Abstract

Global issues are such that we should assess and manage a variety of risks and uncertainties. Due to increasing world complexity, the development of an adequate and innovative conceptual framework, anchored in the literature, is required. This article contributes to this effort with an approach particularly relevant to decision-makers dealing with threats of different natures, limited heterogeneous information, and experts’ assessments tainted by doubts. Our approach is based on two pillars: 1) An “acuity scale”, based on the probability of the occurrence of an event, its impact and the experts’ degree of doubt; 2) A taxonomy focused on the concepts of risk, uncertainty, gamble and butterfly ambiguity. Accordingly, we present in a second step the major management implications of such approach. Global policy trends (e.g., sustainability transition) put energy sector decision-makers at the forefront of risk and uncertainty management. Consequently, we carry out a case study focused on Swiss energy policy since the 1980s, including its inception, the turnaround provoked by the Fukushima accident, and the government’s 2050 energy strategy. Our investigation shows that the proposed conceptual framework allows for the development of an original analysis of the main drivers that influence governmental policies and stakeholder strategies.

“In general, there is a degree of doubt, caution, and modesty, which, in all kinds of scrutiny and decision, ought for ever to accompany a just reasoner.”(David Hume, An enquiry concerning human understanding, 1748).

1. Introduction

The world as we know it is tainted by risk, uncertainty and ambiguity. These concepts have been shaped by a long intellectual history, at the beginning of which we find thinkers such as Pascale and the Bernoullis [1]. Global challenges, such as climate change and financial crises, have stimulated the creation of new concepts and tools of analysis [2,3]. Some issues have engendered big controversies, such as ionizing radiation’s health effects or the precautionary principle [4,5]. Many scholars have deployed considerable effort in this regard, as pointed out below and in references [6,7].

Energy is amongst the topics of most concern in these problems and discussions [8]. Decision-makers have to deal with political, socio-economic and environmental events, either real or potential. They vary in their nature and can manifest themselves as sudden phenomena or gradual changes, at an international, national and local scale. In addition, the energy supply depends on critical infrastructures, which require long-lasting, capital-intensive investments [9]. New tools of assessment and management are necessary, notably in view of the transition towards a more sustainable energy system. In turn, energy represents an ideal field in which to develop new tools to deal with complex topics.

Indeed, there exists an abundance of quantitative, semi-quantitative and qualitative literature on the assessment and management of risk and uncertainty in the field of energy. For instance, Ioannou et al. summarized an array of methods that have been widely employed for sustainable energy planning [10], in particular mean-variance portfolio analysis (MVP), real-options analysis (ROA), stochastic optimization techniques, Monte Carlo simulation (MCS), scenario analysis and multi-criteria decision analysis (MCDA). In more recent articles, Hamarat and Pruyt focus on adaptive policy making under deep uncertainty [11], whereas Rabe et al. concentrate on the concept of risk and the possibility of applying mathematical methods to support decision-making aimed at promoting sustainable energy development [12].

Our approach is relatively simple, but original. We have developed a conceptual framework based on the probability of occurrence of events of different nature and their potential impact. The degree of doubt that often taints experts’ assessments represents an important feature of our approach. The conceptual framework includes, on the one hand, an acuity scale, which allows for the classification of potential events, and on the other hand, a taxonomy, focused on risk, uncertainty and ambiguity, which allows for their characterization. It is thus possible to deduce management strategies, although the relationship between assessment and management is not straightforward.

The approach is, above all, useful when decision-makers and stakeholders face complex problems, including a large number of variables of different nature, and only possess limited and heterogenous information. This is often the case when defining or evaluating energy policies and strategies. We have indeed developed our approach within the framework of the Swiss National Research Program “Energy” [13], intended to deliver decision-making tools for the implementation of energy transition. Moreover, this article provides a case study focused on Swiss energy policy since the 1980s, including its inception, the turnaround provoked by the Fukushima accident, and the government’s 2050 energy strategy. This analysis makes it possible to verify the relevance, the usefulness and the limits of our approach.

Of course, we do not pretend that our approach is better than the others. Its originality lies in the fact that it provides a framework to assess potential events, rank and label them, give priorities, consider different management strategies, or perform a preliminary assessment with. The existing and emerging tools of analysis and management are essential to go deeper into the different aspects and details of the problems that may have been highlighted by our approach.

In the next section, we present the conceptual framework. Then, we work through the case study, followed by the discussion and conclusions. The limits of our approach and the research required for further developments are highlighted.

2. Conceptual Framework

2.1. Risk Assessment

The definition of “risk” has given rise to great discussion and deep controversy, involving prominent scholars and various disciplines. Hansson highlighted five incompatible interpretations [14]. As finding a broad consensus on a general definition is extremely unlikely, one must clearly highlight the definition adopted and remain consistent throughout the analysis. This is the purpose of this section. We discuss the definitions adopted, without discounting other conceptual frameworks, which are presented and discussed by a well-known literature (see, for example, [15]).

Despite its simplicity, the following equation represents a useful starting point to understand how risk is approached by prominent institutions and scholars, in many fields, from engineering to economics, from natural hazards to energy supply:

where R is the risk of an event, p the probability of occurrence and I the impact.

R = p ∗ I

For instance, Haimes recognizes that risk is commonly defined as “a measure of the probability and severity of adverse effects” [16]. UNISDR defines risk as “The combination of the probability of an event and its negative consequences” [17]. The risk analysis recommended by ISO 31000 starts by considering the causes and sources of risk, their consequences, and the likelihood that those consequences will occur [18].

From this perspective, risk is measured by means of a mathematical expectation. One should be aware of the fact that a low-probability/high-impact event can have the same risk as a high-probability/low-impact event. The “all or nothing” nature of risk should also be taken into consideration [16]. Furthermore, the probability distribution should be carefully considered. Very often, one supposes that events are distributed according to a “Gaussian bell curve” (normal distribution), which has “thin tails”, in the sense that “large events are considered possible but far too rare to be consequential”, as pointed out by Mandelbrot and Taleb [19]. In fact, “fat tails”, i.e., a higher probability of extreme values, may be more relevant. The same goes for leptokurtic, platykurtic and similar distributions [20].

Finding a consensus on the definition of “uncertainty” and its link with “risk” is even more challenging. The distinction made by Knight between “risk”, which relates to objective (measurable) probabilities, and “uncertainty”, which relates to subjective (unmeasurable) probabilities, brought about deep controversies, which still emerge today [21]. The interpretation of de Finetti, which assumes that probability only exists subjectively within the minds of individuals, is more often accepted [22,23]. Even in the very simple case of throwing a dice, one can assign an objective probability to the outcome only if he/she can rule out any dice’s imperfections [24]. From this perspective, probability is always a measure of the experts’ degree of belief, which is tainted by some degree of doubt.

In our article, we assume that risk occurs when the degree of doubt is low for both probability and impact. Indeed, one can state that throwing a six-face balanced dice is a situation of risk, because everyone will agree the probability of any single face turning up is about one-sixth. On the contrary, if the degree of doubt is high, one is in a situation of uncertainty, which, in its severe form, means, as highlighted by Ben-Haim, “lack of information”, “deficiency of understanding”, or “potential for surprise” [25]. Therefore, in this perspective, we assume that doubt is a characteristic of both risk and uncertainty, but we use the concept of “uncertainty” to characterize situations where the degree of doubt is high, and the concept of “risk” if the degree of doubt is relatively low.

The degree of doubt is therefore fundamental in our framework. It can be expressed qualitatively or quantitatively. In principle, one can state that the degree of doubt is high if a significant proportion of the expert community disagrees on the probability of occurrence and/or the potential impact of a certain event. The disagreement can be provoked by a poor understanding of the phenomena involved, the models and the simplifications adopted, the quality and interpretation of the data used, the way of implementing results, etc. [16].

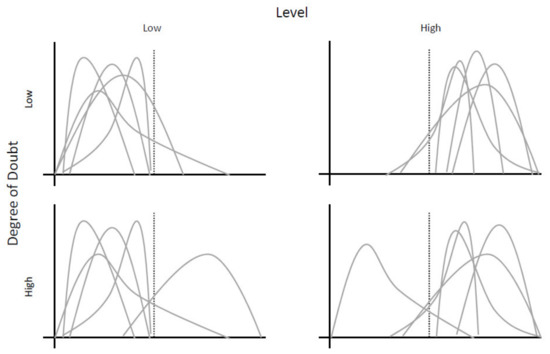

Figure 1 shows a case in which five experts are asked to estimate the impact distribution of an event. If the impact level is low according to four experts, and high for the fifth, one can consider that the degree of doubt is high. The same reasoning applies to probability. In this respect, an interesting example concerning the assessment of the global climate sensitivity to changes in CO2 concentrations is provided by Heal and Millner [26]. They point out that, “Although there are significant differences between these estimates, all are generated by intellectually respectable modelling groups”.

