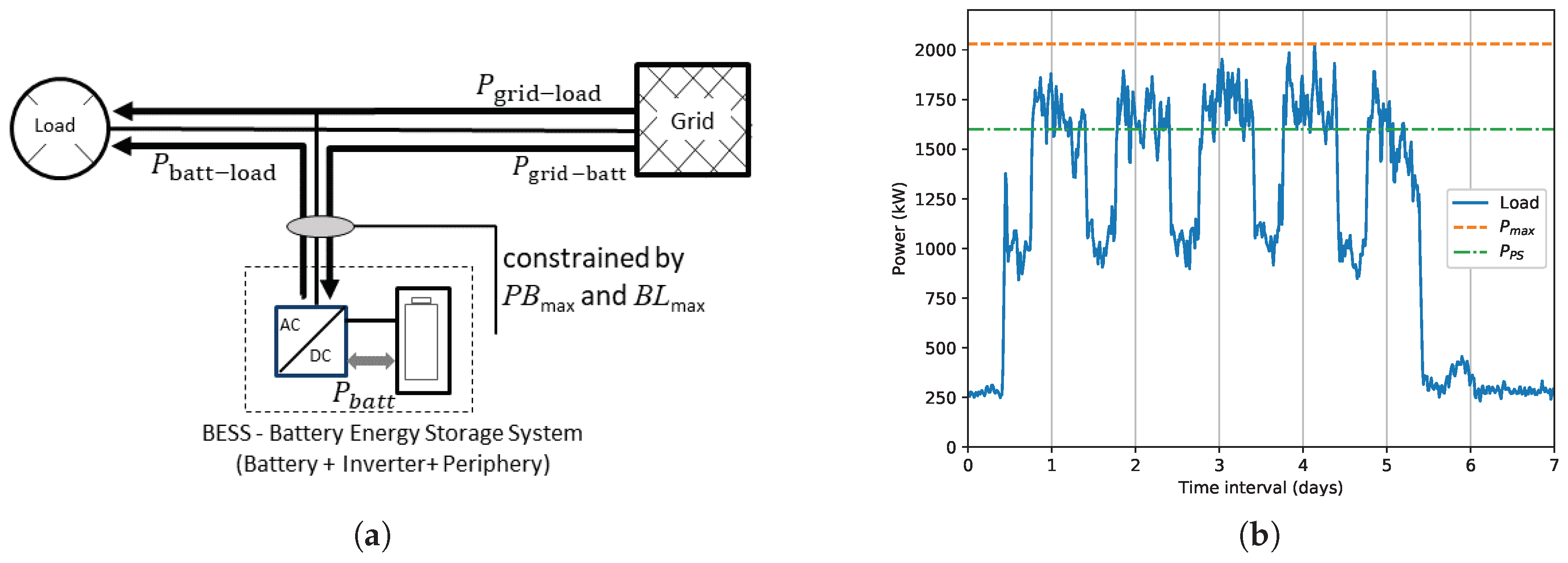

This section presents the application of the introduced model for dimensioning BESS for industrial peak shaving application. The industrial customer is responsible for buying, installing, maintaining, and operating the storage system. In this model, the energy used to charge the battery and the energy used for immediate consumption have the same cost, and both are considered in the industrial customer peak power calculation. As a result, the usage of a storage system is transparent from the point of view of the utility company.

3.1. Linear Optimization of BESSs

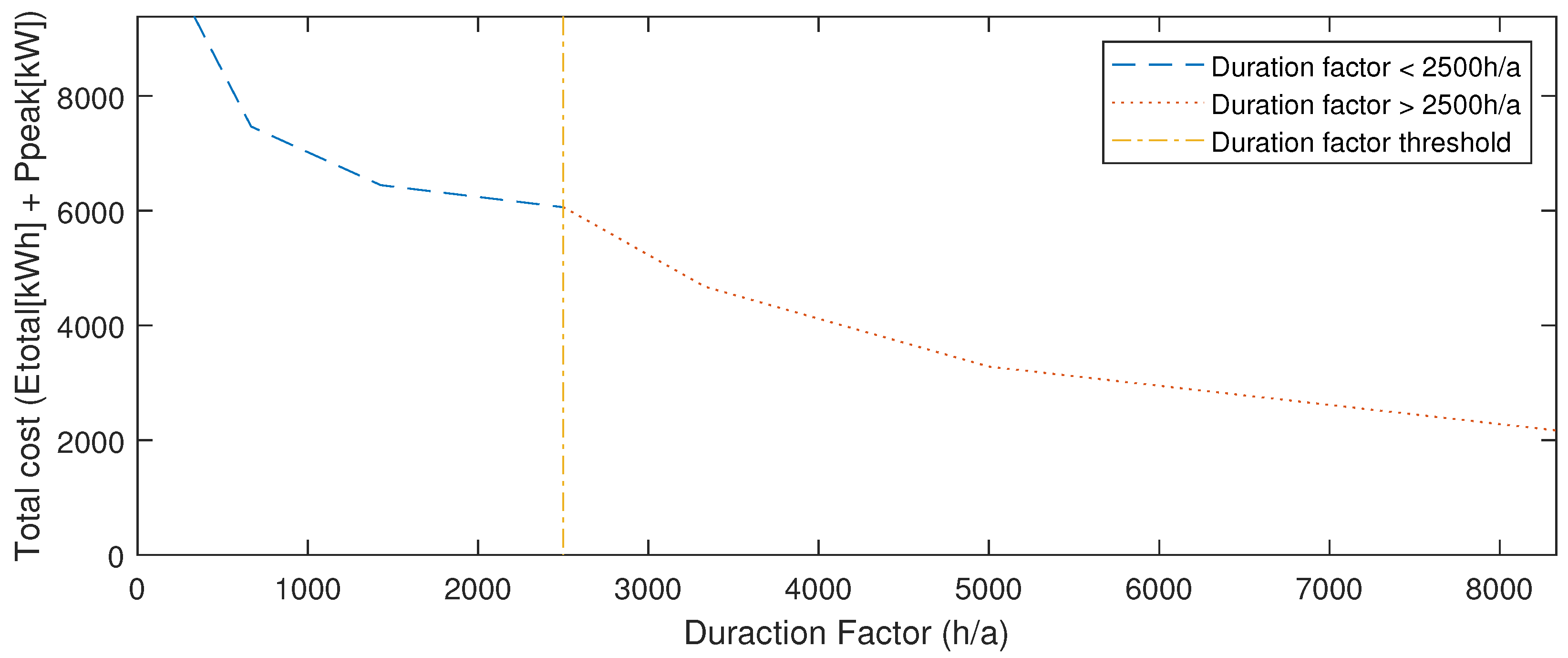

The economically optimal battery storage component sizing for an industrial customer equipped with storage system is obtained using LP. The load demand profiles considered in this study cover one full year, to capture all seasons with their characteristic. As the intent is to minimize the overall electricity cost, three types of costs are considered: the energy cost , the power cost , and the battery degradation cost . The energy cost is composed of the base energy price, fees, taxes, and stock exchange price. The power cost is charged by the network operator on the basis of the duration factor. The battery degradation cost, also called aging cost, is the major cost driver during storage operation, caused by cyclic and calendric aging.

