1. Introduction

Natural gas pipelines extend through every state in North America to connect producers, distributors, and customers. Proposals to construct, expand, or repurpose pipelines often lead to contention over risks to host communities. Examples include recent debates over the Mountain Valley, Atlantic Coast, and Tennessee Gas pipelines. Some communities have enacted policies to deter natural gas pipelines [

1], while others have welcomed them [

2]. Decisions about pipeline construction and regulation are often made with scant information about the risks and costs for host communities. If well informed, prospective host communities can weigh the risks associated with natural gas transmission against the long-term benefits. This article provides information to assist communities and pipeline operators with the appropriate cost–benefit analysis, and offers possible remedies for the problems communities face regarding risk spreading and uncertainty.

In 2019, pipelines supported annual expenditures of almost

$150 billion on natural gas in the United States for the production of heat, electricity, plastics, fertilizers, pharmaceuticals, fabrics, and organic chemicals, among other uses [

3].

Figure 1 shows the steadily increasing use of natural gas in the United States.

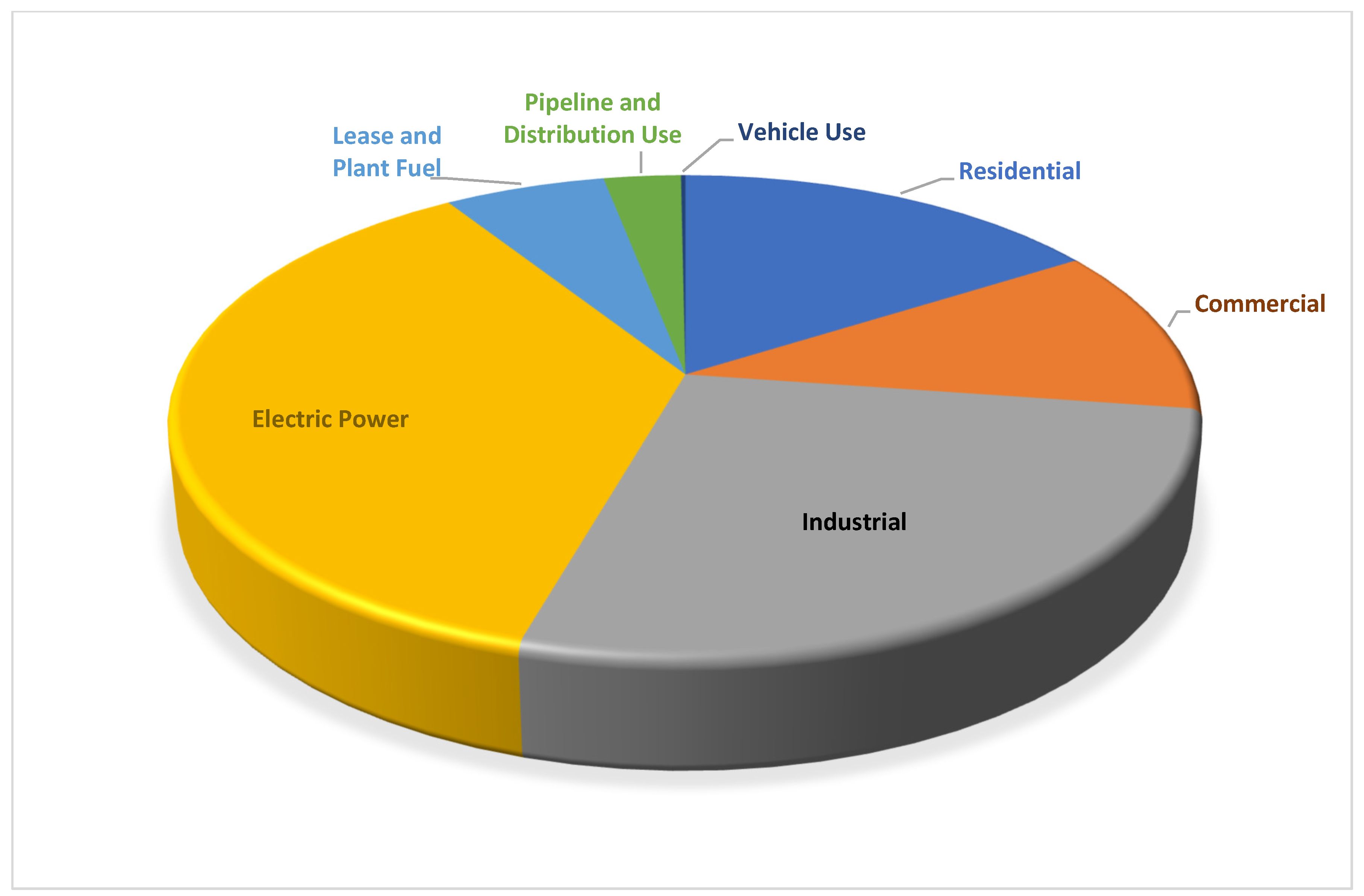

Figure 2 shows the percentage of natural gas used for each purpose. With the benefits of natural gas transmission come the threats of damage to life and property. After the construction phase of pipelines, the external costs stem largely from leaks or the combustion of toxic loads and the resulting damage to property, health, and the environment.

The Pipeline and Hazardous Materials Safety Administration (PHMSA) reports a total of 12,316 natural gas, hazardous liquids, and liquefied natural gas pipeline incidents between 2000 and 2019 [

4]. The repercussions included 309 deaths, 1232 injuries, and

$10.96 billion in property damage. These figures are accessible, yet a majority of the underlying incidents are irrelevant to communities that might host a natural gas transmission pipeline. Some of the incidents occurred offshore, some involve more volatile substances than natural gas, and some occurred in gas gathering and distribution operations that stem from a different set of decisions than transmission pipelines.

This article focuses on the information relevant to prospective host communities for natural gas pipelines. Using data paired down to include only onshore natural gas transmission pipeline incidents, the article provides incident rates and estimated costs of bodily injury, lost life, and property damage. Regression analysis provides further insights into expected damage costs based on community and pipeline characteristics. The article also discusses approaches to risk management for communities that could be applied in any country.

Section 2 of this article provides a review of the related literature.

Section 3 explains the methods used to establish the dataset and estimate the regression coefficients.

Section 4 reports the results.

Section 5 discusses implications and possible remedies for host communities’ exposure to risk and uncertainty.

Section 6 concludes the paper.

2. Literature Review

The previous literature on the costs of pipelines to host communities focuses largely on the effects of pipelines on property values [

