Multi-Time Scale Spillover Effect of International Oil Price Fluctuation on China’s Stock Markets

Abstract

:1. Introduction

2. Literature Review

3. Models and Data

3.1. Model Construction

3.1.1. Wavelet Analysis Model

3.1.2. Marginal Distribution Estimation Model and Time-Varying t-Copula Model

3.2. Variable and Data

4. Results Analysis

4.1. Descriptive Statistical Analysis

4.2. Multi-Time scale Decomposition of International Oil Price and China’s Stock Index According to MODWT

4.2.1. Maximum Overlapping Discrete Wavelet Decomposition of Brent Spot Crude Oil and the Stock Index

4.2.2. Multi-Time scale Correlation Analysis between Spot Brent Crude Oil and the Stock Index

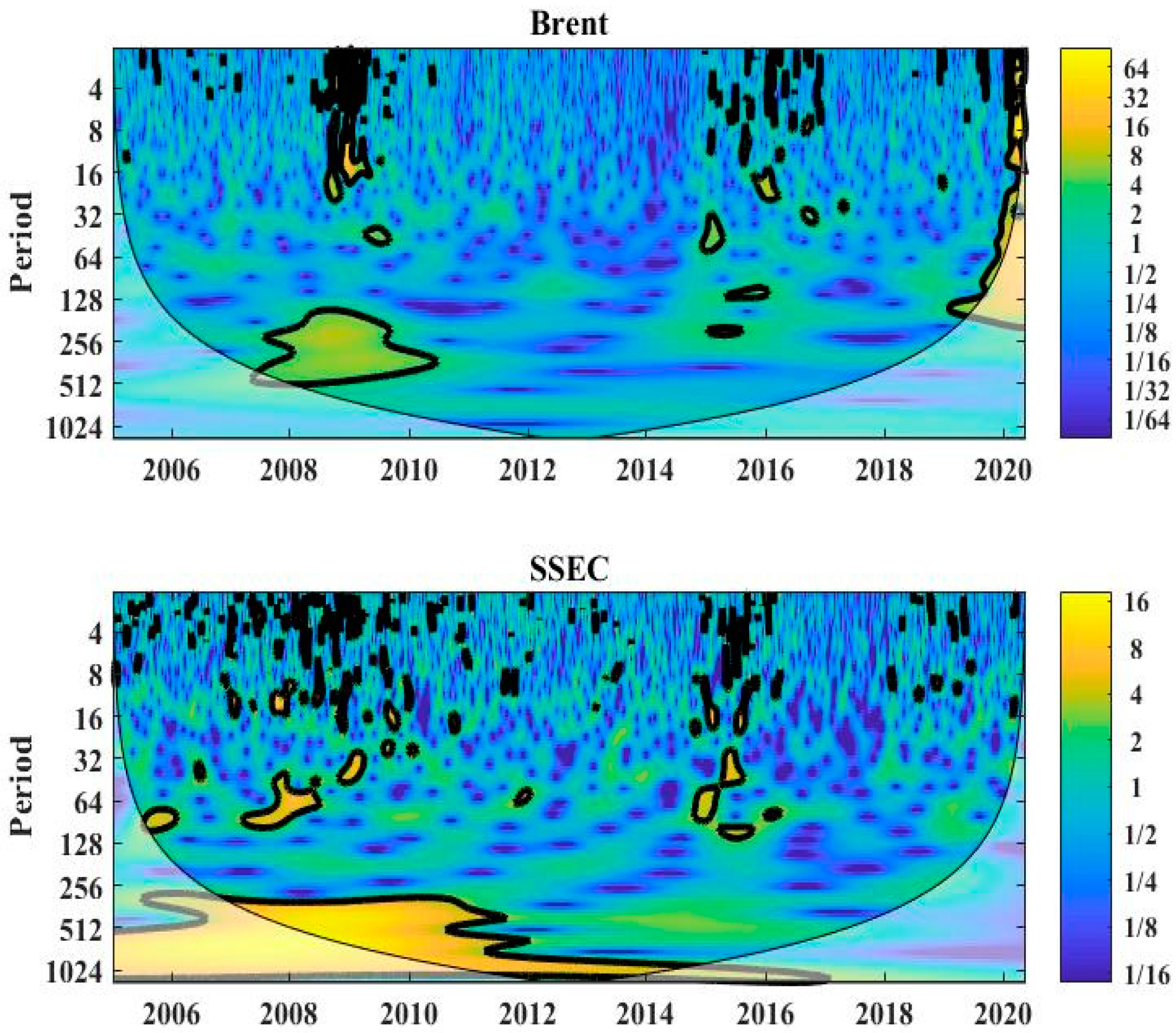

4.3. Multi-Time scale Analysis of the Influences of International Oil Price Fluctuation on the Shanghai Composite Index According to Continuous and Cross Wavelets

