1. Introduction

In order to lower greenhouse gas (GHG) emissions and to help achieve the goal of climate change mitigation, electric vehicle (EV) adoption has been discussed worldwide. Policies aiming to incentivize consumers have been widely adopted by governments in North America, Europe, and Asia. The effectiveness of policies to increase the market share of EVs has always been discussed in the literature.

We all know that the higher acquisition cost of electric vehicles compared to conventional vehicles is one of the important barriers to adoption, due to R&D investment and fixed asset investment of the car manufactures. For a new environment-friendly technology, the barriers also include the lack of knowledge for consumers and low consumer risk tolerance [

1], leading to an inefficient allocation of goods and services, known as a market failure in economics. Thus, adopting policy incentives is reasonable to fix the market.

As for electric vehicles, policy incentives include financial incentives and non-financial incentives.

Table 1 is adapted from reports of International Energy Agency (IEA), listing the existing policies in some selected countries in 2018/2019 [

2]. Financial incentives consist of direct purchasing subsidy, registration/emission/tax fee exemption, etc., which are most widely used worldwide to lower the initial purchasing cost and cost in daily use. The authors of [

3] studied financial and tax incentive policies in Norway based on a survey and found that tax exemptions were significant motivators for more than 80% of the respondents. Moreover, [

4] concluded that the markets with high EV penetration, such as Norway, the Netherlands, and the State of California, were mainly attributed to supportive incentive policies. However, existing literatures have conflicting results regarding the effectiveness of financial incentives. The authors of [

5] found that financial incentives were significantly correlated to EV uptake, whereas [

6] showed a very weak correlation between purchase subsidies and consumers’ willingness to buy EVs. There are literatures show that repealing incentives may result in a sharp drop in sales. For example, the U.S. state Georgia experienced a drop in EV sales by over 80% after the state government repealed the tax credit [

7] and [

8] found that when subsidies and tax exemption for EVs are abrogated with no change to other policies, the market share of EVs will suffer a sharp fall by 42%. Thus, it is important to explore the crucial factors influencing EV adoption.

As substitutes and complements of financial incentives, non-financial incentives and public charging infrastructures also matter a lot to EV adoption. Non-financial incentive policies are designed for the convenience of EV users and vary across countries, such as free parking policy, toll tax exemption, highway lane excess, etc. The authors of [

3] supported that convenience measures such as free parking are very effective for an increase in EV sales using stated preference (SP) data. Based on a large number of EV consumers, free access to bus lanes and exemption from toll taxes were the crucial factors for EV adoption. Furthermore, [

9] attributed about 25% of California’s EV sales to high-occupancy vehicle (HOV) lane access policy. However, [

10] demonstrated that access to bus lanes and road toll waivers are not statistically significant, whereas charging infrastructures are a strong predictor to EV adoption. The authors of [

