Optimal Distribution Grid Operation Using DLMP-Based Pricing for Electric Vehicle Charging Infrastructure in a Smart City

Abstract

1. Introduction

- Minimize power loss;

- Minimize power not supplied;

- Minimize line congestion;

- Minimize the power generation curtailment;

- Minimize the power from external suppliers;

- Distribution network radial topology.

- The use of an EV user behavior simulator. This simulator is used to simulate the EV user behavior aspects, such as: stochastic EV user aspects, importance of EV charging price, importance of comfort, choosing slow or fast charge, and the user sensibility of the the state of the battery;

- Present a distribution network operation/reconfiguration optimization problem in an SG context with high DER penetration concerning the behavior aspects of the EV users and the dynamic EV charging price considering DLMPs using the Benders decomposition method;

- Analyze how and to what extent dynamic EV charging prices contribute positively to smart distribution network operation;

- Understand how and to what extent dynamic EV charging prices can contribute to a positive impact on the electric vehicles’ charging cost.

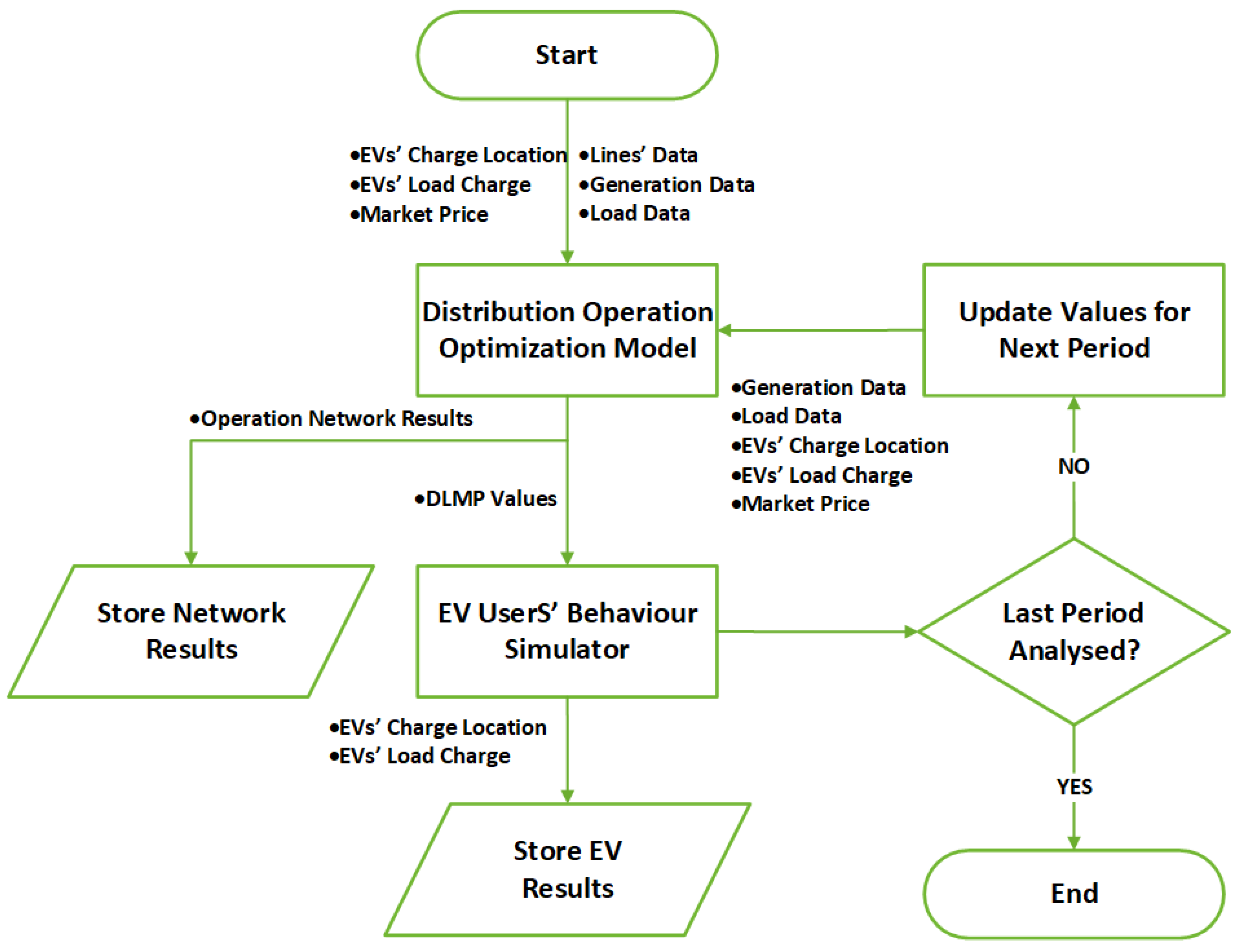

2. Proposed Methodology

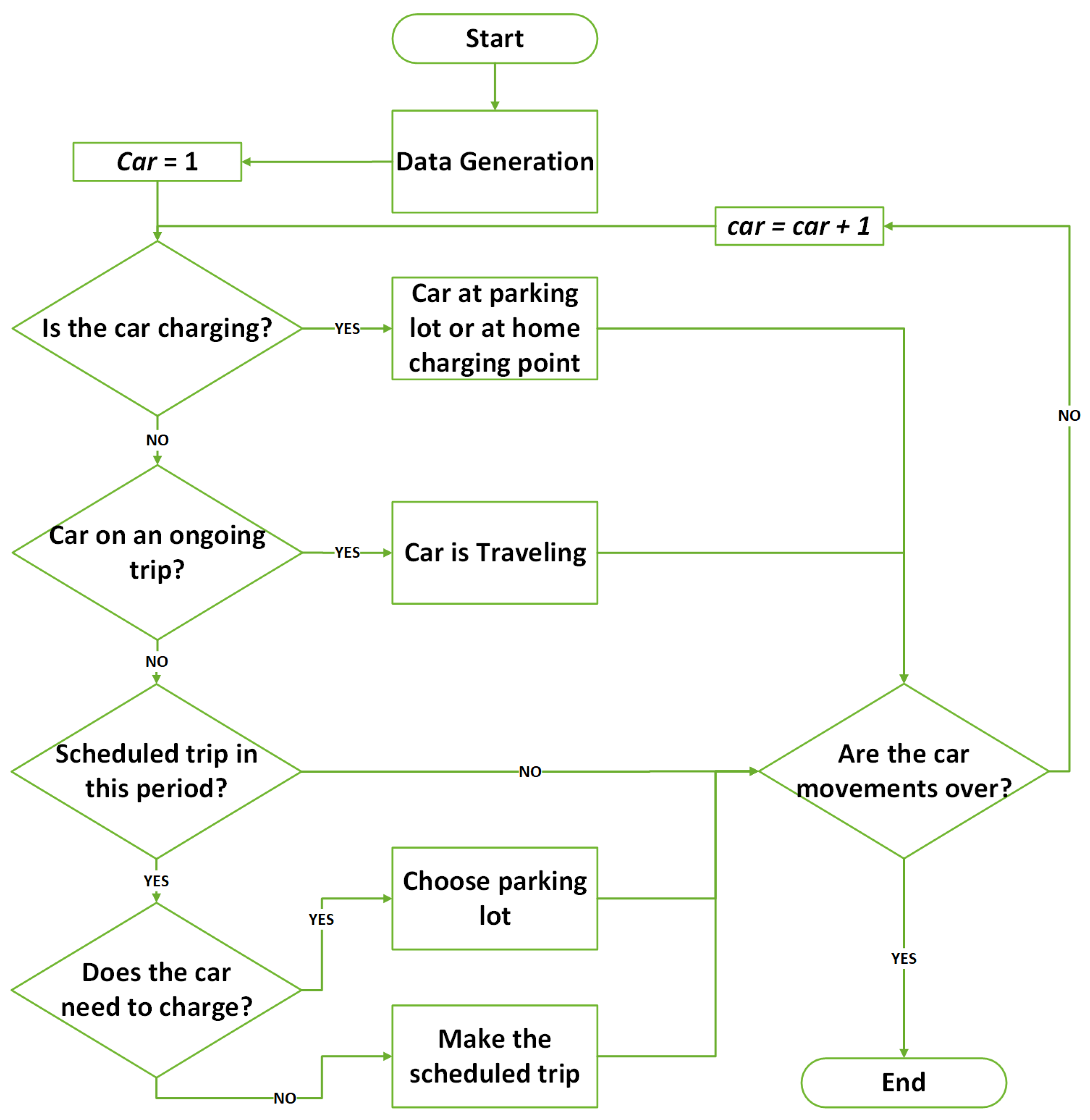

2.1. Simulator of Urban Mobility

- DEP: Dynamic EV charging price for each period (€/kWh)

- DLMP: Distribution locational marginal pricing (€/kWh)

- TariffMV: Energy tariff price for each period (in the Case Study Section, the reader can find the energy tariff price for each considered period) (€/kWh)

- PLG: Additional profit margin of the parking owner

- VAT: Value-added tax

- ACNR: Additional cost related to the fixed term of network price rate to be charged to the customer (€/kWh) and given by (2):

