Comparative Analysis of Adjustable Robust Optimization Alternatives for the Participation of Aggregated Residential Prosumers in Electricity Markets

Abstract

1. Introduction

1.1. Overview

1.2. Literature Review

1.3. About the Present Paper

- Propose a model for market participation of prosumer aggregation including the effects of multiple sources of uncertainty, i.e., energy prices, PV production, electrical and thermal demand, and including the effects of battery degradation.

- Propose modified versions of ARO to counter conservatism for prosumer aggregation by changes in the model regarding the budget of uncertainty and comparing performance with hybrid robust/stochastic solutions.

- Present numerical results to demonstrate the advantages of the proposed modifications over deterministic formulations in terms of both operation cost and risk. These tests are performed on a home energy management system with data from a real-life demonstrator.

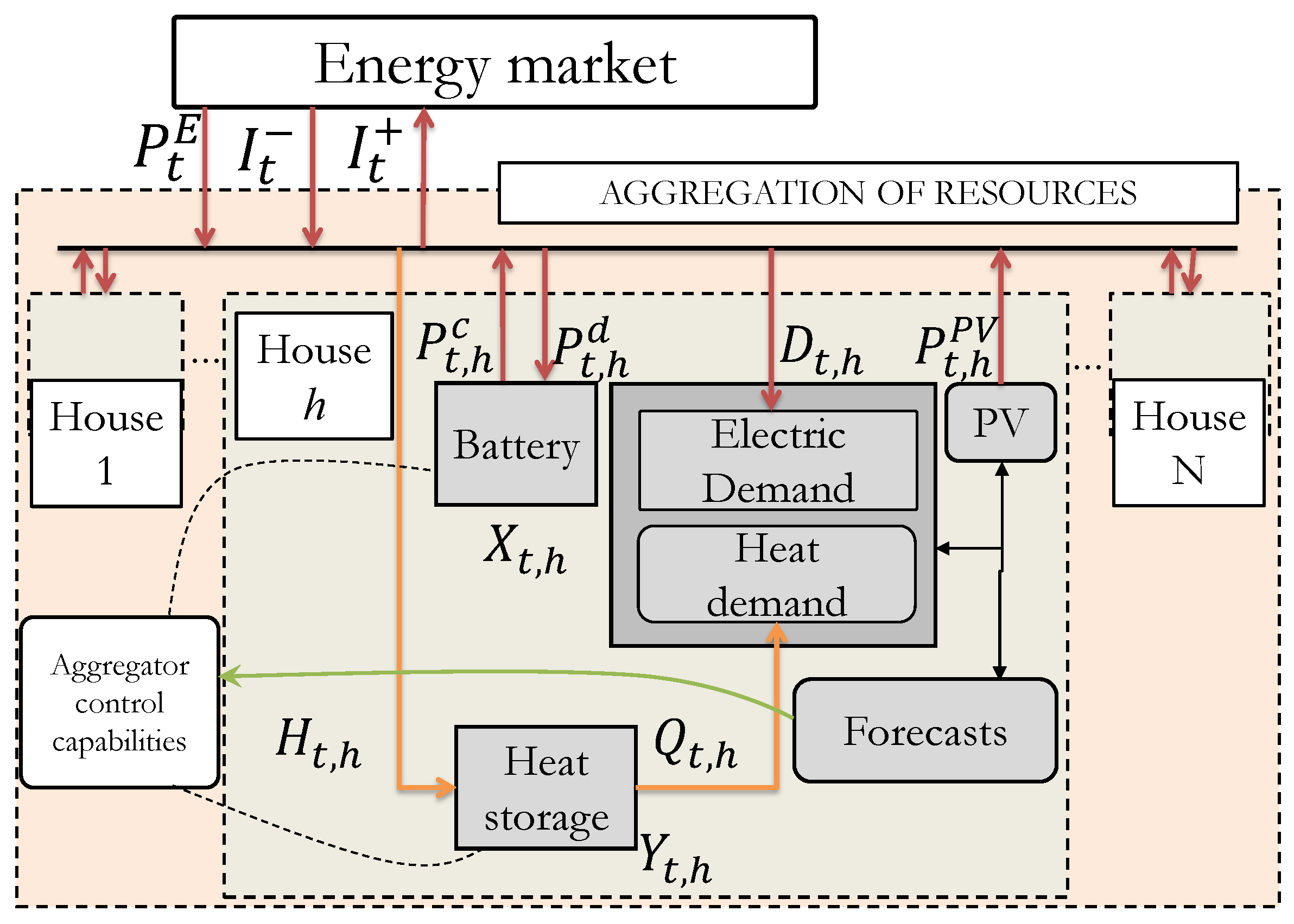

2. Framework and Mathematical Model

2.1. Objective Function

- : the cost of the day-ahead traded energy with the wholesale market.

- : the cost of purchasing additional blocks of energy (negative imbalance) and the prices received for selling surplus energy (positive imbalance) due to deviations with respect to the day-ahead committed energy. Imbalance prices presume an indirect penalization given that they are less attractive than settled day-ahead prices.

- : cycling or equivalent degradation cost of the batteries in each household h. This cost is a function of the SOC vector (), i.e., the SOC of each battery during the day-ahead operation time horizon, provided that the SOC represents the cycling pattern.

2.2. Load Balance Constraints

2.3. BESS Constraints

2.4. TES Constraints

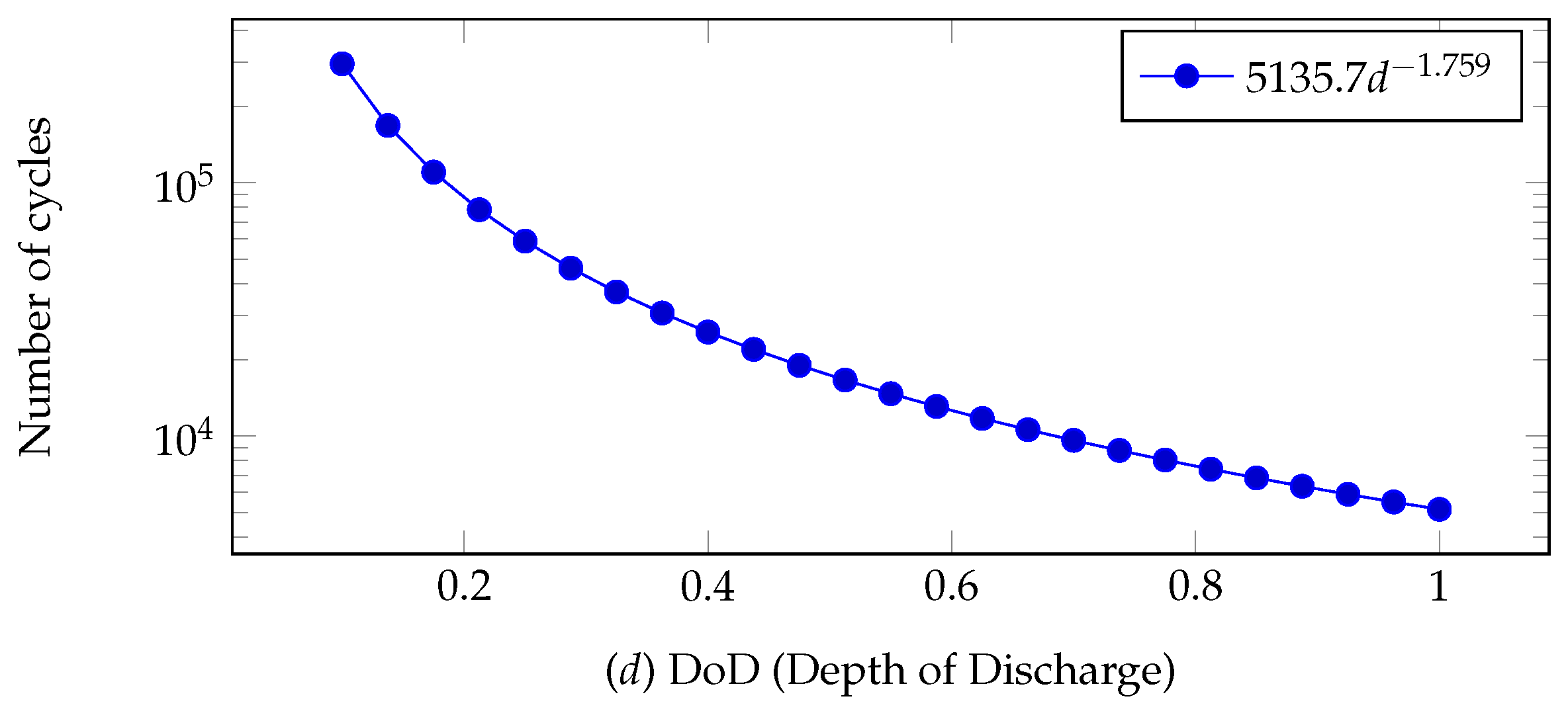

2.5. Battery Degradation Costs

3. Robust Counterpart

- (27): is the robust counterpart of the objective function.

