Two-Stage Optimal Microgrid Operation with a Risk-Based Hybrid Demand Response Program Considering Uncertainty

Abstract

1. Introduction

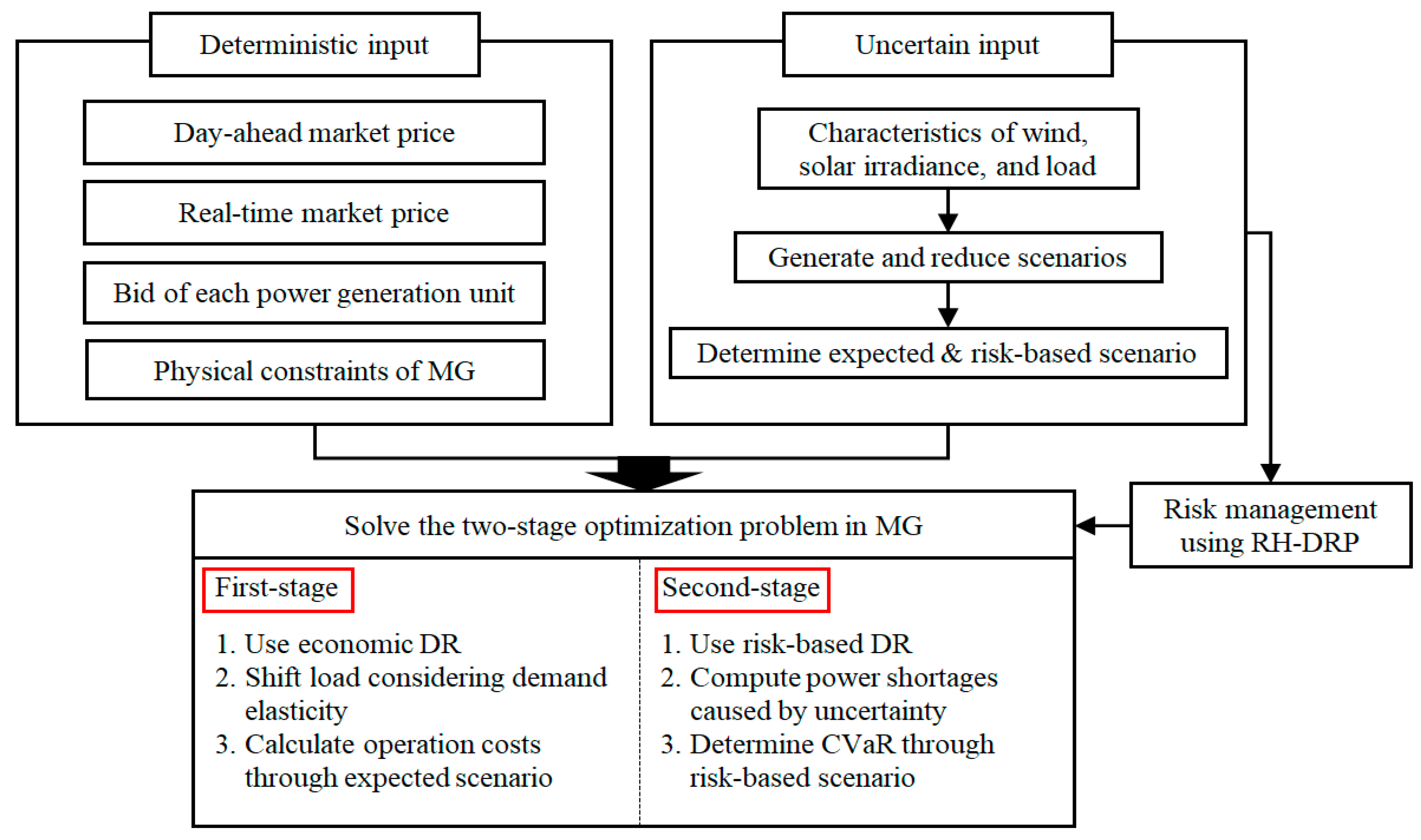

- The proposed two-stage optimization is developed to calculate the risk-based operation costs while considering uncertainty based on scenarios. It assists MGOs make decisions from more additional degree of freedom.

- The effectiveness of applying the RH-DRP is evaluated in terms of the total risk-based operation costs reduction, and the superiority of the RH-DRP is demonstrated via comparison analysis with different DR strategies.

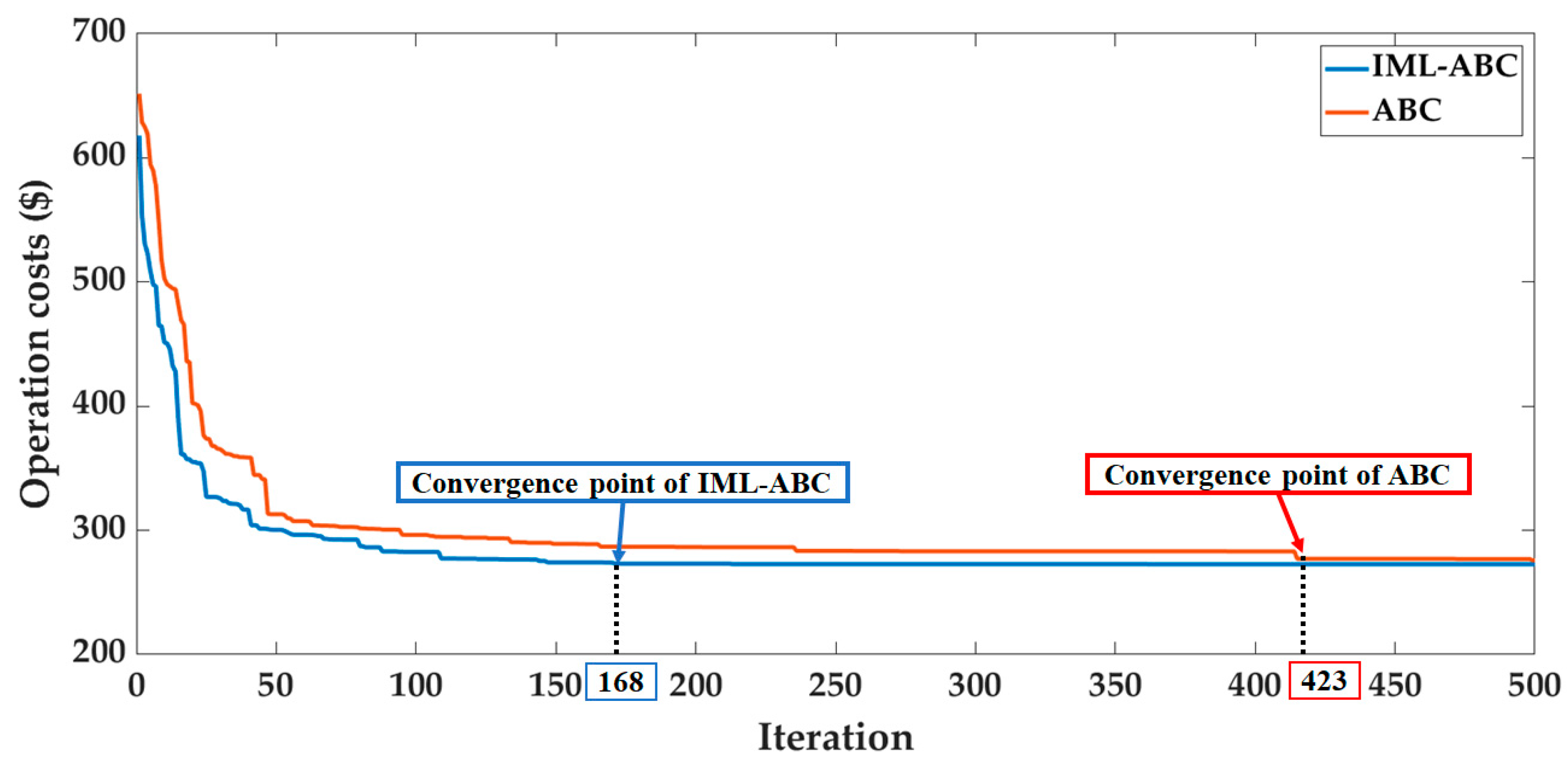

- The IML-ABC shows better performance in searching for optimal solutions in comparison with the different optimal algorithms. Furthermore, it achieves simulation time reduction with the rapid convergence speed and can be applied for a variety of optimization problems.