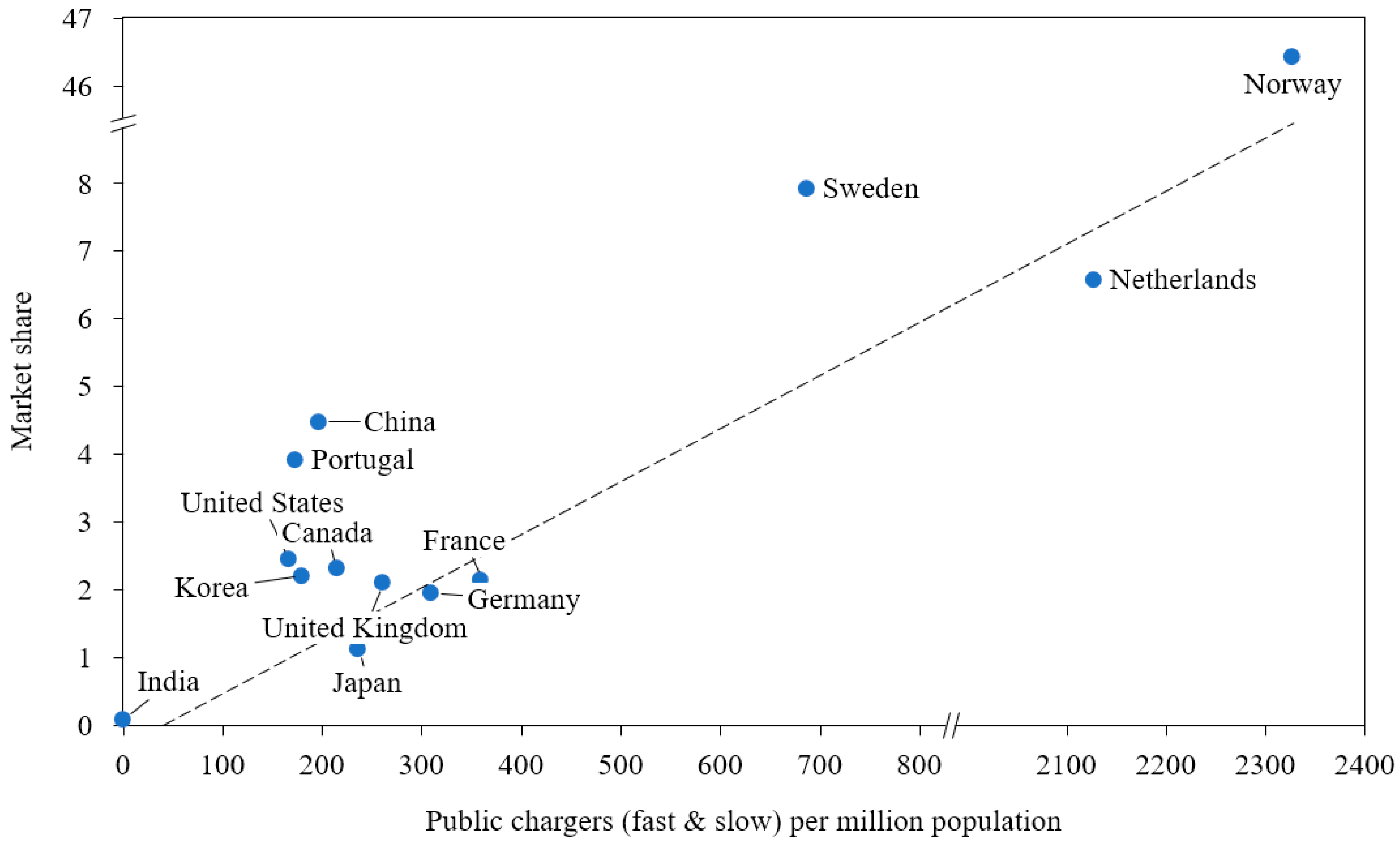

5] drew a similar conclusion regarding the relationship between the market share of electric vehicles and the number of charging stations per capita on national level.

Besides, government regulations are important factors to facilitate EV sales, targeting both consumers and automobile manufacturers, usually including setting goals for EV uptake, restricting the fuel used and mandating the EV production. A few examples of such regulations are GHG standards, a zero-emission vehicle mandate, and a low-carbon fuel standard. The authors of [

11] revealed that corporate average fuel economy (CAFE) regulation could help promote the market penetration of EV, especially if executed along with other incentives. The authors of [

12] studied dual-credit policy in China and found that the Corporate Average Fuel Consumption rules alone may stimulate more plug-in electric vehicle (PEV) sales than the dual-credit policy; however, the dual-credit policy could stimulate more battery electric vehicles (BEVs) in the market compared to other policy scenarios. Additionally, more economic benefits could be achievable for fleet owners once the carbon tax is introduced [

13].

Battery electric vehicles (BEVs) operating solely on electricity are not the only alternative for the electrification of passenger cars. Plug-in hybrid electric vehicles (PHEV) running on both gasoline and electricity, usually with a lower cruising range, have the potential to replace fuel used with electricity and thus lower the impact on the environment, without compromising the range of the vehicle [

14]. Since PHEVs do not suffer from range limitation, they bring higher flexibility for drivers and can be well suited for diversified driving needs. For which type of EVs to become a major option on the private car market, the total economics of the EV type would presumably have to be favorable compared to the alternatives, since the currently dominant battery technology (Li-ion) is still relatively expensive. Earlier studies have commonly focused on total battery cost and some recent studies have discussed the marginal cost and its effect on cost-effective battery sizing. For example, [

15] found the battery range has a small impact on the total cost of ownership (TCO) for PHEVs, while [

16] concluded that short-range PHEVs would reduce more gasoline consumption than PHEVs with a larger range. These different characteristics caused different market shares for EVs and PHEVs even in the same country. It will be interesting to study the effects of incentives on BEVs and PHEVs separately.

The trend of the relevant studies in recent five years is summarized in

Table 2, adapted from a review by [

13], selecting researches in field of Business Management and policy, as well as the field of Transportation and Environment science together. The adoption of electric vehicles is most frequently discussed in the USA and China, since the they have the largest EV markets. Studies in the USA are the most over the years, while studies based on other countries have been increasing, with China being the second, especially from 2017 onwards. The more prominent research design used in literature is a quantitative method compared to a qualitative method. Survey-based methodology is the most predominant method used for EV adoption, followed by simulation, optimization techniques, and secondary data analysis. Most cross-country studies used survey-based analysis and secondary data analysis, which indicates that heterogeneity, causality, and locational disparity are important indicators in the area [

17]. Noticeably, the stated preference (SP) data of consumers may be subjective and are usually not be in accordance with reality [

8]; thus, quantitative research using fact analysis may be preferred.

