How to Comply with the Paris Agreement Temperature Goal: Global Carbon Pricing According to Carbon Budgets

Abstract

1. Introduction

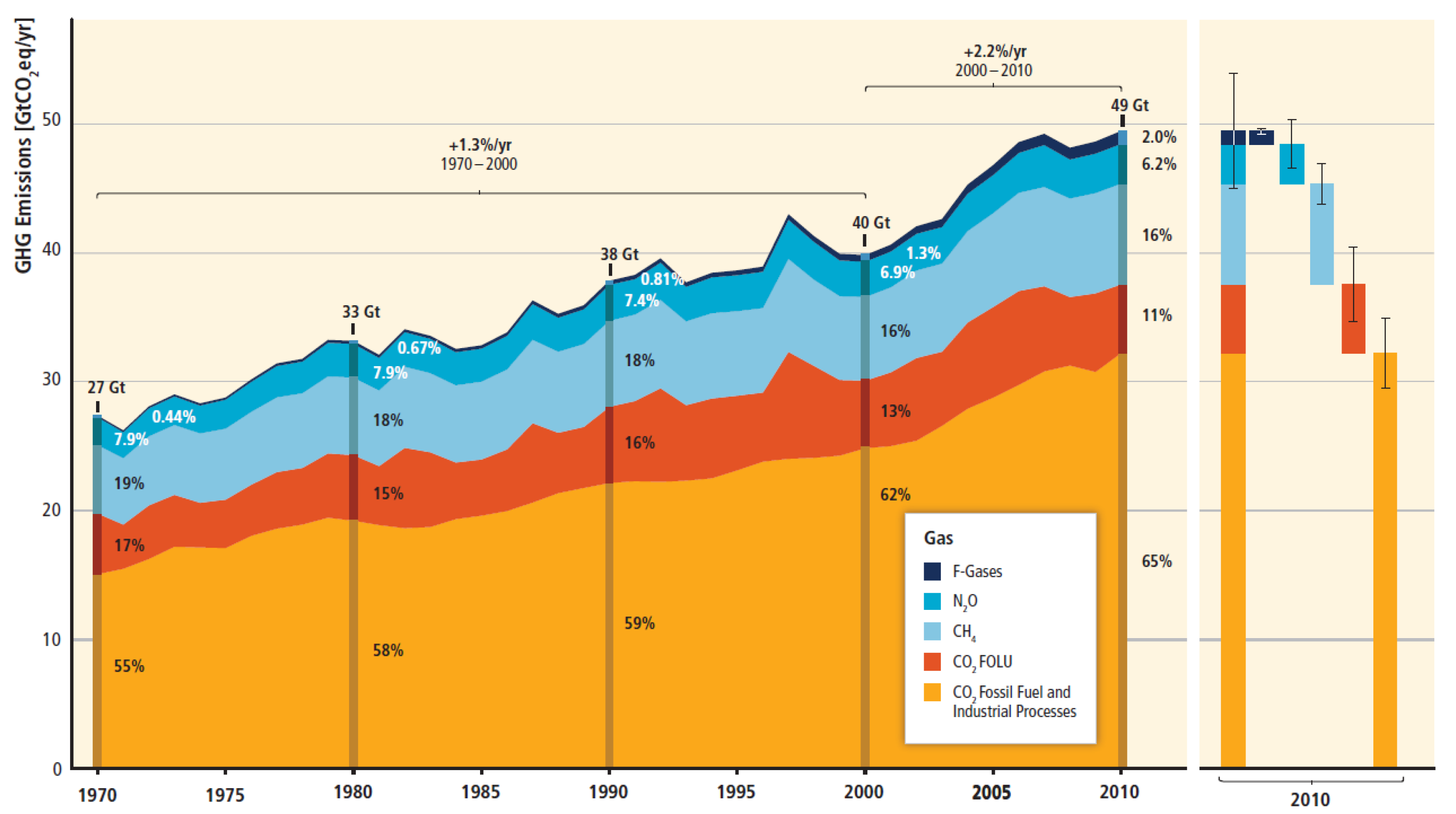

2. Status Quo Concerning GHG Emissions

- CO2 from fossil fuel and industrial processes, with 65%;

- Methane, with 16%, and nitrous oxide, with 6%, e.g., from agriculture;

- Reduction of CO2 sinks, with 11%, e.g., through deforestation or the destruction of forests.

