Power Exchange Prices: Comparison of Volatility in European Markets

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Power Prices

3.2. Price Volatility Methodology

4. Results

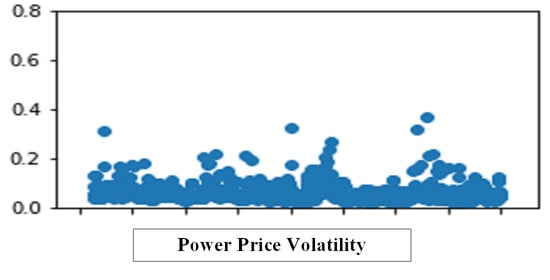

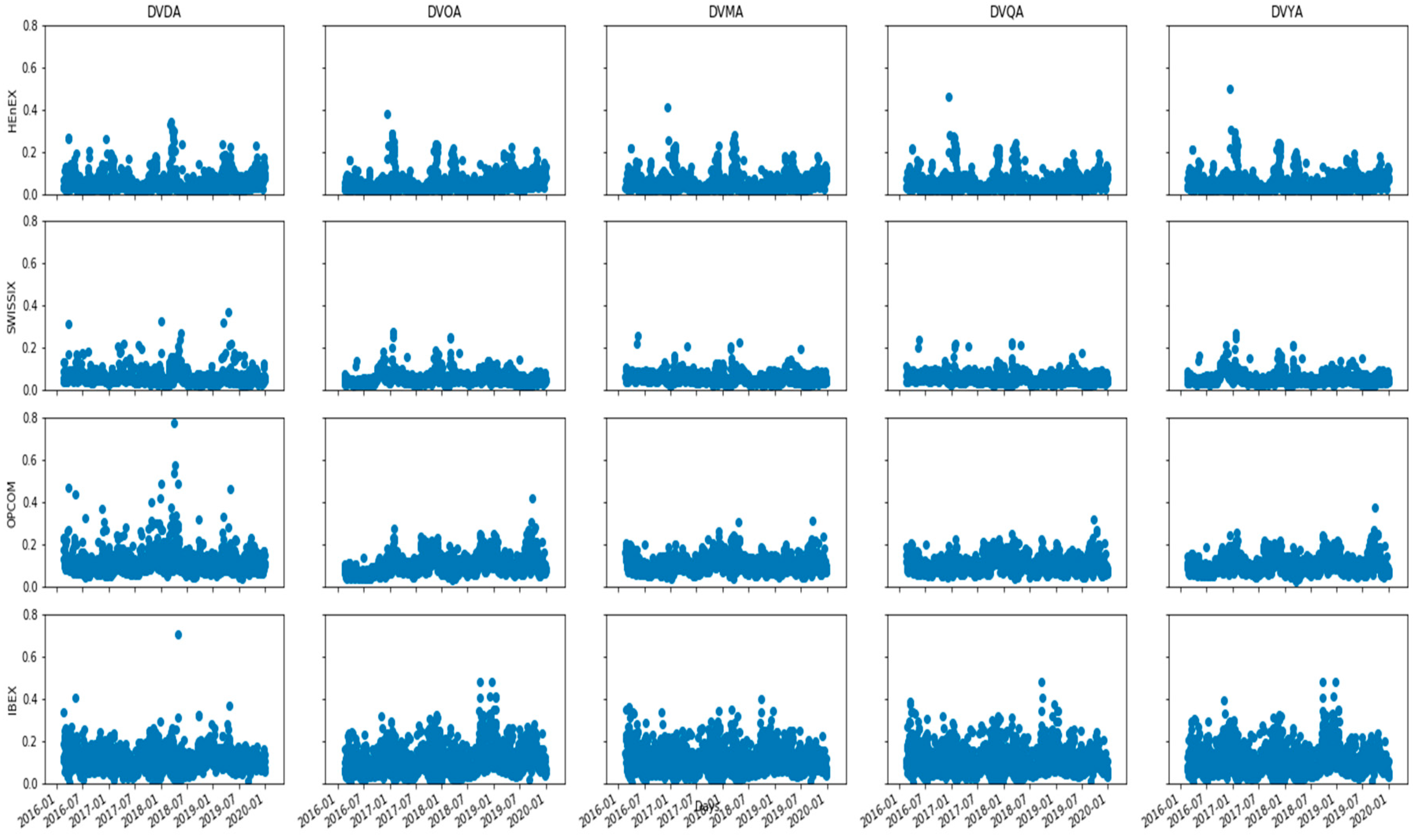

4.1. Volatility Results

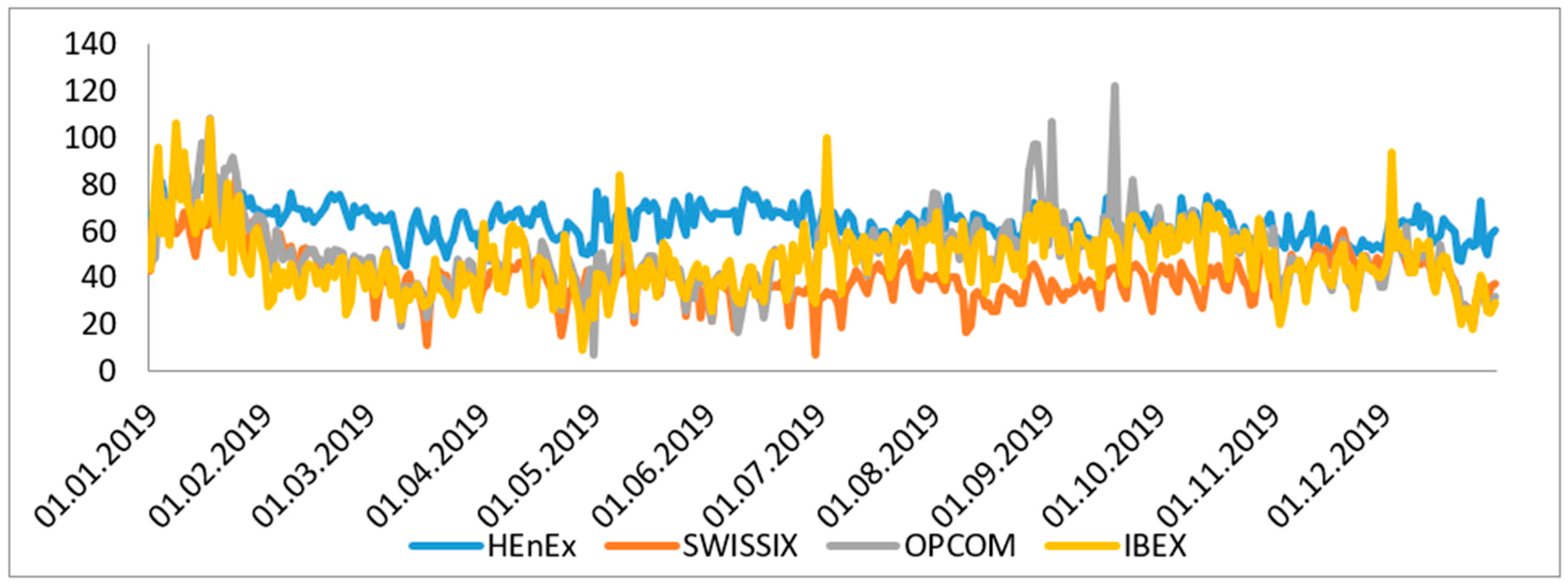

4.2. Correlation between Power Markets

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Monteiro, C.; Fernandez-Jimenez, L.A.; Ramirez-Rosado, I.J. Predictive Trading Strategy for Physical Electricity Futures. Energies 2020, 13, 3555. [Google Scholar] [CrossRef]

- Haar, L.N.; Marinescu, N. Energy policy and European utilities’ strategy: Lessons from the liberalisation and privatisation of the energy sector in Romania. Energy Policy 2011, 39, 2245–2255. [Google Scholar] [CrossRef]

- Dertinger, A.; Hirth, L. Reforming the electric power industry in developing economies evidence on efficiency and electricity access outcomes. Energy Policy 2020, 139, 111348. [Google Scholar] [CrossRef]

- Cerjan, M.; Petričić, A.; Delimar, M. HIRA Model for Short-Term Electricity Price Forecasting. Energies 2019, 12, 568. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J. The U.S. Electricity Industry after 20 Years of Restructuring. Annu. Rev. Econ. 2015, 7, 437–463. [Google Scholar] [CrossRef]

- Newbery, D. Issues and Options for Restructuring Electricity Supply Industries. CMI Working Paper. 2004. Available online: https://www.repository.cam.ac.uk/handle/1810/308 (accessed on 20 August 2020).

