Reducing the Decarbonisation Cost Burden for EU Energy-Intensive Industries

Abstract

1. Introduction

2. European Policy Landscape

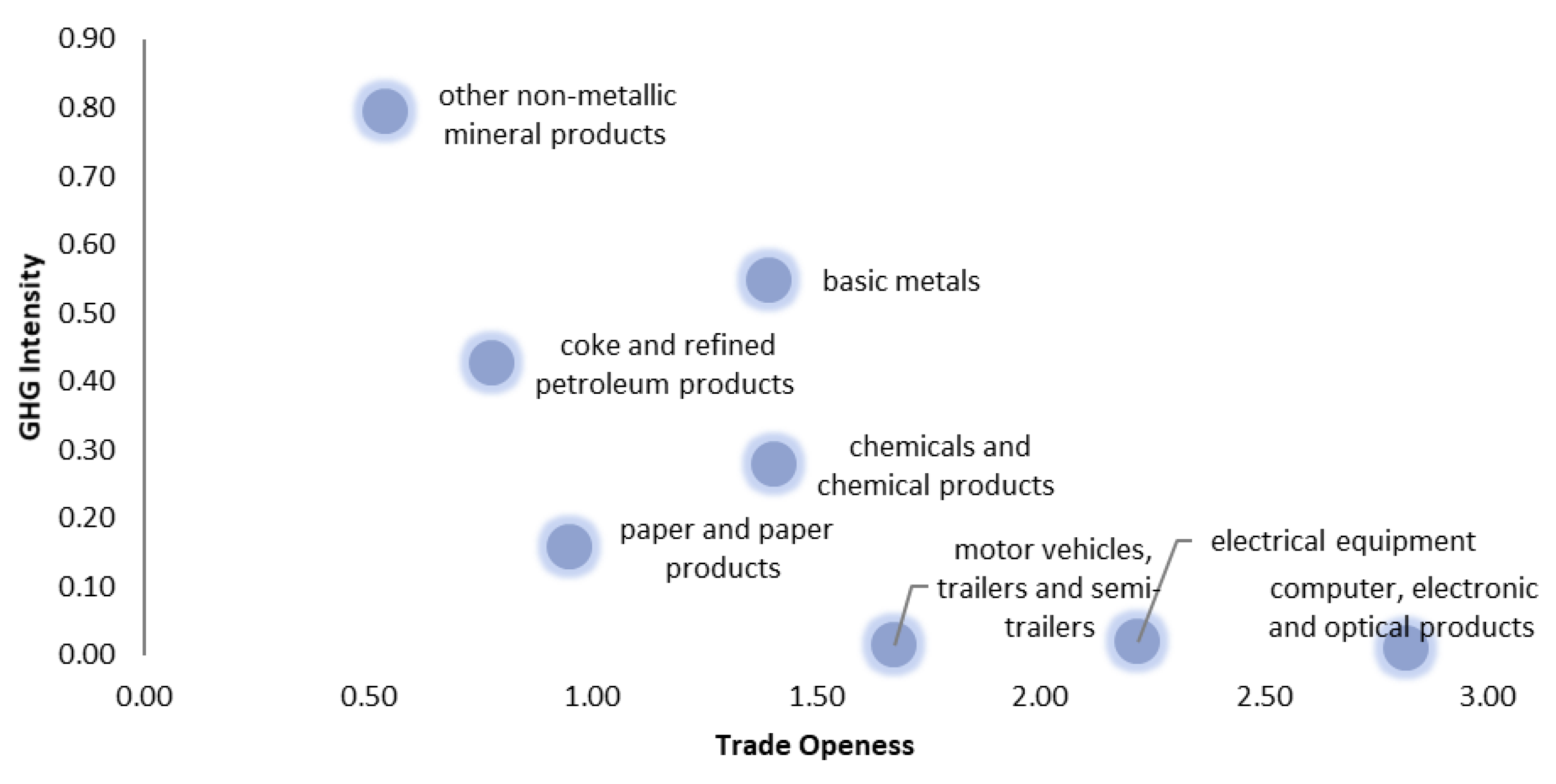

