Comparison between Inflexible and Flexible Charging of Electric Vehicles—A Study from the Perspective of an Aggregator

Abstract

1. Introduction

2. Assumptions

3. Problem Formulation

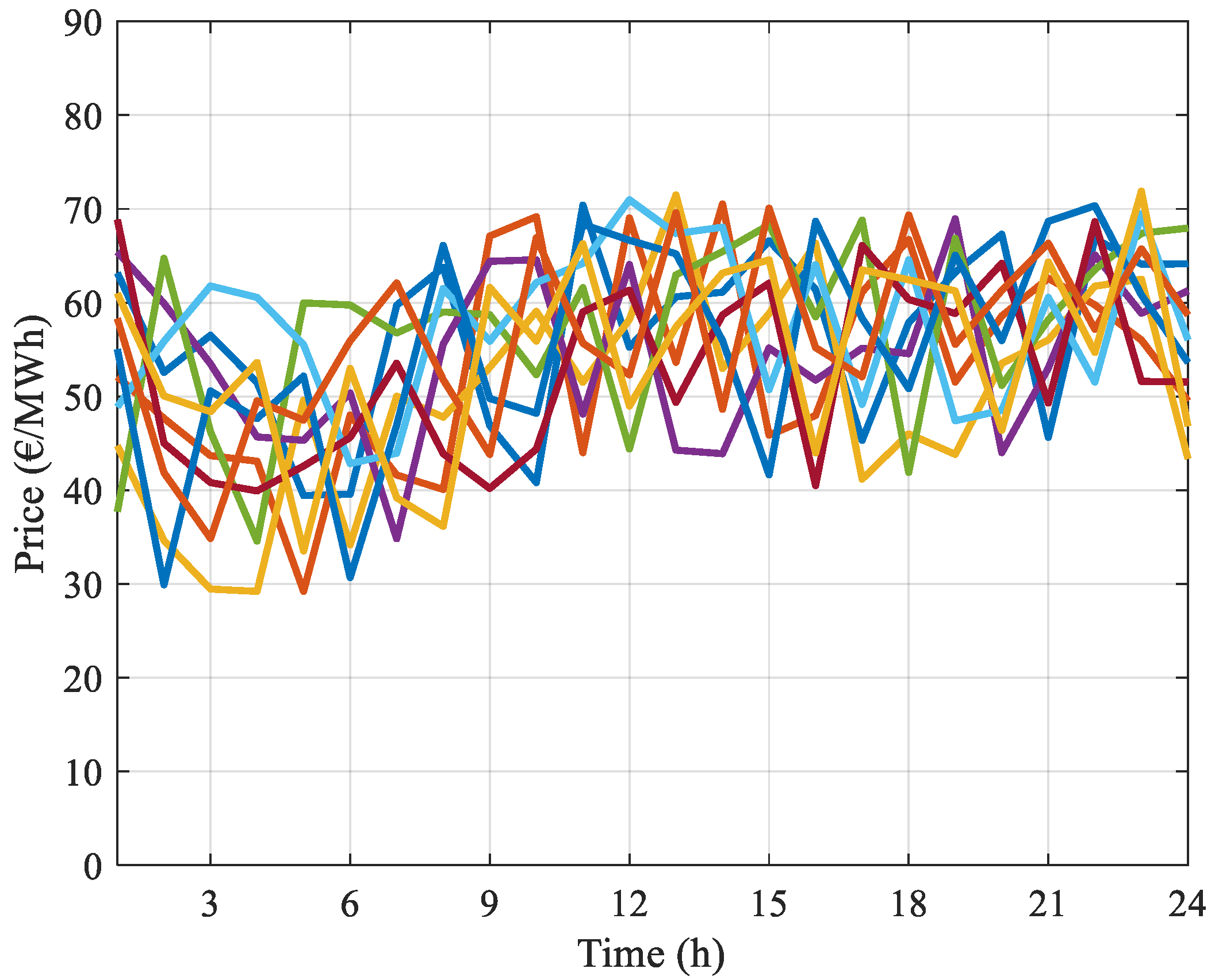

4. Uncertainty Modeling

4.1. Scenario Generation

4.2. Scenario Reduction

5. Case Studies

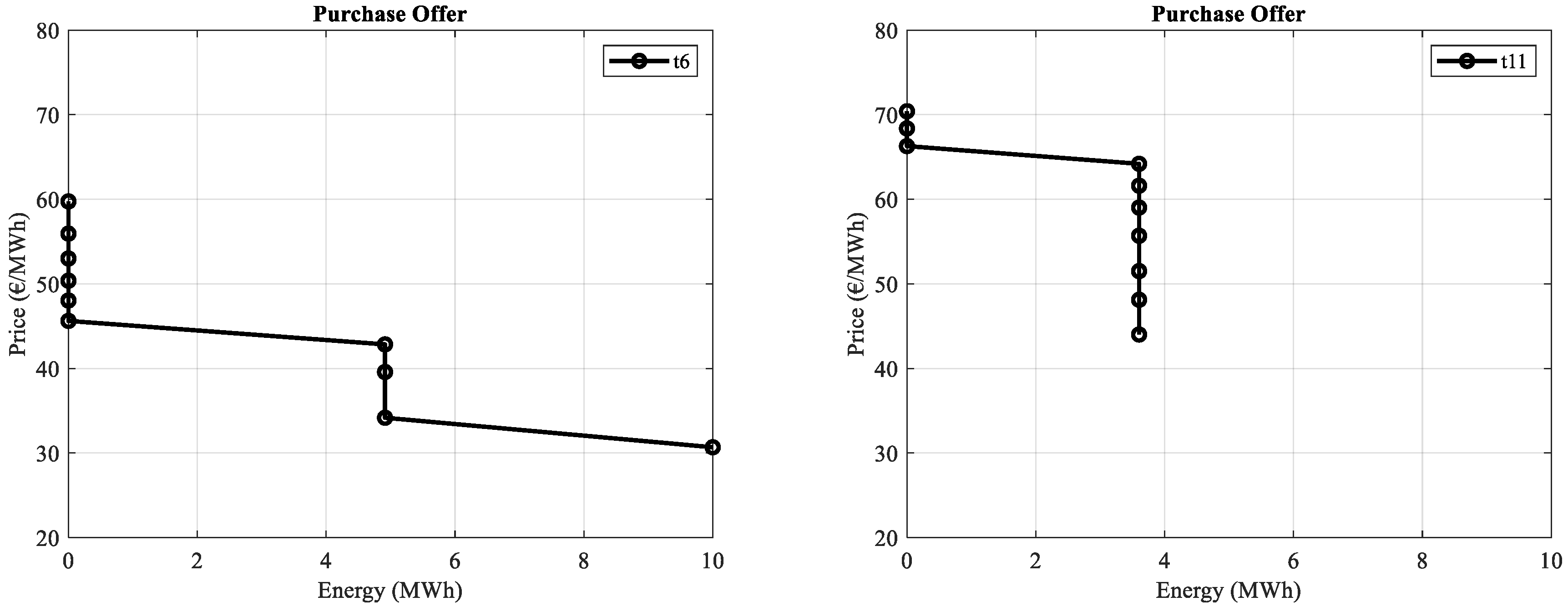

