Link between Energy Efficiency and Sustainable Economic and Financial Development in OECD Countries

Abstract

1. Introduction

- RQ1: What are the differences in energy efficiency between OECD countries?

- RQ2: What is the trend of energy efficiency in OECD countries?

- RQ3: What kind of relationship is there between energy efficiency and sustainable economic and financial development in OECD countries?

- RQ4: Does this relationship remain the same for all of the analysed countries?

2. Energy Efficiency, Sustainable Economic and Financial Development

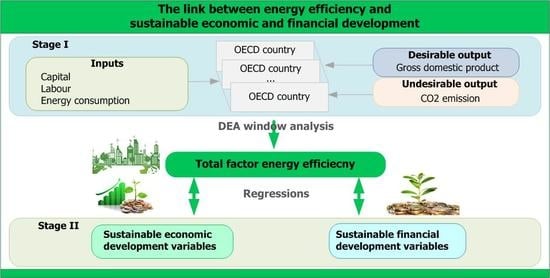

3. Materials and Methods

3.1. DEA Window Analysis

3.2. Panel Data Regression Models

3.3. Data and Variable Selection

4. Results

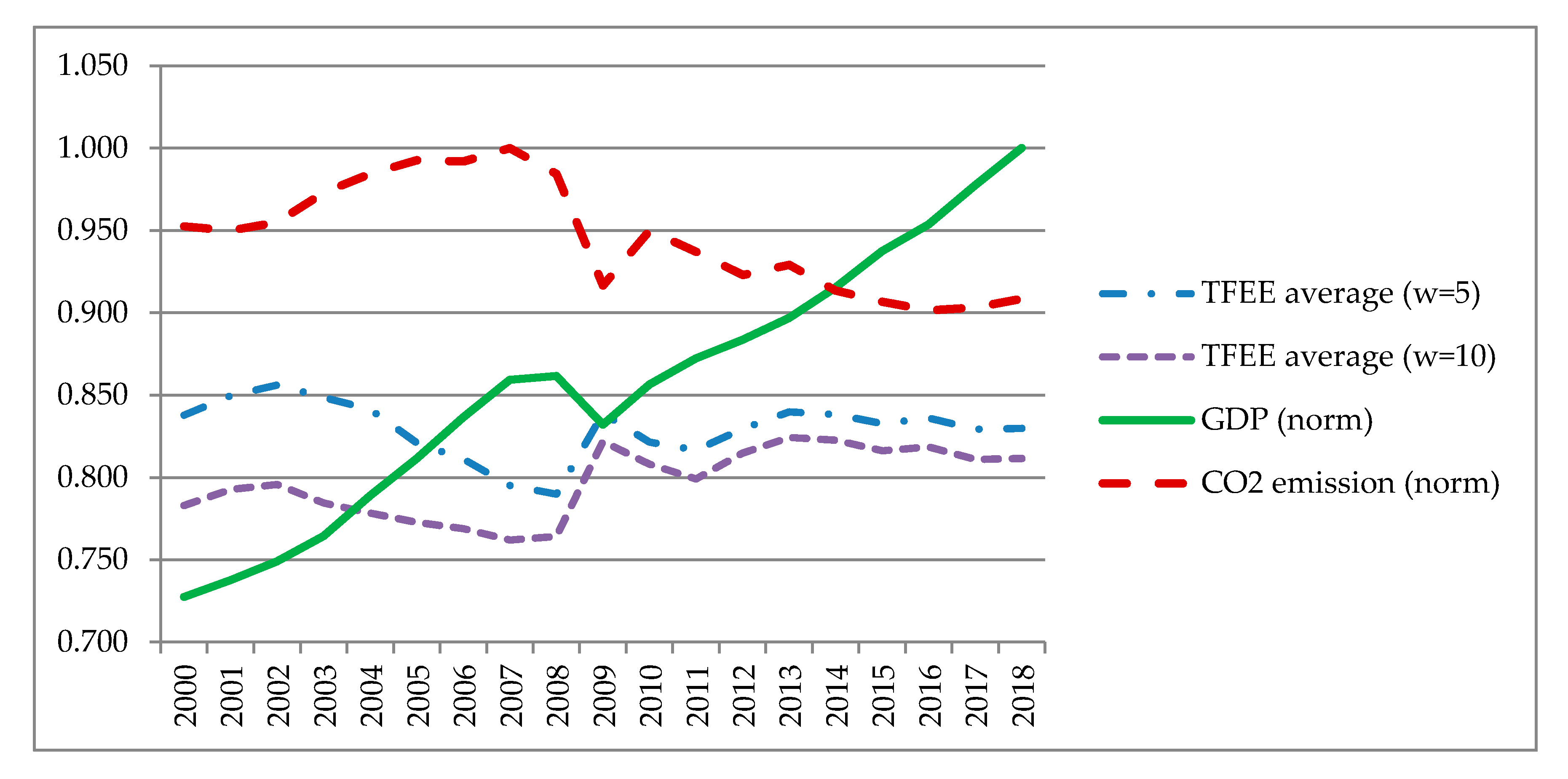

4.1. Total Factor Energy Efficiency

4.2. Contributions of Multiple Factors to Efficiency Based on Panel-Data Regression Model

4.2.1. Contributions of Sustainable Economic Development

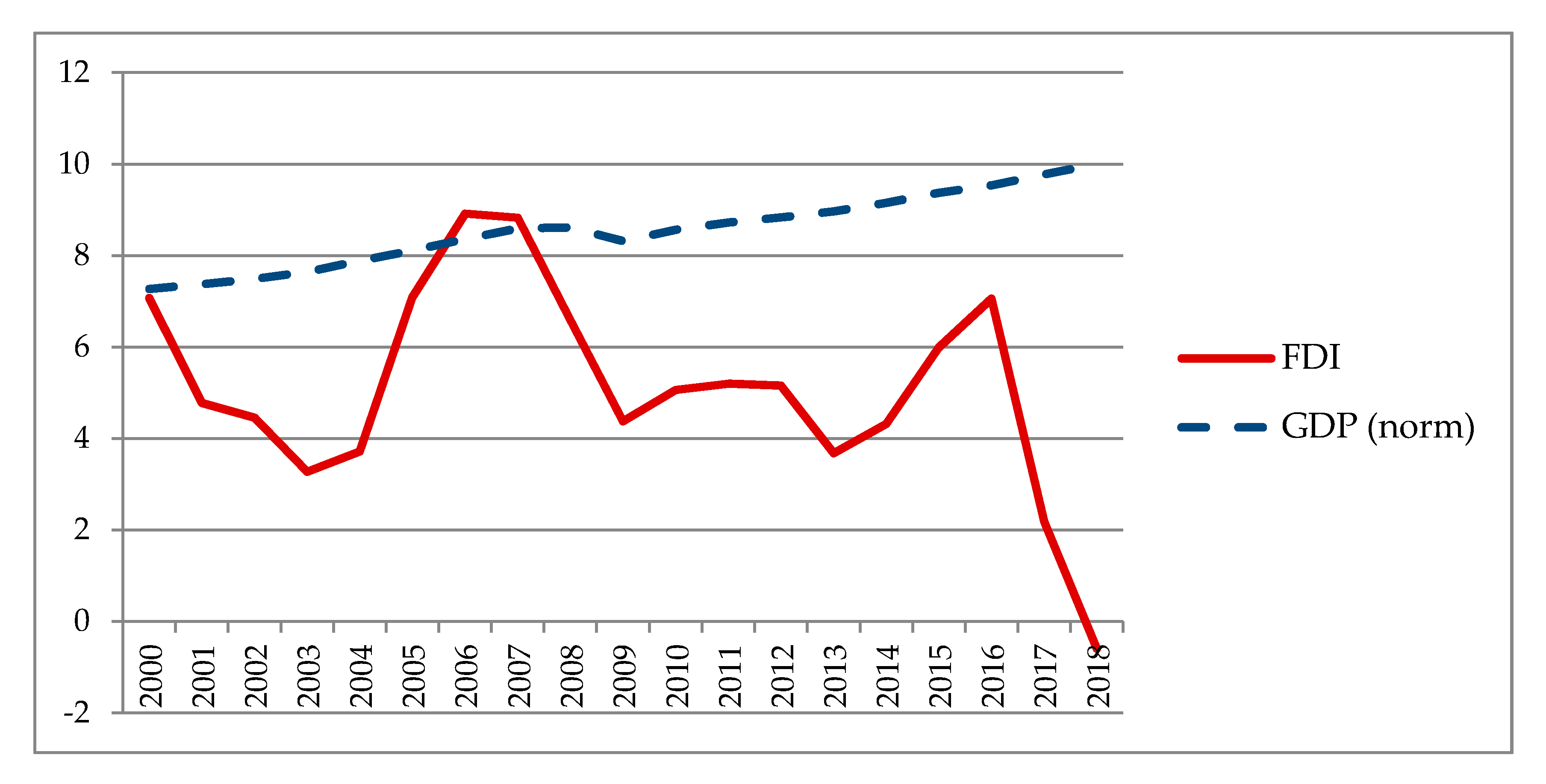

4.2.2. Contributions of Sustainable Financial Development

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Authors | Period | Country | Input Variables | Output Variables | Methodology | Results |

|---|---|---|---|---|---|---|

| Hu and Wang, 2006 | 1995–2002 | Regions in China | Labour, capital stock, energy consumption | Real GDP | DEA | Regional energy efficiency improved during observed period; U-shaped relationship between income and energy efficiency |

