Scenario Analysis in the Electric Power Industry under the Implementation of the Electricity Market Reform and a Carbon Policy in China

Abstract

1. Introduction

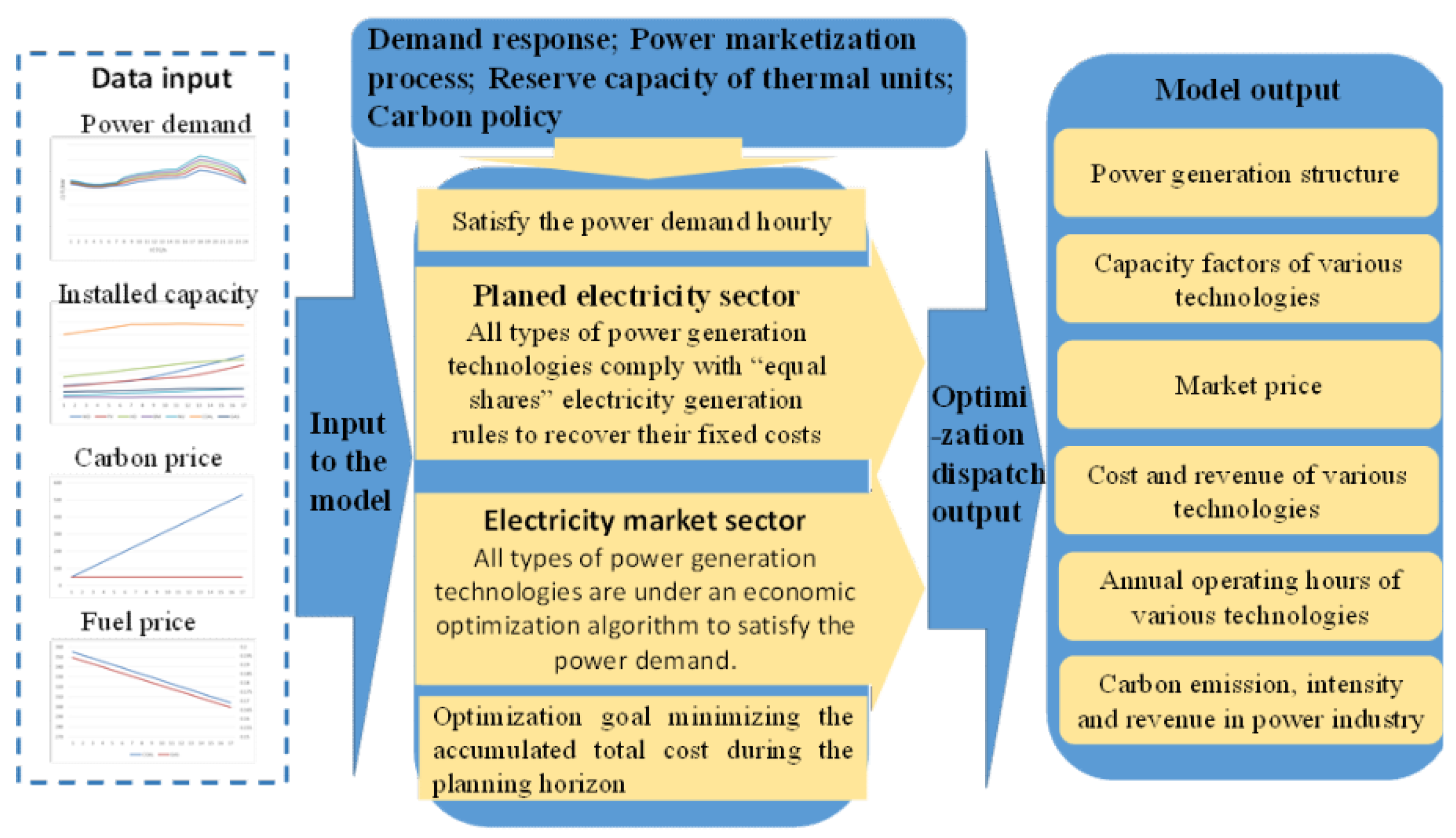

2. Methodology

2.1. Structure and Assumptions

2.2. Mathematical Formulation

3. Case Study and Discussion

3.1. Scenario Analysis Approach

3.2. Data

3.2.1. Power Demand

3.2.2. Future Capacity Mix of Power Technologies

3.2.3. Technological and Economical Parameters

4. Results and Discussion

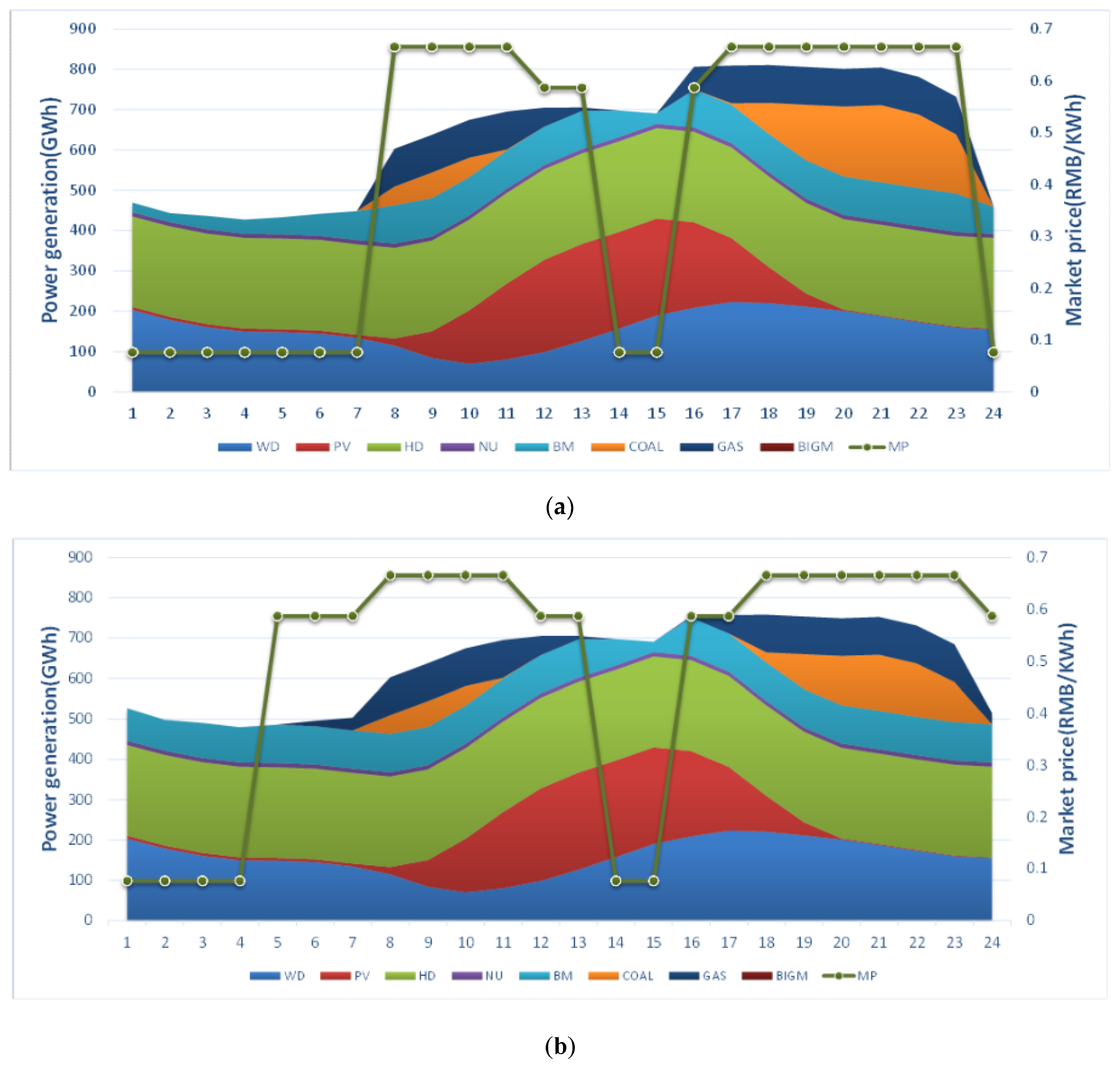

4.1. The Impact of the Demand Response

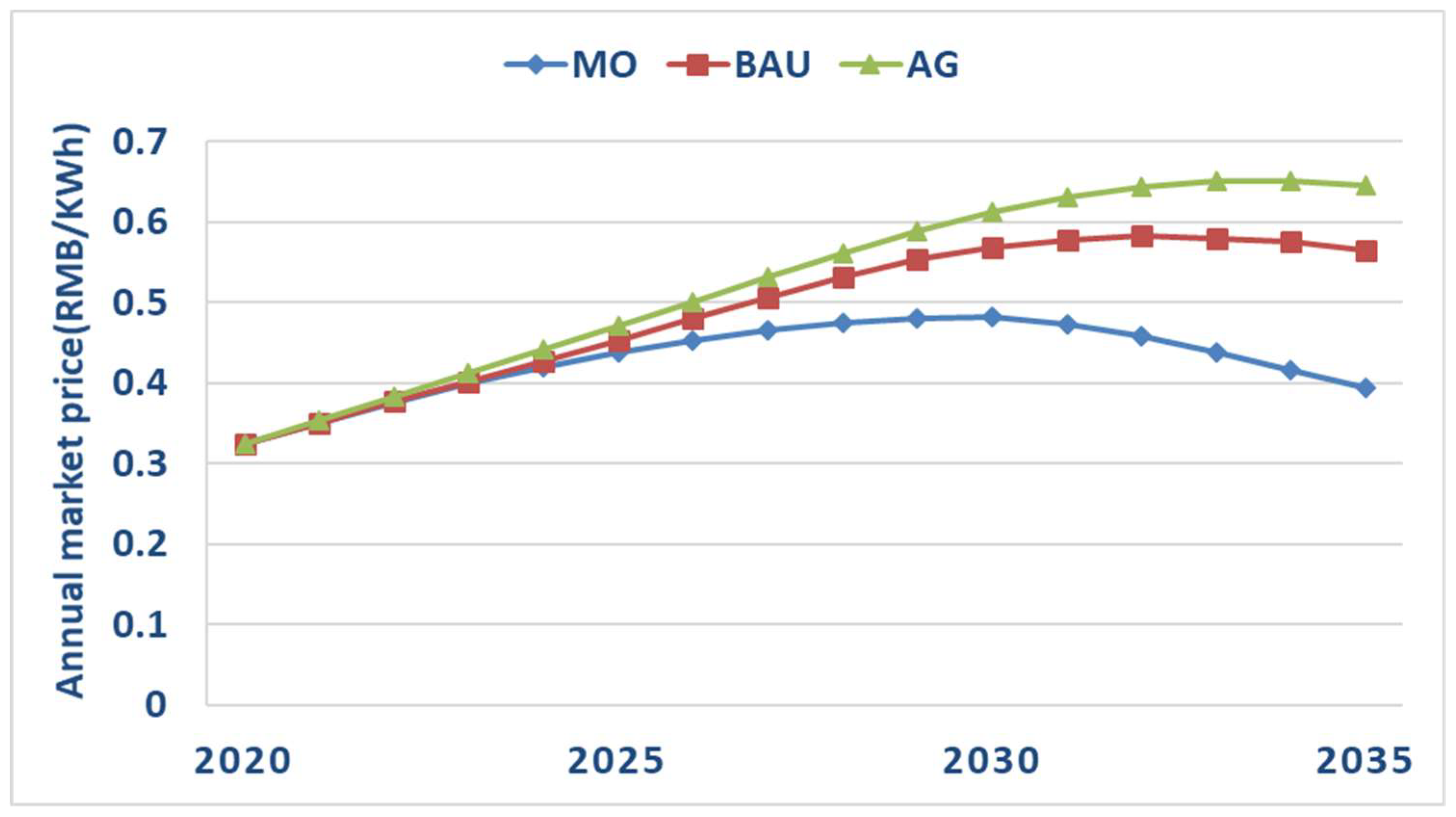

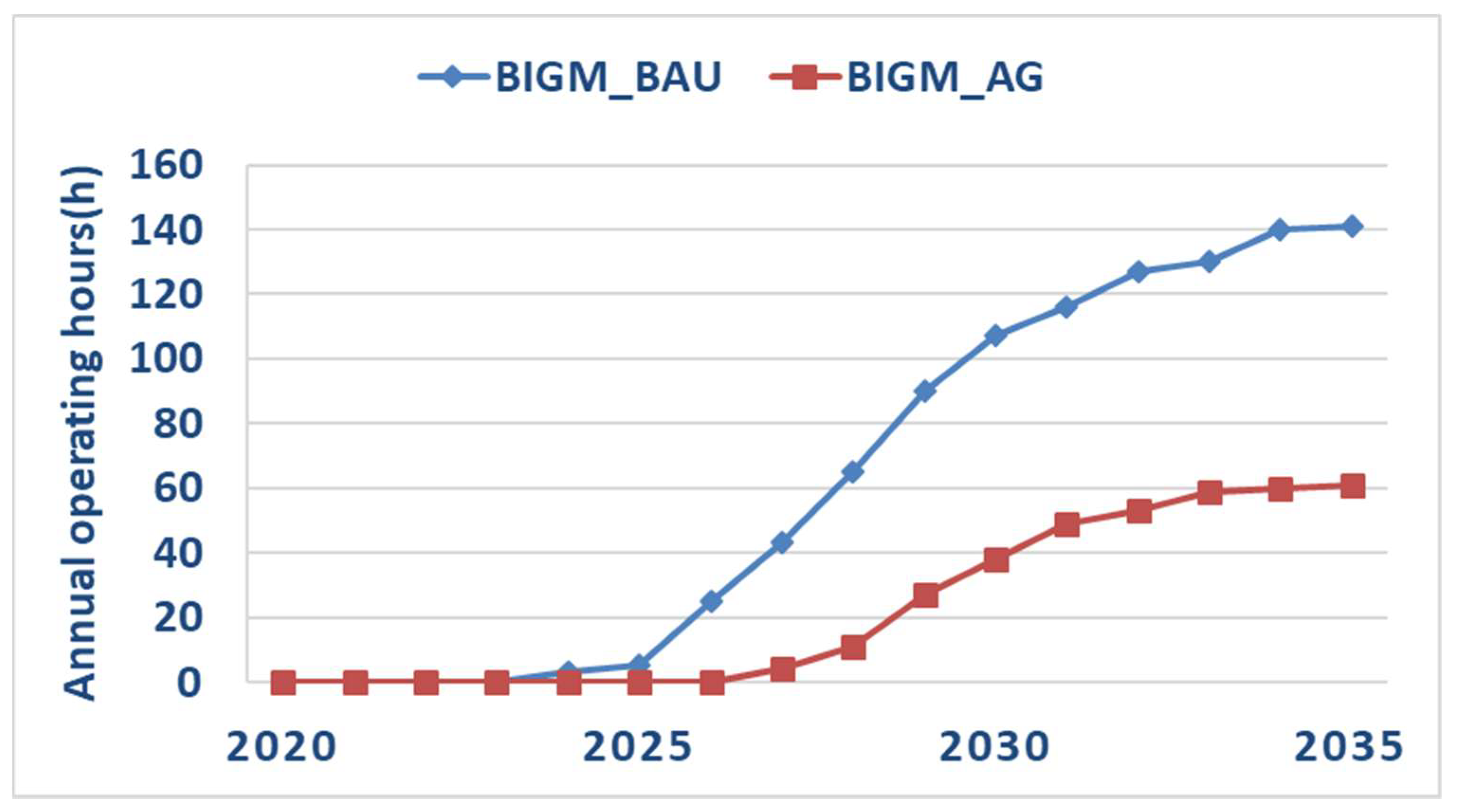