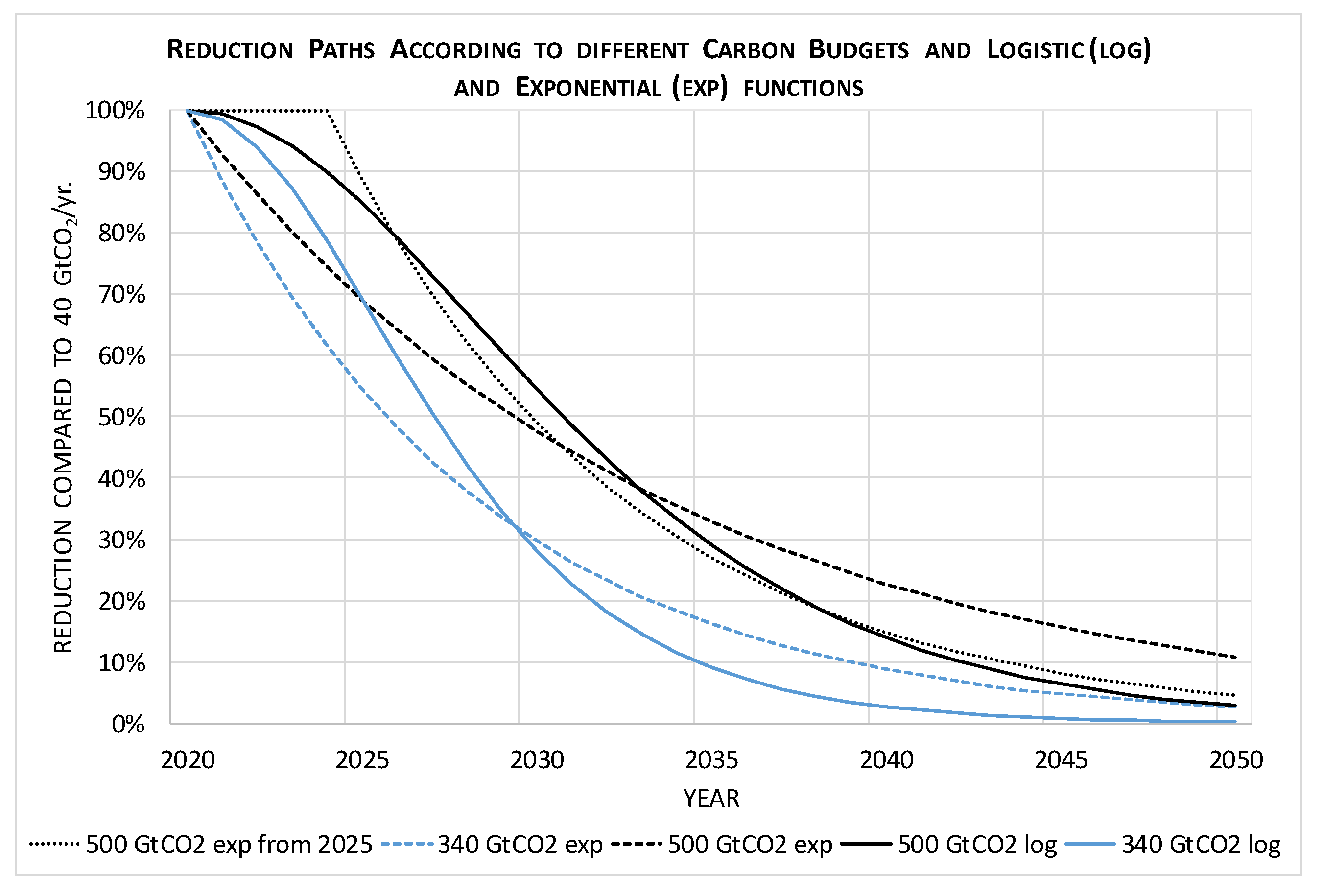

3. Reduction Paths: Carbon Law Adapted to a 1.5 °C Target with an Exponential or Logistic Decrease

- The severity of damage increases nonlinearly, with a GMST increase of over 2 °C [8]. Acting too late or not ambitiously enough could lead to nonlinear self-reinforcing and irreversible processes (tipping points, cf. Section 6.6) that would amplify warming, despite costly efforts;

- The reliance on net negative emissions to return warming to a specific temperature limit should be minimized, as there is still a lack of understanding of how the carbon cycle responds to net negative emissions. Thus, the effectiveness of negative emissions technologies to decrease the temperature after a peak is uncertain [7];

- Furthermore, “[…] delaying GHG emissions reductions over the coming years also leads to economic and institutional lock-in into carbon-intensive infrastructure, that is, the continued investment in and use of carbon-intensive technologies that are difficult or costly to phase-out, once deployed” [7].

- 11–22 GtCO2/yr. by 2030, i.e., a reduction of 46–72%, compared to 2020;

- 1–9 GtCO2/yr. by 2040, i.e., a reduction of 77–97%, compared to 2020;

- 0–4 GtCO2/yr. by 2050, i.e., a reduction of 89–100%, compared to 2020.

4. Internalization of the External Effects of Anthropogenic GHG Emissions: Possible Policy Frameworks

- Legal requirements (command and control approach), e.g., statutory emissions thresholds;

- Pigouvian tax and subsidies;

- Emissions trading.

- Legal requirements, e.g., a uniform emissions threshold for all polluters, lead to a lack of options for polluters to implement measures at the lowest marginal abatement costs;

- A design of the legal requirements, in accordance with the lowest marginal abatement costs, would require the state to be aware of the marginal abatement costs of each polluter. The state would therefore be dependent on receiving correct information from all polluters, the monitoring effort would be considerable, and there would be uncertainties in the accuracy of the information;

- Additionally, the regulator would have to adjust the requirements over time so that the private benefits from investing in the new technology equal the social benefits—a task that seems very difficult to achieve, considering the complexity of the systems involved and the uncertainties associated with the necessary estimates;

- The incentive to invest in new technologies, as well as in the most cost-effective ones, is lower for the legal requirements than for the market-based instruments.

5. Global Carbon Pricing

5.1. Quantity Control (Emissions Trading) vs. Price Control (Pigouvian Tax)

- The sum of the abatement and damage costs is minimal; in other words:

- The marginal damage is equal to the marginal abatement costs.

- Criterion for exclusion: A Pigouvian tax controls the price, not the quantity. Hence, it will not necessarily ensure that global CO2 emissions stay within a previously defined remaining carbon budget, which is a necessary condition for an instrument to be useful in limiting global warming to a specific temperature limit;

- Marginal abatement costs and marginal damage costs, and even the slope of them, cannot be calculated with sufficient accuracy. Hence, Weitzman’s rule cannot be used to identify a case where a Pigouvian tax would eventually be more favorable than emissions trading;

- Weitzman’s rule tells us that there is likewise a chance that emissions trading is more favorable than a Pigouvian tax, even if the criterion for exclusion would not hold.

