Abstract

With the average solar radiation reaching up to 5 kWh/m2, Vietnam is considered as a country showing an excellent potential for solar power production. Since the year 2000, there have been a lot of studies about the potential of this source in Vietnam. So far, many applications of solar power have been implemented on small, medium, and large scales. In fact, the total capacity of current grid-connected solar power plants has exceeded the planned capacity by 2020 nearly 6 times. However, the studies of solar potential in Vietnam are still incomplete. The policies and mechanisms for developing solar power projects have received attention from the authorities but have not been really satisfactory. The infrastructure is still poor and the power system does not keep up with the development of modern grids. This paper reviewed the potential and actual implementation stage of photovoltaic projects in Vietnam. Moreover, the barriers and challenges of institution, technique, economy, and finance have been considered explicitly for the future development of solar energy in Vietnam.

1. Introduction

Vietnam is a high economic growth country with an annual average gross domestic product (GDP) of around 7% for past decade [1,2,3,4]. In this growth, the energy sector played and still plays a key role. Both the primary and final energy demand increased over 5% each year, and the main fuels covering such growth come from coal and oil, while the share of renewables was negligible [1,4]. As an effect of such growing energy consumption, Vietnam will have to increasingly rely on energy imported from foreign countries, including coal and oil. This situation puts under severe risk the national energy security issue [5,6]. Moreover, the oil-based fuels are predicted to be exhausted in 2020–2030 and the coal resources are not easily exploitable because of technical and economic limits [1,6]. The electricity consumption in the final energy demand rises sharply from about 8% in 2005 to 21.6% in 2015, and will continue to increase strongly in 2020–2040 [3,4]. In such situations, the availability of energy resources to be given to Vietnamese policymakers and the alternative energy sources like renewables are good choices for sustainable development and for ensuring energy security. Some recent works [3,7,8,9] and policy documents confirmed that Vietnam has huge potential from renewables, especially hydropower, solar, wind, and biomass.

For this reason, in 2007, the Vietnamese government formulated the national energy development strategy up to 2020 with a vision to 2050 under Decision 1855/QD-TTg [10]. Particularly, renewables should develop synchronously with the other primary sources like crude oil and coal, and their targets are 5% and 11% in turn of total primary energy consumption coverage in 2020 and 2050.

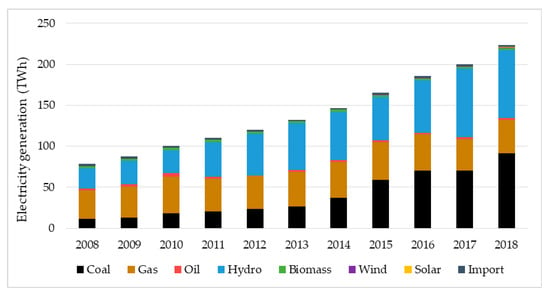

However, except for hydropower and biomass, the share of other renewables still appeared to be negligible [1,4]. Even for electricity generation, hydropower covered up to 38% of total electricity production, but solar, wind and biomass only accounted for less than 1% of total electricity output in 2018 [1,4,9], see Figure 1.

Figure 1.

Electricity generation by source by 2018.

In the context of an increasing shortage of energy sources appeared in recent years, the diversification of energy sources, including renewable sources, seems to ensure reliable and safe energy supply. Moreover, the development of renewable sources would contribute significantly to the increase of the energy independence in Vietnam, whereby supplying high quality energy at a low cost, improving energy security and sustainable socio-economic development.

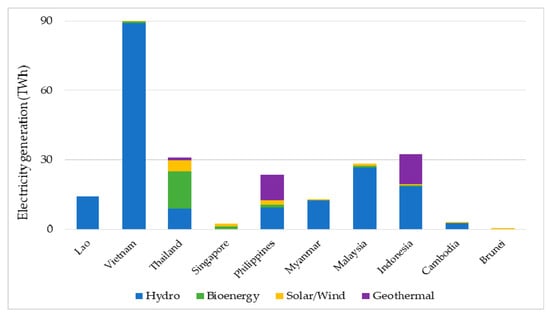

As other developing countries in Southeast Asia, the renewable industry in Vietnam is still in its initial phase. By 2018, the energy development path in region has largely relied on fossil fuels like coal, oil, and natural gas [6]. The share of renewables covered about 24% in power generation, but the electricity production from solar and wind energy have remained low, less than 6%. Thailand was the leading country in region of wind and solar power, but the electricity generation from these renewables was still very modest, below 10 TWh. Vietnam was mainly developing in hydropower, which could be said to be the largest in region with nearly 90 TWh of electricity output, but the output from solar and wind energy were less than 10% of Thailand, see Figure 2. The financial resources for solar photovoltaics (PV) and wind energy were the lowest compared to coal and gas, hydroelectric, and geothermal energy. Even the financial sources for solar PV was only about 10% for wind energy.

Figure 2.

Electricity generation from renewables in Southeast Asia as of 2017.

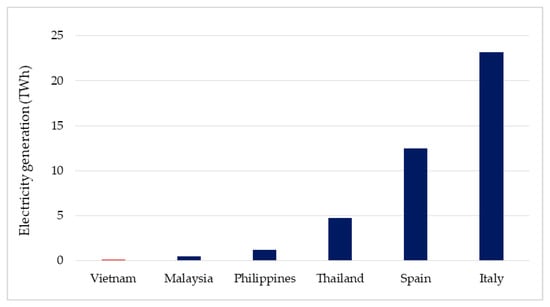

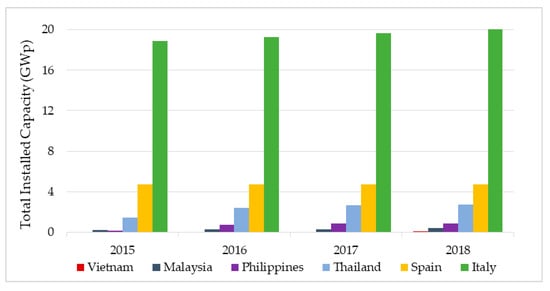

Among current renewable energy sources in Vietnam, solar energy has been considered as the most potential source, up to 300 GW [3]. Even, the solar radiation in Vietnam has been better than other countries at similar potential like Thailand, the Philippines, Malaysia, Spain, or Italy [9,11]. Nevertheless, by 2018, the electricity output from solar energy in Vietnam compared to Thailand, Spain, and Italy was very low [12], see Figure 3. The studies on the supporting policies for solar energy have not received enough attention from the local and international organizations.

Figure 3.

Electricity generation by solar power in selected countries as of 2018.

A review paper [5] about energy efficiency and conservation policies (EE&C) in Vietnam underlines that greater efforted relating to improvement on collection, analysis, and management of energy data; capacity building; close coordination among policymakers, research organizations, and agencies during the implementation of EE&C policies and programs; etc. should be put forward. Other papers [13,14] analyzed the causal relation between economic growth and energy consumption in Vietnam and ASEAN countries. One of the main results of the paper is that investments to boost renewable energy penetration can provide sufficient supplies of energy to speed up economic expansion. Other more recent papers [15] do not focus on Vietnam, but rather on ASEAN countries and conclude that to achieve the target of 23% renewables in the energy mix by 2025, governments should take policy measures such as removal of subsidies for fossil fuels, regional market integration, and implementation of the existing projects. Moreover, these measures require sustainable leadership, political vision and concrete actions and enhance cooperation across the region. In [16], a number of recommendations are given to policymakers and stakeholders to reduce the potential risks of investment in wind and solar energy in Vietnam. Solar energy economic potential in Vietnam is analyzed in [17], however the paper dates back to 2009 and does not capture a lot of factors that strongly characterize the current situation and related challenges.

None of the analyzed papers in the literature focus on the recent policy and implementation plans in Vietnam for the deployment of solar energy, although solar energy is the most promising source. This paper reviews the state of the art of political decisions and measures to support photovoltaic power generation in Vietnam. The paper also traces realistic development scenarios for the future, while looking at the recent experiences on the field. The issues of barriers and challenges for the future development of solar energy is thus another important outcome of this study.

2. Assessments of Solar Energy Potential in Vietnam

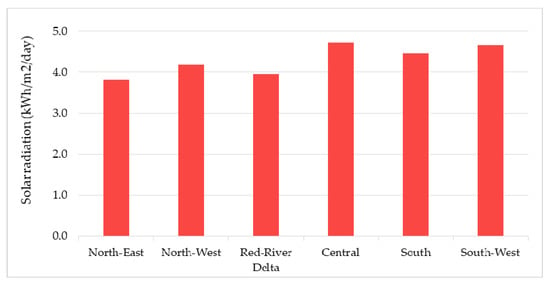

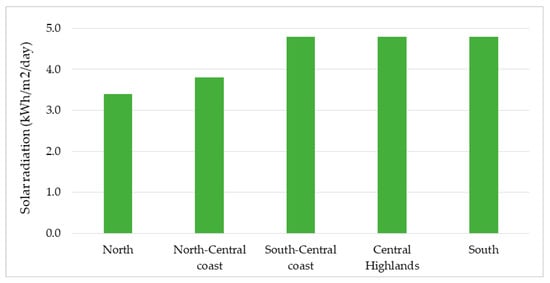

With a favorable geographic location, near the equator, Vietnam is considered to have high solar potential with a lot of sunshine hours a year. This assertion has been proved by the registration of solar irradiation that can be found in the database of solar power measured by meteorological stations of Vietnam National Meteorological and Hydrological Administration (VNMHA) via studies by Institute of Energy Science (IES) under Vietnam Academy of Science and Technology (VAST) [7]. This agency has nearly 200 ground meteorological stations distributed across the country, but only 14 automatic solar radiation monitoring stations (http://www.monre.gov.vn/). The database normally includes the direct radiation and diffuse radiation recorded 5 times a day from 6:30 to 18:30, and statistics on the average amount of radiation and hours of sunshine. The average values of irradiation intensity and number of sunshine hours were obtained after data processing and calculations. Accordingly, the average solar energy potential in the whole country ranged between 4 and 5 kWh/m2 in a day and the average number of sunshine hours were from 1600 to 2600 h in a year. The annual daily average of solar irradiation was the highest in regions from Da Nang to the south with a solar radiation ranging from 4.5 to 5 kWh/m2, and the lowest being in Northeast with below 4 kWh/m2 due to the influence of the northeast monsoon in winter (see Figure 4).