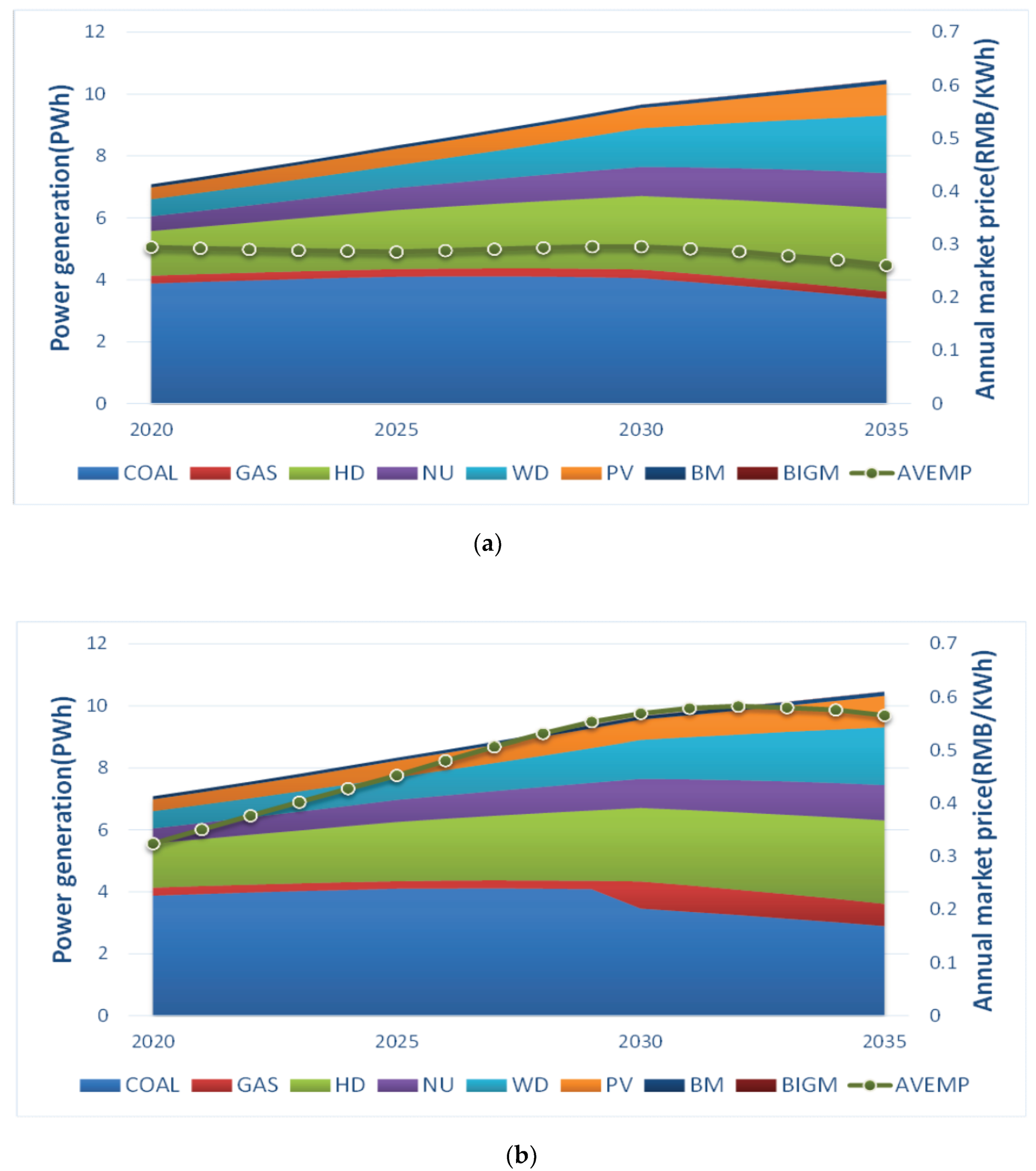

4.2. The Impact of Electricity Marketization Process

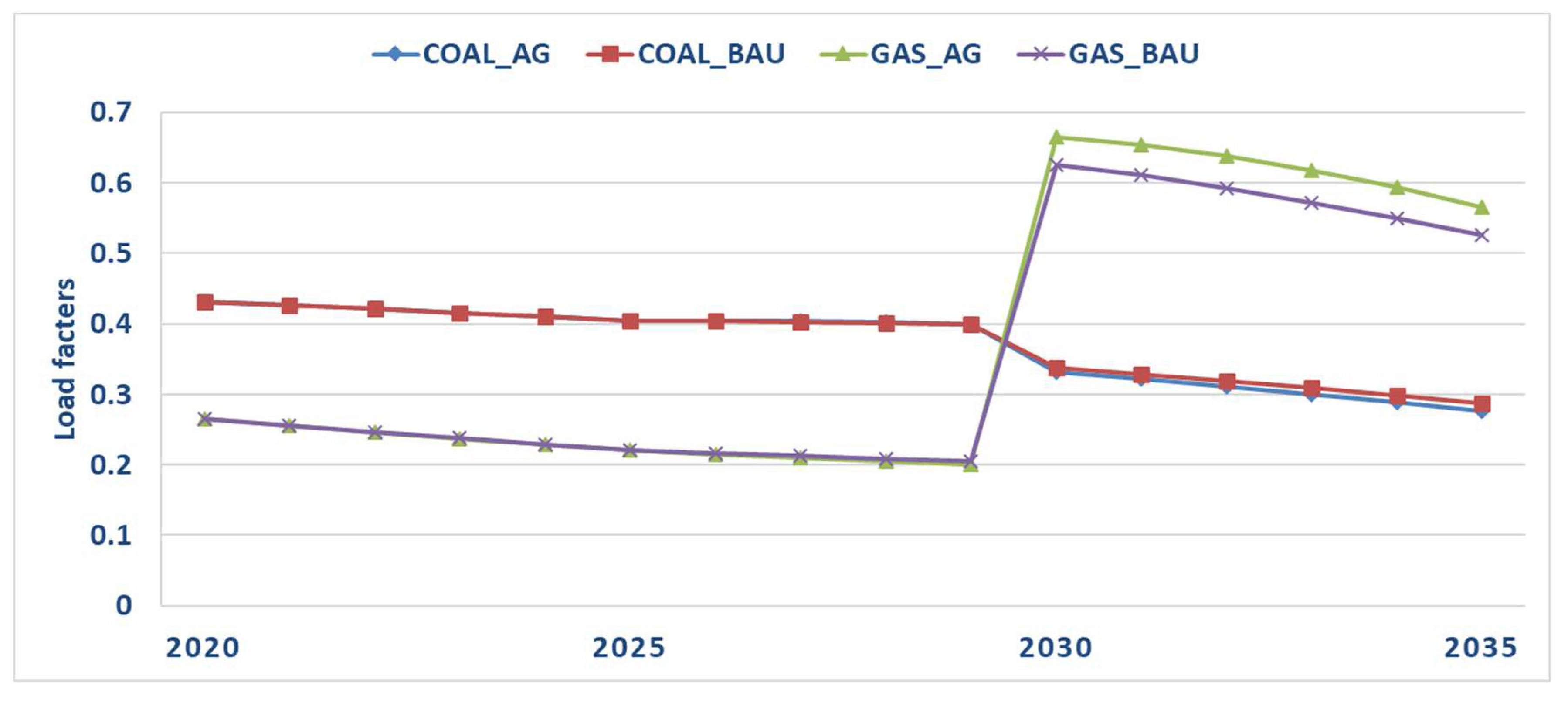

4.3. The Impact of Thermal Unit Reserve Capacity Adjustment

4.4. The Impact of Carbon Policy

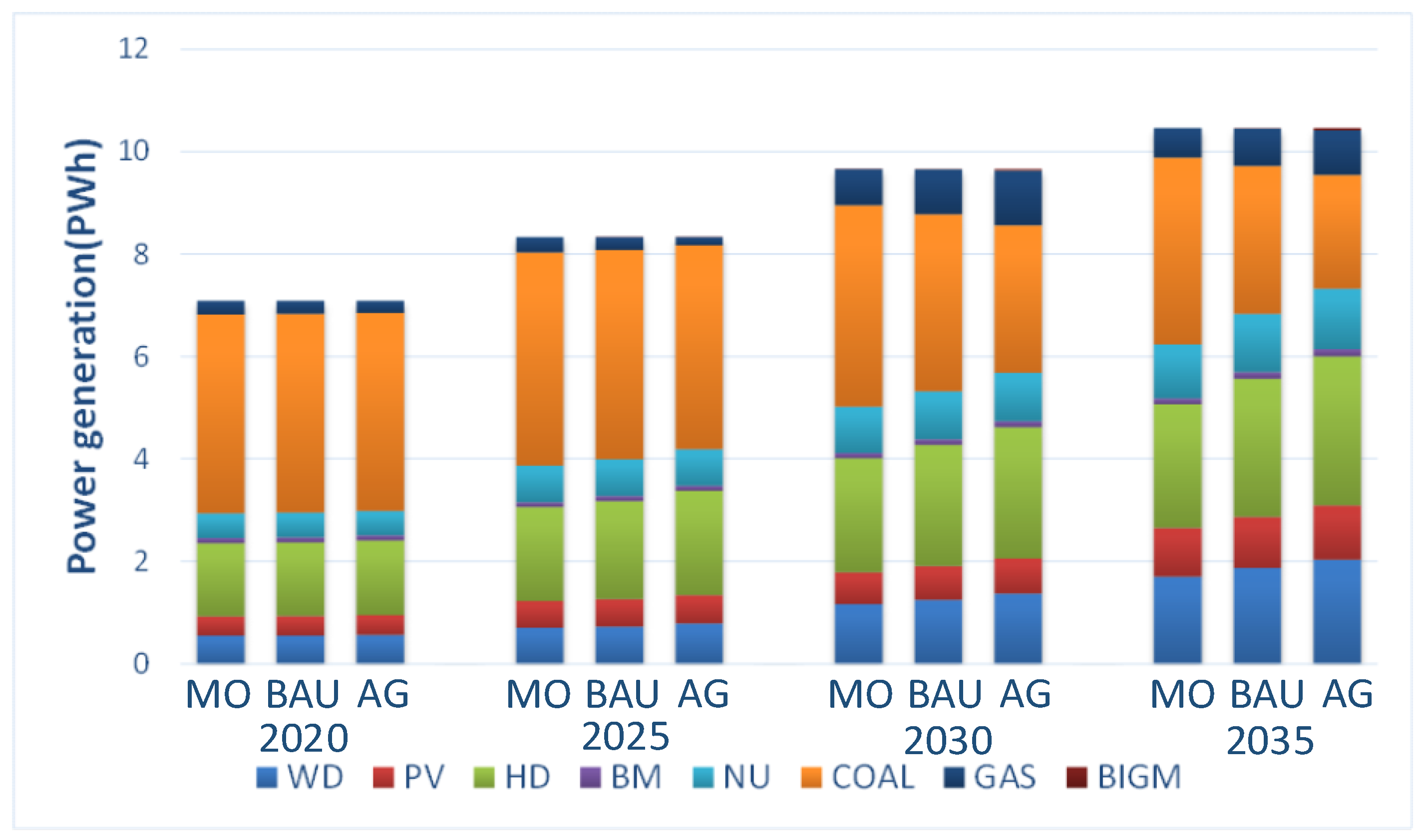

4.5. The Comparison of the Scenerios

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- China Low Carbon Development Report in 2017. Available online: http://hbw.chinaenvironment.com/zxxwlb/index_54_94219.html (accessed on 9 February 2019).

- National Bureau of Statistics of China (NBSC). 2013–2017 China Energy Statistical Yearbook; China Statistics Press: Beijing, China, 2017.

