Abstract

The co-evolution of techno-economic, societal, environmental and political-institutional systems towards sustainable energy transitions is largely influencing the disruptive reconfiguration of the energy sector across the globe. At the heart of this disruption is the peer-to-peer energy sharing concept. Nonetheless, peer-to-peer energy sharing business models are yet very little put into practice due to the rigid energy market structures and lagging regulatory frameworks across the globe. In view of this, this paper presents a novel peer-to-peer energy sharing business model developed specifically for the context of the Portuguese energy market, which was successfully trialed in three pilot projects in Portugal under real market conditions. All things considered, the novelty of this paper lies on an innovative approach for the collaborative use of the surplus electricity generation from photovoltaic systems between end-users under the same low voltage/medium voltage transformer substation, which resulted in direct financial benefits to them. While absent deregulation obstructs the implementation of effective peer-to-peer energy sharing markets in Portugal, such demonstration projects are essential to challenge restrictive regulatory frameworks that do not keep pace with techno-economic and societal innovations, thus helping to build the emerging consumer-centric energy regime and disrupt the old one.

1. Introduction

The growing affordability of distributed generation and energy storage technologies (automotive and stationary) combined with the evolution of new information & communications technology (ICT) systems is largely influencing the disruptive transformation and reconfiguration of the energy sector across the globe [1]. As a result of this global movement towards sustainable energy transitions, electricity consumers are starting to have greater autonomy to manage and control their load flexibility, thus evolving from merely passive paying customers to active participants in the energy market [2]. Also, a growing number of electricity consumers are becoming prosumers—which refers to those who fulfil changing roles as both producers and consumers of electricity [3,4].

This shift towards smarter and more distributed energy systems aligned with the emergence of consumer-centric markets allow the development of innovative value streams within the energy sector [1]. At the heart of such innovative value streams is the peer-to-peer (P2P) energy sharing concept, which refers to flexible, independent and direct exchanges of electricity between grid-connected peers [3,5]. Under this new energy market structure, end-users are entitled to self-organise as energy communities in autonomous, voluntary and collective ways, within which they are entitled to generate, consume, store and supply renewable energy directly between each other or in all suitable markets on a level playing field with other market actors without the need for a middle-man to carry out these transactions on their behalf. This, as a result, empowers them to actively provide energy services that were once solely provided by conventional players in energy markets [6].

In light of this, it can be inferred that by disintermediating the energy supply model, P2P energy sharing networks aim to push the makeover of traditional energy systems from an overly controlled, unidirectional and centralised model towards a more collaborative, accessible, adaptive, networked, distributed and dynamic one. This contemporary shift in power relations within energy markets challenges common practice, threatening to overturn traditionally well-established hierarchies and urging those conventional energy market players to redesign their operations and value chains to deliver innovative energy products and services that embrace the P2P energy sharing concept [1,3,7].

The European Union (EU) is strongly pushing EU member states to develop enabling national policy frameworks in line with this new modus operandi of future energy markets as a means to contribute to climate change mitigation targets. This can be clearly seen in the latest EU’s Clean Energy for All Europeans legislative package [8], which introduced two new official EU-level definitions for energy communities: (i) Renewable Energy Community (REC) and (ii) Citizen Energy Community (CEC). All in all, both definitions refer to collective self-organisational structures centred on end-users that enable them to participate in energy-related activities (e.g., collective self-consumption or closed distribution system) that primarily promote environmental, economic or social benefits for its members rather than commercial profits [8]. Although at their core both share the same ownership, governance and a non-commercial structures, what mainly differs one another is that the REC logic is fairly more stringent given that geographic proximity is one of its requirements [9]. Because of that, Roberts et al. [9] explains that generally speaking RECs can be a subset of CEC.

Despite the level of infancy of this concept within academia, a fast-growing number of research has emerged in recent years in an attempt to define the first techno-economic attributes of P2P energy sharing models, thus uncovering trends, open issues and insights into future research directions [10,11,12,13,14,15,16,17]. Furthermore, the first trials to implement P2P energy sharing models in real market conditions have lately started to appear across the world—namely in the Netherlands, Germany, the UK, the USA, Australia, and is steadily spreading worldwide [18,19]. While some of these trials focused on the development of business models that are centred on the value creation for energy community managers (e.g., Piclo [20], Vandebron [21] and SonnenCommunity [22]), others narrowed the focus on the development of the ICT technology infrastructure to support P2P energy trading (e.g., PeerEnergyCloud [23]). In any case, in general terms P2P energy sharing business models are yet very little put into practice due to the rigid energy market structures and lagging regulatory frameworks across the globe.

Fundamentally, refashioning the highly regulated energy industry represents a cumbersome task that may only be feasible if the P2P energy sharing concept is translated into a wide array of tangible real case studies across the world that demonstrate its advantages and benefits, thus creating enough momentum to disrupt the status quo within which conventional energy market models are conceptualised. In view of this, this paper focuses primarily on the presentation of a novel P2P energy sharing business model developed specifically for the context of the Portuguese energy market, which was successfully trialled in 3 pilots in Portugal under real market conditions. This paper notes that the designed approach is constrained by regulatory barriers currently imposed by the Portuguese Energy Services Regulatory Authority (ERSE). With that said, this paper aims to answer the following research questions:

- (1)

- What are the main practical implications of the existent regulatory barriers in terms of the feasibility of the demonstration of P2P energy sharing models in Portugal?

- (2)

- What sort of novel P2P energy sharing business model can be designed for the context of the Portuguese energy market, considering its stringent regulatory barriers?

- (3)

- What are the financial benefits for different end-users in a prospective deregulated P2P energy sharing scenario in Portugal?

By answering the abovementioned questions, this paper aims to provide novel insights related to the design of P2P energy sharing business models that will spur the development of increasingly more complex business models. Additionally, this paper expects to push forward the makeover of outdated energy policies towards the deregulation of P2P energy sharing market models in Portugal.

2. Methodology

This section presents the methodology tailored to support the implementation of the proposed business model. It first introduces the demonstration project used as field trial to test out the feasibility of the proposed business model. Then, it deliberates about the rationale behind the proposed business model, analysing the current regulatory framework for the Portuguese energy sector to suggest an ameliorated and more progressive mode of commercialisation of surplus distributed electricity generation as a means to acknowledge P2P energy sharing market models. Moreover, it discusses about the structure of the proposed new Final Sales tariff applicable to surplus distributed electricity traded within low voltage P2P energy sharing communities. Finally, it describes the underlying smart ICT infrastructure layer conceived to support the implementation of the proposed business model.

