2.1. Methods

The main functional activities of strategic selection are divided into three phases [

36]. The first phase is the information input. In this phase, we incorporate, organize and classify information—including information collected or considered—as well as information on the strengths, weaknesses, opportunities and threats of organizations that directly influence the strategy. The second is the match. This phase relies on the information obtained during the information input phase to match external opportunities and threats with internal strengths and weaknesses. In order to effectively build an alternative strategy, matching external and internal important factors is critical. The third phase is decision-making. In this phase, matching techniques define alternative strategies, while analysis and intuition provide the basis for strategic decision-making. At this point, the strategic management team needs to reexamine the organization’s ultimate purpose, evaluate the context in which the organization operates and evaluate the organization’s alternative strategy.

As one of the strategic planning methods, SWOT analysis is widely used to define organizations and company development strategies. However, it is also used to assess people or investment projects [

37]. The SWOT method is universally used in strategic research because of its intuitive analysis and simple use [

38]. The reliability and scientific of the SWOT analysis depends mainly on the capabilities and expertise of the participants [

36]. Tzelepi et al. studied the challenges in the scenario of lignite substitution with biomass using a SWOT analysis in order to achieve the coal phase-out EU goal [

39]. Kordana et al. laid the foundation for the development of a strategy to develop drain water heat recovery systems by the SWOT/TOWS method [

40].

As a decision-making method, AHP was firstly proposed by Professor T. L. Saaty of the University of Pittsburgh. It is a process of layering and structuring multiple influencing factors [

41]. The biggest feature of AHP is that the qualitative description is transformed into a quantitative way to express the subjective judgment of the evaluator [

42], it offers a reliable basis for the development of scientific and rational decision-making goals [

43]. Numata et al. used AHP to conduct barrier analyses for the deployment of renewable-based minigrids in Myanmar [

44]; Iva and Mateo also used the AHP approach to choose optimal solar power plant locations in Croatia [

45]. However, AHP has its limitations. In fact, it is difficult to ask the respondents to repeat evaluations, as their judgments are not consistent.

Combining the SWOT analysis method with the AHP analysis method—and based on the SWOT qualitative descriptive analysis method—the quantitative analysis method AHP is introduced to quantify the more complicated strategic decision problems in reality, and the elements in the decision-making process can be systematically evaluated. The priority of this enhances the ability of SWOT analysis in strategic decision-making [

46].

Kurttila et al. applied AHP–SWOT analysis to the strategic decision of Finnish forestry for the first time [

47]. In recent years, many scholars have adopted the AHP–SWOT analysis method in decision-making processes in different fields. Shrestha et al. applied AHP–SWOT analysis to the strategic decision-making of forestry and animal husbandry complex systems in central and southern Florida [

46]; Oliver Gottfried et al. applied SWOT–AHP–TOWS analyses to provide a reference for strategic decision-making of private investment in biogas [

48]. Other areas of application include the biomass energy industry [

49,

50], water resources [

51,

52], new energy transportation [

53], solar energy [

54], cultural tourism [

55,

56,

57], aquaculture [

58], electronic consumption [

59], etc.

2.2. Data Collection

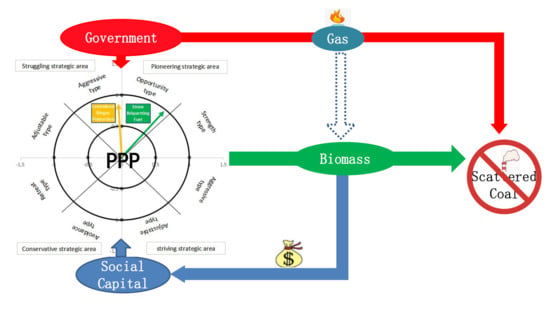

2.2.1. SWOT Analysis

First, by consulting the literature and field research methods, we identified a database, then organized experts to screen, and finally determine the key factors of the strategy, the strengths (S) and weaknesses (W) of the internal environment and opportunities (O) and threats (T) of the external environment. From June to July 2018, we investigated in Hebei Province and Shandong Province, constructing a list of key factors for the PPP strategy of the CBP and SBF projects. The main reasons for choosing these two provinces as the investigation objects were mainly based on: (1) Both of the provinces are located in areas with relatively serious air pollution; (2) both have promoted the “coal to gas”; (3) straw resources are relatively abundant; (4) both are vigorously carrying out the PPP model in various fields.

