Effect of Electrical Energy on the Manufacturing Setup Cost Reduction, Transportation Discounts, and Process Quality Improvement in a Two-Echelon Supply Chain Management under a Service-Level Constraint

Abstract

1. Introduction

2. Problem Definition, Notation, and Assumptions

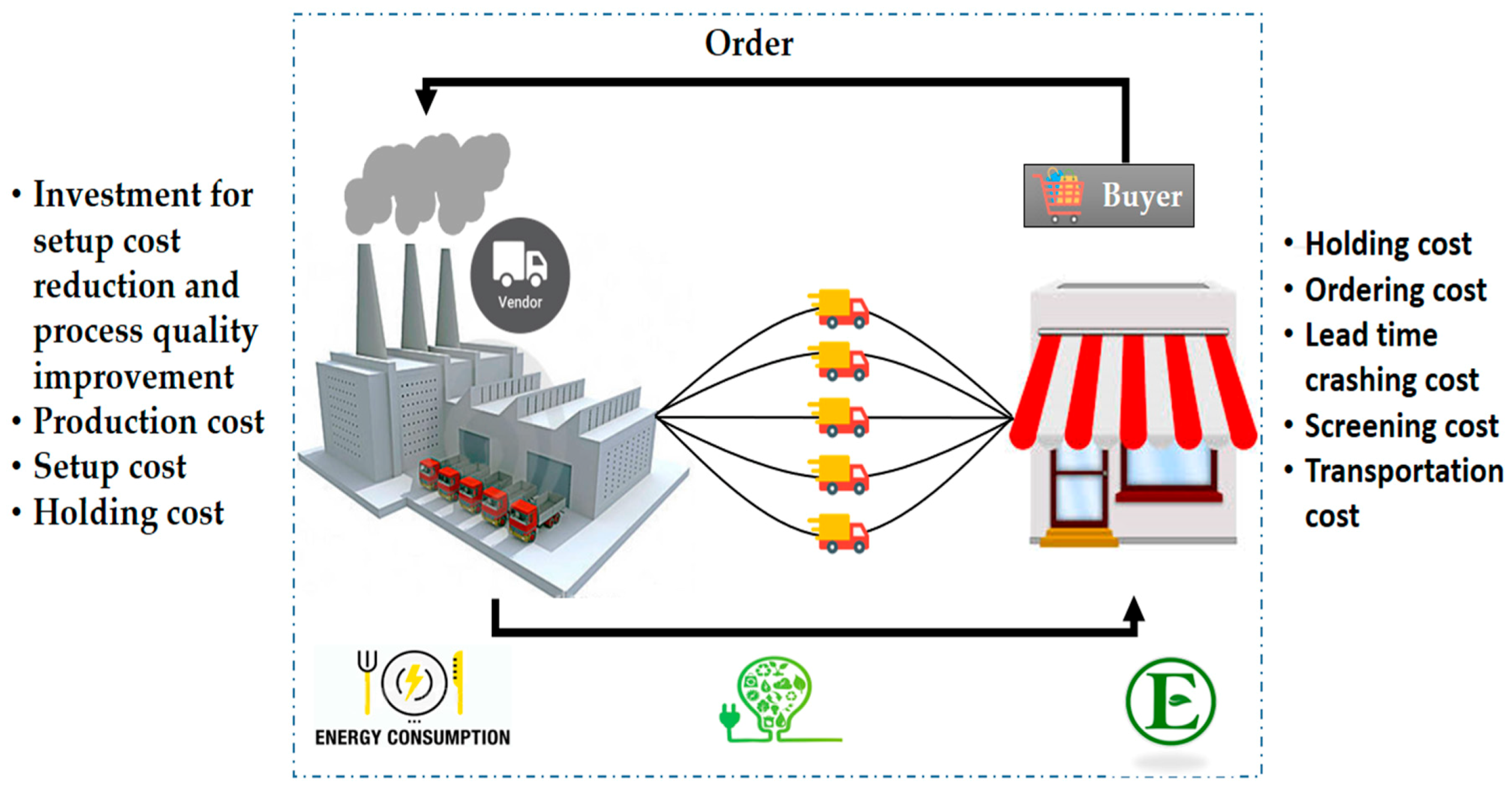

2.1. Problem Definition

2.2. Notation

2.3. Assumptions

- In this supply chain model, the cost of electrical energy consumed during the entire operations (e.g., during setup, ordering, inspection, and inventory holding time) is considered for a single type of product.

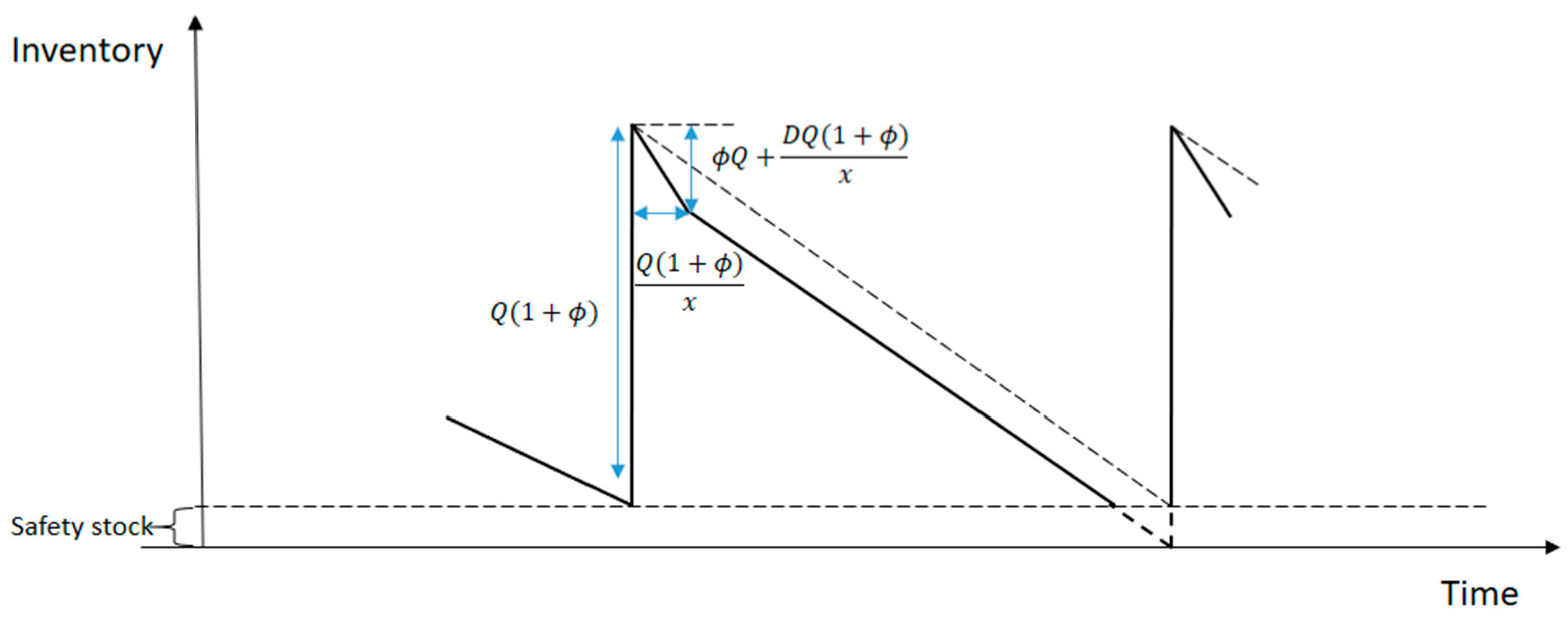

- The electrical energy consumption is taken care of thoroughly with continuous review of the buyer’s inventory; when the inventory level falls to the reorder point, the replenishments are made.

- When the buyer receives the lot, it is assumed that the complete lot is inspected with the screening rate under efficient electrical energy consumption. Furthermore, the assumption is made that the inspection process is non-destructive and error-free in nature.

- To omit the shortages from the model, a service-level constraint is utilized with a specific fill rate.

- The initial capital investments are made for process quality improvement and setup cost reduction by which advanced equipment can be used that consumes the minimum amount of electrical energy.