4.3.1. Continuous Wavelet Decomposition of Brent Spot Crude Oil and the Shanghai Composite Index

4.3.2. Multi-Time scale Leading-Lag Relation Analysis between Brent Spot Crude Oil and the Shanghai Composite Index

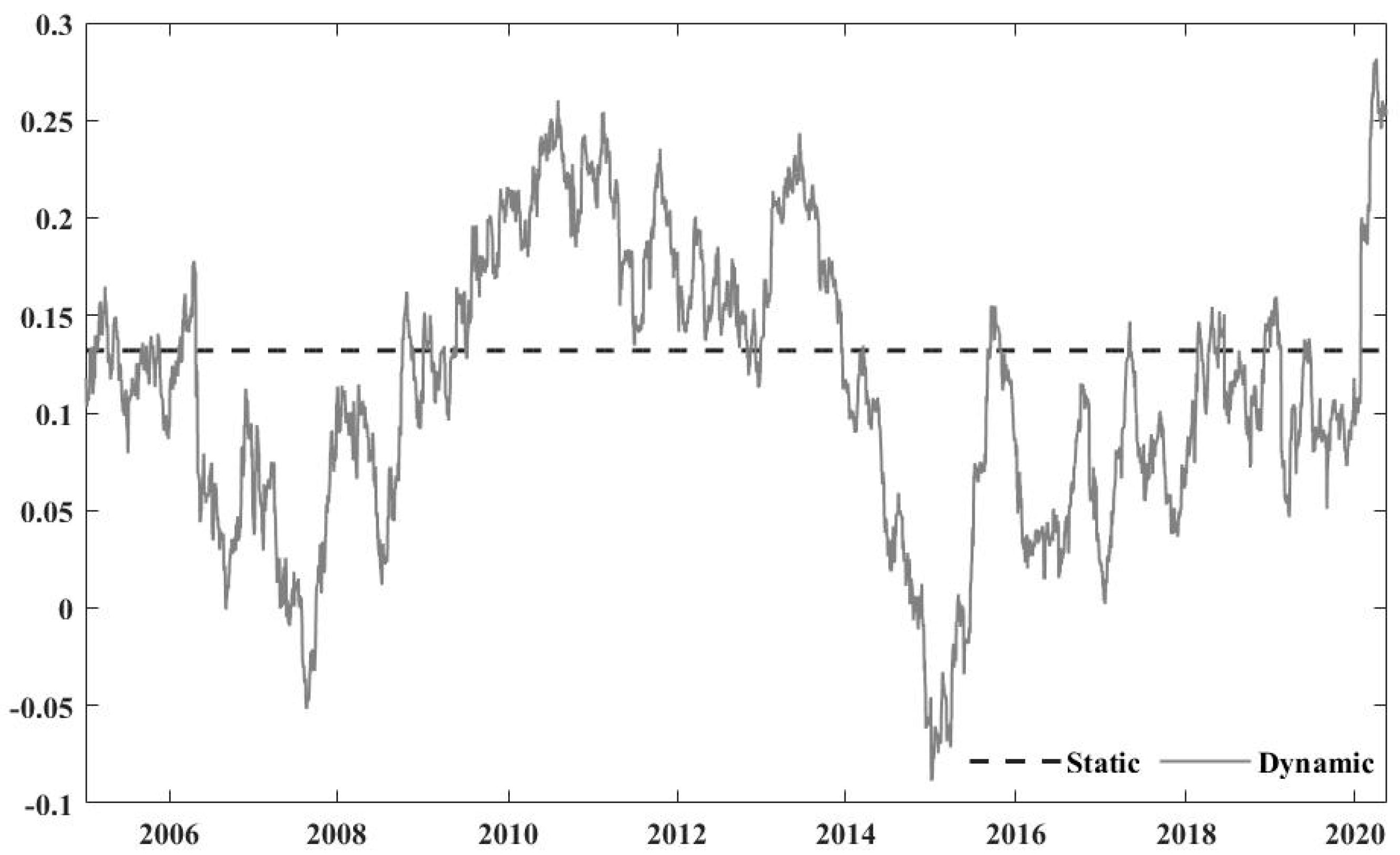

4.3.3. Multi-Resolution Correlation Analysis between Brent Spot Crude Oil and the Shanghai Composite Index

4.4. Spillover Effect Analysis of International Oil Price Fluctuation on the Stock Index of China Securities Industry According to a Time-Varying t-Copula Model

4.4.1. Marginal Distribution Estimations of Brent Spot Crude Oil and the Stock Index of China Securities Industry

4.4.2. Multi-Time scale Spillover Effect of Brent Spot Crude Stock and Stock Index of China Securities Industry According to a Time-Varying t-Copula Model

4.5. Robustness Test

5. Discussions

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Log(L) | AIC | SC | |

|---|---|---|---|

| GARCH (1,1) | 8905.961 | −4.947405 | −4.925031 |

| EGARCH (1,1) | 8945.225 | −4.968693 | −4.944598 |

| GJR-GARCH (1,1) | 8937.777 | −4.964549 | −4.940454 |

| LGARCH (1,1) | 8907.726 | −4.947831 | −4.923735 |

| TGARCH (1,1) | 8926.472 | −4.95321 | −4.937914 |

| VGARCH (1,1) | 8916.509 | −4.949598 | −4.925781 |

| CSIE | CSIMA | CSII | CSIO | CSIC | CSIME | CSIF | CSIIN | CSIT | CSIPU | |

|---|---|---|---|---|---|---|---|---|---|---|

| Static Student-t-Copula parameters | ||||||||||

| ρ | 0.052 *** | 0.062 *** | 0.062 *** | 0.049 *** | 0.070 *** | 0.061 *** | 0.050 *** | 0.051 *** | 0.042 ** | 0.056 *** |

| (−0.018) | (−0.018) | (−0.018) | (−0.018) | (−0.017) | (−0.018) | (−0.018) | (−0.018) | (−0.019) | (−0.018) | |

| DOF | 30.167 | 199.953 | 135.249 *** | 65.583 *** | 79.717 *** | 37.686 ** | 27.811 ** | 30.596 ** | 53.285 | 199.988 *** |

| (22.990) | (2.767) | (29.777) | (9.976) | (10.685) | (15.932) | (15.492) | (14.852) | (48.455) | (32.646) | |

| Log(L) | 6.253 | 7.466 | 7.480 | 5.382 | 8.513 | 7.480 | 6.099 | 4.724 | 3.326 | 5.964 |

| AIC | −10.506 | −12.931 | −12.959 | −8.765 | −15.026 | −12.960 | −10.198 | −7.448 | −4.651 | −9.927 |

| DCC-Student-t-Copula parameters | ||||||||||

| ρ | 0.050 *** | 0.063 *** | 0.063 *** | 0.051 *** | 0.067 *** | 0.058 *** | 0.048 *** | 0.043 *** | 0.039 *** | 0.057 *** |

| (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | |

| DOF | 50.687 *** | 199.929 *** | 197.640 ** | 199.962 | 199.908 *** | 199.973 | 86.229 *** | 199.759 | 199.978 | 200.000 *** |

| (14.891) | (4.380) | (96.289) | (839.122) | (3.140) | (1990.256) | (20.625) | (330.381) | (2827.011) | (3.145) | |

| α | 0.338 *** | 0.314 *** | 0.310 *** | 0.305 *** | 0.317 *** | 0.318 | 0.325 *** | 0.325 *** | 0.327 | 0.305 *** |

| (0.019) | (0.018) | (0.020) | (0.072) | (0.019) | (0.581) | (0.020) | (0.033) | (2.780) | (0.019) | |

| β | 0.117 ** | 0.151 ** | 0.068 | 0.075 | 0.000 | 0.054 | 0.000 | 0.124 * | 0.101 | 0.060 |