Figure 4.

Chart of annual average of daily solar irradiation by VNMHA.

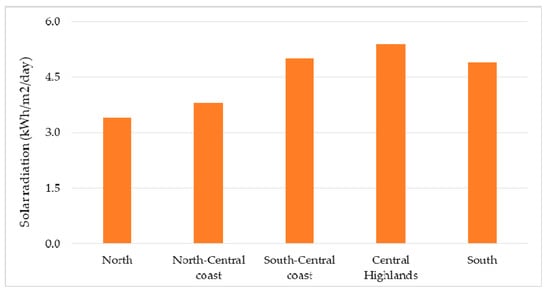

In 2015, under the framework of governmental collaboration between Spain and Vietnam, a project of mapping the solar resource and potential in Vietnam [18] has been carried out by the Spanish Research Centre for Energy, Environment and Technology (CIEMAT) and the Ministry of Industry and Trade of Vietnam (MoIT). The images from Satellite of Meteosat IODC and MTSAT2 were used for this project. The values of solar global irradiation and other meteorological variables have been determined by the SKIRON model with input data from the Global Forecast System (GFS). The input data as daily values (from 2003 to 2012) of aerosol optical depth (AOD) have been taken from Monitoring Atmospheric Composition and Climate (MACC), and data about precipitable water were taken from NCEP/NCAR reanalysis datasets. The input data of global horizontal irradiation (GHI) and direct normal irradiation (DNI) have been taken from different sources, including satellite imagery under the well-known Heliosat method revised of atmospheric input, SKIRON model for daily GHI values, REST2 model, and DirInt model for daily GHI and DNI values. In addition, the data of sunshine duration was estimated by a cluster analysis using k-means algorithm following the solar radiation behavior in Vietnam.

The study [18] showed that the annual average value of daily GHI is the best in the Southern, Highlands, and South-Central coast regions with approximately 5 kWh/m2, and the lowest in Northern area with around 3.4 kWh/m2 (see Figure 5). The annual average value of daily DNI is similar with the best in Highlands and the lowest in Northern and Central coast, but the daily average value of regions is slightly lower. In addition, the estimations of total technical potential were conducted for each solar power technology, namely from 60 to 100 GWh/year for concentrated solar power (CSP) and from 0.8 to 1.2 GWh/year for photovoltaic (PV). However, the estimations of total solar radiation was not determined due to a lack of ground measurement data.

Figure 5.

Chart of annual average of daily GHI by CIEMAT&MoIT.

In 2019, the World Bank (WB) Group also released the maps and data of solar energy potential for Vietnam as with over 100 other countries in the world. Whereby, the database of GHI and DNI hereby was computed by Solargis model from atmospheric and satellite data with 10-, 15-, or 30-min time steps. The effects of terrain were estimated at resolution of 250 m, and the data of air-temperature above ground was collected from ERA5 database. However, there was some limits for regional model validation in the yearly GHI and DNI estimate due to a lack of high-quality ground information.

The below solar atlas (https://solargis.com/) (Figure 6) showed that the solar power potential is the highest in regions from Da Nang to the south, and the lowest in the northeast of Vietnam. The index of GHI in annual daily average is around 5 kWh/m2 in southern and south-central Vietnam, and about 3.2 kWh/m2 in the northeast. Regarding the DNI, it has the same regional allocation as the GHI, but the annual daily average values are a bit lower depending on the region. Besides, the estimations of the technical potential were shown, but only for PV technology with from 0.9 to 1.7 MWh/kWp in a year.

Figure 6.

Chart of average of daily and yearly of GHI by WB Group.

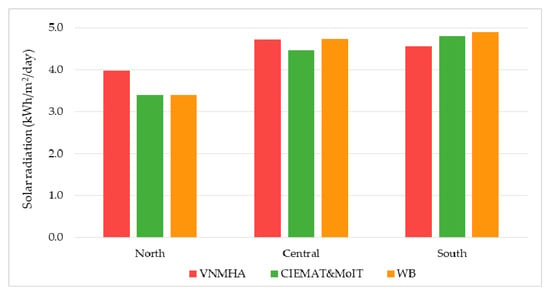

Moreover, according to World Bank, the solar potential in Vietnam seems to be even better than in Thailand, the Philippines, Malaysia, and Italy. The best values of GHI in annual daily average of Thailand, Malaysia, the Philippines, Italy or Spain range from 5.2 to 5.4 kWh/m2 while Vietnam is up to 5.6 kWh/m2. This showed that Vietnam is really an attractive area to develop solar energy.

It has been found that all above organizations conducted solar potential assessments have their limitations and advantages in terms of infrastructure and measurement methods. However, the estimates of solar potential in Vietnam from these organizations were quite similar in terms of the distribution of solar potential by region. The average values of solar irradiation were instead slightly different, in which the data of CIEMAT and MoIT were a bit lower than those by VNMHA and WB Group, see Figure 7. Therefore, for starting a solar power project in Vietnam, the investor could refer the above databases, but re-evaluating the solar energy potential at a candidate site is necessary to get the most reliable prediction about power production.

Figure 7.

Comparison of solar potential assessment between VNMHA (2005), CIEMAT&MoIT (2015), and WB (2019).

3. Status Quo of Applications and Projects of Solar PV Power

Although Vietnam has a high solar energy potential, the development of solar power in Vietnam is still low. Before 2005, the installed capacity of solar PV in Vietnam was not significant, with around 1.1 MWp capacity installed throughout the country [7]. The earliest applications of solar PV hereby were mainly for lighting, residential activities in rural, remote areas or on islands. The capacity of each PV system was from 40 Wp to 220 Wp, and divided into three main groups by usage: 50% specialized activities, 30% hospitals and schools, and 20% household. The number of stations at that time reached 10,000 small-scale off-grid stations, including PV systems and hybrid systems of PV and diesel/wind power. In addition, the local grids using a large number of small-scale PV power stations have been employed to provide electricity to remote residential clusters in several provinces in Vietnam such as Kon Tum, Gia Lai. Most of these systems were implemented under research projects funded by Vietnamese government or state organizations.

By 2015, the installed capacity of PV solar power increased up to roughly 5 MWp in the whole country, of which, about 20% of total capacity was connected to the grid [11]. These grid-tied PV stations had a medium size of around 50 kWp, and were owned by a few large organizations and businesses, such as Intel Corporation, Big C (Hanoi), the National Conference Hall (Hanoi), the UNDP (Hanoi), the new National Assembly (Hanoi), and the MoIT (Hanoi). Most of these grid-connected PV systems have been set up for public relations purposes or because of social responsibility of corporations and funded by their own budgets.

Even by 2018, Vietnam’s solar PV power also recorded a remarkable growth compared to 2017, but this number was still too small compared to some other countries with similar potential as Italy or the Philippines, even lower potential as Maylaysia or Thailand [19] (see Figure 8). Specifically, the total installed capacity of solar PV power in Vietnam was 106 MWp, still less than 1% of Italy and only about 4% of Thailand. Compared to the Philippines and Malaysia, this growth of solar PV capacity in Vietnam is also quite significant, going from 1% in 2017 to 12% in 2018 of the Philippines, and from 3% in 2017 to over 24% in 2018 of Malaysia.

Figure 8.

Total installed capacity of solar PV power in selected countries by 2018.

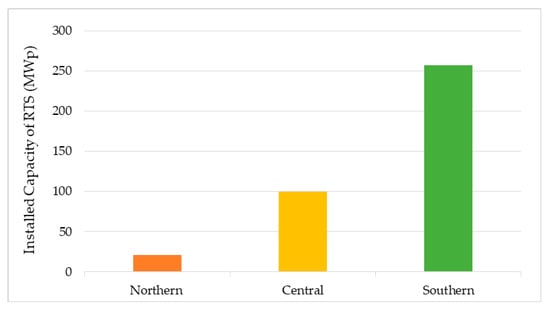

By the end of 2019, the total capacity of PV solar power has increased sharply to around 5 GWp, including about 4.5 GWp [1] of newly grid-connected solar power plants (SPP) and nearly 0.4 GWp [20] of rooftop solar systems (RTS). Regarding rooftop solar applications, the total number of RTS installed in 2019 has been more than 22,000 systems, including 416 systems of a capacity of over 100 kWp [20]. The installed capacity in the south of Vietnam was the highest with over 250 MWp, followed by the central region, and in the north the installed capacity was the lowest below 30 MWp (see Figure 9).

