Cost–Benefit Analysis of a Virtual Power Plant Including Solar PV, Flow Battery, Heat Pump, and Demand Management: A Western Australian Case Study

Abstract

:1. Introduction

- Developing an affordable concept design for residential VPPs, which include a rooftop solar farm, flow battery, heat pump hot water systems, and demand management.

- Providing a detailed model for the expenses associated with the deployment of a VPP in WA, including the expenses pertaining to the wholesale electricity market and to the capital expenditure.

- Developing a detailed model for the revenues of a VPP in WA, including the revenues obtained by selling electricity to the wholesale electricity market and to the residents of the VPP.

- Developing an effective system for controlling battery, heat pumps, and residential demands in order to optimize the benefits for both the VPP owner and the residents.

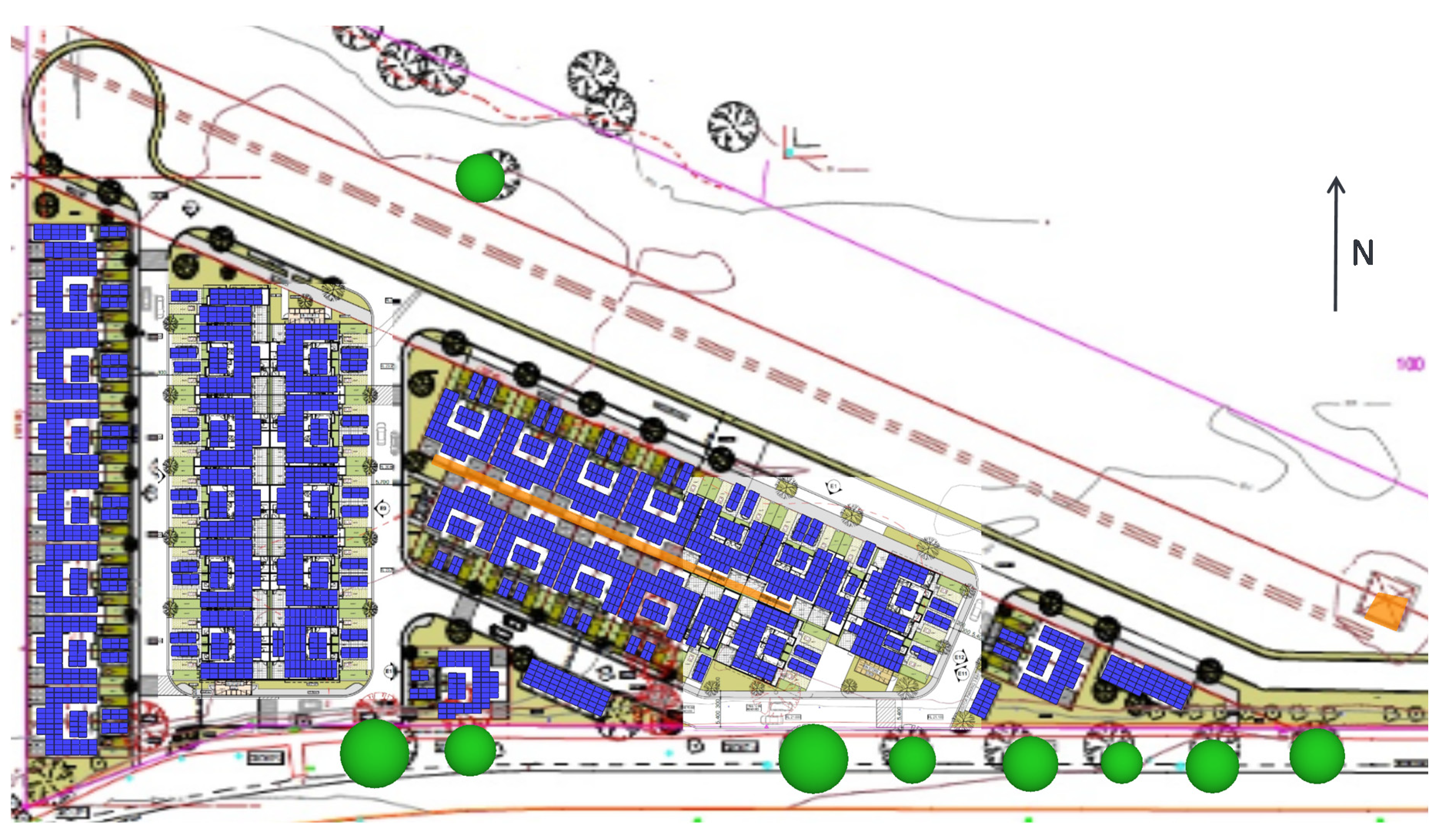

- Investigating and modeling the economics of a real-world VPP comprising 67 residential dwellings in WA including all of the above-mentioned aspects for a VPP.

- Providing recommendations for VPP businesses and policy-makers under similar market and economic situations.

