1. Introduction

Energy is acknowledged to be a vital input that catalyzes the output level; thus, it is regarded as one of the major attributes of growth of the world economy [

1]. Keeping the energy consumption-induced growth phenomenon into consideration, several existing studies have scrutinized the energy consumption-economic growth nexus [

2,

3,

4]. In line with this notion, Rafindadi and Ozturk [

5] asserted that the level of energy consumption within an economy directly determines its growth level. Besides, it is anticipated that ensuring energy security is a pre-requisite to undergoing economic expansion which, in turn, can be anticipated to result in value addition for attaining economic growth [

6].

Although in the past energy consumption, in general, was unanimously believed to foster the economic growth strategies pursued by the global economies, the contemporary studies have debunked this preconceived notion by affirming that for economic growth to sustain, the choice of the energy resource to be consumed is equally important [

7]. Consequently, several studies have also put forward the economic adversities linked to energy consumption [

5,

8]. Besides, some studies have also nullified any sort of association between energy consumption and economic growth [

9] 2020. Hence, these equivocal assertions highlight the ambiguous nature of the energy consumption-economic growth nexus.

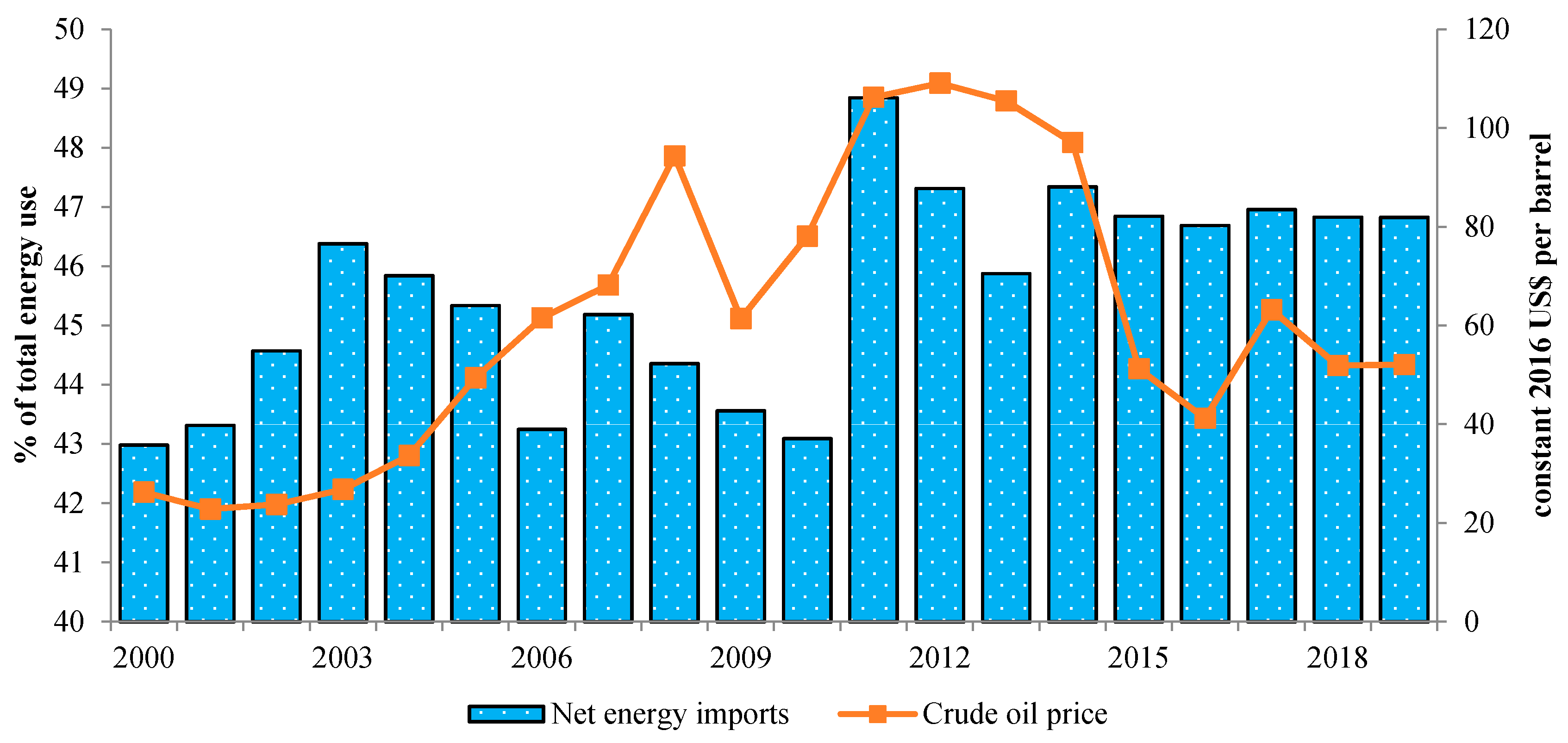

Since energy, like any other commodity, is not free of cost, movements in energy prices tend to both directly impact the energy consumption levels [