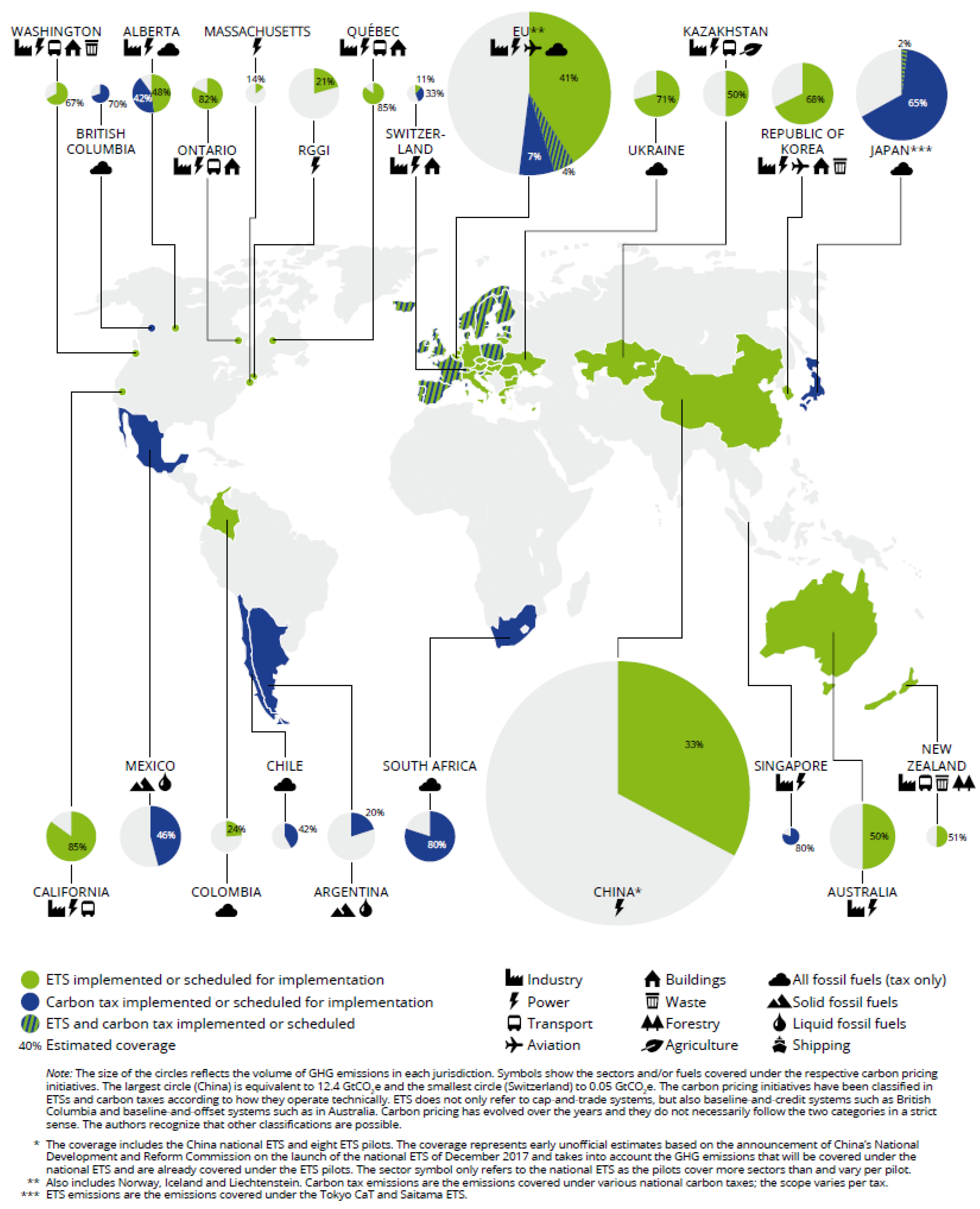

5.2. National vs. International and Sectoral vs. Cross-Sectoral Structuring

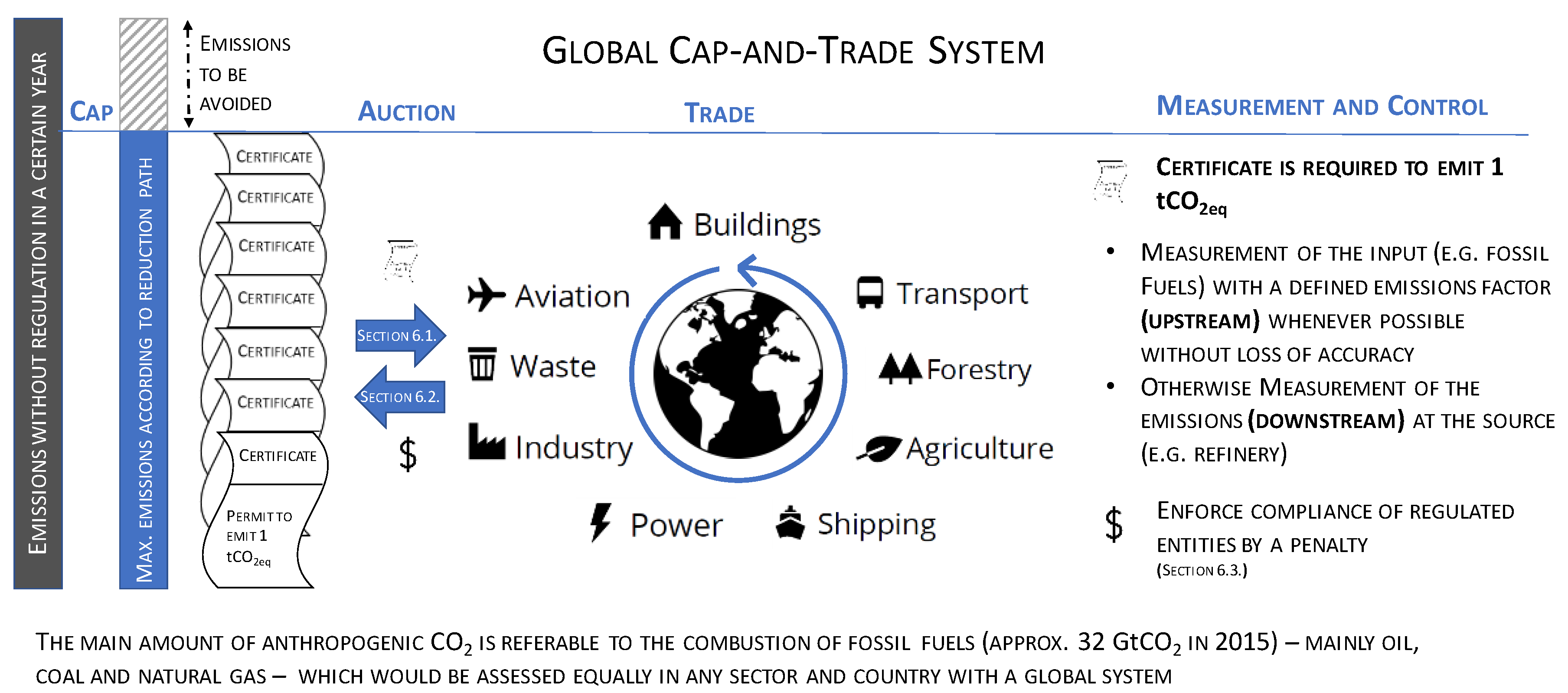

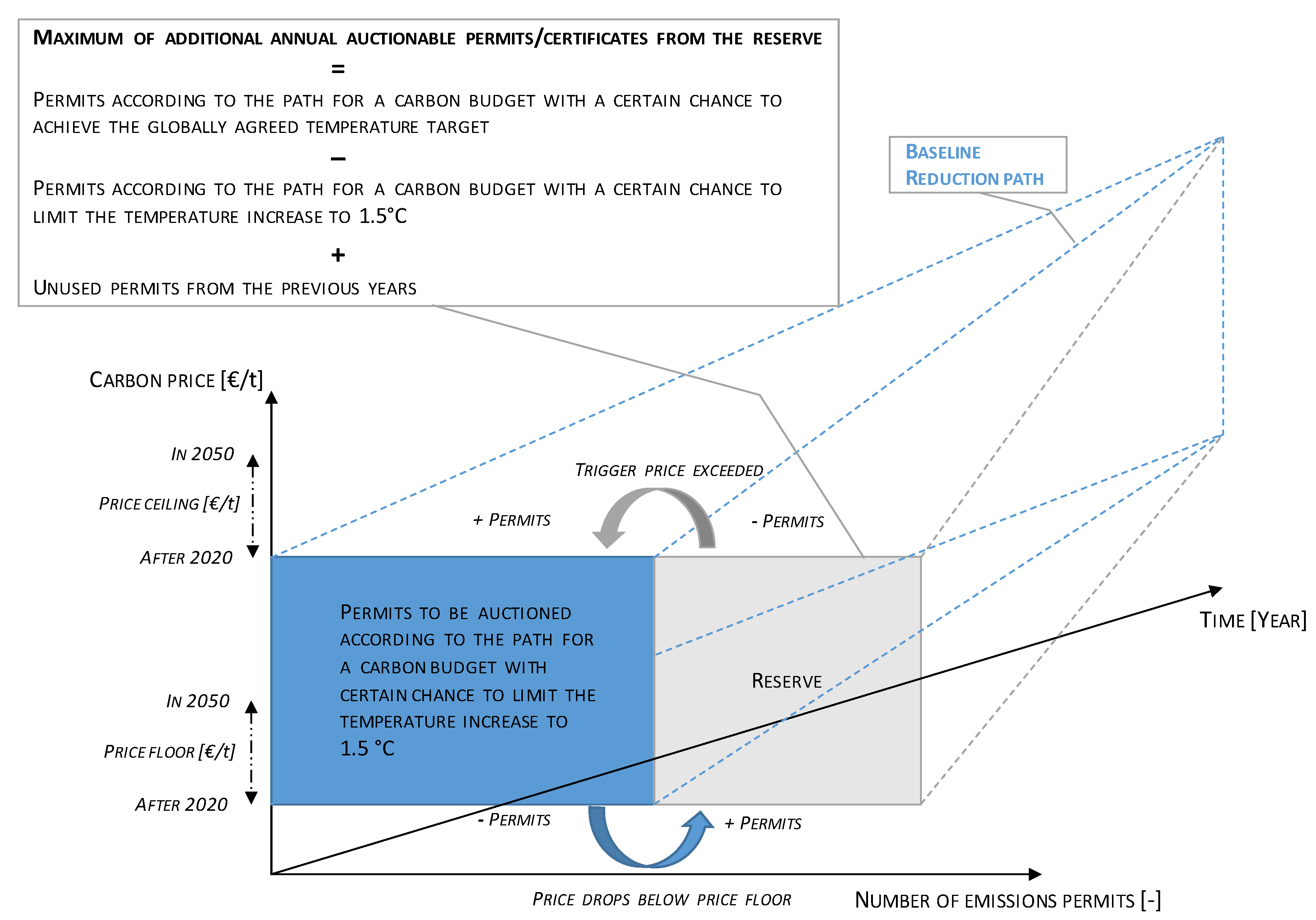

6. Derived Political Instrument—A Global Cap-and-Trade System across All Sectors

6.1. Auctioning Emissions Permits

6.2. What Should the Money Be Used for That Is Collected within the Global Cap-and-Trade System

- Cushioning losses in value due to non-insurable damages that can be traced back to climate change;

- Enabling adaptation and investments, in developing countries that eventually lack the funding to implement even the cost-efficient solutions. This could be based on existing funds, like the Green Climate Fund (GCF) or Global Environmental Facility (GEF);

- Financing the net negative emissions, which may be necessary especially from 2050;

- Compensating for the eventual collapses of countries, industries and the financial system due to stranded assets caused by the fossil phase-out.