2.1. The Community S Project

The Community S project represents the first P2P energy sharing initiative trialled in real-life settings and under real market conditions in Portugal [24]. This represents an unprecedent demonstration project at national level and novel demonstration project worldwide, given the scarce amount of robust P2P energy sharing business models implemented trialled under similar circumstances. Because of that, it can be inferred that the Community S project plays an important role in providing the first insights about the feasibility of the implementation of P2P energy sharing systems in the Portuguese energy market.

The Community S project was officially launched in September 2016 and concluded in September 2018. This Portugal 2020 demonstration project was developed in line with the Priority Areas of the National Research & Development (R&D) Strategy of Portugal, focusing on the development of innovative solutions for the smart, decentralised and collective management of distributed renewable generation at the community scale (see Acknowledgement section for more details). The project consortium comprised 3 distinct entities, which are:

- Virtual Power Solutions (VPS <https://www.vps.energy/>: Leader of the consortium. VPS is a private technology-based company that focused on the provision of smart and interconnected hardware and software solutions to enable the smart and collective management of distributed energy resources;

- Simples Energia <https://www.energiasimples.pt/>: Simples Energia is a private energy retailer and aggregator that focused on the design and validation of the P2P energy sharing business model proposed in this project;

- Research Group on Intelligent Engineering and Computing for Advanced Innovation and Development—GECAD <http://www.gecad.isep.ipp.pt>: GECAD is a public R&D centre from the Institute of Engineering at the Polytechnic of Porto that focused on the development of algorithms for the optimisation of the services offered in the project.

2.2. Rationale behind the Proposed Business Model

While the lack of a suitable regulatory framework obstructs the implementation of effective P2P energy sharing transactions in Portugal, new progressive approaches that go beyond the status quo must be foreseen as a means to circumvent these immediate regulatory barriers and consequently push forward the makeover of restrictive energy policies. Considering this, a pragmatic and straightforward business model was envisioned for the Community S project—namely the creation of P2P energy sharing communities where all its members were under the same Low Voltage/Medium Voltage (LV/MV) transformer substation. Specifically, these P2P energy sharing communities have been structured so that each municipality (i.e., providers) served its inhabitants (i.e., consumers) with surplus distributed generation from its PV systems.

This business model was trialed in three pilot projects, namely in the municipalities of Alfândega da Fé and Vila Real (Lordelo) located in the Northern region of Portugal, and the municipality of Penela located in the Central region of Portugal. Each pilot was composed of four public buildings with PV systems (i.e., prosumers) and approximately 35 grid-connected households (i.e., consumers).

Generally speaking, PV systems in public buildings generate surplus electricity during periods of low to nearly-zero electricity consumption, such as: during lunch hours; vacation periods; public holidays; weekends; before and after working hours; etc. However, at present, the Portuguese regulatory framework discourages the generation of surplus electricity for owners of PV systems for self-consumption (i.e., UPACs in Portuguese) by establishing an unattractive Feed-In tariff for this parcel of electricity. That is, the price that prosumers get from their net export of surplus distributed generation to the medium/high voltage (MV/HV) distribution grid is approximately 90% of the average monthly price in the wholesale electricity market in the Iberian Peninsula (i.e., OMIE). Simply put, this means that prosumers sell their surplus electricity to the distribution grid at a rate that is 10% lower than the rate of the electricity that they usually buy from the distribution grid as consumers (more details in Appendix A).

However, by creating P2P energy sharing communities under the same LV/MV transformer substation (as proposed in the Community S project), the surplus distributed generation would be primarily consumed locally within the boundaries of the low voltage distribution network, which would result in lower net exports of surplus distributed generation than usual to higher voltage levels (i.e., medium or high voltage network routes), thus reducing power grid stress. This can be achieved through optimal matching between supply & demand, where the surplus generation from PV systems in public buildings would be first sold to grid-connected households before being injected into the distribution grid in a Business-as-Usual (BaU) scenario.

Nonetheless, it is fundamental to highlight some remarks regarding the proposed approach. As put by Park and Yong [19], the notion that a consumer can buy electricity from a specific prosumer is only logical from a market clearing perspective. At the physical level, however, one cannot identify the source of the electricity that flows within the low voltage network into each household. In other words, technically seen, the surplus generation from prosumers cannot be stamped nor distinguished from other electricity sources and cannot be sent to targeted locations. Therefore, at present the only way to effectively simulate the P2P energy trading is by changing the load pattern in each P2P energy sharing community to match the surplus distributed generation that is injected in the grid in real-time, as a means to optimise the absorption of this surplus electricity within the LV/MV transformer substation and thus prevent to the maximum the net export of power to the next higher voltage level (i.e., to the MV/HV distribution grid).

In summary, any ICT architecture implemented to support P2P energy sharing models is only relevant to optimise the balance between supply & demand and record these information flows, but not to mechanically redirect the multiple energy flows of surplus electrons to desired physical locations under the same LV/MV transformer substation.

2.3. Supporting ICT Infrastructure

The deployment of P2P energy sharing business models is only possible with the support of an underlying smart ICT infrastructure layer. To enable that, VPS implemented an interconnected ICT network composed of smart Home Energy Management Systems (HEMS) and smart Building Energy Management Systems (BEMS) (as schematically illustrated in Figure 1) that monitored and controlled in real-time granular data regarding distributed generation from prosumers and energy demand from consumers in each P2P energy sharing community. This allowed the project consortium to simulate and validate the potential monthly P2P energy sharing interactions in each low voltage P2P energy sharing community during the total time span of the field trials (i.e., from January 2018 to June 2018), which lasted 6 months.

Figure 1.

Cloogy and Kisense’s schematic representation. Source: Authors’ own elaboration.

2.3.1. Smart Home Energy Management System

For the deployment of the Community S project, each household was equipped with a smart HEMS entitled Cloogy, which allowed end-users to optimise energy usage in real-time in accordance with lower energy prices as well as remotely control specific electric devices via Cloogy’s web platform or mobile app (e.g., switching Heating, Ventilation & Air Conditioning (HVAC) systems on/off; scheduling laundry cycles, etc.). Cloogy is comprised by the following elements:

- Smart power plug: it monitors and controls electricity consumption data from any individual electrical appliance;

- Sensor/clamp: it collects consumption data from the electrical panel, as well as from PV systems (if existent);

- Transmitter: it sends data collected by the clamp to the hub;

- Hub: it receives data from the transmitter and smart power plugs, sending it to the database;

- End-user interfaces: it allows end-users to establish the working time of their electrical appliances; turn them on/off remotely and in real-time; eliminate stand-by consumption; and establish monthly electricity consumption thresholds.