In January–February 2019, 50 people were invited to screen key factors through questionnaires and interviews. All of these 50 people were professionals in the biomass energy industry. Among them, 32 were employed in a biomass energy enterprise (mainly worked as the investment managers, senior executives, etc., 19 of them had PPP project investment experience, and 13 had received PPP investment training.); 7 scientific researchers lacked PPP investment experience, but they had academic research on PPP investment; 2 administrative staffs worked in the government, they had PPP investment management experience in the public sector; 4 administrative staffs worked in industry associations, they participated the preparation of research reports on PPP investment projects; 5 doctoral candidates, who focused on the subject of biomass resource utilization and had studied PPP investment expertise at a deeper level. In the questionnaire design, we listed 6–10 factors for each SWOT group and asked the respondents to rank the importance of the factors in each group of the lists based on their own understanding of the project. According to the order of importance, we calculated the score for each factor—and based on the score for each group—filtered out 4 key factors.

2.2.2. AHP Analysis

On the basis of determining the key factors of SWOT, in April 2019, 20 experts who were focused on the utilization of biomass resources were invited to evaluate quantitatively by the Delphi method. The 20 experts were all from biomass energy enterprise, mainly served as investment managers, senior executives, etc. The experts were also very professional in the SWOT survey. Among the experts, more than 70% had worked for more than 5 years in the biomass energy industry. All of them had a bachelor’s degree or above. Nineteen experts had PPP project investment experience, and 1 had received PPP investment training. The evaluation used the 1–9 scale method (

Table 1) [

41]. The methods mainly included questionnaires, interviews and comparing the S, W, 0, T groups and the elements in each group. Then, we scored them to obtain their relative important values. After two rounds of scoring and communication, the expert pair-wise comparison scores were weighted proportionately to find the final numeric rating in rounding. Finally, we obtained the judgment matrix of SWOT groups and the judgment matrix of each subfactor [

42].

When all the indicators are compared, a comparison judgment matrix can be obtained:

is expressed under the criterion layer , the importance of is relative to .

Calculating the weighting factor. According to the judgment matrix, finding the largest eigenvalue.

The feature vector

corresponding to

is normalized, that is, the order of importance of each evaluation factor is sorted. The formula for calculating

is as follows:

Then calculating the geometric mean of each row element of the judgment matrix

:

where

is the order of the judgment matrix

.

Then normalizing the vector:

where

is the weight coefficient value of each index sought, and the last weight coefficient values constitute the weight vector:

We also conducted a consistency check. The purpose of the consistency check was to confirm whether the weight distribution obtained above is reasonable. If the matrix failed the consistency check, it was necessary to provide feedback to the scorer to make appropriate modifications to the indicator score. The evaluation indicators were calculated as follows:

In the judgment matrix,

CR is the random consistency ratio.

CI is an indicator for measuring the deviation of the judgment matrix from consistency:

RI is the average random consistency index of the judgment matrix. The values of the specific 1–9 order

RI are as follows (

Table 2) [

41].

When CR ≤ 0.1, judgment matrix is generally considered to have satisfactory consistency. Otherwise, the judgment value should be adjusted until the consistency check is passed.

The process of determining the key factors was as follows: Since the criterion layer was divided into four categories of S/W/O/T in the process of analytic selection of key factors, only the weight of factors under a single criterion is calculated and the calculation of combined weights can be omitted. In principle, factors with a weight coefficient greater than 1/n (n is the number of factors under each criterion) are key factors.

2.3. Calculation

This process of calculating the collected data, include strategy quadrilateral, strategy azimuth and strategy intensity coefficient. The specific calculation process is as follows [

43,

55].