Figure 9.

Total installed capacity of RTS in 2019.

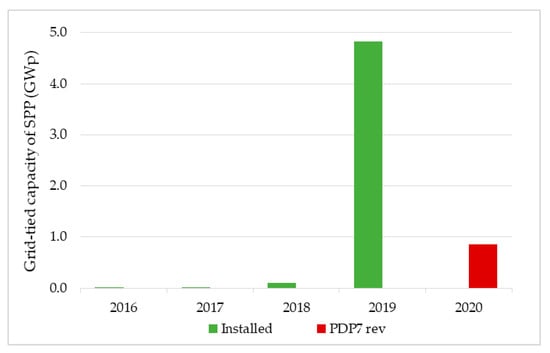

For solar power plants, in 2019, most SPPs that installed and connected to the national grid, have been mainly concentrated in the central and southern provinces [21]. From very low penetration level in 2015, the solar power has succeeded in penetrating the national grid in Vietnam with the integration level of 1000 times higher in a very short time after the issuance of Decision 11/2017/QĐ-TTg and Decision 02/2019/QĐ-TTg on mechanisms to support the development of solar power projects in Vietnam (see Figure 10). In fact, there are more than 100 solar PV projects approved with a total installed capacity of 7.2 GWp, but only about 90 plants are now operating and connected to the grid with total capacity of about 4.5 GWp [1,21]. Besides, there are many projects in stages of planning, construction, or awaiting authorization with a total capacity of registered projects of up to 32 GWp [1].

Figure 10.

Total capacity of grid-tied SPPs by 2019 and in Power Development Plan 7 revised.

It can be noticed that off-grid solar applications have been increasingly reduced, especially after the issuance of policies and the implementation of programs on rural, mountainous and island power supply in period of 2013–2020 under Decision 2081/QĐ-TTg [22]. Accordingly, priority has been given to the development of the national grid to supply the electricity to rural and remote areas. In cases where it was not possible and or too expensive to supply electricity from the national grid, these areas were to be supplied by local energy sources like renewable energy sources.

In fact, the off-grid solar PV applications could be found in remote areas and islands outside the national grid area. Most of these applications have been under government donor projects or corporate social responsibility programs [23].

In contrast to that, grid-connected applications using solar PV has been growing more and more strongly in Vietnam. The total capacity of grid-connected solar PV projects now has by far exceeded its own installed capacity in 2018 [19] and planned capacity in 2020 [24]. As a result, solar PV alone has accounted for over 8% of total planned capacity of Vietnam power system, and over 80% of total planned capacity for renewables in 2020.

4. Key Policies and Scenarios for Developing Solar Power

4.1. National Strategy for Developing Energy

In 2007, the Vietnamese government formulated the national energy development strategy up to 2020 with a vision to 2050 under Decision 1855/QD-TTg [10]. Accordingly, the renewables have been directed to develop aside the other sources like oil and coal. The targets for renewables are 5% and 11% of total primary energy consumption in 2020 and 2050, respectively. Moreover, the potential of renewables needs to be adequately assessed also considering the power system’s features, and further surveys need to be carried out to get reliable data for finding areas, planning, investment, and exploitation.

However, the above indicators have not really been linked to the current situation and resources as well as the national and local socio-economic development plans.

In such a context, early 2020, the government of Vietnam has developed and issued a national energy development strategic orientation to 2030 with a vision to 2045 under the Resolution 55-NQ/TW [25] with revised guidelines for the energy sector in general and renewable energy in particular.

As a result, the proportion of renewable energy sources in the total primary energy consumption will reach about 15–20% by 2030, and 25–30% by 2045.

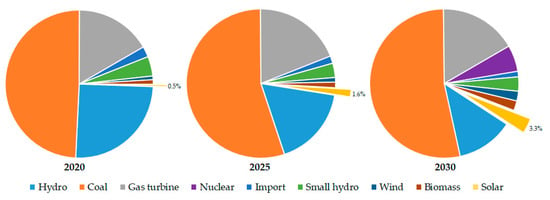

4.2. National Master Plan for Developing Power System

In 2011, the Seventh Power Development Plan (PDP7) was issued by the Vietnam government under Decision 1208/QD-TTg [26], and it was then revised in 2016 (PDP7 rev) under Decision 428/QD-TTg [24] to concretize the viewpoints, strategies and development goals of the national energy system up to 2020 with an outlook to 2030. The targets for installed capacity and electricity production from renewables are about 6000 MW and 17 billion kWh in 2020, roundly 12,000 MW and 27.6 billion kWh in 2025; and above 27,000 MW and 61 billion kWh in 2030, correspondingly. Particularly, solar power was expected to increase up to 850 MWp, 4000 MWp, and 12,000 MWp in order to cover 0.5%, 1.6%, and 3.3% respectively of the total electricity production in 2020, 2025, and 2030 (see Figure 11).

Figure 11.

Share of Electricity production by fuel under PDP7 rev.

Currently, Vietnam government is amending targets of solar power in the Eighth Power Development Plan (PDP8) for a period of 2021–2030 with a target of solar PV power installation capacity of 18 GWp by 2030 [27]. This Master Plan is expected to be completed and announced by the beginning of 2020.

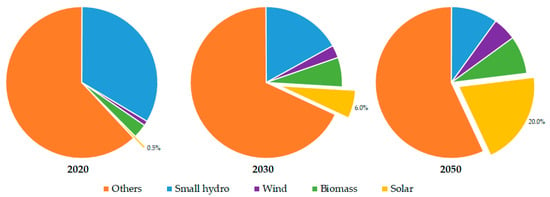

4.3. National Strategy for Developing Renewable Energy

In 2015, the strategy for renewable energy development of Vietnam (REDS) has been brought down with an outlook to 2050 under Decision 2068/QD-TTg [28] by the Vietnam government. The targets of electricity production from renewables were planned to reach 101 billion kWh in 2020, 186 billion kWh in 2030, and 452 billion kWh in 2050, equivalent to 38%, 32%, and 43% of the total national electricity production. Specifically, the electricity production from solar energy was planned to reach 1.4 billion kWh in 2020, 35.4 billion kWh in 2030 and 210 billion kWh in 2050, accounting for 0.5%, 6% and 20% of the total electricity production respectively (see Figure 12).

Figure 12.

Share of Electricity production by renewables under REDS.

Even though it seems that this document is no longer relevant to the current development of renewable energy after the spectacular breakthrough of solar power in 2019.

4.4. Supporting Mechanisms to the Solar Power Development

In 2017, Vietnam government issued the Decision 11/2017/QD-TTg [29] on mechanisms to support the development of solar power projects in Vietnam and guided the implementation by the Circular 16/2017/TT-BCT [30]. The solar power plant components bought in other countries would be exempted of the duties on imported goods. Furthermore, taxes on the use and hire of land for these projects would be waived or reduced depending on item type of project. In addition, the purchaser, Electricity of Vietnam Corporation (EVN), is responsible for buying the entire electricity output from grid-connected projects using solar cells or modules with an efficiency of over 16% or 15% respectively with the purchase price of 9.35 UScents/kWh. However, this feed-in-tariff (FIT1) price has expired since 30 June 2019.

In 2019, the Vietnam government issued the Decision 02/2019/QD-TTg [31] and Circular 05/2019/TT-BCT [32] for amending and supplementing to certain articles of [29] and [30] respectively in order to encourage the development of rooftop solar PV projects. The issues of taxes on import, land use, and hire were the same as for solar power plant projects. However, the RTS systems would implement a two-way electricity trading mechanism: buying electricity from the grid and selling electricity to the grid of households installing RTS systems. According to [31], the electricity from the grid would be purchased by EVN at the current price, and the FIT price for the RTS systems would be 9.35 UScents/kWh, but this FIT1 price has also expired since 30 June 2019, just like its previous version [29].

While the old FIT price, FIT1, has been expired more than half a year, the issue of announcing the new FIT price seems unlikely due to the inconsistency between the Government and the MoIT. According to Notice 402/TB-VPCP [33], dated 22 November 2019 by the Government Office, the issued FIT, FIT1, would be considered for solar power projects that have signed electricity purchase contracts and could be put into commercial operation by 2020, but not for the remaining projects and new upcoming projects. Nevertheless, in documents of Dispatch 9608/BCT-DL [34] dated 16 December 2019 and Dispatch 89/BCT-DL [35] dated 6 January 2020, the MoIT proposed to consider suspending proposals and agreements on SPP projects and RTS systems under the expired FIT price in [29,31] and the proposed FIT price in Proposal 10170/TTr-BCT [36] dated 31 December 2019 until new guidance from the authorities.