The communication protocol used by Cloogy is the ZigBee (2.4 GHz) home automation technology, which provides many advantages in terms of platform standardisation and scalability. Finally, Cloogy’s easy-to-use frontend interfaces (either in the form of a web platform or mobile app) allowed end-users from households to explore processed and aggregated data regarding electricity consumption and distributed generation (if existent) in intuitive ways.

2.3.2. Smart Building Energy Management System

For the deployment of the Community S project, each public building was equipped with a smart BEMS entitled Kisense as well as a PV system, which allowed them to optimise energy usage in real-time in accordance with their own distributed generation or lower energy prices. Kisense provided advanced data analytics and forecast insights regarding electricity consumption and distributed electricity generation in public buildings via intuitive user interfaces. Some of Kisense’s functionalities include: (i) data aggregation/disaggregation and correlation for forecasting; (ii) energy tariff comparison and management; (iii) load shedding; (iv) load shifting to take full advantage of PV generation and energy tariffs; (v) savings tracking; etc. Kisense’s frontend web platform interface allowed end-users from public buildings to explore processed and aggregated data regarding electricity consumption and distributed generation in intuitive ways.

Kisense was implemented in four public buildings per pilot, as detailed below:

- Alfândega da Fé: City Hall, Municipal Library, Municipal Market, Cultural Centre;

- Penela: Multipurpose Pavilion, Penela School Centre, Espinhal School Centre, Municipal Library and Auditorium;

- Vila Real (Lordelo): Public Indoor Swimming Pool Facility; Sports Centre; Árvores School Centre, Vila Velha Museum.

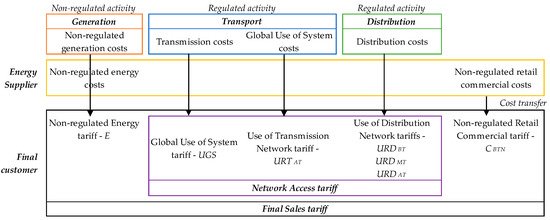

2.4. Structure of the New Final Sales Tariff

The components that make up energy tariff models worldwide usually reflect varying costs associated with the generation, transportation, distribution and sales of electricity. In Portugal, the methodology chosen by ERSE to calculate energy tariffs is based on the principle of tariff additivity [25]. This means that the Final Sales tariff applicable to final customers are in fact a sum of different supply activity tariffs associated with the use of energy network infrastructures to deliver electricity.

Illustratively, the Final Sales tariff paid by final customers connected to the low voltage networks is higher than that paid by final customers connected to the medium or high voltage networks, given that the electricity used by the former must access greater distribution network routes to reach its endpoint. The Final Sales tariff presented to final customers in Portugal is obtained through the sum of the following tariffs:

- Energy tariff (E): this elementary tariff allows Energy Retailers to profit from activities associated with the purchase and sale of electricity and any operational costs attached to it;

- Retail Commercial tariff (CBTN): this tariff corresponds to the price set by each Energy Retailer in the liberalised energy market, which is negotiated individually with each end-user and which reflects the profitability of Energy Retailers to keep their regulated supply activities;

- Network Access tariff (NAT): this tariff is paid by all final customers in the liberalised energy market. It is composed by the integration of three distinct types of tariffs:

- ○

- Global Use of System tariff (UGS): it allows Transmission System Operators (TSOs) to profit from activities associated with the operation of the system; with energy or environmental policy measures; with matters of economic interest; or with the maintenance of the contractual balance. This activity is conducted on a monopoly basis in Portugal;

- ○

- Use of Transmission Network tariff (URTAT): it allows TSOs to profit from activities associated with the transportation of electricity, namely the setup, operation and maintenance of extra high voltage networks and interconnections. This activity is conducted on a monopoly basis in Portugal;

- ○

- Use of Distribution Network tariff (URDAT; URDMT; URDBT): it allows DSOs to profit from activities associated with the distribution of electricity, namely the planning, set up, operation and maintenance of low, medium and high voltage networks.

Figure 2 schematically represents all the abovementioned components of the final sales tariff that is offered in the liberalised Portuguese energy market:

Figure 2.

Components of the final sales tariff presented to final customers in the liberalised Portuguese energy market. Source: Adapted from Energy Services Regulatory Authority [26].

In summary the general structure of the Final Sales tariff presented to low voltage network customers in Portugal is composed by the sum of the following:

- E—Energy tariff;

- UGS—Global Use of System tariff to be applied by DSOs;

- URTAT—Use of Transmission Network tariff in high voltage networks;

- URDAT—Use of Distribution Network tariff in high voltage networks;

- URDMT—Use of Distribution Network tariff in medium voltage networks;

- URDBT—Use of Distribution Network tariff in low voltage networks;

- CBTN—Retail Commercial Tariff in low voltage networks.

As previously explained, this demonstration project argued that the Final Sales tariff for the surplus generation traded within low voltage P2P energy sharing communities should be exempted from NATs associated with medium and high voltage networks (which are approved and published annually by ERSE [27]). Considering that the regulated tariff system in Portugal is additive, the simple subtraction of the NATs associated with medium voltage networks URDMT (which already implicitly encompasses the NATs associated with high voltage networks, namely URTAT and URDAT) from the NATs associated with low voltage networks URDBT can effectively reduce the Final Sales tariff. This calculation is shown in Table 1.

Table 1.

Network Access tariff reductions applicable for surplus distributed electricity traded within low voltage P2P energy sharing communities.

The proposed network access tariff reductions were only considered for on-peak hours and mid-peak hours. That is because the proposed business model considered solar energy as the only source of surplus distributed generation, and there is zero or nearly-zero distributed generation from PV systems during off-peak hours and super off-peak hours. Also, the proposed business model disregarded the use of batteries (either automotive or stationary) due to their high investment costs and overly low return of investment at present.

In summary, the main idea behind the proposed business model is that the surplus renewable generation that is locally produced and distributed among the low voltage P2P energy sharing community should be exempted to bear the costs associated with higher voltage levels (i.e., medium and high voltage networks). However, given that these P2P energy sharing communities would still be connected to these higher voltage levels as a means to provide security of supply in case of shortages within the low voltage grid level, this paper argues that this contingent security of supply could also be financially considered in a renewed NAT (eventually represented by an additional variable in the NAT such as security of supply insurance). This represents a reasonable recommendation especially considering that the margin of the proposed NAT reduction in this study is fairly wide (ranging from 22.1% to 56.4%). Nonetheless, this idea goes beyond the scope of the demonstration proposed in this study and will be considered in future work.

3. Results

3.1. Implementation of the Proposed Business Model

In possession of the granular data from the interconnected smart ICT network, the consortium was able to evaluate the amount of surplus electricity from PV systems in public buildings that were sold each month to the distribution grid under a BaU scenario. In fact, this surplus generation represented the parcel of electricity that could have been shared with other grid-connected peers in each low voltage P2P energy sharing community in a prospective deregulated scenario.