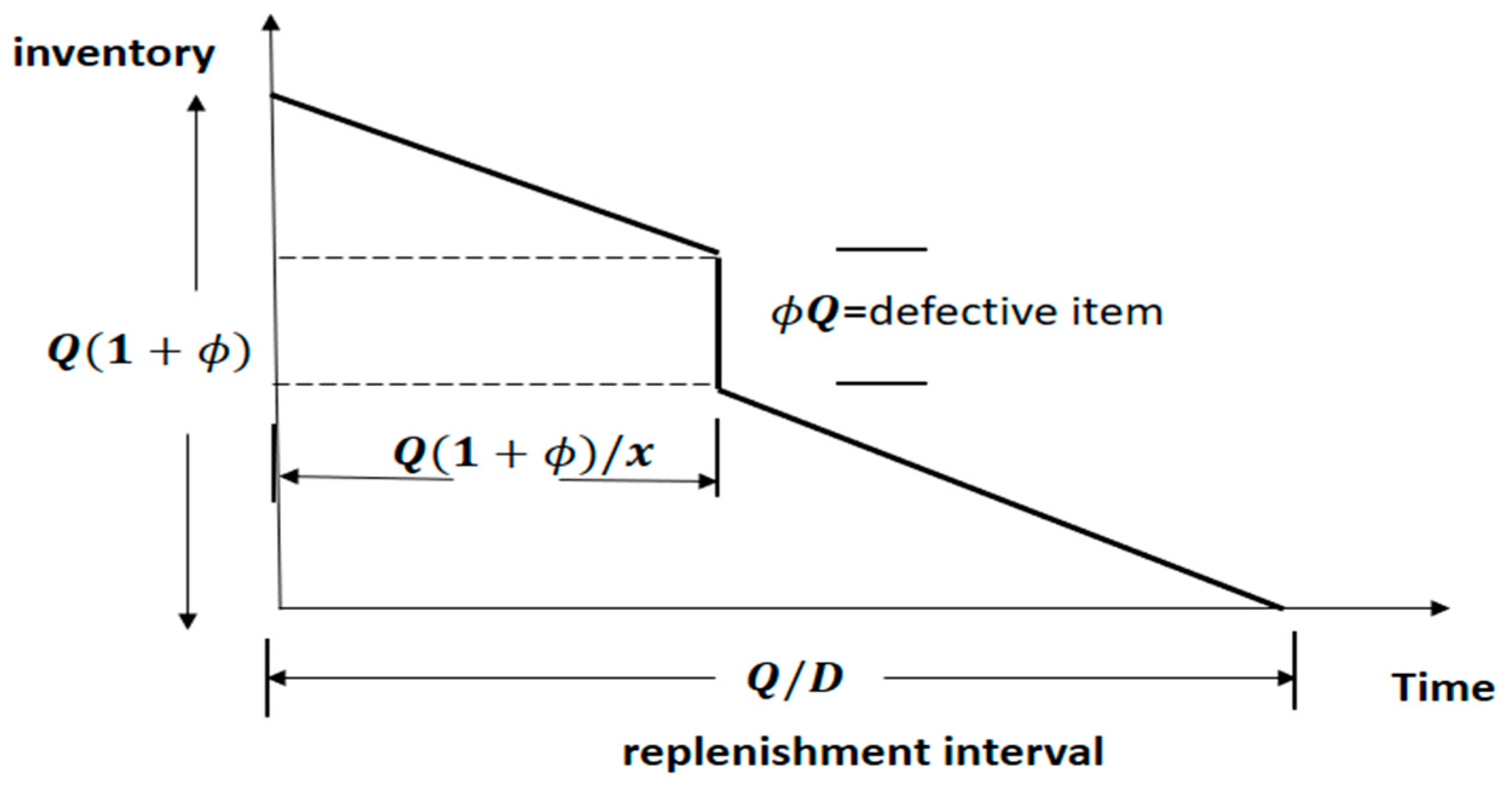

- To avoid the extra cost of electrical energy incurred due to the shortages, the supplier production rate and the screening rate are higher than the demand rate. The assumption indicates that which can be simplified as (refer to Salameh and Jaber [3]). Figure 2 shows the flow of inventory in relation to inspection time.

