BRIM: An Accurate Electricity Spot Price Prediction Scheme-Based Bidirectional Recurrent Neural Network and Integrated Market

Abstract

1. Introduction

1.1. Research Motivation

1.2. Main Contributions

- Exploiting the idea of market integration (i.e., neighboring markets play a role in improving price forecasting accuracy) and utilizing the earlier announced electricity price of another inter-connected electricity market as the future price indicator of the market to be predicted;

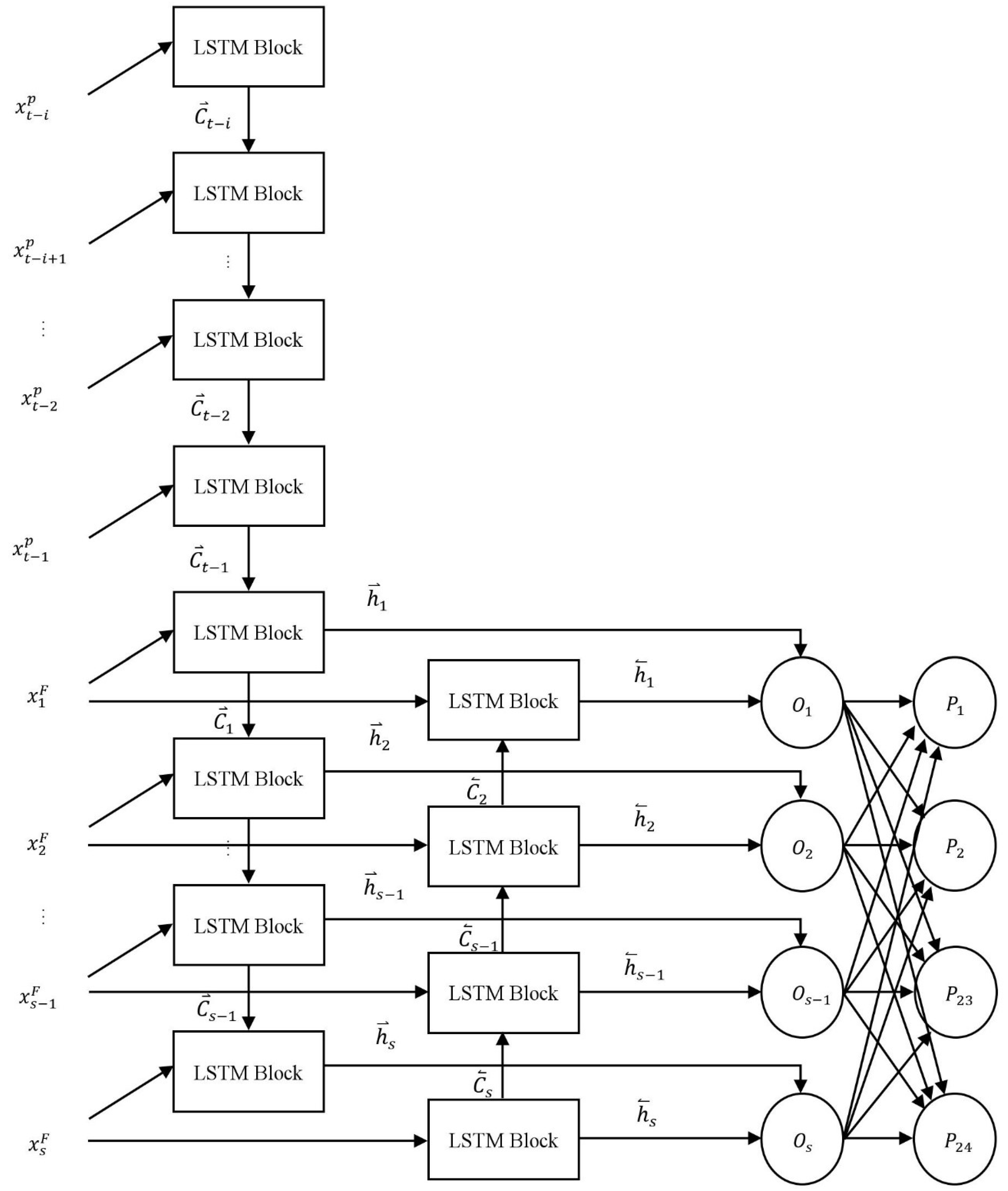

- Designing the bidirectional LSTM network structure, in which the historical price data are input into the conventional LSTM (forward LSTM), and the future price data are used for two purposes: one as the input features to the backward LSTM, and another as the input features to the forward LSTM.

