - | 3.49 (100%) | 13.4 (95%) | 87.49 (100%) |

| Offered Compensation [MWh] (% activation) | - | - | 0.93 (100%) | 7.76 (92%) | 6.74 (100%) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schmitt, C.; Gaumnitz, F.; Blank, A.; Rebenaque, O.; Dronne, T.; Martin, A.; Vassilopoulos, P.; Moser, A.; Roques, F. Framework for Deterministic Assessment of Risk-Averse Participation in Local Flexibility Markets †. Energies 2021, 14, 3012. https://doi.org/10.3390/en14113012

Schmitt C, Gaumnitz F, Blank A, Rebenaque O, Dronne T, Martin A, Vassilopoulos P, Moser A, Roques F. Framework for Deterministic Assessment of Risk-Averse Participation in Local Flexibility Markets †. Energies. 2021; 14(11):3012. https://doi.org/10.3390/en14113012

Chicago/Turabian StyleSchmitt, Carlo, Felix Gaumnitz, Andreas Blank, Olivier Rebenaque, Théo Dronne, Arnault Martin, Philippe Vassilopoulos, Albert Moser, and Fabien Roques. 2021. "Framework for Deterministic Assessment of Risk-Averse Participation in Local Flexibility Markets †" Energies 14, no. 11: 3012. https://doi.org/10.3390/en14113012

APA StyleSchmitt, C., Gaumnitz, F., Blank, A., Rebenaque, O., Dronne, T., Martin, A., Vassilopoulos, P., Moser, A., & Roques, F. (2021). Framework for Deterministic Assessment of Risk-Averse Participation in Local Flexibility Markets †. Energies, 14(11), 3012. https://doi.org/10.3390/en14113012