10,

11]; thus, indirectly affecting the economic growth performances as well [

12,

13]. Consequently, several studies have also explored the oil price volatility impacts on economic growth [

14,

15]. The energy consumption responses to exogenous shocks to the world oil prices are not symmetric across the global economies. The adverse impacts of positive oil price shocks are relatively depressing for energy importers while the energy exporters are, to some extent, sovereign to such movements. According to the International Energy Agency, positive shocks to oil prices are particularly detrimental to net oil-importing nations due to their predominant oil-dependency issues [

16].

On the other hand, most of the developing economies often fail to ensure energy security due to their indigenous energy resources being unable to bridge their respective energy demand. Consequently, these economies rely on energy imports to resolve their energy deficits. Energy trade has been recognized as a means to boosting the energy consumption levels which, in turn, is believed to be effective in enhancing the growth of the energy-importing nations, in particular [

17]. In contrast, energy imports can also exert growth-depressing impacts on the energy-importing economies by surging their import bills [

18]. Thus, the effects of energy imports on economic growth is said to be ambiguous. As a result, addressing the ambiguous impacts of imported-energy dependency on economic growth is critically important.

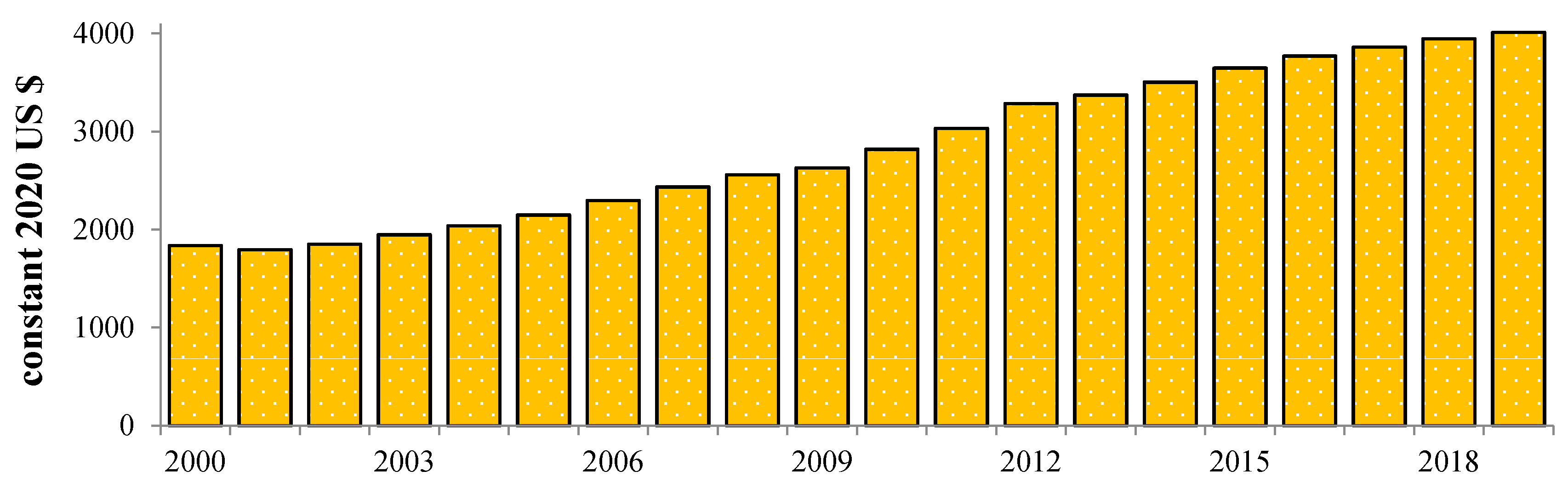

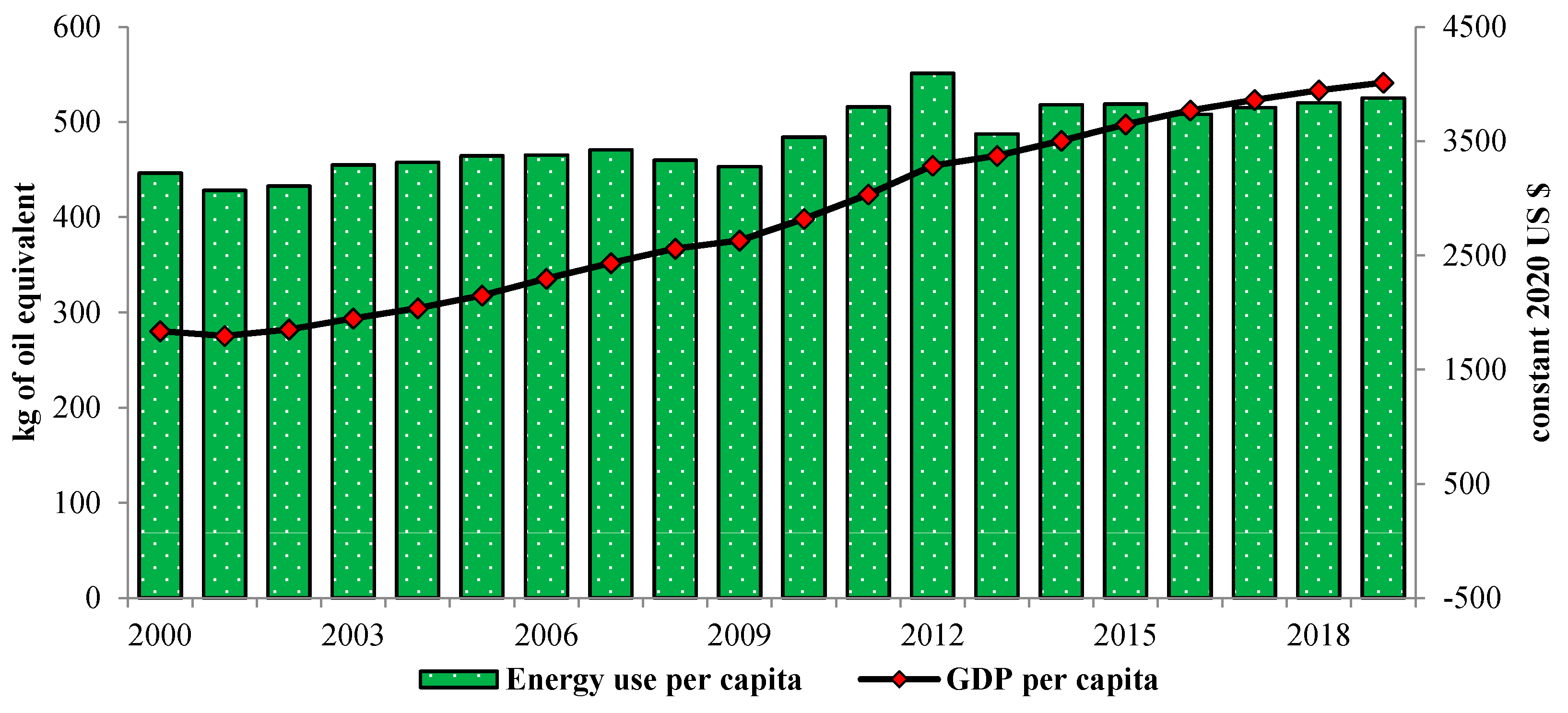

Against this milieu, this paper aims to probe into the dynamic impacts of energy consumption, energy price movements and energy import-dependency on economic growth in Sri Lanka between 1971 and 2018. The choice of Sri Lanka is justified from the perspective that this South Asian nation has traditionally been a net-importer of energy whereby overarching relationships between its energy consumption levels and economic growth performances can be anticipated [

11]. Besides, almost 77% of Sri Lanka’s electricity output is generated from both local and imported fossil fuels [

19]. Moreover, 43% of the total petroleum demand of Sri Lanka is met by imported crude and refined oils while the nation also imports coal from India in particular [

20]. Hence, these statistics clearly highlight the predominant imported energy-dependency of the Sri Lanka. On the other hand, the energy consumption per capita figures of Sri Lanka are lower than that of India and several other Southeast Asian underdeveloped nations [

21]. Recently, the power generation crisis of Sri Lanka has turned out to be a major growth-inhibiting factor for the nation [

20]. Hence, the volume of energy imports can be expected to surge which, in turn, is likely to further aggravate the nation’s dependency on imported energy. In this regard, examining the impacts of Sri Lanka’s imported energy-dependency on its economic growth is important.