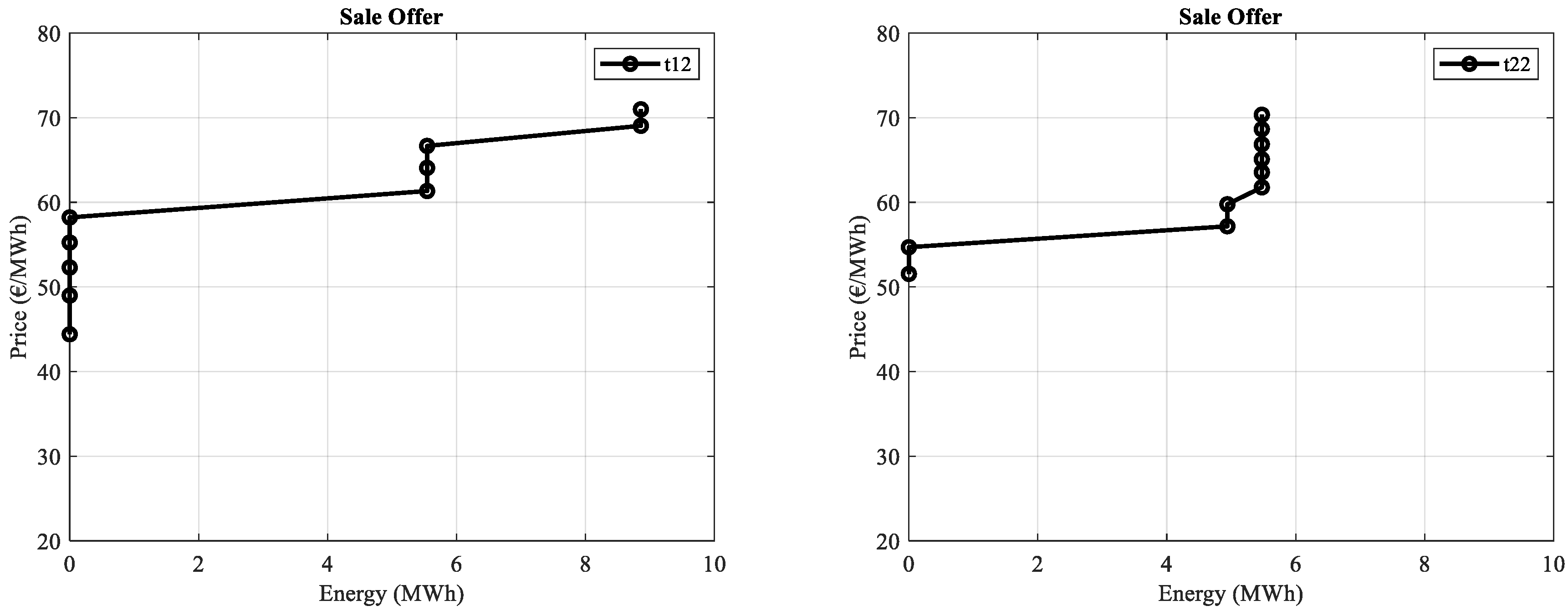

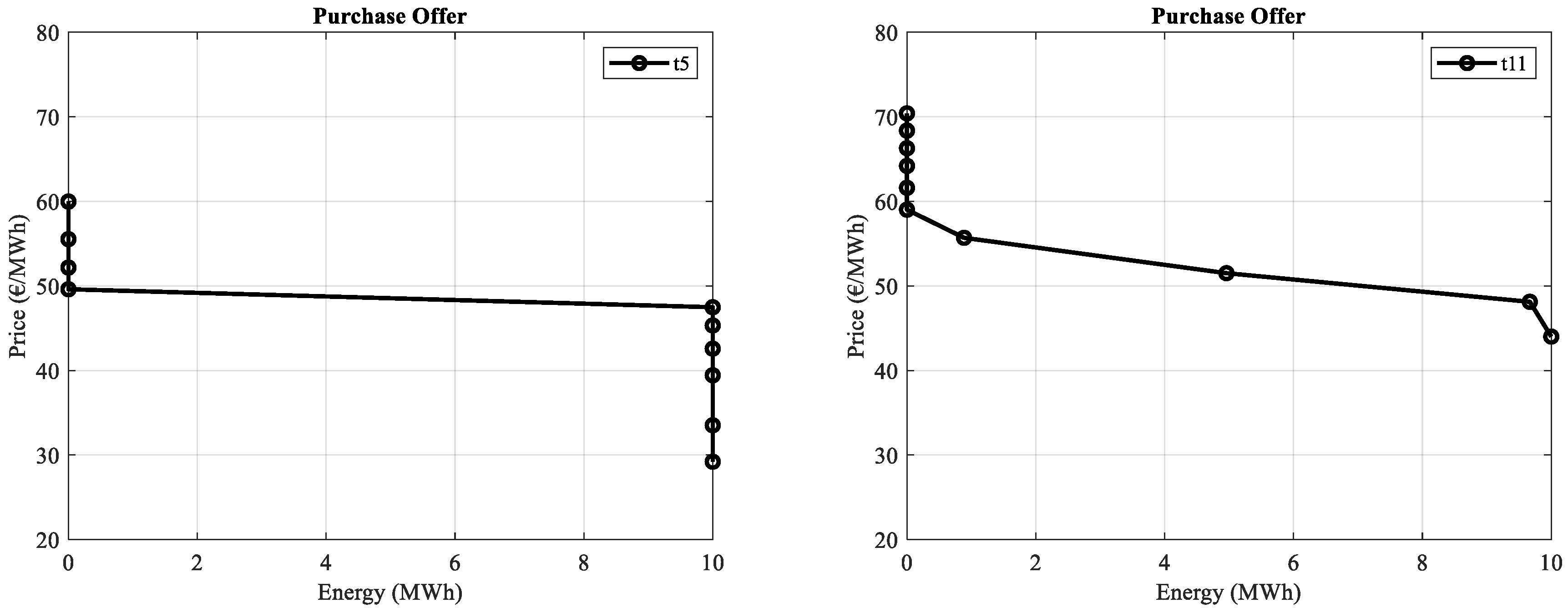

5.1. Case_1—Inflexible

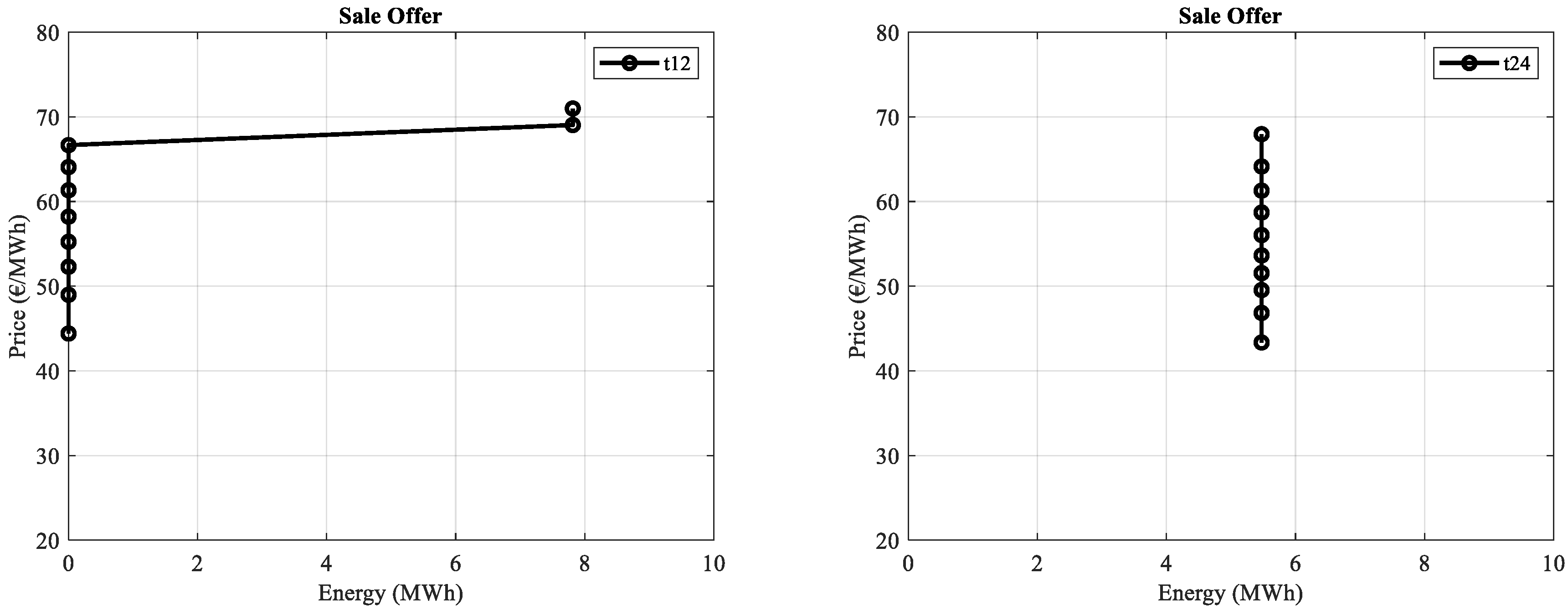

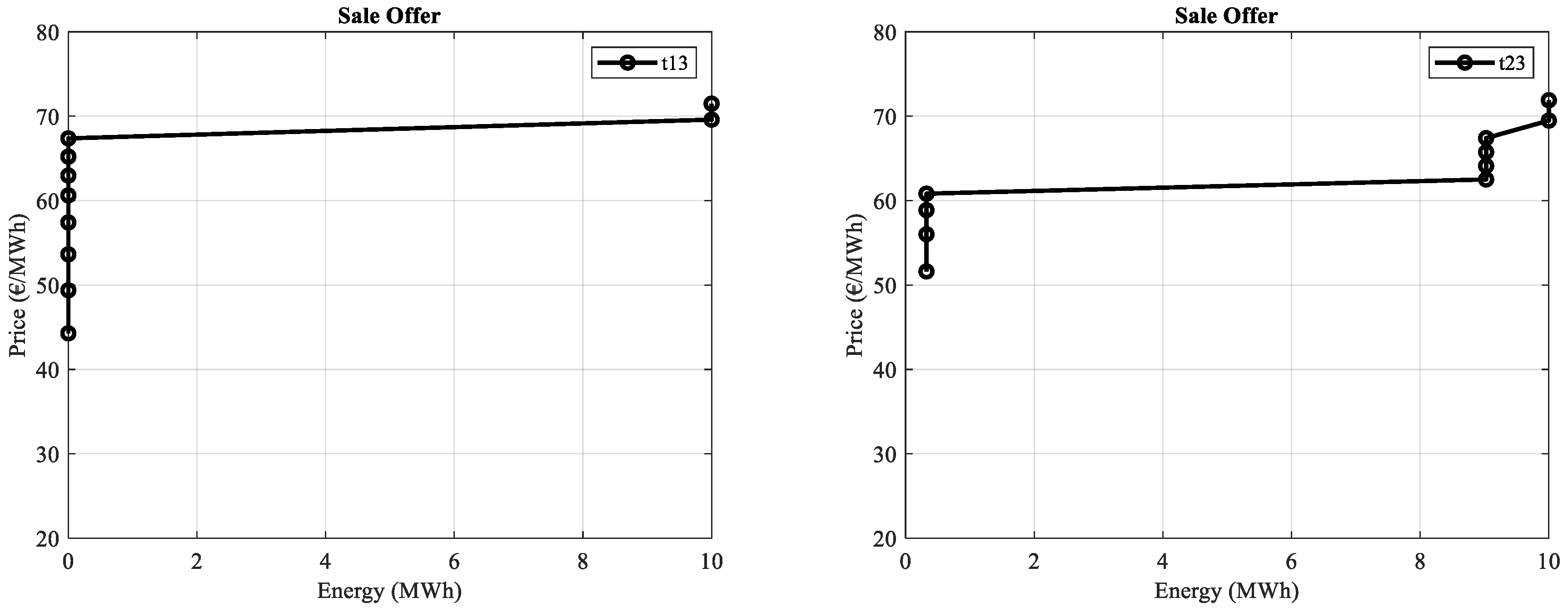