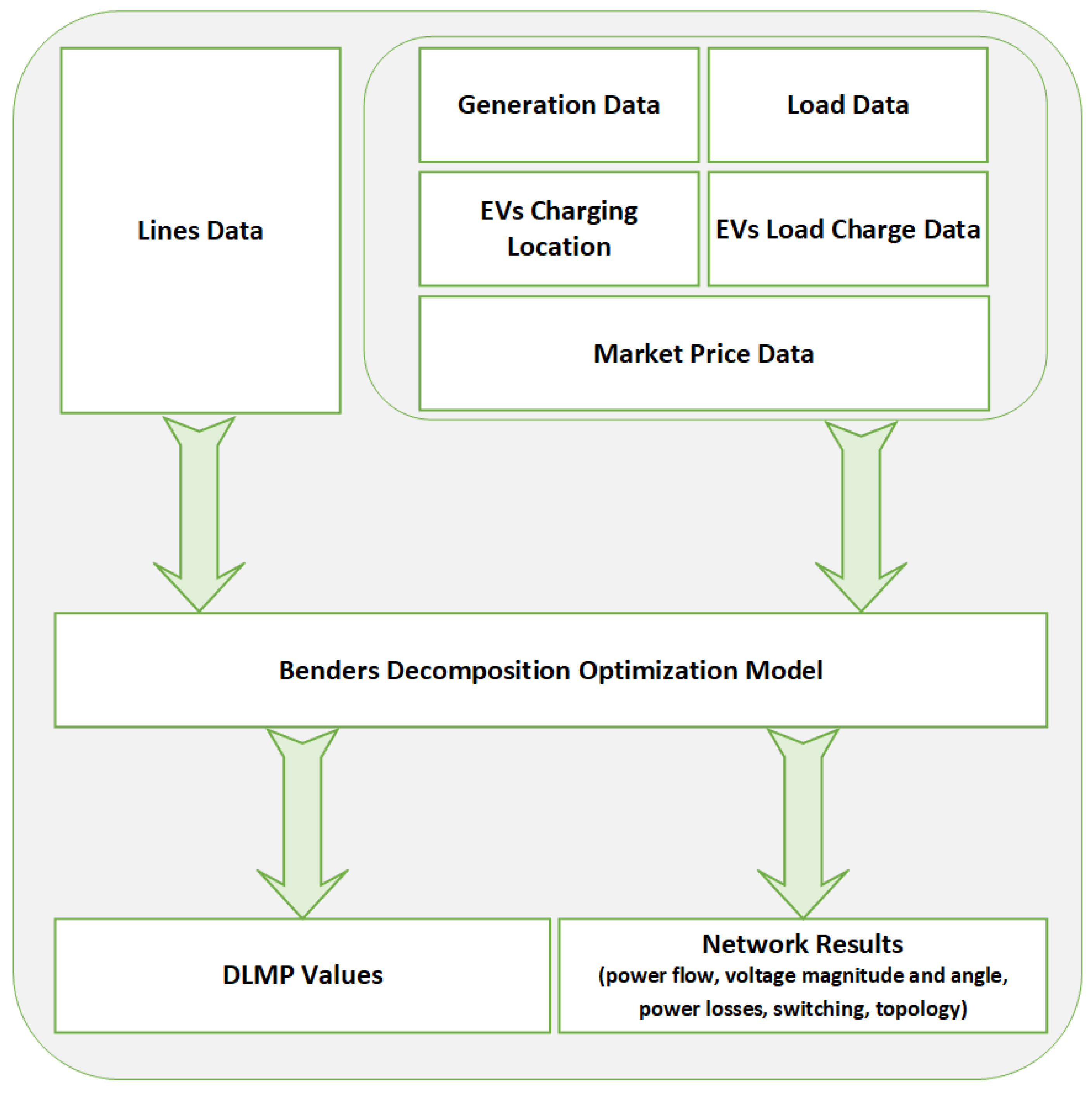

2.2. DLMP-Based Network Operation

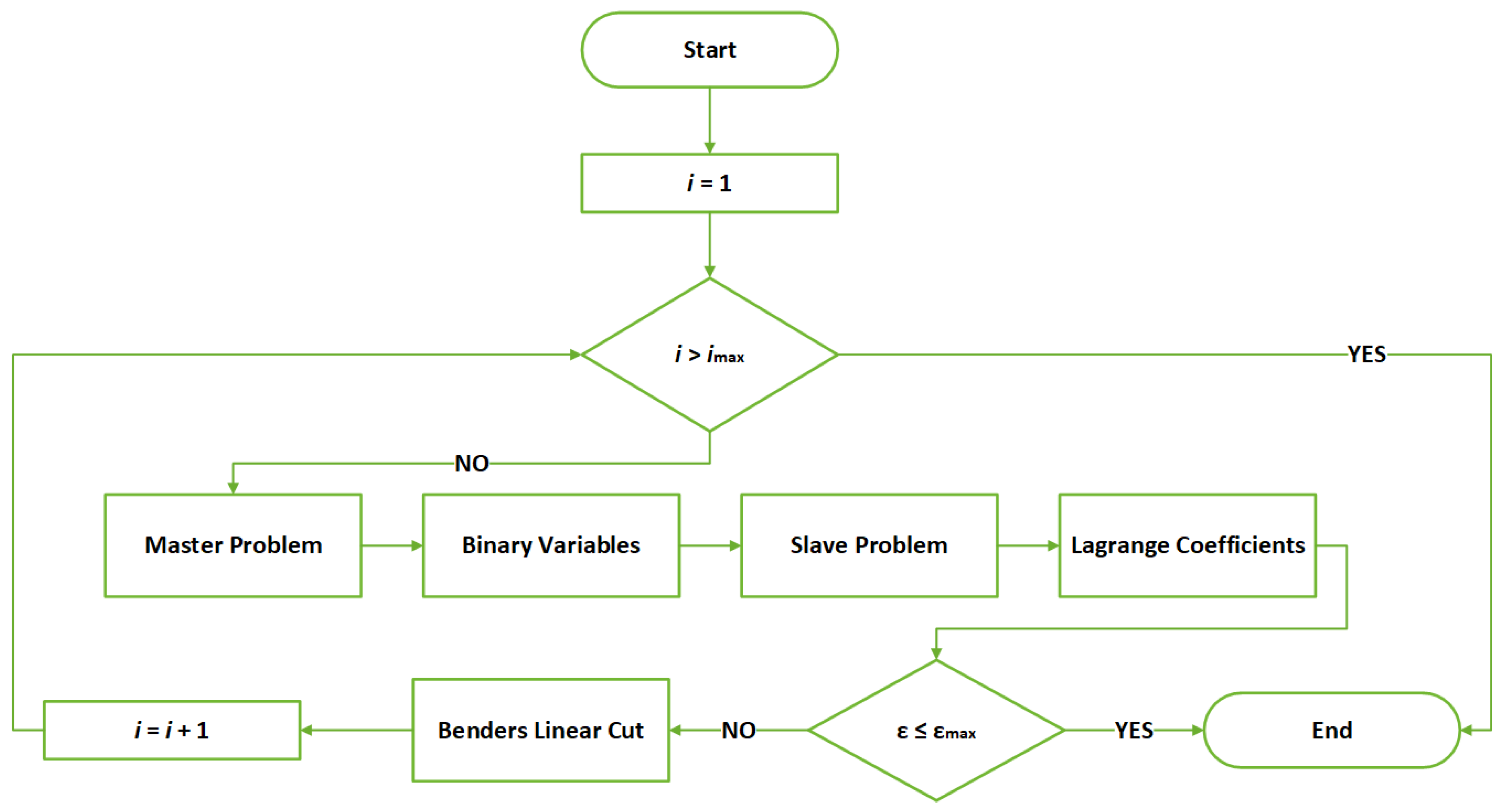

2.2.1. Master Problem

- Minimize the power losses’ cost;

- Minimize the power not supplied cost;

- Minimize the lines’ congestion cost;

- Minimize the power generation curtailment cost;

- Minimize the power from external suppliers’ cost.

