Estimating the Economic Impacts of Net Metering Schemes for Residential PV Systems with Profiling of Power Demand, Generation, and Market Prices

Abstract

:1. Introduction

- Make a brief overview of the support schemes in use.

- Formulate the problem of maximising the profit of the prosumers and substantiate the algorithm for its resolution.

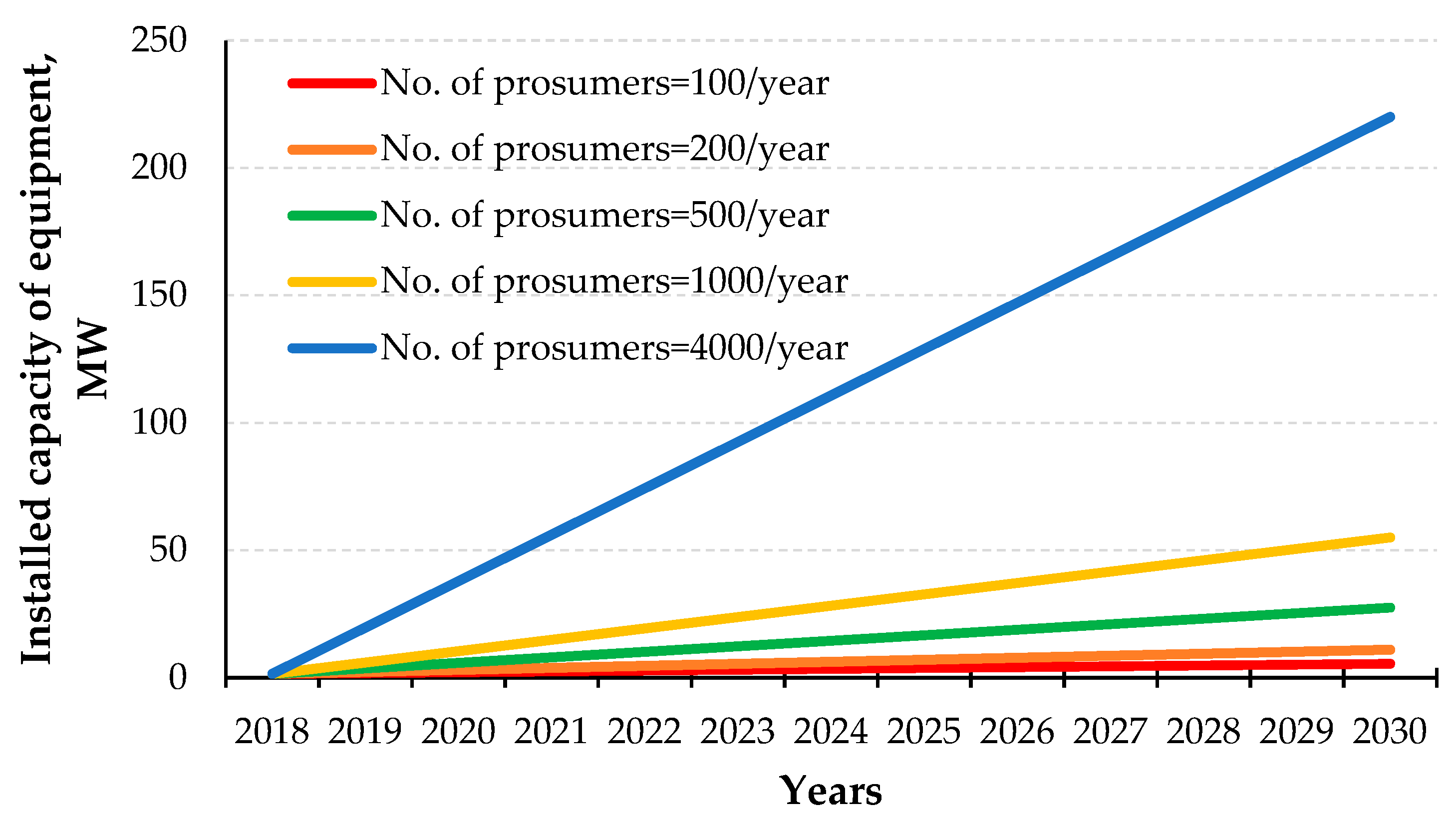

- Solve the problem of estimating the influence of a large number of generators on the operation of the power system as a whole.

- Based on the collected experimental data and the selected scenarios, demonstrate the possibility of increasing the profitability and number of prosumers.

2. Methodology and Models

2.1. The Methodology of Feasibility Studies

2.2. Evaluation of the Economic Benefit from Support Schemes

- The fixed volume (FV) component is based on the connection capacity (kVA);

- The variable progressive (VP) component: in this component, the tariff per kWh increases along with an increasing measured consumption level;

2.3. The Basic Tasks of the Study

- To evaluate the benefits received by the individual prosumer and the factors that influence them, as a result of equipping the household in question with PV.

- To evaluate the influence of a sharp increase in the number of prosumers and their capacity on the power system and the other energy consumers.