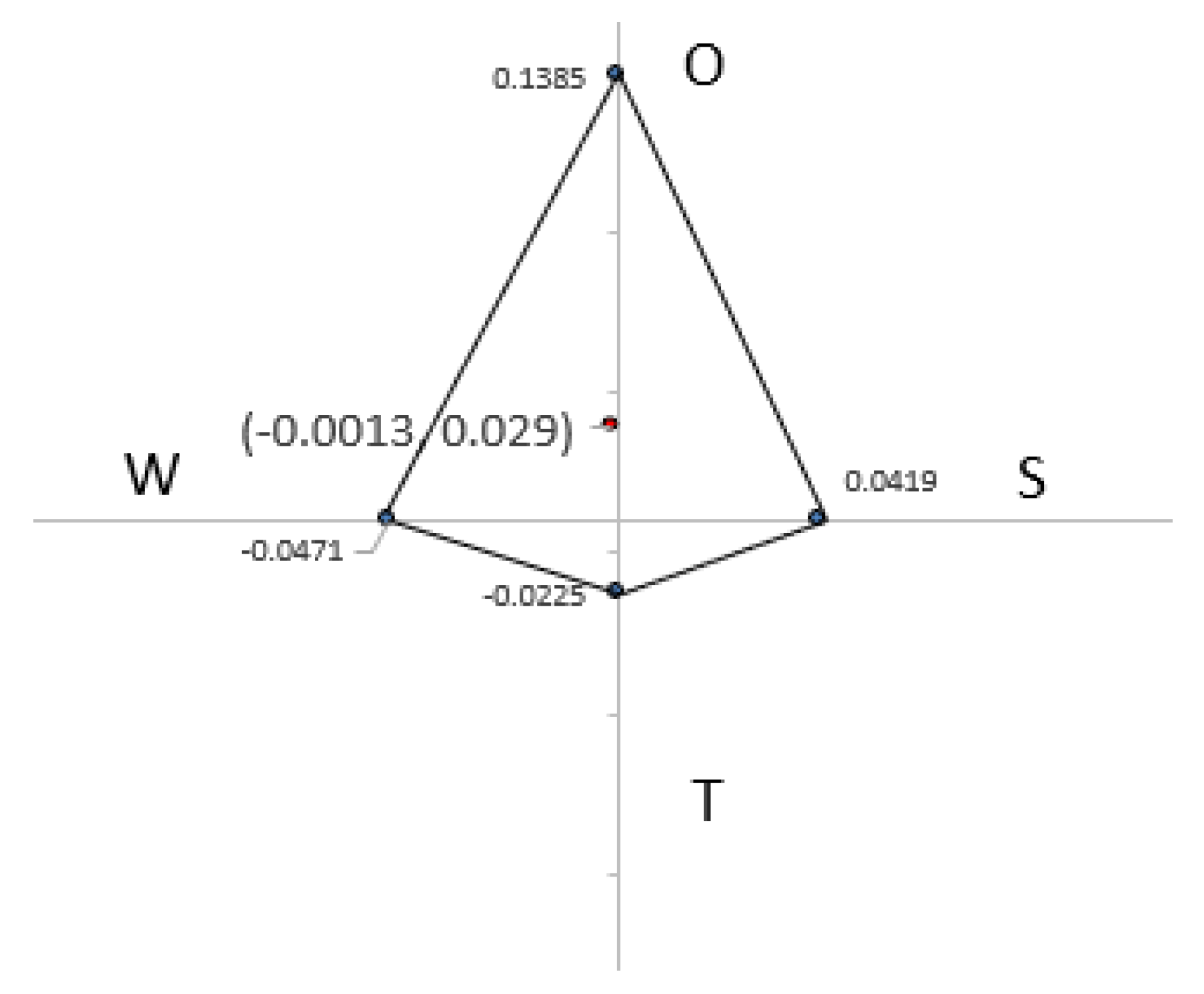

The calculation process of the strategy quadrilateral is:

First, by calculating the weights within each group, we can get the local priority:

Second, by calculating the weights between groups, we get Sw, Ww, Ow, Tw.

Third, we calculate the global priority GS

i/GW

i/GO

i/GT

iForth, according to the weight of each factor, we calculate the total strengths, total weaknesses, total opportunities and total threats. The formula is as follows:

The four variables of S/W/O/T are each a semi-axis to form a coordinate system. The four-point connection is obtained in turn to obtain the development strategy quadrilateral, and the center of gravity of the quadrilateral reflects the combined effect of the four factors. That is to say, the corresponding development strategy of the interval where the center of gravity coordinates is taken.