- China Electric Council (CEC). 2013–2017 China’s Electric Power Industry Statistical Yearbook; China’s Electric Power Press: Beijing, China, 2017. [Google Scholar]

- China Electricity Yearbook Editorial Board. 2013–2017 China Electric Power Yearbook; China Electric Power Press: Beijing, China, 2017. [Google Scholar]

- Opportunities, Challenges and Countermeasures for China to Implement the Paris Agreement. Available online: https://www.sohu.com/a/150121338_714210 (accessed on 16 February 2019).

- Lin, K.-C.; Purra, M.M. Transforming China’s electricity sector: Politics of institutional change and regulation. Energy Policy 2019, 124, 401–410. [Google Scholar] [CrossRef]

- Zeng, M.; Yang, Y.; Wang, L.; Sun, J. The power industry reform in China 2015: Policies, evaluations and solutions. Renew. Sustain. Energy Rev. 2016, 57, 94–110. [Google Scholar] [CrossRef]

- The Implementation of National Carbon Market in China. Available online: https://www.sohu.com/a/211653530_611233 (accessed on 23 February 2019).

- Cai, W.; Wang, C.; Wang, K.; Zhang, Y.; Chen, J. Scenario analysis on CO2 emissions reduction potential in China’s electricity sector. Energy Policy 2007, 35, 6445–6456. [Google Scholar] [CrossRef]

- Sithole, H.; Cockerill, T.T.; Hughes, K.J.; Ingham, D.B.; Ma, L.; Porter, R.T.J.; Pourkashanian, M. Developing an optimal electricity generation mix for the UK 2050 future. Energy 2016, 100, 363–373. [Google Scholar] [CrossRef]

- Guo, Z.; Ma, L.; Liu, P.; Jones, I.; Li, Z. A long-term multi-region load-dispatch model based on grid structures for the optimal planning of China’s power sector. Comput. Chem. Eng. 2017, 102, 52–63. [Google Scholar] [CrossRef]

- Zhang, D.; Liu, P.; Ma, L.; Li, Z.; Ni, W. A multi-period modelling and optimization approach to the planning of China’s power sector with consideration of carbon dioxide mitigation. Comput. Chem. Eng. 2020, 37, 227–247. [Google Scholar] [CrossRef]