6.3. Measurement and Control

6.4. Extension of the CO2-Based Global Cap-and-Trade System to Non-CO2 GHG Emissions, AFOLU and Carbon Sinks

6.5. Substitution of Existing CO2-Related Governmental Intervention by the Global Cap-and-Trade System

6.6. Refutation of Objections to the Implementation of a Global Cap-and-Trade System

7. Discussion

- What are the impediments to a global carbon price agreement, and how can they be overcome?

- How should a global ETS fund be structured and managed?

- Provided that the implementation of a global ETS is agreed upon, how can existing governmental interventions concerning climate protection be phased out? What would be an adequate roadmap for the discontinuation of national subsidies for fossil fuels?

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- United Nations Framework Convention on Climate Change (UNFCCC). The Paris Agreement. Available online: https://unfccc.int/resource/bigpicture/index.html#content-the-paris-agreemen (accessed on 24 March 2019).

- IPCC. Summary for Policymakers. In Global Warming of 1.5 °C: An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; World Meteorological Organization: Geneva, Switzerland, 2018. [Google Scholar]

- IPCC. Climate Change 2013. The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Stocker, F.T., Qin, D., Plattner, G.-K., Tignor, M., Allen, S.K., Boschung, J., Nauels, A., Xia, Y., Bex, V., Midgley, P.M., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2013. [Google Scholar]

- IPCC. Climate Change 2014. Mitigation of Climate Change: Working Group III Contribution to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Edenhofer, O., Pichs-Madruga, R., Sokona, Y., Farahani, E., Kadner, S., Seyboth, K., Adler, A., Baum, I., Brunner, S., Eickemeier, P., et al., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014. [Google Scholar]

- International Energy Agency (IEA). CO2 Emissions from Fuel Combustion. Higlights: OECD/IEA 2017. Available online: https://www.iea.org/publications/freepublications/publication/CO2EmissionsfromFuelCombustionHighlights2017.pdf (accessed on 18 June 2019).

- Allen, M.R.; de Coninck, H.; Dube, O.P.; Hoegh-Guldberg, O.; Jacob, D.; Jiang, K.; Revi, A.; Rogelj, J.; Roy, J.; Shindell, D.; et al. Technical Summary. In Global Warming of 1.5 °C: An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; World Meteorological Organization: Geneva, Switzerland, 2018. [Google Scholar]

- Rogelj, J.; Shindell, D.; Jiang, K.; Fifita, S.; Forster, P.; Ginzburg, V.; Handa, C.; Kheshgi, H.; Kobayashi, S.; Kriegler, E.; et al. Mitigation Pathways Compatible with 1.5 °C in the Context of Sustainable Development. In Global Warming of 1.5 °C: An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; World Meteorological Organization: Geneva, Switzerland, 2018. [Google Scholar]

- Allen, M.R.; Dube, O.P.; Solecki, W.; Aragón-Durand, F.; Cramer, W.; Humphreys, S.; Kainuma, M.; Kala, J.; Mahowald, N.; Mulugetta, Y.; et al. Framing and Context. In Global Warming of 1.5 °C: An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; World Meteorological Organization: Geneva, Switzerland, 2018. [Google Scholar]

- Rockström, J.; Gaffney, O.; Rogelj, J.; Meinshausen, M.; Nakicenovic, N.; Schellnhuber, H.J. A roadmap for rapid decarbonization. Science 2017, 355, 1269–1271. [Google Scholar] [CrossRef] [PubMed]

- Zapf, M.; Pengg, H.; Bütler, T.; Bach, C.; Weindl, C. Kosteneffiziente und nachhaltige Automobile. Bewertung der Klimabelastung und der Gesamtkosten—Heute und in Zukunft, 1st ed.; Springer Vieweg: Wiesbaden, Germany, 2019; ISBN 3658240598. [Google Scholar]

- United Nations Environment Programme (UNEP). Ozone Secretariat. Ozone Depleting Substances (ODS) Consumption. Available online: https://ozone.unep.org/countries/data (accessed on 29 April 2019).

- Hegglin, M.I.; Fahey, D.W.; McFarland, M.; Montzka, S.A.; Nash, E.R. Twenty Questions and Answers about the Ozone Layer; World Meteorological Organization: Geneva, Switzerland, 2015; ISBN 978-9966-076-02-1. [Google Scholar]

- European Environment Agency (EEA). Sulphur Dioxide (SO2) Emissions. Available online: https://www.eea.europa.eu/data-and-maps/indicators/eea-32-sulphur-dioxide-so2-emissions-1/assessment-3 (accessed on 16 April 2019).

- Massetti, E.; Brown, M.A.; Lapsa, M.; Sharma, I.; Bradbury, J.; Cunliff, C.; Li, Y. Environmental Quality and the U.S. Environmental Quality and the U.S. Power Sector: Air Quality, Water Quality, Land Use and Environmental Justice. Available online: https://www.energy.gov/sites/prod/files/2017/01/f34/Environment%20Baseline%20Vol.%202--Environmental%20Quality%20and%20the%20U.S.%20Power%20Sector--Air%20Quality%2C%20Water%20Quality%2C%20Land%20Use%2C%20and%20Environmental%20Justice.pdf (accessed on 6 June 2019).

- Grübler, A. The Rise and Fall of Infrastructures. Dynamics of Evolution and Technological Change in Transport; Physica-Verlag: Heidelberg, Germany, 1990; ISBN 978-0387913742. [Google Scholar]

- Pezzey, J.C.V. Why the social cost of carbon will always be disputed. WIREs Clim. Chang. 2018, 10, e558. [Google Scholar] [CrossRef]

- Bester, H. Theorie der Industrieökonomik, 7th ed.; Springer Gabler: Berlin/Heidelberg, Germany, 2017; ISBN 9783662481400. [Google Scholar]

- Sturm, B.; Vogt, C. Umweltökonomik. Eine anwendungsorientierte Einführung, 2nd ed.; Springer Gabler: Berlin, Germany, 2018; ISBN 9783662541265. [Google Scholar]

- Deimer, K.; Pätzold, M.; Tolkmitt, V. Ressourcenallokation, Wettbewerb und Umweltökonomie; Springer Gabler: Berlin, Germany, 2017; ISBN 978-3-662-52765-8. [Google Scholar]

- Schubert, R.; Ohndort, M.; Rohling, M. Umweltökonomie Kapitel III: Internalisierung Externer Effekte. Available online: http://webarchiv.ethz.ch/vwl/down/v-schubert/Umwelt/2012/Umwelt%20MR%20II.pdf (accessed on 22 March 2019).