Figure 1.

Four cases of the impact’s distribution of an event according to five experts.

Table 1 shows that, besides situations of risk and uncertainty, there are situations of ambiguity. If the degree of doubt is high with respect to the probability, but low with respect to the impact, the ambiguity concerns the probability (we call it “Gamble ambiguity”). In the opposite situation, the ambiguity relates to the impact (called “Butterfly ambiguity”). The former concept of ambiguity has been borrowed from Ellsberg (1961), who presents a gambling example with a known outcome and ill-defined probability [27]. The latter relates to the butterfly effect hypothesis, highlighted by chaos theory, where the probability of a wing flapping can be precisely measured contrary to its remote consequences [28].

Table 1.

Taxonomy of an event according to the degree of doubt concerning the assessment of its probability and impact.

2.2. Acuity Scale

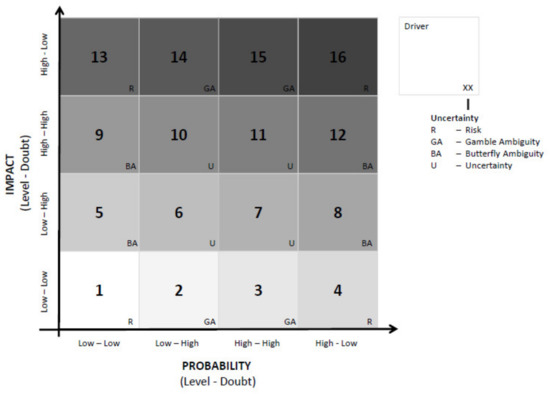

Table 2 defines an “acuity scale” by integrating the characteristics of an event into an ascending single dimension. A graphical representation is provided by Figure 2. This scale is based on a combination of the probability of occurrence and the impact of different events, notably their level (high or low) and the doubt that characterizes their evaluations (high or low).

Table 2.

Acuity scale of an event according to its probability and impact, level and degree of doubt.

“Very high” (16) means the probability of the event and its impact are high, while the related degree of doubt is low. “Very low” (1) means that the probability, impact and related degree of doubt are low. These cases correspond to the top right corner, respectively the bottom left corner of Figure 2. We consider “high” and “low” values only in order to avoid being attracted by average values in the empirical analysis.

More precisely, the acuity depends on the impact’s level and the related degree of doubt. The high-impact events are all situated at the top half of the scale (9–16), and the opposite for low-impact events (1–8). The “high impact–low doubt” events are at the top of the scale (13–16); the “low impact–low doubt” are at the bottom (1-4). They correspond to the top line; the bottom line of Figure 2.

The probabilities of occurrence and the related degree of doubt are linked to each homogeneous “impact–doubt” set (i.e., to the lines 1–4, 5–8, etc., of Figure 2) according to the following rule: The lowest rank is given to the couple “low probability–low doubt” (1, 5, 9 and 13, i.e., the first colon of Figure 2); the highest rank to the couple “high probability–low doubt” (4, 8, 12 and 16, i.e.,. the fourth colon).

If we consider the taxonomy of Table 1, we notice the situations of risk corresponding to ranks 1, 4, 13 and 16 of the acuity scale, while the situations of uncertainty correspond to ranks 6, 7, 10 and 11. The former corresponds to Figure 2′s corners; the latter, to the Figure’s central part. Table 2 also provides some examples that allow the intuitive judging of the relevance of this scale. As some of them are controversial or questionable, the reader can check if our classification corresponds to his/her point of view.

Despite the extent of the acuity scale from 1 to 16, the taxonomy remains very simple. It includes four cases, which derive from the combination of the probability of the occurrence of an event, its potential impact and the associated degree of doubt, as shown by Table 1.

We should point out that we borrowed the word “acuity” from medical vocabulary. The Canadian emergency health care system introduced it in order to sort patients in relation to the severity of their illness [29]. As in the case of our approach, this triage system considers objective as well as subjective information; and requires re-evaluation as situations evolve.

2.3. Management

The acuity scale supports the development of management strategies, taking stock of the abundant literature on this topic. Indeed, the potential events considered can be prioritized on the basis of the scale 1–16, whereas specific strategies can be tailored to single events by taking into consideration the probability of occurrence, potential impact and related degree of doubt.

On principle, management strategies should focus on the events situated at the top half of the scale (9 to 16), because of their potentially high impact. However, one should be aware that doubt is high from 9 to 12, which means that the potential impact may be overestimated. On the other hand, between 5 and 8, potential impact is low, and doubt remains high, so impact may be underestimated. The probability of occurrence should be considered with the same caution whenever the related degree of doubt and potential impact are high. Management should not neglect potential events situated at the bottom of the acuity scale, despite the low potential impact and doubt, as “low doubt” doesn’t mean “no doubt at all”.

Doubt not only strongly influences the acuity scale, but it is an important element that should be carefully considered by management. In certain cases, it can be reduced by acquiring new information, reviewing expert findings or pooling their opinions [30]. In other cases, in particular in the situation of “deep uncertainty”, this is not possible. According to Walker et al. “deep uncertainty” is characterized by the fact experts cannot agree on the appropriate models that should be used, and stakeholders have very dissimilar views on the desirability of different outcomes [31].

In the case of risk, doubt is always low. By definition, the problem is well-understood and decision-makers may apply optimization techniques to minimize the expected costs. Risk includes the extremes of the acuity scale, which means that a negative potential event is (almost) acceptable, and, respectively, (almost) unacceptable. Often the strategy is “do nothing” or “risk transfer”, and, respectively, “avoid the risk as far as possible”, “strengthen safety”, “reduce vulnerability” or “prepare for the worst” [32].

In the case of ambiguity, doubt relates to probability or impact; in the case of uncertainty, both. The difference with risk is, in fact, due to doubt. The fact that doubt is high or low only partially affects the management strategy. For instance, in a situation of gamble ambiguity, one can focus on the probability of occurrence (high doubt) or, alternatively, on the potential impact (low doubt). In fact, to some extent, the strategy depends on the potential event’s specificities.

However, in a situation of a high degree of doubt, two approaches may make a difference: namely flexibility and robustness. Decisions are flexible to the extent that “[they] can be reversed or modified as more information becomes available in the future” [33]. They are robust to the extent that they are “resilient to surprise, immune to ignorance” [25]. In other words, “A decision is robust to uncertainty if it achieves required outcomes even if adverse surprises occur”.

3. Swiss Case Study

We now apply the acuity scale to the Swiss energy sector in order to prove its relevance. We consider Switzerland in its international context, without pretending to be exhaustive. In the following section, we carry out a retrospective analysis, which includes the energy policy take-off in the 1990s, the “turnaround” after the Fukushima accident, the opening of the electricity market to competition in the first decade of the century, and the so-called “hydropower crisis” few years later. In Section 3.2, we perform a prospective analysis by focusing on the future of hydropower and considering some changes that can reshape the electric landscape by the middle of the century.

3.1. Retrospective Analysis

We thus retrospectively assess, from an ex-ante perspective, the probability of occurrence of some important events, their potential impact and the related degree of doubt that influenced past decisions. We discuss the ex-post evolution and the main policy measures that were recommended at that time to deal with various challenges, concerning energy supply, the environment, and socio-economic welfare. They include strengthening installation safety at certain key installations, fossil fuel reduction and substitution, public and private governance, and adaptation to changes.

Table 3 shows the results of the retrospective analysis. Col. (a) indicates the events that had or could have had a significant impact on energy policy, market organization and wholesale electricity prices. Col. (b) makes a distinction between sudden and gradual events. Col. (c) and (d) respectively show the probability and the impact (assessed before the occurrence of the event); the relative degree of doubt is also indicated. The acuity scale, deduced from col. (c) and (d), is indicated in col. (e). Col. (f) shows the main measures that were taken to deal with the events considered; it also indicates whether they aimed to influence the probability or the impact. Col. (g) indicates the sources used.

Table 3.

Acuity of some selected events according to the probability of occurrence, potential impact and related doubt—Swiss retrospective case study.

