Long-term Analysis of the Effects of Production Management in Coal Mining in Poland

Abstract

1. Introduction

2. Materials and Method

2.1. Theoretical Background

2.2. Methods and Data

- Coal mining by underground methods;

- Steam coal production;

- A lack of organizational changes such as merging or separating coal mines;

- Good financial results and the sufficiency of coal reserves, guaranteeing long-term perspective of excavation.

- Indices of dynamics for measuring the level of changes:where:

- —value in the examined period,

- —value in the based period.

Coefficients of variation for estimating the range of observed changes:where:- —arithmetic average,

- —standard deviation.

- Pearson linear correlation coefficients for checking the relation between examined economic parameters:where:

- —covariation of x and y,

- s(x), s(y)—standard deviations of x and y.

- Coefficients of determination for assessing the range of influence:where:

- —Pearson linear correlation coefficients of x and y.

- Linear regression functions to describe the relations between total costs and the volume of production:where:

- —regression coefficients,

- —explanatory variable,

- ε—error term.

3. Results

4. Discussion

5. Conclusions

Funding

Conflicts of Interest

References

- Gawlik, L.; Majchrzak, H.; Mokrzycki, E.; Uliasz-Bocheńczyk, A. Perspektywy węgla kamiennego i brunatnego w Polsce i w Unii Europejskiej. Przegląd Górniczy 2010, 66, 1–8. [Google Scholar]

- Lorek, E. Rozwój zrównoważony energetyki w wymiarze międzynarodowym, europejskim i krajowym; [w:] Graczyk, A. (red.): Teoria i praktyka zrównoważonego rozwoju, Akademia Ekonomiczna we Wrocławiu, Katedra Ekonomii Ekologicznej; Wydawnictwo EkoPress: Białystok-Wrocław, Poland, 2007; pp. 163–176. [Google Scholar]

- Białecka, B.; Biały, W. Tereny Pogórnicze—Szanse, Zagrożenia. Analiza Przypadku; Monografia; Wydawnictwo PA NOVA: Gliwice, Poland, 2014. [Google Scholar]

- Mishra, S.K.; Hitzhusen, J.F.; Sohngen, B.L.; Guldmann, J.M. Cost of abandoned coal mine reclamation and associated recreation benefits in Ohio. J. Environ. Manag. 2012, 100, 52–58. [Google Scholar] [CrossRef] [PubMed]

- Gawlik, L. Kompozycja przyszłości energetycznej do 2050 roku według Światowej Rady Energetycznej; [w:] Światowe prognozy dla rynku energii. Izba Gospodarcza Gazownictwa; Warszawa, IV Kongres Polskiego Przemysłu Gazowniczego: Warszawa, Poland, 2014; pp. 58–66. [Google Scholar]

- Gawlik, L.; Mokrzycki, E. Scenariusze wykorzystania węgla w polskiej energetyce w świetle polityki klimatycznej Unii Europejskiej. Przegląd Górniczy 2014, 70, 1–8. [Google Scholar]

- Lorenz, U. Gospodarka Węglem Kamiennym Energetycznym; Wydawnictwo IGSMiE PAN: Kraków, Poland, 2011. [Google Scholar]

- Lorenz, U.; Grudziński, Z. Międzynarodowe rynki węgla kamiennego energetycznego; Studia, Rozprawy, Monografie, Wydawnictwo Instytutu Gospodarki Surowcami Mineralnymi i Energią PAN: Kraków, Poland, 2009. [Google Scholar]

- Sojda, A. Analiza statystyczna wskaźników finansowych dla przedsiębiorstw górniczych. Zeszyty Naukowe Politechniki Śląskiej, seria: Organizacja i Zarządzanie 2014, 68, 255–264. [Google Scholar]

- Michalak, A.; Nawrocki, T. Analiza porównawcza kosztu kapitału własnego przedsiębiorstw górnictwa węgla kamiennego w ujęciu międzynarodowym. Gospodarka Surowcami Mineralnymi = Mineral Resources Management 2015, 31, 49–72. [Google Scholar] [CrossRef]