By the beginning of April 2020, the Vietnamese government has issued a new policy on the FIT prices (FIT2) for grid-connected solar PV projects with commercial operation date (COD) before 1 January 2021 [37]. Specifically, the FIT price for floating SPP is 7.69 UScents/kWh, for ground SPP is 7.09 UScents/kWh, and for RTS is 8.38 UScents/kWh. Particularly for Ninh Thuan province, the FIT price from grid-connected solar PV projects included in the PDP at all levels with a cumulative capacity of less than 2000 MW is 9.35 UScents/kWh. The term of Power Purchase Agreements (PPA) for these projects is 20 years from the COD. However, these FIT prices take effect after nearly 2 months, on 22 May 2020.

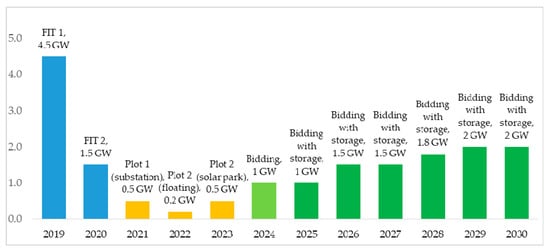

In parallel with the issuance of the new FIT price for solar PV projects, the government is planning to switch from FIT mechanism to competitive bidding mechanism under the strategy of development roadmap for solar power in period of 2020–2030 [27,36]. Accordingly, Vietnam would pilot a competitive bidding in 2020/2021 through three different plans with a total capacity of 1.2 GW: (i) 500 MW for substation-based competitive bidding, (ii) 200 MW for floating solar power parks, and (iii) 500 MW for ground solar parks. After the pilot phase, a capacity of about 1–2 GW per year would be required for both bidding schemes of the substation-based model and solar park (see Figure 13).

Figure 13.

Solar deployment per year of COD.

4.5. Developing Solar Power Projects and Model Power Purchase Agreements

The documents given by MoIT [30] and [32] have concretized the development of solar power projects and standardized PPA for them in Vietnam. According to these documents, solar power projects must be approved by provincial/national administrations before setting up the related investment projects, except rooftop solar projects with capacity less than 1 MW. For rooftop solar projects under 1 MW, they only need to directly register the main specifications to the provincial power company in order to ensure safety for the grid. The above circulars also required the measurement of solar radiation potential at project location before approval and establishment of investment.

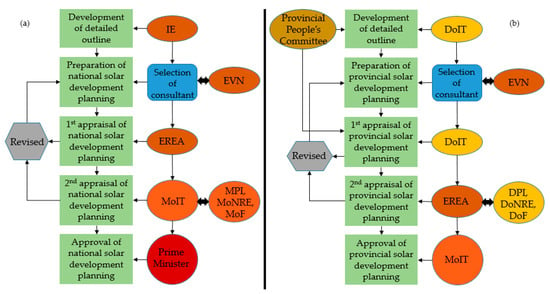

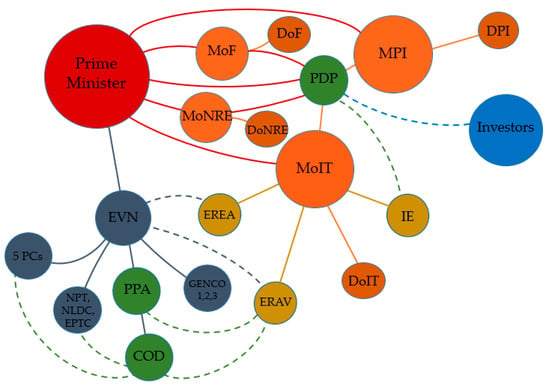

In addition, the indications for preparation, submission and approval of solar power development planning have been given in [30] and [32] at provincial level, and in [29] at national level, see Figure 14. In both cases, the determination of theoretical and technical solar energy potential, technical solutions, as well as financial performance of the submitted project are the main determinants. The difference between provincial and national levels is only in the authorities in controlling the procedures, thus producing duplicated efforts and possibly contrasting outcomes.

Figure 14.

Procedures for formulation, submission, appraisal and approval of solar development planning at national (a) and provincial (b) level.

In Figure 14, EREA is the Electricity & Renewable Energy Authority; EVN is Vietnam Electricity; DoF is Department of Finance; DoIT is Department of Industry and Trade; DoNRE is Department of Natural Resources and Environment; DPI is Department of Planning and Investment; IE is Institute of Energy; MoF is Ministry of Finance; MoIT is the Ministry of Industry and Trade; MoNRE is the Ministry of Natural Resources and Environment; MPI is the Ministry of Planning and Investment.

5. Barriers and Challenges for Developing the Solar Power in Vietnam

It is clear that solar energy has many economic, social, and environmental benefits, but this energy source is currently growing too fast and is unsustainable in Vietnam due to the barriers and challenges of institutional, technical, and economic-financial issues.

5.1. Institutional Issues

5.1.1. Lack of National Planning for Solar Energy

Currently, Vietnam just has a solar power development plan at the provincial level, especially concentrated in some provinces and cities with good solar potential. In addition, these provincial plans just have been applied to grid-connected solar power plants, not to rooftop solar power projects [29,31]. This could have a negative impact on the orientation of connecting solar power projects to the national power system in short-term as well as the possibility of sustainable and synchronized development across the country in long-term. Specifically, the current total capacity of additional solar projects is very large compared to the plan in the revised PDP 7, especially overinvestment in some areas such as Ninh Thuan, Binh Thuan, and Khanh Hoa [36]. This made it difficult for power transmission development and land clearance, while impacting negatively on productivity of solar plants, operability of the national power system, and the interests of investors [36,38].

Moreover, solar project deployment requires a large area of land, but the existing land plannings are to allocate and zone spatially for defense and security, socio-economic goals, or administrative units. The land planning for developing solar power projects has not received the proper attention of the competent authorities in Vietnam. Therefore, the current solar PV projects have taken a lot of time and money for land clearance and compensation.

To overcome this, it is necessary to develop adequate plans and investments for surveys and research the supplement data for planning and zoning solar development areas as well as grid reinforcement in whole country.

5.1.2. Backward Support Policies and Mechanisms

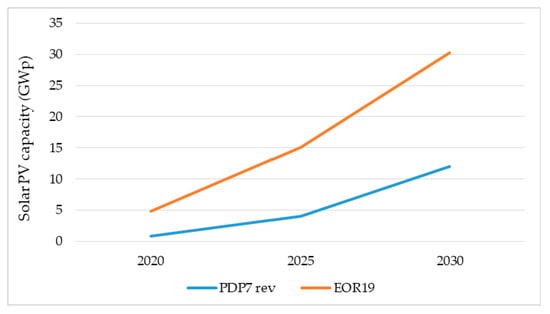

Support policies and mechanisms of solar energy are issued slowly and do not keep up with the development of this energy source in reality. Specifically, in 2011, solar power did not have specific targets in power development planning scenarios of PDP 7 [26]. By 2015, solar energy had more specific targets in the strategy for renewable energy development [28] with a coverage of 0.5%, 6%, and 20% of total electricity production in 2020, 2030, and in 2050 respectively. And in 2016, solar power was included in power development scenarios of PDP 7 revised. Accordingly, solar power has specific targets such as 0.5%, 1.6%, and 3.3% of total electricity production in 2020, 2025, and 2030, respectively [24]. However, the goals of solar energy according to the documents [24,28] still do not reflect the current development roadmap of solar power in Vietnam which tends to be much higher than expected, see Figure 15. According to EOR19 [1], the total capacity of registered projects has now reached 32 GWp, including 10.3 GWp of approved capacity to supplement the plan by 2025.

Figure 15.

Total solar PV capacity planned in PDP7 rev and assumed by authors following EOR19.

This showed the confusion in the planning and governance capacity of the relevant authorities in Vietnam. To get the better of this situation, the Vietnam government can refer to Thailand, a country in Southeast Asia like Vietnam but with a successful solar industry.

In Thailand, the strategy for alternative energy development hereby was given by government in 2009 under the Alternative Energy Development Plan (AEDP) in the period 2012–2021 [39]. This planning sets targets for solar power is 3000 MW, accounting for 5.4% of electricity generated. The next AEDP in period 2015–2036 was issued in 2015 [40] with the targets for solar energy of 6000 MW, equivalent to 7.2% of total installed capacity by 2036. In fact, total cumulative installed capacity of solar PV applications in Thailand by 2018 reached to 2700 MW, closely following the government’s targets [19]. It showed the good vision and governance capacity in control the solar PV roadmap of Thailand government.

Finally, the law of planning [41] and its implementing documents were slowly issued, causing difficulties in implementation and a lack of synchronism between power development planning and other infrastructures such as transport planning, land use planning, and urban planning.

5.1.3. Unsustainable FIT Mechanisms

The mechanisms of FIT prices are confusing. The FIT1 price, old FIT, has expired since mid-2019. However, the new FIT prices have been issued and canceled several times before they officially take effect after nearly a year, and even their validity period is very short, only about 7 months [37]. This has negatively affected the interests and confidence of investors.

Besides, none of the FIT mechanisms mentioned the technology type and installation size of solar PV applications. In the latest FIT price mechanism [37], it can be realized that the FIT prices simply refer to the type of solar PV project, without any additional regulations on technology type, installation scale, or project location. This can make it difficult to deploy advanced technologies of solar PV projects.

Moreover, the Vietnam government issued the FIT price for solar PV quite late, 2017, much later than other countries with the same potential of solar as Thailand, Italy, or even lower potential like Germany and Slovakia (https://solargis.com/). The FIT mechanisms have been issued early and successfully operated in supporting the development of solar PV power in these countries today.