The center of gravity coordinates of the strategic quadrilateral is

Respectively, and .

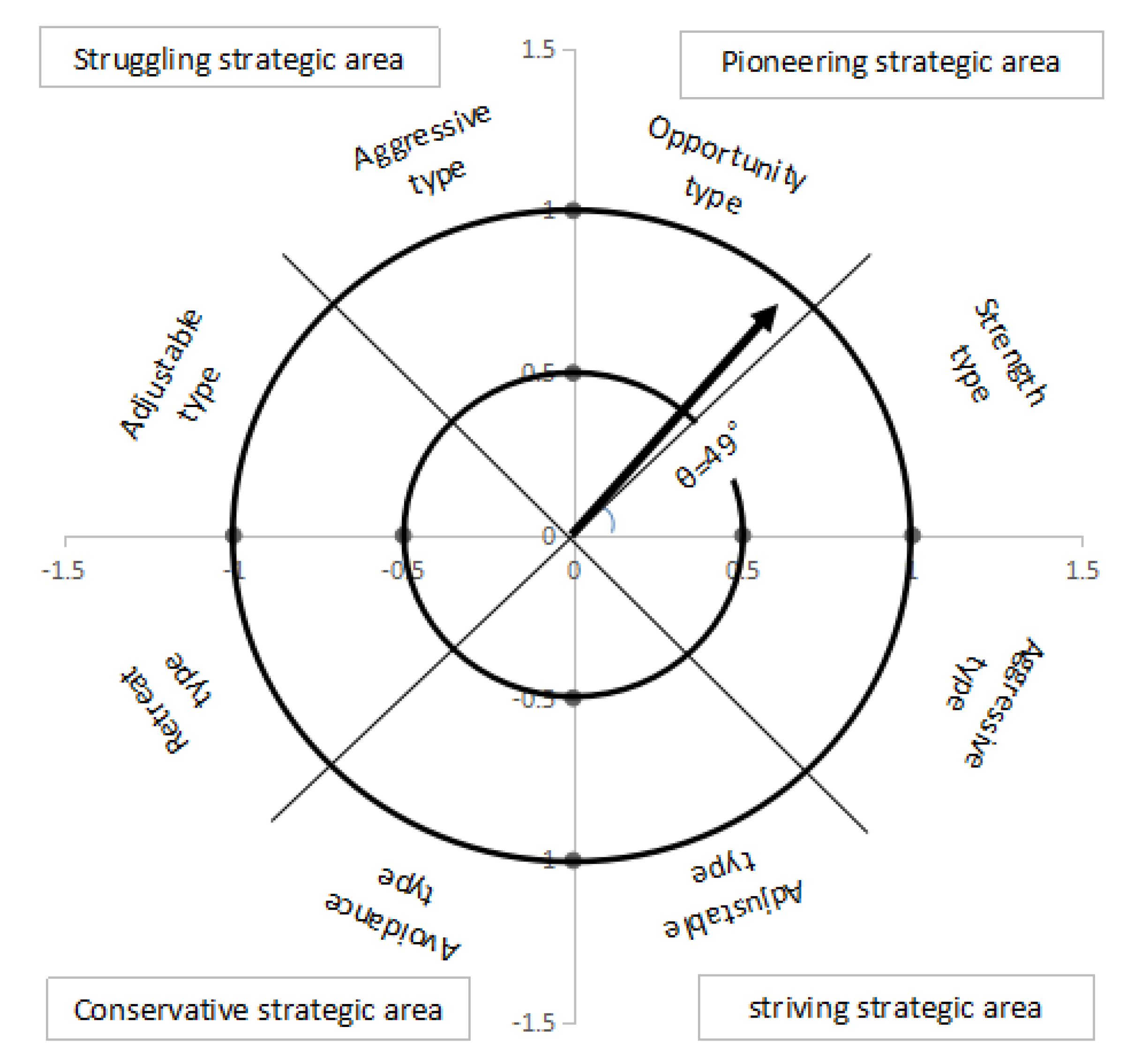

The calculation process of the strategy azimuth is:

The strategic azimuth angle θ (0 ≤ θ ≤ 2π) = arctan (Y/X). In particular, when X = 0 and Y > 0, θ = π/2, when X = 0 and Y < 0, θ = 3π/2. The strategy type is determined according to the θ size.

