2.1. The Methodology

The specification and measures implemented to assess the energy investment RMs, involving PV and wind energy are briefly commented next (a full account of the methodology is presented in [

1]). The conventional economic criterion to assess RMs is their implied total net cost discounted to the present. As a complementary measure, the total amount of CO

2 avoided, and possibly other GHG are customarily given as well. A more encompassing economic measure, broadly defined as the unitary break-even price of a given energy source is the LCOE. It is conventionally implemented for the evaluation of individual energies, and it can offer a more complete perspective on the economics of a complete RM of investments as well. This is because minimizing the LCOE, i.e., the unitary break-even cost of energy, is akin to profit maximization, which is the principle under which competitive markets are supposed to work efficiently; see [

9]. Even when just one single energy source is involved this implementation implies less obvious choices, the main reason being that then a social or global point of view has to be considered, which implies accounting for all possible kinds of externalities as well as the LR effect of capacity on prices. Questions derived from this global point of view, and other more economic aspects which arise from the whole series of annual investments involved are tackled in the empirical assessment reported.

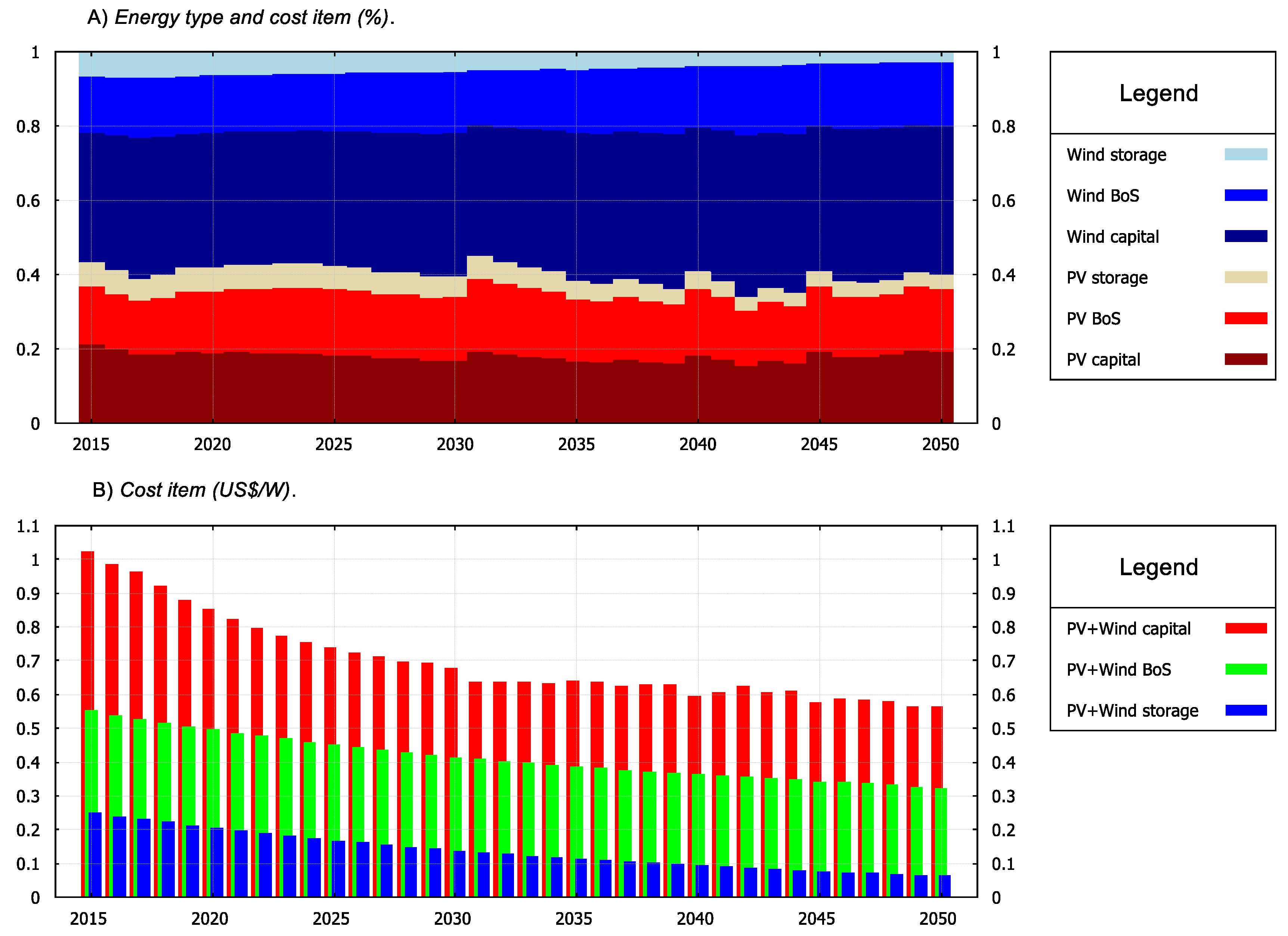

Three types of related criteria are considered: (a) the unitary cost of energy as given by the LCOE and total capital expenditures; (b) avoided carbon (AC) emissions and their valuation; and, (c) risk measures. The calculation of the LCOE requires, as a first step, the specification of the LR effect on prices derived from expanding installed capacities; see [

10] for PV estimates, and [

11] for onshore wind estimates. Capital and remaining balance of system costs (BoS) can be derived from there with additional specifications. Energy generated is calculated accounting for the depreciation rate and lifetime of physical capital and its capacity factor. The RM assessment accounts for three main externalities: First, as an appropriate measure of discount rate, a social discount rate is implemented according to the discussion in the relevant literature—see e.g., [

12]; second, storage needs implied by intermittent renewable energies and their cost are also accounted for; and finally third, energy generated by a renewable rather than by a fossil source, allows the estimation of the amount of carbon emissions avoided by that investment and their valuation according to several possible criteria.

2.2. Effective Capital Stock

Central to all calculations is the correct estimation of the effective capital stock after accounting for wearing out as discussed next. Gross investment at time t,

