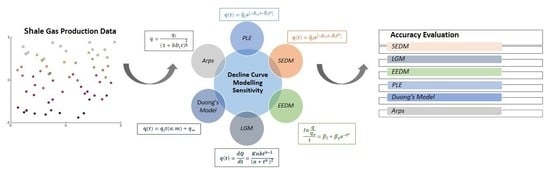

The Evaluation and Sensitivity of Decline Curve Modelling

Abstract

1. Introduction

2. Overview of Shale Gas Production

3. Characteristics and Production Behavior of Shale Gas

- Fracture/Early Linear Flow: A transient flow regime that occurs when the production flow is linear to the single fractures. This flow regime governs the known life of most shale wells. A negative half slope on a log-log plot of rate versus time can be used to differentiate this linear flow.

- Fracture Boundary Flow: Follows after a certain period of production when an interference occurs i.e., from linear to simulated reservoir volume (SRV). Many of the existing horizontal shale wells have not experienced this regime, but some of the newer wells with huge fracture treatments have been observing this regime early. This can be observed on a log-log plot by deviation from a –1/2 slope line on a log-log plot of rate versus time.

- Matrix Linear Flow: When production from the matrix, beyond the SRV, starts to govern the production, a linear type flow will be seen. This regime is most likely will not be observed in the economic life of the well. Comparable to fracture linear flow, this regime can be observed using a negative half slope line on a log-log plot of rate versus time.

- Matrix Boundary Flow: After the outer matrix transient has reached the drainage boundaries of the well, a deviation from the negative half slope, corresponding to matrix linear flow, will be observed. This deviation is equivalent to matrix boundary flow. Similar to the matrix, linear flow will most likely not be observed.