We should stress that these assessments do not represent our points of view, but are based on different types of sources, which include reports published by the International Energy Agency (IEA), the European Union (EU), and the Swiss Confederation. Scientific articles are also quoted, although our analysis is as extensive as possible based on institutional or semi-institutional sources. A certain degree of subjectivity is unavoidable in these analyses, because, in general, the sources are not explicit about probabilities, impacts and doubts. However, we did our best to remain faithful to the sources. The following sections briefly summarize the essence of the information that substantiates our conclusions.

3.1.1. Energy Policy: Take-Off

The Swiss government developed a comprehensive energy policy in the eighties, approved by a popular vote in 1990. Four events are generally referenced explaining its take-off: the oil shocks in the 1970s; the nuclear accidents of Three Mile Island (1979) and Chernobyl (1986); the forest dieback in the 1980s.

The idea of an oil shock represented a threat to Western countries in the 1980s, despite the fact that oil prices gradually declined and remained relatively low and stable for a long time. The experience of previous shocks did not leave much doubt regarding the socio-economic impact of such an event. The IEA’s 1982 World Energy Outlook (WEO) highlighted the main oil market features, which were reiterated by other reports in the years that followed, notably the “risk that a closely balanced demand and supply equilibrium could once again be precipitated by political events in the Middle East”; “the basic vulnerability of the world economy to oil supply disruptions”; the uncertainty about the future path of oil prices [34]. The conclusion was that “vigorous energy policies” were required. A “Low Oil Reference Scenario” was designed in an attempt to outline a consistent energy picture minimizing oil imports. On this basis, we can conclude that the probability of the occurrence of an oil shock and its potential impact were both high; the degree of doubt was respectively high for the former and low for the latter. The high doubt regarding the probability was due to the complexity of the situation. On the contrary, there was little doubt about the economic impact.

The debate on nuclear energy was deeply influenced by Three Mile Island and Chernobyl. In the former case, the radioactive release into the atmosphere was almost negligible. In the second case, there was radioactive fallout in vast areas of the European continent, and an exclusion zone had to be created around the nuclear power plant. Both accidents hinder the development of nuclear energy. The IEA pointed out that Three Mile Island “has shown that accidents, however low their probability, can happen” [34]. Its main concern was possible public distrust, which is “the most important uncertainty facing nuclear power” [34]. The probability and potential impact of a nuclear accident were quantified by “Probabilistic Risk Analyses” (PRA). Vesely and Rasmuson summarized the findings by pointing out that “The frequency versus consequence curves have large uncertainties because of the sensitivity of the shape of the curve to specific frequency and consequence estimates” [37]. We assume at that time the probability of occurrence of a major accident was low but the degree of doubt high; the potential impact and its related doubt were both high.

In the 1980s, forest dieback was a gradual phenomenon already in progress. Some pristine environments that belong to the Swiss national landscape were affected by acid rains. One should, however, recognize that a decade later the problem turned out to be less severe than expected. This threat was taken so seriously that an extraordinary session of the Federal Assembly was organized in 1985 to discuss the measures to be implemented. The Swiss government stressed that “damage to forests in Switzerland is rapidly worsening” [38]. Canada and Scandinavian countries were particularly concerned [34]. A broad assessment regarding the situation in Europe highlighted that “Much of this [landscape] is already acidified, and the potential exists for even more widespread acidification in the coming decades […] In many cases even ecosystems more robust to acidification are threatened” [39]. The conclusion was that “Energy policies over and above the existing ones are required to reverse the trends in European acidification” [39]. In conclusion, we can assume that the probability of occurrence of forest dieback, as well as its potential impact, were high; the degree of doubt was low.

3.1.2. Energy Policy: Turnaround

The turnaround of Swiss energy policy, as in some other European countries, took place in the aftermath of the Fukushima disaster in 2011. The strategy designed by the government was endorsed by the people in 2017. Another important driver was the threat of climate change, while gas supply security could have played a significant role if a unilateral decision by certain exporting countries had destabilized the European market.

The 2007 energy scenarios of the Swiss government stressed, “Disastrous scenarios or technical revolutions are excluded from this work. It would be costly or imprudent to target a policy on the worst possible development or on an unexpected technological breakthrough” [42]. However, a few years later, a disaster that happened thousands of miles away provoked a turnaround in energy policy. As an old adage of the nuclear industry says, “an accident anywhere is an accident everywhere” [60], and Fukushima acted as a catalyst in the decision to phase out nuclear energy, and gradually but substantially reduce the use of fossil fuels [61].

Up until the day before the Fukushima accident, the consensus around nuclear energy was increasing, due to growing concerns about the rising CO2 emissions and the dependence of most Western countries on oil and gas imports [41]. The concern surrounding nuclear risk was, however, still present in the debates. The IEA pointed out that “Safety, nuclear waste disposal and the risk of proliferation are real challenges which have to be solved to the satisfaction of the public, or they will hinder the development of new nuclear power plants” [40]. The Swiss Confederation argued that an accident entailing leakage of radioactive substances would be “particularly serious in a densely populated country” [32]. We assume that the situation remains the same as in the 1980s, except for the degree of doubt around the impact, which now can be assumed to be low.

A disruption of gas supply in Europe, instead of a nuclear disaster, could have encouraged the development of nuclear power as a substitute for fossil fuel [62]. The IEA expressed concerns following a series of supply disruptions, in particular the Russian–Ukrainian dispute in 2006 [40,41]. A memorandum of understanding on cooperation in upstream activities between Gazprom (Russia) and Sonatrach (Algeria), signed in 2006, alerted European decision-makers about its implications for competition and prices. Despite the geopolitical tensions and possible collaboration between exporting nations to artificially inflate prices, one cannot conclude that the probability of occurrence of a gas supply disruption in Western Europe was high; doubts, however, were legitimate and could not be dismissed. Due to the strategic role played by gas in some regions, the potential impact was high; doubt low. In order to face these threats, IEA highlighted the “benefits of diversifying away from imported oil and gas” [40]. The “importance of giving full rein to markets in balancing supply and demand” was also stressed [41]. Some of the 2007 Swiss Confederation scenarios considered the development of combined cycle gas turbines (CCGT) and heat and power plants (CHP); however, the limited opportunities for gas supply diversification were recognized [42].

Besides nuclear risk, the climate change threat turned out to be the single most important driver of energy policy, at a European as well as at a Swiss level [61,63]. On the basis of the documents quoted in Table 3, we can state that, at that time, the probability of occurrence and the potential impact were already high, and the degree of doubt low, as in the case of the forest dieback in the 1980s. We recognize the uncertainties that still taint our understanding of climate change (for instance, the cloud feedback phenomena), but a consensus exists on the temperature increase and its impact, and that even in the most favorable case, the above conclusions remain valid. The IEA pointed out that “The Reference Scenario puts us on a path to doubling the aggregate concentration in CO2 equivalent terms by the end of this century, entailing an eventual global average temperature increase up to 6 °C.” [41]. For its part, the Intergovernmental Panel on Climate Change (IPCC) stressed that “Warming of the climate system is unequivocal, as is now evident from observations of increases in global average air and ocean temperatures, widespread melting of snow and ice and rising global average sea level” [43]. The IPCC stressed “many natural systems are being affected by regional climate changes” [43]. According to the Swiss Confederation, “Global warming is the biggest global challenge” [42]. The IEA pointed out that “Strong, urgent action is needed to curb the growth in greenhouse-gas emissions” [41]. Co-benefits are lower fossil fuel imports, lower import bills, and reduced local air pollution.

3.1.3. Market Organization: Liberalization

Several countries and states opened their electricity markets to competition in the 1990s [64]. The EU made the decision in 1996. In Switzerland, liberalization was at first rejected by a popular vote in 2002 (the Swiss Confederation is not part of the EU). Following a subsequent compromise, the market was, however, partially opened to competition in 2007 [47]. We now consider three drivers that had an important impact on the decisions taken in Switzerland at that time: the opening of the EU market, the ideological clash between supporters and opponents of liberalization, and the electricity crises, notably in California.

The EU decided to open the market in 1996, following long and strained discussions [45]. The 1996/1992/EC directive defined the common rules for the internal market in electricity [44]. When the Swiss people had to vote on this issue, the probability of the completion of the ongoing European reforms, as well as the potential impact, were high, and doubts were low.

The Swiss government decided to follow the path drawn by the EU for multiple reasons: to ensure that Swiss electricity companies had free access to the EU market; to put the Swiss industry on an equal footing with its European competitors; to increase efficiency; to take better account of the customers’ needs; and to promote innovation [46,47]. The Swiss government had a positive view of the experiences of the countries that had already opened their markets to competition, in particular England and Norway [46]. However, some key issues were highlighted among which were: 1) prices had fallen but became volatile; 2) natural gas was replacing coal in some countries, which had positive effects on the environment but raised concerns about the diversification of the electricity mix; 3) in the future, certain “national champions” (i.e., former national monopolies) may dominate the market.