| Zhou and Ang, 2008 | 1997–2001 | 21 OECD countries | Capital stock, labour force, four categories of energy consumption | GDP and CO2 emissions | DEA, linear programming models | Three models were compared; findings show different results depending on the model |

| Honma and Hu, 2008 | 1993–2003 | Regions in Japan | Labour employment, private and public stocks, 11 energy sources | GDP | DEA | Inland regions and most regions along the sea achieve energy efficiency |

| Lenz et al., 2018 | 2008–2014 | 28 EU countries | Labour, capital, energy | GDP and CO2 and SOx emission | DEA SBM | Energy efficiency does not incorporate carbon pollution |

| Song et al., 2013 | 2009–2010 | BRICS countries | Capital formation rate, number of the economically active population, energy consumption | GDP | DEA SBM | Energy efficiency in BRICS countries is low, but there is an increasing trend |

| Chang, 2020 | 2010–2014 | EU 28 countries | Real capital stock, labour force, fossil fuel energy consumption | Real GDP | DEA, metafrontier analysis | Models for energy efficiency in the EU are Denmark, Sweden, Luxembourg and the UK |

| Chien and Hu, 2007 | 2001–2002 | OECD and non-OECD countries | Labour, capital stock, energy consumption | GDP | DEA | OECD economies have higher technical efficiency than non-OECD countries. |

| Zhang et al., 2011 | 1980–2005 | 23 Developing countries | Labour force, capital stock, energy consumption | GDP | DEA window | Highest rise in total energy efficiency in China due to effective energy policy U-shape between income and TFEE is found |

| Borozan, 2018 | 2005–2013 | EU regions | Gross fixed capital formation, total final energy consumption, employment rate of 15–64 age group | GDP | DEA, Tobit regression | Most EU regions have energy efficiency; more developed economies have higher energy efficiency |

| Simsek, 2014 | 1995–2009 | OECD | Labour, capital, energy consumption | GDP, CO2 emissions | DEA, bad output index | Results differ among countries due to inputs used; inefficiency occurs by using labour, oil, and natural gas as inputs; inefficient economy produces GDP with high CO2 emissions |

| Zhao et al., 2018 | 2015 | 35 BRICS countries | Energy, capital, labour | GDP, carbon emissions | Three-stage DEA model | Energy-saving and CO2 emission reduction are highest in economies with low TFEE |

| Lin and Xu, 2017 | 2006–2015 | Regions in China | Labour, capital, energy | Real GDP, SO2 emissions, chemical oxygen | DEA, Tobit regression model | TFEE is low and unbalanced throughout regions; environmental regulations affect TFEE |

| Relationship between energy efficiency (energy intensity) and economic and financial development | ||||||

| Authors | Period | Country | Input Variables | Relationship between variables | Methodology | Results |

| Lan-yue et al., 2017 | 1996–2013 | Nine countries in different stages of development | Energy use per capita, population, GDP at market prices | Energy intensity and economic output | 3GR model | Energy consumption (EC), economic output (EO), and energy intensity (EI) have a linear relationship; EC is codetermined by EO and EI effects; Developed countries show similar effects of EO and EI on economic growth, energy consumption, and emission decline; interactive EO and EI effects co-determine EC |

| Deichmann et al., 2018 | 1990–2014 | 137 countries | Energy consumption, GDP, population, value added of agriculture, services and industry | Energy intensity and economic growth | Flexible piecewise linear regression model | EI negatively correlated with economic growth but decreasing rate slows by 25% after income per capita reaches $5000 Structural changes are important for EI level; in poor countries, EI decline is expected as economies develop |

| Mohmood and Ahmad, 2018 | 1995–2015 | 19 European countries | Energy intensity, real GDP growth rate, population, taxes, energy prices | Economic growth energy intensity | Neoclassical growth framework, causality | Economic growth and energy intensity have an inverse relationship; declining trend of energy intensity in all observed European countries due to energy-saving techniques and change in structure of GDP towards lower energy consuming sectors; higher economic growth, higher promotion of energy efficiency |

| Destais et al., 2007 | 1950–1999 | 44 countries | Primary energy consumption, population, GDP | Economic development, energy intensity | Panel smooth transition regression models | No linear relationship between income and energy demand; threshold is determined by income level |

| Lin and Abudu, 2019 | 1990–2014 | Regions Sub Saharan Africa | GDP, gross capital formation, labour force, total primary energy consumption | Economic development, energy intensity | Translog production approach, regression | In countries with lower GDP per capita, energy intensity is higher; higher energy intensity leads to higher CO2 intensity |

| Zhong, 2016 | 1995–2009 | 41 countries (27 EU and rest of major economies) and 35 sectors | GDP, GDP pc, energy consumption, trade data | Economic development, energy intensity | Input-output model, multilevel mixed-effects model | Advanced economies show change in energy use on supply side is larger than on demand side Key role of energy intensity is changing in sectors; U-shape exists between income and energy intensity |

| Pan et al., 2019 | 1985–2015 | Bangladesh | Energy intensity, industrial share of GDP, ratio of international trade to GDP, GDP per capita, number of patents | Energy intensity, economic development | Path model (extension of multiple linear regression) | Industrialisation has a direct linear impact on energy intensity; trade openness has a direct negative influence on energy intensity |

| Ohene-Asare et al., 2020 | 1980–2011 | 46 African countries | Capital stock at current PPP, labour, total primary energy consumption, GDP, CO2 emissions | Total factor energy efficiency, economic development | DEA SBM, bootstrapped truncated regression model, two-equation system | Economic development and technology have positive effects on energy efficiency; bi-causal relationship exists between TFPP and economic development |

| Pan et al., 2020 | 1990–2013 | 35 European countries | Capital, labour, GPD, GDP per capita, population, energy utilisation and consumption | Energy efficiency, economic development | Stochastic frontier production function model | U-shape exists between energy efficiency and income per capita; increased labour and national prices reduce energy efficiency |

| Yang and Li, 2017 | 2003–2014 | China | Labour, capital, fixed asset investment in energy industry economised with different ownership structures | Annual regional GDP, general budget revenue of local government, number of patents authorised in China | Multivariable constrained nonlinear functions based on DEA SBM model | Investment in energy efficiency brings the highest energy efficiency to Beijing and Shanghai; other regions obtain low energy efficiency by investment regardless of ownership structure |

| Azhgaliyeva et al., 2020 | 1990–2016 | 44 OECD and non-OECD countries | Energy intensity, GDP, electricity prices, fossil fuel, industry value added per GDP, trade per GDP | Economic and financial development, energy intensity | Regression | Higher GDP per capita and energy prices lead to energy intensity decline; five energy-efficiency policies (fiscal taxes, standards and labelling, grants and subsidies, strategic planning and support, government direct investment) lead to lower energy intensity |

| Shahbaz, 2012 | 1971–2009 | Portugal | CO2 emissions, energy intensity per capita, financial development (real domestic credit to private sector per capita), economic development (GDP per capita) | Economic and financial development, energy intensity | ARDL, VECM Granger causality | Variables are cointegrated for a long-run relationship; economic growth and energy intensity increase and financial development reduces CO2 emissions |

| Canh et al., 2020 | 1997–2013 | 81 economies | Production and consumption energy intensity, GDP per capita, industry value added % GDP, trade, urban population FDI net inflows, energy oil prices, overall financial development, financial institutions, financial markets indices, etc. | Financial development, energy intensity | GMM estimators, inclusive estimation strategy for empirical robustness | Energy intensity is observed as production (associated with technology development) and consumption (associated with urbanisation and affluence) energy intensity; financial institutions and oil price shocks decrease production energy intensity; financial markets reduce consumption energy intensity |

| Chen, Huang and Zheng, 2019 | 1990–2014 | 21 OECD and 77 non-OECD countries | Energy intensity, financial development (domestic credit to private sector by bank, private credit by deposit money banks to GDP, Chin-Ito index), share of urbanisation, population aged 65 and above, service value added % GDP, GDP growth, total factor productivity | Financial development, energy intensity | Two-way fixed-effects model | Financial development has a negative effect on the energy intensity for non-OECD countries and a limited impact on the energy reduction for OECD countries due to the maturity of the financial systems |

| Adom et al., 2019 | 1970–2016 | Ghana | Energy intensity, prices of electricity and price, vectors of financial development indicators and other control variables, technological spillovers (trade openness), industry value-added % GDP | Financial development, energy intensity | Dynamic OLS | Financial development lowers energy intensity; government should stimulate financial sector and form energy efficiency policies, establish green banks for green investment |

| Aydin and Onay, 2020 | 1990–2015 | BRICS countries | CO2 emissions, financial development index, energy intensity | Financial development, energy intensity, carbon emissions | Panel smooth transition regression model | Three threshold levels of energy intensity exist; above the threshold point, financial development causes environmental pollution |

| Pan et al., 2019 | 1976–2014 | Bangladesh | Trade openness, financial development (market capitalisation to GDP ratio, banks’ private credit to GDP ratio), technological innovation, energy intensity | Financial development, trade openness, technological innovation, energy intensity | DAG technique, SVAR model | Financial development, trade openness, and technological innovation affect energy intensity |

| Ziaei, 2015 | 1989–2011 | 13 European and 12 Asia and Oceania countries | Energy consumption, CO2 emissions, ratio of domestic credit to private sector to GDP, stock traded turnover ratio | Financial development, energy consumption, CO2 emissions | Panel VAR model | Different results in different countries; financial development influences CO2 emissions and vice versa; energy consumption affects CO2 emissions Markets with higher levels of asset development affect energy consumption; financial development attracts FDI and new technology, which influence economic growth and energy intensity |

| Hübler and Keller, 2010 | 1975–2004 | 60 developing countries | Total primary energy supply, energy intensity, share of industrial value added % GDP, net inflows of FDI % GDP, imports % GDP, official development assistance, total income, GDP per capita | Foreign direct investments (FDI), energy intensity | OLS, regression | Foreign direct investments inflow lowers energy intensity in developing countries |

| Jiang et al., 2014 | 2003–2011 | 29 Chinese provinces | Energy intensity, GPD per capita, investments, capital–labour ratio, FDI, energy reserve, spatial spillover effects | Energy intensity, income, FDI | Durbin error model | FDI has a negative spatial spillover impact on energy intensity |

References

- OECD. Green Growth Studies Energy; OECD Publishing: Paris, France, 2012. [Google Scholar]

- BP Energy Outlook 2019 Edition. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2019.pdf (accessed on 5 August 2020).