Though plenty of researchers have done a considerable amount of work on EV-related policies, few papers have discussed the diminishing effect of subsidies for EVs using quantitative analysis on cross-country data. This scenario is also well known as the post subsidy era, referring to the stage when subsidies retreat and have less impact on consumers’ purchasing decisions. This paper focuses on this recent subtle change of subsidies and fills the gap by using multiple linear regression and panel data on 13 countries from 2015 to 2018 to examine the impact of policies and infrastructures on electric vehicle market.

The rest of the paper is organized as follows.

Section 2 gives the descriptive statistics of the data in 13 countries and introduces the methodology.

Section 3 demonstrates the impact of the policy incentives and infrastructures on EV uptake, and explanations for the findings are given in this section.

Section 4 draws conclusions and provides policy implications.

2. Data and Methods

2.1. Data Description

EV market share and sales data were collected from International Energy Agency [

2], containing 13 countries over 4 years (2015–2018). These countries are Canada, China, France, Germany, India, Japan, Korea, the Netherlands, Norway, Portugal, Sweden, the United Kingdom and the United States. Electric vehicles in the 13 countries accounted for over 90% worldwide in recent years. The macroeconomic data were collected from the website of World Bank. Details of variables and data sources are provided in

Appendix A.

Policies we selected in the paper are considered as important ones to EV adoption or have conflicting results in related literatures. All these countries mentioned above are adopting targeted zero emission vehicle (ZEV) regulations and incentives to accelerate the rate of deployment. Mandate and purchasing restriction are dummy variables, indicating whether it is implemented. The other non-financial policies are categorical variables evaluated by policy intensity. The wider the policy is applied in the country, the higher the scores it gets. Details about how we quantify the effect of non-financial policies by assigning different values are provided in

Appendix B.

Table 3 provides the financial and non-financial policies we have considered in our model. Fuel standard is the level of fuel standards/regulations drivers need to meet and has been raised over the years to meet air quality standards and greenhouse gas emission reduction goals. ZEV (Zero emission vehicle) mandates on manufacturers can also result in increased model availability in the market. Insufficient model options can deter consumers from purchasing EVs even after adequate emphasis on consumer incentives and charging infrastructures.

Among the non-financial policy incentives, the variable target evaluates the governments’ ambition to promote EVs. Different countries released a different target year to ban internal combustion engine (ICE) sales and achieve 100% ZEV sales. For example, Norway took the lead and promised to replace all fuel cars by 2025 [

18], followed by some other European countries, such as Denmark and Iceland, announcing 100% ZEV by 2030. The Netherlands and the UK promised to replace all traditional vehicles later than 2040. The earlier the 100% ZEV target year is, the higher scores the variable target will get. We expected a positive relationship between the goal and EV uptake. [

19] has highlighted the importance of policy goals in the UK and Germany to decrease GHG emissions; however, [

20] found that the EV climate mitigation strategy was not effective in the United Kingdom. Despite the conflicting conclusions, the policy goal will be considered and tested in our model.

For better accuracy, after using dummy variables to describe the policies, we collected numerical dollar values to describe the purchasing incentives (usually are tax credits or purchasing subsidies). The numerical incentives are used in the extended analysis part where BEVs and PHEVs are discussed, respectively. BEVs, which totally use electricity were able to receive higher subsidies because the level of subsidies was usually decided by battery capacity across the countries. In this study, we assigned the highest level of money (tax credits or subsidies) a passenger vehicle can receive from the central government to the variable subsidy. Though we did not use median or average values because of data unavailability, the maximum value can still reflect the intensity of the subsidy, since both manufacturers and consumers will strive for the maximum subsidy. It is also a reason that a government giving a higher upper limit for subsidy standard, tends to provide a higher medium level of subsidies, that is to say, the maximum value of standard should be highly related to the average subsidy consumers get. Furthermore, we used linear regression for analysis; thus, we care much more about the relative relationship between countries and the difference between years, than the absolute value of subsidies. Thus, using the highest level of subsidy standard is reasonable. Besides, the subsidy itself is based on many parameters, and each country or even each province has different standards. For a global scope research involving 13 countries and 4 years, it is too complicated to refine and calculate subsidies and we only divided it into two categories: BEV and PHEV subsidies, which are considered as two variables and will be applied to BEV and PHEV sales, respectively.

For BEVs, Korea and China offered the highest subsidy in Asia. The subsidy in Korea was up to 10,900 dollars and was the highest of all countries over the years, although the standard of getting total subsidy was not easy to meet. China offered a subsidy up to 8900 dollars before 2018, slightly higher than the federal tax credits (USD 7500) in the United States. Norway was the most generous country in Europe to subsidize the promotion of electric vehicles with the highest level of 10,300 dollars over the 4 years. Except for France and Sweden, the other European countries, such as Germany and Portugal, gave lower than average subsidies (USD 6000) to EV consumers. Among all the countries listed in our study, India gave the least subsidies of up to 2000 dollars for BEVs, lower than Portugal (USD 2400), which ranked the second last.