4. Overview of Decline Curve Models

4.1. Arps Decline Curve and the Modified Hyperbolic Decline Model (MHD)

4.2. Power Law Exponential Model (PLE)

4.3. Stretched Exponential Decline Model (SEDM)

4.4. The Extended Exponential Model (EEDM)

4.5. Doung’s Decline Model

4.6. Logistic Growth Model (LGM)

4.7. Autoregressive Intergrated Moving Average (ARIMA) and Neutral Network Models (NNM) (Hybrid Model)

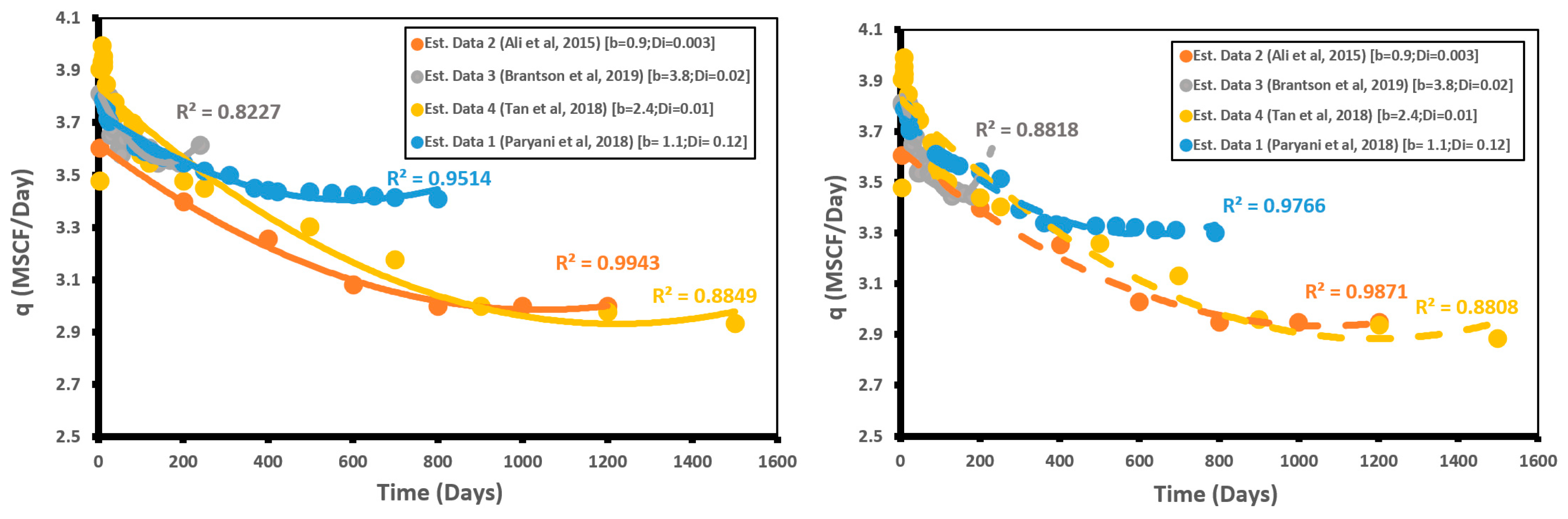

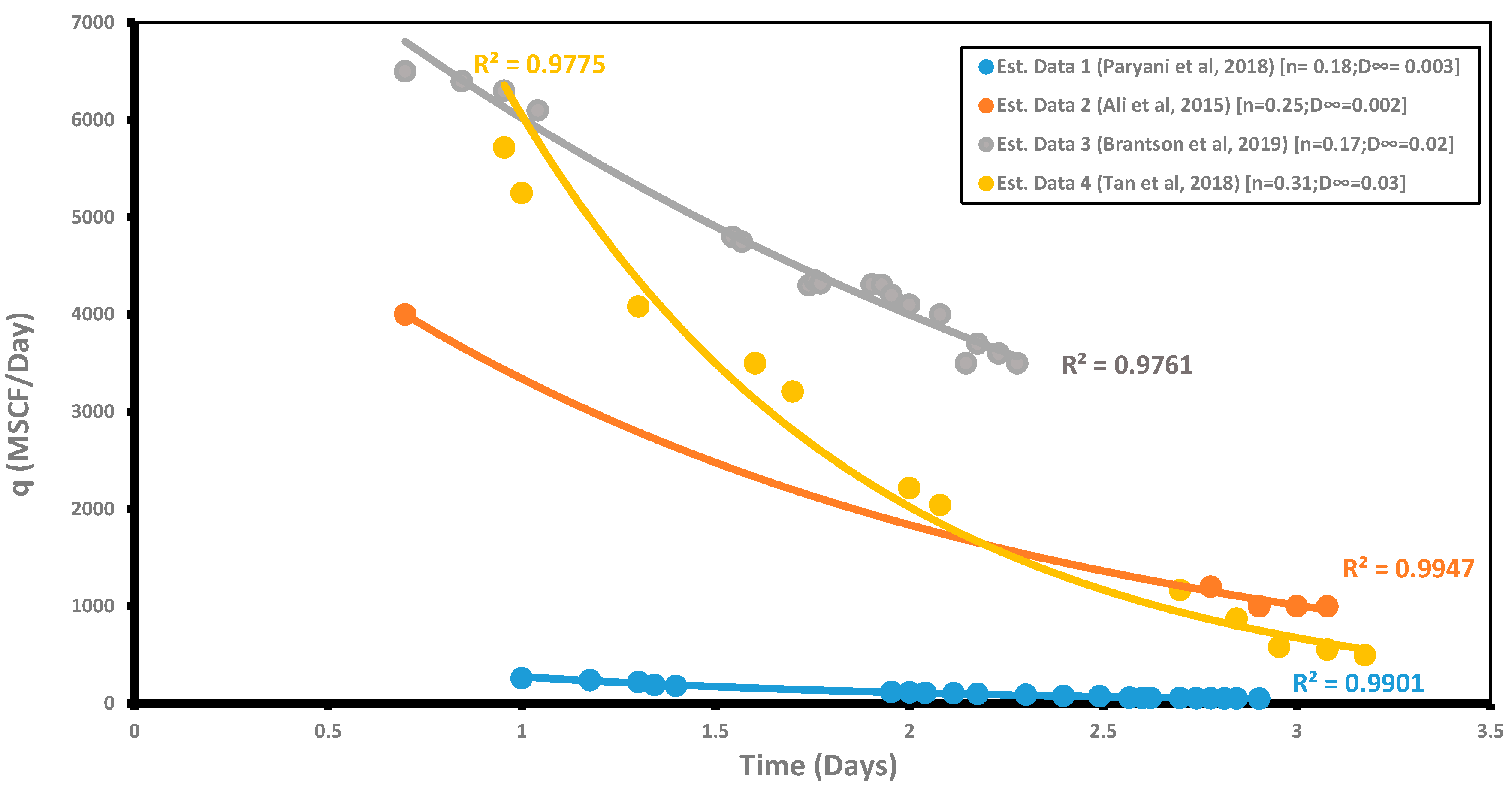

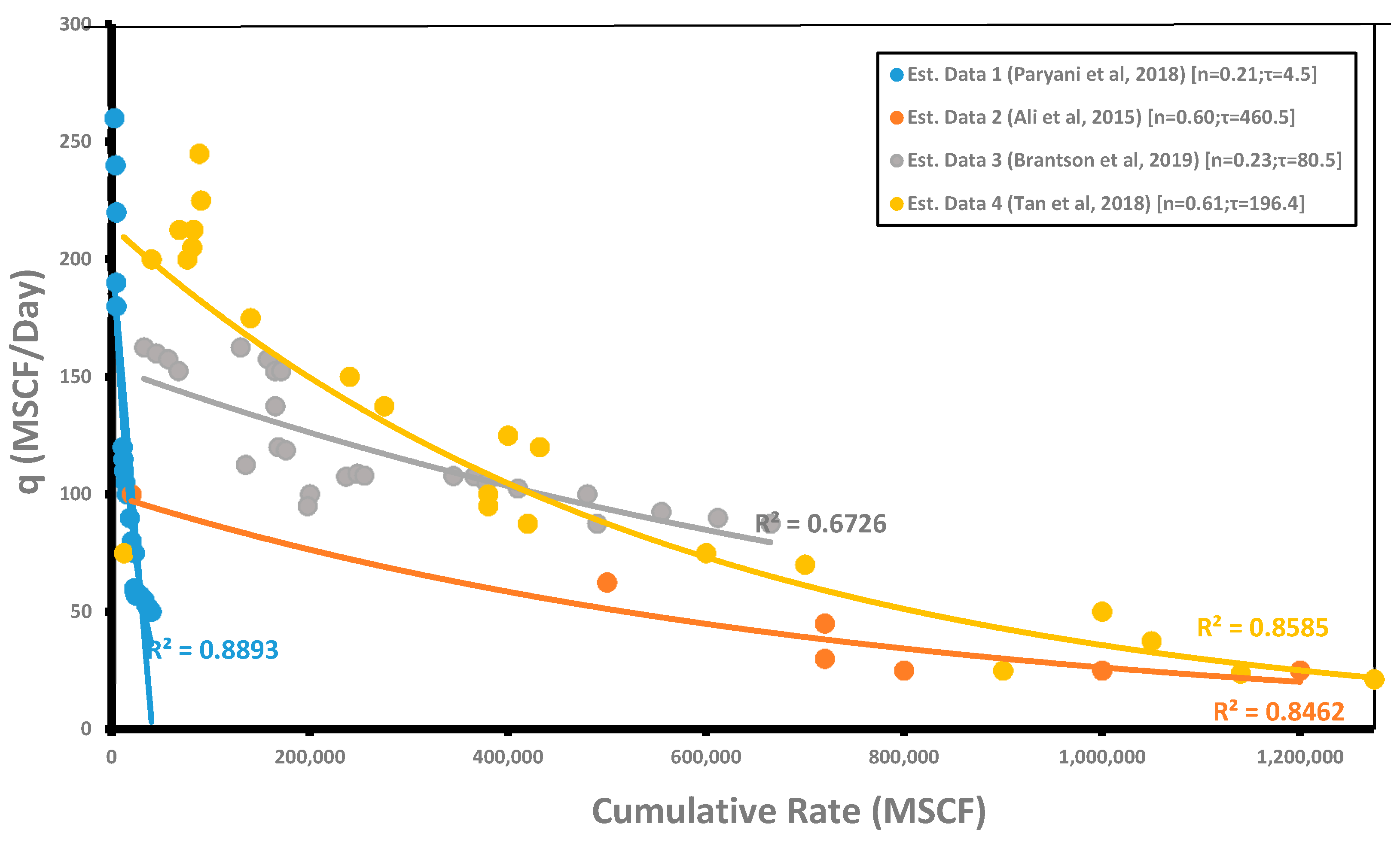

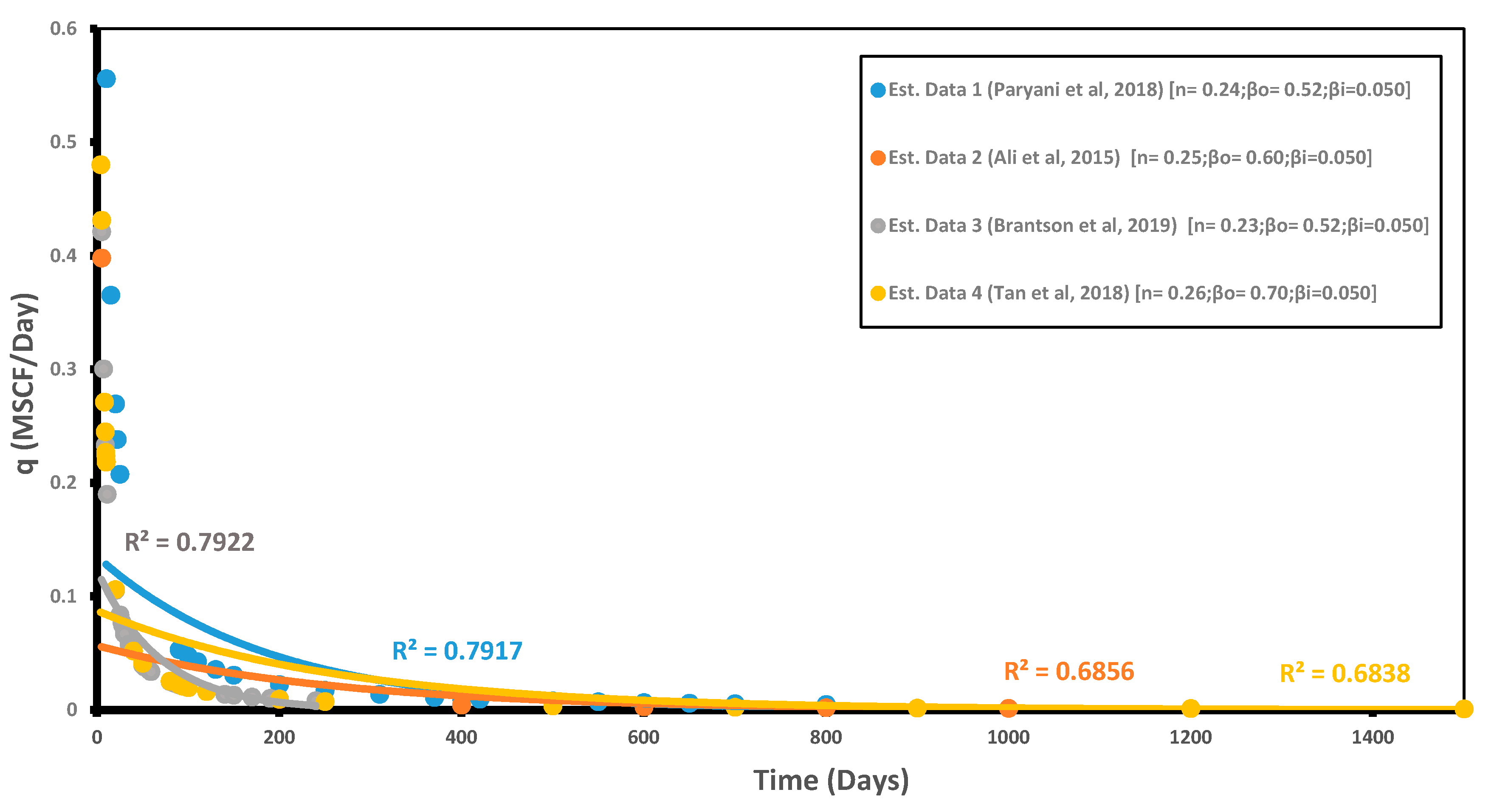

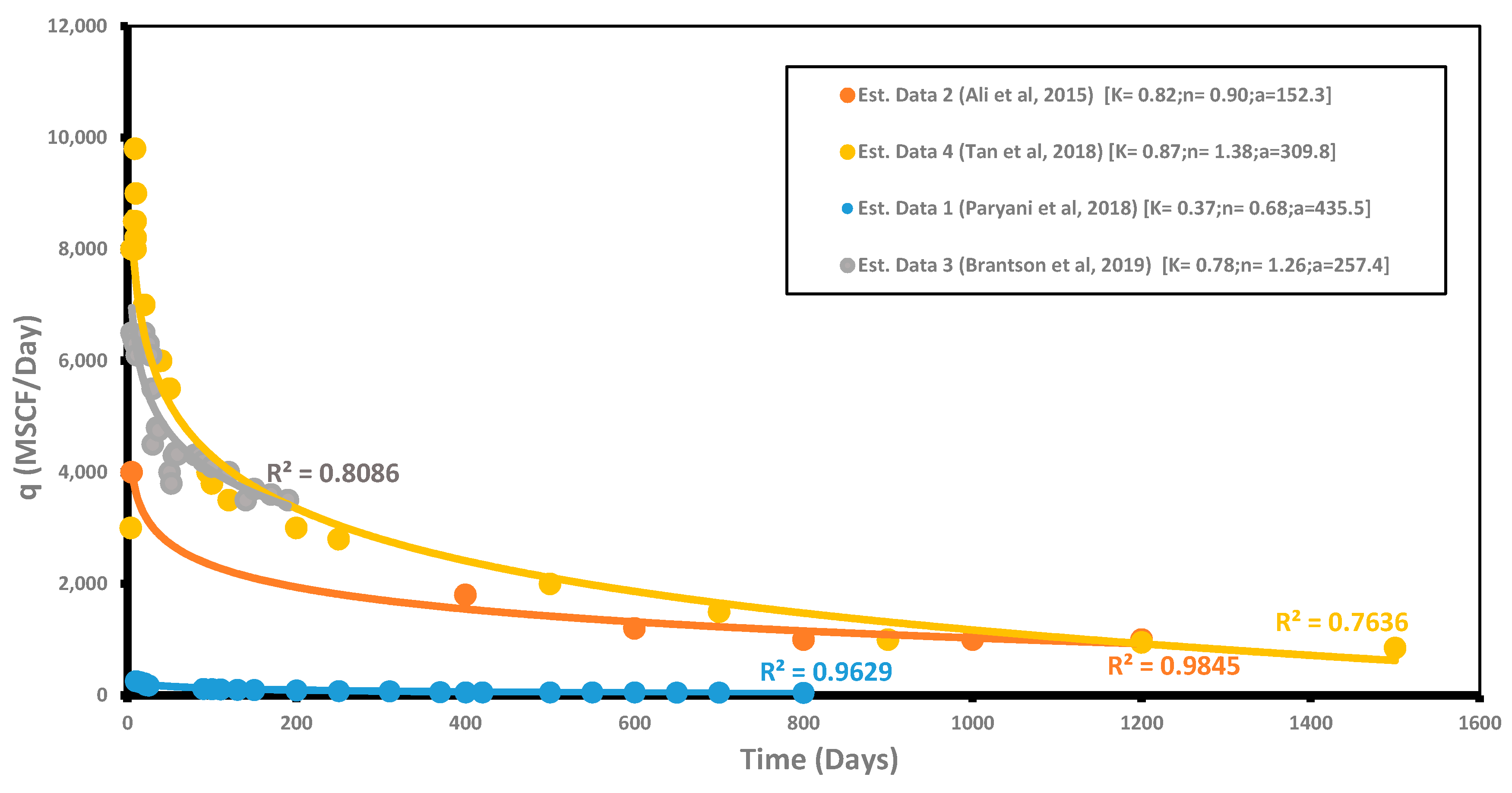

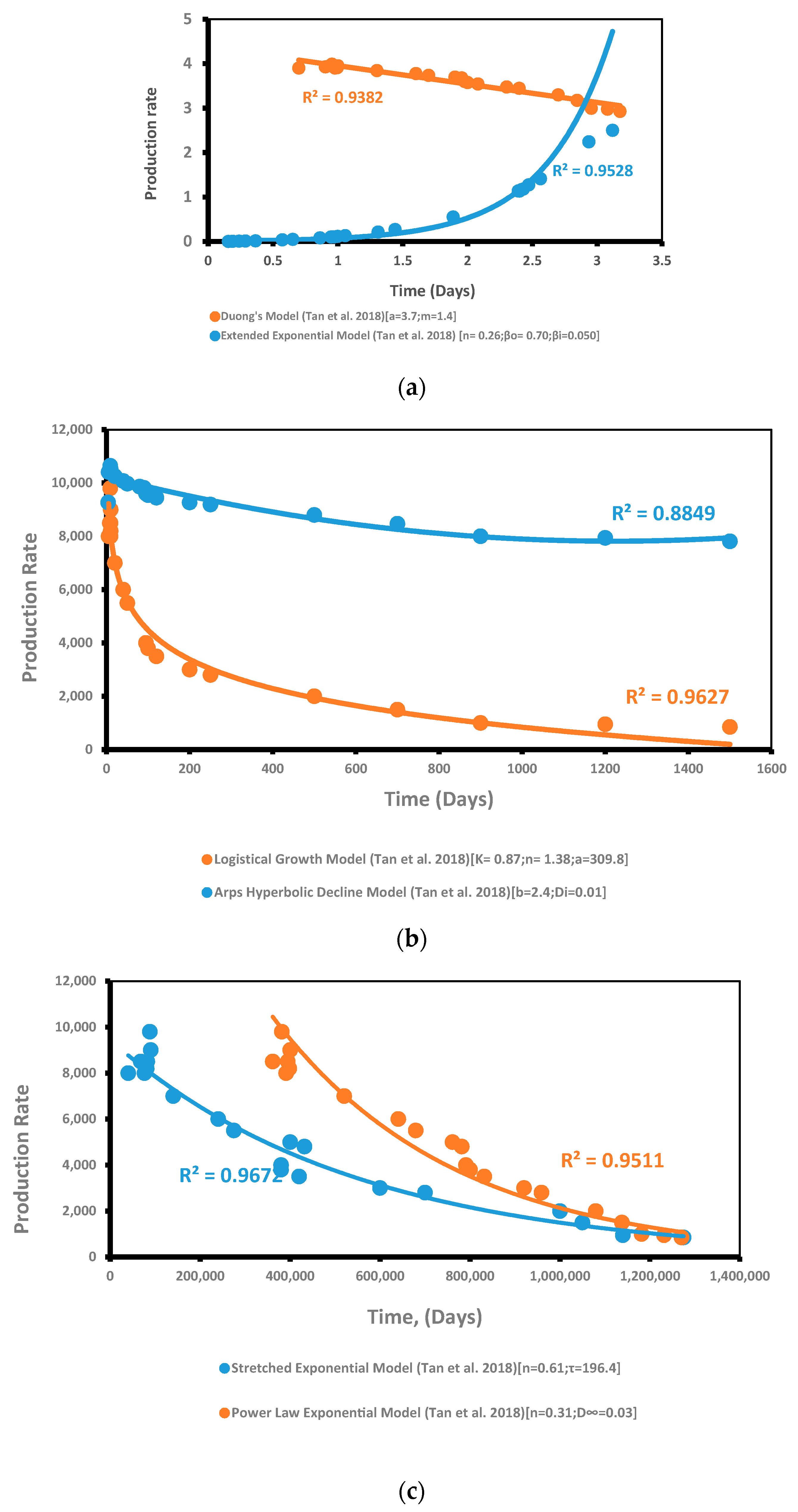

5. Accuracy of Current Decline Curve Models with Field Data

