1. Introduction

The market is first of all a place where purchase and sale transactions are concluded, the market is a place where price trade-offs and trade transactions are settled [

1]. Determining the right price of electricity is a complex problem, as it concerns, inter alia, transfer of energy with transmission losses. Electricity markets around the world mainly use two models of the price settled: (a) zonal pricing and (b) nodal pricing. In the simplified zonal model, the costs are incurred jointly and severally by all, regardless of whether these costs are actually incurred. In European Union practice, a simplified transmission network is taken into account. In the nodal model, however, the energy costs depend on the place to which it is delivered. Each producer is paid by customers in accordance with the local price at the node where it is located [

2,

3]. The market is a place where demand meets supply [

4]. In the case of the electricity market, it is analogous, except that maintaining the supply and demand balance is much more important than on other markets, as electricity cannot be stored [

5]. Therefore, work on the energy storage option has a key role to play in the transition to a carbon neutral economy in the future due to, inter alia, the unpredictable and uneven production of energy from renewable sources [

6].

The main aim of the research which was realized on the energy market in the 21st century was to analyze the role that a well configured model (nodal model) plays in adapting to the new challenges and to analyze the passive consumers that will transform into active prosumers. The next aspect of the research was to indicate the direction in which the energy market should develop in order to meet the state of the art technical, ecological and social challenges.

We consider the electricity market from two points of view—energy sector entities and consumer position. The market is changing due to changes in the environment (legal, political, technological, ecological, social), which include the construction of a European single energy market and the willingness of consumers to participate in the market [

5,

7,

8]. It is also important to look for solutions to problems throughout the entire energy supply chain, such as energy demand management.

The energy market and system operation must be in constant balance. Any serious imbalance can affect the stability of the system, causing blackout and loss of access to electricity by a large group of recipients as was the case in the recent past during the California crisis in 2001 [

9], and the events of 2003 (a giant blackout on the US east coast and Canada [

10]) or in Italy, which dramatically highlighted the remaining instabilities in the still imperfectly constructed European transmission grid [

11,

12]. The electricity market should be flexible [

13,

14]. The flexibility of the power system means its ability to maintain continuous operation in conditions of rapid and large fluctuations in the generation and consumption of electricity.

The widespread and necessary use of electricity in the economic activity of individual countries and its widespread use in households make it a public good. Therefore, it is a commodity that should be provided to all consumers, which means that rationalization of the costs of its production and physical delivery is, for the economy of every country, a challenge to take strategic actions and translates into the proper creation of appropriate models of the electricity markets [

15,

16].

The electricity market is the whole of the processes taking place between final customers (end-users) and producers with the participation of network system operators and various types of intermediaries enabling the most favorable satisfaction of the electricity needs of customers with reasonable profits of the companies involved in supplies. A well-developed market model requires stimulation of relevant supply-side investments by market prices to be appropriate to finance both operational costs and the market fixed costs. However, it should be noted that generating appropriate price signals is becoming more and more difficult during the energy transformation phase, mainly shaped by the development of distributed renewable energy sources (RESs) [

17,

18,

19]. In the last decade, the energy market has experienced important changes toward deregulation and competition, including economics effectiveness [

8,

20]. Deregulation is understood as a change of direction and a departure from tightly regulated monopolies created under long-established and standing regulations (inter alia energy regulations, legal regulations, financial regulations) [

8,

21]. Over the past two decades, reforms and changes related to the deregulation of the electricity market have been common in the global economy [

22].

The electricity market may have a monopoly or competitive market structure. In many countries, the power industry is owned by private corporations, but there are countries where the power sector is owned by the state [

23,

24]. If the electricity sector operates in the form of a monopoly and is at the same time state-owned, then the efficiency of such a market model is lower, as the sector also performs social and political functions imposed by the state. Decisions related to the location of power plants, network development, purchase of equipment, and implementation of investments are quite often politically motivated. African markets are an example of low efficiency in the power sector. In many African countries, according to Fraune and Knodt, leaders very effectively present their achievements and in a rhetorical style convince public opinion about the achievements in the field of electrification of the country. If people see that these are just empty promises, they will want to take matters into their own hands instead of waiting for the government to provide them with electricity [

25].

From the point of view of management sciences, a systemic approach can be used, and the entire energy sector can be considered as one large system consisting of various subsystems. The subsystems can be defined as the mining and generation, transmission, distribution and retail subsystems [

5,

21]. In the electricity market, it is necessary to separate energy as a product from its supply or service. These two items should then be valued separately. Purchase of electricity by the buyer is inseparably connected with the necessity of its transmission from the producer (power plant) to the buyer. By buying electricity, the customer acquires

This situation is one of the basic features of the energy market, because the energy generated in the power plant is currently transmitted by at least two different companies and can be sold to customers by a third independent entity. Electricity and its transmission service are the basic elements on the energy market. In the energy market, which is considered as a product market, the basic conditions should be met—namely, equal rights of participants, free access to the market, and free shaping of the price of electricity.