- Bacon, R. Taking Stock of the Impact of Power Utility Reform in Developing Countries: A Literature Review; The World Bank: Washington, DC, USA, 2018; p. 8460. [Google Scholar]

- Joskow, P.L. Lessons Learned from Electricity Market Liberalization. Energy J. 2008, 29, 9–43. [Google Scholar] [CrossRef]

- Pollitt, M.G. Electricity Liberalisation in the European Union: A Progress Report; University of Cambridge: Cambridge, UK, 2009. [Google Scholar]

- Kanagaraj, A.; Pandu, K.D.R. Investigations of Various Market Models in a Deregulated Power Environment Using ACOPF. Energies 2020, 13, 2354. [Google Scholar] [CrossRef]

- Dagoumas, A.S.; Koltsaklis, N.E.; Panapakidis, I.P. An integrated model for risk management in electricity trade. Energy 2017, 124, 350–363. [Google Scholar] [CrossRef]

- Taljan, G.; Fowler, M.; Canizares, C.; Verbič, G. Hydrogen storage for mixed wind–nuclear power plants in the context of a Hydrogen Economy. Int. J. Hydrogen Energy 2008, 33, 4463–4475. [Google Scholar] [CrossRef]

- Nyamdash, B.; Denny, E. The impact of electricity storage on wholesale electricity prices. Energy Policy 2013, 58, 6–16. [Google Scholar] [CrossRef]

- Beus, M.; Pavić, I.; Stritof, I.; Capuder, T.; Pandzic, H. Electricity Market Design in Croatia within the European Electricity Market—Recommendations for Further Development. Energies 2018, 11, 346. [Google Scholar] [CrossRef]

- Ioannidis, F.; Makridou, G.; Kosmidou, K.; Andriosopoulos, K. Market design of an energy exchange: The case of Greece. Energy Policy 2019, 133, 110887. [Google Scholar] [CrossRef]

- Ringler, P.; Keles, D.; Fichtner, W. How to benefit from a common European electricity market design. Energy Policy 2017, 101, 629–643. [Google Scholar] [CrossRef]

- Karova, R. Regional electricity markets in Europe: Focus on the Energy Community. Util. Policy 2011, 19, 80–86. [Google Scholar] [CrossRef]

- Pollitt, M. Evaluating the evidence on electricity reform: Lessons for the South East Europe (SEE) market. Util. Policy 2009, 17, 13–23. [Google Scholar] [CrossRef]

- Vailati, R. Electricity transmission in the energy community of South East Europe. Util. Policy 2009, 17, 34–42. [Google Scholar] [CrossRef]

- Deitz, L.; Stirton, L.; Wright, K. South East Europe’s electricity sector: Attractions, obstacles and challenges of Europeanisation. Util. Policy 2019, 17, 4–12. [Google Scholar] [CrossRef]

- Sakellaris, K. SEE regional wholesale market design: Recommendations, available options and implementation. In Proceedings of the 8th International Conference on the European Energy Market (EEM), Zagreb, Croatia, 25–27 May 2011. [Google Scholar]

- Hooper, E.; Medvedev, A. Electrifying integration: Electricity production and the South East Europe regional energy market. Util. Policy 2009, 17, 24–33. [Google Scholar] [CrossRef][Green Version]

- Kristiansen, T. Cross-border transmission capacity allocation mechanisms in South East Europe. Energy Policy 2007, 35, 4611–4622. [Google Scholar] [CrossRef]

- Višković, A.; Franki, V.; Valentić, V. Effect of regulation on power-plant operation and investment in the South East Europe Market: An analysis of two cases. Util. Policy 2014, 30, 8–17. [Google Scholar] [CrossRef]

- Hrovatin, N.; Pittman, R.; Zorič, J. Organisation and reforms of the electricity sector in Slovenia. Util. Policy 2009, 17, 134–143. [Google Scholar] [CrossRef]

- Taleski, R. Electricity reform in the Republic of Macedonia. Util. Policy 2009, 17, 88–101. [Google Scholar] [CrossRef]

- Kennedy, D. South-East Europe regional energy market: Challenges and opportunities for Romania. Energy Policy 2005, 33, 2202–2215. [Google Scholar] [CrossRef]

- Newbery, D.; Strbac, G.; Viehoff, I. The benefits of integrating European electricity markets. Energy Policy 2016, 94, 253–263. [Google Scholar] [CrossRef]

- Papaioannou, G.; Dikaiakos, C.; Kaskouras, C.; Evangelidis, G.; Georgakis, F. Granger Causality Network Methods for Analyzing Cross-Border Electricity Trading between Greece, Italy, and Bulgaria. Energies 2020, 13, 900. [Google Scholar] [CrossRef]