5]. Reductions in property values near pipelines reveal perceptions of the risks of leaks and explosions. If consumers were informed, rational, and risk-neutral, the loss in property values would accurately reflect the expected cost of such incidents, and it would be redundant to add pipeline-related decreases in property values to the costs of property damage, injuries, and deaths when calculating the total cost of pipeline incidents. If consumers have imperfect information, the effect of pipelines on property values is not an accurate measure of the expected cost. Residents who perceive no risk of pipeline incidents are willing to pay the same amount for a home regardless to its proximity to a pipeline.

The findings on pipelines’ effects on property values are inconclusive. Studies by McElveen et al. [

6] and Integra Realty Resources [

7] are among those suggesting that pipelines have no significant influence on property values. In contrast, Simons et al. [

8] and Hanson et al. [

9] estimate that major incidents involving oil and gas pipelines lower property values by 10.9%–12.6% and 4.65%, respectively. Kielisch [

10] provides evidence from realtors, homeowners, real estate appraisers, and land sale analysis that natural gas pipelines can lower property values significantly, and in some cases by as much as 39%. Herrnstadt and Sweeney [

11] point out that accurate information on pipeline risks would allow people to respond with appropriate safety plans. Another benefit of the present research is that it provides information with which homebuyers can make better decisions about their willingness to pay for homes near pipelines.

Another body of research presents models of risk assessment for pipelines. That research allows operators to fine-tune their risk estimates based on situation-specific characteristics such as the density and pressure of gas within the pipeline [

12,

13,

14]. The present research incorporates broader community characteristics such as mean income and population density, along with the age of the pipeline, as determinants of the cost of an accident. The latter determinants are relatively constant and readily available to communities considering the prospect of a new pipeline.

Economists must reluctantly place a value on human life to inform decisions about tradeoffs between money and lives, including decisions about safety regulations, environmental policies, and pipelines. The existing literature addresses the value of unidentified or “statistical” lives such as the lives that could be lost by a community hosting a pipeline. We know that statistical lives have finite value because communities make decisions that have finite benefits and involve risk to life. By allowing people to drive cars, cross streets, operate farm machinery, smoke, and use natural gas, it is inevitable that deaths will result. If the value of a statistical life were infinite, none of these activities would be acceptable. Estimates of the value of a statistical life come from real-world tradeoffs people make between money and risks of death as revealed in labor markets among other settings. In a recent synthesis of the available research, Viscusi [

15] estimated that the bias-corrected mean value of a statistical life is

$10.45 million. Several U.S. agencies apply similar estimates, including the Occupational Safety and Health Administration, the Food and Drug Administration, and the Environmental Protection Agency. A related vein of literature exists for the value of bodily injury. Viscusi and Aldy [

16] provide a summary of 24 relevant studies of the value of a statistical injury, the mean of which is

$90,697. These values for a statistical life and a statistical injury are applied to deaths and injuries in the present study.