2. Uncertainty Modeling for Microgrid Operation

2.1. Uncertainty Modeling

2.1.1. Wind Generation Modeling

2.1.2. Solar Generation Modeling

2.1.3. Load Modeling

2.2. Scenario Generation and Reduction

3. Demand Response Strategy

3.1. Demand Response Elasticity

3.2. Pattern of Each Power Consumer

3.3. Risk-Based Hybrid Demand Response Program

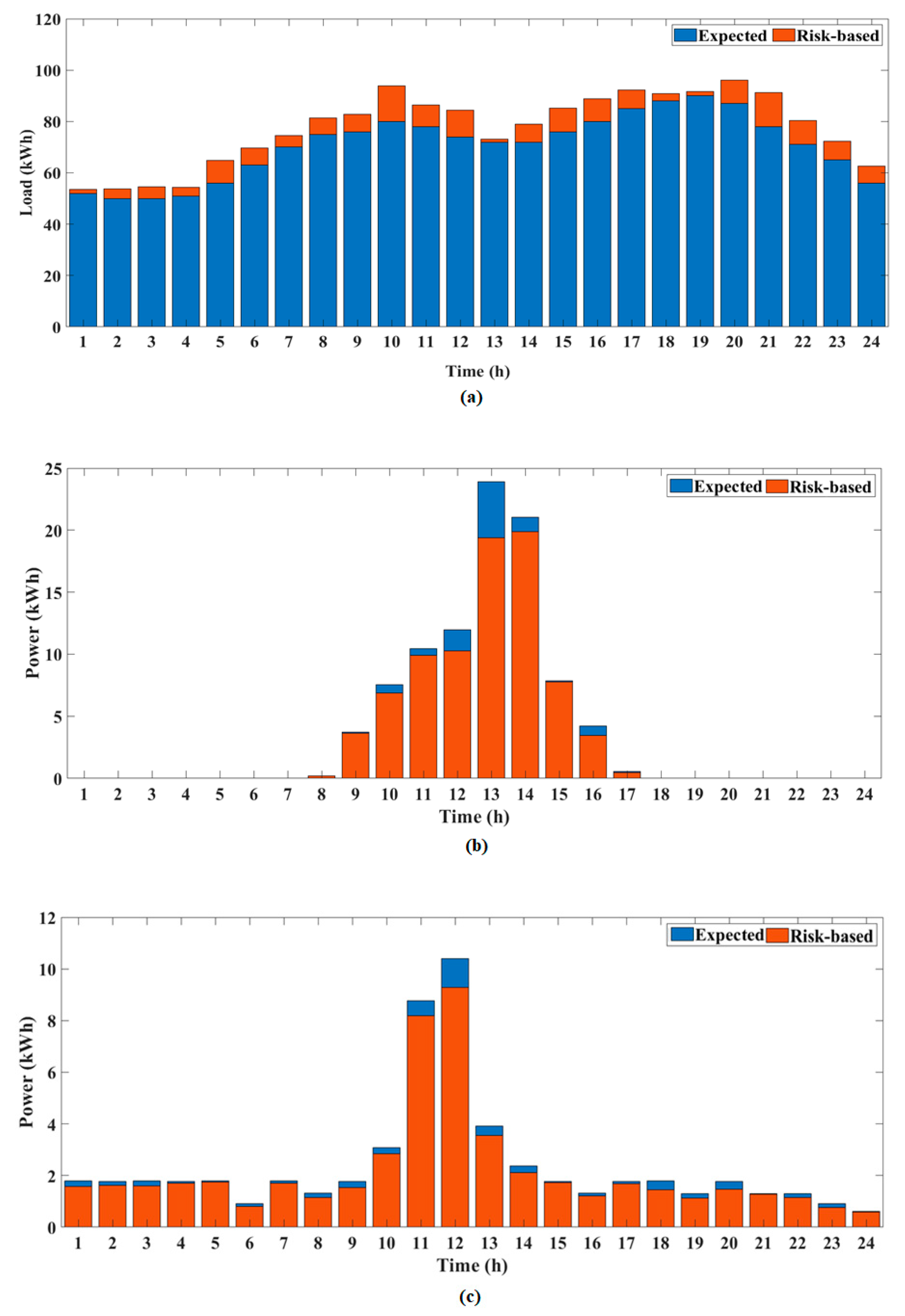

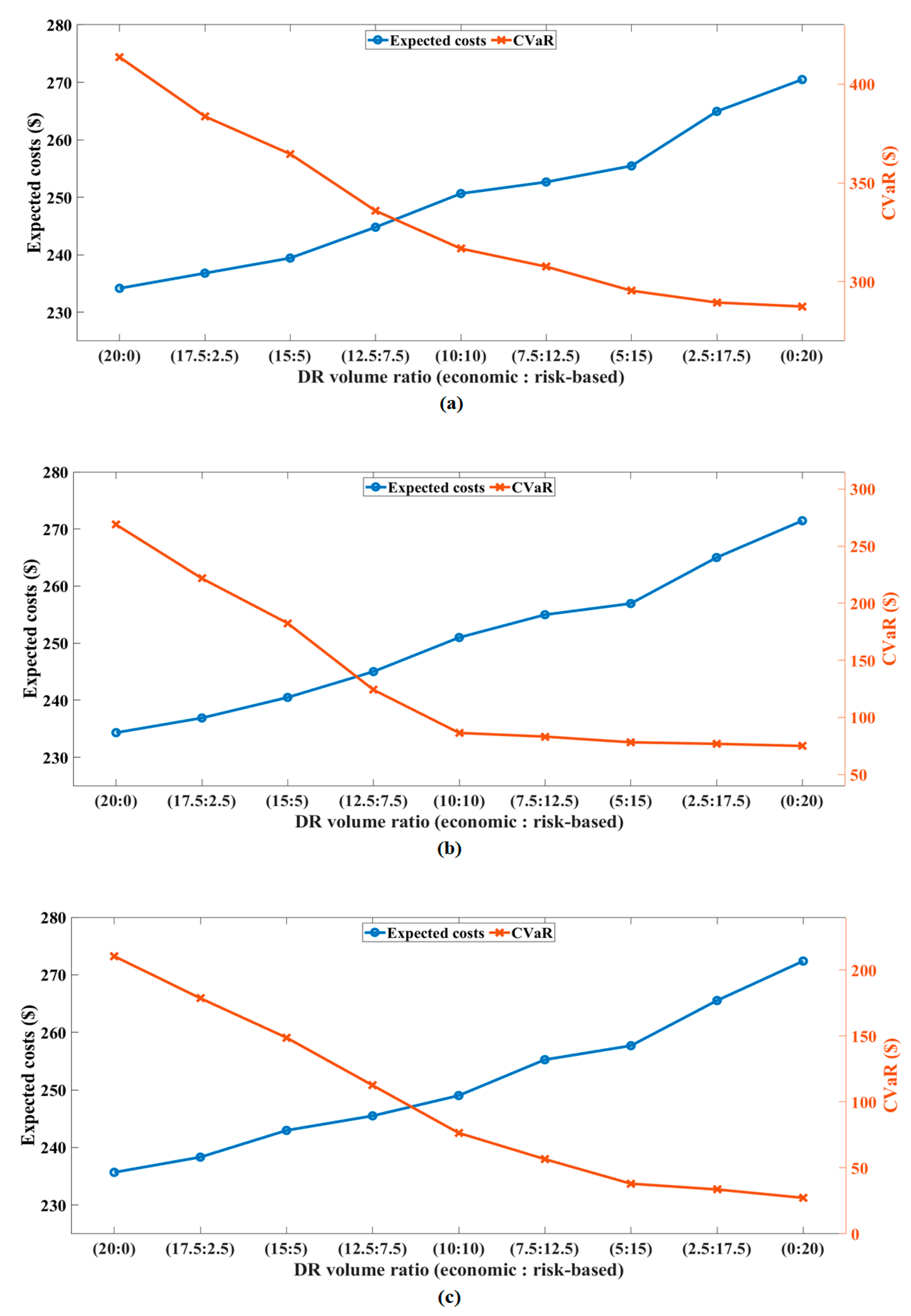

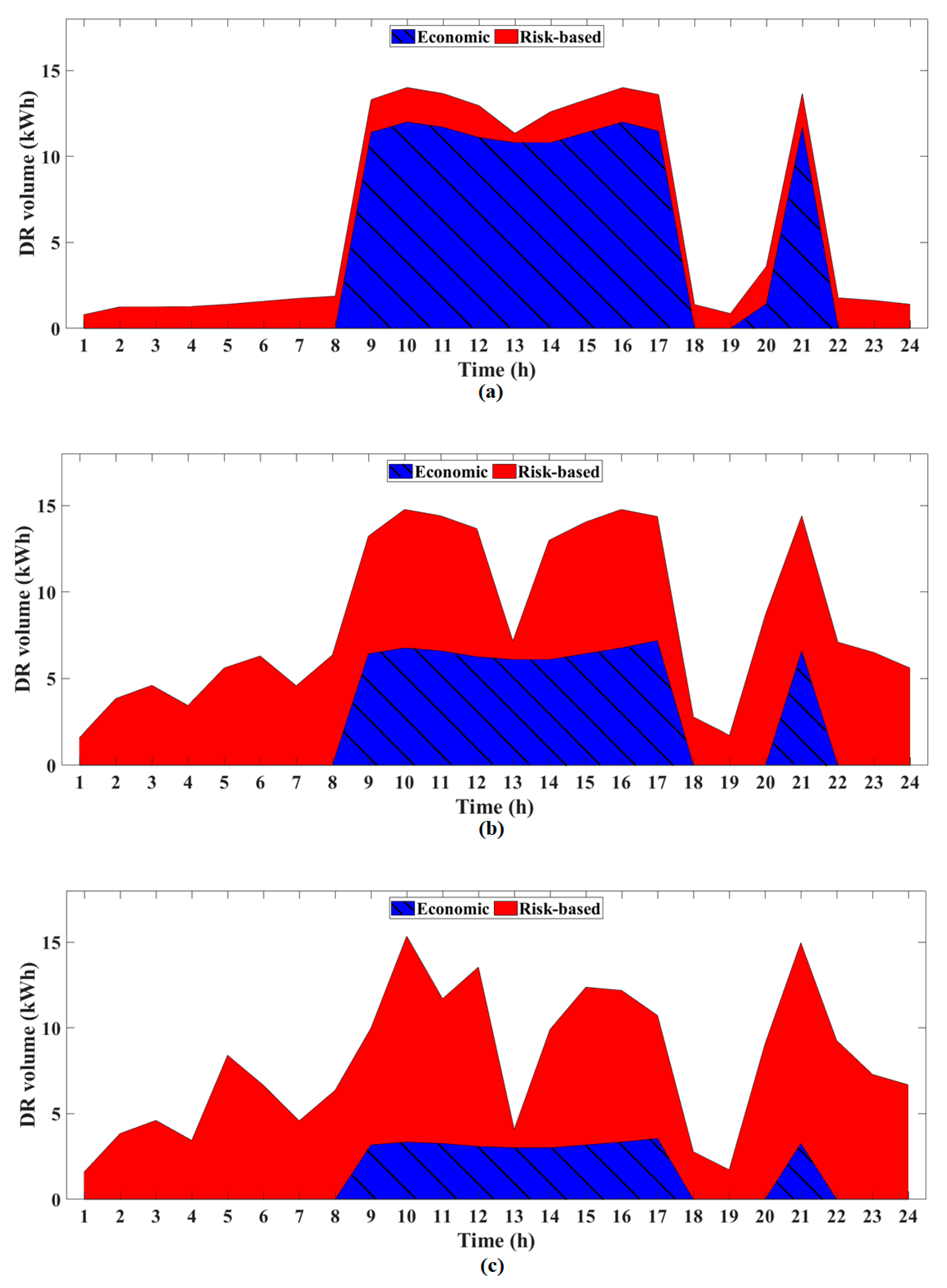

- The RH-DRP consists of economic and risk-based DR. Economic DR affects the economic improvement of MG operational scheduling and is applied via a contract with MGOs by considering the substitution elasticity in a day-ahead market. Meanwhile, risk-based DR reduces the risk costs of uncertainty and can be considered the self-price elasticity in real time without a precontract.

- It determines the load capacity that each consumer can offer to participate in the DR. Thus, MGOs can reasonably request DR from consumers considering by the stability and economics of the power system, and the consumers should respond immediately.

