1. Introduction

The deregulated electric industry, in reality, approaches higher economic efficiency and lower electricity prices. The restructured power system network has the balance to supply demand from flexible coal generators and partially unpredictable renewable energy sources. In contemporary renewable energy, the spinning and non-spinning reserves meet unexpected rises in demand. This milieu enforces the optimal scheduling of all generations. The levy paid for an MW increase in demand at a node, decided by the independent system operator (ISO), depends on the source of supply, which defines the locational marginal pricing (LMP) or the nodal pricing. The penetration pricing of renewable energy is set low to reach a wide fraction of the electricity market, which redefines thermal generation as the flexible generation, and also plays a vital role in the assessment of LMP.

There are various approaches to determining LMP, considering the transmission, contingency, reserve constraints, etc., which meet reliability and security in a system, i.e., with optimal generation unit dispatch. In 1988, F.C.Schweppe introduced the term locational marginal pricing [

1]. The concept of LMP has been implemented by many ISOs, for example, PJM, New York ISO, CAISO, ISO—New England, and Midwest ISO. LMP, being the by-product of OptimalPower Flow (OPF), can be solved by either DCOPF or ACOPF. DCOPF analysis gives an exact value of energy cost, which can be further analyzed for congestion cost and loss cost, whereas ACOPF gives a levy, which requires a unique decomposition of costs. A systematic DCOPF approach presents a wide view of congestion and price vs. load, i.e., the price at a node with uncertainty in the load [

2]. Load uncertainty leads to volatility in LMP, which is described as LMP uncertainty in the probabilistic sense [

3]. This LMP fluctuation requires a price risk hedging instrument, which involves the correct decomposition of loss and congestion components, which are very critical for the calculation and settlement of these financial questions. The developed LMP decomposition algorithm overcomes the dependence on the choice of the slack bus [

4,

5].

The load-serving entity (LSE) and energy-consuming entity (ECE) work for their own maximum profit by bidding on the selling and purchase price. Maximizing the profit or minimizing the fuel cost becomes the objective function in clearing the electricity market, subjected to various constraints. The objective function decides the optimal dispatch of generators. On the other side, by assessment of the size and location of distributed generators (DGs), the LMP can be minimized. The DGs contribute to more advantages, including environmental, economic, and technical.

Wind power is the emerging renewable energy-generation resource in many countries [

6]. With increasing oil and gas prices and growing global energy demand, wind power has strong potential for future power generation. Wind power generation is an attractive auxiliary to turbulent fossil fuel prices in the global environment, because of its fuel-free and emission-free nature [

7]. The main issue with wind power is its unpredictability and uncertainty. Unpredictability means the inability to predict wind power accurately, which leads to variations in power balance. Wind speed varies with the seasons and the time of the day, and wind generation strongly depends on wind speed.

In countries like North America, wind power is scheduled either in the day-ahead market or the real-time market, because of its uncertainty [

8]. In such cases, a sufficient quantity of reserve is also maintained in operational planning. This reserve requirement can be calculated by the probability distribution function (PDF) of wind power generation. The wind speed profile is developed by a known PDF and transformed into corresponding wind power distribution. A review of wind speed probability distribution was done in Reference [

9]. An economic load dispatch model was developed in Reference [

10], considering wind and thermal generators with the probability of stochastic wind power generation as a constraint. Additionally, the study included a factor for the overestimation and underestimation of wind power in an optimal power flow model, along with an objective function, i.e., fuel cost minimization. Rather than forecasting the wind and enforcing a penalty for overestimation and underestimation, this paper ensured the maximum scheduling of available wind power for energy, as well as the reserve market. The high penetration and large scale integration of wind farms have reduced the role of thermal generators, but wind cannot compensate for fast-acting generators, because of its volatility. A novel approach was presented in Reference [

11], with two-stage robust energy and reserve scheduling taking into account wind generation uncertainty.