3. Energy Market Model in the European Union

The European electricity system is currently undergoing major changes [

27,

28]. The European Union, in recent years, has made significant and noticeable progress in implementing its plans for the united internal electricity market [

29]. The shift to a low carbon and zero-emissions economy implies a growing importance for renewable energy in the energy system, pivotal meaning of energy efficiency, and taking further activities concerning the electrification of transport (e.g., electromobility) and other sectors [

18,

30]. Limiting the negative impact on the surrounding environment and society [

31] while adhering and maintaining the principles of sustainable development has influences the construction of new and innovation development strategies and new market model [

32]. The Energy Union Strategy [

33] aims to create an energy union that will provide all consumers in the European Union area—both households and businesses—with safe and secure (uninterrupted deliveries with the same parameters), sustainable, competitive, and inexpensive energy [

13]. Since 2015, the countries belonging to the European community have made a significant step toward creating a single, common European internal energy market, i.e., a European Energy Union [

34]. Electricity markets have undergone major changes in recent years, and especially in the last decade, around the world, inter alia, through the rapid increase in renewable energy production [

18,

35] and reduction of CO

2 and other greenhouse gas emissions. In some places, energy production based on wind, the sun, or water energy (i.e., from renewable sources) sometimes exceeds the total demand in electrical networks. Thus, the energy market has an obligation to organize in an impartial and non-discriminatory manner the exchange of data concerning basic information such demand of energy, supply of energy, and potential flexibility [

36]. For example, the planned energy transformation in Germany is to enable the generation of 100% of all energy from renewable sources [

37,

38]. By 2050, Germany will be a climate neutral country, i.e., with zero emissions [

39]. This transformation is to stimulate the development of renewable energy sources in Germany and to contribute to the reduction of CO

2 emissions in the transport and other sectors. In addition, in the energy sector of Germany, there is a plan to implement a node model and stimulate investment in cross-border transmission capacity. Poland has two synchronous connections with Germany, and the cooperation, despite political differences in terms of climate, renewable, and conventional energy, is correct at the level of energy trade. In 2019, energy imports from Germany amounted to 2.3 TWh [

40,

41] due to the lower price of energy generated in wind turbines in northern Germany. Some projects, called the “GerPol Power Bridge,” are realized in order to increase of grid transfer capability on the Polish–German border [

42].

The EU path to the common electricity market began more than 20 years ago. In 1996, together with the publication of the first energy package, conditions were introduced for the development of competition in distribution and trading segments. Later, the legal framework strengthening the idea of building a common energy market was clarified twice more—in 2003 and 2009, in the II and III energy packages. The idea of building a common energy future in the EU was additionally emphasized in the document entitled “Clean Energy for all Europeans” regulation package presented in November 2016, i.e., the winter package [

13]. In order to prevent system instability and rising energy costs for individual and business end users, changes to the current shape of the electricity market should be started.

Another drawback and one of the biggest obstacles to market efficiency is the inability to increase inter-zonal exchange capacity—stronger interconnections [

13]. EU plans assume that, in 2050, international inter-zone exchange will be able to send 50% of the electricity produced in the EU [

43]. Currently, only about 8% of such connections can be sent.

Figure 2 shows the synchronous network in Europe, which is a network connection between regions.

In

Figure 2, we can see five regional groups (RGs) in Europe with a synchronous grid. A synchronous wide area network also known as a synchronous zone is a power grid of a regional scale or larger, operating on a synchronized grid frequency and electrically connected in normal system conditions, the strongest is the continental Europe synchronous network (ENTSO-E—the European Network of Transmission System Operators for Electricity) with 667 gigawatts (GW) of generation [

45]. ENTSO-E is primarily meant to support optimal management and promote the reliable operation of the system on a European scale and to support development, in a sustainable manner, of the international electricity transmission system in EU. The organization is also responsible for ensuring security of supply and meeting the needs of the internal, unified electricity market [

45,

46].