3. Mathematical Model

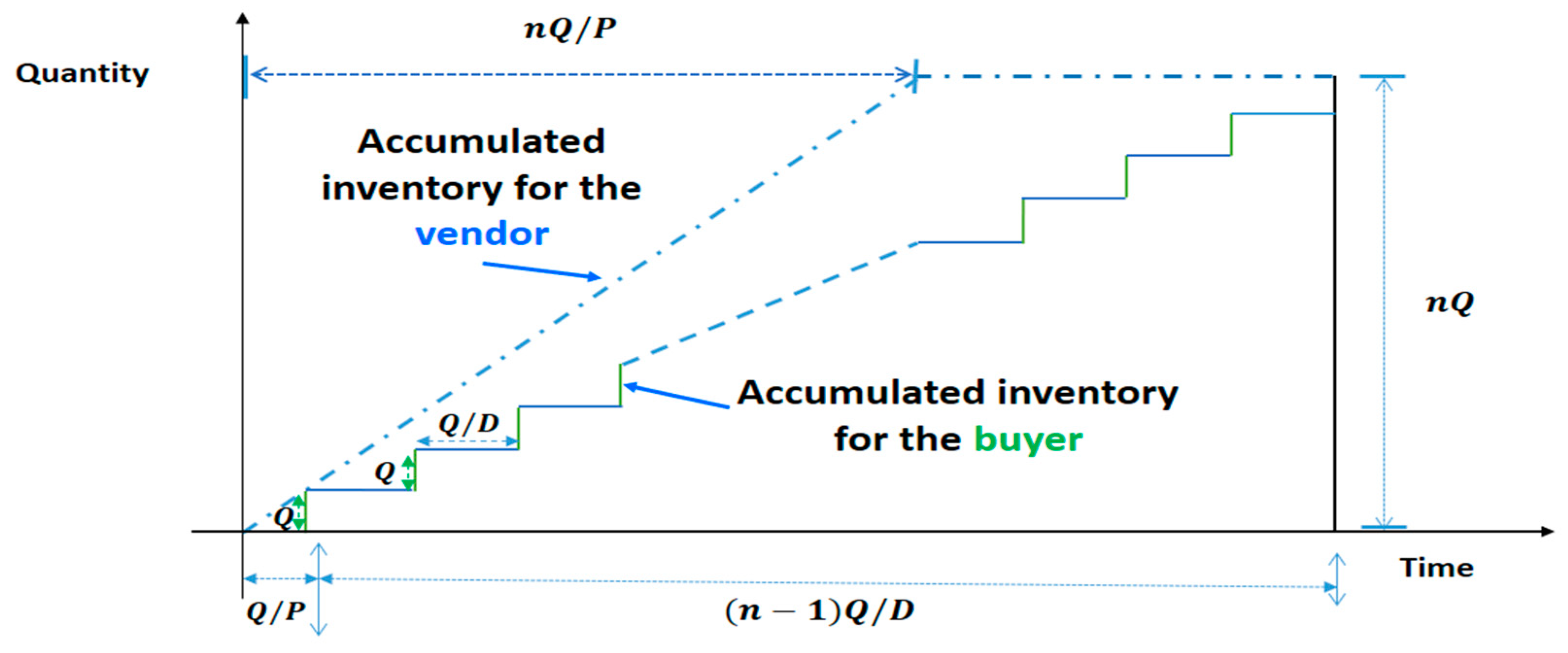

3.1. Vendor’s Model

3.2. Buyer’s Model

3.3. Supply Chain Cost

3.3.1. Centralized Analysis

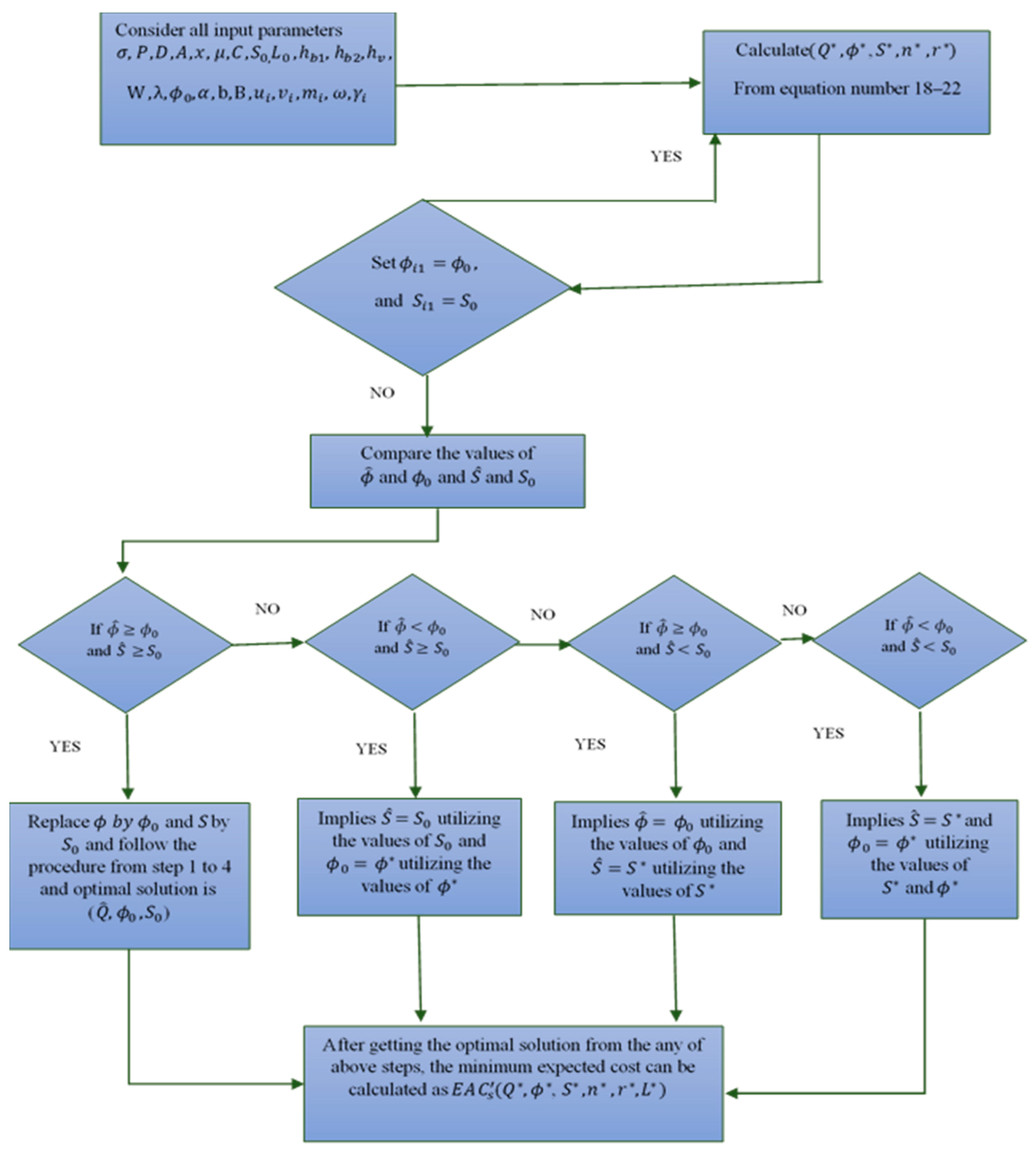

| Algorithm 1. Solution algorithm. | |

| Step 1 | Consider all input parameters, |

| Step 2 | For each and execute Steps 2.1 to 2.2. |

| Step 2.1 | Set and |

| Step 2.2 | Substitute the value of and in Equation (18) to evaluate |

| Step 2.3 | Use the value of to obtain , and from Equations (19) and (20). |

| Step 2.4 | Suppose , and repeat the above steps from 2.2 and 2.3 until no changes occur in the values of ; then, denote the solution by and . |

| Step 3 | In this step, and and and are compared. |

| Step 3.1 | If and , then the values obtained in Step 2 are the optimal solution for the given ; express this solution by ) and then proceed to Step 4. |

| Step 3.2 | If and , then set S = and use Step 2 to determine the () values from Equation (18) and Equation (20). If , then the optimal solution for given is ) = () and progress to Step 5. Otherwise, go to Step 3.3. |

| Step 3.3 | If and , then set and use Step 2 to calculate new () values from Equations (18) and (19). If , then the optimal solution for given is ) = (), and then proceed to Step 4. Otherwise, move to Step 3.4. |

| Step 3.4 | and ; then set and and utilize Step 2 for calculating from Equation (18). Then, denote these values as ) = () and move to Step 3. |

| Step 4 | If all , k = 1, 2, 3, …, K are greater than or less than , chose the nearest , and stop. Otherwise, calculate the of the two nearest point using Equation (20) and select the , with the least joint total cost. Express this solution by the vector . |