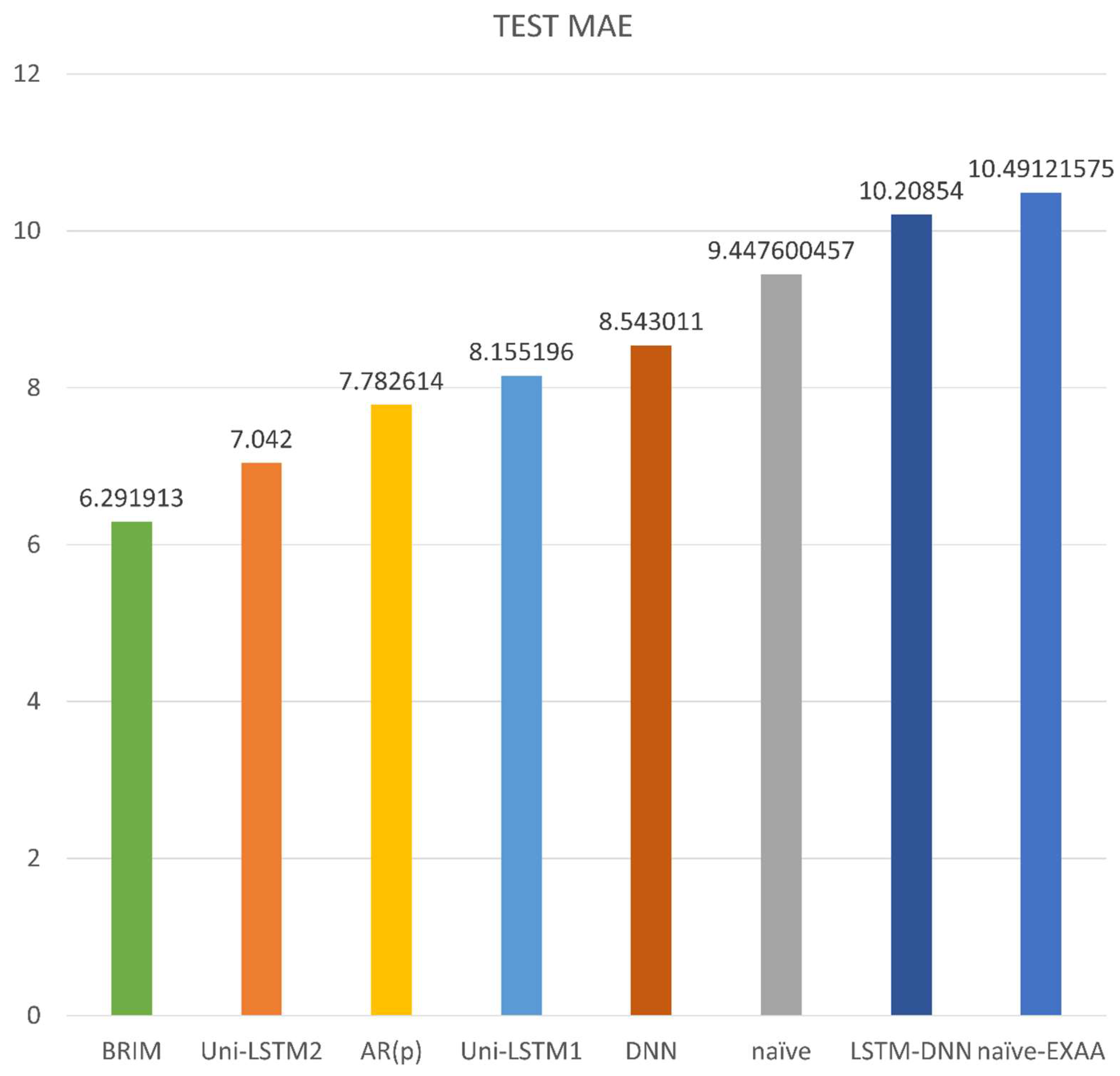

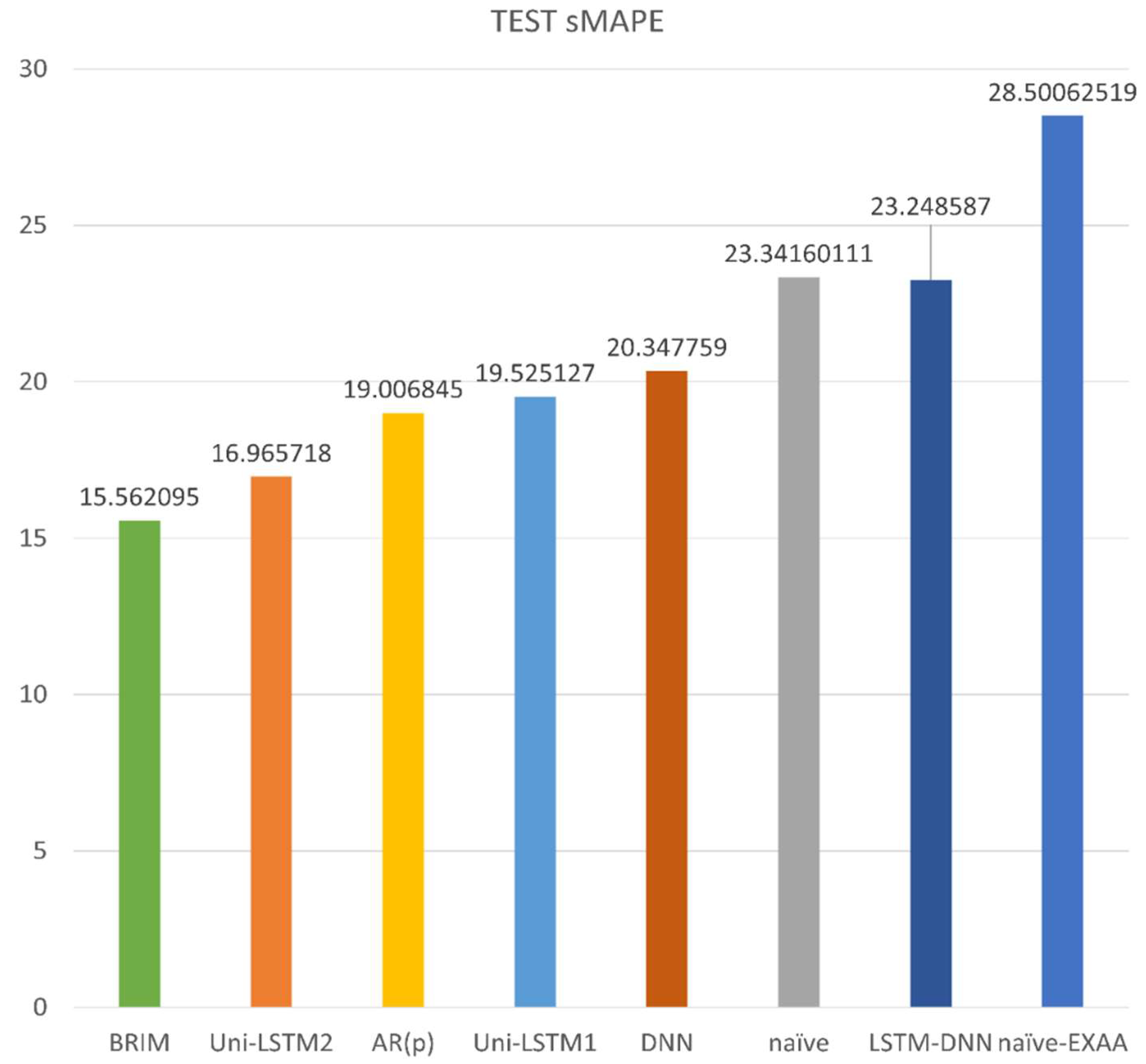

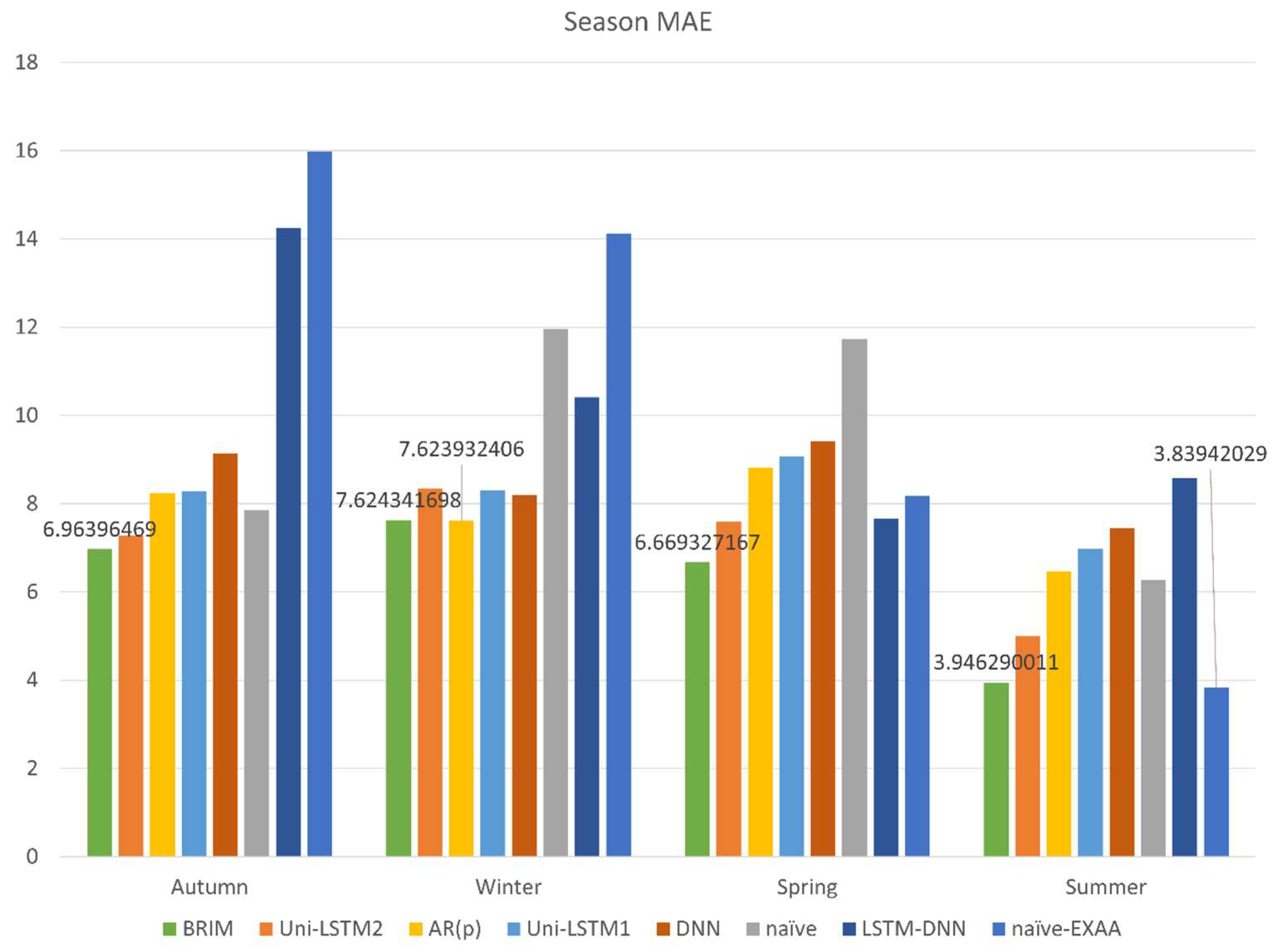

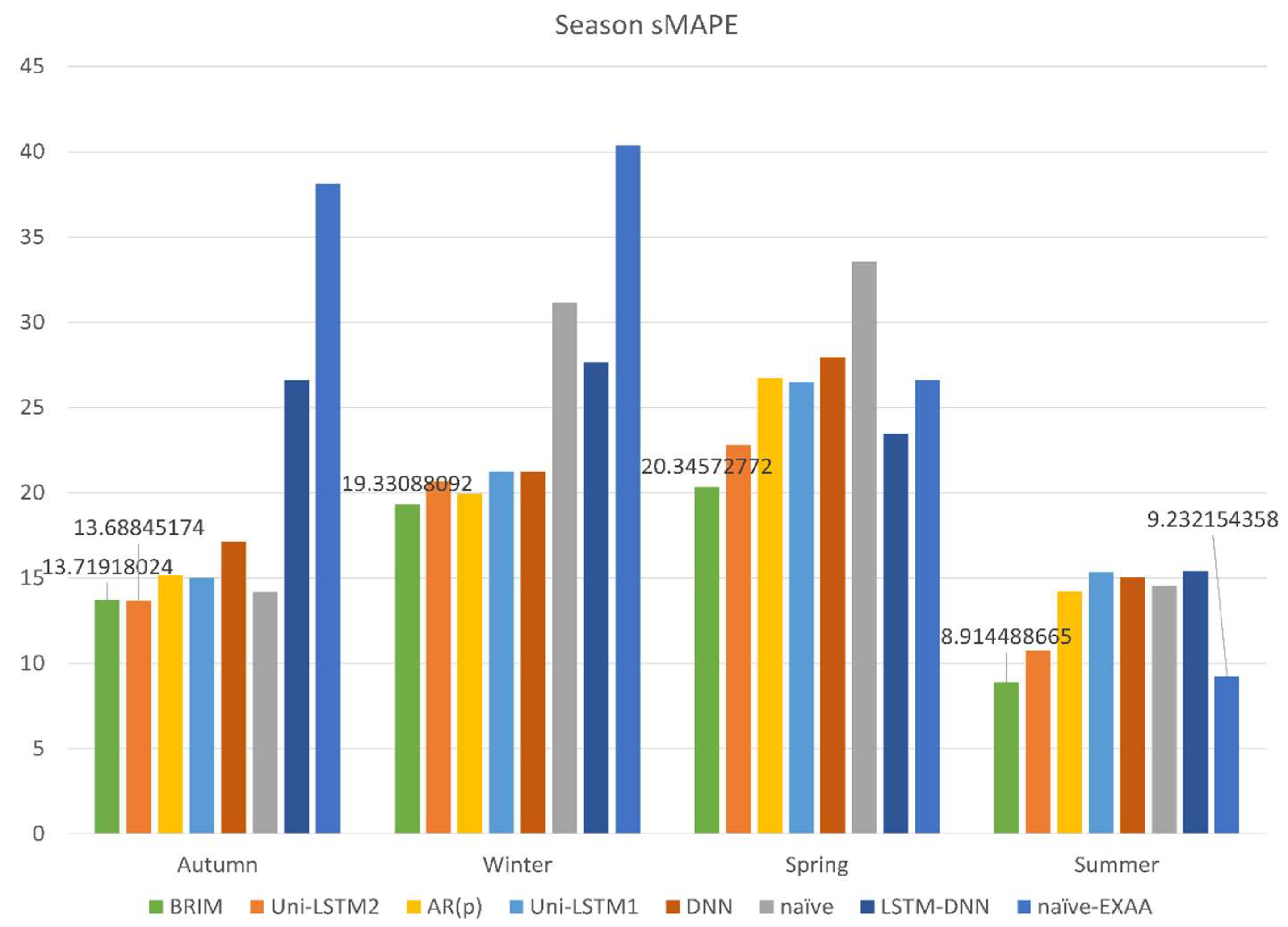