- Nawrocki, T.; Jonek-Kowalska, I. Assessing operational risk in coal mining enterprises—Internal, industrial and international perspectives. Resour. Policy 2016, 48, 50–67. [Google Scholar] [CrossRef]

- Karbownik, A. Zarządzanie procesem dostosowawczym w górnictwie węgla kamiennego w świetle dotychczasowych doświadczeń; Wydawnictwo Politechniki Śląskiej: Gliwice, Poland, 2005. [Google Scholar]

- Dubiński, J.; Turek, M. Chances and threats of hard coal mining development in Poland—The results of experts research. Arch. Min. Sci. 2014, 59, 359–411. [Google Scholar]

- Olkuski, T. Zasoby węgla kamiennego—najpewniejsze źródło energii. Przegląd Górniczy 2011, 7–8, 42–45. [Google Scholar]

- Bąk, P.; Michalak, A. Extraction Costs Forecast in the Hard Coal Mining Sector; [w:] Zbìrnik naukovih prac’ Donec’kogo deržavnogo unìversitetu upravlìnnâ. Serìâ: Tehnìčnì nauki: Upravlìnnâ proektami ta programami. T. 13, vip. 245; Donec’kij deržavnij universitet upravlinnâ: Donec’k, Ukraine, 2012; pp. 196–211. [Google Scholar]

- Brzychczy, E. The planning optimization system for underground hard coal mines. Arch. Min. Sci. 2011, 56, 161–178. [Google Scholar]

- Snopkowski, R. Próba oceny wpływu niestabilności efektywnego czasu pracy w ścianie na uzyskiwane wydobycie na podstawie badań modelowych. Przegląd Górniczy 2009, 65, 111–114. [Google Scholar]

- Snopkowski, R.; Napieraj, A. Method of the production cycle duration time modeling within hard coal longwall faces. Arch. Min. Sci. 2012, 57, 121–138. [Google Scholar]

- Jonek-Kowalska, I.; (red.). Zarządzanie kosztami w przedsiębiorstwach górniczych w Polsce. Stan aktualny i kierunki doskonalenia; Difin: Warszawa, Poland, 2013. [Google Scholar]

- Turek, M. Analiza i ocena kosztów w górnictwie węgla kamiennego w Polsce w aspekcie poprawy efektywności wydobycia; Difin: Warszawa, Poland, 2013. [Google Scholar]

- Bijańska, J.; Wodarski, K. Risk management in the planning of development projects in the industrial enterprises. Metalurgija 2014, 53, 276–278. [Google Scholar]

- Zieliński, M. Efektywność—ujęcie ekonomiczne i społeczne. Zeszyty Naukowe Politechniki Śląskiej, seria: Organizacja i Zarządzanie 2013, 66, 137–148. [Google Scholar]

- Mela, M.; Heinisuo, M. Weight and cost optimization of welded high strength steel beams. Eng. Struct. 2014, 79, 254–264. [Google Scholar] [CrossRef]

- Pehrsson, L.; Ng, A.C.C.; Stockton, D. Industrial cost modelling and multi-objective optimization for decision support in production systems development. Comput. Ind. Eng. 2013, 66, 1036–1048. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Chen, C.K.; Chang, H.C. Quality improvement, set up cost and lead time reductions in lot size reorder point models with an imperfect production process. Comput. Oper. Res. 2001, 29, 1701–1717. [Google Scholar] [CrossRef]

- Sarkar, B.; Chaudhuri, K.; Moon, I. Manufacturing setup cost reduction and quality improvement for the distribution free continuous-review inventory model with a service level constraint. J. Manuf. Syst. 2015, 34, 203–214. [Google Scholar] [CrossRef]

- Yoo, S.H.; Kim, D.S.; Park, M.S. Lot sizing and quality investment with quality cost analyses for imperfect production and inspection processes with commercial return. Int. J. Prod. Econ. 2012, 140, 922–933. [Google Scholar] [CrossRef]