5.2. Case_2—Partially-Flexible

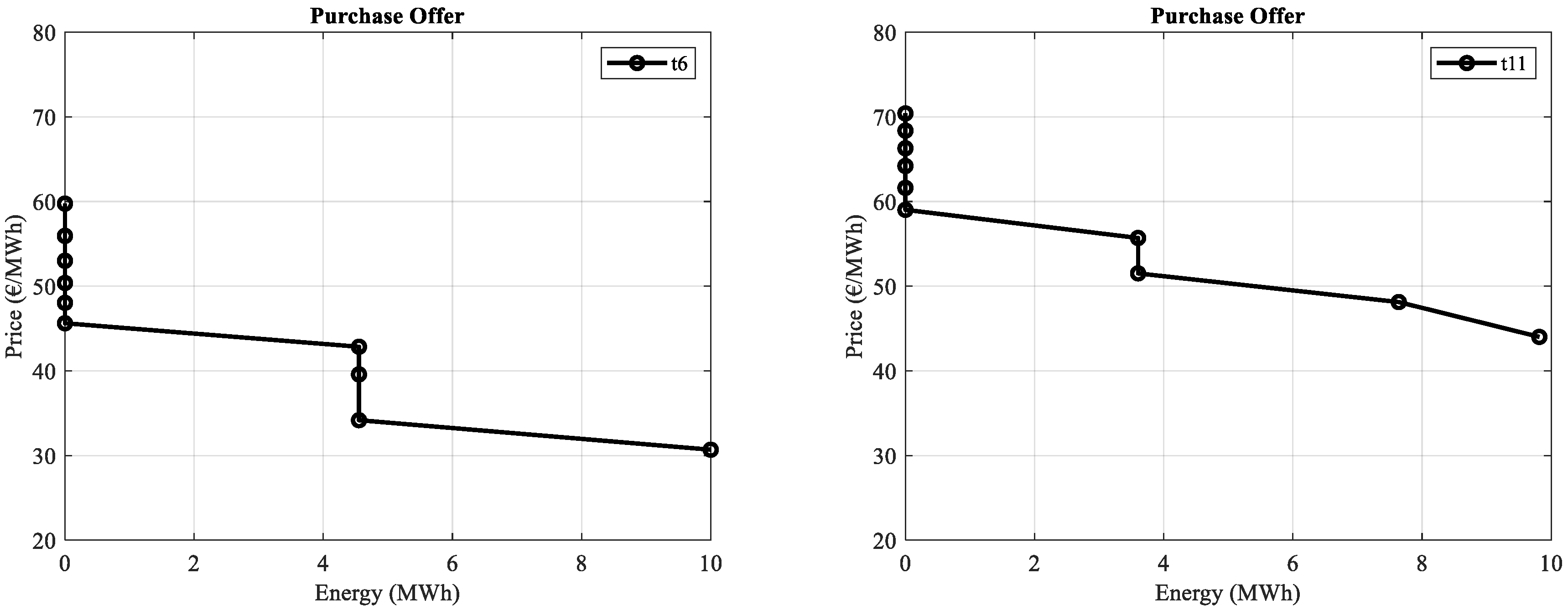

5.3. Case_3—Flexible

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

List of Symbols

| index of scenarios | |

| index of periods | |

| day-ahead market price | |

| V2G tariff to encourage the electric vehicle owners to operate in the vehicle to grid mode | |