- Weron, R. Energy price risk management. Phys. A Stat. Mech. Its Appl. 2000, 285, 127–134. [Google Scholar] [CrossRef]

- Tashpulatov, S.N. Estimating the volatility of electricity prices: The case of the England and Wales wholesale electricity market. Energy Policy 2013, 60, 81–90. [Google Scholar] [CrossRef]

- Huisman, R.; Huurman, C.; Mahieu, R. Hourly electricity prices in day-ahead markets. Energy Econ. 2007, 29, 240–248. [Google Scholar] [CrossRef]

- Simonsen, I. Volatility of power markets. Phys. A Stat. Mech. Its Appl. 2005, 355, 10–20. [Google Scholar] [CrossRef]

- De Jonghe, C.; Meeus, L.; Belmans, R. Power exchange price volatility analysis after one year of trilateral market coupling. In Proceedings of the 5th international conference on the european electricity market, Lisbon, Portugal, 28–30 May 2008. [Google Scholar]

- Mandelbrot, B. The Variation of Some Other Speculative Prices. J. Bus. 1967, 40, 393–413. [Google Scholar] [CrossRef]

- Sapio, A. Modeling the distribution of day-ahead electricity returns: A comparison. Quant. Financ. 2012, 12, 1935–1949. [Google Scholar] [CrossRef]

- Ignatieva, K. A nonparametric model for spot price dynamics and pricing of futures contracts in electricity markets. Stud. Nonlinear Dyn. Econ. 2014, 18, 483–505. [Google Scholar] [CrossRef]

- Lago, J.; De Ridder, F.; Vrancx, P.; De Schutter, B. Forecasting day-ahead electricity prices in Europe: The importance of considering market integration. Appl. Energy 2018, 211, 890–903. [Google Scholar] [CrossRef]

- Ziel, F.; Steinert, R.; Husmann, S. Forecasting day ahead electricity spot prices: The impact of the EXAA to other European electricity markets. Energy Econ. 2015, 51, 430–444. [Google Scholar] [CrossRef]

- Raviv, E.; Bouwman, K.E.; Van Dijk, D. Forecasting day-ahead electricity prices: Utilizing hourly prices. Energy Econ. 2015, 50, 227–239. [Google Scholar] [CrossRef]

- Malo, P. Modeling electricity spot and futures price dependence: A multifrequency approach. Phys. A Stat. Mech. Its Appl. 2009, 388, 4763–4779. [Google Scholar] [CrossRef]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef]

- Voronin, S.; Partanen, J. Price Forecasting in the Day-Ahead Energy Market by an Iterative Method with Separate Normal Price and Price Spike Frameworks. Energies 2013, 6, 5897–5920. [Google Scholar] [CrossRef]

- Bailey, E.M. Electricity Markets in the Western United States. Electr. J. 1998, 11, 51–60. [Google Scholar] [CrossRef]

- Joskow, P.L.; Kohn, E. A quantitative analysis of pricing behavior in California’s wholesale electricity market during summer 2000. Energy J. 2000, 23, 1–36. [Google Scholar]

- Borenstein, S. The Trouble with Electricity Markets: Understanding California’s Restructuring Disaster. J. Econ. Perspect. 2002, 16, 191–211. [Google Scholar] [CrossRef]

- Garcia, R.C.; Contreras, J.; Van Akkeren, M.; Garcia, J. A GARCH forecasting model to predict day-ahead electricity prices. IEEE Trans. Power Syst. 2005, 20, 867–874. [Google Scholar] [CrossRef]

- Zareipour, H.; Bhattacharya, K.; Canizares, C.A. Electricity market price volatility: The case of Ontario. Energy Policy 2007, 35, 4739–4748. [Google Scholar] [CrossRef]

- Higgs, H.; Worthington, A. Systematic features of high-frequency volatility in Australian electricity markets: Intraday patterns, information arrival and calendar effects. Energy J. 2005, 26, 23–42. [Google Scholar] [CrossRef]

- Green, R.J.; Newbery, D.M. Competition in the British Electricity Spot Market. J. Political Econ. 1992, 100, 929–953. [Google Scholar] [CrossRef]

- Dong, S.; Hailong, L.; Wallin, F.; Avelin, A.; Zhang, Q.; Yu, Z. Volatility of electricity price in Denmark and Sweden. Energy Procedia 2019, 158, 4331–4337. [Google Scholar] [CrossRef]

