1. Introduction

The traditional way of using energy involve receiving and consuming energy unilaterally from energy suppliers. However, due to the 4th industrial revolution and the activation of the sharing economy, the paradigm of the energy industry has also shifted with energy decentralization and independence, in which consumers can directly consume or sell the energy produced by installing energy facilities. In particular, in the power sector, energy prosumers that generate electricity through small distributed energy resources (DERs) and trade leftover electricity for other consumers have emerged.

Energy prosumers are divided into three types: net energy metering, wholesale market transaction, and peer-to-peer (P2P) energy trading, depending on the buyer or transaction methods. First, in net energy metering, surplus power among the electricity produced from DERs is transferred back to the grid, and this is subtracted from the amount of electricity received to settle the electricity bill. Second, according to the wholesale market transaction, the aggregators recruit small-scale DERs to proxy the transaction in the electricity wholesale market and distribute the sales revenue. Lastly, in P2P trading, individuals directly generate and consume energy and trade surplus electricity directly with each other without going through the power exchange.

Recently, a massive number of energy-users have transformed into prosumers because of numerous reasons such as the strong society attitude with respect to alleviation of negative climate impacts, desires to decrease electricity costs, and various government regulations, including generous feed-in tariff schemes. Factors influencing the prosumer’s revitalization vary in terms of social values, technological development, etc. [

1,

2,

3,

4,

5,

6], but the most frequently mentioned are renewable energy generation costs and electricity prices [

7,

8,

9,

10]. In general, the cost of power generation is compared with the levelized cost of electricity (LCOE) [

11]. Korea’s utility-scale PV LCOE is 0.102 USD/kWh [

12], which is higher than the world average utility-scale PV LCOE of 0.085 USD/kWh [

13]. In particular, LCOE of residential solar PV systems for prosumers is higher than the utility scale. PV LCOE around the world is steadily decreasing because of technological advances, production scale expansion, and operations and maintenance efficiency. However, Korea’s PV LCOE is higher than that of nuclear power plants or conventional fossil fuel-based power plants, and Korea is not achieving grid parity. Among countries where P2P energy trading is in effect, the Netherlands and Germany have reached grid parity [

14], while the United Kingdom and the United States are nearly approaching grid parity [

15,

16,

17]. Electricity prices vary by country, but are generally increasing. This economic burden on electricity bills is also an important factor in the emergence of prosumers, and energy prosumers in EU have been shown to participate in the market to reduce energy costs [

18]. Korea’s electricity price for households is 110.45 USD/MWh, which is cheaper than that in other countries [

19]. Consumers are encouraged to participate in energy production if it is cheaper to generate and use electricity directly than to use conventional electricity. However, if the cost of generating electricity is higher than the revenue gained from reducing or trading, the cause disappears. These high LCOE and low electricity prices in Korea are a barrier to P2P energy trading.

The price of P2P energy trading for a house is affected by the electricity cost of that building, installation cost of the PV system, and supply price of electricity, among others. The existing power transactions are divided into a spot market that is traded at auctioned rates and a contract market that is traded at a certain fixed rate. The spot market fluctuates depending on the supply and demand; recently, the spot market transaction prices in Korea have been continuously decreasing. In the spot market scenario, it is difficult to secure sufficient economic feasibility to attract participation from small-scale power generation companies.

The Korean prosumer market is still in its infancy. Korea has not yet entered grid parity. Thus, there is little incentive for individuals or private companies to enter the prosumer market. However, globally, the cost of renewable energy generation continues to fall, and there is a possibility that electricity rates will rise as energy demand increases. Moreover, as artificial intelligence and blockchain technology are used in the prosumer market, the energy trading market is evolving into various P2P models beyond net metering and wholesale market sales [

20]. P2P energy trading is an inevitable trend.

Various studies have been proposed to secure the economic feasibility of P2P energy trading. Baghaee et al. [

21] presented an algorithm for planning and designing an optimized microgrid system in terms of the supply reliability and cost. However, this algorithm is suitable for designing independent RE systems in microgrids but unsuitable for renewable energy systems integrated into buildings. Moreover, there are limits to applying the energy produced by considering energy consumptions in buildings toward P2P energy trading. Pillai et al. [

22] proposed the prosumer electricity unit cost for calculating economic benefits. The case studies compared different climate and operating conditions in the two locations. They pointed out the importance of installed locations and demand-generation matching for economic benefits of grid-connected residential PV systems. Delgado et al. [

23] studied economic analysis for heat and electricity prosumers in zero-energy buildings in Finland. They found that it is difficult to reach zero-energy balances in cost effective ways with the low retail prices and without demand control. The time difference between occupancy and PV generation has led to additional electric charges. Camilo et al. [

