Real Levelized Cost of Energy with Indirect Costs and Market Value of Variable Renewables: A Study of the Korean Power Market

Abstract

1. Introduction

1.1. Background and Literature Review

1.2. Contribution and Paper Organization

- (1)

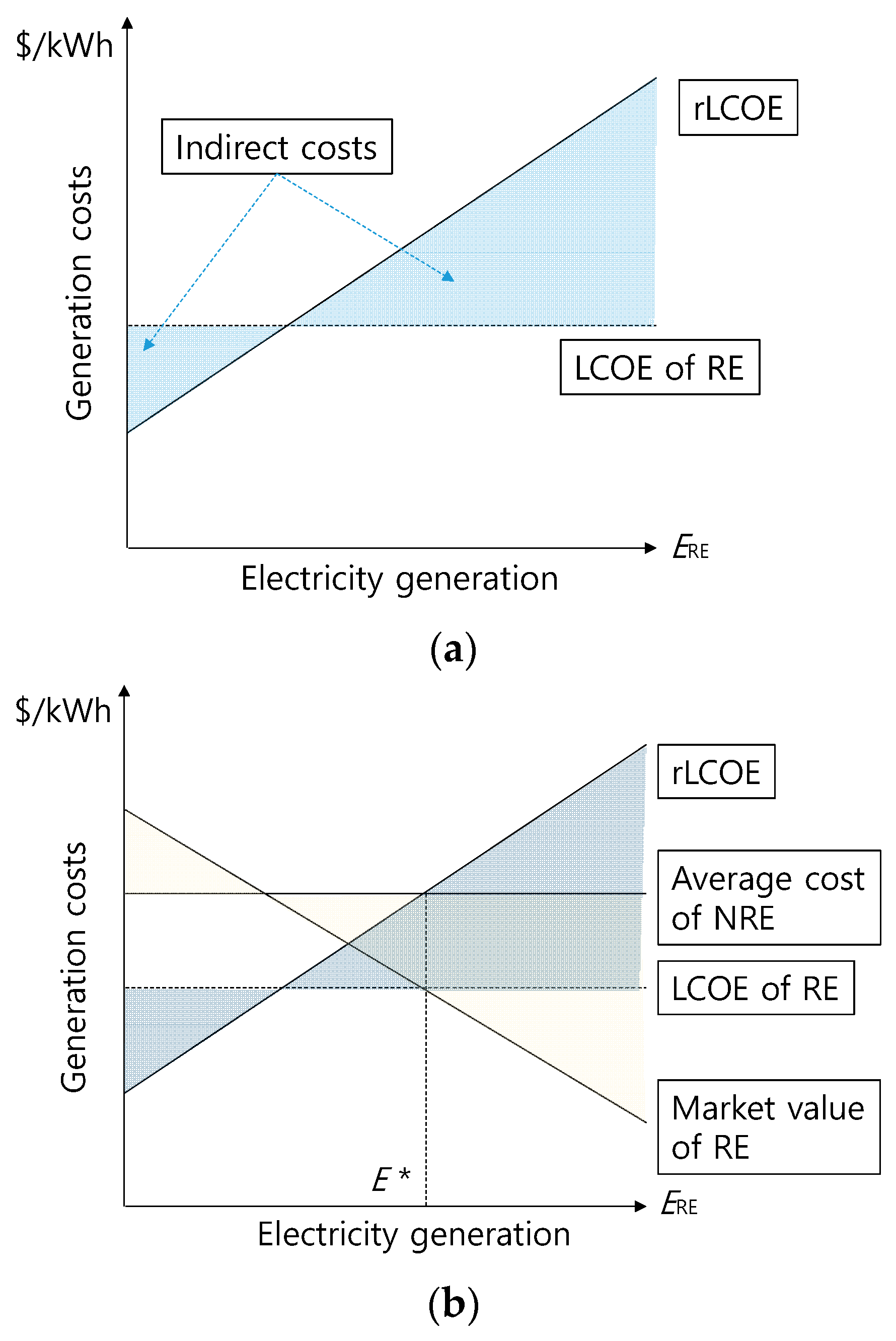

- The evaluation of power generation costs using the LCOE is constructed to be applicable to the comparison of generation sources. The rLCOE is intuitive and incorporates existing LCOE principles while expanding it to reflect external costs.

- (2)

- The rLCOE is linked to the economic concept of the market value, in contrast, the LCOE is only based on and limited to the current operation of the power system. More importantly, the estimation of the cost of the power system considers both direct and indirect effects; both are related to economic theory.