3.1. Modification Alternatives to the Original Formulation

- Create a number of initial samples using the probabilistic price forecasts, which are based on Kernel Density Estimation (KDE), and define a target number of scenarios.

- Calculate KD for each pair of scenarios in the current set. This calculation leads to a Kantorovich Distance Matrix (KDM).

- For each scenario, identify its closest neighbor j. This can be done by identifying the lowest value in each row i of the KDM.

- For each closest neighbor j in each row i, calculate , where is the probability of scenario i.

- From the i-position vector containing of all values of , select the lowest value. Identify scenario i.

- Eliminate scenario i, and assign a probability of i to . Update the KDM.

- Repeat Steps 3–6 until the target number of scenarios is obtained.

3.1.1. Modifications Regarding Objective Function

3.1.2. Modifications Regarding PV and Demand Uncertainty

3.1.3. Modifications Regarding Control Parameter

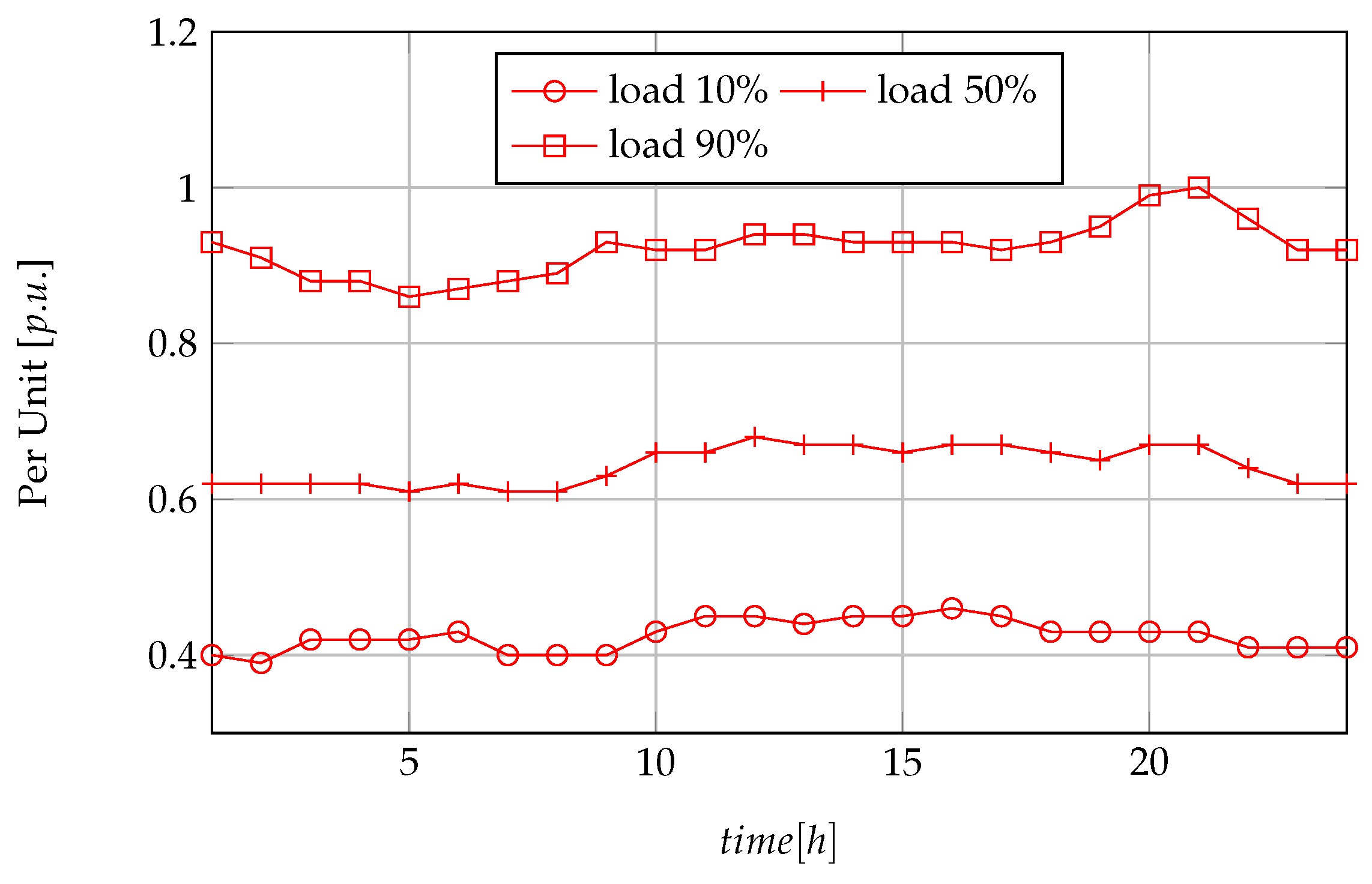

3.2. Electrical Load Forecasts

3.3. PV Forecasts

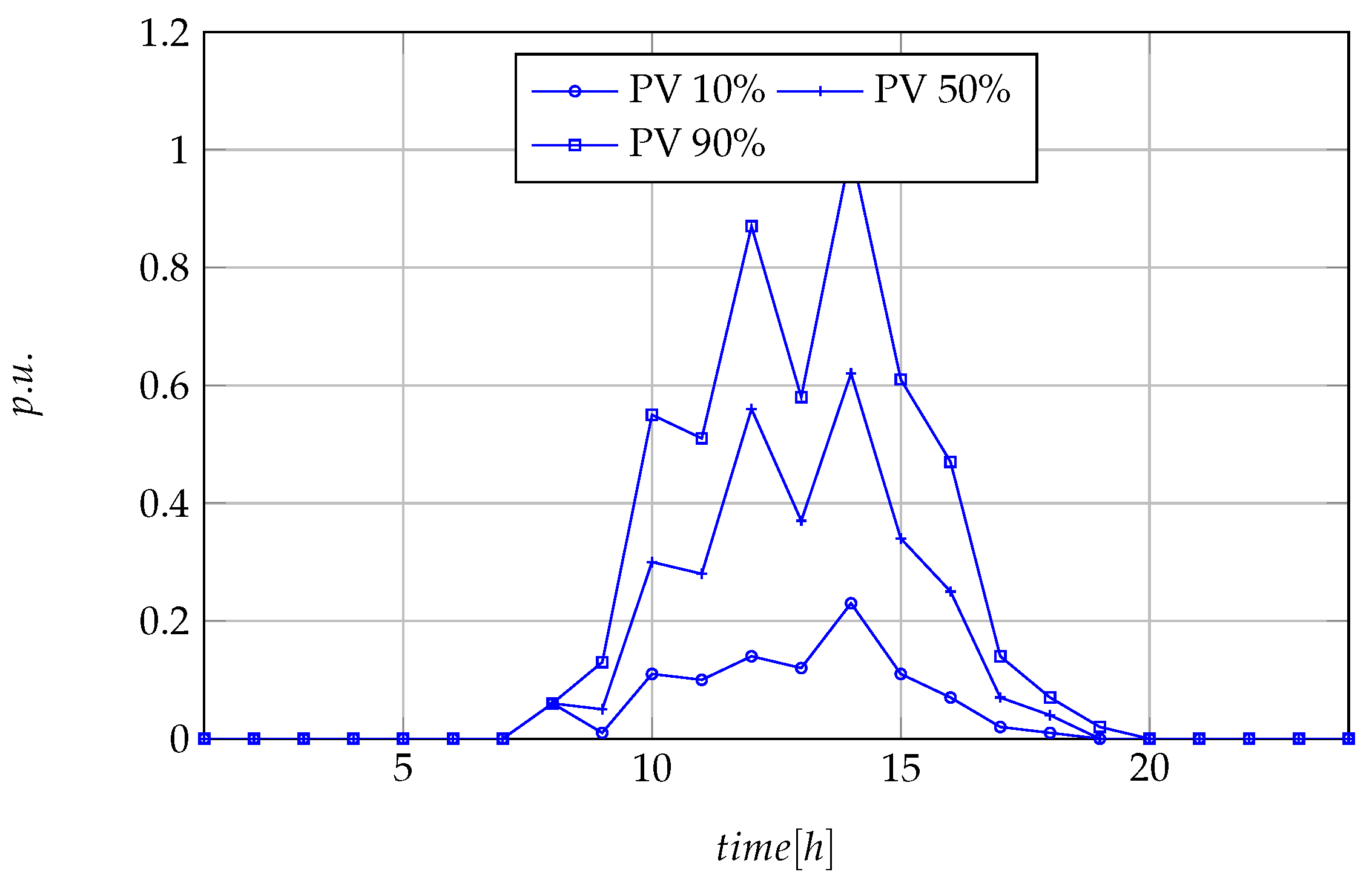

3.4. Thermal Load Forecasts

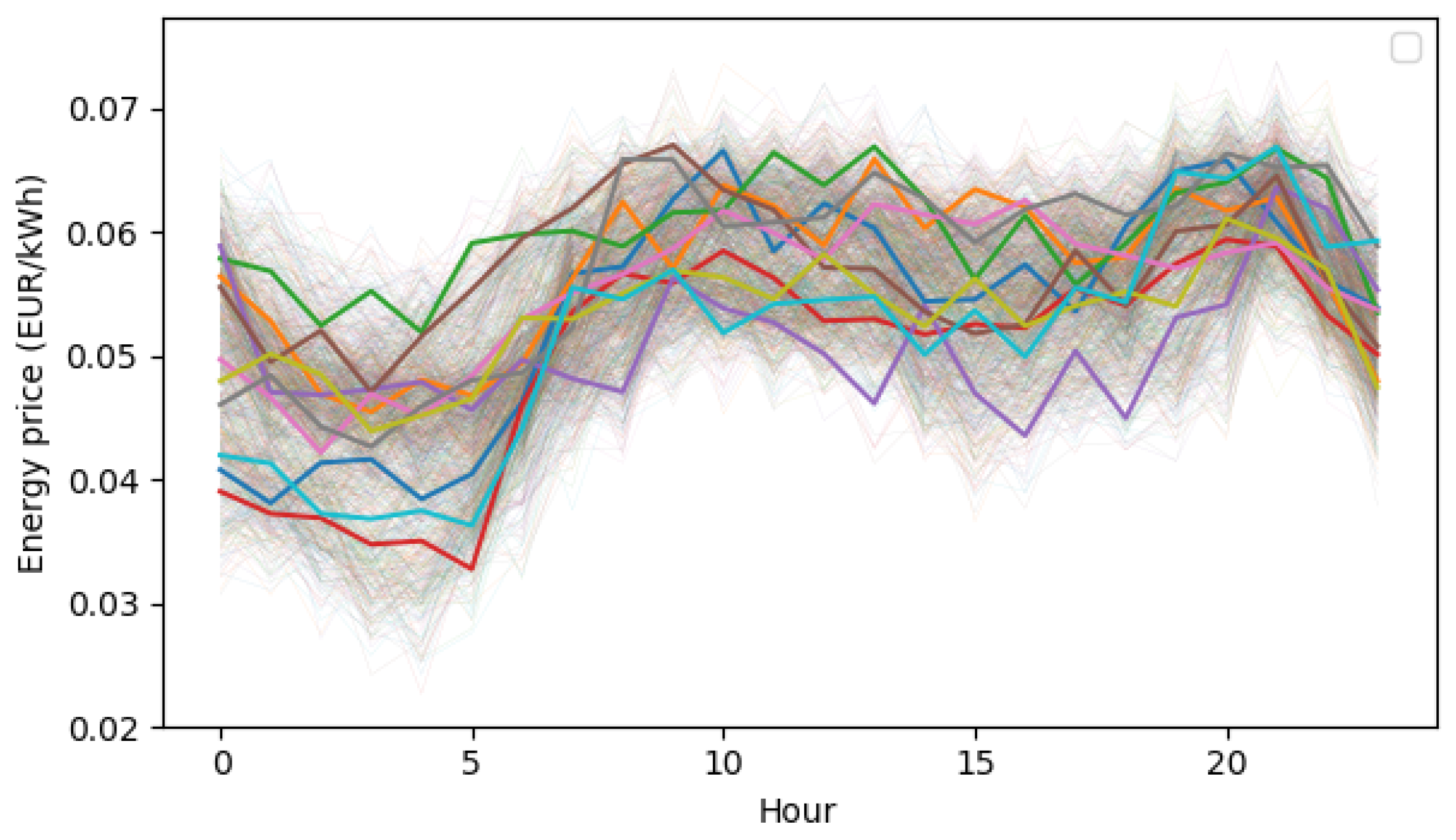

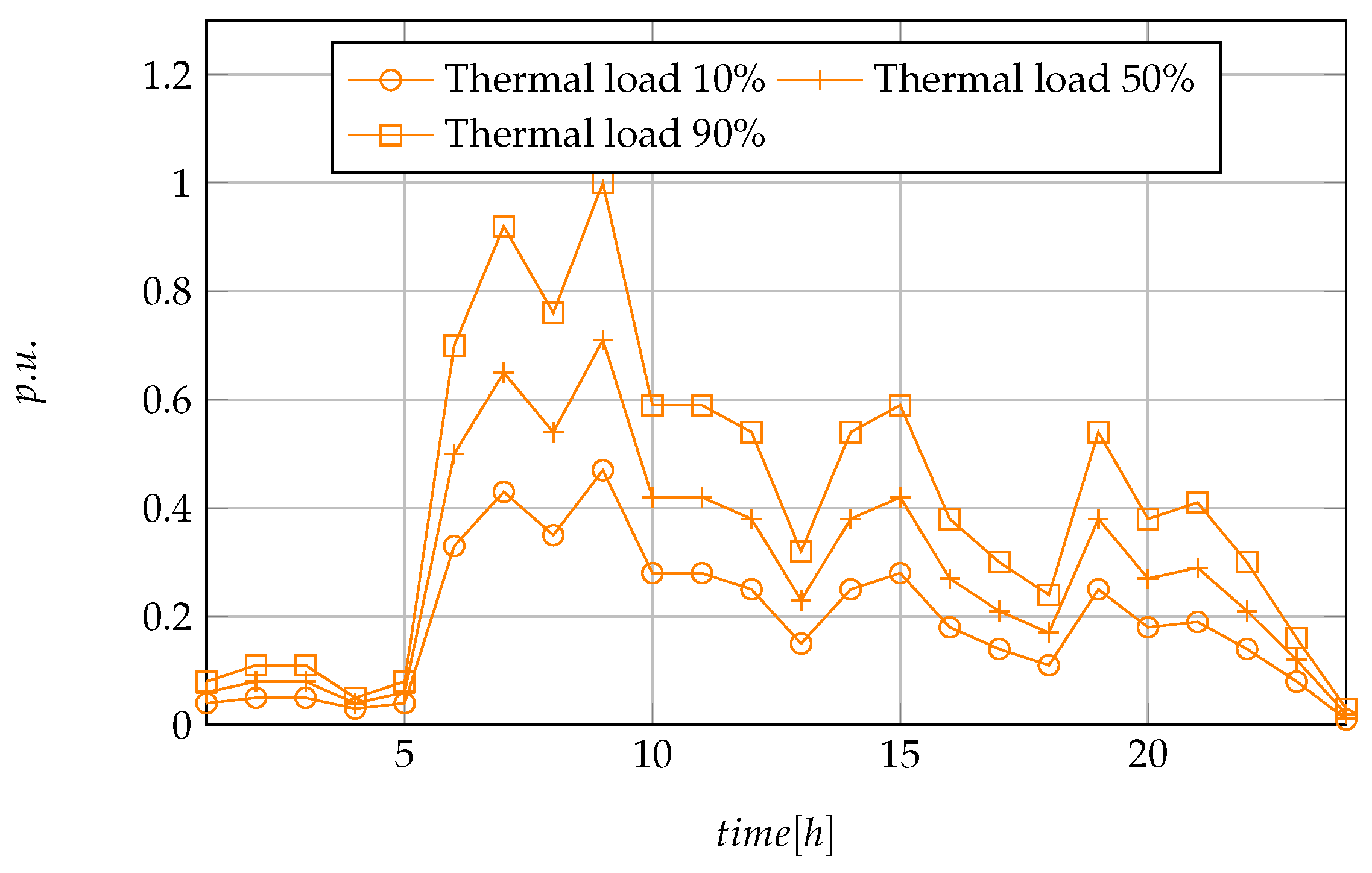

3.5. Energy Price Forecasts

- We wanted to avoid over-simplified calculations of the uncertainty set for the robust optimization models, such as arbitrary deviations from the mean or expected forecasted values, which is a common practice in the literature [9,15,30,40] for creating confidence intervals when using robust optimization approaches.

