The Digital Transformation of the Retail Electricity Market in Spain

Abstract

1. Introduction

2. The Spanish Electricity Market Landscape

2.1. Regulatory Framework and Market Agents

2.2. Electricity Retailing

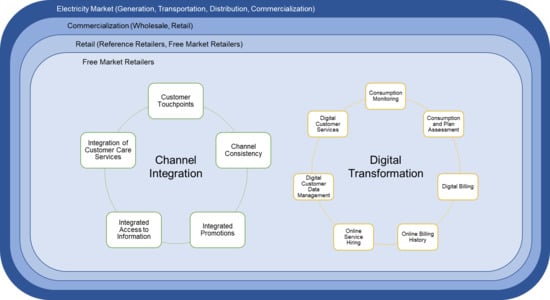

3. The Digital Transformation of Electricity Retailers: A Consumers’ View

3.1. Digital Transformation

Impact of the Digital Transformation in the Spanish Electricity Market

3.2. Channel Integration

Measuring Channel Integration in the Electricity Retail Market

4. Materials and Methods

4.1. Research Method

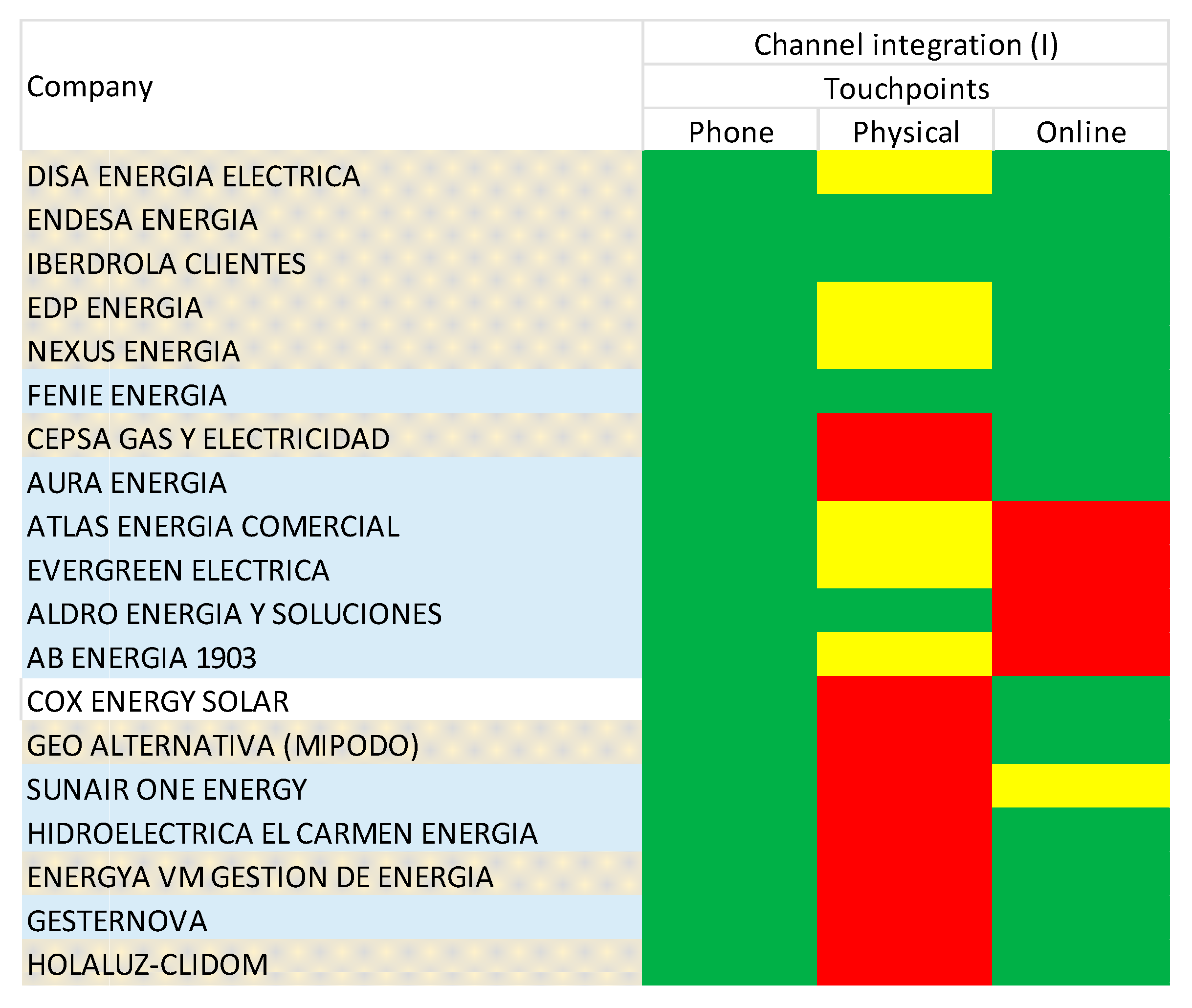

- Channel integration I (3): customer touchpoints, or presence in different channels for end-user services (3): telephone, physical channel, online channel.