- (3)

- The indirect effect is related to the variability of RE. It can be quantified in terms of all benefits generated due to RE using the rLCOE approach.

- (4)

- It can explain the most important factors affecting the unit generation cost while analyzing the effect of the RE share through rLCOE.

- (5)

- All social welfare (SW) measures that incorporate the indirect effects from the RE share can be calculated, and differences from the existing methodology can be presented.

2. rLCOE Analysis

3. Evaluation of Social Welfare Using rLCOE

4. Estimation of Indirect Costs

4.1. Sensitivity Analysis

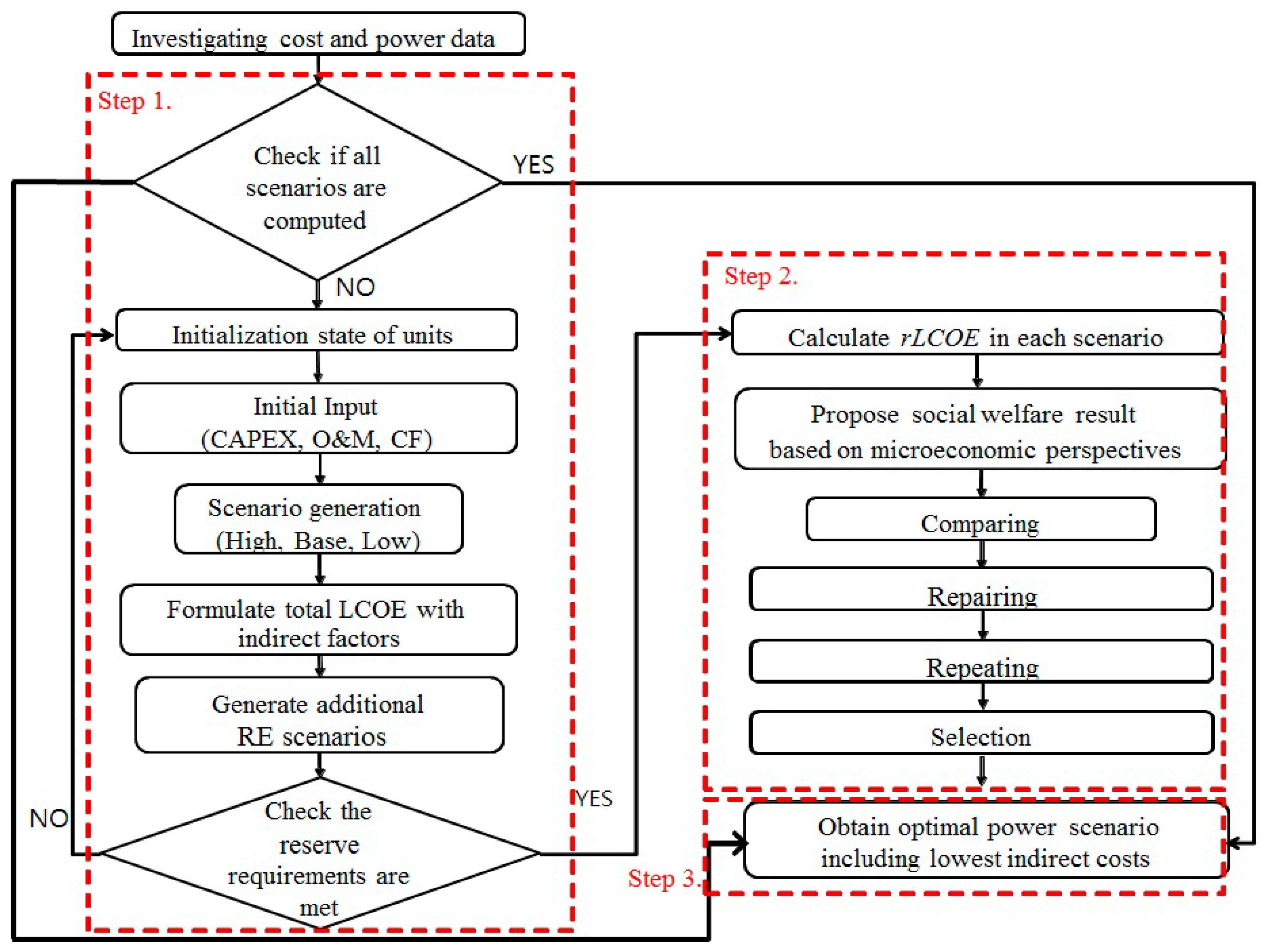