In Thailand, since 2007, the FIT prices have been applied for solar PV systems [42]. In 2013, Thailand’s FIT price was divided into three levels with different applications of solar PV power including solar farm, solar rooftop, and solar for community in range of 0.19 to 0.21 USD/kWh. The issues of project cost, installation capacity, contract capacity, operation time, and project location were also reflected in FIT prices. Besides, these FIT prices for solar power have been continuously adjusted in the following years to meet the current situation and demand in national electricity supply.

In Italy, the government issued the FIT prices for solar PV systems in 2005. They were divided into different levels in range of 0.48 to 0.53 USD/kWh, depending on installation capacity and purpose of use [43]. This FIT price was then adjusted in subsequent years, with additions according to the installation capacity, used typology and technology of solar PV systems. Since the end of 2012, the FIT was fixed to be different for each type of PV system, based on the peak capacity of solar PV systems and the current month.

In Germany, FIT prices have been established for solar PV systems since 2000 [44]. These FIT prices were subsequently revised annually based on feedback from the rapid growth of the market and corresponding price cuts. Since 2012, the FIT prices were adjusted month by month following the actual installation of the previous quarter.

In Slovakia, the fixed FIT for electricity generation from renewables was issued in 2009, including hydropower, solar, wind, geothermal, biomass biogas, sewage gas, and bio methane [45]. Accordingly, these FIT prices consist of two components: a market price and an additional payment. The market price was represented by the electricity price and the additional payment was the difference between the market price and the tariff of renewables. The FIT prices were different depending on the type of renewables, used technology, installation size, and operation date.

In Australia, the FIT prices for solar PV systems were issued in 2010 [46]. The FIT prices were different in the different states and territories. These FITs are set based on the cost of producing solar PV power in each state. For example, the states with low solar potential often have a higher cost of producing solar PV power, so the FIT prices would be higher and vice versa. This really helped solar PV power in Australia become more popular and more evenly developed.

Regarding planning of competitive bidding mechanisms for PV systems [27,36], it can be said that this is a big step of Vietnam government on the roadmap of developing the solar PV industry. In some countries with a developed solar PV industry, a competitive bidding mechanism for solar PV systems has also been implemented, such as Denmark in 2016, France in 2015, Germany in 2015, and Japan in 2017 [44]. This mechanism allows the governments to grasp the market’s development trends and devise appropriate policies. Combining ceiling or floor payment can guarantee the interests of investors and the government. However, this requires close coordination among the stakeholders, and a clear identification of the roles and responsibilities of each participant. The investors may be at risk because it does not guarantee payback time. The governments and communities are also at risk if prices rise. In case of ceiling payments lower than the actual market price, it would not be able to attract investors.

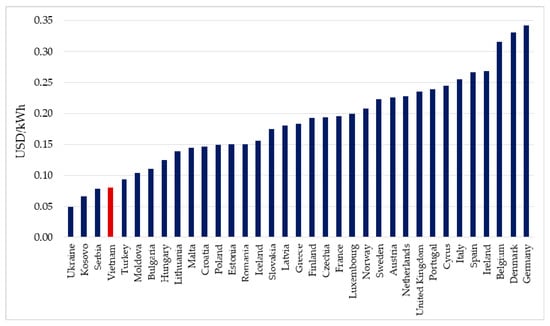

5.1.4. Disadvantages on Electricity Price

In 2019, the average level of electricity price in Vietnam have been raised to cover increased production costs, 1864 VND/kWh equivalent to about 0.08 USD/kWh [47]. However, the retail electricity price in Vietnam is quite low in comparison with the international price [6,48] (see Figure 16). Accordingly, this price in Vietnam is equivalent to Serbia, and a little bit higher than in Kosovo and Ukraine. This has been a disincentive for investments in energy sector due to it is relative to the competitiveness of solar power in the process of substitution of conventional fossil fuel-based power generation.

Figure 16.

Retail electricity prices in some countries in 2019.

The high electricity price is a favorable condition for developing power plants using renewables, including solar PV power. For example, in Germany, the average electricity price is even more than two times higher than the FIT price for residential PV systems of 0.123 UScents/kWh [44]. As a result, Germany is now one of the countries with the highest cumulative solar PV capacity in the world with around 50 GWp.

5.1.5. Limited Transparency about Management Roles of Authorities

The coordination of the authorities from central to local administrations in developing solar energy has not been really effective. There is no clear distinction of roles and responsibilities among the parties. This could lead to delay and limit the progress of solar projects, thereby reducing the confidence of investors.

As outlined in Figure 17, too many stakeholders are responsible for the same tasks in different ministries and organizations such as MoIT, MPI, MoNRE, MoF, EVN at a national level; and DPI, DoIT, DoNRE, and DoF at a provincial level.

Figure 17.

Actors in PDP, PPA, and COD of Vietnam solar power.

As an example, at national level, the Government of Vietnam, represented by the Prime Minister, is directly involved in cross-sectoral issues of the PDP. The MoIT is responsible for managing and coordinating the relevant ministries and government agencies in building and implementing the policies of PDP as well as solar energy development. In this level, the MoIT is a focal point for the elaboration of the national solar power development plan and submits it to the Prime Minister for approval; publish, guide, monitor and inspect the implementation of the approved planning. The MPI is mandated to study specific and feasible regulations on investment and planning policies, such as laws for investment, laws for planning, and related guiding documents. These activities are to timely adjust and supplement the PDP in power supplies and/or expanding the national grid in order to ensure sufficient socio-economic development of the country and the locality. The MoNRE is a focal point on issues related to land use for the PDP, the effects of power deployment projects on the environment, water resources, natural forests and protection forests. The MoF takes the lead in matters related to the national budget for PDP, studies and supplements the regulations on taxes and fees for solar power projects. The state-owned enterprises EVN is the largest producer, transmission, distributor and trader of electricity; controls the transmission and distribution of electricity in national power system with its subsidiaries. The MPI, MoNRE, MoF, and EVN act as MoIT’s consultants in solar development planning at a national level.

At a provincial level, the provincial People’s Committee, which has the potential to develop solar power, is a focal point on the elaboration of a provincial solar power development plan and submit to the MoIT for approval. Based on the proposed budget for the PDP, the provincial DoIT is responsible for preparing the detailed outline, estimating budget and selecting a consulting organization to prepare a planning and then submit to the provincial People’s Committee for approval. The MoIT, represented by EREA, is responsible for appraising the provincial Planning Scheme. In a similar way to the national level, the related DPI, DoNRE, DoF, and EVN’s subsidiaries act as consultants of DoIT in solar power development plan and EREA in appraising the local Planning Scheme.

In activities of PPA and COD, the EVN plays a leading role with its subsidiaries like Electric Power Trading Company (EPTC), three power generation corporations (GENCO 1,2,3), the National Load Dispatch Center (NLDC), National Power Transmission Corporation (NPT), and five power corporations (PCs) including North Power Corporation, Central Power Corporation, South Power Corporation, Hanoi Power Corporation, and Ho Chi Minh City Power Corporation. However, the PPA and COD could only be signed under the licenses of Electricity Regulatory Authority of Vietnam (ERAV) and must be verified and approved by EREA when having supplementary planning.

On the side of investors, for solar power projects on the list of the national/provincial PDP or approved solar power development plan, the investor must have research results on assessment of solar potential before setting up and approving project investment. Once the solar power development plan at all levels has completed the potential assessment in project site, the investors can use this data to develop and approve investment projects. For new solar power project proposals not on the approved list of national/provincial solar power development plans, the investor must conduct the potential measurement and evaluation according to stipulating after the approval on the planning supplement of the People’s Committee at provincial level or the MoIT at national level.

5.1.6. Lack of Management Experience

Like other countries in the early stage of solar energy development, the local utilities in Vietnam are not really familiar with solar PV power. Most power companies have not studied how solar PV power can fit into the grid. This limited understanding would lead to investors take too long time to obtain information from the government or power companies for conducting grid integration studies for a project. In case of incomplete grid integration studies, the project has the potential to be at risk in operation. Therefore, this problem could become a significant barrier in the development of solar power projects if there is no agreement regarding the responsibilities of each stakeholder.

5.2. Technical Issues

5.2.1. Lack of a Reliable Database

As mentioned above, there are many studies of solar energy resources currently being conducted by domestic and foreign organizations, but they are incomplete and not sufficiently reliable as a basis for the deployment of solar power projects. This makes it difficulty for potential investors to obtain useful information about the solar potential of Vietnam when looking for investment opportunities.

In addition, the competitive demand for land affects solar power deployment, but the land planning is not carried out in a synchronized manner with power source development planning. The data of land availability needs to be analyzed and supplemented, such as grid development capacity, land, and rooftop responsiveness.

In such a context, the investigation and research is needed to obtain reliable data for solar PV planning at all levels. In particular, the planning needs to be fully developed at the national level to prepare for sustainable investment and exploitation.