- Guo, Z.; Cheng, R.; Xu, Z.; Liu, P.; Wang, Z.; Li, Z.; Jones, I.; Sun, Y. A multi-region load dispatch model for the long-term optimum planning of China’s electricity sector. Appl. Energy 2017, 185, 556–572. [Google Scholar] [CrossRef]

- Cheng, R.; Xu, Z.; Liu, P.; Wang, Z.; Li, Z.; Jones, I. A multi-region optimization planning model for China’s power sector. Appl. Energy 2015, 137, 413–426. [Google Scholar] [CrossRef]

- Wang, C.; Ye, M.; Cai, W.; Chen, J. The value of a clear, long-term climate policy agenda: A case study of China’s power sector using a multi-region optimization model. Appl. Energy 2014, 125, 276–288. [Google Scholar] [CrossRef]

- Li, W.; Zhang, Y.-W.; Lu, C. The impact on electric power industry under the implementation of national carbon trading market in China: A dynamic CGE analysis. J. Clean. Prod. 2018, 200, 511–523. [Google Scholar] [CrossRef]

- Dai, Y.; Hu, X.; Jiang, K.; Xu, H.; Zhu, Y.; Bai, Q. Low Carbon Development Pathway for China towards 2050 Scenario Analysis on Energy Demands and Carbon Emissions; Science and Technology Press: Beijing, China, 2009. (In Chinese) [Google Scholar]

- Wu, Q.; Peng, C. Scenario analysis of carbon emissions of China’s electric power industry up to 2030. Energies 2016, 9, 988. [Google Scholar] [CrossRef]

- Yuan, J.; Xu, Y.; Hu, Z. Delivering power system transition in China. Energy Policy 2012, 50, 751–772. [Google Scholar] [CrossRef]

- Adelman, D.E.; Spence, D.B. U.S. climate policy and the regional economics of electricity generation. Energy Policy 2018, 120, 268–275. [Google Scholar] [CrossRef]

- Najafi, A.; Marzband, M.; Mohamadi-Ivatloo, B.; Contreras, J.; Pourakbari-Kasmaei, M.; Lehtonen, M.; Godina, R. Uncertainty-Based Models for Optimal Management of Energy Hubs Considering Demand Response. Energies 2019, 12, 1413. [Google Scholar] [CrossRef]

- Lu, Z.; Zhang, N.; Wang, Q.; Du, E.; Kroposki, B.; Hodge, B.-M.; Kang, C.; Xia, Q. Operation of a High Renewable Penetrated Power System With CSP Plants: A Look-Ahead Stochastic Unit Commitment Model. IEEE Trans. Power Syst. 2018, 34, 140–151. [Google Scholar]

- Cheng, Y.; Zhang, N.; Wang, Y.; Yang, J.; Kang, C.; Xia, Q. Modeling Carbon Emission Flow in Multiple Energy Systems. IEEE Trans. Smart Grid 2018, 3053, 1–13. [Google Scholar] [CrossRef]

- Pourakbari-Kasmaei, M.; Mantovani, J.R.S.; Rashidinejad, M.; Habibi, M.R.; Contreras, J. Carbon footprint allocation among consumers and transmission losses. In Proceedings of the 2017 IEEE International Conference on Environment and Electrical Engineering and 2017 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Milan, Italy, 6–9 June 2017; pp. 1–6. [Google Scholar]

- Cheng, Y.; Zhang, N.; Lu, Z.; Kang, C. Planning Multiple Energy Systems towards Low-Carbon Society: A Decentralized Approach. IEEE Trans. Smart Grid 2018, 11, 1–6. [Google Scholar] [CrossRef]

- Home-Ortiz, J.M.; Melgar-Dominguez, O.D.; Pourakbari-Kasmaei, M.; Mantovani, J.R.S. A stochastic mixed-integer convex programming model for long-term distribution system expansion planning considering greenhouse gas emission mitigation. Int. J. Electr. Power Energy Syst. 2019, 108, 86–95. [Google Scholar] [CrossRef]

- Gnansounou, E.; Dong, J. Opportunity for inter-regional integration of electricity markets: The case of Shandong and Shanghai in East China. Energy Policy 2004, 32, 1737–1751. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, X. China’s electricity market-oriented reform: From an absolute to a relative monopoly. Energy Policy 2012, 51, 143–148. [Google Scholar] [CrossRef]

- Mou, D. Understanding China’s electricity market reform from the perspective of the coal-fired power disparity. Energy Policy 2014, 74, 224–234. [Google Scholar] [CrossRef]

- Zhang, S.; Andrews-Speed, P.; Li, S. To what extent will China’s ongoing electricity market reforms assist the integration of renewable energy? Energy Policy 2018, 114, 165–172. [Google Scholar] [CrossRef]

- Zhou, K.L.; Li, Y.W. Carbon finance and carbon market in China: Progress and challenges. J. Clean. Prod. 2019, 214, 536–549. [Google Scholar] [CrossRef]

- Dormady, N. Carbon Auction Revenue and Market Power: An Experimental Analysis. Energies 2016, 9, 897. [Google Scholar] [CrossRef]

- Liu, Z.; Zheng, W.; Qi, F.; Wang, L.; Zou, B.; Wen, F.; Xue, Y. Optimal dispatch of a virtual power plant considering demand response and carbon trading. Energies 2018, 11, 1488. [Google Scholar] [CrossRef]

- Benavides, C.; Gonzales, L.; Diaz, M.; Fuentes, R.; García, G.; Palma-Behnke, R.; Ravizza, C. Correction to The impact of a carbon tax on the Chilean electricity generation sector. Energies 2015, 8, 6247–6248. [Google Scholar] [CrossRef]

- Zhou, Z.; Zhang, J.; Liu, P.; Li, Z.; Georgiadis, M.C.; Pistikopoulos, E.N. A two-stage stochastic programming model for the optimal design of distributed energy systems. Appl. Energy 2013, 103, 135–144. [Google Scholar] [CrossRef]

