A Stackelberg Game-Based Approach for Transactive Energy Management in Smart Distribution Networks

Abstract

1. Introduction

1.1. Literature Review

1.2. Novelty and Contributions

- Designing a distinct LEM to create a novel platform for the TE exchange at the distribution level.

- Presenting a Stackelberg game-based approach to model a TE environment in which the exchanged energy between autonomous financial entities and the DSO results in the equilibrium of the system.

- Providing a novel framework in which all participants of the distribution network are able to take part in separate markets that have no exchange between each other.

- Determining an AG of decentralized DERs to establish an appropriate cooperative environment between various energy sources for the purpose of trading energy in both WEM and LEM.

2. Materials and Methods

2.1. Proposed Methodology and Markets Structure

2.2. Uncertainty Characterization

2.3. Problem Formulation

2.3.1. Objective Function and Constraints of the Leader: DSO

2.3.2. Objective Function and Constraints of the Follower: DER Aggregator

2.3.3. Bi-Level Programming Outline

2.3.4. Reformulation of the Proposed Model to a Single Level

3. Numerical Results and Discussion

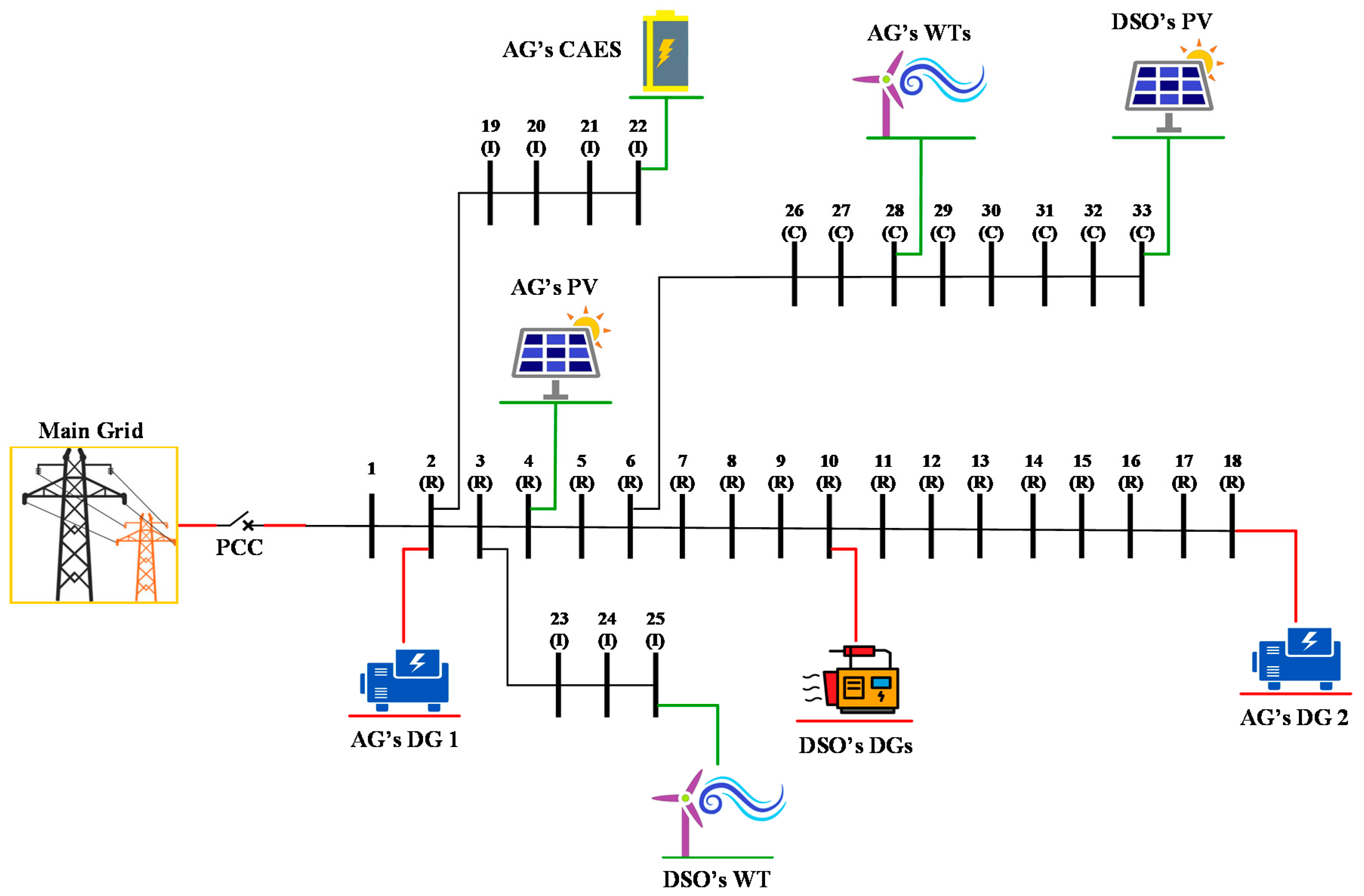

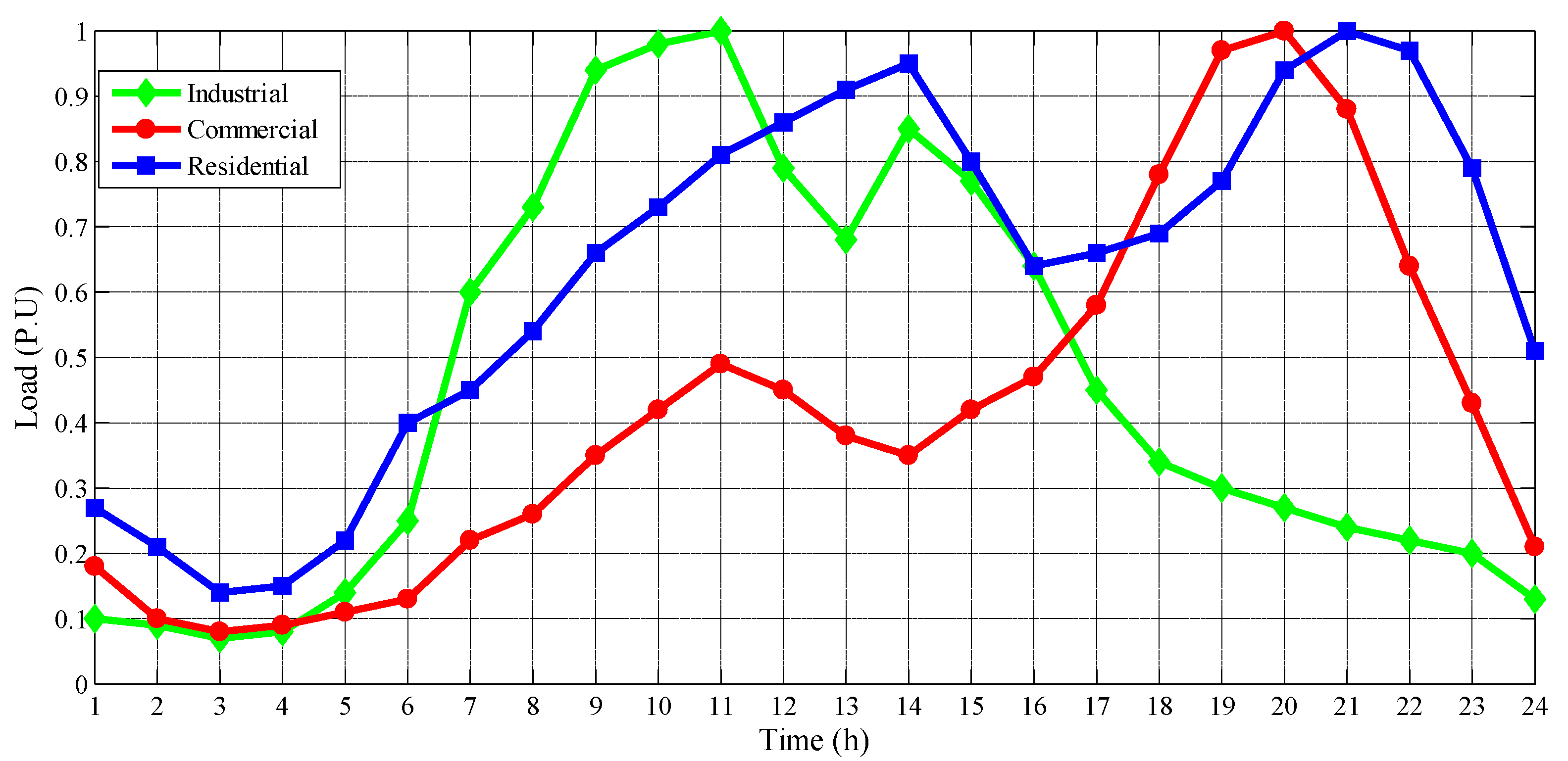

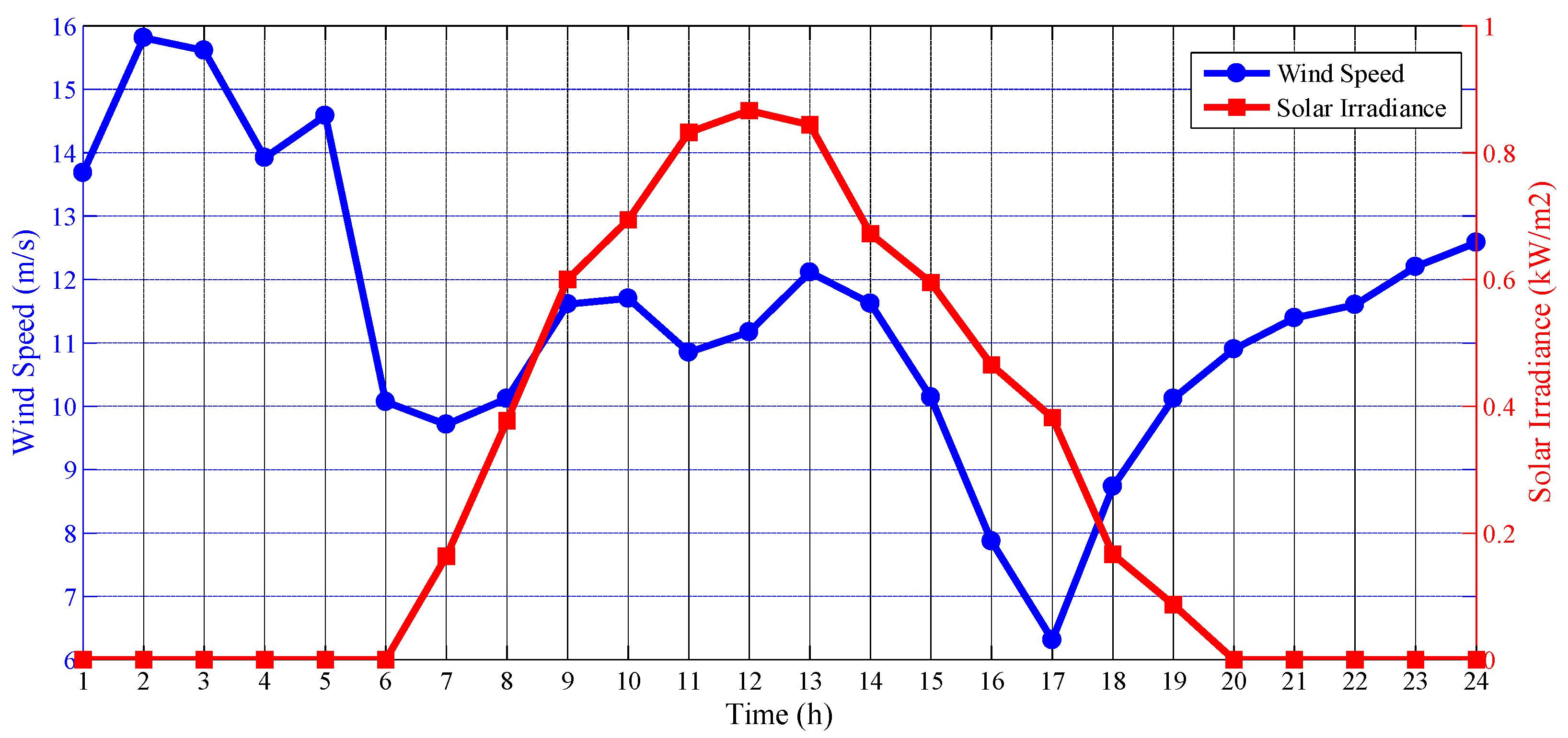

3.1. Input Data

3.2. Analysis of Simulation Results

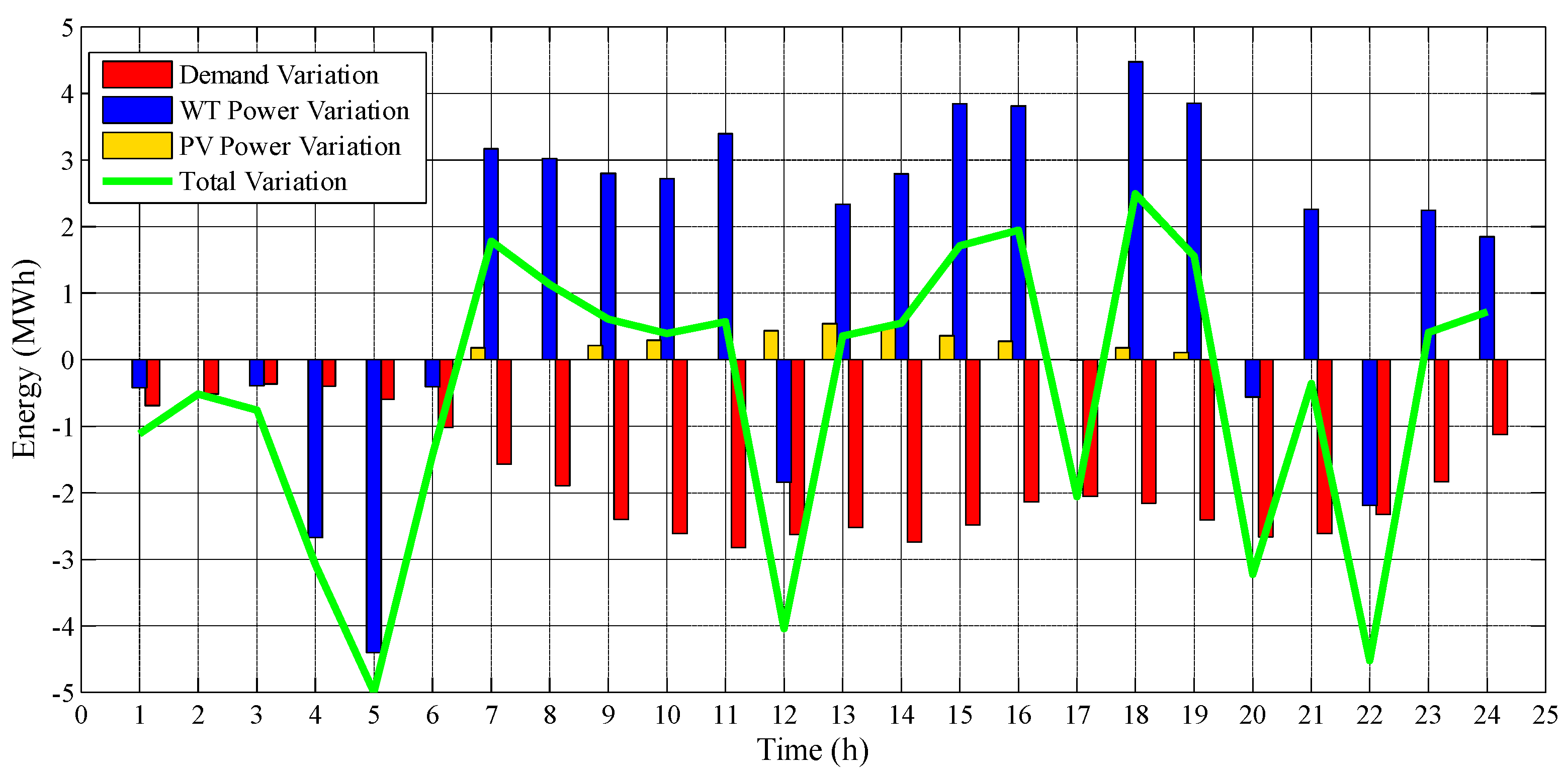

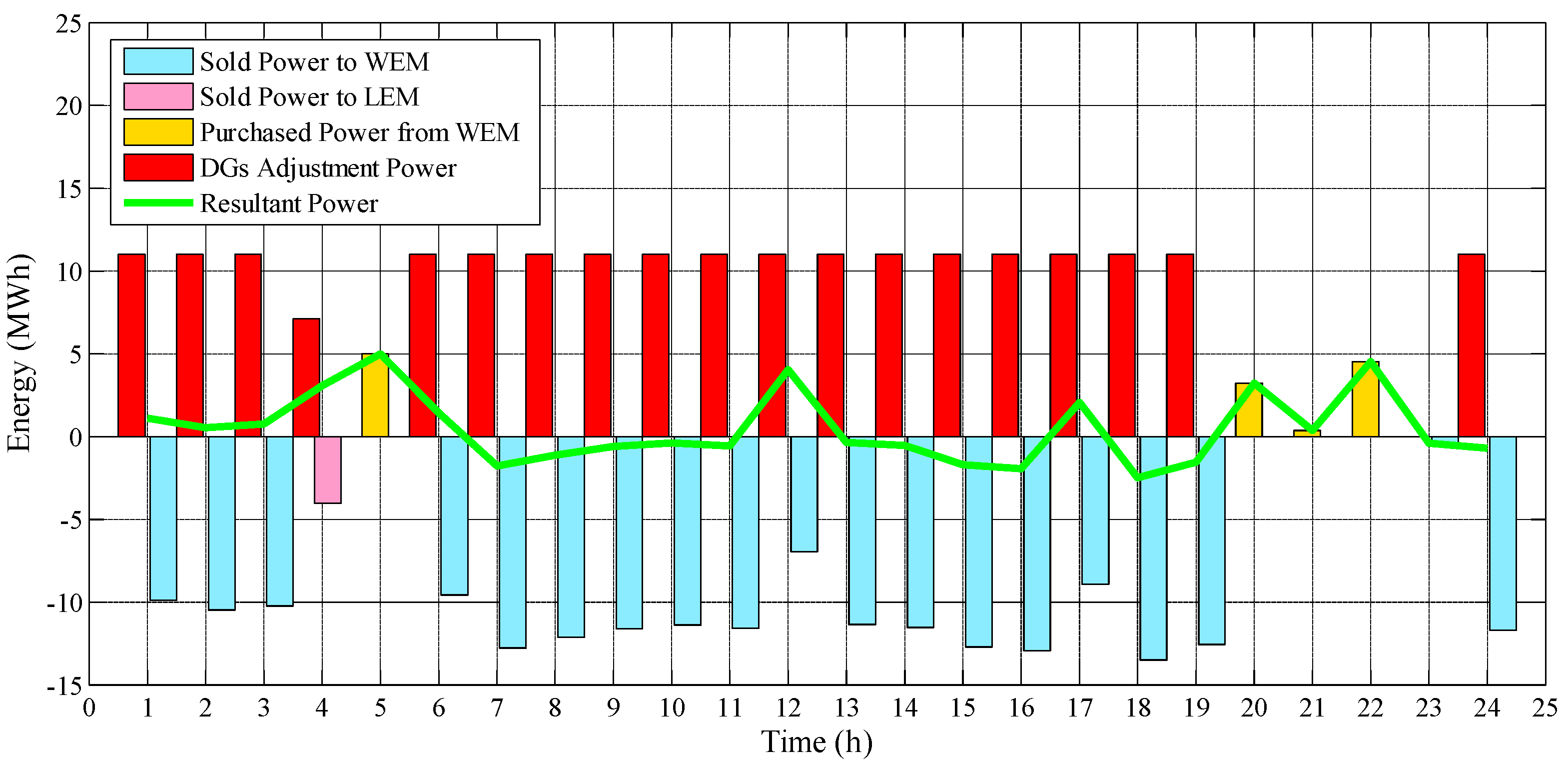

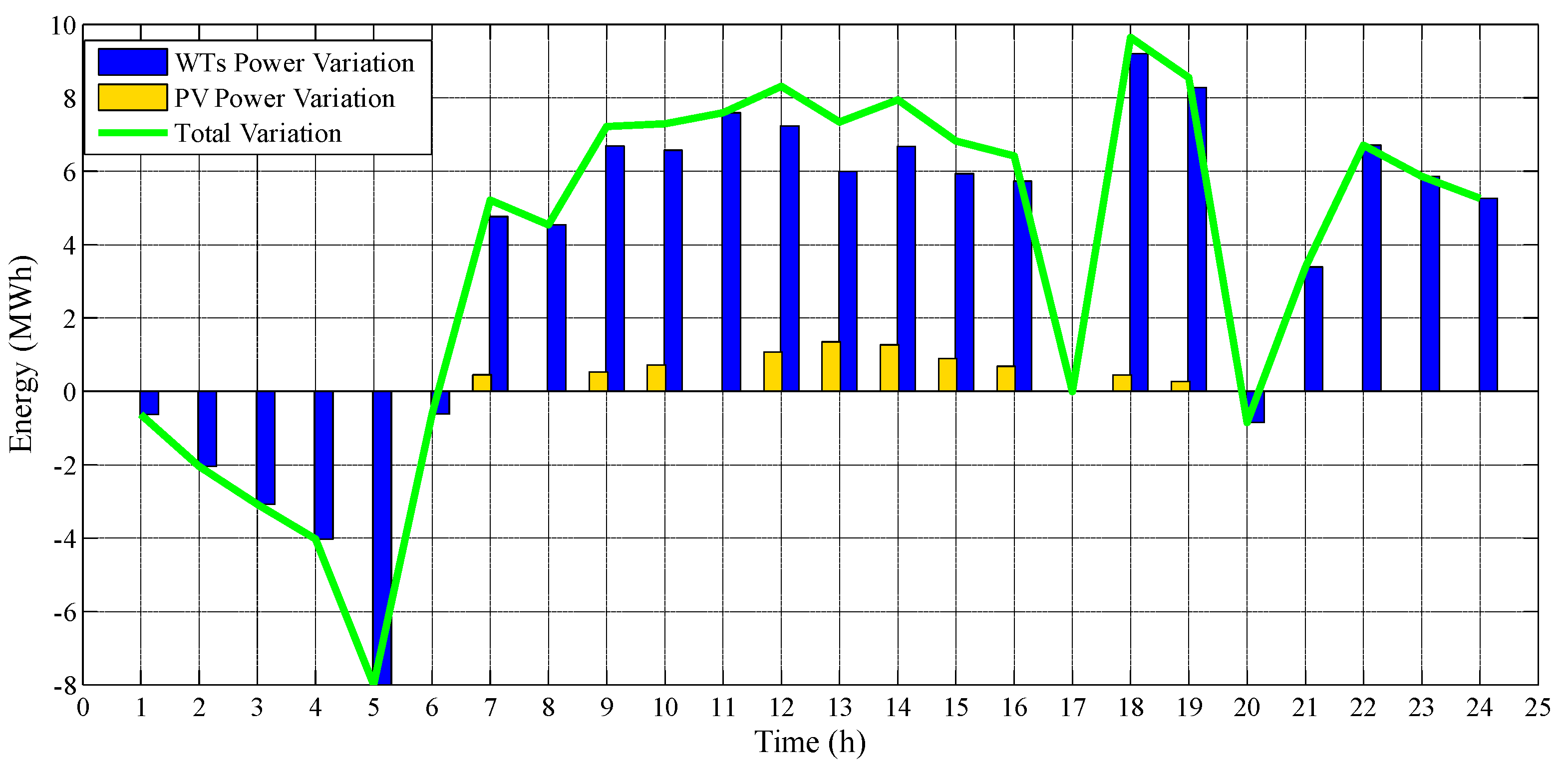

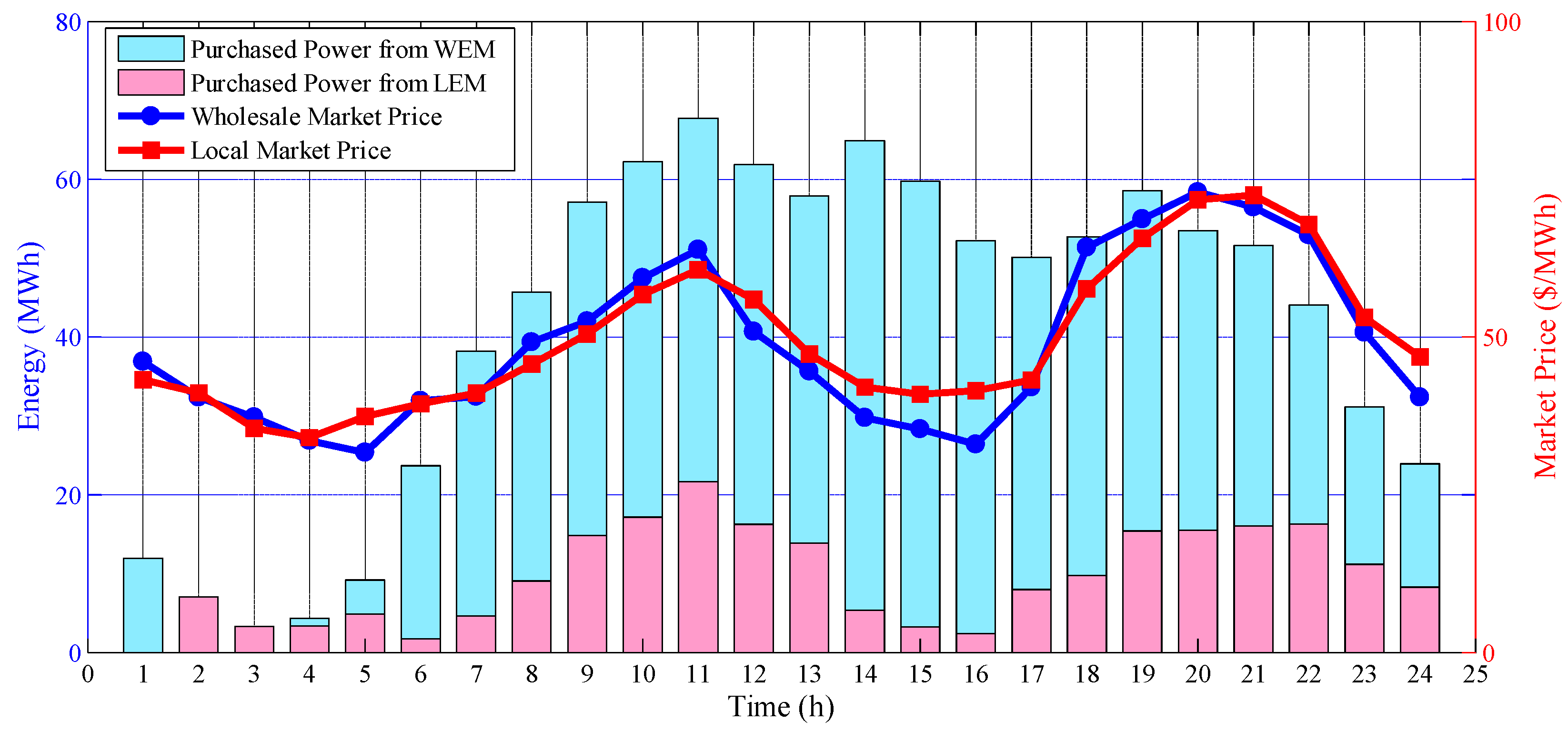

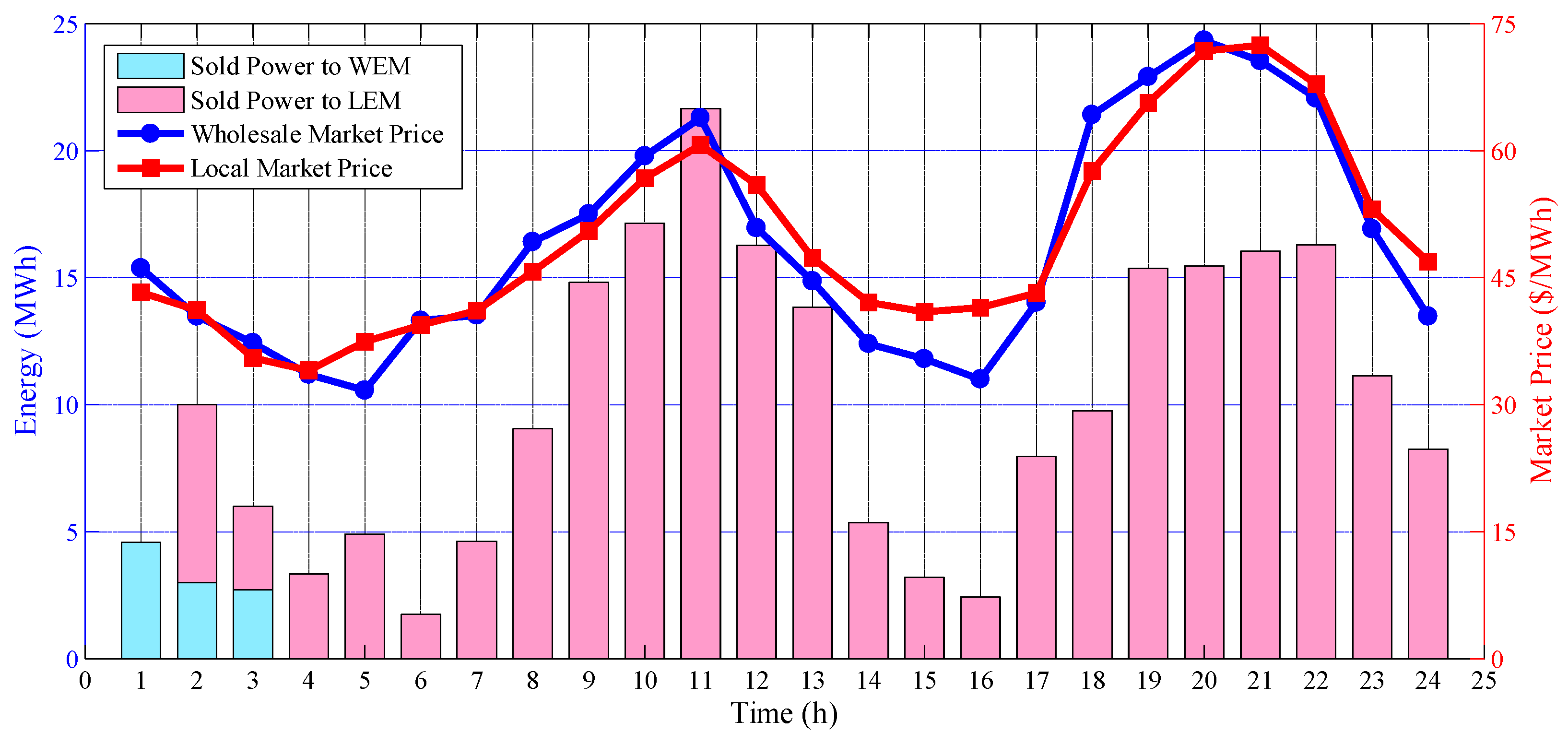

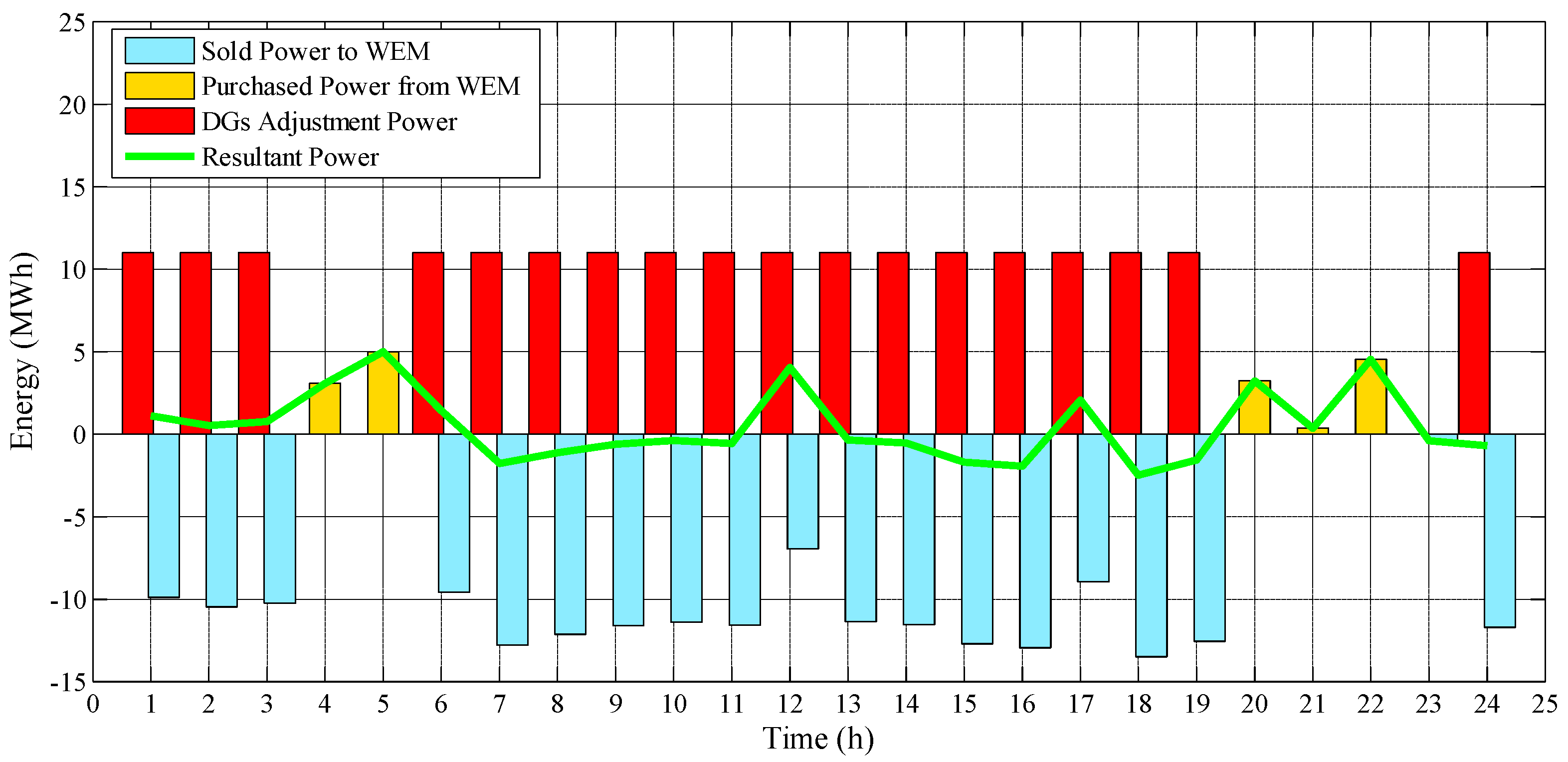

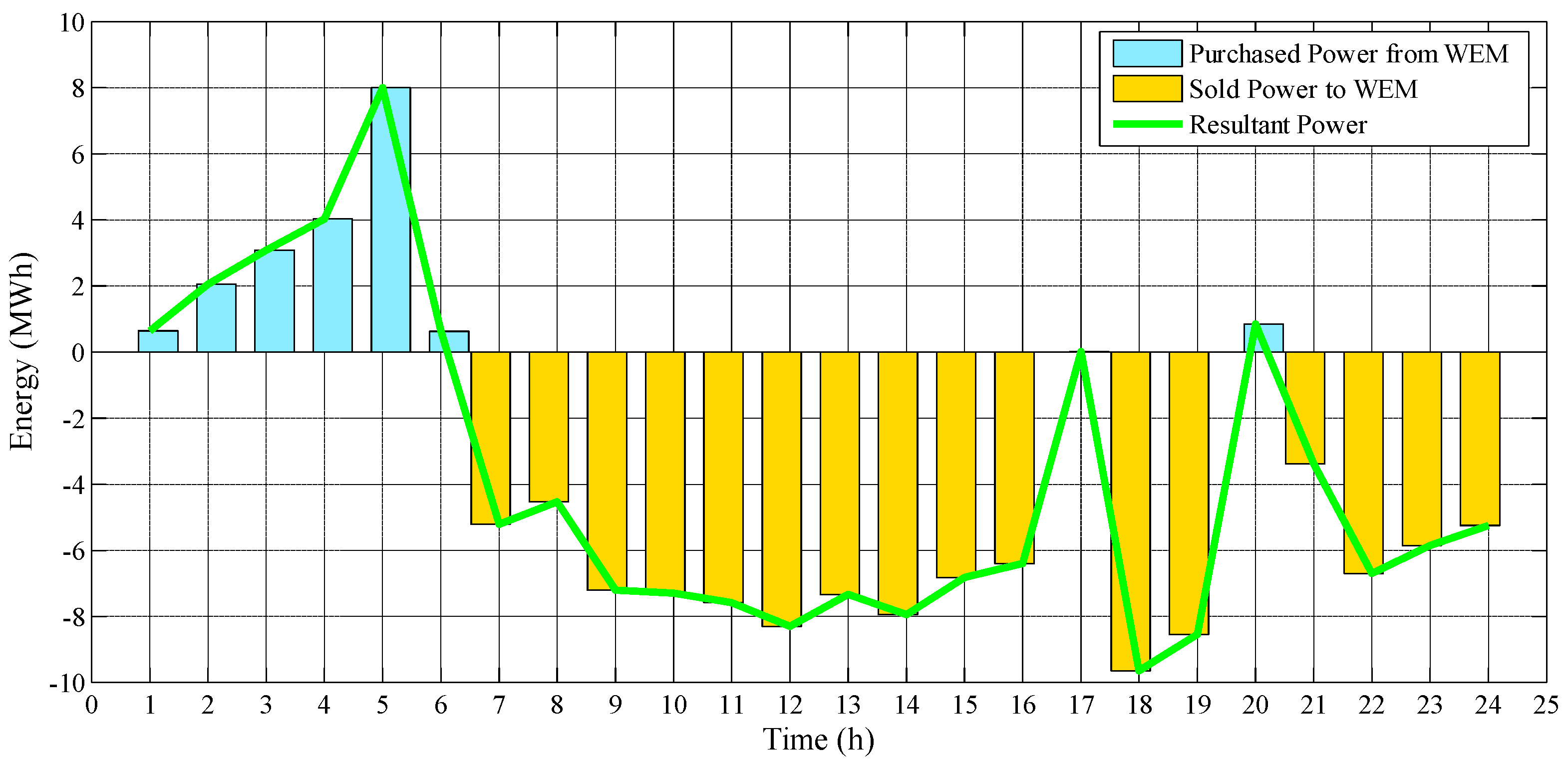

3.2.1. Case Study 1: Considering the Game-Theoretic Approach

3.2.2. Case Study 2: Without Considering the Game-Theoretic Approach