4.2. Procedure of Proposed rLCOE Approach

5. Case Study

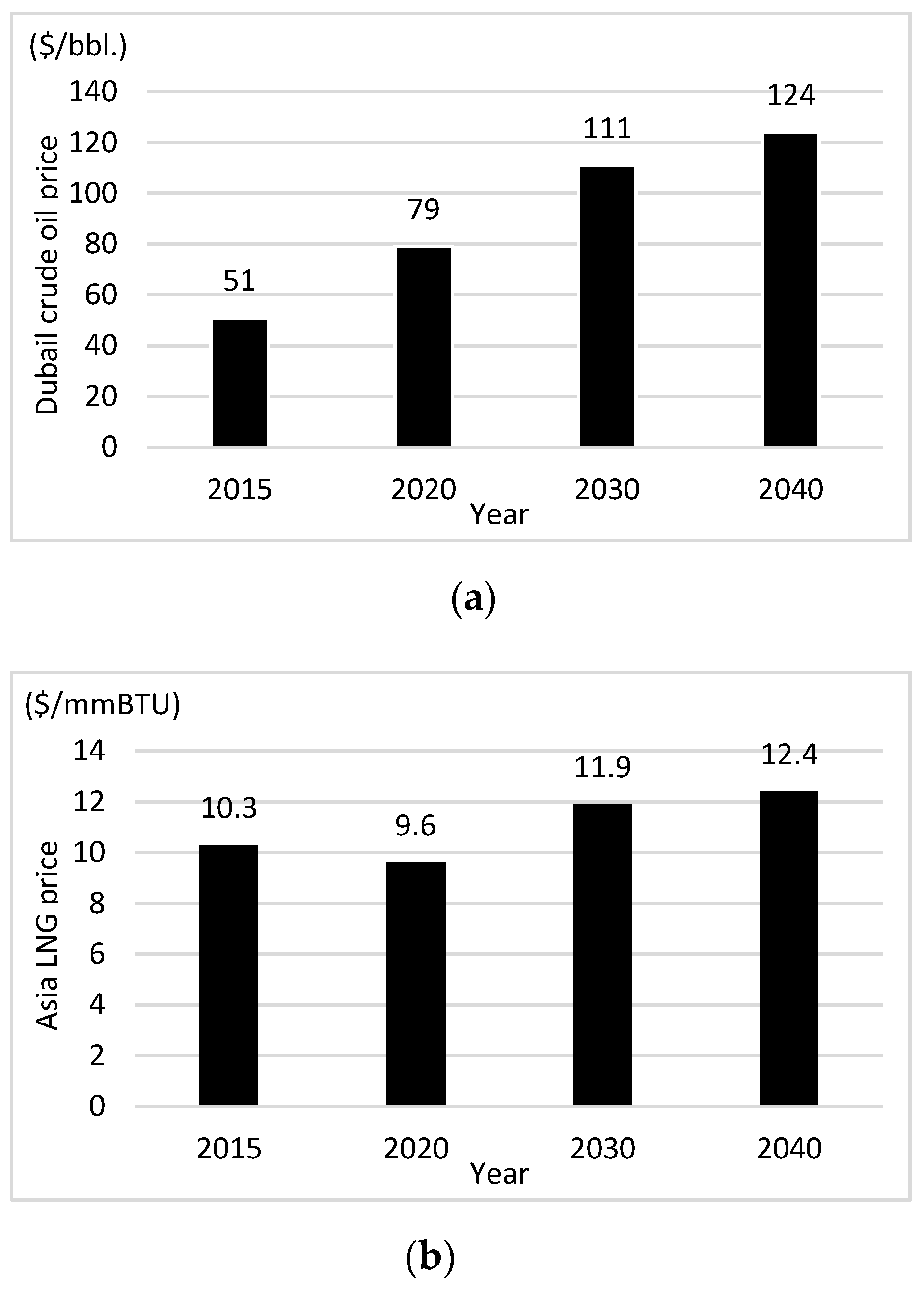

5.1. Data Description and Scenario Assumptions

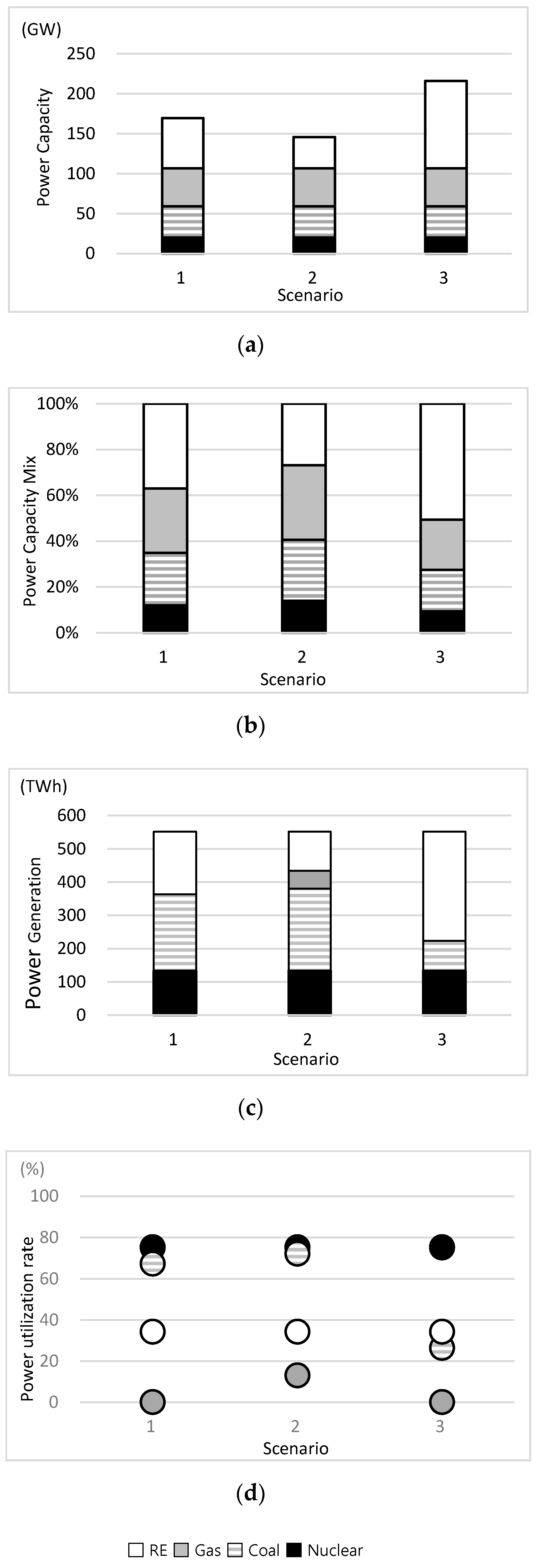

5.2. Simulation Results

5.2.1. Impact of RE on the Grid

5.2.2. Market Value of RE

5.3. Sensitivity Analysis

6. Conclusions

- (1)