24] compared the economic efficiency of different prosumer’s scenarios according to whether it is self-consumed and whether there is a battery. They obtained the most effective way for PV owners to trade the remaining amount of electricity after self-consumption. Because the investment for batteries is still too high, they claimed that it was not economical to store surplus energy in a battery and then trade it later. According to the survey of Oberst et al. [

25] on the energy consumption patterns in prosumer and non-prosumer households, energy consumption attitudes were not different. Instead, more energy-efficient equipment was used in prosumer households, resulting in lower energy consumption. In other words, it is not necessary to save energy due to changes in the behavior of the occupants but to save energy in the facilities of the building or the building itself for prosumers. In this context, economic energy trading requires demand control in the building itself and not the storage of surplus energy. Although P2P energy trading is expected to be actively pursued, there are very few reported works that address the possibility of energy trading between individuals by considering self-consumption according to the energy performances of buildings. For the economic feasibility of P2P energy trading, the balance between the energy demand of buildings and the amount of production is important, but research on it is insufficient.

The purpose of this study is to analyze the suitability of P2P energy trading according to the energy performance of buildings in photovoltaic installed houses. In addition, the profitability of each electricity trading type was compared to analyze the economic feasibility of P2P energy trading. In this study, to investigate the applicability of P2P energy trading according to building performance, the transaction amounts were analyzed based on the electricity rate systems without considering the price fluctuations due to network congestion and spot pricing. The paper is organized as follows. In