The key point is that wind energy is variable and intermittent. This variable nature of wind energy has been discussed in Reference [

12]. Even during severe storms, the turbines need several hours to shut down—they will not disconnect altogether. Additionally, the failure of a turbine does not affect the system, as they are modular and diffused. Wind speed is predictable and wind power generation has been forecasted within a reasonable margin of error. Here, optimal power flow modeling has been done to utilize wind power in the energy market, and also in the reserve market. The incorporation of renewable energy is a challenging problem, and its uncertainty is addressed in Reference [

13], in which the author proposed a novel optimal scheduling strategy for hybrid renewable generation systems.

The operating reserve includes the spinning and the non-spinning reserve. The spinning reserve (SR) is the vital supplementary service used to maintain system reliability if any unforeseen events occur, e.g., generator outages, line outages, and generation changes. Spinning reserve procurement has a significant bearing on economic dispatch and unit commitment; hence, it is kept at a minimum. The units generated for SR are therefore adjusted to maintain minimum operating costs [

14]. Transmission line contingency with a high penetration of renewables has been discussed in Reference [

15]. If the same generators contribute to the energy and reserve markets, then this provides more secure economic solutions. The non-spinning reserve is also defined as readily available generating capacity, but with a short time delay.

North American Electric Reliability Corporation (NERC) defines contingency reserve (CR) as all the committed reserves that can take up the demand in the required time. In deregulated power systems, CR has been taken into account in operational reliability analysis. Even PJM and CAISO include CR in their system operation process. Customer participation becomes a key issue in contingency reserve allocation. Based on customer requirements, they bid for quantity as well as the price they are willing to pay. Some need uninterrupted energy supply even during a contingency and are not bothered about the price, whereas some will be interrupted, because of the high contingency reserve cost and their unwillingness to pay this high cost. The LSEs and ECEs bid every hour in the market to supply and purchase energy, along with their bid price and quantity, and the ISO schedules the energy and reserve MW quantity. This joint clearing has been analyzed in many articles to determine the LMP of energy and reserve. Since there is a single power balance equation at a node, there can be only one price, but the reserve price charged cannot be the same as the energy price. Abetter strategy has to be implemented to ameliorate the negative effects of the deregulated energy market. Some ECEs dislike curtailment and thus put forth a bilateral contract with the LSE stating their willingness to pay and the quantity to be supplied even at times of contingency. The energy market clearing and settlement when the ECE also submits a bid to the ISO was presented in Reference [

16] using the distributed slack bus concept, which reduces the burden of supplying loss by a single slack bus. Settlement and optimal pricing in restructured power systems have been analyzed in recent studies using various artificial intelligence techniques.

This paper presents an optimal power flow model for optimal MW generation scheduling and MW reserve scheduling of thermal generators and wind generators. With low wind penetration, wind generation acts a negative load, i.e., scheduling is of thermal generators alone. In such cases, all wind power is to be consumed and the levy given by the ISO must be accepted. Here, wind power is considered only dispatchable, i.e., not schedulable. This is to increase the allocation of wind generation. With an increase in wind penetration, wind generation can also be scheduled, and thus can bid in the market. However, a considerable amount of reserve must be allocated. If bids are accepted, the contracted power has to be delivered, if not, penalties are imposed. To avoid penalties, better forecasting tools and techniques are used by wind farms. However, wind farms are allowed to bid only in the day-ahead electricity market. At times, depending on availability, they enter into the real-time market. The ISO is also responsible for clearing the energy and the reserve market, after obtaining the bid price and bid quantity from the LSEs and ECEs.

This paper presents an optimal power flow model with elastic and inelastic demand for the assessment of locational marginal pricing and locational contingency marginal reserve pricing (LCMRP). The model also includes the high penetration of wind generation as both schedulable and non-schedulable. Additionally, a modified optimal power flow model for the unique pricing of the operating reserve and energy has been developed. Considering the zero fuel cost of wind and accurate forecasting of wind generation in the day-ahead market, the wind farm is allowed to participate in the energy market and also as CR in the operating reserves market, in such a way that maximum wind power is used, subject to operating conditions. That is, wind generators behave similarly to conventional generators, with the main difference that the maximum wind generation depends on wind availability at that hour. Except for the above, wind generators are less constrained than conventional thermal generators, i.e., no minimum generation limits, no minimum up times, usually high ramp rates. To conclude, wind generators are allowed to participate as flexible generators in energy and reserve markets. Herein, we bridge the gap of using wind farm generation for the energy market alone. However, there is a difference between the scheduling of generators in the real-time market and the day-ahead market; hence, a better bidding strategy should be adopted for true optimal scheduling of generators [

17,

18].