The annual cost flow analysis presented here takes into account the discounted storage cost caused by degradation. As such, this simulation allows to estimate the profitability of a BESS for a full life of the battery.

All variables and parameters considered in this study are described in

Table 2.

To meet the electrical demand,

, the system attempts to use power from the battery,

, or it draws power from the grid,

, i.e.,

In the same way, the power imported from the grid (

) in each time step

i is restricted to the maximum power for the period. The two constraints can be represented as

where

represents the highest point of demand in the billing period

j. For instance, considering only the highest load of the year, all data points

i should be limited to the same maximum annual limit

. However, if we consider the seasonal billing period where there are two independent thresholds, each season is limited to its own limit. The peak power is used to calculate the optimal solution power cost.

The bidirectional power flow from the storage inverter to the battery is stored in an auxiliary variable,

, and correlated with the inverter efficiency,

, as follows

where

is the average one-way efficiency of the inverter. The reciprocal efficiencies are the battery charge power

and the discharge power,

, both limited by the nominal power flow from the inverter to the battery

where

corresponds to the inverter size. The battery energy content at time step

i (

) satisfies the recurrence relation

where

represents the self-discharge factor of the battery and

the conversion factor of time steps per day. The energy content of the storage system is furthermore confined by an upper boundary, that decreases upon usage and aging according to the

. The

is defined as the irreversible capacity fade over time, related to the nominal battery capacity, and

is a fraction of the total energy content of the battery installed:

The state of health of the storage system at time step

i also satisfies the recurrence relation

Using Equations (

6) and (

7), the calendric and cyclic aging can be estimated as

and

The calendric aging is affected by the storage temperature and its

level according to Swierczynski et al. [

32]. Despite the fact that the charge/discharge process leads to dissipative heat generation and unavoidable temperature changes within the battery, the very low utilization ratio of the storage system and the restriction to a maximum C-rate of 3 limits the effects of temperature variations significantly.

As a result, the additional cyclic aging degradation of time step

i is estimated by the energy throughput in time step

i divided by the energy content of the system

and is normalized with the factor of 0.5 and the technology specific cycle life indicator

. Similarly, the

can be expressed as

The inverter nominal power is limited to three times the battery nominal capacity

The optimal solution must satisfy all constraints described above. It aims to reduce the overall cost by minimizing the expenses for energy purchase and implicit cost caused by battery degradation. This cost model is divided into three components, i.e.,

The first component

comprises the cost of energy purchased from the grid, while the second component

is the peak induced cost based on the highest point of demand (or peak) within billing period (monthly or annually). These two components are evaluated as follows:

where

and

are the retail electricity price and the peak-power tariff, respectively. The third component estimates the storage system degradation cost that can be represented as

where

denotes the time span covered with the simulation (here one year) and

the total battery aging. The full battery related cost is then calculated in consideration of the initial installation investment cost.

3.3. Effect of Sizing Considering BESS Degradation Cost

The objective function and the constraints structured in this study have linear relationships. This means that the effect of changing a decision variable is proportional to its magnitude. For this reason, the economically optimal battery storage component sizing for peak shaving is obtained using LP. The linear optimization was implemented in MATLAB (MathWorks, Natick, MA, USA) code using a dual-simplex algorithm, which is based on a conventional simplex algorithm on the dual problem [

41]. Each one-year simulation considered 15-min time resolution, co-optimized the storage and inverter size, and took on average 700 s on a workstation with Intel Core i5 processor at 3.5 Ghz and 16 GB of memory.

The optimal storage and inverter size for each profile (A–D), as well as a number relevant technical and economical indicators, are presented in

Table 4.

The investment comprises the overall cost

described in Equation (

3). The operation cost,

, reflects the German market and is calculated as 0.6% of the investment plus 6 €/kW.

Table 5 shows the OPEX components considered in this paper.

The total return equal to the internal return rate (IRR) [

42], is calculated without inflation or price changes based on the total savings of the first year. Likewise, total savings and amortization time are static calculations