| Step 5 | Choose the minimum cost for each |

| Step 5.1 | = . |

| Step 5.2 | Let , and repeat Steps 2 to 5 until satisfying an inequality, . |

| Step 6 | Choose the minimum cost for each and calculate the reorder point |

3.3.2. Decentralized Analysis (Stackelberg Approach)

4. Numerical Examples

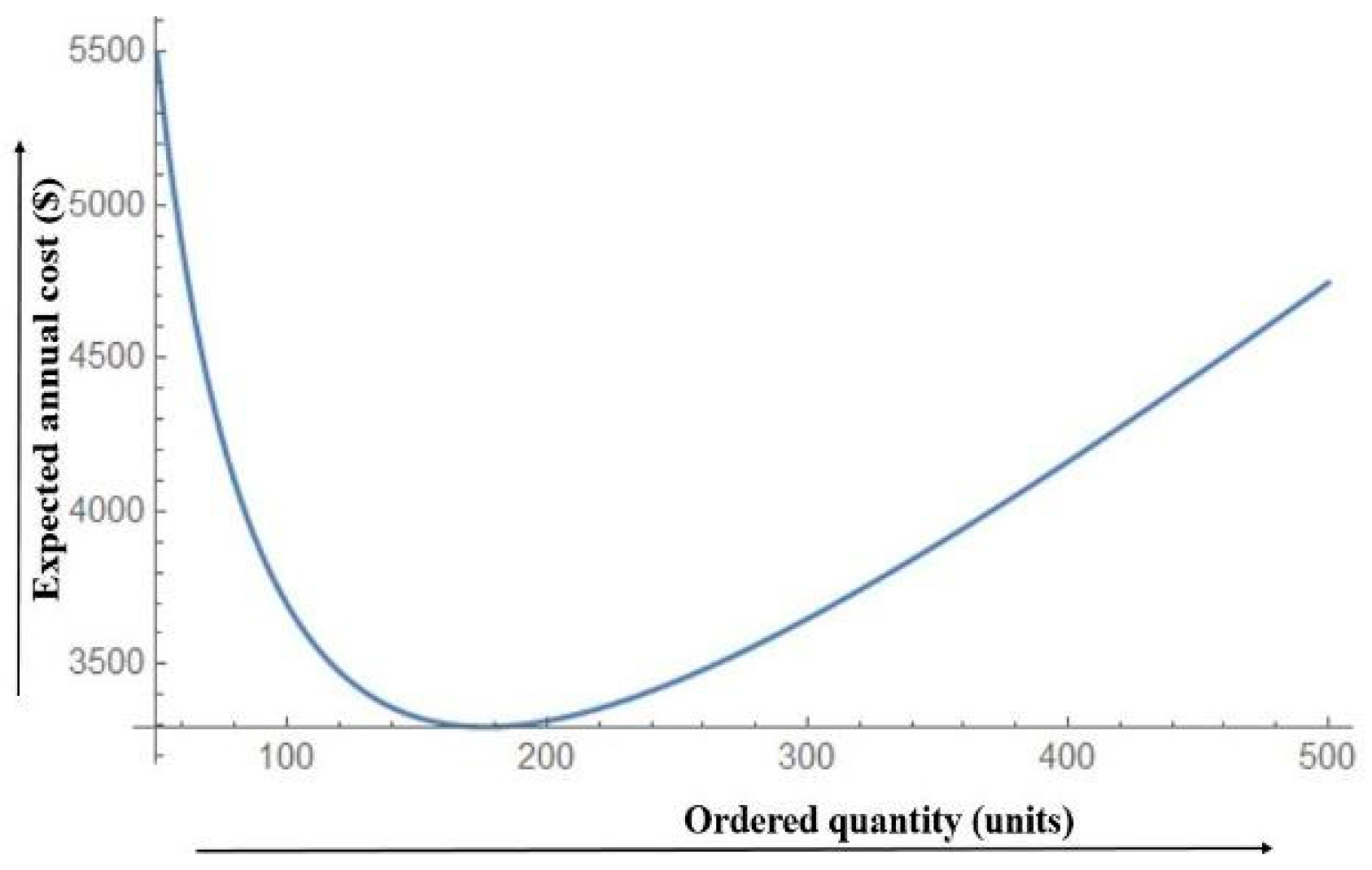

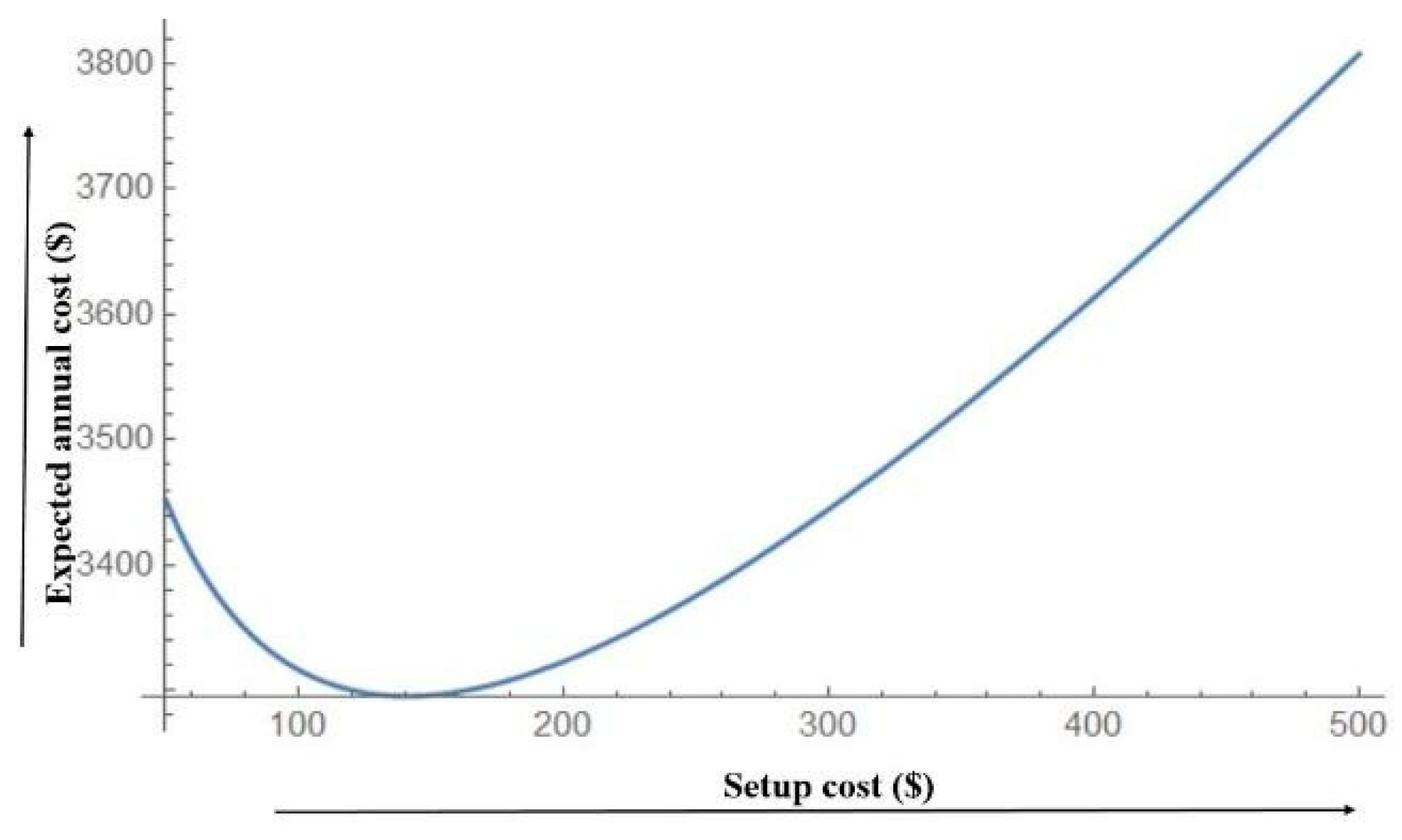

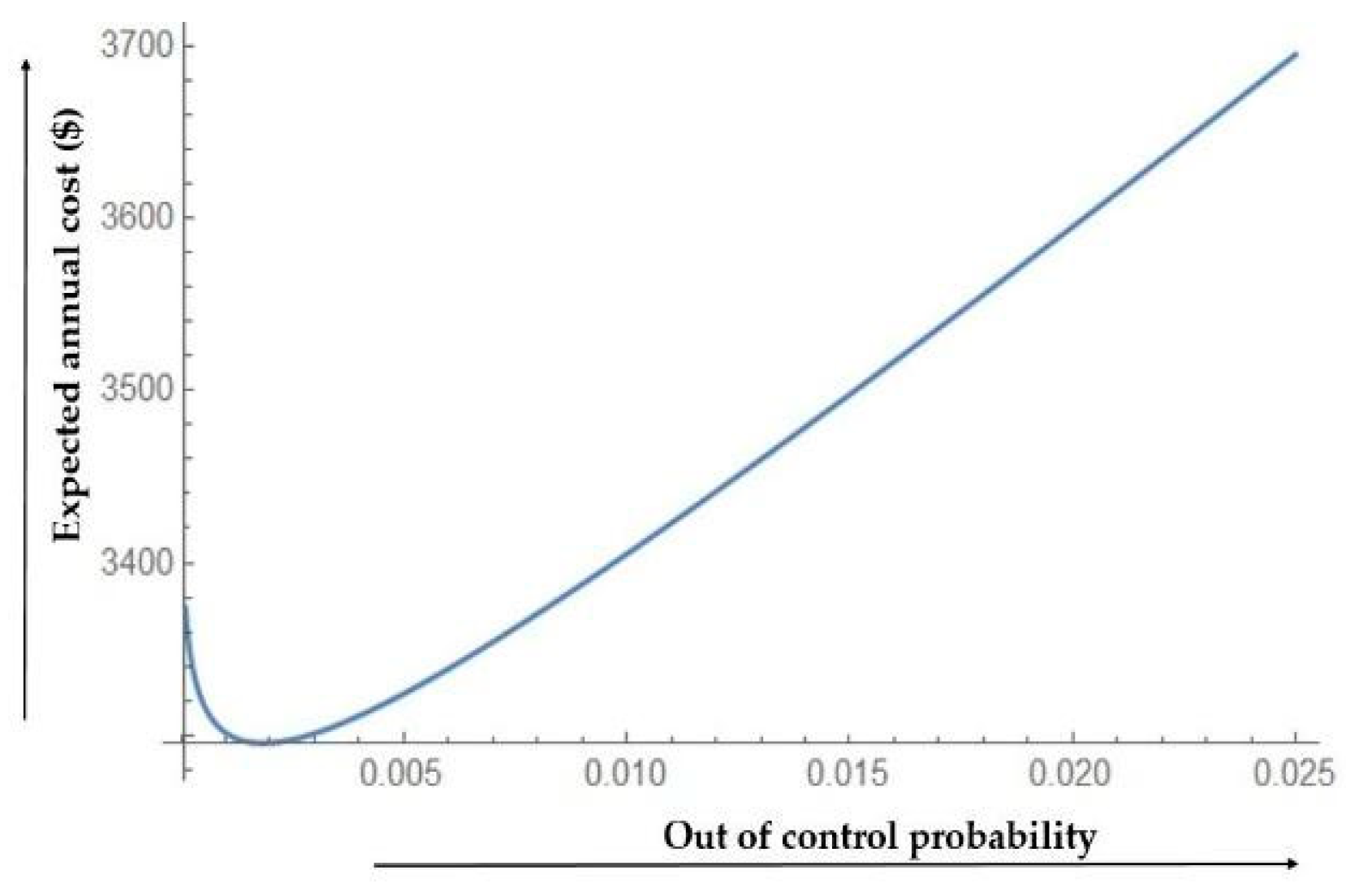

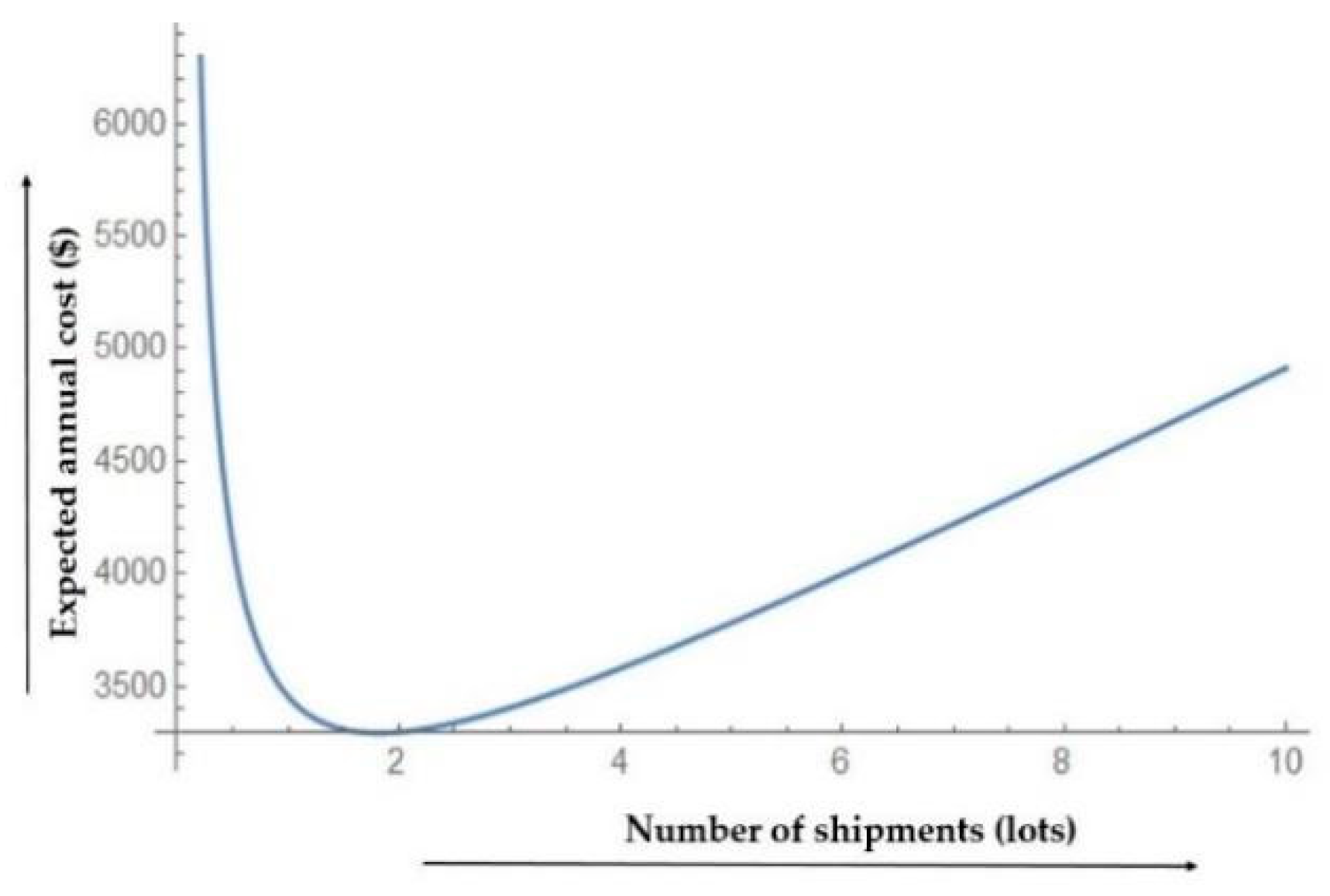

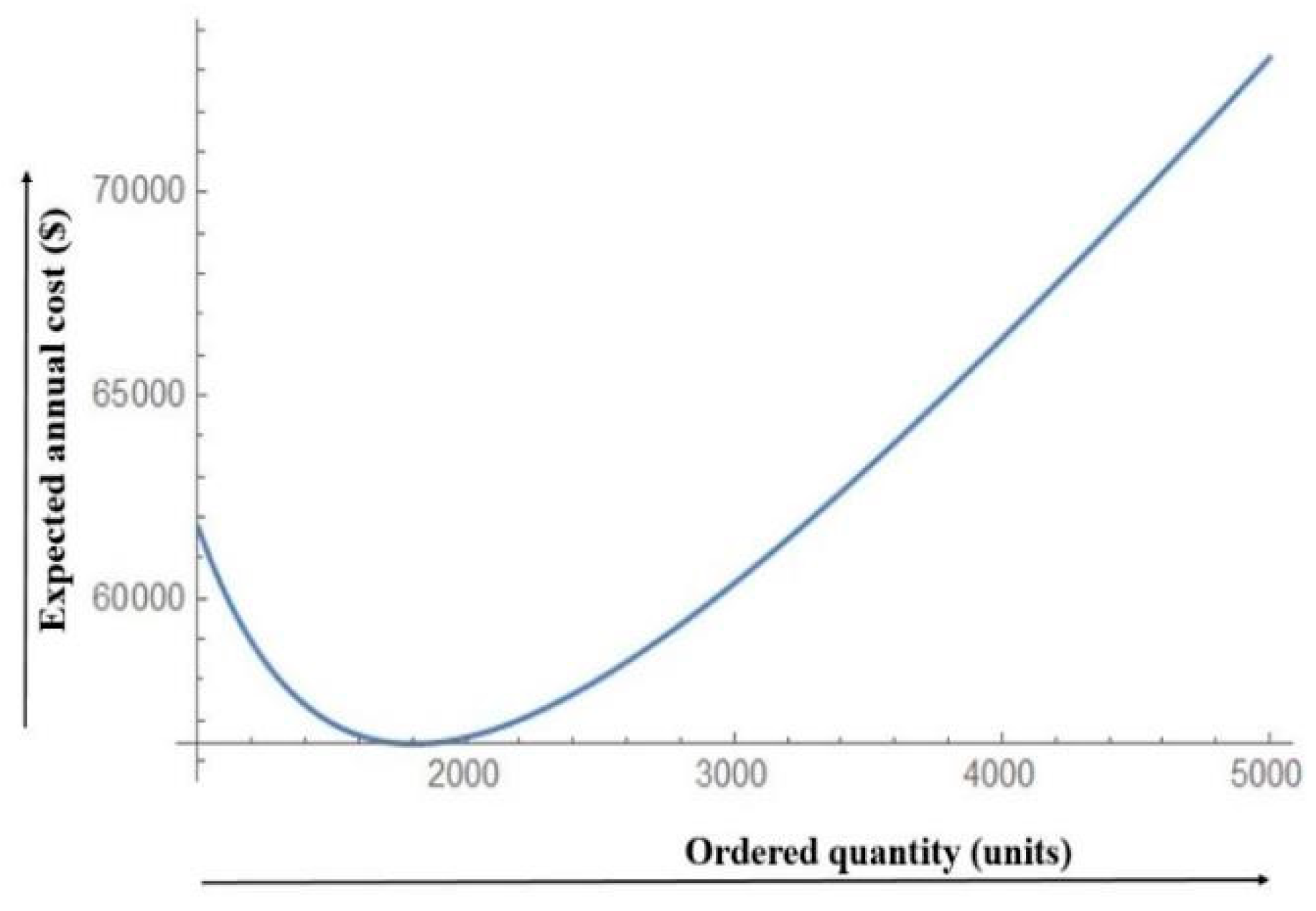

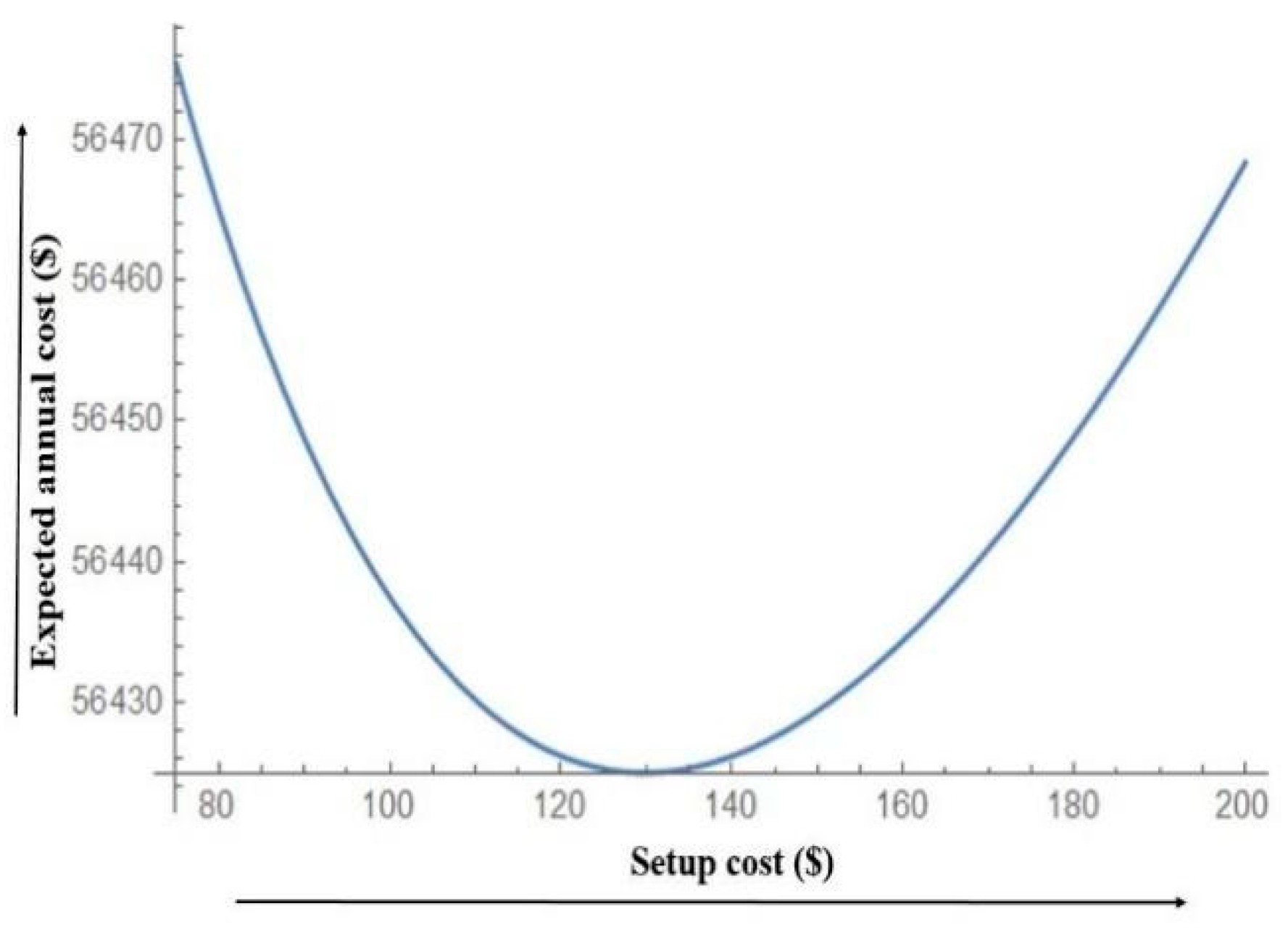

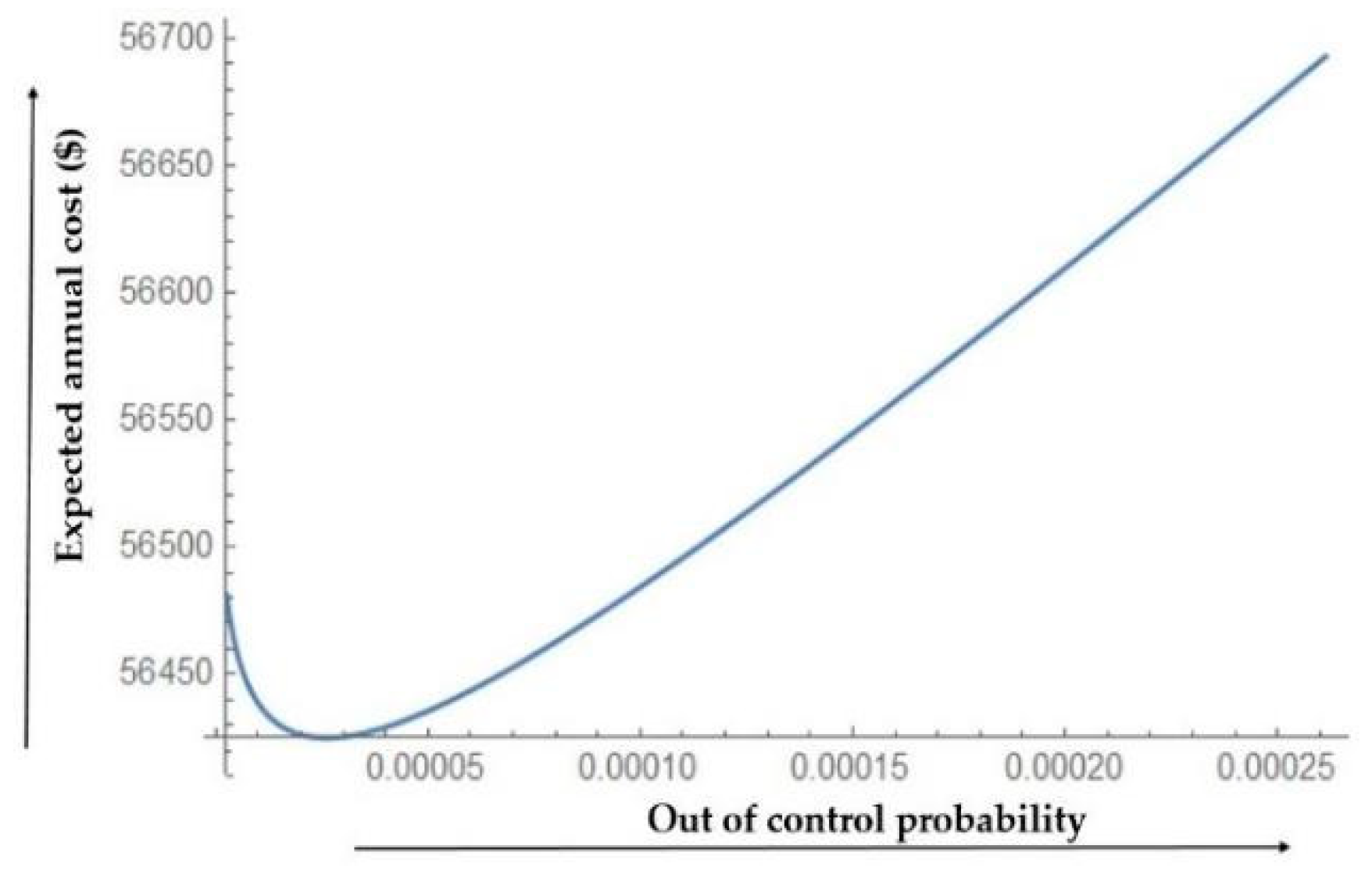

5. Sensitivity Analysis

- If the investment in the quality is reduced by 50%, a small increase in the expected annual cost is observed, which means that the quality of the product is affected, and the extra energy is consumed through reproducing and keeping defective items. Similarly, if the investment in the quality is reduced by 25%, then a significant increase in the total cost is observed due to extra energy consumption on the defective items. The capital cost is more sensitive to the increase in investment than to its reduction.

- The negative change for the capital investment in setup cost reduces the total cost, but if the setup cost increases, the total cost also increases. The capital investment for the setup cost reduces the optimal order quantity.

- The fractional cost for the capital investment has an asymmetrical effect on the total cost, and it is considered as a sensitive parameter in this model. If the capital investments are reduced by 25%, the cost increases by 25%.

- The holding cost of the buyer for defective items is less sensitive than the total cost, because the amount of the defective products is less.