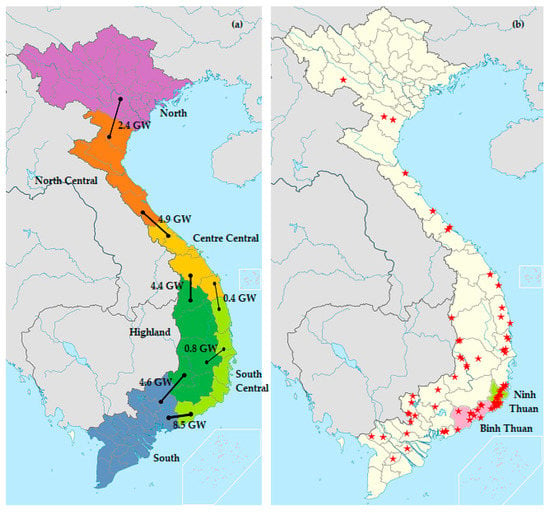

5.2.2. Concerns Regard Vietnam’s Grid

Vietnam’s transmission grid is divided into six geographical regions—including North, North Central, Center-Central, South-Central, Highland, and South—with transmission voltage levels of 500 kV and 220 kV [21,49], see Figure 18. The voltage level of distribution grid is below 110 kV, and most of power generating plants using renewables (including solar PV power) are connected to this grid. In fact, the electricity consumption is uneven across regions, of which the largest is the South with nearly 50% of total consumption, followed by the North with more than 35%. The South-Central region accounts for only about 7% of total consumption in whole country.

Figure 18.

Transmission grid (a) and location of approved solar PV plants (b) in Vietnam for 2019.

The existing grids mainly transfer traditional configurations for electricity supply in the whole country, such as coal-fired power plants, oil-fired power plants, gas turbine power plants or hydropower plants [38,50]. This has led to the fact that the grid infrastructure of 110–500 kV has been built mainly in areas with a rich potential for traditional fuels, such as the North, South, and Highlands regions. In other regions, the grid infrastructure major has been reinforced with voltage levels of 22–35 kV, including provinces having good wind and solar potential such as Ninh Thuan and Binh Thuan.

The boom of solar PV plants in 2019 has put great pressure on existing infrastructure and called for the need to reinforce and establish new connections to the grid in a short time. In particular, this has happened in the two provinces of Ninh Thuan and Binh Thuan, where solar power plants are concentrated with high density but the demand for electricity on-site is very low [21,38], see Figure 18. As a result, the grid overload is unavoidable while the calculation, development and reinforcement of the grid to connect to these plants seem to be not simple and takes a large amount of time. Specifically, in Ninh Thuan, the total planned and installed capacity is currently so big with over 2500 MW, while the grid-connected capacity is still very low, less than 1000 MW [36]. With such an overloaded situation, the power system would be very likely to encounter problems of power line and substation congestion, possibly causing system instability and dangerous situations for the devices.

It can be realized that the promotion of solar power development in Vietnam is necessary. However, in the current situation, the first thing the Vietnam government needs to do is to strengthen the grid structure, then to invest in expanding the grid as well as upgrading lines and transformers with modern and more reliable equipment.

Moreover, Vietnam can learn from experiences from countries that have developed solar power industry. These countries also had periods of out-of-control solar PV power, and then they had to take some measures to reduce the system’s overload, such as limited production for a certain number of hours in a day in Spain [51], or the limit of maximum installed capacity in Slovakia [45].

In the other aspect, the production of solar power depends on the weather. The power generated could vary, fluctuate at timescales from minutes to hours, to multiple days, and even by years [52]. Therefore, the power system would need fast responding redundant (even storage) sources to maintain a balance between power supply and transmission. This also create challenges for the fledgling solar industry and increase the pressure on power system with potential risks of Vietnam.

5.2.3. Unclear Standards and Technical Regulations

Conventions of standards and technical regulations to meet practical requirements in the process of design, construction, operation, and management of solar power projects are still inadequate. In addition, the unified connection standards for solar power are also unavailable.

In detail, for what concerns the national grid code, Vietnam has Circular 39/2015/TT-BCT [53] in 2015 on electricity distribution system and Circular 25/2016/TT-BCT [54] in 2016 on electricity transmission system. The document [53] detailed correspondingly the connection rules of medium voltage (MV) and low voltage (LV) distribution grids for both hydropower, thermal power, solar and wind projects. In addition, in order to meet the current development requirements of the new power sources, the Vietnamese Government has issued a revised document of these two circulars, the Circular 30/2019/TT-BCT in November 2019 [55]. Specifically, characteristic curves of the ability to adjust reactive power according to the voltage range were also added. Besides, when the frequency is higher than 50.5 Hz, a solar power plant is capable of reducing active power according to the relative slope of droop characteristics in range of 2% to 10%. Nevertheless, the generation capacity into the national grid of solar power plants must comply with the dispatch order of the NLDC.

Other technical standards not only do not have specific instructions, but are also referenced from any international standards, such as standards for design, construction, and testing of PV systems or indicates on the protection against electric shocks in electrical system installation including PV system [56].

In this problem, Vietnam can refer to the method of Italy, a country with similar solar potential but having a very developed solar PV industry with a total current installed capacity of over 20 GWp [19]. Italy’s government, represented by the Italian Electrotechnical Committee has issued technical standards, CEI 0-16 [57] and CEI 0-21 [58], to connect passive and active users (including PV systems) with MV and LV distribution networks since 2008. These standards have been added and revised over the years to meet new demands in terms of technology, network scale, and advanced control functions. Accordingly, these standards show mandatory requirements for all generator protection devices and the operators of the distribution system must check the characteristics of the protection system before allowed to operate. In parallel with that, they provide instructions for connecting battery storage systems to grid-connected PV plants as well as the participation of PV systems in voltage and primary frequency regulations. Besides, several other technical standards are also issued by the Italian technical committee. For example, CEI 82-25 standard provides instructions for the design, construction, and testing of PV systems; or CEI 64-8 standard provides instructions for protection against electric shock in installations including PV systems [59,60].

In fact, since 2014, all distributed generators (including solar PV systems) in Italy have been established to receive external signals from the operators for control functions like primary frequency and the voltage regulation.

5.2.4. Lack of Project Development Capacity

In Vietnam today, skilled human resources to implement a complete solar power project are really lacking. The basic technical and maintenance services, operation and management after installation of solar power plants are unable to employ 100% of domestic labor. This has a great influence on the ability to operate independently in particular for what concerns the project itself as well as the electricity system in general. Thus, short-term and long-term training programs in human resource development for electric companies and administrations are needed. The professional training for managers, technicians, and skilled workers for solar power projects should be promoted.

5.2.5. Poor Infrastructure

Many areas have high potential, but implementing extensively solar PV resources is difficult due to weak infrastructure (roads, railways, power infrastructure and supply, etc.). This makes it difficult for solar projects to develop and the investors have to spend additional resources to consolidate the infrastructure, leading to a significant increase in the total investment cost.

5.2.6. Technology Dependence

Currently, Vietnam has several solar panel factories, including manufacturers in the latest tier 1 solar panels list in 2019—such as Trina Solar, Canadian Solar, and First Solar—but only one of them is owned by Vietnamese people. Most of the technical equipment in solar power projects have been imported from abroad due to the desire to minimize investment capital and other expenses. In addition, so far, Vietnam has not set up any professional technology research and development institute on solar energy to become a guide for domestic organizations and businesses in the solar power sector.

5.3. Economic and Financial Issues

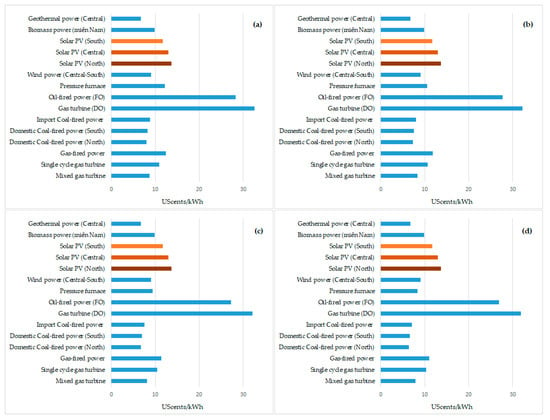

5.3.1. Relatively High Levelized Cost of Electricity

Currently, in Vietnam, the levelized cost of electricity (LCOE) for renewable power in general and solar power in particular is still quite high, due to the large initial investment costs. In addition, the current solar industry in Vietnam is heavily dependent on foreign countries, both in terms of technology, engineering, and project development capability. According to [50], in Vietnam, the LCOE of solar PV power is the third highest, ranked below gas turbine (DO), and oil-fired power (FO), provided that the capacity factor of fossil fuel plants is 70% or more, see Figure 19.

Figure 19.

LCOE of power plants operated in 2020 with capacity factors of 60% (a), 70% (b), 80%, (c) and 90% (d) for fossil fuel plants.

Figure 19 gives a comparison of the LCOE from selected key technologies in Vietnam. The capacity factors for power plants using gas, oil, and coal are assumed at 60%, 70%, 80%, and 90%. It can be seen that the LCOE of solar PV is quite high compared to other sources, including fossil fuels as coal, gas (gas turbine).