This paper contributes to the literature in multiple aspects. Firstly, to the best of knowledge, this is the seminal study that evaluates the impacts of energy consumption, energy price shocks and energy import-dependency on both the gross and sectoral value-added figures of Sri Lanka. The preceding studies have primarily focused on the impacts of these energy-related variables on the overall growth of the Sri Lankan economy. However, a disaggregated analysis is important for formulation of sector-specific energy policies. Secondly, this paper contributes to the energy economics literature that has largely ignored the empirical analysis of the impacts of energy-import dependency on the growth of the net-importers of energy in particular. Hence, this gap in the literature is bridged through the evaluation of the dynamic impacts of Sri Lanka’s imported energy-dependency on its gross and sectoral value-added figures. Thirdly, the joint impacts of energy price shocks and energy imports on the growth figures are also ascertained. The existing studies in the literature have primarily emphasized on only the direct roles of these variables on the economic growth; but exploring the indirect channels is also important for crucial policy implications. Finally, this paper further contributes to the literature by using econometric methods that are efficient in accounting for structural breaks issues in the data. It is pertinent to control for the structural break issues since Sri Lanka has experienced a prolonged period of civil war from 1983 to 2009 [

22] which is likely to have substantially impacted the nation’s growth performances. The majority of the relevant studies on Sri Lanka have overlooked the structural breaks concerns whereby the conclusions documented in the literature can be presumed to be biased to some extent.

The remainder of the paper is organized as follows:

Section 2 presents some stylized facts on the relationships between economic growth, energy consumption, energy prices and energy import-dependency in the context of Sri Lanka. A review of the literature is provided in

Section 3. The econometric model and the data attributes are discussed in

Section 4. The econometric methodology used in this paper is explained in

Section 5.

Section 6 reports and discusses the findings from the empirical analyses. Finally,

Section 7 concludes with some key policy implications.

5.3. Regression Analysis

Following Azam et al. [

66], the fully-modified ordinary least squares (FMOLS) estimator, proposed by Phillips and Hansen [

67], is employed to predict the long-run elasticities. The FMOLS estimator is a non-parametric approach that modifies the conventional ordinary least squares (OLS) estimator to correct of the endogeneity bias and autocorrelation issues [

66]. Since the regression models considered in this paper include oil prices, energy imports and energy consumption as the principal explanatory variables of concern, the correlations between these variables could lead to endogeneity issues. Besides, the FMOLS method is claimed to generate efficient elasticity outputs in the context of the regression model comprising of short time-series and variables that are cointegrated and integrated at their first difference [

67]. The FMOLS estimator

is derived from a generalized linear model which can be specified as:

where

Xt is a vector of

i explanatory variables that are stationary at first difference, I(1). Hence, the stationary process of

Xt is given by:

where ∆ denotes the first difference operator;

is the vector of drift parameters;

is the vector of stationary variables. The FMOLS approach assumes

and the estimation of the FMOLS estimator involves two stages. In the first stage, the outcome variable

Yt is modified for the long-run T which is interdependent of

and

. Besides,

is said to be identically and independently distributed (i.i.d.) much like the residuals of the OLS process [

66].

where

=

for

t = 2, 3, …, n;

. The long-run variance of

can be specified as:

where

and

is the lag window with horizon m [

66]. Now assuming:

In the second stage, the FMOLS estimator (

) can be specified as:

where

,

and

.

Following, Murshed et al. [

68], the robustness of the elasticity estimates are checked using the Dynamic Ordinary Least Squares (DOLS) estimator of Stock and Watson [

69]. The DOLS estimator, ideally suited for short time-series dataset, predicts efficient elasticity outputs by correcting for simultaneity bias by including leads and lags [

70]. In contrast to the FMOLS method involving a non-parametric approach, the DOLS method uses a parametric approach to perform the regression analysis in the context of variables having the same or mixed orders or integration [

71]. Furthermore, the elasticity estimates generated by the DOLS estimator are said to be asymptotically efficient in the context of endogeneity issues [

69].