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Acronyms | |

| AG | Aggregator |

| CAES | Compressed Air Energy Storage |

| DA | Day-Ahead |

| DER | Distributed Energy Resource |

| DSO | Distribution System Operator |

| LEM | Local Electricity Market |

| MCS | Monte Carlo Simulation |

| MDT | Minimum Down Time |

| MUT | Minimum Up Time |

| Probability Distribution Function | |

| PV | Photovoltaic System |

| RT | Real-Time |

| TE | Transactive Energy |

| WEM | Wholesale Electricity Market |

| WT | Wind Turbine |

| Indices and Sets | |

| Auxiliary index for MUT/MDT modeling, running from 1 to max (MUT(i), MDT(i)) | |

| Index and set of the DSO and AG’s dispatchable units | |

| Index and set of the AG’s CAES systems | |

| Index and set of the DSO’s loads | |

| Index and set of scenarios | |

| Index and set of times | |

| Index and set of the DSO and AG’s PVs | |

| Index and set of the DSO and AG’s WTs | |

| Index of buses | |

| Set of lines | |

| Set of dispatchable units’ mapping into the set of buses | |

| Set of CAES systems’ mapping into the set of buses | |

| Set of loads’ mapping into the set of buses | |

| Set of PVs’ mapping into the set of buses | |

| Set of WTs’ mapping into the set of buses | |

| Set of all decision variables | |

| Parameters | |

| Cost of the DSO’s ith dispatchable unit for providing downward/upward energy in the RT (USD/MWh) | |

| Coefficients of linear cost function for the DSO’s ith dispatchable unit (USD/MWh, USD) | |

| Marginal generation cost of the AG’s ith dispatchable unit (USD/MWh) | |

| Auxiliary parameters for the MDT limitation of the DSO’s ith dispatchable unit | |

| Initial amount of the stored energy in the AG’s jth CAES at the beginning of the first-time interval (MWh) | |

| Final amount of the stored energy in the AG’s jth CAES at the end of the last time interval (MWh) | |