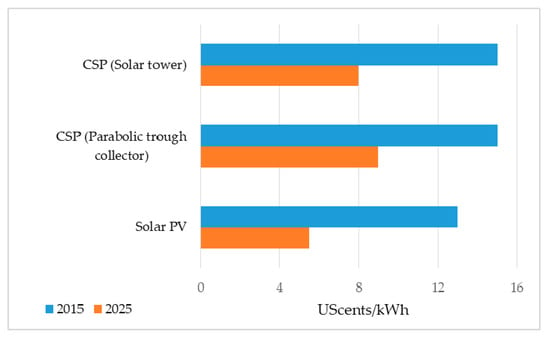

However, the investment cost for solar PV tends to decrease very quickly. According to IRENA [61], the global weighted average LCOE could fall by 59% from solar PV by 2025, equivalent to 6% per year, see Figure 20. Therefore, it is estimated that in the next few years, solar PV power could completely compete with power plants using traditional configurations.

Figure 20.

Comparison of global weighted average LCOE between 2015 and 2025.

5.3.2. Difficult in Mobilizing Capital in the Long-Term

In recent years, there have been many domestic commercial banks involved in deploying loan packages for individuals and businesses in installing solar power, such as VietinBank, Vietcombank, HSBC, HDBank, or BIDV, but all of these loans are short to medium term (from 3 to 5 years). This shows a shortage of long-term deposits and interest rates by horizontal term deposits. Besides, the current provisions in PPAs under [30,32] make the independent power producers (IPP) less accessible to project finance in USD. Specifically, the purchase price is currently regulated in VND/kWh and would be adjusted from year to year according to the announce by the State Bank of Vietnam. Although Vietnam has lifted its currency conversion control, foreign investors remain concerned about the long-term availability of foreign exchange. This causes a big problem for investors in seeking funding as well as reducing risks in the long-term.

5.3.3. Unclear Responsibility for Risk Sharing

PPAs for solar projects in documents [30,32] have not met loan requirements because risk sharing does not conform to international best practices. Specifically, there are risks in project stages of preparation, construction, and operation. Those are policy risks such as changes in policies, laws, tax policies, fees, prices, planning, development plans, etc.; or financial risks such as equity, loans not sufficiently mobilized, loan interest rates, exchange rates, etc.; or force majeure risks such as floods, earthquakes, not under the authority of state agencies and out of the control of project enterprises. However, the provisions in the PPA do not specify the responsibilities of each stakeholder risk nor the government’s support in sensitive projects such as the energy sector. This puts investors at greater risk, especially for IPPs, as well as hinders foreign expertise and cheap cross-border capital in approaching to Vietnam’s solar sector. Therefore, there is a need for a unified and clearly defined risk sharing mechanism in PPAs, in line with international practice and in accordance with requirements of Vietnam.

5.3.4. Risks of Land Ownership

Secured land use rights are important for long-term investment and financial mobilization. The main asset considered as security for lender is solar power plant, and the plant ownership depends on legal rights to the land. If the land is not secured so that the project can get bank loans, normally the IPPs would not dare to invest in the project.

5.3.5. Difficult in Mobilizing Capital at Local Scale

Investors in small centers are limited in capital resources, and solar energy is a new field of investment for them. Besides, the potential risks in ensuring certain profits also make them hesitate. This may cause new investors to reconsider intent to pour capital into solar power projects.

Moreover, the investors may also have difficulty obtaining financing at low interest rates. Financial institutions are generally not familiar with new technologies of solar power, especially financial institutions in small centers. They are able to perceive the risk of projects, so they tend to lend at higher interest rates.

6. Conclusions

The goal of developing renewable energy in Vietnam is related to energy security, reducing dependence on fossil fuels and reducing the environmental impact of energy production. Vietnam has a good potential for solar energy due to its geographical advantage. The studies showed that the solar potential in Vietnam is similar to some countries having a developed solar industry. The highest potential locations have concentrated in the South and South Central.

However, the current development of solar power in Vietnam is still not commensurate with its potential. The barriers and challenges for developing solar power exist in most of the institutional, technical, financial, and economic aspects. Solar energy has been mentioned in Vietnam’s policies since 2007, but it was not activated until 2017 in the form of regulated FIT prices. Thanks to these policies, solar power projects have increased rapidly, from insignificant in 2015 to exceeding the target nearly 10 times in 2019. Nevertheless, the institutional issues have not been satisfactorily addressed. The poor technique and infrastructure have put pressure on the fledgling solar power industry. The problems of economic and financial also have slowed down the popularity of solar PV power. Finally, the asynchronous development of all above aspects has made big challenges for the sustainable development of the solar power industry in Vietnam.

Therefore, to ensure the sustainable development of solar energy, the government needs to continuously improve existing policies to develop more comprehensive policies, particularly FIT price mechanism. Duplication of efforts over the same tasks coupled with inadequate competences in governmental institutions and companies widen authorization times to a limit that make investments no more attractive for private investors. While seeking for lighter bureaucratic processes, the government would also need to increase funding for R&D programs, create investment channels, and build up training programs to create highly qualified human resources in order to meet the industrial development needs of the country. Simultaneously, the grid and infrastructure issues also need to be addressed. Reinforcing the power system and upgrading the infrastructure should be done early with priority given to areas that have better potential for exploitation.

Author Contributions

Conceptualization, E.R.S., H.L.T.T., and M.-H.P.; Validation, M.L.D.S., N.N.Q., and S.F.; Resources, M.L.D.S., N.N.Q., and S.F.; Data curation, H.L.T.T.; Writing—original draft preparation, H.L.T.T.; Writing—review and editing, E.R.S., H.L.T.T., and M.-H.P.; Visualization, H.L.T.T.; Supervision, E.R.S. and M.-H.P.; Project administration, E.R.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the project “Design and installation of a grid connected microgrid 100 kWp PV plant and study solutions for developing solar generation in Vietnam to 2030, taking into account greenhouse gas emission reduction”. Code NĐT.80.ITA/20.

Acknowledgments

The authors especially thank Department of Engineering—University of Palermo and Institute of Energy Science—Vietnam Academy of Science and Technology for providing fund and creating favor in this work during studying.

Conflicts of Interest

The authors declare no conflict of interest.

References

- EREA&DEA. Vietnam Energy Outlook Report 2019; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- IMF. World Economic Outlook. Global Manufacturing Downturn, Rising Trade Barriers; International Monetary Fund: Washington DC, USA, 2019. [Google Scholar]

- MoIT&DEA. Vietnam Energy Outlook 2017; Danish Energy Agency: Hanoi, Vietnam, 2017. [Google Scholar]

- Kimura, S.; Han, P.; Kamiyama, S.; Li, Y.; Dang, H.D.T.; Ahmad, S.; Gillispie, C.E.; Sahari, R.; Sarasy, C.; Hao, Y.; et al. Energy Outlook and Energy Saving Potential in East Asia 2019; Economic Research Institute for ASEAN and East Asia: Tokyo, Japan, 2019. [Google Scholar]

- Luong, N.D. A critical review on Energy Efficiency and Conservation policies and programs in Vietnam. Renew. Sustain. Energy Rev. 2015, 52, 623–634. [Google Scholar] [CrossRef]

- IEA. Southeast Asia Energy Outlook 2019; International Energy Agency: Bangkok, Thailand, 2019. [Google Scholar]

- Hoat, D.D.; Tuyen, T.K.; Hang, L.T.T.; Thanh, N.V.; Thanh, T.Q.; Quoc, T.H.; Minh, N.T. Research Overview of New and Renewable Energy in Vietnam and Development Orientation; Vietnam Academy of Science and Technology: Hanoi, Vietnam, 2007. [Google Scholar]

- Cattelaens, P.; Limbacher, E.-L.; Reinke, F.; Stegmueller, F.F.; Brohm, R. Overview of the Vietnamese Power Market. A Renewable Energy Perspective; GIZ Energy Support Programme: Hanoi, Vietnam, 2015. [Google Scholar]

- Zissler, R. Renewable Energy to Replace Coal Power in Southeast Asia. Pragmatism to Deliver a Sustainable Bright Future; Renewable Energy Institute: Tokyo, Japan, 2019. [Google Scholar]

- Prime Minister. Decision 1855/QD-TTg of Approving Vietnam’s National Energy Development Strategy up to 2020, with Vision to 2050; Vietnam Government: Hanoi, Vietnam, 2007.

- Brohm, R. Framework Assessment for the Promotion of Solar Energy in Vietnam. A Market Survey and Stakeholder Mapping of the Vietnamese Solar Energy Sector; GIZ Project Study: Hanoi, Vietnam, 2015. [Google Scholar]

- CEERP. BP Statistical Review of World Energy 2019; BP International Limited: London, UK, 2019. [Google Scholar]

- Foon, C.; Wah, B.; Ozturk, I. Energy consumption and economic growth in Vietnam. Renew. Sustain. Energy Rev. 2015, 54, 1506–1514. [Google Scholar] [CrossRef]

- Huber, M.; Roger, A.; Hamacher, T. Optimizing long-term investments for a sustainable development of the ASEAN power system. Energy 2015, 88, 180–193. [Google Scholar] [CrossRef]

- Mamat, R.; Sani, M.S.M.; Sudhakar, K. Renewable energy in Southeast Asia: Policies and recommendations. Sci. Total Environ. 2019, 670, 1095–1102. [Google Scholar] [CrossRef]

- Mallon, K.L.; Johnson, R. Financing Sustainable Development in Viet Nam: Solar and Wind Energy Promotion; Policy Brief: Paris, France, 2019; Number 5. [Google Scholar]

- Nhan, N.T.; Minh, H.-D. Economic Potential of Renewable Energy in Vietnam’s Power Sector. Energy Policy 2009, 37, 1601–1613. [Google Scholar] [CrossRef]

- Polo, J.; Martínez, S.; Fernandez-Peruchena, C.M.; Navarro, A.A.; Vindel, J.M.; Gastón, M.; Ramírez, L.; Soria, E.; Guisado, M.V.; Bernardos, A.; et al. Maps of Solar Resource and Potential in Vietnam; Vietnam Ministry of Industry and Trade & Spanish Agency for International Development Cooperation: Hanoi, Vietnam, 2015.