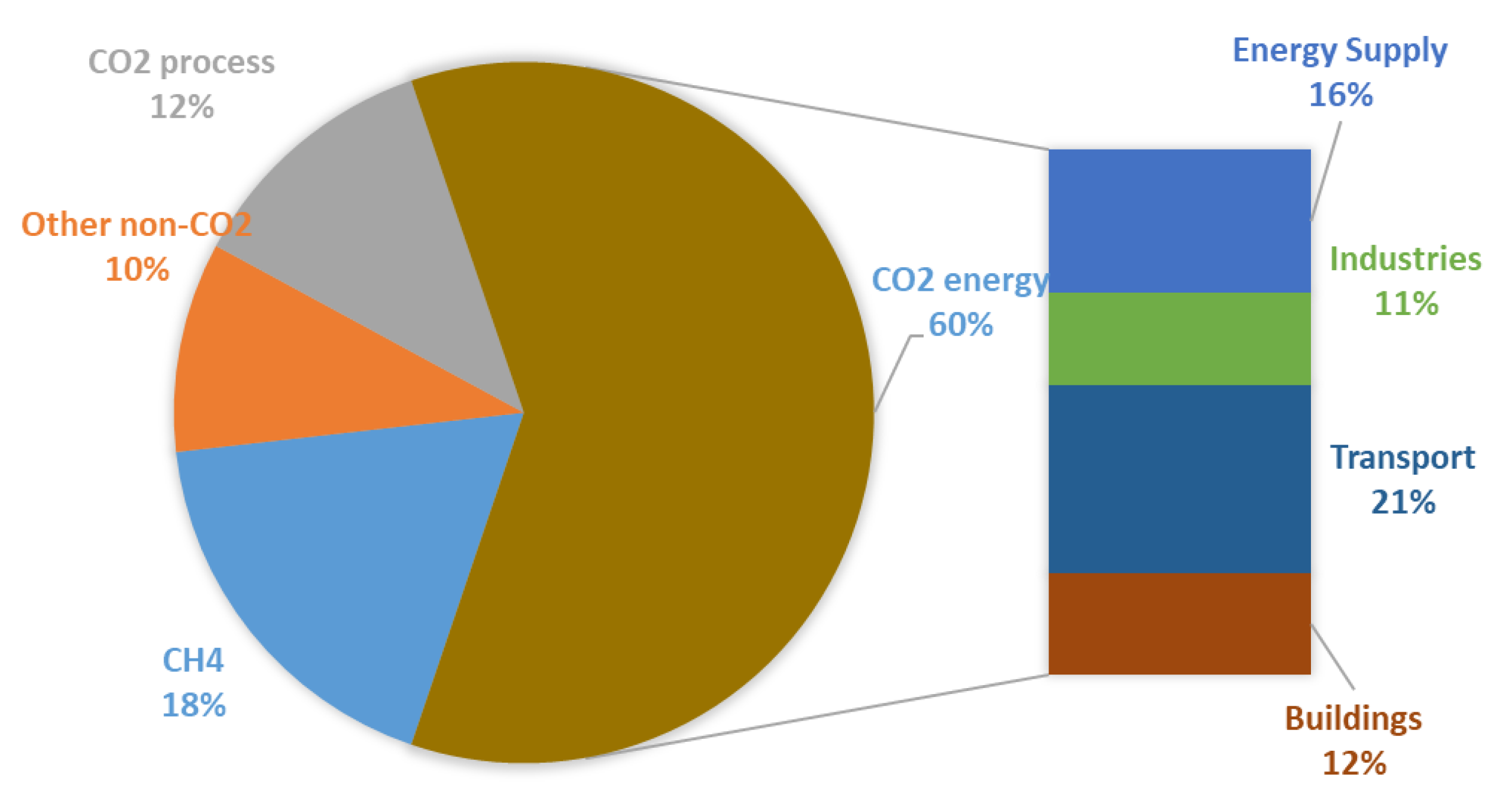

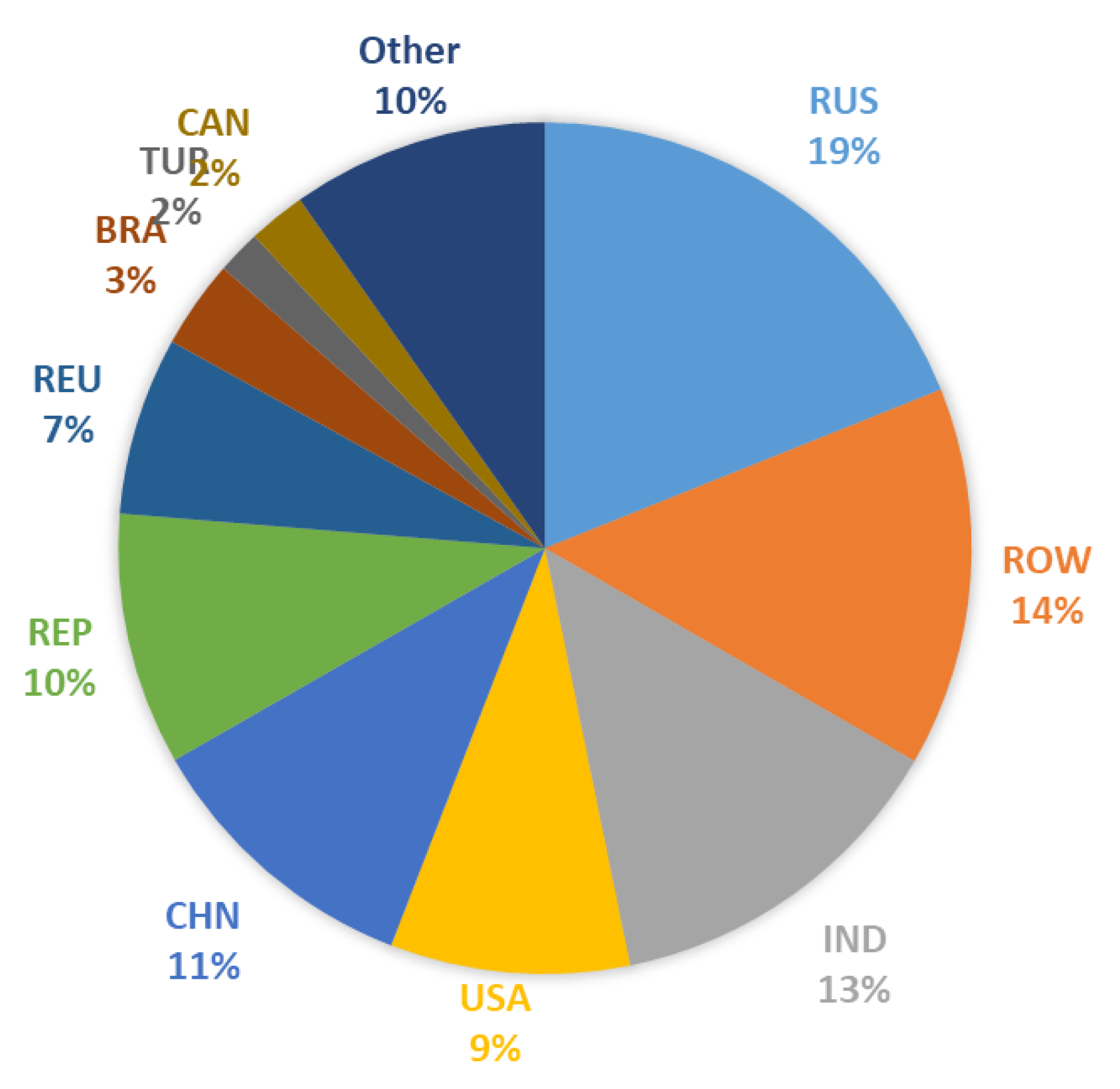

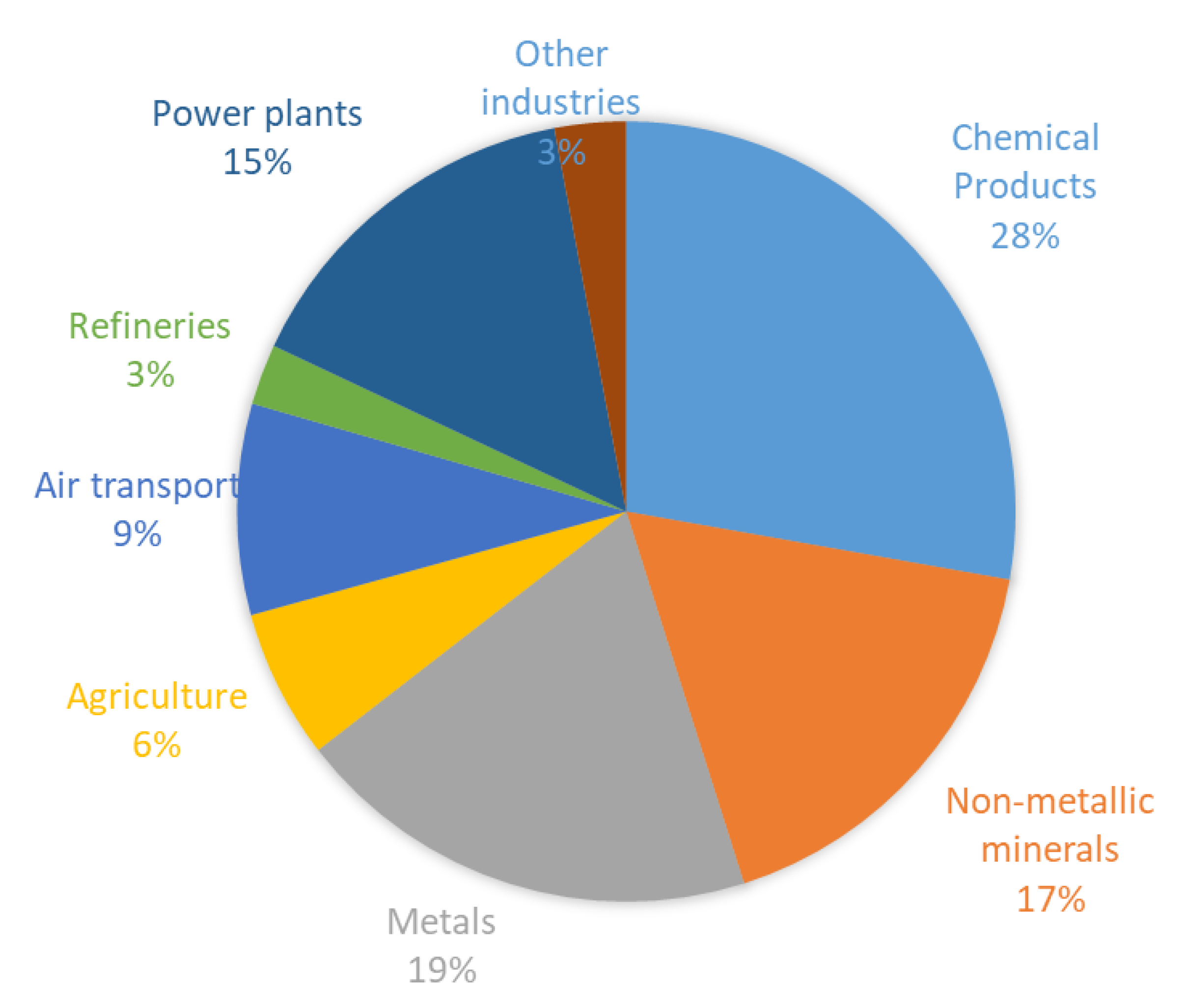

2.1. The European Industrial Context

2.2. European Policies on Carbon Leakage

- ETS pricing would increase its production cost, calculated as a share of gross value added, by at least 5%; and

- its trade intensity with countries outside the EU is above 10%.