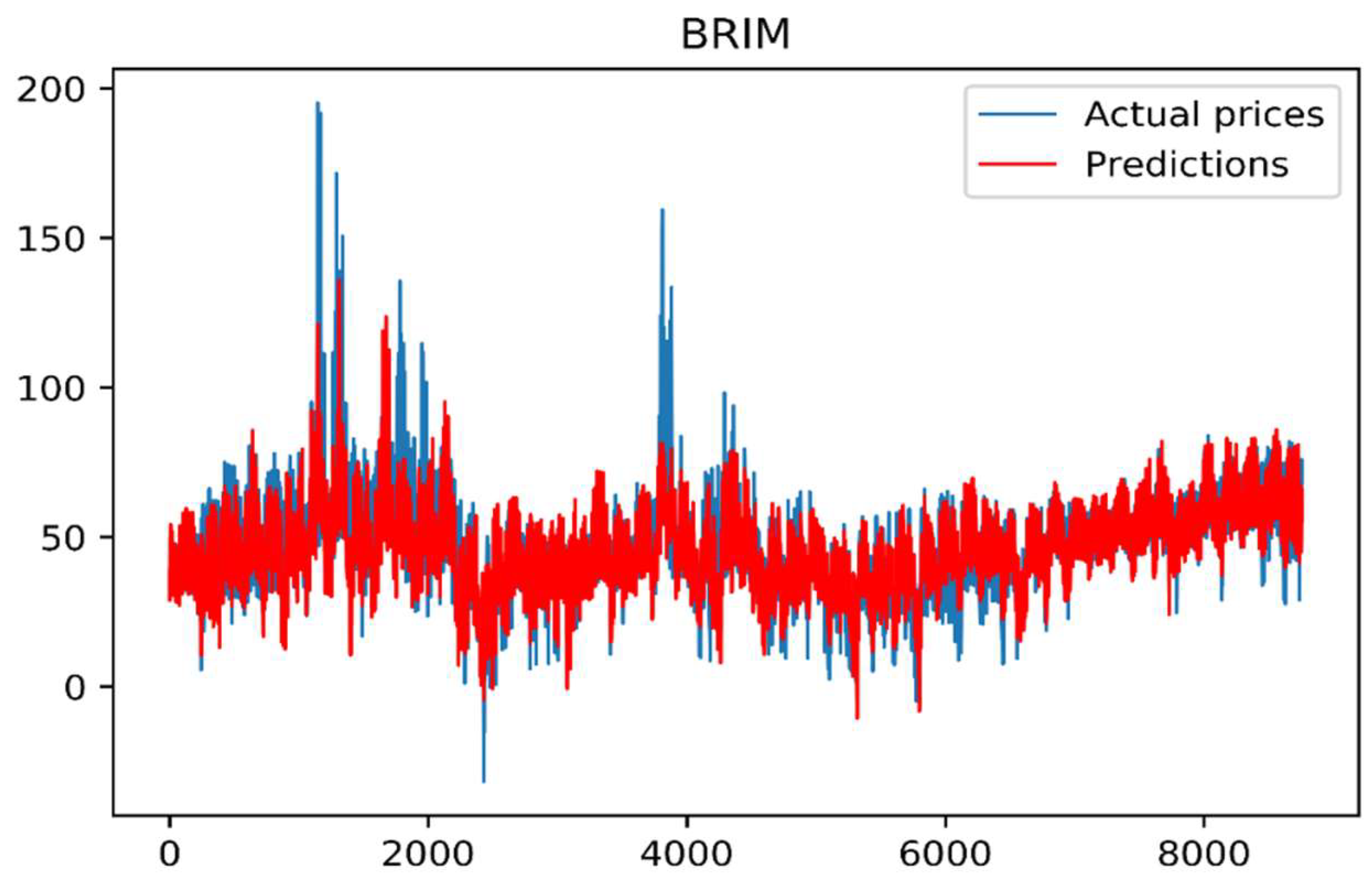

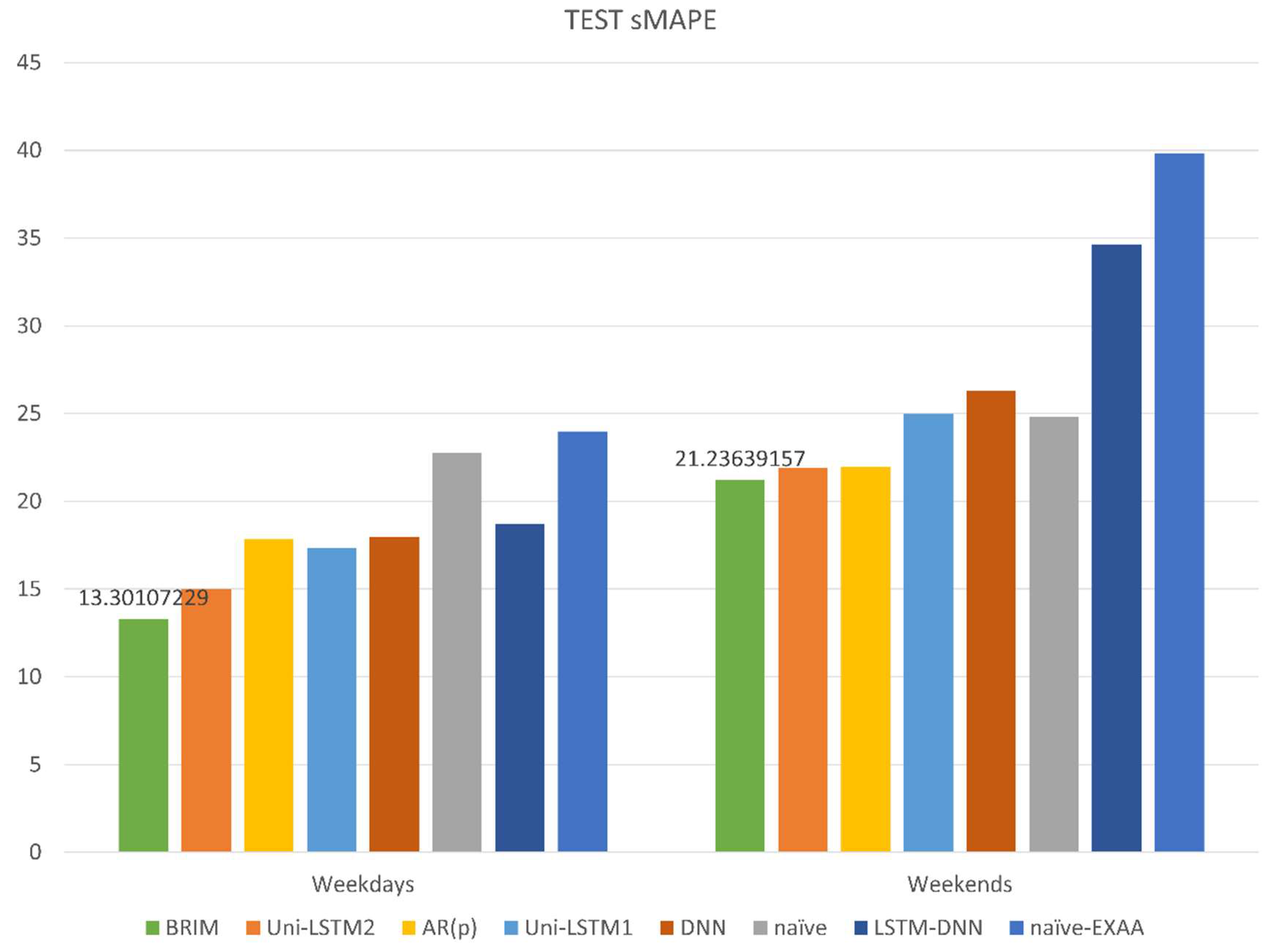

- Thorough experiments and comparisons with typical existing schemes are conducted to verify the prediction performance of our proposal, in terms of MAE (mean absolute error) and sMAPE (symmetric mean absolute percentage error). Furthermore, the Diebold-Mariano (DM) test is used to show the difference of our proposed BRIM model from other forecasting models, and indirectly demonstrates our forecasting model’s statistical significance.