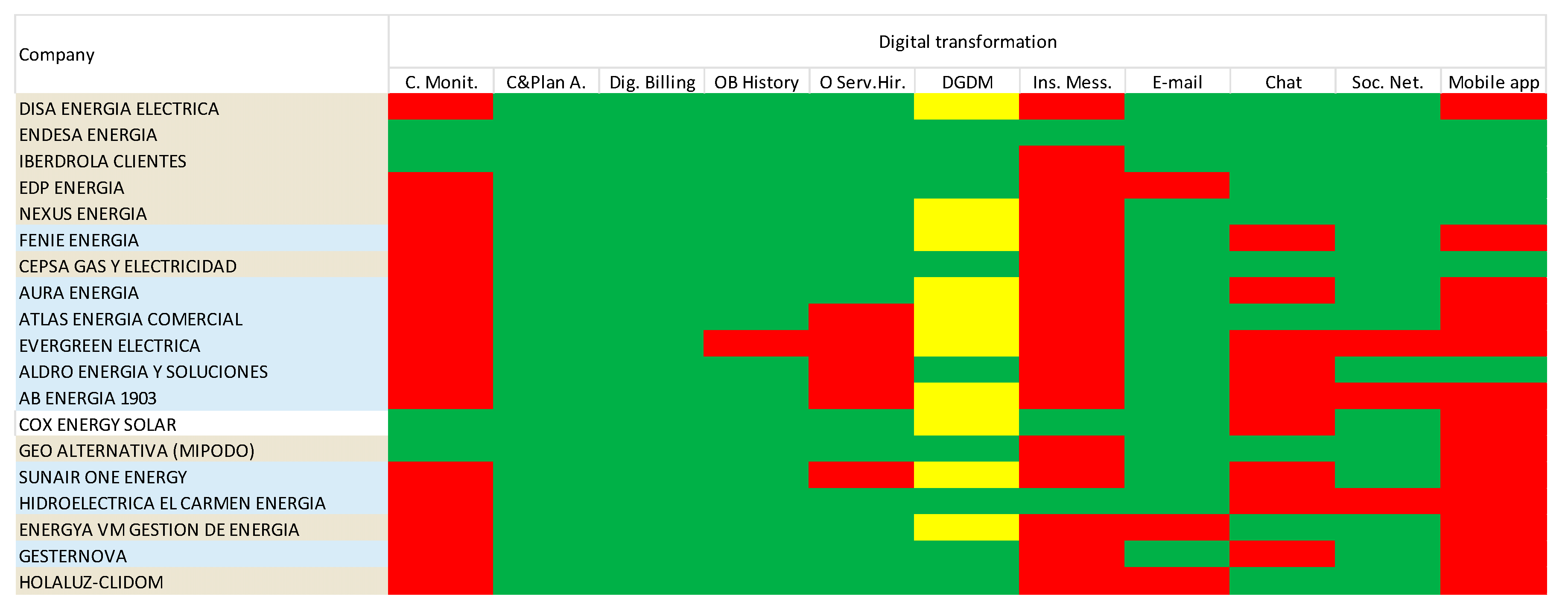

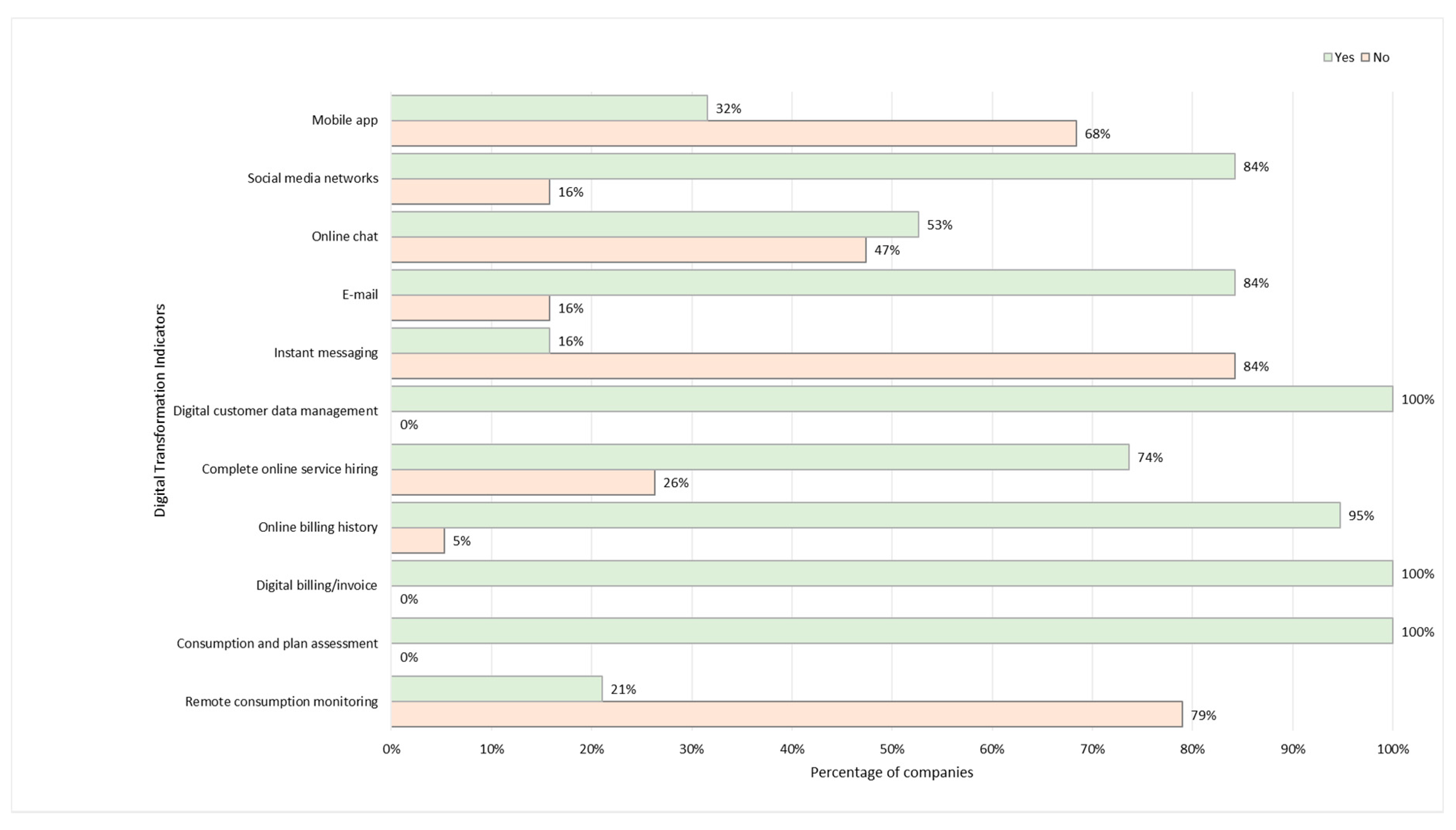

- Digital transformation (11): consumption monitoring, consumption and plan assessment, digital billing, online billing history, complete online service hiring, digital customer data management, availability of digital customer services via: (a) instant messaging; (b) e-mail; (c) online chat; (d) social networks; and (e) mobile app.