- Ang, B.W.; Xu, X. Energy Efficiency Indicator; Springer Science and Business Media LLC: Berlin, Germany, 2014; pp. 1894–1897. [Google Scholar]

- Directive, E.E. Directive 2012/27/EU of the European Parliament and of the Council of 25 October 2012 on energy efficiency, amending Directives 2009/125/EC and 2010/30/EU and repealing Directives 2004/8/EC and 2006/32. Off. J. Eur. Union 2012, 315, 1–56. [Google Scholar]

- Ayres, R.U.; Turton, H.; Casten, T. Energy efficiency, sustainability and economic growth. Energy 2007, 32, 634–648. [Google Scholar] [CrossRef]

- Rajbhandari, A.; Zhang, F. Does energy efficiency promote economic growth? Evidence from a multicountry and multisectoral panel dataset. Energy Econ. 2018, 69, 128–139. [Google Scholar] [CrossRef]

- Zioło, M.; Filipiak, B.Z.; Bąk, I.; Cheba, K.; Țîrcă, D.-M.; Novo-Corti, I. Finance, Sustainability and Negative Externalities. An Overview of the European Context. Sustainability 2019, 11, 4249. [Google Scholar] [CrossRef]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Shahbaz, M.; Jam, F.A.; Bibi, S.; Loganathan, N. Multivariate Granger Causality Between CO2 Emissions, Energy Intensity and Economic Growth in Portugal: Evidence from Cointegration and Causality Analysis. Technol. Econ. Dev. Econ. 2015, 22, 47–74. [Google Scholar] [CrossRef]

- Tracking Report. Tracking Industry. IEA-International Energy Agency. 2019. Available online: https://www.iea.org/reports/tracking-industry-2020 (accessed on 12 August 2020).

- Adewuyi, A.O.; Awodumi, O.B. Renewable and non-renewable energy-growth-emissions linkages: Review of emerging trends with policy implications. Renew. Sustain. Energy Rev. 2017, 69, 275–291. [Google Scholar] [CrossRef]

- Danish; Saud, S.; Baloch, M.A.; Lodhi, R.N. The nexus between energy consumption and financial development: Estimating the role of globalization in Next-11 countries. Environ. Sci. Pollut. Res. 2018, 25, 18651–18661. [Google Scholar] [CrossRef]

- Charfeddine, L.; Kahia, M. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renew. Energy 2019, 139, 198–213. [Google Scholar] [CrossRef]

- Baloch, M.A.; Danish; Fanchen, M. Modeling the non-linear relationship between financial development and energy consumption: Statistical experience from OECD countries. Environ. Sci. Pollut. Res. 2019, 26, 8838–8846. [Google Scholar] [CrossRef]

- Ohene-Asare, K.; Tetteh, E.N.; Asuah, E.L. Total factor energy efficiency and economic development in Africa. Energy Effic. 2020, 13, 1177–1194. [Google Scholar] [CrossRef]

- Canh, N.P.; Thanh, S.D.; Nasir, M.A. Nexus between financial development & energy intensity: Two sides of a coin? J. Environ. Manag. 2020, 270, 110902. [Google Scholar] [CrossRef]

- Vlahinić-Dizdarević, N.; Šegota, A. Total-factor energy efficiency in the EU countries. In Zbornik Radova Ekonomskog Fakulteta u Rijeci: Časopis za Ekonomsku Teoriju i Praksu; Sveučilište u Rijeci, Ekonomski fakultet: Rijeka, Hrvatska, 2012; Volume 30, pp. 247–265. [Google Scholar]

- OECD. Measuring Distance to the SDG Targets. Measuring Distance to the SDG Targets; OECD, 2019. Available online: http://www.oecd.org/sdd/OECD-Measuring-Distance-to-SDG-Targets.pdf (accessed on 12 August 2020).

- Vehmas, J.; Kaivo-Oja, J.; Luukkanen, J. Energy efficiency as a driver of total primary energy supply in the EU-28 countries-incremental decomposition analysis. Heliyon 2018, 4, e00878. [Google Scholar] [CrossRef] [PubMed]

- BP Energy Outlook 2030. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2011.pdf (accessed on 5 August 2020).

- IEA Energy Efficiency Indicators. Statistcs Report–June. 2020. Available online: https://www.iea.org/reports/energy-efficiency-indicators-2020 (accessed on 12 August 2020).

- Jednak, S.; Kragulj, D. Economic Aspects of Energy Efficiency and Sustainability, Relevance of Energy Efficiency in the Context of Sustainable Development; FON: Belgrade, Serbia, 2020; pp. 7–29. [Google Scholar]

- Filipovic, S.; Verbič, M.; Radovanović, M. Determinants of energy intensity in the European Union: A panel data analysis. Energy 2015, 92, 547–555. [Google Scholar] [CrossRef]

- Bhatia, S. Energy resources and their utilisation. Adv. Renew. Energy Syst. 2014, 1–31. [Google Scholar] [CrossRef]

- Hu, J.-L.; Wang, S.-C. Total-factor energy efficiency of regions in China. Energy Policy 2006, 34, 3206–3217. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B. Linear programming models for measuring economy-wide energy efficiency performance. Energy Policy 2008, 36, 2911–2916. [Google Scholar] [CrossRef]

- Mardani, A.; Zavadskas, E.K.; Streimikiene, D.; Jusoh, A.; Khoshnoudi, M. A comprehensive review of data envelopment analysis (DEA) approach in energy efficiency. Renew. Sustain. Energy Rev. 2017, 70, 1298–1322. [Google Scholar] [CrossRef]

- Yu, D.; He, X. A bibliometric study for DEA applied to energy efficiency: Trends and future challenges. Appl. Energy 2020, 268, 115048. [Google Scholar] [CrossRef]

- Lenz, N.V.; Šegota, A.; Maradin, D. Total-factor Energy Efficiency in EU: Do Environmental Impacts Matter? Int. J. Energy Econ. Policy 2018, 8, 92. [Google Scholar]

- Honma, S.; Hu, J.-L. Total-factor energy efficiency of regions in Japan. Energy Policy 2008, 36, 821–833. [Google Scholar] [CrossRef]

- Song, M.-L.; Zhang, L.-L.; Liu, W.; Fisher, R. Bootstrap-DEA analysis of BRICS’ energy efficiency based on small sample data. Appl. Energy 2013, 112, 1049–1055. [Google Scholar] [CrossRef]

- Chang, M.-C. An application of total-factor energy efficiency under the metafrontier framework. Energy Policy 2020, 142, 111498. [Google Scholar] [CrossRef]

- Chien, T.; Hu, J.-L. Renewable energy and macroeconomic efficiency of OECD and non-OECD economies. Energy Policy 2007, 35, 3606–3615. [Google Scholar] [CrossRef]

- Zhang, X.-P.; Cheng, X.-M.; Yuan, J.-H.; Gao, X.-J. Total-factor energy efficiency in developing countries. Energy Policy 2011, 39, 644–650. [Google Scholar] [CrossRef]

- Borozan, D. Technical and total factor energy efficiency of European regions: A two-stage approach. Energy 2018, 152, 521–532. [Google Scholar] [CrossRef]

- Zhao, C.; Zhang, H.; Zeng, Y.; Li, F.; Liu, Y.; Qin, C.; Jia-Hai, Y. Total-Factor Energy Efficiency in BRI Countries: An Estimation Based on Three-Stage DEA Model. Sustainability 2018, 10, 278. [Google Scholar] [CrossRef]

- Lin, J.; Xu, C. The Impact of Environmental Regulation on Total Factor Energy Efficiency: A Cross-Region Analysis in China. Energies 2017, 10, 1578. [Google Scholar] [CrossRef]

- Şimşek, N. Energy Efficiency with Undesirable Output at the Economy-Wide Level: Cross Country Comparison in OECD Sample. Am. J. Energy Res. 2014, 2, 9–17. [Google Scholar] [CrossRef]

- Lan-Yue, Z.; Yao, L.; Jing, Z.; Bing, L.; Ji-Min, H.; Shi-Huai, D.; Xin, H.; Ling, L.; Fei, S.; Hong, X.; et al. The relationships among energy consumption, economic output and energy intensity of countries at different stage of development. Renew. Sustain. Energy Rev. 2017, 74, 258–264. [Google Scholar] [CrossRef]