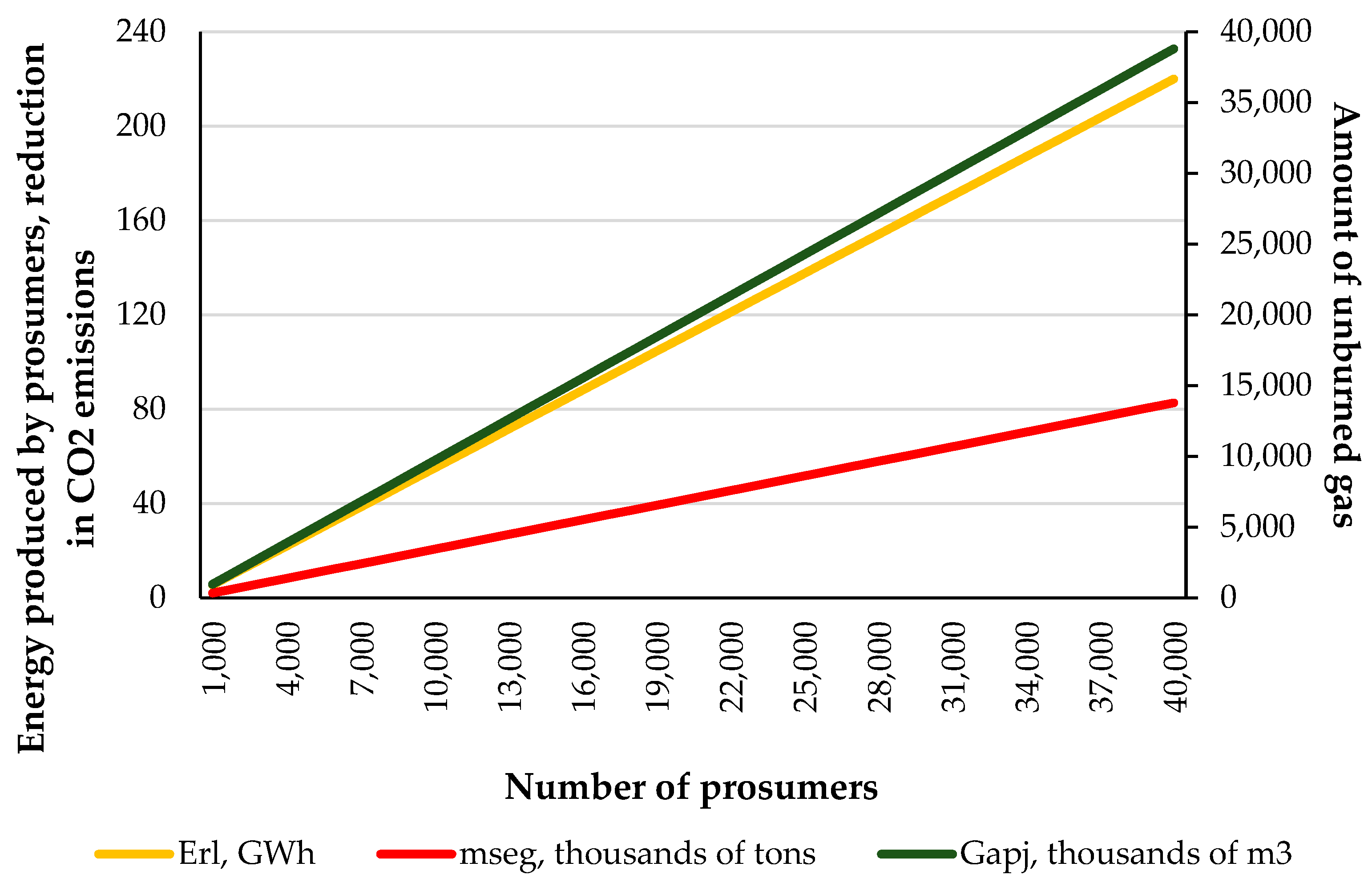

- A diminished dependence on gas imports;

- A diminished amount of atmospheric emissions of CO2.