Historically, the power systems in European and American countries very often functioned as a vertically integrated, state-owned monopoly operating large centralized nuclear power plants or power utilities using traditional fossil fuel. These energy utilities as well as domestic and international transmission networks were under control and “owned by monopolies” [

47]. All the elements of the international interconnection system were owned by monopolies. This meant that no one but the owners was authorized to access the network [

48]. This situation was unfavorable to consumers. The monopoly structure has many disadvantages, including lack of scientific and technological progress, lowering the quality of products, and setting prices at its own discretion [

49]. Therefore, the effect of the state monopoly may dictate the terms of sales, energy prices, the level of distribution fees, the transitional fee or renewable energy charges, and other premiums that may appear, e.g., for the development of electromobility. The most universal economic criterion determining the effectiveness of a given organizational structure of the energy market is the measure of social well-being. From the point of view of social sciences, but also economic sciences, the social harmfulness of a monopoly can be represented on a price-quantity chart. Loss of efficiency and social welfare is shown at the

Figure 3.

The loss of prosperity caused by the monopoly is illustrated in

Figure 3 and is compared to the optimal situation for consumers, i.e., in conditions of perfect competition. In perfect competition, the market price is p

PC, the production volume equals q

PC, the consumer surplus in monetary terms equals the sum of D + C’ + A fields, and the surplus of producers equals the sum of C + B fields. If this market is a monopoly, then consumers’ situation will change for the worse. The price will increase to p

M and the production volume will decrease to q

M. The consumer surplus will decrease to field D. Field C’ is taken over by the monopolist and is now the producer surplus. Field A, on the other hand, is part of the consumer’s surplus from perfect competition, which is lost, i.e., a loss of consumer welfare. Field B is a loss for producers. The sum of the A + B fields represents the loss of prosperity caused by market monopolization (deadweight loss). In order to make short term energy market more competitive the nodal model can be used. The nodal model of the market uses a single centralized auction to jointly clear short-term energy and transmission markets. The auctioneer selects the lowest cost bids that balance energy supply and demand in each node given the transmission constraints and the physical laws governing the network flows. The market clearing price in a node is equal to the marginal cost of supplying energy to that node [

50]. This type of clearing is the best solution for the end users and gives them the competitive price of energy [

51].

The weakening or elimination of the structure of state monopolists and the transition toward a competitive market took place very slowly, due to concerns of market participants about the credibility of new entities. In years gone by, electricity consumers were only passive market participants and often bought electricity at regulated prices that were not directly related to the market situation. In this situation, it can be said that “energy flows only in one direction,” and it is characterized by passivity of consumers, and the price elasticity of demand is very low. In the future, it should be possible for customers to have full market share under the same conditions as other market participants [

13], and customers should have the possibility to manage their own energy consumption. Energy management will be important for both retail customers and businesses [

52]. Many consumers may introduce flexibility in their households regarding energy and its use. This is especially true for users with inertial or delayed processes, independent on day/night-time period e.g., washing, cleaning, etc. [

53,

54]. These customers can postpone or delay periods when they will need high energy consumption for periods in which electricity will be low cost, without risking losses or disruptions to their operations or business. This approach in the energy sector is what we call demand response or demand-side management (DSM) [

55]: inter alia energy users shift their energy demand from the high-price period to the lower-price period of the day/night tariff in the frame of a constant optimization. It is obvious that not all consumers will be able to change their electricity consumption behavior. Thanks to growing consumer awareness and implementing technological, economic, organizational, and social innovations, the future of energy market is going in the active consumer (prosumer) direction, which is shown at

Figure 4.

As was shown in

Figure 4, producer-consumers (prosumers) can buy and sell electricity in what is called participation in the system in both directions. Prosumers can generate electricity either to meet their own needs only or generated surpluses to send to other users through transmission to the network. In the first case, we are dealing with off-grid prosumption, and in the second, on-grid prosumption [

36,

57,

58]. Energy users will no longer just be simple electricity consumers but prosumers who produce energy through, for instance, photovoltaic panels installed on the roof or around their houses and using innovative equipment such as energy storage devices (i.e., batteries) [

59]. To convert citizens into active consumers (prosumers), public authorities are responsible for creating the right, appropriate, and favorable regulatory and financial climate [

60]. The new paradigm will also allow market liberalization and price formation and energy transfer beyond one zone, which is indicated in

Figure 4 as decentralization and ignoring the boundaries. In order to integrate the systematically increasing share of energy from renewable sources, the future power system (market structure) should adapt to all possible sources of flexibility (many small power producers [

61]), especially solutions regarding energy demand and storage, and thanks to the implementation and integration of innovative technologies into the power system that also use digitization. Significant development of energy storage systems and the latest energy storage technologies currently available (including electrochemical technologies, chemical and hydrogen energy storage, battery, thermal, thermochemical, compressed air, flywheel, pumped, and magnetic storage) has the chance to change the status quo, enabling its storage from seconds to weeks or months [

59]. Electricity storage is the key to solving the problem of using renewable sources. As wind, water, and sun only generate electricity when weather conditions (changeable and unpredictable) permit, they must be integrated into an efficient energy storage system [