- Camp, C.H.V.; Huq, F. CO2 and cost optimization of reinforced concrete frames using a big bang-big crunch algorithm. Eng. Struct. 2013, 48, 363–372. [Google Scholar] [CrossRef]

- Cohen, R.R.H. Use of microbes for cost reduction of metal removal from metals and mining industry waste streams. J. Clean. Prod. 2006, 14, 1146–1157. [Google Scholar] [CrossRef]

- Rahman, S.M.; Kirkman, G.A. Costs of certified emission reductions under the Clean Development Mechanism of the Kyoto Protocol. Energy Econ. 2015, 47, 129–134. [Google Scholar] [CrossRef]

- Xiao, H.; Wei, Q.; Wang, H. Marginal abatement cost and carbon reduction potential outlook of key energy efficiency technologies in China’s building sector to 2030. Energy Policy 2014, 69, 92–105. [Google Scholar] [CrossRef]

- Giustolisi, O.; Berardi, L.; Laucelli, D. Supporting decision on energy vs. asset cost optimization in drinking water distribution networks. Procedia Eng. 2014, 70, 734–743. [Google Scholar] [CrossRef][Green Version]

- Mollahassani-Pour, M.; Abdollahi, A.; Rashidinejad, M. Application of a novel cost reduction index to preventive maintenance scheduling. Electr. Power Energy Syst. 2014, 56, 235–240. [Google Scholar] [CrossRef]

- García-Barberena, J.; Monreal, A.; Mutuberria, A.; Sánchez, M. Towards cost-competitive solar towers–Energy cost reductions based on Decoupled Solar Combined Cycles (DSCC). Energy Procedia 2014, 49, 1350–1369. [Google Scholar] [CrossRef]

- Sierpińska, M. Nowoczesne narzędzia zarządzania finansami w przedsiębiorstwie górniczym. Controlling projektów-jego zakres i narzędzia. Wiadomości Górnicze 2006, nr 5, 283–288. [Google Scholar]

- Wodarski, K.; Bijańska, J. Prognozowanie rentowności produkcji węgla kamiennego na przykładzie wybranej kopalni; [w:] XVI Szkoła Ekonomiki i Zarządzania w Górnictwie 2011, Stowarzyszenie Inżynierów i Techników Górnictwa; Zarząd Główny: Katowice, Poland, 2011; pp. 173–176. [Google Scholar]

- Turek, M.; Czabanka, J. Minimalizacja kosztów produkcji w Gliwickiej Spółce Węglowej SA. Przegląd Górniczy 1995, 2, 15–18. [Google Scholar]

- Turek, M. Nosal, P. Kierunki działania w zakresie minimalizacji kosztów produkcji w Gliwickiej Spółce Węglowej, S.A.; Szkoła Ekonomiki i Zarządzania w Górnictwie, Akademia Górniczo- Hutnicza: Kraków, Poland, 1995; pp. 430–452. [Google Scholar]

- Karbownik, A.; Turek, M. Zmiany w górnictwie węgla kamiennego—geneza, przebieg, efekty. Przegląd Górniczy 2011, 7–8, 11–18. [Google Scholar]

- Lisowski, A. Podstawy ekonomicznej efektywności podziemnej eksploatacji złóż; Wydawnictwo GiG, Wydawnictwo PWN: Katowice-Warszawa, Poland, 2001. [Google Scholar]

- Magda, R. Możliwości obniżania cen zbytu węgla w zależności od przyjętego poziomu średniej akumulacji jednostkowej ze sprzedaży. Wiadomości Górnicze 2014, 1, 47–52. [Google Scholar]

- Gorczyńska, A. Zarządzanie kosztami w przedsiębiorstwie w świetle badań literaturowych; [w:] Jonek-Kowalska, I. (red.): Zarządzanie kosztami w przedsiębiorstwach górniczych w Polsce. Stan aktualny I kierunki doskonalenia; Difin: Warszawa, Poland, 2013; pp. 13–21. [Google Scholar]