- The value of at least one of the above indicators is higher than 30%

2.3. Policy Measures to Protect Domestic Industries

3. Methodology

3.1. The GEM-E3-FIT Modelling Framework

3.2. Study and Scenario Design

4. Scenario Results

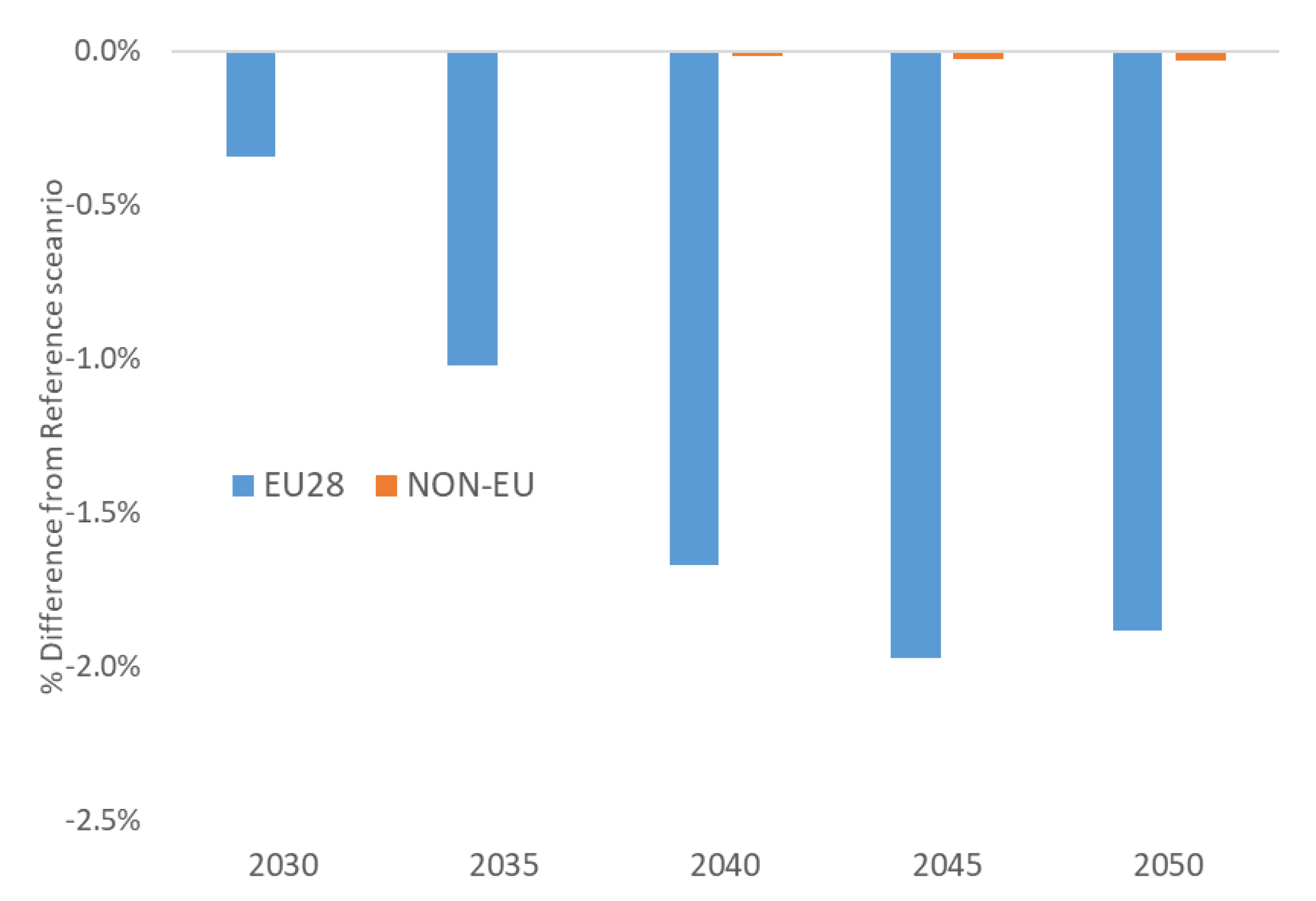

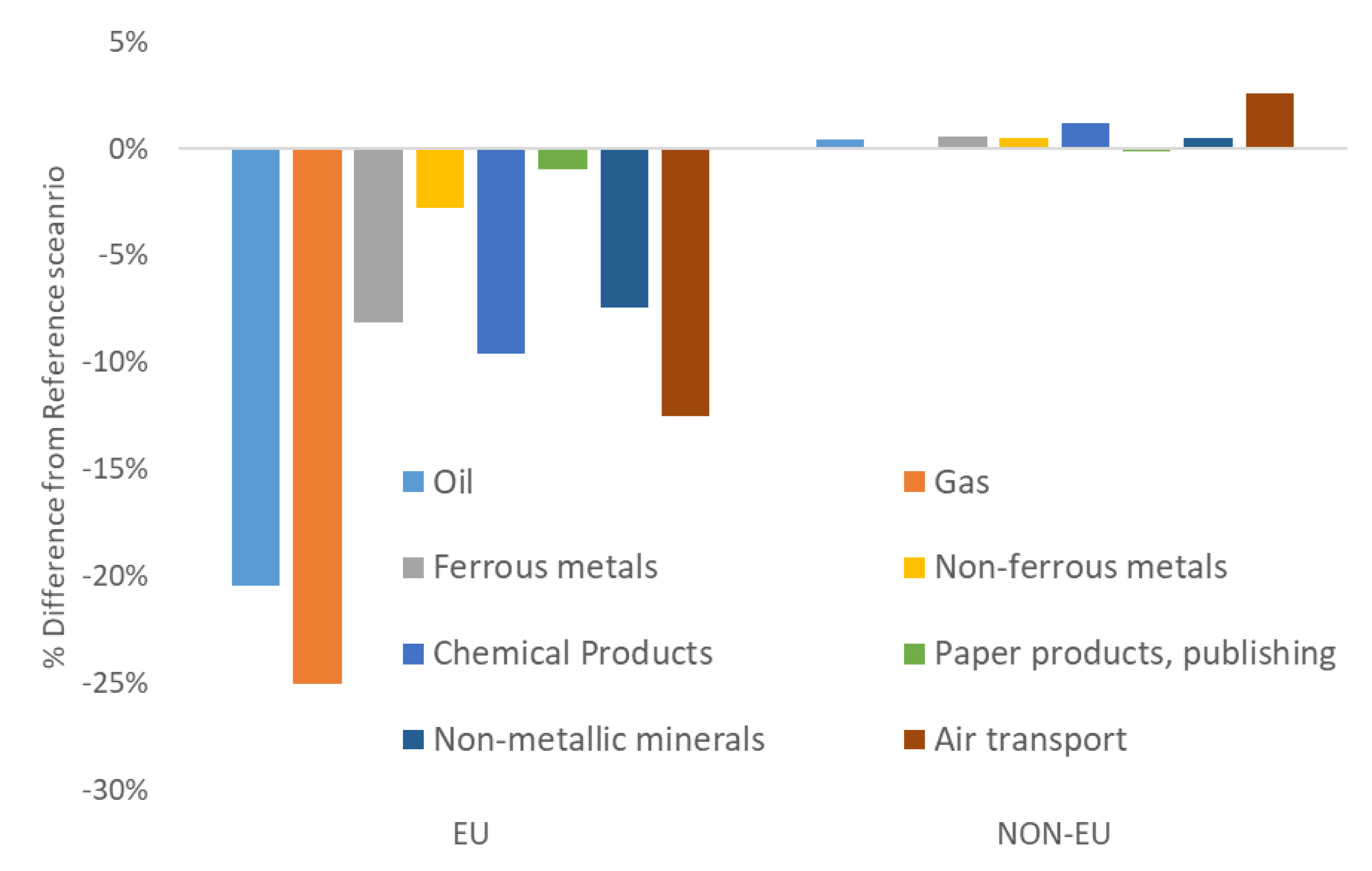

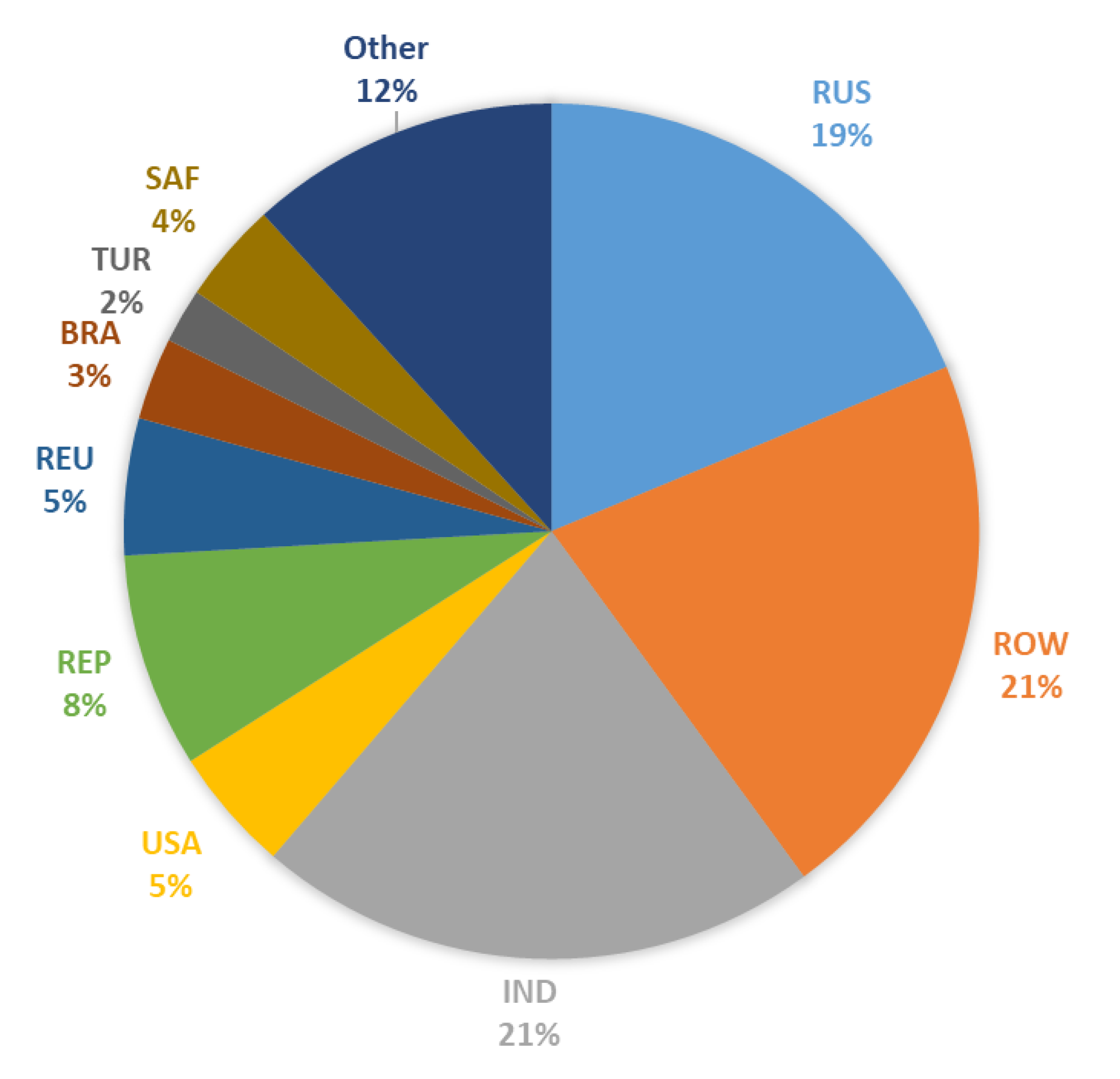

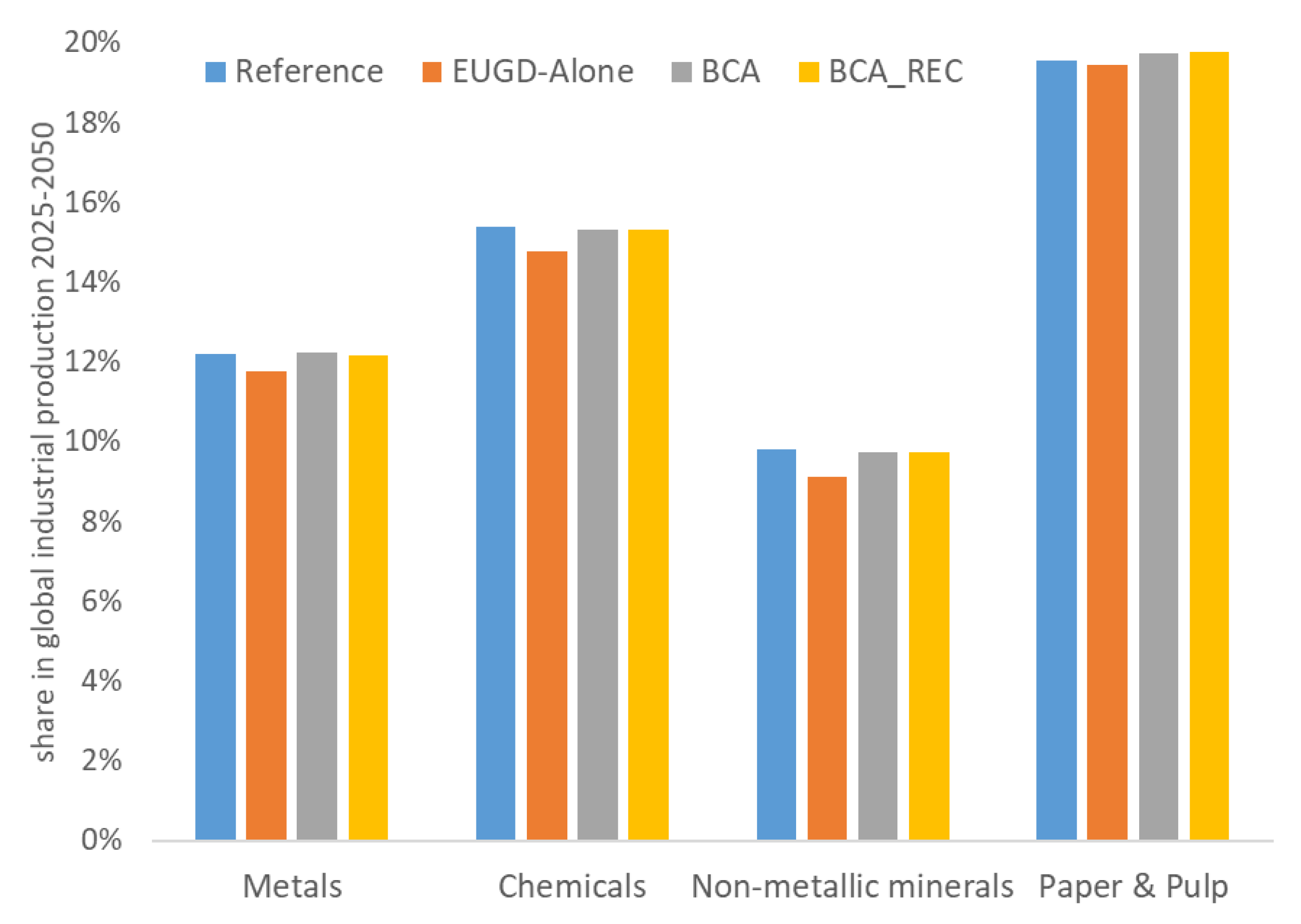

4.1. Impacts of Unilateral Ambitious European Climate Policies

4.2. Impacts of Joint EU–China Ambitious Climate Action

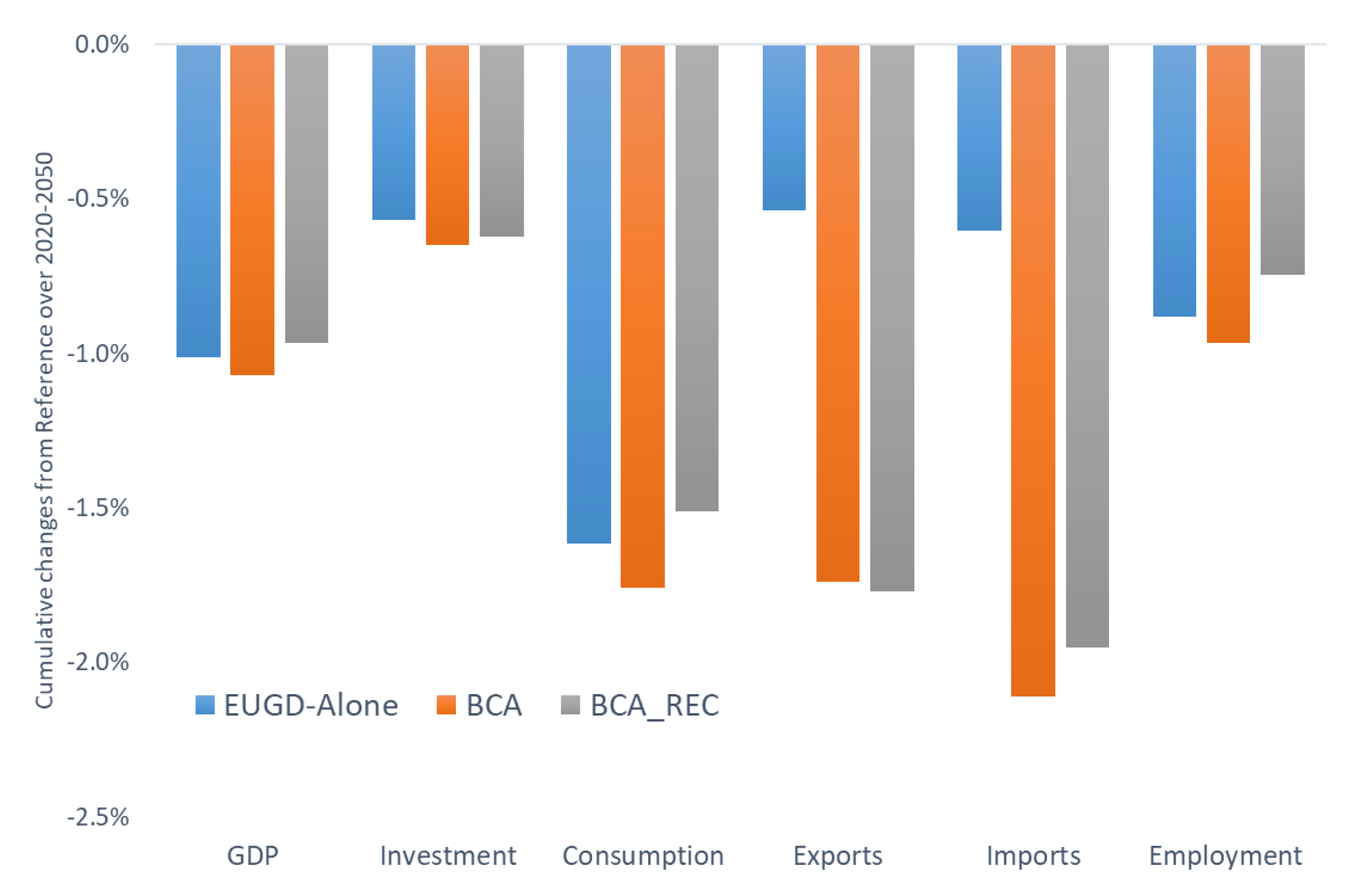

4.3. How Effective Is the Border Carbon Adjustment?

5. Policy Recommendations and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. GEM-E3-FIT Model Description

- (i)

- It moderates the short-term stress on capital markets by allocating capital requirements over a longer period (long-term financing schemes/loans). This effect is particularly visible in scenarios where the economy transits to a more capital-intensive structure and any limited availability of financing capital implies that capital costs will always rise.

- (ii)

- It allows to simulate the role of carbon funds in implementation of ambitious climate policies.

- (iii)

- It allows the assessment of socioeconomic impacts of investment projects characterized by different risk profiles performed by agents with different risk/debt profiles.

- (iv)

- It allows for a detailed budgeting of debt by agent while it takes into account the impact of debt accumulation and debt sustainability in the ability of agents to borrow.

- (v)

- Endogenous computation of interest rates for different financial assets (deposits, bonds, household and business financing, etc.) and direct link of nominal variables to the real economy.

- (vi)

- Versatile financing options that correct market gaps (i.e., financing to low income households through energy-saving programs) and inclusion of financial repayment plans that allow to trace the interest payments in the future.

- represents the share of car types in total new car registrations,

- is the scale parameter used for the calibration of technology shares,

- is the price by car type (reflecting total transport cost),

- is the elasticity of substitution between alternative car types.