For each pilot, this overall amount of surplus electricity from public buildings was aggregated and then equitably divided between all participating households each month. Then, it was converted to monetary values, following the proposed NAT reductions calculated in Table 1. These final monetary values per household represented their potential monthly energy bill reductions in case they were able to buy the surplus electricity from public buildings under the proposed new energy tariff for low voltage P2P energy sharing communities.

As a way to demonstrate the viability of the proposed business model and to motivate participating households, the consortium offered free of charge these monthly NAT reductions to them in the form of direct rebates in their energy bills during the 6-month field trial period (i.e., from January to June 2018) instead of selling the surplus electricity per se as expected in a deregulated scenario. For that purpose, Energia Simples tailored a unique and advantageous energy contract for the Community S project that incorporated these NAT reductions, as seen in Table 2.

Table 2.

Energy contract tailored by Energia Simples for participants of the Community S project, which encompassed the proposed NAT reductions for the surplus electricity shared within each pilot.

As can be inferred from the analysis of Table 2, the proposed NAT reductions translated to effective energy bill reductions that ranged from 15.1% to 23.6% depending on the energy tariff structure of each participating household.

Given that P2P energy sharing transactions are not yet deregulated in Portugal, it is important to highlight that the only way for participating households to have had (indirect) access to the monthly surplus generation from photovoltaic (PV) systems was through accession to this contract, which was voluntary and did not offered any drawbacks to their participation in the project in case they opted not to.

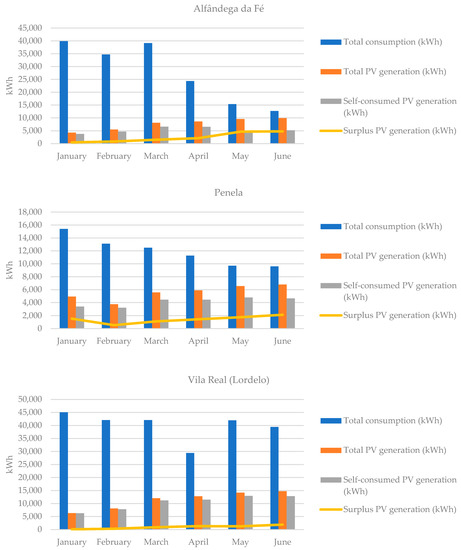

3.2. Data Analysis

Because of budget constraints, not all participating public buildings could be equipped with PV systems within the scope of this demonstration project. In such cases, simulations were carried out to assess what their potential PV generation output would be in case they had PV systems, using for that purpose data from a software entitled PVGIS [28]. On the other hand, in the case of those buildings equipped with PV systems, their monthly PV generation output was monitored through Kisense as previously stated. By doing so, it was possible to evaluate the monthly generation output (i.e., real or simulated) of the 12 participating public buildings in the Community S project.

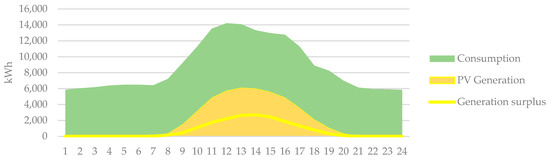

Using this data, as well as data regarding the electricity consumption profile of each respective public building, it was possible to calculate the monthly net export of surplus electricity that was injected (or would have been injected in the case of simulations) in the distribution grid during the 6-month field trial period. This data is graphically illustrated in Figure 3.

Figure 3.

Distribution of total electricity consumption, total PV generation, parcel of self-consumed PV generation and resulting parcel of surplus electricity per month during the field trial period for Alfândega da Fé, Penela and Vila Real (Lordelo), respectively. Source: Authors’ own elaboration.

As previously mentioned, the monthly rebates that each participating household could have received varied based on the following criteria:

- The aggregated amount of available surplus generation from PV systems in participating public buildings each month in each pilot (e.g., surplus generation is higher during Summer months);

- The number of participating households in each pilot;

- The specific tariff structure of each participating household (i.e., flat rate, 2- or 3-period Time-Of-Use rates);

- The electricity usage profile of each participating household in the case of 2- or 3-period Time-Of-Use rates (i.e., NAT reductions could only be applied during mid-peak and on-peak hours for such tariff structures, as there is no distributed generation during off-peak and super off-peak hours). This meant that if the overall consumption profile of a given household during mid-peak and on-peak hours in a given month was lower than the amount of available surplus PV generation per household in that given month, this given household would not be able to access 100% of the tariff reduction.

3.3. Economic Feasibility Analysis

In order to validate the economic feasibility of the proposed business model, the consortium performed analysis from the perspective of both electricity consumers and prosumers.

3.3.1. Consumers’ Perspective

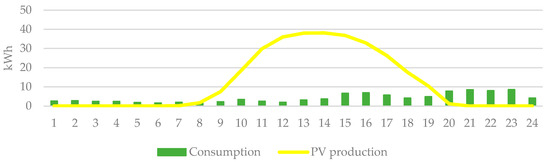

From the consumers’ perspective, the economic feasibility analysis of the proposed NAT reduction during the 6-month trial period (i.e., January–June 2018) was performed by comparing the sum of the hourly energy consumption data of a reference household in a given pilot with the sum of the available hourly surplus renewable generation from the 4 public buildings per household in that pilot (i.e., City Hall, Municipal Market, Municipal Library and Cultural Centre).

The reference household data was selected through random sampling from a data pool comprising data from all participating consumers that had their HEMS working properly throughout the 6-month trial period. Given that the selected data belonged to a consumer from Alfândega da Fé, the reference data for the available hourly surplus renewable generation per household also came from the 4 public buildings in Alfândega da Fé, as illustrated in Figure 4.

Figure 4.

Comparison between the sum of the hourly energy consumption data of a reference household and the sum of the hourly available surplus renewable generation data from the 4 public buildings in Alfândega da Fé per household during the 6-month trial period. Source: Authors’ own elaboration.

By analysing Figure 4, it can be inferred that there was a significant amount of surplus renewable generation that could have been shared with each household during the 6-month trial period.

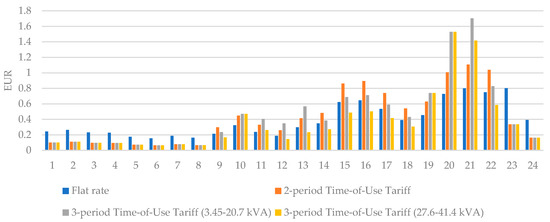

Furthermore, the economic feasibility analysis of the proposed NAT reduction also considered the 4 different energy tariff options for end-users (i.e., Flat rate; 2-period Time-Of-Use rate; 3-period Time-Of-Use rates (3.45–20.7 kVA & 27.6–41.4 kVA)). This step is extremely important given that the hourly NAT costs varied differently according to each energy tariff option, as given in Figure 5.