4. Two-Stage Optimal Formulation

4.1. Objective Function

4.1.1. First-Stage Objective Function

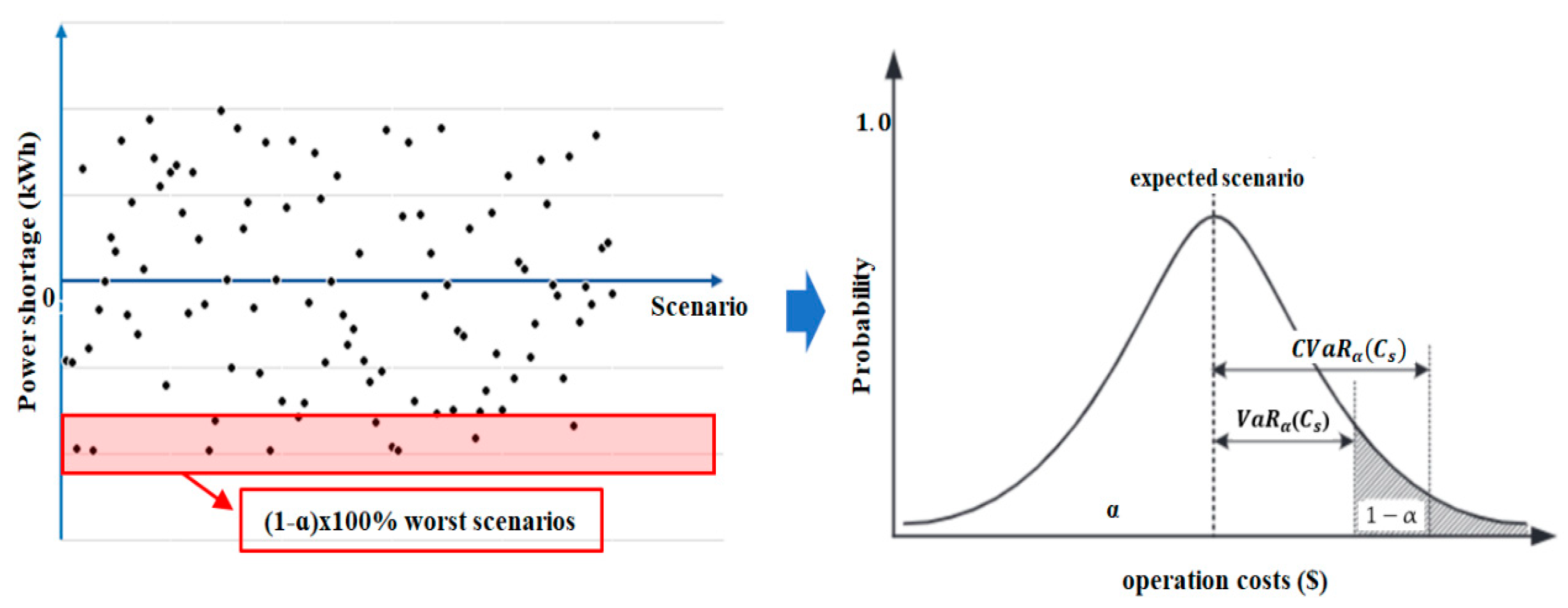

4.1.2. Second-Stage Objective Function

4.2. Constraints

4.2.1. Power Balance Constraints

4.2.2. Power Generation Constraints

4.2.3. RH-DRP Constraints

4.2.4. Energy Storage Constraints

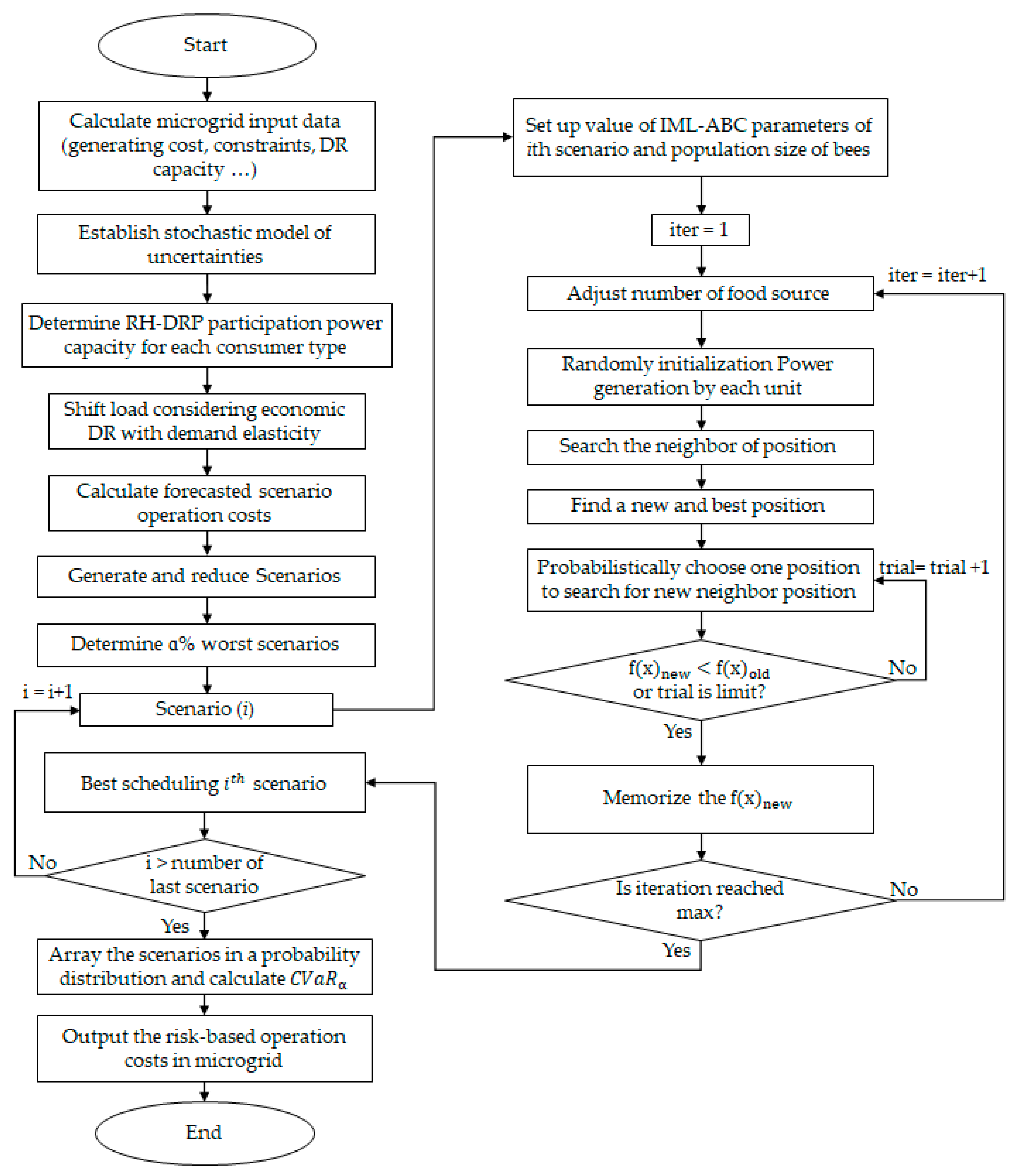

5. Solution Method

5.1. Improved Multi-Level Artificial Bee Colony Algorithm

- (i)

- Adjusting level: In the IML-ABC algorithm, the number of bees increases in the initial iteration and decreases according to the number of iterations to find the initial global minimum efficiently.Here, FNn and FN are the number of food sources in the nth iteration and mean number of food sources, respectively. In addition, σFN, λ, and iter are the rate of food source adjustment, value of dividing the phase of the iteration, and number of iterations, respectively.

- (ii)

- Initialization level: The IML-ABC algorithm makes a random initial population of food source positions. Each food source xi (i = 1, 2, …, SN) has a D-dimensional problem space and can be expressed aswhere xij is the jth decision variable of the ith solution vector, and xjmin and xjmax represent the lower and upper limit values of the j components for the Xi vector, respectively.

- (iii)

- Employed bees level: Each bee constantly explores to find a food source. When it finds the optimum solution, it selects a new and best position (vij) close to the reference position. In the IML-ABC algorithm, to determine a better global minimum solution, employed bees explore large ranges in initial iterations and search for the best solution in a narrow range as the number of iterations increases. This can be computed as follows:where vij represents the new position of the food source i for the jth component, φij is a random number in the range [−1, 1], and R is the value of the exploration range reduction based on the number of iterations.

- (iv)

- Onlooker bees’ level: An onlooker bee finds new positions that are closed to the old position and searches for food sources according to the probability value associated with the corresponding food source. Then, the greedy method is applied; the probability value of the selected food source can be expressed as follows:where Pi and fiti are the probability value and fitness value of the ith food source evaluated by the ith employed bee, respectively; and Fi is the value of the objective function for the Xi solution.

- (v)

- Scout bee level: If solution of Xi cannot be improved through the number of predetermined trials (limit), this solution is abandoned, and the corresponding employed bee is converted to a scout bee. This scout bee randomly attempts to find a new food source in the solution space to replace the abandoned solution using Equation (44). This procedure is repeated for several maximum cycles.