| price for driving requirements | |

| binary variable modeling discharge cycles | |

| binary variable modeling charge cycles | |

| binary parameter for input status of electric vehicles | |

| discharge efficiency of batteries of electric vehicles | |

| charge efficiency of batteries of electric vehicles | |

| driving requirements of electric vehicles | |

| capacity of battery of electric vehicles | |

| discharge power of electric vehicles/sale offer | |

| charge power of electric vehicles/purchase offer | |

| / | minimum/maximum discharge power |

| / | minimum/maximum charge power |

| state of charge of electric vehicles | |

| / | minimum/maximum state of charge |

| cost of battery degradation | |

| cost of batteries of electric vehicles | |

| linear approximated slope of battery life as a function of the number of cycles |

Appendix A

| Hour\Scenario | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 8 | 2.083 | 1.185 | 1.909 | 1.340 | 1.468 | 1.994 | 2.165 | 1.694 | 1.587 | 1.808 |

| 9 | 1.339 | 2.492 | 1.863 | 2.221 | 1.982 | 1.594 | 2.373 | 1.732 | 2.101 | 1.472 |

| 10 | 0.000 | 1.998 | 1.399 | 0.000 | 1.036 | 1.646 | 0.000 | 0.000 | 1.839 | 1.922 |

| 13 | 2.661 | 0.000 | 1.033 | 1.859 | 2.540 | 0.000 | 2.139 | 0.000 | 2.369 | 1.486 |

| 14 | 2.482 | 0.000 | 0.000 | 1.715 | 2.827 | 2.186 | 0.000 | 1.271 | 0.000 | 2.708 |

| 19 | 0.000 | 2.497 | 1.298 | 2.330 | 2.027 | 0.000 | 1.723 | 0.000 | 0.000 | 0.000 |

| 20 | 2.723 | 1.109 | 1.863 | 2.263 | 3.130 | 2.065 | 2.927 | 1.626 | 1.397 | 2.495 |

| 21 | 2.321 | 1.558 | 1.800 | 2.221 | 1.707 | 2.103 | 1.628 | 1.906 | 1.997 | 1.490 |

| 22 | 2.992 | 0.000 | 2.562 | 0.000 | 2.073 | 1.664 | 0.000 | 1.324 | 2.838 | 0.000 |

| Hour\Scenario | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 8 | 2.083 | 1.185 | 1.909 | 1.340 | 1.468 | 1.994 | 2.165 | 1.694 | 1.587 | 1.808 |

| 9 | 1.339 | 4.490 | 3.262 | 2.221 | 3.018 | 3.240 | 2.373 | 1.732 | 3.940 | 3.393 |

| 14 | 5.143 | 0.000 | 1.033 | 3.574 | 5.367 | 2.186 | 2.139 | 1.271 | 2.369 | 4.194 |

| 19 | 2.321 | 4.055 | 3.098 | 4.551 | 3.734 | 2.103 | 3.351 | 1.906 | 1.997 | 1.490 |

| 20 | 5.715 | 1.109 | 4.425 | 2.263 | 5.203 | 3.729 | 2.927 | 2.951 | 4.235 | 2.495 |

References

- Organization for Economic Co-Operation and Development. OECD: Reducing Transport Greenhouse Emissions: Trends & Data; International Transport Forum: Leipzig, Germany, 2010. [Google Scholar]

- Lane, B.W.; Dumortier, J.; Carley, S.; Siddiki, S.; Clark, K.-S.; Graham, J.D. All plug-in electric vehicles are not the same: Predictors of preference for a plug-in hybrid versus a battery electric vehicle. Transp. Res. Part D Transp. Environ. 2018, 65, 1–13. [Google Scholar] [CrossRef]

- Yao, J.; Xiong, S.; Ma, X. Comparative analysis of national policies for electric vehicle uptake using econometric models. Energies 2020, 13, 3604. [Google Scholar] [CrossRef]

- Chen, L.; Zhang, Y.; Figueiredo, A. Spatio-temporal model for evaluating demand response potential of electric vehicles in power-traffic network. Energies 2019, 12, 1981. [Google Scholar] [CrossRef]

- Gomes, I.L.R.; Melicio, R.; Mendes, V.M.F. Electric vehicles aggregation in market environment: A stochastic grid-to-vehicle and V2G management. In Technological Innovation for Industry and Service Systems; Springer: Cham, Switzerland, 2019; pp. 343–352. [Google Scholar]

- Lopes, J.P.; Soares, F.J.; Almeida, P.M.R. Integration of electric vehicles in electric power system. Proc. IEEE 2011, 99, 168–183. [Google Scholar] [CrossRef]