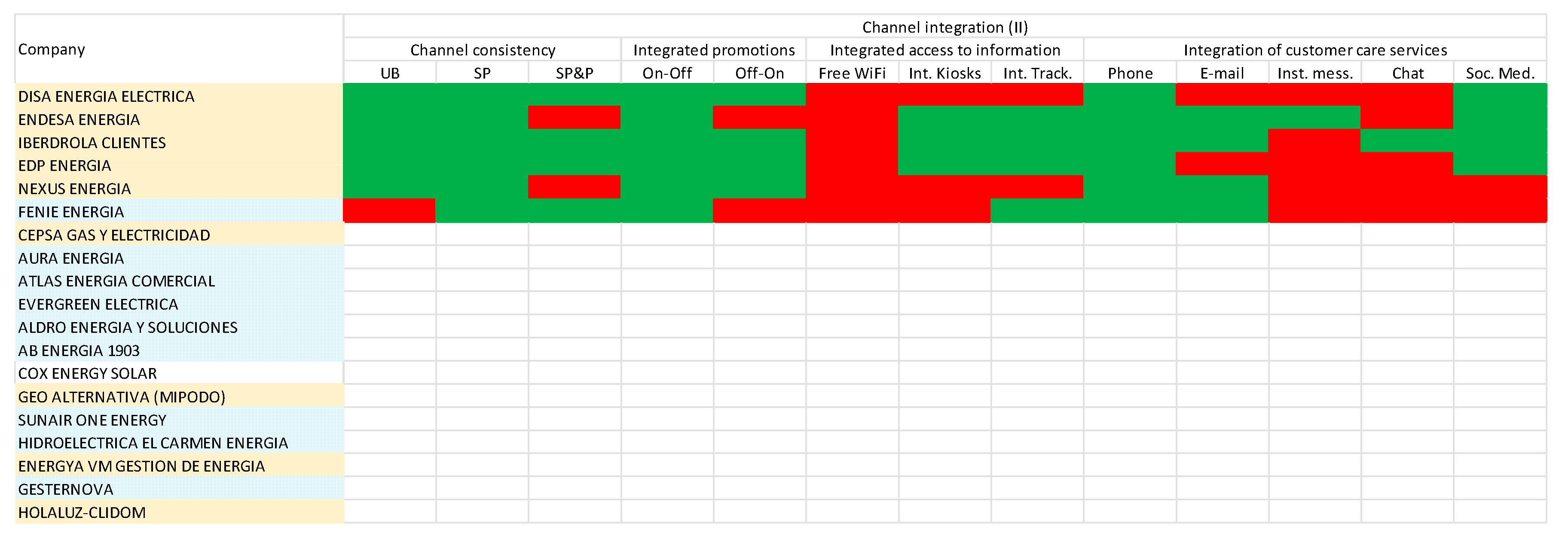

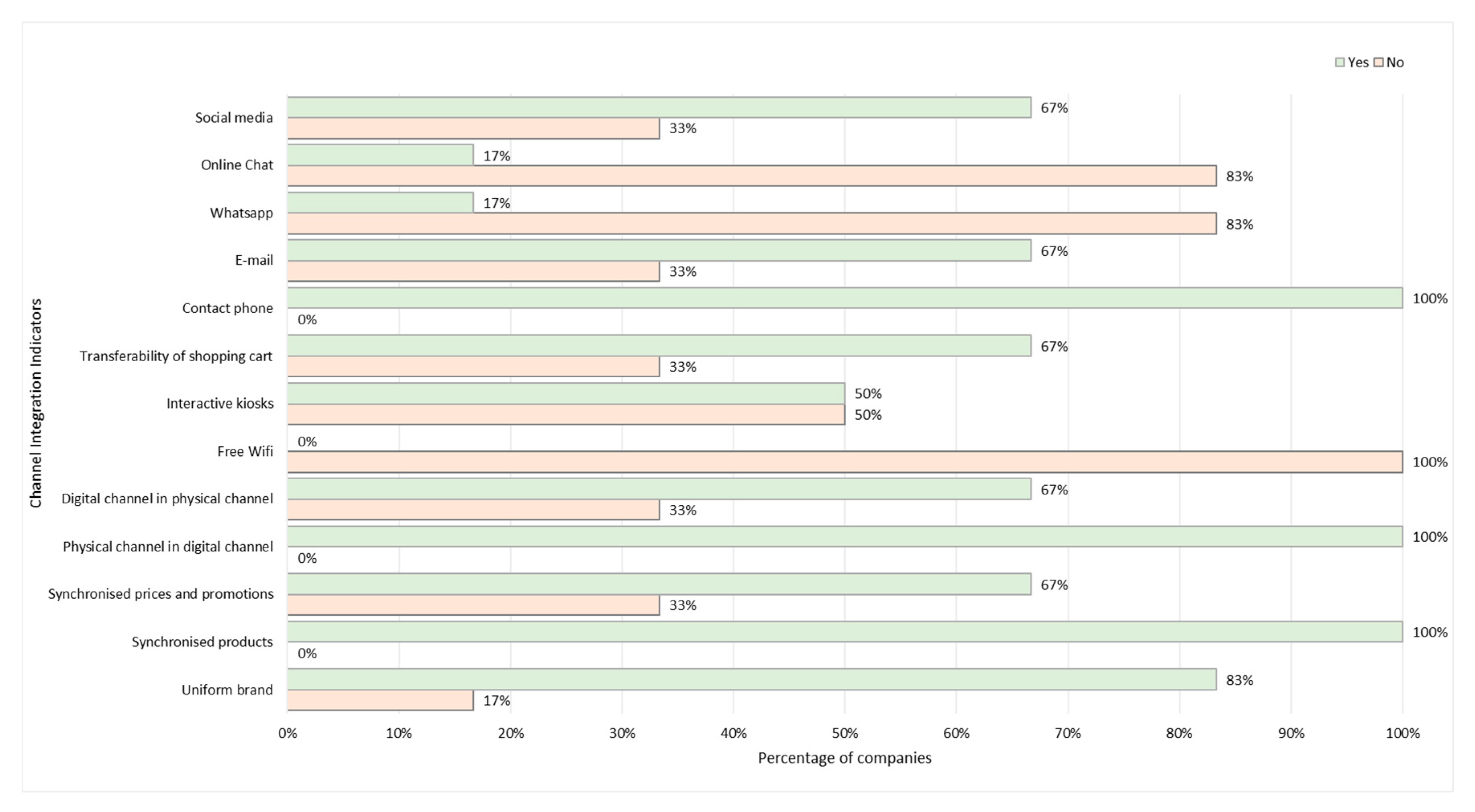

- Channel integration II (13): channel consistency (3): uniform brand, synchronized products, synchronized prices and promotions; integrated promotions (2): online to offline, offline to online; integrated access to information (3): free WiFi, interactive kiosks, integrated tracking of hired services; integration of customer care services (5): contact phone, e-mail, instant messaging, online chat and social media.

4.2. Sample Selection

- A list of all (564) electricity retailers in Spain has been collected from the official information provided by the CNMC, the Spanish National Commission for Markets and Competence. From this list, currently deregistered (195) companies have been removed.

- From the remaining 369 companies, only those that are classified as operating at a national level (73) have been chosen.

- A second list of companies was elaborated with information from the eInforma (https://ranking-empresas.eleconomista.es) database (a complete database with financial information of all Spanish companies), where the selection criteria were companies considered “large” or “corporate”—revenue higher than 3 million euro—and under the code “3514. Commercialization of electric energy”. The total number of companies from this list is 99.

- Only matching companies (61) across both lists are retained and inspected one by one. Because this study focuses on electricity retailers that offer their services to end consumers in the free market across the whole country, it has been necessary to remove the four reference retailers, as well as companies that only offer service to businesses and those that operate only in a specific area in Spain. The final list includes 19 companies.