2.2.2. Slave Problem

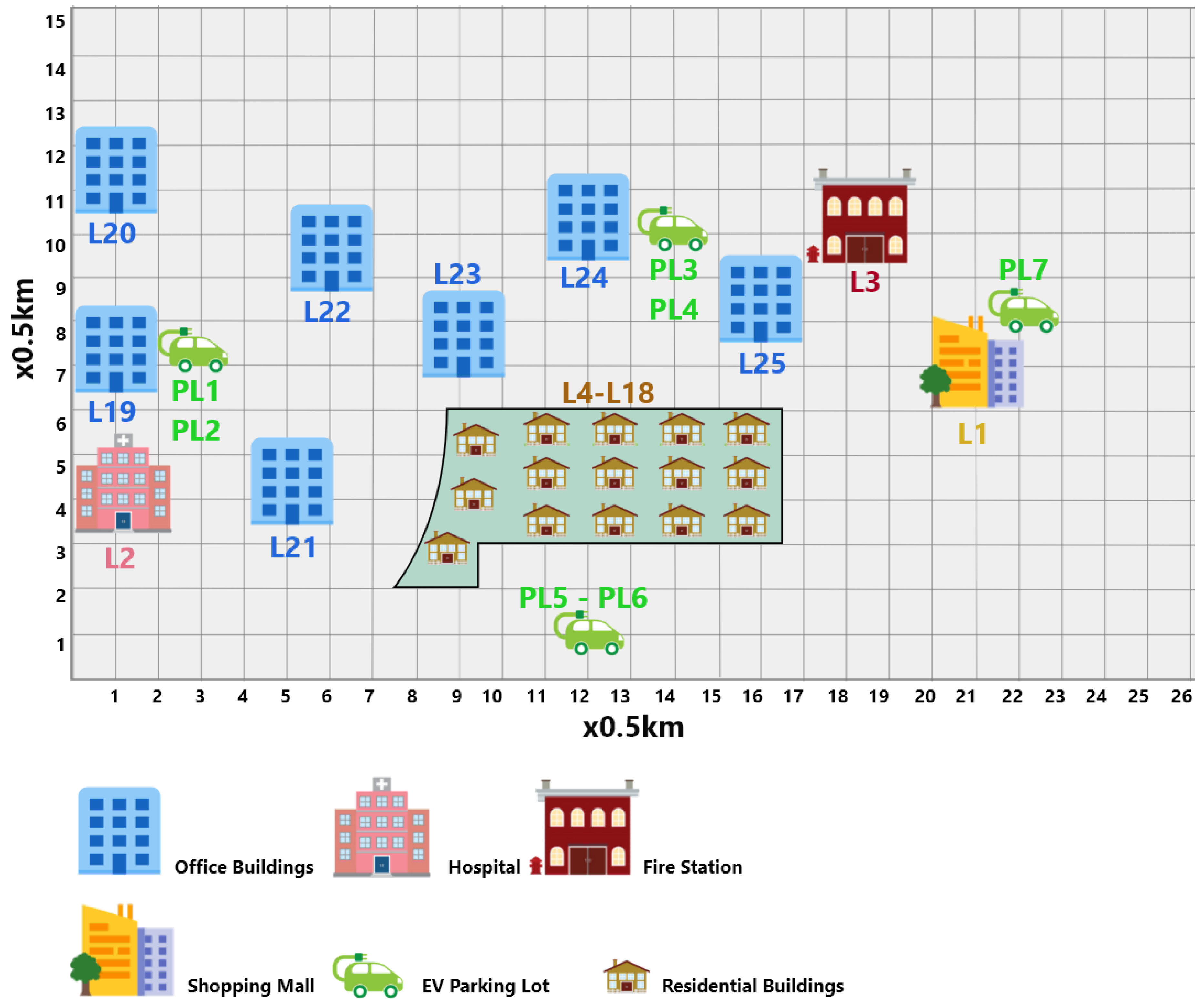

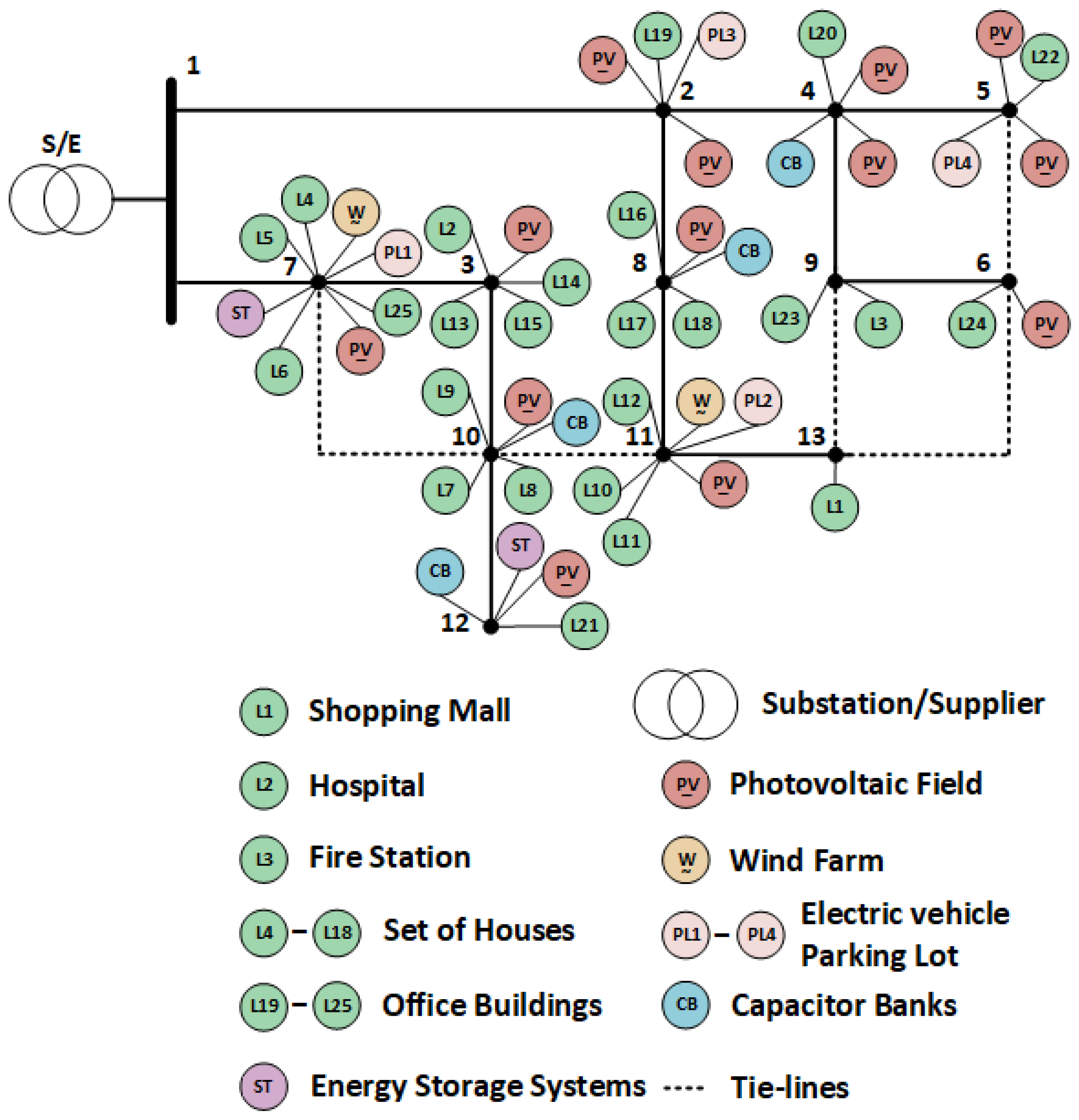

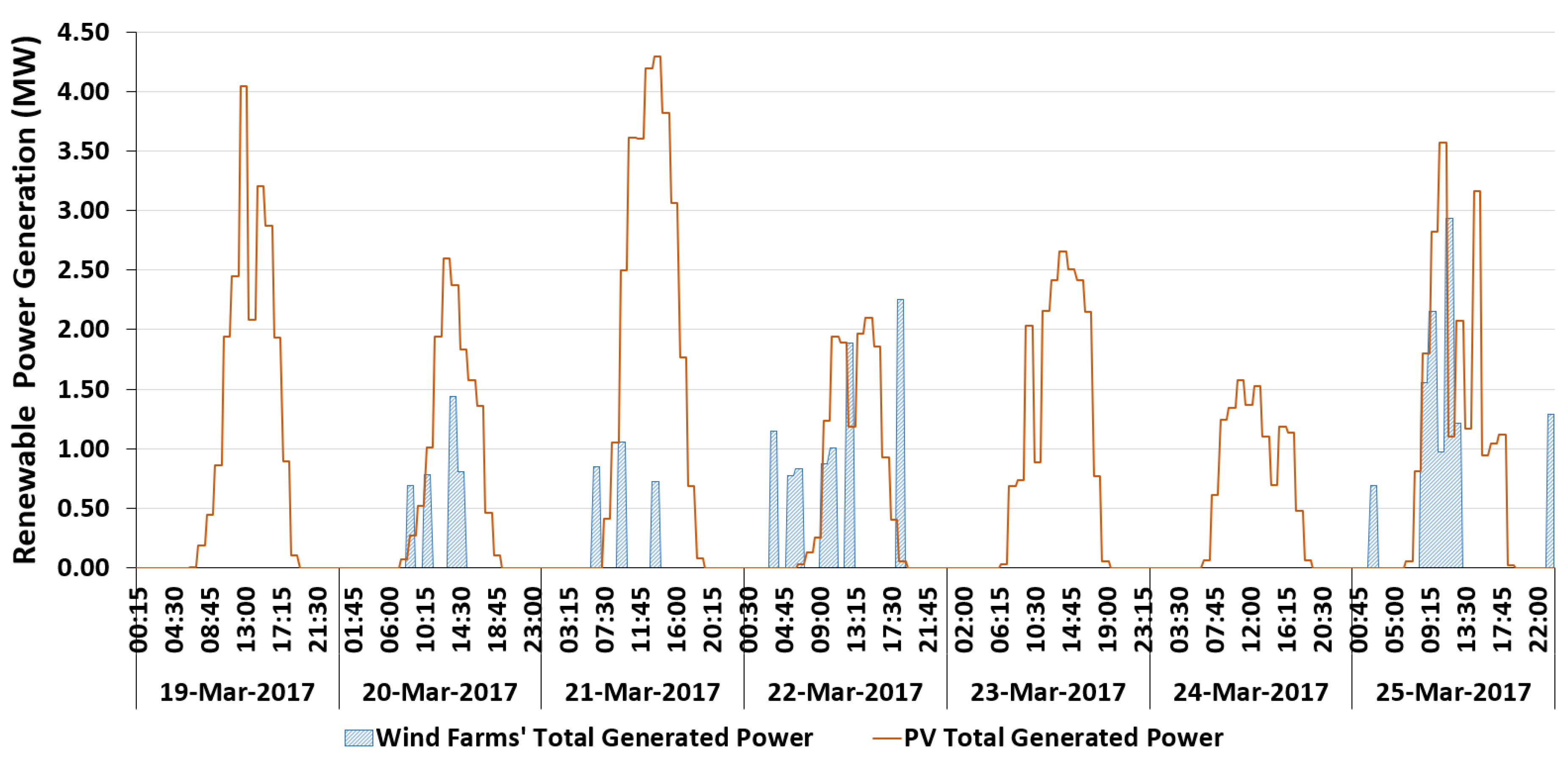

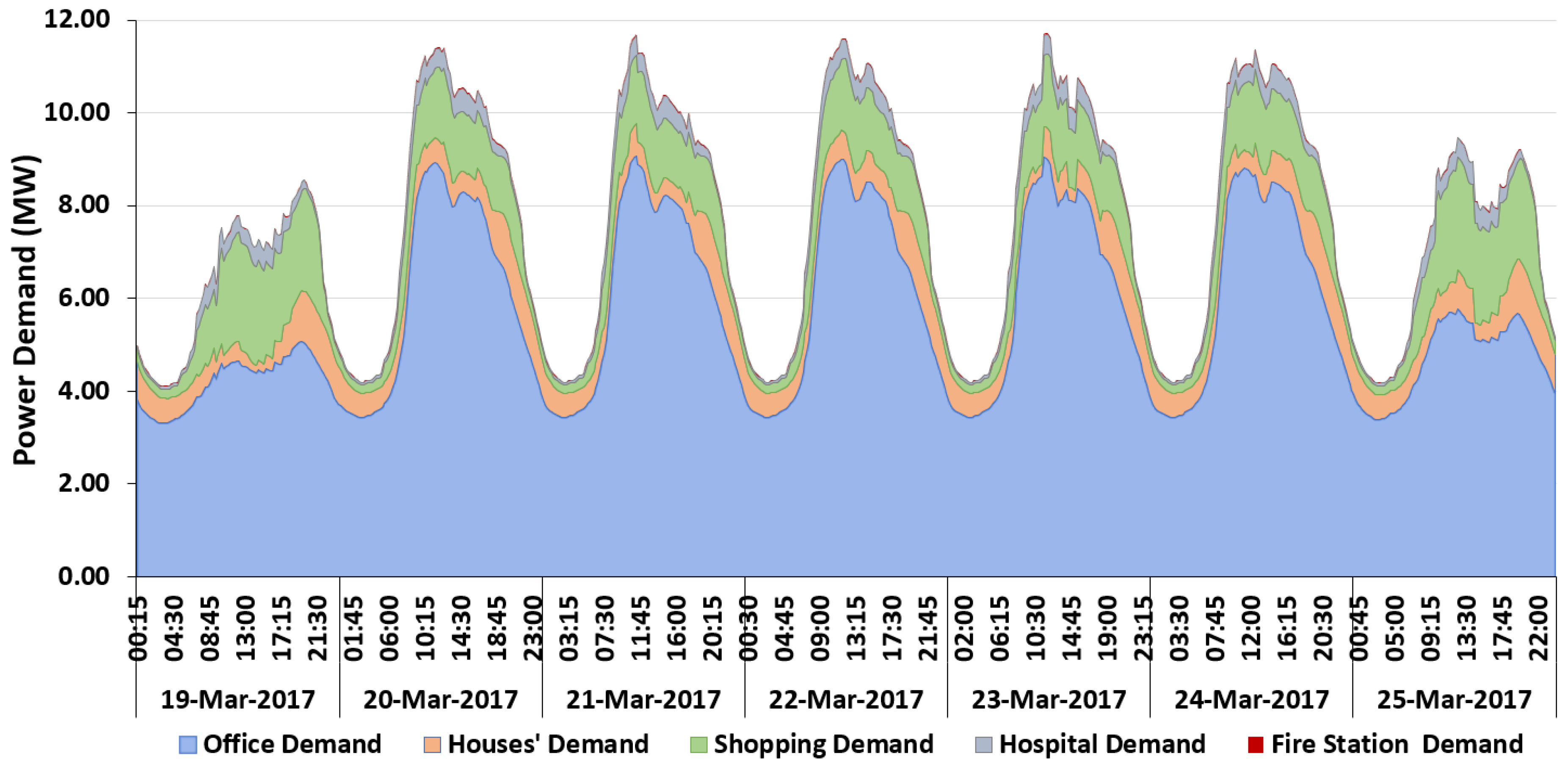

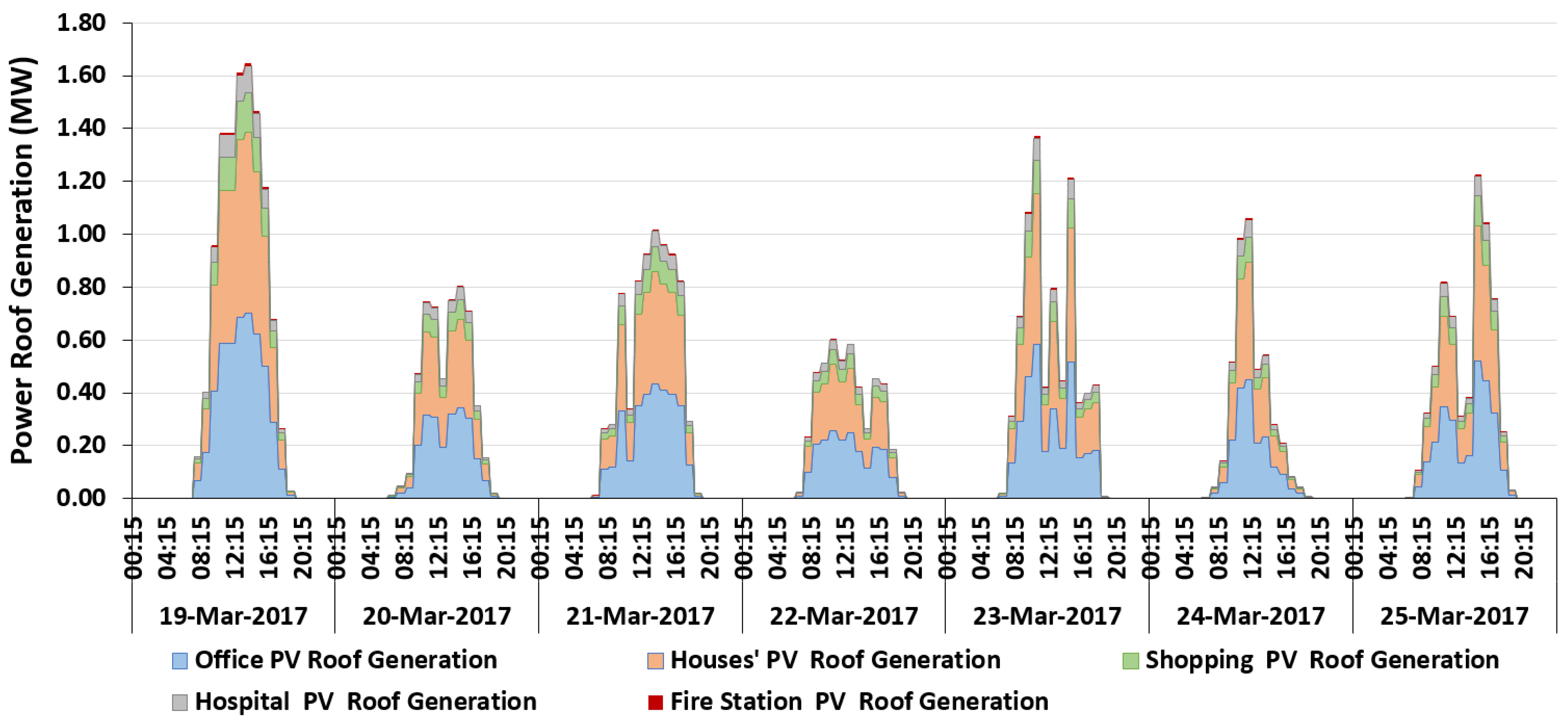

3. Case Study

- Residential buildings (1375 homes);

- Office buildings (seven buildings);

- Hospital;

- Fire Station;

- Shopping Mall.