The goodness of fit of the respective models can be assessed from the values of the adjusted coefficient of determination (Adj. R2) which ranges from 0 (poor fit) to 1 (good fit). Besides, the stability of the long-run estimates for all five models is evaluated using a set of diagnostic tests. The Durbin-Watson and the Breusch-Godfrey Lagrange Multiplier (χ2 LM) tests are used to explore the serial correlation problems. The normality of the residuals is evaluated using the Jarque-Berra test (J-B normality). The heteroscedasticity issues are diagnosed with the autoregressive conditional heteroskedasticity (χ2 ARCH) effects and WHITE test (χ2 WHITE). The correct functional forms of the models are assessed using the Ramsey RESET (χ2 RESET) test.

5.4. Causality Analysis

The regression analysis, by default, assumes that the dependent variable affects the independent variable without considering the possible reverse association between the variables. Thus, it is pertinent to assess the causal associations which can be unidirectional or bidirectional. This paper uses the Hacker-Hatemi-J bootstrapped causality estimation method proposed by Hacker and Hatemi-J [

71]. This method is a developed version of the technique proposed by Hacker and Hatemi-J [

72] in which the modified Wald statistics are generated using a two-stage bootstrapped approach. In the first stage, the optimal lag structure is calculated, while in the second-stage the modified Wald statistic is estimated for evaluating the Granger causality between a set of two variables. The modification of the Wald statistic is effective in handling heteroscedasticity problems and also for accounting the autoregressive conditional heteroscedasticity effects. The statistics are predicted under the null hypothesis of the independent variable not Granger causing the dependent variable against the alternative hypothesis of Granger causality stemming from the independent variable to the dependent variable.

6. Results and Discussion

The results from the Zivot-Andrews unit root analysis are reported in

Table 3. It is evident from the statistical significance, at a 1% level, of the test statistics that all the variables, despite being non-stationary at their levels, are stationary at their first differences. Hence, a common order of integration among the variables is ascertained. This implies that the variables are mean-reverting at their first differences. Thus, the possibility of estimating spurious elasticity estimates is nullified.

The Gregory-Hansen cointegration analysis follows the Zivot-Andrews unit root exercises. The results, as reported in

Table 4, statistically certify the presence of cointegrating equations in the context of all four models. The statistically significant test statistics reject the null hypothesis on no cointegrating association to affirm the long-run relationships between the gross and sectoral per capita growth figures and energy consumption per capita levels, energy prices, energy import shares, capital and labor.

The long-run elasticities are predicted using the FMOLS and DOLS estimators. The corresponding results from the regression analysis are reported in

Table 5 and

Table 6. The signs and statistical significance of the elasticity estimates, although differing in terms of the magnitudes, are seen to be homogeneous across the different regression estimators used in this paper. Thus, the results are claimed to be robust across alternative regression methods. Besides, the adjusted R-squared values imply good fits of the regression models.

In the context of model (1), the corresponding elasticity estimates reported in

Table 5 demonstrate that energy consumption is effective in enhancing the gross value-added figures of Sri Lanka. A 1% rise in the energy consumption per capita level is found to increase the real gross value-added per capita figures by 1.39–1.71%, on average,

ceteris paribus. Thus, the paramount importance of energy use for increasing the overall level of economic growth in Sri Lanka can be understood from these estimates. Therefore, it is pertinent for the Sri Lankan economy to ensure energy sufficiency for attaining higher growth performances. Thus, Sri Lanka should focus on pursuing energy-led growth policies whereby boosting energy supplies can be anticipated to contribute to the development of the economy. This finding corroborates the results reported by Esen and Bayrak [

32] in the context of 75 net energy importers. The similarity of the findings can be reasoned from the perspective that Sri Lanka has also been a tradition net oil-importing nation. The positive association between energy consumption and economic growth were also highlighted in the studies by Ivanovski et al. [

73] for selected OECD and non-OECD countries, Samu et al. [

74] for Zimbabwe and Bouyghrissi et al. [

75] for Morocco.

On the other hand, a negative correlation is unearthed between world crude oil prices and the gross value-added per capita figures of Sri Lanka. The corresponding elasticity estimates show that a 1% rise in the real crude oil prices per barrel in the world markets is accompanied by a reduction in the gross value-added per capita figures by 0.09–0.15%, on average,

ceteris paribus. Hence, these results reflect the vulnerability of Sri Lanka to positive shocks and fluctuations in the world prices of crude oil. This can primarily be attributed to the nation’s imported oil-dependency which has also been highlighted in the study by Murshed and Tanha [

11]. Under such circumstances, safeguarding the economy against the exogenously determined volatile oil price movements is necessary for fostering the overall growth of the Sri Lankan economy. In this regard, Sri Lanka is better-off making greater use of its indigenous energy resources to generate electricity. This would not only be effective in curbing the nation’s vulnerability to exogenous energy price shocks but would also increase the overall energy supplies to further contribute to economic growth. This result echoe the findings highlighted by Arshad et al. [