- Deichmann, U.; Reuter, A.; Vollmer, S.; Zhang, F. Relationship between Energy Intensity and Economic Growth: New Evidence from a Multi-Country Multi-Sector Data Set; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Mahmood, T.; Ahmad, E. The relationship of energy intensity with economic growth:Evidence for European economies. Energy Strat. Rev. 2018, 20, 90–98. [Google Scholar] [CrossRef]

- Destais, G.; Fouquau, J.; Hurlin, C. The Econometrics of Energy Systems; Springer Science and Business Media LLC: Berlin, Germany, 2007; pp. 98–120. [Google Scholar]

- Lin, B.; Abudu, H.; Abidu, H. Changes in Energy Intensity During the development Process: Evidence in Sub-Saharan Africa and Policy Implications. Energy 2019, 183, 1012–1022. [Google Scholar] [CrossRef]

- Zhong, S. Energy Consumption, Energy Intensity and Economic Development Between 1995 and 2009: A Structural Decomposition Approach; UNU-MERIT Working Paper: Maastricht, The Netherlands, 2016. [Google Scholar]

- Pan, X.; Uddin, M.K.; Saima, U.; Jiao, Z.; Han, C. How do industrialisation and trade openness influence energy intensity? Evidence from a path model in case of Bangladesh. Energy Policy 2019, 133, 110916. [Google Scholar] [CrossRef]

- Pan, X.X.; Chen, M.L.; Ying, L.M.; Zhang, F.F. An empirical study on energy utilisation efficiency, economic development, and sustainable management. Environ. Sci. Pollut. Res. 2020, 27, 12874–12881. [Google Scholar] [CrossRef] [PubMed]

- Yang, W.; Li, L. Energy Efficiency, Ownership Structure, and Sustainable Development: Evidence from China. Sustainability 2017, 9, 912. [Google Scholar] [CrossRef]

- Creţan, R.; Vesalon, L. The Political Economy of Hydropower in the Communist Space: Iron Gates Revisited. Tijdschr. Econ. Soc. Geogr. 2017, 108, 688–701. [Google Scholar] [CrossRef]

- Vãran, C.; Creţan, R. Place and the spatial politics of intergenerational remembrance of the Iron Gates displacements in Romania, 1966–1972. Area 2017, 50, 509–519. [Google Scholar] [CrossRef]

- Azhgaliyeva, D.; Liu, Y.; Liddle, B. An empirical analysis of energy intensity and the role of policy instruments. Energy Policy 2020, 145, 111773. [Google Scholar] [CrossRef]

- Shahbaz, M. Multivariate granger causality between CO2 emissions, energy intensity, financial development and economic growth: Evidence from Portugal MPRA Paper No. 37774. 2012, pp. 1–49. Available online: https://mpra.ub.uni-muenchen.de/37774/1/MPRA_paper_37774.pdf (accessed on 15 August 2020).

- Chen, Z.; Huang, W.; Zheng, X. The decline in energy intensity: Does financial development matter? Energy Policy 2019, 134, 110945. [Google Scholar] [CrossRef]

- Adom, P.K.; Appiah, M.O.; Agradi, M.P. Does financial development lower energy intensity? Front. Energy 2019, 14, 1–15. [Google Scholar] [CrossRef]

- Aydin, C.; Onay, R.D. Does Energy Intensity Affect the Relationship Between Financial Development and Environmental Pollution? Brain Broad Res. Artif. Intell. Neurosci. 2020, 11, 144–156. [Google Scholar] [CrossRef]

- Pan, X.; Uddin, K.; Han, C.; Pan, X. Dynamics of financial development, trade openness, technological innovation and energy intensity: Evidence from Bangladesh. Energy 2019, 171, 456–464. [Google Scholar] [CrossRef]

- Ziaei, S.M. Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renew. Sustain. Energy Rev. 2015, 42, 752–759. [Google Scholar] [CrossRef]

- Hübler, M.; Keller, A. Energy savings via FDI? Empirical evidence from developing countries. Environ. Dev. Econ. 2009, 15, 59–80. [Google Scholar] [CrossRef]

- Jiang, L.; Folmer, H.; Ji, M. The drivers of energy intensity in China: A spatial panel data approach. China Econ. Rev. 2014, 31, 351–360. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W. Preface to topics in data envelopment analysis. Ann. Oper. Res. 1984, 2, 59–94. [Google Scholar] [CrossRef]

- Asmild, M.; Paradi, J.C.; Aggarwall, V.; Schaffnit, C. Combining DEA Window Analysis with the Malmquist Index Approach in a Study of the Canadian Banking Industry. J. Prod. Anal. 2004, 21, 67–89. [Google Scholar] [CrossRef]

- Tobin, J. Estimation of Relationships for Limited Dependent Variables. Econ. Soc. 1958, 26, 24. [Google Scholar] [CrossRef]

- Halkos, G.; Tzeremes, N.G. Exploring the existence of Kuznets curve in countries’ environmental efficiency using DEA window analysis. Ecol. Econ. 2009, 68, 2168–2176. [Google Scholar] [CrossRef]

- McDonald, J. Using least squares and tobit in second stage DEA efficiency analyses. Eur. J. Oper. Res. 2009, 197, 792–798. [Google Scholar] [CrossRef]

- Wang, S.; Qiu, S.; Ge, S.; Liu, J.; Peng, Z. Benchmarking Toronto wastewater treatment plants using DEA window and Tobit regression analysis with a dynamic efficiency perspective. Environ. Sci. Pollut. Res. 2018, 25, 32649–32659. [Google Scholar] [CrossRef] [PubMed]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Cvetkoska, V.; Savić, G. Efficiency of bank branches: Empirical evidence from a two-phase research approach. Econ. Res. 2017, 30, 318–333. [Google Scholar] [CrossRef]

- Jia, Z.Y.; Li, C.C.; Yuan, D. Analysis of Energy Consumption Efficiency Based on DEA-Tobit. Appl. Mech. Mater. 2011, 84, 739–742. [Google Scholar] [CrossRef]

- Savić, G.; Dragojlović, A.; Vujošević, M.; Arsic, M.; Martic, M. Impact of the efficiency of the tax administration on tax evasion. Econ. Res. 2015, 28, 1138–1148. [Google Scholar] [CrossRef]

- Banker, R.D.; Natarajan, R.; Zhang, D. Two-stage estimation of the impact of contextual variables in stochastic frontier production function models using Data Envelopment Analysis: Second stage OLS versus bootstrap approaches. Eur. J. Oper. Res. 2019, 278, 368–384. [Google Scholar] [CrossRef]

- Hoff, A. Second stage DEA: Comparison of approaches for modelling the DEA score. Eur. J. Oper. Res. 2007, 181, 425–435. [Google Scholar] [CrossRef]

- Ai, C.; Li, H.; Lin, Z.; Meng, M. Estimation of panel data partly specified Tobit regression with fixed effects. J. Econ. 2015, 188, 316–326. [Google Scholar] [CrossRef]

- Skrondal, A.; Rabe-Hesketh, S. Generalised Latent Variable Modeling: Multilevel, Longitudinal, and Structural Equation Models; Chapman & Hall/CRC: Boca Raton, FL, USA, 2004. [Google Scholar]

- Arellano, M. Panel Data Econometrics; Oxford University Press (OUP): Oxford, UK, 2003. [Google Scholar]

- Wang, K.; Wei, Y.-M.; Zhang, X. A comparative analysis of China’s regional energy and emission performance: Which is the better way to deal with undesirable outputs? Energy Policy 2012, 46, 574–584. [Google Scholar] [CrossRef]

- Iram, R.; Zhang, J.; Erdogan, S.; Abbas, Q.; Mohsin, M. Economics of energy and environmental efficiency: Evidence from OECD countries. Environ. Sci. Pollut. Res. 2019, 27, 3858–3870. [Google Scholar] [CrossRef] [PubMed]

- Halkos, G.; Petrou, K.N. Treating undesirable outputs in DEA: A critical review. Econ. Anal. Policy 2019, 62, 97–104. [Google Scholar] [CrossRef]

- Ali, A.I.; Seiford, L.M. Translation invariance in data envelopment analysis. Oper. Res. Lett. 1990, 9, 403–405. [Google Scholar] [CrossRef]

- Cooper, W.W.; Seiford, L.M.; Tone, K. Introduction to Data Envelopment Analysis and its Uses: With DEA-Solver Software and References; Springer Science & Business Media: Berlin, Germany, 2006. [Google Scholar]

- A StataCorp. Stata Statistical Software: Release 13; StataCorp LP: College Station, TX, USA, 2013. [Google Scholar]

- Li, Y.; Chiu, Y.-H.; Lin, T.-Y. Research on New and Traditional Energy Sources in OECD Countries. Int. J. Environ. Res. Public Health 2019, 16, 1122. [Google Scholar] [CrossRef]

- OECD Factbook 2015–2016–Energy and Transportation. Available online: https://www.oecd-ilibrary.org/docserver/factbook-2015-40 (accessed on 5 August 2020).