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zhang, X.; Wang, X.; Hou, X.; Xu, W. Rate decline analysis of vertically fractured wells in shale gas reservoirs. Energies 2017, 10, 1602. [Google Scholar] [CrossRef]

- Wang, H. What factors control shale gas production and production decline trend in fractured systems: A comprehensive analysis and investigation. SPE J. 2017, 22, 562–581. [Google Scholar] [CrossRef]

- Xu, B.; Haghighi, M.; Li, X.; Cooke, D. Development of new type curves for production analysis in naturally fractured shale gas/tight gas reservoirs. J. Pet. Sci. Eng. 2013, 105, 107–115. [Google Scholar] [CrossRef]

- Tan, L.; Zuo, L.; Wang, B. Methods of decline curve analysis for shale gas reservoirs. Energies 2018, 11, 552. [Google Scholar] [CrossRef]

- Yuan, J.; Luo, D.; Feng, L. A review of the technical and economic evaluation techniques for shale gas development. Appl. Energy 2015, 148, 49–65. [Google Scholar] [CrossRef]

- Knudsen, B.R.; Foss, B.; Whitson, C.H.; Conn, A.R. Target-rate tracking for shale-gas multi-well pads by scheduled shut-ins. IFAC Proc. Vol. 2012, 45, 107–113. [Google Scholar] [CrossRef]

- Nwaobi, U.; Anandarajah, G.A. Critical Review of Shale Gas Production Analysis and Forecast Methods. Saudi J. Eng. Technol. (SJEAT) 2018, 3, 276–285. [Google Scholar]

- Adekoya, F. Production Decline Analysis of Horizontal Well in Gas Shale Reservoirs. Master’s Thesis, West Virginia University, Morgantown, WV, USA, 2009. [Google Scholar]

- Nelson, P.H. Pore-throat sizes in sandstones, tight sandstones, and shales. AAPG Bull. 2009, 93, 329–340. [Google Scholar] [CrossRef]