3. Case Study

The modified IEEE 30 bus system was analyzed to compare the various market models. The different market models were formulated to determine the optimum dispatch of flexible coal generators and wind farms in the grid. The test system consisted of six generators at buses 1, 2, 5,8,11, and 13. The wind farms W1, W2, and W3 were assumed to be at buses 5, 15, and 25, respectively, and their hourly wind speed profile is given in

Table A5. The wind speeds used were from Ottawa, Quebec, and Toronto weather stations, and the cut-in speeds were considered unique for each station. The maximum wind power generated [

19] during each hour was determined based on the mathematical expression:

where

are, respectively, cut-in and cut-out (furling) wind speeds, and

is the rated wind speed at which the wind turbine rated output will be the rated output power

.

The LSE cost coefficient profile and the branch profile of the modified IEEE 30 bus system are shown in

Table A1 and

Table A2, respectively. The cost coefficient profile of windfarm is shown in

Table A3. The contingency reserve required was generally based on some heuristics such as the largest expected generation outage or a percentage of the expected demand, or both [

20]. The linear bid was considered for the contingency reserve, which must supply the demand requirement without curtailment, and the demand requirement during contingency was 20% of the day-ahead load schedule. The contingency reserve was allocated within the maximum capacity of every LSE, and the maximum reserve quantity amounted to

. Since the same generator can supply the energy and the contingency reserve, their reserve bid levy was 25% more than that of the energy bid. Thus, the pricing for nodal energy and reserve market at a node varied. The day-ahead load profile for every hour is shown in

Table A4, and the load was shared across all nodes of the network.

The energy market and reserve market clearing and settlement for the proposed market models were illustrated using the IEEE 30 bus system in three steps.

Analysis I: Energy and reserve schedules of the available LSEs were analyzed.

Analysis II: Calculation of LMP in the energy market, which acts as a signal to the reserve market.

Analysis III: Impact of wind penetration on negative LMP was analyzed.

3.1. Analysis I: Energy and Reserve Schedule of LSEs

Here, the contributions of the LSEs, i.e., the thermal and windfarm generators for the energy and reserve markets, to different models were analyzed. The optimal scheduling was done with the minimization of fuel cost as an objective function. As a result, a low-cost LSE will be cleared to the maximum quantity by the ISO, but the optimization has to balance the transmission line constraints.