- Nomikos, N.K.; Soldatos, O.A. Modelling short and long-term risks in power markets: Empirical evidence from Nord Pool. Energy Policy 2010, 38, 5671–5683. [Google Scholar] [CrossRef]

- Erdogdu, E. Asymmetric volatility in European day-ahead power markets: A comparative microeconomic analysis. Energy Econ. 2016, 56, 398–409. [Google Scholar] [CrossRef]

- Bosco, B.; Parisio, L.P.; Pelagatti, M.M. Deregulated Wholesale Electricity Prices in Italy: An Empirical Analysis. Int. Adv. Econ. Res. 2007, 13, 415–432. [Google Scholar] [CrossRef]

- Cuaresma, J.C.; Hlouskova, J.; Kossmeier, S.; Obersteiner, M. Forecasting electricity spot-prices using linear univariate time-series models. Appl. Energy 2004, 77, 87–106. [Google Scholar] [CrossRef]

- Nakamura, M.; Nakashima, T.; Niimura, T. Electricity markets volatility: Estimates, regularities and risk management applications. Energy Policy 2006, 34, 1736–1749. [Google Scholar] [CrossRef]

- Sadorsky, P. Risk factors in stock returns of Canadian oil and gas companies. Energy Econ. 2001, 23, 17–28. [Google Scholar] [CrossRef]

- Boyer, M.M.; Filion, D. Common and fundamental factors in stock returns of Canadian oil and gas companies. Energy Econ. 2007, 29, 428–453. [Google Scholar] [CrossRef]

- Mastro, M. Financial Derivative and Energy Market Valuation: Theory and Implementation in Matlab; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Shore, S.; Muermann, A. Spot Market Power and Future Market Trading. Financ. Mark. Group 2005, 531. [Google Scholar] [CrossRef]

- Cavallo, L.; Termini, V. Electricity Derivatives and the Spot Market in Italy. Mitigating Market Power in the Electricity Market. SSRN Electron. J. 2005. [Google Scholar] [CrossRef]

- Li, Y.; Flynn, P.C. Deregulated power prices: Comparison of volatility. Energy Policy 2004, 31, 1591–1601. [Google Scholar] [CrossRef]

- Li, Y.; Flynn, P.C. Deregulated power prices: Comparison of diurnal patterns. Energy Policy 2004, 32, 657–672. [Google Scholar] [CrossRef]

- Auer, B.R. How does Germany’s green energy policy affect electricity market volatility? An application of conditional autoregressive range models. Energy Policy 2016, 98, 621–628. [Google Scholar] [CrossRef]

- Meloun, M.; Militky, J. Statistical Data Analysis: A Practical Guide; Woodhead Publishing: Cambridge, UK, 2011. [Google Scholar]

| Market | Name | Short Name | Website |

|---|---|---|---|

| Hungary | Hungarian power exchange | HUPX | https://hupx.hu/en/ |

| Slovenia | BSP SouthPool Energy Exchange | BSP | https://www.bsp-southpool.com/home.html |

| Croatia | Croatian power exchange | CROPEX | https://www.cropex.hr/en/ |

| Austria | Energy exchange Austria | EXAA | https://www.exaa.at/de |

| Germany | EPEX SPOT | PHELIX | https://www.epexspot.com/en |

| Switzerland | EPEX SPOT | SWISSIX | https://www.epexspot.com/en |

| France | EPEX SPOT | FRANCE | https://www.epexspot.com/en |

| Italy: North | GestoreMercatiEnergetici | GME North | https://www.mercatoelettrico.org/En |

| Italy: South | GestoreMercatiEnergetici | GME South | https://www.mercatoelettrico.org/En |

| Greece | Hellenic Energy Exchange | HEnEx | http://www.enexgroup.gr/en |

| Serbia | SEE Power Exchange | SEEPEX | http://seepex-spot.rs/sr/ |

| Czech Republic | Czech electricity and gas | OTE | https://www.ote-cr.cz/en/ |

| Bulgaria | Independent Bulgarian Energy Exchange | IBEX | http://www.ibex.bg/en/ |

| Romania | Romanian electricity and gas | OPCOM | https://www.opcom.ro/pp/home.php |