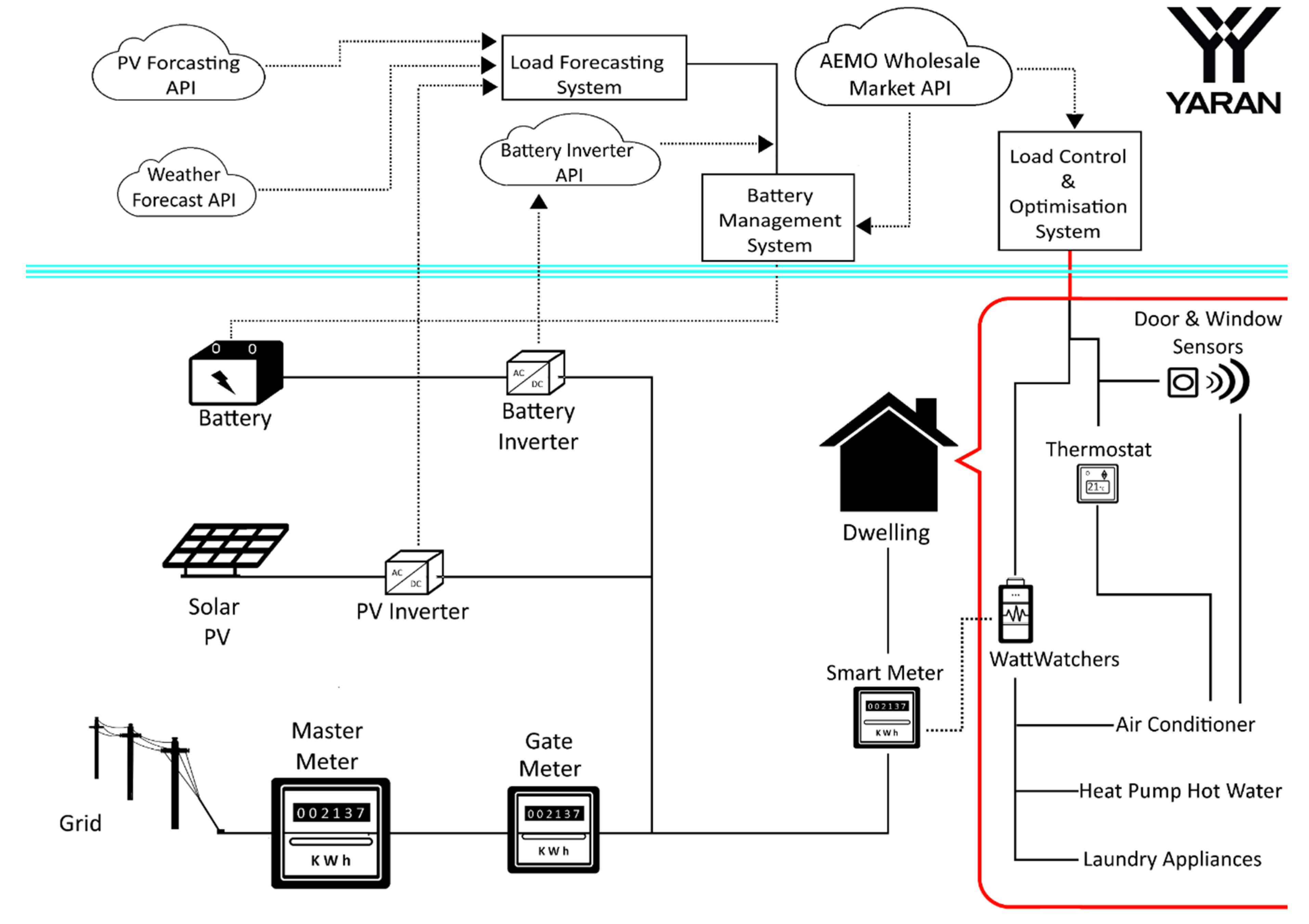

2. The Proposed Architecture of the VPP

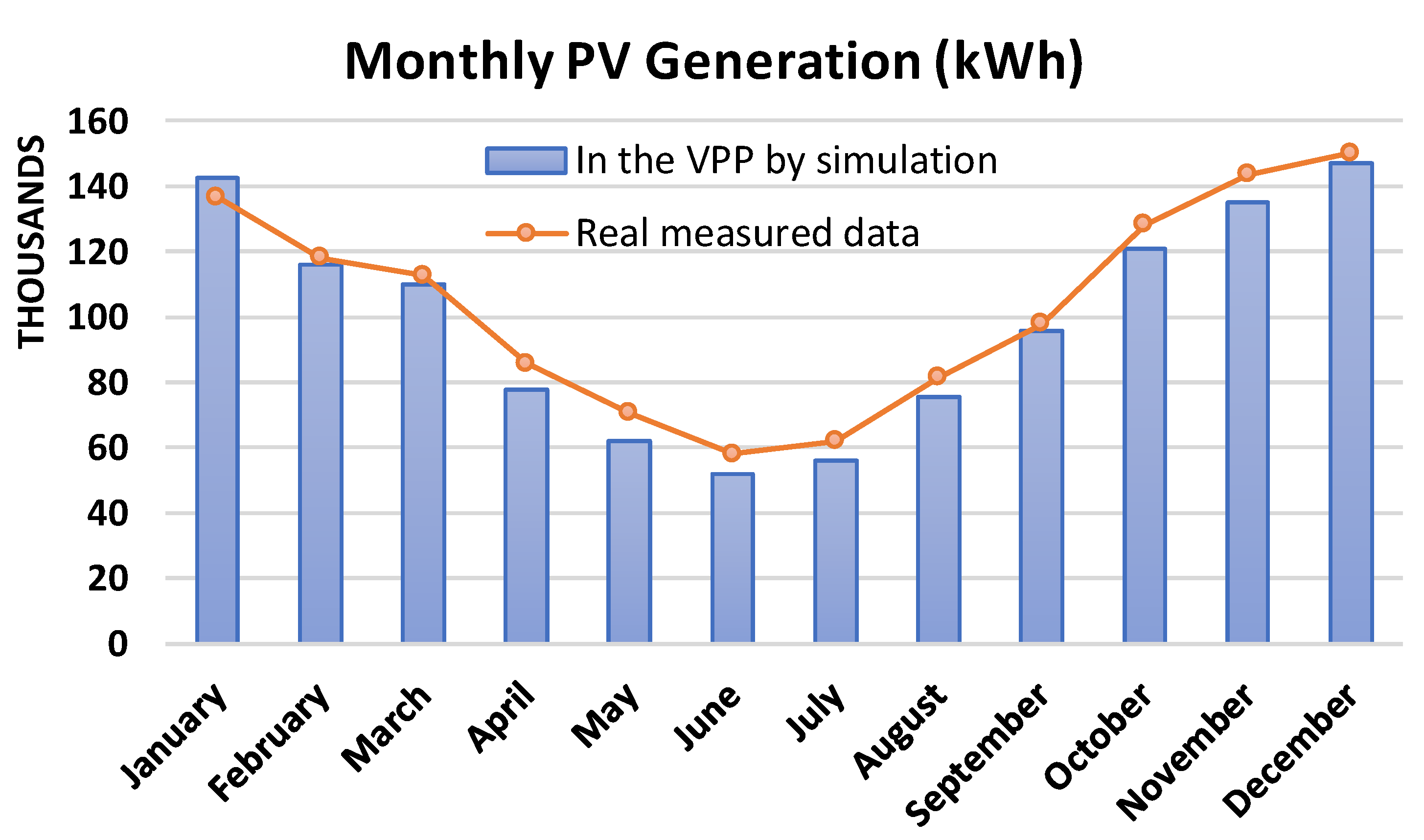

2.1. Rooftop Solar Farm

2.2. Vanadium Redox Flow Battery (VRFB)

2.3. Heat Pump Hot Water System

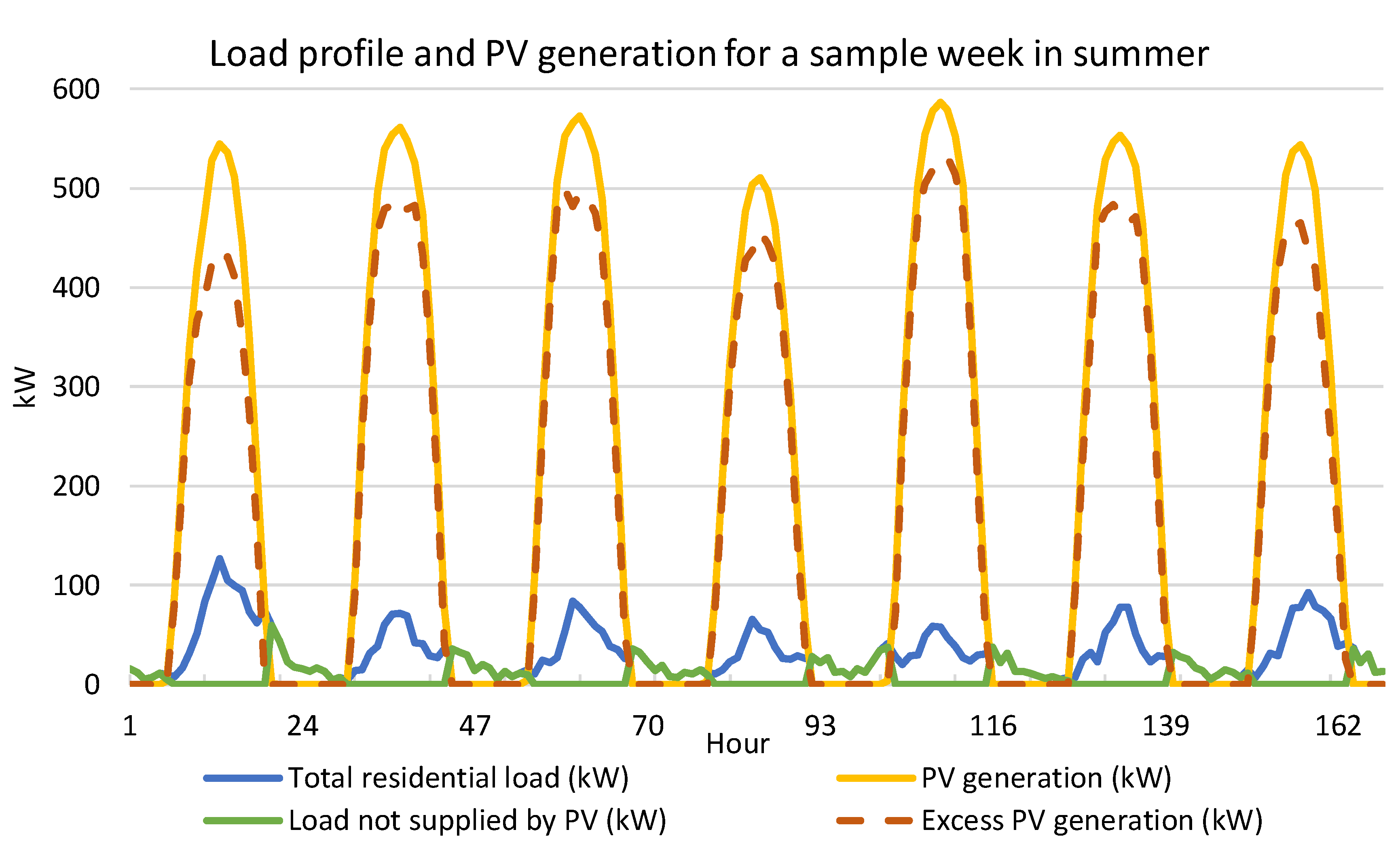

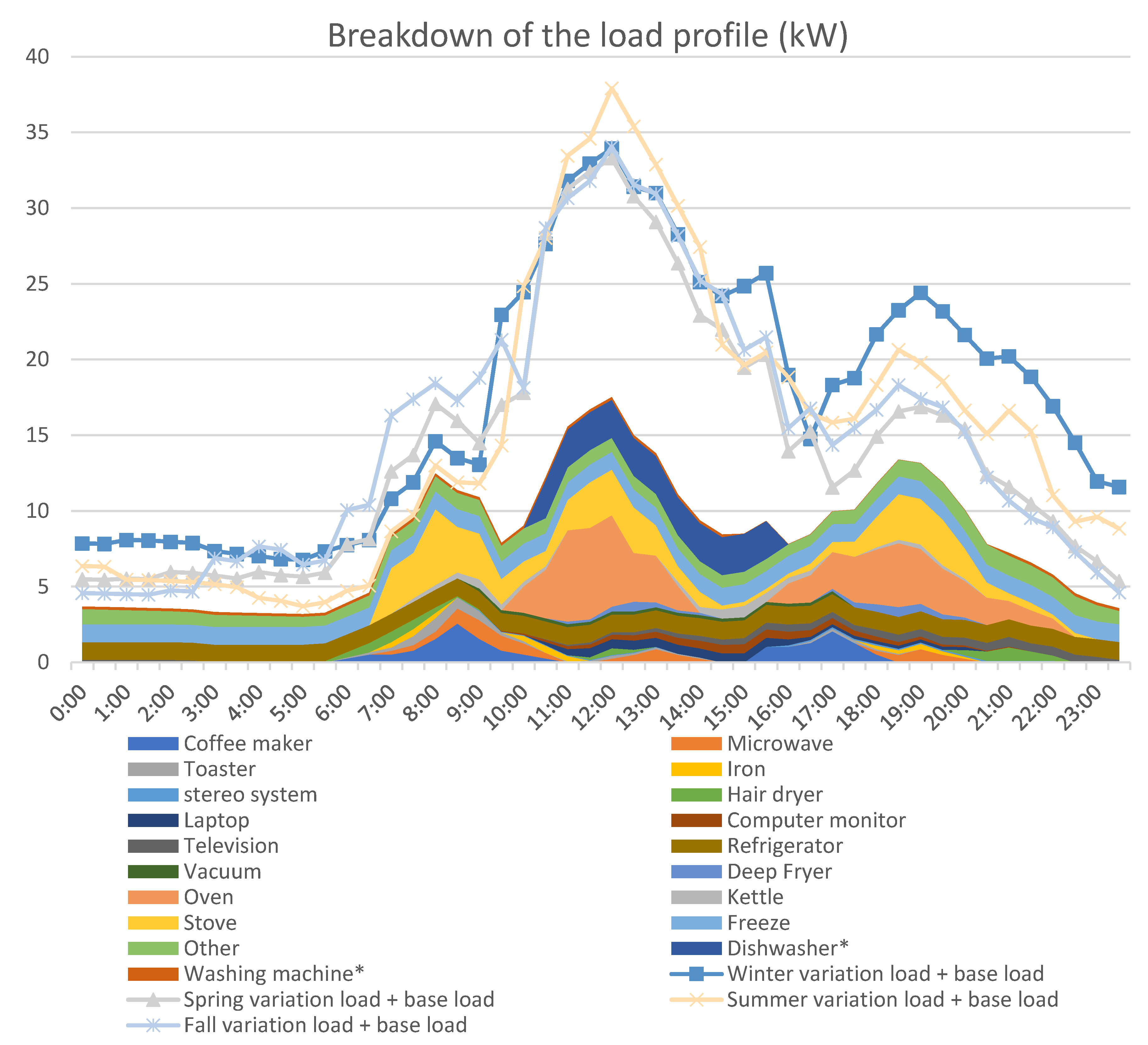

3. Load Modeling

Air Conditioning Load

4. The Formulation of Expenses and Revenues

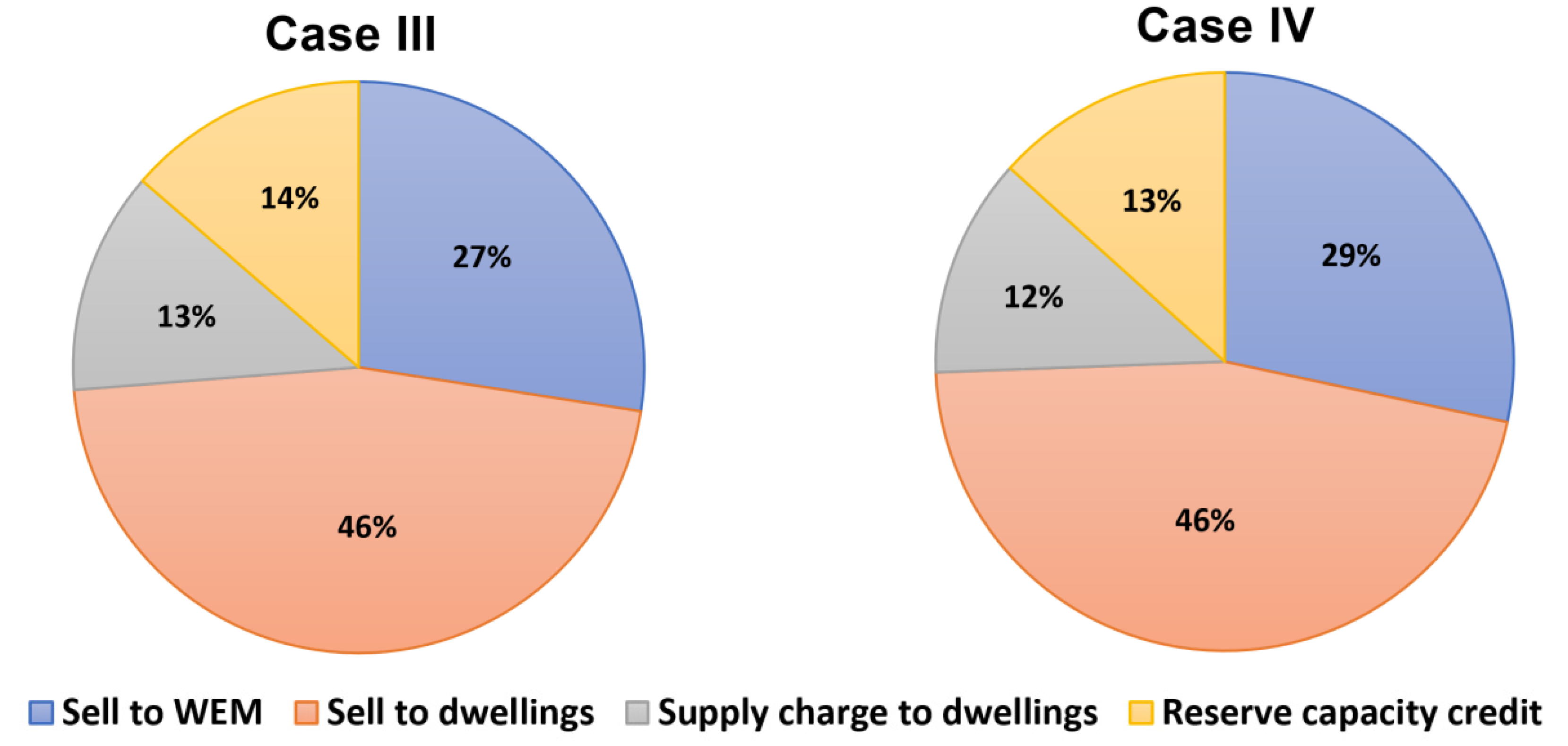

4.1. The Expenses of the VPP

- is the NPV of the WEM-related expenses at y-th year;

- is the horizon year and is the index for the year;

- is the NPV cost of purchasing energy from the WEM balancing market at the y-th year, which is formulated as follows:where is the purchased energy from WEM and is the WEM electricity price at the h-th hour of the y-th year, and is the interest year. The coefficient is applied here to convert the cost at year to the net present value.

- is the NPV cost of the retailer margin expense associated with the purchase from the WEM. This cost is calculated as a percentage, namely, in this paper, of the cost of purchasing energy from the WEM, which is formulated as follows:

- is the NPV cost of the retailer margin expense associated with the export from the VPP to the WEM. This cost is also calculated as a percentage () of the NPV of the revenue from selling energy to the WEM, namely, here, which is formulated as follows:

- is the NPV of the energy tariff charge, which is calculated based on the tariff that is applied to the VPP. In this case, the applied tariff is RT16 [40], which is for the business customers with the time of use (TOU) bi-directional service, and it is formulated as shown below. is the energy tariff price at the hour h of year y.

- is the NPV cost of the loss factor, which is calculated as a constant coefficient ( equal to 0.0603 for 2019–2020) times the NPV of the network charge in each year, which is

- is the Clean Energy Regulator fee, which is applied to the big customers, proportional to the energy imported from the grid. The fee is AUD (Australian dollars) per kWh purchased from the grid in each year, namely, , which is formulated as shown below. is 0.02256 AUD per kWh for 2019–2020.