| Maximum/minimum amount of the stored energy in the AG’s jth CAES (MWh) | |

| Reference irradiance (kW/m2) | |

| Solar irradiation forecast at time t (kW/m2) | |

| Solar irradiation at time t and scenario s (kW/m2) | |

| Heat rate of the AG’s jth CAES in discharging mode (MMBtu/MWh) | |

| Maximum limitation of current from bus to bus (kA) | |

| Sufficiently large parameter for linearization of non-linear equations | |

| MDT of the DSO’s ith dispatchable unit (h) | |

| MUT of the DSO’s ith dispatchable unit (h) | |

| Operation and maintenance cost of the jth CAES’s compressor (USD/MWh) | |

| Operation and maintenance cost of the jth CAES’s expander (USD/MWh) | |

| Maximum/minimum output power of the AG’s ith dispatchable unit (MW) | |

| Maximum/minimum output power of the DSO’s ith dispatchable unit (MW) | |

| Maximum/minimum compression capacity of the jth CAES’s compressor (MW) | |

| Maximum/minimum generation capacity of the jth CAES’s expander (MW) | |

| DSO’s lth forecasted load at time t (MW) | |

| DSO’s lth load at time t and scenario s (MW) | |

| Forecasted power of the AG’s vth PV at time t (MW) | |

| Output power of the AG’s vth PV at time t and scenario s (MW) | |

| Rated power of the AG’s vth PV (MW) | |

| Forecasted power of the DSO’s vth PV at time t (MW) | |

| Output power of the DSO’s vth PV at time t and scenario s (MW) | |

| Rated power of the DSO’s vth PV (MW) | |

| Forecasted power of the AG’s wth WT at time t (MW) | |

| Output power of the AG’s wth WT at time t and scenario s (MW) | |

| Rated power of the AG’s wth WT (MW) | |

| Forecasted power of the DSO’s wth WT at time t (MW) | |

| Output power of the DSO’s wth WT at time t and scenario s (MW) | |

| Rated power of the DSO’s wth WT (MW) | |

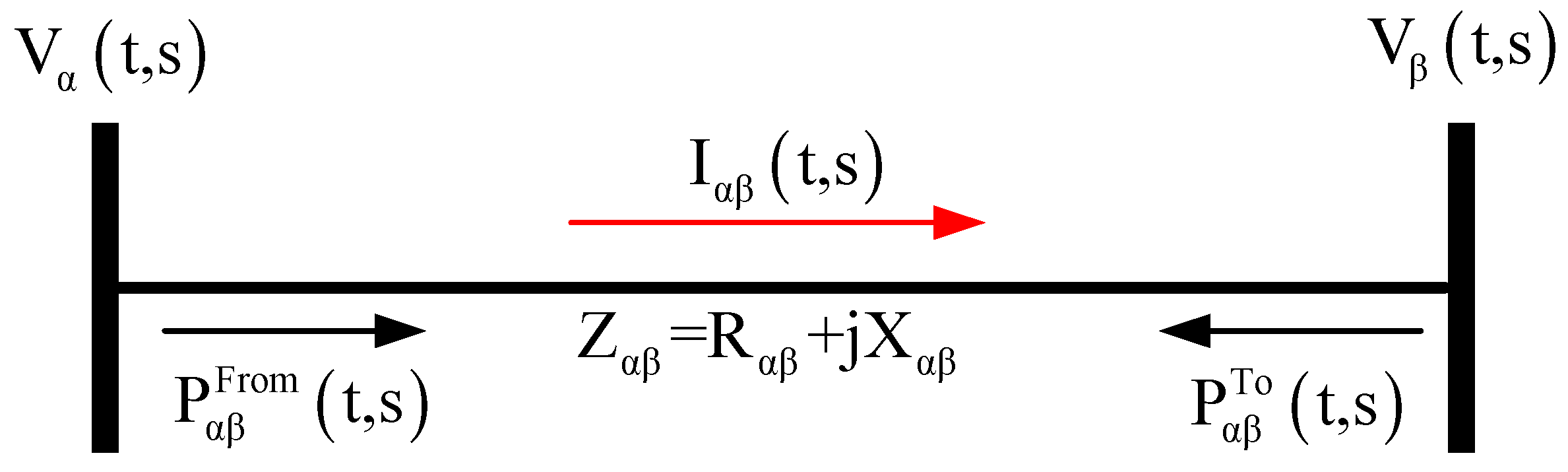

| Resistance of the line between the and buses () | |

| Ramp down/up rate of the AG’s ith dispatchable unit (MW/h) | |

| Shut-down cost of the DSO’s ith dispatchable unit (USD) | |

| Start-up cost of the DSO’s ith dispatchable unit (USD) | |

| Ambient temperature forecast at time t (°C) | |

| Reference temperature (°C) | |

| Auxiliary parameters for the MUT limitation of the DSO’s ith dispatchable unit | |

| Wind speed forecast at time t (m/s) | |

| Wind speed at time t and scenario s (m/s) | |

| Cut-in/cut-out speed of the AG’s wth WT (m/s) | |

| Rated speed of the AG’s wth WT (m/s) | |

| Cut-in/cut-out speed of the DSO’s wth WT (m/s) | |

| Rated speed of the DSO’s wth WT (m/s) | |

| Maximum/Minimum amount of voltage at bus (kV) | |

| Reactance of the line between the and buses () | |

| Impedance of the line between the and buses () | |

| Probability of scenario s (constant) | |

| DA price of the LEM at time t (USD/MWh) | |

| DA price of the WEM at time t (USD/MWh) | |

| RT price of the LEM at time t and scenario s (USD/MWh) | |

| RT price of the WEM at time t and scenario s (USD/MWh) | |

| Price of natural gas (USD/MMBtu) | |

| Efficiency of the injected/produced power to/of the AG’s jth CAES (%) | |

| PV panels’ coefficient of temperature (1/°C) | |

| DA Decision Variables | |

| Amount of the stored energy in the AG’s jth CAES at the beginning of each time interval (MWh) | |

| Current from bus to bus at time t (kA) | |

| DSO’s purchased power from the AG in the DA LEM at time t (MW) | |

| AG’s purchased power from the DA WEM at time t (MW) | |

| DSO’s purchased power from the DA WEM at time t (MW) | |

| Amount of active power flows at time t (MW) | |

| Active power flow from bus to bus at time t (MW) | |

| Amount of active power losses at time t (MW) | |

| Active power flow from bus to bus at time t (MW) | |

| Output power of the AG’s ith dispatchable unit at time t (MW) | |

| Output power of the DSO’s ith dispatchable unit at time t (MW) | |

| Discharged power of the AG’s jth CAES at time t (MW) | |

| Charged power of the AG’s jth CAES at time t (MW) | |

| DSO’s sold power to the AG in the DA LEM at time t (MW) | |

| AG’s sold power to the DA WEM at time t (MW) | |

| DSO’s sold power to the DA WEM at time t (MW) | |

| Shut-down cost of the DSO’s ith dispatchable unit at time t (USD) | |

| Start-up cost of the DSO’s ith dispatchable unit at time t (USD) | |

| Voltage of the buses at time t (V) | |

| Voltage of the buses at time t (V) | |

| Dual variables for the DA expressions | |

| RT Decision Variables | |

| Current from bus to bus at time t and scenario s (kA) | |

| DSO’s purchased power from the AG in the RT LEM at time t and scenario s (MW) | |

| AG’s purchased power from the RT WEM at time t and scenario s (MW) | |

| DSO’s purchased power from the RT WEM at time t and scenario s (MW) | |

| Amount of active power flows at time t and scenario s (MW) | |

| Active power flow from bus to bus at time t and scenario s (MW) | |

| Amount of active power losses at time t and scenario s (MW) | |

| Active power flow from bus to bus at time t and scenario s (MW) | |

| Downward power adjustment of the DSO’s ith dispatchable unit in the RT at time and scenario s (MW) | |

| Upward power adjustment of the DSO’s ith dispatchable unit in the RT at time and scenario s (MW) | |

| DSO’s sold power to the AG in the RT LEM at time t and scenario s (MW) | |

| AG’s sold power to the RT WEM at time t and scenario s (MW) | |

| DSO’s sold power to the RT WEM at time t and scenario s (MW) | |

| Voltage of the buses at time t and scenario s (V) | |

| Voltage of the buses at time t and scenario s (V) | |

| Dual variables for RT expressions | |

| Binary variables | |

| Binary variable for operation of the DSO’s ith dispatchable unit at time t | |

| Binary variables for linearization of non-linear equations | |

References

- Haghifam, S.; Dadashi, M.; Zare, K.; Seyedi, H. Optimal operation of smart distribution networks in the presence of demand response aggregators and microgrid owners: A multi follower Bi-Level approach. Sustain. Cities Soc. 2020, 55, 102033. [Google Scholar] [CrossRef]

- Cheng, L.; Yu, T. Game-theoretic approaches applied to transactions in the open and ever-growing electricity markets from the perspective of power demand response: An overview. IEEE Access 2019, 7, 25727–25762. [Google Scholar] [CrossRef]

- Saad, W.; Han, Z.; Poor, H.V.; Basar, T. Game-theoretic methods for the smart grid: An overview of microgrid systems, demand-side management, and smart grid communications. IEEE Signal Process. Mag. 2012, 29, 86–105. [Google Scholar] [CrossRef]

- Rashidizadeh-Kermani, H.; Vahedipour-Dahraie, M.; Shafie-khah, M.; Siano, P. A regret-based stochastic Bi-level framework for scheduling of DR aggregator under uncertainties. IEEE Trans. Smart Grid 2020. [Google Scholar] [CrossRef]

- Gröwe-Kuska, N.; Heitsch, H.; Römisch, W. Scenario reduction and scenario tree construction for power management problems. In Proceedings of the 2003 IEEE Bologna Power Tech Conference Proceedings, Bologna, Italy, 23–26 June 2003; Volume 3, p. 7. [Google Scholar]

- Renani, Y.K.; Ehsan, M.; Shahidehpour, M. Optimal transactive market operations with distribution system operators. IEEE Trans. Smart Grid 2017, 9, 6692–6701. [Google Scholar] [CrossRef]

- Di Somma, M.; Graditi, G.; Siano, P. Optimal bidding strategy for a DER aggregator in the day-ahead market in the presence of demand flexibility. IEEE Trans. Ind. Electron. 2018, 66, 1509–1519. [Google Scholar] [CrossRef]

- Qiu, J.; Meng, K.; Zheng, Y.; Dong, Z.Y. Optimal scheduling of distributed energy resources as a virtual power plant in a transactive energy framework. IET Gener. Transm. Distrib. 2017, 11, 3417–3427. [Google Scholar] [CrossRef]

- Wang, J.; Zhong, H.; Wu, C.; Du, E.; Xia, Q.; Kang, C. Incentivizing distributed energy resource aggregation in energy and capacity markets: An energy sharing scheme and mechanism design. Appl. Energy 2019, 252, 113471. [Google Scholar] [CrossRef]

- Hatziargyriou, N.D.; Asimakopoulou, G.E. DER integration through a monopoly DER aggregator. Energy Policy 2020, 137, 111124. [Google Scholar] [CrossRef]

- Bahramara, S.; Sheikhahmadi, P.; Lotfi, M.; Catalão, J.P.; Santos, S.F.; Shafie-khah, M. Optimal Operation of Distribution Networks through Clearing Local Day-ahead Energy Market. In Proceedings of the 2019 IEEE Milan PowerTech, Milan, Italy, 23–27 June 2019; pp. 1–6. [Google Scholar]

- Cornélusse, B.; Savelli, I.; Paoletti, S.; Giannitrapani, A.; Vicino, A. A community microgrid architecture with an internal local market. Appl. Energy 2019, 242, 547–560. [Google Scholar] [CrossRef]

- Nunna, H.K.; Srinivasan, D. Multiagent-based transactive energy framework for distribution systems with smart microgrids. IEEE Trans. Ind. Inform. 2017, 13, 2241–2250. [Google Scholar] [CrossRef]

- Faqiry, M.N.; Edmonds, L.; Zhang, H.; Khodaei, A.; Wu, H. Transactive-market-based operation of distributed electrical energy storage with grid constraints. Energies 2017, 10, 1891. [Google Scholar] [CrossRef]

- Lezama, F.; Soares, J.; Hernandez-Leal, P.; Kaisers, M.; Pinto, T.; Vale, Z. Local Energy Markets: Paving the path toward fully transactive energy systems. IEEE Trans. Power Syst. 2018, 34, 4081–4088. [Google Scholar] [CrossRef]

- Correa-Florez, C.A.; Michiorri, A.; Kariniotakis, G. Optimal participation of residential aggregators in energy and local flexibility markets. IEEE Trans. Smart Grid 2019, 11, 1644–1656. [Google Scholar] [CrossRef]

- Guzman, C.P.; Bañol Arias, N.; Franco, J.F.; Rider, M.J.; Romero, R. Enhanced coordination strategy for an aggregator of distributed energy resources participating in the day-ahead reserve market. Energies 2020, 13, 1965. [Google Scholar] [CrossRef]