- Hepburn, C. Regulation by Prices, Quantities, or Both: A Review of Instrument Choice. Oxf. Rev. Econ. Policy 2006, 22, 226–247. [Google Scholar] [CrossRef]

- Schmalensee, R.; Stavins, R.N. Lessons Learned from Three Decades of Experience with Cap and Trade. Rev. Environ. Econ. Policy 2017, 11, 59–79. [Google Scholar] [CrossRef]

- Newell, R.G.; Stavins, R.N. Cost Heterogeneity and the Potential Savings from Market-Based Policies. J. Regul. Econ. 2003, 23, 43–59. [Google Scholar] [CrossRef]

- Global Carbon Pricing. The Path to Climate Cooperation; Cramton, P.C., MacKay, D.J.C., Ockenfels, A., Stoft, S., Eds.; The MIT Press: Cambridge, MA, USA; London, UK, 2017; ISBN 9780262036269. [Google Scholar]

- Zaklan, A. Linking Cap-and-Trade Systems. Available online: https://www.diw.de/de/diw_01.c.593319.de/presse/diw_roundup/linking_cap_and_trade_systems.html#_ftn1 (accessed on 4 April 2019).

- International Carbon Action Partnership. Emissions Trading Worldwide. Status Report 2018; ICAP: Berlin, Germany, 2018. [Google Scholar]

- World Bank. Ecofys. State and Trends of Carbon Pricing 2018; License: Creative Commons Attribution CC BY 3.0 IGO; World Bank: Washington, DC, USA, 2018. [Google Scholar] [CrossRef]

- Cai, Y.; Lenton, T.M.; Lontzek, T.S. Risk of multiple interacting tipping points should encourage rapid CO2 emission reduction. Nat. Clim. Chang. 2016, 6, 520–525. [Google Scholar] [CrossRef]

- Nordhaus, W.D. Revisiting the social cost of carbon. Proc. Natl. Acad. Sci. USA 2017, 114, 1518–1523. [Google Scholar] [CrossRef] [PubMed]

- Fleurbaey, M.; Ferranna, M.; Budolfson, M.; Dennig, F.; Mintz-Woo, K.; Socolow, R.; Spears, D.; Zuber, S. The Social Cost of Carbon: Valuing Inequality, Risk, and Population for Climate Policy. Monist 2019, 102, 84–109. [Google Scholar] [CrossRef]

- FUND—Climate Framework for Uncertainty, Negotiation and Distribution. Available online: http://www.fund-model.org/home (accessed on 1 July 2019).

- Nordhaus, W.D. The ‘DICE’ Model: Background and Structure of a Dynamic Integrated Climate-Economy Model of the Economics of Global Warming; Cowles Foundation for Research in Economics, Yale University: New Haven, CT, USA, 1992. [Google Scholar]

- Hope, C.; Anderson, J.; Wenman, P. Policy analysis of the greenhouse effect. Energy Policy 1993, 21, 327–338. [Google Scholar] [CrossRef]

- Diaz, D.; Moore, F. Quantifying the economic risks of climate change. Nat. Clim. Chang. 2017, 7, 774–782. [Google Scholar] [CrossRef]

- Nordhaus, W.D. To Tax or Not to Tax: Alternative Approaches to Slowing Global Warming. Rev. Environ. Econ. Policy 2007, 1, 26–44. [Google Scholar] [CrossRef]

- Weitzman, M.L. Prices vs. Quantities. Rev. Econ. Stud. 1974, 41, 477–491. [Google Scholar] [CrossRef]

- Stavins, R.N. Correlated Uncertainty and Policy Instrument Choice. J. Environ. Econ. Manag. 1996, 30, 218–232. [Google Scholar] [CrossRef]

- Fell, H.; MacKenzie, I.A.; Pizer, W.A. Prices versus quantities versus bankable quantities. Resour. Energy Econ. 2012, 34, 607–623. [Google Scholar] [CrossRef]

- Pommeret, A.; Schubert, K. Intertemporal Emission Permits Trading under Uncertainty and Irreversibility. Environ. Resour. Econ. 2018, 71, 73–97. [Google Scholar] [CrossRef]

- Leiby, P.; Rubin, J. Intertemporal Permit Trading for the Control of Greenhouse Gas Emissions. Environ. Resour. Econ. 2001, 19, 229–256. [Google Scholar] [CrossRef]

- Roberts, M.J.; Spence, M. Effluent charges and licenses under uncertainty. J. Public Econ. 1976, 5, 193–208. [Google Scholar] [CrossRef]

- Pizer, W.A. Combining price and quantity controls to mitigate global climate change. J. Public Econ. 2002, 85, 409–434. [Google Scholar] [CrossRef]

- Stranlund, J.K.; Moffitt, L.J. Enforcement and price controls in emissions trading. J. Environ. Econ. Manag. 2014, 67, 20–38. [Google Scholar] [CrossRef]

- Yu, J.; Mallory, M.L. An Optimal Hybrid Emission Control System in a Multiple Compliance Period Model. SSRN J. 2013. [Google Scholar] [CrossRef]