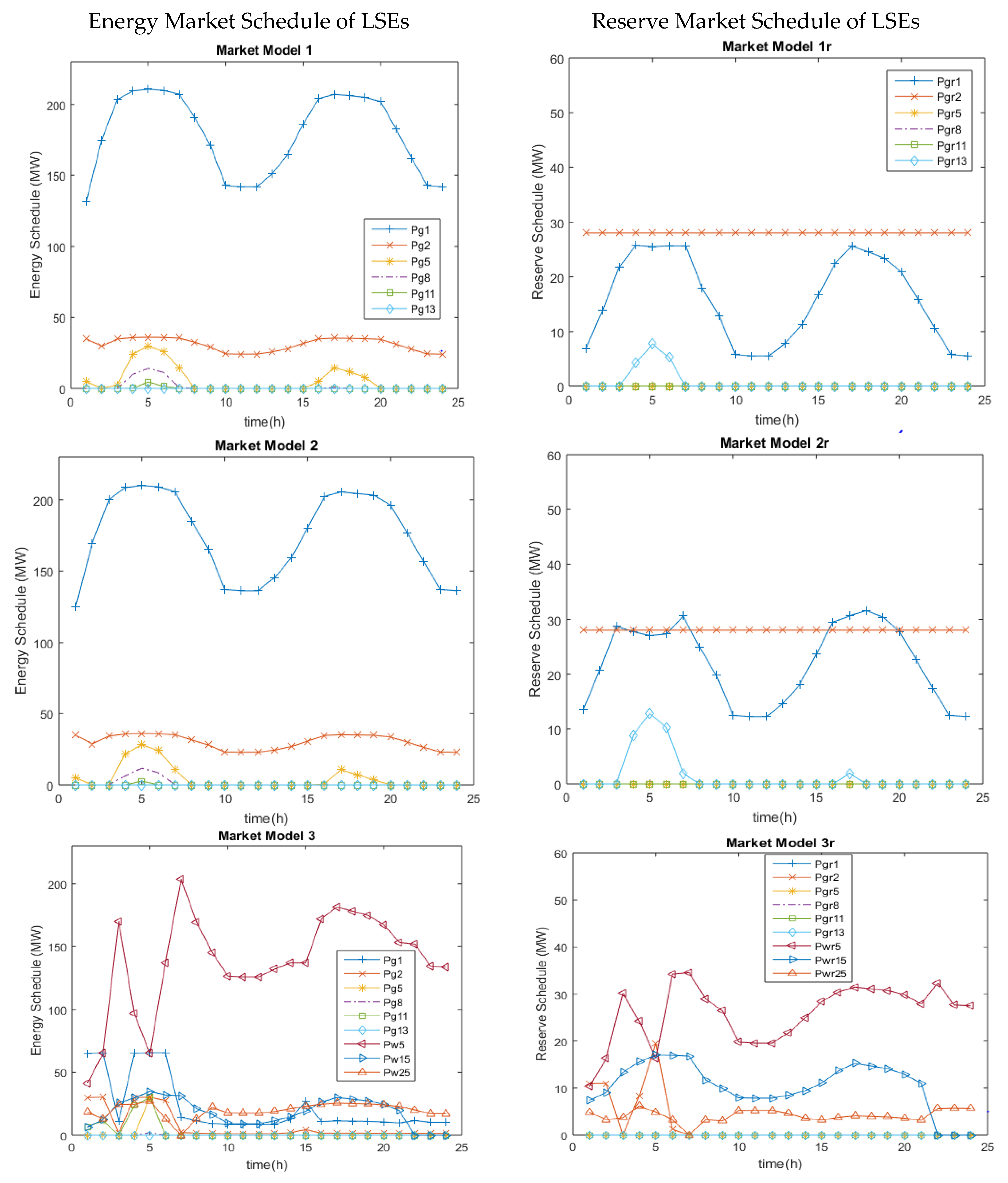

Figure 1 gives the day-ahead energy schedule and reserve schedule in columns 1 and 2, respectively. Considering Market Model 1, the lowest levy generator Pg1, was scheduled the highest. The generator Pg5 contributed during the peak load period. Even though the costs of Pg1 and Pg2 were the same, Pg2 made less contribution. In Market Model2, the contribution of low-cost generators was reduced considerably compared to Market Model 1, as the wind farm generation at a node was solely devoured by the demand at that corresponding node. Market Model3 never incited the cost of thermal generators. In Market Model 3, the wind generators with pricing equal to that of low-levy generators became functional, and the OPF forced the maximum usage of available wind farm generation in that particular hour, which led to a major share of scheduling being granted to wind power. Additionally, the network constraints did not allow complete usage of the wind farm generation. Hence, the rock-bottom scheduling of thermal generators became imperative.

Considering the day-ahead reserve market schedule in

Figure 1, since the low-levy LSEs filled the demand in the base case of the OPF market models, the remnant

in each LSE was scheduled for the reserve market. Under such a scenario, the IOPF was forced to use the high-levy LSEs to meet the contingency demand requirement (CDR), as a result of which, the MW from the available low-levy LSEs, followed by the high-levy LSEs were scheduled in the reserve market. The highest contribution by Pg2 was in Market Model1r. Market Model2r utilized the high-cost LSEs only during the peak contingency demand requirement. In Model 3r, the wind farm LSEs alone shared the scheduling.