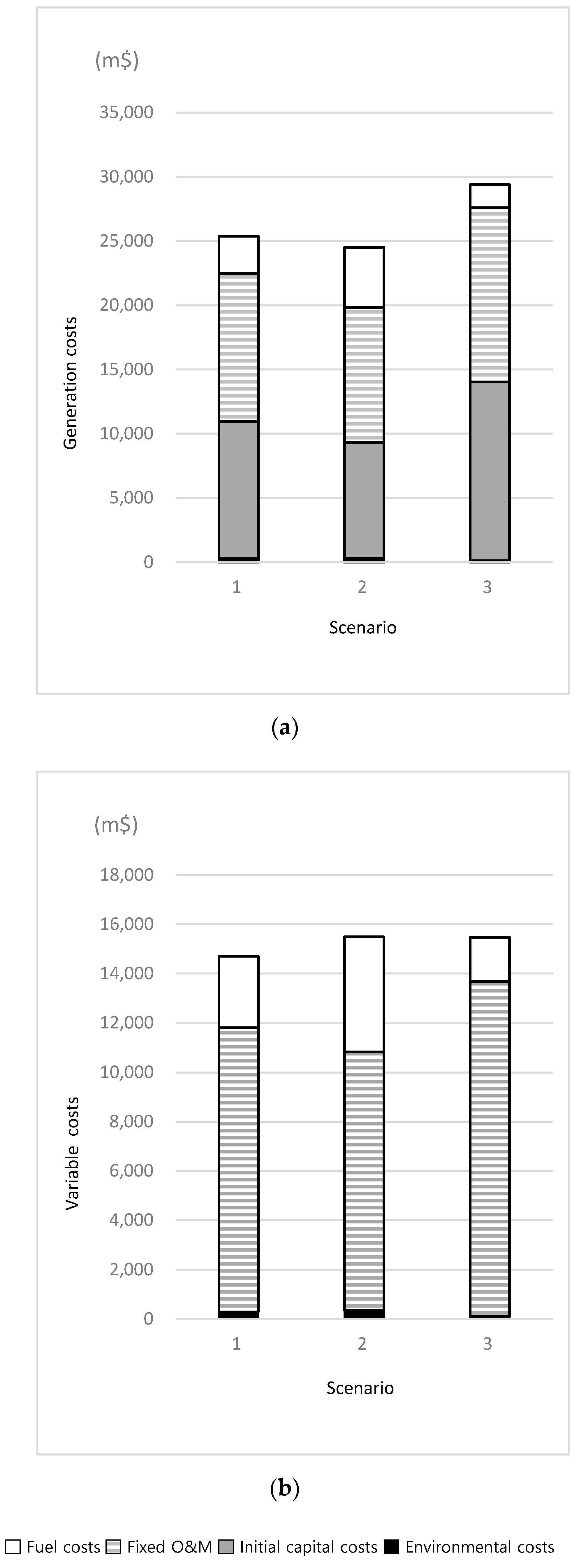

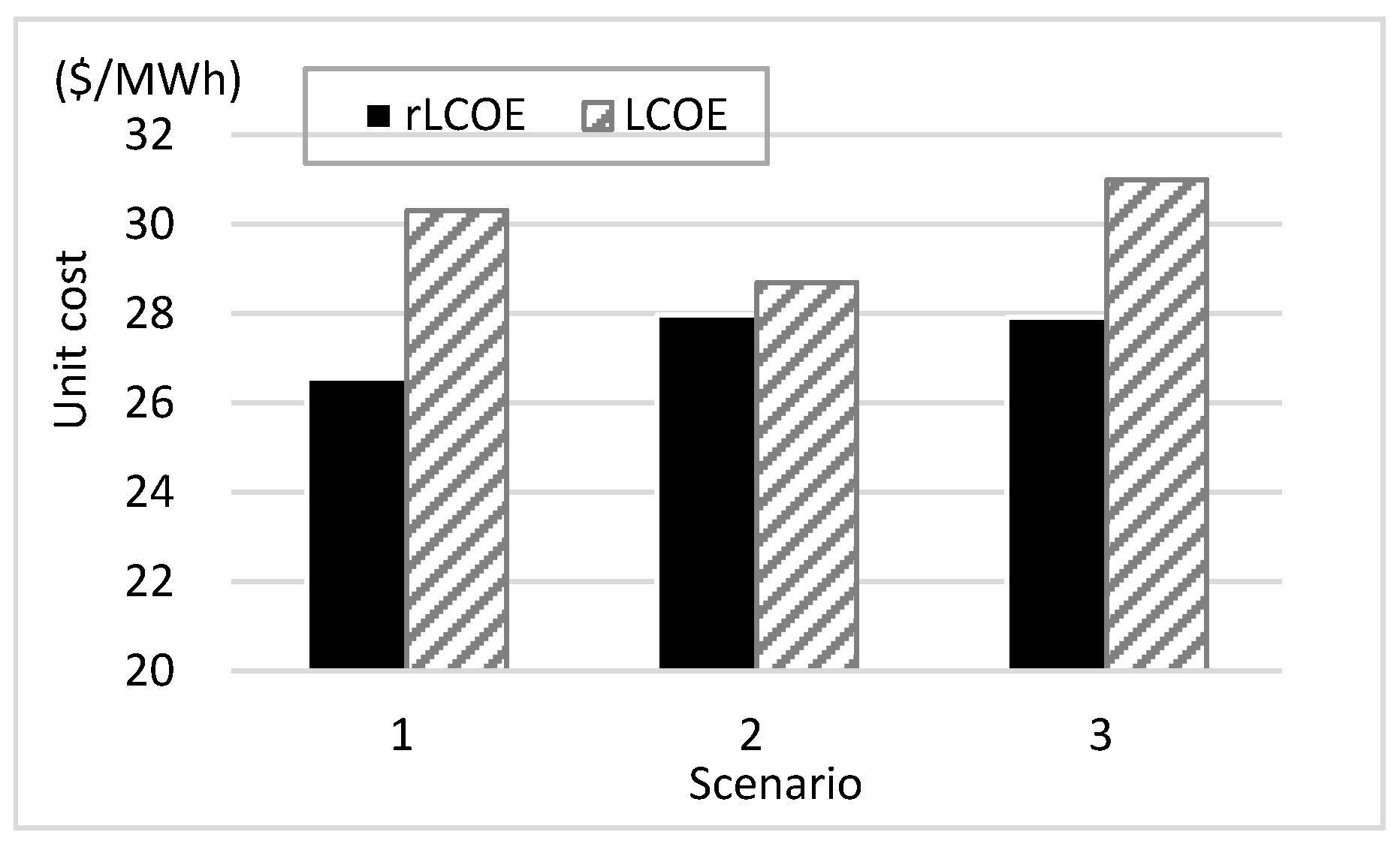

- In the proposed approach, the indirect costs decreased with an increase in the market value of the power market as the proportion of RE increased. Using the rLCOE approach, the simulation results of scenarios 1, 2, indicate that the rLCOE decreased with lower RE penetration and increased in scenario 3 with a higher RE share, respectively. On the other hand, LCOE increased with higher RE penetration and scenarios 3 shows the highest LCOE. This indicates that an increase in RE penetration reduced the rLCOE via a decrease in the average fuel costs of curtailment effect.

- (2)

- The rLCOE and the total costs were significantly reduced by the RE supply, which could be an accelerator for RE capacity expansion. It means that RE capacity could be expanded until the SW of RE becomes stagnant. However, if the market value ceases to increase due to a high proportion of RE, no further installation will be necessary. Although the difference between rLCOE and LCOE was increased from scenario 2 to scenario 1, the value was decreased in scenario 3. Since indirect benefits decrease with a growing share of RE in the market, it could be an economic barrier to deploying RE with higher shares.

- (3)

- Our work indicates that the largest cost driver in the electricity market is the reduction of NRE, even though the residual capacity mix optimally adapts to RE deployment. With an increasing share of RE, indirect costs occurred and grew rapidly. According to optimal shares in scenario 2, RE shows positive indirect effects due to a high FC of NRE.

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Home-Ortiz, J.M.; Melgar-Dominguez, O.D.; Pourakbari-Kasmaei, M.; Mantovani, J.R.S. A stochastic mixed-integer convex programming model for long-term distribution system expansion planning considering greenhouse gas emission mitigation. Int. J. Electr. Power Energy Syst. 2019, 108, 86–95. [Google Scholar] [CrossRef]