4.3. Data Analysis and Results

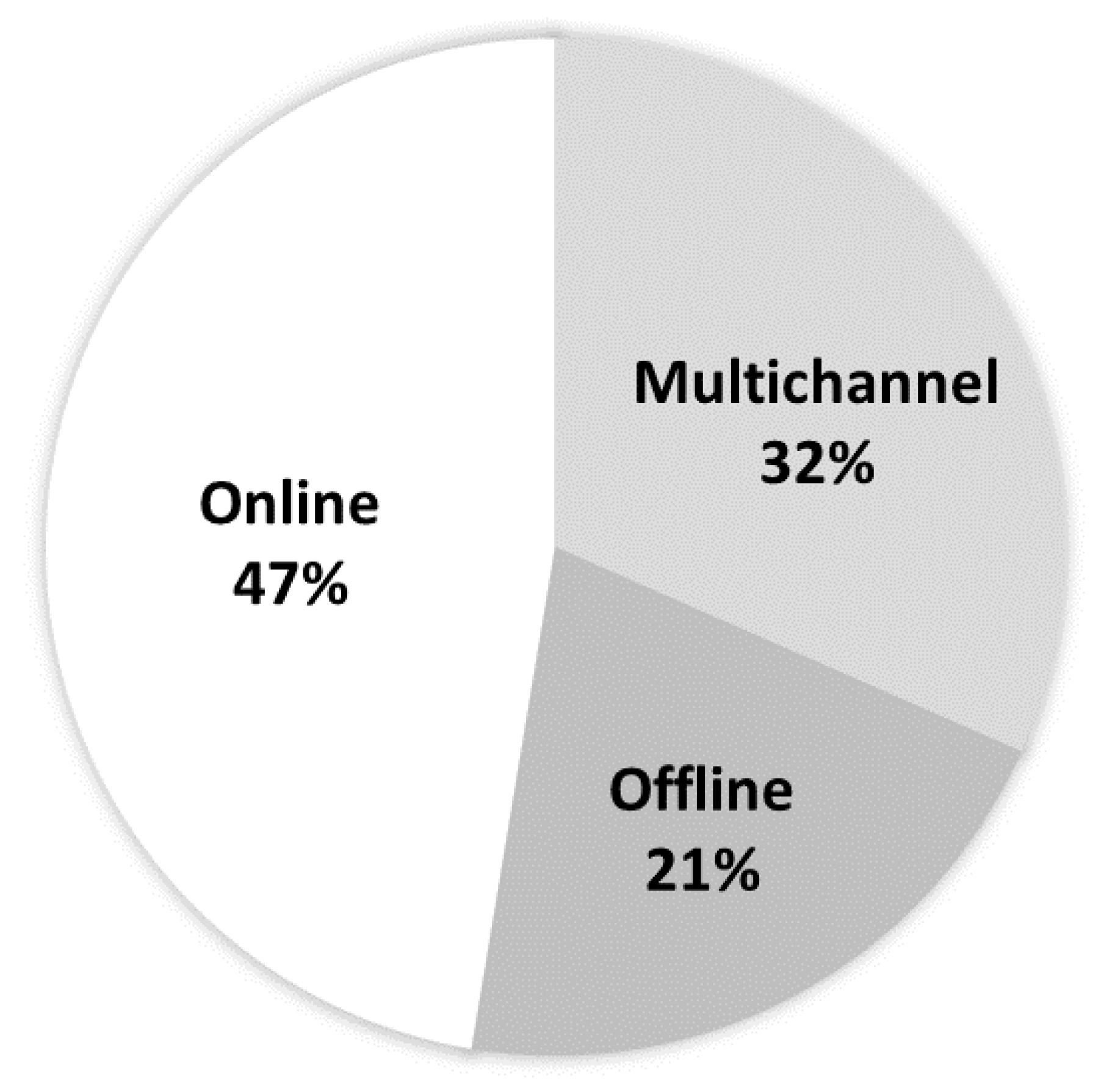

4.3.1. Customer Touchpoints (Channel Offering)

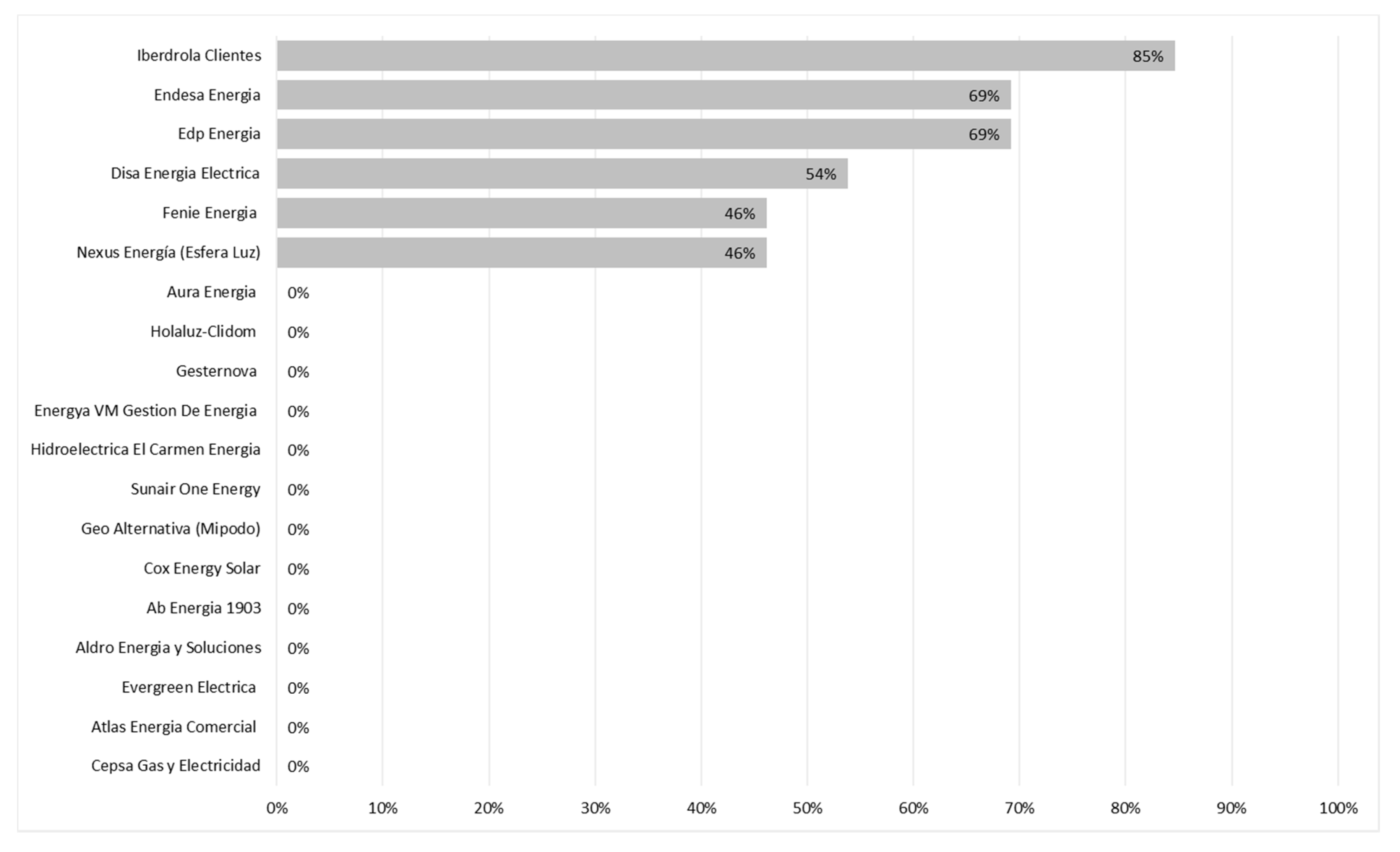

4.3.2. Digital Transformation: Global Overview and Indicators

4.3.3. Channel Integration: Global Overview

5. Discussion

5.1. Main Findings

5.2. Limitations of the Study and Avenues of Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Pollitt, M.G. The European Single Market in Electricity: An Economic Assessment. Rev. Ind. Organ. 2019, 55, 63–87. [Google Scholar] [CrossRef]