- is the ancillary service fee, which is a constant percentage of the energy imported from the grid. The fee is AUD per kWh purchased from the grid in each year, which is formulated as shown below. is 0.00372 AUD per kWh for 2019–2020.

- is the market fee, which is a constant percentage of the energy imported from the grid. The fee is AUD per kWh for 2019–2020.

- is the daily supply charge, which is a constant daily charge as per the tariff of RT16. This charge is AUD per day for 2019–2020, which is applied for all 365 days of a year.The formulation of CAPEX-related costs is also presented here.

- is the cost associated with the PV system during the project, including the cost of PV panels (), inverter (), installation and commissioning (), and PV panel maintenance (), such as annual washing and cleaning. is the small-scale technology certificate (STC) rebate calculated based on Reference [41], which is granted as an incentive to those who install solar systems. Although this is revenue for the VPP, it is located here with other costs of PV for the sake of clarification. If the horizon year is no longer than the lifetime of the PV panels, the NPV cost of PV panels and the associated installation cost are equal to the investment cost at the beginning of the project. As the lifetime of inverters, e.g., 12 years, is shorter than the lifetime of PV panels, e.g., 20 years, it is required to replace the inverters during the life of the project. In this case, we need to consider the cost of the inverter in year 12, for example, and calculate the corresponding NPV cost. is the maintenance cost of PV panels per dwelling in year y.

- is the cost associated with the VRFB system, including the cost of the battery (), the cost of maintenance (), and the cost of installation (), such as designing and constructing a slab and foundations for the battery. The 20-year warranty is included in the price of the VRBF. is the maintenance cost of the VRFB in year y.