5.2. Improved Multi-Level Artificial Bee Colony Algorithm

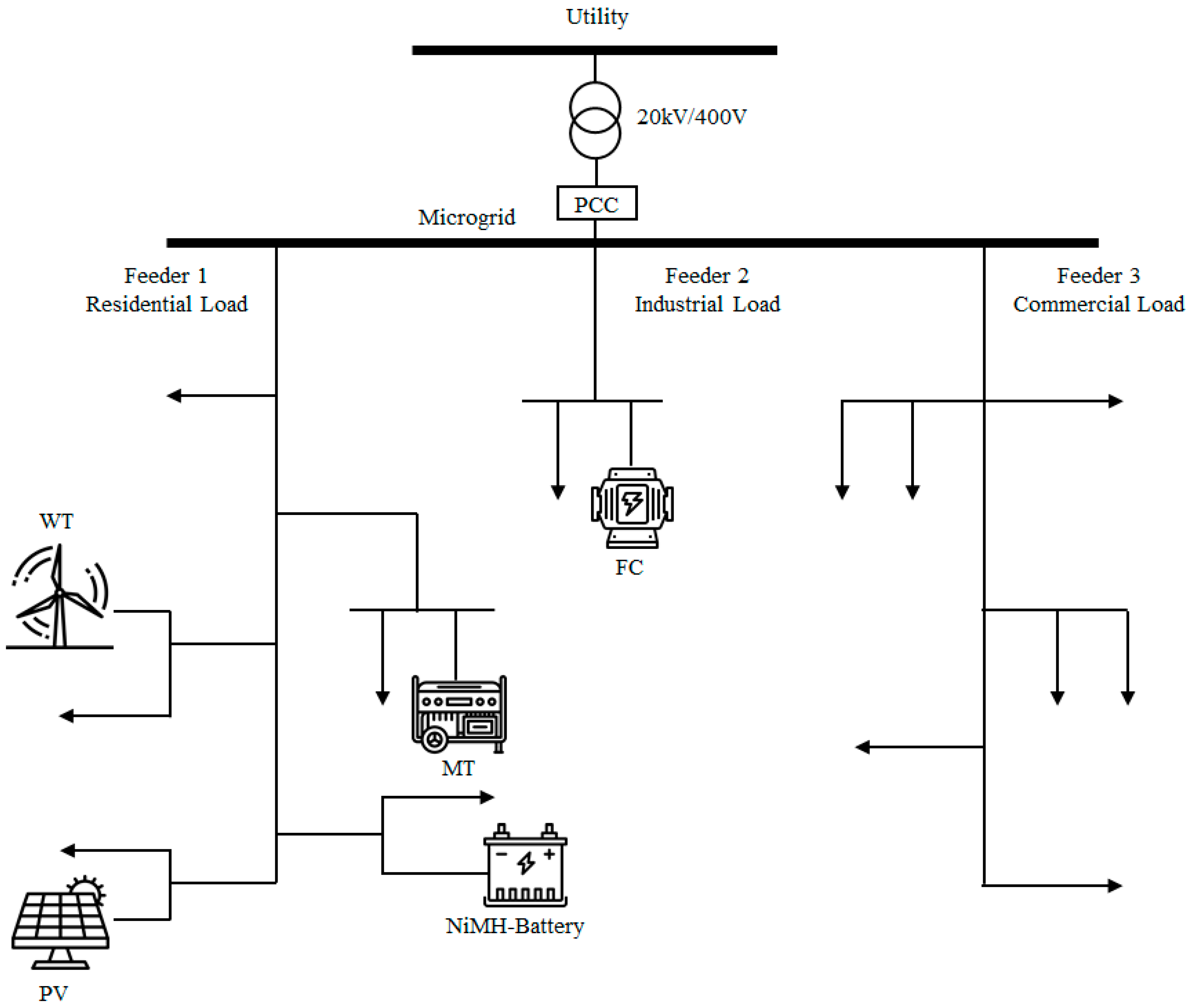

6. Numerical Analysis

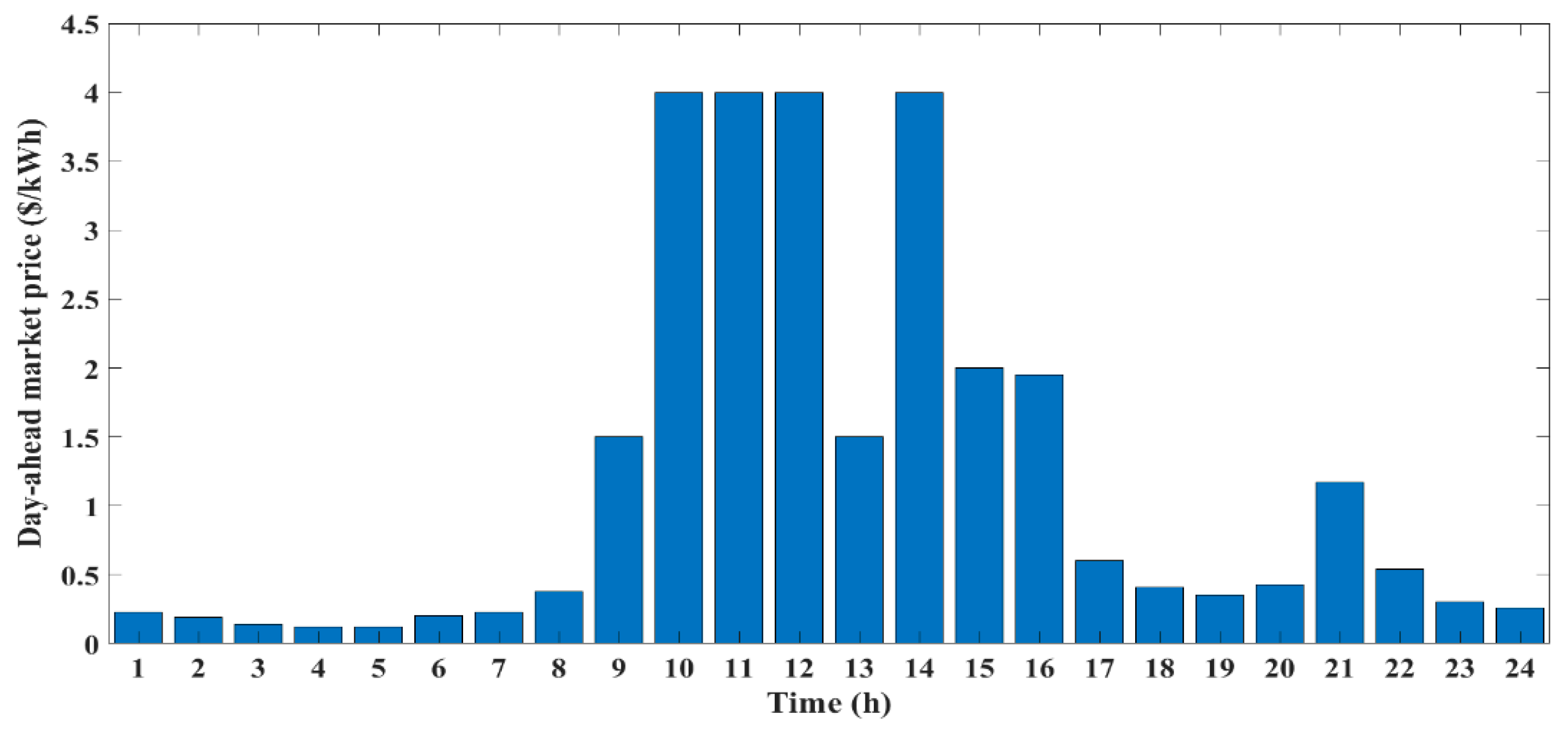

6.1. Input Data

6.2. Proposed Optimization Results

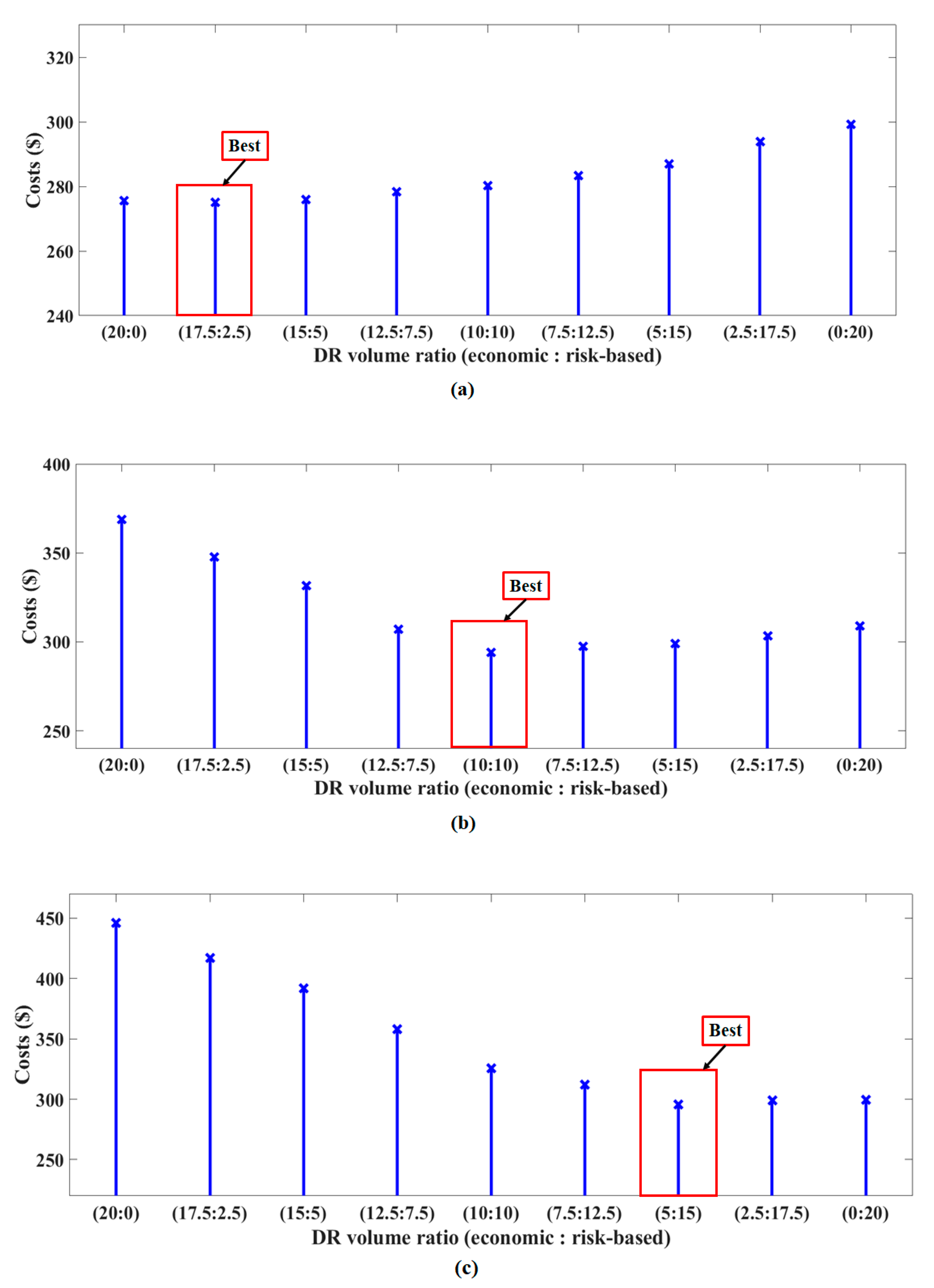

6.3. Comparison of DR Analysis

- Case 1:

- MG operation model without DRP.