- Huber, M.; Roger, A.; Hamacher, T. Optimizing long-term investments for a sustainable development of the ASEAN power system. Energy 2015, 88, 180–193. [Google Scholar] [CrossRef]

- Li, F.-F.; Qiu, J. Multi-objective optimization for integrated hydro–photovoltaic power system. Appl. Energy 2016, 167, 377–384. [Google Scholar] [CrossRef]

- Milligan, M.; Frew, B.A.; Bloom, A.; Ela, E.; Botterud, A.; Townsend, A.; Levin, T. Wholesale electricity market design with increasing levels of renewable generation: Revenue sufficiency and long-term reliability. Electr. J. 2016, 29, 26–38. [Google Scholar] [CrossRef]

- Kahrl, F.; Williams, J.; Ding, J.H.; Hu, J.F. Challenges to China’s transition to a low carbon electricity system. Energy Policy 2011, 39, 4032–4041. [Google Scholar] [CrossRef]

- Excel Model for Electric Market. Available online: https://repositories.lib.utexas.edu/bitstream/handle/2152/40929/CUEVASTHESIS-2016.pdf?Sequence=1&isAllowed=y (accessed on 9 October 2018).

- Zarnikau, J. Successful renewable energy development in a competitive electricity market: A Texas case study. Energy Policy 2011, 39, 3906–3913. [Google Scholar] [CrossRef]

- Hui, J.; Cai, W.; Wang, C.; Ye, M. Analyzing the penetration barriers of clean generation technologies in China’s power sector using a multi-region optimization model. Appl. Energy 2017, 185, 1809–1820. [Google Scholar] [CrossRef]

- Parrish, B.; Gross, R.; Heptonstall, P. On demand: Can demand response live up to expectations in managing electricity systems? Energy Res. Soc. Sci. 2019, 51, 107–118. [Google Scholar] [CrossRef]

- The Analysis of National Electricity Market Transaction in 2018. Available online: http://www.cec.org.cn/guihuayutongji/dianligaige/2019-03-04/189190.html (accessed on 5 March 2019).

- Naranjo Palacio, S.; Kircher, K.J.; Zhang, K.M. On the feasibility of providing power system spinning reserves from thermal storage. Energy Build. 2015, 104, 131–138. [Google Scholar] [CrossRef]

- Khanna, N.Z.; Zhou, N.; Fridley, D.; Ke, J. Quantifying the potential impacts of China’s power-sector policies on coal input and CO2 emissions through 2050: A bottom-up perspective. Util. Policy 2016, 41, 128–138. [Google Scholar] [CrossRef]

- Outlook for China Power Development for 2050. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFDLAST2018&filename=ZGLN201803007&uid=WEEvREdxOWJmbC9oM1NjYkZCbDdrdWdYWlUycFVQNS80OFQybzBwMDh3USs=$R1yZ0H6jyaa0en3RxVUd8df-oHi7XMMDo7mtKT6mSmEvTuk11l2gFA!!&v=MDIzNDNIWUxHNEg5bk1ySTlGWTRSOGVYMUx1eFlTN0RoMVQzcVRyV00xRnJDVVJMT2ZZdVpzRnlIbVVickxQeXI= (accessed on 9 February 2019).

| Scenario | 2020 | 2025 | 2030 | 2035 | ||||

|---|---|---|---|---|---|---|---|---|

| Plan | Market | Plan | Market | Plan | Market | Plan | Market | |

| MO | 70% | 30% | 70% | 30% | 70% | 30% | 70% | 30% |

| BAU | 68% | 32% | 57% | 43% | 48% | 52% | 40% | 60% |

| AG | 62% | 38% | 34% | 66% | 18% | 82% | 10% | 90% |

| Scenario | COAL | GAS |

|---|---|---|

| BAU | 20% | 10% |

| AG | 10% | 5% |

| Scenario | 2020 | 2025 | 2030 | 2035 |

|---|---|---|---|---|

| MO | 50 | 50 | 50 | 50 |

| BAU | 80 | 230 | 380 | 530 |

| 2020 (TWh) | 2020–2025 Growth Rate (%) | 2025 (TWh) | 2025–2030 Growth Rate (%) |

2030 (TWh) |

2030–2035 Growth Rate (%) |

2035 (TWh) | |

|---|---|---|---|---|---|---|---|

| Power demand | 7085.6 | 3.3% | 8334.5 | 3.0% | 9661.9 | 1.6% | 10460.1 |

| Technology Type | 2020 (GW) | 2020–2025 Growth Rate (%) | 2025 (GW) | 2025–2030 Growth Rate (%) | 2030 (GW) | 2030–2035 Growth Rate (%) | 2035 (GW) |