- IRENA. Renewable Energy Statistics 2019; International Renewable Energy Agency: Abu Dhabi, UAE, 2019; Volume 1. [Google Scholar]

- VEPG. Vietnam Factsheet on Rooftop Solar Development 2019; Vietnam Energy Partnership Group: Hanoi, Vietnam, 2019. [Google Scholar]

- EREA&DEA. Detailed Grid Modelling of the Vietnamese Power System. Background to the Vietnam Energy Outlook Report 2019; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- Prime Minister. Decision 2081/QD-TTg of Approving the Program on Electricity Supply in Rural, Mountainous and Island Areas in Period of 2013–2020; Vietnam Government: Hanoi, Vietnam, 2013.

- Sinh, T.D.; Long, N.H.; Dung, N.T.M. Report on Rural Electrification Policies and Supporting Mechanisms for Off-Grid Community; Green Innovation and Development Centre: Hanoi, Vietnam, 2017. [Google Scholar]

- Prime Minister. Decision 428/QD-TTg of Approval of the Revised National Power Development Master Plan for the 2011–2020 Period with the Vision to 2030; Vietnam Government: Hanoi, Vietnam, 2016.

- CCCV. Politburo’s Resolution 55-NQ/TW on the Orientation of the Vietnam’s National Energy Development Strategy to 2030 and Outlook to 2045; Central Commitee of the Communist Party of Vietnam: Hanoi, Vietnam, 2020.

- Prime Minister. Decision 1208/QD-TTg Dated July 21, 2011 of Approving the National Master Plan for Power Development in the 2011–2020 Period, with Considerations to 2030; Vietnam Government: Hanoi, Vietnam, 2011.

- WB Group. Vietnam Solar Competitive Bidding Strategy and Framework; World Bank Group: Washington, DC, USA, 2019. [Google Scholar]

- Prime Minister. Decision 2068/QD-TTg of Approving the Vietnam’s Renewable Energy Development Strategy up to 2030 with an Outlook to 2050; Vietnam Government: Hanoi, Vietnam, 2015.

- Prime Minister. Decision 11/2017/QD-TTg on Mechanism for Encouragement of the Development of Solar Power Projects in Vietnam; Vietnam Government: Hanoi, Vietnam, 2017.

- MoIT. Circular 16/2017/TT-BCT on Project Development and Model Power Purchase Agreements Applied to Solar Power Projects; Ministry of Industry and Trade: Hanoi, Vietnam, 2017.

- Prime Minister. Decision 02/2019/QD-TTg on Amendments and Supplements to Certain Articles of Decision No. 11/2017/QD-TTG on the Mechanism for Encouragement of Development of Solar Power in Vietnam; Vietnam Government: Hanoi, Vietnam, 2019.

- MoIT. Circular 05/2019/TT-BCT of Amendments to Circular 16/2017/TT-BCT on Development of Solar Power Projects and Standard Form Power Purchase Agreement (PPA) Thereof; Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- VGO. Notice 402/TB-VPCP of Prime Minister’s Conclusions on the Draft of Solar Power Promotion Mechanism in Vietnam, Applied from July 1, 2019, Following Decision 11/2017/QD-TTg; Vietnam Goverment Office: Hanoi, Vietnam, 2019.

- MoIT. Dispatch 9608/BCT-DL on Suspension of Proposal and Agreement for Solar Power Projects under FIT Price Mechanism; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- MoIT. Dispatch 89/BCT-DL on Implementation of Agreements with Rooftop Solar Power; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2020.

- MoIT. Proposal 10170/TTr-BCT of a New Draft Decision on the Mechanism for Developing Solar Power Projects in Vietnam; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- Prime Minister. Decision 13/2020/QD-TTg on Mechanism for Encouragement of the Development of Solar Power in Vietnam; Vietnam Government: Hanoi, Vietnam, 2020.

- MoIT. Report 58/BC-BCT on Implementation of Power Projects in the Revised Power Development Plan 7 (In Vietnamese); Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- Tongsopit, S.; Chaitusaney, S.; Limmanee, A.; Kittner, N.; Hoontrakul, P. Scaling Up Solar PV: A Roadmap for Thailand; Energy Research Institute: Bangkok, Thailand, 2015. [Google Scholar]

- DoRED&EE. Alternative Energy Development Plan: AEDP2015; Thailand Ministry of Energy: Bangkok, Thailand, 2015.

- VNA. Law 21/2017/QH14 of Planning; Vietnam National Assembly: Hanoi, Vietnam, 2017.

- Yoomak, S.; Patcharoen, T.; Ngaopitakkul, A. Performance and Economic Evaluation of Solar Rooftop Systems in Different Regions of Thailand. Sustainability 2019, 11, 6647. [Google Scholar] [CrossRef]

- Orioli, A.; Franzitta, V.; Di Gangi, A.; Foresta, F. The Recent Change in the Italian Policies for Photovoltaics: Effects on the Energy Demand Coverage of Grid-Connected PV Systems Installed in Urban Contexts. Energies 2016, 9, 944. [Google Scholar] [CrossRef]

- Jäger-Waldau, A. PV Status Report 2018; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Brückmann, R.; Jirouš, F.; Spitzley, J.-B.; Herling, J.; Bauknecht, D. Integration of Electricity from Renewables to the Electricity Grid and to the Electricity Market—RES National Report: Slovakia; Institute for Applied Ecology: Berlin, Germany, 2012. [Google Scholar]

- Zahedi, A. A review on feed-in tariff in Australia, what it is now and what it should be. Renew. Sustain. Energy Rev. 2010, 14, 3252–3255. [Google Scholar] [CrossRef]

- MoIT. Decision 648/QD-BCT on Adjusting the Average Electricity Retail Price and Stipulating Electricity Selling Price; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- EC. Electricity Price Statistics; Eurostat—Statistics Explained: Luxembourg, 2020. [Google Scholar]

- EREA&DEA. Data Report. Background to the Vietnam Energy Outlook Report 2019; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- IE. Detail Report of the Revised National Power Development Master Plan for the Period 2011–2020 with a Vision to 2030; Institute of Energy: Hanoi, Vietnam, 2016. [Google Scholar]

- Guaita-Pradas, I.; Blasco-Ruiz, A. Analyzing Profitability and Discount Rates for Solar PV Plants. A Spanish Case. Sustainability 2020, 12, 3157. [Google Scholar] [CrossRef]

- Wild, M.; Folini, D.; Henschel, F.; Fischer, N.; Müller, B. Projections of long-term changes in solar radiation based on CMIP5 climate models and their influence on energy yields of photovoltaic systems. Solar Energy 2015, 116, 12–24. [Google Scholar] [CrossRef]

- MoIT. Circular 39/2015/TT-BCT on Electricity Distribution System; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2015.

- MoIT. Circular 25/2016/TT-BCT of Electricity Transmission System; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2016.

- MoIT. Circular 30/2019/TT-BCT of Amendments and Supplements to Several Articles of Circular 25/2016/TT-BCT of Electricity Transmission System and Circular 39/2015/TT-BCT of Electricity Distribution System; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- Di Silvestre, M.L.; Favuzza, S.; Sanseverino, E.R.; Zizzo, G.; Ngoc, T.N.; Pham, M.H.; Giang Nguyen, T. Technical Rules for Connecting PV Systems to the Distribution Grid: A Critical Comparison of the Italian and Vietnamese Frameworks. In Proceedings of the 2018 IEEE International Conference on Environment and Electrical Engineering and 2018 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I and CPS Europe), Palermo, Italy, 12–15 June 2018. [Google Scholar] [CrossRef]

- CEI Standard 0-16. Reference Technical Rules for the Connection of Active and Passive Consumers to the HV and MV Electrical Networks of Distribution Company; Italian Electrotechnical Committee: Milano, Italy, 2014. [Google Scholar]

- CEI Standard 0-21. Reference Technical Rules for the Connection of Active and Passive Users to the LV Electrical Utilities; IItalian Electrotechnical Committee: Milano, Italy, 2014. [Google Scholar]

- CEI Standard 82-25. Guide for Design and Installation of Photovoltaic (PV) Systems Connected to MV and LV Networks; Italian Electrotechnical Committee: Milano, Italy, 2011. [Google Scholar]

- CEI Standard 64-8. Low Voltage Electrical Installations; Italian Electrotechnical Committee: Milano, Italy, 2012. [Google Scholar]

- IRENA. The Power to Change: Solar and Wind Cost Reduction Potential to 2025; International Renewable Energy Agency: Bonn, Germany, 2016. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).