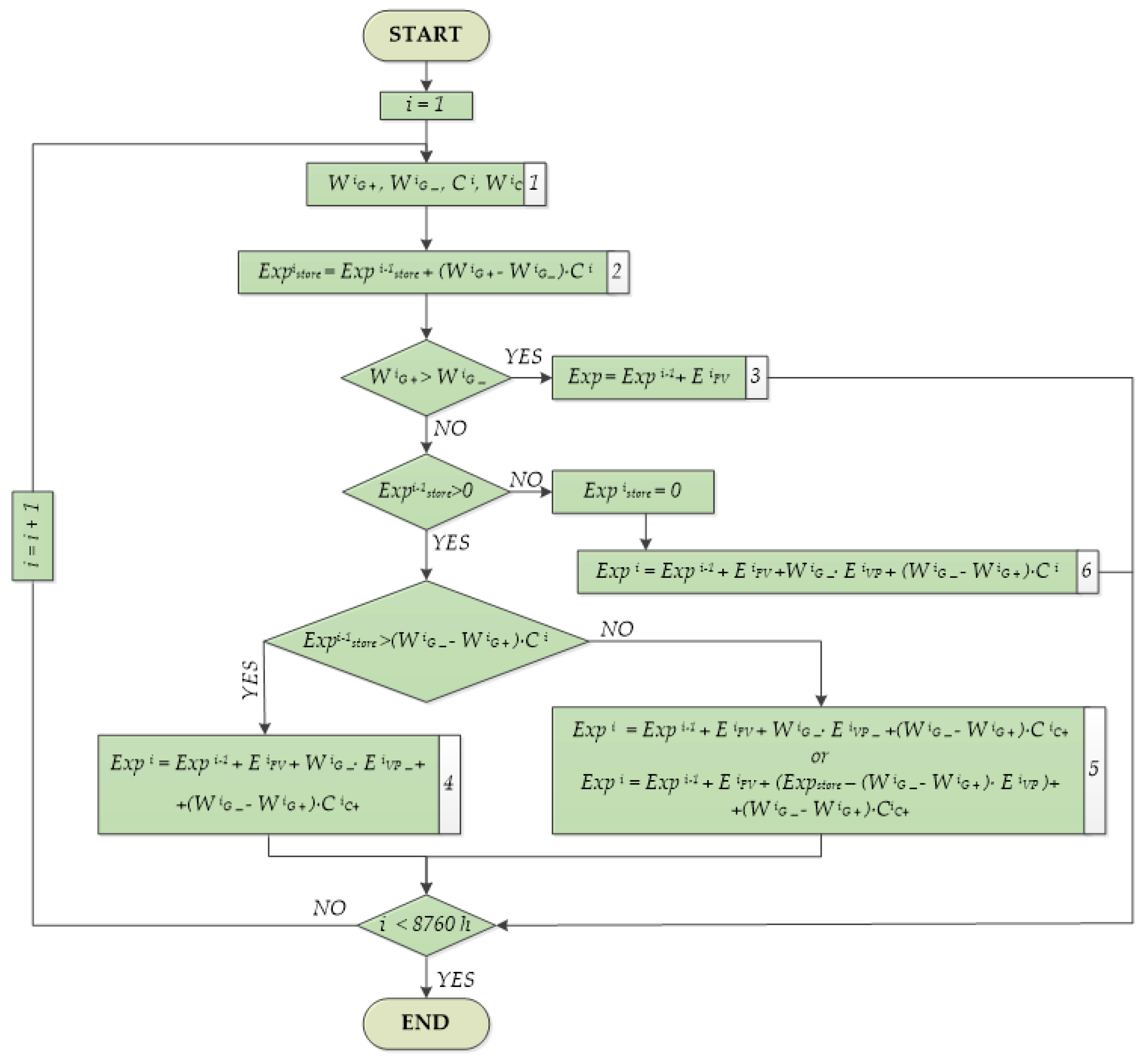

2.3.1. Implementation of the First Task

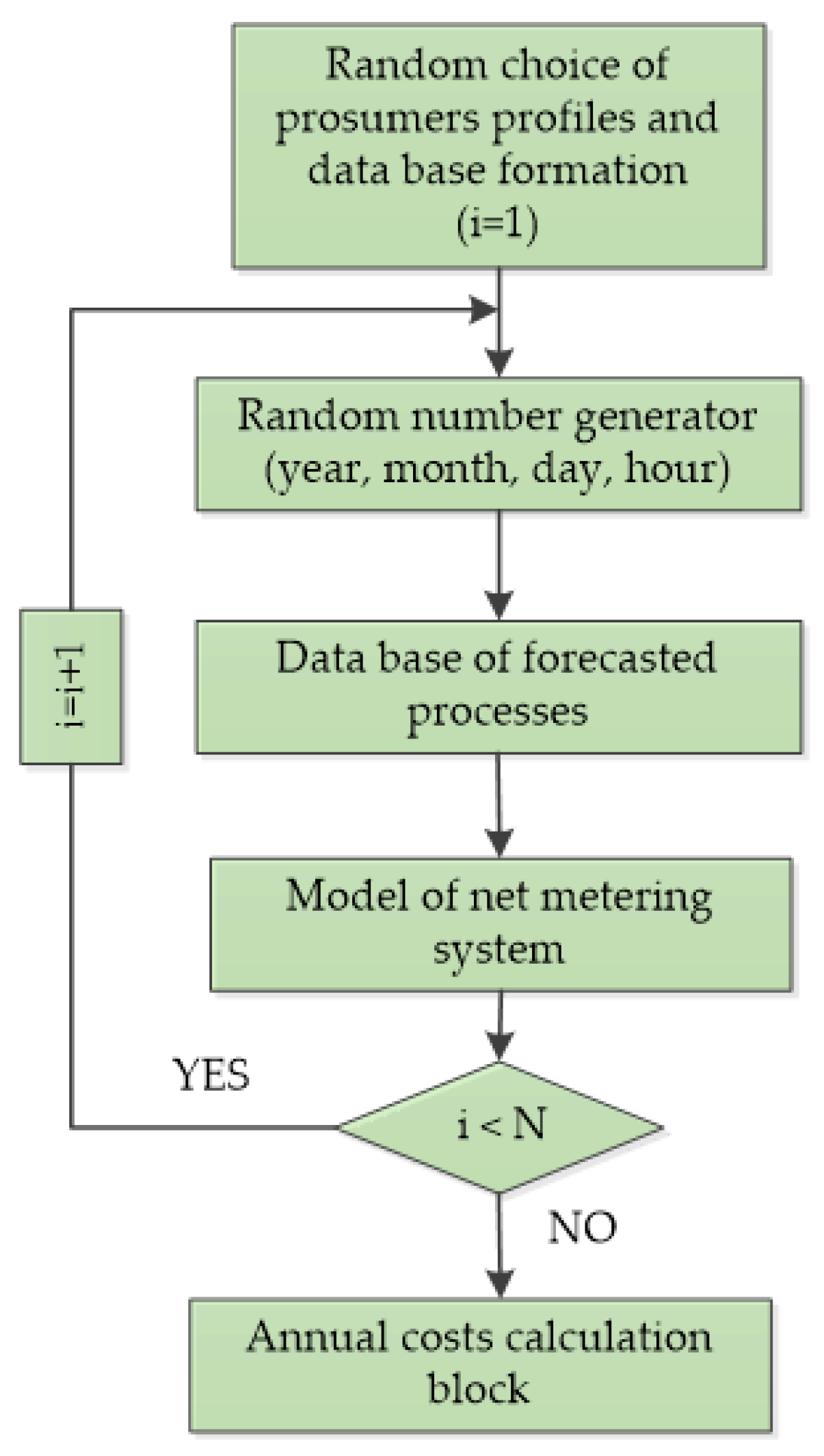

2.3.2. Implementation of the Second Task

2.4. Input Information and Assumptions

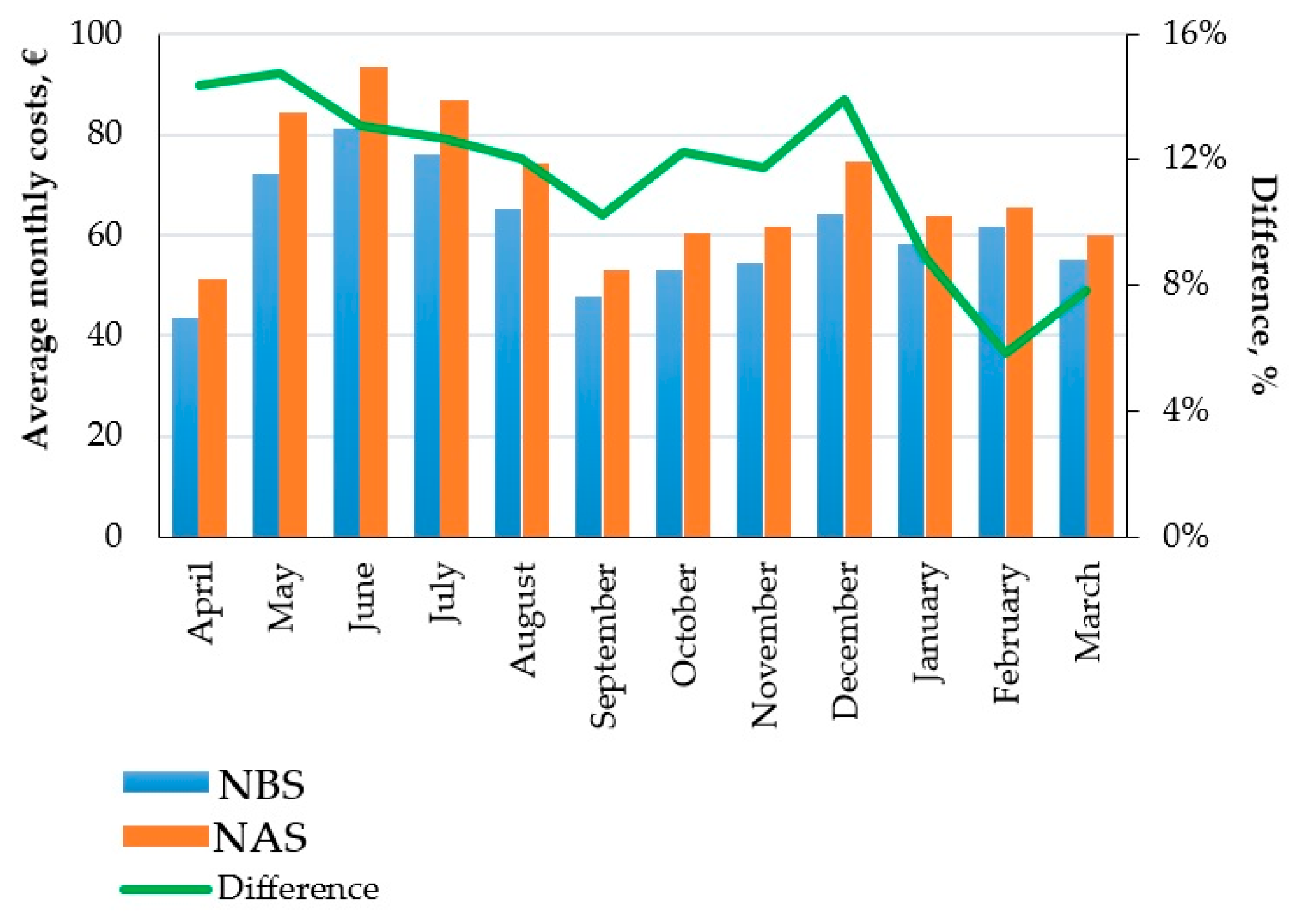

- The base case, when the householder does not have an NS.

- The case, when the householder has an NBS.

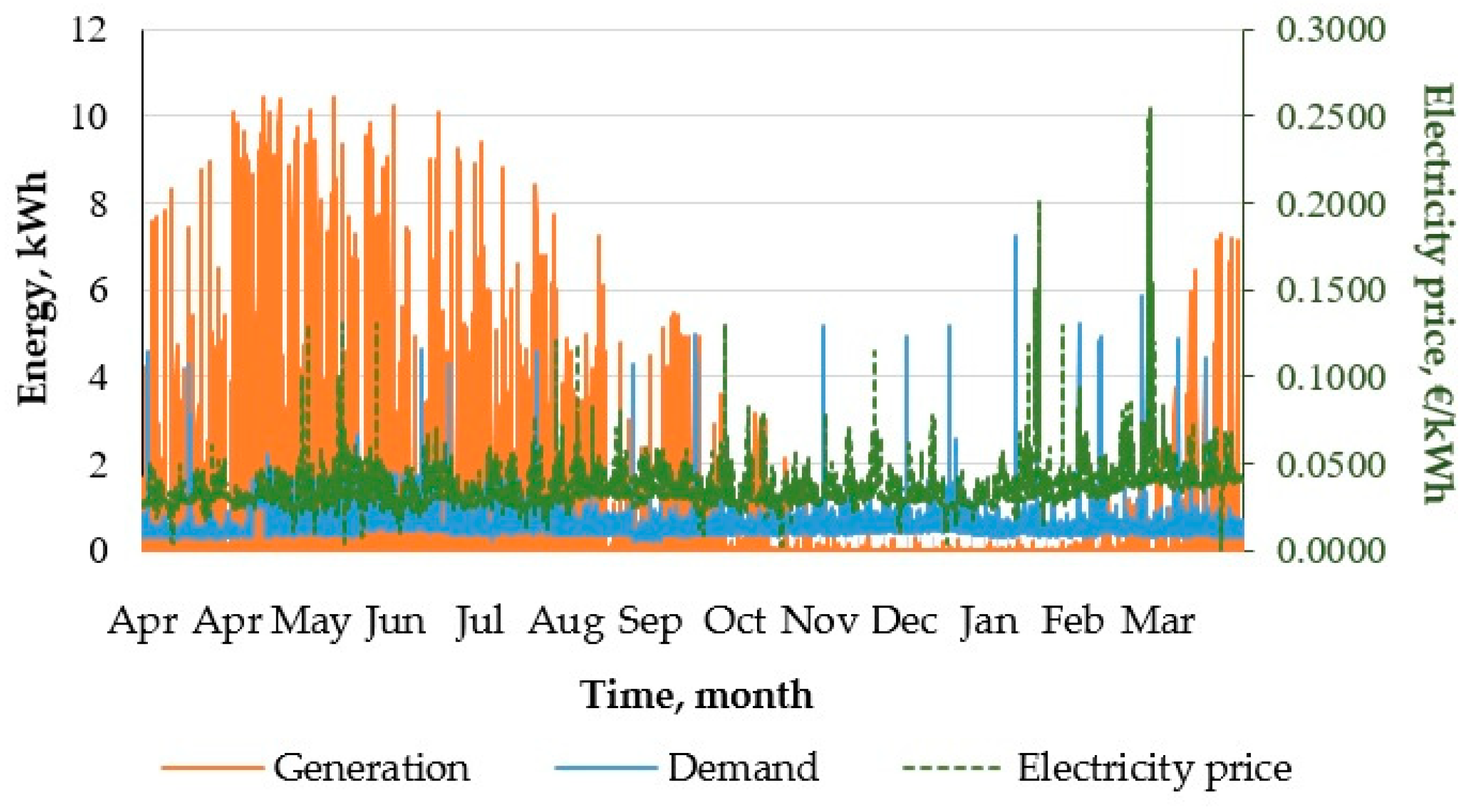

- Power demand: information is required regarding the energy demand profiles of a large number of prosumers. We use the records of the smart meters of one hundred different randomly selected consumers over a period of one year [23];

- Power generation: the generation of the potential 100 prosumers is simulated by using the records of a newly installed generator for the year 2017. These records are modified by changing the equipment capacity for each of the 100 prosumers in such a way as to achieve a balance between the annual energy generation and consumption figures;

- Electricity market prices: the Nord Pool market prices are used. By using the Fourier transform [39], we single out the constant component, which we set as a variable depending on the number of the planning year. The average price changes are set by using the published results and the selected scenarios [39].

- The NS billing period is maintained according to the valid legislation, i.e., from April 1 till March 31. This period is suitable for the prosumers of Nordic countries [1] since in the winter period the prosumer has the possibility to use the electricity submitted to the grid to the maximum extent. This period increases the economic profitability for the prosumers.

- Retail prices are assumed to rise by 7.5% each year [50] (from 2018 to 2030), then by 2% (from 2030 till 2040) and fall by 1% (from 2040 till 2043) according to the EU Outlook 2050 energy price scenario, released by Energy Brainpool (June 2017).

- For the hourly load of end users, the time series collected by the smart meters were used, covering a whole year.

- We assume that, for the consumers connected to the grid, the consumption remains the same for future years as well. The loan interest rate was assumed in accordance with the interest rates laid down by the Bank of Latvia, i.e., 2.6% per annum [53]. The discount rate was assumed to be 2.0% per annum. The credit period is assumed to be equal to the equipment service life—25 years.