| (0.053) | (0.065) | (0.070) | (0.970) | (0.122) | (3.668) | (0.101) | (0.074) | (3.781) | (0.061) | |

| Log(L) | 166.904 | 150.145 | 147.518 | 144.007 | 155.677 | 159.633 | 166.098 | 156.638 | 155.362 | 143.620 |

| AIC | −327.807 | −294.290 | −289.037 | −282.015 | −305.354 | −313.265 | −326.196 | −307.276 | −304.724 | −281.240 |

| CSIE | CSIMA | CSII | CSIO | CSIC | CSIME | CSIF | CSIIN | CSIT | CSIPU | |

|---|---|---|---|---|---|---|---|---|---|---|

| Static Student-t-Copula parameters | ||||||||||

| ρ | 0.215 *** | 0.163 *** | 0.145 *** | 0.133 *** | 0.129 *** | 0.105 *** | 0.170 *** | 0.151 *** | 0.071 *** | 0.066 *** |

| (−0.016) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | |

| DOF | 100.121 | 36.558 | 168.019 *** | 19.427 ** | 199.996 *** | 199.950 | 200.000 *** | 24.737 ** | 27.803 ** | 199.980 |

| (135.661) | (31.692) | (3.025) | (8.075) | (35.291) | (488.769) | (16.884) | (11.907) | (11.564) | (162.293) | |

| Log(L) | 54.246 | 35.264 | 27.085 | 28.336 | 21.680 | 10.028 | 31.763 | 34.193 | 6.373 | 5.400 |

| AIC | −106.492 | −68.528 | −52.171 | −54.672 | −41.359 | −18.056 | −61.525 | −66.385 | −10.745 | −8.800 |

| DCC-Student-t-Copula parameters | ||||||||||

| ρ | 0.189 *** | 0.147 *** | 0.129 *** | 0.121 *** | 0.116 *** | 0.093 *** | 0.152 *** | 0.146 *** | 0.061 *** | 0.065 *** |

| (0.007) | (0.008) | (0.008) | (0.008) | (0.008) | (0.008) | (0.008) | (0.010) | (0.008) | (0.009) | |

| DOF | 199.997 *** | 199.972 *** | 199.995 *** | 200.000 | 199.997 *** | 199.997 *** | 200.000 | 29.580 ** | 199.997 *** | 91.835 |

| (22.490) | (31.856) | (27.313) | (230.155) | (3.347) | (3.690) | (208.628) | (14.225) | (12.183) | (390.177) | |

| α | 0.500 *** | 0.500 *** | 0.500 *** | 0.500 *** | 0.500 *** | 0.500 *** | 0.500 *** | 0.186 *** | 0.500 *** | 0.257 |

| (0.019) | (0.075) | (0.035) | (0.060) | (0.022) | (0.023) | (0.029) | (0.018) | (0.022) | (0.197) | |

| β | 0.263 *** | 0.319 ** | 0.316 ** | 0.321 *** | 0.268 *** | 0.290 *** | 0.316 *** | 0.796 *** | 0.291 *** | 0.699 ** |

| (0.036) | (0.124) | (0.061) | (0.101) | (0.034) | (0.038) | (0.049) | (0.023) | (0.039) | (0.286) | |

| Log(L) | 808.200 | 902.390 | 873.549 | 928.625 | 803.379 | 828.612 | 851.719 | 913.556 | 853.109 | 898.159 |

| AIC | −1610.400 | −1798.781 | −1741.098 | −1851.249 | −1600.759 | −1651.224 | −1697.439 | −1821.113 | −1700.219 | −1790.318 |

| CSIE | CSIMA | CSII | CSIO | CSIC | CSIME | CSIF | CSIIN | CSIT | CSIPU | |

|---|---|---|---|---|---|---|---|---|---|---|

| Static Student-t-Copula parameters | ||||||||||

| ρ | 0.259 *** | 0.215 *** | 0.073 *** | 0.216 *** | 0.423 *** | 0.247 *** | 0.153 *** | 0.217 *** | 0.112 *** | 0.015 |

| (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.050) | |

| DOF | 6.273 *** | 9.212 *** | 14.907 *** | 7.951 *** | 9.698 *** | 5.265 *** | 24.985 ** | 7.784 *** | 6.297 *** | 199.999 *** |

| (0.723) | (1.498) | (3.589) | (0.984) | (1.396) | (0.544) | (11.090) | (0.958) | (0.800) | (7.710) | |

| Log(L) | 137.750 | 77.286 | 9.389 | 79.149 | 284.857 | 153.642 | 27.284 | 86.832 | 47.629 | −1.370 |

| AIC | −273.500 | −152.571 | −16.779 | −156.297 | −567.714 | −305.284 | −52.569 | −171.664 | −93.257 | 4.739 |

| DCC-Student-t-Copula parameters | ||||||||||

| ρ | 0.258 *** | 0.213 *** | 0.083 *** | 0.202 *** | 0.374 *** | 0.226 *** | 0.155 *** | 0.198 *** | 0.101 *** | 0.050 *** |

| (0.010) | (0.010) | (0.009) | (0.009) | (0.006) | (0.009) | (0.009) | (0.010) | (0.010) | (0.010) | |

| DOF | 199.989 *** | 199.938 *** | 198.798 *** | 199.997 *** | 199.982 *** | 199.986 *** | 199.977 ** | 199.024 *** | 200.000 *** | 199.988 *** |

| (1.486) | (10.210) | (1.512) | (1.462) | (15.296) | (11.954) | (79.923) | (2.019) | (22.408) | (1.447) | |

| α | 0.027 *** | 0.022 *** | 0.038 *** | 0.039 | 0.199 | 0.054 | 0.021 *** | 0.028 *** | 0.015 *** | 0.028 |

| (0.001) | (0.002) | (0.008) | (0.051) | (0.165) | (1.122) | (0.001) | (0.001) | (0.001) | (0.041) | |

| β | 0.972 *** | 0.977 *** | 0.958 *** | 0.957 *** | 0.675 ** | 0.934 | 0.978 *** | 0.971 *** | 0.984 *** | 0.970 *** |

| (0.001) | (0.002) | (0.009) | (0.083) | (0.280) | (1.062) | (0.001) | (0.001) | (0.001) | (0.048) | |

| Log(L) | 1145.849 | 1155.166 | 996.643 | 988.382 | 975.807 | 1185.507 | 891.787 | 1107.444 | 1165.992 | 996.152 |