, given a finite maturity or lifespan of the investment,

ls, will have to recover the already obsolete investment made

ls periods before, i.e.,

where

is the capacity increase foreseen in the roadmap at time t, i.e., nominal investment.

is therefore gross capital stock at time

t, and denoting the rate of capital depreciation by δ, effective or

net capital stock,

, at

t, will be given by the sum of all previous investments before the maturity date, and appropriately discounted for depreciation, i.e.,

For the values

, and a realistic capital growth rate of

, straightforward algebra shows that this yields a value of 92.7%, i.e., a 7.3% reduction in the value of nominal installed capacity,

. These are realistic values for PV energy: [

13,

14] give

ls = 30, [

15]

ls = 25 and [

16] an even lower 0.5% depreciation rate. For the IEA values

, the ratio yields a slightly lower value, 90%, attesting that the correction is significant. For wind energy a study considering individual site conditions and different turbine vintages found that load factors lost 1.6 ± 0.2% of their output each year [

17]. According to [

17] this decay rate is similar to that of other rotating machinery and was obtained under a variety of estimation methods, all yielding very close results. Regarding the lifetime of wind investments a common accepted value in the literature is 25 years [

18,

19], and according to the expert survey in [

20,

21], it is expected to increase 20% by 2030.

The next and immediate question to be considered is the energy generated by this effective capacity at a future date in the RM proposed given by,

where,

Et is energy generated in period

t,

Cet effective capacity given in (2),

Cf the net capacity factor, and

h per year; note that if

Cet is measured, say, in MW,

Et will be MWh, and similarly for other measurement units. The net capacity factor of a power plant, i.e., the ratio of its actual output over a period of time to its potential output operating at full nameplate capacity continuously over the same period, varies significantly among different locations in the world, both for PV and wind energies. Although a world average is dependent on the specific locations where the facilities are located, institutions like Irena [

22] have been tracking this measure for several years and their results show that it was close to 20% in 2014 for PV and slowly increasing over time, because of sunnier locations selected for the PV facilities and other minor efficiency improvements. Irena [

22] concludes that it will increase linearly to reach 25% in 2030 and will stay fixed at that value thereon. As for wind energy, Irena [

18] gives a world average of 28% in 2015 for the capacity factor and the expert surveys in [

20,

21], suggest a 10% increase in 2030: these are the values applied in the empirical simulations reported (see

Appendix A for a summary).