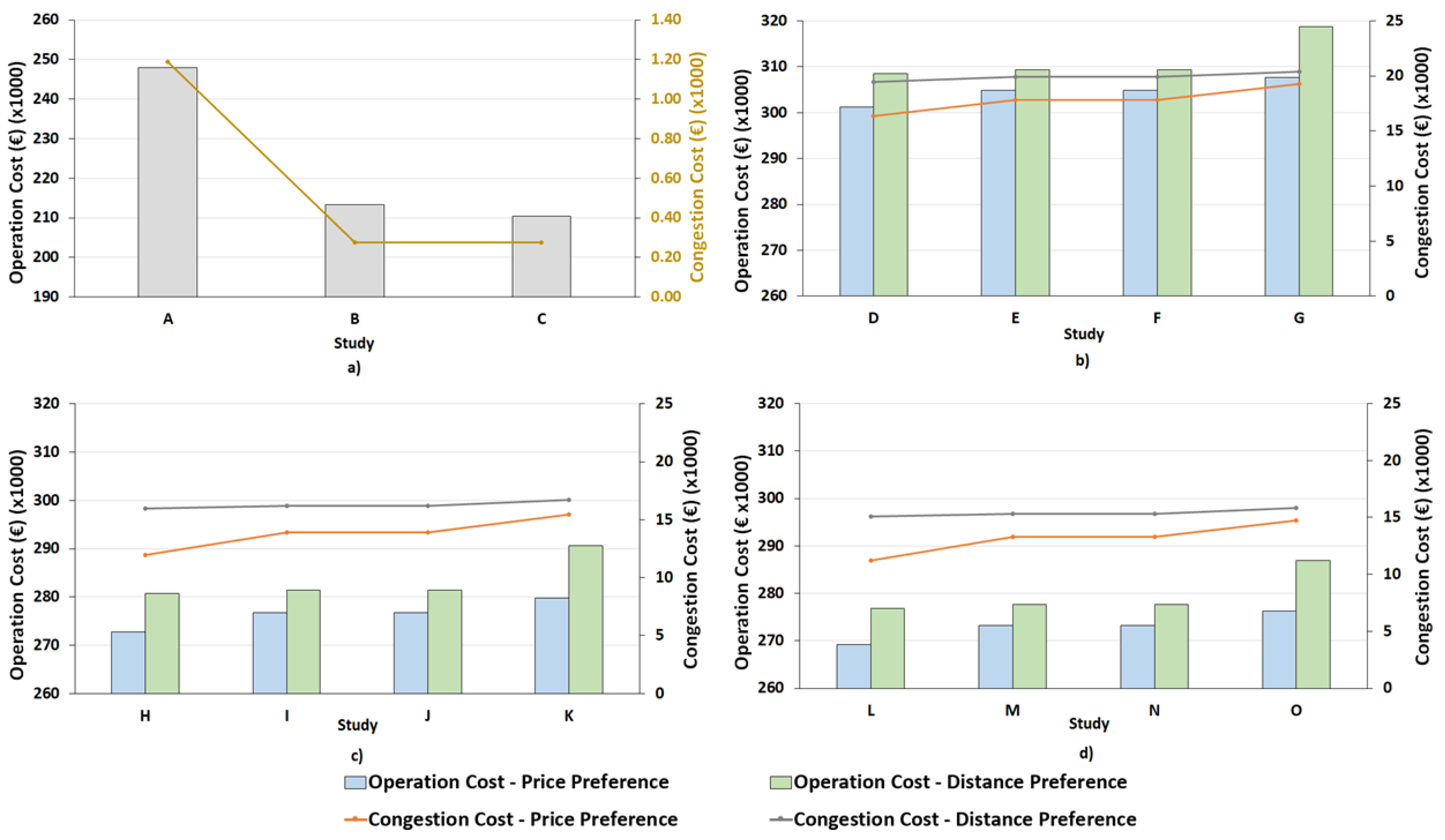

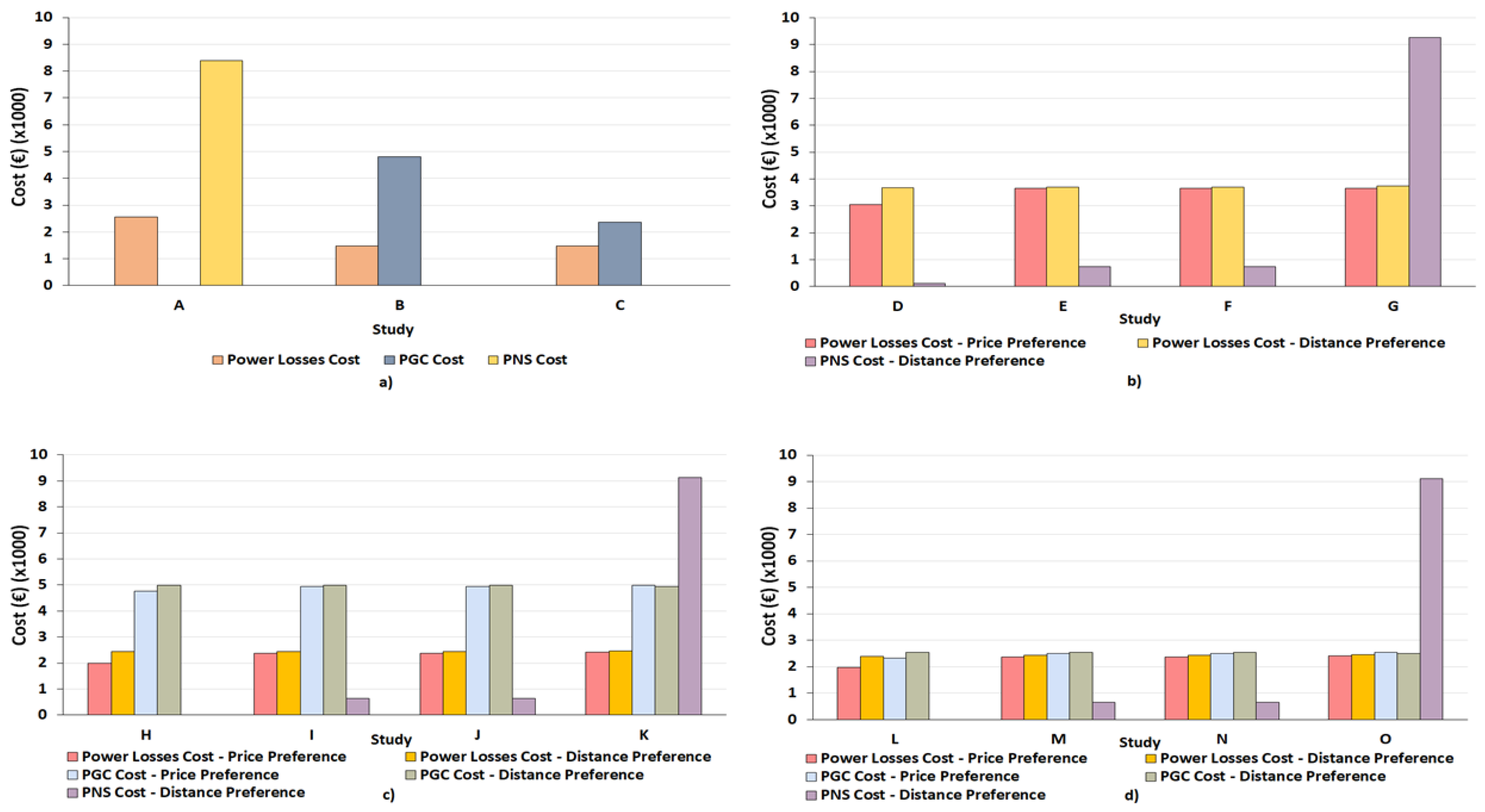

4. Results and Discussion

4.1. The Operator’s Perspective

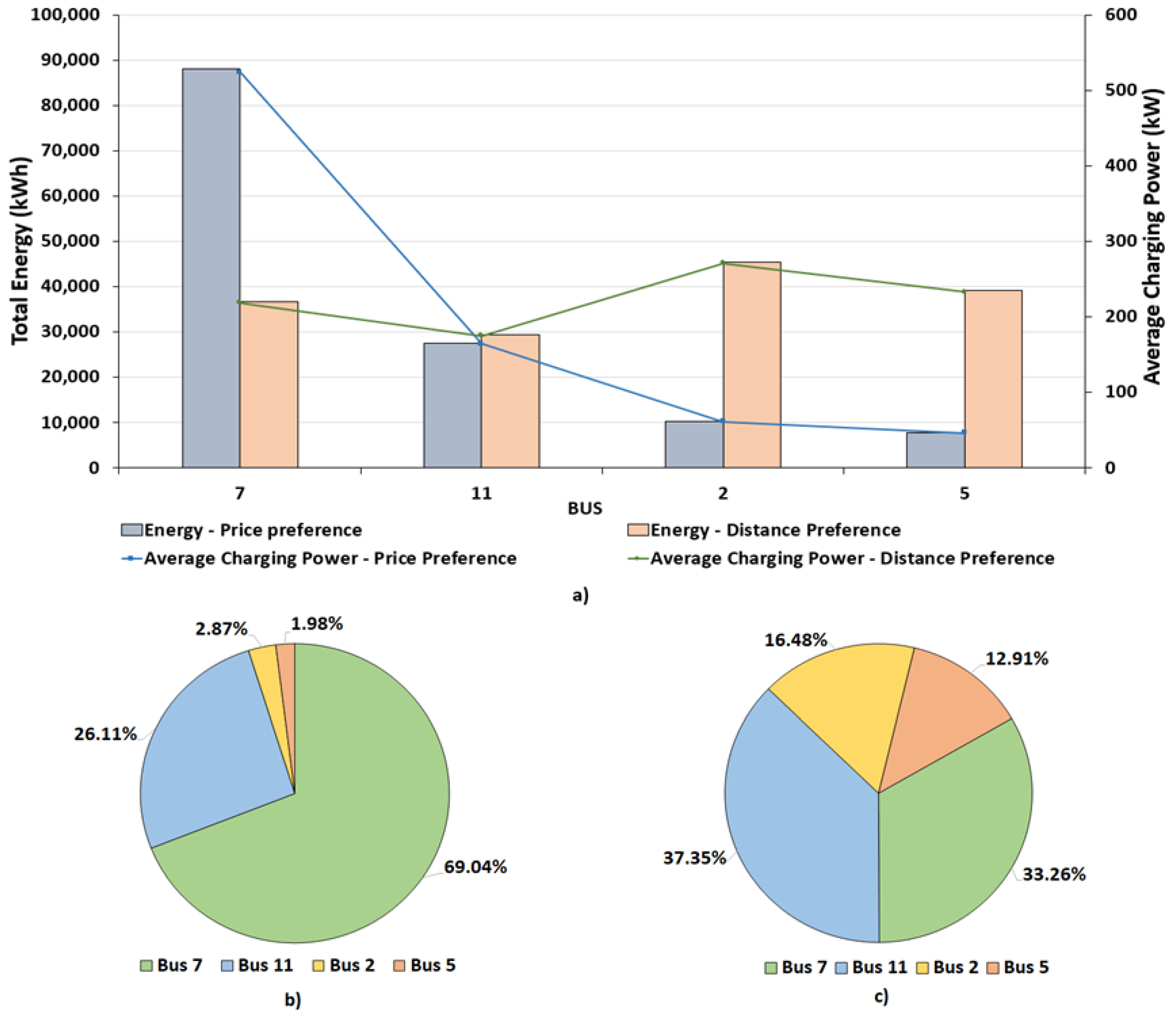

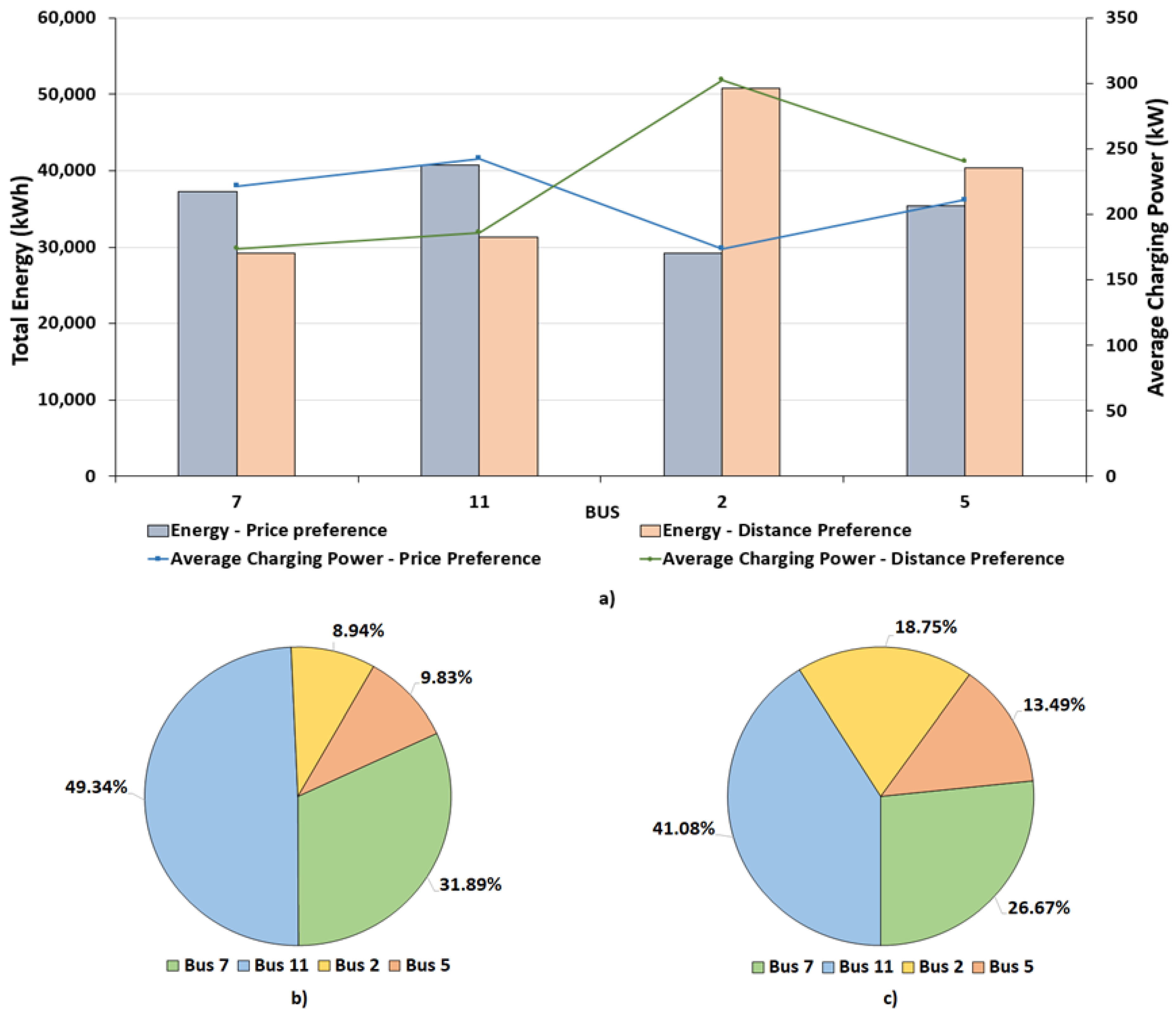

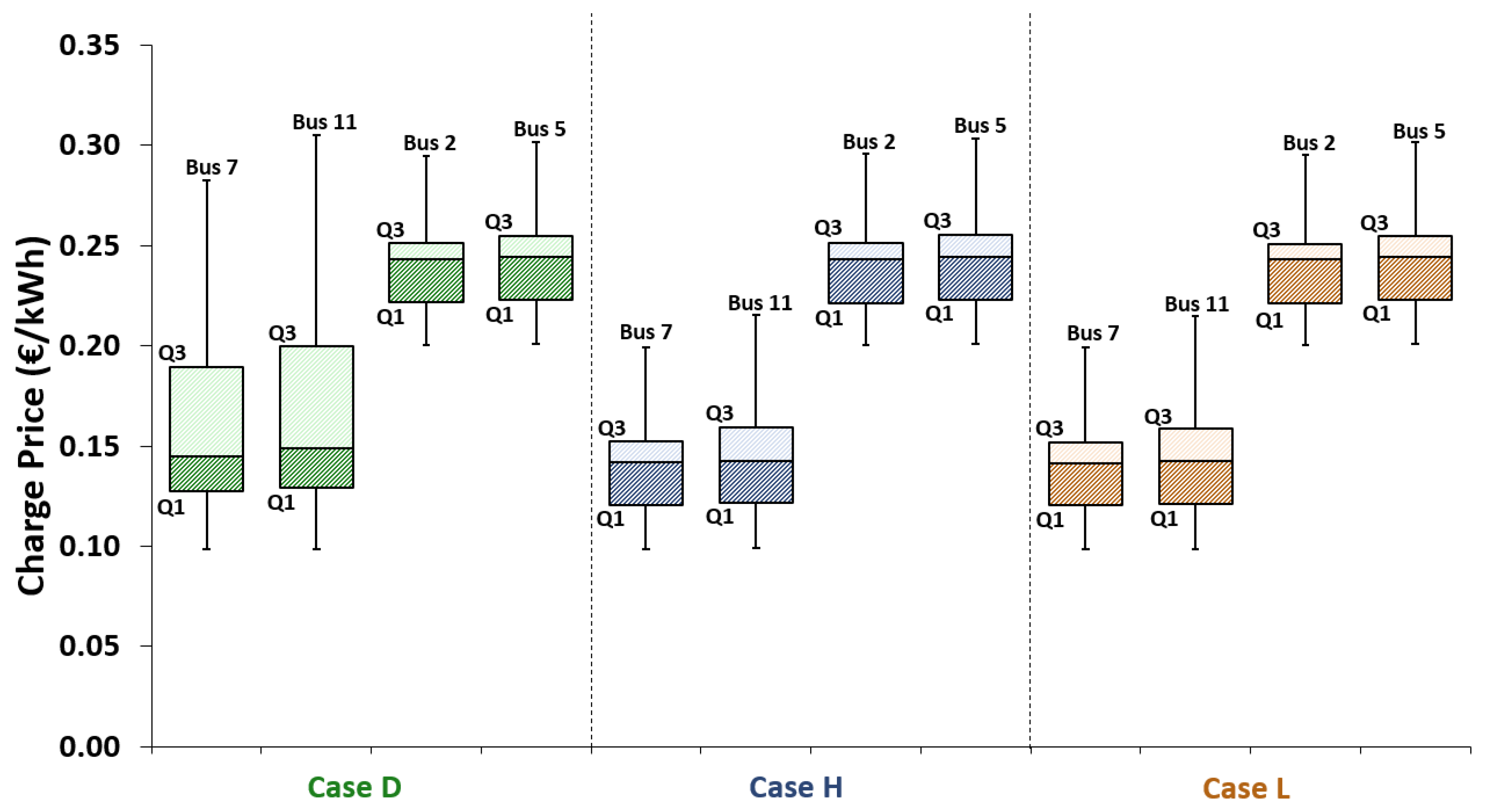

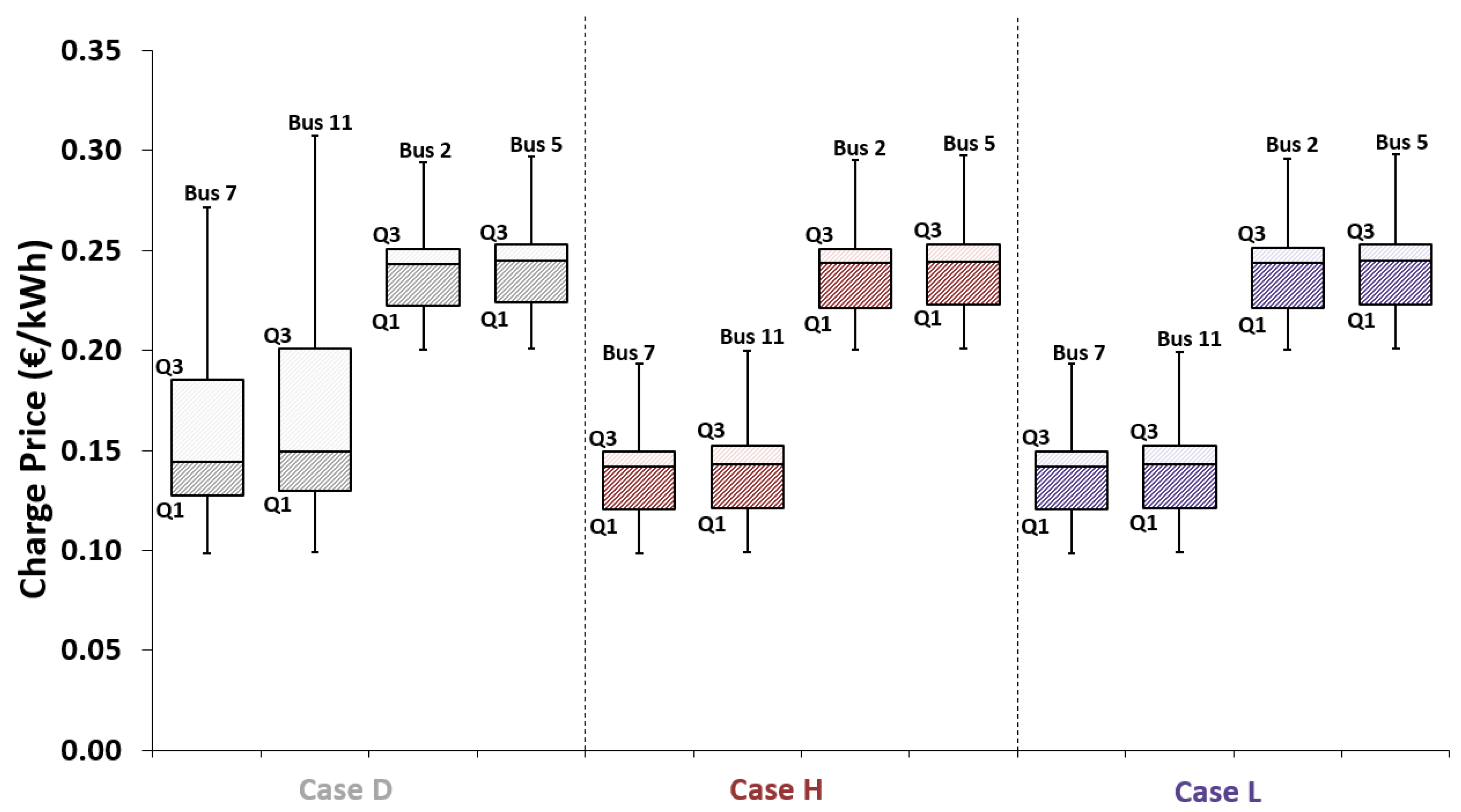

4.2. User Perspective

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| DER | Distributed energy resources |

| DG | Distributed generators |

| DLMP | Locational marginal pricing |

| DN | Distribution network |

| DNR | Distribution network reconfiguration |

| DSO | Distribution system operator |

| ESS | Energy storage systems |

| EU | European Union |

| EV | Electric vehicle |

| FCh | Fast charge |

| LMP | Locational marginal pricing |

| MINLP | Mixed-integer nonlinear programming |

| MOC | Master subproblem objective function |

| MV | Medium voltage |

| OMIE | Iberian electricity market operator |

| PGC | Power generation curtailment |

| PL | Power losses |

| PNS | Power not supplied |

| PV | Photovoltaic |

| RES | Renewable energy sources |

| SC | Smart city |

| SCh | Slow charge |

| SG | Smart grid |

| VAT | Value-added tax |

| Indices | |

| c | Line options |

| i | Electrical buses |

| j | Electrical buses |

| Loads | |

| External supplier | |

| Capacitor bank | |

| g | Distributed generator unit |

| e | Energy storage systems |

| v | Electric vehicles parking lot |

| m | Bender’s cuts iteration |

| Parameters | |