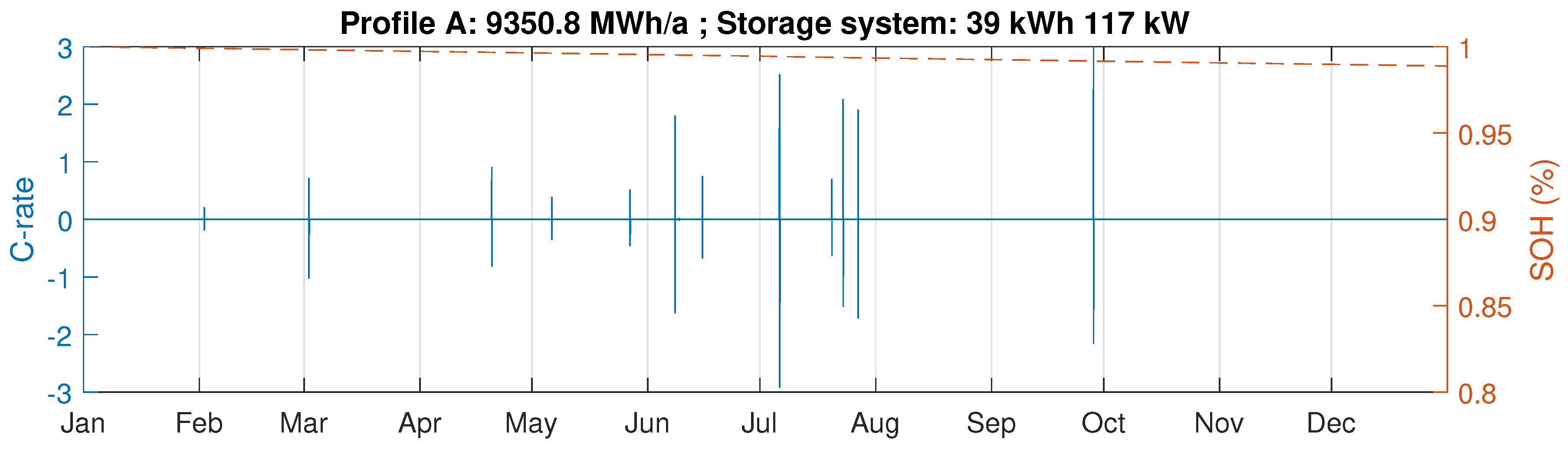

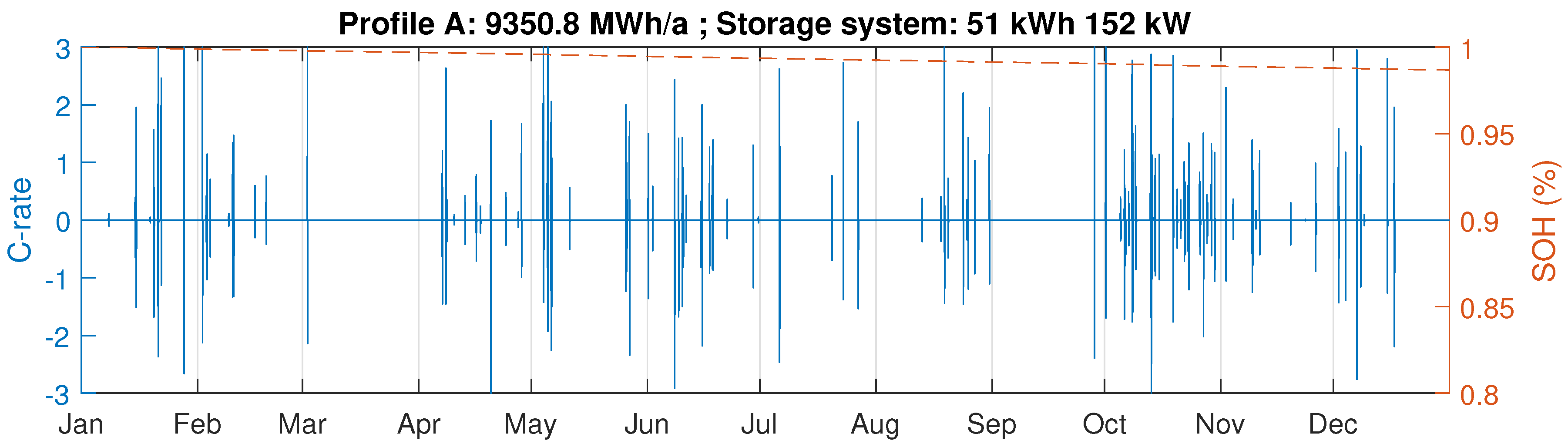

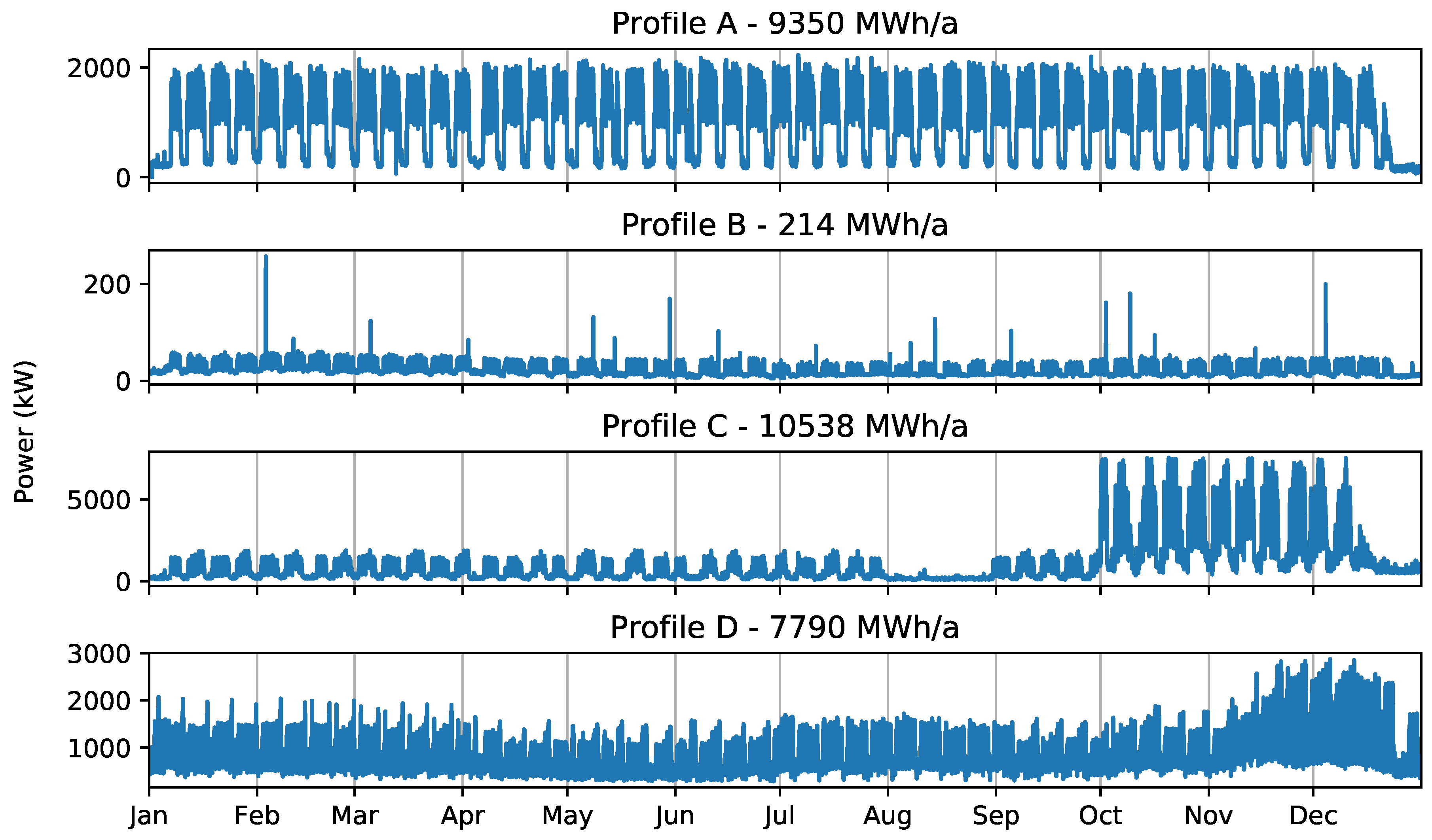

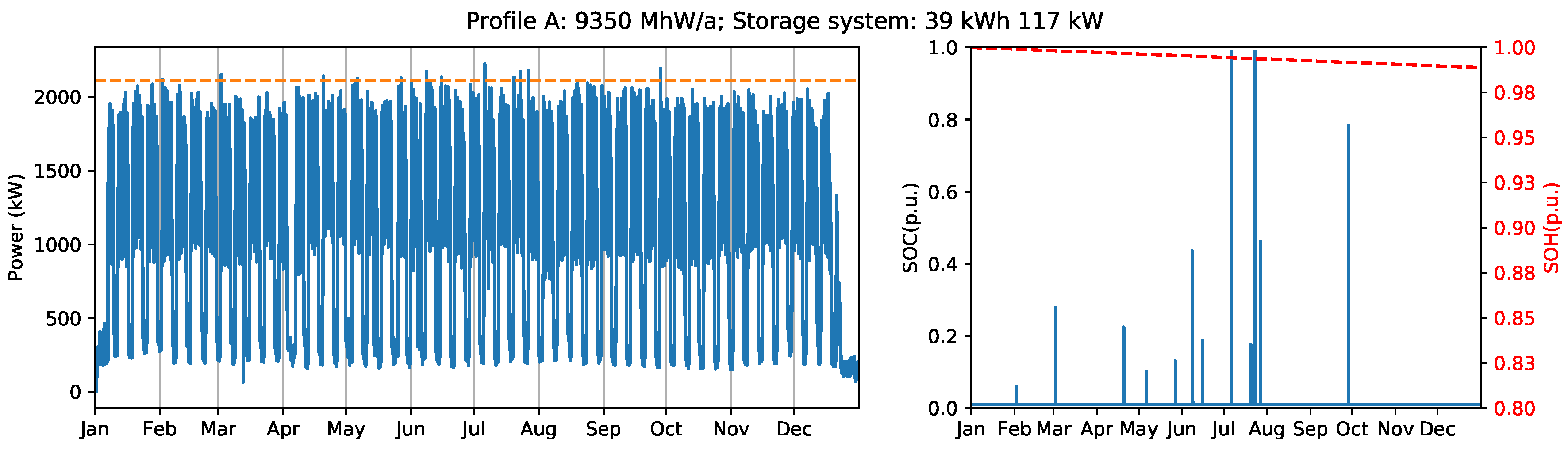

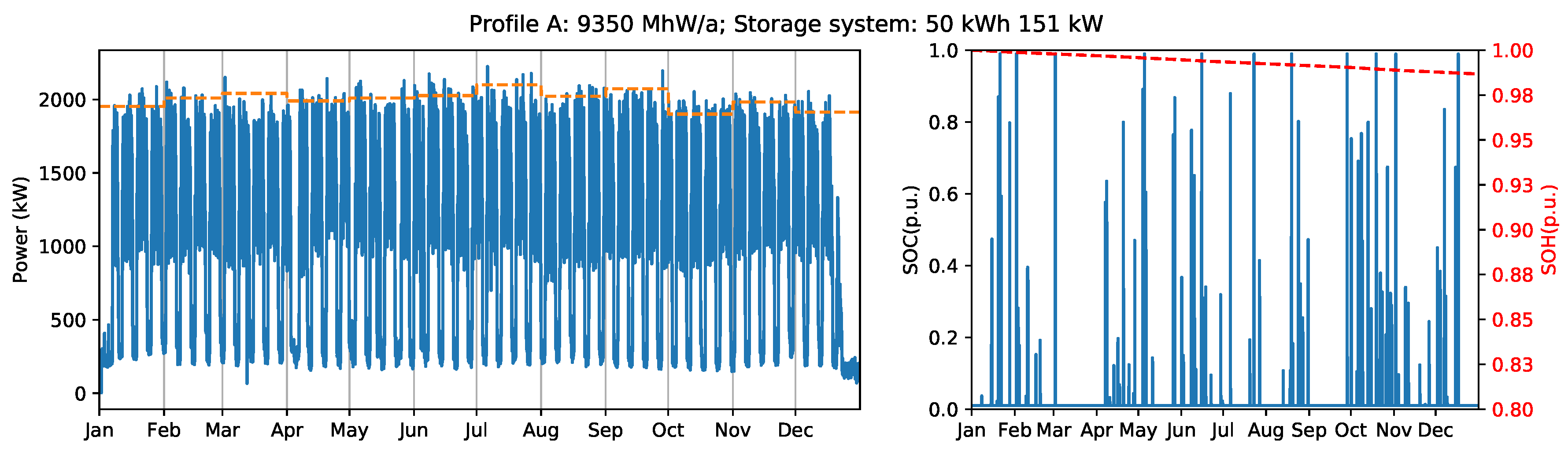

‘Profile A’ has an annual load of 9350 MWh and features weekday peaks and small load during weekends. As shown in

Table 4, this profile exhibits similar results for yearly and monthly billing scheme.

Figure 6 and

Figure 7 illustrate the results obtained for the two billing schemes.

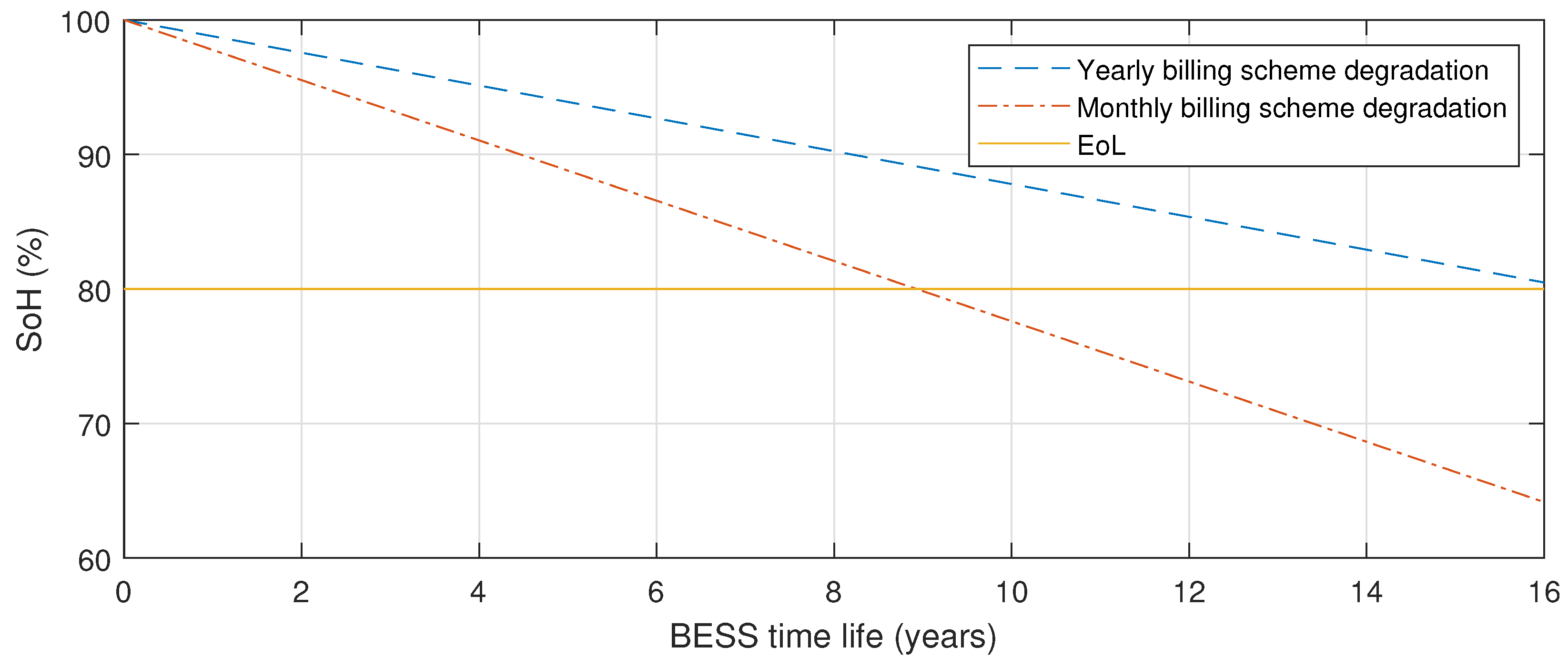

The yearly billing scheme requires an initial investment of almost €20.000 less compared to the cost of the system optimized for monthly billing, and it can generate additional 5% of total return in a shorter time. Although monthly billing scheme with a 51 kWh battery and 152 kW inverter (

Figure 7) can increase the peak load capping, it also shortens the battery end of life by seven years (

Figure 8). Therefore, all things considered, the yearly billing scheme is more suitable for ‘Profile A’ because it delays the battery replacement and provides several extra years of saving grid charges before it becomes necessary to invest in a new battery system.