42] in the context of Pakistan which, like Sri Lanka, is another net-oil importing South Asian nation. Similar results were also concluded by Adam et al. [

76] for Indonesia and Ferdaus et al. [

77] for net oil-importing Next Eleven countries. In contrast, Foudeh [

44] revealed the complementary association between oil prices and economic growth in the context of the oil-exporting economy of Saudi Arabia. Kisswani [

78] also asserted positive oil price shocks to enhance economic growth in selected Southeast Asian countries that are relatively more developed than Sri Lanka. Besides, Ferdaus et al. [

77] showed that positive oil price shocks promote growth only in the context of the net oil-exporting Next Eleven nations. Therefore, such contrasting findings can be reasoned from the understanding that positive oil price shocks are particularly detrimental to the growth performances of the net energy-importing nations.

As far as the impacts of energy import-dependency on Sri Lanka’s gross value-added per capita figures are concerned, the corresponding elasticity estimates denote that dependency on imported energy is not conducive to enhancing the overall growth level of the Sri Lankan economy. A percentage rise in the share of imported energy in the aggregate energy consumption figure is predicted to reduce the gross value-added per capita figures by 0.56–0.73%, on average,

ceteris paribus. These findings can be rationalized from the understanding that Sri Lanka has traditionally registered deficits in its trade balances, which could be attributed to the nation’s substantially large import bills. Therefore, it can be asserted that elevating the share of indigenous energy in the aggregate energy consumption levels is critically important in boosting the overall economic growth level in Sri Lanka. Thus, augmenting the domestic energy resources into the national energy-mix, while simultaneously reducing the imported energy-dependency, could be an ideal policy move to catalyze economic growth in Sri Lanka. Similarly, Adams et al. [

79] also claimed that energy imports hurt the long-run growth performances of Thailand by deteriorating the country’s balance of payments deficits. Once again, the similarity of Sri Lanka and Thailand in respect of both countries being net importers of energy can be asserted to be the reason behind the identical results in both these studies. In the same vein, Frondel et al. [

80] also emphasized on reducing dependency on imported energy to contribute to economic growth and environmental welfare in Germany.

On the other hand, the elasticity estimates also portray the joint adverse impacts of positive oil price movements and higher imported-energy dependency in Sri Lanka. The negative signs and statistical significance of the predicted elasticity parameters attached to the interaction term affirm this claim. Therefore, it is important that the Sri Lanka government adopts relevant policies to curb the imported-energy dependency of the nation while protecting the economy against exogenous shocks to the world oil prices. Finally, the positive signs of the elasticity parameters attached to

lnK and

lnL validate the neoclassical conjecture of capital accumulation and labor employment positively contributing to the value-added. Similar results were reported by Ahmed et al. [

81] for Iran, Bal et al. [

82] for India, Saova et al. [

83] and Fadiran et al. [

84] for European countries. In contrast, Keho [

85] found labor to adversely impact the economic growth in Cote d’Ivoire. This contrasting finding could be due to the fact that the real GDP per capita level of Sri Lanka is almost double than that of Cote d’Ivoire [

21].

As part of the diagnostic tests, the Durbin-Watson statistic and the statistical insignificance of the χ2 LM statistic imply no serial correlation problems in both the models. Also, the statistical insignificance of the J-B normality test indicates normal distributions of the residuals for both the models. Similarly, the statistical insignificance of the χ2 WHITE and χ2 ARCH statistics denote that the models are free from heteroscedasticity issues as well. On the other hand, the statistical insignificance of the χ2 RESET test implies that the functional forms of the models are well-specified.

Table 6 reports the long-run elasticities of the sectoral value-added per capita figures with respect to changes in the explanatory variables considered in the respective models. It is evident that energy consumption not only positively contributes to the gross value-added figures of Sri Lanka, it also enhances, although in different magnitudes, the sectoral value-added figures.