- Joshi, K.J. Comparison of Various Deterministic Forecasting Techniques in Shale Gas Reservoirs with Emphasis on the Duong Method. Ph.D. Thesis, Texas A&M University, College Station, TX, USA, 2012. [Google Scholar]

- Zhang, H.; Rietz, D.; Cagle, A.; Cocco, M.; Lee, J. Extended exponential decline curve analysis. J. Nat. Gas Sci. Eng. 2016, 36, 402–413. [Google Scholar] [CrossRef]

- Boah, E.A.; Borsah, A.A.; Brantson, E.T. Decline Curve Analysis and Production Forecast Studies for Oil Well Performance Prediction: A Case Study of Reservoir X. Int. J. Eng. Sci. (IJES) 2018, 7, 56–67. [Google Scholar]

- Paryani, M.; Ahmadi, M.; Awoleke, O.; Hanks, C. Decline Curve Analysis: A Comparative Study of Proposed Models Using Improved Residual Functions. J. Pet. Environ. Biotechnol. 2018, 9, 362. [Google Scholar]

- Ali, T.A.; Sheng, J.J. Production decline models: A comparison study. In Proceedings of the SPE Eastern Regional Meeting, Morgantown, WV, USA, 13–15 October 2015. [Google Scholar]

- Yuhu, B.; Guihua, C.; Bingxiang, X.; Ruyong, F.; Ling, C. Comparison of typical curve models for shale gas production decline prediction. China Pet. Explor. 2016, 21, 96–102. [Google Scholar]

- Li, P.; Hao, M.; Hu, J.; Ru, Z.; Li, Z. A new production decline model for horizontal wells in low-permeability reservoirs. J. Pet. Sci. Eng. 2018, 171, 340–352. [Google Scholar] [CrossRef]

- Arps, J.J. Analysis of decline curves. Trans. AIME 1945, 160, 228–247. [Google Scholar] [CrossRef]

- Qu, Z.; Lin, J.E. (Eds.) Proceedings of the International Field Exploration and Development Conference 2017; Springer: Singapore, 2018. [Google Scholar]