- Bulut, U.; Durusu-Ciftci, D. Revisiting energy intensity convergence: New evidence from OECD countries. Environ. Sci. Pollut. Res. 2018, 25, 12391–12397. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. DEA environmental assessment in time horizon: Radial approach for Malmquist index measurement on petroleum companies. Energy Econ. 2015, 51, 329–345. [Google Scholar] [CrossRef]

- Li, M.-J.; Tao, W.-Q. Review of methodologies and polices for evaluation of energy efficiency in high energy-consuming industry. Appl. Energy 2017, 187, 203–215. [Google Scholar] [CrossRef]

- Sadorsky, P. Do urbanisation and industrialisation affect energy intensity in developing countries? Energy Econ. 2013, 37, 52–59. [Google Scholar] [CrossRef]

- Costa-Campi, M.; García-Quevedo, J.; Trujillo-Baute, E. Challenges for R&D and innovation in energy. Energy Policy 2015, 83, 193–196. [Google Scholar] [CrossRef]

- IEA World Energy Outlook to 2010. Energy Explor. Exploit. 1996, 14, 448–452. [CrossRef]

| Abbreviation | Variable Name | Unit of Measurement | Source |

|---|---|---|---|

| K | Capital | Gross capital formation (constant 2010 US$) | World Development Indicators |

| L | Labour | Labour force, total | World Development Indicators |

| E | Energy consumption | Primary energy consumption (in Exajoules) | BP Statistical Review of World Energy |

| GDP | Gross domestic product | GDP (Constant 2010 US$) | World Development Indicators |

| CO2 | CO2 emissions | Carbon Dioxide Emissions in Million tonnes of carbon dioxide | BP Statistical Review of World Energy |

| Sustainable Economic Development Variables | |||

| ANS | Adjusted net savings * | Adjusted net savings, including particulate emission damage (% of GNI) | World Development Indicators |

| GDP pc | GDP per capita | GDP per capita (constant 2010 US$) | World Development Indicators |

| Industry | Industry value added | Industry (including construction), value added (% of GDP) | World Development Indicators |

| Urban | Urbanisation | Urban population (% of total population), | World Development Indicators |

| Renew E | Renewable energy | Renewable energy Consumption (Exajoules) | BP Statistical Review of World Energy |

| Sustainable financial development variables | |||

| FD | Domestic credit to private sector by banks | Domestic credit to private sector by banks (% of GDP) | World Development Indicators |

| FM | Financial markets | Financial Markets Index | IMF database |

| FI | Financial institutions | Financial Institutions Index | IMF database |

| RD | Research and development expenditure | Research and development expenditure (% of GDP) | World Development Indicators |

| H | Health expenditure | Current health expenditure (% of GDP) | World Development Indicators |

| FDI | Foreign direct investment | Foreign direct investment, net inflows (% of GDP) | World Development Indicators |

| Abbreviation | Variable Name | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| TFEE Indicators | |||||

| K (in 000000) | Capital | 269,259.781 | 551,929.864 | 1902.592 | 38,778,517.216 |

| L (in 000000) | Labour | 16.723 | 27.740 | 0.169 | 165.483 |

| E | Energy consumption | 6.309 | 15.324 | 0.115 | 96.996 |

| GDP (in 000000) | Gross domestic product | 1,216,475.716 | 2,592,751.302 | 10,535.472 | 10,535.472 |

| CO2 | CO2 emissions | 350.690 | 894.055 | 2.509 | 5884.151 |

| Sustainable economic development variables | |||||

| ANS | Adjusted net savings | 9.806 | 6.261 | –11.279 | 38.591 |

| GDP pc | GDP per capita | 36,186.253 | 22,195.159 | 4862.876 | 111,968.350 |

| Industry | Industry value added | 25.312 | 5.441 | 10.527 | 41.107 |

| Urban | Urbanisation | 76.469 | 11.095 | 50.754 | 98.001 |

| Renew E | Renewable energy | 0.193 | 0.531 | 0.000 | 5.504 |

| Sustainable financial development variables | |||||

| FD | Domestic credit to private sector by banks | 87.066 | 42.849 | 0.187 | 308.792 |

| FM | Financial markets | 0.537 | 0.257 | 0.019 | 1.000 |

| FI | Financial institutions | 0.685 | 0.179 | 0.203 | 1.000 |

| RD | RD expenditure | 1.751 | 1.032 | 0.129 | 4.953 |

| H | Health expenditure | 8.249 | 2.142 | 3.988 | 17.197 |

| FDI | Foreign direct investment | 5.111 | 10.326 | −58.322 | 86.589 |

| Five-Year Window (w = 5) | Ten-Year Window (w = 10) | ||||||

|---|---|---|---|---|---|---|---|

| Country | Average Overall TFEE by Country | Rank | Average Annual Growth | Average Overall TFEE by Country | Rank | Average Annual Growth | Rank Difference |

| (w = 5 vs. w = 10) | |||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

| Australia | 0.886 | 15 | −0.02% | 0.862 | 15 | 0.12% | 0 |

| Austria | 0.805 | 22 | 0.22% | 0.782 | 21 | 0.28% | 1 |

| Belgium | 0.841 | 20 | 0.12% | 0.817 | 17 | 0.18% | 3 |

| Canada | 0.842 | 19 | 0.05% | 0.813 | 18 | 0.24% | 1 |

| Chile | 0.742 | 27 | −1.21% | 0.689 | 27 | −0.97% | 0 |

| Colombia | 0.771 | 25 | −1.21% | 0.743 | 25 | −1.35% | 0 |

| Czech Republic | 0.559 | 36 | −0.21% | 0.514 | 36 | −0.02% | 0 |

| Denmark | 0.976 | 10 | 0.00% | 0.948 | 10 | 0.15% | 0 |

| Estonia | 0.698 | 31 | −0.91% | 0.664 | 29 | −0.77% | 2 |

| Finland | 0.800 | 23 | 0.29% | 0.774 | 23 | 0.39% | 0 |

| France | 0.993 | 4 | 0.13% | 0.975 | 4 | 0.20% | 0 |

| Germany | 0.962 | 11 | 0.21% | 0.939 | 11 | 0.32% | 0 |

| Greece | 0.845 | 18 | 0.46% | 0.807 | 19 | 0.80% | −1 |

| Hungary | 0.636 | 34 | 0.20% | 0.590 | 34 | 0.35% | 0 |

| Iceland | 0.977 | 9 | −0.12% | 0.976 | 3 | −0.12% | 6 |

| Ireland | 0.889 | 14 | 0.34% | 0.866 | 14 | 0.50% | 0 |

| Israel | 0.826 | 21 | 0.19% | 0.780 | 22 | 0.43% | −1 |

| Italy | 0.984 | 8 | −0.06% | 0.969 | 6 | −0.10% | 2 |

| Japan | 0.988 | 5 | 0.20% | 0.971 | 5 | 0.33% | 0 |

| Korea | 0.516 | 37 | 0.17% | 0.487 | 37 | 0.42% | 0 |

| Latvia | 0.915 | 12 | −0.08% | 0.885 | 13 | −0.24% | −1 |

| Lithuania | 0.874 | 16 | −0.67% | 0.787 | 20 | −0.90% | −4 |

| Luxembourg | 0.998 | 1 | −0.01% | 0.986 | 2 | −0.07% | −1 |

| Mexico | 0.716 | 30 | −0.07% | 0.643 | 32 | 0.11% | −2 |

| Netherlands | 0.909 | 13 | 0.21% | 0.885 | 12 | 0.26% | 1 |

| New Zealand | 0.736 | 28 | −0.69% | 0.685 | 28 | −0.39% | 0 |

| Norway | 0.995 | 2 | −0.02% | 0.991 | 1 | 0.17% | 1 |

| Poland | 0.724 | 29 | −0.09% | 0.653 | 30 | −0.01% | −1 |

| Portugal | 0.790 | 24 | 0.47% | 0.757 | 24 | 0.66% | 0 |

| Slovakia | 0.585 | 35 | 0.01% | 0.544 | 35 | 0.08% | 0 |

| Slovenia | 0.689 | 32 | 0.55% | 0.648 | 31 | 0.37% | 1 |

| Spain | 0.760 | 26 | 0.02% | 0.738 | 26 | 0.23% | 0 |

| Sweden | 0.860 | 17 | 0.13% | 0.828 | 16 | 0.25% | 1 |

| Switzerland | 0.984 | 7 | 0.04% | 0.964 | 8 | 0.25% | −1 |

| Turkey | 0.644 | 33 | −0.42% | 0.607 | 33 | −0.10% | 0 |

| United Kingdom | 0.988 | 6 | 0.00% | 0.963 | 9 | 0.43% | −3 |

| US | 0.994 | 3 | 0.20% | 0.969 | 7 | 0.36% | −4 |

| Average | 0.830 | −0.04% | 0.797 | 0.07% | |||

| Min | 0.516 | −1.21% | 0.487 | −1.35% | |||

| Max | 0.998 | 0.55% | 0.991 | 0.80% | |||

| Average by Term | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 0.890 | 0.943 | 0.934 | 0.904 | 0.888 | 0.875 | 0.862 | 0.863 | 0.868 | 0.867 | 0.865 | 0.864 | 0.881 | 0.882 | 0.883 | 0.882 | 0.895 | 0.896 | 0.896 |

| Austria | 0.765 | 0.774 | 0.804 | 0.783 | 0.805 | 0.806 | 0.819 | 0.810 | 0.816 | 0.817 | 0.827 | 0.811 | 0.816 | 0.817 | 0.821 | 0.812 | 0.805 | 0.799 | 0.798 |

| Belgium | 0.819 | 0.851 | 0.899 | 0.905 | 0.865 | 0.831 | 0.836 | 0.823 | 0.824 | 0.845 | 0.849 | 0.825 | 0.836 | 0.856 | 0.841 | 0.828 | 0.814 | 0.824 | 0.809 |