- Case 2:

- MG operation model with prevalent economic DRP.

- Case 3:

- MG operation model with RH-DRP.

6.4. Performance Test for the IML-ABC

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Ding, Z.; Hou, H.; Yu, G.; Hu, E.; Duan, L.; Zhao, J. Performance analysis of a wind-solar hybrid power generation system. Energy Convers. Manag. 2019, 181, 223–234. [Google Scholar] [CrossRef]

- Millstein, D.; Wiser, R.; Bolinger, M.; Barbose, G. The climate and air-quality benefits of wind and solar power in the United States. Nat. Energy 2017, 2. [Google Scholar] [CrossRef]

- Jo, K.-H.; Kim, M.-K. Stochastic Unit Commitment Based on Multi-Scenario Tree Method Considering Uncertainty. Energies 2018, 11, 740. [Google Scholar] [CrossRef]

- Kim, M.K. Multi-objective optimization operation with corrective control actions for meshed AC/DC grids including multi-terminal VSC-HVDC. Int. J. Electr. Power Energy Syst. 2017, 93, 178–193. [Google Scholar] [CrossRef]

- Mansouri, S.; Ahmarinejad, A.; Ansarian, M.; Javadi, M.; Catalao, J. Stochastic planning and operation of energy hubs considering demand response programs using Benders decomposition approach. Int. J. Electr. Power Energy Syst. 2020, 120, 106030. [Google Scholar] [CrossRef]

- Kim, H.; Kim, M.-K. Multi-Objective Based Optimal Energy Management of Grid-Connected Microgrid Considering Advanced Demand Response. Energies 2019, 12, 4142. [Google Scholar] [CrossRef]

- Sharma, S.; Bhattacharjee, S.; Bhattacharya, A. Probabilistic operation cost minimization of Micro-Grid. Energy 2018, 148, 1116–1139. [Google Scholar] [CrossRef]

- Che, L.; Zhang, X.; Shahidehpour, M.; Alabdulwahab, A.; Abusorrah, A. Optimal interconnection planning of community microgrids with renewable energy y sources. IEEE Trans. Smart Grid 2017, 8, 1054–1063. [Google Scholar] [CrossRef]

- Alipour, M.; Mohammadi-Ivatloo, B.; Zare, K. Stochastic Scheduling of Renewable and CHP-Based Microgrids. IEEE Trans. Ind. Inform. 2015, 11, 1049–1058. [Google Scholar] [CrossRef]

- Niknam, T.; Golestaneh, F.; Malekpour, A. Probabilistic model of polymer exchange fuel cell power plants for hydrogen, thermal and electrical energy management. J. Power Sources 2013, 229, 285–298. [Google Scholar] [CrossRef]

- Motevasel, M.; Seifi, A.R. Expert energy management of a micro-grid considering wind energy uncertainty. Energy Convers. Manag. 2014, 83, 58–72. [Google Scholar] [CrossRef]

- Wang, M.Q.; Gooi, H.B. Spinning Reserve Estimation in Microgrids. IEEE Trans. Power Syst. 2011, 26, 1164–1174. [Google Scholar] [CrossRef]

- Rezaei, N.; Kalantar, M. Smart microgrid hierarchical frequency control ancillary service provision based on virtual inertia concept: An integrated demand response and droop controlled distributed generation framework. Energy Convers. Manag. 2015, 92, 287–301. [Google Scholar] [CrossRef]

- Albadi, M.; El-Saadany, E. A summary of demand response in electricity markets. Electr. Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Aghajani, G.; Shayanfar, H.; Shayeghi, H. Demand side management in a smart micro-grid in the presence of renewable generation and demand response. Energy 2017, 126, 622–637. [Google Scholar] [CrossRef]

- Jalali, A.; Aldeen, M. Risk-Based Stochastic Allocation of ESS to Ensure Voltage Stability Margin for Distribution Systems. IEEE Trans. Power Syst. 2018, 34, 1264–1277. [Google Scholar] [CrossRef]

- Kim, S.; Lee, Y.; Kim, M.-K. Flexible risk control strategy based on multi-stage corrective action with energy storage system. Int. J. Electr. Power Energy Syst. 2019, 110, 679–695. [Google Scholar] [CrossRef]

- Fossati, J.P.; Galarza, A.; Martín-Villate, A.; Fontán, L. A method for optimal sizing energy storage systems for microgrids. Renew. Energy 2015, 77, 539–549. [Google Scholar] [CrossRef]

- Samadi, P.; Wong, V.W.; Schober, R. Load Scheduling and Power Trading in Systems With High Penetration of Renewable Energy Resources. IEEE Trans. Smart Grid 2016, 7, 1802–1812. [Google Scholar] [CrossRef]

- Sortomme, E.; El-Sharkawi, M.A. Optimal Power Flow for a System of Microgrids with Controllable Loads and Battery Storage. In Proceedings of the 2009 IEEE/PES Power Systems Conference and Exposition, Seattle, WA, USA, 15–18 March 2009; pp. 1–5. [Google Scholar] [CrossRef]

- Mohammadi, S.; Soleymani, S.; Mozafari, B. Scenario-based stochastic operation management of MicroGrid including Wind, Photovoltaic, Micro-Turbine, Fuel Cell and Energy Storage Devices. Int. J. Electr. Power Energy Syst. 2014, 54, 525–535. [Google Scholar] [CrossRef]

- Mazidi, M.; Zakariazadeh, A.; Jadid, S.; Siano, P. Integrated scheduling of renewable generation and demand response programs in a microgrid. Energy Convers. Manag. 2014, 86, 1118–1127. [Google Scholar] [CrossRef]

- Gazijahani, F.S.; Salehi, J. Optimal Bilevel Model for Stochastic Risk-Based Planning of Microgrids Under Uncertainty. IEEE Trans. Ind. Informatics 2017, 14, 3054–3064. [Google Scholar] [CrossRef]

- Petrollese, M.; Valverde, L.; Cocco, D.; Cau, G.; Guerra, J. Real-time integration of optimal generation scheduling with MPC for the energy management of a renewable hydrogen-based microgrid. Appl. Energy 2016, 166, 96–106. [Google Scholar] [CrossRef]

- Kanungo, T.; Mount, D.; Netanyahu, N.; Piatko, C.; Silverman, R.; Wu, A. An efficient k-means clustering algorithm: Analysis and implementation. IEEE Trans. Pattern Anal. Mach. Intell. 2002, 24, 881–892. [Google Scholar] [CrossRef]

- Shirazi, M.M.H.; Mowla, D. Energy optimization for liquefaction process of natural gas in peak shaving plant. Energy 2010, 35, 2878–2885. [Google Scholar] [CrossRef]

- Moghaddam, M.P.; Abdollahi, A.; Rashidinejad, M. Flexible demand response programs modeling in competitive electricity markets. Appl. Energy 2011, 88, 3257–3269. [Google Scholar] [CrossRef]

- Soroudi, A.; Amraee, T. Decision making under uncertainty in energy systems: State of the art. Renew. Sustain. Energy Rev. 2013, 28, 376–384. [Google Scholar] [CrossRef]