- The dataset of 90 days was used to capture the seasonality of price-trajectories. In addition, given the obvious higher presence of weekdays in the dataset, the decision of using the same weekday to create the forecasts and not the complete 90-day data as input responded to: (a) avoiding price trajectories that mimic weekday behavior when the analysis is performed on a weekend day; or (b) avoiding the presence of the low price values that typically result during weekends, when analyzing weekdays.

- Although the focus of this paper is not on advanced forecast techniques, our approach allows creating the confidence interval with realistic information that is suitable for the practical optimization problem. This way, we avoid the heavy burden on complex forecast tools and detailed probabilistic information, which is one of the advantages of using robust optimization, as explained in Section 1.

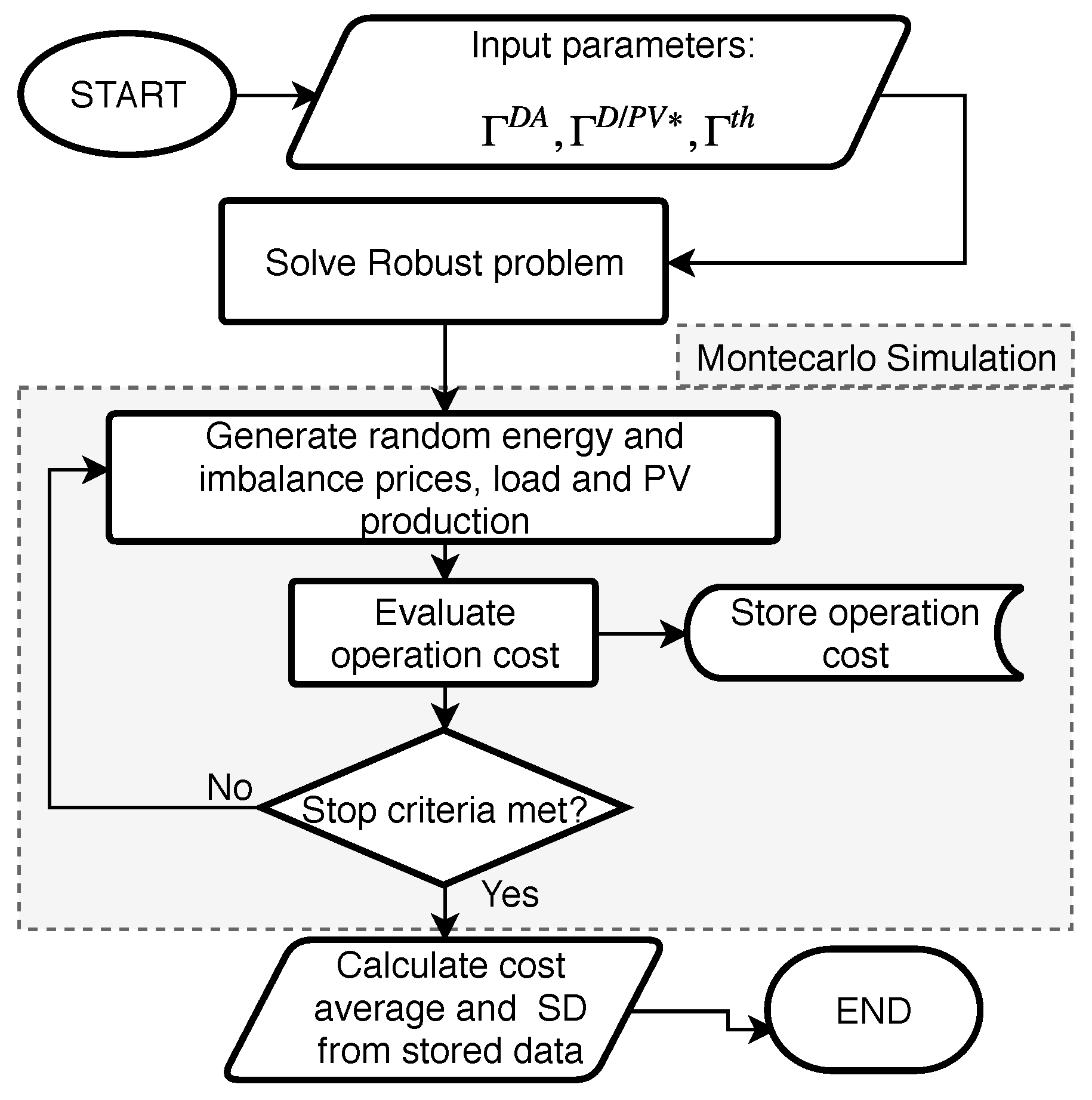

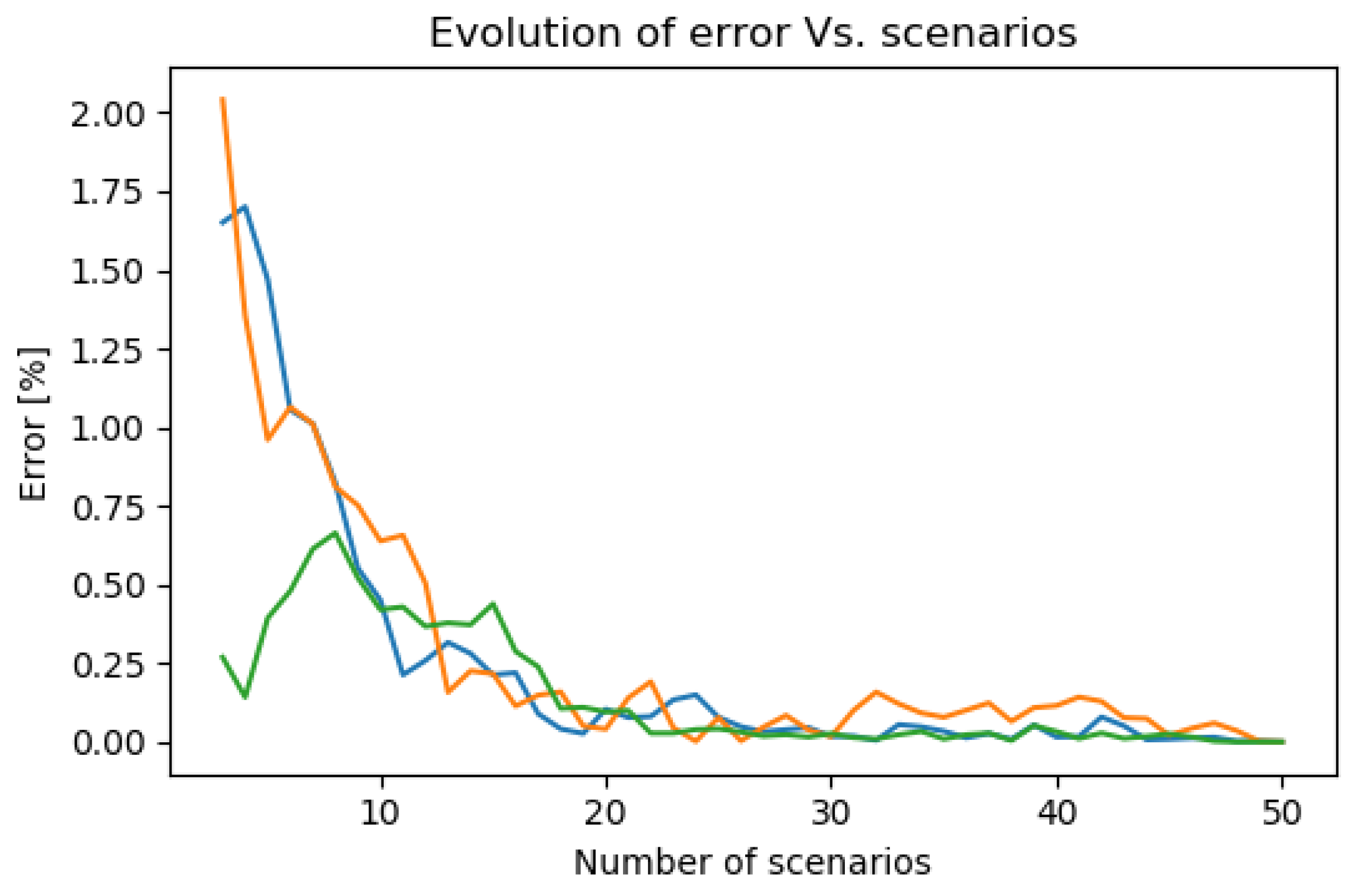

3.6. Performance Evaluation

4. Simulations and Results

4.1. Input Data

4.2. Simulation Setup

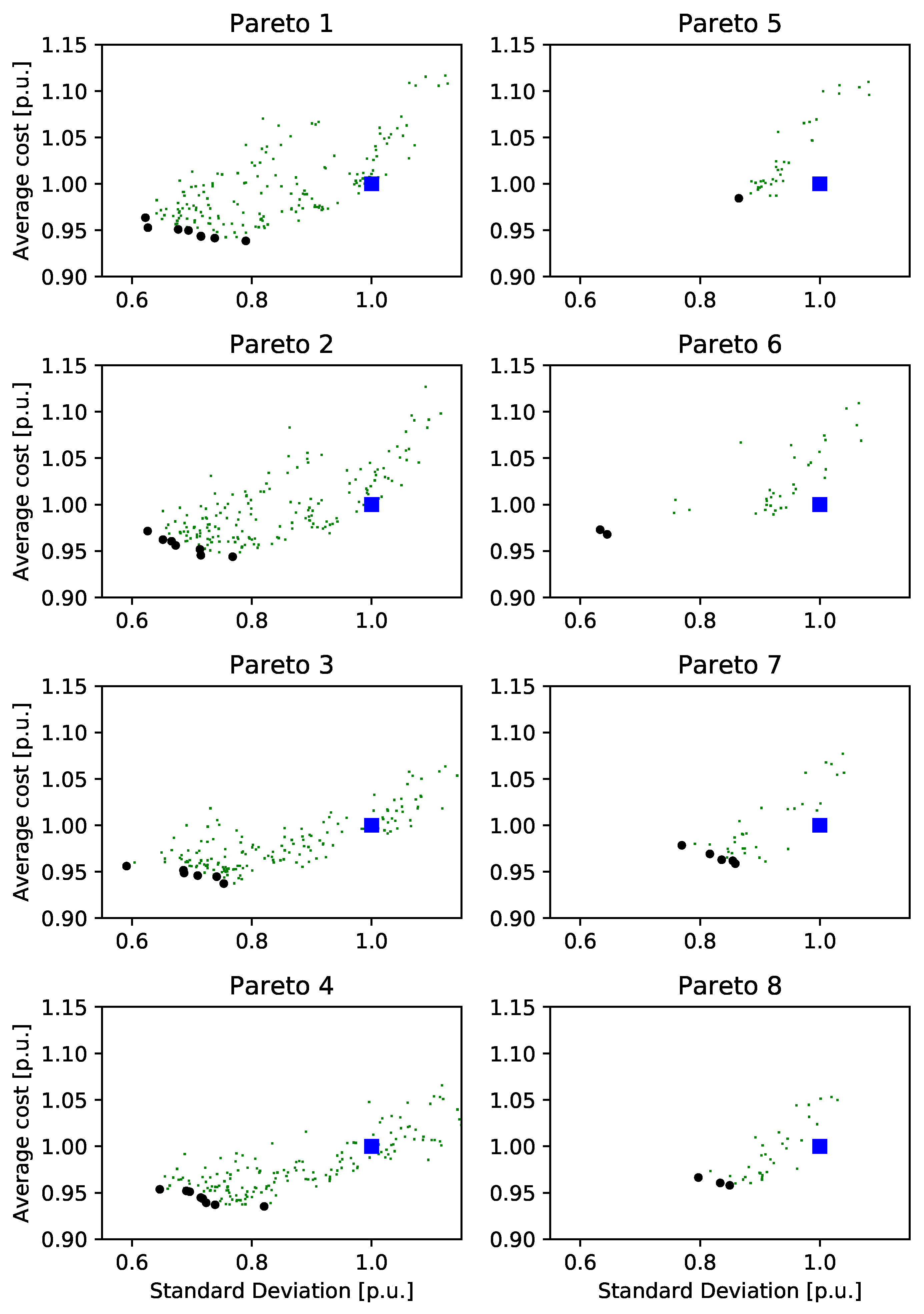

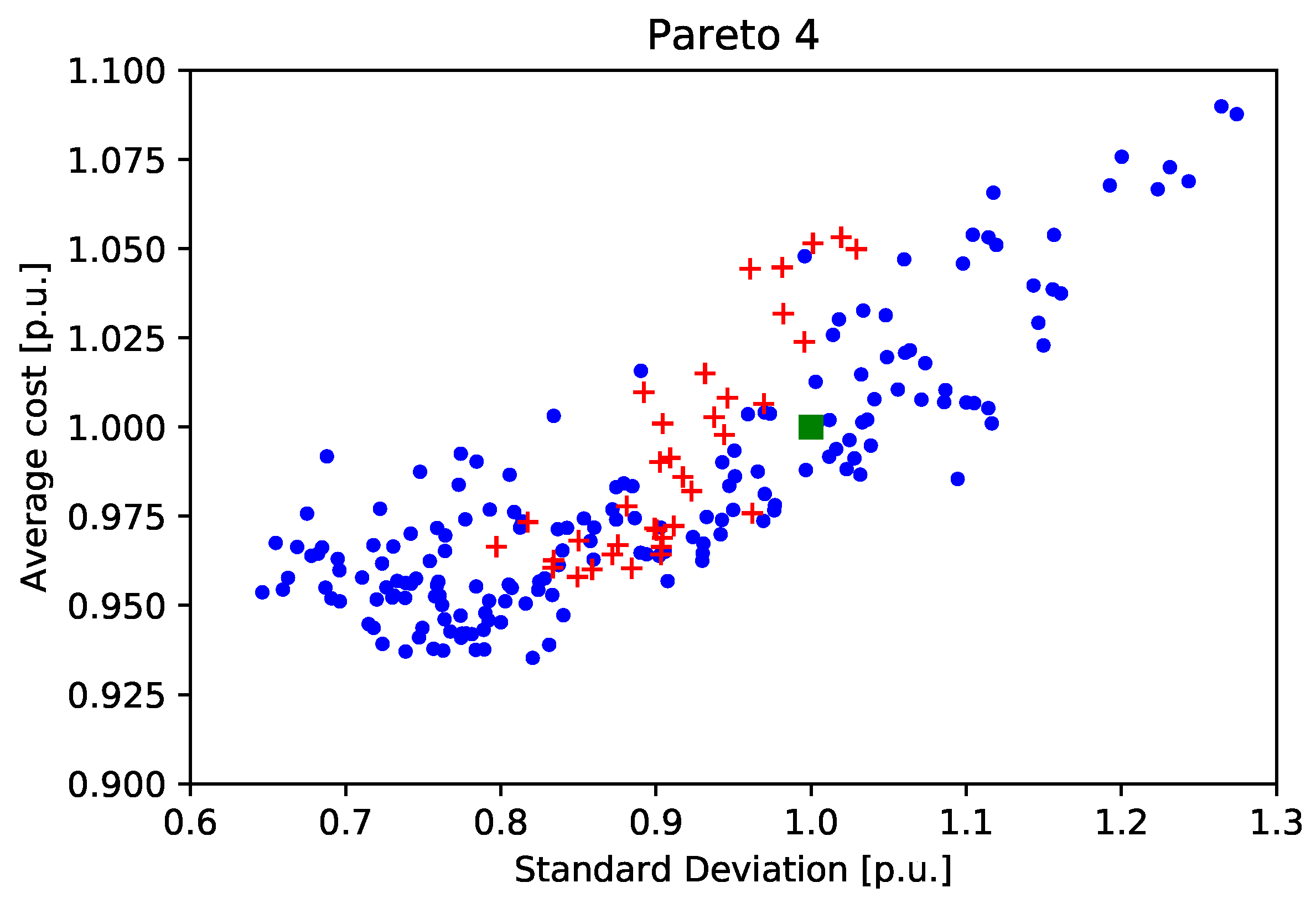

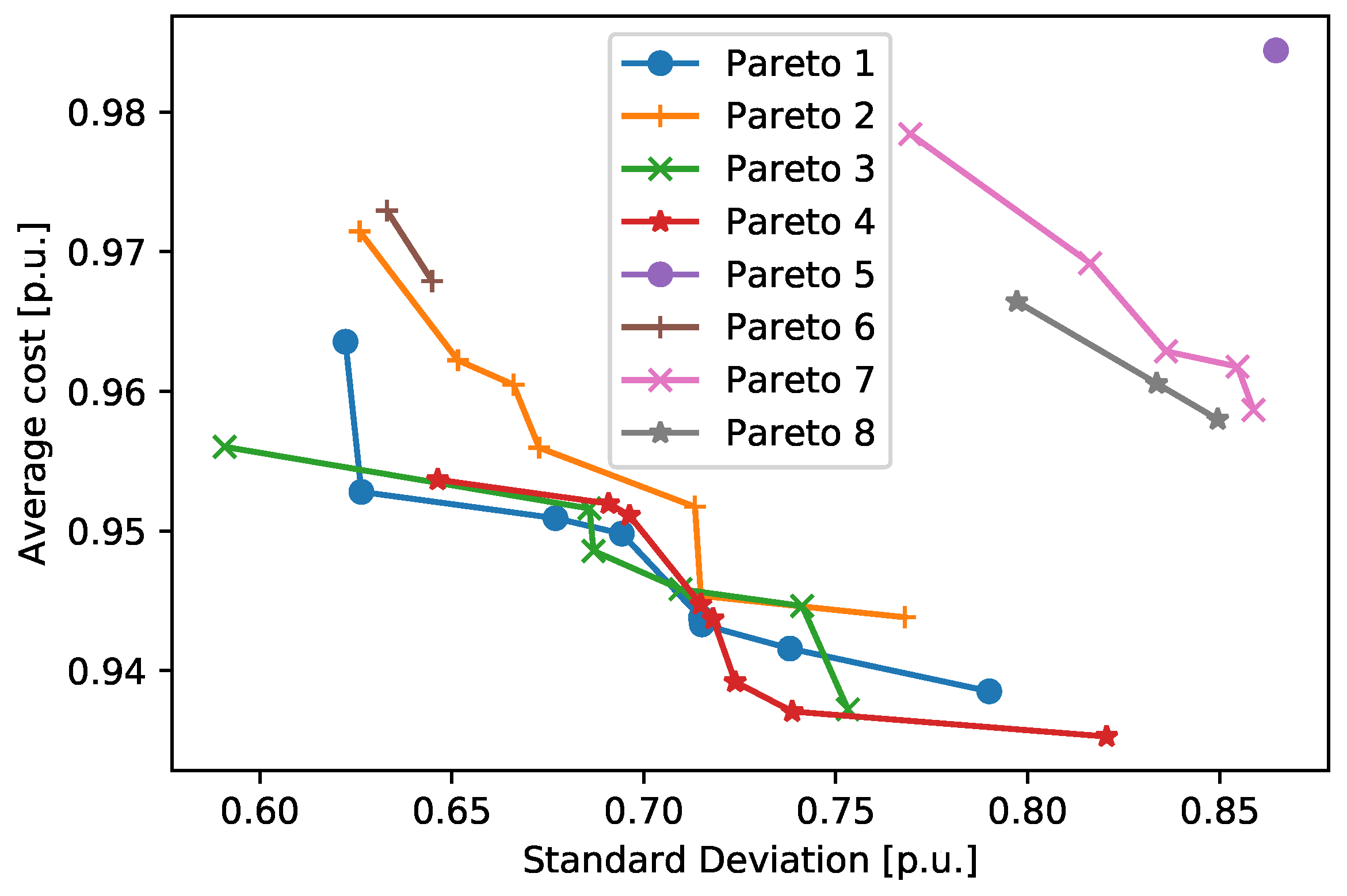

- Unified Complete ARO (UCARO):which corresponds to the robust counterpart when all sources of uncertainty are treated with ARO and PV and demand uncertainty are compacted in the form of net load. The resulting single parameter was employed to model these two sources of uncertainty.