- Zeng, B.; Zhang, J.; Yang, X.; Wang, J.; Dong, J.; Zhang, Y. Integrated planning for transition to low-carbon distribution system with renewable energy generation and demand response. IEEE Trans. Power Syst. 2013, 29, 1153–1165. [Google Scholar] [CrossRef]

- Pourakbari-Kasmaei, M.; Mantovani, J.R.S.; Rashidinejad, M.; Habibi, M.R.; Contreras, J. Carbon footprint allocation among consumers and transmission losses. In Proceedings of the 2017 IEEE International Conference on Environment and Electrical Engineering and 2017 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Milan, Italy, 6–9 June 2017; pp. 1–6. [Google Scholar]

- Cheng, Y.; Zhang, N.; Wang, Y.; Yang, J.; Kang, C.; Xia, Q. Modeling carbon emission flow in multiple energy systems. IEEE Trans. Smart Grid 2019, 10, 3562–3574. [Google Scholar] [CrossRef]

- Cheng, Y.; Zhang, N.; Lu, Z.; Kang, C. Planning Multiple Energy Systems towards Low-Carbon Society: A Decentralized Approach. IEEE Trans. Smart Grid 2018. [Google Scholar] [CrossRef]

- Energy Information Administration (EIA). Levelized Cost Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook, 2019; EIA: Washington, DC, USA, 2019.

- Gough, M.; Lotfi, M.; Castro, R.; Madhlopa, A.; Khan, A.; Catalão, J.P. Urban Wind Resource Assessment: A Case Study on Cape Town. Energies 2019, 128, 1479. [Google Scholar] [CrossRef]

- Lucheroni, C.; Mari, C. Optimal integration of intermittent renewables: A system LCOE stochastic approach. Energies 2018, 113, 549. [Google Scholar] [CrossRef]

- Paul, D.; Ela, E.; Kirby, B.; Milligan, M. Role of Energy Storage with Renewable Electricity Generation; Technical report NREL/TP-6A2-47187; National Renewable Energy Laboratory: Golden, CO, USA, 2010.