Figure 5.

Comparison of the sum of the hourly NAT costs of different energy tariff options during the 6-month trial period. Source: Authors’ own elaboration.

Flat Rate (1.15–20.7 kVA)

In this energy tariff option, there is no separation between on-peak and off-peak hours, which means that the NAT cost is immutable as presented in Table 1.

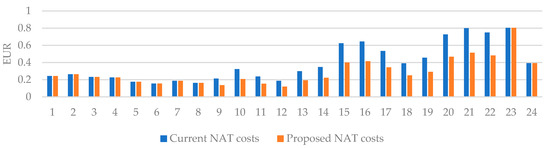

The economic feasibility is assessed by calculating the difference between the sum of hourly NAT costs in a BaU scenario and the sum of hourly NAT costs in the proposed business model during hours of solar irradiation (i.e., when PV cells in public buildings are generating renewable electricity). The NAT cost fluctuations are presented in Figure 6.

Figure 6.

Comparison between the sum of hourly NAT costs for a flat rate in a BaU scenario and in the proposed business model during the 6-month trial period. Source: Authors’ own elaboration.

In view of this, the summed difference of NAT costs during the 6-month trial period went from approximately €9.3 to €6.2, resulting in total savings of €3.1.

2-Period Time-Of-Use Tariff (3.45–20.7 kVA)

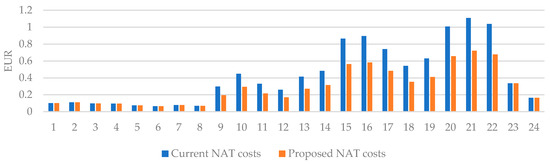

In this energy tariff option, there are two distinct blocks of time (i.e., on-peak and off-peak hours), which means that NAT costs vary throughout the day as presented in Table 1.

The economic feasibility is assessed by calculating the difference between the sum of hourly NAT costs in a BaU scenario and the sum of hourly NAT costs in the proposed business model during hours of solar irradiation (i.e., when PV cells in public buildings are generating renewable electricity). The NAT cost fluctuations are presented in Figure 7.

Figure 7.

Comparison between the sum of hourly NAT costs for a 2-period Time-of-Use rate in a BaU scenario and in the proposed business model during the 6-month trial period. Source: Authors’ own elaboration.

In view of this, the summed difference of NAT costs during the 6-month trial period went from approximately €10.2 to €6.8, resulting in total savings of €3.4.

3-Period Time-Of-Use Tariff (3.45–20.7 kVA)

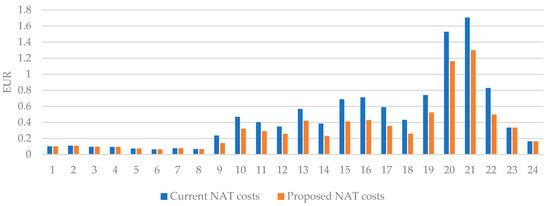

In this energy tariff option, there are three distinct blocks of time (i.e., on-peak, mid-peak and off-peak hours), which means that NAT costs vary throughout the day as presented in Table 1.

The economic feasibility is assessed by calculating the difference between the sum of hourly NAT costs in a BaU scenario and the sum of hourly NAT costs in the proposed business model during hours of solar irradiation (i.e., when PV cells in public buildings are generating renewable electricity). The NAT cost fluctuations are presented in Figure 8.

Figure 8.

Comparison between the sum of hourly NAT costs for a 3-period Time-of-Use rate (3.45–20.7 kVA) in a BaU scenario and in the proposed business model during the 6-month trial period. Source: Authors’ own elaboration.

In view of this, the summed difference of NAT costs during the 6-month trial period went from approximately €10.8 to €7.8, resulting in total savings of €3.0.

3-Period Time-Of-Use Tariff (27.6–41.4 kVA)

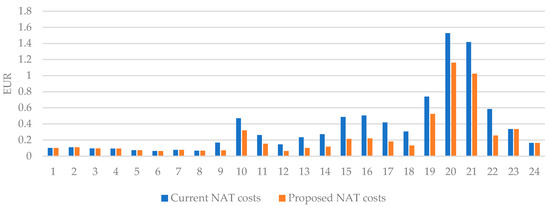

In this energy tariff option, there are three distinct blocks of time (i.e., on-peak, mid-peak and off-peak hours), which means that NAT costs vary throughout the day as presented in Table 1.

The economic feasibility is assessed by calculating the difference between the sum of hourly NAT costs in a BaU scenario and the sum of hourly NAT costs in the proposed business model during hours of solar irradiation (i.e., when PV cells in public buildings are generating renewable electricity). The NAT cost fluctuations are presented in Figure 9.

Figure 9.

Comparison between the sum of hourly NAT costs for a 3-period Time-of-Use rate (27.6–41.4 kVA) in a BaU scenario and in the proposed business model during the 6-month trial period. Source: Authors’ own elaboration.

In view of this, the summed difference of NAT costs during the 6-month trial period went from approximately €8.7 to €5.7, resulting in total savings of €3.0.

3.3.2. Prosumers’ Perspective

In the context of the business model framework proposed in this study, the economic feasibility for the prosumers’ perspective took into account the existing legal framework on distributed renewable generation for self-consumption (i.e., Decree-Law no. 153/2014 [25], which is thoroughly reviewed on Appendix A). As previously explained, at present in Portugal the net export of surplus distributed renewable generation must be sold to the Last Resort Retailer (i.e., EDP Universal) at the price of 90% of the average monthly price in the wholesale electricity market in the Iberian Peninsula (OMIE). Simply put, this means that at present prosumers are penalised in Portugal, since the Feed-In tariff is 10% lower than the rate of the electricity that is usually bought from the distribution grid.

However, as a means to bring more fairness to end-users that decided to become active participants in future local energy markets, this study proposed to equate the Feed-In tariff with the average monthly price in the wholesale electricity market in the Iberian Peninsula (OMIE). To illustrate the economic feasibility of the proposed approach for the perspective of a single prosumer, this study compared the price differences between the current Feed-In tariff in Portugal and the proposed new Feed-In tariff on the sum of hourly surplus renewable generation from the 4 public buildings in Alfândega da Fé (i.e., City Hall, Municipal Market, Municipal Library and Cultural Centre) during the 6-month trial period (see Figure 10).

Figure 10.

Sum of hourly photovoltaic generation, electricity consumption and surplus renewable generation from the 4 public buildings in Alfândega da Fé during the 6-month trial period. Source: Authors’ own elaboration.