| AIC | −2285.698 | −2304.331 | −1987.285 | −1970.764 | −1945.614 | −2365.014 | −1777.574 | −2208.888 | −2325.984 | −1986.303 |

| CSIE | CSIMA | CSII | CSIO | CSIC | CSIME | CSIF | CSIIN | CSIT | CSIPU | |

|---|---|---|---|---|---|---|---|---|---|---|

| Static Student-t-Copula parameters | ||||||||||

| ρ | 0.109 *** | 0.088 *** | 0.095 *** | 0.088 *** | 0.068 *** | 0.070 *** | 0.091 *** | 0.070 *** | 0.069 *** | 0.086 *** |

| (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | |

| DOF | 16.206 *** | 13.913 *** | 15.158 *** | 13.897 *** | 18.810 ** | 14.953 *** | 13.484 *** | 16.204 *** | 18.313 ** | 16.728 *** |

| (5.011) | (3.561) | (4.071) | (3.948) | (7.551) | (3.840) | (3.307) | (5.086) | (7.664) | (4.953) | |

| Log(L) | 33.231 | 26.078 | 26.340 | 25.883 | 16.702 | 19.583 | 27.360 | 18.688 | 17.279 | 22.340 |

| AIC | −64.461 | −50.157 | −50.680 | −49.767 | −31.404 | −37.167 | −52.720 | −35.377 | −32.558 | −42.680 |

| DCC-Student-t-Copula parameters | ||||||||||

| ρ | 0.120 *** | 0.097 *** | 0.103 *** | 0.099 *** | 0.083 *** | 0.085 *** | 0.097 *** | 0.084 *** | 0.086 *** | 0.096 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| DOF | 18.565 *** | 15.936 *** | 16.083 *** | 14.798 *** | 20.405 ** | 15.439 *** | 14.618 *** | 17.919 *** | 19.344 ** | 16.948 *** |

| (6.072) | (4.974) | (4.273) | (4.220) | (9.110) | (4.170) | (3.674) | (6.067) | (6.995) | (5.569) | |

| α | 0.006 | 0.007* | 0.015 ** | 0.015 *** | 0.010 * | 0.010* | 0.005 * | 0.014 ** | 0.036 ** | 0.017 ** |

| (0.004) | (0.004) | (0.006) | (0.006) | (0.006) | (0.006) | (0.003) | (0.006) | (0.017) | (0.008) | |

| β | 0.990 *** | 0.989 *** | 0.954 *** | 0.939 *** | 0.950 *** | 0.941 *** | 0.990 *** | 0.946 *** | 0.000 | 0.938 *** |

| (0.011) | (0.009) | (0.025) | (0.024) | (0.034) | (0.037) | (0.009) | (0.024) | (0.320) | (0.032) | |

| Log(L) | 39.853 | 35.827 | 33.699 | 30.524 | 19.354 | 21.811 | 34.079 | 23.481 | 19.861 | 28.169 |

| AIC | −73.705 | −65.655 | −61.398 | −55.048 | −32.709 | −37.623 | −62.158 | −40.961 | −33.722 | −50.337 |

References

- Kolodziej, M.; Kaufmann, R.K.; Kulatilaka, N.; Bicchetti, D.; Maystre, N. Crude oil: Commodity or financial asset? Energy Econ. 2014, 46, 216–223. [Google Scholar] [CrossRef]

- Antolin-Lopez, R.; Martinez-del-Rio, J.; Cespedes-Lorente, J. Environmental entrepreneurship as a multi-component and dynamic construct: Duality of goals, environmental agency, and environmental value creation. Bus. Ethics 2019, 28, 407–422. [Google Scholar] [CrossRef]

- Lee, B.J.; Yang, C.W.; Huang, B.N. Oil price movements and stock markets revisited: A case of sector stock price indexes in the G7 countries. Energy Econ. 2012, 34, 1284–1300. [Google Scholar] [CrossRef]

- Ahmed, K.; Bhutto, N.A.; Kalhoro, M.R. Decomposing the links between oil price shocks and macroeconomic indicators: Evidence from SAARC region. Resour. Policy 2019, 61, 423–432. [Google Scholar] [CrossRef]

- Azimli, A. The oil price risk and global stock returns. Energy 2020, 198, 1–9. [Google Scholar] [CrossRef]

- Fang, S.; Egan, P. Measuring contagion effects between crude oil and Chinese stock market sectors. Q. Rec. Econ. Financ. 2018, 68, 31–38. [Google Scholar] [CrossRef] [Green Version]

- Yu, W.; Qin, S.K.; Li, X.F.; Zhu, S.; Wei, G.W. Oil price fluctuation, stock market and macroeconomic fundamentals: Evidence from China before and after the financial crisis. Financ. Res. Lett. 2019, 30, 23–29. [Google Scholar]

- Gu, F.; Wang, J.Q.; Guo, J.F.; Fan, Y. Dynamic linkages between international oil price, plastic stock index and recycle plastic markets in China. Int. Rev. Econ. Financ. 2020, 68, 167–179. [Google Scholar] [CrossRef]

- Sakellaris, P. Irreversible capital and the stock market response to shocks in profitability. Int. Econ. Rev. 1997, 21, 351–379. [Google Scholar] [CrossRef]

- Wei, C. Energy, the stock market, and the putty-clay investment model. Am. Econ. Rev. 2003, 93, 311–323. [Google Scholar] [CrossRef] [Green Version]

- Antonakakis, N.; Chatziantoniou, I.; Fills, G. Oil shocks and stock markets: Dynamic connectedness under the prism of recent geopolitical and economic unrest. Int. Rev. Financ. Anal. 2017, 50, 1–26. [Google Scholar] [CrossRef] [Green Version]

- Olarte, J.; Gisbert-Trejo, N.; Ferret-Poza, R.; Zulueta, E. Energy storage: Keys for Europe in the coming years. DYNA 2019, 94, 592–597. [Google Scholar] [CrossRef]

- Hoque, M.E.; Zaidi, M.A. The impacts of global economic policy uncertainty on stock market returns in regime switching environment: Evidence from sectoral perspectives. Int. J. Financ. Econ. 2019, 24, 991–1016. [Google Scholar]