For PHEVs, subsidies were much lower. The UK with USD 7100 subsidies ranked first and Norway with USD 7000 ranked second. Though Korea offered the highest subsidy for BEVs, PHEVs could only get the maximum of USD 860 dollars. When BEVs and PHEVs are considered as a whole, we used the weighted average of subsidies by the sales volume.

Appendix B shows the value of some non-financial policy and numerical variables, such as subsidies and charger density, in 2018.

Table 4 below is the summary statistics, which contains the characteristics of all variables. The variables fast/slow chargers per million population means the number of chargers per million people in the country, which can also be presented by chargers’ density. EV share is the proportion of electric vehicle sales in total vehicle sales. We implemented a logit transformation to normalize the distribution of EV share because the data are skewed to the right [

21]. After the transformation, the data showed a normal distribution and validated the ordinary least squares (OLS) regression we plan to use. This is one of the necessary conditions for a good estimation result, not a sufficient condition. OLS regression also needs to satisfy the assumptions of homoscedasticity of the error term, no multicollinearity, etc. We have tested them below in the study and all results are satisfactory. To solve traffic congestion and air pollution problem, China adopts administrative orders to control the supply of vehicle licenses, while the restrictions is not applicable for EVs [

22]. To identify this effect, the variable purchasing restriction is considered in the pooled regression in the basic results part.

In

Table 5, correlation coefficients are provided. Between a pair of independent variables, the correlation between slow chargers and fast chargers shows the largest cross-correlation coefficient of 0.804. Thus, there should be no severe linear correlations during regressions.