2. Related Work

2.1. Market Integration

2.2. Deep Learning-Based Prediction Models

3. Proposed BRIM Prediction Scheme

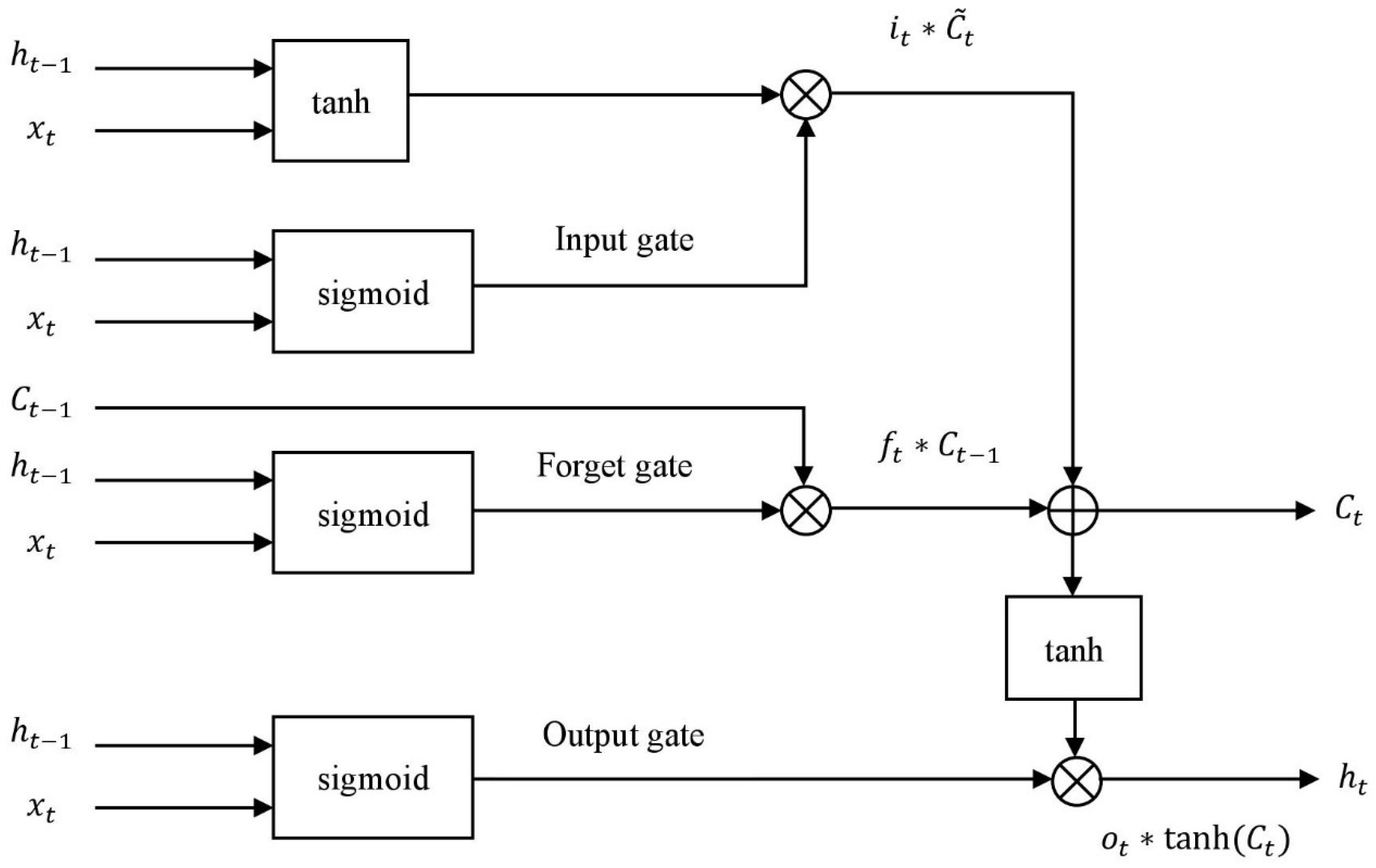

3.1. The LSTM Model

3.2. The BRIM Framework

4. Performance Evaluation

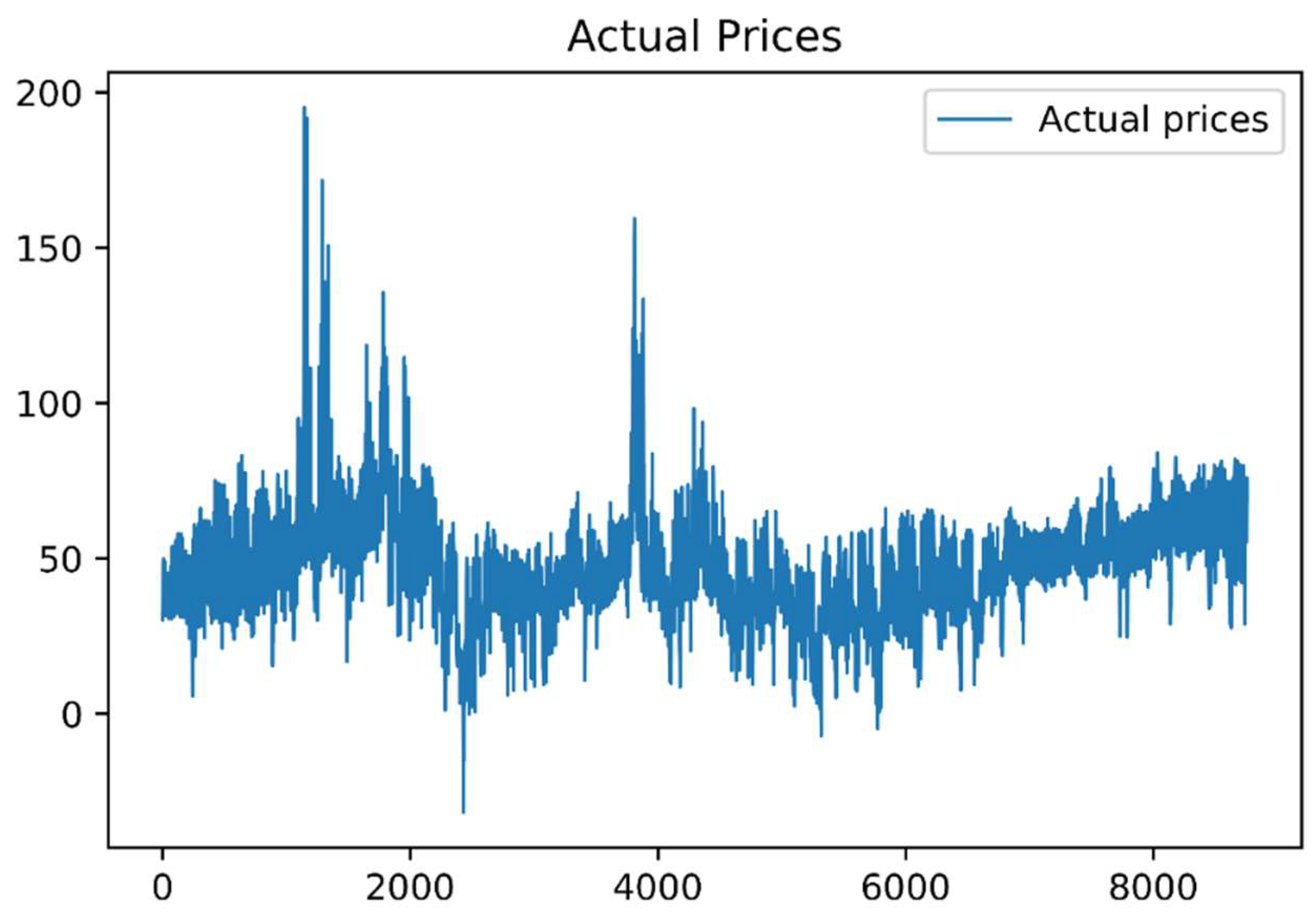

4.1. Dataset Description

- The past prices in the EPEX-FR (France), representing past information.