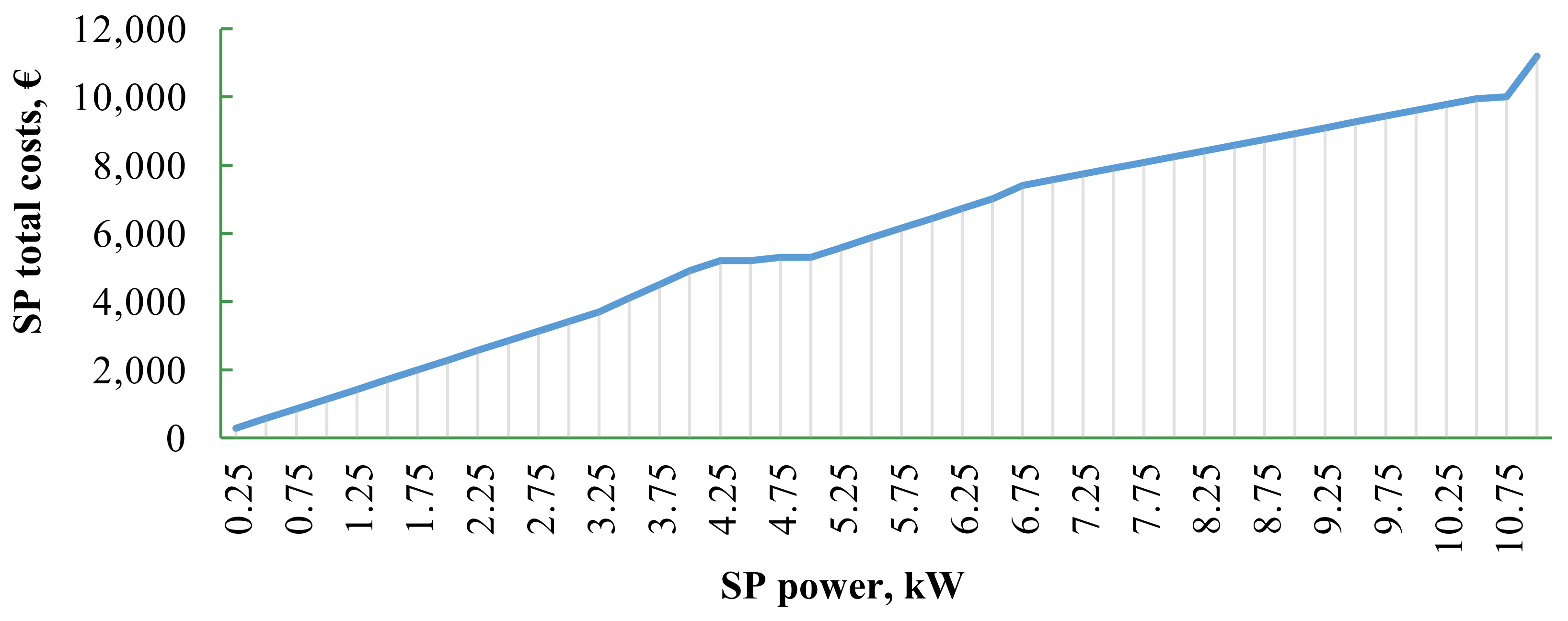

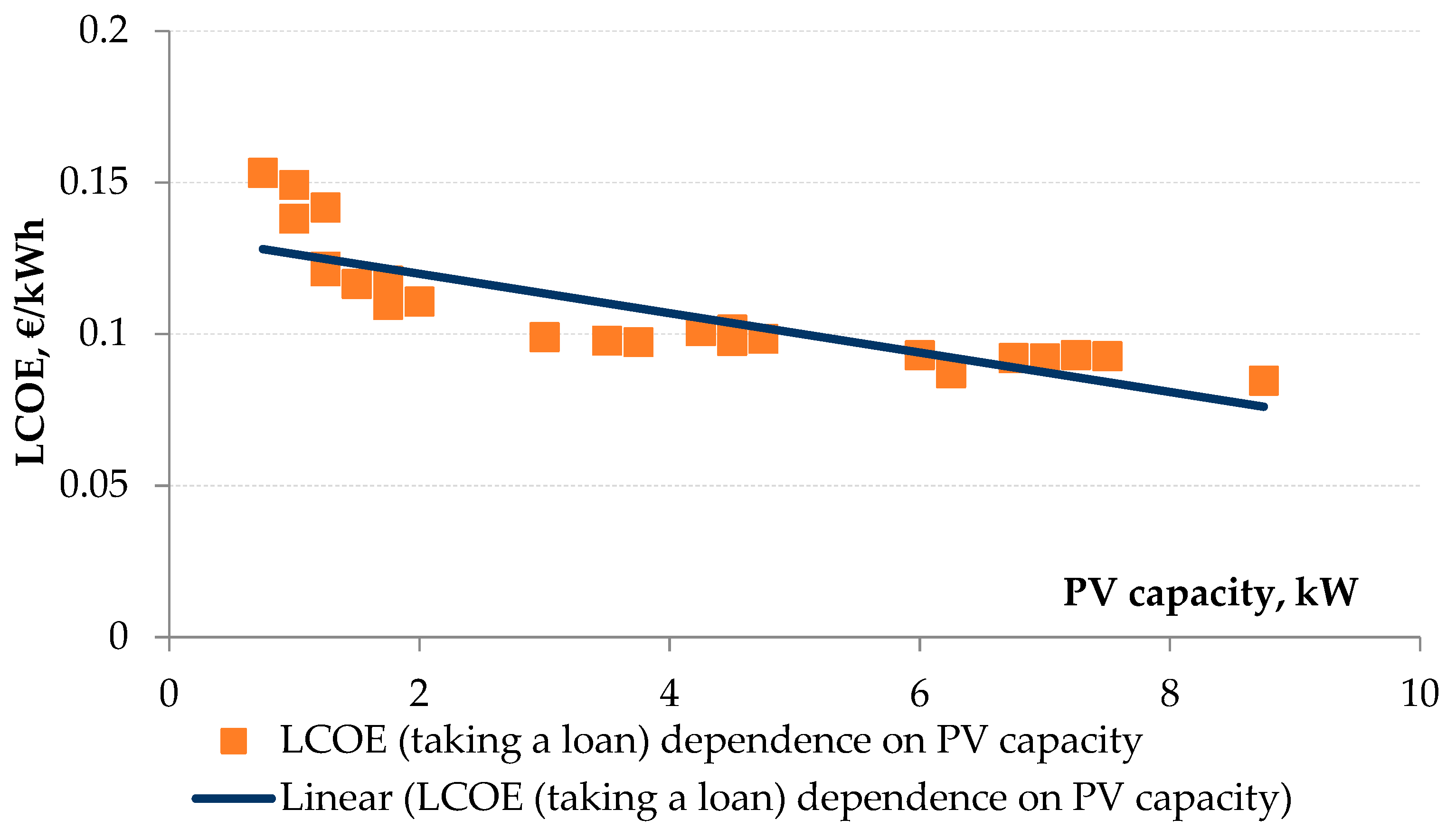

- The capacity of the PV technology and the corresponding amount of investment was determined on the basis of solar radiation in Latvia, to enable the prosumer with its individual consumption to use the energy produced by the PV technology for end consumption to a maximum extent.