- Kost, C.; Mayer, J.N.; Thomsen, J.; Hartmann, N.; Senkpiel, C.; Philipps, S.; Schlegl, T. Levelized cost of electricity renewable energy technologies. Fraunhofer Inst. Sol. Energy Syst. I.S.E. 2013, 144. [Google Scholar]

- Merrick, J.H. On representation of temporal variability in electricity capacity planning models. Energy Econ. 2016, 59, 261–274. [Google Scholar] [CrossRef]

- Reichenberg, L.; Hedenus, F.; Odenberger, M.; Johnsson, F. The marginal system LCOE of variable renewables—Evaluating high penetration levels of wind and solar in Europe. Energy 2018, 152, 914–924. [Google Scholar] [CrossRef]

- Hirth, L.; Ueckerdt, F.; Edenhofer, O. Integration costs revisited–An economic framework for wind and solar variability. Renew. Energy 2015, 74, 925–939. [Google Scholar] [CrossRef]

- Brouwer, A.S.; van den Broek, M.; Zappa, W.; Turkenburg, W.C.; Faaij, A. Least-cost options for integrating intermittent renewables in low-carbon power systems. Appl. Energy 2016, 161, 48–74. [Google Scholar] [CrossRef]

- Frew, B.A.; Clark, K.; Bloom, A.P.; Milligan, M. Marginal Cost Pricing in a World Without Perfect Competition: Implications for Electricity Markets with High Shares of Low Marginal Cost Resources; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2017.

- Chinmoy, L.; Iniyan, S.; Goic, R. Modeling wind power investments, policies and social benefits for deregulated electricity market—A review. Appl. Energy 2019, 242, 364–377. [Google Scholar] [CrossRef]

- Rouwendal, J. Indirect effects in cost-benefit analysis. J. Benefit-Cost Anal. 2012, 3, 1–27. [Google Scholar] [CrossRef][Green Version]

- Mills, A. Changes in the Economic Value of Variable Generation at High Penetration Levels: A Pilot Case Study of California; Ernest Orlando Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2012.

- Lamont, A.D. Assessing the long-term system value of intermittent electric generation technologies. Energy Econ. 2008, 30, 1208–1231. [Google Scholar] [CrossRef]

- Liljas, B. How to calculate indirect costs in economic evaluations. Pharmacoeconomics 1998, 13, 1–7. [Google Scholar] [CrossRef]

- Obi, M.; Jensen, S.M.; Ferris, J.B.; Bass, R.B. Calculation of levelized costs of electricity for various electrical energy storage systems. Renew. Sustain. Energy Rev. 2017, 67, 908–920. [Google Scholar] [CrossRef]

- Ilas, A.; Ralon, P.; Rodriguez, A.; Taylor, M. Renewable Power Generation Costs in 2017; International Renewable Energy Agency (IRENA): Abu Dhabi, UAE, 2018. [Google Scholar]

- Benes, K.J.; Augustin, C. Beyond LCOE: A simplified framework for assessing the full cost of electricity. Electr. J. 2016, 29, 48–54. [Google Scholar] [CrossRef]

- Lew, D.; Brinkman, G.; Ibanez, E.; Hodge, B.M.; Hummon, M.; Florita, A.; Heaney, M. The Western Wind and Solar Integration Study Phase 2; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2013.

- Pacione, M. Urban environmental quality and human wellbeing-a social geographical perspective. Landsc. Urban Plan. 2003, 65, 19–30. [Google Scholar] [CrossRef]

- Conn, D. The evaluation of social costs and benefits. Ind. Mark. Manag. 1972, 2, 35–44. [Google Scholar] [CrossRef][Green Version]

- Fripp, M.; Wiser, R.H. Effects of temporal wind patterns on the value of wind-generated electricity in California and the northwest. IEEE Trans. Power Syst. 2008, 23, 477–485. [Google Scholar] [CrossRef]

- Song, Y.H.; Kim, H.J.; Kim, S.W.; Jin, Y.G.; Yoon, Y.T. How to find a reasonable energy transition strategy in Korea? Quantitative analysis based on power market simulation. Energy Policy 2018, 119, 396–409. [Google Scholar] [CrossRef]

- Christopher Frey, H.; Patil, S.R. Identification and review of sensitivity analysis methods. Risk Anal. 2002, 22, 553–578. [Google Scholar] [CrossRef]

- The 8th Power Supply Plan in Korea. Available online: https://bit.ly/2VRvYU3 (accessed on 29 December 2017).

- RE 3020 Plan in Korea. Available online: https://bit.ly/2Lug8ec (accessed on 20 December 2017).

- Korea Power Exchange. Available online: https://www.kpx.or.kr (accessed on 12 December 2017).