- The day-ahead prices in the EXAA, representing future information.

- Training set (from 26 December 2011 to 21 September 2016) is used to train forecasting models.

- Validation set (from 22 September 2016 to 21 September 2017) is used for model selection.

- Test set (from 22 September 2017 to 21 September 2018) is used to evaluate the model.

4.2. Experimental Setup

4.3. Benchmark Schemes

- Unidirectional LSTM model using only past price sequences in the forward time direction, containing 41 neurons. It is named as Uni-LSTM1 in our experiments.

- Unidirectional LSTM model using both past and future prices in the positive/forward time direction, containing 47 neurons. It is named as Uni-LSTM2 in our experiments.

- DNN model proposed by [22]. This model is a simple extension to the traditional MLP (Multi-layer Perception), containing 239 in the first layer and 162 neurons in second hidden layers. It is named as DNN in our experiments.

- LSTM-DNN model proposed by [13], containing 92 and 41 neurons in the DNN layer and LSTM layer, respectively. In detail, the past prices are processed by a forward LSTM, while the day-ahead prices representing future information are input into a DNN. Then, the outputs from these two separate networks are concatenated to determine the final prediction. It is named as LSTM-DNN in our experiments.

- Persistent model, persistent EXAA-based model, and Univariate AR() proposed by [20], respectively, abbreviated as naïve, naïve-EXAA, and AR() in our experiments. In naïve mode, the electricity price is estimated to be the same as 168 h ago (usually representing one week). In naïve-EXAA model, since the EXAA day-ahead prices are released at an earlier point in time, it simply regards that the day-ahead electricity prices in the EPEX are the same as that in the EXAA. AR() is the autoregressive process of order , which is selected by minimizing the Akaike information criterion.

4.4. Experimental Results and Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Aggarwal, S.K.; Saini, L.M.; Kumar, A. Electricity price forecasting in deregulated markets: A review and evaluation. Int. J. Electr. Power Syst. 2009, 31, 13–22. [Google Scholar] [CrossRef]

- Liu, B.; Nowotarski, J.; Hong, T.; Weron, R. Probabilistic load forecasting via quantile regression averaging on sister forecasts. IEEE Trans. Smart Grid 2017, 8, 730–737. [Google Scholar] [CrossRef]

- Ziel, F.; Steinert, R. Probabilistic mid-and long-term electricity price forecasting. Renew. Sustain. Energy Rev. 2018, 94, 251–266. [Google Scholar] [CrossRef]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef]

- Cheng, C.; Chen, F.; Li, G.; Tu, Q. Market equilibrium and impact of market mechanism parameters on the electricity price in yunnan’s electricity market. Energies 2016, 9, 463. [Google Scholar] [CrossRef]

- Bello, A.; Bunn, D.; Reneses, J.; Muñoz, A. Parametric density recalibration of a fundamental market model to forecast electricity prices. Energies 2016, 9, 959. [Google Scholar] [CrossRef]

- Cifter, A. Forecasting electricity price volatility with the markov-switching garch model: Evidence from the nordic electric power market. Electr. Power Syst. Res. 2013, 102, 61–67. [Google Scholar] [CrossRef]

- Krizhevsky, A.; Sutskever, I.; Hinton, G.E. Imagenet classification with deep convolutional neural networks. In Proceedings of the 25th International Conference on Neural Information Processing Systems, Lake Tahoe, NV, USA, 3–6 December 2012; pp. 1097–1105. [Google Scholar]

- Hinton, G.; Deng, L.; Yu, D.; Dahl, G.; Mohamed, A.R.; Jaitly, N.; Senior, A.; Vanhoucke, V.; Nguyen, P.; Kingsbury, B.; et al. Deep neural networks for acoustic modeling in speech recognition. IEEE Signal Process. Mag. 2012, 29, 82–97. [Google Scholar] [CrossRef]

- Bengio, Y.; Simard, P.; Frasconi, P. Learning long-term dependencies with gradient descent is difficult. IEEE Trans. Neural Netw. 1994, 5, 157–166. [Google Scholar] [CrossRef]

- Hochreiter, S.; Schmidhuber, J. Long short-term memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef]

- Sutskever, I.; Vinyals, O.; Le, Q.V. Sequence to sequence learning with neural networks. In Proceedings of the 27th International Conference on Neural Information Processing Systems, Montreal, QC, Canada, 8–13 December 2014; MIT Press: Cambridge, MA, USA; pp. 3104–3112. [Google Scholar]

- Lago, J.; De Ridder, F.; De Schutter, B. Forecasting spot electricity prices: Deep learning approaches and empirical comparison of traditional algorithms. Appl. Energy 2018, 221, 386–405. [Google Scholar] [CrossRef]

- Jamasb, T.; Pollitt, M. Electricity market reform in the European Union: Review of progress toward liberalization & integration. Energy J. 2005, 26, 11–41. [Google Scholar]

- Gugler, K.; Haxhimusa, A.; Liebensteiner, M. Integration of European Electricity Markets: Evidence from Spot Prices. Energy J. 2018, 39, 41–67. [Google Scholar] [CrossRef]

- Bunn, D.W.; Gianfreda, A. Integration and shock transmissions across European electricity forward markets. Energy Econ. 2010, 32, 278–291. [Google Scholar] [CrossRef]

- De Menezes, L.M.; Houllier, M.A. Reassessing the integration of European electricity markets: A fractional cointegration analysis. Energy Econ. 2016, 53, 132–150. [Google Scholar] [CrossRef]

- Meeus, L.; Belmans, R. Electricity market integration in Europe. Revue E-Societe Royale Belge Des Electriciens 2008, 124, 5. [Google Scholar]

- Bollino, C.A.; Ciferri, D.; Polinori, P. Integration and convergence in European electricity markets. MPRA Pap. 2013. [Google Scholar] [CrossRef]