6,

62]. In this case of many different unforeseeable energy sources that are used, coordination and timing of energy supply and demand in a continuous manner in many complementary energy systems should be developed [

19]. Today, most of the energy infrastructure is not digitalized at all, as digitalization in the energy sector is still in its infancy [

63], so bringing new technologies and ideas into a tightly regulated sector is challenging for the energy sector. The digitization and automation of the elements belonging to the distribution network, as well as the quick and efficient integration of renewable distributed energy sources (DERs) with the grid, fundamentally changes the dynamics and requirements of the power sector. Due to the high volatility and uncertainty of energy production through DER, special attention is paid to the possibility of using flexible loads and smart meters to improve system reliability [

64]. New technologies in the range of digitalization will have on the future energy system. Digitalization will support an increasingly automated and digital energy sector [

8]. Big data, innovative machine learning, artificial intelligence processes, the Internet of Things, and distributed ledger technology (DLT) are now known in the scientific community as blockchain [

65,

66]. Distributed ledgers are relatively new, and not without significant challenges. As more and more attention is paid in the energy industry to researching more diffuse models, including peer-to-peer trading, microgrids, and local demand response, DLT can play a key role as a driver of interactions without the need to involve a central authority [

51,

67].

4. Zonal Model

European energy policy is based on three foundations—zonal market architecture, guaranteeing security of supply along with Europe’s global competitiveness, and climate policy [

60,

68]. The zone model is the primary mechanism that was introduced to deal with congestion. Due to many initial assumptions, this model is a very far-reaching simplification in relation to the real situation in the nodal market, which is the result of the laws of physics in force in nature. Market transactions for the purchase and sale of energy are made by market players who are parties to the transaction, bypassing the restrictions of the transmission network, which is frequently related to the technical impracticability of this kind of operations and the need for corrective actions by the transmission system operator (TSO). However, this model is more often politically accepted as a mechanism for equal treatment of energy trade participants. The legal approach to structure of zones in the EU reflects the political decision of a zonal rather than a nodal market model [

69]. Hence, most European countries use the market zonal model. Unification of the EU energy market is a huge undertaking now associating 28 countries and, thus, more than 500 million electricity consumers. The EU energy market is divided into large price areas (zones) and is based on the assumption that trade opportunities in these zones are almost limitless—the only limitation is transmission capacity [

70]. With regard to the European market model, the following three features can be identified:

(1) The market model is characterized by zones, which means that the energy system in Europe is integrated and can be treated as part of the process of a close economic bond in which national markets connect into one united pan-European market. The instrument intended to integrate energy systems is the zonal market model, and the regulations are valid in Europe. Those elements are used to create one, common for all Europeans zonal power market [

69,

71,

72]. The concept of the zonal model has also been used in many regions of the world. In the zonal model of the electricity market, it is characteristic that the entire electricity market is divided into zones for which a uniform price of electricity applies. Usually, a zone is defined as a large area within one country or (in the most common approach) the zone means the whole country. Usually, the division criterion is the occurrence of congestion on the border lines. It is assumed that there are no transmission restrictions within the zone. Price differentiation between zones will appear when the above-mentioned restrictions on long-distance connections occur. Therefore, this model is based on price zones or market areas in which the same price exists, operating on the assuming no loss or any limitations in transmission capacity and commercial possibilities within each price zone: the assumption of a “copper plate” [

73]. “Copper plate” is a concept that assumes that energy can be sent anywhere from one place to another without any restrictions [

74]. Despite the fact that in real conditions this copper plate does not exist, the adopted assumptions and the entire structure of the electricity sector market are consciously based on a kind of illusion that this is how the market can function. In fact, there are limitations of the transmission network and production as well as transmission to the final recipient in one place costs more expensive in another cheaper. The principle of the copper plate does not take into account the losses of energy transmission. The loss ratio (index) according to the laws of physics should be calculated based on the following basic formula:

ΔE—losses and balance differences in the network at a given voltage level,

EI—electricity fed into the network at a given voltage level.

The “copper plate” principle, therefore, discourages investments in “difficult” (costly) areas, thus providing a wide spectrum of problems to the transmission system operator (the TSO must ensure the supply of energy to all locations and assume additional costs). The actual delimitation of zones in Europe, however, was carried out taking into account primarily the existing administrative boundaries (with a few exceptions, it overlaps with national borders), not the analysis of transmission capacities within them. Individual zones are connected by interconnectors, which—having certain transmission capacities—should determine the scale of transactions between them. The concept of the zonal market has been supplemented in European regulations by a mechanism of possible dynamic revision of zones (i.e., the possibility of easily changing zone borders), which, however, is in practice difficult or impossible to achieve for political reasons.