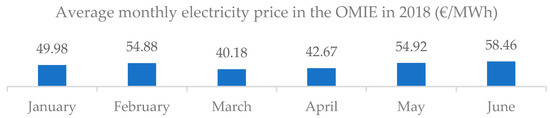

Figure 11 presents the average monthly price in the wholesale electricity market in the Iberian Peninsula (OMIE) during the 6-month trial period (i.e., January–June 2018).

Figure 11.

Average monthly electricity price (€/MWh) in the wholesale market in the Iberian Peninsula (OMIE) during the 6-month trial period (i.e., January–June 2018). Source: Adapted from OMIE [29].

In view of the data presented in Figure 11, the average sales price of the net export of surplus renewable generation using the current feed-in tariff during the 6-month trial period can be calculated using the following expression:

P = [(49.98 + 54.88 + 40.18 + 42.67 + 54.92 + 58.46)/6] × 90% = 45.16 €/MWh,

Then, considering that the total availability of surplus renewable generation during the 6-month trial period in the four public buildings in Alfândega da Fé amounted to 17,953.00 kWh, the average profit that it got from this net export can be calculated using the following formula:

P = 17.953 MWh × 45.16 €/MWh = €810.76,

However, under the prospective new scenario (without a penalisation of 10%), the profit that it would have obtained would be higher, as presented in the following formula:

P = [(49.98 + 54.88 + 40.18 + 42.67 + 54.92 + 58.46)/6)] €/MWh × 17.953 MWh = 900.96 €/MWh,

In conclusion, it can be inferred that the four public buildings in Alfândega da Fé would get an additional €90.2 for all surplus renewable generation traded within the low voltage energy community during the 6-month trial period (in comparison to injecting it in the distribution grid with the current Feed-In tariff).

4. Discussion

While absent deregulation obstructs the implementation of effective P2P energy sharing markets in Portugal, such demonstration projects are essential to challenge restrictive legislative frameworks and policies that do not keep up with the pace of technological and socioeconomic innovations, thus fomenting fruitful discussions not only about incremental change, but also about transition policies that can be exceptionally transformative and complement existing ones. In this sense, the Community S can be taken as a reference model for the further development of increasingly more complex business models in this field of research, thus helping to build the emerging energy regime and disrupting the old one. Surely, a wide array of additional questions arises from the content presented in this paper, which should be addressed in future R&D projects, namely:

- Considering that the low voltage P2P energy sharing communities would still need to use existing low voltage energy networks, shouldn’t there be a usage fee to pay for the maintenance and running costs of these infrastructures? If so, how these costs could be spread in the P2P energy sharing pricing structure?

- In order to increase the resilience of P2P energy sharing markets, shouldn’t it also accommodate a more diversified group of end-users offering different flexibility services other than just distributed renewable generation (e.g., electric vehicles, stationary energy storage, Demand-Response programmes, etc.)?

- Is blockchain technology a necessity in the deployment of such market models or should the centralised management model by traditional utilities be maintained?

- How should a platform architecture be like to comprehensively embody all decentralised, flexible, independent and direct interactions among grid-connected peers within P2P energy sharing markets?

- As for the optimisation of the services being delivered in a P2P energy sharing market, shouldn’t a peer-to-community also be considered to unlock additional benefits to the P2P energy sharing community (as in an aggregated resource pool that is managed in a collective manner) rather than a strictly peer-to-peer approach?

- Should all transactions be monetised, or could P2P energy sharing models also embody free-of-charge electricity sharing to disadvantaged peers in energy poverty?

In view of this, the Flexigy project is introduced (i.e., R&TD Co-Promotion Project no. 034067; Call no. 03/SI/2017, SI I&DT). This project intends to carry on the R&D activities accomplished within the framework of the Community S project, aiming to address the issues highlighted in the abovementioned questions. Its main objective is to design an online marketplace platform where grid-connected peers will be able to trade electricity with each other and sell various flexibility services to an aggregator (i.e., a central coordinator) in an ad hoc manner. Moret and Pinson [6] argues that the presence of such third-party supervision simplifies market regulation and the communication with the system operator. In view of this, the development of such a platform could be of interest for utilities or energy providers that aim to evolve their energy services provision in the face of ever-growing and inevitable prosumer-centric energy markets.

In effect, the new paradigm brought up by both projects empowers end-users to become their own energy traders, thus eliminating the traditional role of utilities that usually intermediate energy services on their behalf. By doing so, these two projects expect to provide novel insights associated with the P2P energy sharing concept that will spur the development of more decentralised, democratic, accessible, adaptive, networked, collaborative, sustainable and smarter energy systems.

5. Conclusions

This study envisioned a novel approach for the collaborative use of the surplus electricity generation from PV systems in public buildings within low voltage P2P energy sharing communities. Namely, it proposed the creation of P2P energy sharing communities where all its members are under the same LV/MV transformer substation. In this way, this study argued that the surplus renewable generation that is locally produced and distributed among the low voltage P2P energy sharing community should be exempted to bear the costs associated with higher voltage levels (i.e., medium and high voltage networks).

All things considered, the feasibility of the proposed business model was highlighted in this paper, which would have benefited all actors involved in the P2P energy sharing model in case this market was deregulated in Portugal. Illustratively, consumers would have paid a reduced price for the electricity bought from grid-connected prosumers within the P2P energy sharing market in comparison to the electricity bought from energy utilities, as in this case they would be exempted to pay for Network Access Tariff charges in its totality. This translated to an effective reduction of the global energy tariff that ranged between 15.1% and 23.6%, depending on the energy tariff structure of each household. During the 6-month trial period, the economic analysis showcased that this economic benefit would have accumulated to up to €3.4 per consumer.

Similarly, prosumers would have made bigger profits by trading surplus generation within the P2P energy sharing community rather than selling it to the distribution grid, given that at present in Portugal the Feed-In tariff pays 90% of the monthly price of electricity purchased from the distribution grid. During the 6-month trial period, this profit would have accumulated to approximately €90.2 for the four public buildings in Alfândega da Fé.

Furthermore, it would have strategically benefited transmission and distribution network operators (i.e., TNOs & DNOs), as P2P energy sharing transactions within low voltage distribution networks reduce the congestion in MV/HV distribution networks and HV/Extra HV transmission lines. Consequently, this would result in the alleviation of grid maintenance costs, in the mitigation of transmission and distribution losses, in the adjournment of investments related to the reinforcement of transmission lines and, altogether, in the balancing of the energy grid.

