Renewable Energy Auction Prices: Near Subsidy-Free?

Abstract

:1. Introduction

1.1. Setting the Context

1.2. State-of-the-Art

1.3. Contribution

2. Materials and Methods

3. Results

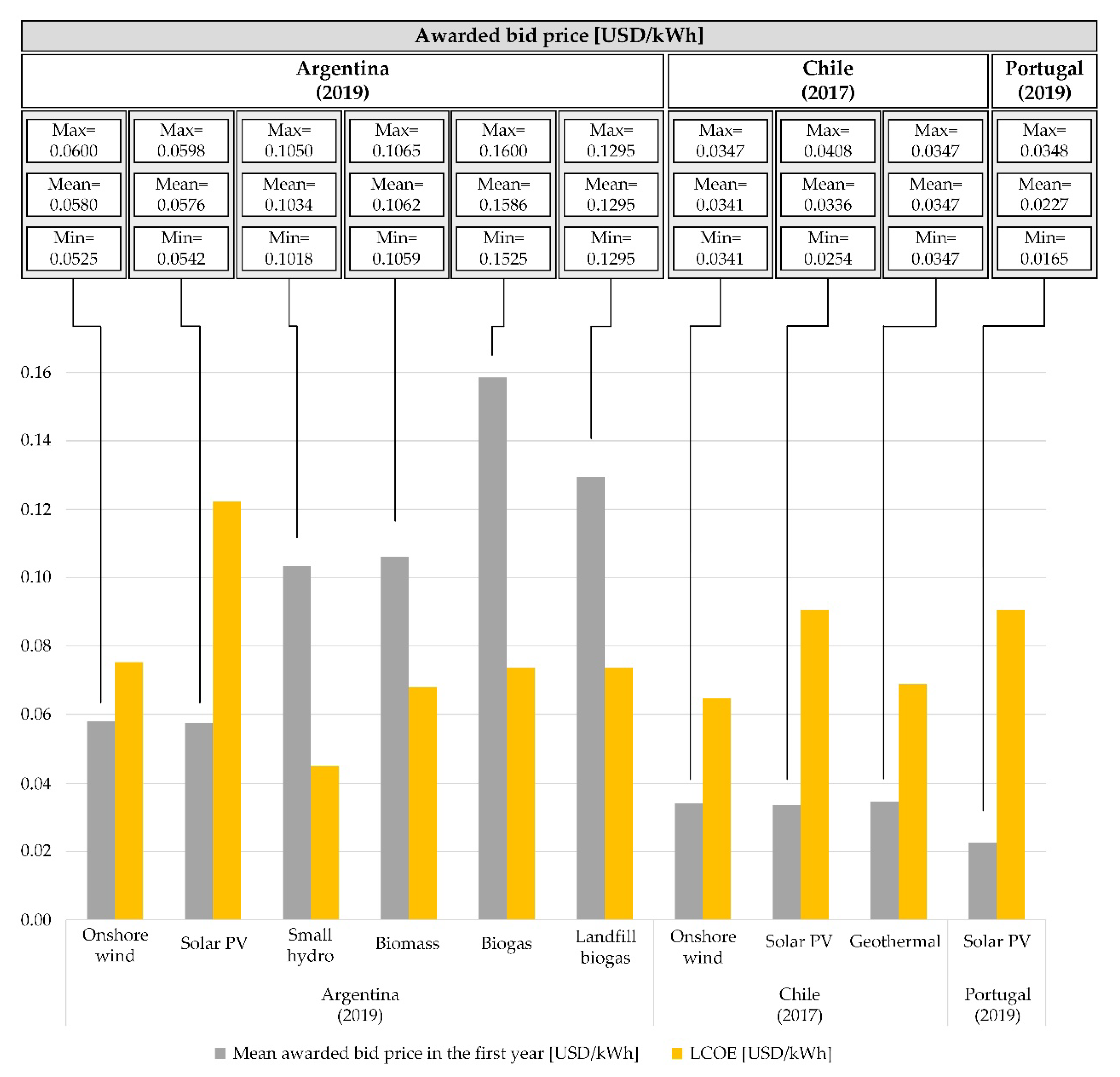

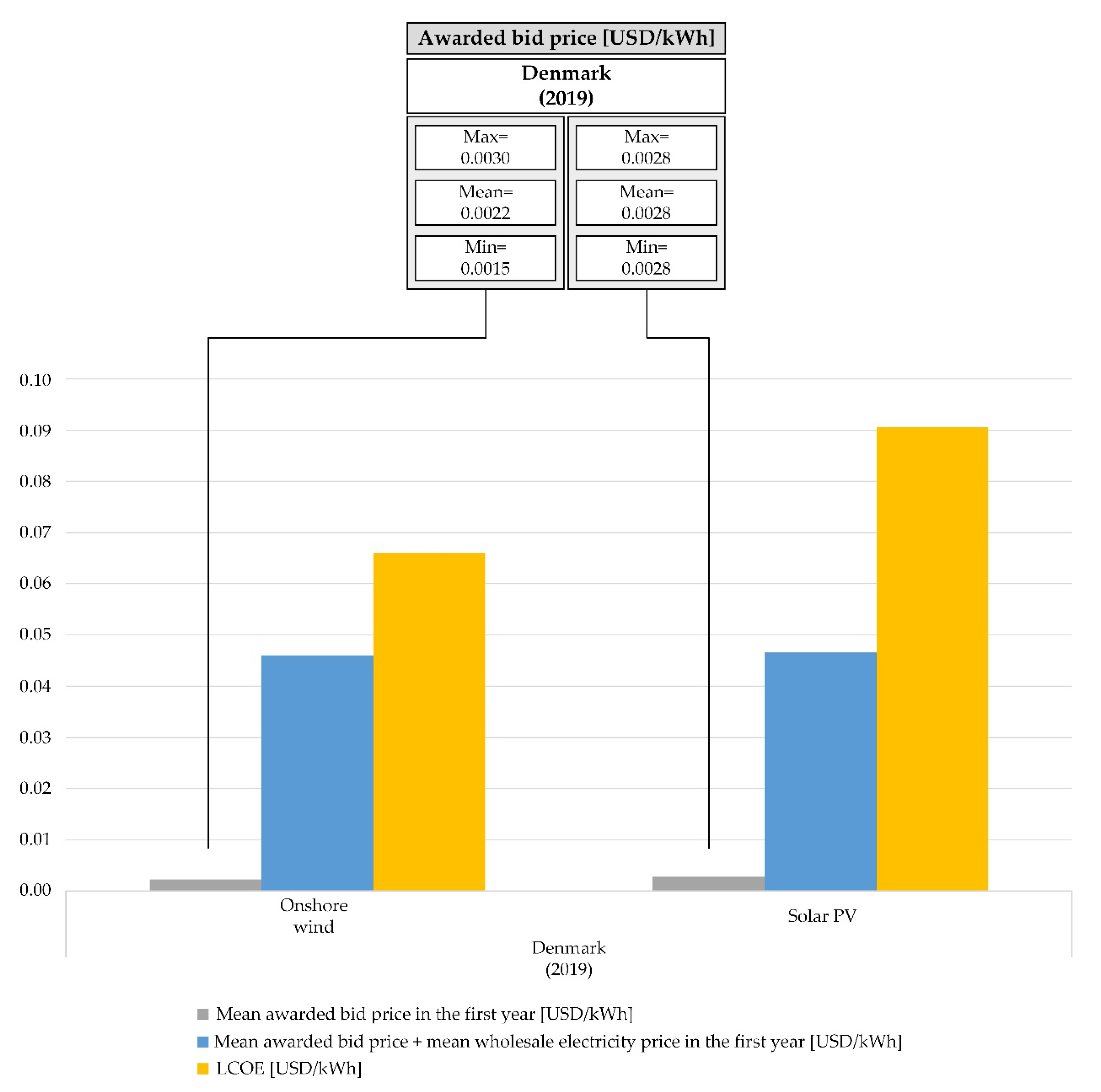

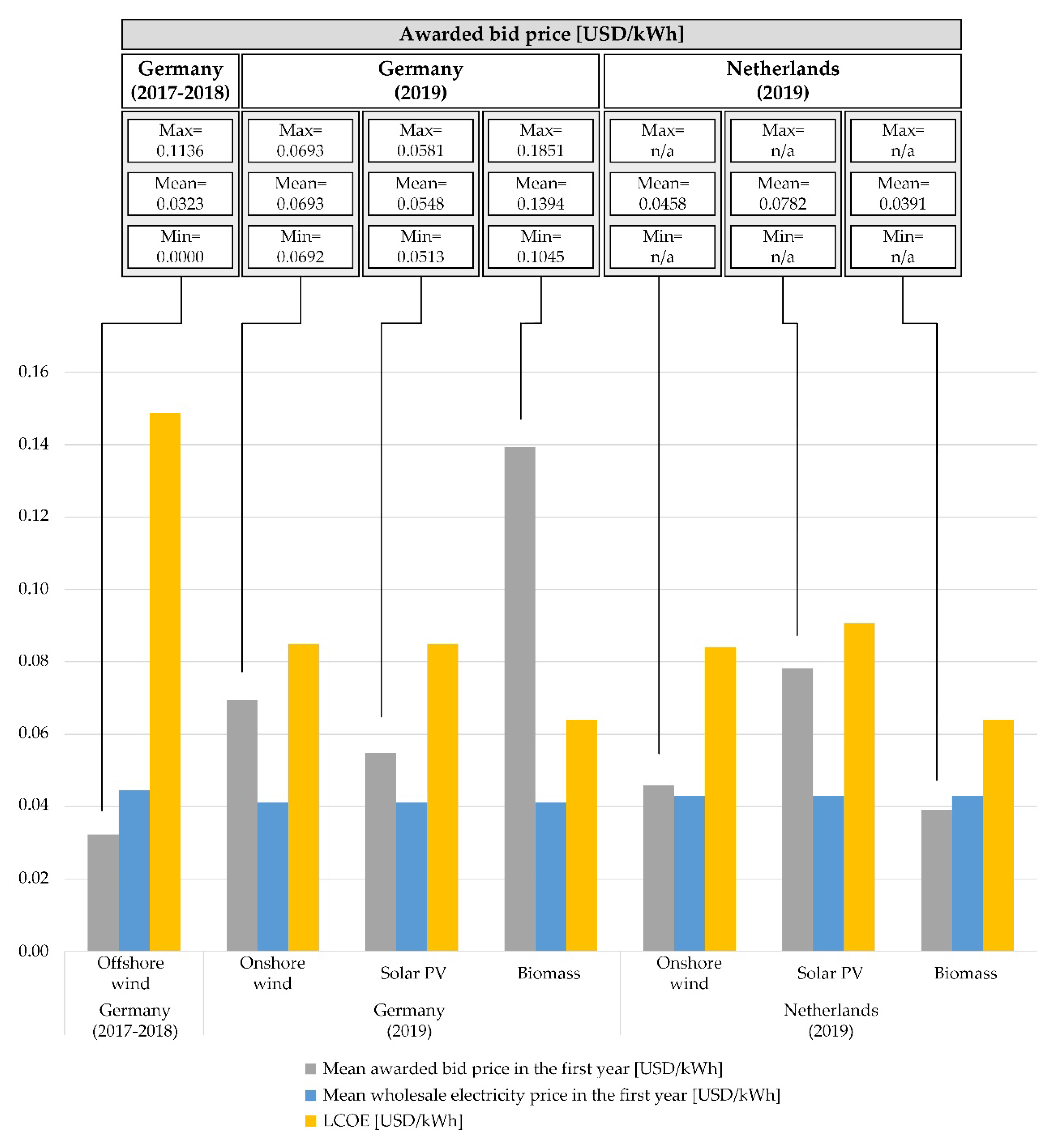