- Turek, M. System zarządzania kosztami w cyklu istnienia wyrobiska wybierkowego w kopalni węgla kamiennego; Difin: Warszaw, Poland, 2013. [Google Scholar]

- Tee, K.F.; Khan, L.R.; Chen, H.P.; Alani, A.M. Reliability based life cycle cost optimization for underground pipeline networks. Tunn. Undergr. Space Technol. 2014, 43, 32–40. [Google Scholar] [CrossRef]

- Trojnar, A.; Więckol-Ryk, A.; Niemiec, B. Koszty profilaktyki zagrożenia tąpaniami w kopalniach węgla kamiennego. Wiadomości Górnicze 2014, 4, 209–221. [Google Scholar]

- Czopek, K. Sposób wyznaczania i wykorzystania kosztów stałych w kopalniach węgla brunatnego; Prace Naukowe Instytutu Górnictwa Politechniki Wrocławskiej, nr 98, Seria Konferencje: Nr 34; Materiały III Międzynarodowego Kongresu Górnictwa Węgla Brunatnego: Bełchatów, Poland, 2002; pp. 111–118. [Google Scholar]

- Gawlik, L. Koszty stałe i zmienne pozyskania węgla kamiennego jako element zarządzania produkcją. Polityka Energetyczna 2007, 10, 471–482. [Google Scholar]

- Dźwigoł, H. Oddziałowy Rachunek Kosztów oraz model budżetowania kosztów w górnictwie węgla kamiennego; Materiały konferencyjne z konferencji naukowej nt. Reformy polskiego górnictwa węgla kamiennego; Zarządzanie innowacjami: Szczyrk, Poland, 2001. [Google Scholar]