(2) The market is a single commodity market—possibly supplemented in the short term by capacity mechanisms supporting generation sufficiency [

45,

75]. Unlike the two-commodity market model, on the single-commodity market, only energy is sold and bought in the form of products defined by quantity and time and zone of delivery [

76]. Consumers pay for megawatt hours of energy. In addition, the TSO of a given area provides system services for the continuity, stability and quality of work in this area of the power system [

13]. The wholesale price is set at the level of the price offered by the last (most expensive) included producer in accordance with the merit order. As a result, prices are at the level of the short-term variable cost of the latter generating unit, i.e., the current operating cost of such units. In EU regulations, capacity mechanisms, such as the strategic reserve or capacity market, intended to secure generation in the medium term, remain in the short-term complement to the single-goods market. The admission of these mechanisms, however, is accompanied by the assumption that they are a form of state aid and that is why they can only be of a temporary nature.

(3) The market is intended to support pan-European integration of the sector, and therefore, long-distance exchanges gain regulatory preferences relative to intra-zone exchanges. For some time now, European regulations, and in particular the Clean Energy for All Europeans Package (CEP) [

13], have seen a growing emphasis on supporting between zone exchange, even at the expense of inter-zone exchange. This is to be a tool for deepening the integration of transnational markets. However, it seems to be used at the expense of security of supply for the European consumer. This means that when calculating the transmission capacity, assumptions would be made that do not take into account actual technological conditions and system operation restrictions. Theoretically, this contributes to price convergence and more efficient use of generating units in Europe. In reality, however, price signals generated in such conditions have little to do with the system requirements. What is more, this type of simplification also required remedial action, which contributed to the emergence of a large-scale cross-border re-dispatching market, differently organized and with different price levels than the wholesale market. The inter-operator exchange of energy between operators of neighboring systems is implemented as a remedy correcting physical flows resulting from the trade exchange of market participants. The purpose of inter-operator exchange is to ensure the working conditions of power networks, individually and as interconnected systems that meet the security criteria. Thus, it is an action focused on ensuring security of energy supply to consumers. Some researchers believe that market reforms can induce very significant cost savings to the benefit of final consumers (end-users) of electricity [

77].

5. Disadvantages of the Zonal Model

Currently, the zonal market model, widespread in the EU, does not take into account the limitations of the transmission network and ignores the huge complexity of the network, and the transactions do not take into consideration the limitations of the network. As a result, it is the network operators that have to carry out very expensive activities, such as re-dispatching to ensure the proper operation of the network, and the scale of these interventions is systematically growing. Cross-border re-dispatching is an action agreed between operators and accepted by Regulators necessary to restore the required level of network security [

69]. Cross-border re-dispatching can contribute to large jumps in energy prices. Such a situation may e.g., occur in periods of uneven operation of renewable energy sources in a neighboring country with which trade is carried out. The operators of these countries agree, for example, to increase energy production in one country and reduce in their neighbors. Ordering the operator of one country to increase production capacity may require, for example, the launch of a more expensive block, and the resulting costs are divided between operators in both countries, which is the reason for a temporary increase in energy prices on the balancing market.

Cross-border re-dispatching, as an action necessary to ensure network security, has absolute priority in the hierarchy of operators’ activities [

69,

78]. The elimination of the risk of cascading outages in the network, leading to a failure in a large area of Europe, is key to ensuring security of energy supply to consumers. What’s more, the zonal market is not fully exploiting the possibility of using renewable sources and EU regulation try to change this problem [

79]. If the cost of transmission and trade of energy between zones is not high enough, the competitive balance between the production of energy from conventional sources, including coal, and the production of energy from renewable energy cannot be changed. There is no incentive to invest in renewable energy.

Another important issue (negative from the investment side) related to zonal energy settlement is the lack or low quality of price signals on the market for potential investors in the manufacturing sector, which causes the need to introduce additional mechanisms to ensure the sufficiency and security of electricity supply in the long-term horizon (e.g., the capacity market). The capacity market is a regulatory solution to prevent future electricity shortages [

80]. The main purpose of the capacity market is to create investment incentives to build new and modernize existing generating units. These solutions are also aimed at activating energy management and making electricity demand more flexible [

78]. The introduction of the capacity market means a change in the architecture of the energy market from a single-commodity market to a two-commodity market, where not only generated electricity is subject to purchase-sale transactions, but also net available capacity, i.e., readiness to supply energy to the grid. This solution is used in many European countries, although in details it differs from the legislative side in particular countries [

81]. The capacity mechanism is designed to minimize impact on market functioning [

82,

83].