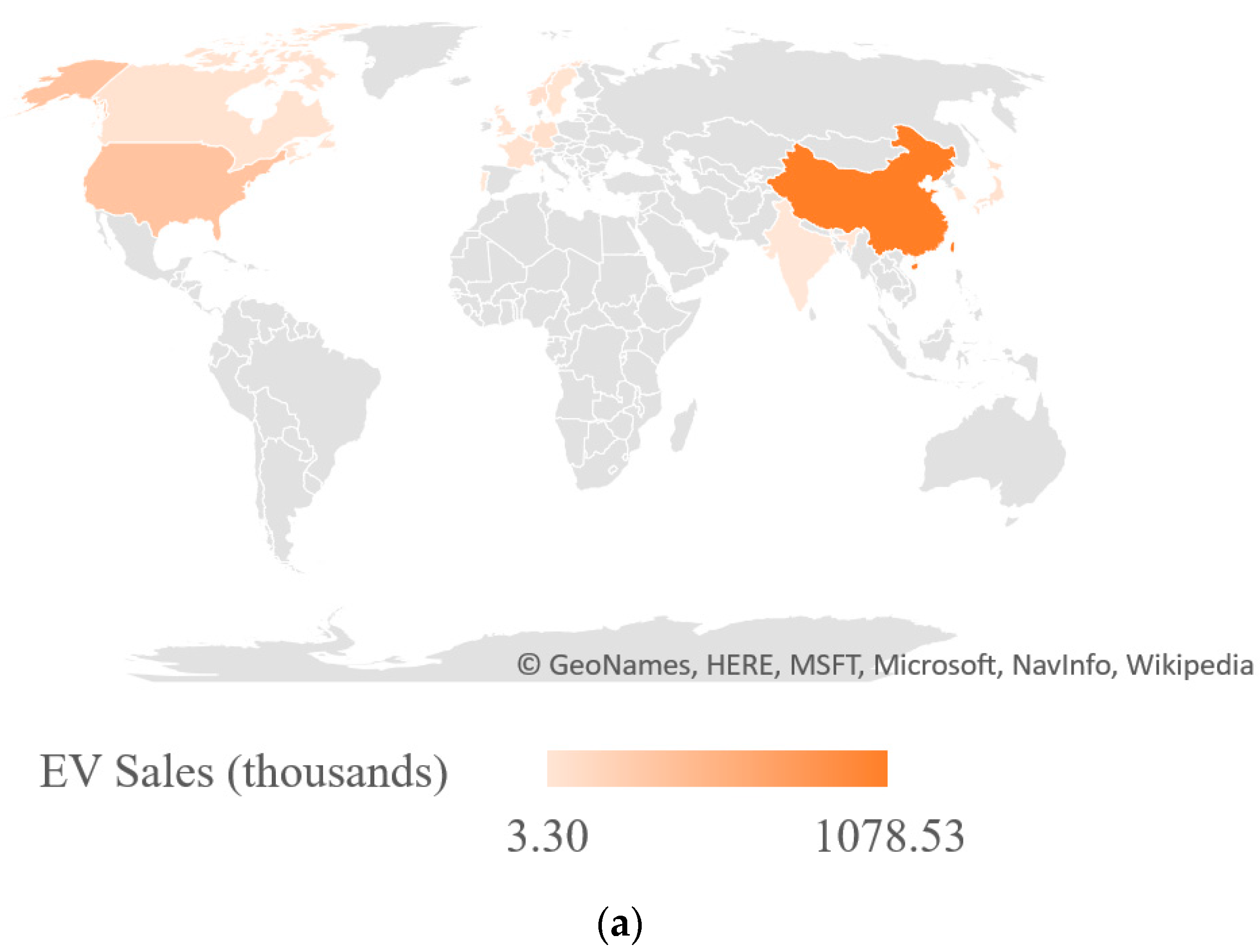

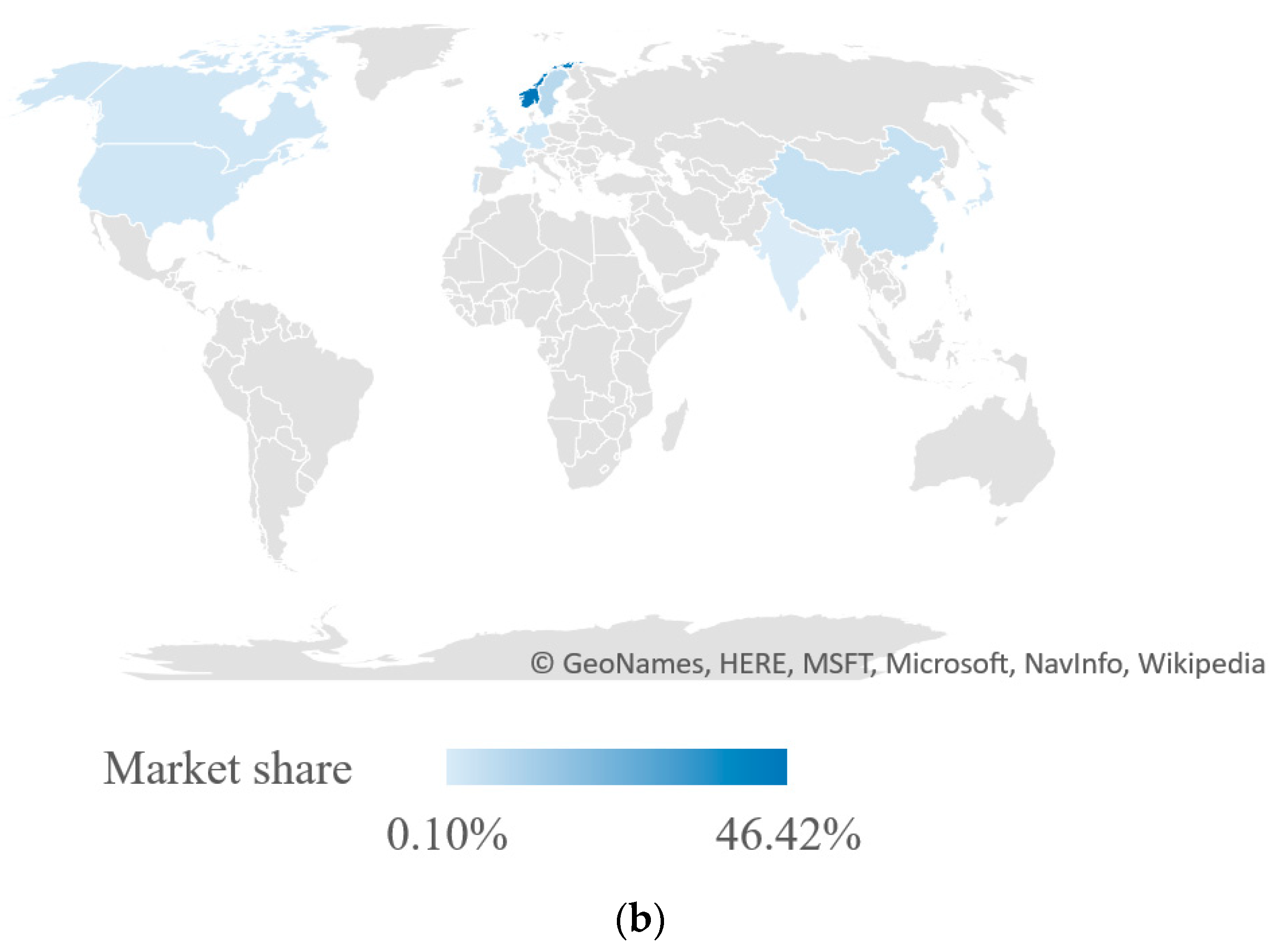

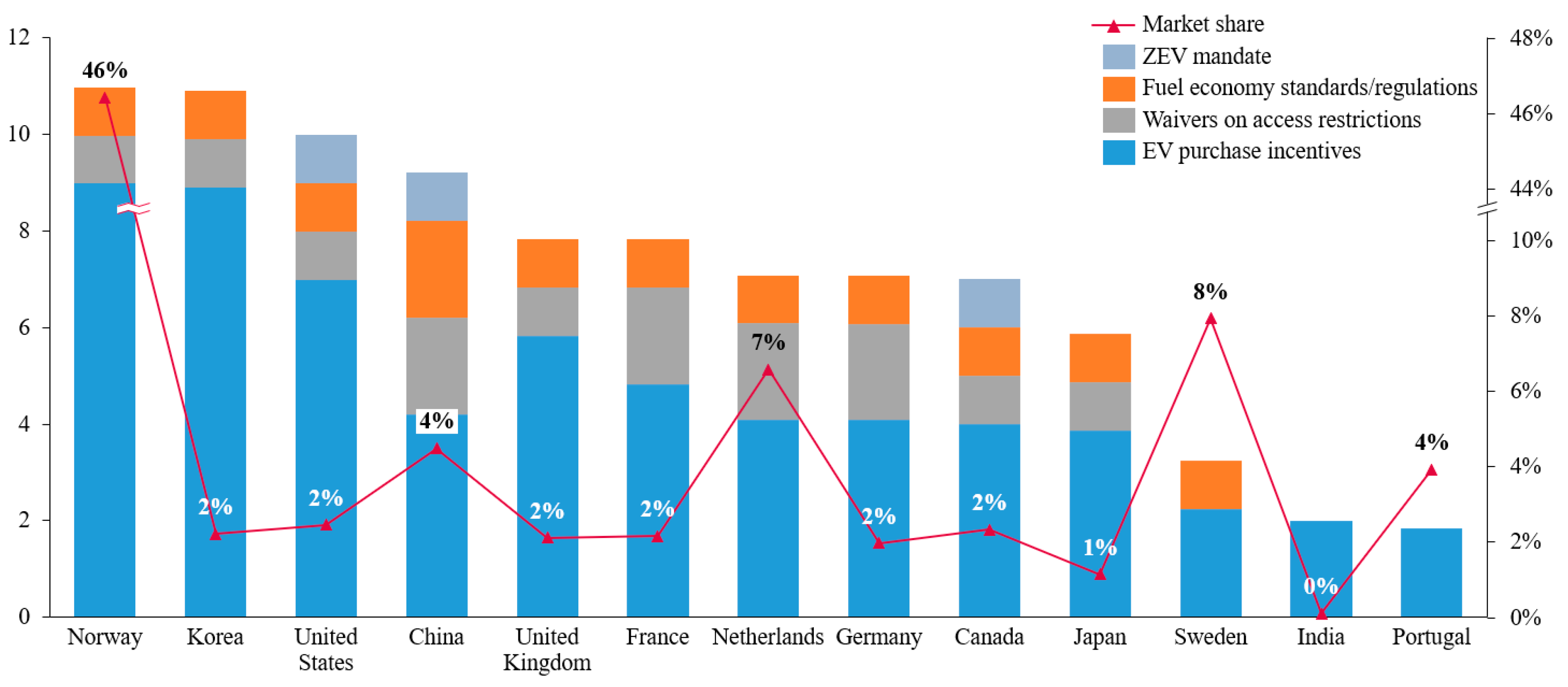

For an overview of the electric vehicle markets, we used cross-sectional data in 2018 to draw a worldwide map of the sales and market share of EVs as shown in

Figure 1. Though both crediting to the governments’ effort in promotion, market shares and sales give different information on the countries’ EV market. EV sales is more related to the market volume given that China and United States made remarkable achievements, while market shares showed the overall recognition of the citizens for EVs; thus, European countries showed higher EV share, especially Norway, the highest of all. Later in the basic result part, we will interpret the difference with statistical models.

2.2. Model

We used panel data regression to analyze EV uptake to reduce time-invariant heterogeneity resulting from some unobservable variables that affect the EV market share in different countries. The multiple linear regression model with panel data is shown as follows:

where subscripts

i and

t represent the

i-th country and the

t-th year, respectively. The dependent variable is

represent a logit transformation of

for country

i in year

t.

represents the EV share or EV sales, respectively, in two different regressions.

is the fixed effects for individual countries and

is the time fixed effects. Using this model, we evaluated the effectiveness of policies and charging infrastructures with macroeconomic factors controlled. To reduce the level of heteroscedasticity, some variables are taken natural logarithm along with EV shares [

23].

Moreover, a simplified model of this is used in the basic results part for a pooled regression to look at the effectiveness of different policies and other influential factors, shown in Equation (2):

The pooled regression model is one type of model that has constant coefficients, referring to both intercepts and slopes. For this model, we can pool all of the data and run an ordinary least squares regression model without considering difference across countries and years.

Two types of models are usually considered for panel data regressions: the fixed effects and random effects model, different in dealing with endogeneity. Before deciding on the best regression method, we first have to figure out if our predictor variables are endogenous. The Hausman specification test was used to detect endogenous regressors in a regression model [

24,

25]. Details of the tests will be provided in the result part.