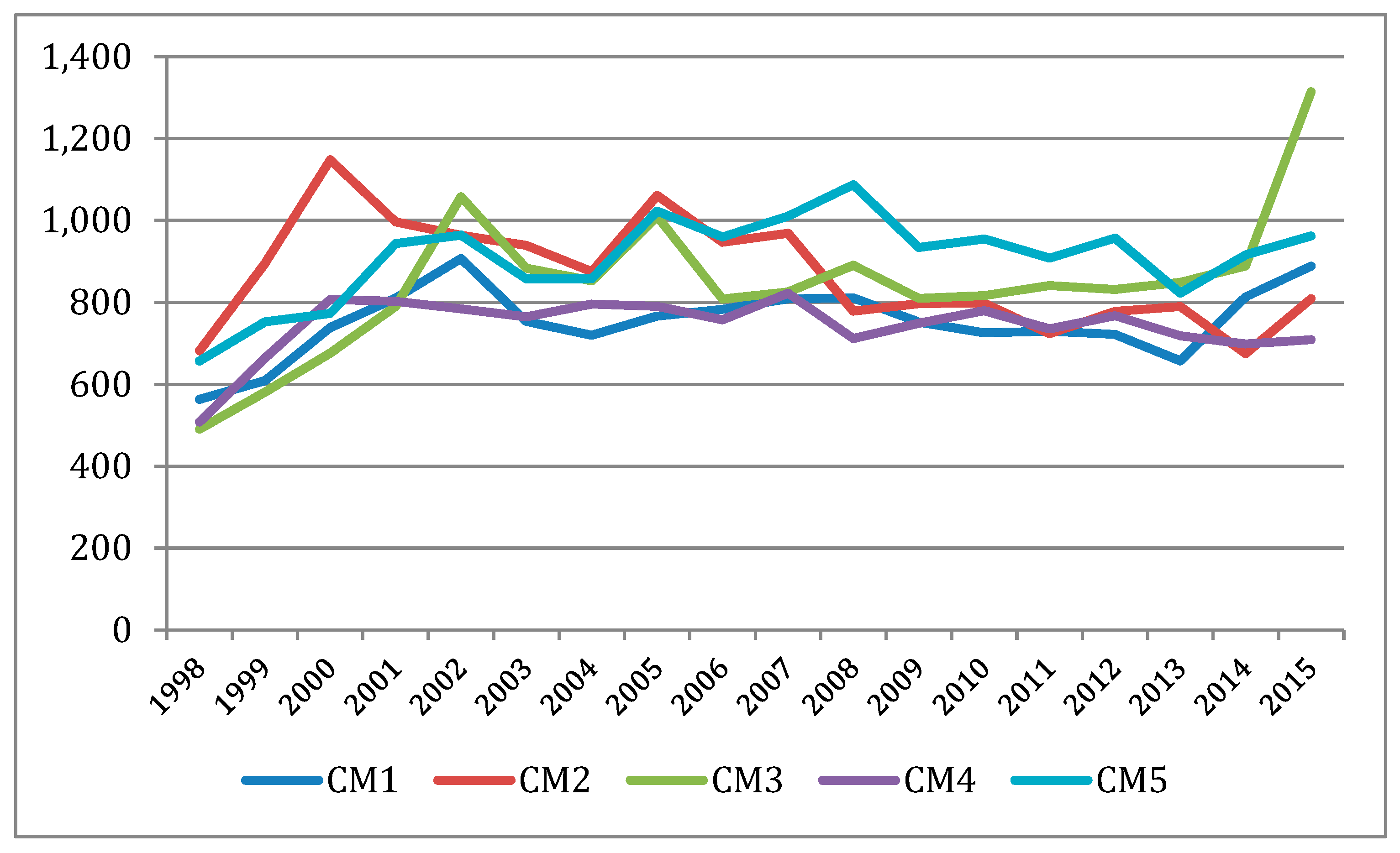

| Coal Mine * No. | — Arithmetic Average | — Standard Deviation | CV-Coefficients of Variation | Maximum | Minim | Maximum− Minimum |