- Khodabakhsh, R.; Sirouspour, S. Optimal Control of Energy Storage in a Microgrid by Minimizing Conditional Value-at-Risk. IEEE Trans. Sustain. Energy 2016, 7, 1264–1273. [Google Scholar] [CrossRef]

- Karaboga, D.; Basturk, B. A powerful and efficient algorithm for numerical function optimization: Artificial bee colony (ABC) algorithm. J. Glob. Optim. 2007, 39, 459–471. [Google Scholar] [CrossRef]

- Zhang, H.; Xie, Z.; Lin, H.-C.; Li, S. Power Capacity Optimization in a Photovoltaics-Based Microgrid Using the Improved Artificial Bee Colony Algorithm. Appl. Sci. 2020, 10, 2990. [Google Scholar] [CrossRef]

- Al-Sakkaf, S.; Kassas, M.; Khalid, M.; Abido, M.A. An Energy Management System for Residential Autonomous DC Microgrid Using Optimized Fuzzy Logic Controller Considering Economic Dispatch. Energies 2019, 12, 1457. [Google Scholar] [CrossRef]

- Habib, H.U.R.; Subramaniam, U.; Waqar, A.; Farhan, B.S.; Kotb, K.M.; Wang, S. Energy Cost Optimization of Hybrid Renewables Based V2G Microgrid Considering Multi Objective Function by Using Artificial Bee Colony Optimization. IEEE Access 2020, 8, 62076–62093. [Google Scholar] [CrossRef]

- Aghajani, G.; Shayanfar, H.; Shayeghi, H. Presenting a multi-objective generation scheduling model for pricing demand response rate in micro-grid energy management. Energy Convers. Manag. 2015, 106, 308–321. [Google Scholar] [CrossRef]

- Faria, P.; Vale, Z. Demand response in electrical energy supply: An optimal real time pricing approach. Energy 2011, 36, 5374–5384. [Google Scholar] [CrossRef]

- Apx Power Spot Exchange. Available online: https://www.apxgroup.com/trading-clearing/apx-power-uk/ (accessed on 1 December 2019).

- The Solar Power Group Company. Available online: http://thesolarpowergroup.com (accessed on 1 December 2019).

- Anvari-Moghaddam, A.; Seifi, A.R.; Niknam, T.; Pahlavani, M.R.A. Multi-objective operation management of a renewable MG (micro-grid) with back-up micro-turbine/fuel cell/battery hybrid power source. Energy 2011, 36, 6490–6507. [Google Scholar] [CrossRef]

- Baziar, A.; Kavousi-Fard, A. Considering uncertainty in the optimal energy management of renewable micro-grids including storage devices. Renew. Energy 2013, 59, 158–166. [Google Scholar] [CrossRef]

- Niknam, T.; Golestaneh, F.; Malekpour, A. Probabilistic energy and operation management of a microgrid containing wind/photovoltaic/fuel cell generation and energy storage devices based on point estimate method and self-adaptive gravitational search algorithm. Energy 2012, 43, 427–437. [Google Scholar] [CrossRef]

| ID | Type | Min. Power (kW) | Max. Power (kW) | Bid ($/kWh) | Start-Up/Shut-Down Costs ($) |

|---|---|---|---|---|---|

| 1 | MT | 6 | 30 | 0.457 | 0.96 |

| 2 | FC | 3 | 30 | 0.294 | 1.65 |

| 3 | PV | 0 | 25 | 2.584 | 0 |

| 4 | WT | 0 | 15 | 1.073 | 0 |

| 5 | ESS | −30 | 30 | 0.38 | 0 |

| 6 | Utility | −30 | 30 | - | - |

| Type of Consumer | Elasticity | Incentive Costs per Power ($/kWh) | Initial Demand (kWh/day) |