- The holding cost of the buyer’s non-defective items is the most sensitive parameter. If the holding decreases by 50%, the total cost reduces by 7%. Further, a 50% increase in the holding cost leads to an increase in the total cost by 16%. The inventory of the buyer’s non-defective items is more in quantity in this supply chain model; this is the reason behind the increase in total cost, and it consumes more energy.

- The variation in the holding cost of the vendor affects the total cost. If the holding cost decreases, the total cost reduces. Similarly, by increasing the holding cost, the total cost increases. A huge amount of energy is consumed while holding the products, and it also increases the holding cost, which ultimately increases the total cost of the supply chain model.

- The screening cost with energy consumption cost has a symmetrical effect on the total cost differently from the other parameters, which has an asymmetric impact on the entire cost of the supply chain, and it has no effect on the other decision variables. The screening cost includes the energy consumption cost during the screening and the variation observed for –50% and +50% is around 4% of the total cost of the supply chain.

- If the cost for the defective unit replacement with the energy consumption cost is decreased by 50%, then the total cost is reduced by a small percentage; however, if the decrement is 25%, then the total cost is increased by 10%. There is a small effect of positive percentage increase on the defective unit replacement cost.

6. Managerial Insights

- The major recommendation from this study for decision makers is the capital investment for process quality improvement. The investment is made for bringing in new technology, which uses optimum energy consumption; simultaneously, it reduces the probability that the system will move to an out-of-control state. It is proven from the numerical experiment that the investment reduces the total cost of the supply chain with minimum energy consumption.

- Another important insight for the present study from the decision maker’s point of view is the initial capital investment for setup cost reduction. This model suggests that decision makers ought to invest more initially to get the latest machinery and equipment, which can be used to reduce the whole supply chain cost with minimum energy consumption, as proven numerically.

- Due to the controllable lead time, if the buyer must make the decision related to lead-time reduction, by facing an additional crashing cost, he can reduce the lead time.

- In this model, the stockout costs are replaced with the service-level constraint, which helps managers overcome the difficult situations that occur due to the shortages, as well as the, enormous amount of energy consumed during the supply chain process. To avoid such situations, this model suggests the optimum level of inventory to be satisfied from the available stock to reduce energy consumption.

- In many cases, the objective of the managers is to minimize the cost by optimizing the decision variables. In this model, the energy costs are considered to elaborate the importance of the quantity of the consumed energy in the system, which is not considered in available supply chain models. If the cost incurred on the energy consumption is known to the managers, then the optimized level of energy consumption can be decided.