References

- Fragkos, P. Global Energy System Transformations to 1.5 °C: The Impact of Revised Intergovernmental Panel on Climate Change Carbon Budgets. Energy Technol. 2020, 8, 2000395. [Google Scholar] [CrossRef]

- Böhringer, C.; Balistreri, E.; Rutherford, T. The role of border carbon adjustment in unilateral climate policy: Overview of an Energy Modeling Forum study (EMF 29). Energy Econ. 2012, 34, S97–S110. [Google Scholar] [CrossRef]

- Weyant, J.P. (Ed.) The Costs of the Kyoto Protocol: A Multi-Model Evaluation; The Energy Journal (Special Issue); Cleveland, OH, USA; pp. 1–398. Available online: https://web.stanford.edu/group/emf-research/docs/emf16/CostKyoto.pdf (accessed on 15 October 2020).

- Paroussos, L.; Fragkos, P.; Capros, P.; Fragkiadakis, K. Assessment of carbon leakage through the industry channel: The EU perspective. Technol. Forecast. Soc. Chang. 2014, 90, 204–219. Available online: https://www.sciencedirect.com/science/article/abs/pii/S0040162514000602 (accessed on 15 October 2020). [CrossRef]

- Carbone, J.; Rivers, N. The Impacts of Unilateral Climate Policy on Competitiveness: Evidence from Computable General Equilibrium Models. Rev. Environ. Econ. Policy 2017, 11, 24–42. [Google Scholar] [CrossRef]

- European Commission. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions. In The European Green Deal Brussels; COM 640 final; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Hoel, M. Global Environmental Problems: The Effects of Unilateral Actions Taken by One Country. J. Environ. Econ. Manag. 1991, 20, 55–70. [Google Scholar] [CrossRef]

- Böhringer, C.; Carbone, J.; Rutherford, T.F. Embodied Carbon Tariffs; NBER working paper; National Bureau of Economic Research: Cambridge, UK, 2011; p. 17376. [Google Scholar]

- European Commission. State of the Union 2017–Industrial Policy Strategy: Investing in a Smart, Innovative and Sustainable Industry; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Wesseling, J.H.; Lechtenböhmer, S.; Åhman, M.; Nilsson, L.J.; Worrell, E.; Coenen, L. The transition of energy intensive processing industries towards deep decarbonization: Characteristics and implications for future research. Renew. Sustain. Energy Rev. 2017, 79, 1303–1313. [Google Scholar] [CrossRef]

- Aldy, J.; Pizer, E. The Competitiveness Impacts of Climate Change Mitigation Policie. J. Assoc. Environ. Resour. Econ. 2015, 2, 565–595. Available online: http://www.nber.org/papers/w17705 (accessed on 15 October 2020).

- DeCian, E.; Parrado, R.; Grubb, M.; Drummond, P.; Coindoz, L.; Mathy, S.; Stolyarova, E.; Georgiev, A.; Sniegoki, A.; Bukowski, M. A Review of Competitiveness, Carbon Leakage and EU Policy Options in the Post-Paris Landscape; Deliverable 3.1 of the COP21-RIPPLES H2020 project; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Zachmann, G.; McWilliams, B. A European Carbon Border Tax: Much Pain, Little Gain; Policy Contribution 05/2020; Bruegel: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Study on Energy Prices, Costs and Their Impact on Industry and Households; DG ENER.; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Fragkiadakis, K.; Fragkos, P.; Paroussos, L. Low-Carbon R&D Can Boost EU Growth and Competitiveness. Energies 2020, 13, 5236. [Google Scholar]

- Fragkos, P.; Tasios, N.; Paroussos, L.; Capros, P.; Tsani, S. Energy system impacts and policy implications of the European Intended Nationally Determined Contribution and low-Carbon pathway to 2050. Energy Policy 2017, 100, 216–226. [Google Scholar] [CrossRef]

- Capros, P.; Vita, D.A.; Tasios, N.; Siskos, P.; Kannavou, M.; Petropoulos, A.; Evangelopoulou, S.; Zampara, Z.; Papadopoulos, D.; Nakos, C.; et al. EU Reference Scenario 201–Energy, Transport. and GHG Emissions Trends to 2050; European Commission Directorate General for Energy, Directorate General for Climate Action and Directorate General for Mobility and Transport: Brussels, Belgium, 2016. [Google Scholar]

- Armington, P.S. Theory of Demand for Products Distinguished by Place of Production. IMF Staff. Pap. 1969, 16, 159–178. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook; International Energy Agency: Paris, France, 2019. [Google Scholar]

- European Commission. Ageing Report; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- IRENA. Renewable Power Generation Costs in 2019; International Renewable Energy Agency: Abu Dhabi, UAE, 2020. [Google Scholar]

- McCollum, D.L.; Zhou, W.; Bertram, C.; Boer, H.-S.d.; Bosetti, V.; Busch, S.; Després, J.; Drouet, L.; Emmerling, J.; Fay, M.; et al. Energy investment needs for fulfilling the Paris agreement and achieving the sustainable development goals. Nat. Energy 2018, 3, 589–599. [Google Scholar] [CrossRef]

- Cosbey, A.; Droege, S.; Fischer, C.; Reinaud, J.; Stephenson, J.; Weischer, L.; Wooders, P. A Guide for the Concerned: Guidance on the elaboration and implementation of border carbon adjustment. Int. Inst. Sustain. Dev. 2012, 2012, 22. [Google Scholar] [CrossRef][Green Version]

- Karkatsoulis, P.; Capros, P.; Fragkos, P.; Paroussos, L.; Tsani, S. First-Mover advantages of the European Union’s climate change mitigation strategy. Int. J. Energy Res. 2016, 40, 814–830. [Google Scholar] [CrossRef]

- Paroussos, L.; MANDEL, A.; Fragkiadakis, K.; Fragkos, P.; Hinkel, J.; Vrontisi, Z. Climate clubs and the macro-economic benefits of international cooperation on climate policy. Nat. Clim. Chang. 2019, 9, 542–546. [Google Scholar] [CrossRef]

- Li, M.; Weng, Y.; Duan, M. Emissions, energy and economic impacts of linking China’s national ETS with the EU ETS. Appl. Energy 2019, 235, 1235–1244. [Google Scholar] [CrossRef]