- is the cost of heat pump HWS for 67 dwellings. The government provides a rebate for the use of heat pumps as well [42]; thus, the cost is adjusted based on this incentive. Moreover, the difference between the cost of heat pump and instantaneous electric HWS is considered in the NPV calculations;

- is the cost of the power transformer and associated cabling and protection system that connects the VPP to the grid;

- is the cost of the smart meters for 67 dwellings including the cloud storage for monitoring, auditing, and control purposes;

- is the cost of design of the embedded network, communication, and electrical design.

4.2. The Revenues of the VPP

4.3. The Profit of the VPP

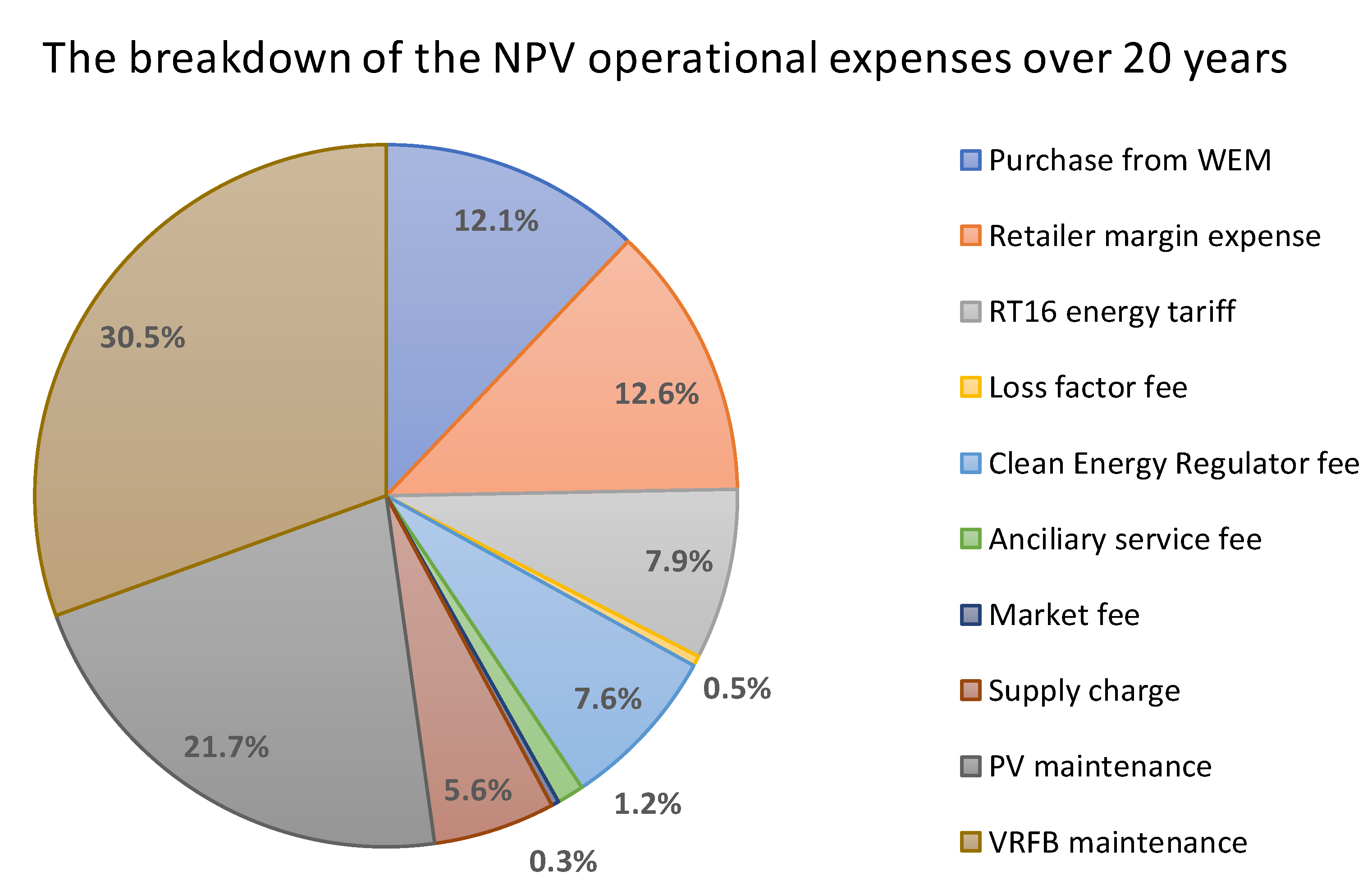

5. Battery and Demand Management

5.1. Demand Management

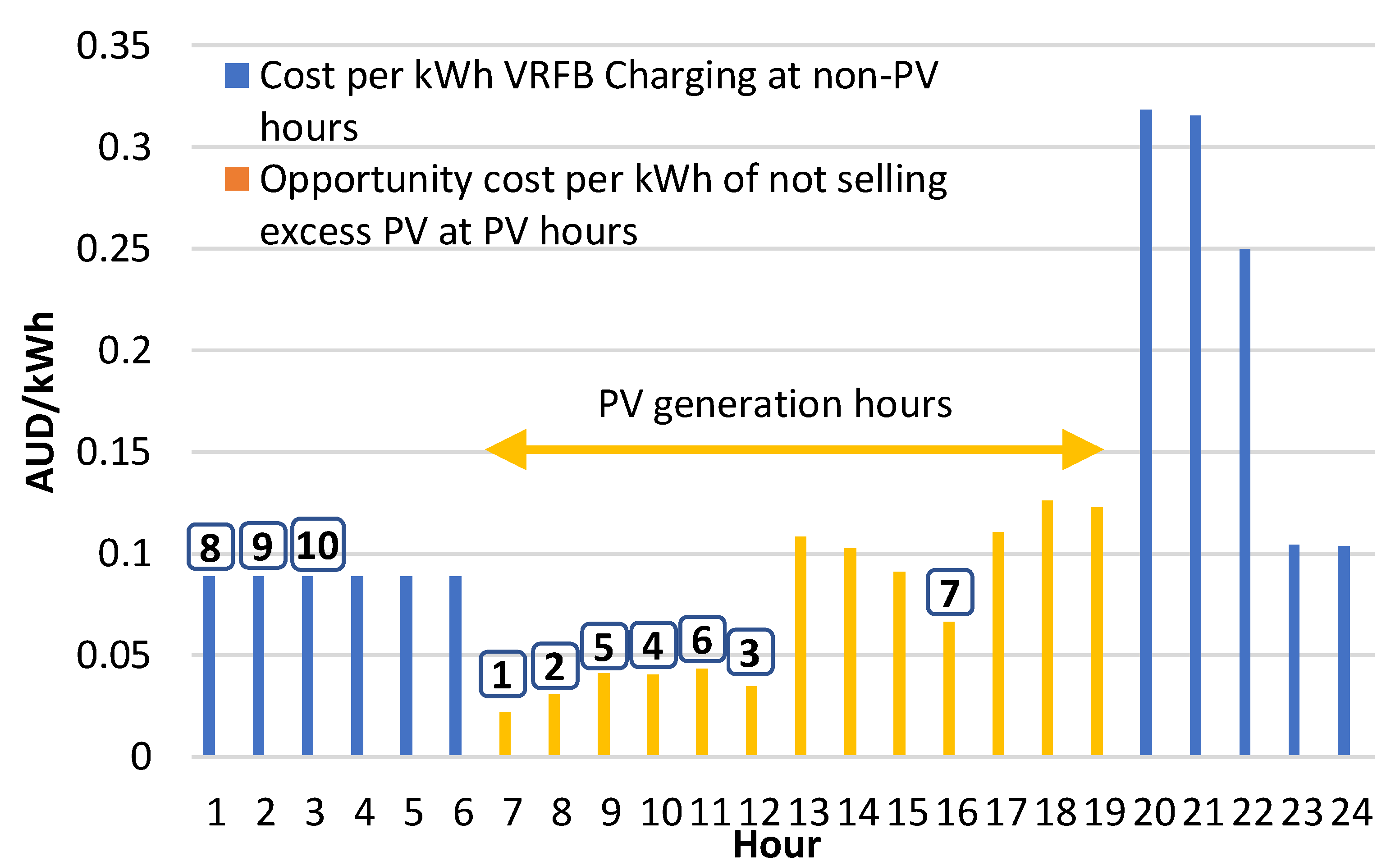

5.2. Battery Management

- (a)

- The revenue per kWh of selling excess PV to WEM at the h-th hour of the y-th year, which is equal to the opportunity cost of not selling excess PV to WEM, which is defined as follows:

- (b)

- The cost of purchasing 1 kWh energy at the h-th hour of the y-th year for charging the battery at non-PV hours, which is equal to the avoided cost of not purchasing energy from the grid at RT16, which is calculated as follows:

6. Input Parameters and Assumptions

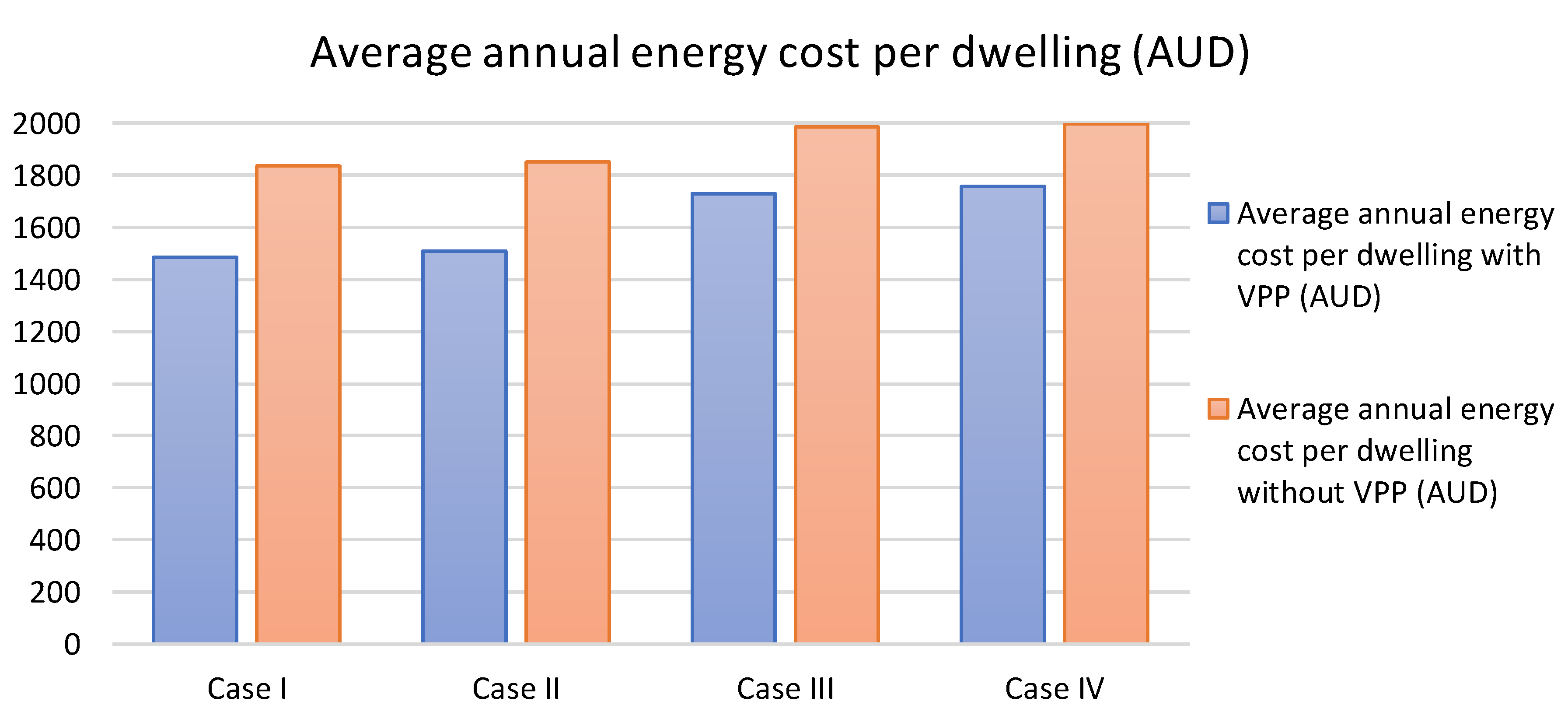

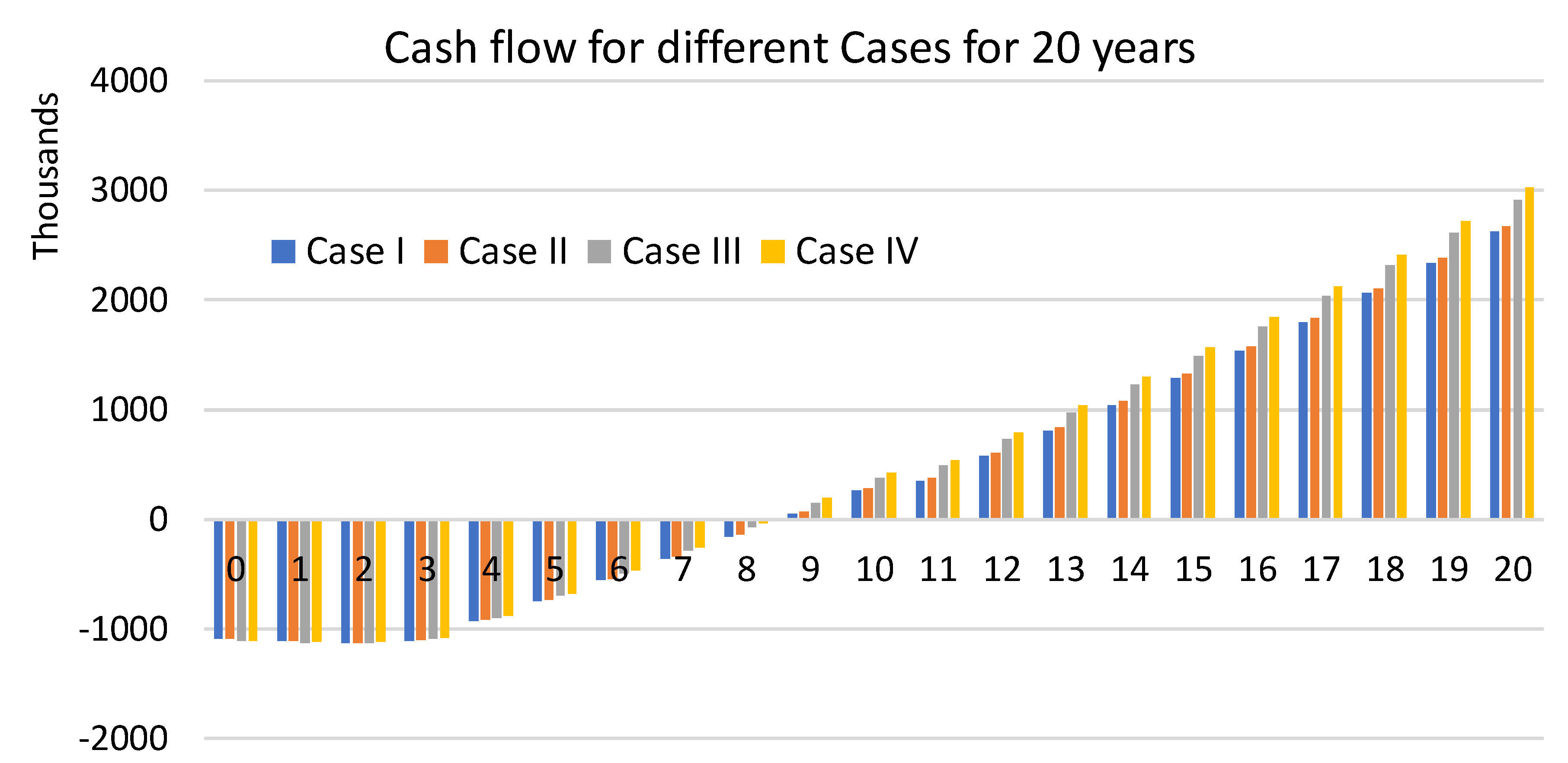

7. Simulation Results

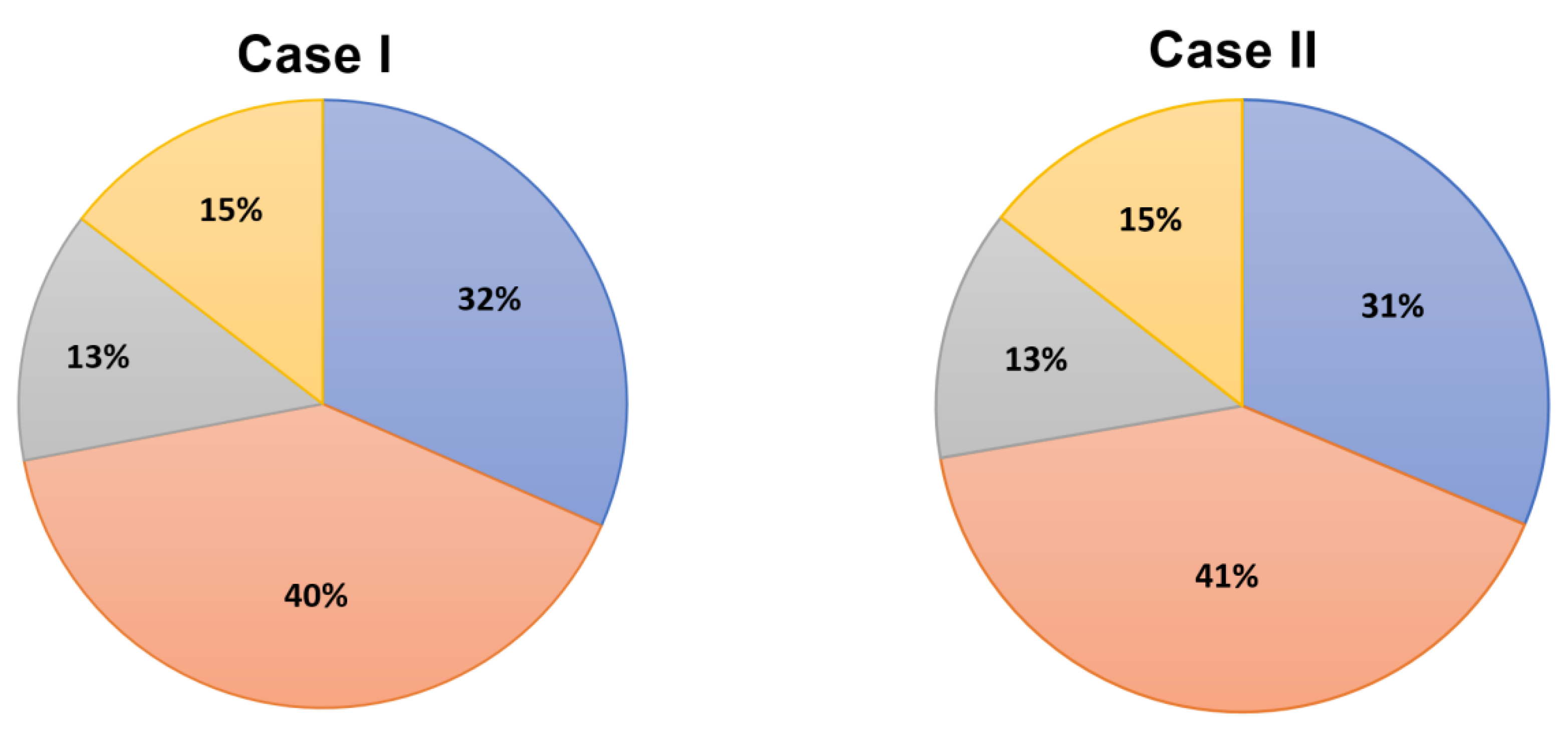

- Case I: the VPP with heat pump and DM;

- Case II: the VPP with heat pump without DM;

- Case III: the VPP without heat pump (instead, instant electric HWS is used) with DM for dishwasher, dryer, and washing machine;

- Case IV: the VPP without heat pump and without DM.

7.1. Comparison of Different Cases

7.2. Recommendations

- Long-term planning of VPPs:The successful and sustainable rollout of VPPs requires reliable long-term planning including investment and operational analysis for 20 years, for example. This assessment gives both the VPP owners and policy-makers a better understanding of affordability of such a structure in the long-term and the required logistic and regulatory supports. Through this planning exercise, the costs and benefits of the VPP are determined and possible future revenues are investigated.

- Wholesale electricity market interaction:The involvement of VPPs in WEM requires extensive development of the regulations and procedures related to this interaction. The preparation of such guidelines is initiated in some countries such as Australia. It is critical that the costs and benefits for VPP owners are considered in these rules and guidelines in order to minimize the costs of VPP implementation for the business. Moreover, the regulations should facilitate multiple revenue streams for VPPs to make the business sustainable in the long term. For example, in addition to the energy market, VPPs can participate in a demand response market or a frequency control market, which needs an appropriate set-up and regulation. Participating in multi-markets will reduce the payback period of investment for VPP owners and encourage more investors to enter this business.

- Incentivizing VPP projects:The governments and policy-makers need to incentivize different configurations of VPPs and different locations to evaluate the cost/benefits and barriers to VPP implementation in the real-world. Using this approach, they can collect required technical and financial data from a realistic VPP to use in regulation and procedure development. Moreover, these incentives will encourage more investors to invest in VPPs; thus, the government can achieve the goal of renewable integration and customer engagement in a shorter period of time.

- Batteries and PVs:The cost of batteries is still high for investors. Additionally, the cost of VRFBs and PV maintenance is high. Therefore, the regulators should plan for and incentivize the research and development of low-cost VRFBs and PVs, including investment and maintenance costs. In addition, the VPP owners can evaluate other options, such as leasing batteries for a period of time, which may be more profitable for them.

- Data availability:Although there are very good resource data on the WEM, environment, and generation, the evaluation and implementation of a VPP requires a wider range of data including the costs associated with environmental factors, customer behavior, the load profile of different categories of consumers, and economic factors. Therefore, policy-makers should facilitate the creation and development of the required data for VPP implementations. Incentivizing VPP development is one way to speed up the preparation of such data.

- Forecasting tools:The performance of a VPP in controlling PV, battery, and demand is mainly dependent on the reliable forecasting of WEM, weather, PV output, and electricity load. VPP owners should pay significant attention to the selection of the most accurate forecasting tools, which in many cases result in higher investment costs for the VPP owner. Therefore, the policy-maker can facilitate the use and development of such forecasting tools by encouraging and incentivizing the research in that domain and developing the right specifications for those tools.