The elasticity estimates imply that the agricultural value-added per capita of Sri Lanka is relatively less elastic to changes in the energy consumption per capita levels in comparison to the corresponding elasticities of the industrial and services value-added per capita figures. A 1% rise in the energy consumption per capita level in Sri Lanka increases the agricultural value-added per capita figures by merely 0.04–0.05% as opposed to increasing the industrial and services value-added per capita figures by 1.71–1.80% and 1.94–2.15%, respectively,

ceteris paribus. A particular reason behind these contrasting findings could be justified from the perspective that the agriculture sector of Sri Lanka, much like in the cases of similar developing nations, is relatively more labor-intensive as compared to the comparatively energy-intensive industry and services sectors. Similar conclusions were put forward in the study by Chandio et al. [

35] in which the authors asserted that natural gas and electricity consumption positively attributed to the growth of Pakistan’s agriculture sector. However, Chandio et al. [

35] opined that energy consumption is ineffective in explaining the variations in Pakistan’s industrial value-added. In another relevant study on G20 economies, Paramati et al. [

36] found energy consumption to be effective in boosting the services value-added figures.

The other elasticity estimates show that the agricultural value-added levels of Sri Lanka are unaffected by exogenous shocks to world crude oil prices. The statistical insignificance of the corresponding elasticity estimates certifies this claim. In contrast, much like in the case of the gross value-added figures, positive shocks to crude oil prices in the world markets are seen to dampen Sri Lanka’s industrial and services value-added per capita figures. Besides, energy imports are found to homogeneously dampen the sectoral value-added figures. A rise in the share of net energy imports in the aggregate energy consumption figures by 1% reduces the agricultural, industrial and sectoral value-added per capita figures by 0.22–0.23%, 0.49–0.83% and 0.73–0.87%, respectively, ceteris paribus. Moreover, the joint negative impacts of crude oil price shocks and energy imports on the sectoral value-added per capita levels are also ascertained. Similarly, capital and labor inputs are also found to homogeneously boost the sectoral value-added figures in Sri Lanka.

Besides, the high adjusted R-squared values imply good fit of the respective models. Besides, the results from the diagnostic tests once again provide reliability of the long-run ARDL estimates. The Durbin-Watson statistic and the statistical insignificance of the χ2 LM statistic imply no serial correlation problems in all the models. Also, the statistical insignificance of the J-B normality test indicates normal distributions of the residuals for all the models. Similarly, the statistical insignificance of the χ2 WHITE and χ2 ARCH statistics denote that all the models are free from heteroscedasticity issues as well. On the other hand, the statistical insignificance of the χ2 RESET test implies that the functional forms of all the models are well-specified.

Finally, to assess the four underlying hypotheses concerning the energy consumption-economic growth nexus in the context of Sri Lanka, the Hacker-Hatemi-J bootstrapped causality analysis is conducted. The key findings from the causality exercise are summarized in

Table 7. The statistical significance of the modified Wald statistics affirms the bidirectional causality between the energy consumption and gross value-added figures of Sri Lanka. Thus, the

feedback hypothesis between these variables portrays the pertinence of ensuring energy security to safeguard the sustainability of economic growth in Sri Lanka. The

feedback hypothesis was also validated in the studies by Destek and Aslan [

86] for Greece and South Korea, Shakouri and Yazdi [

87] for South Africa and Aydin [

88] for Russia. In contrast, the

feedback hypothesis did not hold in the study conducted by Paramati et al. [

36] on G20 nations which, as opposed to Sri Lanka, comprises of some of the world’s most advance and energy-exporting countries. Besides, in the context of the industrial and services sectors, the feedback causal linkages between energy consumption and sectoral growth are also ascertained. These findings once again highlight the importance of ensuring energy sufficiency in Sri Lanka. Thus, ensuring energy security in this regard can be thought of a major facilitator of the fourth industrial revolution in Sri Lanka which not only would expand the relatively energy-intensive industry and services sectors but would also enhance the overall growth of the Sri Lankan economy. Similar findings were reported by Marques et al. [

39] in which the authors found evidence of bidirectional causality between energy consumption and industrial value-added figures of Greece. In a relevant study on the electricity consumption-industrial value-added nexus, Sankaran et al. [

89] also reported the

feedback hypothesis in the context of Peru which is also a late industrialized economy like Sri Lanka. In contrast, no causal association in this regard could be established in the context of the agricultural sector. In line with these findings, it can be said that energy consumption is particularly important for industrialization and services sector development in Sri Lanka. Therefore, enhancing the reliability of energy supplies for these sectors is critically important in governing the overall economic growth of Sri Lanka.