The ECEs were scattered around the network. In the day-ahead market, the generation schedule varied for every generator for different market models.

Table 1 shows the comprehensive power supplied by the LSEs for the energy and reserve markets, along with their operating costs for a day. Market Model3 concluded that the optimal energy and the reserve allocation schedule was reduced when compared with Models 1 and 2. Hence, the operating cost was also reduced. Market Models 1 and 1r showed high energy and reserve allocation compared to the other models. The operating cost of Market Model 2 was reduced by 5547

$/MWhr and the operating cost of Market Model 3 was reduced by 38,602

$/MWhr when compared with the operating cost of Market Model 1.

In the case of the contingency reserve market, the operating cost was reduced by 6462 $/MWhr in Market Model 3r when compared with Market Model 1r, because of the contingency demand requirement being supplied by the wind farms. The hourly schedule of the LSEswas minimized, and the major share was from the wind farms in Market Model 3 and 3r.

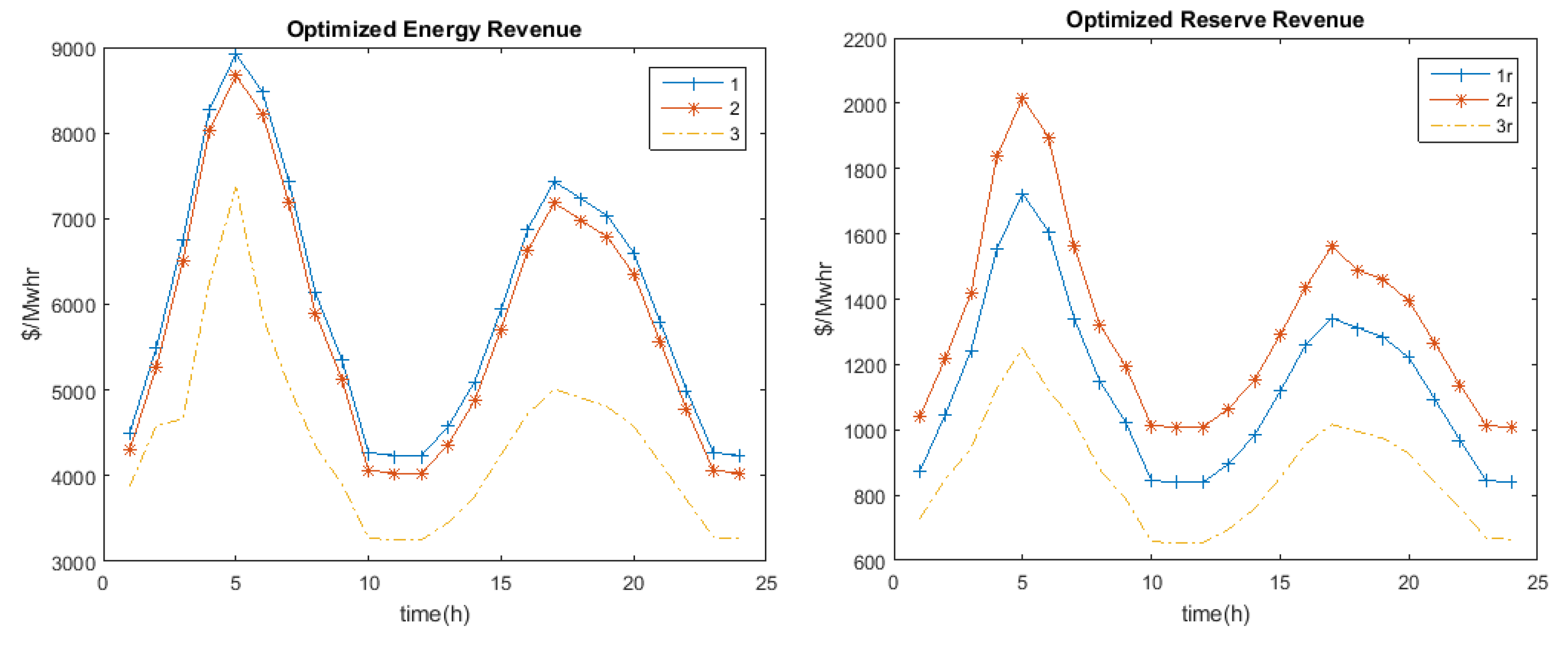

Figure 2 gives the optimized energy and reserve operating cost for 24 h. The operating costs were in direct proportion with the demand, as the hourly price bids were assumed to be the same for all market models.