The zonal model of the market averages spatially differentiated price signals within large price areas, without showing energy values in a given location. Consequently, system users, and in particular investors, do not know the true value of energy in a given location (node) but only the average value of energy in the market area, which is not conducive to the optimal location of new sources [

84]. The problems with price impulses are followed by the lack of the ability to initiate investments in generation capacity based on market conditions, which can be understood as the difficulty of ensuring the long-term sufficiency of generation sources. Consequently, the attractiveness of the location is assessed without taking into account the state of network development and local demand. Sellers of electricity trading on the stock exchange tend to transfer variable prices of production, while they do not contribute to bearing investment costs. This means that they sell energy without thinking that they should invest in the long run and save money for capital-intensive investments [

85]. This situation leads to the phenomenon that sellers earn in the short term without being interested in the development of the sector in the future [

76].

The zonal market in its current form has served well, but it has exhausted its possibilities. Today’s challenges are different from when the market was emerging [

8]. Today, we need to optimize all activities—hence, the need for a location market that facilitates system management with hundreds of distributed sources. The current (zonal) market model does not correctly take into account physical phenomena that significantly affect the costs of providing energy to the end user. As a result, the dissonance between the market and the physical capabilities of the power system increases with the progressive energy transformation. The zonal model of the energy market was relatively easy to implement; however, the longer its functioning is observed, the more it can be seen that this model requires changes. Changes were introduced gradually, which successively and without excessive burden on producers and recipients will lead to an increase in technical and economic efficiency of the energy market [

69]. Attention should be paid to the correct designation of market areas, taking into account technical conditions and capabilities of the transmission system of a given area. Currently, within the EU, this division (except for a few countries) is based on national borders. In order to improve the current system, some researchers propose some modifications to the zonal model by combining several countries into regional groups. To analyze the implications of such couplings in the zonal model of the energy market, a model based on the multi-regional energy system market can be developed. The model simulates a multi-regional energy market (using market optimization and network theory), taking into account the particular representation of each region present in the model as an energy subsystem. By using the integrated hourly analysis in the model, a general model of the energy systems of several countries connected in a network can be prepared. Then the existing elements can be developed as a common electricity market. The model designed and proposed in this way can inform the energy policy about the results of the integration of energy based on renewable sources on the international energy market [

86].

Another solution proposed more and more by representatives of European countries is the implementation of the localization model [

73,

87].

6. Localization Model (Nodal)

The localization (nodal) market boils down to a market where there is practically no exchange and transactions are managed by the Operator through a mechanism that is something like an auction where individual suppliers submit their offers taking into account current prices, costs of future investments and the place of energy supply and consumption, i.e., nodal costs [

88]. Nodal markets exist in US, Australia, New Zealand and the experience from mentioned countries with node prices offer a wide range of opportunities to meet the emerging challenges on the market and thus can easily facilitate further integration of intermittent renewable generation technologies [

87,

89]. The principals of nodal pricing can be implemented in different ways: (a) full nodal pricing, i.e., both generators and the demand side are exposed to nodal prices like in case of New Zealand and US (Pennsylvania, New Jersey, Maryland) [

90] or mixed like in case of Australia e.g., price changed into a weighted average of the nodal prices in a region, rather than being the price at a single node in the region, and nodally dispatched but zonally settled [

90,

91]. The dynamic development of distributed generation, including renewable energies sources (RESs) connected to the distribution network, will have a significant impact on the role and functioning of distribution system operators (DSOs) [

74]. The development of small generating units in the field of power generation will allow the active participation of the final customer (end users) connected even to the low voltage network. The transition to new market model is leading to a new role for citizens, from passive energy consumers to active energy citizens—prosumers [

92]. The end-user will be a key player in future electricity markets [

67,

93,

94]. This means that dwellers are able to produce and feed electrical power into the grid thus obtaining the status of an energy producer and reducing the load on the national power grid system [

95]. Distributed energy represented by prosumers has the potential to shape overall demand and offer significant value to the energy system, inter alia by reducing investment needs in additional generation and transmission infrastructure. However, it should be remembered that the appropriate motivation of prosumers to coordinate their locally owned dispersed resources belongs to the representatives of the energy system and is very often a challenge and at the same time a field for conducting active research in Smart Grids [

96]. Settlement of a numerous of individual transactions on the energy market can be carried out via blockchain called as distributed ledger technologies. Blockchain can clearly benefit operations in the energy system, the energy market and consumers. Blockchain offers transparency of executed operations and conducting transactions resistant to manipulation or speculation. Most importantly, however, blockchain offers innovative solutions that enable consumers, end-users and small renewable energy producers to play a more active role in the energy market and maintain liquidity by easily selling their assets [

51,

97]. In a blockchain system, consumers and prosumers exchange energy directly in a decentralized manner through well-designed smart contracts with minimal intervention by intermediaries (energy companies) [

67]. A dynamic power system as the basis of an interconnected grid that makes the best use of local grid energy production with distributed generation resources, smart appliances, and other equipment and intelligent devices is shown in the

Figure 5.