- ICT, data storage, and securityOne of the important prerequisites of long-term profitability of a VPP is a stable, scalable, and cost-effective ICT connectivity amongst different components within the VPP including PV, battery, demand, control system, and forecast tools. For controlling and forecasting purposes, an efficient and secured, cloud-based storage platform for data should be established. Furthermore, the ICT system should be secure enough for communication and control signals and for different types of data including consumers’ data. All these aspects require the right knowledge for the VPP owners to choose the correct and cost-effective ICT, storage, and security systems. Obviously, such arrangements will increase the cost of investment for VPP owners, and the policy-makers need to facilitate the consultation service to VPPs about this matter. Incentivizing a VPP project will again help reduce the associated costs of ICT, storage, and security.

- Enhancing the community knowledge and involvement:A VPP needs to have a very good market for its services. In other words, a VPP owner should have enough customers to use the energy delivered by the VPP. Therefore, it is very critical that the community’s knowledge is increased about the advantages of a VPP, to encourage them to be involved in a VPP. The enhancement of community awareness is a collaborative task between the governments and the VPP investors. The government and policy-makers should promote the use of services provided by VPPs. On the other hand, VPP owners should provide attractive packages for the customers to encourage them to become involved in the VPP. If the VPP owner is successful in engaging customers in the investment and operation of the VPP, this collaboration will unlock many more benefits to the customers and the VPP owner.

- Local utility interaction:An establishment of a VPP requires some local utility approvals for the connection of the facility to the local grid. These approvals are usually time- and money-consuming, which adversely affects the affordability of a VPP by deferring its operation. Policy-makers can develop some guidelines and procedures to facilitate such approvals for VPPs. Additionally, the VPPs can contribute to the local voltage control in the grid, for which VPP owners can receive a signal from the local utility about how to react in order to satisfy the voltage grid standard. To achieve this aim, a contractual framework is necessary, and the policy-makers should play a very active role in developing it.

- Energy trading amongst VPPs:Another revenue stream for the VPPs would be energy trading amongst neighborhood VPPs in the future. A VPP can decide to purchase energy from the wholesale market or from another VPP nearby that provides more cost-effective energy. This arrangement enables purchasing local energy from another VPP without going through the electricity market arrangement and paying extra fees associated with the operation of the market. However, a network charge will be applied by the local utility for the use of the network. Policy-makers need to provide the required regulations and procedures for such local trading.

8. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- 2020 Large-Scale Renewable Energy Target Capacity Achieved; Clean Energy Regulator: Canberra, Australia, 2019.

- About the Renewable Energy Target. 2018. Available online: http://www.cleanenergyregulator.gov.au/RET/About-the-Renewable-Energy-Target (accessed on 31 May 2018).

- Ghavidel, S.; Li, L.; Aghaei, J.; Yu, T.; Zhu, J. A review on the virtual power plant: Components and operation systems. In Proceedings of the 2016 IEEE International Conference on Power System Technology (POWERCON), Wollongong, NSW, Australia, 28 September–1 October 2016; IEEE: Piscataway, NJ, USA, 2016; pp. 1–6. [Google Scholar]

- Ponds, K.T.; Arefi, A.; Sayigh, A.; Ledwich, G. Aggregator of demand response for renewable integration and customer engagement: Strengths, weaknesses, opportunities, and threats. Energies 2018, 11, 2391. [Google Scholar] [CrossRef] [Green Version]

- AEMO. Virtual Power Plant (VPP) Demonstrations. 2019. Available online: https://aemo.com.au/initiatives/major-programs/nem-distributed-energy-resources-der-program/pilots-and-trials/virtual-power-plant-vpp-demonstrations (accessed on 1 December 2018).