|---|---|---|---|---|---|---|---|

| COAL | 1028 | 0.024 | 1159 | 0.002 | 1170 | −0.004 | 1149 |

| GAS | 111 | 0.031 | 129 | 0.044 | 160 | −0.005 | 156 |

| HD | 360 | 0.051 | 461 | 0.040 | 561 | 0.021 | 621 |

| NU | 61 | 0.081 | 90 | 0.059 | 120 | 0.059 | 160 |

| WD | 220 | 0.050 | 281 | 0.108 | 469 | 0.077 | 681 |

| PV | 210 | 0.067 | 290 | 0.038 | 349 | 0.088 | 531 |

| BM | 30 | −0.007 | 29 | 0.013 | 31 | 0.052 | 40 |

| TOTAL | 2020 | 0.038 | 2439 | 0.032 | 2860 | 0.031 | 3338 |

| Technology Type | Unit | COAL | GAS | HD | NU | WD | PV | BM |

|---|---|---|---|---|---|---|---|---|

| RMB/kW | 9000 | 2954 | 13,780 | 13,662 | 7500 | 6500 | 7840 | |

| Annual increasing rate | % | −3 | −3 | 0.11 | 0 | −4 | −5 | −2 |

| Technology Type | COAL | GAS | HD | NU | WD | PV | BM |

|---|---|---|---|---|---|---|---|

| (years) | 30 | 30 | 70 | 60 | 20 | 20 | 20 |

| Technology Type | COAL | GAS | HD | NU | WD | PV | BM |

|---|---|---|---|---|---|---|---|

| (h) | 5031 | 4000 | 3429 | 7924 | 2097 | 1700 | 3372 |

| Technology Type | Unit | COAL | GAS | HD | NU | WD | PV | BM |

|---|---|---|---|---|---|---|---|---|

| RMB/MWh | 35 | 35 | 12 | 7 | 0 | 0 | 70 | |

| RMB/kW-year | 315 | 70 | 580 | 700 | 580 | 515 | 560 | |

| Annual increasing rate | % | −3 | −3 | 0.11 | 0 | −4 | −5 | −2 |

| Fuel consumption Rate | 2019 | 2035 |

|---|---|---|

| COAL (kgce/kWh) | 294 | 0.1855 |

| GAS (m3/kWh) | 271.443183 | 0.183 |

| Scenario | 2020 | 2025 | 2030 | 2035 |

|---|---|---|---|---|

| BAU | 0 | 0 | 53 | 59 |

| AG | 0 | 5 | 107 | 141 |

| AG vs BAU | 0 | 5 | 54 | 82 |

| Scenario | 2020 | 2025 | 2030 | 2035 |

|---|---|---|---|---|

| MO | 13.07% | 14.68% | 18.52% | 25.38% |

| BAU | 13.15% | 15.18% | 19.68% | 27.45% |

| AG | 13.35% | 16.06% | 21.21% | 29.51% |

| Scenario | COAL | GAS | BIGM | ||||||

|---|---|---|---|---|---|---|---|---|---|

| MO | BAU | AG | MO | BAU | AG | MO | BAU | AG | |

| 2020 | 8738 | 8750 | 8758 | 0 | 0 | 12 | 0 | 0 | 0 |

| 2025 | 8328 | 8731 | 8758 | 1 | 62 | 221 | 0 | 5 | 82 |

| 2030 | 4416 | 6131 | 7042 | 6693 | 8278 | 8684 | 3 | 107 | 267 |

| 2035 | 2820 | 4629 | 5462 | 4190 | 6347 | 7237 | 0 | 141 | 316 |

| Scenario | Carbon Intensity (gCO2/kWh) | CO2 Emissions (Mt) | ||||

|---|---|---|---|---|---|---|

| MO | BAU | AG | MO | BAU | AG | |

| 2020 | 552.22 | 550.65 | 547.01 | 3912.79 | 3901.70 | 3875.89 |

| 2025 | 481.18 | 471.36 | 454.17 | 4010.38 | 3928.58 | 3785.30 |

| 2030 | 391.21 | 353.21 | 308.01 | 3779.87 | 3412.68 | 2975.94 |

| 2035 | 315.16 | 259.39 | 210.00 | 3296.55 | 2713.26 | 2196.63 |

| Scenario | COAL | GAS | ||

|---|---|---|---|---|

| BAU | AG | BAU | AG | |

| 2020 | 0.4304 | 0.4304 | 0.2650 | 0.2650 |

| 2025 | 0.4035 | 0.4037 | 0.2215 | 0.2199 |

| 2030 | 0.3373 | 0.3350 | 0.6252 | 0.6455 |

| 2035 | 0.2878 | 0.2861 | 0.5256 | 0.5430 |

| Scenario | Carbon intensity (gCO2/kWh) | CO2 emissions (Mt) | ||||

| BAU | MO | BAU vs MO | BAU | MO | BAU vs MO | |

| 2030 | 353.21 | 384.34 | −31.13 | 3412.68 | 3713.58 | −300.9 |

| 2035 | 259.39 | 281.81 | −22.42 | 2713.26 | 2947.75 | −234.49 |

| Scenario | Carbon price (RMB/t) | CO2 revenue (billion RMB) | ||||

| BAU | MO | BAU vs MO | BAU | MO | BAU vs MO | |

| 2030 | 380 | 50 | 330 | 1296.82 | 1856.79 | 1111.14 |

| 2035 | 530 | 50 | 480 | 1438.03 | 1473.87 | 1290.64 |

| Scenario | RES | CO2 Emissions (Mt) | ||||

|---|---|---|---|---|---|---|

| MO | BAU | AG | MO | BAU | AG | |

| Demand response | 27% | 27% | 2713.26 | 2636.67 | ||

| Power marketization process | 25% | 27% | 30% | 3296.55 | 2713.26 | 2196.63 |

| Reserve capacity adjustment of thermal power units | 27% | 27% | 2713.26 | 2708.11 | ||

| Carbon policy | 27% | 27% | 2947.75 | 2713.26 | ||

| Scenario | Gas capacity Factor | Goal capacity Factor | ||||

|---|---|---|---|---|---|---|

| MO | BAU | AG | MO | BAU | AG | |

| Demand response | 53% | 57% | 29% | 28% | ||

| Power marketization process | 42% | 53% | 63% | 36% | 29% | 22% |

| Reserve capacity adjustment of Thermal power units | 53% | 54% | 29% | 29% | ||

| Carbon policy | 17% | 53% | 34% | 29% | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, P.; Li, M. Scenario Analysis in the Electric Power Industry under the Implementation of the Electricity Market Reform and a Carbon Policy in China. Energies 2019, 12, 2152. https://doi.org/10.3390/en12112152

Wang P, Li M. Scenario Analysis in the Electric Power Industry under the Implementation of the Electricity Market Reform and a Carbon Policy in China. Energies. 2019; 12(11):2152. https://doi.org/10.3390/en12112152

Chicago/Turabian StyleWang, Peng, and Meng Li. 2019. "Scenario Analysis in the Electric Power Industry under the Implementation of the Electricity Market Reform and a Carbon Policy in China" Energies 12, no. 11: 2152. https://doi.org/10.3390/en12112152

APA StyleWang, P., & Li, M. (2019). Scenario Analysis in the Electric Power Industry under the Implementation of the Electricity Market Reform and a Carbon Policy in China. Energies, 12(11), 2152. https://doi.org/10.3390/en12112152