- Robertson, S. Generalised Hyperbolic Equation; Society of Petroleum Engineers: Richardson, TX, USA, 1988. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Brantson, E.T.; Ju, B.; Ziggah, Y.Y.; Akwensi, P.H.; Sun, Y.; Wu, D.; Addo, B.J. Forecasting of Horizontal Gas Well Production Decline in Unconventional Reservoirs using Productivity, Soft Computing and Swarm Intelligence Models. Nat. Resour. Res. 2019, 28, 717–756. [Google Scholar] [CrossRef]

- Ilk, D.; Rushing, J.A.; Perego, A.D.; Blasingame, T.A. Exponential vs hyperbolic decline in tight gas sands: Understanding the origin and implications for reserve estimates using Arps decline curves. In Proceedings of the SPE Annual Technical Conference and Exhibition, Denver, CO, USA, 21–24 September 2008. [Google Scholar]

- McNeil, R.; Jeje, O.; Renaud, A. Application of the power law loss-ratio method of decline analysis. In Proceedings of the Canadian International Petroleum Conference, Calgary, AB, Canada, 16–18 June 2009. [Google Scholar]

- Seshadri, J.N.; Mattar, L. Comparison of power law and modified hyperbolic decline methods. In Proceedings of the Canadian Unconventional Resources and International Petroleum Conference, Calgary, AB, Canada, 19–21 October 2010. [Google Scholar]

- Kanfar, M.S.; Wattenbarger, R.A. Comparison of Empirical Decline Curve Methods for Shale Wells. In Proceedings of the SPE Canadian Unconventional Resources Conferences, Calgary, AB, Canada, 30 October–1 November 2012. [Google Scholar]

- Vanorsdale, C.R. Production decline analysis lessons from classic shale gas wells. In Proceedings of the SPE Annual Technical Conference and Exhibition, New Orleans, LA, USA, 30 September–2 October 2013. [Google Scholar]

- Hu, Y.; Weijermars, R.; Zuo, L.; Yu, W. Benchmarking EUR estimates for hydraulically fractured wells with and without fracture hits using various DCA methods. J. Pet. Sci. Eng. 2018, 162, 617–632. [Google Scholar] [CrossRef]

- Johnson, N.L.; Currie, S.M.; Ilk, D.; Blasingame, T.A. A Simple methodology for direct estimation of gas-in-place and reserves using rate-time data. In Proceedings of the SPE Rocky Mountain Petroleum Technology Conference, Denver, CO, USA, 14–16 April 2009. [Google Scholar]

- Valko, P.P. Assigning value to stimulation in the Barnett Shale: A simultaneous analysis of 7000 plus production hystories and well completion records. In Proceedings of the SPE Hydraulic Fracturing Technology Conference, The Woodlands, TX, USA, 19–21 January 2009. [Google Scholar]

- Valkó, P.P.; Lee, W.J. A better way to forecast production from unconventional gas wells. In Proceedings of the SPE Annual Technical Conference and Exhibition, Florence, Italy, 19–22 September 2010. [Google Scholar]

- Kisslinger, C. The stretched exponential function as an alternative model for aftershock decay rate. J. Geophys. Res.: Solid Earth 1993, 98, 1913–1921. [Google Scholar] [CrossRef]

- Can, B.; Kabir, C.S. Probabilistic performance forecasting for unconventional reservoirs with stretched-exponential model. In Proceedings of the North American Unconventional Gas Conference and Exhibition, The Woodlands, TX, USA, 14–16 June 2011. [Google Scholar]

- Zhou, L.Z.; Selim, H.M. Application of the fractional advection-dispersion equation in porous media. Soil Sci. Soc. Am. J. 2003, 67, 1079–1084. [Google Scholar] [CrossRef]

- Fetkovich, M.J. Decline curve analysis using type curves. J. Pet. Technol. 1980, 32, 1065–1077. [Google Scholar] [CrossRef]

- Duong, A.N. Rate-decline analysis for fracture-dominated shale reservoirs. SPE Reserv. Eval. Eng. 2011, 14, 377–387. [Google Scholar] [CrossRef]

- Lee, K.S.; Kim, T.H. Integrative Understanding of Shale Gas Reservoirs; Springer: Heidelberg, Germany, 2016. [Google Scholar]

- Clark, A.J. Decline Curve Analysis in Unconventional Resource Plays Using Logistic Growth Models. Ph.D. Thesis, The University of Texas at Austin, Austin, TX, USA, 2011. [Google Scholar]

- Clark, A.J.; Lake, L.W.; Patzek, T.W. Production forecasting with logistic growth models. In Proceedings of the SPE Annual Technical Conference and Exhibition, Denver, CO, USA, 30 October–2 November 2011. [Google Scholar]

- Tsoularis, A.; Wallace, J. Analysis of logistic growth models. Math. Biosci. 2002, 179, 21–55. [Google Scholar] [CrossRef]

- Bacaër, N. Verhulst and the logistic equation (1838). In A Short History of Mathematical Population Dynamics; Springer: London, UK, 2011; pp. 35–39. [Google Scholar]