2.3. Avoided Carbon

The total amount of AC emissions is a relevant measure for assessing an investment RM being given as,

where, E

t is energy generated and

kC is a measure of CO

2 avoided per unit of energy generated, e.g., kilograms of CO

2 per kWh. If

Et is measured in kWh and

kC in kilograms per kWh accordingly, then

gives the total amount of avoided

CO2 tons which is a standard measurement unit. Similar values, according to different sources, for coal emissions,

kC, are reported in the literature: e.g., the IPCC gives 0.82 kgCO2eq/kWh [

23], and the IEA 0.78 [

24].

A related measure is the avoided carbon value (ACV) for the whole roadmap given by,

where,

is the unitary price of the chosen measure for carbon, e.g., USD per kg of CO

2, which simplifies to

if

, i.e., is constant. A thorough and recent survey on methods for pricing carbon from the global point of view, or social cost of carbon (SCC), is reported in [

25]. The extensive literature survey that they provide yields minimum values of 6.7 and 14.7 USD per tons of CO

2 for the years 2015 and 2050 respectively. Maximum values are also reported but are considerably higher than average values common in the literature so that, finally, a rather conservative choice suggests selecting the minimum values provided in the survey discussed [

25]. Carbon taxes provide another complementary measure, since they are the immediate cost from the individual perspective as opposite to the global point of view of the SCC. A recent and thorough report conducted on behalf of the World Bank (WB) by Stiglitz and Stern [

26] suggests the values 40 to 80 USD/tCO2eq in 2020, and 50 to 100 USD/tCO2eq beyond 2030. Both valuation methods are implemented in the empirical results.