- Bessa, R.J.; Matos, M.A. The role of an aggregator agent for EV in the electricity market. In Proceedings of the 7th Mediterranean Conference and Exhibition on Power Generation, Transmission, Distribution and Energy Conversion (MedPower 2010), Agia Napa, Cyprus, 7–10 November 2010; pp. 1–9. [Google Scholar]

- Gomes, I.L.R.; Pousinho, H.M.I.; Melicio, R.; Mendes, V.M.F. Aggregation platform for wind-pv-thermal technology in electricity market. In Proceedings of the International Symposium on Power Electronics, Electrical Drives, Automation and Motion, Amalfi, Italy, 20–22 June 2018; pp. 799–804. [Google Scholar]

- Gomes, I.L.R.; Pousinho, H.M.I.; Melicio, R.; Mendes, V.M.F. Stochastic coordination of joint wind and photovoltaic systems with energy storage in day-ahead market. Energy 2017, 124, 310–320. [Google Scholar] [CrossRef]

- Gomes, I.L.R.; Melicio, R.; Mendes, V.M.F. Decision making for sustainable aggregation of clean energy in day-ahead market: Uncertainty and risk. Renew. Energy 2019, 133, 692–720. [Google Scholar] [CrossRef]

- Gomes, I.L.R.; Melicio, R.; Mendes, V.M.F. Dust Effect impact on PV in an aggregation with wind and thermal powers. Sustain. Energy Grids Netw. 2020, 22, 100359. [Google Scholar] [CrossRef]

- Gomes, I.L.R.; Pousinho, H.M.I.; Melicio, R.; Mendes, V.M.F. Bidding and optimization strategies for wind power-pv systems in electricity markets assisted by CPS. Energy Procedia 2016, 106, 111–121. [Google Scholar] [CrossRef]

- Laia, R.; Pousinho, H.M.I.; Melicio, R.; Mendes, V.M.F. Self-scheduling and bidding strategies of thermal units with stochastic emission constraints. Energy Convers. Manag. 2015, 89, 975–984. [Google Scholar] [CrossRef]

- Laia, R.; Pousinho, H.M.I.; Melicio, R.; Mendes, V.M.F. Bidding strategy of wind-thernal energy producers. Renew. Energy 2016, 99, 673–681. [Google Scholar] [CrossRef]

- Vandael, S.; Claessens, B.; Hommelberg, M.; Holvoet, T.; Deconinck, G. A scalable three-step approach for demand side management of plug-in hybrid vehicles. IEEE Trans. Smart Grid 2013, 4, 720–728. [Google Scholar] [CrossRef]

- Vaya, P.; Baringo, L.; Krause, T.; Andersson, G.; Almeida, P.; Geth, F.; Rapoport, S. EV aggregation models for different charging scenarios. In Proceedings of the 23rd International Conference on Electricity, Lyon, France, 15–18 June 2015; pp. 1–5. [Google Scholar]

- Jain, P.; Das, A.; Jain, T. Aggregated electric vehicle resource modeling for regulation services commitment in power grid. Sustain. Cities Soc. 2019, 45, 439–450. [Google Scholar] [CrossRef]

- Sortome, E.; Sharkavi, M.A.-E. Optimal charging strategies for unidirectional V2G. IEEE Trans. Smart Grid 2011, 2, 131–138. [Google Scholar] [CrossRef]

- Naharudinsyah, I.; Limmer, S. Optimal charging of electric vehicles with trading on the intraday electricity market. Energies 2018, 11, 1416. [Google Scholar] [CrossRef]

- Baringo, L.; Amaro, R.S. A stochastic robust optimization approach for the bidding strategy of an electric vehicle aggregator. Electr. Power Syst. Res. 2017, 146, 362–370. [Google Scholar] [CrossRef]

- Donadee, J.; Ilic, M.D. Stochastic optimization of grid to vehicle frequency regulation capacity bids. IEEE Trans. Smart Grid 2014, 5, 1061–1069. [Google Scholar] [CrossRef]

- Vagropoulos, S.I.; Bakirtzis, A.G. Optimal bidding strategy for electric vehicle aggregators in electricity markets. IEEE Trans. Power Syst. 2013, 28, 4031–4041. [Google Scholar] [CrossRef]

- Wu, H.; Shahidehpour, M.; Alabdulwahab, A.; Absusorrach, A. A game theoric approach to risk-based optimal bidding strategies for electric vehicle aggregators in electricity markets with variable wind energy resources. IEEE Trans. Sustain. Energy 2016, 7, 374–385. [Google Scholar] [CrossRef]