| Power generation curtailment cost [€/MW] | |

| Market price [€/MWh] | |

| Power not supplied cost [€/MW] | |

| Power losses cost [€/MW] | |

| Charge efficiency of energy storage systems | |

| Discharge efficiency of energy storage systems | |

| Lines congestion cost [€/MW] | |

| Market price [€/MW] | |

| Power not supplied cost [€/MW] | |

| Resistance for i,j line[] | |

| Power losses cost [€/MW] | |

| Power generation curtailment [€/MW] | |

| Power generation for g DG unit [MW] | |

| Power charge for EV parking lot in the bus i [MW] | |

| Maximum admissible line flow between bus i and bus j [MW] | |

| Number of DG units | |

| Minimum limit of power supplied by substation/supplier bs [MW] | |

| Maximum limit of power supplied by substation/supplier bs [MW] | |

| Generated power of distributed generation g [MW] | |

| Active power demand for load lo [MW] | |

| Power congestion factor | |

| ESS discharge rate [MW] | |

| ESS charge rate [MW] | |

| Decision for ESS e discharge {0,1} | |

| ESS e capacity [MWh] | |

| Decision for ESS e discharge {0,1} | |

| Duration of the period [hours] | |

| Energy stored in e ESS in previous period for master subproblem [MWh] | |

| Energy stored in e ESS in previous period for slave subproblem [MWh] | |

| Minimum capacity limit of the ESS e | |

| Minimum market price value that will permit the ESS discharge | |

| Sensitivities associated to the radiality decision taken by the master problem in the previous iteration | |