|---|---|---|---|---|---|---|

| CM1 | 753 | 83.76 | 11.12% | 907 | 563 | 344 |

| CM2 | 868 | 127.43 | 14.68% | 1148 | 675 | 473 |

| CM3 | 845 | 171.55 | 20.29% | 1315 | 490 | 824 |

| CM4 | 743 | 70.64 | 9.51% | 822 | 508 | 315 |

| CM5 | 908 | 102.54 | 11.29% | 1088 | 657 | 431 |

| Specification | Coal Mine (CM) | ||||

|---|---|---|---|---|---|

| CM1 | CM2 | CM3 | CM4 | CM5 | |

| Production | −0.0348 | 0.7145 * | −0.1784 | 0.7471 * | 0.4454 |

| Employment | −0.8308 * | −0.3272 | −0.7586 * | 0.2891 | −0.7835 * |

| Total costs | −0.2390 | −0.6894 * | −0.3167 | 0.3693 | −0.0233 |

| Specification | Coal Mine (CM) | ||||

|---|---|---|---|---|---|

| CM1 | CM2 | CM3 | CM4 | CM5 | |

| Production | 0.12% | 51.05% * | 3.18% | 55.82% * | 19.84% |

| Employment | 69.02% * | 10.71% | 57.55% * | 8.36% | 61.39% * |

| Total costs | 5.71% | 47.53% * | 10.03% | 13.64% | 0.05% |

| Specification | Coal Mine (CM) | ||||

|---|---|---|---|---|---|

| CM1 | CM2 | CM3 | CM4 | CM5 | |

| Production | −0.3677 | −0.2647 | 0.8413 * | −0.0072 | −0.1035 |

| Employment | 0.0582 | 0.5303 * | 0.7772 * | −0.2898 | −0.0463 |

| Specification | Coal Mine (CM) | ||||

|---|---|---|---|---|---|

| CM1 | CM2 | CM3 | CM4 | CM5 | |

| Production | 13.52% | 7.01% | 70.78% * | 0.01% | 1.07% |

| Employment | 0.34% | 28.12% * | 60.40% * | 8.40% | 0.21% |

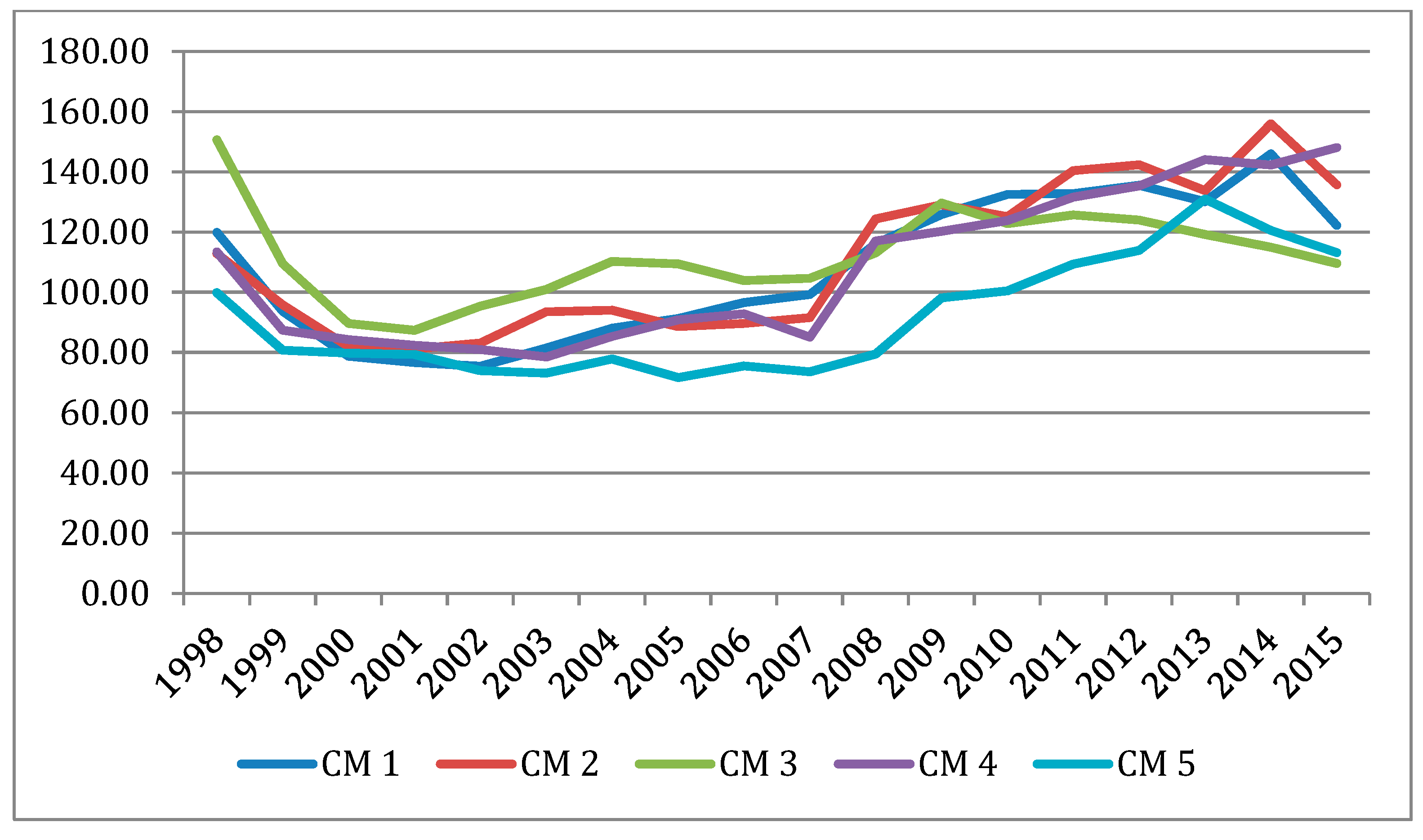

| Specification | Year | ||||||||

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

| CM1 | 1.0000 | 1.0806 | 1.2141 | 1.0972 | 1.1188 | 0.8307 | 0.9548 | 1.0653 | 1.0220 |

| CM2 | 1.0000 | 1.3128 | 1.2834 | 0.8679 | 0.9673 | 0.9741 | 0.9322 | 1.2126 | 0.8923 |

| CM3 | 1.0000 | 1.1842 | 1.1640 | 1.1695 | 1.3381 | 0.8354 | 0.9651 | 1.1843 | 0.8002 |

| CM4 | 1.0000 | 1.3072 | 1.2159 | 0.9948 | 0.9767 | 0.9751 | 1.0410 | 0.9928 | 0.9589 |

| CM5 | 1.0000 | 1.1460 | 1.0272 | 1.2208 | 1.0218 | 0.8892 | 1.0005 | 1.1920 | 0.9385 |

| Specification | Year | ||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

| CM1 | 1.0325 | 1.0027 | 0.9277 | 0.9650 | 1.0052 | 0.9893 | 0.9108 | 1.2374 | 1.0926 |