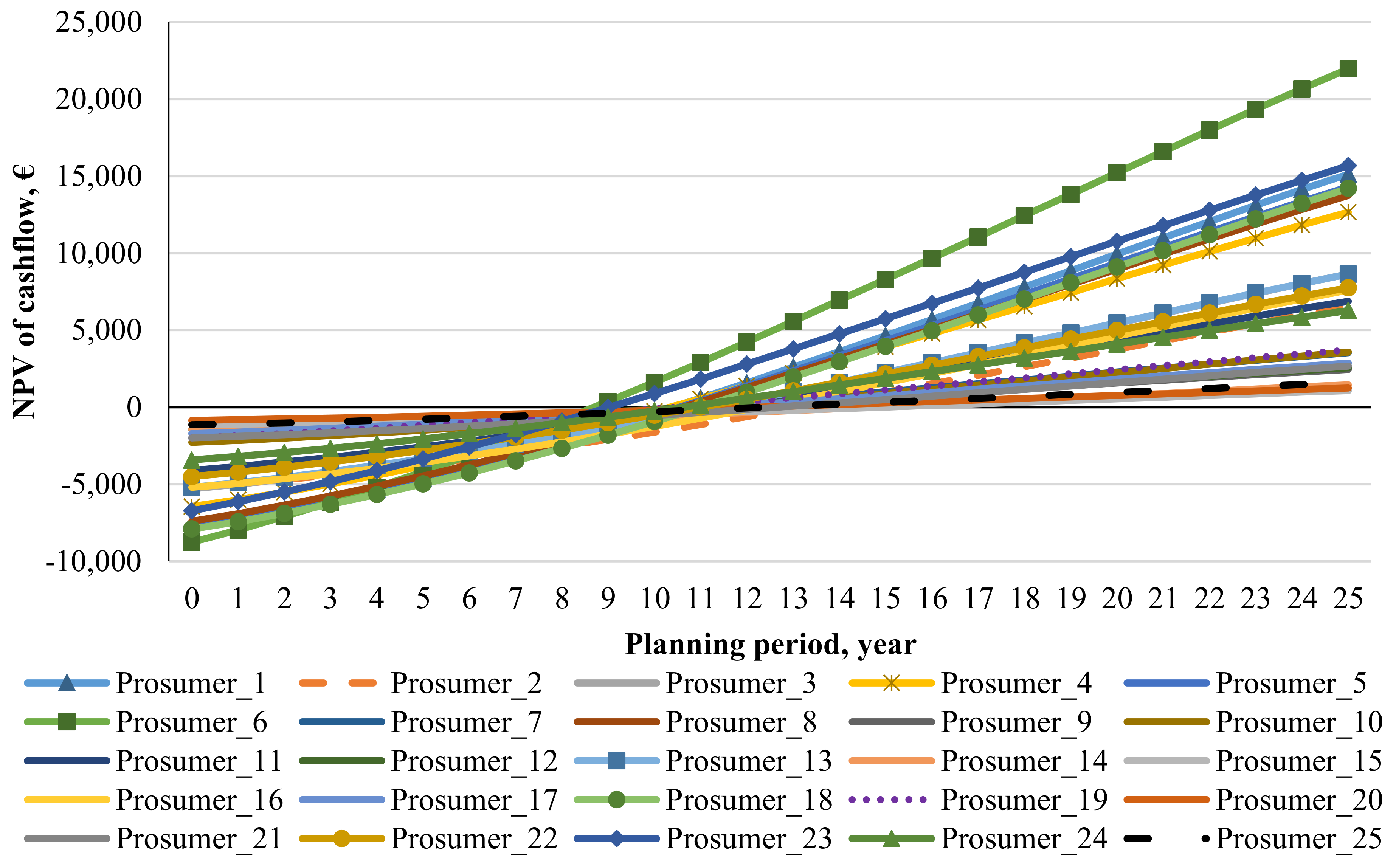

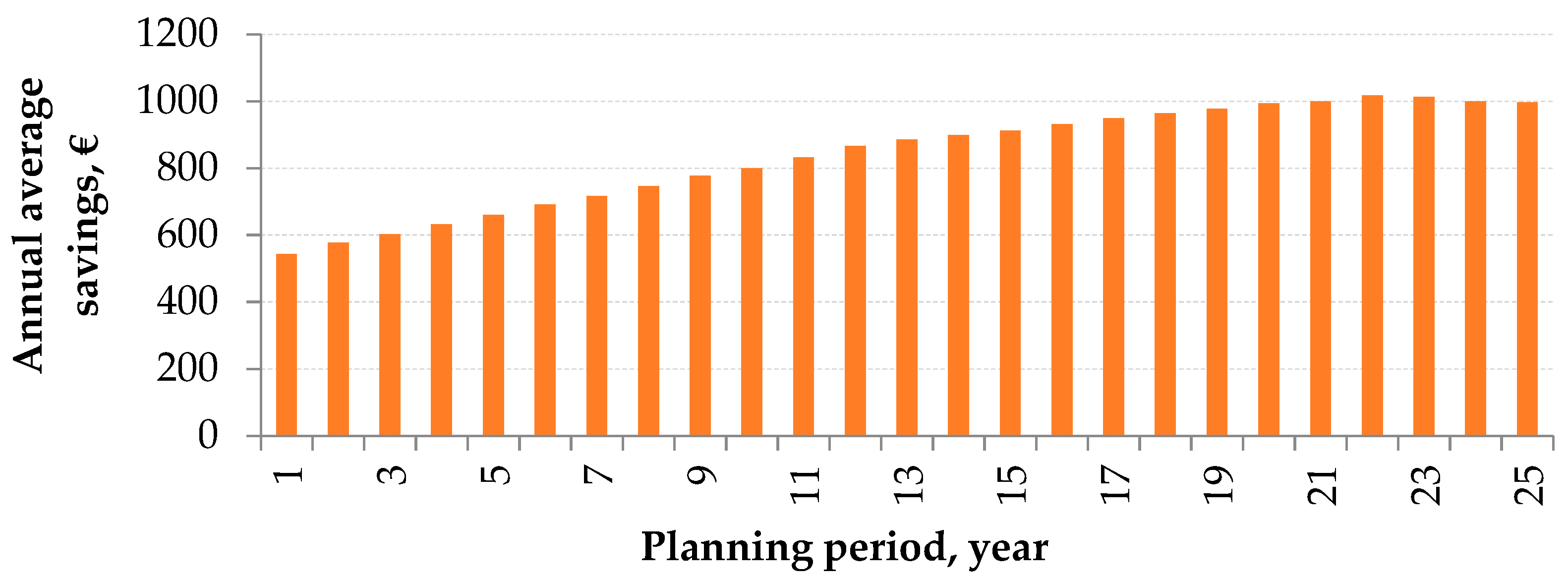

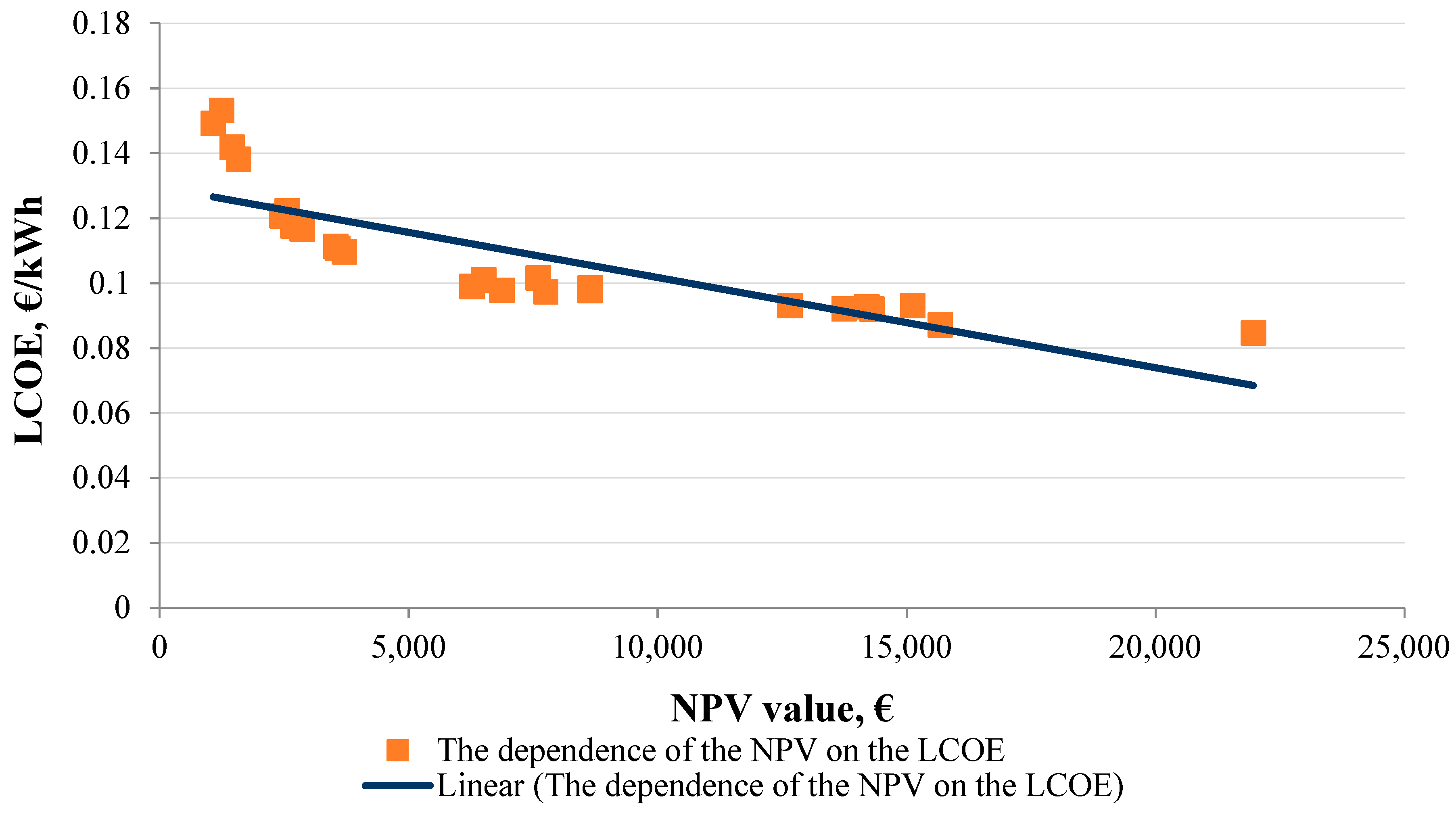

- The NPV is calculated for two alternatives: Alternative 1 presumes taking a loan; Alternative 2 entails no loan; using the prosumer’s savings, Expstore.

- The NPV is calculated by taking into account the prosumer’s income, Expstore, which is obtained from the energy produced by the PV technology.

- No subsidy is applied. There are currently no grants or financing incentives available for PV generation in Latvia.

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- European Commission Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC (2009). Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2009:140:0016:0062:en:PDF (accessed on 15 August 2018).

- Renewable Energy Policy Network for the 21st Century Renewables 2017 Global Status Report—REN21. Available online: http://www.ren21.net/wp-content/uploads/2017/06/17-8399_GSR_2017_Full_Report_0621_Opt.pdf (accessed on 5 November 2018).

- European Commission. Energy Efficiency Directive—European Commission. Available online: https://ec.europa.eu/energy/en/topics/energy-efficiency/energy-efficiency-directive (accessed on 5 November 2018).

- Technology Roadmap-Smart Grids. (International Energy Agency, Paris). Available online: https://www.iea.org/publications/freepublications/publication/TechnologyRoadmapHow2GuideforSmartGridsinDistributionNetworks.pdf (accessed on 3 November 2018).