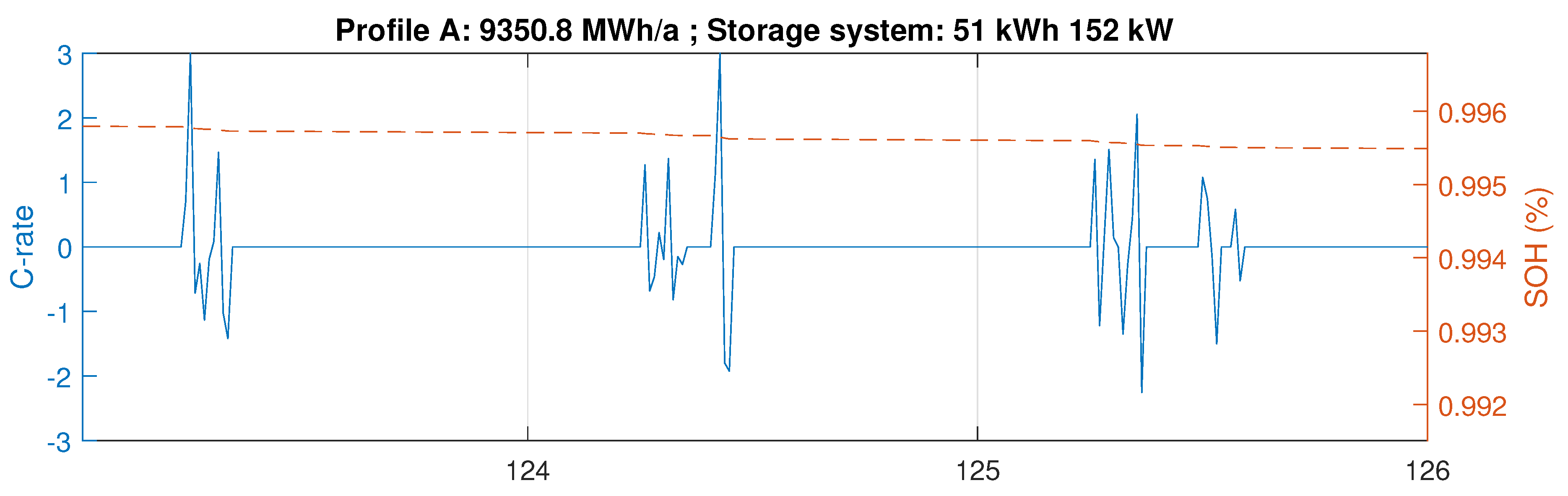

Further considering the monthly billing scheme, the optimizer determines the optimal storage size of 51 kWh and inverter nominal power of 152 kW.

Figure 9 illustrates the power flows for a three-day period during the first week of May. The left panel shows the load consumption, the power flow imported from the grid for direct use or to charge the battery, as well as the maximum power peak after shave. The right panel shows the periodically changing charge level of the storage system (

), and the evolution of battery degradation (

). It clearly shows that the capacity fade is stronger when the energy throughput is high.

Figure 10 shows the battery power profile and the same capacity fade in the terms of C-rate.

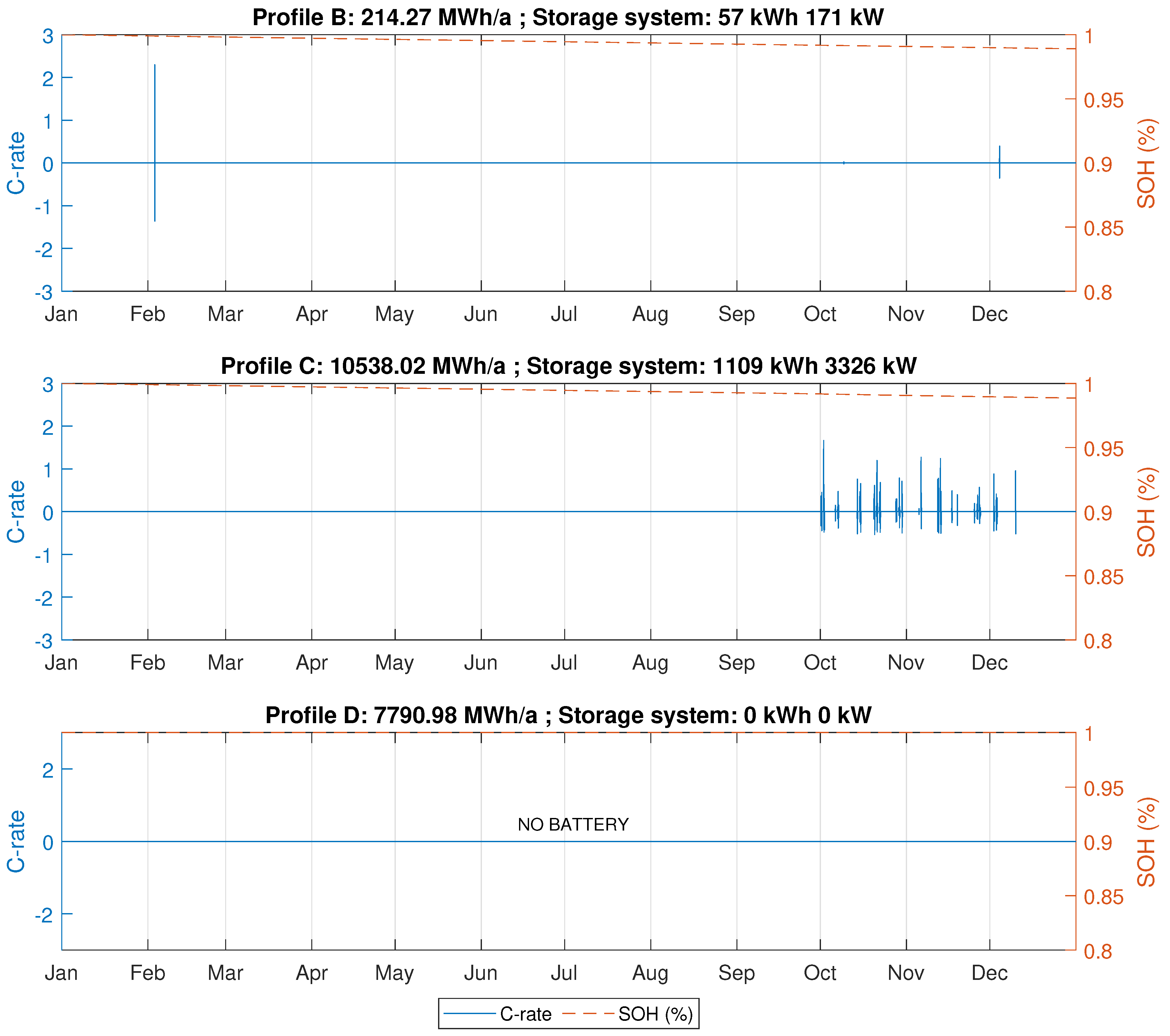

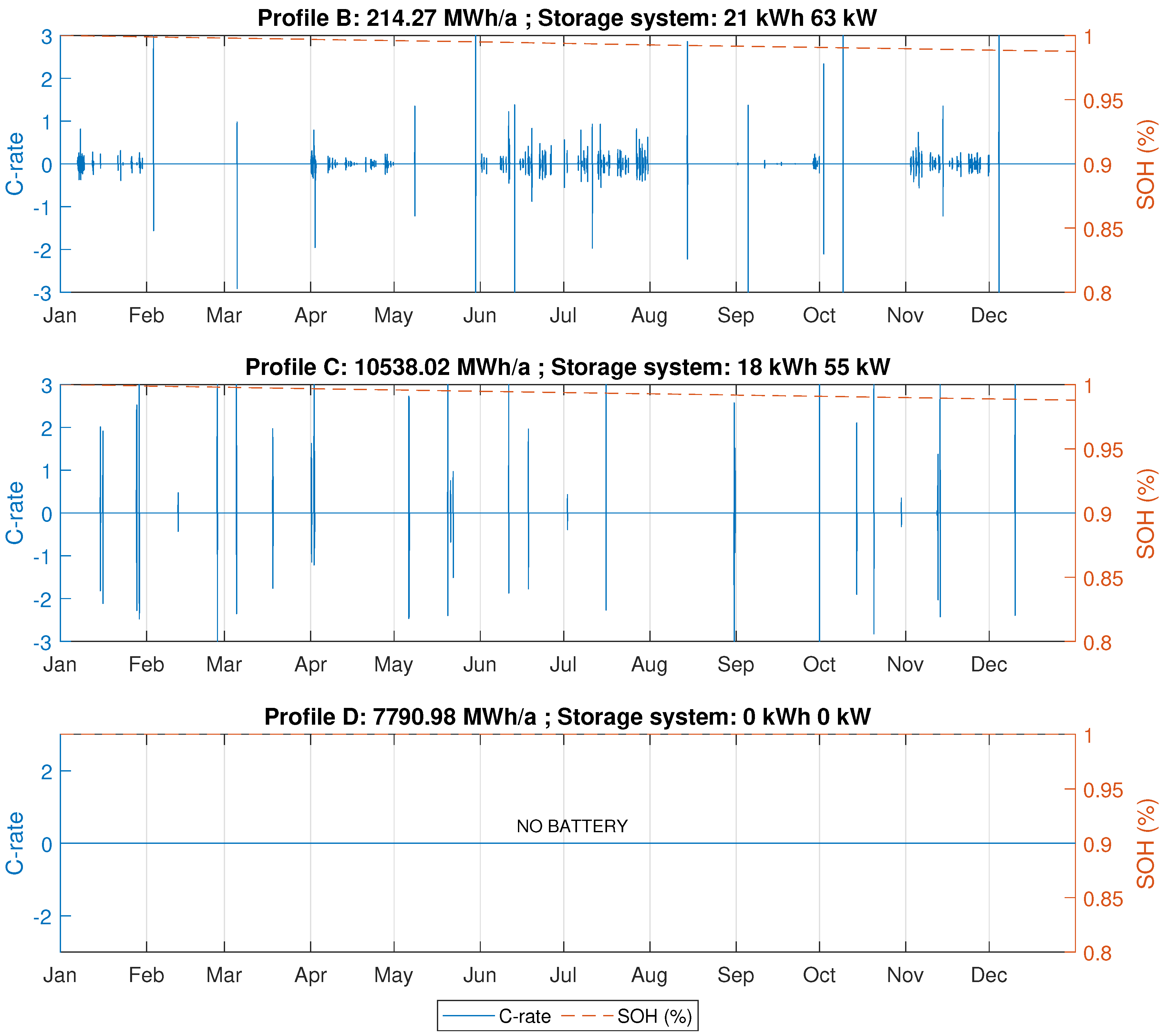

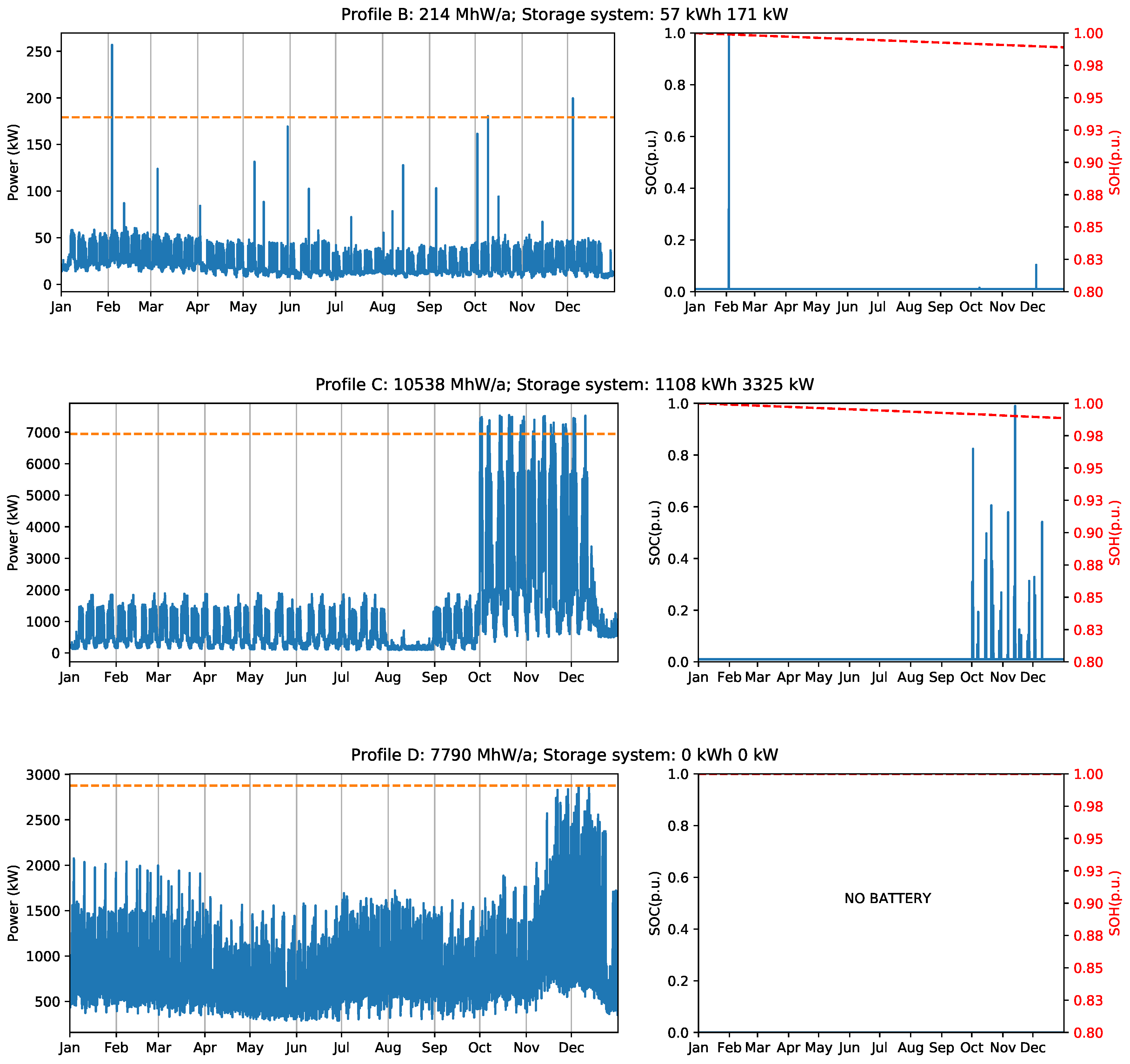

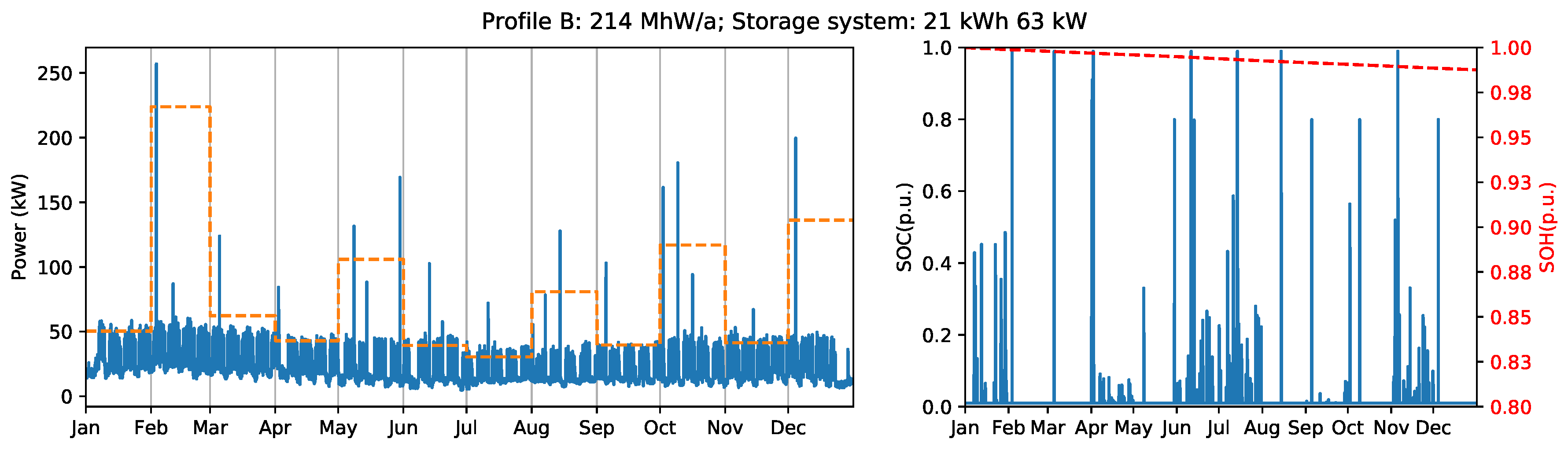

In contrast to ‘Profile A’, results for ‘Profile B’ show that the yearly billing scheme is not suitable for profiles with low average load and relatively high peaks. Although it is possible to reduce 30% of the peak load using a 57 kWh BESS with 171 kW inverter, this system configuration provides no savings to support the initial investment. In this case, the monthly scheme is more profitable, resulting in a peak reduction of 13% with a 21 kWh battery and 63 kW inverter.

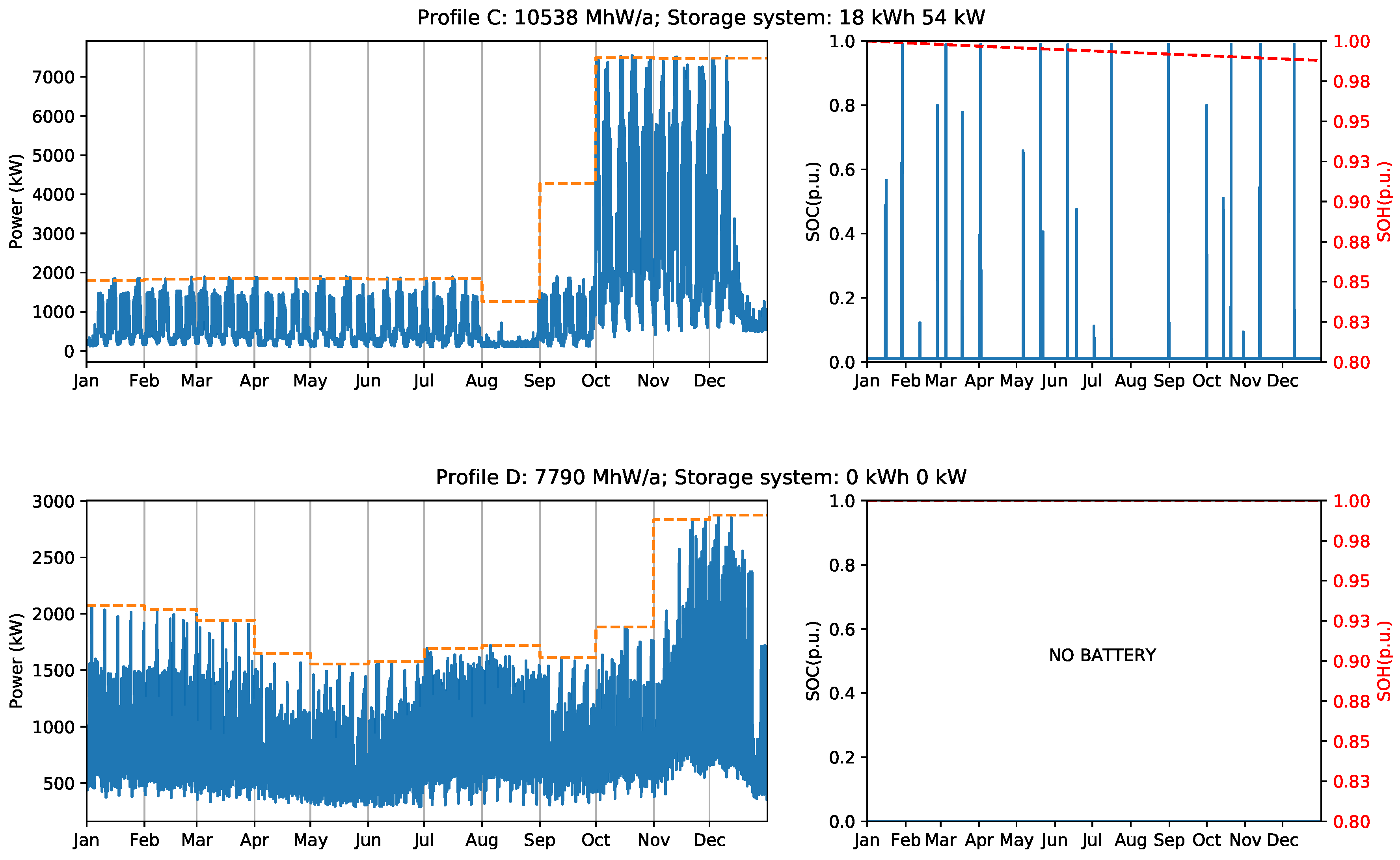

Similarly, ‘Profile C’ has a negative IRR when considering the yearly billing scheme. This is caused by the seasonal nature of the load. As can be seen in

Figure 5, the consumption in the last three months of the year is very high compared to the rest of the year. Analyzing the total return value in

Table 4, the monthly billing scheme appears to be the right choice for this profile. However, a peak load reduction of only 1% is too slow to justify the installation of a BESS.

Finally, ’Profile D’ presents the most extreme case. Considering the exposed investment cost for BESS and price schemes, there is no advantage to installing a BESS for peak shaving purpose for this profile.

Figure 11 illustrates the optimal annual peak shaving limit for the profiles B, C, and D, as well as the state of charge and state of health for the storage system used in each case. Similarly,

Figure 12 shows the optimal monthly peak shaving limit, the

, and

for the same three profiles. The

Appendix A provides the battery power profiles for all investigated scenarios.

It can be seen that the optimization process minimizes expenses using the capacity of the storage system to decrease the peak power. The optimal power flow shows that the battery cycles are short, meaning that the battery is charged to the maximum necessary level just before being drained. This occurs due to the presence of -dependent calendric degradation as one of the optimization criteria. At the same, cyclic aging is not a determinant in peak shaving applications because the BESS has only a low number of charging/discharging cycles and energy is never stored in the battery for a long time. For this reason, calendric degradation is the most important cost driver in storage systems for peak shaving applications.

To analyze the relation between load size and return of investment, consider

Table 6. Optimization runs were performed scaling the load size of Profile A from 10 to 40,000 MWh/a. The relation between the peaks and the loads were kept the same as in the original profile, resulting in exactly the same shape of battery

profile. As an overall trend, customers with large loads require BESS with large storage size and large nominal power of the inverter. Loads smaller than 1000 MWh/a have a negative IRR and an extensive payback period, rendering them unsuitable for BESS-based peak shaving applications. On the other hand, larger load profiles have a substantial improvement in the payback period. The results show that the BESS can be used for almost 18 years before reaching end of life at

of

. Although the peak capping is the same in all simulations, the battery usage differs for each load size because of the assumed discrete sizing of BESS and inverters in steps of 10 kWh and 10 kW respectively.

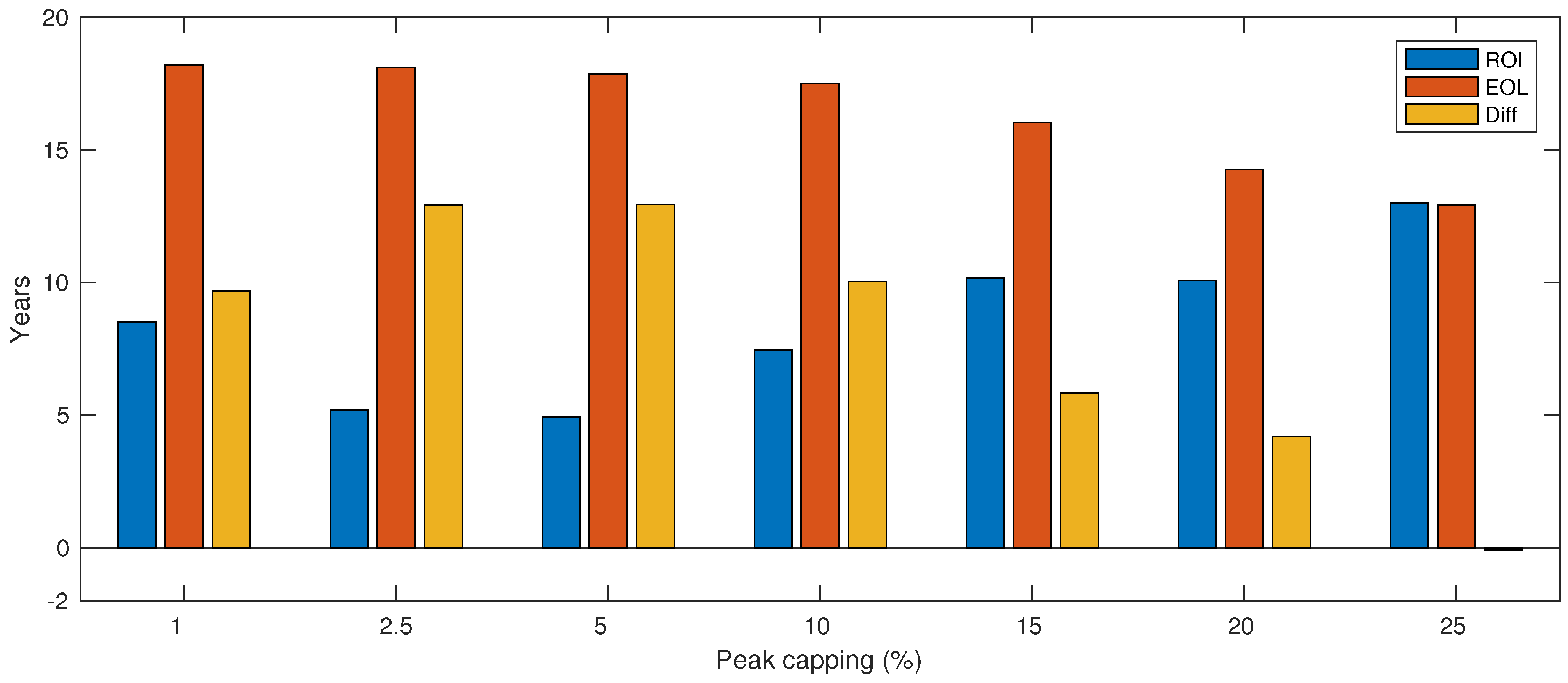

It is clear that larger load sizes can benefit from BESS-based peak shaving with better economical results. In addition, it is interesting to analyze the impact of the peak capping variation on the payback period as well as the battery life time. Refer to

Figure 13 and

Table 7 for a detailed comparison. To generate these results, an additional constraint was added to the linear model described in

Section 3.1

where

is the fixed amount of the peak that must be shaved. As shown in

Table 7, all scenarios are profitable. However, the best IRR is obtained for peak capping equal to 5% of the total load. Smaller peak capping values extend the battery lifetime, but also extend the payback time as less savings of peak power reduction may be attained. In contrast, larger peak capping values increase the payback, but shorten the battery life.

As an overall trend, the increase of inverter size has a direct relation to the peak shaved load, i.e., 2.5% of load shaving needs a 60 kW inverter, and 25% load shaving requires ten times more. It is a straightforward relation because the inverter is sized according to the load power peak. Interestingly, the battery sizing does not follow the same trend because it is related to the number of peaks that must be shaved. In contrast to the optimal result where the battery is charged closer to the load peaks, larger peak load capping results in a smaller C-rate because the battery is charged slowly to avoid violating the maximum power peak allowed, and the battery must keep energy content for a longer period.