- Li, Y.; Gao, W.; Ruan, Y. Feasibility of virtual power plants (VPPs) and its efficiency assessment through benefiting both the supply and demand sides in Chongming country, China. Sustain. Cities Soc. 2017, 35, 544–551. [Google Scholar] [CrossRef]

- Lehmbruck, L.; Kretz, J.; Aengenvoort, J.; Sioshansi, F. Aggregation of front-and behind-the-meter: The evolving VPP business model. In Behind and Beyond the Meter; Academic Press: Cambridge, MA, USA, 2020; pp. 211–232. [Google Scholar]

- van Summeren, L.F.; Wieczorek, A.J.; Bombaerts, G.J.; Verbong, G.P. Community energy meets smart grids: Reviewing goals, structure, and roles in Virtual Power Plants in Ireland, Belgium and the Netherlands. Energy Res. Soc. Sci. 2020, 63, 101415. [Google Scholar] [CrossRef]

- Elgamal, A.H.; Kocher-Oberlehner, G.; Robu, V.; Andoni, M. Optimization of a multiple-scale renewable energy-based virtual power plant in the UK. Appl. Energy 2019, 256, 113973. [Google Scholar] [CrossRef]

- Parag, Y.; Ainspan, M. Sustainable microgrids: Economic, environmental and social costs and benefits of microgrid deployment. Energy Sustain. Dev. 2019, 52, 72–81. [Google Scholar] [CrossRef]

- Magdy, F.E.Z.; Ibrahim, D.K.; Sabry, W. Virtual Power Plants Modeling and Simulation using Innovative Electro-Economical Concept. In Proceedings of the 2019 16th Conference on Electrical Machines, Drives and Power Systems (ELMA), Varna, Bulgaria, 6–8 June 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–5. [Google Scholar]

- Veilleux, G.; Potisat, T.; Pezim, D.; Ribback, C.; Ling, J.; Krysztofiński, A.; Ahmed, A.; Papenheim, J.; Pineda, A.M.; Sembian, S.; et al. Techno-economic analysis of microgrid projects for rural electrification: A systematic approach to the redesign of Koh Jik off-grid case study. Energy Sustain. Dev. 2020, 54, 1–13. [Google Scholar] [CrossRef]

- Royapoor, M.; Pazhoohesh, M.; Davison, P.J.; Patsios, C.; Walker, S. Building as a virtual power plant, magnitude and persistence of deferrable loads and human comfort implications. Energy Build. 2020, 213, 109794. [Google Scholar] [CrossRef]

- Arefi, A.; Abeygunawardana, A.; Ledwich, G. A new risk-managed planning of electric distribution network incorporating customer engagement and temporary solutions. IEEE Trans. Sustain.Energy 2016, 7, 1646–1661. [Google Scholar] [CrossRef]

- Wang, H.; Riaz, S.; Mancarella, P. Integrated techno-economic modeling, flexibility analysis, and business case assessment of an urban virtual power plant with multi-market co-optimization. Appl. Energy 2020, 259, 114142. [Google Scholar] [CrossRef]

- Loßner, M.; Böttger, D.; Bruckner, T. Economic assessment of virtual power plants in the German energy market—A scenario-based and model-supported analysis. Energy Econ. 2017, 62, 125–138. [Google Scholar] [CrossRef]

- Moreno, B.; Díaz, G. The impact of virtual power plant technology composition on wholesale electricity prices: A comparative study of some European Union electricity markets. Renew. Sustain. Energy Rev. 2019, 99, 100–108. [Google Scholar] [CrossRef]

- Dietrich, K.; Latorre, J.M.; Olmos, L.; Ramos, A. Modelling and assessing the impacts of self supply and market-revenue driven Virtual Power Plants. Electr. Power Syst. Res. 2015, 119, 462–470. [Google Scholar] [CrossRef]

- German virtual power plant project using 25 BlueGen mCHP units. Fuel Cells Bull. 2012, 2012, 4. [CrossRef]

- Zajc, M.; Kolenc, M.; Suljanović, N. Virtual power plant communication system architecture. In Smart Power Distribution Systems; Yang, Q., Yang, T., Li, W., Eds.; Academic Press: Cambridge, MA, USA, 2019; pp. 231–250. [Google Scholar]

- Taskforce, E.T. Registration and Participation Framework in the Wholesale Electricity Market. Australia, 2020. Available online: https://www.wa.gov.au/sites/default/files/2020-03/Registration%20and%20Participation%20Framework%20in%20the%20Wholesale%20Electricity%20Market.pdf (accessed on 28 February 2020).

- Australian PV Institute. PV Performance by Climate Region. Available online: https://pv-map.apvi.org.au/performance (accessed on 1 January 2007).

- Lombardi, P.; Sokolnikova, T.; Styczynski, Z.; Voropai, N. Virtual power plant management considering energy storage systems. IFAC Proc. Vol. 2012, 45, 132–137. [Google Scholar] [CrossRef]

- Sun, Z.W.; Duan, Z.N.; Bai, J.Q.; Wang, Y. Numerical study of the performance of all vanadium redox flow battery by changing the cell structure. J. Energy Storage 2020, 29, 101370. [Google Scholar] [CrossRef]

- Lourenssen, K.; Williams, J.; Ahmadpour, F.; Clemmer, R.; Tasnim, S. Vanadium redox flow batteries: A comprehensive review. J. Energy Storage 2019, 25, 100844. [Google Scholar] [CrossRef]

- Ontiveros, L.J.; Mercado, P.E. Modeling of a vanadium redox flow battery for power system dynamic studies. Int. J. Hydrog. Energy 2014, 39, 8720–8727. [Google Scholar] [CrossRef]

- Dassisti, M.; Mastrorilli, P.; Rizzuti, A.; Cozzolino, G.; Chimienti, M.; Olabi, A.G.; Matera, F.; Carbone, A. Vanadium: A transition metal for sustainable energy storing in redox flow batteries. In Reference Module in Materials Science and Materials Engineering; Elsevier BV: Amsterdam, The Netherlands, 2016. [Google Scholar]

- Balint, A.; Kazmi, H. Determinants of energy flexibility in residential hot water systems. Energy Build. 2019, 188–189, 286–296. [Google Scholar] [CrossRef]

- Willem, H.; Lin, Y.; Lekov, A. Review of energy efficiency and system performance of residential heat pump water heaters. Energy Build. 2017, 143, 191–201. [Google Scholar] [CrossRef] [Green Version]

- Baniasadi, A.; Habibi, D.; Al-Saedi, W.; Masoum, M.A.; Das, C.K.; Mousavi, N. Optimal sizing design and operation of electrical and thermal energy storage systems in smart buildings. J. Energy Storage 2020, 28, 101186. [Google Scholar] [CrossRef]

- Fischer, D.; Madani, H. On heat pumps in smart grids: A review. Renew. Sustain. Energy Rev. 2017, 70, 342–357. [Google Scholar] [CrossRef] [Green Version]

- Baniasadi, A.; Habibi, D.; Bass, O.; Masoum, M.A. Optimal real-time residential thermal energy management for peak-load shifting with experimental verification. IEEE Trans. Smart Grid 2018, 10, 5587–5599. [Google Scholar] [CrossRef]

- Terreros, O.; Spreitzhofer, J.; Basciotti, D.; Schmidt, R.R.; Esterl, T.; Pober, M.; Kerschbaumer, M.; Ziegler, M. Electricity market options for heat pumps in rural district heating networks in Austria. Energy 2020, 196, 116875. [Google Scholar] [CrossRef]

- Energy Use in the Australian Residential Sector 1986-2020 [Electronic Resource]/Department of the Environment, Water, Heritage and the Arts (PANDORA electronic collection)). Canberra, A.C.T: Department of the Environment, Water, Heritage and the Arts. 2008. Available online: https://nla.gov.au/nla.cat-vn4390814 (accessed on 1 January 2008).

- Marszal-Pomianowska, A.; Heiselberg, P.; Larsen, O.K. Household electricity demand profiles–A high-resolution load model to facilitate modelling of energy flexible buildings. Energy 2016, 103, 487–501. [Google Scholar] [CrossRef]

- Ren, Z.; Foliente, G.; Chan, W.Y.; Chen, D.; Ambrose, M.; Paevere, P. A model for predicting household end-use energy consumption and greenhouse gas emissions in Australia. Int. J. Sustain. Build. Technol. Urban Dev. 2013, 4, 210–228. [Google Scholar] [CrossRef] [Green Version]

- McGee, C. Energy. 2013. Available online: https://www.yourhome.gov.au/energy (accessed on 1 January 2013).

- Shi, Q.; Chen, C.F.; Mammoli, A.; Li, F. Estimating the profile of incentive-based demand response (IBDR) by integrating technical models and social-behavioral factors. IEEE Trans. Smart Grid 2019, 11, 171–183. [Google Scholar] [CrossRef]

- Authority, E.R. Wholesale Electricity Market Rules. 2020. Available online: https://www.erawa.com.au/rule-change-panel/wholesale-electricity-market-rules (accessed on 27 March 2020).

- Power, W. 2019/20 Price List. Available online: https://westernpower.com.au/media/3361/price-list-2019-2020.pdf (accessed on 28 February 2019).

- Registry, R. Small Generation Unit STC Calculator. 2020. Available online: https://www.rec-registry.gov.au/rec-registry/app/calculators/sgu-stc-calculator (accessed on 1 January 2020).

- Regulator, C.E. Small-Scale Systems Eligible for Certificates. 2019. Available online: http://www.cleanenergyregulator.gov.au/RET/Scheme-participants-and-industry/Agents-and-installers/Small-scale-systems-eligible-for-certificates (accessed on 20 February 2019).

- AEMO. Benchmark Reserve Capacity Price. 2020. Available online: https://aemo.com.au/energy-systems/electricity/wholesale-electricity-market-wem/wa-reserve-capacity-mechanism/benchmark-reserve-capacity-price (accessed on 1 January 2020).