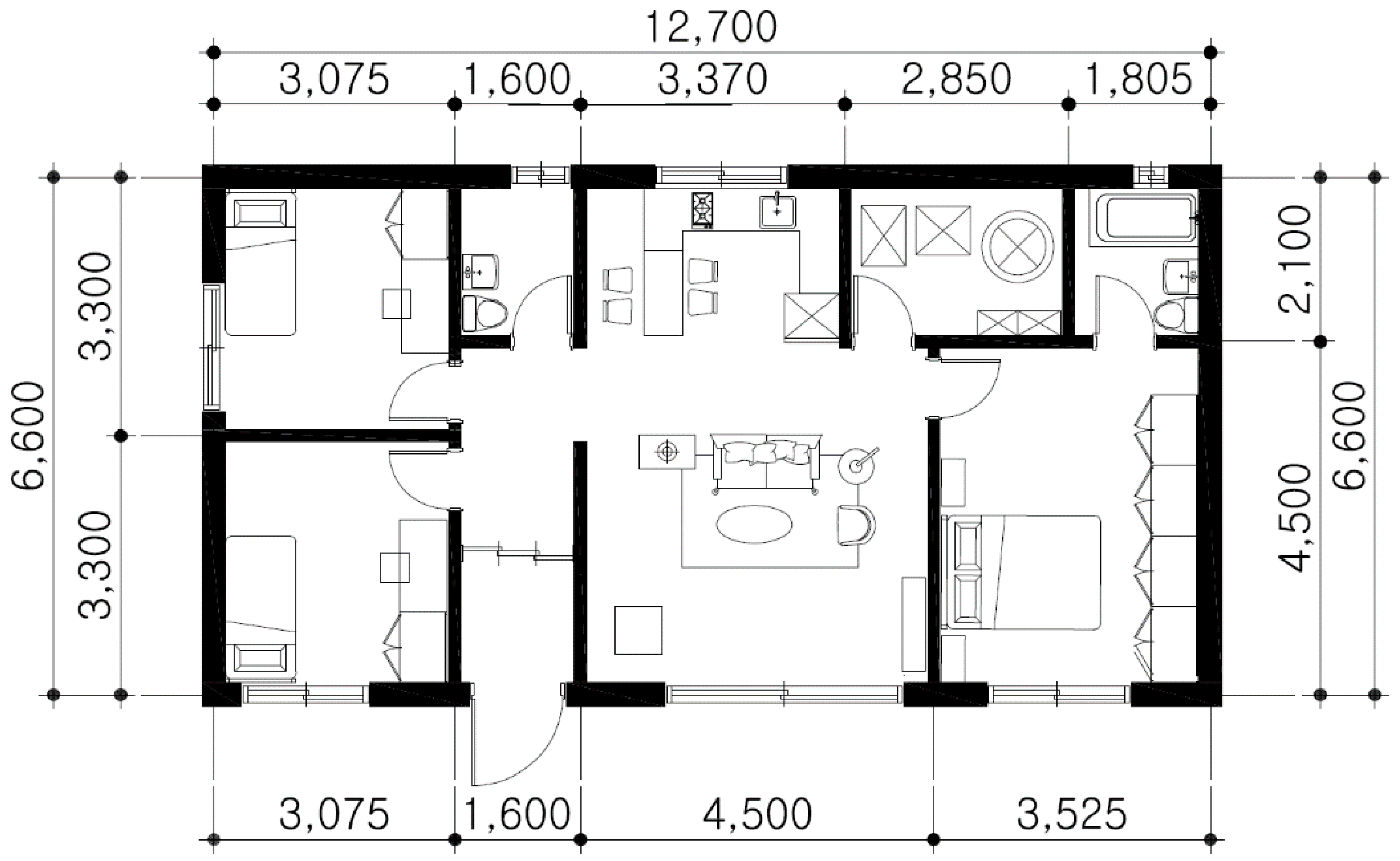

Section 2, the building model for simulated and electricity tariffs for residential buildings in Korea are described. The buildings are divided into existing houses (EH), newly-built houses (NH), and zero-energy houses (ZH) according to the time of construction and energy performance.

Section 3 presents the results regarding building energy consumption and electricity rates by building types.

Section 4 discusses and analyses the results. The economic feasibility was compared based on trading types and building types.