The opening of the electricity market to competition provoked ideological clashes, which may contribute to answering the question raised by Joskow, “Why is electricity sector liberalization so difficult and subject to so much opposition?” [64]. Most of the opponents belonged to the anti-globalization and anti-liberalization movement. They challenged restructuration in the fields of energy, transport, and communication. In some countries, they stood out as the defenders of the so-called “public service”, which embodies certain political convictions and social values [48].

The Swiss government summed up the opponents’ arguments in the 2002 vote: “The market law and the privatization it entails will destroy the public service, and the people will no longer have a say. The price will be determined by the market and therefore speculators. It will fluctuate even more strongly than the price of oil and gasoline […]” [49]. The Swiss people rejected the liberalization of the electricity sector despite the assurances given by the government, in particular regarding public service. We can conclude that the probability and potential impact of such clashes were high, because of the determination and the arguments of the anti-liberalization movement; doubts were also high, as is common when assessing the real influence of these movements.

The California power crisis of 2000/2001 strongly influenced the debate on electricity reforms abroad, much more than other crises that occurred elsewhere in the world. It overshadowed positive experiences in other countries and states. As pointed out by Faruqui et al., “California’s power crisis has implications for power markets worldwide, because of the severity and unpredictability of its impacts” [50]. Sweeney argued, “At the time of the restructuring, it would have been reasonable to believe that if the perfect storm descended on the state, the political system would adjust to the new reality. Unfortunately, as has become painfully apparent, this reasonable belief has proved to be disastrously wrong” [51]. Sweeney also pointed out that the risks were underestimated by the legislators, who unanimously passed the bill, although market behavior couldn’t be predicted since the system was untested at that time. Viewed from abroad, such a crisis was unimaginable in the Golden State. We thus assume that the probability of occurrence, the potential impact and the related doubts were low.

3.1.4. Electricity Wholesale Market Price: Hydropower Crisis

In the past, in Switzerland, hydropower has been a thriving economic sector, a source of revenue for shareholders, royalties for public bodies, jobs for the mountain regions and income for the trade balance [65]. Since 2011, the sector has been experiencing a crisis. The Confederation has allocated subsidies to the most vulnerable hydropower plants and a reduction in water fees is on the agenda. Hydropower represents about 60% of domestic supply; part of it is sold abroad. Thanks to the water reservoirs and pump-storage facilities, it provides energy during peak periods and power for network regulation [66]. The crisis has been provoked by the very low electricity wholesale prices on the European market. The depressed CO2 market, as well as renewables’ strong penetration, are other drivers that should be considered.

We can infer from the sources quoted in Table 3 that, in the first decade of the twenty-first century, the probability of a long period of very low prices and excess capacity was low, however, the potential impact would have been high. In both cases, the degree of doubt was low. The Swiss government argued that prices tend to fall during a transitional period. However, the excess capacity will disappear thanks to competition and prices will rise again. Hydroelectricity will take advantage of the fact that peak prices increase more than base-load prices [46,47]. The federal administration pointed out that “If capacity is not developed [...] a shortage of electricity will appear from 2018–2020” [42], while the electricity sector noted that “the high-price scenario is more likely than the low-price one” [52]. For its part, the European Commission (EC) stated that “new power plants are needed to replace the obsolete ones and to substitute the ones not complying with the environmental regulations” [53]. Some doubts were raised, such as a surplus period that would last longer than expected, due to market distortions and state intervention but, overall, they can be described as low [46].

Market power was a topical issue during liberalization. The hypothesis was that, thanks to mergers and partnerships, or strategic behavior, some electricity companies were able to influence the market price. The supervision of the competition commissions was, however, a deterrent. The Swiss government argued that “Some large companies would tend to dominate the market” [46]. Bushnell considered the market power potential for hydropower companies [56]. A certain degree of market power could have avoided the hydropower crisis, because imperfect competition may facilitate investment, contrary to perfect competition, which may jeopardize it [55,57]. We conclude that, at that time, the probability of market power and its potential impact were low, because of the difficulties in implementing this kind of strategy and their effectiveness. However, doubts were high in both instances.

The EU greenhouse gas emissions trading scheme (ETS), created in 2005, could have had an impact on fossil-fuel power plant generating costs. It would have affected hydropower competitiveness to the extent that carbon prices would have reached a relatively high level. In fact, they were only high enough to have an impact on the electricity market in the first phase. Despite some market reforms, the price remained low. In the 2005 scenarios, EC supposed a constant price of €5/t CO2, “which reflects the expected medium-term price level of the emerging international carbon market” [53]. The Swiss Confederation supposed higher prices, but recognized the recent price drop [42]. We assume the probability of a relatively high price was low, but doubt was high; the potential impact was high, and doubt was low.

On principle, a strong penetration of wind power and photovoltaic should create a new, profitable market for storage hydropower. Indeed, backup power is needed to compensate for the natural intermittency of these energy sources. However, the problem turned out to be more complex. In particular, solar energy, which has been strongly subsidized, competes with hydropower on one of its most interesting market sections, i.e., the middle of the day.

Since the beginning of the twenty-first century, the EC recognized “Renewable energy are expected to play an important role for power generation in the future” [58], but it was only in 2009 that it made quite impressive inroads in this scenario [54]. The EC bet on wind energy, which was becoming competitive, supposed a slow penetration of the photovoltaic technology [53,59]. The need for back-up power became a critical issue as soon as a relatively important share of renewable energy was included in the scenarios [54]. The Swiss electricity branch argued that storage and pumped-storage facilities could play the role of a “battery” in this respect [52]. However, one shouldn’t overlook the possible shift towards small decentralized installations, pointed out by both the EC and the Swiss government. Furthermore, decentralization can be stimulated by the uncertainty surrounding investments’ profitability in large power plants [42,47]. Our conclusion is the probability of a kind of “clash” between hydropower and photovoltaics, as well as the potential impact on hydropower, were low. Doubts were also low.

3.2. Prospective Analysis

In this section, we focus on the future of hydropower, which could experience a revival but could also see a decline, or even abandonment. In the following paragraphs, we briefly present the electricity highways and microgrids which may change the electric landscape profoundly. Then, we will focus on new market design, which is required to adapt the market to the energy turnaround, and to fix the so-called “missing money problem” [57] provoked by the very low electricity wholesale prices previously mentioned. Finally, we present drivers that can influence the future of hydropower and are also of utmost importance for the electricity highways and microgrids’ development.

As for the retrospective analysis, we carry out a qualitative analysis and we consider Switzerland in the context of the European Union. We focus on a middle/medium term (2021–2035) and on a long-term horizon (2036–2050). The main sources used are documents published by the European Commission [67], the Swiss Confederation [68], international organizations [69,70,71], and research programs [13,72,73,74,75,76]. We have also considered some academic articles.

An “electricity highway” is a transmission line able to transport large quantities of electricity over long distances. Its capacity is significantly higher than the existing high-voltage transmission grids. The EU’s project is to build a pan-European grid which includes major corridors connecting Northern and Southern countries to the central continental area. The goals are to integrate and optimize the European electricity market, to improve its reliability and supply security, and to move large amounts of energy from renewable sources over long distances. As pointed out by e-Highway2050 [73], “A pan-European electricity grid is also required in order to facilitate the future transport of wind energy from the North Sea, solar power from north Africa or biomass electricity from Russia, for example, to consumption centres via electricity highways”.

A “microgrid” is a small electricity distribution network incorporating distributed generation, different kinds of electricity storage, and smart meters. “Distributed generation” refers to small-scale generators. “Smart grid” is another important concept: “the expanded use of new communications, sensing, and control systems throughout all levels of the electric grid” [75]. Although on principle, microgrids can separate from the interconnexion and operate autonomously as electric islands for a certain period of time, they should be depicted as clusters connected to the high voltage lines for security and economic reasons.

There is a quite large consensus concerning the necessity to re-design the electric market, due to i) the missing money problem; ii) the decentralization of the electric system; iii) the production of large amounts of intermittent renewable energy and iv) the need for flexibility. The following statements are very clear in this respect: “Changes in policy and regulatory frameworks, as well as economic incentives, are essential to ensure timely investment in flexibility assets and to make the most of the flexibility potential of existing power plants [70]; “Market design rules will need to be updated to incorporate the growing move towards decentralization”, “the current regulatory framework needs a robust overhaul in order to deliver the needed price signals to trigger investments in capacities and to enhance flexibility” [71]; “the presence of distributed energy resources and large amounts of renewable, zero-marginal cost resources may require additional upgrades to nearly every aspect of these markets” [76]. ENTSO-E comes to the same conclusions [69]. The presentation of the envisaged solutions, including their advantages and disadvantages, goes beyond the purpose of this article [77].