| Slovakia | Slovak short-term market | OKTE | https://www.okte.sk/en |

| Power Market | DVOA | DVYA | DVQA | DVMA | DVDA | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Std. Dev. | CV | Min | Max | Std. Dev. | CV | Min | Max | Std. Dev. | CV | Min | Max | Std. Dev. | CV | Min | Max | Std. Dev. | CV | Min | Max | |

| HUPX | 0.04 | 0.46 | 0.03 | 0.66 | 0.04 | 0.42 | 0.03 | 0.62 | 0.04 | 0.39 | 0.03 | 0.53 | 0.03 | 0.35 | 0.03 | 0.38 | 0.05 | 0.47 | 0.03 | 0.68 |

| BSP | 0.05 | 0.55 | 0.02 | 0.51 | 0.05 | 0.52 | 0.03 | 0.48 | 0.05 | 0.5 | 0.02 | 0.48 | 0.05 | 0.48 | 0.02 | 0.42 | 0.08 | 0.8 | −1.34 | 1.27 |

| CROPEX | 0.05 | 0.52 | 0.03 | 0.58 | 0.05 | 0.48 | 0.03 | 0.53 | 0.05 | 0.46 | 0.03 | 0.46 | 0.04 | 0.44 | 0.03 | 0.37 | 0.11 | 1.1 | −3.4 | 1.22 |

| PHELIX | 0.04 | 0.46 | 0.03 | 0.35 | 0.04 | 0.46 | 0.03 | 0.43 | 0.04 | 0.45 | 0.02 | 0.51 | 0.04 | 0.47 | 0.02 | 0.56 | 0.76 | 8.51 | −23.59 | 13.67 |

| EXAA | 0.03 | 0.41 | 0.03 | 0.42 | 0.03 | 0.44 | 0.03 | 0.38 | 0.03 | 0.41 | 0.03 | 0.29 | 0.03 | 0.41 | 0.03 | 0.32 | 0.5 | 7.54 | −17.68 | 2.68 |

| GME North | 0.03 | 0.48 | 0.02 | 0.31 | 0.03 | 0.48 | 0.02 | 0.3 | 0.03 | 0.44 | 0.01 | 0.28 | 0.03 | 0.42 | 0.02 | 0.26 | 0.02 | 0.35 | 0.02 | 0.21 |

| GME South | 0.03 | 0.43 | 0.01 | 0.28 | 0.03 | 0.44 | 0.01 | 0.31 | 0.03 | 0.45 | 0.02 | 0.35 | 0.03 | 0.45 | 0.02 | 0.34 | 0.04 | 0.49 | 0.01 | 0.39 |

| HEnEx | 0.04 | 0.83 | 0 | 0.38 | 0.04 | 0.84 | 0 | 0.5 | 0.04 | 0.82 | 0 | 0.46 | 0.04 | 0.79 | 0 | 0.41 | 0.04 | 0.83 | 0 | 0.34 |

| SEEPEX | 0.03 | 0.42 | 0.03 | 0.43 | 0.03 | 0.37 | 0.03 | 0.4 | 0.03 | 0.36 | 0.03 | 0.35 | 0.03 | 0.35 | 0.03 | 0.24 | 0.04 | 0.5 | 0.03 | 0.91 |

| OTE | 0.04 | 0.42 | 0.03 | 0.35 | 0.04 | 0.42 | 0.03 | 0.3 | 0.03 | 0.4 | 0.03 | 0.26 | 0.03 | 0.39 | 0.03 | 0.27 | 0.36 | 3.48 | −3.65 | 10.04 |

| IBEX | 0.07 | 0.57 | 0 | 0.48 | 0.07 | 0.57 | 0 | 0.48 | 0.06 | 0.54 | 0 | 0.48 | 0.06 | 0.52 | 0 | 0.4 | 0.05 | 0.44 | 0 | 0.71 |

| OPCOM | 0.04 | 0.41 | 0.03 | 0.42 | 0.04 | 0.36 | 0.03 | 0.37 | 0.04 | 0.35 | 0.04 | 0.32 | 0.04 | 0.34 | 0.04 | 0.31 | 0.06 | 0.51 | 0.04 | 0.78 |

| OKTE | 0.05 | 0.49 | 0.03 | 0.32 | 0.04 | 0.48 | 0.03 | 0.32 | 0.04 | 0.45 | 0.03 | 0.31 | 0.04 | 0.44 | 0.03 | 0.29 | 0.36 | 3.22 | −3.65 | 10.04 |