| Canada | 0.833 | 0.852 | 0.860 | 0.843 | 0.831 | 0.810 | 0.808 | 0.837 | 0.826 | 0.843 | 0.818 | 0.817 | 0.816 | 0.816 | 0.833 | 0.869 | 0.903 | 0.889 | 0.902 |

| Chile | 0.972 | 0.947 | 0.968 | 1.000 | 1.000 | 0.835 | 0.763 | 0.748 | 0.613 | 0.751 | 0.626 | 0.576 | 0.563 | 0.582 | 0.631 | 0.628 | 0.636 | 0.641 | 0.624 |

| Colombia | 1.000 | 0.995 | 0.987 | 0.955 | 0.956 | 0.914 | 0.809 | 0.747 | 0.687 | 0.720 | 0.694 | 0.657 | 0.652 | 0.651 | 0.621 | 0.641 | 0.641 | 0.656 | 0.661 |

| Czech Republic | 0.599 | 0.582 | 0.582 | 0.606 | 0.592 | 0.585 | 0.554 | 0.500 | 0.492 | 0.538 | 0.531 | 0.534 | 0.544 | 0.561 | 0.553 | 0.541 | 0.569 | 0.581 | 0.575 |

| Denmark | 0.976 | 0.989 | 1.000 | 1.000 | 0.995 | 0.989 | 0.932 | 0.926 | 0.941 | 0.996 | 1.000 | 0.998 | 1.000 | 0.986 | 0.982 | 0.983 | 0.956 | 0.956 | 0.931 |

| Estonia | 0.870 | 0.806 | 0.711 | 0.648 | 0.662 | 0.679 | 0.639 | 0.599 | 0.694 | 0.854 | 0.732 | 0.686 | 0.661 | 0.653 | 0.664 | 0.716 | 0.700 | 0.651 | 0.639 |

| Finland | 0.744 | 0.765 | 0.791 | 0.791 | 0.791 | 0.768 | 0.797 | 0.789 | 0.803 | 0.831 | 0.818 | 0.792 | 0.806 | 0.827 | 0.833 | 0.837 | 0.814 | 0.813 | 0.791 |

| France | 0.969 | 0.986 | 1.000 | 1.000 | 0.993 | 0.989 | 0.996 | 0.999 | 0.995 | 0.993 | 0.991 | 0.992 | 0.993 | 0.991 | 1.000 | 0.995 | 0.996 | 0.996 | 1.000 |

| Germany | 0.921 | 0.939 | 0.963 | 0.948 | 0.969 | 0.970 | 0.952 | 0.956 | 0.955 | 0.947 | 0.946 | 0.965 | 0.987 | 0.964 | 0.973 | 0.978 | 0.976 | 0.979 | 0.983 |

| Greece | 0.759 | 0.765 | 0.782 | 0.722 | 0.756 | 0.802 | 0.711 | 0.683 | 0.709 | 0.812 | 0.846 | 0.909 | 0.966 | 0.976 | 0.965 | 1.000 | 0.989 | 0.949 | 0.961 |

| Hungary | 0.598 | 0.645 | 0.647 | 0.665 | 0.609 | 0.628 | 0.622 | 0.623 | 0.593 | 0.679 | 0.641 | 0.645 | 0.657 | 0.654 | 0.632 | 0.634 | 0.654 | 0.637 | 0.614 |

| Iceland | 1.000 | 1.000 | 1.000 | 0.997 | 1.000 | 0.800 | 0.989 | 0.989 | 0.999 | 1.000 | 1.000 | 1.000 | 1.000 | 0.994 | 0.976 | 0.957 | 0.948 | 0.952 | 0.959 |

| Ireland | 0.825 | 0.837 | 0.850 | 0.836 | 0.858 | 0.809 | 0.797 | 0.818 | 0.827 | 0.887 | 0.992 | 0.993 | 0.894 | 0.952 | 0.885 | 0.938 | 0.929 | 0.974 | 1.000 |

| Israel | 0.791 | 0.807 | 0.871 | 0.929 | 0.939 | 0.892 | 0.856 | 0.824 | 0.805 | 0.832 | 0.812 | 0.775 | 0.768 | 0.814 | 0.816 | 0.815 | 0.788 | 0.783 | 0.786 |

| Italy | 0.995 | 1.000 | 1.000 | 0.981 | 0.977 | 0.988 | 0.990 | 0.998 | 0.990 | 0.988 | 0.980 | 0.987 | 0.993 | 0.998 | 0.992 | 0.987 | 0.960 | 0.946 | 0.938 |

| Japan | 0.951 | 0.965 | 0.969 | 0.973 | 0.981 | 0.980 | 0.989 | 1.000 | 0.992 | 1.000 | 1.000 | 1.000 | 0.997 | 0.999 | 0.991 | 0.992 | 1.000 | 1.000 | 1.000 |

| Korea | 0.483 | 0.498 | 0.499 | 0.489 | 0.490 | 0.491 | 0.486 | 0.488 | 0.494 | 0.522 | 0.510 | 0.518 | 0.538 | 0.554 | 0.558 | 0.552 | 0.548 | 0.529 | 0.548 |

| Latvia | 0.930 | 0.844 | 0.855 | 0.791 | 0.809 | 0.818 | 0.906 | 0.919 | 0.921 | 0.981 | 0.970 | 0.964 | 0.929 | 0.950 | 1.000 | 0.996 | 0.975 | 0.898 | 0.930 |

| Lithuania | 1.000 | 0.969 | 0.930 | 0.912 | 0.822 | 0.839 | 0.788 | 0.660 | 0.637 | 0.984 | 0.843 | 0.787 | 0.891 | 0.973 | 0.994 | 0.879 | 0.905 | 0.894 | 0.888 |

| Luxembourg | 1.000 | 1.000 | 1.000 | 1.000 | 0.997 | 0.989 | 1.000 | 1.000 | 0.998 | 1.000 | 0.992 | 1.000 | 0.991 | 1.000 | 0.998 | 0.999 | 1.000 | 0.998 | 1.000 |

| Mexico | 0.730 | 0.832 | 0.840 | 0.841 | 0.829 | 0.765 | 0.713 | 0.672 | 0.621 | 0.643 | 0.637 | 0.623 | 0.619 | 0.656 | 0.681 | 0.682 | 0.704 | 0.745 | 0.765 |

| Netherlands | 0.869 | 0.866 | 0.888 | 0.897 | 0.910 | 0.917 | 0.917 | 0.879 | 0.899 | 0.909 | 0.925 | 0.929 | 0.949 | 0.953 | 0.981 | 0.849 | 0.909 | 0.910 | 0.917 |

| New Zealand | 0.867 | 0.832 | 0.816 | 0.754 | 0.719 | 0.698 | 0.737 | 0.674 | 0.696 | 0.767 | 0.736 | 0.714 | 0.723 | 0.713 | 0.702 | 0.717 | 0.720 | 0.699 | 0.709 |

| Norway | 1.000 | 0.967 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.996 | 0.992 | 0.985 | 0.982 | 0.996 | 0.995 | 1.000 | 1.000 |

| Poland | 0.740 | 0.858 | 0.940 | 0.944 | 0.868 | 0.856 | 0.768 | 0.639 | 0.619 | 0.694 | 0.649 | 0.596 | 0.623 | 0.678 | 0.635 | 0.634 | 0.679 | 0.677 | 0.655 |

| Portugal | 0.701 | 0.703 | 0.741 | 0.789 | 0.771 | 0.763 | 0.761 | 0.742 | 0.733 | 0.750 | 0.738 | 0.805 | 0.904 | 0.929 | 0.907 | 0.839 | 0.841 | 0.801 | 0.793 |

| Slovakia | 0.584 | 0.530 | 0.554 | 0.640 | 0.602 | 0.537 | 0.546 | 0.545 | 0.527 | 0.658 | 0.576 | 0.554 | 0.630 | 0.619 | 0.627 | 0.588 | 0.606 | 0.599 | 0.600 |

| Slovenia | 0.584 | 0.609 | 0.619 | 0.597 | 0.571 | 0.588 | 0.561 | 0.565 | 0.521 | 0.634 | 0.683 | 0.721 | 0.825 | 0.811 | 0.827 | 0.875 | 0.874 | 0.829 | 0.799 |

| Spain | 0.756 | 0.753 | 0.754 | 0.721 | 0.718 | 0.712 | 0.710 | 0.710 | 0.722 | 0.746 | 0.740 | 0.764 | 0.793 | 0.830 | 0.821 | 0.794 | 0.810 | 0.802 | 0.789 |

| Sweden | 0.836 | 0.841 | 0.880 | 0.867 | 0.888 | 0.884 | 0.866 | 0.840 | 0.859 | 0.972 | 0.882 | 0.857 | 0.881 | 0.866 | 0.845 | 0.831 | 0.827 | 0.814 | 0.814 |

| Switzerland | 0.977 | 0.955 | 0.964 | 0.951 | 0.999 | 0.972 | 0.976 | 1.000 | 0.997 | 0.959 | 0.994 | 0.994 | 0.983 | 1.000 | 0.996 | 0.985 | 0.997 | 0.995 | 1.000 |

| Turkey | 0.723 | 0.970 | 0.811 | 0.743 | 0.691 | 0.632 | 0.587 | 0.566 | 0.570 | 0.620 | 0.574 | 0.568 | 0.597 | 0.592 | 0.600 | 0.592 | 0.589 | 0.574 | 0.630 |