|---|---|---|---|

| Industrial | −0.38 | 0.12 | 847.5 |

| Commercial | −0.20 | 0.20 | 565 |

| Residential | −0.14 | 0.18 | 252.5 |

| Type | Parameter | Value |

|---|---|---|

| Wind turbine data | Pr (kW) | 15 |

| Vr (m/s) | 12.5 | |

| Vci (m/s) | 3 | |

| Vco (m/s) | 25 | |

| Weibull PDF factor | d | 2 |

| C | 6.77 |

| Hour | PV (kW) | WT (kW) | Hour | PV (kW) | WT (kW) |

|---|---|---|---|---|---|

| 1 | 0 | 1.7850 | 13 | 23.9000 | 3.9150 |

| 2 | 0 | 1.7850 | 14 | 21.0500 | 2.3700 |

| 3 | 0 | 1.7850 | 15 | 7.8750 | 1.7850 |

| 4 | 0 | 1.7850 | 16 | 4.2250 | 1.3050 |

| 5 | 0 | 1.7850 | 17 | 0.5500 | 1.7850 |

| 6 | 0 | 0.9150 | 18 | 0 | 1.7850 |

| 7 | 0 | 1.7850 | 19 | 0 | 1.3020 |

| 8 | 0.2000 | 1.3050 | 20 | 0 | 1.7850 |

| 9 | 3.7500 | 1.7850 | 21 | 0 | 1.3005 |

| 10 | 7.5250 | 3.0900 | 22 | 0 | 1.3005 |

| 11 | 10.4500 | 8.7750 | 23 | 0 | 0.9150 |

| 12 | 11.9500 | 10.4100 | 24 | 0 | 0.6150 |

| Type | β = 0.1 | β = 0.5 | β = 1 |

|---|---|---|---|

| Expected costs ($) | 239.7650 | 251.9952 | 255.6907 |

| CVaR ($) | 383.1010 | 86.3655 | 38.0064 |

| Operational costs ($) (10% worst scenario) | 622.8660 | 338.3607 | 293.6971 |

| Hour | Units (kWh) | |||||

|---|---|---|---|---|---|---|

| MT | FC | PV | WT | ESS | Utility | |

| 1 | 6.0715 | 30.0000 | 0.0000 | 1.7900 | −6.8677 | 30.0000 |

| 2 | 6.0024 | 30.0000 | 0.0000 | 1.7800 | −8.8357 | 30.0000 |

| 3 | 6.0446 | 30.0000 | 0.0000 | 1.7900 | −8.8879 | 30.0000 |

| 4 | 6.0282 | 30.0000 | 0.0000 | 1.7800 | −7.6826 | 30.0000 |

| 5 | 6.0493 | 30.0000 | 0.0000 | 1.7900 | −1.8190 | 30.0000 |

| 6 | 6.0045 | 30.0000 | 0.0000 | 0.9200 | 7.3482 | 30.0000 |

| 7 | 6.0027 | 30.0000 | 0.0000 | 1.7900 | 14.3143 | 30.0000 |

| 8 | 6.0005 | 30.0000 | 0.2000 | 1.3100 | 27.4728 | 13.7642 |

| 9 | 29.997 | 30.0000 | 3.7500 | 1.7800 | 30.0000 | −29.3026 |

| 10 | 29.0909 | 30.0000 | 7.5300 | 3.0900 | 30.0000 | −30.0000 |

| 11 | 18.7481 | 30.0000 | 10.4500 | 8.7700 | 30.0000 | −30.0000 |

| 12 | 12.1225 | 30.0000 | 11.9500 | 10.4100 | 30.0000 | −30.0000 |

| 13 | 6.0163 | 30.0000 | 23.9000 | 3.9100 | 28.9134 | −30.0000 |

| 14 | 10.3198 | 30.0000 | 20.0500 | 2.3700 | 30.0000 | −30.0000 |

| 15 | 26.5753 | 30.0000 | 7.8700 | 1.7800 | 30.0000 | −30.0000 |

| 16 | 29.9974 | 30.0000 | 4.2200 | 1.3100 | 30.0000 | −25.8165 |

| 17 | 29.9980 | 30.0000 | 0.5500 | 1.7800 | 30.0000 | −17.1583 |

| 18 | 6.0017 | 30.0000 | 0.0000 | 1.7900 | 30.0000 | 21.0241 |

| 19 | 6.0002 | 30.0000 | 0.0000 | 1.3000 | 28.7291 | 30.0000 |

| 20 | 6.0005 | 30.0000 | 0.0000 | 1.7800 | 30.0000 | 17.9934 |

| 21 | 29.9983 | 30.0000 | 0.0000 | 1.3000 | 30.0000 | −23.3302 |

| 22 | 29.9999 | 30.0000 | 0.0000 | 1.3000 | 30.0000 | −15.6415 |

| 23 | 6.0054 | 30.0000 | 0.0000 | 0.9200 | 4.7649 | 30.0000 |

| 24 | 6.0074 | 30.0000 | 0.0000 | 0.6200 | −2.6961 | 30.0000 |

| Hour | Units (kWh) | |||||

|---|---|---|---|---|---|---|

| MT | FC | PV | WT | ESS | Utility | |

| 1 | 6.0196 | 30.0000 | 0.0000 | 1.7900 | −9.6310 | 30.0000 |

| 2 | 6.0204 | 30.0000 | 0.0000 | 1.7800 | −11.8594 | 30.0000 |

| 3 | 6.0031 | 30.0000 | 0.0000 | 1.7900 | −11.8298 | 30.0000 |

| 4 | 6.2472 | 30.0000 | 0.0000 | 1.7800 | −10.9673 | 30.0000 |

| 5 | 6.0209 | 30.0000 | 0.0000 | 1.7900 | −5.1570 | 30.0000 |

| 6 | 6.0083 | 30.0000 | 0.0000 | 0.9200 | 3.5573 | 30.0000 |

| 7 | 6.0050 | 30.0000 | 0.0000 | 1.7900 | 10.5224 | 30.0000 |

| 8 | 6.0014 | 30.0000 | 0.2000 | 1.3100 | 8.9664 | 30.0000 |

| 9 | 29.9970 | 30.0000 | 3.7500 | 1.7800 | 30.0000 | −25.9567 |

| 10 | 29.9918 | 30.0000 | 7.5300 | 3.0900 | 30.0000 | −27.3799 |

| 11 | 22.1811 | 30.0000 | 10.4500 | 8.7700 | 30.0000 | −30.0000 |

| 12 | 15.3795 | 30.0000 | 11.9500 | 10.4100 | 30.0000 | −30.0000 |

| 13 | 8.0987 | 30.0000 | 23.9000 | 3.9100 | 30.0000 | −30.0000 |