The system in terms of price is on the one hand more complicated, the market is less liberal (because it is heavily controlled by the Operator), but on the other hand it is more safety from a long-term perspective [

99]. However, it can be said that if locational prices were determined by the actual dispatch, it would make the problem simple. Calculating marginal location costs for actual dispatch would be fairly easy [

87,

100]. The node market is a market where electricity prices depend on the location of the customer, current generation sources, and infrastructure development. Nodal pricing yields optimal dispatch and congestion management through the market, and as such an optimal utilization of energy generation and network [

70,

90]. Nodal market is cleared for all nodes taking into account all resources and transmission constraints [

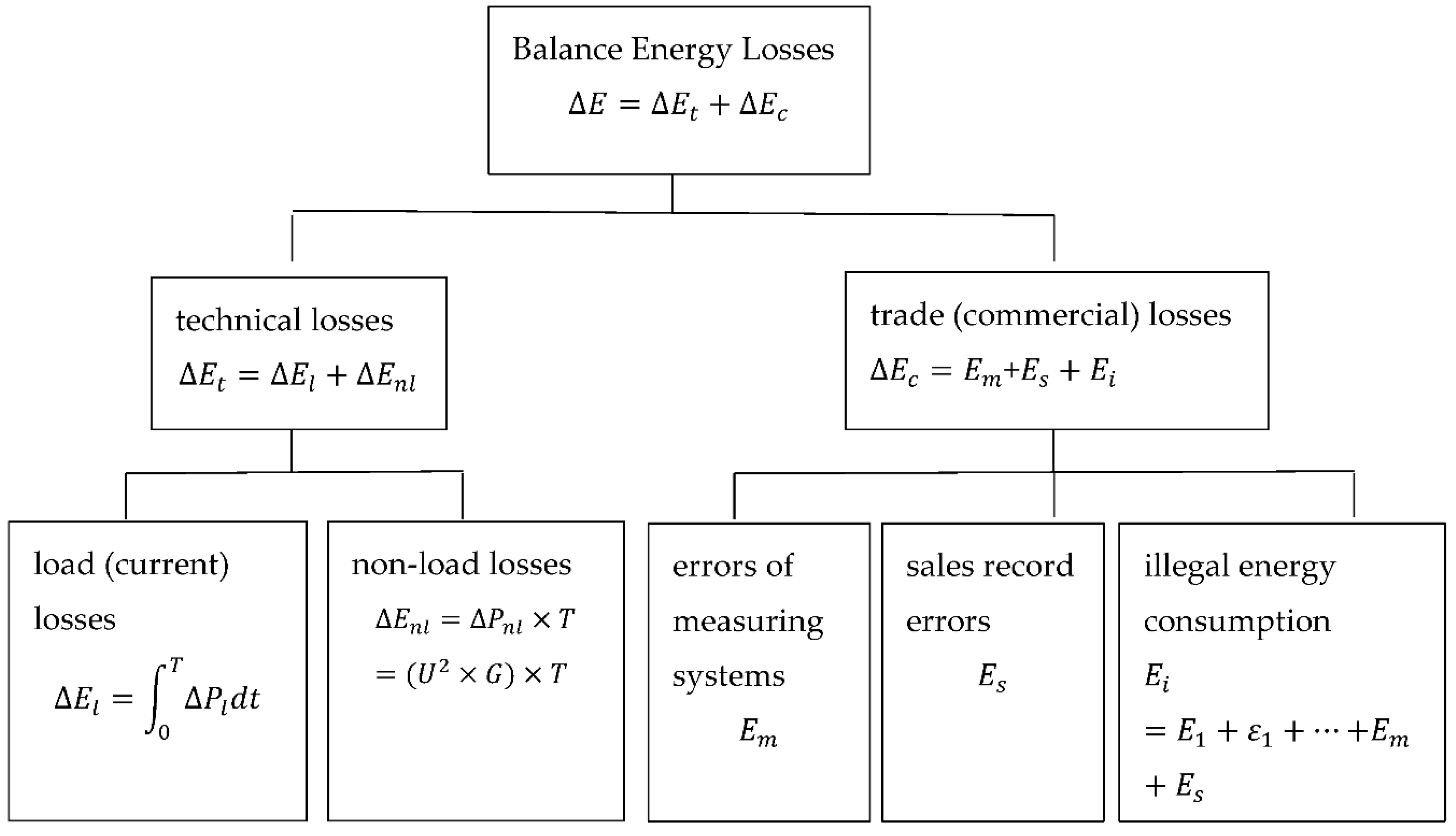

101]. This means that it is a market illustrating the real situation in the power system, serves to reduce the dissonance between technical and market issues regarding the transmission of electricity. The flow of electric current is a physical phenomenon characterized by the occurrence of losses. As mentioned earlier, losses occur during the transmission of energy through electrical wires and when transforming voltage [