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- Sarkar, M.; Sarkar, B. Optimization of safety stock under controllable production rate and energy consumption in an automated smart production management. Energies 2019, 12, 2059. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S.; Sinha, D.; Hur, S. Effect of unequal lot sizes, variable setup cost, and carbon emission cost in a supply chain model. Math Probl. Eng. 2015, 2015, 469486. [Google Scholar] [CrossRef]

- Salameh, M.; Jaber, M. Economic production quantity model for items with imperfect quality. Int. J. Prod. Econ. 2000, 64, 59–64. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Chen, C.K.; Chang, H.C. Quality improvement, setup cost and lead-time reductions in lot size reorder point models with an imperfect production process. Comput. Oper. Res. 2002, 29, 1701–1717. [Google Scholar] [CrossRef]

- Ben-Daya, M.; Hariga, M. Integrated single vendor single buyer model with stochastic demand and variable lead time. Int. J. Prod. Econ. 2004, 92, 75–80. [Google Scholar] [CrossRef]

- Dey, O.; Giri, B. Optimal vendor investment for reducing defect rate in a vendor–buyer integrated system with imperfect production process. Int. J. Prod. Econ. 2014, 155, 222–228. [Google Scholar] [CrossRef]

- Khan, M.; Jaber, M.; Guiffrida, A.; Zolfaghari, S. A review of the extensions of a modified EOQ model for imperfect quality items. Int. J. Prod. Econ. 2011, 132, 1–12. [Google Scholar] [CrossRef]

- Chung, K.J. The economic production quantity with rework process in supply chain management. Comput. Math. Appl. 2011, 62, 2547–2550. [Google Scholar] [CrossRef]

- Tayyab, M.; Sarkar, B. Optimal batch quantity in a cleaner multi-stage lean production system with random defective rate. J. Clean. Prod. 2016, 139, 922–934. [Google Scholar] [CrossRef]

- Cárdenas-Barrón, L.E.; Taleizadeh, A.A.; TreviñO-Garza, G. An improved solution to replenishment lot size problem with discontinuous issuing policy and rework, and the multi-delivery policy into economic production lot size problem with partial rework. Expert Syst. Appl. 2012, 39, 13540–13546. [Google Scholar] [CrossRef]

- Scarf, H. A min-max solution of an inventory problem. In Studies in the Mathematical Theory of Inventory and Production; Stanford University Press: Redwood City, CA, USA, 1958. [Google Scholar]

- Gallego, G.; Moon, I. The distribution free newsboy problem: Review and extensions. J. Oper. Res. Soc. 1993, 44, 825–834. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Wu, K.S. Mixture inventory model involving variable lead time with a service level constraint. Comput. Oper. Res. 1997, 24, 875–882. [Google Scholar] [CrossRef]

- Moon, I.; Choi, S. The distribution free continuous review inventory system with a service level constraint. Comput. Ind. Eng. 1994, 27, 209–212. [Google Scholar] [CrossRef]

- Tajbakhsh, M.M. On the distribution free continuous-review inventory model with a service level constraint. Comput. Ind. Eng. 2010, 59, 1022–1024. [Google Scholar] [CrossRef]

- Ma, W.M.; Qiu, B.B. Distribution-free continuous review inventory model with controllable lead time and setup cost in the presence of a service level constraint. Math. Probl. Eng. 2012, 2012, 867847. [Google Scholar] [CrossRef]

- Harris, F.W. How many parts to make at once. In Factory, The Magazine of Management; University of Michigan: Arbor, MI, USA, 1913. [Google Scholar]

- Cárdenas-Barrón, L.E. Observation on:” Economic production quantity model for items with imperfect quality” [Int. J. Production Economics 64 (2000) 59-64]. Int. J. Prod. Econ. 2000, 67, 201. [Google Scholar]

- Ciavotta, M.; Meloni, C.; Pranzo, M. Minimising general setup costs in a two-stage production system. Int. J. Prod. Res. 2013, 51, 2268–2280. [Google Scholar] [CrossRef]

- Dellino, G.; Kleijnen, J.P.; Meloni, C. Robust optimization in simulation: Taguchi and response surface methodology. Int. J. Prod. Econ. 2010, 125, 52–59. [Google Scholar] [CrossRef]

- Goyal, S.K.; Cárdenas-Barrón, L.E. Note on: Economic production quantity model for items with imperfect quality–A practical approach. Int. J. Prod. Econ. 2002, 77, 85–87. [Google Scholar] [CrossRef]

- Huang, C.K. An optimal policy for a single-vendor single-buyer integrated production–inventory problem with process unreliability consideration. Int. J. Prod. Econ. 2004, 91, 91–98. [Google Scholar] [CrossRef]

- Kim, M.S.; Kim, J.S.; Sarkar, B.; Sarkar, M.; Iqbal, M.W. An improved way to calculate imperfect items during long-run production in an integrated inventory model with backorders. J. Manuf. Syst. 2018, 47, 153–167. [Google Scholar] [CrossRef]

- Sarkar, B. Supply chain coordination with variable backorder, inspections, and discount policy for fixed lifetime products. Math Probl. Eng. 2016, 2016, 6318737. [Google Scholar] [CrossRef]

- Tang, L.; Che, P.; Liu, J. A stochastic production planning problem with nonlinear cost. Comput. Oper. Res. 2012, 39, 1977–1987. [Google Scholar] [CrossRef]

- Gahm, C.; Denz, F.; Dirr, M.; Tuma, A. Energy-efficient scheduling in manufacturing companies: A review and research framework. Ejor 2016, 248, 744–757. [Google Scholar] [CrossRef]

- Keller, F.; Reinhart, G. Energy Supply Orientation in Production Planning Systems. Procedia Cirp 2016, 40, 244–249. [Google Scholar] [CrossRef]

- Du, Y.; Hu, G.; Xiang, S.; Zhang, K.; Liu, H.; Guo, F. Estimation of the diesel particulate filter soot load based on an equivalent circuit model. Energies 2018, 11, 472. [Google Scholar] [CrossRef]

- Todde, G.; Murgia, L.; Caria, M.; Pazzona, A. A comprehensive energy analysis and related carbon footprint of dairy farms, Part 2: Investigation and modeling of indirect energy requirements. Energies 2018, 11, 463. [Google Scholar] [CrossRef]

- Tomić, T.; Schneider, D.R. The role of energy from waste in circular economy and closing the loop concept–Energy analysis approach. Renew. Sustain. Energy Rev. 2018, 98, 268–287. [Google Scholar] [CrossRef]

- Haraldsson, J.; Johansson, M.T. Review of measures for improved energy efficiency in production-related processes in the aluminium industry–From electrolysis to recycling. Renew. Sustain. Energy Rev. 2018, 93, 525–548. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Chang, H.C. Impact of investing in quality improvement on (Q, r, L) model involving the imperfect production process. Prod. Plan. Cont. 2000, 11, 598–607. [Google Scholar] [CrossRef]

- Porteus, E.L. Optimal lot sizing, process quality improvement and setup cost reduction. Oper. Res. 1986, 34, 137–144. [Google Scholar] [CrossRef]

- Shin, D.; Guchhait, R.; Sarkar, B.; Mittal, M. Controllable lead time, service level constraint, and transportation discounts in a continuous review inventory model. Rairo-Oper. Res. 2016, 50, 921–934. [Google Scholar] [CrossRef]

- Braglia, M.; Castellano, D.; Song, D. Distribution-free approach for stochastic Joint-Replenishment Problem with backorders-lost sales mixtures, and controllable major ordering cost and lead times. Comput. Oper. Res. 2017, 79, 161–173. [Google Scholar] [CrossRef]

- Tsao, Y.C.; Lu, J.C. A supply chain network design considering transportation cost discounts. Trans. Res. Part E Log. Rev. 2012, 48, 401–414. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Chen, L.Y.; Yang, C.T. Impacts of collaborative investment and inspection policies on the integrated inventory model with defective items. Int. J. Prod. Res. 2013, 51, 5789–5802. [Google Scholar] [CrossRef]

- Jha, J.; Shanker, K. An integrated inventory problem with transportation in a divergent supply chain under service level constraint. J. Manuf. Syst. 2014, 33, 462–475. [Google Scholar] [CrossRef]

- Priyan, S.; Uthayakumar, R. Trade credit financing in the vendor–buyer inventory system with ordering cost reduction, transportation cost and backorder price discount when the received quantity is uncertain. J. Manuf. Syst. 2014, 33, 654–674. [Google Scholar] [CrossRef]

- Gutgutia, A.; Jha, J. A closed-form solution for the distribution free continuous review integrated inventory model. Oper. Res. 2018, 18, 159–186. [Google Scholar] [CrossRef]

- Hadley, G.; Whitin, T.M. Analysis of Inventory Systems: G. Hadley, TM Whitin; Prentice-Hall: Upper Saddle River, NJ, USA, 1963. [Google Scholar]