- Bahramara, S.; Sheikhahmadi, P.; Mazza, A.; Chicco, G.; Shafie-khah, M.; Catalão, J.P. A Risk-Based Decision Framework for the Distribution company in mutual interaction with the wholesale day-ahead market and microgrids. IEEE Trans. Ind. Inform. 2019, 16, 764–778. [Google Scholar] [CrossRef]

- Naebi, A.; SeyedShenava, S.; Contreras, J.; Ruiz, C.; Akbarimajd, A. EPEC approach for finding optimal day-ahead bidding strategy equilibria of multi-microgrids in active distribution networks. Int. J. Electr. Power Energy Syst. 2020, 117, 105702. [Google Scholar] [CrossRef]

- Wu, Y.; Shi, J.; Lim, G.; Fan, L.; Molavi, A. Optimal management of transactive distribution electricity markets with Co-optimized bidirectional energy and ancillary service exchanges. IEEE Trans. Smart Grid 2020. [Google Scholar] [CrossRef]

- Liu, Z.; Wang, L.; Ma, L. A transactive energy framework for coordinated energy management of networked microgrids with distributionally robust optimization. IEEE Trans. Power Syst. 2020, 35, 395–404. [Google Scholar] [CrossRef]

- Wang, J.; Wang, Q.; Zhou, N.; Chi, Y. A novel electricity transaction mode of microgrids based on blockchain and continuous double auction. Energies 2017, 10, 1971. [Google Scholar] [CrossRef]

- Akbari-Dibavar, A.; Mohammadi-Ivatloo, B.; Zare, K. Electricity Market Pricing: Uniform Pricing vs. Pay-as-Bid Pricing. In Electricity Markets; Springer: Berlin/Heidelberg, Germany, 2020; pp. 19–35. [Google Scholar]

- Pandžić, K.; Pandžić, H.; Kuzle, I. Virtual storage plant offering strategy in the day-ahead electricity market. Int. J. Electr. Power Energy Syst. 2019, 104, 401–413. [Google Scholar] [CrossRef]

- Hwang, Y.M.; Sim, I.; Sun, Y.G.; Lee, H.-J.; Kim, J.Y. Game-Theory Modeling for social welfare maximization in smart grids. Energies 2018, 11, 2315. [Google Scholar] [CrossRef]

- Schmitt, C.; Cramer, W.; Vasconcelos, M.; Thie, N. Impact of Spot Market Interfaces on Local Energy Market Trading. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Łódź, Poland, 28 June 2019; pp. 1–6. [Google Scholar]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Market framework for local energy trading: A review of potential designs and market clearing approaches. IET Gener. Transm. Distrib. 2018, 12, 5899–5908. [Google Scholar] [CrossRef]

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making under Uncertainty in Electricity Markets; Springer: Berlin/Heidelberg, Germany, 2010; Volume 1. [Google Scholar]

- Soares, J.; Canizes, B.; Ghazvini, M.A.F.; Vale, Z.; Venayagamoorthy, G.K. Two-stage stochastic model using Benders’ decomposition for large-scale energy resource management in smart grids. IEEE Trans. Ind. Appl. 2017, 53, 5905–5914. [Google Scholar] [CrossRef]

- Ghazvini, M.A.F.; Faria, P.; Ramos, S.; Morais, H.; Vale, Z. Incentive-based demand response programs designed by asset-light retail electricity providers for the day-ahead market. Energy 2015, 82, 786–799. [Google Scholar] [CrossRef]

- Heitsch, H.; Römisch, W. Scenario reduction algorithms in stochastic programming. Comput. Optim. Appl. 2003, 24, 187–206. [Google Scholar] [CrossRef]

- Silvente, J.; Papageorgiou, L.G.; Dua, V. Scenario tree reduction for optimisation under uncertainty using sensitivity analysis. Comput. Chem. Eng. 2019, 125, 449–459. [Google Scholar] [CrossRef]

- Do Prado, J.C.; Qiao, W. A stochastic decision-making model for an electricity retailer with intermittent renewable energy and short-term demand response. IEEE Trans. Smart Grid 2018, 10, 2581–2592. [Google Scholar] [CrossRef]

- Rider, M.J.; López-Lezama, J.M.; Contreras, J.; Padilha-Feltrin, A. Bilevel approach for optimal location and contract pricing of distributed generation in radial distribution systems using mixed-integer linear programming. IET Gener. Transm. Distrib. 2013, 7, 724–734. [Google Scholar] [CrossRef]

- Kazempour, S.J.; Conejo, A.J.; Ruiz, C. Strategic generation investment using a complementarity approach. IEEE Trans. Power Syst. 2010, 26, 940–948. [Google Scholar] [CrossRef]

- Dadashi, M.; Haghifam, S.; Zare, K.; Haghifam, M.-R.; Abapour, M. Short-term scheduling of electricity retailers in the presence of Demand Response Aggregators: A two-stage stochastic Bi-Level programming approach. Energy 2020, 205, 117926. [Google Scholar] [CrossRef]

- Exizidis, L.; Kazempour, J.; Pinson, P.; De Grève, Z.; Vallée, F. Impact of public aggregate wind forecasts on electricity market outcomes. IEEE Trans. Sustain. Energy 2017, 8, 1394–1405. [Google Scholar] [CrossRef]

- Asl, R.M.; Zargin, E. Energy Procurement via Hybrid Robust-Stochastic Approach. In Robust Energy Procurement of Large Electricity Consumers; Springer: Berlin/Heidelberg, Germany, 2019; pp. 105–123. [Google Scholar]

- Feng, C.; Li, Z.; Shahidehpour, M.; Wen, F.; Li, Q. Stackelberg game based transactive pricing for optimal demand response in power distribution systems. Int. J. Electr. Power Energy Syst. 2020, 118, 105764. [Google Scholar] [CrossRef]

- Akbari, E.; Hooshmand, R.-A.; Gholipour, M.; Parastegari, M. Stochastic programming-based optimal bidding of compressed air energy storage with wind and thermal generation units in energy and reserve markets. Energy 2019, 171, 535–546. [Google Scholar] [CrossRef]

- Aliasghari, P.; Zamani-Gargari, M.; Mohammadi-Ivatloo, B. Look-ahead risk-constrained scheduling of wind power integrated system with compressed air energy storage (CAES) plant. Energy 2018, 160, 668–677. [Google Scholar] [CrossRef]

- Asensio, M.; Muñoz-Delgado, G.; Contreras, J. Bi-level approach to distribution network and renewable energy expansion planning considering demand response. IEEE Trans. Power Syst. 2017, 32, 4298–4309. [Google Scholar] [CrossRef]

- Haghifam, S.; Zare, K.; Dadashi, M. Bi-level operational planning of microgrids with considering demand response technology and contingency analysis. IET Gener. Transm. Distrib. 2019, 13, 2721–2730. [Google Scholar] [CrossRef]

- Ghalelou, A.N.; Fakhri, A.P.; Nojavan, S.; Majidi, M.; Hatami, H. A stochastic self-scheduling program for compressed air energy storage (CAES) of renewable energy sources (RESs) based on a demand response mechanism. Energy Convers. Manag. 2016, 120, 388–396. [Google Scholar] [CrossRef]

| Ref. | Participation of the SDN’s Entities in Both WEM and LEM | Stackelberg Game-Based Approach for Local TE Trading | Coordination of Decentralized DERs by an Independent AG |

|---|---|---|---|

| [6] | ✗ | ✗ | ✓ |

| [7] | ✗ | ✗ | ✓ |

| [8] | ✗ | ✗ | ✓ |

| [9] | ✗ | ✗ | ✓ |

| [10] | ✗ | ✗ | ✓ |

| [11] | ✓ | ✗ | ✗ |

| [12] | ✓ | ✗ | ✗ |

| [13] | ✓ | ✗ | ✗ |

| [14] | ✓ | ✗ | ✗ |

| [15] | ✓ | ✗ | ✗ |

| [16] | ✓ | ✗ | ✓ |

| [17] | ✓ | ✗ | ✓ |

| [18] | ✓ | ✓ | ✗ |

| [19] | ✓ | ✓ | ✗ |

| [20] | ✓ | ✓ | ✗ |

| [21] | ✓ | ✓ | ✗ |

| This Paper | ✓ | ✓ | ✓ |

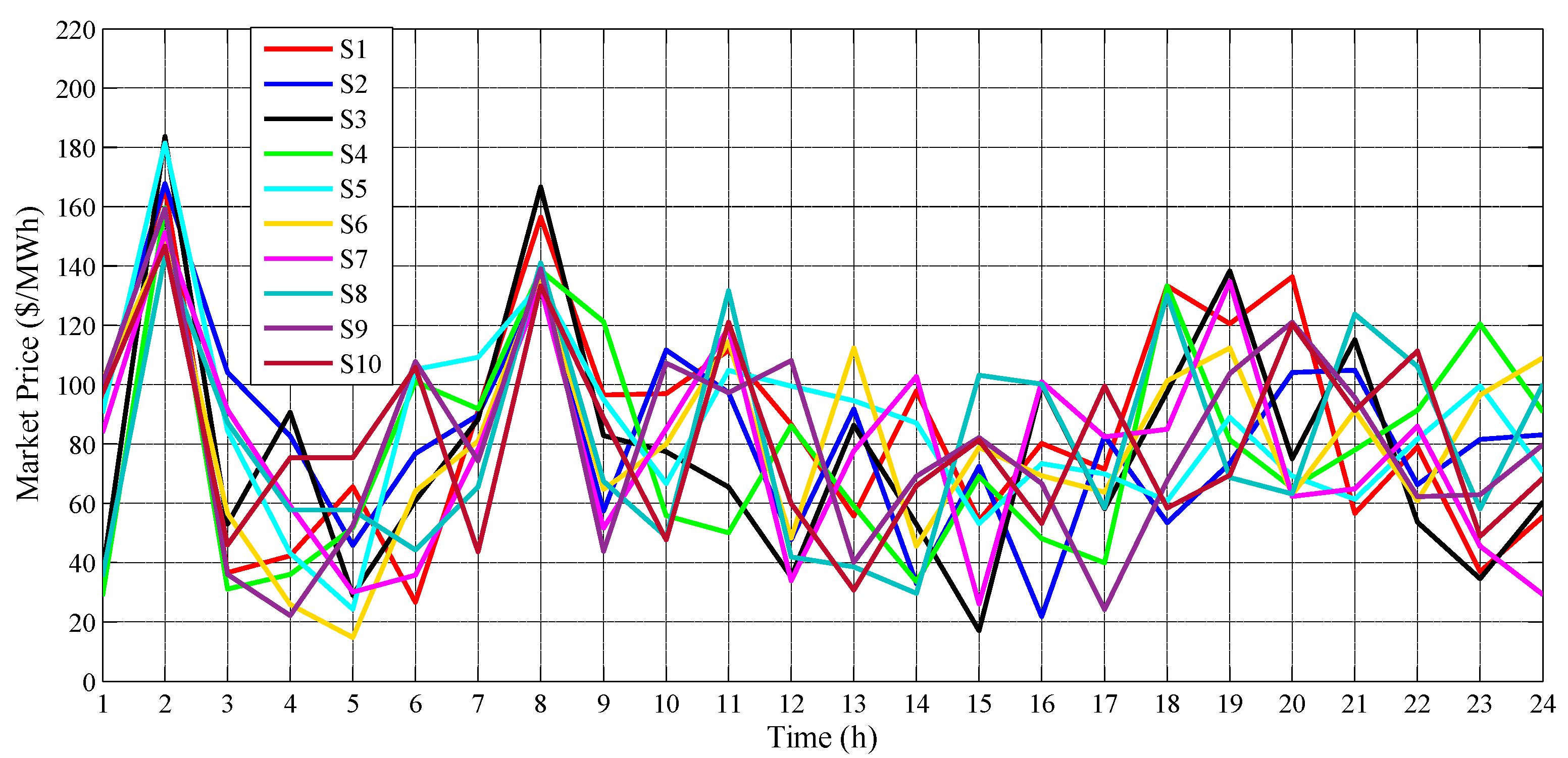

| # Scenario | S1 | S2 | S3 | S4 | S5 | S6 | S7 | S8 | S9 | S10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Probability | 0.082 | 0.084 | 0.101 | 0.123 | 0.169 | 0.121 | 0.114 | 0.064 | 0.070 | 0.072 |