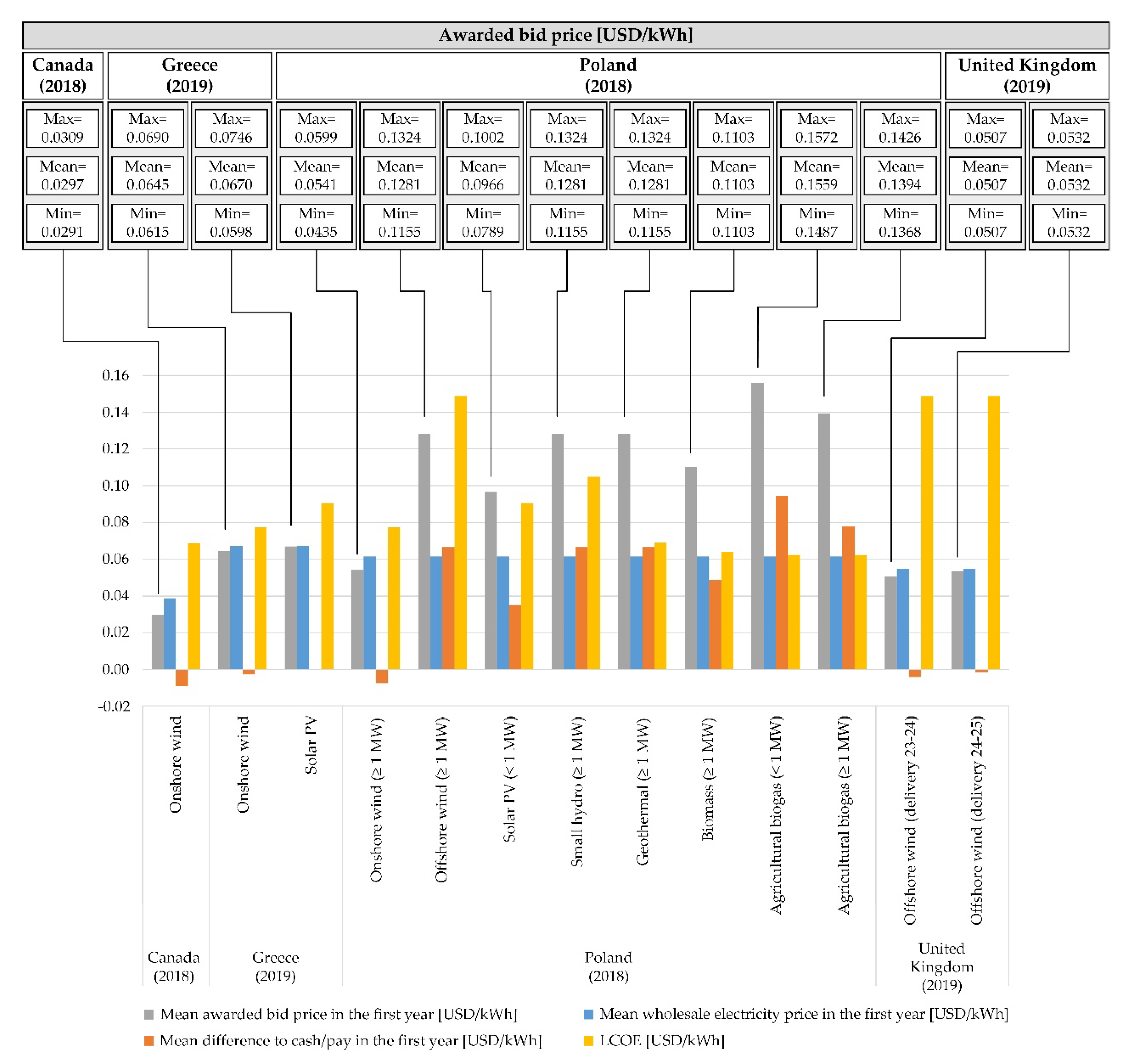

3.1. Auction Prices and LCOE Comparison Results

3.2. NPV and IRR Results for Opposed Cases

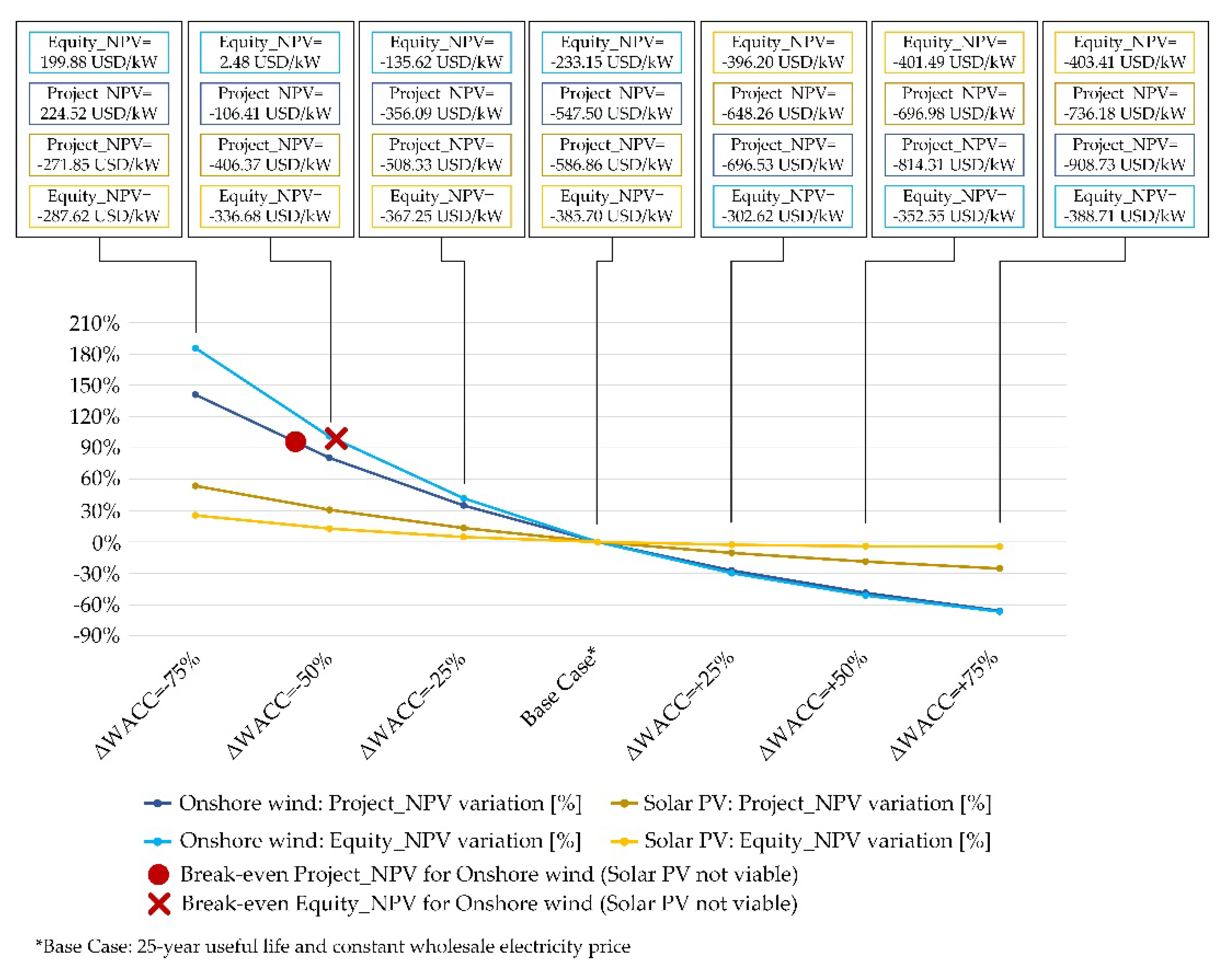

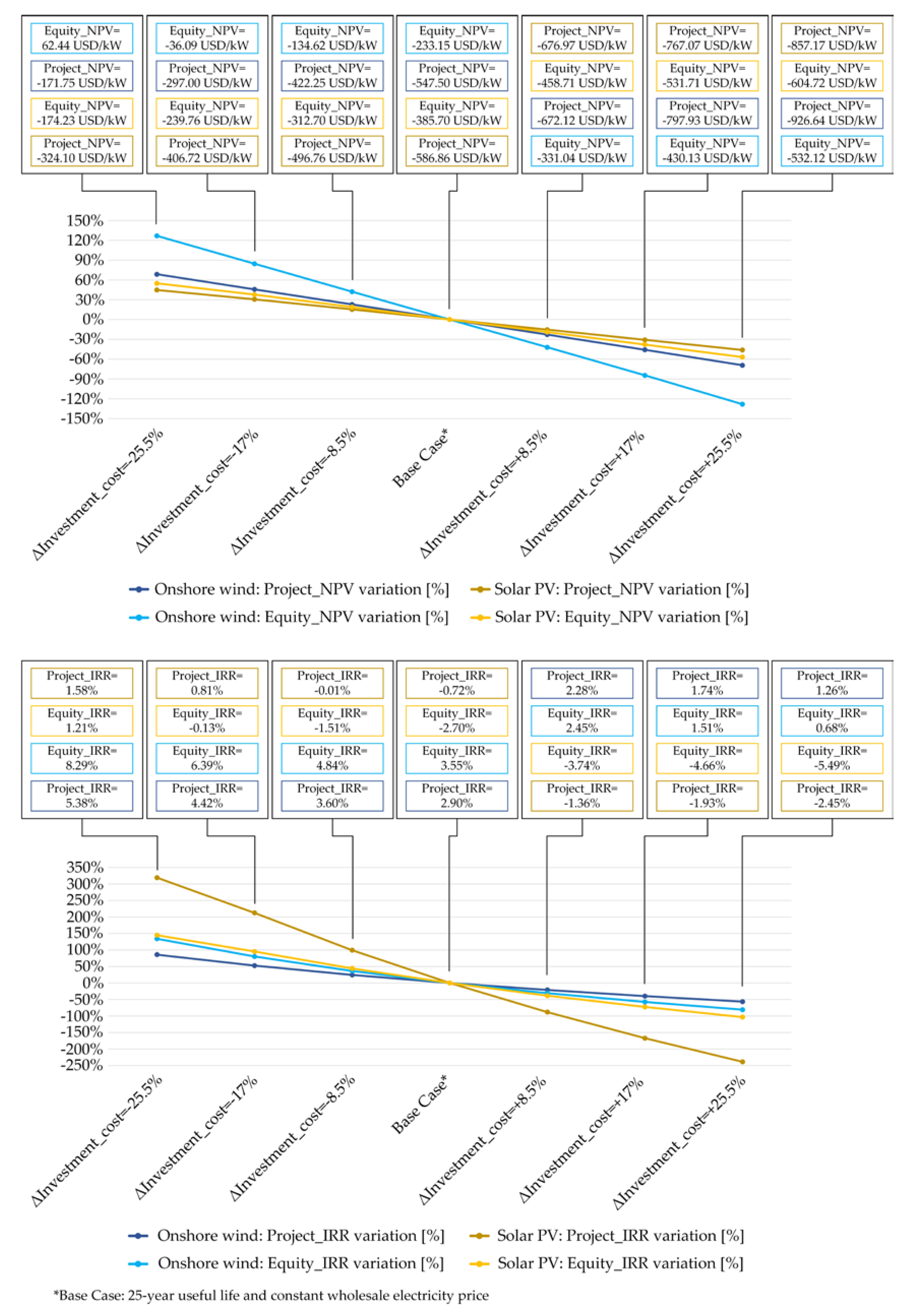

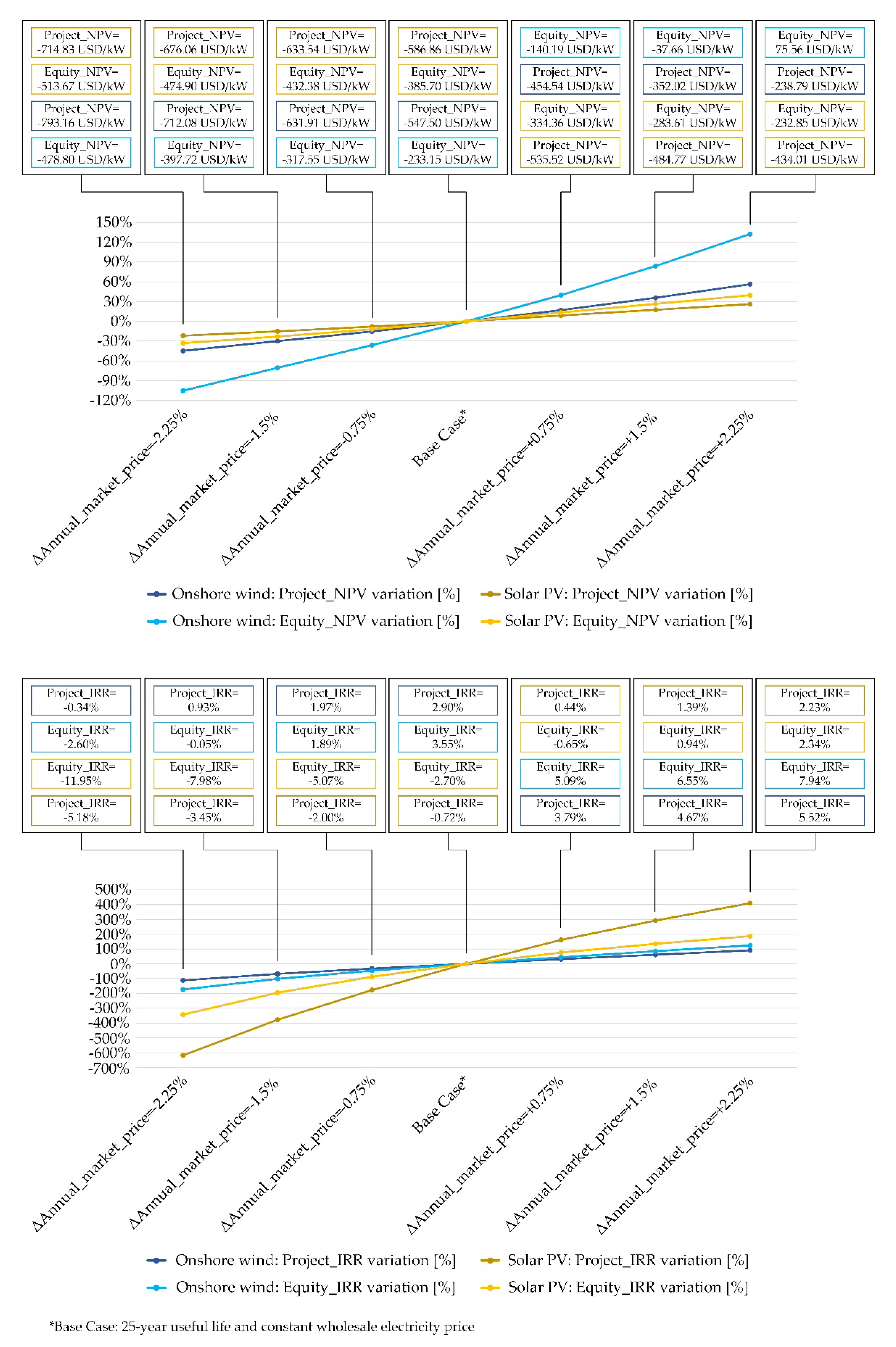

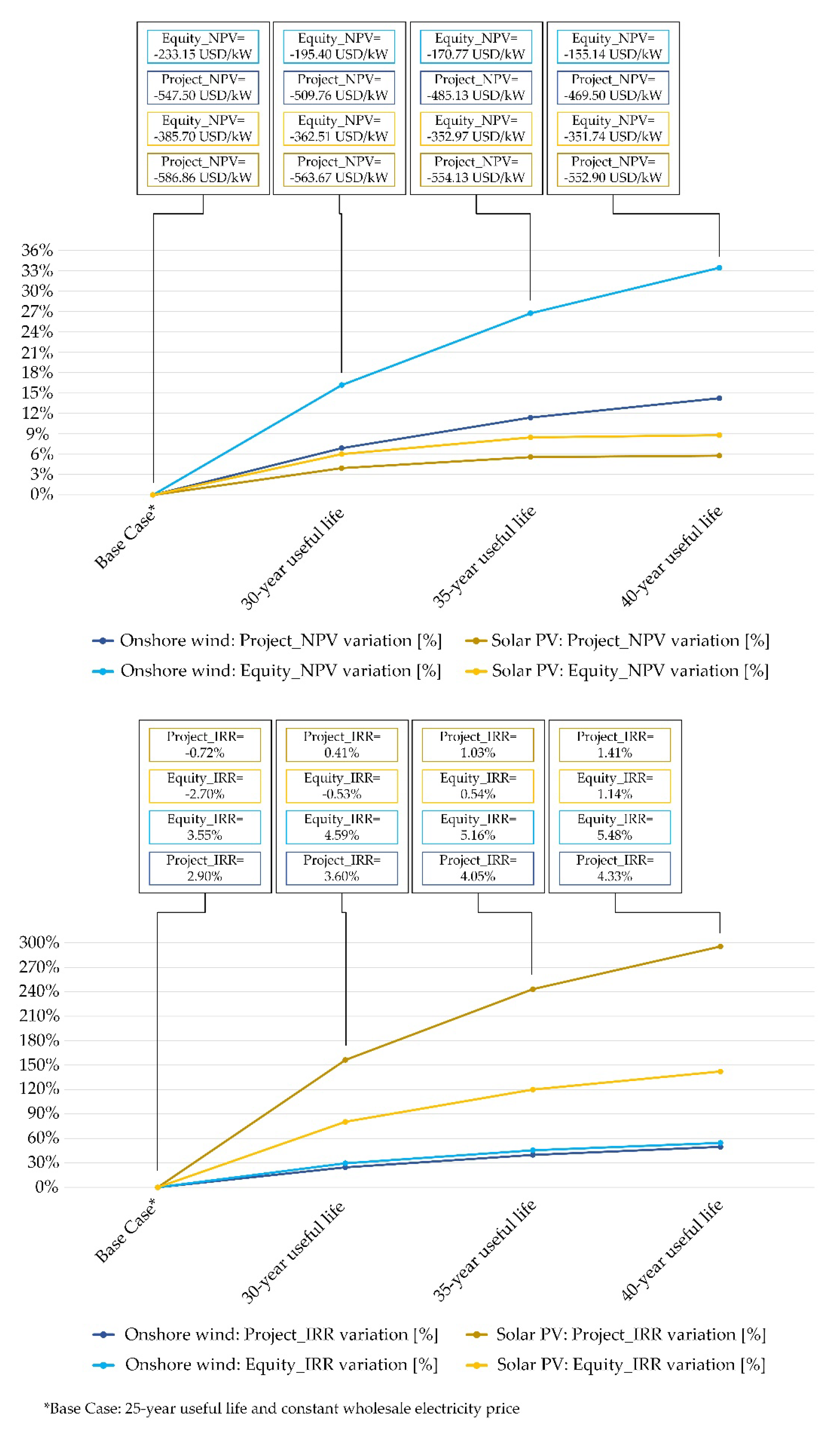

3.3. NPV and IRR Sensitivity Results for the Danish Case

4. Discussion

4.1. Analysis of Auction Prices and LCOE Comparison Results

4.2. Analysis of NPV and IRR Results for Opposed Cases

4.3. Analysis of the NPV and IRR Sensitivity Results for the Danish Case

4.4. Final Remarks

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Acronyms

| CfD | contract for differences |

| PI | consumer price index |

| FIP | Feed-in premium |

| IRR | internal rate of return |

| LCOE | levelised cost of energy |

| NPV | net present value |

| OECD | Organization for Economic Co-operation and Development |

| O&M | operation and maintenance |

| PPA | power purchase agreement |

| PV | solar photovoltaics |

| RES | renewable energy sources |

| UK | United Kingdom |

| US | United States |

| USD | United States dollar |

| WACC | weighted average cost of capital |

Appendix A

References

- IRENA. Renewable Energy Auctions: Status and Trends beyond Price; International Renewable Energy Agency: Abu Dhabi, UAE, 2019. [Google Scholar]