- Jesus, D.P.; Bezerra, B.F.; Besarria, C.N. The non-linear relationship between oil prices and stock prices: Evidence from oil-importing and oil-exporting countries. Res. Int. Bus. Financ. 2020, 54, 1–14. [Google Scholar] [CrossRef]

- Huang, R.D.; Masulis, R.W.; Stoll, H.R. Energy shocks and financial markets. J. Futures Mark. 1996, 16, 1–27. [Google Scholar] [CrossRef]

- Jones, C.M.; Kaul, G. Oil and the Stock Markets. J. Financ. 1996, 51, 463–491. [Google Scholar] [CrossRef]

- Park, J.; Ratti, R.A. Oil price shocks and stock markets in the U.S. and 13 European countries. Energy Econ. 2008, 30, 2587–2608. [Google Scholar] [CrossRef]

- Samanta, N. Transplantation of Anglo-American corporate governance and its impact on financial market growth: A comparative analysis of nineteen developing countries 1995–2014. Corp. Gov. Int. J. Bus. Soc. 2019, 19, 884–922. [Google Scholar] [CrossRef]

- Shahrestani, P.; Rafei, M. The impact of oil price shocks on tehran stock exchange returns: Application of the Markov switching vector autoregressive models. Resour. Policy 2020, 65, 15–24. [Google Scholar] [CrossRef]

- Jamali, D.; Barkemeyer, R.; Leigh, J.; Samara, G. Open access, open science, and coronavirus: Mega trends with historical proportions. Bus. Ethics 2020, 29, 419–421. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef] [Green Version]

- Kang, W.; Ratti, R.A. Oil shocks, policy uncertainty and stock market return. J. Int. Financ. Mark. Inst. Money 2013, 26, 305–318. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Filis, G. Oil price shocks and stock market returns: New evidence from the United States and China. J. Int. Financ. Mark. Inst. Money 2014, 33, 417–433. [Google Scholar] [CrossRef] [Green Version]

- Ready, R.C. Oil prices and the stock market. Rev. Financ. 2018, 22, 155–176. [Google Scholar] [CrossRef]

- Aloui, R.; Aissa, M.S.B.; Nguyen, D.K. Conditional dependence structure between oil prices and exchange rates: A copula-GARCH approach. J. Int. Money Financ. 2013, 32, 719–738. [Google Scholar] [CrossRef]

- Jia, X.; An, H.; Fang, W.; Sun, X.; Huang, X. How do correlations of crude oil prices co-move? A grey correlation-based wavelet perspective. Energy Econ. 2016, 49, 588–598. [Google Scholar] [CrossRef]

- Huang, S.; An, H.; Gao, X.; Sun, X. Do oil price asymmetric effects on the stock market persist in multiple time horizons? Appl. Energy 2017, 25, 18–32. [Google Scholar] [CrossRef]

- Sarwar, S.; Tiwari, A.K.; Cao, T.Q. Analyzing volatility spillovers between oil market and Asian stock markets. Resour. Policy 2020, 66, 1–12. [Google Scholar] [CrossRef]

- Yahya, M.; Oglend, A.; Dahl, R.E. Temporal and spectral dependence between crude oil and agricultural commodities: A wavelet-based copula approach. Energy Econ. 2019, 80, 277–296. [Google Scholar] [CrossRef]

- Feng, Y.; Xu, D.; Failler, P.; Li, T. Research on the Time-Varying Impact of Economic Policy Uncertainty on Crude Oil Price Fluctuation. Sustainability 2020, 12, 6523. [Google Scholar] [CrossRef]

- Torrence, C.; Compo, G.P. A practical guide to wavelet analysis. Bull. Am. Meteorol. Soc. 1998, 79, 61–78. [Google Scholar] [CrossRef] [Green Version]

- Yang, L.; Cai, X.J.; Hamori, S. Does the crude oil price influence the exchange rates of oil-importing and oil-exporting countries differently? A wavelet coherence analysis. Int. Rev. Econ. Financ. 2017, 49, 536–547. [Google Scholar] [CrossRef]

- Nelson, D.B. Conditional heteroskedasticity in asset returns: A new approach. Econometrica 1991, 59, 347–370. [Google Scholar] [CrossRef]

- Bekiros, S.D.; Nguyen, D.K.; Junior, L.S.; Uddin, G.S. Information diffusion, cluster formation and entropy-based network dynamics in equity and commodity markets. Eur. J. Oper. Res. 2017, 256, 945–961. [Google Scholar] [CrossRef] [Green Version]

- Berger, T.; Uddin, G.S. On the dynamic dependence between equity markets, commodity futures and economic uncertainty indexes. Energy Econ. 2016, 56, 374–383. [Google Scholar] [CrossRef]

- Daubechies, I. Ten Lectures on Wavelets; Society for Industrial and Applied Mathematics: Philadelphia, PA, USA, 1992; pp. 115–140. [Google Scholar]

- Orazalin, N.; Mahmood, M. The financial crisis as a wake-up call: Corporate governance and bank performance in an emerging economy. Corp. Gov. 2019, 19, 80–101. [Google Scholar] [CrossRef]

- Simpson, S.N.; Aprim, F. Do corporate social responsibility practices of firms attract prospective employees? Perception of university students from a developing country. Int. J. Corp. Soc. Res. 2018, 3, 1–11. [Google Scholar] [CrossRef] [Green Version]

- Korotin, V.; Dolgonosov, M.; Popov, V.; Korotina, O.; Korolkova, I. The Ukrainian crisis, economic sanctions, oil shock and commodity currency: Analysis based on EMD approach. Res. Int. Bus. Financ. 2019, 48, 156–168. [Google Scholar] [CrossRef]

- Bosnjakovic, M.; Tadijanovic, V. Environment impact of a concentrated solar power plant. Tehnički Glasnik 2019, 13, 68–74. [Google Scholar] [CrossRef] [Green Version]

- Lv, X.; Lien, D.; Yu, C. Who affects who? Oil price against the stock return of oil-related companies: Evidence from the U.S. and China. Int. Rev. Econ. Financ. 2020, 67, 85–100. [Google Scholar] [CrossRef]

- Strotmann, H.; Volkert, J.; Schmidt, M. Multinational companies: Can they foster well-being in the eyes of the poor? Results from an empirical case study. Int. J. Corp. Soc. Res. 2019, 4, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Sorli-Pena, M.; Parra-Gomez, A. China in context: Current situation, strategies and uncertainties. Dyna 2020, 95, 233–236. [Google Scholar]