- Separated Complete ARO (SCARO):which is the robust counterpart when all sources of uncertainty are treated with ARO and PV and demand uncertainty are treated in separate forms, resulting in two different uncertainty budgets, i.e., and . In this case, it was assumed that , to reflect equal uncertainty budget values for both electrical and thermal demand.

- Unified Hybrid Stochastic Robust Optimization (UHSRO):This problem corresponds to the robust counterpart when stochastic optimization is used to model price uncertainty and ARO is used to model thermal consumption, PV, and electrical demand uncertainty, with the latter two treated in a unified form.

- Separated Hybrid Stochastic Robust Optimization (SHSRO):This is the robust counterpart when stochastic optimization is used to model price uncertainty and ARO is used to model thermal consumption, PV, and electrical demand uncertainty, with the latter two treated in a separate form.

- Alternative 1: UCARO scheme with traditional .

- Alternative 2: SCARO scheme with traditional .

- Alternative 3: UCARO scheme with .

- Alternative 4: SCARO scheme with .

- Alternative 5: UHSRO scheme with traditional .

- Alternative 6: SHSRO scheme with traditional .

- Alternative 7: UHSRO scheme with .

- Alternative 8: SHSRO scheme with .

- Both robust models were fed with different information, specifically for prices. In [30], the price forecasts were obtained with a persistence model and a deviation of 10% from the central value. In this paper, the KDE and quantile calculation were used to create the confidence interval. The difference in the input data regarding the uncertainty set will lead the optimization of the algorithm towards different setpoints in a different search space; hence, the direct comparison is not adequate.

- In [30], random price values for the performance evaluation were generated using a uniform distribution around a central value that came from the same persistence model. In this paper, we propose a different approach based on KDE, which will lead to a misleading comparison of average cost and SD values after Monte Carlo simulation, given the different nature of the data.

4.3. Simulations

- Average cost of all points: average value of the y-axis points belonging to each alternative.

- Average cost of Pareto points: average value of the y-axis Pareto points belonging to each alternative.

- Median cost of all points: median of the y-axis points belonging to each alternative.

- Average SD of all points: average value of the x-axis points belonging to each alternative.

- Average SD of Pareto points: average value of the x-axis Pareto points belonging to each alternative.

- Median SD of all points: median of the x-axis points belonging to each alternative.

- Number of points in the global Pareto: when all points of the performance of each alternative are combined, the number of points present in the global Pareto from each alternative.

- Best cost: identifies if the alternative was able to find the best global cost.

- Best SD: identifies if the alternative was able to find the best global SD.