| Bus Number | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Demand (MW) | – | 2.19 | 0.92 | 3.58 | 1.08 | 2.69 | 5.50 | 5.38 | 1.15 | 1.73 | 0.27 |

| Bus Number | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| Demand (MW) | 1.81 | 1.88 | 3.04 | 0.92 | 1.23 | 1.38 | 2.73 | 1.85 | 2.42 | 2.19 | 1.73 |

| Bus Number | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 |

| Demand (MW) | 1.77 | 10.38 | 10.62 | 0.92 | 1.85 | 1.04 | 3.54 | 5.73 | 3.15 | 5.73 | 1.58 |

| DSO’s Dispatchable Resources | ||||||

| Units | (MW) | (MW) | (USD/MWh) | (USD) | (h) | (h) |

| 1 | 0.5 | 6.0 | 26.1 | 42.0 | 2.0 | 2.0 |

| 2 | 0.5 | 6.0 | 26.1 | 42.0 | 2.0 | 2.0 |

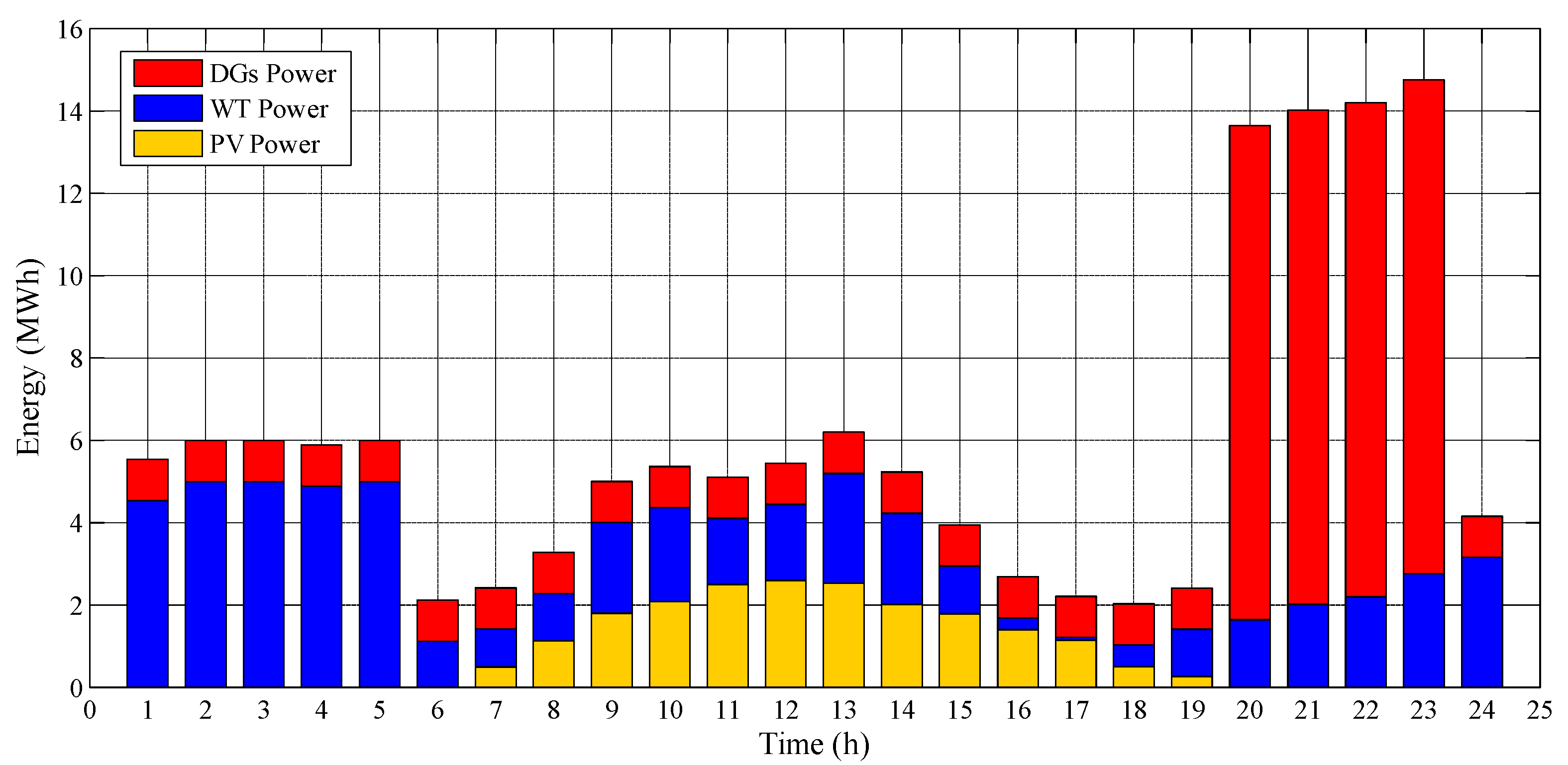

| AG’s Dispatchable Resources | ||||||

| Units | (MW) | (MW) | (USD/MWh) | (MW) | (MW) | |

| 1 | 0.5 | 5.0 | 51.0 | 1.5 | 2.0 | |

| 2 | 0.5 | 4.0 | 41.0 | 1.0 | 1.5 | |

| DSO’s Resources | AG’s Resources | ||

|---|---|---|---|

| Parameter | Value | Parameter | Value |

| 5 (MW) | 2 × 5 (MW) | ||

| 14 (m/s) | 15 (m/s) | ||

| 4 (m/s) | 4 (m/s) | ||

| 20 (m/s) | 25 (m/s) | ||

| 3 (MW) | 7.5 (MW) | ||

| 25 (°C) | 25 (°C) | ||

| 1 (kW/m2) | 1 (kW/m2) | ||

| −0.005 (1/°C) | −0.005 (1/°C) | ||

| 2.00 (MWh) | 20.00 (MWh) | 3.09 (USD/MWh) | 3.09 (USD/MWh) | 3.99 (MMBtu/MWh) | 1.87 (USD/MMBtu) | 4.00 (MWh) | 4.00 (MWh) |