- Pérez González, D.; Solana-González, P.; Trigueros Preciado, S. Economía del dato y transformación digital en pymes industriales: Retos y oportunidades. Econ. Ind. 2018, 409, 37–45. [Google Scholar]

- Pelau, C.; Acatrinei, C. The Paradox of Energy Consumption Decrease in the Transition Period towards a Digital Society. Energies 2019, 12, 1–16. [Google Scholar] [CrossRef]

- Reis, J.; Amorim, M.; Melão, N.; Matos, P. Digital Transformation: A Literature Review and Guidelines for Future Research. Adv. Intell. Syst. Comput. 2018, 745, 411–421. [Google Scholar]

- Piotrowicz, W.; Cuthbertson, R. Introduction to the Special Issue Information Technology in Retail: Toward Omnichannel Retailing. Int. J. Electron. Commer. 2014, 18, 5–16. [Google Scholar] [CrossRef]

- Simone, A.; Sabbadin, E. The New Paradigm of the Omnichannel Retailing: Key Drivers, New Challenges and Potential Outcomes Resulting from the Adoption of an Omnichannel Approach. Int. J. Bus. Manag. 2017, 13, 85–109. [Google Scholar] [CrossRef]

- Frambach, R.T.; Roest, H.C.; Krishnan, T.V. The impact of consumer Internet experience on channel preference and usage intentions across the different stages of the buying process. J. Interact. Mark. 2007, 21, 26–41. [Google Scholar] [CrossRef]

- Blázquez, M. Fashion Shopping in Multichannel Retail: The Role of Technology in Enhancing the Customer Experience. Int. J. Electron. Commer. 2014, 18, 97–116. [Google Scholar] [CrossRef]

- Gensler, S.; Verhoef, P.C.; Böhm, M. Understanding consumers’ multichannel choices across the different stages of the buying process. Mark. Lett. 2012, 23, 987–1003. [Google Scholar] [CrossRef]

- Bendoly, E.; Blocher, J.D.; Bretthauer, K.M.; Krishnan, S.; Venkataramanan, M.A. Online/In-Store Integration and Customer Retention. J. Serv. Res. 2005, 7, 313–327. [Google Scholar] [CrossRef]

- European Commission. EU Energy Markets 2014; EU: Brussels, Belgium, 2014. [Google Scholar]

- Consejo Económico y Social España. El Sector Eléctrico En España; Consejo Económico y Social España: Madrid, Spain, 2017. [Google Scholar]

- Consejo económico y social España. La Digitalización de la Economía; Consejo económico y social España: Madrid, Spain, 2017. [Google Scholar]

- Roland Berger. España 4.0: El reto de la Transformación Digital de la Economía; Roland Berger: Madrid, Spain, 2016. [Google Scholar]

- Acquila-Natale, E.; Chaparro-Peláez, J. The long road to omnichannel retailing: An assessment of channel integration levels across fashion and apparel retailers. Eur. J. Int. Manag. 2020. (In press) [CrossRef]

- Red Eléctrica de España. El Marco Legal Estable: Economía del Sector Eléctrico Español 1988-1997; Red Eléctrica de España: Madrid, Spain, 2008. [Google Scholar]

- Boletín Oficial del Estado. Ley 54/1997 del Sector Eléctrico (de 27 de Noviembre); Boletín Oficial del Estado: Madrid, Spain, 1997. [Google Scholar]

- Ministerio para la Transición Ecológica y el Reto Demográfico. Estructura del Sector. Available online: https://energia.gob.es/electricidad/Paginas/sectorElectrico.aspx (accessed on 1 March 2020).

- Energía y Sociedad. Manual de la Energía. Available online: http://www.energiaysociedad.es/manenergia/energia-y-sociedad/ (accessed on 1 March 2020).

- MITECO/IDEA. Energía Eléctrica: Evolución por Sectores; 2018. Available online: http://sieeweb.idae.es/consumofinal (accessed on 27 March 2020).

- Boletín Oficial del Estado. Ley 24/2013 del Sector Eléctrico (26 de Diciembre); Boletín Oficial del Estado: Madrid, Spain, 2013. [Google Scholar]

- Deloitte. Situación Económico-Financiera de las Principales Empresas del Sector Eléctrico en España 2016–2018; Deloitte: Madrid, Spain, 2019. [Google Scholar]

- Comisión Nacional de los Mercados y la Competencia. Listado de Comercializadoras de Electricidad. Available online: https://sede.cnmc.gob.es/listado/censo/2 (accessed on 15 January 2020).