3. Data and Methods

Data on natural gas pipeline incidents are available from the Pipeline and Hazardous Materials Safety Administration (PHMSA), a division of the U.S. Department of Transportation [

17]. The PHMSA dataset offers information on every reported natural gas pipeline incident in the United States, including the location of the incident, the cost of property damage, the number of injuries and deaths, and the age of the pipeline. The PHMSA requires that incidents be reported if they cause a death or in-patient hospitalization; at least

$50,000 in property damage excluding lost gas; the unintentional loss of at least 3 million cubic feet of gas; an emergency shutdown of an underground natural gas storage facility; or an event that is significant in the judgment of the operator, even if it does not meet the other criteria [

18].

Natural gas pipeline incidents involve both explicit and implicit costs. The explicit costs include the costs of public and private property damage and emergency responses, all of which are reported to the PHMSA. The implicit costs are the costs of injuries and lost life, estimated by multiplying the number of injuries and deaths by the value of each type of occurrence drawn from the literature on the value of a statistical injury and life [

15,

16].

For the regression analysis, those pipeline data were paired at the zip-code level with information from the U.S. Bureau of the Census on population density, and information from the Statistics of Income Division of the U.S. Internal Revenue Service on income, real estate taxes, and the percentage of tax returns that are farm tax returns. The population data come from the 2010 census, conducted halfway through the 2000–2019 time period being studied. The tax data came from 2017, the most recent year for which complete data were available.

Table 1 provides variable definitions for the dataset.

The selected variables represent location characteristics that could influence the consequences of a pipeline incident. In related regression analysis of property damage from hazardous liquid pipeline incidents, Restrepo et al. [

19] use a dummy variable for high-consequence areas, which include areas with high population density. The present research uses population density among other values that similarly affect incident cost. The specification was subject to the availability of data. It would be ideal to have measures of the population density and the value of real estate within close proximity of the pipeline. Actual data are available at the zip code level, which is not always limited to areas in close range of the pipeline. The specification was adjusted in response to empirical findings on the contribution of particular variables, as discussed further below.

The population density, mean income, and real estate taxes per square mile could each influence damage costs positively or negatively. A higher population density could increase the likelihood of a leak or explosion being near buildings and people. At the same time, areas with high population densities can have stricter requirements for pipe strength, stress levels, or monitoring, which decrease the likelihood of a high-cost incident [

20]. Higher mean income similarly increases the likelihood that an incident of any particular scale would cause costly damage, but correlates with greater protections against major incidents. For example, Pless [

21] reports that the U.S. state with the lowest mean income, Mississippi, had 50.7 inspection person days per 1000 miles (1609 km) of natural gas transmission pipeline in 2009, whereas the U.S. state with the highest mean income, Massachusetts, had 764.3. Controlling for population density and mean income, having higher real estate taxes per square mile is hypothesized to have a positive influence on the cost of property damage because, for any given tax rate, it rises with property values.

Incidents along gathering and distribution lines are not included in this research, because they result from a different decision-making process than transmission lines. The risk of incidents along transmission lines is an inherent aspect of playing host for the natural gas industry as it brings its product to distant markets. In contrast, distribution lines are the result of consumers in each municipality deciding to use natural gas as fuel. Further, many of the incidents in the distribution pipeline category occur at customers’ homes and businesses. Gathering lines are in a distinct category as well. They are part of the natural gas production process and serve the purpose of bringing fuel from the extraction site to a central collection site. Offshore pipeline incidents are not included, because they are not related to the issue of communities hosting transmission pipelines.

The primary equation used to estimate the determinants of pipeline incident costs is

Region is a vector of the East, Midwest, and South dummy variables. The West dummy variable is omitted to avoid multicollinearity. Zip codes starting with 0–2 are in the East, those starting with 4–6 are in the Midwest, those starting with 8 or 9 are in the West, and those starting with 3 or 7 are in the South. The dummy variable Midwest is used instead of North because the observation level is zip-code areas, which are numbered from east to west. Zip-code areas starting with 8 and 9 run from the northern border to the southern border of the United States. It is, therefore, more practical to delineate the Midwest and West regions. The empirical investigation included several variations of this equation to assure the robustness of the findings.