| United Kingdom | 0.988 | 0.973 | 0.969 | 0.982 | 0.993 | 0.986 | 0.979 | 0.990 | 0.995 | 1.000 | 0.979 | 1.000 | 0.998 | 0.995 | 0.978 | 0.976 | 0.985 | 1.000 | 1.000 |

| US | 0.956 | 0.991 | 1.000 | 1.000 | 0.986 | 0.983 | 0.993 | 0.999 | 0.992 | 1.000 | 0.998 | 1.000 | 1.000 | 0.995 | 0.991 | 0.993 | 1.000 | 1.000 | 1.000 |

| Mean | 0.838 | 0.850 | 0.856 | 0.849 | 0.841 | 0.821 | 0.811 | 0.795 | 0.790 | 0.839 | 0.821 | 0.817 | 0.830 | 0.840 | 0.838 | 0.833 | 0.836 | 0.829 | 0.830 |

| St. Dev. | 0.145 | 0.140 | 0.140 | 0.140 | 0.147 | 0.143 | 0.151 | 0.163 | 0.170 | 0.146 | 0.157 | 0.164 | 0.157 | 0.154 | 0.154 | 0.151 | 0.146 | 0.147 | 0.148 |

| Average by Term | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 0.839 | 0.886 | 0.878 | 0.860 | 0.844 | 0.837 | 0.833 | 0.841 | 0.842 | 0.843 | 0.843 | 0.845 | 0.868 | 0.875 | 0.883 | 0.882 | 0.895 | 0.896 | 0.896 |

| Austria | 0.730 | 0.734 | 0.758 | 0.740 | 0.765 | 0.769 | 0.786 | 0.780 | 0.790 | 0.806 | 0.819 | 0.803 | 0.807 | 0.807 | 0.808 | 0.798 | 0.790 | 0.786 | 0.786 |

| Belgium | 0.783 | 0.813 | 0.854 | 0.859 | 0.832 | 0.804 | 0.807 | 0.790 | 0.783 | 0.816 | 0.825 | 0.806 | 0.823 | 0.849 | 0.833 | 0.821 | 0.809 | 0.818 | 0.802 |

| Canada | 0.768 | 0.790 | 0.797 | 0.777 | 0.765 | 0.766 | 0.781 | 0.819 | 0.814 | 0.833 | 0.811 | 0.811 | 0.810 | 0.811 | 0.829 | 0.854 | 0.873 | 0.868 | 0.878 |

| Chile | 0.872 | 0.850 | 0.874 | 0.874 | 0.836 | 0.703 | 0.655 | 0.655 | 0.583 | 0.704 | 0.614 | 0.570 | 0.560 | 0.580 | 0.629 | 0.626 | 0.634 | 0.639 | 0.623 |

| Colombia | 1.000 | 0.982 | 0.944 | 0.880 | 0.842 | 0.809 | 0.729 | 0.703 | 0.668 | 0.714 | 0.688 | 0.654 | 0.649 | 0.648 | 0.619 | 0.639 | 0.638 | 0.654 | 0.660 |

| Czech Republic | 0.517 | 0.502 | 0.502 | 0.511 | 0.498 | 0.504 | 0.496 | 0.469 | 0.477 | 0.527 | 0.521 | 0.522 | 0.528 | 0.541 | 0.526 | 0.510 | 0.537 | 0.545 | 0.540 |

| Denmark | 0.919 | 0.927 | 0.929 | 0.935 | 0.927 | 0.926 | 0.891 | 0.887 | 0.906 | 0.993 | 1.000 | 0.996 | 1.000 | 0.981 | 0.979 | 0.980 | 0.954 | 0.953 | 0.931 |

| Estonia | 0.812 | 0.757 | 0.688 | 0.619 | 0.624 | 0.643 | 0.615 | 0.566 | 0.632 | 0.818 | 0.718 | 0.658 | 0.629 | 0.628 | 0.642 | 0.687 | 0.678 | 0.621 | 0.590 |

| Finland | 0.701 | 0.719 | 0.741 | 0.744 | 0.752 | 0.738 | 0.769 | 0.761 | 0.775 | 0.821 | 0.808 | 0.777 | 0.792 | 0.811 | 0.812 | 0.812 | 0.794 | 0.796 | 0.777 |

| France | 0.938 | 0.952 | 0.962 | 0.953 | 0.954 | 0.954 | 0.968 | 0.980 | 0.972 | 0.977 | 0.979 | 0.982 | 0.986 | 0.987 | 1.000 | 0.995 | 0.996 | 0.996 | 1.000 |

| Germany | 0.878 | 0.891 | 0.907 | 0.897 | 0.914 | 0.917 | 0.921 | 0.933 | 0.935 | 0.935 | 0.932 | 0.952 | 0.976 | 0.959 | 0.973 | 0.978 | 0.976 | 0.979 | 0.983 |

| Greece | 0.656 | 0.664 | 0.680 | 0.637 | 0.672 | 0.720 | 0.667 | 0.659 | 0.696 | 0.807 | 0.832 | 0.886 | 0.953 | 0.971 | 0.965 | 1.000 | 0.988 | 0.938 | 0.950 |

| Hungary | 0.524 | 0.562 | 0.564 | 0.565 | 0.521 | 0.535 | 0.543 | 0.552 | 0.549 | 0.634 | 0.607 | 0.618 | 0.637 | 0.641 | 0.626 | 0.630 | 0.651 | 0.636 | 0.613 |

| Iceland | 1.000 | 1.000 | 1.000 | 0.997 | 0.999 | 1.000 | 0.982 | 0.981 | 0.997 | 1.000 | 1.000 | 1.000 | 1.000 | 0.981 | 0.955 | 0.934 | 0.913 | 0.908 | 0.906 |

| Ireland | 0.770 | 0.781 | 0.795 | 0.783 | 0.801 | 0.760 | 0.755 | 0.782 | 0.802 | 0.885 | 0.988 | 0.988 | 0.889 | 0.945 | 0.883 | 0.938 | 0.929 | 0.974 | 1.000 |

| Israel | 0.698 | 0.711 | 0.757 | 0.796 | 0.805 | 0.787 | 0.785 | 0.779 | 0.785 | 0.829 | 0.807 | 0.768 | 0.756 | 0.805 | 0.811 | 0.805 | 0.781 | 0.771 | 0.780 |

| Italy | 0.989 | 0.995 | 0.978 | 0.962 | 0.956 | 0.965 | 0.967 | 0.975 | 0.967 | 0.967 | 0.962 | 0.971 | 0.984 | 0.988 | 0.987 | 0.977 | 0.953 | 0.941 | 0.934 |

| Japan | 0.908 | 0.917 | 0.921 | 0.929 | 0.947 | 0.954 | 0.965 | 0.975 | 0.962 | 0.997 | 1.000 | 0.998 | 0.993 | 0.997 | 0.991 | 0.992 | 1.000 | 1.000 | 1.000 |

| Korea | 0.408 | 0.421 | 0.430 | 0.429 | 0.439 | 0.451 | 0.460 | 0.472 | 0.486 | 0.520 | 0.506 | 0.513 | 0.530 | 0.542 | 0.542 | 0.535 | 0.530 | 0.514 | 0.532 |

| Latvia | 0.930 | 0.844 | 0.855 | 0.788 | 0.802 | 0.793 | 0.857 | 0.849 | 0.844 | 0.904 | 0.908 | 0.892 | 0.878 | 0.922 | 0.996 | 0.988 | 0.956 | 0.875 | 0.930 |

| Lithuania | 0.957 | 0.866 | 0.780 | 0.744 | 0.676 | 0.716 | 0.701 | 0.611 | 0.609 | 0.945 | 0.826 | 0.753 | 0.840 | 0.896 | 0.888 | 0.768 | 0.797 | 0.792 | 0.786 |

| Luxembourg | 1.000 | 1.000 | 1.000 | 1.000 | 0.989 | 0.978 | 0.998 | 1.000 | 0.993 | 1.000 | 0.977 | 0.862 | 0.970 | 0.987 | 0.990 | 0.996 | 1.000 | 0.997 | 1.000 |

| Mexico | 0.622 | 0.709 | 0.716 | 0.709 | 0.698 | 0.660 | 0.633 | 0.616 | 0.591 | 0.633 | 0.623 | 0.606 | 0.595 | 0.616 | 0.623 | 0.618 | 0.628 | 0.653 | 0.666 |

| Netherlands | 0.836 | 0.834 | 0.853 | 0.855 | 0.871 | 0.883 | 0.888 | 0.850 | 0.872 | 0.893 | 0.912 | 0.917 | 0.936 | 0.938 | 0.961 | 0.836 | 0.892 | 0.893 | 0.900 |

| New Zealand | 0.759 | 0.728 | 0.714 | 0.659 | 0.633 | 0.633 | 0.677 | 0.644 | 0.676 | 0.756 | 0.723 | 0.695 | 0.694 | 0.675 | 0.663 | 0.675 | 0.678 | 0.662 | 0.677 |

| Norway | 0.959 | 0.967 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.984 | 1.000 | 0.997 | 0.988 | 0.985 | 0.979 | 0.982 | 0.995 | 0.995 | 1.000 | 1.000 |