- Comisión Nacional de los Mercados y la Competencia. Informe de Supervisión del Mercado Minorista de Electricidad; Comisión Nacional de los Mercados y la Competencia: Madrid, Spain, 2019. [Google Scholar]

- European Commission. Consumer Markets Scoreboard: Making Markets Work for Consumers; EC: Brussels, Belgium, 2018. [Google Scholar]

- Fitzgerald, M.; Kruschwitz, N.; Bonnet, D.; Welch, M. Embracing digital technology: A new strategic imperative. MIT Sloan Manag. Rev. 2014, 55, 1–16. [Google Scholar]

- McDonald, M.P.; Rowsell-Jones, A. The Digital Edge: Exploiting New Technology and Information for Business Advantage; Gartner Inc.: Stamford, CT, USA, 2012. [Google Scholar]

- Yeager, K.E. Electricity for the 21st century: Digital electricity for a digital economy. Technol. Soc. 2004, 26, 209–221. [Google Scholar] [CrossRef]

- Osmundsen, K. Competences for Digital Transformation: Insights from the Norwegian Energy Sector. In Proceedings of the 53rd Hawaii International Conference on System Sciences, Maui, HI, USA, 7–10 January 2020; Volume 3, pp. 4326–4335. [Google Scholar]

- Glachant, J.M.; Rosetto, N. The Digital World Knocks at Electricity’s Door: Six Building Blocks to Understand Why. In Florence School of Regulation; European University Institute: Florence, Italy, 2018; pp. 1–8. [Google Scholar]

- Frazer, M.; Stiehler, B.E. Omnichannel Retailing: The Merging of the Online and Off-Line Environment. Glob. Conf. Bus. Financ. Proc. 2014, 9, 655–657. [Google Scholar]

- Nielsen. Global Connected Commerce: Is e-Tail Therapy the New Retail Therapy? Nielsen: New York, NY, USA, 2016. [Google Scholar]

- Verhoef, P.C.; Kannan, P.K.; Inman, J. From Multi-Channel Retailing to Omni-Channel Retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Hu, Y.J.; Rahman, M.S. Competing in the Age of Omnichannel Retailing. MIT Sloan Manag. Rev. 2013, 54, 23–29. [Google Scholar]

- Cao, L.; Li, L. The Impact of Cross-Channel Integration on Retailers’ Sales Growth. J. Retail. 2015, 91, 198–216. [Google Scholar] [CrossRef]

- Beck, N.; Rygl, D. Categorization of multiple channel retailing in Multi-, Cross-, and Omni-Channel Retailing for retailers and retailing. J. Retail. Consum. Serv. 2015, 27, 170–178. [Google Scholar] [CrossRef]

- Cook, G. Customer experience in the omni-channel world and the challenges and opportunities this presents. J. Direct Data Digit. Mark. Pr. 2014, 15, 262–266. [Google Scholar] [CrossRef]

- Kemperman, A.; Van Delft, L.; Borgers, A. Omni Channel Fashion Shopping, in Successful Technological Integration for Competitive Advantage in Retail Settings; IGI Global: Hershey, PA, USA, 2015; pp. 144–167. [Google Scholar]

- McCormick, H.; Cartwright, J.; Perry, P.; Barnes, L.; Lynch, S.; Ball, G. Fashion retailing—past, present and future. Text. Prog. 2014, 46, 227–321. [Google Scholar] [CrossRef]

- Peltola, S.; Vainio, H.; Nieminen, M. Key Factors in Developing Omnichannel Customer Experience with Finnish Retailers. Springer Int. Publ. 2015, 9191, 335–346. [Google Scholar]

- Seck, A.M. The issue of Multichannel Integration, a Key Challenge for Service Firms in a context Multichannel Services Distribution. Int. Bus. Res. 2013, 6, 160–167. [Google Scholar]

- Stone, M.; Hobbs, M.; Khaleeli, M. Multichannel customer management: The benefits and challenges. J. Database Mark. Cust. Strat. Manag. 2002, 10, 39–52. [Google Scholar] [CrossRef]

- Saghiri, S.; Wilding, R.; Mena, C.; Bourlakis, M. Toward a three-dimensional framework for omni-channel. J. Bus. Res. 2017, 77, 53–67. [Google Scholar] [CrossRef]

- Accenture. Cross Channel Integration: The Next Step for High Performing Retailers; Accenture: Dublin, Ireland, 2010. [Google Scholar]

- Gajanan, S.; Basuroy, S. Multichannel Retailing And Its Implications On Consumer Shopping Behavior. J. Shopp. Cent. Res. 2007, 14, 1–28. [Google Scholar]

- ATKearney. On Solid Ground: Brick-and-Mortar Is the Foundation of Omnichannel Retailing; ATKearney: Chicago, IL, USA, 2014. [Google Scholar]

- Forrester. Customer Desires vs. Retailer Capabilities: Minding the Omni-Channel Commerce Gap; Forrester: Cambridge, MA, USA, 2014. [Google Scholar]

- Weill, P.; Woerner, S.L. Thriving in an Increasingly Digital Ecosystem. MIT Sloan Manag. Rev. 2015, 56, 27–34. [Google Scholar]

- Avensia. OmniChannel Retail 2015: A Scandinavian Omni-Channel Index; Avensia: Lund, Sweden, 2015. [Google Scholar]

- Murray, A.; Hernandez, T. The Canadian Omni-Channel Retail Landscape; Centre for the Study of Commercial Activity (CSCA): Toronto, ON, Canada, 2016. [Google Scholar]

- National Retail Federation. Omnichannel Retail Index; National Retail Federation: Washington, DC, USA, 2015. [Google Scholar]

- Mhe Consumer. OmniChannel Mhe Retail Index 2018; Mhe Consumer: Madrid, Spain, 2018. [Google Scholar]