4. Results

Looking only at the data on onshore natural gas transmission pipelines, between 2000 and 2019, there were 1846 incidents, 49 deaths, 173 injuries, and

$1.7 billion in property damage. Of the 12,316 total pipeline incidents reported in the introduction, only 15% were along onshore transmission pipelines, which shows the importance of breaking out this category of incidents.

Table 2 separates these figures by region for the most recent decade. The West had the most deaths, the most injuries, and the most property damage, despite having the second-lowest number of incidents. The coefficients on the regional dummy variables in the regression findings below support this finding and provide further insights into regional differences.

There are about 300,000 miles (482,803 km) of onshore natural gas transmission pipelines in the United States, and there were 115 incidents in 2019.

Table 3 shows the number of incidents per 10,000 miles (16,093 km) of these pipelines over the past 20 years. The numbers are notably consistent, with a mean of 3.11 and a standard deviation of 0.596. This indicates the relative predictability of incidents on a national scale and the inability of current safety regulations to eliminate risks.

Table 4 provides the results of the primary regression. Except for the

Midwest and

South dummy variables, the effects of these variables are statistically significant at the 95% confidence level. Population density and the natural logs of mean income have negative and significant coefficients, showing that the influence of these variables on safety precautions dominates the influence of population density and income on the proximity of people and buildings to the pipeline, as discussed in Section III. This is the case holding constant the real estate taxes per square mile, a gauge for the value of property in the area. When the real estate tax variable is removed, as shown in

Table 5, the significance of mean income falls, perhaps because mean income becomes a proxy for both more inspections (a negative influence) and more valuable property (a positive influence).

The negative coefficients on

East,

Midwest, and

South were expected given the relatively large cost of incidents in the West, as apparent from

Table 2. As hypothesized, the coefficient on the

Log real estate taxes variable was positive and significant at the 95% level, showing that in areas with relatively valuable real estate, and thus larger yields for real estate taxes, an incident causes more costly damage.

The coefficient on Log pipeline age indicates that a one percent increase in the age of a pipeline corresponds to a 0.222% increase in the expected cost of a pipeline incident. Applying that to the average cost of a pipeline incident, a one percent increase in pipeline age represents an increase of $3293 in the cost of the average incident along that pipeline.

The influence of pipeline age on damage costs is relevant to potential host communities for several reasons. To the extent that newer pipelines are safer than older pipelines, new projects have lower expected damage costs than existing projects. The rate of decline in pipeline safety over time is also relevant to communities as they consider the prospect of incidents well into the future, when the character of the community and its level of development may change. In addition, the risks associated with old pipelines must be considered when new projects involve the repurposing of existing pipelines. The average year of installation for a pipeline involved in an incident since 2000 is 1973.

Overall, the regression analysis reveals the indiscriminate nature of damages from pipeline incidents. The

R-squared indicates that 7.4% of the variation in costs is caused by the variables in the equation. So even factoring in the influence of these variables, there is considerable uncertainty about the cost imposed by a leak or explosion. The largest sources of variation are specific to individual cases and are not captured by the variables in the dataset. This motivates communities’ need for additional forms of insurance to mitigate risk and uncertainty, as discussed in

Section 4.

Several versions of the regression equation were estimated to test the robustness of the findings.

Table 5 shows the results. The signs on the coefficients and their significance are largely consistent with a few exceptions. Regression 1 repeats the findings discussed above for the purpose of comparison. Regression 2 is a linear version of the specification, which is an inferior fit but demonstrates the robustness of the findings. Regression 3 substitutes the percent of farms for the real estate taxes per square mile. Like the real estate taxes variable, the percent farms variable has a negative coefficient and is significant at the 95% level. Using both of those variables lowers the adjusted

R-squared and causes both variables to lose their significance at the 95% level. Regression 4 includes neither real estate taxes nor percent farms, yielding results similar to the other regressions but an inferior fit. Regression 5 provides coefficients for the specification with a dependent variable of property cost only, rather than total cost.

5. Discussion

The results indicate that incidents along onshore natural gas transmission lines represent a small fraction—15%—of all pipeline incidents reported to the PHMSA between 2000 and 2019. Over the past decade, an average of 101 such incidents occurred annually in the United States. When an incident occurs, the damage can devastate the local community. Compensation for lost lives, bodily injuries, property damage, environmental damage, and related expenses are often subject to litigation. Pipelines can also create fears and anxieties in communities that go uncompensated. The findings of this research give communities a better idea of the scale and frequency of relevant incidents and quantify identifiable influences on damage costs.