4. Discussion

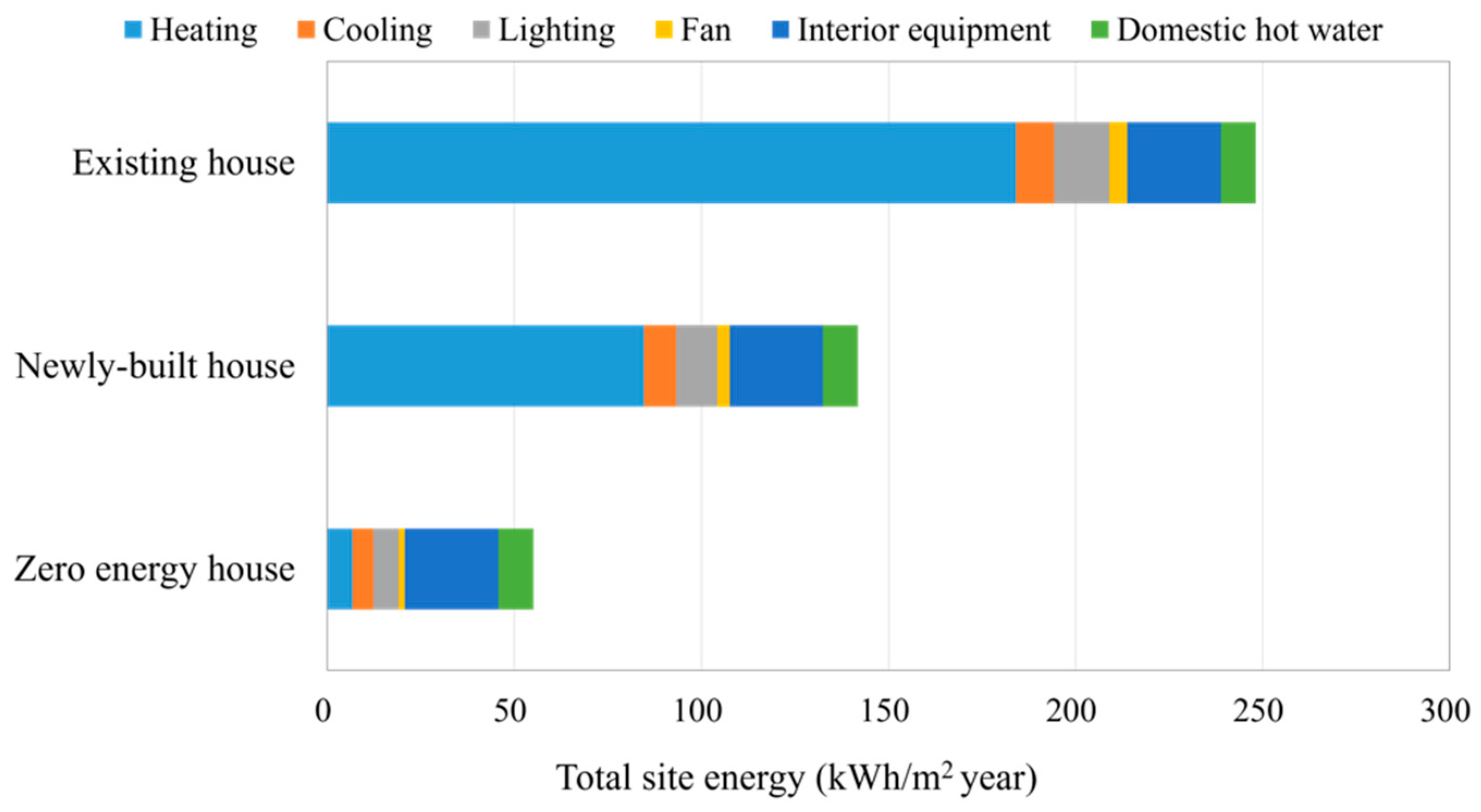

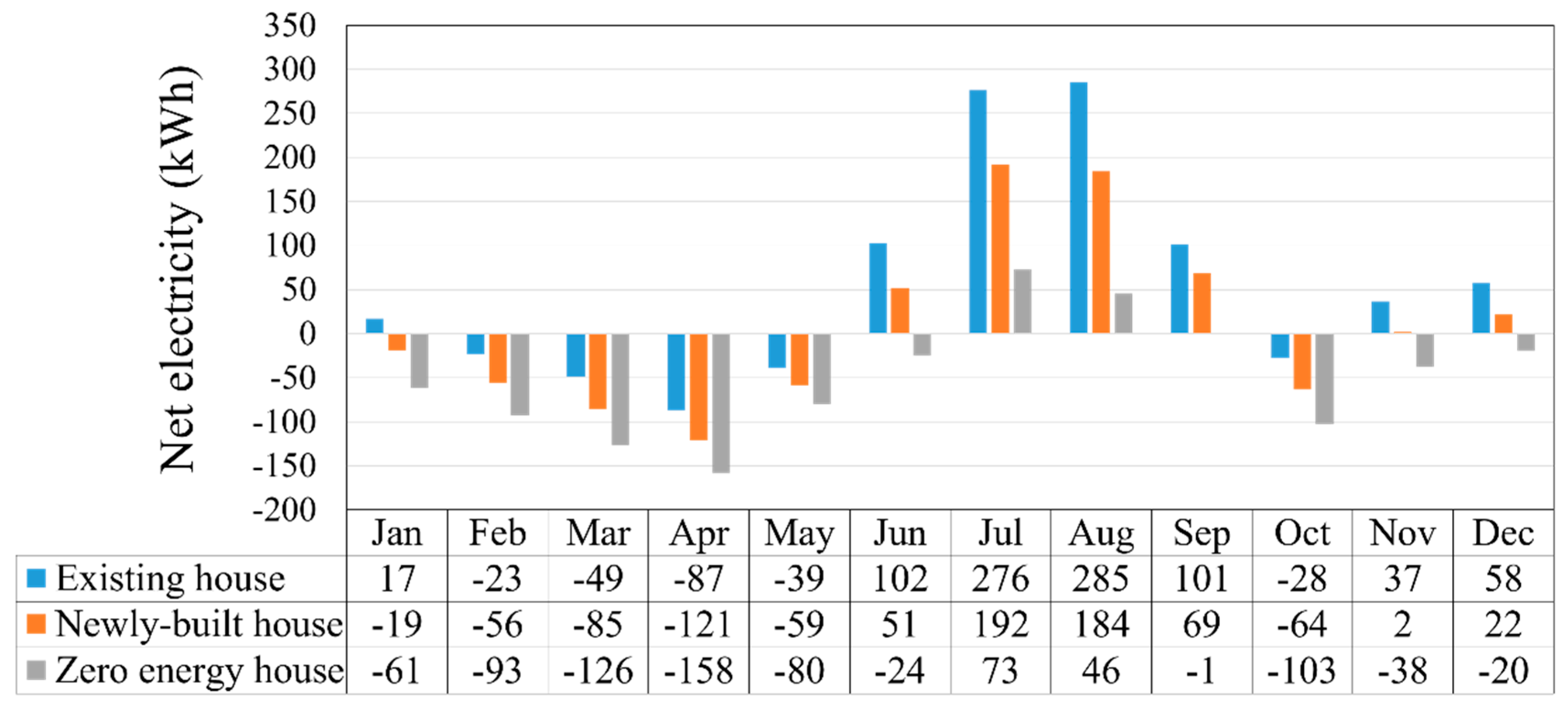

As the energy performance of a building improves, its gas energy consumption decreases dramatically. Most Korean households use gas for heating and electricity for cooling. According to the improvements in energy performances of buildings, reduction of heating energy has the largest effect, whereas the reduction rates of cooling and lighting energies have smaller effects. That is, even if the energy performance of a building is improved with ZH, a certain amount of electricity is still consumed. Although the consumption of electric energy is concentrated in the summer for cooling purposes, the installation angle of the PV system is determined based on the annual energy consumption, so the load pattern and production energy pattern do not match. Therefore, the trading type should be considered from the initial stage of the PV system installation.