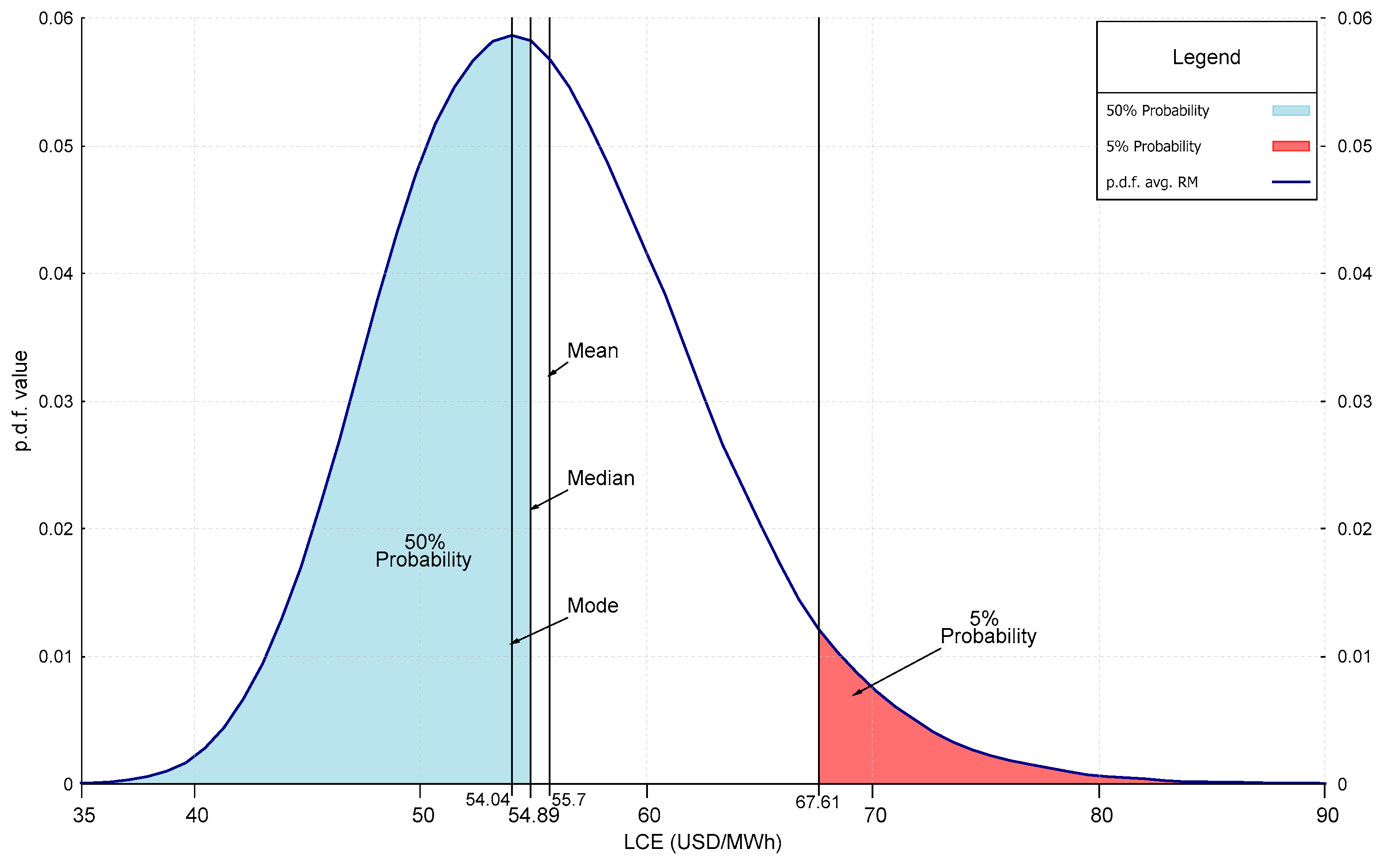

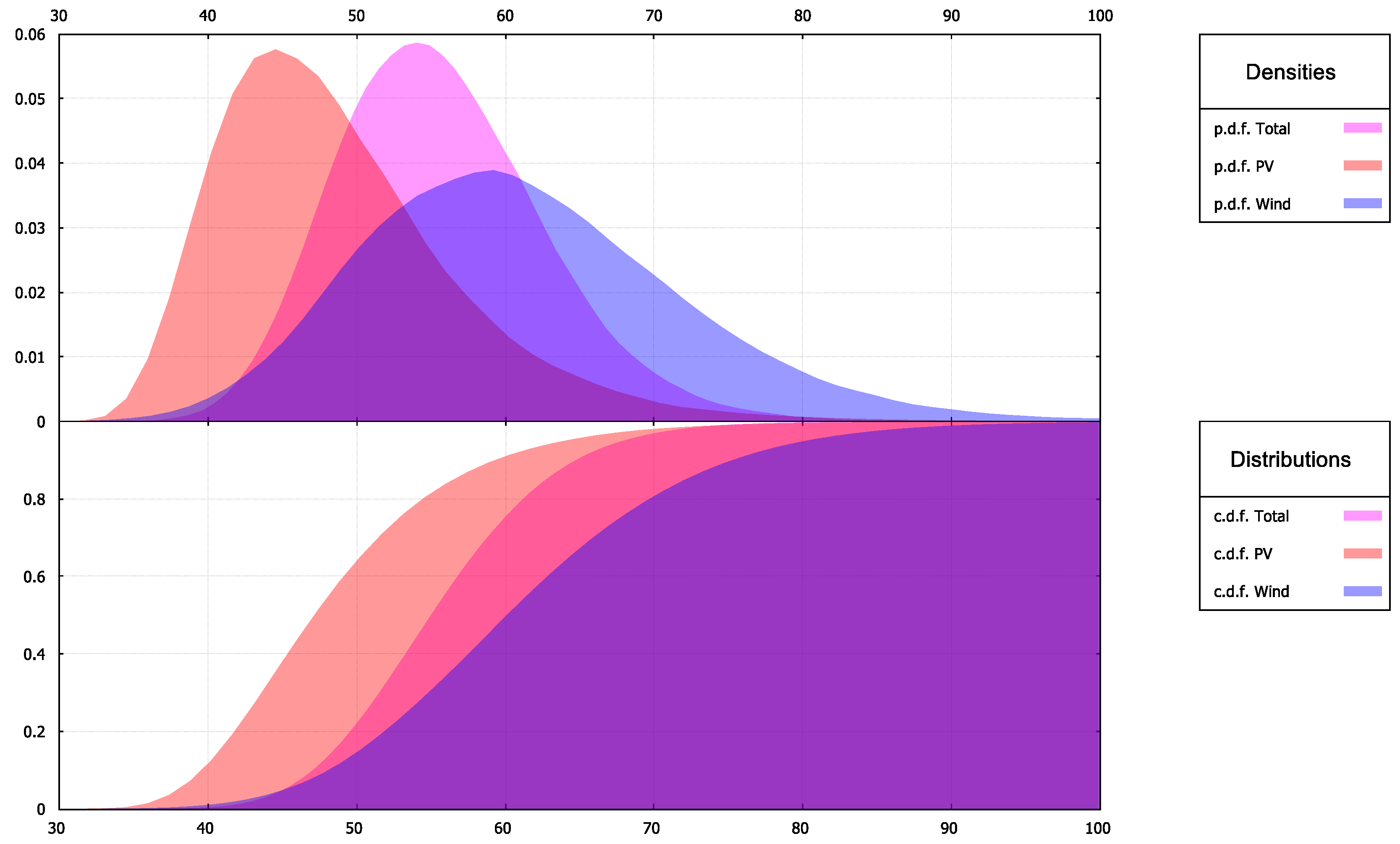

2.4. Risk Measures

A further set of questions which derive from the uncertainty of the statistically estimated LR parameters and equations relate to risk, and specifically to financial risks. Given that the available LR parameters are estimated and therefore are random, so are all simulated future values involving them, and specifically the LCOE and capital expenditures. This uncertainty cannot be avoided although it is possible to implement measures to control it. Two basic risk control measures proposed in the literature are the value at risk (VaR) and the expected value at risk (EVaR). The equivalent measures in this context are the LCOE or capital expenditures at risk (AR), and expected at risk (

EAR); see [

11,

27]. Given a probability value, e.g., 95%, LCOE AR, (

), is the highest value that the LCOE can reach within that probability, i.e.,

and similarly for capital expenditures. LCOE expected at risk (

) in turn is defined by,

and yields the expected average value of the LCOE, should the unlikely event of the LCOE rising above the 95% limit happen. As such, it is a complementary measure to the AR value. An entirely similar analysis applies to capital expenditures. A further derived risk measure is the ratio of the expected value at risk over the average value: This provides a gauge of the maximum risk as a proportion over the expected value. Both measures are applicable to the LCOE and the financial capital requirements.