Current approaches to pipeline safety focus on regulation. For example, in response to deadly incidents along onshore gas pipelines, the PHMSA tightened its integrity management requirements in 2019. The new rules require pipeline operators to take further precautions, such as additional monitoring of the pressure in natural gas transmission pipelines and more assessments of pipelines in areas that are populated but not designated as high-consequence areas [

22]. Such regulations are valuable attempts to increase pipeline safety, but they do not assist the victims of pipeline accidents when, despite the regulations, they occur.

To serve both pipeline companies and host communities well, policymakers must attend to the dual realities of low-incident probabilities and high costs for the rare victims. Solutions should also address the troubling uncertainty for pipeline hosts. The five worst onshore natural gas transmission pipeline incidents over the past decade each caused more than

$25 million worth of property damage [

4]. All damage is disruptive to the property owners and victims, whether compensation is provided or not. Incidents involving explosions generate inordinate media attention and corresponding fears and concerns.

Communities would benefit from the certainty of insurance against the downside risk of a pipeline leak or explosion. One solution is for pipeline operators to act as insurers. These firms have a relatively clear understanding of the risks. They also make decisions that influence the pipelines’ safety, meaning there are beneficial incentive effects of pipeline operators serving as insurers. Operators could budget for the expected cost with knowledge of the pipeline’s history, the safety measures in place, and the monitoring practices, and they provide certain compensation when problems occur.

The pipeline operators are able to spread the risk of a costly incident across their entire pipeline network. In his concurring opinion on the legal case of

Escola vs.

Coca Cola [

23], Justice Roger J. Traynor remarked on the ability of companies such as Coca Cola to spread the risk of injuries caused by their products broadly as a cost of doing business. Already, many of the costs of pipeline incidents are covered by the pipeline operators as payments to communities and damage awards in litigation. If full compensation of host communities became mandated or contractual, the pipeline owners would provide certainty where it is needed. In addition, by internalizing the external costs of their decisions, baring other sources of market failure, firms would make socially optimal decisions about pipeline construction and use.

Personal injuries have explicit and implicit values and require special consideration. In the case of lost human life, no amount of ex-post compensation is enough. However, we can apply the value of a statistical life—the life of an unidentified individual whose death we can anticipate due to the risks inherent in pipeline use. The literature review explains that the estimated value of a statistical injury is $90,697 and the estimated value of a statistical life is $10.45 million. If guaranteed in advance, compensation at these levels would provide appropriate incentives for firms and fitting ex-ante assurance for communities.

One form of the insurance remedy would be an application of the precautionary polluter pays principle [

24]. The pipeline owners could create a trust fund with the amount that would compensate the victims for the worst-case scenario. That amount would go to the community in the event of damage and the trust fund would be replenished. If no damage occurred over the lifetime of the pipeline, the money in the fund would be returned to the pipeline owner. The results of this study regarding the expected cost and the influence of pipeline age, among other variables, would be informative for any such solution.

6. Conclusions

Expansive pipeline networks carry natural gas from source to use. Communities grapple with their stance on these conduits and need specific information to do so prudently. This article examines the costs communities face in the particular case of hosting natural gas transmission lines in the United States. Several community characteristics have a statistically significant effect on the cost of pipeline incidents, as does the age of the pipeline.

Reportable incidents along onshore natural gas transmission pipelines occur about three times per 10,000 miles (16,093 km) of pipeline per year. The low probability of an incident is coupled with the potential for catastrophic harm. Extensive media coverage of the worst disasters exacerbates community fears. The resulting uncertainty leaves many communities discomforted by the prospect of hosting a pipeline. Without remedies for the uncertainty, both full information and safety regulations fall short of solving the problem.

Given the ongoing pattern of tragic pipeline incidents, communities need solutions that provide certain compensation. Possibilities include variants on the precautionary polluter pays principle. This would place the burden on those most informed, most able to minimize the risks, and most able to spread the risks broadly across many communities. This approach would alleviate uncertainty for communities and remove the need for costly litigation over compensation for damages. This type of solution might also reduce the need for some other regulatory measures because it causes the pipeline operators to internalize the external costs of risky behavior. The remedies discussed here could apply similarly to pipelines carrying other substances in any country.