| Sensitivities associated to the ESS charge decision taken by the master problem in the previous iteration | |

| Slave problem infeasibilities cost [€] | |

| Minimum voltage magnitude limit in the bus i [V] | |

| Maximum voltage magnitude limit in the bus i [V] | |

| Minimum voltage angle limit in the bus i [rad] | |

| Maximum voltage angle limit in the bus i [rad] | |

| Reactive power demand for load lo [Mvar] | |

| Maximum limit of the capacitor bank cb [Mvar] | |

| Real term of the element i,j in the bus admittance matrix | |

| Imaginary term of the element i,j in the bus admittance matrix | |

| Reactance for i,j line [] | |

| Minimum limit of active power supplied by substation/supplier bs [MW] | |

| Maximum limit of active power supplied by substation/supplier bs [MW] | |

| Minimum limit of reactive power supplied by substation/supplier bs [Mvar] | |

| Maximum limit of reactive power supplied by substation/supplier bs [Mvar] | |

| Variables | |

| Fictitious load for each distributed generator g | |

| Power supplied by substation bs [MW] | |

| Power not supplied for load lo in the master subproblem [MW] | |

| Power flow in the line i,j for the master subproblem [MW] | |

| Power generation curtailment for master subproblem in the g DG unit [MW] | |

| Linear Benders’ cut variable | |

| Power discharge of ESS e for master subproblem [MW] | |

| Power charge of ESS e for master subproblem[MW] | |

| Binary decision variable {0,1} for the line usage between bus i and bus j | |

| Fictitious flow associated with branch i,j | |

| Power congestion for line i,j in the master subproblem [MW] | |

| Binary decision variable {0,1} for ESS e charge | |

| Binary decision variable {0,1} for ESS e discharge | |

| Energy stored in e ESS for master subproblem [MWh] | |

| Sum of the infeasibilities of the slave problem | |

| Slack variable for active power balance | |

| Slack variable for reactive power balance | |

| Slack variable for thermal lines capacity | |

| Power congestion for line i,j in the salve subproblem [MW] | |

| Active power supplied by substation bs[MW] | |

| Reactive power supplied by substation bs[Mvar] | |

| Power generation curtailment for slave subproblem in the g DG unit [MW] | |

| Power not supplied for slave subproblem in the load lo [MW] | |

| Apparent power loss in the line i,j [MVA] | |

| Voltage magnitude in the bus i [V] | |

| Voltage angle in the bus i [rad] | |

| Active injected power in the bus i [MW] | |

| Reactive injected power in the bus i [Mvar] | |

| Reactive power from capacitor bank cb [Mvar] | |

| Active power flow in the i,j line [MW] | |

| Reactive power flow in the i,j line [Mvar] | |

| Apparent power flow in the i,j line [MVA] | |

| Active power loss in the i,j line [MW] | |

| Reactive power loss in the i,j line [Mvar] | |

| Power flow in the i,j line for slave subproblem [MW] | |

| Power discharge of ESS e for slave subproblem [MW] | |

| Power charge of ESS e for slave subproblem[MW] | |

| Energy stored in e ESS for slave subproblem [MWh] | |

| Dynamic EV charging price for each period [€/kWh] | |

| Energy tariff price for each period [€/kWh] | |

| Additional profit margin of the parking owner | |

| Additional cost related to the fixed term of network price rate to be charged to the customer [€/kWh] | |

| Sets | |

| Set of buses | |

| Set of substation buses | |

| Set of capacitor banks buses | |

| Set of load buses | |

| Set of ESS buses | |

| Set of EV parking lot buses | |

| Set of substations | |

| Set of capacitor banks | |

| Set of lines | |

| Set of non-dispatchable DG buses |

References

- Mokryani, G.; Hu, Y.F.; Papadopoulos, P.; Niknam, T.; Aghaei, J. Deterministic approach for active distribution networks planning with high penetration of wind and solar power. Renew. Energy 2017. [Google Scholar] [CrossRef]

- The European Union Leading in Renewables. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/cop21-brochure-web.pdf (accessed on 8 February 2019).

- Paaso, A.; Kushner, D.; Bahramirad, S.; Khodaei, A. Grid Modernization Is Paving the Way for Building Smarter Cities [Technology Leaders]. IEEE Electr. Mag. 2018, 6, 6–108. [Google Scholar] [CrossRef]

- Curiale, M. From smart grids to smart city. In Proceedings of the IEEE 2014 Saudi Arabia Smart Grid Conference (SASG), Jeddah, Saudi Arabia, 14–17 December 2014; pp. 1–9. [Google Scholar] [CrossRef]

- Tuballa, M.L.; Abundo, M.L. A review of the development of Smart Grid technologies. Renew. Sustain. Energy Rev. 2016, 59, 710–725. [Google Scholar] [CrossRef]

- Kazmi, S.A.A.; Shahzad, M.K.; Khan, A.Z.; Shin, D.R. Smart Distribution Networks: A Review of Modern Distribution Concepts from a Planning Perspective. Energies 2017, 10, 501. [Google Scholar] [CrossRef]

- Blesl, M.; Das, A.; Fahl, U.; Remme, U. Role of energy efficiency standards in reducing CO2 emissions in Germany: An assessment with TIMES. Energy Policy 2007. [Google Scholar] [CrossRef]

- Erickson, L.E.; Robinson, J.; Brase, G.; Cutsor, J. Solar Powered Charging Infrastructure for Electric Vehicles: A Sustainable Development; CRC Press: Boca Raton, FL, USA, 2016. [Google Scholar]

- Alam, M.M.; Mekhilef, S.; Seyedmahmoudian, M.; Horan, B. Dynamic Charging of Electric Vehicle with Negligible Power Transfer Fluctuation. Energies 2017, 10, 701. [Google Scholar] [CrossRef]

- Foley, A.M.; Winning, I.; O Gallachoir, B.; Ieee, M. State-of-the-art in electric vehicle charging infrastructure. In Proceedings of the IEEE Vehicle Power and Propulsion Conference, Lille, France, 1–3 September 2010. [Google Scholar] [CrossRef]

- Heydt, G.T. The Impact of Electric Vehicle Deployment on Load Management Strategies. IEEE Power Eng. Rev. 1983. [Google Scholar] [CrossRef]

- Rahman, S.; Shrestha, G.B. An investigation into the impact of electric vehicle load on the electric utility distribution system. IEEE Trans. Power Deliv. 1993. [Google Scholar] [CrossRef]

- Salihi, J.T. Energy Requirements for Electric Cars and Their Impact on Electric Power Generation and Distribution Systems. IEEE Trans. Ind. Appl. 1973, IA-9, 516–532. [Google Scholar] [CrossRef]

- Geske, M.; Komarnicki, P.; Stötzer, M.; Styczynski, Z.A. Modeling and simulation of electric car penetration in the distribution power system—Case study. In Proceedings of the 2010 Modern Electric Power Systems, Wroclaw, Poland, 20–22 September 2010; pp. 1–6. [Google Scholar]

- Juanuwattanakul, P.; Masoum, M.A. Identification of the weakest buses in unbalanced multiphase smart grids with plug-in electric vehicle charging stations. In Proceedings of the 2011 IEEE PES Innovative Smart Grid Technologies, ISGT Asia 2011 Conference: Smarter Grid for Sustainable and Affordable Energy Future, Perth, WA, Australia, 13–16 November 2011. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, C.; Sun, J.; Zheng, P.; Lin, X.; Bo, Z. Impacts of Electric Vehicles on the Transient Voltage Stability of Distribution Network and the Study of Improvement Measures. In Proceedings of the IEEE PES Asia-Pacific Power and Energy Engineering Conference, Hong Kong, China, 7–10 December 2014. [Google Scholar] [CrossRef]

- Dharmakeerthi, C.H.; Mithulananthan, N.; Saha, T.K. Impact of electric vehicle fast charging on power system voltage stability. Int. J. Electr. Power Energy Syst. 2014. [Google Scholar] [CrossRef]

- Ul-Haq, A.; Cecati, C.; Strunz, K.; Abbasi, E. Impact of Electric Vehicle Charging on Voltage Unbalance in an Urban Distribution Network. Intell. Ind. Syst. 2015, 1, 51–60. [Google Scholar] [CrossRef]

- De Hoog, J.; Muenzel, V.; Jayasuriya, D.C.; Alpcan, T.; Brazil, M.; Thomas, D.A.; Mareels, I.; Dahlenburg, G.; Jegatheesan, R. The importance of spatial distribution when analysing the impact of electric vehicles on voltage stability in distribution networks. Energy Syst. 2014. [Google Scholar] [CrossRef]

- Zhang, Y.; Song, X.; Gao, F.; Li, J. Research of voltage stability analysis method in distribution power system with plug-in electric vehicle. In Proceedings of the 2016 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Xi’an, China, 25–28 October 2016; pp. 1501–1507. [Google Scholar] [CrossRef]

- Staats, P.T.; Grady, W.M.; Arapostathis, A.; Thallam, R.S. A statistical analysis of the effect of electric vehicle battery charging on distribution system harmonic voltages. IEEE Trans. Power Deliv. 1998. [Google Scholar] [CrossRef]

- Gómez, J.C.; Morcos, M.M. Impact of EV battery chargers on the power quality of distribution systems. IEEE Trans. Power Deliv. 2003. [Google Scholar] [CrossRef]

- Basu, M.; Gaughan, K.; Coyle, E. Harmonic distortion caused by EV battery chargers in the distribution systems network and its remedy. In Proceedings of the 39th International Universities Power Engineering Conferences, Bristol, UK, 6–8 September 2004. [Google Scholar]

- Jiang, C.; Torquato, R.; Salles, D.; Xu, W. Method to assess the power-quality impact of plug-in electric vehicles. IEEE Trans. Power Deliv. 2014. [Google Scholar] [CrossRef]

- McCarthy, D.; Wolfs, P. The HV system impacts of large scale electric vehicle deployments in a metropolitan area. In Proceedings of the 2010 20th Australasian Universities Power Engineering Conference, Christchurch, New Zealand, 5–8 December 2010. [Google Scholar]

- Putrus, G.; Suwanapingkarl, P.; Johnston, D.; Bentley, E.; Narayana, M. Impact of electric vehicles on power distribution networks. In Proceedings of the 2009 IEEE Vehicle Power and Propulsion Conference, Dearborn, MI, USA, 7–10 September 2009. [Google Scholar] [CrossRef]

- Fan, Y.; Guo, C.; Hou, P.; Tang, Z. Impact of Electric Vehicle Charging on Power Load Based on TOU Price. Energy Power Eng. 2013, 05, 1347–1351. [Google Scholar] [CrossRef]

- Di Silvestre, M.L.; Riva Sanseverino, E.; Zizzo, G.; Graditi, G. An optimization approach for efficient management of EV parking lots with batteries recharging facilities. J. Ambient Intell. Hum. Comput. 2013. [Google Scholar] [CrossRef]

- Sehar, F.; Pipattanasomporn, M.; Rahman, S. Demand management to mitigate impacts of plug-in electric vehicle fast charge in buildings with renewables. Energy 2017. [Google Scholar] [CrossRef]

- Hüls, J.; Remke, A. Coordinated charging strategies for plug-in electric vehicles to ensure a robust charging process. In Proceedings of the ACM 10th EAI International Conference on Performance Evaluation Methodologies and Tools, Taormina, Italy, 25–28 October 2017. [Google Scholar] [CrossRef]

- Biegel, B.; Andersen, P.; Stoustrup, J.; Bendtsen, J. Congestion Management in a Smart Grid via Shadow Prices. IFAC Proc. Volumes 2012. [Google Scholar] [CrossRef]

- Bohn, R.E.; Caramanis, M.C.; Schweppe, F.C. Optimal Pricing in Electrical Networks over Space and Time. RAND J. Econ. 1984. [Google Scholar] [CrossRef]

- Sotkiewicz, P.M.; Vignolo, J.M. Nodal pricing for distribution networks: Efficient pricing for efficiency enhancing DG. IEEE Trans. Power Syst. 2006. [Google Scholar] [CrossRef]