Table 4 lists the drivers that we will discuss in the following paragraphs. It also shows the probability of occurrence of the different events and evolutions, the potential impact, the related doubts, as well as the resulting acuity. The impact concerns the future of hydropower in the power market as we know it at present in Europe (in other words, we don’t consider market re-design). We don’t pretend to be exhaustive—for instance, we don’t consider the investments in CCGTs or CHP, which are not discarded by the Swiss energy strategy to make the transition [61], or the water concessions’ renewal and the water fees’ reform, which represent important issues for stakeholders [78].

Table 4.

Acuity of some selected events according to the probability of occurrence, potential impact and related doubt—Swiss prospective case study.

An important energy policy goal in the EU and in Switzerland is to decrease overall electricity consumption by improving the efficiency of the devices and processes and promoting less energy-consuming behaviors. However, the substitution of fossil fuels by electricity, which allows for a greater penetration of renewable energies in the energy mix, could work in the opposite direction. IEA is more optimistic, by pointing out that the “[consumption] growth linked to increasing digitalization and electrification is largely offset by energy efficiency improvements” [70]. To a certain extent, the drop in consumption can depress the market, and thus have a negative impact on hydropower profitability. Our conclusion is that the probability of a decrease in electricity consumption is high and doubts are also high. The potential negative impact on hydropower is high, doubts low.

Renewable energy’s penetration will continue at a sustained pace thanks to several policy measures, in particular subsidies, which have already provoked a breakthrough in certain countries, such as Germany. The reduction in generating costs represents a powerful driver in this respect. As stated by WEC, “The decrease in prices of photovoltaic panels and wind turbines has boosted the attractiveness to invest into these technologies” [71]. As previously experienced, the injection of important amounts of renewables can depress the market. Furthermore, the market price would tend towards zero if wind farms (or photovoltaics) represent the marginal installation brought into service, as its marginal cost is about zero. We can state that the probability of an important penetration of renewables in the electricity mix is high; the potential negative impact on hydropower is also high; doubts are low.

The decommissioning of nuclear and coal power plants can tighten the demand–supply balance and provoke an increase in wholesale market prices. However, the probability of a breakthrough in this field within the next 15 years is low, mainly due to the fact that the pace of decommissioning of nuclear power plants in Switzerland and coal power plants in Germany is slow. There is little doubt in this regard. The impact on the market, and thus on hydropower, would be high; doubts would be low. On the contrary, the probability of decommissioning after 2035 is high, the impact is also high, and doubts low [79]. The carbon price will no longer have any impact on the price of electricity in the post-fossil era. However, at least until 2035, one may suppose the opposite, although past experience raises many doubts [80].

Until around the middle of the century, climate change had a positive impact on hydroelectric production, due to the runoff increase resulting from the thawing of glaciers [81]. The opposite phenomenon will appear at some stage, following the gradual disappearance of glaciers. Based on an annual average, the water volumes in the second half of our century will decrease to reach the same volume as of the beginning of the twentieth century, when the glaciers’ retreat was very slow. However, one will record higher runoff peaks, and probably interannual variability. A change in seasonality is also expected, with snowmelt earlier in the year and lower flows in summer. There is little doubt in this regard, because the different scenarios’ forecasts converge to a large extent [82]. Local specificities are, however, important [83]. Our conclusion is that the probability that hydropower is affected by the climate change is high in the two periods considered and doubts are low. The impact is positive but low; doubts are low.

The exchange of electricity between surplus and deficit regions increases the power system’s flexibility. From this perspective, even intermittent renewable energy can provide flexibility. However, this implies strengthening interconnections between and within countries. These investments should be carried out with a long-term perspective, which takes into account the pan-European grid project described above. As pointed out by the European commission (EC), “When we need a lot of electricity in the peak of the day of a cold winter, we must make sure that the clean and cheap electricity from the wind farms in Northern Europe or from the solar farms of Southern Europe can arrive where it is most needed” [67]. This vision is supported by ENTSO-E [65].

We should point out that the Swiss energy strategy partially relies on electricity imports to deal with possible imbalances during the transition. This can happen during the winter months in particular, when the productive potential is lower. Carrying over summer surpluses into the winter by storing water in hydropower reservoirs is only possible to a limited extent, due to the reservoirs’ insufficient capacity, and their extension is limited for technical and environmental reasons [84].

Our conclusion is that the probability of a strong growth of such exchanges is relatively low in the period 2021–2035 and high in the period 2036–2050. Doubts are, respectively, high and low. The negative impact on peak prices, and thus on hydropower and, more generally, on back-up capacity, is high in both periods. Doubts are low.

We are experiencing a breakthrough in the field of electricity storage technologies. The use of batteries is accelerating worldwide [70]. They can have a capacity of the order of kW, usually in combination with small photovoltaic systems, or of the order of MW, to provide flexibility to the network. They represent an essential part of microgrids. The “compressed air energy storage” (CAES) is another promising technology. In the case of Switzerland, thanks to its geology, this system could have a fairly large diffusion. Furthermore, one must mention “power to gas”. These new technologies compete with hydroelectricity in flexibility supply [85]. The probability of a large diffusion in the next fifteen years in low and doubts are low. In the long term, the probability is high and doubts low. The impact is high, doubts low.

Innovative and active demand-side management (DSM) represents an important source of flexibility. As pointed out by IEA, “Demand-side response has a large part to play in meeting rising flexibility needs, for example by curbing peak demand and redistributing electricity to time periods when the load is smaller and electricity is cheaper” [70]. On the one hand, DSM relies on the diffusion of smart meters, digitalisation and real-time pricing; on the other hand, it also relies on consumer behaviours and acceptability. The impact on hydropower is negative because DSM can take market share away from it. The probability of a large DSM diffusion is high, but for the period 2021–2035, one can raise some doubts, notably regarding the adoption of these technologies by consumers. The impact is high; doubts low.

While being a hub for the European interconnection, Switzerland’s integration into the European institutions and markets is limited, due to the deadlock in the bilateral agreements between Bern and Brussels [86]. Without an electric agreement, Switzerland is excluded from participating in the European market coupling mechanisms. Besides a loss of market opportunities, this has undesired effects on the management of cross-border lines. This situation hampers the hydropower business. Our guess is that the probability of an electric agreement in the near future is quite high, and doubts are high in the medium term, but low in the long term; the impact is high, doubts low.

4. Discussion

The acuity scale allows for the classification and prioritization of potential events on the basis of their probability of occurrence and their impact. The degree of doubt strongly influences their ranking. Besides the acuity scale, a taxonomy is proposed, including: 1) risk; 2) uncertainty; 3) gamble ambiguity; and 4) butterfly ambiguity. This conceptual framework may help, on the one hand, in establishing priorities when defining management strategies, and on the other, in choosing between several approaches, as pointed out in Section 2.3. A risk situation may require optimization approaches, while flexibility and robustness should be considered whenever doubt is high. In a nutshell, the acuity scale makes it possible to carry out an initial sort, and the taxonomy makes it possible to characterize the different potential events; management strategies may be defined based on both of them. Doubt is fundamental in our framework. In many cases, it cannot be reduced. However, at a time when the results of scientific research are questioned with great ease according to disparate needs, doubt must be adequately justified and motivated. One has to recognize that “low doubt” does not mean “no doubt at all”; thus, there is no magic silver bullet. Each case must be analysed individually.

This approach is particularly relevant when one has to deal with several potential events of different nature (natural, technological, socio-economic, political and even ideological), and the information available is heterogenous and relatively limited. The aim is to enable decision-makers to consider all issues coherently, on the basis of the best information available (quantitative and qualitative). Doubts should not be hidden.