| Poland | 0.655 | 0.769 | 0.844 | 0.813 | 0.727 | 0.721 | 0.653 | 0.556 | 0.563 | 0.661 | 0.623 | 0.578 | 0.603 | 0.647 | 0.593 | 0.588 | 0.621 | 0.609 | 0.584 |

| Portugal | 0.632 | 0.632 | 0.661 | 0.696 | 0.689 | 0.696 | 0.710 | 0.709 | 0.716 | 0.745 | 0.730 | 0.795 | 0.890 | 0.918 | 0.898 | 0.834 | 0.837 | 0.797 | 0.792 |

| Slovakia | 0.530 | 0.477 | 0.496 | 0.550 | 0.510 | 0.464 | 0.479 | 0.491 | 0.491 | 0.623 | 0.550 | 0.534 | 0.604 | 0.590 | 0.599 | 0.575 | 0.594 | 0.588 | 0.600 |

| Slovenia | 0.578 | 0.593 | 0.600 | 0.571 | 0.547 | 0.562 | 0.539 | 0.539 | 0.508 | 0.631 | 0.666 | 0.689 | 0.778 | 0.748 | 0.749 | 0.780 | 0.787 | 0.740 | 0.712 |

| Spain | 0.694 | 0.712 | 0.706 | 0.690 | 0.687 | 0.685 | 0.686 | 0.690 | 0.699 | 0.732 | 0.735 | 0.762 | 0.787 | 0.813 | 0.804 | 0.785 | 0.797 | 0.787 | 0.774 |

| Sweden | 0.780 | 0.783 | 0.818 | 0.811 | 0.830 | 0.829 | 0.823 | 0.800 | 0.805 | 0.910 | 0.851 | 0.838 | 0.869 | 0.863 | 0.841 | 0.827 | 0.824 | 0.812 | 0.811 |

| Switzerland | 0.917 | 0.905 | 0.919 | 0.912 | 0.964 | 0.944 | 0.960 | 0.988 | 0.980 | 0.938 | 0.976 | 0.978 | 0.971 | 1.000 | 0.996 | 0.985 | 0.997 | 0.995 | 1.000 |

| Turkey | 0.625 | 0.857 | 0.707 | 0.634 | 0.600 | 0.574 | 0.546 | 0.541 | 0.558 | 0.614 | 0.571 | 0.565 | 0.593 | 0.590 | 0.599 | 0.590 | 0.583 | 0.573 | 0.616 |

| United Kingdom | 0.881 | 0.894 | 0.906 | 0.923 | 0.938 | 0.950 | 0.957 | 0.975 | 0.986 | 1.000 | 0.976 | 0.998 | 0.994 | 0.985 | 0.977 | 0.976 | 0.985 | 0.999 | 1.000 |

| US | 0.901 | 0.905 | 0.913 | 0.927 | 0.946 | 0.959 | 0.968 | 0.976 | 0.977 | 1.000 | 0.995 | 0.995 | 0.990 | 0.985 | 0.986 | 0.992 | 0.999 | 1.000 | 1.000 |

| Mean | 0.783 | 0.793 | 0.796 | 0.785 | 0.778 | 0.773 | 0.769 | 0.762 | 0.764 | 0.822 | 0.808 | 0.799 | 0.815 | 0.824 | 0.823 | 0.816 | 0.819 | 0.811 | 0.812 |

| St. Dev. | 0.159 | 0.151 | 0.149 | 0.150 | 0.158 | 0.158 | 0.163 | 0.173 | 0.172 | 0.146 | 0.158 | 0.162 | 0.159 | 0.158 | 0.159 | 0.159 | 0.153 | 0.155 | 0.157 |

| TFEE (w = 5) | Coef. | Std. Err. | z | P > |z| | [95% Conf. Interval] | |

| ANS | −0.004018 | 0.000985 | −4.080 | 0.000 | −0.005949 | −0.002087 |

| GDP pc | 0.000001 | 0.000001 | 1.080 | 0.282 | −0.000001 | 0.000003 |

| Industry | −0.005445 | 0.001527 | −3.570 | 0.000 | −0.008437 | −0.002453 |

| Urban | −0.000119 | 0.001349 | −0.090 | 0.929 | −0.002763 | 0.002524 |

| Renew E | 0.006004 | 0.010383 | 0.580 | 0.563 | −0.014346 | 0.026354 |

| _cons | 0.985239 | 0.118606 | 8.310 | 0.000 | 0.752776 | 1.217702 |

| /sigma_u | 0.119695 | 0.019473 | 6.150 | 0.000 | 0.081528 | 0.157862 |

| /sigma_e | 0.065855 | 0.001961 | 33.580 | 0.000 | 0.062010 | 0.069699 |

| rho | 0.767635 | 0.0605029 | 0.634115 | 0.868512 | ||

| Prob > chi2 = 0.000 | ||||||

| TFEE (w = 10) | Coef. | Std. Err. | Z | P>|z| | [95% Conf. Interval] | |

| ANS | −0.004193 | 0.000839 | −5.000 | 0.000 | −0.005839 | −0.002548 |

| GDP pc | 0.000009 | 0.000001 | 4.410 | 0.000 | 0.000002 | 0.000004 |

| Industry | −0.007713 | 0.001294 | −5.960 | 0.000 | −0.010249 | −0.005176 |

| Urban | 0.001705 | 0.001105 | 1.540 | 0.123 | −0.000460 | 0.003870 |

| Renew E | 0.019746 | 0.008519 | 2.320 | 0.020 | 0.003048 | 0.036443 |

| _cons | 0.799461 | 0.094377 | 8.470 | 0.000 | 0.614485 | 0.984437 |

| /sigma_u | 0.092393 | 0.012201 | 7.570 | 0.000 | 0.068479 | 0.116306 |

| /sigma_e | 0.057194 | 0.001634 | 35.000 | 0.000 | 0.053991 | 0.060397 |

| rho | 0.722963 | 0.054726 | 0.606949 | 0.819104 | ||

| Prob > chi2 = 0.000 | ||||||

| TFEE (w = 5) | Coef. | Std. Err. | Z | P > |z| | [95% Conf. Interval] | |

| FD | 0.000216 | 0.000133 | 1.620 | 0.106 | −0.000046 | 0.000477 |

| FM | −0.075980 | 0.038203 | −1.990 | 0.047 | −0.150860 | −0.001110 |

| FI | −0.451370 | 0.052162 | −8.650 | 0.000 | −0.553600 | −0.349130 |

| RD | 0.028597 | 0.008829 | 3.240 | 0.001 | 0.011292 | 0.045901 |

| H | 0.007501 | 0.003075 | 2.440 | 0.015 | 0.001474 | 0.013528 |

| FDI | 0.000032 | 0.000243 | 0.130 | 0.894 | −0.000440 | 0.000508 |

| _cons | 1.043029 | 0.048460 | 21.520 | 0.000 | 0.948049 | 1.138008 |

| /sigma_u | 0.175687 | 0.021930 | 8.010 | 0.000 | 0.132704 | 0.21867 |

| /sigma_e | 0.054809 | 0.001580 | 34.700 | 0.000 | 0.051713 | 0.057906 |

| rho | 0.911306 | 0.020861 | 0.863090 | 0.945574 | ||

| Prob > chi2 = 0.000 | ||||||

| TFEE (w = 10) | Coef. | Std. Err. | Z | P>|z| | [95% Conf. Interval] | |

| FD | 0.000284 | 0.000130 | 2.18 | 0.029 | 0.000029 | 0.000539 |

| FM | 0.012506 | 0.036456 | 0.34 | 0.732 | −0.058950 | 0.083957 |

| FI | −0.360030 | 0.050475 | −7.13 | 0.000 | −0.458960 | −0.261100 |

| RD | 0.048495 | 0.008554 | 5.67 | 0.000 | 0.031730 | 0.065260 |

| H | 0.016429 | 0.002999 | 5.48 | 0.000 | 0.010552 | 0.022307 |

| FDI | −0.000057 | 0.000238 | −0.24 | 0.810 | −0.000520 | 0.000409 |

| _cons | 0.788811 | 0.044105 | 17.89 | 0.000 | 0.702367 | 0.875254 |

| /sigma_u | 0.149550 | 0.018274 | 8.18 | 0.000 | 0.113733 | 0.185367 |

| /sigma_e | 0.053654 | 0.001544 | 34.75 | 0.000 | 0.050628 | 0.056680 |

| rho | 0.885962 | 0.025494 | 0.828017 | 0.928445 | ||

| Prob > chi2 = 0.000 | ||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ziolo, M.; Jednak, S.; Savić, G.; Kragulj, D. Link between Energy Efficiency and Sustainable Economic and Financial Development in OECD Countries. Energies 2020, 13, 5898. https://doi.org/10.3390/en13225898

Ziolo M, Jednak S, Savić G, Kragulj D. Link between Energy Efficiency and Sustainable Economic and Financial Development in OECD Countries. Energies. 2020; 13(22):5898. https://doi.org/10.3390/en13225898

Chicago/Turabian StyleZiolo, Magdalena, Sandra Jednak, Gordana Savić, and Dragana Kragulj. 2020. "Link between Energy Efficiency and Sustainable Economic and Financial Development in OECD Countries" Energies 13, no. 22: 5898. https://doi.org/10.3390/en13225898

APA StyleZiolo, M., Jednak, S., Savić, G., & Kragulj, D. (2020). Link between Energy Efficiency and Sustainable Economic and Financial Development in OECD Countries. Energies, 13(22), 5898. https://doi.org/10.3390/en13225898