- REN21. Renewables 2019 Global Status Report; REN21: Paris, France, 2019. [Google Scholar]

- Dobrotkova, Z.; Surana, K.; Audinet, P. The price of solar energy: Comparing competitive auctions for utility-scale solar PV in developing countries. Energy Policy 2018, 118, 133–148. [Google Scholar] [CrossRef]

- Matthäus, D. Designing effective auctions for renewable energy support. Energy Policy 2020, 142, 111462. [Google Scholar] [CrossRef]

- Welisch, M. Multi-unit renewables auctions for small markets—Designing the Danish multi-technology auction scheme. Renew. Energy 2019, 131, 372–380. [Google Scholar] [CrossRef]

- Gutiérrez, J.; Zuluaga, L.J.; Giraldo, J.C.; Grosso, K. Renewable Energy Auctions in Colombia: Lessons Learned in Energy Policy Design. In Proceedings of the 2019 FISE-IEEE/CIGRE Conference—Living the energy Transition (FISE/CIGRE), Medellin, Colombia, 4–6 December 2019; pp. 1–5. [Google Scholar]

- Welisch, M.; Poudineh, R. Auctions for allocation of offshore wind contracts for difference in the UK. Renew. Energy 2020, 147, 1266–1274. [Google Scholar] [CrossRef]

- Welisch, M. The Importance of Penalties and Pre-qualifications: A Model-based Assessment of the UK Renewables Auction Scheme. Econ. Energy Environ. Policy 2018, 7, 15–31. [Google Scholar] [CrossRef]

- Bose, A.S.; Sarkar, S. India’s e-reverse auctions (2017–2018) for allocating renewable energy capacity: An evaluation. Renew. Sustain. Energy Rev. 2019, 112, 762–774. [Google Scholar] [CrossRef]

- Thapar, S.; Sharma, S.; Verma, A. Analyzing solar auctions in India: Identifying key determinants. Energy Sustain. Dev. 2018, 45, 66–78. [Google Scholar] [CrossRef]

- Batz, T.; Müsgens, F. A first analysis of the photovoltaic auction program in Germany. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; pp. 1–5. [Google Scholar] [CrossRef]

- Lundberg, L. Auctions for all? Reviewing the German wind power auctions in 2017. Energy Policy 2019, 128, 449–458. [Google Scholar] [CrossRef]

- Grashof, K.; Berkhout, V.; Cernusko, R.; Pfennig, M. Long on promises, short on delivery? Insights from the first two years of onshore wind auctions in Germany. Energy Policy 2020, 140, 111240. [Google Scholar] [CrossRef]

- Müsgens, F.; Riepin, I. Is Offshore Already Competitive? Analyzing German Offshore Wind Auctions. In Proceedings of the 2018 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; pp. 1–6. [Google Scholar] [CrossRef]

- Kreiss, J.; Ehrhart, K.-M.; Hanke, A.-K. Auction-theoretic analyses of the first offshore wind energy auction in Germany. J. Phys. Conf. Ser. 2017, 926, 012015. [Google Scholar] [CrossRef] [Green Version]

- Romeiro, D.L.; de Almeida, E.L.F.; Losekann, L. Systemic value of electricity sources—What we can learn from the Brazilian experience? Energy Policy 2020, 138, 111247. [Google Scholar] [CrossRef]

- Washburn, C.; Pablo-Romero, M. Measures to promote renewable energies for electricity generation in Latin American countries. Energy Policy 2019, 128, 212–222. [Google Scholar] [CrossRef]

- Botta, E. An experimental approach to climate finance: The impact of auction design and policy uncertainty on renewable energy equity costs in Europe. Energy Policy 2019, 133, 110839. [Google Scholar] [CrossRef]

- Kruger, W.; Stritzke, S.; Trotter, P.A. De-risking solar auctions in sub-Saharan Africa—A comparison of site selection strategies in South Africa and Zambia. Renew. Sustain. Energy Rev. 2019, 104, 429–438. [Google Scholar] [CrossRef]

- Menzies, C.; Marquardt, M.; Spieler, N. Auctions for the Support of Renewable Energy in Argentina. D2.1-AR.; December 2019. Available online: http://aures2project.eu/wp-content/uploads/2020/02/AURES_II_case_study_Argentina.pdf (accessed on 2 May 2020).

- Del Río, P.; Kiefer, C. Auctions for the Support of Renewable Energy in Chile. D2.1-CL.; November 2019. Available online: http://aures2project.eu/wp-content/uploads/2019/12/AURES_II_case_study_Chile.pdf (accessed on 2 May 2020).

- Del Río, P.; Lucas, H.; Dézsi, B.; Diallo, A. Auctions for the Support of Renewable Energy in Portugal. D2.1-PT.; December 2019. Available online: http://aures2project.eu/wp-content/uploads/2020/02/AURES_II_case_study_Portugal.pdf (accessed on 2 May 2020).

- Garzón González, M.; Kitzing, L. Auctions for the Support of Renewable Energy in Denmark. D2.1-DK.; December 2019. Available online: http://aures2project.eu/wp-content/uploads/2019/12/AURES_II_case_study_Denmark.pdf (accessed on 2 May 2020).

- Sach, T.; Lotz, B.; von Blücher, F. Auctions for the Support of Renewable Energy in Germany. D2.1-DE.; December 2019. Available online: http://aures2project.eu/wp-content/uploads/2020/04/AURES_II_case_study_Germany_v3.pdf (accessed on 2 May 2020).