The calculation process of the strategy intensity coefficient is:

For the same type of strategy, we can adopt a positive development attitude or conservative attitude. The specific strategic positive intensity and strategic negative intensity need to be considered comprehensively [

43,

55]. Therefore, it can be judged by calculating the strategic intensity coefficient ρ.

The strategic positive intensity is U = O × S, where O and S, respectively represent opportunities and strengths, that is, the strategic positive intensity is the result of the interaction of external opportunities and internal strengths;

The strategic negative intensity is V = T × W, where T and W, respectively represent threats and weaknesses, that is, the strategic negative intensity is the result of the interaction of external threats and internal weaknesses.

What kind of intensity should be taken requires a combination of the strategic positive intensity and the strategic negative intensity. It can be judged by calculating the strategic intensity coefficient. The strategic intensity coefficient ρ is defined as ρ = U/(U + V), ρ ∈ [0, 1], and the magnitude of ρ reflects the intensity of implementation of the strategic type. As the value of U increasing, the strategic intensity coefficient increases, indicating that the strategic intensity is enhanced. As the V value increasing, the strategic intensity coefficient decreases, indicating that the strategic intensity is weakened. Generally, 0.5 is used as a critical point. When ρ > 0.5, a positive strategy is adopted; when ρ < 0.5, a conservative strategy should be adopted.