| SWISSIX | 0.03 | 0.46 | 0.01 | 0.28 | 0.03 | 0.46 | 0.01 | 0.27 | 0.02 | 0.4 | 0.01 | 0.24 | 0.02 | 0.39 | 0.01 | 0.26 | 0.2 | 3.47 | −6.77 | 2.1 |

| FRANCE | 0.09 | 0.99 | 0.03 | 1.63 | 0.09 | 1.09 | 0.03 | 1.87 | 0.06 | 0.72 | 0.03 | 1.17 | 0.06 | 0.66 | 0.03 | 1.08 | 0.09 | 0.94 | 0.03 | 2.28 |

| PX | DVOA | PX | DVYA | PX | DVQA | PX | DVMA | PX | DVDA |

|---|---|---|---|---|---|---|---|---|---|

| HEnEx | 0.0496 | HEnEx | 0.0497 | HEnEx | 0.0498 | HEnEx | 0.0499 | HEnEx | 0.0509 |

| SWISSIX | 0.0567 | SWISSIX | 0.0572 | SWISSIX | 0.0585 | SWISSIX | 0.0586 | SWISSIX | 0.0574 |

| GME North | 0.0675 | GME North | 0.0678 | GME North | 0.0684 | GME North | 0.0682 | EXAA | 0.0657 |

| GME South | 0.0725 | GME South | 0.0733 | GME South | 0.0738 | GME South | 0.0743 | GME North | 0.0676 |

| EXAA | 0.0746 | SEEPEX | 0.077 | EXAA | 0.0782 | EXAA | 0.0785 | GME South | 0.0756 |

| SEEPEX | 0.0775 | EXAA | 0.0773 | SEEPEX | 0.0784 | SEEPEX | 0.0792 | SEEPEX | 0.0816 |

| OTE | 0.0845 | OTE | 0.0851 | OTE | 0.0861 | OTE | 0.0864 | PHELIX | 0.0896 |

| FRANCE | 0.0865 | FRANCE | 0.0873 | FRANCE | 0.0867 | FRANCE | 0.0867 | FRANCE | 0.0926 |

| PHELIX | 0.0906 | PHELIX | 0.0913 | PHELIX | 0.0921 | HUPX | 0.0929 | HUPX | 0.0963 |

| HUPX | 0.0919 | HUPX | 0.0918 | HUPX | 0.0927 | PHELIX | 0.0931 | CROPEX | 0.101 |

| OKTE | 0.0923 | OKTE | 0.0927 | OKTE | 0.0937 | OKTE | 0.0938 | BSP | 0.1031 |

| BSP | 0.0981 | BSP | 0.0983 | BSP | 0.0992 | BSP | 0.0995 | OTE | 0.1034 |

| CROPEX | 0.0988 | CROPEX | 0.0987 | CROPEX | 0.0996 | CROPEX | 0.1001 | OKTE | 0.1113 |

| OPCOM | 0.1053 | OPCOM | 0.1047 | OPCOM | 0.106 | OPCOM | 0.1068 | OPCOM | 0.114 |

| IBEX | 0.1168 | IBEX | 0.1175 | IBEX | 0.1168 | IBEX | 0.1168 | IBEX | 0.1153 |

| Markets | HUPX | BSP | CROPEX | PHELIX | EXAA | GME North | GME South | HEnEx | SEEPEX | OTE | IBEX | OPCOM | OKTE | SWISSIX | ERANCE |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HUPX | 1 | ||||||||||||||