- Cao, L. Business Model Transformation in Moving to a Cross-Channel Retail Strategy: A Case Study. Int. J. Electron. Commer. 2014, 18, 69–96. [Google Scholar] [CrossRef]

- Zhang, J.; Farris, P.W.; Irvin, J.W.; Kushwaha, T.; Steenburgh, T.J.; Weitz, B. Crafting Integrated Multichannel Retailing Strategies. J. Interact. Mark. 2010, 24, 168–180. [Google Scholar] [CrossRef]

- Neslin, S.A.; Grewal, D.; Leghorn, R.; Shankar, V.; Teerling, M.; Thomas, J.S.; Verhoef, P.C. Challenges and Opportunities in Multichannel Customer Management. J. Serv. Res. 2006, 9, 95–112. [Google Scholar] [CrossRef]

- Shankar, V.; Inman, J.; Mantrala, M.; Kelley, E.; Rizley, R. Innovations in Shopper Marketing: Current Insights and Future Research Issues. J. Retail. 2011, 87, S29–S42. [Google Scholar] [CrossRef]

- Goersch, D. Multi-channel integration and its implications for retail web sites. In Proceedings of the 10th European Conference On Information Systems (ECIS), Gdańsk, Poland, 6–8 June 2002; 11, pp. 748–758. [Google Scholar]

- Picot-Coupey, K.; Huré, E.; Piveteau, L. Channel design to enrich customers’ shopping experiences. Int. J. Retail. Distrib. Manag. 2016, 44, 336–368. [Google Scholar] [CrossRef]

- Oh, L.-B.; Teo, H.-H.; Sambamurthy, V. The effects of retail channel integration through the use of information technologies on firm performance. J. Oper. Manag. 2012, 30, 368–381. [Google Scholar] [CrossRef]

- Avery, J.; Steenburgh, T.J.; Deighton, J.; Caravella, M. Adding Bricks to Clicks: Predicting the Patterns of Cross-Channel Elasticities over Time. J. Mark. 2012, 76, 96–111. [Google Scholar] [CrossRef]

- Schramm-Klein, H.; Wagner, G.; Steinmann, S.; Morschett, D. Cross-channel integration—Is it valued by customers? Int. Rev. Retail. Distrib. Consum. Res. 2011, 21, 501–511. [Google Scholar] [CrossRef]

- Black, N.J.; Lockett, A.; Ennew, C.; Winklhofer, H.; McKechnie, S. Modelling consumer choice of distribution channels: An illustration from financial services. Int. J. Bank Mark. 2002, 20, 161–173. [Google Scholar] [CrossRef]

- Park, J.; Stoel, L. Effe, ct of brand familiarity, experience and information on online apparel purchase. Int. J. Retail. Distrib. Manag. 2005, 33, 148–160. [Google Scholar] [CrossRef]

- Herhausen, D.; Binder, J.; Schoegel, M.; Herrmann, A. Integrating Bricks with Clicks: Retailer-Level and Channel-Level Outcomes of Online–Offline Channel Integration. J. Retail. 2015, 91, 309–325. [Google Scholar] [CrossRef]

- Deloitte. Global Powers of Retailing 2015: Embracing Innovation; Deloitte: London, UK, 2015. [Google Scholar]

- Wu, I.-L.; Wu, S.-M. A strategy-based model for implementing channel integration in e-commerce. Internet Res. 2015, 25, 239–261. [Google Scholar] [CrossRef]

- Wilson, A. The Use of Mystery Shopping in the Measurement of Service Delivery. Serv. Ind. J. 1998, 18, 148–163. [Google Scholar] [CrossRef]

- PwC. The Digital Transformation of Small and Medium-Sized Enterprises. Available online: https://www.pwc.nl/en/topics/economic-office/europe-monitor/the-digital-transformation-of-smes.html (accessed on 2 April 2020).

- Beck, A.L.; Chitalia, S.; Rai, V. Not so gameful: A critical review of gamification in mobile energy applications. Energy Res. Soc. Sci. 2019, 51, 32–39. [Google Scholar] [CrossRef]

- Huré, E.; Picot-Coupey, K.; Ackermann, C.-L. Understanding omni-channel shopping value: A mixed-method study. J. Retail. Consum. Serv. 2017, 39, 314–330. [Google Scholar] [CrossRef]

- Grewal, D.; Roggeveen, A.L.; Nordfält, J. The Future of Retailing. J. Retail. 2017, 93, 1–6. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chaparro-Peláez, J.; Acquila-Natale, E.; Hernández-García, Á.; Iglesias-Pradas, S. The Digital Transformation of the Retail Electricity Market in Spain. Energies 2020, 13, 2085. https://doi.org/10.3390/en13082085

Chaparro-Peláez J, Acquila-Natale E, Hernández-García Á, Iglesias-Pradas S. The Digital Transformation of the Retail Electricity Market in Spain. Energies. 2020; 13(8):2085. https://doi.org/10.3390/en13082085

Chicago/Turabian StyleChaparro-Peláez, Julián, Emiliano Acquila-Natale, Ángel Hernández-García, and Santiago Iglesias-Pradas. 2020. "The Digital Transformation of the Retail Electricity Market in Spain" Energies 13, no. 8: 2085. https://doi.org/10.3390/en13082085

APA StyleChaparro-Peláez, J., Acquila-Natale, E., Hernández-García, Á., & Iglesias-Pradas, S. (2020). The Digital Transformation of the Retail Electricity Market in Spain. Energies, 13(8), 2085. https://doi.org/10.3390/en13082085