2.4. Modeling and Judgment

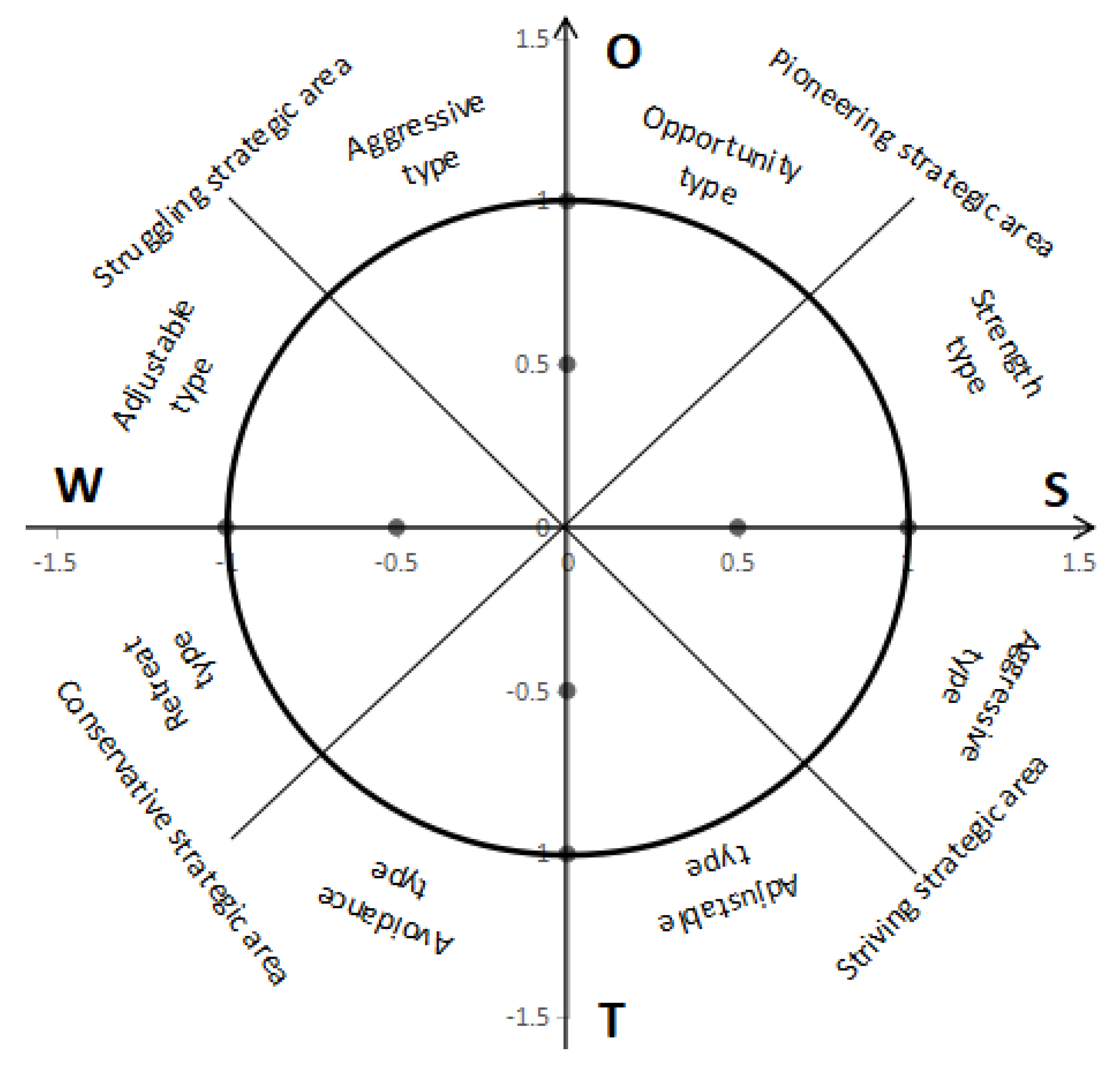

A generally accepted judgment criterion for vector (θ, ρ) is as

Figure 1.

Pioneering strategy (S–O strategy): In this region, opportunities and advantages dominate. This means that the opportunities and advantages of the project are great. Efforts should be made to get the maximum utilization of these opportunities and advantages and to take measures to accelerate the implementation of the project. According to the value of θ, it is divided into two types. The group 0 < θ < π/4 is named “strength type”. In this region, the advantage of the project itself is more obvious, and the capital investment should be increased. The group π/4 < θ < π/2 is named “opportunity type”. In this region, the opportunities of the project are more obvious, and the project opportunities should be seized to speed up the project implementation progress. As the value of ρ increasing, the opportunities and advantages of pioneering strategies will be more significant.

Struggling strategy (W–O strategy): Opportunities and weaknesses coexist in this region. This means that while seizing the opportunity, we should fully recognize the weaknesses of the project, reduce the negative impact of the weakness and even turn the weakness into an advantage through various means. According to the value of θ, it is divided into two types. The group π/2 < θ < 3π/4 is named “aggressive type”. In this region, the opportunity has obvious advantages, and the opportunity should be grasped cautiously. As the value of ρ increasing, a more positive attitude should be adopted. The group 3π/4 < θ < π is named “adjustable type”. In this region, weakness is greater than the opportunity, the weakness of the project itself should be fully recognized, the weaknesses should be reduced through various means, and the opportunity should be considered on the basis of fully adjusting the weaknesses. As the value of ρ increasing, a more positive attitude should be taken.

Conservative strategy (W–T strategy): In this region, internal weaknesses and external threats coexist, which means that the risk of this project is large, a conservative strategy should be adopted. It should take waiting and avoiding strategy for this type of project. According to the value of θ, it is divided into two types. The group π < θ < 5π/4 is named “retreat type”. In this region, the disadvantage is greater than the threat. The group 5π/4 < θ < 3π/2 is named “avoidance type”. In this region, the threat is greater than the disadvantage. Under these two strategies, it should stay on the sidelines of the project and do not get involved easily. As the value of ρ increasing, it can try to evaluate the project with a more positive attitude.

Striving strategy (S–T strategy): In this region, internal strengths coexist with external threats. This means that while making full use of the project’s advantages, it is essential to fully understand the external threats, reduce the adverse impact of external threats and even turn external threats into opportunities through various means. According to the value of θ, it is divided into two types. The group 3π/2 < θ < 7π/4 is named “adjustable type”. In this region, the external threat is greater than the advantage, the external threat should be fully recognized, the threat should be reduced through various conversion strategies. As the value of ρ increasing, a more positive attitude should be taken. The group 7π/4 < θ < 2π is named “aggressive type”. In this region, the advantage is greater than the threat. The advantage of the project itself should be fully utilized. On the basis of fully understanding and striving to transform external threats, it should give full play to its own advantages and be prudent to invest. As the value of ρ increasing, a more positive attitude should be taken.