- Perkis, D.F.; Cason, T.N.; Tyner, W.E. An Experimental Investigation of Hard and Soft Price Ceilings in Emissions Permit Markets. Environ. Resour. Econ. 2016, 63, 703–718. [Google Scholar] [CrossRef]

- Fell, H.; Burtraw, D.; Morgenstern, R.D.; Palmer, K.L. Soft and hard price collars in a cap-and-trade system: A comparative analysis. J. Environ. Econ. Manag. 2012, 64, 183–198. [Google Scholar] [CrossRef]

- Burtraw, D.; Palmer, K.; Kahn, D. A symmetric safety valve. Energy Policy 2010, 38, 4921–4932. [Google Scholar] [CrossRef]

- Fell, H.; Morgenstern, R.D. Alternative Approaches to Cost Containment in a Cap-and-Trade System. Environ. Resour. Econ. 2010, 47, 275–297. [Google Scholar] [CrossRef]

- Mehling, M.A.; van Asselt, H.; Das, K.; Droege, S. Beat protectionism and emissions at a stroke. Nature 2018, 559, 321–324. [Google Scholar] [CrossRef] [PubMed]

- Edenhofer, O.; Flachsland, C.; Arlinghaus, J.; Haywood, L.; Kalkuhl, M.; Knopf, B.; Koch, N.; Kornek, U.; Pahle, M.; Pietzcker, R.; et al. Eckpunkte einer CO2-Preisreform für Deutschland: MCC Working Paper No. 1/2018. Available online: https://www.mcc-berlin.net/fileadmin/data/B2.3_Publications/Working%20Paper/2018_MCC_Working_Paper_1_CO2-Preisreform.pdf (accessed on 3 June 2019).

- Stern, N. The Economics of Climate Change; Cambridge University Press: Cambridge, UK, 2007; ISBN 9780511817434. [Google Scholar]

- Cramton, P.; Ockenfels, A.; Stoft, S.S. An International Carbon-Price Commitment Promotes Cooperation. EEEP 2015. [Google Scholar] [CrossRef]

- Nordhaus, W. Climate Clubs: Overcoming Free-riding in International Climate Policy. Am. Econ. Rev. 2015, 105, 1339–1370. [Google Scholar] [CrossRef]

- Die Wissenschaftlichen Dienste des Deutschen Bundestages (WD). Nationale bzw. EU-Weite Einbeziehung Weiterer Sektoren in das Europäische Emissionshandelssystem. Available online: https://www.bundestag.de/resource/blob/554054/d82fa4578090812799515b50409f453e/wd-8-013-18-pdf-data.pdf (accessed on 19 March 2019).

- Ekardt, F. Arbeitspapier zur Möglichen Totalrevision des Emissionshandels in Richtung Eines Upstream-ETS Entlang der Ziele Aus Art. 2 Abs. 1 Paris Abkommen. Available online: http://www.sustainability-justice-climate.eu/files/texts/Arbeitspapier-Totalrevision-ETS.pdf (accessed on 19 March 2019).

- Achtnicht, M.; von Graevenitz, K.; Koesler, S.; Löschel, A.; Schoeman, B.; Tovar, M. Including Road Transport in the EU-ETS—An Alternative for the Future? Available online: http://ftp.zew.de/pub/zew-docs/gutachten/RoadTransport-EU-ETS_ZEW2015.pdf (accessed on 10 July 2019).

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- United Nations Framework Convention on Climate Change (UNFCCC). Emissions Trading. Available online: https://unfccc.int/process/the-kyoto-protocol/mechanisms/emissions-trading (accessed on 4 June 2019).

- Brunner, S.; Flachsland, C.; Luderer, G.; Edenhofer, O. Emissions Trading Systems: An Overview: Discussion Paper. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.535.2125&rep=rep1&type=pdf (accessed on 5 April 2019).

- Cramton, P.; Kerr, S. Tradeable carbon permit auctions. Energy Policy 2002, 30, 333–345. [Google Scholar] [CrossRef]

- Goeree, J.K.; Palmer, K.; Holt, C.A.; Shobe, W.; Burtraw, D. An Experimental Study of Auctions versus Grandfathering to Assign Pollution Permits. J. Eur. Econ. Assoc. 2010, 8, 514–525. [Google Scholar] [CrossRef]

- De Coninck, H.; Revi, A.; Babiker, M.; Bertoldi, P.; Buckeridge, M.; Cartwright, A.; Dong, W.; Ford, J.; Fuss, S.; Hourcade, J.-C.; et al. Strengthening and Implementing the Global Response. In Global Warming of 1.5 °C: An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; World Meteorological Organization: Geneva, Switzerland, 2018. [Google Scholar]

- European Commission. Innovation Fund. Available online: https://ec.europa.eu/clima/policies/innovation-fund_de (accessed on 3 June 2019).

- Allen, M.R.; Shine, K.P.; Fuglestvedt, J.S.; Millar, R.J.; Cain, M.; Frame, D.J.; Macey, A.H. A solution to the misrepresentations of CO2-equivalent emissions of short-lived climate pollutants under ambitious mitigation. Npj Clim. Atmos. Sci. 2018, 1, 16. [Google Scholar] [CrossRef]

- Bock, L.; Burkhardt, U. Contrail cirrus radiative forcing for future air traffic. Atmos. Chem. Phys. 2019, 19, 8163–8174. [Google Scholar] [CrossRef]

- Matthes, S.; Grewe, V.; Dahlmann, K.; Frömming, C.; Irvine, E.; Lim, L.; Linke, F.; Lührs, B.; Owen, B.; Shine, K.; et al. A Concept for Multi-Criteria Environmental Assessment of Aircraft Trajectories. Aerospace 2017, 4, 42. [Google Scholar] [CrossRef]

- Jones, C.D.; Ciais, P.; Davis, S.J.; Friedlingstein, P.; Gasser, T.; Peters, G.P.; Rogelj, J.; van Vuuren, D.P.; Canadell, J.G.; Cowie, A.; et al. Simulating the Earth system response to negative emissions. Environ. Res. Lett. 2016, 11, 95012. [Google Scholar] [CrossRef]