- Singh, R.K.; Goswami, S.K. Optimum allocation of distributed generations based on nodal pricing for profit, loss reduction, and voltage improvement including voltage rise issue. Int. J. Electr. Power Energy Syst. 2010. [Google Scholar] [CrossRef]

- Meng, F.; Chowdhury, B.H. Distribution LMP-based economic operation for future Smart Grid. In Proceedings of the 2011 IEEE Power and Energy Conference at Illinois, PECI 2011, Champaign, IL, USA, 25–26 February 2011. [Google Scholar] [CrossRef]

- Heydt, G.T.; Chowdhury, B.H.; Crow, M.L.; Haughton, D.; Kiefer, B.D.; Meng, F.; Sathyanarayana, B.R. Pricing and control in the next generation power distribution system. IEEE Trans. Smart Grid 2012. [Google Scholar] [CrossRef]

- Shaloudegi, K.; Madinehi, N.; Hosseinian, S.H.; Abyaneh, H.A. A novel policy for locational marginal price calculation in distribution systems based on loss reduction allocation using game theory. IEEE Trans. Power Syst. 2012. [Google Scholar] [CrossRef]

- O’Connell, N.; Wu, Q.; Østergaard, J.; Nielsen, A.H.; Cha, S.T.; Ding, Y. Day-ahead tariffs for the alleviation of distribution grid congestion from electric vehicles. Electric Power Syst. Res. 2012. [Google Scholar] [CrossRef]

- Li, R.; Wu, Q.; Oren, S.S. Distribution Locational Marginal Pricing for Optimal Electric Vehicle Charging Management. IEEE Trans. Power Syst. 2014, 29, 203–211. [Google Scholar] [CrossRef]

- Liu, W.; Wu, Q.; Wen, F.; Ostergaard, J. Day-ahead congestion management in distribution systems through household demand response and distribution congestion prices. IEEE Trans. Smart Grid 2014. [Google Scholar] [CrossRef]

- Huang, S.; Wu, Q.; Oren, S.S.; Li, R.; Liu, Z. Distribution Locational Marginal Pricing Through Quadratic Programming for Congestion Management in Distribution Networks. IEEE Trans. Power Syst. 2015. [Google Scholar] [CrossRef]

- Clement-Nyns, K.; Haesen, E.; Driesen, J. The impact of Charging plug-in hybrid electric vehicles on a residential distribution grid. IEEE Trans. Power Syst. 2010. [Google Scholar] [CrossRef]

- Leemput, N.; Geth, F.; Van Roy, J.; Delnooz, A.; Buscher, J.; Driesen, J. Impact of electric vehicle on-board single-phase charging strategies on a flemish residential grid. IEEE Trans. Smart Grid 2014. [Google Scholar] [CrossRef]

- Rezaee, S.; Farjah, E.; Khorramdel, B. Probabilistic analysis of plug-in electric vehicles impact on electrical grid through homes and parking lots. IEEE Trans. Sustain. Energy 2013. [Google Scholar] [CrossRef]

- Bin Humayd, A.S.; Bhattacharya, K. Assessment of distribution system margins to accommodate the penetration of plug-in electric vehicles. In Proceedings of the 2015 IEEE Transportation Electrification Conference and Expo, ITEC 2015, Dearborn, MI, USA, 14–17 June 2015. [Google Scholar] [CrossRef]

- Möller, F.; Meyer, J.; Schegner, P. Load model of electric vehicles chargers for load flow and unbalance studies. In Proceedings of the 9th International: 2014 Electric Power Quality and Supply Reliability Conference, PQ 2014—Proceedings, Rakvere, Estonia, 11–13 June 2014. [Google Scholar] [CrossRef]

- Min, Z.; Qiuyu, C.; Jiajia, X.; Weiwei, Y.; Shu, N. Study on influence of large-scale electric vehicle charging and discharging load on distribution system. In Proceedings of the IEEE 2016 China International Conference on Electricity Distribution (CICED), Xi’an, China, 10–13 August 2016; pp. 1–4. [Google Scholar] [CrossRef]

- Sarker, M.R.; Ortega-Vazquez, M.A.; Kirschen, D.S. Optimal Coordination and Scheduling of Demand Response via Monetary Incentives. IEEE Trans. Smart Grid 2015. [Google Scholar] [CrossRef]

- Mou, Y.; Xing, H.; Lin, Z.; Fu, M. Decentralized optimal demand-side management for PHEV charging in a smart grid. IEEE Trans. Smart Grid 2015. [Google Scholar] [CrossRef]

- Zou, S.; Ma, Z.; Liu, X.; Hiskens, I. An Efficient Game for Coordinating Electric Vehicle Charging. IEEE Trans. Autom. Control 2017. [Google Scholar] [CrossRef]

- Veldman, E.; Verzijlbergh, R.A. Distribution grid impacts of smart electric vehicle charging from different perspectives. IEEE Trans. Smart Grid 2015. [Google Scholar] [CrossRef]

- Li, C.; Schaltz, E.; Vasquez, J.C.; Guerrero, J.M. Distributed coordination of electric vehicle charging in a community microgrid considering real-time price. In Proceedings of the 2016 18th European Conference on Power Electronics and Applications, EPE 2016 ECCE Europe, Karlsruhe, Germany, 5–9 September 2016. [Google Scholar] [CrossRef]

- Akbari, H.; Fernando, X. Futuristic model of Electric Vehicle charging queues. In Proceedings of the IEEE 2016 3rd International Conference on Signal Processing and Integrated Networks (SPIN), Noida, India, 11–12 February 2016; pp. 789–794. [Google Scholar] [CrossRef]

- Wang, R.; Wang, P.; Xiao, G. Two-Stage Mechanism for Massive Electric Vehicle Charging Involving Renewable Energy. IEEE Trans. Veh. Technol. 2016. [Google Scholar] [CrossRef]

- Nguyen, H.N.T.; Zhang, C.; Zhang, J. Dynamic Demand Control of Electric Vehicles to Support Power Grid With High Penetration Level of Renewable Energy. IEEE Trans. Transp. Electr. 2016, 2, 66–75. [Google Scholar] [CrossRef]

- Jin, C.; Sheng, X.; Ghosh, P. Optimized Electric Vehicle Charging With Intermittent Renewable Energy Sources. IEEE J. Sel. Top. Signal Process. 2014, 8, 1063–1072. [Google Scholar] [CrossRef]

- Schuelke, A.; Erickson, K. The potential for compensating wind fluctuations with residential load shifting of electric vehicles. In Proceedings of the 2011 IEEE International Conference on Smart Grid Communications, SmartGridComm 2011, Brussels, Belgium, 17–20 October 2011. [Google Scholar] [CrossRef]

- Sourkounis, C.; Einwachter, F. Smart charge management of electric vehicles in decentralized power supply systems. In Proceedings of the IEEE 11th International Conference on Electrical Power Quality and Utilisation, Lisbon, Portugal, 17–19 October 2011; pp. 1–6. [Google Scholar] [CrossRef]

- Xiong, Y.; Chu, C.C.; Gadh, R.; Wang, B. Distributed optimal vehicle grid integration strategy with user behavior prediction. In Proceedings of the 2017 IEEE Power & Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Gan, L.; Topcu, U.; Low, S.H. Optimal decentralized protocol for electric vehicle charging. IEEE Trans. Power Syst. 2013. [Google Scholar] [CrossRef]

- Wang, B.; Wang, Y.; Qiu, C.; Chu, C.C.; Gadh, R. Event-based electric vehicle scheduling considering random user behaviors. In Proceedings of the 2015 IEEE International Conference on Smart Grid Communications, SmartGridComm 2015, Miami, FL, USA, 2–5 November 2016. [Google Scholar] [CrossRef]

- Cao, Y.; Tang, S.; Li, C.; Zhang, P.; Tan, Y.; Zhang, Z.; Li, J. An optimized EV charging model considering TOU price and SOC curve. IEEE Trans. Smart Grid 2012. [Google Scholar] [CrossRef]

- Franke, T.; Krems, J.F. Interacting with limited mobility resources: Psychological range levels in electric vehicle use. Transp. Res. Part A Policy Pract. 2013, 48, 109–122. [Google Scholar] [CrossRef]

- Franke, T.; Bühler, F.; Cocron, P.; Neumann, I.; Krems, J.F. Enhancing Sustainability of Electric Vehicles: A Field Study Approach to Understanding User Acceptance and Behavior. Available online: https://www.tu-chemnitz.de/hsw/psychologie/professuren/allpsy1/pdf/Franke_et_al._2012_SustainEV.pdf (accessed on 8 February 2019).

- Franke, T.; Neumann, I.; Bühler, F.; Cocron, P.; Krems, J.F. Experiencing Range in an Electric Vehicle: Understanding Psychological Barriers. Appl. Psychol. 2012, 61, 368–391. [Google Scholar] [CrossRef]

- Franke, T.; Krems, J.F. Understanding charging behavior of electric vehicle users. Transp. Res. Part F Traffic Psychol. Behav. 2013, 21, 75–89. [Google Scholar] [CrossRef]

- Lu, X.; Chen, B.; Chen, C.; Wang, J. Coupled Cyber and Physical Systems: Embracing Smart Cities with Multistream Data Flow. IEEE Electr. Mag. 2018, 6, 73–83. [Google Scholar] [CrossRef]

- Hung, D.Q.; Mithulananthan, N. Loss reduction and loadability enhancement with DG: A dual-index analytical approach. Appl. Energy 2014, 115, 233–241. [Google Scholar] [CrossRef]

- Santos, S.F.; Fitiwi, D.Z.; Cruz, M.R.; Cabrita, C.M.; Catalão, J.P. Impacts of optimal energy storage deployment and network reconfiguration on renewable integration level in distribution systems. Appl. Energy 2017, 185, 44–55. [Google Scholar] [CrossRef]

- Song, I.K.; Jung, W.W.; Kim, J.Y.; Yun, S.Y.; Choi, J.H.; Ahn, S.J. Operation Schemes of Smart Distribution Networks With Distributed Energy Resources for Loss Reduction and Service Restoration. IEEE Trans. Smart Grid 2013, 4, 367–374. [Google Scholar] [CrossRef]

- Hung, D.Q.; Mithulananthan, N.; Bansal, R. A combined practical approach for distribution system loss reduction. Int. J. Ambient Energy 2015, 36, 123–131. [Google Scholar] [CrossRef]

- Dorostkar-Ghamsari, M.R.; Fotuhi-Firuzabad, M.; Lehtonen, M.; Safdarian, A. Value of Distribution Network Reconfiguration in Presence of Renewable Energy Resources. IEEE Trans. Power Syst. 2016, 31, 1879–1888. [Google Scholar] [CrossRef]

- Hung, D.Q.; Mithulananthan, N.; Bansal, R. An optimal investment planning framework for multiple distributed generation units in industrial distribution systems. Appl. Energy 2014, 124, 62–72. [Google Scholar] [CrossRef]

- Munoz-Delgado, G.; Contreras, J.; Arroyo, J.M. Joint Expansion Planning of Distributed Generation and Distribution Networks. IEEE Trans. Power Syst. 2015, 30, 2579–2590. [Google Scholar] [CrossRef]

- Capitanescu, F.; Ochoa, L.F.; Margossian, H.; Hatziargyriou, N.D. Assessing the Potential of Network Reconfiguration to Improve Distributed Generation Hosting Capacity in Active Distribution Systems. IEEE Trans. Power Syst. 2015, 30, 346–356. [Google Scholar] [CrossRef]

- Wu, Y.K.; Lee, C.Y.; Liu, L.C.; Tsai, S.H. Study of Reconfiguration for the Distribution System With Distributed Generators. IEEE Trans. Power Deliv. 2010, 25, 1678–1685. [Google Scholar] [CrossRef]

- Abu-Mouti, F.S.; El-Hawary, M.E. Optimal Distributed Generation Allocation and Sizing in Distribution Systems via Artificial Bee Colony Algorithm. IEEE Trans. Power Deliv. 2011, 26, 2090–2101. [Google Scholar] [CrossRef]

- Lueken, C.; Carvalho, P.M.; Apt, J. Distribution grid reconfiguration reduces power losses and helps integrate renewables. Energy Policy 2012, 48, 260–273. [Google Scholar] [CrossRef]

- Esmaeilian, H.R.; Fadaeinedjad, R. Energy Loss Minimization in Distribution Systems Utilizing an Enhanced Reconfiguration Method Integrating Distributed Generation. IEEE Syst. J. 2015, 9, 1430–1439. [Google Scholar] [CrossRef]