- Alexeeva-Talebi, V.; Böhringer, C.; Löschel, A.; Voigt, S. The value added of sectoral disaggregation: Implications on competitive consequences of climate change policies. Energy Econ. 2012, 34 (Suppl. 2), S127–S142. [Google Scholar] [CrossRef]

- Yumashev, A.; Ślusarczyk, B.; Kondrashev, S.; Mikhaylov, A. Global Indicators of Sustainable Development: Evaluation of the Influence of the Human Development Index on Consumption and Quality of Energy. Energies 2020, 13, 2768. [Google Scholar] [CrossRef]

- Lisin, A. Prospects and Challenges of Energy Cooperation between Russia and South Korea. Int. J. Energy Econ. Policy 2020, 10, 130. [Google Scholar] [CrossRef]

- Meynkhard, A. Long-Term prospects for the development energy complex of Russia. Int. J. Energy Econ. Policy 2020, 10, 224–232. [Google Scholar] [CrossRef]

| σx | σm | σx | σm | ||

|---|---|---|---|---|---|

| Transport | 1.90 | 3.80 | Coal | 3.05 | 6.10 |

| Construction | 1.90 | 3.80 | Consumer Goods | 3.21 | 6.43 |

| Non Market Services | 1.90 | 3.80 | Chemical Products | 3.30 | 6.60 |

| Market Services | 2.03 | 4.06 | Transport equipment | 3.55 | 7.10 |

| Oil products | 2.10 | 4.20 | Electric Vehicles | 3.55 | 7.10 |

| Gas | 2.80 | 5.60 | Non-ferrous metals | 3.98 | 7.95 |

| Power Supply | 2.80 | 5.60 | Equipment goods | 4.05 | 8.10 |

| Ferrous metals | 2.95 | 5.90 | Batteries | 4.05 | 8.10 |

| Paper Products | 2.95 | 5.90 | Electronic Goods | 4.08 | 8.15 |

| Agriculture | 3.03 | 6.07 | Crude Oil | 5.20 | 10.40 |

| Country | NDC Emission Targets | Energy-Related NDC Targets in 2030 |

|---|---|---|

| EU | −40% GHG in 2030 relative to 1990 | 30% RES in gross final demand |

| China | −60% (−65%) CO2 intensity in 2030 rel. 2005 | 20% Non-fossil in primary energy |

| India | −33% (−35%) CO2 intensity from 2005 | 40% Non-fossil in power capacity |

| USA | −26% (−28%) GHG in 2025 from 2005 | |

| Japan | −26% GHGs in 2030 from 2013 | 20–22% Nuclear and 22–24% RES share in electricity in 2030 |

| Brazil | −43% GHGs in 2030 from 2005 | |

| Russia | 25–30% below 1990 levels by 2030 | |

| S. Korea | 37% below Business as Usual by 2030 | |

| S. Africa | Peak GHG emissions in 2025 and plateau for a decade |

| Scenario Description | EU Climate Target | Non-EU Climate Targets | |

|---|---|---|---|

| REF | Reference scenario | Meets the EU NDC | All countries meet NDCs in 2030, no increase in policy ambition after 2030 |

| 2DEG | Decarbonisation to 2 °C with all options available | All countries adopt ambitious climate policies/universal carbon pricing to meet the 2 °C temperature target | |

| EUGD_Alone | EU meets the EU Green Deal Targets by 2030 and 2050 | EU achieves 55/90% reduction in 2030/2050 from 1990 | Non-EU countries meet their NDCs in 2030, policy ambition does not increase beyond 2030 |

| EUGD_BCA | Green Deal Targets are met, BCA is implemented on EU imports | EU achieves 55/90% reduction in 2030/2050 from 1990 | Non-EU countries meet their NDCs in 2030, policy ambition does not increase beyond 2030 |

| EUGD_BCA_REC | As EUGD_BCA but BCA revenues are used to reduce social security contributions | EU achieves 55/90% reduction in 2030/2050 from 1990 | Non-EU countries meet their NDCs in 2030, policy ambition does not increase beyond 2030 |

| EUGD-CHN | EU and China adopt ambitious climate policies | EU achieves 55/90% reduction in 2030/2050 from 1990 | Countries do not intensify policy ambition beyond 2030; China develops along a 2DEG trajectory |

| Change from Reference over 2025–2050 (in bn Euro 2010) | EU Production | Non-EU Production |

|---|---|---|

| Oil | −3272 | 559 |

| Gas | −142 | 5 |

| Ferrous metals | −1103 | 795 |

| Non-ferrous metals | −251 | 419 |

| Chemicals | −2265 | 1803 |

| Paper and pulp, publishing | −153 | 63 |

| Non-metallic minerals | −1107 | 689 |

| Air transport | −1206 | 914 |

| Production Change from Reference over 2025–2050 (in bn Euro 2010) | EU | China | Non-Abating Countries |

|---|---|---|---|

| Oil | −2620 | −4642 | 701 |

| Gas | −115 | −30 | 14 |

| Ferrous metals | −290 | −4901 | 2710 |

| Non-ferrous metals | 52 | −1907 | 1155 |

| Chemicals | −1214 | −3558 | 2401 |

| Paper, publishing | −128 | −239 | 87 |

| Non-metallic minerals | −546 | −4282 | 1748 |

| Air transport | −794 | −122 | 580 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fragkos, P.; Fragkiadakis, K.; Paroussos, L. Reducing the Decarbonisation Cost Burden for EU Energy-Intensive Industries. Energies 2021, 14, 236. https://doi.org/10.3390/en14010236

Fragkos P, Fragkiadakis K, Paroussos L. Reducing the Decarbonisation Cost Burden for EU Energy-Intensive Industries. Energies. 2021; 14(1):236. https://doi.org/10.3390/en14010236

Chicago/Turabian StyleFragkos, Panagiotis, Kostas Fragkiadakis, and Leonidas Paroussos. 2021. "Reducing the Decarbonisation Cost Burden for EU Energy-Intensive Industries" Energies 14, no. 1: 236. https://doi.org/10.3390/en14010236

APA StyleFragkos, P., Fragkiadakis, K., & Paroussos, L. (2021). Reducing the Decarbonisation Cost Burden for EU Energy-Intensive Industries. Energies, 14(1), 236. https://doi.org/10.3390/en14010236