3.2. Analysis II: LMP as a Signal to Reserve Market

Locational marginal pricing is a way to calculate the outright purchase price of electric energy that reflects its value at different locations, by taking into account the network paradigm, load pattern, generation limits, and transmission constraints for the next MW required. The pricing of the next MW required to meet the CDR was defined as the locational contingency marginal reserve pricing or reserve LMP. The ACOPF gives a levy that includes the cost of energy, loss, and congestion.

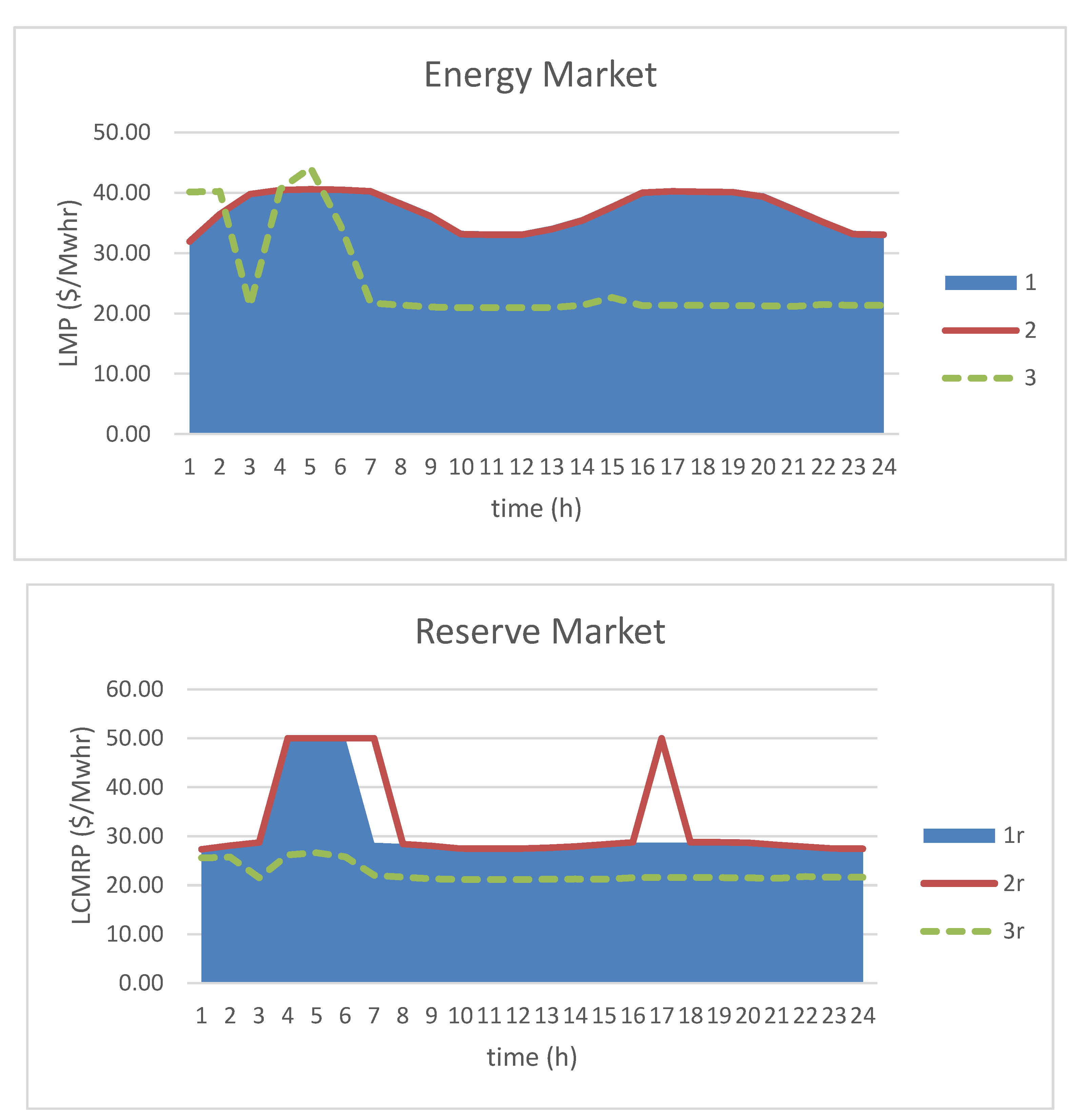

Figure 3 gives the maximum LMP in 24 h for the energy and reserve markets.

The maximum LMP for the energy market did not vary much for Market Models1 and 2. Market Model3 gave the minimum value of the maximum LMPs for the day. The maximum LMP for the reserve market was the minimum for Market Model 3r, compared to Market Models 1r and 2r.

The LMP varied in proportion with the demand quantity. The highest demand node, node 5, experienced the maximum price for the next MW required.

Table 2 gives the nodes at which the price was the maximum for various energy and reserve market models. In the day-ahead energy market, the energy LMP was the maximum at node 5 throughout the day, with an average of maximum LMP (AML) of 37.41

$/MWhr for Market Model 1. The same node 5 also experienced the maximum LMP in Market Model 2, but with a reduced AML of 37.02

$/MWhr. In Market Model 3, the eventuality of the maximum LMP was shifted to other nodes 8, 11, 15, and 25, with a much-reduced value of maximum LMP and an average value of 25.21

$/MWhr.

In the day-ahead reserve market, the LCMRP was maximum at node 5 in the case of Market Model 1r and was shifted to other nodes in Market Model 3r, with a much-reduced AML value of 22.40 $/MWhr. By means of simultaneous scheduling of wind farms and conventional thermal generators, the average value of the maximum LMP in the reserve market came close to the energy market. The next MW contingency reserve can be allocated at the price of nodal energy.