- Liao, C.J.; Shyu, C.H. An analytical determination of lead time with normal demand. Int. J. Oper. Prod. Manag. 1991, 11, 72–78. [Google Scholar] [CrossRef]

| Author(s) | Supply Chain Management | Electrical Energy Consumption | Process Quality Improvement in Imperfect Production | Setup Cost Reduction | Distribution-Free Approach | Transportation Discount |

|---|---|---|---|---|---|---|

| Porteus [33] | ✓ | ✓ | ||||

| Gallego and Moon [12] | ✓ | |||||

| Moon and Choi [14] | ✓ | |||||

| Ouyang and Wu [13] | ✓ | |||||

| Ouyang et al. [4] | ✓ | ✓ | ✓ | |||

| Ma and Qiu [16] | ✓ | ✓ | ||||

| Tsao and Lu [36] | ✓ | |||||

| Ouyang et al. [37] | ✓ | ✓ | ||||

| Jha and Shanker [38] | ✓ | ✓ | ||||

| Dey and Giri [6] | ✓ | ✓ | ||||

| Priyan and Uthayakumar [39] | ✓ | ✓ | ✓ | |||

| Tayyab and Sarkar [9] | ✓ | |||||

| Ben-Daya and Hariga [5] | ✓ | |||||

| Tang et al. [25] | ✓ | |||||

| Shin et al. [34] | ✓ | ✓ | ||||

| Kim et al. [23] | ✓ | ✓ | ✓ | ✓ | ||

| Gutgutia and Jha [40] | ✓ | ✓ | ||||

| This paper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Decision variable | |

| order quantity (units) | |

| probability of production process that may go to out-of-control state | |

| setup cost for vendor per setup ($/setup) | |

| number of shipments per lot (positive integer) | |

| length of the lead time (weeks) | |

| reorder point | |

| Parameters | |

| production rate (units/year) | |

| reciprocal of (years/unit) | |

| screening rate (units/year) | |

| average demand per year (units/year) | |

| standard deviation of demand (units/week) | |

| expected value of | |

| lead-time demand that has a probability distribution function | |

| max | |

| expected shortage per replenishment cycle | |

| mean of the lead-time demand | |

| ordering cost of the buyer ($/order) | |

| cost of the energy consumed per order of the buyer ($/order) | |

| crashing cost per order ($/order) | |

| cost for amount of energy consumed during lead-time crashing ($/order) | |

| initial setup cost for vendor per lot ($/setup) | |

| cost of energy consumed during setup ($/setup) | |

| initial lead time length in weeks (weeks) | |

| holding cost for buyer’s defective products per unit per year ($/unit/year) | |

| cost of energy consumed during buyer’s defective products holding ($/unit/year) | |

| holding cost for buyer’s non-defective products per unit per year ($/unit/year), | |

| cost of energy consumed during buyer’s non-defective products holding ($/unit/year) | |

| holding cost for vendor’s per unit per year ($/unit/year) | |

| cost of energy consumed during the vendor holding ($/unit/year) | |

| s | screening cost per unit ($/unit) |

| energy cost consumed during screening ($/unit) | |

| defective unit replacement cost ($/defective unit) | |

| energy cost consumed during defective unit replacement ($/defective unit) | |

| fractional annual cost of capital investment ($/year) | |

| the fraction of customers’ regular satisfied demand | |

| the initial probability of the production process shifting from control state to out-of-control state | |

| coefficient to control quality improvement capital investment cost | |

| coefficient of capital investment for controlling setup cost reduction | |

| minimum duration for jth lead-time component (days), | |

| normal duration for jth lead-time component (days), | |

| crashing cost per day for ith component of lead time ($/day), | |

| cost of energy consumed during crashing for ith component ($/day), | |

| crashing cost per day for jth component of lead time with as ($/day), | |

| cost of energy consumed during crashing for jth component ($/day), | |

| transportation cost, | |

| energy consumed during transportation, | |

| Lead-Time Component | Normal Duration (Days) | Minimum Duration (Days) | Crashing Cost Per Unit ($/Days) | Cost of Electrical Energy Consumed ($/Days) |

|---|---|---|---|---|

| 1 | 20 | 6 | 0.3 | 0.1 |

| 2 | 20 | 6 | 1.0 | 0.2 |

| 3 | 16 | 9 | 4.5 | 0.5 |

| Quantity Range (units) | Unit Transportation Cost ($/unit) | Unit Transportation Cost with Energy ($/unit) |

|---|---|---|

| 0.18 | 0.02 | |

| 0.13 | 0.02 | |

| 0.17 | 0.02 | |

| 0.14 | 0.3 |

| Lead-Time weeks | $/year | units | lots | $/year | units | |

|---|---|---|---|---|---|---|

| 4 | 3380.87 | 5 | 249.05 | 49.10 | ||

| 6 | 119.34 | 6 | 0.00188 | 286.42 | 71.05 | |

| 8 | 3317.19 | 178.04 | 2 | 0.00183 | 242.43 | 64.26 |

| with Quality Improvement, and Setup Cost Reduction | When No Investments are Made for Process Quality Improvement and Setup Cost Reduction | ||

|---|---|---|---|

| $/year | |||

| (176.16, 2, 0.0018, 140.93, 30.2, 3) | () |

| with Quality Improvement, and Setup Cost Reduction | with No Investment for Process Quality Improvement | ||

|---|---|---|---|

| $/year | $/year | ||

| (176.16, 2, 0.00183, 140.93, 30.2, 3) | () |

| with Quality Improvement, and Setup Cost Reduction | with No Investment for Setup Cost Reduction | ||

|---|---|---|---|

| $/year | $/year | ||

| (176.16, 2, 0.0018, 140.93, 30, 3) | () |

| Leader | Follower | (units) | ($/setup) | (units) | Buyer Cost ($/year) | Vendor Cost ($/year) | Total Cost ($/year) | ||

|---|---|---|---|---|---|---|---|---|---|

| Vendor | Buyer | 45.07 | 7 | 126.20 | 0.002 | 50.86 | 3308.26 | 1402.4 | 4710.73 |

| Buyer | Vendor | 158.41 | 1 | 63.36 | 0.002 | 19.43 | 1894.17 | 1577.06 | 3471.23 |

| Centralized supply chain | 176.16 | 2 | 140.93 | 0.0018 | 30.20 | N/A | N/A | 3295.45 | |

weeks | $/year | units | $/setup | units | ||

|---|---|---|---|---|---|---|

| 3 | 19 | 188.85 | 2391.19 | |||

| 6 | 304.46 | 14 | 0.000026 | 30.09 | ||

| 8 | 4 |

| with Quality Improvement and Setup Cost Reduction | without Quality Improvement and Setup Cost Reduction | ||

|---|---|---|---|

| $/year | $/year | ||

| (1802.36, 9, 129.77, 0.000026, 2190.29, 4) | (350.34, 307, 11,402.8, 4) |

| with Quality Improvement and Setup Cost Reduction | without Quality Improvement | ||

|---|---|---|---|

| $/year | $/year | ||

| (1802.3, 9, 129.7, 0.000026, 2190.29, 4) | () |

| with Quality Improvement and Setup Cost Reduction | without Investment in Setup Cost Reduction | ||

|---|---|---|---|

| $/year | $/year | ||

| (1802.36, 9, 129.7, 0.000026, 2190.29, 4) | ) |

| Input Parameters | Percentage (%) Changes in Value | |

|---|---|---|

| –50 | 0.26 | |

| –25 | 1.20 | |

| +25 | 2.78 | |

| +50 | 1.45 | |

| –50 | –11.35 | |

| –25 | –3.65 | |

| +25 | 14.51 | |

| +50 | 4.72 | |

| –50 | –6.38 | |

| –25 | 25.55 | |

| +25 | 6.84 | |

| +50 | 6.17 | |

| –50 | –0.030 | |

| –25 | 2.02 | |

| +25 | 0.01 | |

| +50 | 0.02 | |

| –50 | –6.45 | |

| –25 | –8.36 | |

| +25 | 7.95 | |

| +50 | 15.63 | |

| –50 | –1.86 | |

| –25 | –2.73 | |

| +25 | 1.51 | |

| +50 | 2.44 | |

| –50 | –3.80 | |

| –25 | –1.90 | |

| +25 | 1.90 | |

| +50 | 3.80 | |

| –50 | –0.74 | |

| –25 | 10.79 | |

| +25 | 0.25 | |

| +50 | 0.45 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, I.; Jemai, J.; Lim, H.; Sarkar, B. Effect of Electrical Energy on the Manufacturing Setup Cost Reduction, Transportation Discounts, and Process Quality Improvement in a Two-Echelon Supply Chain Management under a Service-Level Constraint. Energies 2019, 12, 3733. https://doi.org/10.3390/en12193733

Khan I, Jemai J, Lim H, Sarkar B. Effect of Electrical Energy on the Manufacturing Setup Cost Reduction, Transportation Discounts, and Process Quality Improvement in a Two-Echelon Supply Chain Management under a Service-Level Constraint. Energies. 2019; 12(19):3733. https://doi.org/10.3390/en12193733

Chicago/Turabian StyleKhan, Irfanullah, Jihed Jemai, Han Lim, and Biswajit Sarkar. 2019. "Effect of Electrical Energy on the Manufacturing Setup Cost Reduction, Transportation Discounts, and Process Quality Improvement in a Two-Echelon Supply Chain Management under a Service-Level Constraint" Energies 12, no. 19: 3733. https://doi.org/10.3390/en12193733

APA StyleKhan, I., Jemai, J., Lim, H., & Sarkar, B. (2019). Effect of Electrical Energy on the Manufacturing Setup Cost Reduction, Transportation Discounts, and Process Quality Improvement in a Two-Echelon Supply Chain Management under a Service-Level Constraint. Energies, 12(19), 3733. https://doi.org/10.3390/en12193733