- Aksu, U.; Halicioglu, R. A review study on energy harvesting systems for vehicles. Tehnički Glasnik Tech. J. 2018, 12, 251–259. [Google Scholar] [CrossRef] [Green Version]

- Zhang, X.; Zhao, Y.; Qi, R.; Usman, M. The impact of bank competition on stock price crash risk: Evidence from the Chinese market. Transform. Bus. Econ. 2019, 18, 900–920. [Google Scholar]

- Arendas, P.; Tkacova, D.; Bukoven, J. Seasonal patterns in oil prices and their implications for investors. J. Int. Stud. 2018, 11, 180–192. [Google Scholar] [CrossRef] [PubMed]

- Loganathan, N.; Streimikiene, D.; Mursitama, T.N.; Shahbaz, M.; Mardani, A. How real oil prices and domestic financial instabilities are good for GCC countries tourism demand in Malaysia? Econ. Sociol. 2018, 11, 112–125. [Google Scholar] [CrossRef]

- Lu, J.T.; Ren, L.C.; Yao, S.Q.; Rong, D.; Skare, M.; Streimikis, J. Renewable energy barriers and coping strategies: Evidence from the Baltic States. Sustain. Dev. 2020, 28, 352–367. [Google Scholar] [CrossRef]

- Lu, J.T.; Ren, L.C.; Yao, S.Q.; Qiao, J.Y.; Mikalauskiene, A.; Streimikis, J. Exploring the relationship between corporate social responsibility and firm competitiveness. Econ. Res. Ekon Istraz 2020, 33, 1621–1646. [Google Scholar] [CrossRef]

| Name | Mean (%) | SD (%) | Median (%) | Max | Min | Skewness | Kurtosis |

| Brent | 0.006 | 2.531 | 0.028 | 0.247 | −0.245 | 0.033 | 17.552 |

| SSEC | 0.023 | 1.663 | 0.075 | 0.090 | −0.128 | −0.591 | 8.188 |

| CSIE | 0.011 | 2.052 | 0.043 | 0.113 | −0.131 | −0.294 | 6.356 |

| CSIMA | 0.025 | 2.043 | 0.129 | 0.087 | −0.130 | −0.660 | 6.219 |

| CSII | 0.027 | 1.929 | 0.105 | 0.095 | −0.130 | −0.679 | 7.089 |

| CSIO | 0.044 | 1.927 | 0.120 | 0.106 | −0.125 | −0.681 | 6.745 |

| CSIC | 0.081 | 1.845 | 0.123 | 0.089 | −0.098 | −0.395 | 6.111 |

| CSIME | 0.069 | 1.913 | 0.118 | 0.112 | −0.128 | −0.541 | 6.618 |

| CSIF | 0.049 | 1.968 | 0.020 | 0.097 | −0.144 | −0.272 | 7.188 |

| CSIIN | 0.044 | 2.263 | 0.191 | 0.095 | −0.118 | −0.643 | 5.331 |

| CSIT | 0.045 | 2.216 | 0.131 | 0.095 | −0.127 | −0.481 | 6.015 |

| CSIPU | 0.016 | 1.735 | 0.055 | 0.083 | −0.132 | −0.765 | 8.069 |

| Name | Observations | Jarque–Bera | Q(20) | Q2(20) | ARCH(20) | ADF Test | PP Test |

| Brent | 3595 | 31,721.501 *** | 155.634 *** | 3960.360 *** | 891.862 *** | −9.775 *** | −56.634 *** |

| SSEC | 3595 | 4240.923 *** | 41.016 *** | 1073.372 *** | 356.440 *** | −22.078 *** | −60.157 *** |

| CSIE | 3595 | 1738.687 *** | 39.405 *** | 1014.757 *** | 328.398 *** | −21.881 *** | −58.712 *** |

| CSIMA | 3595 | 1812.970 *** | 39.263 *** | 1364.110 *** | 411.244 *** | −27.221 *** | −57.786 *** |

| CSII | 3595 | 2780.631 *** | 35.422 *** | 1722.179 *** | 476.589 *** | −25.627 *** | −57.599 *** |

| CSIO | 3595 | 2379.025 *** | 30.749 *** | 1357.891 *** | 410.318 *** | −28.177 *** | −58.147 *** |

| CSIC | 3595 | 1543.140 *** | 37.178 *** | 1291.039 *** | 403.570 *** | −26.933 *** | −57.792 *** |

| CSIME | 3595 | 2135.775 *** | 49.503 *** | 1374.190 *** | 407.636 *** | −12.462 *** | −57.487 *** |

| CSIF | 3595 | 2671.719 *** | 55.475 *** | 1223.606 *** | 392.147 *** | −23.146 *** | −60.844 *** |

| CSIIN | 3595 | 1061.952 *** | 19.713 *** | 1375.198 *** | 408.505 *** | −33.114 *** | −57.861 *** |

| CSIT | 3595 | 1499.983 *** | 27.423 *** | 1430.055 *** | 448.300 *** | −28.560 *** | −59.501 *** |

| CSIPU | 3595 | 4199.110 *** | 41.764 *** | 2258.069 *** | 562.643 *** | −26.553 *** | −58.378 *** |

| Original Returns Series | Scale 1 (2–4 days) | Scale 2 (4–8 days) | |||||||

| Pearson | Kendall | Spearman | Pearson | Kendall | Spearman | Pearson | Kendall | Spearman | |