- Jakob, M.; Noothout, P.; von Bluecher, F.; Klessmann, C. Auctions for the Support of Renewable Energy in the Netherlands. D2.1-NL.; December 2019. Available online: http://aures2project.eu/wp-content/uploads/2019/12/AURES_II_case_study_Netherlands.pdf (accessed on 2 May 2020).

- Menzies, C.; Marquardt, M. Auctions for the Support of Renewable Energy in Alberta, Canada. D2.1-CA.; December 2019. Available online: http://aures2project.eu/wp-content/uploads/2020/02/AURES_II_case_study_Canada.pdf (accessed on 2 May 2020).

- Anatolitis, V. Auctions for the Support of Renewable Energy in Greece. D2.1-EL.; February 2020. Available online: http://aures2project.eu/wp-content/uploads/2020/03/AURES_II_case_study_Greece.pdf (accessed on 2 May 2020).

- Diallo, A.; Dézsi, B.; Bartek-Lesi, M.; Mezősi, A.; Szajkó, G.; Kácsor, E.; Szabó, L. Auctions for the Support of Renewable Energy in Poland. D2.1.; August 2019. Available online: http://aures2project.eu/wp-content/uploads/2019/08/Polish-Auctions_final.pdf (accessed on 2 May 2020).

- Woodman, B.; Fitch-Roy, O. Auctions for the Support of Renewable Energy in the UK. D2.1.; September 2019. Available online: http://aures2project.eu/wp-content/uploads/2019/10/AURES_II_UK_case_study.pdf (accessed on 2 May 2020).

- IRENA. Renewable Power Generation Costs in 2018; International Renewable Energy Agency: Abu Dhabi, UAE, 2019; ISBN 978-92-9260-126-3. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/May/IRENA_Renewable-Power-Generations-Costs-in-2018.pdf (accessed on 2 May 2020).

- OpenEI. Transparent Cost Database. National Renewable Energy Laboratory. Available online: https://openei.org/apps/TCDB/#blank (accessed on 2 May 2020).

- Tao, J.Y.; Finenko, A. Moving beyond LCOE: Impact of various financing methods on PV profitability for SIDS. Energy Policy 2016, 98, 749–758. [Google Scholar] [CrossRef]

- Cassetta, E.; Monarca, U.; Nava, C.R.; Meleo, L. Is the answer blowin’ in the wind (auctions)? An assessment of the Italian support scheme. Energy Policy 2017, 110, 662–674. [Google Scholar] [CrossRef]

- Held, A.; Ragwitz, M.; Gephart, M.; de Visser, E.; Klessmann, C. Design Features of Support Schemes for Renewable Electricity. Cooperation between EU MS under the Renewable Energy Directive and Interaction with Support Schemes, Project Number DESNL13116, Task 2 Report. European Commission, Brussels. 2014. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/2014_design_features_of_support_schemes.pdf (accessed on 2 May 2020).

- Foster, J.; Wagner, L.; Bratanova, A. LCOE Models: A Comparison of the Theoretical Frameworks and Key Assumptions; Energy Economics and Management Group Working Papers from School of Economics, University of Queensland: Brisbane, Australia, 2014. [Google Scholar]

- Bazilian, M.; Onyeji, I.; Liebreich, M.; MacGill, I.; Chase, J.; Shah, J.; Gielen, D.; Arent, D.; Landfear, D.; Zhengrong, S. Re-considering the economics of photovoltaic power. Renew. Energy 2013, 53, 329–338. [Google Scholar] [CrossRef]

- Simpson, J.; Loth, E.; Dykes, K. Cost of Valued Energy for design of renewable energy systems. Renew. Energy 2020, 153, 290–300. [Google Scholar] [CrossRef]

- Ondraczek, J.; Komendantova, N.; Patt, A. WACC the dog: The effect of financing costs on the levelized cost of solar PV power. Renew. Energy 2015, 75, 888–898. [Google Scholar] [CrossRef]

- Mora, D.; Islam, M.; Soysal, E.R.; Kitzing, L.; Blanco, A.L.A.; Förster, S.; Tiedemann, S.; Wigand, F. Experiences with auctions for renewable energy support. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017; pp. 1–6. [Google Scholar]

- Nasirov, S.; Cruz, E.; Agostini, C.A.; Silva, C. Policy Makers’ Perspectives on the Expansion of Renewable Energy Sources in Chile’s Electricity Auctions. Energies 2019, 12, 4149. [Google Scholar] [CrossRef]

| Country | Support | Date | Duration [Years] | Technology | Mean Awarded Bid Price [USD/kWh] |

|---|---|---|---|---|---|

| Argentina | PPA (in USD) annually adjusted | July 2019 | 20 | Onshore wind | 0.0580 |

| Solar PV | 0.0576 | ||||

| Small hydro | 0.1034 | ||||

| Biomass | 0.1062 | ||||

| Biogas | 0.1586 | ||||

| Landfill biogas | 0.1295 | ||||

| Chile | PPA (in USD) US CPI updated | November 2017 | 20 | Onshore wind | 0.0341 |

| Solar PV | 0.0336 | ||||

| Geothermal | 0.0347 | ||||

| Portugal | PPA | July 2019 | 15 | Solar PV | 0.0227 |

| Denmark | Fixed FIP | September–November 2019 | 20 | Onshore wind | 0.0022 |

| Solar PV | 0.0028 | ||||

| Germany | Sliding FIP | April 2017–April 2018 | 20 | Offshore wind | 0.0323 |

| October–November 2019 | Onshore wind | 0.0693 | |||

| Solar PV | 0.0548 | ||||

| Biomass | 0.1394 | ||||

| Netherlands | Sliding FIP | Spring 2019 | 15 | Onshore wind | 0.0458 |

| Solar PV | 0.0782 | ||||

| 12 | Biomass | 0.0391 | |||

| Canada | 2-sided CfD periodically adjusted | December 2018 | 20 | Onshore wind | 0.0297 |

| Greece | 2-sided CfD | December 2019 | 20 | Onshore wind | 0.0645 |

| Solar PV | 0.0670 (≤20 MW) | ||||

| Poland | 2-sided CfD CPI updated | 2018 | 15 Or until 31–12–35 | Onshore wind | 0.0541 (≥1 MW) |