Besides, we used two statistical tests for our data and model in

Section 3: the White test [

26] (verifying the data conforming to the OLS homoscedasticity assumption) and the variance inflation factor test [

27] (making sure that there is no multicollinearity problem in the pooled model). The tests showed that our data meet the requirements/assumptions of OLS regression.

For further analysis, we implemented the vector autoregression (VAR) model as an alternative method, in order to take time lag into consideration. Ordinarily, regressions reflect “mere” correlations, but [

28] argued that causality in economics could be tested for by measuring the ability to predict the future values of a time series using prior values of another time series. The VAR model proposed by [

29] is used to capture the linear interdependencies among multiple time series, with the lagged values of all endogenous variables to estimate the reverse impact of them [

30]. Moreover, it allows us to consider both long-run and short-run restrictions justified by economic considerations [

31]. Consequently, the VAR model can be used to capture the dynamic impacts of the influencing factors on EV sales. The mathematical expression of the general VAR model is given as follows:

where the observation

(

i periods back) is called the

i-th lag of

y,

is a vector of constants (intercepts),

is a time-invariant matrix and

is a vector of error terms. In this paper, we used one period lag for VAR, which is

i equals to 1, and we explored the relationship between subsidies, infrastructures and EV sales as three variables. We showed the results of Granger causality test, which is a statistical hypothesis test for determining whether one time series is useful in forecasting another, first proposed in 1969 and widely used for explaining the results of VAR models [

28].