- Manijeh, A.; Mohammadi, B.-I.; Moradi, M.-D.; Zare, K. Stochastic scheduling of aggregators of plug-in electric vehicles for participation in energy and ancillary service markets. Energy 2017, 118, 1168–1179. [Google Scholar]

- Vardanyan, Y.; Madsen, H. Optimal coordinated bidding of a profit maximizing, risk-averse EV aggregator in three-settlement markets under uncertainty. Energies 2019, 12, 1755. [Google Scholar] [CrossRef]

- Batista, N.C.; Melicio, R.; Matias, J.C.O.; Catalão, J.P.S. ZigBee standard in the creation of wireless networks for advanced metering infrastructures. In Proceedings of the 16th IEEE Mediterranean Electrotechnical Conference (MELECON’2012), Medina Yasmine Hammamet, Tunisia, 10 May 2012; pp. 220–223. [Google Scholar]

- Batista, N.C.; Melicio, R.; Mendes, V.M.F. Services enabler architecture for smart grid and smart living services providers under industry 4.0. Energy Build. 2017, 141, 16–27. [Google Scholar] [CrossRef]

- Guo, Y.; Liu, W.; Wen, F.; Salam, A.; Mao, J.; Li, L. Bidding strategy for aggregators of electric vehicles in day-ahead electricity markets. Energies 2017, 10, 144. [Google Scholar] [CrossRef]

- Rashidizadeh-Kermani, H.; Najafi, H.R.; Anvari-Moghaddam, A.; Guerrero, J.M. Optimal decision-making strategy of an electric vehicle in short-term electricity markets. Energies 2018, 11, 2413. [Google Scholar] [CrossRef]

- Aliasghari, P.; Mohammadi-Ivatloo, B.; Abapour, M.; Ahmadian, A.; Elkamel, A. Goal programming application for contract pricing of electric vehicle aggregator in join day-ahead market. Energies 2020, 13, 1771. [Google Scholar] [CrossRef]

- Sarker, M.R.; Dvorkin, Y.; Ortega, M.A.-V. Optimal participation of an electric vehicle aggregator in day-ahead energy and reserve markets. IEEE Trans. Syst. 2016, 31, 3506–3515. [Google Scholar] [CrossRef]

- Martinez, W.L.; Martinez, A.R. Computational Statistics Handbook with MATLAB, 3rd ed.; CRC Press: Boca Raton, FL, USA, 2016. [Google Scholar]

- Viegas, J.L.; Vieira, S.M.; Melicio, R.; Mendes, V.M.F.; Sousa, J.M.C. Classification of new electricity costumers based on surveys and smart metering data. Energy 2016, 107, 804–817. [Google Scholar] [CrossRef]

- REE-Red Elétrica de España. Available online: https://www.esios.ree.es/es (accessed on 9 March 2020).

- Pasaoglu, G.; Fiorello, D.; Martino, A.; Scarcella, G.; Alemanno, A.; Zubaryeva, A.; Thiel, C. Driving and Parking Patterns of European Car Drivers—A Mobility Survey; European Commission Joint Research Centre: Luxembourg, 2012. [Google Scholar]

- Ortega-Vazquez, M.A.; Bouffard, F.; Silva, V. Electric Vehicle Aggregator/System Operator Coordination for Charging Scheduling and Services Procurement. IEEE Trans. Power Syst. 2013, 28, 1806–1815. [Google Scholar] [CrossRef]

| Expected Profit (€) | Degradation Cost (€) | |

|---|---|---|

| Case 1 | 504 | 254 |

| Case 2 | 666 | 333 |

| Case 3 | 1153 | 487 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gomes, I.; Melicio, R.; Mendes, V. Comparison between Inflexible and Flexible Charging of Electric Vehicles—A Study from the Perspective of an Aggregator. Energies 2020, 13, 5443. https://doi.org/10.3390/en13205443

Gomes I, Melicio R, Mendes V. Comparison between Inflexible and Flexible Charging of Electric Vehicles—A Study from the Perspective of an Aggregator. Energies. 2020; 13(20):5443. https://doi.org/10.3390/en13205443

Chicago/Turabian StyleGomes, Isaias, Rui Melicio, and Victor Mendes. 2020. "Comparison between Inflexible and Flexible Charging of Electric Vehicles—A Study from the Perspective of an Aggregator" Energies 13, no. 20: 5443. https://doi.org/10.3390/en13205443

APA StyleGomes, I., Melicio, R., & Mendes, V. (2020). Comparison between Inflexible and Flexible Charging of Electric Vehicles—A Study from the Perspective of an Aggregator. Energies, 13(20), 5443. https://doi.org/10.3390/en13205443