Since residential buildings use progressive electricity tariffs, with different unit prices for each tier, it is not economical in the current pricing system to achieve zero electrical energy consumption in buildings by self-consumption of the produced energy. In P2P energy trading, an important factor determining the limit of self-consumption is the unit cost of electricity. Presently, the electricity unit cost for Tier 1 is 0.08 USD/kWh, which is cheaper than the profits from P2P energy trading, so it is most economical to consume the energy produced by the PV system only in excess of that allowable under Tier 1. If the unit prices of electricity increase, then these results and the associated strategies may change.

When multiple distributed generations are combined, those with different characteristics must be combined to supply power to the load, thereby requiring control technology. For stable operation, control systems are used to obtain the information on supply and demand. Real-time control of energy demand and power supply in buildings is required, and real-time energy monitoring and control are needed to maintain the electricity consumption in buildings within Tier 1. To track the load in real time, droop control is the most commonly used strategy. Since the method proposed in this work advocates consuming the energy produced in the building and trading only as much as necessary, it can help reduce congestion compared to the method of separating and controlling distributed generation and demand. The power monitoring and control methods to maintain the electricity consumption within Tier 1 can be achieved through predictive control of electricity consumption, which will be studied later. This study is therefore meaningful as it analyzes the applicability of P2P energy trading based on building energy performance.

5. Conclusions

In this study, residential buildings were classified into EH, NH, and ZH to evaluate the applicability of P2P trading according to the energy performance of buildings; it was assumed that the energy trading was on a small scale and in an individual-to-individual manner. In addition, the energy consumption of each building was analyzed to estimate the transaction amount of electricity generated by the PV system. Furthermore, economic analysis was conducted according to the trading type. The main results of this study are as follows.

The trading type was set to existing net metering, feed-in tariff for small-scale distributed PV systems, and P2P trading. P2P trading was subdivided into P2P-Tier 1 and P2P-Zero according to the ratio of self-consumption of the produced energy.

As a result of calculating the LCOE for each trading type, the minimum trading price was found to be 0.08 USD/kWh due to the drop in system installation prices and the influence of government subsidies. However, because the energy charge of the residential progressive Tier 1 was 0.08 USD/kWh, the minimum trading price was calculated to be 0.09 USD/kWh.

It is assumed that the transaction is conducted with a consumer who consumes a lot of electricity and is applied to Tier 3 of the progressive system, and the default trading price is assumed to be 0.19 USD/kWh considering the energy charge at Tiers 2 and 3. Economics were compared according to the trading type of each building. As a result, it was found that it is most economical to inject the remaining energy into the P2P trading after self-consuming enough to fix the energy consumption of the prosumer in Tier 1.

For the most economical P2P-Tier1, as a result of sensitivity analysis according to trading price, EH generated net profit at a trading price of 0.20 USD/kWh, NH generated net profit at 0.14 USD/kWh, and ZH generated net profit at 0.11 USD/kWh. The higher the building’s energy performance, the greater the range of transaction volumes to secure economics; thus, prosumers will be able to actively participate in P2P trading.

Because this study did not consider the increase in construction costs for each type of building, comparison by building type was impossible, which is a limitation of this study. EH can secure economic efficiency when the unit trading price is secured, but the consumer can be limited to the Tier 3 electricity rate. Depending on the electricity rate system, the economics of EH may fluctuate. In case of P2P trading of ZH, it was found that the electricity tariff saving compared with the existing electricity tariff of ZH is small, so the revenue is calculated to be less than that of EH. The difference in electricity rate is small compared to ZH’s existing electricity rate system, so a lesser profit than EH is calculated. However, we found that it can secure profits because of the large volume of transactions. In other words, as the energy independence of buildings increases, it is possible to secure economic feasibility of P2P trading, so that P2P trading can be activated. Currently, power transactions in Korea are divided according to the power generation capacity; hence, this study assumes that only small-scale transactions through the grid are possible and limited to solar power systems installed in buildings. In other words, this study analyzed the economic feasibility of P2P energy trading based on the unit prices of electricity rates, without comparison of the spot prices. However, when considering P2P energy trading with participation in spot market trading, the economic feasibility may fluctuate with spot price fluctuations. If the business model of P2P trading for each building type is developed based on the results of this study, the help of the government promotes the use of renewable energy.