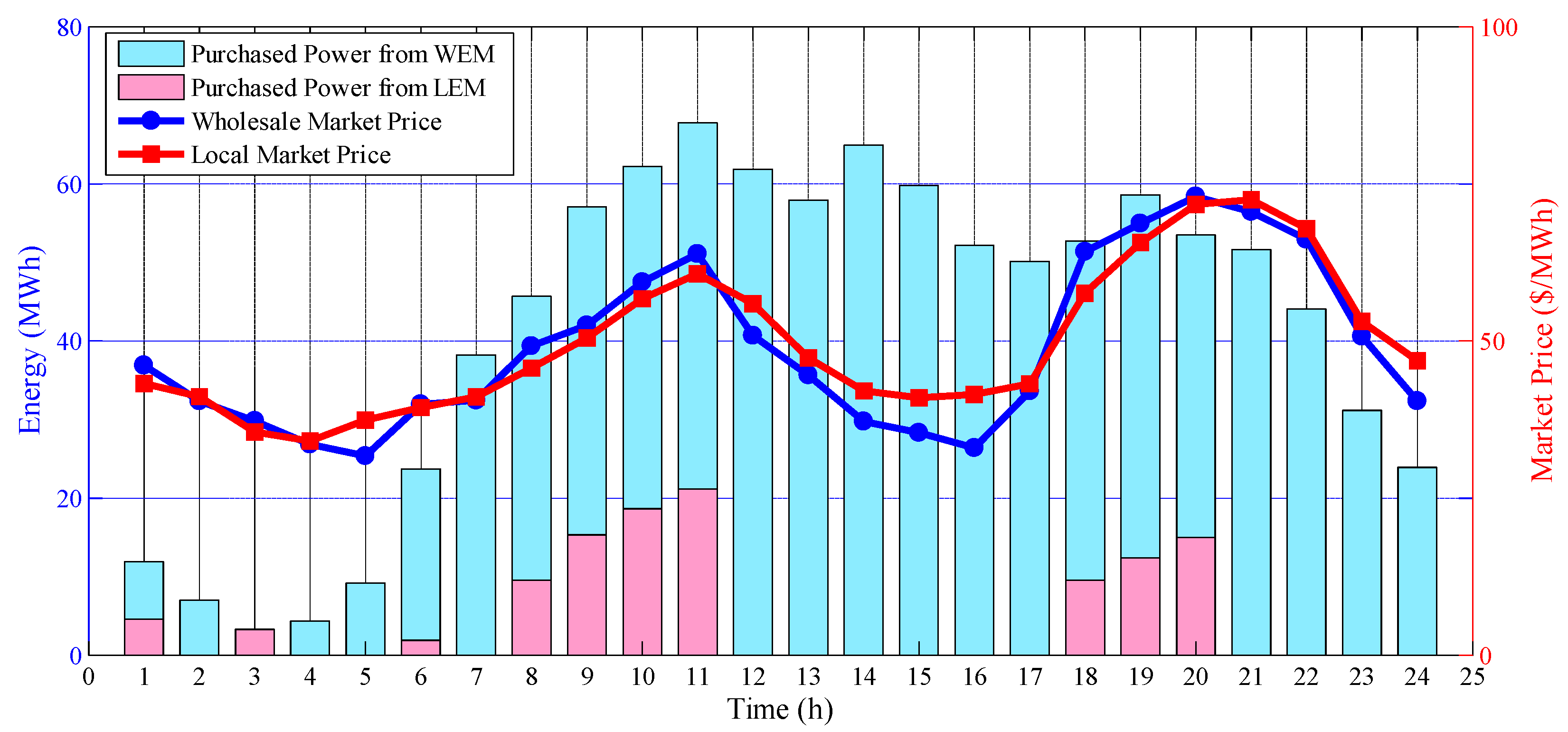

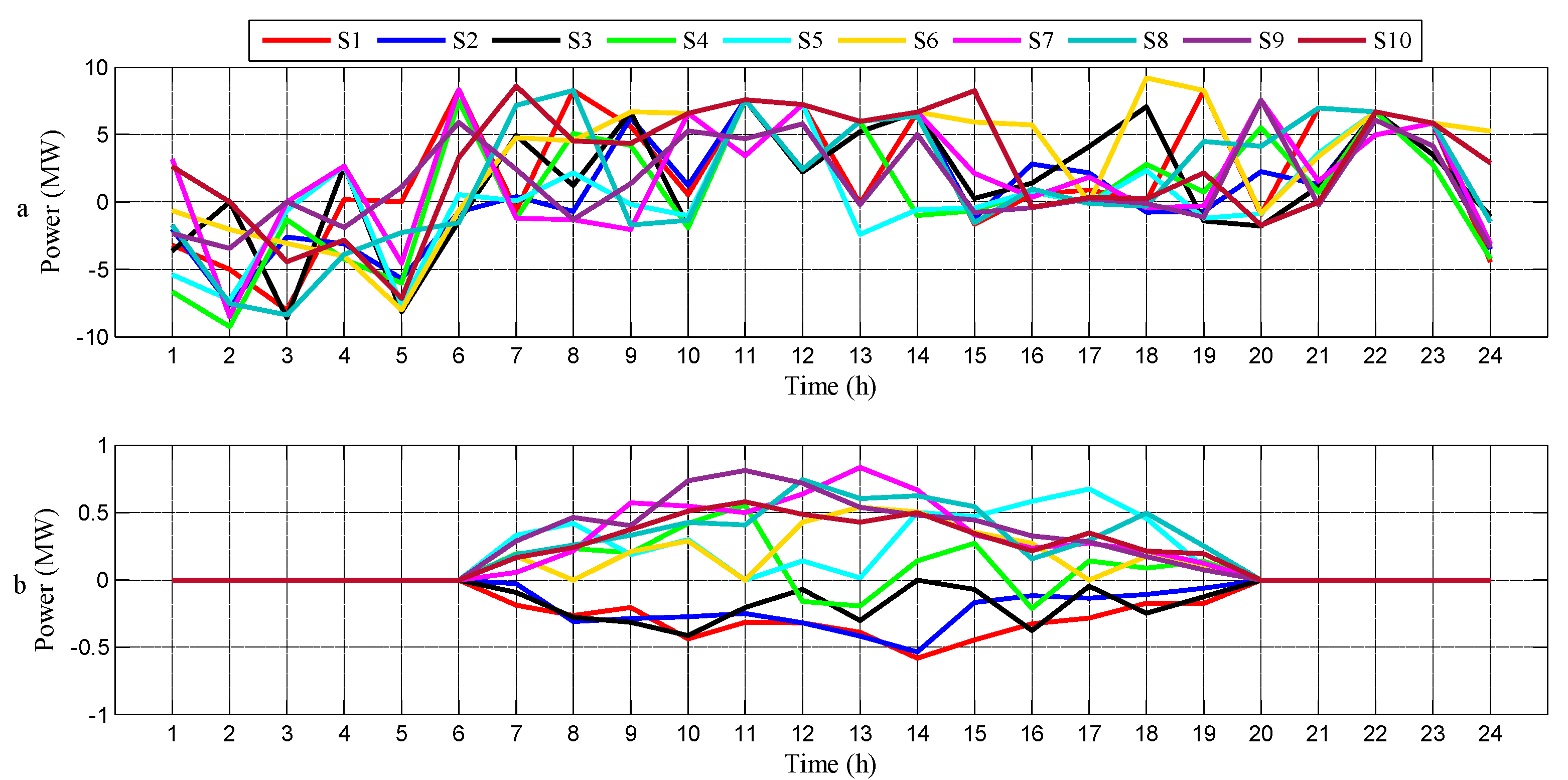

| Market Transaction Cost (USD/day) | Purchased Energy (MWh/day) | Market Transaction Revenue (USD/day) | Sold Energy (MWh/day) | Operating Cost of DERs (USD/Day) | |||||

|---|---|---|---|---|---|---|---|---|---|

| LEM | WEM | LEM | WEM | LEM | WEM | LEM | WEM | ||

| DA | 6375.8 | 44952.8 | 111.3 | 881.3 | 0.0 | 0.0 | 0.0 | 0.0 | 3866.8 |

| RT-S1 | 0.0 | 0.0 | 0.0 | 0.0 | 55.1 | 3430.3 | 12.7 | 448.2 | 707.8 |

| RT-S2 | 0.0 | 0.0 | 0.0 | 0.0 | 44.8 | 1998.3 | 7.1 | 301.6 | 741.5 |

| RT-S3 | 0.0 | 0.0 | 0.0 | 0.0 | 99.6 | 2186.1 | 17.0 | 243.8 | 846.2 |

| RT-S4 | 0.0 | 10.6 | 0.0 | 3.8 | 130.9 | 2425.9 | 17.5 | 205.2 | 1004.9 |

| RT-S5 | 0.0 | 18.3 | 0.0 | 4.8 | 37.2 | 3583.9 | 2.8 | 204.1 | 1644.9 |

| RT-S6 | 0.0 | 78.1 | 0.0 | 13.1 | 33.0 | 2113.0 | 4.0 | 202.3 | 1069.1 |

| RT-S7 | 0.0 | 82.4 | 0.0 | 11.6 | 97.1 | 1272.2 | 11.0 | 130 | 887.2 |

| RT-S8 | 28.8 | 105.9 | 2.6 | 31.8 | 79.6 | 640.0 | 8.6 | 113.3 | 493.5 |

| RT-S9 | 49.4 | 77.6 | 8.6 | 27.1 | 69.9 | 564.4 | 10.4 | 94.3 | 630.1 |

| RT-S10 | 108.0 | 134.3 | 13.2 | 30.2 | 7.2 | 505.8 | 1.4 | 84.8 | 603.4 |

| Market Transaction Cost (USD/day) | Purchased Energy (MWh/day) | Market Transaction Revenue (USD/day) | Sold Energy (MWh/day) | Operating Cost of DERs (USD/day) | |||||

|---|---|---|---|---|---|---|---|---|---|

| LEM | WEM | LEM | WEM | LEM | WEM | LEM | WEM | ||

| DA | 0.0 | 55.9 | 0.0 | 1.4 | 6375.8 | 4891.9 | 111.3 | 102.3 | 4180.6 |

| RT-S1 | 55.1 | 126.8 | 12.7 | 11.4 | 0.0 | 550.6 | 0.0 | 73.5 | – |

| RT-S2 | 44.8 | 181.1 | 7.1 | 21.5 | 0.0 | 305.9 | 0.0 | 56.0 | – |

| RT-S3 | 99.6 | 41.9 | 17.0 | 10.9 | 0.0 | 420.4 | 0.0 | 61.0 | – |

| RT-S4 | 130.9 | 295.0 | 17.5 | 21.3 | 0.0 | 675.0 | 0.0 | 55.8 | – |

| RT-S5 | 37.2 | 318.1 | 2.8 | 25.2 | 0.0 | 758.5 | 0.0 | 44.7 | – |

| RT-S6 | 33.0 | 93.8 | 4.0 | 15.2 | 0.0 | 1092.1 | 0.0 | 108.1 | – |

| RT-S7 | 97.1 | 153.4 | 11.0 | 10.6 | 0.0 | 515.0 | 0.0 | 68.0 | – |

| RT-S8 | 79.6 | 38.5 | 8.6 | 7.9 | 28.8 | 346.3 | 2.6 | 80.8 | – |

| RT-S9 | 69.9 | 146.8 | 10.4 | 21.6 | 49.4 | 276.6 | 8.6 | 58.0 | – |

| RT-S10 | 7.2 | 116.9 | 1.4 | 14.0 | 108.0 | 158.4 | 13.2 | 36.0 | – |

| DSO | DER Aggregator | ||

|---|---|---|---|

| LEM Transaction Cost | 5907.8 (USD/day) | LEM Transaction Benefit | 5907.8 (USD/day) |

| WEM Transaction Cost | 26740.0 (USD/day) | WEM Transaction Benefit | 8422.6 (USD/day) |

| DERs’ Operating Cost | 12495.4 (USD/day) | DERs’ Operating Cost | 4180.6 (USD/day) |

| Total Operating Cost | 45,143.2 (USD/day) | Total Expected Benefit | 10,149.7 (USD/day) |

| DSO | DER Aggregator | ||

|---|---|---|---|

| LEM Transaction Cost | 12699.6 (USD/day) | LEM Transaction Benefit | 12,699.6 (USD/day) |

| WEM Transaction Cost | 20,828.9 (USD/day) | WEM Transaction Benefit | 3803.8 (USD/day) |

| DERs’ Operating Cost | 12,164.0 (USD/day) | DERs’ Operating Cost | 5123.7 (USD/day) |

| Total Operating Cost | 45,692.5 (USD/day) | Total Expected Benefit | 11,379.7 (USD/day) |

| With a Game-Based Approach | Without a Game-Based Approach | |

|---|---|---|

| DSO’s Total Operating Cost | 45,143.2 (USD/day) | 45,692.5 (USD/day) |

| AG’s Total Expected Benefit | 10,149.7 (USD/day) | 11,379.7 (USD/day) |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Haghifam, S.; Zare, K.; Abapour, M.; Muñoz-Delgado, G.; Contreras, J. A Stackelberg Game-Based Approach for Transactive Energy Management in Smart Distribution Networks. Energies 2020, 13, 3621. https://doi.org/10.3390/en13143621

Haghifam S, Zare K, Abapour M, Muñoz-Delgado G, Contreras J. A Stackelberg Game-Based Approach for Transactive Energy Management in Smart Distribution Networks. Energies. 2020; 13(14):3621. https://doi.org/10.3390/en13143621

Chicago/Turabian StyleHaghifam, Sara, Kazem Zare, Mehdi Abapour, Gregorio Muñoz-Delgado, and Javier Contreras. 2020. "A Stackelberg Game-Based Approach for Transactive Energy Management in Smart Distribution Networks" Energies 13, no. 14: 3621. https://doi.org/10.3390/en13143621

APA StyleHaghifam, S., Zare, K., Abapour, M., Muñoz-Delgado, G., & Contreras, J. (2020). A Stackelberg Game-Based Approach for Transactive Energy Management in Smart Distribution Networks. Energies, 13(14), 3621. https://doi.org/10.3390/en13143621