102]. Transformer losses consist of two components: core and coil losses [

103]. Overall the energy losses in the transmission network can be divided into technical losses and trade (commercial) losses, which is shown at

Scheme 1.

In the transmission network, transmission losses are usually at the level of 2–2.5%. In distribution systems, losses can be as high as 8–10%. These losses can be reduced by using superconducting transmission lines [

104,

105]. The cost of energy supply should include losses associated with its transport. In the vast majority of the EU, the costs of losses are recovered by the transmission tariff paid by either only consumer or by various network users [

106]. Losses arising from the transmission of electricity can be taken into account by using nodal prices. The price of energy then depends on the location of the energy producer or recipient. Calculation of losses is a routine part of the system operator’s activity in any power organization system [

53,

106]. The supply of energy over longer distances is directly related to the additional costs of constructing the transmission infrastructure. The zonal market model averages this significant loss and blames it with the cost and infrastructure of all customers. The node market, on the other hand, assumes a specific energy price for a given node, determined on the basis of objective and transparent factors [

88].

The energy price in the location model is to be market-based and is to take into account all cost components borne by producers, the transmission system operator (TSO) and distribution system (DSO), taking into account the potential of the market (demand) [

74,

106]. At the same time, it is not to be an obligatory price. Mechanisms for passive customers can be implemented, for which the average energy price for a given zone will continue to apply. However, nodal prices stimulate end users to actively participate in the market. Demand management programs will allow the use of new control possibilities enabling two-way communication even with relatively small recipients.

As today, the free-market element will allow energy supply contracts to be concluded between any entities on the conditions they specify, given that those entities accept the risk of price volatility and the fact that there are costs of energy transmission between nodes. It is worth noting that there may be many nodes in the area of today’s price zone.

In the nodal model, the most advantageous solution is to use a mathematical model that optimizes all costs, i.e., locational marginal price (

LMP).

LMP allows you to send the right price signals to recipients and manufacturers [

107,

108].

LMPs signal to potential investors where additional energy supplies are most needed.

LMPs serve to induce investment [

109]. The marginal location price at node

k is the sum of the components: energy price LMP

E, congestion price

LMPC and losses price

LMPL.

LMP is also “ecological” because in this model, less emission sources will always be better used. The operation of

LMP can be compared to taxis in which you pay for time and kilometers [

110]. Driving at peak times and far you pay a lot, off-peak and close-little. In the zonal model, everyone pays the same [

87].

The minimized objective function is the cost of balancing the system in conditions of unit increase in demand. To determine network losses, an incremental method is used, assuming a 1 MW increase in load at the receiving node. The network loss coefficients can be determined from the general equation formulated for a given network operating point. The equation then has the following form:

NLFk—network loss factor for node k;

—increase of power in the node “k” assuming that the power flowing from the node has a positive sign, and the stream flowing into the node has a negative sign;

N—number of nodes.

As with any optimization task, the solution must meet the limitations. In the case of the location model, first of all, equality restrictions must be met in all network nodes, which means full coverage of demand. Subsequent restrictions, defined as uneven, reflect the technical characteristics of the system components. Each limit corresponds to reference prices (shadow prices), also called marginal, calculation, clearing or hidden prices. The shadow price (difficult to calculate) of energy should be equal to its market price to represent the truth economic opportunity costs of resources [

111,

112].

Knowledge about the identification of individual components of the nodal price is the next stage allowing for a fuller understanding and better interpretation of the LMP determination process. Power generation should go towards low marginal costs. For real system models, this gives the opportunity to indicate factors that affect the final size of the nodal price. By isolating the components of the nodal price, energy costs, loss costs, and the costs of removing system constraints are expressed by specific values. The total price of energy supply includes the price related to the costs of transmission services, also contains other elements, such as depreciation of equipment, maintenance and repair costs, fees for transmission rights, etc. This ensures greater transparency in the method of determining these prices [

113]. The ability to interpret these contributions is all the more important because, according to the records, in many European countries, the LMP method is likely to become the basis for calculating nodal prices of electricity for the national power system.