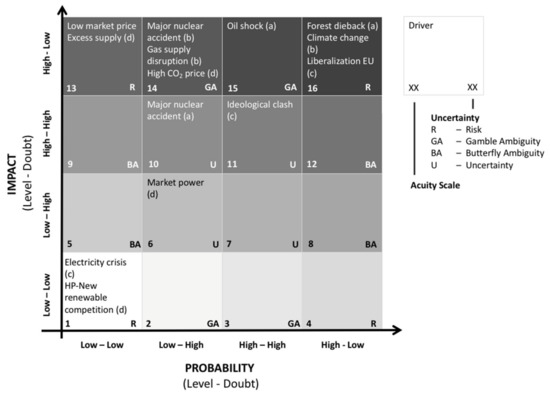

The retrospective analysis highlights the potential events that strongly influenced energy policy, market liberalization and hydropower crisis in Switzerland, summarized in Figure 3. Concerning energy policy, they all rank at the top of the acuity scale (14–16), except nuclear accident in the 1980s and 1990s (10), due to the high doubt in relation to impact. They include risks and gambling ambiguity. Whether they have materialized or not is irrelevant from this perspective. Since the 1980s, there have been no major shocks, however, oil and gas supply still represent an important policy driver. The forest dieback turned out to be less dramatic than expected but, on the basis of the information available at that time, one couldn’t overlook this phenomenon. Climate change was confirmed by further analyses and has acquired growing political relevance. Nuclear energy represented a controversial topic before being put on a dead-end track by the Fukushima accident. To deal with these threats, in some cases the Swiss government focused on the probability of occurrence of the event, and in others, on the potential impact.

Figure 3.

Acuity scale: The drivers of (a) energy policy take-off (1990); (b) energy turnaround; (c) electricity market liberalization (2007); (d) hydropower crisis (since 2011).

The liberalization of the EU power market resulted in the reform of the Swiss electric sector; the ideological clash between supporters and opponents represented an important obstacle. Both drivers rank at the top half of the acuity scale (11–16): they include uncertainty and risk. The high impact was confirmed by the successive evolution. The ideological clash strongly influenced the decisions taken in the first decade of the twentieth century. The same goes for the California electricity crisis, which, however, ranked at the bottom of the acuity scale (1) prior to its occurrence. To deal with these issues, the Swiss government defined new rules better adapted to the new realities.

Energy policy and market liberalization created positive as well as negative synergies. The hydropower crisis, provoked by the persistent drop in wholesale market prices, matured in this environment. The cases of “low market prices/chronic excess supply” were overlooked by stakeholders, because they continued to rely on the hydropower flexibility and high peak prices. On the other hand, the doubt relating to a “high CO2 price” kept some hopes alive. Both of them rank at the top of the acuity scale (13–14); “low market prices/chronic excess supply” represents a risk, while “high CO2 price” represents a gamble ambiguity. The “competition between new renewables and hydropower”, as well as “market power” are situated at the bottom half of the acuity scale (1 and 6); they represent, respectively, a risk and an uncertainty. The former was ruled out because a strong penetration of the new renewables was considered a benefit for hydropower. Market power was often mentioned in the public debate. No specific measures were taken ex-ante by the Swiss government to deal with these issues. The main idea was that the market should be left to sort itself out.

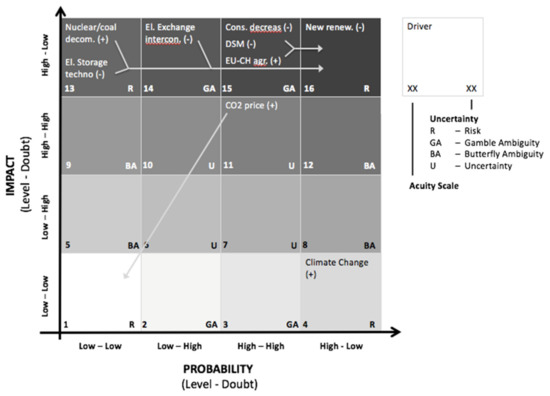

Figure 4 illustrates the findings of the prospective analysis. Concerning the period 2021–2035, all drivers except two are situated at the top of the acuity scale (13–16). Three of them show a situation of risk (doubts are low). Four of them show a situation of gamble ambiguity (doubts concerning the probability are high). The acuity of the remaining drivers is 11 and 4.

Figure 4.

Acuity scale: The hydropower future’s drivers. (+) and (−) indicate, respectively, the positive and negative impact on hydropower. Arrows show how the drivers move on the acuity scale between 2021–2035 and 2036–2050.

The period 2036–2050 reveals a quite different situation. Six drivers are now situated at the very top of the acuity scale (16) and show a situation of risk. Just one driver still shows a situation of gamble ambiguity (acuity 15). The remaining two drivers are situated at the bottom of the acuity scale. The fact that the long-term raises less doubts than the medium-term is almost paradoxical. In fact, this is due to the fact that, towards the middle of the century, the previously perceived trends should confirm it.

The fact that only two drivers out of seven situated at the top of the acuity scale can positively affect hydropower shows that it is not trivial to wonder if there is a future for this source of energy. They are the nuclear and coal power plants’ decommissioning and the electricity agreement between Bern and Brussels. One must also point out that the forecasts for hourly day-ahead and daily balancing market, based on quantitative models, are not promising [72]. Furthermore, it is not clear if the different variants of market design will offer new opportunities to hydropower [72].

The Swiss Confederation, the cantons and the electric companies possess little latitude to deal with the long-term risks highlighted above. Renewable energy development, electricity consumption decreases and “demand side management” belong to the core business of the Swiss and EU energy strategies. Moreover, the development and diffusion of new technologies, in particular smart grids and storage installations, have their own dynamics. The decisions concerning power market reforms and the project of a pan-European network are taken in Brussels. Those relating to the decommissioning of the coal power plants in Germany, or the nuclear power plants in France, are taken, respectively, in Berlin and Paris.

In fact, the only practicable strategy for Switzerland is to bet on hydropower’s flexibility and its capacity to provide backup energy, especially in winter. However, one should avoid the illusions of the past, which were previously highlighted. In addition, the federal government must facilitate the adoption of an electrical agreement with Brussels that ensures the full integration of the European market. This is not necessarily a winning strategy, but it is the only one which allows Switzerland to transform the risks described above into opportunities.

5. Conclusions

The approach developed in this article can be useful whenever decision-makers and stakeholders face complex problems and only possess limited and heterogeneous information, as in the case of energy transition. It facilitates an assessment of potential events on the basis of an acuity scale, as well as making the distinction between situations of risk, uncertainty, gamble and butterfly ambiguity. To a certain extent, management strategies can be deduced from such an assessment.

First, we have shown the relevance of our approach through a retrospective analysis of different phases of Swiss energy policy, the opening of the electricity market to competition and, linked to these, the hydropower crisis. Based on a broad array of the literature, we have assessed an important set of drivers of very different nature, which have contributed to provoking these changes. Thanks to the acuity scale and taxonomy, it was possible to precisely rank and define them. Ex-post, we have seen that some phenomena have been overestimated, whereas others have been underestimated. As a result, some changes have been accelerated, and others slowed down.

Then, we tested the relevance of our approach by means of a prospective analysis. We have identified the drivers that can significantly influence the future profitability of hydropower, in an electricity landscape that can change profoundly. We have shown that doubts are lower in the long-term than in the medium-term. There are many threats to the future of hydropower.

To a large extent, the hydropower crisis was a surprise. The hypothesis that “renewables compete with hydropower” was at the bottom of the acuity scale (1). The “low market prices - excess supply” hypothesis was at the top (13). Both of them represented risks. More active management would have been appropriate in such a situation. As far as possible, the electricity companies should have tried to reduce their vulnerability. The Confederation acted ex-post, by granting a subsidy that, by definition, is not an appropriate long-term strategy. The stakeholders’ margins of latitude are limited. The Swiss Confederation must finalize the electricity agreement with the European Union and companies must take a gamble on flexibility.

Our approach facilitates a preliminary assessment of complex problems, such as the hydropower crisis. This represents its advantage but also its limitation. For a deeper dive into the different aspects and details of a problem, one must rely on the existing and emerging tools of analysis and management. Other limitations are mentioned in the following paragraphs devoted to further research.

The conceptual analysis should go hand in hand with other case studies based on different sources of information to test the relevance of our approach and to improve it. It must be recognized that the exploitation of the sources used in this article was quite difficult. A case study based on interviews with a group of stakeholders and experts will certainly provide new insights. A quantitative analysis would help to strengthen the methodology. The relationship between the acuity scale, the taxonomy and the management strategies warrants further development. The same goes for the distinction between sudden (in some cases, trend breakers) and gradual events, mentioned in Table 3.

Last but not least, contrary to the literature on “probability”, the literature on “doubt” is relatively poor, although doubt represents a “precondition of any real progress in science”, as pointed out by Nobel prize winner Maurice Allais [87]. Not only does the question of its measurement arise, but also of its relevance. In fact, it is often linked to hot controversies, whose origins should be carefully explored [88]. The selection of the relevant sources is critical from this point of view. One can imagine assigning weightings to different interpretations based on source or scenario reliability. However, such an approach requires further development.