2.5. The Roadmaps Analyzed

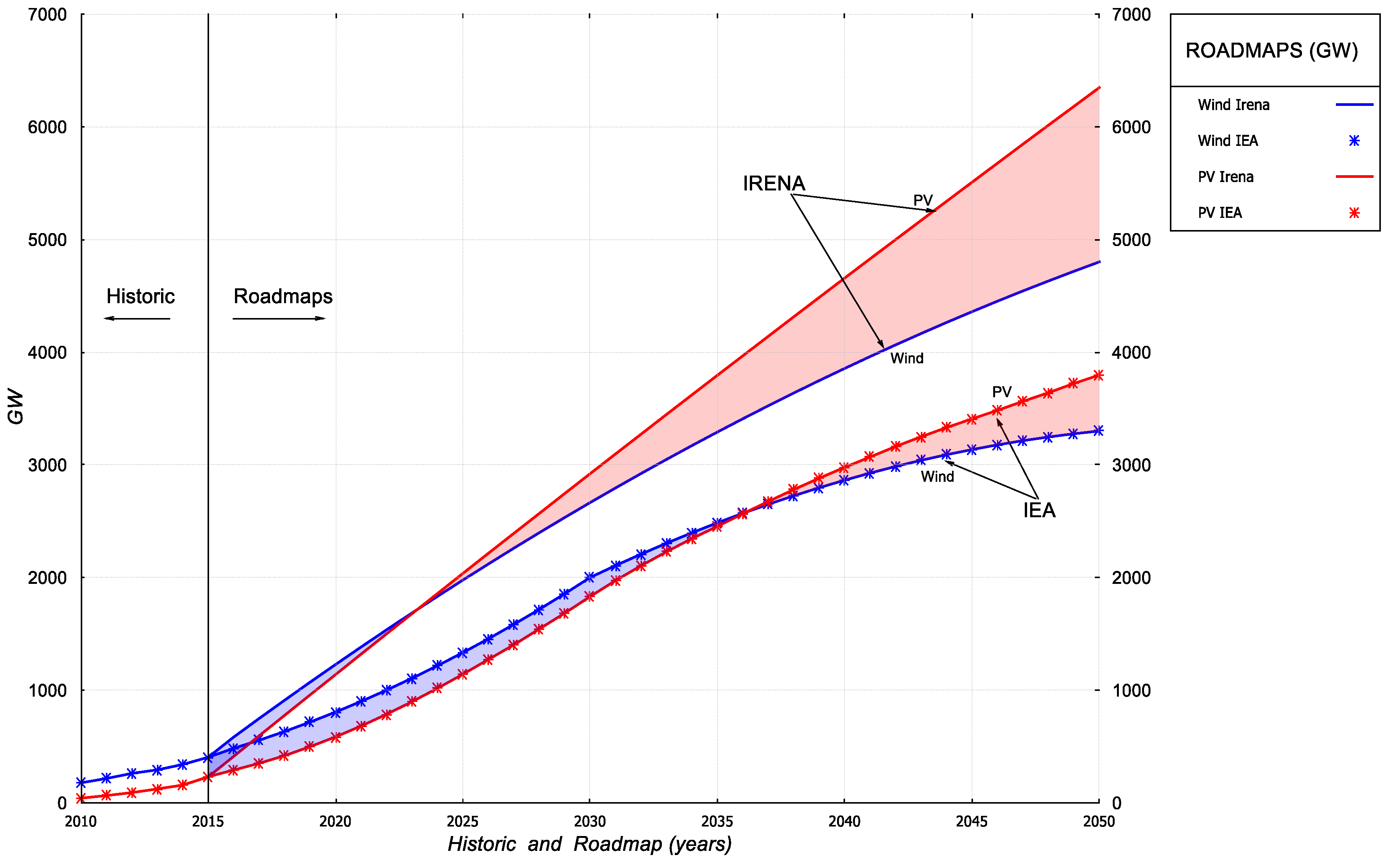

The Irena and IEA RMs for both PV and wind energies are presented in

Figure 1. Both assume a departure from historic values with increased growth rates, almost linear in Irena’s case; both also assume higher rates and end values for PV than for wind, more so towards the end of the period considered. Finally, Irena’s RM is more ambitious, since it does not rely on nuclear energy and only marginally on carbon capture and storage technologies (CCS), whereas the IEA does (see

Appendix A for a summary).

Accelerated RMs are considered, taking as given the end 2050 capital deployment values,

, and imposing a constant linear investment, so that the end targets are achieved in 2030. Several accelerated RM profiles are discussed in [

9], the main conclusion being that the end RM date is far more relevant to the criteria discussed than the specific profile, and therefore a linear investment profile is not a significant restriction on the results. This accelerated deployment would match the IPCC warning concerning the just 12 years remaining to decarbonize the economy [

8]. For comparison purposes delayed RMs are considered as well, assuming that no investment is conducted till 2030, being constant from then on to achieve the specified RM end values in 2050. It should be remarked that most published RMs forecast approximate constant linear investments with the exception of [

4] which assumes an 80% deployment of its final targets for 2030. More specifically, the RMs can be completely specified by the following set of equations: