Economic Optimal Implementation of Virtual Power Plants in the German Power Market

Abstract

1. Introduction

- Data collection of load schemes and market prices (EEX, EPEX) for several market products (base, peak, off-peak, etc.).

- Adaptation of load data to the market products.

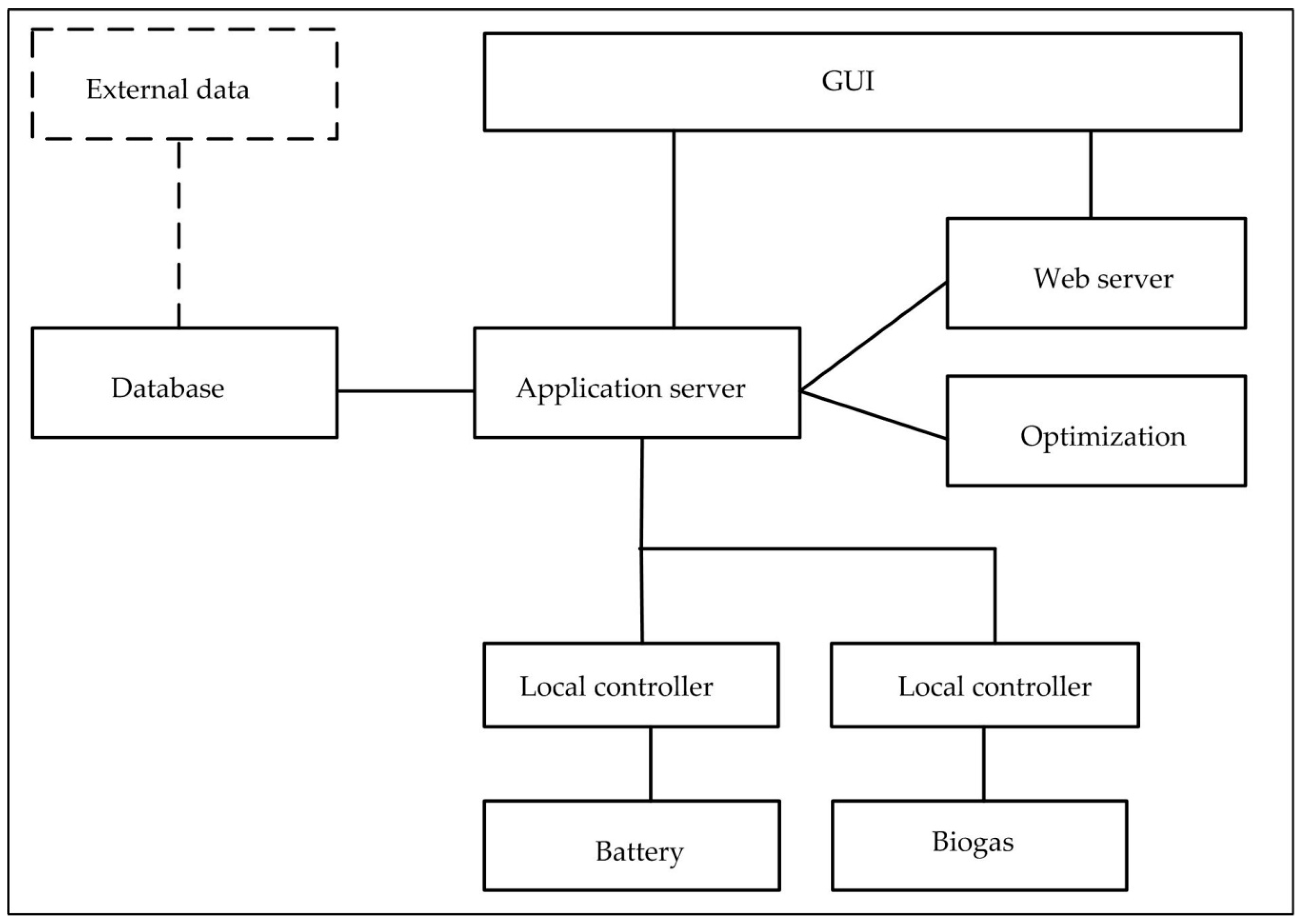

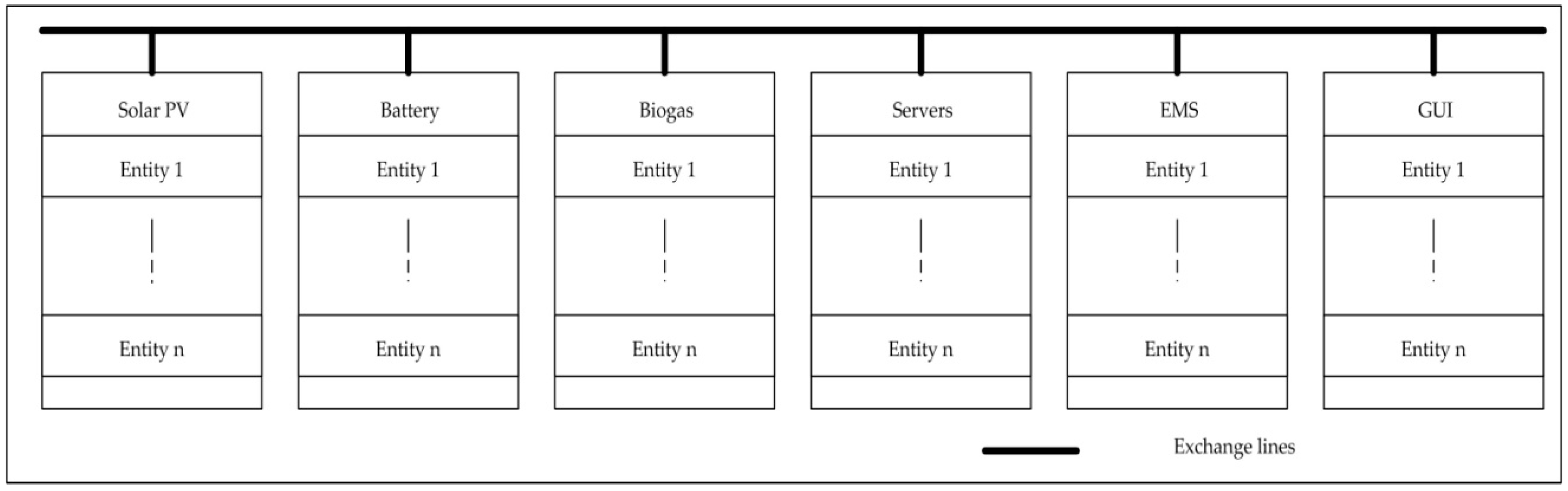

- Design of adapted VPP configurations, including an optimization concept and an information communication technology (ICT) concept.

- Balance of generation and load in an energy management algorithm.

- Sensitivity analyses to adapt and test the VPP components on different market products.

- Calculation of the contribution margin of the VPP in the analyzed scenarios.

2. Materials and Methods

2.1. Material

2.1.1. Load Profile

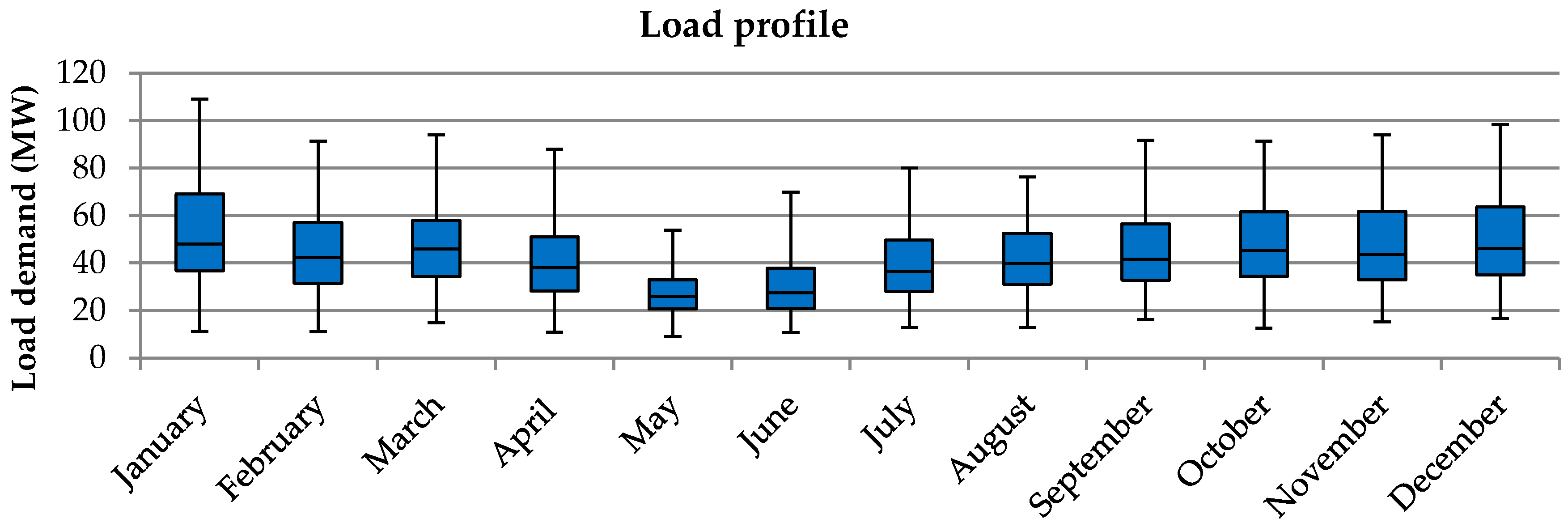

- Visualizing the load data from a twelve-month load profile. The twelve-month load profile showed the load fluctuations over a year by representing a monthly range of load data. The twelve-month load profile of analyzed data (Figure 2) showed an overview of load conditions over the year 2015, which fluctuated between 8 MW and 110 MW.

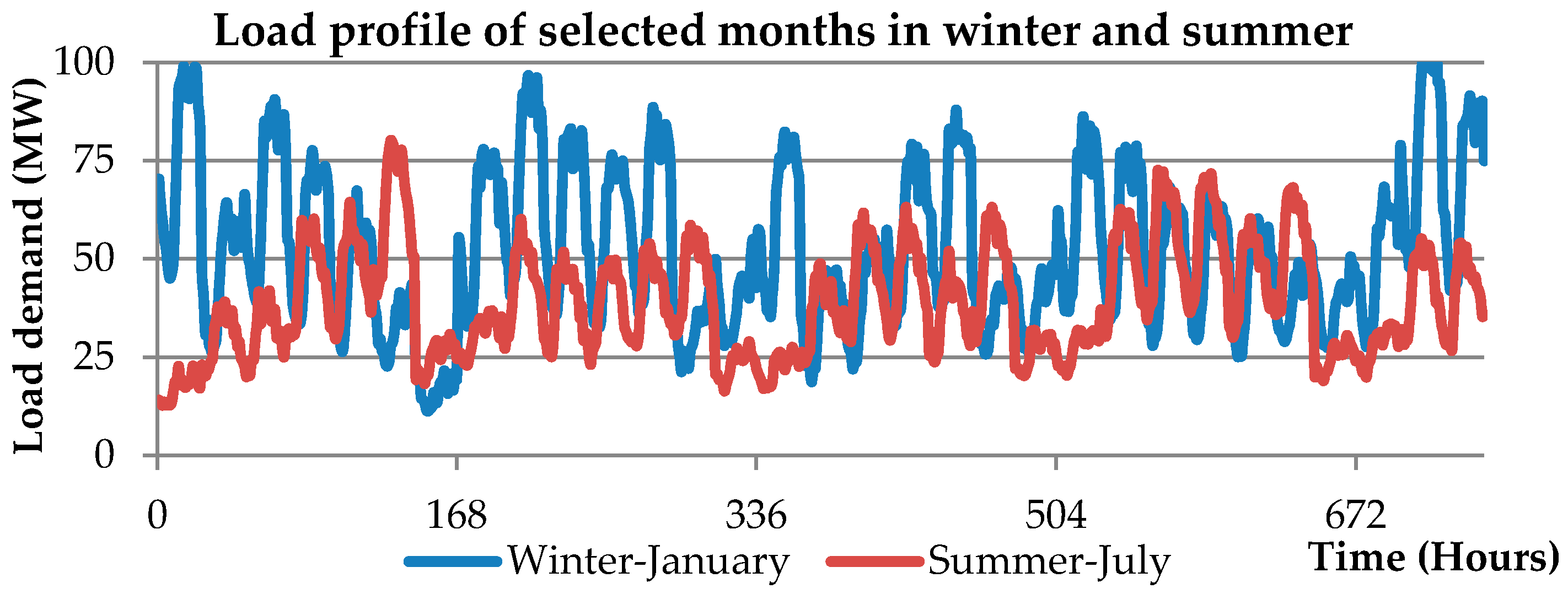

- Selecting a month. The maximum load range occurred during the winter and the summer periods. The load in January and the load in July from (Figure 2) were selected to represent the months that had the highest load levels in winter and summer, respectively. The four-week load data for these selected months were then visualized in an hourly-interval load profile (Figure 3).

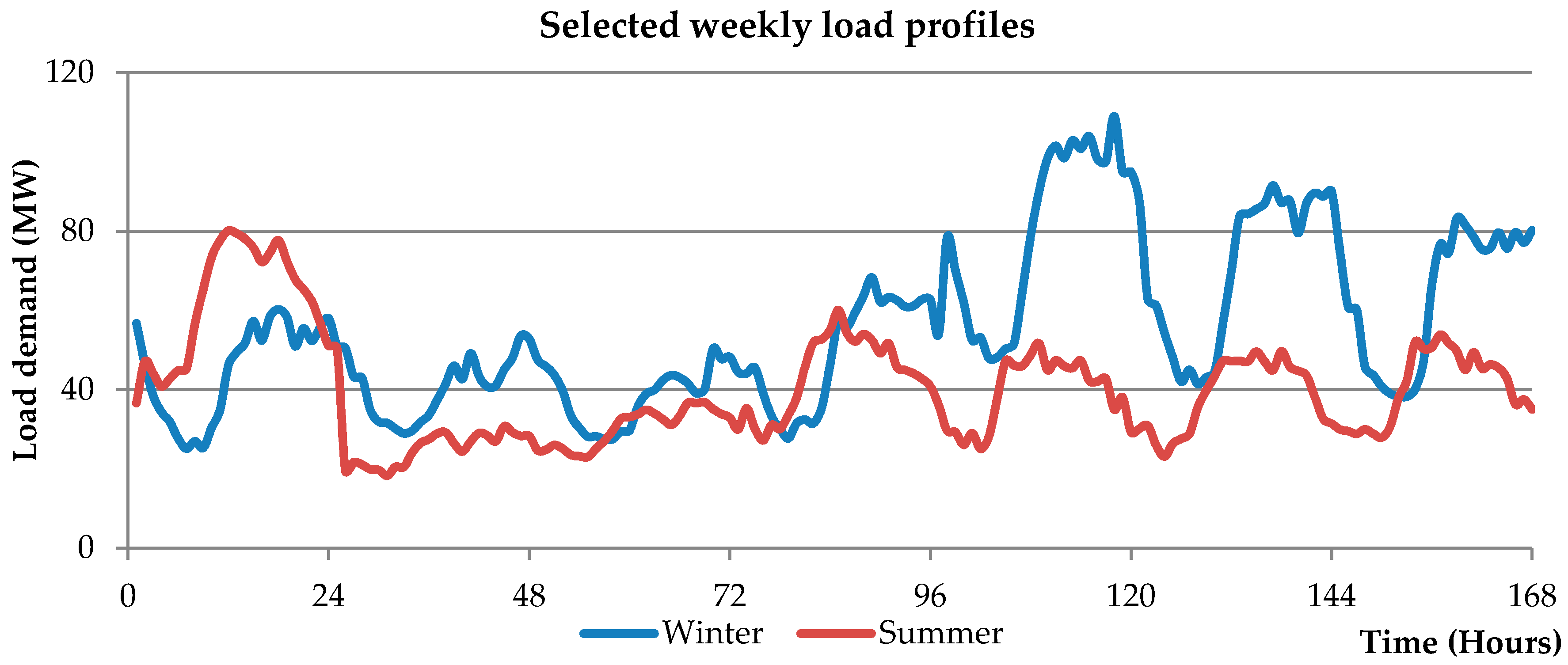

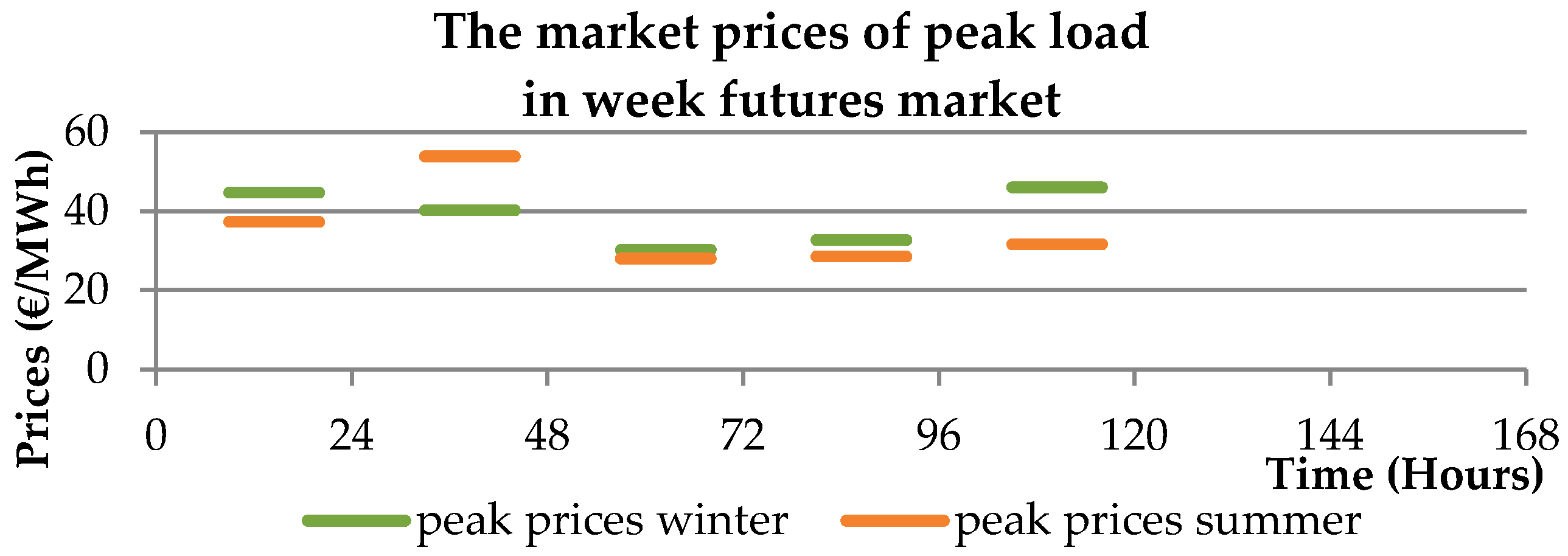

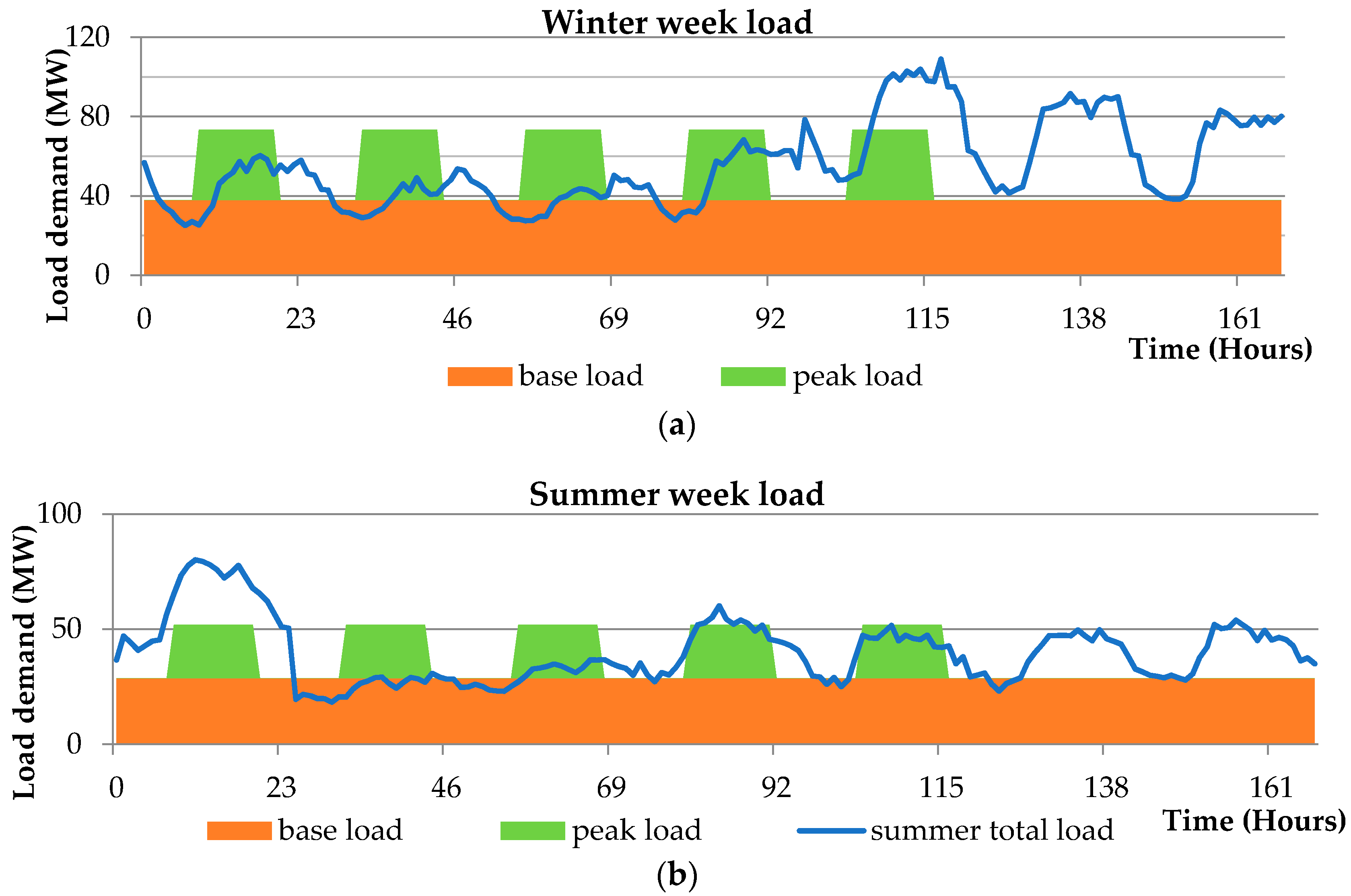

- Selecting a week load data from the selected months. There were no specific criteria in this study for selecting the weekly load data from the selected months over summer and winter (Figure 3). The second week in July and the fourth week in January were randomly selected to be analyzed in this study (Figure 4). These weekly load data over summer and winter were then used in the Week Futures (WF) market.

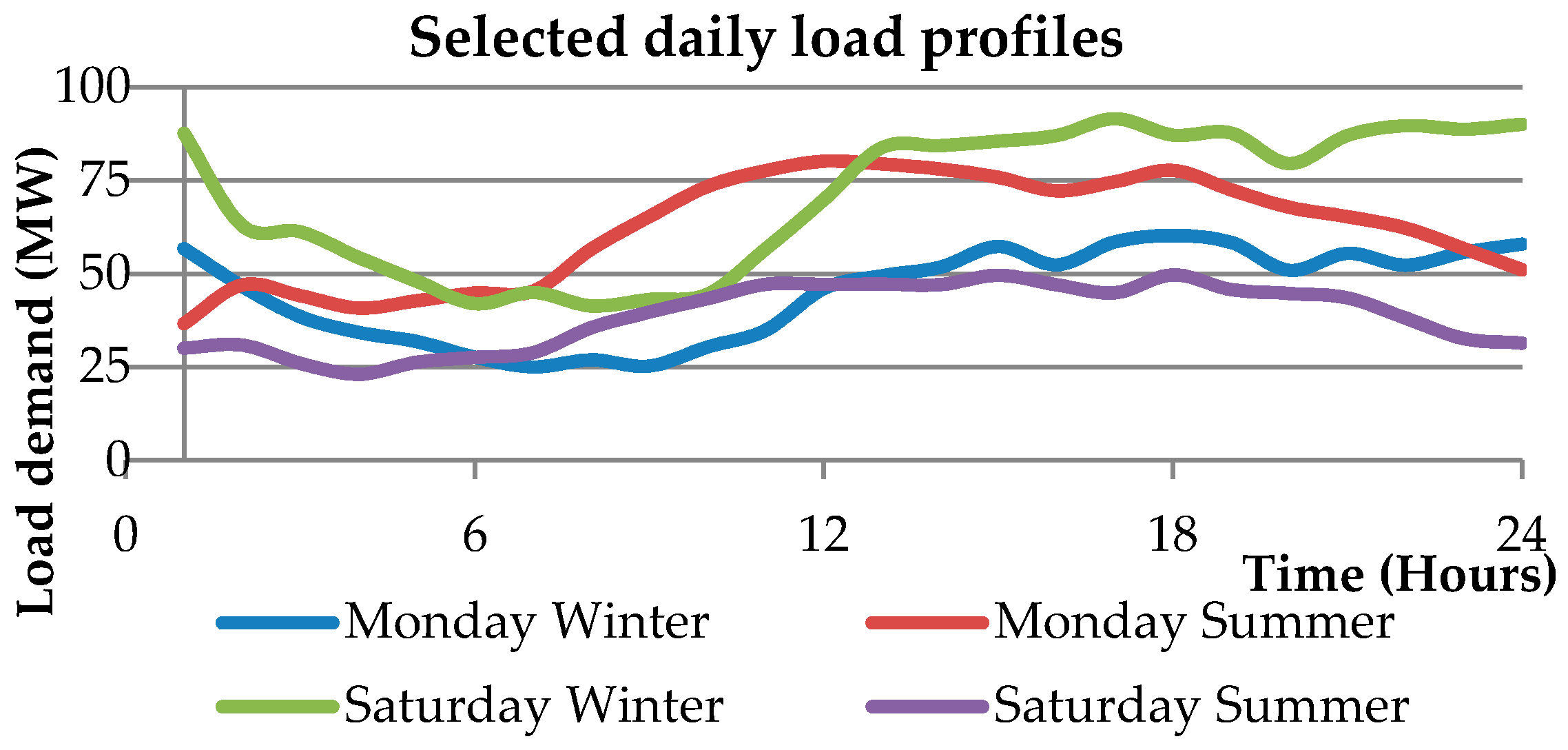

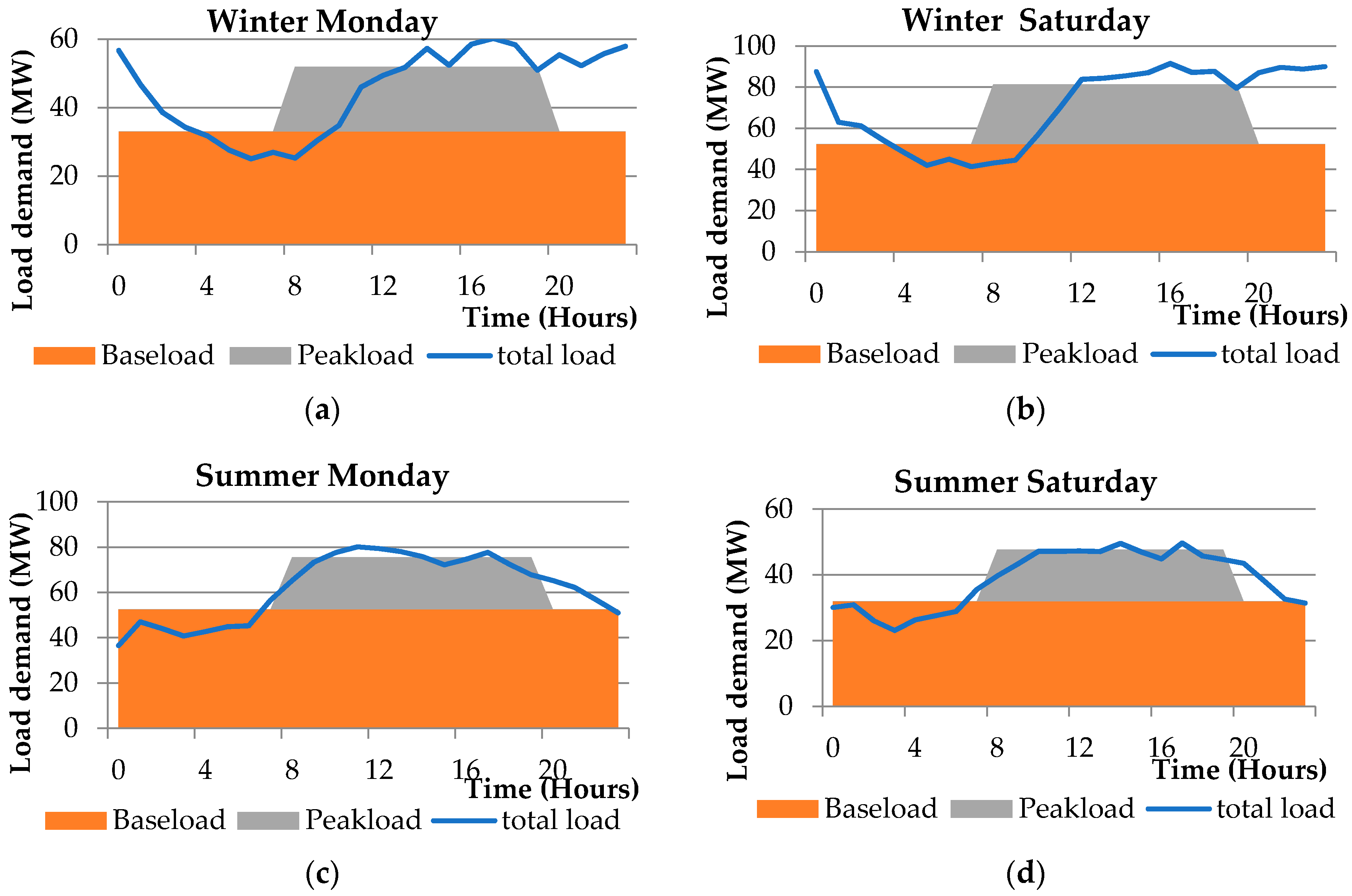

- Selecting two days from the weekly load profiles over summer and over winter as the samples of the load profiles in the Day-Ahead (DA) market in the SPOT market. As can be seen in the load profile in Figure 4, the highest loads during workdays in winter or in summer occurred on Monday, whereas the highest loads during weekends in winter or in summer occurred on Saturday. Thus, Monday and Saturday were selected to be used in the Day-Ahead market operation of the VPP (Figure 5).

2.1.2. Market Prices Data and Market Products

2.1.3. Adaptation of Load Data to Market Products

2.2. Methods

2.2.1. The Configuration of the VPP

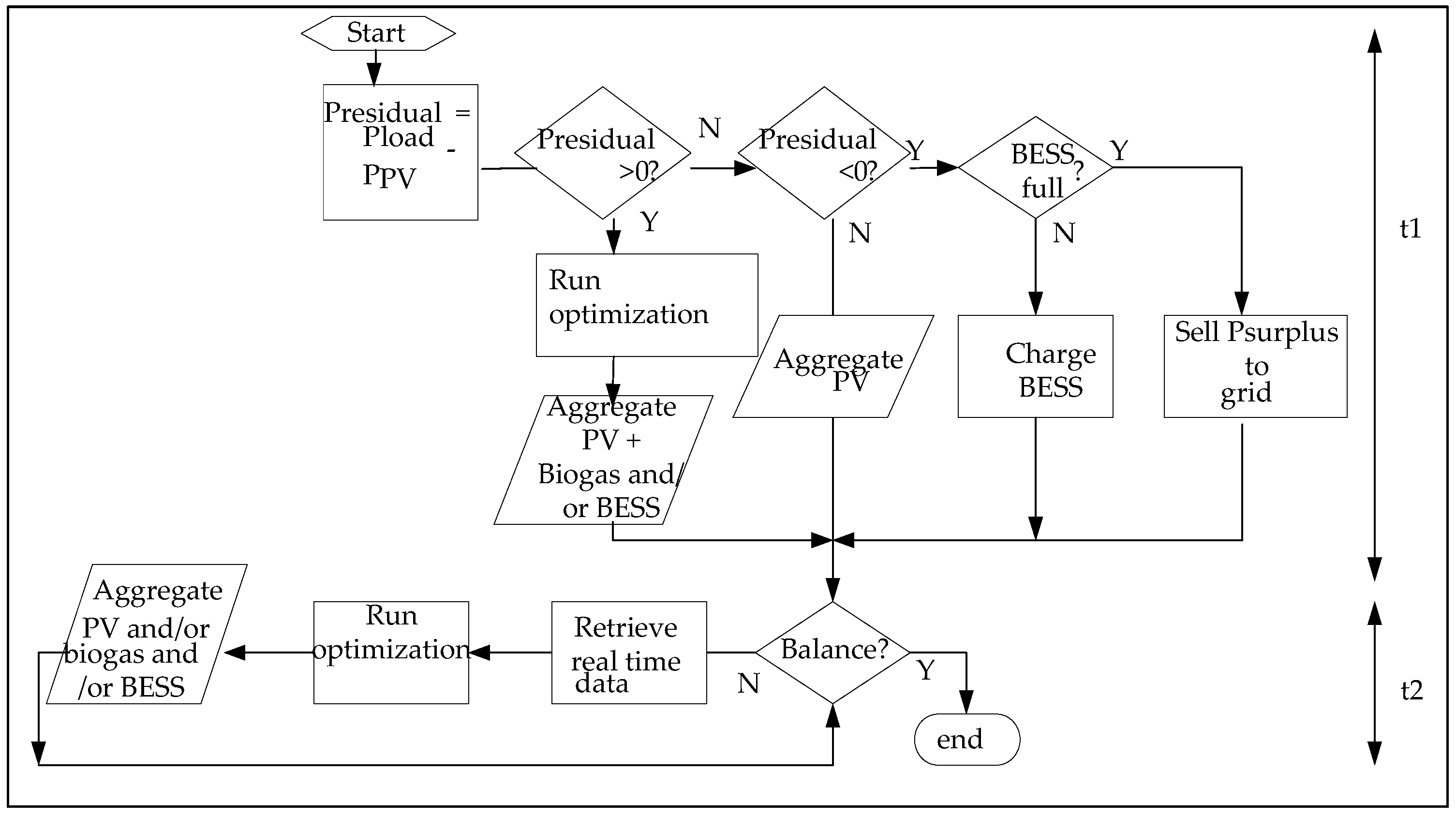

2.2.2. Energy Management

- (a)

- The highest priority to meet the load demand was given to the power plants with the lowest marginal costs. Assuming that the sorted power plants, as based on marginal costs from the lowest to the highest, were the solar PV, the battery energy storage system (BESS), and the flexible biogas, the solar PV thus had the highest priority to meet the load. If the solar PV did not generate enough energy to meet the load, then the energy from the flexible biogas would be combined with the energy from the BESS (if applicable). If the solar PV generated more energy than the load, then the surplus energy from the solar PV would be stored into the BESS (in the case that state-of-charge (SOC) <100%, otherwise there would be nothing to do).

- (b)

- As a result of biological constraints such as digestion time, the flexible biogas may need more time to aggregate its energy than the BESS. Thus, a BESS is still needed to support the flexible biogas in the operation of the VPP. If more/different intermittent RES were installed, that is, wind turbine power plants, the contribution of the BESS in the load could be minimized.

- (c)

- The energy exchange was calculated at time t1, and then it was optimized again at time t2. Time t1 is the time when the aggregator or the operator makes the dispatch schedule for the Day-Ahead or Week Futures markets, such as on the day before the required delivery time for the energy. Time t2 is the minimum time required to compensate the gap between the scheduled and the measured exchanged energies. The balance of generation and load in an energy management system at time t2 is conducted by a comparator algorithm. Future investigation of time t2 should be conducted in practical implementation. In this study, t2 was determined to be about 2 ms with reference to the measured exchange rate in the literature [47].

2.2.3. Sensitivity Analyses

2.2.4. Calculation of the Contribution Margin of the Economic Results

3. Results

4. Discussion

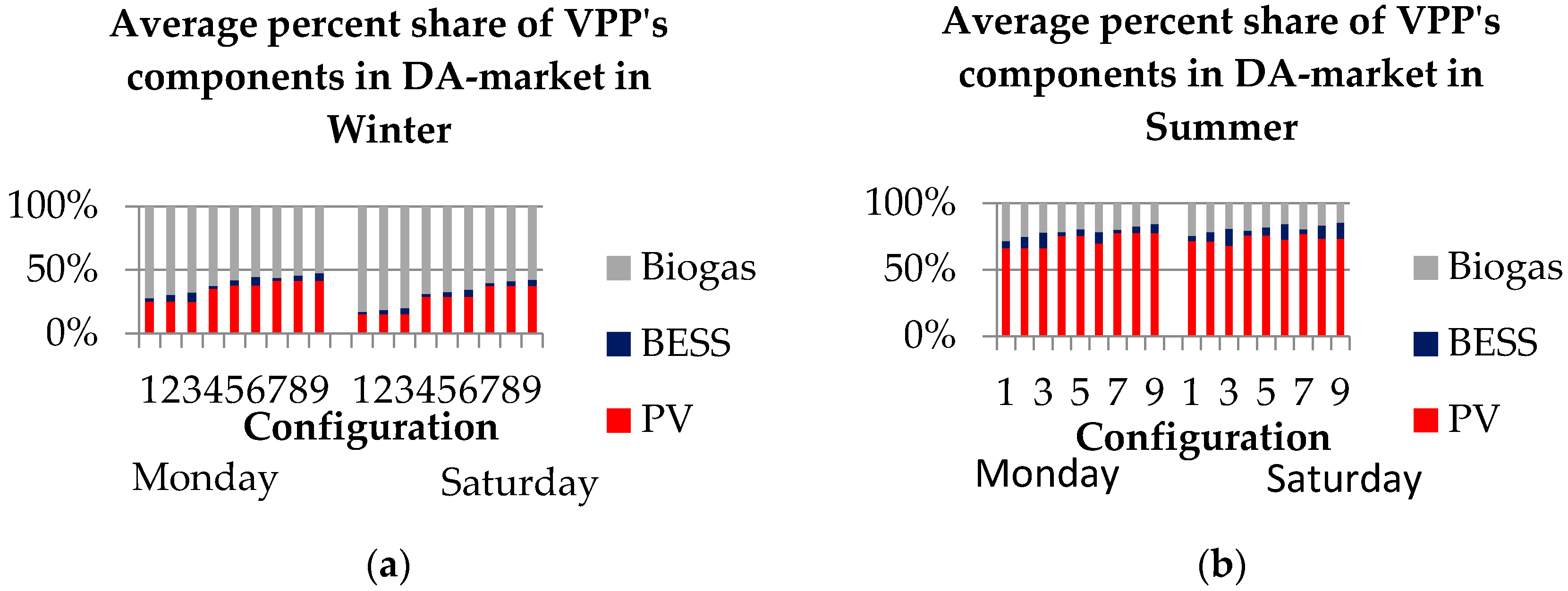

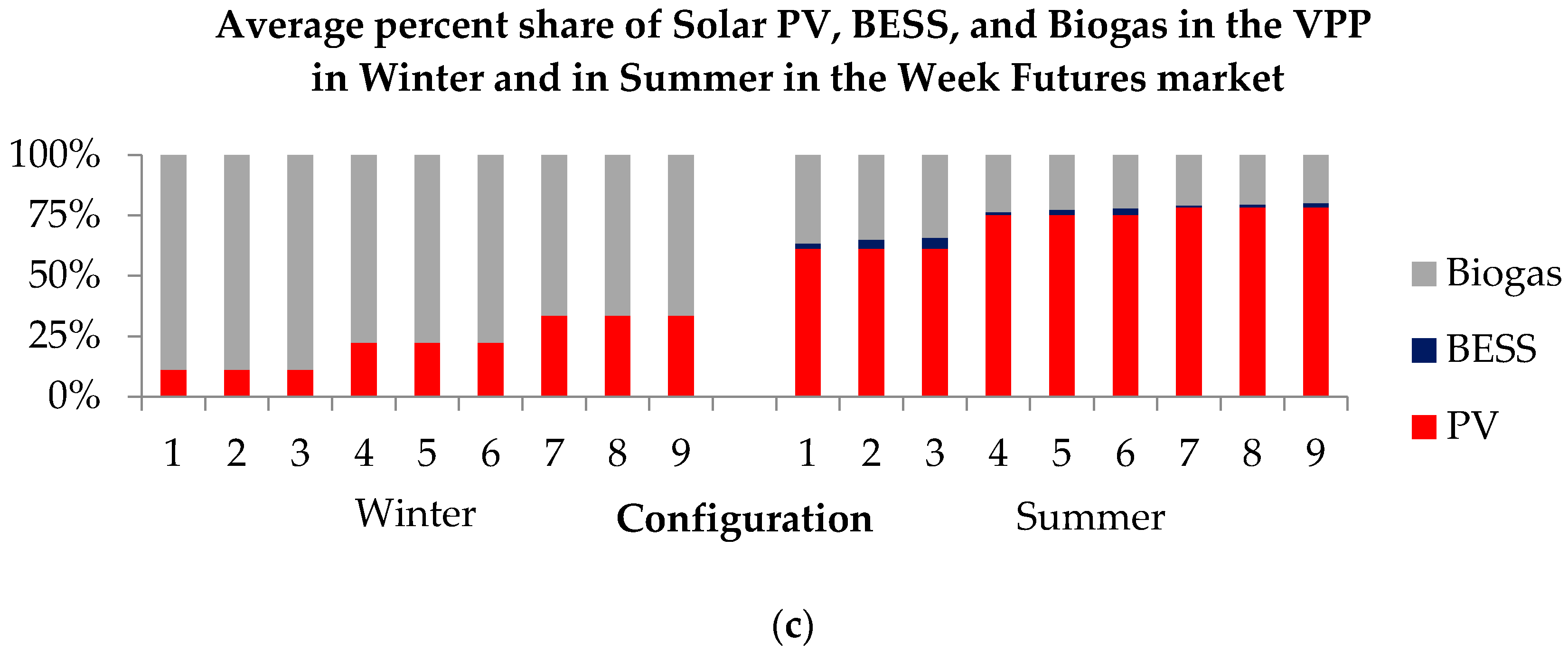

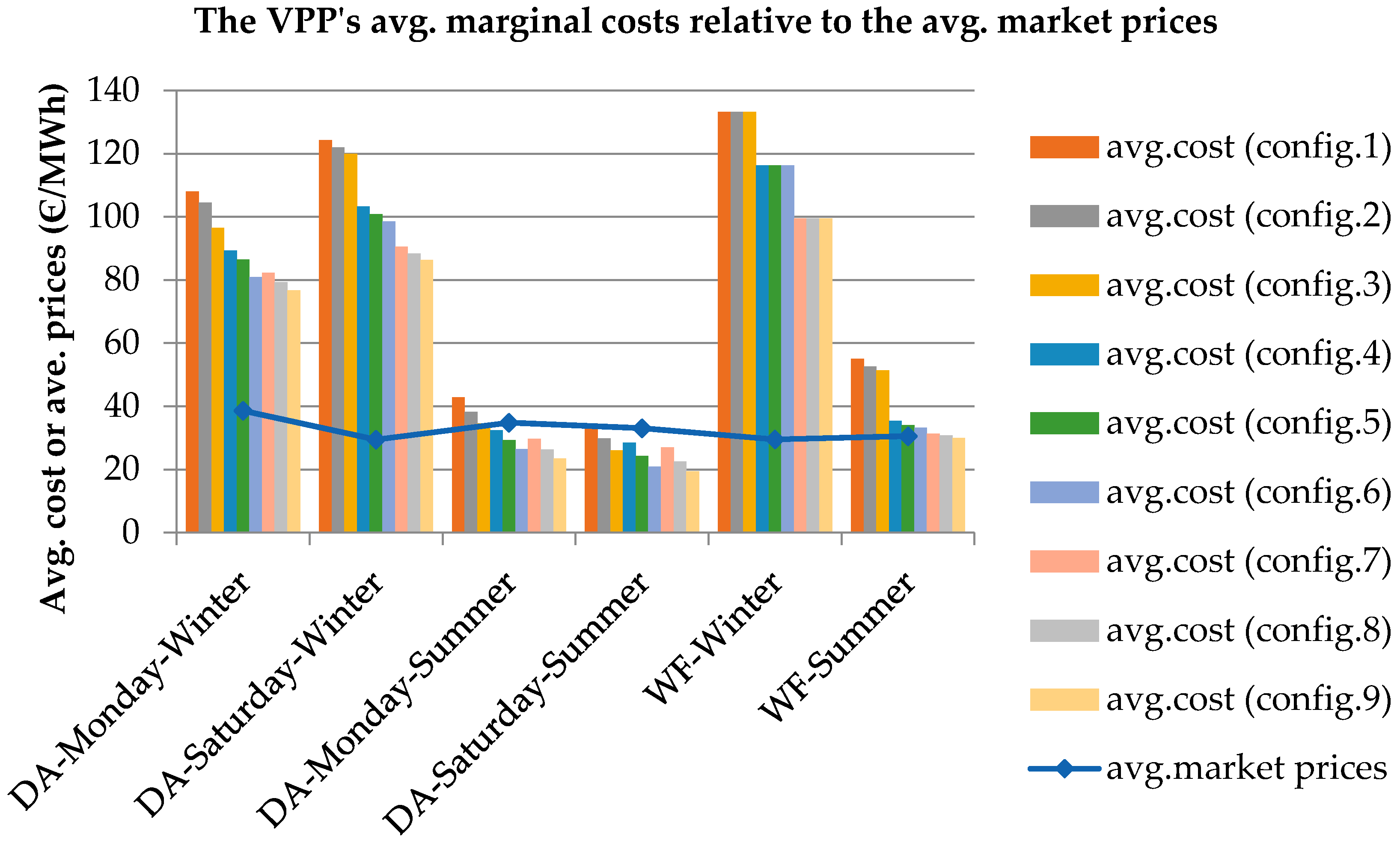

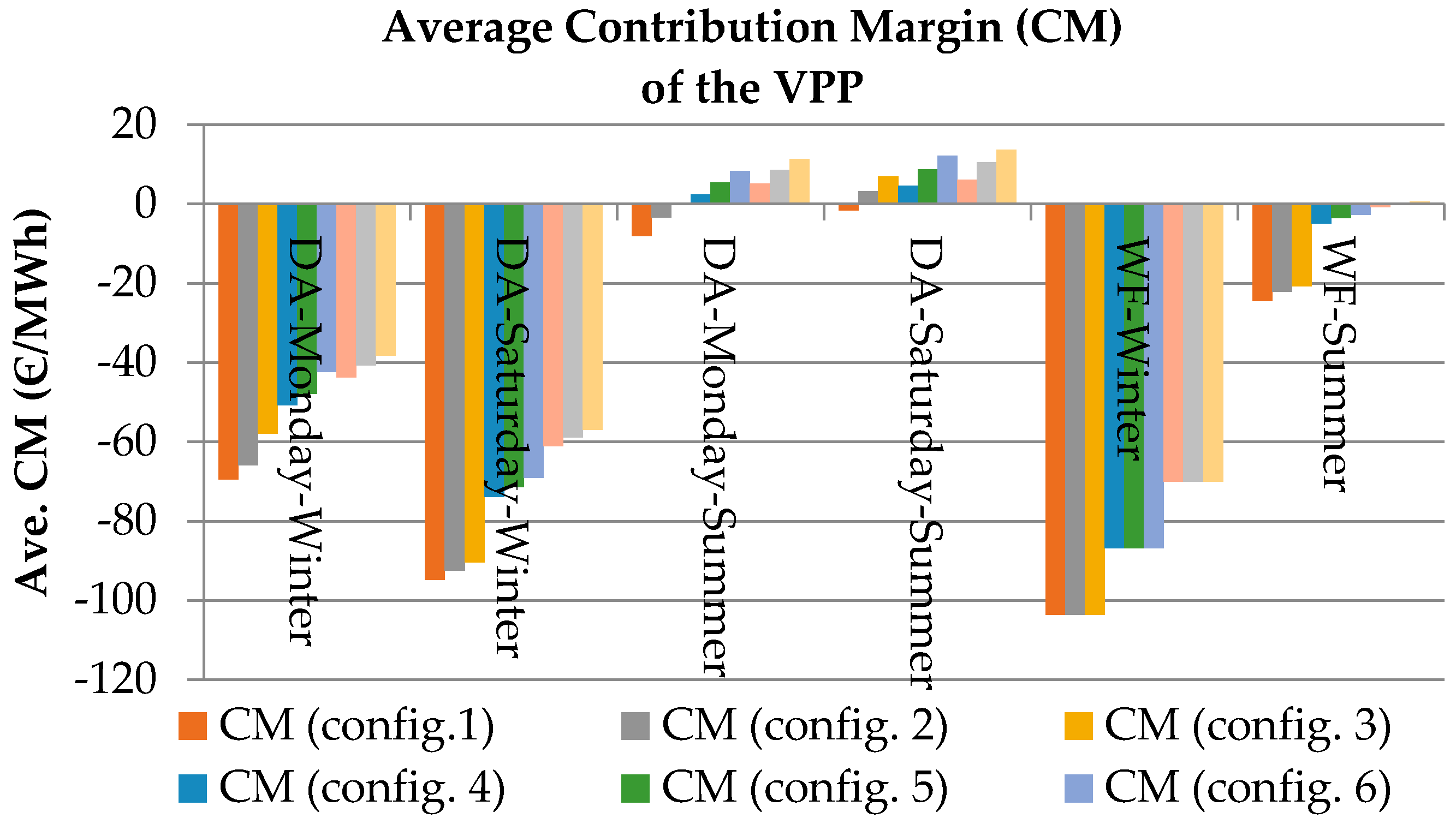

- The energy availability and the marginal costs of the VPP’s components influence decisions on economic optimal VPP configurations for different market products. In this study, it was found that biogas, as a flexible energy resource, followed by solar PV and BESS in the VPP, takes up most of the time in covering load demand as compared with other dependent RES. With the help of an energy management algorithm, the configuration of RES in the VPP will change automatically to their economic optimal compositions.

- Additionally, the size of the VPP components was positively correlated to the components’ share of the energy generated. For an economic optimization, it is thus necessary to maximize the share of cheap stochastic power sources and reduce the amount of expensive deterministic sources. Such can be done by limiting the power of wind and solar power plants in relation to the deterministic sources, so that less power peaks have to be integrated in the power band.

- The organization of RES in VPPs leads to the generation of secured power generation instead of fluctuating power generation. This secured power could be sold in the Futures market at higher and more stable prices compared with the status quo.

5. Conclusions

- for all 9 VPP-configurations in the Day-Ahead and futures market, there were different figures in the economic optimal VPP configuration and contribution margin of the different load schemes. It was not only determined how the VPP manages its resources, but also how the other factors influenced the VPP’s behavior. For instance, the economic optimal configuration of the VPP components (components and size) depends on season, the kind of power plants, and the load profile. As “season” is an external variable that cannot be influenced, and the decision for the VPP components cannot not be changed when undertaken, the selection of the marketing channels allows the greatest chance to maximize the contribution margin.

- The organization of RES in the VPP leads to the generation of secured instead of fluctuating power generation. This secured power could be sold in the futures market at higher and more stable prices compared with the status quo. From this, the average contribution margin of power from RES will increase, and less financial support will be necessary to cover the full costs of RES. By delivering secured power, RES will become competitive against conventional power plants, so that competitive market measures could be used to generate funds (e.g., capacity credits and measurements according to §39j EEG “innovation tender”), which will cause less turbulence in the market compared with the present priority purchase methods that are being used for RES power.

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Abbreviations | |

| MWMN | Monday Winter Middle-Night |

| MWEM | Monday Winter Early Morning |

| MWLM | Monday Winter Late Morning |

| MWEA | Monday Winter Early Afternoon |

| MWRH | Monday Winter Rush-Hour |

| MWOP2 | Monday Winter Off-Peak 2 |

| MWBL | Monday Winter Baseload |

| MWPL | Monday Winter Peakload |

| MWN | Monday Winter Night |

| MWOP1 | Monday Winter Off-Peak 1 |

| MWB | Monday Winter Business |

| MWOP | Monday Winter Off-Peak |

| MWM | Monday Winter Morning |

| MWHN | Monday Winter High Noon |

| MWA | Monday Winter Afternoon |

| MWE | Monday Winter Evening |

| MWSP | Monday Winter Sun Peak |

| MSMN | Monday Summer Middle-Night |

| MSEM | Monday Summer Early Morning |

| MSLM | Monday Summer Late Morning |

| MSEA | Monday Summer Early Afternoon |

| MSRH | Monday Summer Rush-Hour |

| MSOP2 | Monday Summer Off-Peak 2 |

| MSBL | Monday Summer Baseload |

| MSPL | Monday Summer Peakload |

| MSN | Monday Summer Night |

| MSOP1 | Monday Summer Off-Peak 1 |

| MSB | Monday Summer Business |

| MSOP | Monday Summer Off-Peak |

| MSM | Monday Summer Morning |

| MSHN | Monday Summer High Noon |

| MSA | Monday Summer Afternoon |

| MSE | Monday Summer Evening |

| MSSP | Monday Summer Sun Peak |

| WF_SBL | Week Futures Summer Baseload |

| WF_SPL | Week Futures Summer Peakload |

| MWF_WBL | Monday Week Futures Winter Baseload |

| TWF_WBL | Tuesday Week Futures Winter Baseload |

| WWF_WBL | Wednesday Week Futures Winter Baseload |

| ThWF_WBL | Thursday Week Futures Winter Baseload |

| FWF_WBL | Friday Week Futures Winter Baseload |

| SWF_WBL | Saturday Week Futures Winter Baseload |

| SuWF_WBL | Sunday Week Futures Winter Baseload |

| MWF_WPL | Monday Week Futures Winter Peakload |

| TWF_WPL | Tuesday Week Futures Winter Peakload |

| WWF_WPL | Wednesday Week Futures Winter Peakload |

| ThWF_WPL | Thursday Week Futures Winter Peakload |

| FWF_WPL | Friday Week Futures Winter Peakload |

| PL | Peak Load |

| BL | Base Load |

| EA | Early Afternoon |

| B | Business |

| HN | High-Noon |

| SP | Sun Peak |

| MW | Monday Winter |

| SWMN | Saturday Winter Middle-Night |

| SWEM | Saturday Winter Early Morning |

| SWLM | Saturday Winter Late Morning |

| SWEA | Saturday Winter Early Afternoon |

| SWRH | Saturday Winter Rush-Hour |

| SWOP2 | Saturday Winter Off-Peak 2 |

| SWBL | Saturday Winter Baseload |

| SWPL | Saturday Winter Peakload |

| SWN | Saturday Winter Night |

| SWOP1 | Saturday Winter Off-Peak 1 |

| SWB | Saturday Winter Business |

| SWOP | Saturday Winter Off-Peak |

| SWM | Saturday Winter Morning |

| SWHN | Saturday Winter High Noon |

| SWA | Saturday Winter Afternoon |

| SWE | Saturday Winter Evening |

| SWSP | Saturday Winter Sun Peak |

| SSMN | Saturday Summer Middle-Night |

| SSEM | Saturday Summer Early Morning |

| SSLM | Saturday Summer Late Morning |

| SSEA | Saturday Summer Early Afternoon |

| SSRH | Saturday Summer Rush-Hour |

| SSOP2 | Saturday Summer Off-Peak 2 |

| SSBL | Saturday Summer Baseload |

| SSPL | Saturday Summer Peakload |

| SSN | Saturday Summer Night |

| SSOP1 | Saturday Summer Off-Peak 1 |

| SSB | Saturday Summer Business |

| SSOP | Saturday Summer Off-Peak |

| SSM | Saturday Summer Morning |

| SSHN | Saturday Summer High Noon |

| SSA | Saturday Summer Afternoon |

| SSE | Saturday Summer Evening |

| SSSP | Saturday Summer Sun Peak |

| WF_WBL | Week Futures Winter Baseload |

| WF_WPL | Week Futures Winter Peakload |

| MWF_SBL | Monday Week Futures Summer Baseload |

| TWF_SBL | Tuesday Week Futures Summer Baseload |

| WWF_SBL | Wednesday Week Futures Summer Baseload |

| ThWF_SBL | Thursday Week Futures Summer Baseload |

| FWF_SBL | Friday Week Futures Summer Baseload |

| SWF_SBL | Saturday Week Futures Summer Baseload |

| SuWF_SBL | Sunday Week Futures Summer Baseload |

| MWF_SPL | Monday Week Futures Summer Peakload |

| TWF_SPL | Tuesday Week Futures Summer Peakload |

| WWF_SPL | Wednesday Week Futures Summer Peakload |

| ThWF_SPL | Thursday Week Futures Summer Peakload |

| FWF_SPL | Friday Week Futures Summer Peakload |

| LM | Late Morning |

| M | Morning |

| RH | Rush-Hour |

| DA | Day-Ahead market |

| WF | Week Futures market |

| SW | Saturday Winter |

| SS | Saturday Summer |

| Variables | |

| BVOLx | bid volumes of specific market products x |

| x | the market products (see Table A1) such as base load, peak load, off-peak |

| Ptotl,k | a total load of the market category l at time k |

| Pbasel,k | abase load of the market category l at time k |

| Pavgl,k | avg. of load data of the market category l at time k |

| Paravgl,k | avg. deviation of load data of the market category l at time k |

| the peak load market product in winter in the Week Futures market | |

| the peak load market product in summer in the Week Futures market | |

| avg. of load data of Week Futures in winter at time k | |

| avg. deviation of load data of Week Futures in summer at time k | |

| Presl,k | the remaining load of the market category l at time k |

| sx | the number of the signal of the remaining load of the market product x |

| CMl | the average of contribution margin of the market category l at time k |

| Coptl | the average of the optimized cost of the market category l at time k |

| MPl | the average of the market prices of market category l at time k |

| l | the market categories (Table A5) |

| Constants | |

| =1 if k is equal to the times where the specific market product x occurs (see Block Times (h) in Table A2), otherwise 0 | |

| =1 is the signal of the remaining load existence in the specific market product x at time k when the remaining load is bigger than zero, otherwise 0 | |

| k | time 1 to n |

| n | =24 (for Day-Ahead market) or 168 (for Week Futures market) |

Appendix A

| Scenario | Market Types | Bid Types | Season | Day(s) | Date(s) | x |

|---|---|---|---|---|---|---|

| 1 | Day-Ahead (SPOT market) | Middle-Night Block | Winter | Monday | 26 January 2015 | 1 |

| 2 | Day-Ahead (SPOT market) | Early Morning Block | Winter | Monday | 26 January 2015 | 2 |

| 3 | Day-Ahead (SPOT market) | Late morning Block | Winter | Monday | 26 January 2015 | 3 |

| 4 | Day-Ahead (SPOT market) | Early Afternoon Block | Winter | Monday | 26 January 2015 | 4 |

| 5 | Day-Ahead (SPOT market) | Rush Hour Block | Winter | Monday | 26 January 2015 | 5 |

| 6 | Day-Ahead (SPOT market) | Off-Peak 2 Block | Winter | Monday | 26 January 2015 | 6 |

| 7 | Day-Ahead (SPOT market) | Baseload Block | Winter | Monday | 26 January 2015 | 7 |

| 8 | Day-Ahead (SPOT market) | Peakload Block | Winter | Monday | 26 January 2015 | 8 |

| 9 | Day-Ahead (SPOT market) | Night Block | Winter | Monday | 26 January 2015 | 9 |

| 10 | Day-Ahead (SPOT market) | Off-Peak 1 Block | Winter | Monday | 26 January 2015 | 10 |

| 11 | Day-Ahead (SPOT market) | Business Block | Winter | Monday | 26 January 2015 | 11 |

| 12 | Day-Ahead (SPOT market) | Off-Peak Block | Winter | Monday | 26 January 2015 | 12 |

| 13 | Day-Ahead (SPOT market) | Morning Block | Winter | Monday | 26 January 2015 | 13 |

| 14 | Day-Ahead (SPOT market) | High Noon Block | Winter | Monday | 26 January 2015 | 14 |

| 15 | Day-Ahead (SPOT market) | Afternoon Block | Winter | Monday | 26 January 2015 | 15 |

| 16 | Day-Ahead (SPOT market) | Evening Block | Winter | Monday | 26 January 2015 | 16 |

| 17 | Day-Ahead (SPOT market) | Sun Peak Block | Winter | Monday | 26 January 2015 | 17 |

| 18 | Day-Ahead (SPOT market) | Middle-Night Block | Winter | Saturday | 31 January 2015 | 18 |

| 19 | Day-Ahead (SPOT market) | Early Morning Block | Winter | Saturday | 31 January 2015 | 19 |

| 20 | Day-Ahead (SPOT market) | Late morning Block | Winter | Saturday | 31 January 2015 | 20 |

| 21 | Day-Ahead (SPOT market) | Early Afternoon Block | Winter | Saturday | 31 January 2015 | 21 |

| 22 | Day-Ahead (SPOT market) | Rush Hour Block | Winter | Saturday | 31 January 2015 | 22 |

| 23 | Day-Ahead (SPOT market) | Off-Peak 2 Block | Winter | Saturday | 31 January 2015 | 23 |

| 24 | Day-Ahead (SPOT market) | Baseload Block | Winter | Saturday | 31 January 2015 | 24 |

| 25 | Day-Ahead (SPOT market) | Peakload Block | Winter | Saturday | 31 January 2015 | 25 |

| 26 | Day-Ahead (SPOT market) | Night Block | Winter | Saturday | 31 January 2015 | 26 |

| 27 | Day-Ahead (SPOT market) | Off-Peak 1 Block | Winter | Saturday | 31 January 2015 | 27 |

| 28 | Day-Ahead (SPOT market) | Business Block | Winter | Saturday | 31 January 2015 | 28 |

| 29 | Day-Ahead (SPOT market) | Off-Peak Block | Winter | Saturday | 31 January 2015 | 29 |

| 30 | Day-Ahead (SPOT market) | Morning Block | Winter | Saturday | 31 January 2015 | 30 |

| 31 | Day-Ahead (SPOT market) | High Noon Block | Winter | Saturday | 31 January 2015 | 31 |

| 32 | Day-Ahead (SPOT market) | Afternoon Block | Winter | Saturday | 31 January 2015 | 32 |

| 33 | Day-Ahead (SPOT market) | Evening Block | Winter | Saturday | 31 January 2015 | 33 |

| 34 | Day-Ahead (SPOT market) | Sun Peak Block | Winter | Saturday | 31 January 2015 | 34 |

| 35 | Day-Ahead (SPOT market) | Middle-Night Block | Summer | Monday | 6 July 2015 | 35 |

| 36 | Day-Ahead (SPOT market) | Early Morning Block | Summer | Monday | 6 July 2015 | 36 |

| 37 | Day-Ahead (SPOT market) | Late morning Block | Summer | Monday | 6 July 2015 | 37 |

| 38 | Day-Ahead (SPOT market) | Early Afternoon Block | Summer | Monday | 6 July 2015 | 38 |

| 39 | Day-Ahead (SPOT market) | Rush Hour Block | Summer | Monday | 6 July 2015 | 39 |

| 40 | Day-Ahead (SPOT market) | Off-Peak 2 Block | Summer | Monday | 6 July 2015 | 40 |

| 41 | Day-Ahead (SPOT market) | Baseload Block | Summer | Monday | 6 July 2015 | 41 |

| 42 | Day-Ahead (SPOT market) | Peakload Block | Summer | Monday | 6 July 2015 | 42 |

| 43 | Day-Ahead (SPOT market) | Night Block | Summer | Monday | 6 July 2015 | 43 |

| 44 | Day-Ahead (SPOT market) | Off-Peak 1 Block | Summer | Monday | 6 July 2015 | 44 |

| 45 | Day-Ahead (SPOT market) | Business Block | Summer | Monday | 6 July 2015 | 45 |

| 46 | Day-Ahead (SPOT market) | Off-Peak Block | Summer | Monday | 6 July 2015 | 46 |

| 47 | Day-Ahead (SPOT market) | Morning Block | Summer | Monday | 6 July 2015 | 47 |

| 48 | Day-Ahead (SPOT market) | High Noon Block | Summer | Monday | 6 July 2015 | 48 |

| 49 | Day-Ahead (SPOT market) | Afternoon Block | Summer | Monday | 6 July 2015 | 49 |

| 50 | Day-Ahead (SPOT market) | Evening Block | Summer | Monday | 6 July 2015 | 50 |

| 51 | Day-Ahead (SPOT market) | Sun Peak Block | Summer | Monday | 6 July 2015 | 51 |

| 52 | Day-Ahead (SPOT market) | Middle-Night Block | Summer | Saturday | 11 July 2015 | 52 |

| 53 | Day-Ahead (SPOT market) | Early Morning Block | Summer | Saturday | 11 July 2015 | 53 |

| 54 | Day-Ahead (SPOT market) | Late morning Block | Summer | Saturday | 11 July 2015 | 54 |

| 55 | Day-Ahead (SPOT market) | Early Afternoon Block | Summer | Saturday | 11 July 2015 | 55 |

| 56 | Day-Ahead (SPOT market) | Rush Hour Block | Summer | Saturday | 11 July 2015 | 56 |

| 57 | Day-Ahead (SPOT market) | Off-Peak 2 Block | Summer | Saturday | 11 July 2015 | 57 |

| 58 | Day-Ahead (SPOT market) | Baseload Block | Summer | Saturday | 11 July 2015 | 58 |

| 59 | Day-Ahead (SPOT market) | Peakload Block | Summer | Saturday | 11 July 2015 | 59 |

| 60 | Day-Ahead (SPOT market) | Night Block | Summer | Saturday | 11 July 2015 | 60 |

| 61 | Day-Ahead (SPOT market) | Off-Peak 1 Block | Summer | Saturday | 11 July 2015 | 61 |

| 62 | Day-Ahead (SPOT market) | Business Block | Summer | Saturday | 11 July 2015 | 62 |

| 63 | Day-Ahead (SPOT market) | Off-Peak Block | Summer | Saturday | 11 July 2015 | 63 |

| 64 | Day-Ahead (SPOT market) | Morning Block | Summer | Saturday | 11 July 2015 | 64 |

| 65 | Day-Ahead (SPOT market) | High Noon Block | Summer | Saturday | 11 July 2015 | 65 |

| 66 | Day-Ahead (SPOT market) | Afternoon Block | Summer | Saturday | 11 July 2015 | 66 |

| 67 | Day-Ahead (SPOT market) | Evening Block | Summer | Saturday | 11 July 2015 | 67 |

| 68 | Day-Ahead (SPOT market) | Sun Peak Block | Summer | Saturday | 11 July 2015 | 68 |

| 69 | Week Futures | Baseload | Winter | Monday to Sunday | 26 January 2015 to 1 February 2015 | 69 |

| 70 | Week Futures | Peakload | Winter | Monday to Sunday | 26 January 2015 to 1 February 2015 | 70 |

| 71 | Week Futures | Baseload | Summer | Monday to Sunday | 6–12 July 2015 | 71 |

| 72 | Week Futures | Peakload | Summer | Monday to Sunday | 6–12 July 2015 | 72 |

| No. | Market Types | Bid Types | Block Times (h) |

|---|---|---|---|

| 1 | Day-Ahead | Middle-Night Block | 01–04 |

| 2 | Day-Ahead | Early Morning Block | 05–08 |

| 3 | Day-Ahead | Late morning Block | 09–12 |

| 4 | Day-Ahead | Early Afternoon Block | 13–16 |

| 5 | Day-Ahead | Rush Hour Block | 17–20 |

| 6 | Day-Ahead | Off-Peak 2 Block | 21–24 |

| 7 | Day-Ahead | Baseload Block | 01–24 |

| 8 | Day-Ahead | Peakload Block | 08–20 |

| 9 | Day-Ahead | Night Block | 01–06 |

| 10 | Day-Ahead | Off-Peak 1 Block | 01–08 |

| 11 | Day-Ahead | Business Block | 09–16 |

| 12 | Day-Ahead | Off-Peak Block | 01–08 & 21–24 |

| 13 | Day-Ahead | Morning Block | 07–10 |

| 14 | Day-Ahead | High Noon Block | 11–14 |

| 15 | Day-Ahead | Afternoon Block | 15–18 |

| 16 | Day-Ahead | Evening Block | 19–24 |

| 17 | Day-Ahead | Sun Peak Block | 11–16 |

| 18 | Week Futures | Peakload Block | 08–20 (Monday–Friday) |

| 19 | Week Futures | Baseload Block | 01–24 (Monday–Sunday) |

| Bid Types | Prices (€/MWh) | Bid Types | Prices (€/MWh) | Bid Types | Prices (€/MWh) | Bid Types | Prices (€/MWh) |

|---|---|---|---|---|---|---|---|

| MWMN | 26 | SWMN | 26.64 | MSMN | 22.52 | SSMN | 35.23 |

| MWEM | 37.5 | SWEM | 25.4 | MSEM | 28.12 | SSEM | 29.84 |

| MWLM | 48.3 | SWLM | 29.14 | MSLM | 37.16 | SSLM | 30.43 |

| MWEA | 44.28 | SWEA | 28.5 | MSEA | 27.52 | SSEA | 28.26 |

| MWRH | 41.42 | SWRH | 40.39 | MSRH | 47.15 | SSRH | 33.65 |

| MWOP2 | 27.51 | SWOP2 | 28.81 | MSOP2 | 59.86 | SSOP2 | 41.88 |

| MWBL | 37.5 | SWBL | 29.81 | MSBL | 33.21 | SSBL | 37.05 |

| MWPL | 44.67 | SWPL | 32.68 | MSPL | 30.78 | SSPL | 37.28 |

| MWN | 26.15 | SWN | 26.11 | MSN | 21.61 | SSN | 33.06 |

| MWOP1 | 31.75 | SWOP1 | 26.02 | MSOP1 | 25.32 | SSOP1 | 32.54 |

| MWB | 46.29 | SWB | 28.82 | MSB | 32.34 | SSB | 29.34 |

| MWOP | 30.34 | SWOP | 26.95 | MSOP | 36.83 | SSOP | 35.65 |

| MWM | 49.4 | SWM | 27.35 | MSM | 38.76 | SSM | 31.28 |

| MWHN | 46.23 | SWHN | 28.84 | MSHN | 30.58 | SSHN | 29.25 |

| MWA | 42.4 | SWA | 33.12 | MSA | 31.84 | SSA | 28.11 |

| MWE | 31.84 | SWE | 33.62 | MSE | 59.16 | SSE | 40.7 |

| MWSP | 44.97 | SWSP | 28.78 | MSSP | 29.43 | SSSP | 28.59 |

| MWF_WBL | 37.50 | MWF_WPL | 44.67 | MWF_SBL | 37.05 | MWF_SPL | 37.28 |

| TWF_WBL | 32.94 | TWF_WPL | 40.21 | TWF_SBL | 49.02 | TWF_SPL | 53.83 |

| WWF_WBL | 28.18 | WWF_WPL | 30.19 | WWF_SBL | 29.57 | WWF_SPL | 27.98 |

| ThWF_WBL | 26.24 | ThWF_WPL | 32.7 | ThWF_SBL | 28.7 | ThWF_SPL | 28.5 |

| FWF_WBL | 38.24 | FWF_WPL | 46.04 | FWF_SBL | 32.14 | FWF_SPL | 31.62 |

| SWF_WBL | 29.81 | SWF_SBL | 33.21 | ||||

| SuWF_WBL | 29.23 | SuWF_SBL | 27.9 |

| Bid Types | Total Volumes (MWh) | Bid Types | Total Volumes (MWh) | Bid Types | Total Volumes (MWh) | Bid Types | Total Volumes (MWh) |

|---|---|---|---|---|---|---|---|

| MWMN | 44.09 | SWMN | 56.83 | MSMN | 0 | SSMN | 0 |

| MWEM | 0 | SWEM | 0 | MSEM | 0 | SSEM | 14.38 |

| MWLM | 29.65 | SWLM | 43.62 | MSLM | 86.47 | SSLM | 49.62 |

| MWEA | 78.79 | SWEA | 131.34 | MSEA | 95.49 | SSEA | 63.16 |

| MWRH | 95.95 | SWRH | 136.58 | MSRH | 82.63 | SSRH | 57.32 |

| MWOP2 | 89.29 | SWOP2 | 146.11 | MSOP2 | 35.67 | SSOP2 | 24.60 |

| MWBL | 792.41 | SWBL | 1255.63 | MSBL | 1259.63 | SSBL | 766.42 |

| MWPL | 227.47 | SWPL | 347.67 | MSPL | 277.05 | SSPL | 189.36 |

| MWN | 66.14 | SWN | 85.24 | MSN | 0 | SSN | 0 |

| MWOP1 | 88.18 | SWOP1 | 113.65 | MSOP1 | 32.62 | SSOP1 | 28.76 |

| MWB | 124.82 | SWB | 204.20 | MSB | 181.96 | SSB | 112.77 |

| MWOP | 200.08 | SWOP | 304.41 | MSOP | 92.50 | SSOP | 66.13 |

| MWM | 0 | SWM | 0 | MSM | 41.87 | SSM | 30.35 |

| MWHN | 49.99 | SWHN | 85.26 | MSHN | 105.20 | SSHN | 60.88 |

| MWA | 96.33 | SWA | 141.90 | MSA | 90.38 | SSA | 63.45 |

| MWE | 132.53 | SWE | 208.68 | MSE | 74.46 | SSE | 54.06 |

| MWSP | 93.61 | SWSP | 153.15 | MSSP | 148.25 | SSSP | 93.61 |

| WF_WBL | 6379.94 | ||||||

| WF_WPL | 2129.39 | ||||||

| WF_SBL | 4817.15 | ||||||

| WF_SPL | 1398.66 |

| No. | Market Categories | l |

|---|---|---|

| 1 | Day-Ahead Monday Winter | 1 |

| 2 | Day-Ahead Monday Summer | 2 |

| 3 | Day-Ahead Saturday Winter | 3 |

| 4 | Day-Ahead Saturday Summer | 4 |

| 5 | Week Futures Winter | 5 |

| 6 | Week Futures Summer | 6 |

References

- The Federal Ministry for Economic Affairs and Energy. Renewable Energy Sources in Figures. National and International Development. 2016. Available online: https://www.bmwi.de/Redaktion/EN/Publikationen/renewable-energy-sources-in-figures-2016.pdf?__blob=publicationFile&v=5 (accessed on 18 March 2018).

- Bundesverband der Energie—Und Wasserwirtschaft e.V. Foliensatz zur BDEW—Energie—Info Erneuerbare Energien und das EEG: Zahlen, Fakten, Grafiken (2017). Anlagen, Installierte Leistung, Stromerzeugung, Marktintegration der Erneuerbaren Energien, EEG-Auszahlungen und Regionale Verteilung der EEG-Anlagen. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwjglu7L1pncAhXBKJoKHb_3AMAQFggvMAA&url=https%3A%2F%2Fwww.bdew.de%2Fmedia%2Fdocuments%2FAwh_20170710_Erneuerbare-Energien-EEG_2017.pdf&usg=AOvVaw110BDCzB8uWNJv4GOyNbhO (accessed on 18 March 2018).

- Ziesing, H. Energy Consumption. in Germany in 2015. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwiEst2H2ZncAhXhB5oKHR31An4QFggyMAA&url=https%3A%2F%2Fag-energiebilanzen.de%2Findex.php%3Farticle_id%3D29%26fileName%3Dageb_jahresbericht2015_20160418_engl.pdf&usg=AOvVaw3A6wlJImHFPjoz0HtskctZ (accessed on 5 May 2018).

- Bundesnetzagentur für Elektrizität, Gas, Telekommunikation, Post und Eisenbahnen. Monitoring Report 2015. Available online: https://www.bundesnetzagentur.de/SharedDocs/Downloads/EN/BNetzA/PressSection/ReportsPublications/2015/Monitoring_Report_2015_Korr.pdf;jsessionid=3592D4D55ED7B30AC9C561D0CA5788B4?__blob=publicationFile&v=4 (accessed on 22 February 2018).

- Wassermann, S.; Reeg, M.; Nienhaus, K. Current challenges of Germany’s energy transition project and competing strategies of challengers and incumbents: The case of direct marketing of electricity from renewable energy sources. Energy Policy 2015, 76, 66–75. [Google Scholar] [CrossRef]

- Pollitt, M.G.; Anaya, K.L. Can current electricity markets cope with high shares of renewables? A comparison of approaches in Germany, the UK and the State of New York. Energy J. 2016, 37, 69–89. [Google Scholar] [CrossRef]

- Kopp, O.; Eßer-Frey, A.; Engelhorn, T. Können sich erneuerbare Energien langfristig auf wettbewerblich organisierten Strommärkten finanzieren? Z. Energiewirtschaft 2012, 36, 243–255. [Google Scholar] [CrossRef]

- Dotzauer, M.; Naumann, K.; Billig, E.; Thrän, D. Demand for the flexible provision of bioenergy carriers: An overview of the different energy sectors in Germany. In Smart Bioenergy; Springer: Heidelberg, Germany, 2015; pp. 11–31. [Google Scholar]

- Houwing, M.; Papaefthymiou, G.; Heijnen, P.W.; Ilic, M.D. Balancing wind power with virtual power plants of micro-CHPs. In Proceedings of the 2009 IEEE Bucharest Power Tech, Bucharest, Romania, 28 June–2 July 2009; pp. 1–6. [Google Scholar]

- Koraki, D.; Strunz, K. Wind and solar power integration in electricity markets and distribution networks through service-centric virtual power plants. IEEE Trans. Power Syst. 2017, 33, 473–485. [Google Scholar] [CrossRef]

- Garcia, H.E.; Mohanty, A.; Lin, W.-C.; Cherry, R.S. Dynamic analysis of hybrid energy systems under flexible operation and variable renewable generation—Part I: Dynamic performance analysis. Energy 2013, 52, 1–16. [Google Scholar] [CrossRef]

- Heide, D.; Greiner, M.; von Bremen, L.; Hoffmann, C. Reduced storage and balancing needs in a fully renewable european power system with excess wind and solar power generation. Renew. Energy 2011, 36, 2515–2523. [Google Scholar] [CrossRef]

- Gils, H.C. Balancing of Intermittent Renewable Power Generation by Demand Response and Thermal Energy Storage. Ph.D. Thesis, University of Stuttgart, Stuttgart, Germany, December 2015. [Google Scholar]

- Hochloff, P.; Braun, M. Optimizing biogas plants with excess power unit and storage capacity in electricity and control reserve markets. Biomass Bioenergy 2013, 65, 125–135. [Google Scholar] [CrossRef]

- Petersen, M.K.; Hansen, L.H.; Bendtsen, J.; Stoustrup, J. Market integration of virtual power plants. In Proceedings of the 52nd IEEE Conference on Decision and Control, Florence, Italy, 10–13 December 2013; pp. 2319–2325. [Google Scholar]

- Mashhour, E.; Moghaddas-Tafreshi, S.M. Bidding strategy of virtual power plant for participating in energy and spinning reserve markets—Part II: Numerical analysis. IEEE Trans. Power Syst. 2010, 26, 957–964. [Google Scholar] [CrossRef]

- Zamani, A.G.; Zakariazadeh, A.; Jadid, S. Day-ahead resource scheduling of a renewable energy based virtual power plant. Appl. Energy 2016, 169, 324–340. [Google Scholar] [CrossRef]

- Lukovic, S.; Kaitovic, I.; Mura, M.; Bondi, U. Virtual power plant as a bridge between distributed energy resources and smart grid. In Proceedings of the 2010 43rd Hawaii International Conference on System Sciences, Honolulu, HI, USA, 5–8 January 2010; pp. 1–8. [Google Scholar]

- Nikonowicz, L.; Milewski, J. Virtual power plants—general review: Structure, application and optimization. J. Power Technol. 2012, 92, 135–149. [Google Scholar]

- Däneka, C.; König, A.; Mayer, C.; Rohjan, S.; Bischoff, S.; Breuer, A.; Drzisga, T.; Hecht, J.; Holtermann, M.; Luhmann, T.; et al. Future Energy Grid: Migration to the Internet of Energy. Acatech Study. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=0ahUKEwjSvI6H9pncAhUGyKYKHYDnD1wQFgg0MAE&url=http%3A%2F%2Fwww.acatech.de%2Ffileadmin%2Fuser_upload%2FBaumstruktur_nach_Website%2FAcatech%2Froot%2Fde%2FPublikationen%2FEnglisch%2FEIT-ICT-Labs_acatech-Study_Future_Energy_Grid_final.pdf&usg=AOvVaw18kW8X6pcrEhM3g8Qnausr (accessed on 2 May 2018).

- Sexauer, S. Internet of Energy ICT for Energy Markets of the Future: The Energy Industry on the Way to the Internet Age. Available online: https://www.iese.fraunhofer.de/content/dam/iese/en/mediacenter/documents/BDI_initiative_IoE_us-IdE-Broschuere_tcm27-45653.pdf (accessed on 3 February 2018).

- Loßner, M.; Böttger, D.; Bruckner, T. Economic assessment of virtual power plants in the German energy market—A scenario-based and model-supported analysis. Energy Econ. 2017, 62, 125–138. [Google Scholar] [CrossRef]

- Sowa, T.; Krengel, S.; Koopmann, S.; Nowak, J. Multi-criteria operation strategies of power-to-heat-systems in virtual power plants with a high penetration of renewable energies. Energy Proc. 2014, 46, 237–245. [Google Scholar] [CrossRef]

- Plancke, G.; De Vos, K.; Belmans, R.; Delnooz, A. Virtual power plants: Definition, applications and barriers to the implementation in the distribution system. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar]

- Pandžić, H.; Morales, J.M.; Conejo, A.J.; Kuzle, I. Offering model for a virtual power plant based on stochastic programming. Appl. Energy 2013, 105, 282–292. [Google Scholar] [CrossRef]

- Arslan, O.; Karasan, O.E. Cost and emission impacts of virtual power plant formation in plug-in hybrid electric vehicle penetrated networks. Energy 2013, 60, 116–124. [Google Scholar] [CrossRef]

- Kok, K. The PowerMatcher: Smart Coordination for the Smart Electricity Grid. Ph.D. Thesis, Vrije Universiteit, Amsterdam, The Netherlands, 2013. [Google Scholar]

- Chen, Z. Virtual Power Plant Simulation and Control Scheme Design. Master’s Thesis, KTH Royal Institute of Technology, Stockholm, Sweden, 2012. [Google Scholar]

- Bahrami, S.; Amini, H.M.; Shafie-khah, M.; Catalao, J.P.S. A decentralized renewable generation management and demand response in power distribution networks. IEEE Trans. Sustain. Energy 2018. [Google Scholar] [CrossRef]

- Corera, J.; Maire, J. Flexible Electricity Networks to Integrate the Expected Energy Evolution. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=0ahUKEwiE44fe-pncAhWQxKYKHT34DuUQFgg7MAE&url=http%3A%2F%2Ffenix.iee.fraunhofer.de%2Fdocs%2Fatt2x%2F2009_Fenix_Book_FINAL_for_selfprinting.pdf&usg=AOvVaw3CARJB81POiwNDgRmolEiQ (accessed on 13 May 2018).

- Ghadivel, S.; Li, L.; Aghaei, J.; Yu, T.; Zhu, J. A review on the virtual power plant: Components and operation systems. In Proceedings of the 2016 IEEE International Conference on Power System Technology (POWERCON), Wollongong, NSW, Australia, 28 September–1 October 2018; pp. 1–6. [Google Scholar] [CrossRef]

- Siemens, A.G. Virtual Power Plants by Siemens. DEMS-Decentralized Energy Management System. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwiDjYvw-5ncAhXhNpoKHZGoCqUQFgg0MAA&url=https%3A%2F%2Fw3.siemens.com%2Fsmartgrid%2Fglobal%2Fen%2Fresource-center%2Femeterresources%2FDocuments%2FDEMS_DataSheet.pdf&usg=AOvVaw0k331hVRZiolcJCqkBezOV (accessed on 2 February 2017).

- Lombardi, P.; Powalko, M.; Rudion, K. Optimal operation of a virtual power plant. In Proceedings of the Power & Energy Society General Meeting, Calgary, AB, Canada, 26–30 July 2009; pp. 1–6. [Google Scholar]

- Saboori, H.; Mohammadi, M.; Taghe, R. Virtual power plant (VPP), definition, concept, components and types. In Proceedings of the 2011 Asia-Pacific Power and Energy Engineering Conference, Wuhan, China, 25–28 March 2011; pp. 1–4. [Google Scholar]

- Decker, M. Analysis and Design of an SOA for Virtual Power Plants. Master’s Thesis, Technical University of Denmark, Kongens Lyngby, Denmark, 2008. [Google Scholar]

- EI Bakari, K.; Myrzik, J.M.; Kling, W.L. Prospects of a virtual power plant to control a cluster of distributed generation and renewable energy sources. In Proceedings of the 2009 44th International Universities Power Engineering Conference (UPEC), Glasgow, UK, 1–4 September 2009; pp. 1–5. [Google Scholar]

- Vandoorn, T.L.; Zwaenepoel, B.; De Kooning, J.D.M.; Meersman, B.; Vandevelde, L. Smart microgrids and virtual power plants in a hierarchical control structure. In Proceedings of the 2011 2nd IEEE PES International Conference and Exhibition on Innovative Smart Grid Technologies, Manchester, UK, 5–7 December 2011; pp. 1–7. [Google Scholar]

- Olejnczak, T. Distributed Generation and Virtual Power Plants: Barriers and Solutions. Master’s Thesis, Utrecht University, Utrecht, The Netherlands, 2011. [Google Scholar]

- Nezamabadi, P.; Gharehpetian, G. Electrical energy management of virtual power plants in distribution networks with renewable energy resources and energy storage systems. In Proceedings of the 16th Electrical Power Distribution Confernece, Bandar Abbas, Iran, 19–20 April 2011; pp. 1–5. [Google Scholar]

- El Bakari, K.; Kling, W.L. Smart grids combination of ‘virtual power plant’-concept and ‘smart network’-design. In Proceedings of the Young Researchers Symposium, Leuven, Belgium, 29–30 March 2010; pp. 1–5. [Google Scholar]

- Ganagin, W.; Loewen, A.; Hahn, H.; Nelles, M. Flexible Biogaserzeugung durch technische und prozessbiologische Verfahrensanpassung. In Proceedings of the 8. Rostocker Bioenergieforum, Rostock, Germany, 19–20 June 2014; pp. 79–93. [Google Scholar]

- Candra, D.I.; Hartmann, K.; Nelles, M. Conceptual and practical implementation of integrated flexible biogas-intermittent re-battery storage for reliable and secure power supply to meet actual load demand at optimal cost. In Proceedings of the 25th European Biomass Conference and Exhibition, Stockholm, Sweden, 12–15 June 2017; pp. 1863–1872. [Google Scholar]

- Conkling, R.L. Energy Pricing: Economics and Principles. Energy Systems; Springer: Berlin/Heidelberg, Germany, 2011; pp. 301–324. ISBN 978-3-642-15491-1. [Google Scholar]

- Konstantin, P. Praxisbuch Energiewirtschaft: Energieumwandlung, -Transport und -Beschaffung im Liberalisierten Markt; VDI; Springer: Berlin/Heidelberg, Germany, 2013; ISBN 978-3-662-49822-4. [Google Scholar]

- EPEXSPOT. Available online: http://www.epexspot.com/en/market-data/dayaheadauction (accessed on 2 February 2017).

- Zoerner, T. Lastprofil/Lastganganalyse—Synthetische Verteilung der Verbrauchsmengen. Available online: https://blog.stromhaltig.de/2013/06/lastprofillastganganalyse-synthetische-verteilung-der-verbrauchsmengen (accessed on 22 February 2018).

- Candra, D.I.; Hartmann, K.; Nelles, M. Development of a virtual power plant to control distributed energy resources for future smart grid. In Proceedings of the NEIS 2017 Conference on Sustainable Energy Supply and Energy Storage Systems, Hamburg, Germany, 21–22 September 2017; p. 229. [Google Scholar]

- Bhattacharyya, S.C. Energy Economics. Concepts, Issues, Markets and Governance; Springer: London, UK, 2011. [Google Scholar]

- Pandžić, H.; Kuzle, I.; Capuder, T. Virtual power plant mid-term dispatch optimization. Appl. Energy 2012, 101, 134–141. [Google Scholar] [CrossRef]

- Condesso, J.M.A. Electricity Market Simulator for Management of Virtual Power Plants. Master’s Thesis, Tecnico Lisboa, Lisboa, Portugal, 2015. [Google Scholar]

- Rahimiyan, M.; Baringo, L. Strategic bidding for a virtual power plant in the day-ahead and real-time markets: A price-taker robust optimization approach. IEEE Trans. Power Syst. 2016, 31, 2676–2687. [Google Scholar] [CrossRef]

- Shabanzadeh, M.; Sheikh-El-Eslami, M.-K.; Haghifam, M.-R. The design of a risk-hedging tool for virtual power plants via robust optimization approach. Appl. Energy 2015, 155, 766–777. [Google Scholar] [CrossRef]

- Aschmann, V.; Effenberger, M. Biogas-BHKW in der Praxis: Wirkungsgrade und Emissionen. p. 15. Available online: https://www.maiskomitee.de/web/download.aspx?path=/web/upload/documents/kh_docs/versions/a47b8245-5950-4d7b-9f0a-2e66a67c22ba.pdf (accessed on 12 June 2016).

- ASUE. BHKW Kenndaten 2011 Module Anbieter Kosten. Available online: https://asue.de/sites/default/files/asue/themen/blockheizkraftwerke/2011/broschueren/05_07_11_asue-bhkw-kenndaten-0311.pdf (accessed on 2 May 2015).

- Bofinger, S.; Braun, M.; Costa Gomez, C.; Daniel-Gromke, J.; Gerhardt, N. Kurzfassung Die Rolle des Stroms aus Biogasanlagen in zukünftigen Energieversorgungsstrukturen. Available online: http://publica.fraunhofer.de/eprints/urn_nbn_de_0011-n-4066991.pdf (accessed on 2 May 2015).

- Schmid, J.; Rohrig, K.; Braun, M.; Gerhard, N.; Hochloff, P.; Hoffstede, U.; Lesch, K.; Schögl, F.; Speckmann, M.; Ritzau, M.; et al. Wissenschaftliche Begleitung bei der fachlichen Ausarbeitung eines Kombikraftwerksbonus gemäß der Verordnungsermächtigung §64 EEG2009. Available online: https://www.erneuerbare-energien.de/EE/Redaktion/DE/Downloads/Berichte/ausarbeitung-kombikraftwerksbonus.pdf?__blob=publicationFile&v=3 (accessed on 2 May 2015).

- Dachs, G.; Rehm, W. Der Eigenstromverbrauch von Biogasanlagen und Potenziale zu dessen Reduzierung, Solarenergieförderverein. p. 25. Available online: https://www.sev-bayern.de/content/bio-eigen.pdf (accessed on 2 May 2015).

- BMWI. Durchschnittlicher Strompreis für ein Industrieunternehmen in Cent/kWh. Available online: https://www.bmwi.de/Redaktion/DE/Downloads/I/Infografiken/durchschnittlicher-strompreis-industrieunternehmen.pdf?__blob=publicationFile&v=6 (accessed on 25 December 2016).

- Müsgens, F. EWI-Workingpaper. vol. 04.3. Market Power in the German Wholesale Electricity Market. Available online: http://www.ewi.uni-koeln.de/fileadmin/user_upload/Publikationen/Working_Paper/EWI_WP_04-03_German-Wholesale-Electricity-Market.pdf (accessed on 15 May 2017).

- Richter, J.; Adigbli, P. Position Paper of the European Energy Exchange and EPEX SPOT: Further Development of the Renewable Support Schemes in Germany. Available online: https://www.epexspot.com/document/26378/Further%20Development%20of%20the%20Renewable%20Support%20Schemes%20in%20Germany (accessed on 12 January 2018).

| Indicators | Capacity |

|---|---|

| Solar PV (MW) | 15 |

| Biogas (MW) | 15 or 25 1 |

| Battery (MWh) | 7.5 |

| Configuration | Composition of PV/BESS/BIO |

|---|---|

| 1 | 1:1:1 (15:7.5:15 or 25 1) |

| 2 | 1:2:1 |

| 3 | 1:3:1 |

| 4 | 2:1:1 |

| 5 | 2:2:1 |

| 6 | 2:3:1 |

| 7 | 3:1:1 |

| 8 | 3:2:1 |

| 9 | 3:3:1 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Candra, D.I.; Hartmann, K.; Nelles, M. Economic Optimal Implementation of Virtual Power Plants in the German Power Market. Energies 2018, 11, 2365. https://doi.org/10.3390/en11092365

Candra DI, Hartmann K, Nelles M. Economic Optimal Implementation of Virtual Power Plants in the German Power Market. Energies. 2018; 11(9):2365. https://doi.org/10.3390/en11092365

Chicago/Turabian StyleCandra, Dodiek Ika, Kilian Hartmann, and Michael Nelles. 2018. "Economic Optimal Implementation of Virtual Power Plants in the German Power Market" Energies 11, no. 9: 2365. https://doi.org/10.3390/en11092365

APA StyleCandra, D. I., Hartmann, K., & Nelles, M. (2018). Economic Optimal Implementation of Virtual Power Plants in the German Power Market. Energies, 11(9), 2365. https://doi.org/10.3390/en11092365