Author Contributions

The authors contributed equally to the work presented in this article. The research’s design was jointly conceived. The conceptual part, case study and discussion were carried out in close collaboration. The same goes for the preparation of the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

We would like to thank the National Research Program “Energy Turnaround” (NRP 70) of the Swiss National Science Foundation (SNF), who have supported this research.

Acknowledgments

We are grateful to our colleague Guillaume Voegeli for his comments and suggestions, to Luke Gueriane for language proofreading, as well as two anonymous reviewers for their useful comments and suggestions for further research.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bernstein, P.L. Against the Gods: The Remarkable Story of Risk; John Wiley & Sons: New York, NY, USA, 1996. [Google Scholar]

- IPCC (Intergovernmental Panel on Climate Change). Climate Change 2014: Synthesis Report; IPCC: Geneva, Switzerland, 2014. [Google Scholar]

- OECD (Organisation for Economic Co-operation and Development). Disaster Risk Financing: A Global Survey of Practices and Challenges; OECD: Paris, France, 2015. [Google Scholar]

- Romerio, F. Which paradigm for managing the risk of ionizing radiation? Risk Anal. 2002, 22, 59–66. [Google Scholar] [CrossRef] [PubMed]

- Gollier, C. The economics of the precautionary principle. J. Risk Uncertain. 2003, 27, 77–103. [Google Scholar] [CrossRef]

- Menoni, S. (Ed.) Risks Challenging Publics, Scientists and Governments; CRC Press/Balkema: Leiden, The Netherlands, 2010. [Google Scholar]

- Aven, T. On some recent definitions and analysis frameworks for risk, vulnerability, and resilience. Risk Anal. 2011, 31, 515–522. [Google Scholar] [PubMed]

- Smil, V. Energy at the Crossroads: Global Perspective and Uncertainties; MIT Press: Cambridge, MA, USA, 2003. [Google Scholar]

- Farrell, A.E.; Zerriffi, H.; Dowlatabadi, H. Energy infrastructure and security. Annu. Rev. Environ. Resour. 2004, 29, 421–469. [Google Scholar] [CrossRef]

- Ioannou, A.; Angus, A.; Brennan, F. Risk-based methods for sustainable energy system planning: A review. Renew. Sustain. Energy Rev. 2017, 74, 602–615. [Google Scholar] [CrossRef]

- Hamarat, C.; Pruyt, E. Energy transitions: Adaptive policy making under deep uncertainty. In Proceedings of the 4th International Conference on Future-Oriented Technology Analysis (FTA) and Grand Societal Challenges, Seville, Spain, 12–13 May 2011. [Google Scholar]

- Rabe, M.; Streimikiene, D.; Bilan, Y. The concept of risk and possibilities of application of mathematical methods in supporting decision making for sustainable energy development. Sustainability 2019, 11, 1018. [Google Scholar] [CrossRef]

- Balthasar, A.; Schalcher, H.R. Research for Switzerland’s Energy Future. Résumé of the National Research Program “Energy”; Swiss National Science Foundation: Bern, Switzerland, 2020. [Google Scholar]

- Hansson, S.O. A Panorama of the philosophy of risk. In Handbook of Risk Theory. Epistemology, Decision Theory, ETHICS, and Social Implications of Risk; Roeser, S., Hillerbrand, R., Sandin, P., Peterson, M., Eds.; Springer: Dordrecht, The Netherlands, 2012; pp. 27–54. [Google Scholar]

- Roeser, S.; Hillerbrand, R.; Sandin, P.; Peterson, M. (Eds.) Handbook of risk theory. In Epistemology, Decision Theory, Ethics, and Social Implications of Risk; Springer: Dordrecht, The Netherlands, 2012. [Google Scholar]

- Haimes, Y.Y. Risk Modelling, Assessment, and Management; John Wiley & Sons: Hoboken, NJ, USA, 2004. [Google Scholar]

- United Nations International Strategy for Disaster Reduction (UNISDR). Terminology on Disaster Risk Reduction; UNISDR: Geneva, Switzerland, 2009. [Google Scholar]

- International Organization for Standardization (ISO). Risk Management—Principles and Guidelines (ISO 31000); ISO: Geneva, Switzerland, 2009. [Google Scholar]

- Mandelbrot, B.B.; Taleb, N.N. Mild vs. wild randomness: Focusing on those risks that matter. In The Known, the Unknown, and the Unknowable in Financial Risk Management; Diebold, F.X., Doherty, N.A., Herring, R.J., Eds.; Princeton University Press: Princeton, USA, 2010; pp. 47–58. [Google Scholar]

- Trespalacios, A.; Cortés, L.M.; Perote, J. Uncertainty in electricity markets from a semi-nonparametric approach. Energy Policy 2020, 137, 1–12. [Google Scholar] [CrossRef]

- Knight, F.H. Risk, Uncertainty, and Profit; Hart, Schaffner, and Marx: New York, NY, USA, 1921. [Google Scholar]

- de Finetti, B. La prévision: Ses lois logiques, ses sources subjectives. Annales de l’Institut Henri Poincaré 1937, 7, 1–68. [Google Scholar]

- Flage, R.; Aven, T.; Zio, E.; Baraldi, P. Concerns, challenges, and directions of development for the issue of representing uncertainty in risk assessment. Risk Anal. 2014, 34, 1196–1207. [Google Scholar]

- Bikhchandani, S.; Hirshleifer, J.; Riley, J.G. The Analytics of Uncertainty and Information; Cambridge University Press: Cambridge, MA, USA, 2003. [Google Scholar]

- Ben-Haim, Y. Why risk analysis is difficult, and some thoughts on how to proceed. Risk Anal. 2012, 32, 1638–1646. [Google Scholar] [CrossRef]

- Heal, G.; Millner, A. Uncertainty and Ambiguity in Environmental Economics: Conceptual Issues; Working Paper No. 278; University of Leeds and London School of Economics, Centre for Climate Change Economics and Policy: London, UK, 2017. [Google Scholar]

- Ellsberg, D. Risk, ambiguity, and the Savage axioms. Q. J. Econ. 1961, 75, 643–669. [Google Scholar] [CrossRef]

- Lorenz, E. Predictability: Does the flap of a butterfly’s wings in Brazil set off a tornado in Texas? In Proceedings of the American Association for the Advancement of Science, 139th Meeting, Washington, DC, USA, 28 December 1972.

- Beveridge, R. The Canadian triage and acuity scale: A new and critical element in health care reform. J. Emerg. Med. 1998, 16, 507–511. [Google Scholar]

- Aspinall, W. A route to more tractable expert advice. Nature 2010, 463, 294–295. [Google Scholar] [CrossRef]

- Walker, W.E.; Lempert, R.; Kwakkel, J. Deep Uncertainty. In Encyclopedia of Operations Research and Management Science; Gass, S.I., Fu, M.C., Eds.; Springer Verlag: Berlin, Germany, 2013; pp. 395–402. [Google Scholar]

- World Bank; United Nations. Natural Hazards, Unnatural Disasters. The Economics of Effective Prevention; World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Simpson, M.; James, R.; Hall, J.W.; Borgomeo, E.; Ives, M.C.; Almeida, S.; Kingsborough, A.; Economou, T.; Stephenson, D.; Wagener, T. Decision analysis for management of natural hazards. Annu. Rev. Environ. Resour. 2016, 41, 489–516. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). World Energy Outlook; IEA: Paris, France, 1982. [Google Scholar]

- Commission fédérale de la conception globale de l’énergie (CCG). La conception suisse de l’énergie; Confédération suisse: Berne, Switzerland, 1978. [Google Scholar]

- Groupe Experts Scénarios Energétiques (GESE). Scénarios énergétiques; Confédération suisse: Berne, Switzerland, 1988. [Google Scholar]

- Vesely, W.E.; Rasmuson, D.M. Uncertainties in nuclear probabilistic risk analyses. Risk Anal. 1984, 4, 313–322. [Google Scholar] [CrossRef]

- Conseil fédéral (CF). Dépérissement des forêts. Feuille fédérale 1984, 50, 1133–1431. [Google Scholar]

- Stigliani, W.M.; Shaw, W.S. Energy use and acid rain deposition. Ann. Rev. Energy 1990, 15, 201–216. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). World Energy Outlook; IEA: Paris, France, 2006. [Google Scholar]

- International Energy Agency (IEA). World Energy Outlook; IEA: Paris, France, 2008. [Google Scholar]

- Office fédéral de l’énergie (OFEN). Perspectives énergétiques pour 2035; Confédération suisse: Berne, Switzerland, 2007. [Google Scholar]

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2007: Synthesis; WMO-UNEP: Geneva, Switzerland, 2007. [Google Scholar]

- European Parliament and Council. Directive 96/92/EC of 19 December 1996 Concerning Common Rules for the Internal Market in Electricity. Available online: http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:31996L0092:EN:HTML (accessed on 13 December 2019).