4.4. Some Remarks about Computational Times

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| EWH | Electric Water Heater |

| TES | Thermal Energy Storage |

| BESS | Battery Energy Storage System |

| MG | Microgrid |

| LV | Low Voltage |

| KDE | Kernel Density Estimation |

| KD | Kantorovich Distance |

| KDM | Kantorovich Distance Matrix |

| RO | Robust Optimization |

| ARO | Adjustable Robust Optimization |

| HSR | Hybrid Stochastic Robust |

| UCARO | Unified Complete Adjustable Robust Optimization |

| SCARO | Separated Complete Adjustable Robust Optimization |

| UHSRO | Unified Hybrid Stochastic Robust Optimization |

| SHSRO | Separated Hybrid Stochastic Robust Optimization |

| DoD | Depth of Discharge |

| SOC | State of Charge |

References

- Carreiro, A.M.; Jorge, H.M.; Antunes, C.H. Energy management systems aggregators: A literature survey. Renew. Sustain. Energy Rev. 2017, 73, 1160–1172. [Google Scholar] [CrossRef]

- European Commission. Proposal for a Regulation of the European Parliament and of the Council on the Internal Market for Electricity; Publications Office of the European Union: Brussels, Belgium, 2016. [Google Scholar]

- Bessa, R.; Moreira, C.; Silva, B.; Matos, M. Handling renewable energy variability and uncertainty in power systems operation. Wiley Interdiscip. Rev. Energy Environ. 2014, 3, 156–178. [Google Scholar] [CrossRef]

- Alizadeh, M.; Moghaddam, M.P.; Amjady, N.; Siano, P.; Sheikh-El-Eslami, M. Flexibility in future power systems with high renewable penetration: A review. Renew. Sustain. Energy Rev. 2016, 57, 1186–1193. [Google Scholar] [CrossRef]

- Burger, S.; Chaves-Ávila, J.P.; Batlle, C.; Pérez-Arriaga, I.J. A review of the value of aggregators in electricity systems. Renew. Sustain. Energy Rev. 2017, 77, 395–405. [Google Scholar] [CrossRef]

- Liang, H.; Zhuang, W. Stochastic Modeling and Optimization in a Microgrid: A Survey. Energies 2014, 7, 2027–2050. [Google Scholar] [CrossRef]

- Birge, J.R.; Louveaux, F. Introduction to Stochastic Programming, 2nd ed.; Springer: New York, NY, USA, 2011. [Google Scholar]

- Bertsimas, D.; Sim, M. Robust discrete optimization and network flows. Math. Program. Ser. B 2003, 98, 49–71. [Google Scholar] [CrossRef]

- Liu, G.; Xu, Y.; Tomsovic, K. Bidding Strategy for Microgrid in Day-Ahead Market Based on Hybrid Stochastic/Robust Optimization. IEEE Trans. Smart Grid 2016, 7, 227–237. [Google Scholar] [CrossRef]

- Wang, R.; Wang, P.; Xiao, G. A robust optimization approach for energy generation scheduling in microgrids. Energy Convers. Manag. 2015, 106, 597–607. [Google Scholar] [CrossRef]

- Wang, J.; Zhong, H.; Tang, W.; Rajagopal, R.; Xia, Q.; Kang, C.; Wang, Y. Optimal bidding strategy for microgrids in joint energy and ancillary service markets considering flexible ramping products. Appl. Energy 2017, 205, 294–303. [Google Scholar] [CrossRef]

- Hu, W.; Wang, P.; Gooi, H.B. Toward Optimal Energy Management of Microgrids via Robust Two-Stage Optimization. IEEE Trans. Smart Grid 2018, 9, 1161–1174. [Google Scholar] [CrossRef]

- Liu, G.; Starke, M.; Xiao, B.; Tomsovic, K. Robust optimization-based microgrid scheduling with islanding constraints. IET Gener. Transm. Distrib. 2017, 11, 1820–1828. [Google Scholar] [CrossRef]

- Wang, L.; Li, Q.; Ding, R.; Sun, M.; Wang, G. Integrated scheduling of energy supply and demand in microgrids under uncertainty: A robust multi-objective optimization approach. Energy 2017, 130, 1–14. [Google Scholar] [CrossRef]

- Kuznetsova, E.; Li, Y.F.; Ruiz, C.; Zio, E. An integrated framework of agent-based modeling and robust optimization for microgrid energy management. Appl. Energy 2014, 129, 70–88. [Google Scholar] [CrossRef]

- Gupta, R.; Gupta, N.K. A robust optimization based approach for microgrid operation in deregulated environment. Energy Convers. Manag. 2015, 93, 121–131. [Google Scholar] [CrossRef]

- Wang, J.; Li, P.; Fang, K.; Zhou, Y. Robust Optimization for Household Load Scheduling with Uncertain Parameters. Appl. Sci. 2018, 8, 575. [Google Scholar] [CrossRef]

- Diekerhof, M.; Peterssen, F.; Monti, A. Hierarchical Distributed Robust Optimization for Demand Response Services. IEEE Trans. Smart Grid 2018, 9, 6018–6029. [Google Scholar] [CrossRef]

- Zhou, Y.; Wei, Z.; Sun, G.; Cheung, K.W.; Zang, H.; Chen, S. A robust optimization approach for integrated community energy system in energy and ancillary service markets. Energy 2018, 148, 1–15. [Google Scholar] [CrossRef]

- Bertsimas, D.; Brown, D.B.; Caramanis, C. Theory and Applications of Robust Optimization. SIAM Rev. 2011, 53, 464–501. [Google Scholar] [CrossRef]

- Kilkki, O.; Seilonen, I.; Zenger, K.; Vyatkin, V. Optimizing residential heating and energy storage flexibility for frequency reserves. Int. J. Electr. Power Energy Syst. 2018, 100, 540–549. [Google Scholar] [CrossRef]

- Li, J.; Wu, Z.; Zhou, S.; Fu, H.; Zhang, X.P. Aggregator service for PV and battery energy storage systems of residential building. CSEE J. Power Energy Syst. 2015, 1, 3–11. [Google Scholar] [CrossRef]

- Comodi, G.; Giantomassi, A.; Severini, M.; Squartini, S.; Ferracuti, F.; Fonti, A.; Nardi, D.; Morodo, M.; Polonara, F. Multi-apartment residential microgrid with electrical and thermal storage devices: Experimental analysis and simulation of energy management strategies. Appl. Energy 2015, 137, 854–866. [Google Scholar] [CrossRef]

- Good, N.; Karangelos, E.; Navarro-Espinosa, A.; Mancarella, P. Optimization under Uncertainty of Thermal Storage-Based Flexible Demand Response with Quantification of Residential Users’ Discomfort. IEEE Trans. Smart Grid 2015, 6, 2333–2342. [Google Scholar] [CrossRef]

- Xu, Z.; Guan, X.; Jia, Q.S.; Wu, J.; Wang, D.; Chen, S. Performance Analysis and Comparison on Energy Storage Devices for Smart Building Energy Management. IEEE Trans. Smart Grid 2012, 3, 2136–2147. [Google Scholar] [CrossRef]

- Ouammi, A. Optimal Power Scheduling for a Cooperative Network of Smart Residential Buildings. IEEE Trans. Sustain. Energy 2016, 7, 1317–1326. [Google Scholar] [CrossRef]

- Li, X.; Borsche, T.; Andersson, G. PV integration in Low-Voltage feeders with Demand Response. In Proceedings of the 2015 IEEE Eindhoven PowerTech, PowerTech 2015, Eindhoven, The Netherlands, 29 June–2 July 2015. [Google Scholar]

- Xu, B.; Zhao, J.; Zheng, T.; Litvinov, E.; Kirschen, D.S. Factoring the Cycle Aging Cost of Batteries Participating in Electricity Markets. IEEE Trans. Power Syst. 2018, 33, 2248–2259. [Google Scholar] [CrossRef]

- Xu, B.; Shi, Y.; Kirschen, D.S.; Zhang, B. Optimal regulation response of batteries under cycle aging mechanisms. In Proceedings of the 2017 IEEE 56th Annual Conference on Decision and Control (CDC), Melbourne, VIC, Australia, 12–15 December 2017; pp. 751–756. [Google Scholar]

- Correa-Florez, C.A.; Michiorri, A.; Kariniotakis, G. Robust optimization for day-ahead market participation of smart home aggregators. Appl. Energy 2018, 229, 433–445. [Google Scholar] [CrossRef]

- He, G.; Chen, Q.; Kang, C.; Pinson, P.; Xia, Q. Optimal Bidding Strategy of Battery Storage in Power Markets Considering Performance-Based Regulation and Battery Cycle Life. IEEE Trans. Smart Grid 2016, 7, 2359–2367. [Google Scholar] [CrossRef]

- Ortega-Vazquez, M.A. Optimal scheduling of electric vehicle charging and vehicle-to-grid services at household level including battery degradation and price uncertainty. IET Gener. Transm. Distrib. 2014, 8, 1007–1016. [Google Scholar] [CrossRef]

- Duggal, I.; Venkatesh, B. Short-Term Scheduling of Thermal Generators and Battery Storage With Depth of Discharge-Based Cost Model. IEEE Trans. Power Syst. 2015, 30, 2110–2118. [Google Scholar] [CrossRef]