- Taskaya-Temizel, T.; Ahmad, K. Are ARIMA neural network hybrids better than single models? In Proceedings of the International Joint Conference on Neural Networks (IJCNN 2005), Montr’eal, QC, Canada, 31 July–4 August 2005. [Google Scholar]

- Faruk, D.Ö. A Hybrid Neural Network and ARIMA Model for Water Quality Time Series Prediction. Eng. Appl. Artif. Intell. 2010, 23, 586–594. [Google Scholar] [CrossRef]

- Cybenko, G. Approximation by Superpositions of a Sigmoidal Function. Math. Control Signals Syst. 1989, 2, 303–314. [Google Scholar] [CrossRef]

- Dhini, A.; Riefqi, M.; Puspasari, M.A. Forecasting analysis of consumer goods demand using neural networks and ARIMA. Int. J. Technol. 2015, 6, 872–880. [Google Scholar] [CrossRef]

- Wachtmeister, H.; Lund, L.; Aleklett, K.; Höök, M. Production decline curves of tight oil wells in eagle ford shale. Nat. Resour. Res. 2017, 26, 365–377. [Google Scholar] [CrossRef]

- Guo, K.; Zhang, B.; Wachtmeister, H.; Aleklett, K.; Höök, M. Characteristic Production Decline Patterns for Shale Gas Wells in Barnett. Int. J. Sustain. Future Hum. Secur. 2017, 5, 11–20. [Google Scholar] [CrossRef]

- Kenomore, M.; Hassan, M.; Malakooti, R.; Dhakal, H.; Shah, A. Shale gas production decline trend over time in the Barnett Shale. J. Pet. Sci. Eng. 2018, 165, 691–710. [Google Scholar] [CrossRef]

- Harris, S.C. A Study of Decline Curve Analysis in the Elm Coulee Field. Ph.D. Thesis, Texas A&M University, College Station, TX, USA, 2013. [Google Scholar]

- Shah, S. Development of New Decline Model for Shale Oil Reserves. Ph.D. Thesis, University of Houston, Houston, TX, USA, 2013. [Google Scholar]

| EUR (bscf) | Data 1 | Data 2 | Data 3 | Data 4 |

|---|---|---|---|---|

| Arps Model | 0.31 | 20.52 | 18.13 | 5.21 |

| MHD | 0.18 | 4.13 | 13.18 | 4.18 |

| No | Model | Equation | Production Behaviour | Strength | Weakness | Reference |

|---|---|---|---|---|---|---|

| 1 | Arps Hyperbolic Decline | linear to BDF flow | reliable and simple to use | post-production overestimation | [12,13,14,15,16,17,18] | |

| 2 | Modified Hyperbolic Curve | transient and BDF flow | addresses the overestimation limitation of EUR | still unable to determine for production data | [15,19] | |

| 3 | Power Law Exponential Decline | transient and BDF flow | developed precisely for SGR | four unknown variables to solve | [13,16,20,23,24,25,26,27] | |

| 4 | Stretched Exponential Decline | transient flow | bounded nature of EUR and straight-line behavior of recovery potential expression | requires sufficiently long production times | [10,14,26,28,29,30,31,32] | |

| 5 | The Extended Exponential Model | transient and BDF flow | both early and late production profiles can be captured | parameter has an incomplete influence on the curve fitting and is therefore fixed | [11,13,16,33] | |

| 6 | Doung’s Decline | linear or near-linear flow | appears to fit field data from various shale plays | extended periods, a proper rate initialization against pressure is required, and in the event of water breakthrough, a and m increases | [13,20,27,34,35] | |

| 7 | Logistic Growth | long transient boundary-dominated | reserve estimate is inhibited by K as well as the production rate, which terminates at infinite time | growth is only possible up to a certain size | [1,16,20,35,36,37,38,39] | |

| 8 | Hybrid Model | linear and non-linear | high degree of accuracy | approach can be found to not be fit all types of data | [40,41,42,43] |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Manda, P.; Nkazi, D.B. The Evaluation and Sensitivity of Decline Curve Modelling. Energies 2020, 13, 2765. https://doi.org/10.3390/en13112765

Manda P, Nkazi DB. The Evaluation and Sensitivity of Decline Curve Modelling. Energies. 2020; 13(11):2765. https://doi.org/10.3390/en13112765

Chicago/Turabian StyleManda, Prinisha, and Diakanua Bavon Nkazi. 2020. "The Evaluation and Sensitivity of Decline Curve Modelling" Energies 13, no. 11: 2765. https://doi.org/10.3390/en13112765

APA StyleManda, P., & Nkazi, D. B. (2020). The Evaluation and Sensitivity of Decline Curve Modelling. Energies, 13(11), 2765. https://doi.org/10.3390/en13112765