| CM2 | 1.0227 | 0.8036 | 1.0241 | 1.0020 | 0.9061 | 1.0750 | 1.0153 | 0.8546 | 1.1980 |

| CM3 | 1.0213 | 1.0790 | 0.9094 | 1.0079 | 1.0305 | 0.9886 | 1.0207 | 1.0473 | 1.4785 |

| CM4 | 1.0854 | 0.8653 | 1.0527 | 1.0408 | 0.9426 | 1.0447 | 0.9355 | 0.9724 | 1.0154 |

| CM5 | 1.0530 | 1.0760 | 0.8588 | 1.0225 | 0.9508 | 1.0542 | 0.8596 | 1.1132 | 1.0506 |

| Specification | Coal Mines | ||||

|---|---|---|---|---|---|

| CM1 | CM2 | CM3 | CM4 | CM5 | |

| R2 | 0.1352 | 0.0700 | 0.7078 | 0.00005 | 0.0107 |

| Radj2 | 0.1812 | 0.0119 | 0.6896 | - | - |

| F | F(1.16) = 2.5019 | F(1.16) = 1.2054 | F(1.16) = 38.766 | F(1.16) = 0.0008 | F(1.16) = 0.1734 |

| p | p < 0.1333 | p < 0,2885 | p < 0.0001 | p < 0.9774 | p < 0.6826 |

| y | y = −0.3677x + 534 376 740 | y = −0.2647x + 422 624 570 | y = 0.8413x − 89 430 427 | y = 0.00071x + 506 854 732 | y = −0.1035x + 474 856 257 |

| Coal Mine No. | —Arithmetic Average | —Standard Deviation | CV -Coefficients of Variation | Maximum | Minimum | Maximum −Minimum |

|---|---|---|---|---|---|---|

| CM1 | 22.64% | 31.85% | 140.67% | 120.30% | −20.17% | 140.47% |

| CM2 | 19.10% | 29.97% | 156.94% | 105.71% | −18.06% | 123.77% |

| CM3 | 27.54% | 34.93% | 126.83% | 147.72% | −30.42% | 178.14% |

| CM4 | 11.46% | 29.82% | 260.10% | 97.76% | −31.46% | 129.22% |

| CM5 | 24.92% | 42.71% | 171.37% | 175.84% | −17.84% | 193.68% |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jonek-Kowalska, I. Long-term Analysis of the Effects of Production Management in Coal Mining in Poland. Energies 2019, 12, 3146. https://doi.org/10.3390/en12163146

Jonek-Kowalska I. Long-term Analysis of the Effects of Production Management in Coal Mining in Poland. Energies. 2019; 12(16):3146. https://doi.org/10.3390/en12163146

Chicago/Turabian StyleJonek-Kowalska, Izabela. 2019. "Long-term Analysis of the Effects of Production Management in Coal Mining in Poland" Energies 12, no. 16: 3146. https://doi.org/10.3390/en12163146

APA StyleJonek-Kowalska, I. (2019). Long-term Analysis of the Effects of Production Management in Coal Mining in Poland. Energies, 12(16), 3146. https://doi.org/10.3390/en12163146