- Klom, A.M. Electricity deregulation in the European Union. Energy Eur. 1996, 27, 28–37. [Google Scholar]

- Conseil fédéral (CF). Message concernant la loi sur le marché de l’électricité (LME). Feuille Fédérale 1999, 54, 6646–6740. [Google Scholar]

- Conseil fédéral (CF). Message relatif à la modification de la loi sur les installations électriques et à la loi fédérale sur l’approvisionnement en électricité. Feuille Fédérale 2004, 8, 1493–1566. [Google Scholar]

- Von Danwitz, T. Regulation and liberalization of the European electricity market. A German view. Energy Law J. 2006, 27, 423–450. [Google Scholar]

- Conseil fédéral (CF). Votation Populaire du 22 Septembre 2002; Chancellerie fédérale: Berne, Switzerland, 2002. [Google Scholar]

- Faruqui, A.; Chao, H.; Niemeyer, V.; Platt, J.; Stahlkopf, K. Analyzing California’s power crisis. Energy J. 2001, 22, 29–52. [Google Scholar] [CrossRef]

- Sweeney, J. The California Electricity Crisis; Hoover Institution Press Publication: Stanford, CA, USA, 2002. [Google Scholar]

- Verband Schweizerischer Elektrizität (VSE). Vorschau 2006 auf die Elektrizitàtsversorgung der Schweiz im Zeitraum bis 2035/2050; VSE: Aarau, Switzerland, 2006. [Google Scholar]

- European Commission (EC). European Energy and Transport. Trends to 2030—Update 2005; EC: Luxembourg, 2006. [Google Scholar]

- European Commission (EC). EU Energy Trends to 2030—Update 2009; EC: Luxembourg, 2010. [Google Scholar]

- Robinson, C. Energy economists and economic liberalism. Energy J. 2000, 21, 1–22. [Google Scholar] [CrossRef]

- Bushnell, J. A mixed complementary model of hydrothermal electricity competition in the Western United States. Oper. Res. 2001, 51, 80–93. [Google Scholar] [CrossRef]

- Joskow, P.L. Competitive Electricity Markets and Investments in New Generating Capacity; MIT Center for Energy and Environmental Policy Research: Cambridge, MA, USA, 2006. [Google Scholar]

- European Commission (EC). European Energy and Transport. Trends to 2030; EC: Luxembourg, 2003. [Google Scholar]

- European Commission (EC). European energy and Transport. Trends to 2030—Update 2007; EC: Luxembourg, 2008. [Google Scholar]

- Ramana, M.V. Nuclear Power: Economic, safety, health, and environmental issues of near-term technologies. Annu. Rev. Environ. Resour. 2009, 34, 127–152. [Google Scholar] [CrossRef]

- Conseil fédéral (CF). Message relatif au premier paquet de mesures de la Stratégie énergétique 2050 et à l’initiative populaire fédérale “Pour la sortie programmée de l’énergie nucléaire”. Feuille fédérale 2013, 40, 6771–6974. [Google Scholar]

- Romerio, F. Nuclear power. The Swiss experience. In Proceedings of the Conference on Coordinating European Security of Supply Activities (CESSA), Cambridge, UK, 13–15 December 2007. [Google Scholar]

- European Commission (EC). Energy Roadmap 2050; EC: Luxembourg, 2012. [Google Scholar]

- Joskow, P.L. Lessons learned from electricity market liberalization. Energy J. 2008, 29, 9–42. [Google Scholar] [CrossRef]

- Barry, M.; Baur, P.; Gaudard, L.; Giuliani, G.; Hediger, W.; Romerio, F.; Schillinger, M.; Schumann, R.; Voegeli, G.; Weigt, H. The Future of Swiss Hydropower. A Review on Drivers and Uncertainties; National Research Program “Energy”, Swiss National Science Foundation: Bern, Switzerland, 2015. [Google Scholar]

- Gaudard, L.; Romerio, F. The future of hydropower in Europe: Interconnecting climate, markets and policies. Environ. Sci. Policy 2014, 37, 172–181. [Google Scholar] [CrossRef]

- EC (European Commission). Clean Energy for All Europeans; European Union: Luxembourg, 2019. [Google Scholar]

- CF (Conseil fédéral). Révision de la loi sur l’approvisionnement en électricité (ouverture complète du marché de l’électricité, réserve de stockage et modernisation de la régulation du réseau); Confédération suisse: Berne, Switzerland, 2018. [Google Scholar]

- ENTSO-E (European Network of Transmission System Operators for Electricity). European Power System 2040. Completing the map ENTSO-E; ENTSO-E: Brussels, Belgium, 2018. [Google Scholar]

- IEA (International Energy Agency). World Energy Outlook; IEA: Paris, France, 2019. [Google Scholar]

- WEC (World Energy Council). The World Energy Issues Monitor; WEC: London, England, 2019. [Google Scholar]

- Barry, M.; Betz, R.; Fuchs, S.; Gaudard, L.; Geissmann, T.; Giuliani, G.; Hediger, W.; Herter, M.; Kosch, M.; Romerio, F.; et al. The Future of Swiss Hydropower. Realities, Options and Open Questions; National Research Program “Energy”, Swiss National Science Foundation: Bern, Switzerland, 2019. [Google Scholar]

- e-Highway2050. Modular Development Plan of the Pan-European Transmission System 2050; Deutsche Energie-Agentur GmbH: Berlin, Germany, 2013. [Google Scholar]

- e-Highway2050 project. Europe’s Future Secure and Sustainable Electricity Infrastructure. e-Highway2050 Project Results; RTE: La Défence, France, 2015.

- MIT (Massachusetts Institute of Technology). The Future of the Electric Grid; MIT: Cambridge, MA, USA, 2011. [Google Scholar]

- MIT (Massachusetts Institute of Technology). Utility of the Future; MIT: Cambridge, MA, USA, 2016. [Google Scholar]

- Pérez-Arriaga, I. (Ed.) Regulation of the Power Sector; Springer: London, UK, 2013. [Google Scholar]

- Voegeli, G.; Gaudard, L.; Romerio, F.; Hediger, W. Framework for decision-making process in granting rights to use hydropower in the European context. Water 2018, 10, 930. [Google Scholar] [CrossRef]

- Wachstum, K.; Beschäftigung, S.U. Abschlussbericht; Bundesministerium für Wirtschaft und Energie: Berlin, Germany, 2019. [Google Scholar]

- Rabe, M.; Streimikiene, D.; Bilan, Y. EU carbon emissions market development and its impact on penetration of renewables in the power sector. Energies 2019, 12, 2961. [Google Scholar] [CrossRef]

- Gaudard, L.; Gilli, M.; Romerio, F. Climate change impacts on hydropower management. Water Resour. Manag. 2013, 27, 5143–5156. [Google Scholar] [CrossRef]

- Gaudard, L.; Gabbi, J.; Bauder, A.; Romerio, F. Long-term uncertainty of hydropower revenue due to climate change and electricity prices. Water Resour. Manag. 2016, 30, 1325–1343. [Google Scholar] [CrossRef]

- Schaefli, B.; Manso, P.; Fischer, M.; Huss, M.; Farinotti, D. The role of glacier retreat for Swiss hydropower production. Renew. Energy 2019, 132, 615–662. [Google Scholar] [CrossRef]

- Martínez-Jaramillo, J.E.; van Ackere, A.; Larsen, E.R. Towards a solar-hydro based generation: The case of Switzerland. Energy Policy 2019, 138. [Google Scholar] [CrossRef]

- Gaudard, L.; Madani, K. Energy storage race: Has the monopoly of pumped-storage in Europe come to an end? Energy Policy 2019, 126, 22–29. [Google Scholar] [CrossRef]

- van Baal, P.A.; Finger, M. The effect of European integration on Swiss energy policy and governance. Policy Gov. 2019, 7, 6–16. [Google Scholar] [CrossRef]

- Allais, M. Economics as a Science; Graduate Institute of International Studies: Geneva, Switzerland, 1968. [Google Scholar]