- Min, C.G.; Kim, M.K. Impact of the Complementarity between Variable Generation Resources and Load on the Flexibility of the Korean Power System. Energies 2017, 10, 1719. [Google Scholar] [CrossRef]

- Ason, A. Price Reviews and Arbitrations in Asian LNG Markets; Oxford Institute for Energy Studies: Oxford, UK, 2019. [Google Scholar]

- Energy Information Administration (EIA). World Energy Outlook. Available online: https://www.iea.org/weo/ (accessed on 1 January 2018).

- Vujić, J.; Antić, D.P.; Vukmirović, Z. Environmental impact and cost analysis of coal versus nuclear power: The US case. Energy 2012, 45, 31–42. [Google Scholar] [CrossRef]

- Galetovic, A.; Muñoz, C.M. Wind, coal, and the cost of environmental externalities. Energy Policy 2013, 62, 1385–1391. [Google Scholar] [CrossRef]

- Pazheri, F.R.; Othman, M.F.; Malik, N.H.; Safoora, O.K. Reduction in cost with limited emission at hybrid power plant in presence of renewable power. In Proceedings of the 2014 IEEE Global Humanitarian Technology Conference—South Asia Satellite (GHTC-SAS), Trivandrum, India, 26–27 September 2014; pp. 20–24. [Google Scholar]

- Consonni, S.; Giugliano, M.; Grosso, M. Alternative strategies for energy recovery from municipal solid waste: Part B: Emission and cost estimates. Waste Manag. 2005, 25, 137–148. [Google Scholar] [CrossRef] [PubMed]

- Park, J.; Bumsuk, K. An analysis of South Korea’s energy transition policy with regards to offshore wind power development. Renew. Sustain. Energy Rev. 2019, 109, 71–84. [Google Scholar] [CrossRef]

| Energy Source | IC 1 ($/kW) | VOC 2 ($/MWh) | FOC 3 ($/kW/yr) | FC 4 ($/MWh) |

|---|---|---|---|---|

| Gas | 760 | 0.8 | 50 | 30 |

| Coal | 1400 | 0.0 | 80 | 8 |

| Nuclear | 5100 | 0.0 | 160 | 8 |

| Wind | 1400 | 0.0 | 44 | 0 |

| Solar | 600 | 0.0 | 19 | 0 |

| Energy Source | Quantity (Ton) | Cost (USD) |

|---|---|---|

| Crude oil | CO2 | 5,000,000 |

| SO2 | 40,000 | |

| NOx | 25,000 | |

| Fine dust | 25,000 | |

| Coal | CO2 | 6,000,000 |

| SO2 | 120,000 | |

| NOx | 25,000 | |

| Fine dust | 300,000 | |

| Gas | CO2 | 3,000,000 |

| SO2 | 20 | |

| NOx | 13,000 |

| Year | 2018 | 2022 | 2026 | 2030 | 2031 |

|---|---|---|---|---|---|

| Electricity generation (TWh) | 34.4 | 116.6 | 179.0 | 251.6 | 252.0 |

| RE Capacity (GW) | 11.3 | 23.3 | 38.8 | 58.5 | 58.6 |

| Electricity generation (TWh) | 34.4 | 86.6 | 115.6 | 150.1 | 150.3 |

| RE Capacity (GW) | 11.3 | 17.3 | 25.1 | 34.9 | 35.0 |

| Electricity generation (TWh) | 34.4 | 176.7 | 305.9 | 454.6 | 455.4 |

| RE Capacity (GW) | 11.3 | 35.3 | 66.3 | 105.7 | 105.9 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hwang, S.-H.; Kim, M.-K.; Ryu, H.-S. Real Levelized Cost of Energy with Indirect Costs and Market Value of Variable Renewables: A Study of the Korean Power Market. Energies 2019, 12, 2459. https://doi.org/10.3390/en12132459

Hwang S-H, Kim M-K, Ryu H-S. Real Levelized Cost of Energy with Indirect Costs and Market Value of Variable Renewables: A Study of the Korean Power Market. Energies. 2019; 12(13):2459. https://doi.org/10.3390/en12132459

Chicago/Turabian StyleHwang, Sung-Hyun, Mun-Kyeom Kim, and Ho-Sung Ryu. 2019. "Real Levelized Cost of Energy with Indirect Costs and Market Value of Variable Renewables: A Study of the Korean Power Market" Energies 12, no. 13: 2459. https://doi.org/10.3390/en12132459

APA StyleHwang, S.-H., Kim, M.-K., & Ryu, H.-S. (2019). Real Levelized Cost of Energy with Indirect Costs and Market Value of Variable Renewables: A Study of the Korean Power Market. Energies, 12(13), 2459. https://doi.org/10.3390/en12132459