The other key causality findings reveal unidirectional causalities stemming from oil prices to the gross and industrial value-added per capita figures of Sri Lanka. These findings are parallel to the results reported by Nwani [

90] and Bekun and Agboola [

91] for Ecuador and Nigeria, respectively. Thus, keeping the corresponding elasticity estimates into consideration, the statistical evidence of unidirectional causalities from oil price to gross and sectoral value-added in Sri Lanka highlight the adverse impacts of imported energy-dependency of the nation on its economic growth. This assertion is confirmed by the unidirectional causalities running from energy import shares to the gross, industrial and services value-added per capita figures. Besides, the agriculture sector of Sri Lanka is found to be causally unaffected by oil price shocks and energy imports. These findings could be explained in terms of the agriculture sector being predominantly less-reliant on energy inputs and heavily dependent on the labor endowments of the country. On the other hand, both capital and labor inputs were found to causally influence the gross and sectoral value-added per capita figures of Sri Lanka. Hence, these findings provide further support to the corresponding elasticity estimates which revealed the importance of capital accumulation and labor employment in promoting gross and sectoral growth in Sri Lanka. The unidirectional causality from capital accumulation to economic growth was also affirmed in the study by Topcu et al. [

92] in the context of a panel of middle-income-countries including Sri Lanka. On the other hand, Haque et al. [

93] also found evidence of unidirectional causality stemming from female labor force participation and economic growth in Bangladesh.

7. Conclusions

Although the neoclassical growth models have traditionally emphasized on capital and labor endowments being the only determinant of economic growth within an economy, the contemporary growth models have condemned the neoclassical conjecture. Thus, several key macroeconomic aggregates have gradually been augmented into the neoclassical models due to these variables having the capacity to determine the growth of any economy. Among these, the advocates of the energy-led growth strategies have highlighted the paramount importance of energy resources for attaining economic growth. Energy is anticipated to directly contribute to the value-added and also indirectly contribute to it by complementing the capital and labor inputs. Against this backdrop, this paper scrutinized the impacts of energy use, energy prices, energy import-dependency, capital accumulation and labor employment on the gross and sectoral value-added figures of Sri Lanka. The results from the econometric analyses, accounting for structural breaks issues in the data, revealed the favorable impacts of energy consumption on both the overall and sectoral economic growth levels. Besides, the adverse impacts of positive crude oil price shocks and energy import-dependency on the value-added figures, despite of nominal heterogeneity of the findings from the sectoral analysis, were also ascertained. Moreover, the joint adverse economic growth impacts of higher oil prices and greater energy import-dependency were also unearthed. Furthermore, the findings from the causality exercise authenticated the feedback hypothesis in the contexts of the energy consumption-gross value-added, energy consumption-industrial value-added and energy consumption-services value-added nexuses. On the other hand, unidirectional causations were found stemming from crude oil price movements to gross and industrial value-added while energy imports were found to causally influence the gross, industrial and services value-added.

Therefore, the results, in a nutshell, provide two important takeaways. Firstly, economic growth, both at aggregate and disaggregated levels, in Sri Lanka is reliant on greater consumption of energy. However, higher oil prices and greater energy import shares in total energy consumption figures dampen the growth potential to a large extent. Secondly, the industrial and the services sectors are relatively more vulnerable to oil price shocks in comparison to the agriculture sector of Sri Lanka. Hence, keeping these findings into cognizance, it is recommended that the Sri Lankan government ensures energy security within the economy for the sake of sustaining the gross and sectoral growth performances. However, ensuring energy sufficiency by importing energy resources should be discouraged since high dependency on imported energy is found to inhibit the growth of the Sri Lankan economy. In this regard, integration of the locally produced energy into the national energy-mix while simultaneously limiting energy imports can be expected to contribute to economic growth further. Hence, domestic investment in the energy sector of Sri Lanka is critically important to boost domestic energy supplies. Besides, gradually undergoing renewable energy could also be an option that would not only complement the local non-renewable energy supplies in meeting Sri Lanka’s energy demand but would also lessen the nation’s dependency on energy imports. Undergoing the energy transition, from consumption of non-renewable to renewable energy resources, has been referred to be an ideal means of reducing energy imports. Therefore, it is pertinent to incentivize investments for the development of the local renewable energy sector while the energy-import tariff policies should be restructured to limit the volumes of energy imported into Sri Lanka. Moreover, the integration of renewable energy resources into the energy systems can also assist in shielding the Sri Lankan economy against exogenous oil price fluctuations in the world markets.

As part of the future scope of research, this study can also be conducted to decouple the impacts of renewable and non-renewable energy consumption on the gross and sectoral growth of Sri Lanka. Besides, similar studies can also be executed on other developing nations for assessing the generality of the findings.