| Offshore wind | 0.1281 (≥1 MW) | ||||

| Solar PV | 0.0966 (<1 MW) | ||||

| Small hydro | 0.1281 (≥1 MW) | ||||

| Geothermal | 0.1281 (≥1 MW) | ||||

| Biomass | 0.1103 (≥1 MW) | ||||

| Agricultural biogas | 0.1559 (<1 MW) 0.1394 (≥1 MW) | ||||

| UK | 2-sided CfD periodically adjusted | May 2019 | 15 | Offshore wind | 0.0507 (delivery 2023–24) 0.0532 (delivery 2024–25) |

| Country | Technology | Investment Cost [USD/kW] | O&M Costs | Capacity Factor [pu] | Lifetime [Years] | Discount Rate [pu] | |

|---|---|---|---|---|---|---|---|

| Fixed [USD/kW] | Variable [USD/kWh] | ||||||

| Argentina | Onshore w. | 1529.34 | 31.72 | 0.00766 | 0.3380 | 25 | 0.100 |

| Solar PV | 1433.00 | 30.00 | 0.00000 | 0.1820 | 25 | ||

| Small hydro | 2215.39 | 23.20 | 0.00095 | 0.6680 | 30 | ||

| Biomass | 1501.21 | 99.40 | 0.00420 | 0.4930 | 20 | ||

| Biogas | 2074.56 | 99.40 | 0.00420 | 0.5640 | 20 | ||

| Chile | Onshore w. | 1529.34 | 31.72 | 0.00766 | 0.3380 | 25 | 0.075 |

| Solar PV | 1210.20 | 30.00 | 0.00000 | 0.1820 | 25 | ||

| Geothermal | 3976.34 | 112.16 | 0.00506 | 0.8390 | 25 | ||

| Portugal | Solar PV | 1210.20 | 30.00 | 0.00000 | 0.1820 | 25 | 0.075 |

| Denmark | Onshore w. | 1891.21 | 31.72 | 0.00766 | 0.3940 | 25 | 0.075 |

| Solar PV | 1210.20 | 30.00 | 0.00000 | 0.1820 | 25 | ||

| Germany | Onshore w. | 1833.17 | 31.72 | 0.00766 | 0.2900 | 25 | 0.075 |

| Offshore w. | 4353.42 | 90.00 | 0.01970 | 0.4250 | 25 | ||

| Solar PV | 1113.02 | 30.00 | 0.00000 | 0.1820 | 25 | ||

| Biomass | 3373.45 | 99.40 | 0.00420 | 0.8200 | 20 | ||

| Netherlands | Onshore w. | 1949.58 | 31.72 | 0.00766 | 0.3090 | 25 | 0.075 |

| Solar PV | 1210.20 | 30.00 | 0.00000 | 0.1820 | 25 | ||

| Biomass | 3373.45 | 99.40 | 0.00420 | 0.8200 | 20 | ||

| Canada | Onshore w. | 1711.78 | 31.72 | 0.00766 | 0.3460 | 25 | 0.075 |

| Greece | Onshore w. | 1949.58 | 31.72 | 0.00766 | 0.3380 | 25 | 0.075 |

| Solar PV | 1210.20 | 30.00 | 0.00000 | 0.1820 | 25 | ||

| Poland | Onshore w. | 1949.58 | 31.72 | 0.00766 | 0.3380 | 25 | 0.075 |

| Offshore w. | 4353.42 | 90.00 | 0.01970 | 0.4250 | 25 | ||

| Solar PV | 1210.20 | 30.00 | 0.00000 | 0.1820 | 25 | ||

| Small hydro | 4802.37 | 23.20 | 0.00095 | 0.4720 | 30 | ||

| Geothermal | 3976.34 | 112.16 | 0.00506 | 0.8390 | 25 | ||

| Biomass | 3373.45 | 99.40 | 0.00420 | 0.8200 | 20 | ||

| Agr. Biogas | 3341.46 | 99.40 | 0.00420 | 0.8390 | 20 | ||

| UK | Offshore w. | 4353.42 | 90.00 | 0.01970 | 0.4250 | 25 | 0.075 |

| Base Case Assumptions | Germany | Denmark |

|---|---|---|

| Investment cost [USD/kW] | 2888.23 biomass | 1619.18 onshore wind, 1036.130 solar PV |

| Loan duration [years] | 15 | 15 |

| Loan amortisation | linear | linear |

| Equity [pu] | 0.3 | 0.3 |

| Equity Cost [pu] | 0.18 | 0.18 |

| Loan fraction [pu] | 0.7 | 0.7 |

| Loan interest [pu] | 0.03 | 0.03 |

| Corporate tax [pu] | 0.2987 | 0.2200 |

| WACC before tax [pu] | 0.075 | 0.075 |

| 2019 mean market price [USD/kWh] | 0.0411 | 0.0438 |

| Annual market price variation [pu] | 0 | 0 |

| Country | Technology | Project NPV [USD/kW] | Equity NPV [USD/kW] | Project IRR [%] | Equity IRR [%] |

|---|---|---|---|---|---|

| Germany | Biomass | 4301.54 | 4871.74 | 23.66% | 65.01% |

| Denmark | Onshore wind | −547.50 | −233.15 | 2.90% | 3.55% |

| Solar PV | −586.86 | −385.70 | −0.72% | −2.70% |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Martín, H.; Coronas, S.; Alonso, À.; de la Hoz, J.; Matas, J. Renewable Energy Auction Prices: Near Subsidy-Free? Energies 2020, 13, 3383. https://doi.org/10.3390/en13133383

Martín H, Coronas S, Alonso À, de la Hoz J, Matas J. Renewable Energy Auction Prices: Near Subsidy-Free? Energies. 2020; 13(13):3383. https://doi.org/10.3390/en13133383

Chicago/Turabian StyleMartín, Helena, Sergio Coronas, Àlex Alonso, Jordi de la Hoz, and José Matas. 2020. "Renewable Energy Auction Prices: Near Subsidy-Free?" Energies 13, no. 13: 3383. https://doi.org/10.3390/en13133383

APA StyleMartín, H., Coronas, S., Alonso, À., de la Hoz, J., & Matas, J. (2020). Renewable Energy Auction Prices: Near Subsidy-Free? Energies, 13(13), 3383. https://doi.org/10.3390/en13133383