- Zickfeld, K.; Herrington, T. The time lag between a carbon dioxide emission and maximum warming increases with the size of the emission. Environ. Res. Lett. 2015, 10, 31001. [Google Scholar] [CrossRef]

- High-Level Commission on Carbon Prices. Report of the High-Level Commission on Carbon Prices; Creative Commons Attribution CC BY 3.0 IGO; World Bank. License: Washington, DC, USA, 2017. [Google Scholar]

- Hoel, M.; Karp, L. Taxes and quotas for a stock pollutant with multiplicative uncertainty. J. Public Econ. 2001, 82, 91–114. [Google Scholar] [CrossRef]

- Pizer, W.A. The optimal choice of climate change policy in the presence of uncertainty. Resour. Energy Econ. 1999, 21, 255–287. [Google Scholar] [CrossRef]

- Ackerman, F.; Stanton, E.A. Climate Risks and Carbon Prices: Revising the Social Cost of Carbon. Econ. E-J. 2012, 6. [Google Scholar] [CrossRef]

- Dietz, S.; Stern, N. Endogenous Growth, Convexity of Damage and Climate Risk: How Nordhaus’ Framework Supports Deep Cuts in Carbon Emissions. Econ. J. 2015, 125, 574–620. [Google Scholar] [CrossRef]

- Bretschger, L.; Pattakou, A. As Bad as it Gets: How Climate Damage Functions Affect Growth and the Social Cost of Carbon. Environ. Resour. Econ. 2019, 72, 5–26. [Google Scholar] [CrossRef]

- Paul, I.; Howard, P.; Schwartz, J.A. The Social Cost of Greenhouse Gases and State Policy: A Frequently Asked Questions Guide. Available online: https://policyintegrity.org/files/publications/SCC_State_Guidance.pdf (accessed on 19 June 2019).

- Belaia, M. Integrated Assessment of Climate Tipping Points. Ph.D. Thesis, Universität Hamburg, Hamburg, Germany, 2017. [Google Scholar]

- Van der Ploeg, F. The safe carbon budget. Clim. Chang. 2018, 147, 47–59. [Google Scholar] [CrossRef]

- Hoegh-Guldberg, O.; Jacob, D.; Taylor, M.; Bindi, M.; Brown, S.; Camilloni, I. Impacts of 1.5 °C Global Warming on Natural and Human Systems. In Global Warming of 1.5 °C: An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; World Meteorological Organization: Geneva, Switzerland, 2018. [Google Scholar]

- Kopp, R.E.; Shwom, R.L.; Wagner, G.; Yuan, J. Tipping elements and climate-economic shocks: Pathways toward integrated assessment. Earth’s Future 2016, 4, 346–372. [Google Scholar] [CrossRef]

- Steffen, W.; Rockström, J.; Richardson, K.; Lenton, T.M.; Folke, C.; Liverman, D.; Summerhayes, C.P.; Barnosky, A.D.; Cornell, S.E.; Crucifix, M.; et al. Trajectories of the Earth System in the Anthropocene. Proc. Natl. Acad. Sci. USA 2018, 115, 8252–8259. [Google Scholar] [CrossRef] [PubMed]

- Lemoine, D.; Traeger, C.P. Economics of tipping the climate dominoes. Nat. Clim. Chang. 2016, 6, 514–519. [Google Scholar] [CrossRef]

- Van der Ploeg, F. The Safe Carbon Budget. CESifo Working Paper Series No. 6620. Available online: https://ssrn.com/abstract=3036321 (accessed on 18 June 2019).

- Sinn, H.-W. The Green Paradox. A Supply-Side Approach to Global Warming; MIT Press: Cambridge, MA, USA, 2012; ISBN 9780262016680. [Google Scholar]

- Sinn, H.-W. Introductory Comment—The Green Paradox: A Supply-Side View of the Climate Problem. Rev. Environ. Econ. Policy 2015, 9, 239–245. [Google Scholar] [CrossRef]

- Ram, M.; Bogdanov, D.; Aghahosseini, A.; Gulagi, A.; Oyewo, A.S.; Child, M.; Caldera, U.; Sadovskaia, K.; Farfan, J.; Barbosa, L.; et al. Global Energy System Based on 100% Renewable Energy –Power, Heat, Transport and Desalination Sectors; Study by Lappeenranta University of Technology and Energy Watch Group: Lappeenranta, Finland; Berlin, Germany, 2019; ISBN 978-952-335-339-8. [Google Scholar]

- Davis, S.J.; Caldeira, K. Consumption-based accounting of CO2 emissions. Proc. Natl. Acad. Sci. USA 2010, 107, 5687–5692. [Google Scholar] [CrossRef] [PubMed]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zapf, M.; Pengg, H.; Weindl, C. How to Comply with the Paris Agreement Temperature Goal: Global Carbon Pricing According to Carbon Budgets. Energies 2019, 12, 2983. https://doi.org/10.3390/en12152983

Zapf M, Pengg H, Weindl C. How to Comply with the Paris Agreement Temperature Goal: Global Carbon Pricing According to Carbon Budgets. Energies. 2019; 12(15):2983. https://doi.org/10.3390/en12152983

Chicago/Turabian StyleZapf, Martin, Hermann Pengg, and Christian Weindl. 2019. "How to Comply with the Paris Agreement Temperature Goal: Global Carbon Pricing According to Carbon Budgets" Energies 12, no. 15: 2983. https://doi.org/10.3390/en12152983

APA StyleZapf, M., Pengg, H., & Weindl, C. (2019). How to Comply with the Paris Agreement Temperature Goal: Global Carbon Pricing According to Carbon Budgets. Energies, 12(15), 2983. https://doi.org/10.3390/en12152983