As future work, additional sources of distributed renewable generation other than solar energy could be considered, as well as the use of batteries (either automotive or stationary) for optimisation of supply & demand within each P2P energy sharing community. Additionally, this study highlighted that an additional variable could be considered in a renewed NAT (referring to a security of supply insurance), since that the P2P energy sharing communities would still be connected to these higher voltage levels as a means to provide security of supply in case of shortages within the low voltage grid level. This represents a reasonable recommendation especially considering that the margin of the proposed NAT reduction in this study is fairly wide (ranging from 22.1% to 56.4%).

Author Contributions

Conceptualisation, L.P.K., A.K., L.M., J.L. and M.d.A.; methodology; L.P.K., A.K., L.M., J.L. and M.d.A.; validation, L.P.K., A.K., L.M., J.L. and M.d.A.; formal analysis, L.P.K. and A.K.; investigation, L.P.K. and A.K.; resources, L.P.K. and A.K.; data curation, L.P.K. and A.K.; writing—original draft preparation, L.P.K. and A.K.; writing—review and editing, L.P.K. and A.K.; software L.P.K. and A.K.; visualisation, L.P.K. and A.K.; supervision, L.P.K., A.K., L.M., J.L. and M.d.A.; project administration, L.P.K. and A.K.; funding acquisition, L.P.K., A.K., L.M., J.L. and M.d.A. All authors have read and agreed to the published version of the manuscript.

Funding

The development of this manuscript was supported by the Flexigy project, which is co-funded by the Portugal 2020 programme under the Interface Programme and by the EU under the European Structural and Investment Funds (FEEI) [R&TD Co-Promotion Project No. 034067; Call No. 03/SI/2017, SI I&DT].

Acknowledgments

The Community S project (formally implemented as NetEffiCity project) was co-funded by the Portugal 2020 programme under the Operational Programme for Competitiveness and Internationalisation (COMPETE 2020), as well as by the EU under the European Regional Development Fund (FEDER) [Demonstration Co-Promotion Project no. 18015; Call no. 31/SI/2015, SI I&DT] with a total non-reimbursable incentive of €441,796.88.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Existing Regulatory Framework in Portugal with Potential to Facilitate the Development of P2P Energy Sharing Market Models

The successful emergence of P2P energy sharing models relies on several key factors, of which includes the support of national and local governments. The institutional and political back-up in the form of clear legal frameworks, suitable subsidy schemes or allocation of costs is essential to incentivise and facilitate the development of P2P energy sharing energy markets.

At present, the legal framework in Portugal most closely related with the proposed P2P energy sharing business model is the one regarding distributed generation of electricity for self-consumption (i.e., prosumption scheme). This legal framework was deregulated in 2014, after the approval of the New Distributed Generation Regime through Decree-Law no. 153/2014 [25]. This new Decree-Law was enforced to substitute both Decree-Laws no. 363/2007 and no. 34/2011, which established the legal regimes for micro- and mini-generation of distributed electricity, respectively. In view of this, Decree-Law no. 153/2014 established two new distributed generation schemes, which are:

- Prosumption scheme, referred as Generation Units for Self-Consumption (UPACs); and

- Production scheme, referred as Small Generation Units (UPPs).

The abovementioned Decree-Law describes the prosumption scheme (UPACs) as the following:

Translation of the original Portuguese quotation:

“(...) the electricity generated for self-consumption is predominantly used in the facility associated with the generation unit, with the possibility to connect it to the distribution grid (RESP) for the sale of the surplus generation at market price. It should be noted that, under this generation scheme, the prosumer benefits when the generation unit is sized accordingly to the actual consumption needs of the facility.”

Furthermore, Decree-Law no. 153/2014 established two options for the sale of the surplus generation from UPACs in Portugal:

Regulated energy market (Clause 23–27)

It refers to the establishment of sales contract with the Last Resort Supplier (i.e., EDP Universal) within the regulated energy market, which is conducted on a monopoly basis in Portugal, as explained below:

Translation of the original Portuguese quotation (Clause 23):

“Whenever electricity from an UPAC originates from a renewable energy source, the capacity of this UPAC does not exceed 1 MW and the installation is connected to the distribution grid (RESP), the prosumer can celebrate a contract with the Last Resort Supplier to sell any surplus electricity. The Last Resort Supplier formalises the purchase of the surplus electricity from the UPAC when the prosumer requests so.”

Additionally, Clause 24 of the referred Decree-Law defines the remuneration scheme for the sale of surplus distributed generation from UPACs to the Last Resort Supplier within the regulated energy market in Portugal (i.e., Feed-In tariff), setting its price at 90% of the simple arithmetic mean of the daily closing prices of electricity for a given month in the wholesale energy market in the Iberian Peninsula (i.e., OMIE). This means that at present the Feed-In tariff is penalised in Portugal, as it is 10% lower than the rate of the electricity that is usually bought from the distribution grid.

Liberalised energy market (Clause 28)

It refers to the establishment of bilateral sales contract with a preferred Energy Retailer/Aggregator within the liberalised energy market in Portugal, as explained below:

Translation of the original Portuguese quotation:

“The producer who does not establish a sales agreement with the Last Resort Supplier to sell electricity in the terms of Clause 23, therefore establishing another type of commercial relationship (namely the sale of electricity in organised markets or through a bilateral sales contract of electricity that is not consumed by the facility associated with the PV system for self-consumption), is subject in this part to the conditions to be set by the respective licensing entity, having as reference the discipline within the legal regime of electricity generation that contemplates the intended commercial relationship.”

Finally, Decree-Law no. 215-B/2012 [30] discourses about the role of the Aggregator (i.e., Agregador Facilitador de Mercado), who represents any Energy Retailer subject to the acquisition with market remuneration of the electricity produced by producers/prosumers under special regime, being for that matter obliged to place the purchased electricity in the energy market.

With that said, it can be inferred that albeit highly political, the liberalised energy market in Portugal still accommodates a more progressive alternative for the commercialisation of surplus distributed electricity generation, which could consequently facilitate the acknowledgement of P2P energy sharing market models in the future.

References

- Navigant Research. Energy Cloud 4.0—Capturing Business Value through Disruptive Energy Platforms; White Paper; Navigant Consulting Inc.: Chicago, IL, USA, 2018; Available online: https://www.navigant.com/-/media/www/site/insights/energy/2018/energy-cloud-4-capturing-business-value.pdf (accessed on 1 July 2019).

- Australian Renewable Energy Agency; AGL; IBM; MHC. Virtual Peer-to-Peer Energy Trading Using Distributed Ledger Technology: Comprehensive Project Assessment Report; AGL Energy Limited: Sydney, Australia, 2017. Available online: https://arena.gov.au/assets/2017/10/Final-Report-MHC-AGL-IBM-P2P-DLT.pdf (accessed on 1 July 2019).