- Ziel, F.; Steinert, R.; Husmann, S. Forecasting day ahead electricity spot prices: The impact of the EXAA to other European electricity markets. Energy Econ. 2015, 51, 430–444. [Google Scholar] [CrossRef]

- Kong, W.; Dong, Z.Y.; Jia, Y.; Hill, D.J.; Xu, Y.; Zhang, Y. Short-term residential load forecasting based on LSTM recurrent neural network. IEEE Trans. Smart Grid 2019, 10, 841–851. [Google Scholar] [CrossRef]

- Lago, J.; De Ridder, F.; Vrancx, P.; De Schutter, B. Forecasting day-ahead electricity prices in Europe: The importance of considering market integration. Appl. Energy 2018, 211, 890–903. [Google Scholar] [CrossRef]

- Schuster, M.; Paliwal, K.K. Bidirectional recurrent neural networks. IEEE Trans. Signal Process. 1997, 45, 2673–2681. [Google Scholar] [CrossRef]

- Di Persio, L.; Honchar, O. Analysis of recurrent neural networks for short-term energy load forecasting. AIP Conf. Proc. 2017, 1906. [Google Scholar] [CrossRef]

- Cui, Z.; Ke, R.; Wang, Y. Deep bidirectional and unidirectional LSTM recurrent neural network for network-wide traffic speed prediction. arXiv 2018, arXiv:1801.02143. [Google Scholar]

- Althelaya, K.A.; El-Alfy, E.S.M.; Mohammed, S. Evaluation of bidirectional lstm for short-and long-term stock market prediction. In Proceedings of the 2018 9th International Conference on Information and Communication Systems (ICICS), Irbid, Jordan, 3–5 April 2018; pp. 151–156. [Google Scholar]

- Graves, A.; Mohamed, A.R.; Hinton, G. Speech recognition with deep recurrent neural networks. In Proceedings of the 2013 IEEE International Conference on Acoustics, Speech and Signal Processing, Vancouver, BC, Canada, 26–31 May 2013; pp. 6645–6649. [Google Scholar]

- Wu, Y.; Schuster, M.; Chen, Z.; Le, Q.V.; Norouzi, M.; Macherey, W.; Krikun, M.; Cao, Y.; Gao, Q.; Macherey, K.; et al. Google’s neural machine translation system: Bridging the gap between human and machine translation. arXiv 2016, arXiv:1609.08144. [Google Scholar]

- EPEX SPOT SE. Available online: http://www.epexspot.com/en/ (accessed on 24 September 2018).

- EXAA Energy Exchange Austria. Available online: https://www.exaa.at/en/ (accessed on 24 September 2018).

- Statsmodels. Available online: https://pypi.org/project/statsmodels/ (accessed on 25 July 2018).

- TensorFlow. Available online: https://pypi.org/project/tensorflow/ (accessed on 25 July 2018).

- Kingma, D.P.; Ba, J. Adam: A method for stochastic optimization. arXiv 2014, arXiv:1412.6980. [Google Scholar]

- Diebold, F.X.; Mariano, R. Comparing predictive accuracy. J. Bus. Econ. Stat. 1995, 13, 253–265. [Google Scholar]

- Abedinia, O.; Amjady, N.; Zareipour, H. A new feature selection technique for load and price forecast of electrical power systems. IEEE Trans. Power Syst. 2017, 32, 62–74. [Google Scholar] [CrossRef]

| Data Division | Mean | Median | MAD 1 | Std | Min | Max |

|---|---|---|---|---|---|---|

| Training set | 38.95 | 37.79 | 13.19 | 22.59 | −200.00 | 1938.50 |

| Validation set | 45.70 | 40.76 | 15.34 | 26.01 | −2.17 | 874.01 |

| Test set | 48.16 | 47.84 | 13.38 | 17.67 | −31.82 | 195.11 |

| Hyper-Parameter | Value |

|---|---|

| Activation function | Tanh |

| Dropout | No |

| Regularization | No |

| Number of neurons | 47 (both forward and backward) |

| Sequence length | 1 week of past prices (previous 168 h of the EPEX) + 1 day of day-ahead prices (24 h of the EXAA) |

| Contrast Schemes | Uni-LSTM2 and BRIM | AR() and BRIM | Uni-LSTM1 and BRIM | DNN and BRIM | Naïve and BRIM | LSTM-DNN and BRIM | Naïve-EXAA and BRIM | Uni-LSTM1 and Uni-LSTM2 | DNN and Uni-LSTM2 |

|---|---|---|---|---|---|---|---|---|---|

| DM_A 1 | 6.59075 | 4.88679 | 6.58444 | 8.30636 | 6.7 | 8.49038 | 7.43447 | 4.52153 | 5.64248 |

| -value_A | |||||||||

| DM_S 1 | 2.8479 | 3.29291 | 4.29782 | 5.01277 | 5.14705 | 6.67746 | 6.15096 | 3.81107 | 3.74367 |

| -value_S |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Y.; Wang, Y.; Ma, J.; Jin, Q. BRIM: An Accurate Electricity Spot Price Prediction Scheme-Based Bidirectional Recurrent Neural Network and Integrated Market. Energies 2019, 12, 2241. https://doi.org/10.3390/en12122241

Chen Y, Wang Y, Ma J, Jin Q. BRIM: An Accurate Electricity Spot Price Prediction Scheme-Based Bidirectional Recurrent Neural Network and Integrated Market. Energies. 2019; 12(12):2241. https://doi.org/10.3390/en12122241

Chicago/Turabian StyleChen, Yiyuan, Yufeng Wang, Jianhua Ma, and Qun Jin. 2019. "BRIM: An Accurate Electricity Spot Price Prediction Scheme-Based Bidirectional Recurrent Neural Network and Integrated Market" Energies 12, no. 12: 2241. https://doi.org/10.3390/en12122241

APA StyleChen, Y., Wang, Y., Ma, J., & Jin, Q. (2019). BRIM: An Accurate Electricity Spot Price Prediction Scheme-Based Bidirectional Recurrent Neural Network and Integrated Market. Energies, 12(12), 2241. https://doi.org/10.3390/en12122241