| SSEC | 12.58 | 7.41 | 10.86 | 8.04 | 4.73 | 7.00 | 16.17 | 8.72 | 12.90 |

| CSIE | 14.79 | 8.74 | 12.91 | 6.96 | 4.08 | 6.03 | 18.92 | 11.92 | 17.55 |

| CSIMA | 12.29 | 6.90 | 10.17 | 7.12 | 4.13 | 6.12 | 15.68 | 8.79 | 13.04 |

| CSII | 10.96 | 6.00 | 8.85 | 7.98 | 4.65 | 6.89 | 12.76 | 6.46 | 9.58 |

| CSIO | 10.75 | 4.84 | 7.17 | 7.76 | 3.72 | 5.52 | 12.08 | 6.04 | 8.95 |

| CSIC | 10.11 | 4.81 | 7.14 | 9.31 | 5.36 | 7.92 | 9.27 | 4.25 | 6.33 |

| CSIME | 8.20 | 3.85 | 5.71 | 7.37 | 4.76 | 7.06 | 7.61 | 2.91 | 4.31 |

| CSIF | 9.89 | 5.66 | 8.31 | 6.11 | 3.47 | 5.14 | 14.08 | 7.93 | 11.75 |

| CSIIN | 10.98 | 4.99 | 7.37 | 7.32 | 3.81 | 5.59 | 12.41 | 5.60 | 8.28 |

| CSIT | 11.22 | 5.04 | 7.48 | 6.57 | 3.37 | 4.99 | 13.80 | 6.04 | 8.92 |

| CSIPU | 8.82 | 5.26 | 7.77 | 6.70 | 4.31 | 6.42 | 10.33 | 5.54 | 8.23 |

| Scale 3 (8–16 days) | Scale 4 (16–32 days) | Scale 5 (32–64 days) | |||||||

| Pearson | Kendall | Spearman | Pearson | Kendall | Spearman | Pearson | Kendall | Spearman | |

| SSEC | 16.67 | 10.38 | 15.16 | 23.69 | 16.03 | 23.47 | 13.14 | 10.52 | 15.28 |

| CSIE | 25.50 | 16.63 | 24.38 | 29.40 | 18.59 | 27.32 | 15.82 | 15.57 | 22.86 |

| CSIMA | 15.63 | 10.49 | 15.50 | 26.24 | 18.65 | 27.40 | 14.72 | 12.17 | 17.85 |

| CSII | 12.95 | 9.06 | 13.35 | 19.81 | 14.60 | 21.40 | 14.49 | 11.01 | 16.22 |

| CSIO | 11.37 | 8.12 | 12.00 | 18.69 | 12.77 | 18.67 | 14.16 | 9.26 | 13.54 |

| CSIC | 8.47 | 5.38 | 8.01 | 20.45 | 11.75 | 17.33 | 11.21 | 8.76 | 12.90 |

| CSIME | 8.55 | 5.62 | 8.38 | 14.79 | 10.47 | 15.35 | 8.75 | 6.95 | 10.24 |

| CSIF | 11.71 | 7.35 | 10.79 | 16.77 | 11.17 | 16.44 | 13.09 | 10.72 | 15.89 |

| CSIIN | 12.65 | 8.10 | 12.00 | 21.60 | 14.08 | 20.65 | 19.11 | 12.06 | 17.59 |

| CSIT | 18.35 | 10.37 | 15.34 | 24.98 | 14.24 | 21.10 | 11.35 | 6.77 | 10.12 |

| CSIPU | 13.12 | 9.88 | 14.57 | 14.37 | 10.85 | 16.02 | 7.96 | 5.99 | 8.99 |

| Scale 6 (64–128 days) | Scale 7 (128–256 days) | Scale 8 (258–512 days) | |||||||

| Pearson | Kendall | Spearman | Pearson | Kendall | Spearman | Pearson | Kendall | Spearman | |

| SSEC | 11.17 | 9.18 | 13.52 | 38.39 | 28.28 | 41.51 | 22.34 | 15.11 | 21.47 |

| CSIE | 11.79 | 11.95 | 17.79 | 48.46 | 32.32 | 46.85 | 38.24 | 20.65 | 29.68 |

| CSIMA | 8.83 | 6.97 | 10.34 | 37.62 | 28.15 | 41.04 | 28.09 | 16.39 | 23.91 |

| CSII | 6.60 | 4.99 | 7.42 | 32.05 | 25.10 | 36.80 | 16.40 | 11.82 | 16.89 |

| CSIO | 16.23 | 6.43 | 9.56 | 37.71 | 26.20 | 38.27 | 25.93 | 17.21 | 24.65 |

| CSIC | 0.88 | 0.21 | 0.57 | 31.56 | 21.13 | 30.97 | 42.03 | 30.41 | 43.49 |

| CSIME | −3.16 | 0.91 | 1.45 | 24.56 | 15.56 | 23.02 | 19.91 | 16.59 | 22.51 |

| CSIF | 11.14 | 10.23 | 15.31 | 22.89 | 15.83 | 23.49 | 20.09 | 10.69 | 16.37 |

| CSIIN | 16.29 | 6.95 | 10.29 | 26.23 | 19.70 | 28.59 | 15.37 | 8.91 | 12.29 |

| CSIT | 5.51 | 3.06 | 4.75 | 17.91 | 13.23 | 19.27 | 20.86 | 10.59 | 15.53 |

| CSIPU | −1.08 | 1.83 | 2.47 | 23.49 | 15.79 | 23.52 | 8.58 | 8.24 | 11.96 |

| Brent | CSIE | CSIMA | CSII | CSIO | CSIC | CSIME | CSIF | CSIIN | CSIT | CSIPU | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean equation estimates | |||||||||||

| Const. (%) | 0.013 | 0.020 | 0.057 ** | 0.051 ** | 0.052 ** | 0.021 | 0.017 | −0.020 | 0.058 ** | 0.065 ** | 0.007 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.006) | |

| AR(1) | 0.021 | −0.002 | 0.028 * | 0.027 * | 0.013 | 0.028 * | 0.044 *** | −0.029 * | 0.019 | −0.010 | −0.006 |

| (0.016) | (0.016) | (0.016) | (0.016) | (0.016) | (0.017) | (0.017) | (0.016) | (0.017) | (0.016) | (0.016) | |

| GARCH process estimates | |||||||||||

| Const. (Ω) | −0.036 ** | −0.042 ** | −0.072 *** | −0.071 *** | −0.079 *** | −0.123 *** | −0.060 *** | −0.031 ** | −0.067 *** | −0.070 *** | −0.042 ** |

| (0.015) | (0.017) | (0.023) | (0.022 | (0.024) | (0.033) | (0.020) | (0.015) | (0.023) | (0.024) | (0.016) | |

| GARCH (β) | 0.995 *** | 0.995 *** | 0.991 *** | 0.991 *** | 0.990 *** | 0.985 *** | 0.993 *** | 0.996 *** | 0.991 *** | 0.991 *** | 0.995 *** |

| (0.002) | (0.002) | (0.003) | (0.003) | (0.003) | (0.004) | (0.002) | (0.002) | (0.003) | (0.003) | (0.002) | |