- Bertsimas, D.; Sim, M. The Price of Robustness. Oper. Res. 2004, 52, 35–53. [Google Scholar] [CrossRef]

- Razali, N.M.M.; Hashim, A.H. Backward reduction application for minimizing wind power scenarios in stochastic programming. In Proceedings of the 2010 4th International Power Engineering and Optimization Conference (PEOCO), Shah Alam, Malaysia, 23–24 June 2010; pp. 430–434. [Google Scholar]

- Gerossier, A.; Girard, R.; Bocquet, A.; Kariniotakis, G. Robust Day-Ahead Forecasting of Household Electricity Demand and Operational Challenges. Energies 2018, 11, 3503. [Google Scholar] [CrossRef]

- Bocquet, A.; Michiorri, A.; Bossavy, A.; Girard, R.; Kariniotakis, G. Assessment of probabilistic PV production forecasts performance in an operational context. In Proceedings of the 6th Solar Integration Workshop—International Workshop on Integration of Solar Power into Power Systems, Vienna, Austria, 14–15 November 2016. [Google Scholar]

- ENTSOE Transparency. Central Collection and Publication of Electricity Generation, Transportation and Consumption Data and Information for the Pan-European Market, Day-Ahead Prices. Available online: https://transparency.entsoe.eu/transmission-domain/r2/dayAheadPrices/show (accessed on 25 January 2018).

- Pedregosa, F.; Varoquaux, G.; Gramfort, A.; Michel, V.; Thirion, B.; Grisel, O.; Blondel, M.; Prettenhofer, P.; Weiss, R.; Dubourg, V.; et al. Scikit-learn: Machine Learning in Python. J. Mach. Learn. Res. 2011, 12, 2825–2830. [Google Scholar]

- Ampatzis, M.; Nguyen, P.H.; Kamphuis, I.G.; van Zwam, A. Robust optimization for deciding on real-time flexibility of storage-integrated photovoltaic units controlled by intelligent software agents. IET Renew. Power Gener. 2017, 11, 1527–1533. [Google Scholar] [CrossRef]

- SAFT Batteries Lithium Ion Battery Life. May 2014. Available online: saftbatteries.com/force_download/li_ion_battery_life__TechnicalSheet_en_0514 _Protected.pdf (accessed on 20 April 2017).

- IRENA International Renewable Energy Agency. Battery Storage for Renewables: Market Status and Technology Outlook; International Renewable Energy Agency: Abu Dhabi, UAE, 2015. [Google Scholar]

| Pareto Front | / */ | Cost (p.u.) | SD (p.u.) |

|---|---|---|---|

| Pareto 1 | : 12/0/0.6 | 0.941 | 0.738 |

| : 12/0.2/0.2 | 0.938 | 0.790 | |

| : 12/0.2/0.8 | 0.949 | 0.694 | |

| : 12/0.2/1 | 0.950 | 0.677 | |

| : 12/0.4/0 | 0.943 | 0.714 | |

| : 12/0.4/0.6 | 0.943 | 0.715 | |

| : 12/0.4/0.8 | 0.952 | 0.626 | |

| : 12/0.6/0.6 | 0.964 | 0.622 | |

| Pareto 2 | : 12/0/0.4 | 0.952 | 0.713 |

| : 12/0/0.6 | 0.962 | 0.651 | |

| : 12/0.2/0.2 | 0.944 | 0.768 | |

| : 12/0.2/0.4 | 0.945 | 0.715 | |

| : 12/0.4/0.6 | 0.972 | 0.626 | |

| : 12/0.6/0 | 0.956 | 0.673 | |

| : 12/0.8/0.2 | 0.961 | 0.666 | |

| Pareto 3 | : 12/0/0.4 | 0.937 | 0.753 |

| : 12/0/1 | 0.956 | 0.591 | |

| : 12/0.2/0 | 0.945 | 0.741 | |

| : 12/0.2/0.2 | 0.949 | 0.710 | |

| : 12/0.2/0.6 | 0.949 | 0.687 | |

| : 12/0.2/1 | 0.952 | 0.686 | |

| Pareto 4 | : 12/0/0 | 0.945 | 0.715 |

| : 12/0.2/0.2 | 0.937 | 0.739 | |

| : 12/0.8/0 | 0.951 | 0.696 | |

| : 18/0/0.2 | 0.943 | 0.718 | |

| : 18/0/0.4 | 0.952 | 0.691 | |

| : 18/0.2/0.4 | 0.954 | 0.646 | |

| : 18/0.6/0 | 0.939 | 0.724 | |

| : 18/0.6/0.2 | 0.935 | 0.821 | |

| Pareto 5 | : Stochastic/0.2/0.2 | 0.984 | 0.864 |

| Pareto 6 | : Stochastic/0.0/0.4 | 0.968 | 0.645 |

| : Stochastic/0.2/0 | 0.973 | 0.633 | |

| Pareto 7 | : Stochastic/0.0/0.8 | 0.959 | 0.859 |

| : Stochastic/0.2/0 | 0.963 | 0.836 | |

| : Stochastic/0.2/0.4 | 0.969 | 0.816 | |

| : Stochastic/0.2/0.6 | 0.962 | 0.855 | |

| : Stochastic/0.4/0.2 | 0.978 | 0.769 | |

| Pareto 8 | : Stochastic/0.0/0.2 | 0.958 | 0.850 |

| : Stochastic/0.2/0 | 0.966 | 0.797 | |

| : Stochastic/0.4/0 | 0.961 | 0.834 |

| Alt. | Av. Cost All Points | Av. Cost Pareto | Median Cost All Points | Av. SD All Points | Av. SD Pareto | Median SD All Points | Global Pareto * | Best Cost? | Best SD? |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.994 | 0.948 | 0.985 | 0.8355 | 0.697 | 0.817 | 4 | No | No |

| 2 | 0.995 | 0.956 | 0.985 | 0.8426 | 0.688 | 0.810 | 0 | No | No |

| 3 | 0.986 | 0.947 | 0.976 | 0.870 | 0.695 | 0.834 | 3 | No | Yes |

| 4 | 0.982 | 0.945 | 0.972 | 0.890 | 0.719 | 0.855 | 4 | Yes | No |

| 5 | 1.029 | 0.984 | 1.012 | 0.946 | 0.865 | 0.928 | 0 | No | No |

| 6 | 1.025 | 0.970 | 1.012 | 0.925 | 0.639 | 0.934 | 0 | No | No |

| 7 | 0.997 | 0.966 | 0.980 | 0.902 | 0.827 | 0.874 | 0 | No | No |

| 8 | 0.991 | 0.962 | 0.979 | 0.913 | 0.827 | 0.904 | 0 | No | No |

| Alternative | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| Overall computational time (s) | 4274 | 4323 | 5717 | 4004 | 631 | 631 | 686 | 321 |

| Median (s) | 11 | 13 | 15 | 11 | 16 | 15 | 17 | 8 |

| Average (s) | 23 | 24 | 31 | 22 | 17 | 17 | 19 | 9 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Correa-Florez, C.A.; Michiorri, A.; Kariniotakis, G. Comparative Analysis of Adjustable Robust Optimization Alternatives for the Participation of Aggregated Residential Prosumers in Electricity Markets. Energies 2019, 12, 1019. https://doi.org/10.3390/en12061019

Correa-Florez CA, Michiorri A, Kariniotakis G. Comparative Analysis of Adjustable Robust Optimization Alternatives for the Participation of Aggregated Residential Prosumers in Electricity Markets. Energies. 2019; 12(6):1019. https://doi.org/10.3390/en12061019

Chicago/Turabian StyleCorrea-Florez, Carlos Adrian, Andrea Michiorri, and Georges Kariniotakis. 2019. "Comparative Analysis of Adjustable Robust Optimization Alternatives for the Participation of Aggregated Residential Prosumers in Electricity Markets" Energies 12, no. 6: 1019. https://doi.org/10.3390/en12061019

APA StyleCorrea-Florez, C. A., Michiorri, A., & Kariniotakis, G. (2019). Comparative Analysis of Adjustable Robust Optimization Alternatives for the Participation of Aggregated Residential Prosumers in Electricity Markets. Energies, 12(6), 1019. https://doi.org/10.3390/en12061019