| 14 | 13.4887 | 30.0000 | 20.0500 | 2.3700 | 30.0000 | −30.0000 |

| 15 | 29.9203 | 30.0000 | 7.8700 | 1.7800 | 30.0000 | −30.0000 |

| 16 | 29.9975 | 30.0000 | 4.2200 | 1.3100 | 30.0000 | −22.2957 |

| 17 | 29.9998 | 30.0000 | 0.5500 | 1.7800 | 30.0000 | −14.5210 |

| 18 | 6.0007 | 30.0000 | 0.0000 | 1.7900 | 30.0000 | 21.6680 |

| 19 | 6.0001 | 30.0000 | 0.0000 | 1.3000 | 25.6865 | 30.0000 |

| 20 | 6.0004 | 30.0000 | 0.0000 | 1.7800 | 30.0000 | 19.2081 |

| 21 | 29.9994 | 30.0000 | 0.0000 | 1.3000 | 30.0000 | −19.8983 |

| 22 | 29.9998 | 30.0000 | 0.0000 | 1.3000 | 30.0000 | −18.0410 |

| 23 | 6.0036 | 30.0000 | 0.0000 | 0.9200 | 2.5509 | 30.0000 |

| 24 | 6.0600 | 30.0000 | 0.0000 | 0.6200 | −4.6747 | 30.0000 |

| Hour | Units (kWh) | |||||

|---|---|---|---|---|---|---|

| MT | FC | PV | WT | ESS | Utility | |

| 1 | 6.4208 | 30.0000 | 0.0000 | 1.7900 | −13.1397 | 30.0000 |

| 2 | 6.2111 | 30.0000 | 0.0000 | 1.7800 | −15.0381 | 30.0000 |

| 3 | 6.0744 | 30.0000 | 0.0000 | 1.7900 | −14.9114 | 30.0000 |

| 4 | 6.0550 | 30.0000 | 0.0000 | 1.7800 | −13.8230 | 30.0000 |

| 5 | 6.0597 | 30.0000 | 0.0000 | 1.7900 | −8.5424 | 30.0000 |

| 6 | 6.0133 | 30.0000 | 0.0000 | 0.9200 | −0.2126 | 30.0000 |

| 7 | 6.0036 | 30.0000 | 0.0000 | 1.7900 | 6.3406 | 30.0000 |

| 8 | 6.0000 | 30.0000 | 0.2000 | 1.3100 | 30.0000 | 8.1371 |

| 9 | 29.9989 | 30.0000 | 3.7500 | 1.7800 | 30.0000 | −22.7060 |

| 10 | 29.9963 | 30.0000 | 7.5300 | 3.0900 | 30.0000 | −23.9606 |

| 11 | 25.5194 | 30.0000 | 10.4500 | 8.7700 | 30.0000 | −30.0000 |

| 12 | 18.5466 | 30.0000 | 11.9500 | 10.4100 | 30.0000 | −30.0000 |

| 13 | 11.1802 | 30.0000 | 23.9000 | 3.9100 | 30.0000 | −30.0000 |

| 14 | 16.5702 | 30.0000 | 20.0500 | 2.3700 | 30.0000 | −30.0000 |

| 15 | 29.9993 | 30.0000 | 7.8700 | 1.7800 | 30.0000 | −26.8263 |

| 16 | 29.9983 | 30.0000 | 4.2200 | 1.3100 | 30.0000 | −18.8726 |

| 17 | 29.9990 | 30.0000 | 0.5500 | 1.7800 | 30.0000 | −10.8822 |

| 18 | 6.0004 | 30.0000 | 0.0000 | 1.7900 | 30.0000 | 20.9689 |

| 19 | 6.0002 | 30.0000 | 0.0000 | 1.3000 | 23.4763 | 30.0000 |

| 20 | 6.0002 | 30.0000 | 0.0000 | 1.7800 | 30.0000 | 19.9705 |

| 21 | 29.9992 | 30.0000 | 0.0000 | 1.3000 | 30.0000 | −16.5598 |

| 22 | 29.9989 | 30.0000 | 0.0000 | 1.3000 | 30.0000 | −19.6862 |

| 23 | 6.0179 | 30.0000 | 0.0000 | 0.9200 | 0.3184 | 30.0000 |

| 24 | 6.0214 | 30.0000 | 0.0000 | 0.6200 | −7.3639 | 30.0000 |

| Algorithm | Best Solution ($) | Worst Solution ($) | Average ($) | Mean Simulation Time (sec) |

|---|---|---|---|---|

| GA [38] | 277.7444 | 304.5889 | 290.4321 | - |

| PSO [38] | 277.3237 | 303.3791 | 288.8761 | - |

| AMPSO [38] | 274.4317 | 274.7318 | 274.5643 | - |

| θ-PSO [39] | 275.3491 | 281.7841 | 277.6191 | - |

| GSA [40] | 275.5369 | 282.1743 | 277.8021 | - |

| ABC | 274.3801 | 274.9271 | 274.6536 | 35.28 |

| IML-ABC | 272.4761 | 272.6803 | 272.5782 | 29.11 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ryu, H.-S.; Kim, M.-K. Two-Stage Optimal Microgrid Operation with a Risk-Based Hybrid Demand Response Program Considering Uncertainty. Energies 2020, 13, 6052. https://doi.org/10.3390/en13226052

Ryu H-S, Kim M-K. Two-Stage Optimal Microgrid Operation with a Risk-Based Hybrid Demand Response Program Considering Uncertainty. Energies. 2020; 13(22):6052. https://doi.org/10.3390/en13226052

Chicago/Turabian StyleRyu, Ho-Sung, and Mun-Kyeom Kim. 2020. "Two-Stage Optimal Microgrid Operation with a Risk-Based Hybrid Demand Response Program Considering Uncertainty" Energies 13, no. 22: 6052. https://doi.org/10.3390/en13226052

APA StyleRyu, H.-S., & Kim, M.-K. (2020). Two-Stage Optimal Microgrid Operation with a Risk-Based Hybrid Demand Response Program Considering Uncertainty. Energies, 13(22), 6052. https://doi.org/10.3390/en13226052