3.3. Analysis III: Impact of Wind Penetration on LMP

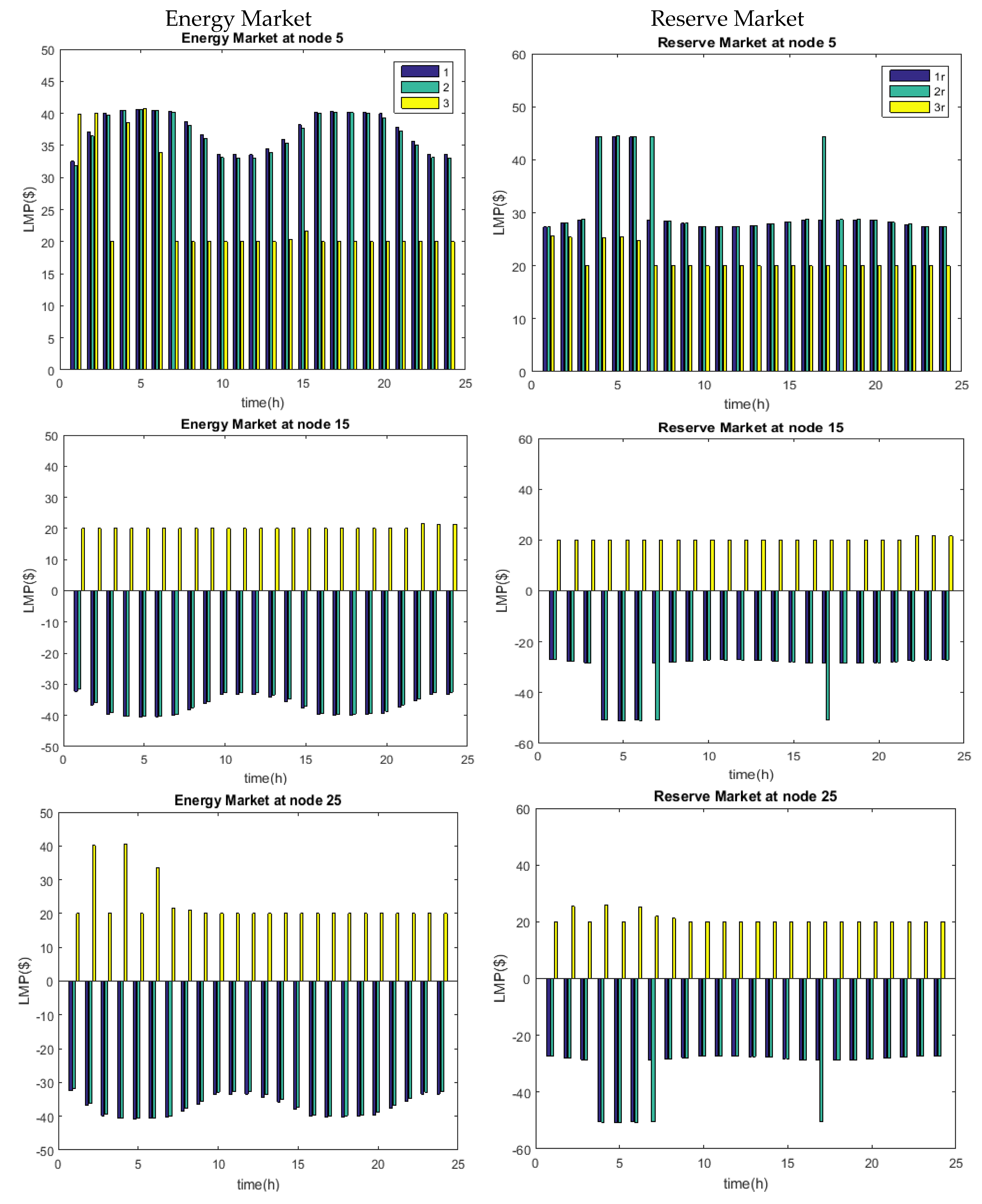

With the high penetration of wind farms, the negative LMP in various market models was converted to positive. The energy and contingency reserve markets were analyzed at nodes 5, 15, and 25. In the IEEE 30 bus system considered, the wind farms were installed at the above-mentioned nodes.

Figure 4 gives the energy prices for Market Models 1, 2, and 3, and the reserve prices for Market Models 1r, 2r, and 3r, in column 1 and column 2, respectively. The LMP at a node may be larger than the largest bid over all the available LSEs in the system. The energy market at node 5 gave a positive value of LMP for all the energy market models. The ECEs at these nodes paid the highest LMP for Market Model 1, a slightly reduced LMP for Market Model 2, and the lowest possible LMP for Market Model 3. The energy market at node 15 and 25 gave a negative value of LMP for Market Models 1 and 2 in the day-ahead market. A negative LMP at a node shows excess generation at that node. The negative LMPs at nodes 15 and 25 became positive in Market Model 3 in most hours. With the reduction in LMP at these nodes, the demand at various other nodes was supplied by these low-levy wind farms, which reduced the total operating cost.

Considering the reserve price/LCMRP for Market Models 1r, 2r, and 3r, the reserve market at node 5 and 11 gave a positive value of LMP for all reserve market modelsand a higher LMP at peak hourly loads. The IOPF implementation for contingency reserve analysis fetched an LMP at the reserve market lower than the lowest bid over all the available reserve-supplying LSEs. The reserve ECEs at these nodes paid a high value of LMP for Market Models 1r and 2r, excluding Market Model 3r. The reserve market at nodes 15 and 25 gave a negative value of LMP for all of Market Models 1r and 2r.In Market Model 3r, the negative LMP was converted to positive LMP, emphasizing the usage of available generation at that node. The contingency reserve bid which was submitted to the ISO was cleared at the cost of energy.