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making Under Uncertainty in Electricity Markets; International Series in Operations Research & Management Science; Springer: Boston, MA, USA, 2010; Volume 153. [Google Scholar] [CrossRef]

- Soares, J.; Canizes, B.; Ghazvini, M.A.F.; Vale, Z.; Venayagamoorthy, G.K. Two-Stage Stochastic Model Using Benders’ Decomposition for Large-Scale Energy Resource Management in Smart Grids. IEEE Trans. Ind. Appl. 2017, 53, 5905–5914. [Google Scholar] [CrossRef]

- Benders, J.F. Partitioning procedures for solving mixed-variables programming problems. Numerische Mathematik 1962, 4, 238–252. [Google Scholar] [CrossRef]

- Conejo, A.; Castillo, E.; Minguez, R.; Garcia-Bertrand, R. Decomposition Techniques in Mathematical Programming; Springer: Berlin/Heidelberg, Germany, 2006. [Google Scholar] [CrossRef]

- Canizes, B.; Soares, J. Data 13 bus Distribution Network. 2019. Available online: https://doi.org/10.5281/zenodo.2556871 (accessed on 8 February 2019).

| Parameter | Description |

|---|---|

| ncars | Number of EVs |

| cdist | Distance increase between two Euclidean points |

| sf | Scale factor of the map |

| hcpower | Home charging power |

| chargineff | Charging mode efficiency |

| Parameter | Description |

|---|---|

| Ilocation | Initial location of the car (usually home) |

| Clocation | Current location at period j |

| ISoC | Initial state of charge |

| CSoC | Current state of charge |

| ae | Car average economy |

| aeppkm | Car average economy percentage per kilometer |

| arp | Available range preference |

| times | Table with the times in which the scheduled trips will be made |

| as | Average speed |

| nd | Number of destinations each car has |

| dest1 | Table with the coordinates of the places of the trips to be carried out |

| i | Boolean variable that determines whether the car will have more than one destination |

| w1, w2 | Weights used in the calculation of the score to determine the best place for charging |

| ti | Table with the importance of each trip (1 being the least important and 3 the most) |

| hc | Boolean variable that determines whether the car has a home charger or not |

| Building | L1 | L2 | L3 | L4 to L18 | L19 | L20 | L21 | L22 | L23 | L24 | L25 | PL1 to PL2 | PL3 to PL4 | PL5 to PL6 | PL7 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coordinates (km) | X Axis | 10.50 | 0.50 | 9.00 | 3.75 to 8.25 | 0.50 | 0.50 | 2.50 | 3.00 | 4.50 | 6.00 | 8.00 | 1.00 | 7.00 | 6.00 | 11.00 |

| Y Axis | 3.50 | 2.00 | 5.00 | 1.00 to 3.00 | 3.50 | 5.50 | 2.00 | 4.50 | 3.50 | 5.00 | 4.00 | 3.50 | 5.00 | 0.50 | 4.00 | |

| Nominal Power (W) | 85.00 |

|---|---|

| Short Circuit Current (A) | 1.62 |

| Nominal Operating Temperature of the Cell (C) | 45.00 |

| Open Circuit Voltage (V) | 56.70 |

| Current at the Maximum Power Point (A) | 1.41 |

| Voltage at the Maximum Power Point (V) | 45.50 |

| Voltage High Temperature Coefficient (>25 C) (V/C) | −0.1531 |

| Voltage Low Temperature Coefficient (−40 C to 25 C) (V/C) | −0.1134 |

| Current Temperature Coefficient (A/C) | |

| PV park at bus 12 | |

| Number of Modules | 104 |

| Number of Panels | 120 |

| Total Number of Modules | 12,480 |

| PV parks at Buses 2–8, 10, and 11 | |

| Number of Modules | 104 |

| Number of Panels | 30 |

| Total Number of Modules | 3120 |

| Model | Battery (kWh) | Slow Charge Power (kW) | Fast Charge Power (kW) | Consumption (kWh/km) |

|---|---|---|---|---|

| Nissan Leaf | 40.00 | 6.60 | 50.00 | 0.1553 |

| Tesla Model S 70D | 75.00 | 7.40 | 50.00 | 0.2100 |

| BMW i3 | 33.20 | 7.40 | 50.00 | 0.1584 |

| Renault Zoe | 41.00 | 7.40 | - | 0.1460 |

| Renault Kangoo | 33.00 | 7.40 | - | 0.1926 |

| VW e-Golf | 24.20 | 7.20 | 40.00 | 0.1584 |

| Ford Focus | 33.50 | 6.60 | 50.00 | 0.1926 |

| Hyundai IONIQ | 30.50 | 6.60 | 50.00 | 0.1429 |

| Preference | Weight (%) | Probability (%) | |

|---|---|---|---|

| w1 | w2 | ||

| Price | 40 | 60 | 30 |

| Distance | 85 | 15 | 70 |

| Preference | Weight (%) | Probability (%) | |

|---|---|---|---|

| w1 | w2 | ||

| Price | 15 | 85 | 70 |

| Distance | 60 | 40 | 30 |

| User Price Preference Scenario | User Distance Preference Scenario | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DG | EV | ESS | Dynamic EV Charging Price | Fixed Price (€/kWh) | DG | EV | ESS | Dynamic EV Charging Price | Fixed Price (€/kWh) | |||||

| SCh= 0.15 FCh= 0.25 | SCh = 0.2 FCh = 0.3 | SCh = 0.3 FCh = 0.4 | SCh = 0.15 FCh = 0.25 | SCh = 0.2 FCh = 0.3 | SCh = 0.3 FCh = 0.4 | |||||||||

| Case A | No | No | No | Yes | No | No | No | No | No | No | Yes | No | No | No |

| Case B | Yes | No | No | Yes | No | No | No | Yes | No | No | Yes | No | No | No |

| Case C | Yes | No | Yes | Yes | No | No | No | Yes | No | Yes | Yes | No | No | No |

| Case D | No | Yes | No | Yes | No | No | No | No | Yes | No | Yes | No | No | No |

| Case E | No | Yes | No | No | Yes | No | No | No | Yes | No | No | Yes | No | No |

| Case F | No | Yes | No | No | No | Yes | No | No | Yes | No | No | No | Yes | No |

| Case G | No | Yes | No | No | No | No | Yes | No | Yes | No | No | No | No | Yes |

| Case H | Yes | Yes | No | Yes | No | No | No | Yes | Yes | No | Yes | No | No | No |

| Case I | Yes | Yes | No | No | Yes | No | No | Yes | Yes | No | No | Yes | No | No |

| Case J | Yes | Yes | No | No | No | Yes | No | Yes | Yes | No | No | No | Yes | No |

| Case K | Yes | Yes | No | No | No | No | Yes | Yes | Yes | No | No | No | No | Yes |

| Case L | Yes | Yes | Yes | Yes | No | No | No | Yes | Yes | Yes | Yes | No | No | No |

| Case M | Yes | Yes | Yes | No | Yes | No | No | Yes | Yes | Yes | No | Yes | No | No |

| Case N | Yes | Yes | Yes | No | No | Yes | No | Yes | Yes | Yes | No | No | Yes | No |

| Case O | Yes | Yes | Yes | No | No | No | Yes | Yes | Yes | Yes | No | No | No | Yes |

| Problem Level | Constraints | Number of Variables Per Period | Average Execution Time Per Period (s) | Peak Memory (kB) | ||||

|---|---|---|---|---|---|---|---|---|

| Linear | Non-Linear | Total | Continuous | Integer | Total | |||

| Master problem | 566 | - | 566 | 573 | 171 | 744 | 1.2 | 4656 |

| Slave problem | 83 | 116 | 199 | 286 | - | 286 | ||

| Case | User Price Preference Scenario | User Distance Preference Scenario | ||||||

|---|---|---|---|---|---|---|---|---|

| Max Voltage | Min Voltage | Max Voltage | Min Voltage | |||||

| bus | Value (p.u.) | bus | Value (p.u.) | bus | Value (p.u.) | bus | Value (p.u.) | |

| A | 2 | 0.9996 | 9 | 0.9819 | 2 | 0.9996 | 9 | 0.9819 |

| B | 7 | 0.9998 | 9 | 0.9844 | 7 | 0.9998 | 9 | 0.9844 |

| C | 7 | 0.9998 | 9 | 0.9844 | 7 | 0.9998 | 9 | 0.9844 |

| D | 2 | 0.9996 | 9 | 0.9814 | 2 | 0.9996 | 6 | 0.9690 |

| E | 2 | 0.9996 | 13 | 0.9761 | 2 | 0.9996 | 6 | 0.9688 |

| F | 2 | 0.9996 | 13 | 0.9761 | 2 | 0.9996 | 6 | 0.9688 |

| G | 2 | 0.9996 | 6 | 0.9685 | 2 | 0.9996 | 5 | 0.9623 |

| H | 7 | 0.9999 | 13 | 0.9826 | 7 | 0.9998 | 6 | 0.9692 |

| I | 7 | 0.9998 | 13 | 0.9763 | 7 | 0.9999 | 6 | 0.9690 |

| J | 7 | 0.9999 | 13 | 0.9763 | 7 | 0.9999 | 6 | 0.9690 |

| K | 7 | 0.9999 | 6 | 0.9687 | 7 | 0.9999 | 5 | 0.9624 |

| L | 7 | 0.9999 | 12 | 0.9832 | 7 | 0.9999 | 6 | 0.9710 |

| M | 7 | 0.9998 | 13 | 0.9763 | 7 | 0.9999 | 6 | 0.9690 |

| N | 7 | 0.9999 | 13 | 0.9763 | 7 | 0.9999 | 6 | 0.9690 |

| O | 7 | 0.9999 | 6 | 0.9687 | 7 | 0.9999 | 5 | 0.9624 |

| Average Price (€/kWh) | ||||||

|---|---|---|---|---|---|---|

| User Preference Scenario | Cases | |||||

| D | H | L | SCh = 0.15 €/kWh FCh = 0.25 €/kWh | SCh = 0.20 €/kWh FCh = 0.30 €/kWh | SCh = 0.30 €/kWh FCh = 0.40 €/kWh | |

| Price | 0.1925 | 0.1877 | 0.1867 | 0.2005 | 0.2281 | 0.2907 |

| Distance | 0.2414 | 0.2180 | 0.2178 | 0.2087 | 0.2370 | 0.2955 |

| Dynamic Price | Fixed Prices | ||

|---|---|---|---|

| Case E | Case F | Case G | |

| Case D | Price preference | ||

| 4.03% | 15.63% | 33.79% | |

| Distance preference | |||

| −15.66% | −1.88% | 18.30% | |

| Dynamic Price | Fixed Prices | ||

|---|---|---|---|

| Case I | Case J | Case K | |

| Case H | Price preference | ||

| 6.42% | 17.73% | 35.45% | |

| Distance preference | |||

| −4.45% | 8.00% | 26.22% | |

| Dynamic Price | Fixed Prices | ||

|---|---|---|---|

| Case M | Case N | Case O | |

| Case L | Price preference | ||

| 6.92% | 18.17% | 35.79% | |

| Distance preference | |||

| −4.33% | 8.10% | 26.30% | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Canizes, B.; Soares, J.; Vale, Z.; Corchado, J.M. Optimal Distribution Grid Operation Using DLMP-Based Pricing for Electric Vehicle Charging Infrastructure in a Smart City. Energies 2019, 12, 686. https://doi.org/10.3390/en12040686

Canizes B, Soares J, Vale Z, Corchado JM. Optimal Distribution Grid Operation Using DLMP-Based Pricing for Electric Vehicle Charging Infrastructure in a Smart City. Energies. 2019; 12(4):686. https://doi.org/10.3390/en12040686

Chicago/Turabian StyleCanizes, Bruno, João Soares, Zita Vale, and Juan M. Corchado. 2019. "Optimal Distribution Grid Operation Using DLMP-Based Pricing for Electric Vehicle Charging Infrastructure in a Smart City" Energies 12, no. 4: 686. https://doi.org/10.3390/en12040686

APA StyleCanizes, B., Soares, J., Vale, Z., & Corchado, J. M. (2019). Optimal Distribution Grid Operation Using DLMP-Based Pricing for Electric Vehicle Charging Infrastructure in a Smart City. Energies, 12(4), 686. https://doi.org/10.3390/en12040686