- AEMO. WEM Price Data Dashboard. Available online: https://aemo.com.au/energy-systems/electricity/wholesale-electricity-market-wem/data-wem/data-dashboard (accessed on 1 January 2006).

| Appliance | Weekday | Weekend | Usage Time | Watts |

|---|---|---|---|---|

| Coffee maker | 40% from 6–10 a.m.; 30% from 4–7 p.m. | 40% from 8–10 a.m.; 30% from 4–7 p.m. | 10 min | 900 –1400 |

| Microwave | 40% 7–10:30 a.m.; 20% 12–2 p.m.; 20% 6–8 p.m. | 40% 7–10:30 a.m.; 20% 12–2 p.m.; 20% 6–8 p.m. | 5 min | 750 –1100 |

| Toaster | 50% 6–10:30 a.m.; 10% 11.30–1 p.m.; 10% 6–8 p.m. | 50% 8–10:30 a.m.; 10% 11.30–1 p.m.; 10% 6–8 p.m. | 3 min | 800 –1400 |

| Iron | 5% 7–8 a.m.; 5% 10–11 a.m.; 5% 6–8 p.m. | 5% 10–11 a.m.; 5% 6–8 p.m. | 15 min | 1000 –1800 |

| Stereo system | 10% 9 a.m.–1 p.m.; 20% 4–10 p.m. | 20% 9 a.m.–4 p.m.; 40% 4–10.30 p.m. | 30–90 min † | 65 –225 |

| Hair dryer | 30% 5.30–9:30 a.m.; 10% 11.30–1 p.m.; 30% 8–10 p.m. | 10% 11.30–1 p.m.; 40% 7.30–10.30 p.m. | 5 min | 1200 –2000 |

| Laptop | 50% 10.30 a.m.–2 a.m. | 50% 10.30 a.m.–2 a.m. | 90–180 min † | 50 |

| PC/monitor | 30% 9.30 a.m.–9 p.m. | 40% 9.30 a.m.–9 p.m. | 90–180 min † | 150 |

| Television | 30% 9.30 a.m.–2 a.m.; 20% 6–11 p.m. | 30% 9.30 a.m.–2 a.m.; 50% 6–11 p.m. | 90–180 min † | 65 –175 |

| Refrigerator, freezer | 100% All time (thermostatically controlled) | 100% All time (thermostatically controlled) | Cont. | 100–200 |

| Vacuum | 10% 9 a.m.–5 p.m. | 15% 9 a.m.–5 p.m. | 30 min | 600 –1800 |

| Deep fryer | 10% 11–2 p.m.; 15% 5–8 p.m. | 10% 11–2 p.m.; 15% 5–8 p.m. | 18 min | 600 –1000 |

| Oven | 20% 10.30 a.m.–12.30 a.m.; 25% 5.30–8.30 p.m. | 30% 10.30 a.m.–12.30 a.m.; 25% 5.30–8.30 p.m. | 44 min | 1000 –1800 |

| Kettle | 30% 7:30–10.30 a.m.; 40% 1.30–4.30 p.m.; 10% 6–8 p.m. | 30% 7:30–10.30 a.m.; 40% 1.30–4.30 p.m.; 10% 6–8 p.m. | 3 min | 2000 –2500 |

| Stove | 20% 7–9 a.m.; 20% 10.30 a.m.–1.30 p.m.; 20% 5.30–8.30 p.m. | 10% 7–9 a.m.; 20% 10.30 a.m.–1.30 p.m.; 20% 5.30–8.30 p.m. | 30 min | 1000 –2000 |

| Dishwasher * | 40% 10.30 a.m.–3.30 p.m. | 60% 10.30 a.m.–3.30 p.m. | 20–60 min † | 1200 –2400 |

| Washing machine * | 10% All time except 15–21 | 20% All time except 15–21 | 20–60 min † | 500 –1300 |

| Appliance | Weekday | Weekend | Watts |

|---|---|---|---|

| Lighting | 70% 6 p.m.–11 p.m.–10% 5–7.30 a.m. 10% 8 p.m.–3 a.m. | 70% 6 p.m.–11 p.m. 25% 8 p.m.–1 a.m. | 10–100 |

| Heat pump HWS | 75% 9.30 a.m.–4 p.m. | 75% 9.30 a.m.–4 p.m. | 550 |

| Air conditioner | 60% 6 a.m.–10 a.m.; 65% 5 p.m.–10 p.m.; 50% other | 60% 6 a.m.–10 a.m.; 65% 5 p.m.–10 p.m.; 55% other | 1000–3000 |

| Appliance | Weekday | Weekend | Watts |

|---|---|---|---|

| Lighting | 70% 7 p.m.–11 p.m.–10% 5–7.30 a.m. 10% 8 p.m.–3 a.m. | 70% 7 p.m.–11 p.m.– 25% 8 p.m.–3 a.m. | 10–100 |

| Heat pump HWS | 70% 9.30 a.m.–4 p.m. | 70% 9.30 a.m.–4 p.m. | 550 |

| Air conditioner | 60% 11 a.m.–4.30 p.m. 80% 4.30 p.m.–10 p.m.; 50% other | 70% 11 a.m.–4.30 p.m. 85% 4.30 p.m.–10 p.m., 55% other | 1000–3000 |

| Appliance | Weekday | Weekend | Watts |

|---|---|---|---|

| Lighting | 70% 5 p.m.–11 p.m.–10% 5–7.30 a.m. 10% 8 p.m.–1 a.m. | 70% 5 p.m.–11 p.m.– 20% 8 p.m.–1 a.m. | 10–100 |

| Heat pump HWS | 80% 9.30 a.m.–4 p.m. | 80% 9.30 a.m.–4 p.m. | 550 |

| Air conditioner | 60% 6 a.m.–5 p.m.; 70% 5–12 p.m.; 55% other | 70% 6–5 a.m.; 80% 5–12 p.m.; 60% other | 1000–3000 |

| Appliance | Working Time |

|---|---|

| Dishwasher | Between 10 and 16 h |

| Dryer and washing machine | Any time except 15–21 h |

| Heat pump HWS | Between 9 and 17 h |

| Parameter | Value |

|---|---|

| Algorithm | SQP |

| Constraint tolerance | 1 × 10−20 |

| Optimality tolerance | 1 × 10−20 |

| Step tolerance | 1 × 10−20 |

| Max iterations | 1000 |

| Max function evaluations | 50,000 |

| Equipment | AUD |

|---|---|

| PV, 810 kW | 530,000 (lifetime = 25 years) |

| Inverters for 810-kW PV | 124,000 (replacement at year 11) |

| PV installation | 500,000 |

| VRFB, 350 kW, 700 kWh | 600,000, payable in 4 instalments over 4 years (lifetime = 25 years) |

| Battery installation | 30,000 |

| 67 × heat pump HWS, 220 L | 165,000 |

| Fixed Cost (Cents/Day) | Peak (Cents/kWh): 8:00 a.m. to 10:00 p.m., Monday to Friday | Off-Peak (cents/kWh): 10:00 p.m. to 8:00 a.m., Monday to Friday and All Times on Saturday and Sunday |

|---|---|---|

| 299.580 | 15.954 | 3.646 |

| Fixed Cost (Cents/Day) | Peak (Cents/kWh): 4:00 p.m. to 10:00 p.m. | Shoulder (Cents/kWh): 8:00 a.m. to 4:00 p.m. | Off-Peak (Cents/kWh): 10:00 p.m. to 8:00 a.m. | Free Electricity: 10:00 a.m. to 2:00 p.m. |

|---|---|---|---|---|

| 103.3263 | 54.81 | 28.71 | 15.10 | 0.00 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Behi, B.; Baniasadi, A.; Arefi, A.; Gorjy, A.; Jennings, P.; Pivrikas, A. Cost–Benefit Analysis of a Virtual Power Plant Including Solar PV, Flow Battery, Heat Pump, and Demand Management: A Western Australian Case Study. Energies 2020, 13, 2614. https://doi.org/10.3390/en13102614

Behi B, Baniasadi A, Arefi A, Gorjy A, Jennings P, Pivrikas A. Cost–Benefit Analysis of a Virtual Power Plant Including Solar PV, Flow Battery, Heat Pump, and Demand Management: A Western Australian Case Study. Energies. 2020; 13(10):2614. https://doi.org/10.3390/en13102614

Chicago/Turabian StyleBehi, Behnaz, Ali Baniasadi, Ali Arefi, Arian Gorjy, Philip Jennings, and Almantas Pivrikas. 2020. "Cost–Benefit Analysis of a Virtual Power Plant Including Solar PV, Flow Battery, Heat Pump, and Demand Management: A Western Australian Case Study" Energies 13, no. 10: 2614. https://doi.org/10.3390/en13102614

APA StyleBehi, B., Baniasadi, A., Arefi, A., Gorjy, A., Jennings, P., & Pivrikas, A. (2020). Cost–Benefit Analysis of a Virtual Power Plant Including Solar PV, Flow Battery, Heat Pump, and Demand Management: A Western Australian Case Study. Energies, 13(10), 2614. https://doi.org/10.3390/en13102614