| BSP | 0.93 | 1 | |||||||||||||

| CROPEX | 0.96 | 0.93 | 1 | ||||||||||||

| PHELIX | 0.66 | 0.66 | 0.63 | 1 | |||||||||||

| EXAA | 0.57 | 0.56 | 0.52 | 0.7 | 1 | ||||||||||

| GME North | 0.74 | 0.8 | 0.74 | 0.62 | 0.49 | 1 | |||||||||

| GME South | 0.68 | 0.7 | 0.67 | 0.57 | 0.49 | 0.83 | 1 | ||||||||

| HEnEx | 0.72 | 0.69 | 0.67 | 0.54 | 0.66 | 0.63 | 0.66 | 1 | |||||||

| SEEPEX | 0.96 | 0.9 | 0.92 | 0.63 | 0.56 | 0.74 | 0.68 | 0.73 | 1 | ||||||

| OTE | 0.77 | 0.76 | 0.73 | 0.92 | 0.72 | 0.71 | 0.64 | 0.6 | 0.74 | 1 | |||||

| IBEX | 0.71 | 0.68 | 0.66 | 0.47 | 0.51 | 0.53 | 0.51 | 0.58 | 0.71 | 0.56 | 1 | ||||

| OPCOM | 0.93 | 0.86 | 0.88 | 0.58 | 0.54 | 0.64 | 0.6 | 0.7 | 0.9 | 0.67 | 0.73 | 1 | |||

| OKTE | 0.84 | 0.83 | 0.81 | 0.85 | 0.65 | 0.75 | 0.67 | 0.63 | 0.81 | 0.93 | 0.61 | 0.76 | 1 | ||

| SWISSIX | 0.66 | 0.7 | 0.65 | 0.68 | 0.49 | 0.85 | 0.68 | 0.53 | 0.66 | 0.73 | 0.45 | 0.56 | 0.73 | 1 | |

| FRANCE | 0.65 | 0.7 | 0.65 | 0.71 | 0.48 | 0.84 | 0.66 | 0.49 | 0.65 | 0.74 | 0.45 | 0.55 | 0.72 | 0.95 | 1 |

| Markets | HUPX | BSP | CROPEX | PHELIX | EXAA | GME North | GME South | HEnEx | SEEPEX | OTE | IBEX | OPCOM | OKTE | SWISSIX | ERANCE |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HUPX | 1 | ||||||||||||||

| BSP | 0.44 | 1 | |||||||||||||

| CROPEX | 0.19 | 0.21 | 1 | ||||||||||||

| PHELIX | 0.03 | 0.12 | 0.17 | 1 | |||||||||||

| EXAA | −0.07 | 0.02 | 0.05 | −0.05 | 1 | ||||||||||

| GME North | 0.31 | 0.27 | 0.13 | 0.04 | 0.05 | 1 | |||||||||

| GME South | 0.25 | 0.18 | 0.11 | 0.03 | 0.03 | 0.57 | 1 | ||||||||

| HEnEx | 0.28 | 0.19 | 0.14 | 0.08 | 0.02 | 0.36 | 0.37 | 1 | |||||||

| SEEPEX | 0.62 | 0.4 | 0.14 | 0.04 | −0.03 | 0.3 | 0.25 | 0.3 | 1 | ||||||

| OTE | 0.16 | 0.23 | 0.2 | 0.12 | 0 | 0.04 | 0.02 | 0.06 | 0.08 | 1 | |||||

| IBEX | 0.31 | 0.24 | −0.16 | 0.04 | −0.07 | 0.15 | 0.13 | 0.14 | 0.23 | 0.09 | 1 | ||||

| OPCOM | 0.67 | 0.34 | 0.12 | 0.02 | −0.04 | 0.27 | 0.26 | 0.34 | 0.52 | 0.1 | 0.21 | 1 | |||

| OKTE | 0.17 | 0.24 | 0.2 | 0.11 | 0 | 0.05 | 0.03 | 0.06 | 0.09 | 0.99 | 0.09 | 0.1 | 1 | ||

| SWISSIX | −0.19 | −0.03 | 0.16 | 0 | 0.15 | 0.05 | 0.06 | 0.06 | −0.09 | −0.22 | −0.18 | −0.09 | −0.22 | 1 | |

| FRANCE | 0.52 | −0.06 | 0.1 | 0.07 | −0.04 | 0.24 | 0.16 | 0.09 | 0.25 | −0.05 | 0.07 | 0.33 | 0.03 | 0.08 | 1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Božić, Z.; Dobromirov, D.; Arsić, J.; Radišić, M.; Ślusarczyk, B. Power Exchange Prices: Comparison of Volatility in European Markets. Energies 2020, 13, 5620. https://doi.org/10.3390/en13215620

Božić Z, Dobromirov D, Arsić J, Radišić M, Ślusarczyk B. Power Exchange Prices: Comparison of Volatility in European Markets. Energies. 2020; 13(21):5620. https://doi.org/10.3390/en13215620

Chicago/Turabian StyleBožić, Zorana, Dušan Dobromirov, Jovana Arsić, Mladen Radišić, and Beata Ślusarczyk. 2020. "Power Exchange Prices: Comparison of Volatility in European Markets" Energies 13, no. 21: 5620. https://doi.org/10.3390/en13215620

APA StyleBožić, Z., Dobromirov, D., Arsić, J., Radišić, M., & Ślusarczyk, B. (2020). Power Exchange Prices: Comparison of Volatility in European Markets. Energies, 13(21), 5620. https://doi.org/10.3390/en13215620