| ARCH (α) | 0.095 *** | 0.118 *** | 0.141 *** | 0.143 *** | 0.154 *** | 0.167 *** | 0.145 *** | 0.117 *** | 0.140 *** | 0.146 *** | 0.141 *** |

| (0.012) | (0.014) | (0.016) | (0.016) | (0.017) | (0.018) | (0.016) | (0.014) | (0.016) | (0.016) | (0.015) | |

| Leverage (θ) | −0.049 *** | 0.015 * | −0.003 | −0.007 | −0.007 | −0.005 | 0.003 | 0.004 | −0.003 | 0.009 | 0.012 |

| (0.007) | (0.008) | (0.008) | (0.009) | (0.009) | (0.010) | (0.009) | (0.008) | (0.009) | (0.009) | (0.009) | |

| DOF | 5.791 *** | 4.711 *** | 5.142 *** | 5.156 *** | 5.647 *** | 6.332 *** | 7.229 *** | 4.437 *** | 6.863 *** | 5.083 *** | 5.357 *** |

| (0.543) | (0.435) | (0.520) | (0.449) | (0.540) | (0.695) | (0.814) | (0.388) | 0.743 | (0.485) | (0.451) | |

| Log(L) | 9011.780 | 9434.185 | 9418.582 | 9739.258 | 9690.367 | 9718.485 | 9703.576 | 9696.404 | 8958.648 | 9090.397 | 9011.780 |

| AIC | −18,009.561 | −18,854.371 | −18,823.164 | −19,464.516 | −19,366.734 | −19,422.971 | −19,393.152 | −19,378.808 | −17,903.297 | −18,166.794 | −18,009.561 |

| BIC | −17,966.250 | −18,811.060 | −18,779.853 | −19,421.205 | −19,323.423 | −19,379.660 | −19,349.841 | −19,335.497 | −17,859.986 | −18,123.483 | −17,966.250 |

| Q(15) | 19.438 | 28.676 | 36.803 | 36.252 | 25.416 | 22.204 | 25.990 | 36.290 | 12.952 | 23.010 | 19.438 |

| Q2(15) | 17.508 | 10.457 | 14.822 | 12.981 | 13.416 | 17.245 | 10.649 | 11.939 | 12.903 | 25.112 | 17.508 |

| ARCH(15) | 18.539 | 10.582 | 14.849 | 12.917 | 13.046 | 17.879 | 10.661 | 12.605 | 12.845 | 25.044 | 18.539 |

| CSIE | CSIMA | CSII | CSIO | CSIC | CSIME | CSIF | CSIIN | CSIT | CSIPU | |

|---|---|---|---|---|---|---|---|---|---|---|

| Static Student-t-Copula parameters | ||||||||||

| ρ | 0.132 *** | 0.109 *** | 0.093 *** | 0.073 *** | 0.073 *** | 0.057 *** | 0.086 *** | 0.076 *** | 0.071 *** | 0.082 *** |

| (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | (−0.018) | (−0.017) | (−0.017) | (−0.017) | (−0.017) | |

| DOF | 13.657 *** | 14.737 *** | 14.982 *** | 13.910 *** | 19.167 ** | 12.018 *** | 11.303 *** | 15.547 *** | 12.100 *** | 15.068 |

| (3.480) | (4.081) | (4.169) | (3.993) | (7.434) | (2.899) | (2.474) | (4.655) | (2.930) | (4.234) | |

| Log(L) | 45.573 | 32.765 | 25.057 | 21.801 | 16.896 | 18.842 | 28.616 | 19.190 | 23.106 | 22.167 |

| AIC | −89.147 | −63.530 | −48.114 | −41.602 | −31.793 | −35.684 | −55.232 | −36.379 | −44.211 | −42.333 |

| DCC-Student-t-Copula parameters | ||||||||||

| ρ | 0.142 *** | 0.113 *** | 0.098 *** | 0.089 *** | 0.083 *** | 0.069 *** | 0.093 *** | 0.083 *** | 0.087 *** | 0.089 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.000) | (0.000) | (0.001) | |

| DOF | 14.884 *** | 16.073 *** | 16.312 *** | 14.811 *** | 20.618 ** | 12.398 *** | 11.707 *** | 16.507 | 12.792 *** | 15.683 *** |

| (4.017) | (4.495) | (5.146) | (4.668) | (8.194) | (3.051) | (2.766) | (122.219) | (3.219) | (4.700) | |

| α | 0.023 | 0.006 * | 0.013 ** | 0.013 ** | 0.009 * | 0.009 * | 0.007 | 0.029 | 0.029 | 0.007 |

| (0.022) | (0.003) | (0.005) | (0.006) | (0.004) | (0.006) | (0.005) | (1.561) | (0.025) | (0.009) | |

| β | 0.922 *** | 0.990 *** | 0.964 *** | 0.951 *** | 0.964 *** | 0.955 *** | 0.988 *** | 0.000 | 0.017 | 0.987 *** |

| (0.118) | (0.007) | (0.021) | (0.024) | (0.021) | (0.032) | (0.013) | (50.261) | (0.454) | (0.027) | |

| Log(L) | 54.715 | 41.233 | 31.587 | 26.081 | 19.519 | 21.058 | 36.823 | 20.460 | 24.349 | 27.844 |

| AIC | −103.430 | −76.465 | −57.174 | −46.163 | −33.038 | −36.116 | −67.647 | −34.920 | −42.697 | −49.687 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, J.; Song, Q.; Streimikiene, D. Multi-Time Scale Spillover Effect of International Oil Price Fluctuation on China’s Stock Markets. Energies 2020, 13, 4641. https://doi.org/10.3390/en13184641

Zhu J, Song Q, Streimikiene D. Multi-Time Scale Spillover Effect of International Oil Price Fluctuation on China’s Stock Markets. Energies. 2020; 13(18):4641. https://doi.org/10.3390/en13184641

Chicago/Turabian StyleZhu, Jingran, Qinghua Song, and Dalia Streimikiene. 2020. "Multi-Time Scale Spillover Effect of International Oil Price Fluctuation on China’s Stock Markets" Energies 13, no. 18: 4641. https://doi.org/10.3390/en13184641

APA StyleZhu, J., Song, Q., & Streimikiene, D. (2020). Multi-Time Scale Spillover Effect of International Oil Price Fluctuation on China’s Stock Markets. Energies, 13(18), 4641. https://doi.org/10.3390/en13184641