- Parag, Y.; Sovacool, B. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Long, C.; Wu, J.; Zhang, C.; Thomas, L.; Cheng, M.; Jenkins, N. Peer-to-peer Energy Trading in a Community Microgrid. In Proceedings of the IEEE PES General Meeting, Chicago, IL, USA, 16–20 July 2017. [Google Scholar]

- Long, C.; Wu, J.; Zhang, C.; Cheng, M.; Al-Wakeel, A. Feasibility of peer-to-peer energy trading in low voltage electrical distribution networks. Energy Procedia 2017, 105, 2227–2232. [Google Scholar] [CrossRef]

- Moret, F.; Pinson, P. Energy Collectives: A Collaborative Approach to Future Consumer-Centric Electricity Markets. 2018. Advance online publication. Available online: http://pierrepinson.com/docs/MoretPinson2017_energycollective.pdf (accessed on 1 July 2019).

- Koirala, B.; Koliou, E.; Friege, J.; Hakvoort, R.; Herder, P. Energetic communities for community energy: A review of key issues and trends shaping integrated community energy systems. Renew. Sustain. Energy Rev. 2016, 56, 722–744. [Google Scholar] [CrossRef]

- European Union. Clean Energy for All Europeans; Publications Office of the European Union: Luxembourg, 2019; ISBN 978-92-79-993835-5. [Google Scholar]

- Roberts, J.; Frieden, D.; d’Herbemont, S. Energy Community Definitions. Deliverable Developed Under the Scope of the COMPILE Project: Integrating Community Power in Energy Islands (H2020-824424). 2019. Available online: https://www.compile-project.eu/ (accessed on 9 December 2019).

- Roy, A.; Bruce, A.; MacGill, I. The Potential Value of Peer-to-Peer Energy Trading in the Australian National Electricity Market. In Proceedings of the Asia-Pacific Solar Research Conference, Canberra, Australia, 29 November–1 December 2016. [Google Scholar]

- Zhang, C.; Cheng, M.; Zhou, Y.; Long, C. A Bidding System for Peer-to-Peer Energy Trading in a Grid-connected Microgrid. Energy Procedia 2016, 103, 147–152. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Jogunola, O.; Ikpehai, A.; Anoh, K.; Adebisi, B.; Hammoudeh, M.; Son, S.-Y.; Harris, G. State-Of-The-Art and Prospects for Peer-To-Peer Transaction-Based Energy System. Energies 2017, 10, 2106. [Google Scholar] [CrossRef]

- Liu, N.; Yu, X.; Wang, C.; Li, C.; Ma, L.; Lei, J. An Energy-sharing model with price-based demand response for microgrids of peer-to-peer prosumers. IEEE Trans. Power Syst. 2017, 32, 3569–3583. [Google Scholar] [CrossRef]

- Long, C.; Wu, J.; Zhou, Y.; Jenkins, N. Peer-to-peer energy sharing through a two-stage aggregated battery control in a community Microgrid. Appl. Energy 2018, 226, 261–276. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C.; Cheng, M.; Zhang, C. Performance Evaluation of Peer-to-Peer Energy Sharing Models. Energy Procedia 2017, 143, 817–822. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C. Evaluation of peer-to-peer energy sharing mechanisms based on a multiagent simulation framework. Appl. Energy 2018, 222, 993–1022. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of existing peer-to-peer energy trading projects. Energy Procedia 2016, 103, 147–152. [Google Scholar] [CrossRef]

- Park, C.; Yong, T. Comparative review and discussion on P2P electricity trading. Energy Procedia 2017, 128, 3–9. [Google Scholar] [CrossRef]

- Open Utility. A Glimpse into the Future of Britain’s Energy Economy. White Paper. 2016. Available online: https://piclo.energy/publications/piclo-trial-report.pdf (accessed on 9 December 2019).

- Vanderbron. Vaderbron. 2019. Available online: https://vandebron.nl/ (accessed on 9 December 2019).

- Sonnen Group. SonnenCommunity. 2019. Available online: https://sonnengroup.com/sonnencommunity/ (accessed on 9 December 2019).

- Software Cluster. PeerEnergyCloud: Efficient Energy Management from the Cloud. 2019. Available online: http://software-cluster.org/projects/peer-energy-cloud/ (accessed on 9 December 2019).

- Klein, L.; Matos, L.; Basílio, S.; Landeck, J. Community S: An Energy Sharing Approach towards Energy Systems. In Proceedings of the 3rd International Conference on Energy and Environment—Bringing Together Engineering and Economics, Porto, Portugal, 29–30 June 2017; ISBN 978-972-95396-9-5. [Google Scholar]

- Official Gazette of the Republic of Portugal. Decree-Law No. 153/2014. Official Gazette of the Republic of Portugal No. 202/2014, Series I from October 10, 2014. Portuguese Ministry of Environment, Land-Use Planning and Energy. 2014; pp. 5298–5311. Available online: https://data.dre.pt/eli/dec-lei/153/2014/10/20/p/dre/pt/html (accessed on 1 March 2019).

- Energy Services Regulatory Authority. How Electricity Tariffs Are Calculated. 2017. Available online: http://www.erse.pt/consumidor/electricidade/querosabermais/comosaocalculadasastarifasdeelectricidade/Paginas/default.aspx (accessed on 1 March 2019).

- Official Gazette of the Republic of Portugal. Directive No. 2/2018. Part E: Energy Services Regulatory Authority. Tariffs and Prices of Electricity and Other Services in 2018. Official Gazette of the Republic of Portugal No. 3, Series II from January 4, 2018. pp. 310–386. Available online: http://www.erse.pt/pt/electricidade/tarifaseprecos/2018/Documents/Diretiva%202_2018%20Tarifas%202018.pdf (accessed on 1 March 2019).

- European Commission. Photovoltaic Geographical Information System (PVGIS)—Geographical Assessment of Solar Resource and Performance of Photovoltaic Technology; European Commission, Joint Research Centre, Institute for Energy, Renewable Energy Unit: Ispra, Italy, 2012; Available online: http://re.jrc.ec.europa.eu/pvgis/ (accessed on 1 March 2019).

- OMIE. Market Results. 2018. Available online: http://m.omie.es/pt/inicio?m=yes (accessed on 9 December 2019).

- Official Gazette of the Republic of Portugal. Decree-Law No. 215-B/2012. Official Gazette of the Republic of Portugal No. 194/2012, 1st Supplement, Series I from October 8, 2012. Portuguese Ministry of Economy and Employment. 2012; pp. 5588-45–5588-133. Available online: https://data.dre.pt/eli/dec-lei/215-b/2012/10/08/p/dre/pt/html (accessed on 1 March 2019).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).