4. Conclusions and Policy Implications

4.1. Conclusions

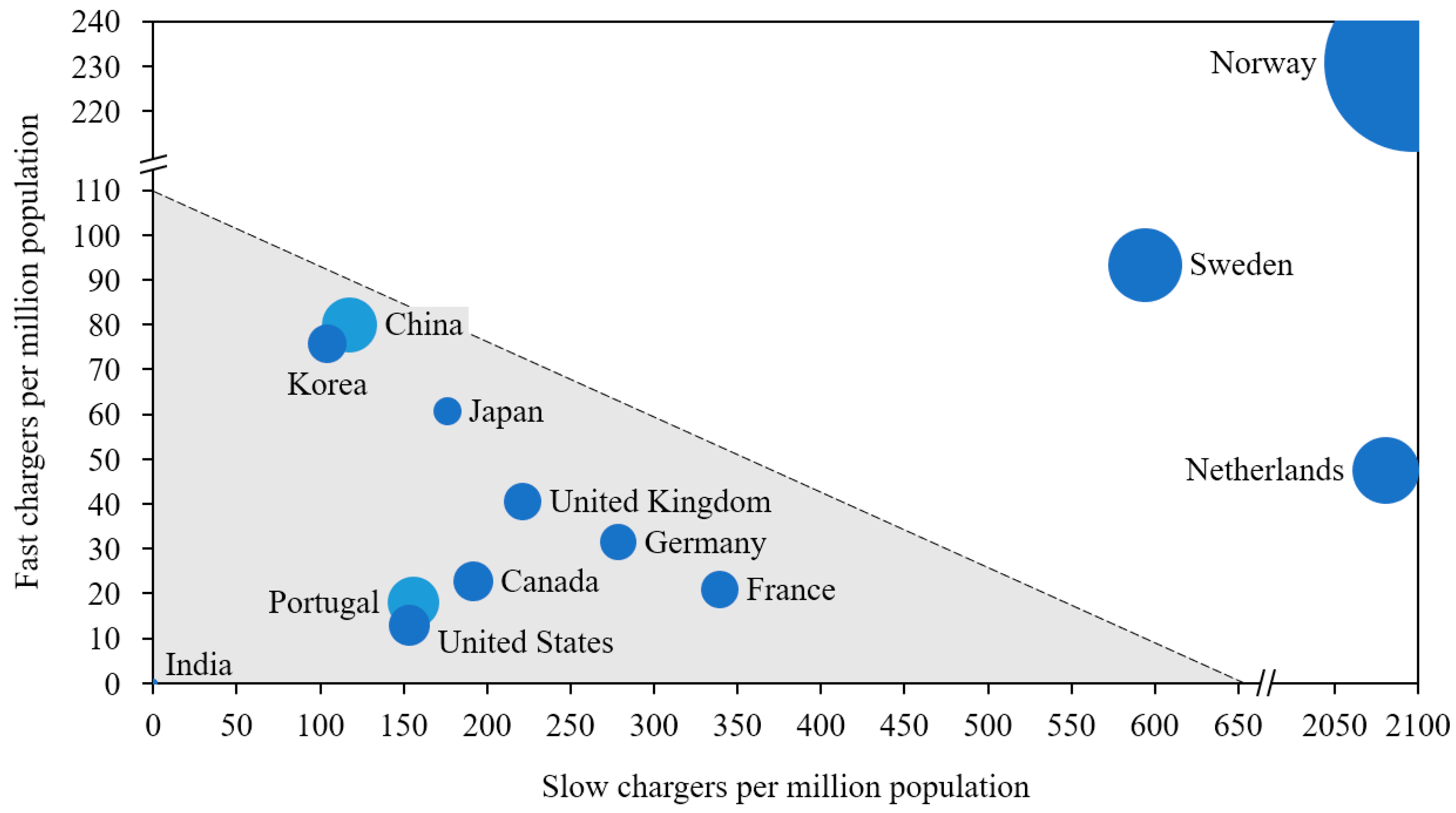

The purpose of this research is to explore the relationship between government incentives and other related factors to electric vehicle adoption across the main countries with EVs. Using panel data from 2015 to 2018, this paper studies the EV uptake among 13 countries. An econometric model for the uptake is established with eight independent variables and two macro control variables. Five of them showed significantly positive effects on 1% level in different regression models: fast/slow charger density, mandate, purchasing restriction and waiver. Subsidies showed significance only on the 5% level for BEVs. The zero–emission vehicle (ZEV) target set did not have apparent impacts. Descriptive analysis drew the same conclusion that charger infrastructure density predicts best for electric vehicle uptake on the national level.

Fast–charge infrastructures were positively related to EV uptake all the time. In the panel data regression, a 1% increase in the density of fast chargers can cause a 0.63% increase for EV uptake or a 0.36% increase for EV sales. It is reasonable that increasing the number of charging stations contributes to EV adoption, while from another perspective, fast–charger density is a sign that the country invested in public infrastructures in recent years. Slow charge infrastructures were positively significant when using pooled regression, that is to take all years into comparation. 1% increase in the density of slow chargers can cause 0.7% increase for EV uptake. Technology always evolves gradually [

35] and even though fast chargers have been common in recent years, slow chargers occupied the market in the primary stage. Those countries with high slow charger density, such as Norway and the Netherlands [

18], usually have developed electric vehicle markets for years. Thus, citizens have a higher acceptance for the new mobility tools, which was shown in the national EV uptake.

On the other hand, waiver, mandate and purchasing restriction (for fuel cars) were significantly effective to sales volume though they seemed to have little impact on EV market share, in pooled regression. They all showed significance in the 1% level, and purchasing restriction has the best effect for EV sales, that is a country with the fuel car restriction would have 1.47% more sales than others, with other factors controlled. We believe the three policies were directly intended for the sales volume and because of the mandatory, it should be effective in the short run, thus not enough to effect EV share. Market share is a better indicator for the overall acceptance of EV, requiring the governments’ persistent work for years, while EV sales are more sensitive to some powerful mandatory policy in the short term.

4.2. Policy Implications

The significance of the policies in the panel regression can be explained well by the logic behind consumers’ behaviors. If the policy makers can understand what people really care about, the policy is likely to be effective. For example, we can use financial policies to encourage the adoption of EVs; however, if we cannot relieve the range anxiety of EV drivers, it will not work well. In addition to increasing the energy density of the battery, which has already been encouraged in various ways, building more fast chargers along the highway is a good choice compared to other incentives. That is why the density of fast chargers was positive and significant in predicting EV adoption rates, especially for BEVs compared with PHEVs, because PHEVs can get refueling easily as traditional cars.

Besides, financial incentives have showed a declining marginal effect in promoting EV. Only the subsidies to BEV showed positive significance at a low level. The time we studied was the post subsidy era (2015–2018) [

36], financial policies have been generous and used for years. Almost all the counties mentioned in the study had high subsidies or tax incentives from central government, not accounting for the local subsidies. The increase in subsidies will not bring as much benefit as before, just as the law of diminishing marginal utility indicates. The marginal effect is higher for the increase in infrastructures. According to the literature, chargers’ density needs more attention paid during this time [

8].

In the future, we should shed more light on the effect of charging infrastructures. Policymakers should focus more on the infrastructures of electric vehicles, especially fast public charging points, which is also consistent with some of the literatures [

5]. Shown in a recent review summarizing the top antecedents in related studies, the first was charging infrastructure [

13]. Many studies also highlighted the importance of fast chargers, especially in densely populated areas [

37,

38]. Apart from public chargers, private chargers have also played an important role in creating a favorable EV ecosystem [

39,

40]. Thus, policies related to vehicle–to–grid, wireless charging, and the use of technology can further increase the likelihood of EV adoption [

41,

42].

Besides, use–based incentive policies designed for the convenience of EV users, such as free parking policy, toll tax exemption and highway lane excess, all showed significance in the pooled regression in this study. The zero–emission mandate is also proved to be relatively effective both in this study and in related literatures. Even policies like the purchasing restriction of fuel cars in China showed a certain level of significance for EV adoption. These policies are not the most widely discussed topics in the literatures, while they are quite effective in reality and worth considering by policymakers.