- Hosenuzzaman, M.; Rahim, N.A.; Selvaraj, J.; Hasanuzzaman, M.; Malek, A.B.M.A.; Nahar, A. Global prospects, progress, policies, and environmental impact of solar photovoltaic power generation. Renew. Sustain. Energy Rev. 2015, 41, 284–297. [Google Scholar] [CrossRef]

- Popovic, I.; Radovanovic, I. Methodology for detection of photovoltaic systems underperformance operation based on the correlation of irradiance estimates of neighboring systems. J. Renew. Sustain. Energy 2018, 10. [Google Scholar] [CrossRef]

- Fraunhofer Institute for Solar Energy Systems—ISE Photovoltaics Report. Available online: https://www.ise.fraunhofer.de/content/dam/ise/de/documents/publications/studies/Photovoltaics-Report.pdf (accessed on 7 November 2018).

- Jäger-Waldau, A. PV Status Report 2017, EUR 28817 EN; Publications Office of the European Union: Luxembourg, 2017; ISBN 978-92-79-74071-8. [Google Scholar] [CrossRef]

- Dijkgraaf, E.; Van Dorp, T.P.; Maasland, E. On the effectiveness of feed-in tariffs in the development of solar photovoltaics. Energy J. 2018, 39, 81–99. [Google Scholar] [CrossRef]

- Dusonchet, L.; Telaretti, E. Comparative economic analysis of support policies for solar PV in the most representative EU countries. Renew. Sustain. Energy Rev. 2015, 42, 986–998. [Google Scholar] [CrossRef]

- García-Álvarez, M.; Cabeza-García, L.; Soares, M. Assessment of energy policies to promote photovoltaic generation in the European Union. Energy 2018, 151, 864–874. [Google Scholar] [CrossRef]

- Electricity Price Statistics. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Electricity_price_statistics#Electricity_prices_for_household_consumers (accessed on 5 October 2018).

- La Monaca, S.; Ryan, L. Solar PV where the sun doesn’t shine: Estimating the economic impacts of support schemes for residential PV with detailed net demand profiling. Energy Policy 2017, 108, 731–741. [Google Scholar] [CrossRef] [Green Version]

- EK “Solar Energy Policy in the EU and the Member States, from the Perspective of the Petitions Received“. Available online: http://www.europarl.europa.eu/RegData/etudes/STUD/2016/556968/IPOL_STU (2016)556968_EN.pdf (accessed on 5 October 2018).

- Zemite, L.; Kutjuns, A.; Bode, I.; Kunickis, M.; Zeltins, N. Consistency Analysis and Data Consultation of Gas System of Gas-Electricity Network of Latvia. Latv. J. Phys. Tech. Sci. 2018, 55, 22–34. [Google Scholar] [CrossRef]

- Dufo-López, R.; Bernal-Agustín, J.L. A comparative assessment of net metering and net billing policies. Study cases for Spain. Energy 2015, 84, 684–694. [Google Scholar] [CrossRef]

- Pyrgou, A.; Kylili, A.; Fokaides, P.A. The future of the feed-in tariff (FiT) scheme in europe: The case of photovoltaics. Energy Policy 2016, 95, 94–102. [Google Scholar] [CrossRef]

- Solarplaza, M.M. Overview of European PV Capacity Running out of Feed-In Tariffs & Alternative Revenue Streams. Available online: https://www.solarplaza.com/channels/asset-management/11738/overview-european-pv-capacity-running-out-feed-tariffs-alternative-revenue-streams/ (accessed on 6 November 2018).

- Yamamoto, Y. Pricing electricity from residential photovoltaic systems: a comparison of feed-in tariffs, net metering, and net purchase and sale. Sol. Energy 2012, 86, 2678–2685. [Google Scholar] [CrossRef]

- Jacobs, D.; Sovacool, B.K. Feed-In Tariffs and Other Support Mechanisms for Solar PV Promotion. Compr. Renew. Energy 2012, 1, 73–109. [Google Scholar] [CrossRef]

- Campoccia, A.; Dusonchet, L.; Telaretti, E.; Zizzo, G. Comparative analysis of different supporting measures for the production of electrical energy by solar pv and wind systems: four representative european cases. Sol. Energy 2009, 83, 287–297. [Google Scholar] [CrossRef]

- Poullikkas, A.; Kourtis, G.; Hadjipaschalis, J. A review of net metering mechanism for electricity renewable energy sources. Int. J. Energy Environ. 2013, 4, 975–1001. [Google Scholar]

- Jasevics, A.; Zemite, L. Kunickis Demand load control with smart meters. In Proceedings of the 58th Annual International Scientific Conference on Power and Electrical Engineering of Riga Technical University (RTUCON), Riga, Latvia, 12–13 October 2017. [Google Scholar]

- Photovoltaic Geographical Information System. Available online: http://re.jrc.ec.europa.eu/pvg_tools/en/tools.html#PVP (accessed on 12 August 2018).

- Legal sources on renewable energy. Latvia: Overall Summary. Available online: http://www.res-legal.eu/search-by-country/latvia/ (accessed on 5 November 2018).

- Electricity Market Law, §30 par.1,2,3,4. Available online: https://www.google.ru/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=2ahUKEwiEobzn0dneAhVEBiwKHQVlAxAQFjAAegQICBAC&url=http%3A%2F%2Fwww.vvc.gov.lv%2Fexport%2Fsites%2Fdefault%2Fdocs%2FLRTA%2FCiti%2FElectricity_Market_Law.doc&usg=AOvVaw3UGSfxk4NRZmm5VG_xTrlT (accessed on 7 November 2018).

- Solar Resource Maps and GIS Data for 200+ Countries. Available online: https://solargis.com/maps-and-gis-data/overview/ (accessed on 7 November 2018).

- Petrichenko, L.; Broka, Z.; Sauhats, A.; Bezrukovs, D. Cost-Benefit Analysis of Li-Ion Batteries in a Distribution Network. In Proceedings of the 2018 15th International Conference on the European Energy Market (EEM), Łódź, Poland, 27–29 June 2018; pp. 1–5. [Google Scholar]

- Zemite, L.; Gerhard, J.; Gorobetz, M.; Levchenkov, A. Optimization of distribution system reliability. In Proceedings of the 16th International Conference on Environment and Electrical Engineering (EEEIC), Florence, Italy, 6–8 June 2016. [Google Scholar]

- Huld, T.; Jäger-Waldau, A.; Ossenbrink, H.; Szábo, S.; Dunlop, E.; Taylor, N. Cost Maps for Unsubsidised Photovoltaic Electricity. Available online: https://setis.ec.europa.eu/sites/default/files/reports/Cost-Maps-for-Unsubsidised-Photovoltaic-Electricity.pdf (accessed on 31 July 2018).

- Dusonchet, L.; Telaretti, E. Economic analysis of different supporting policies for the production of electrical energy by solar photovoltaics in western European Union countries. Energy Policy 2010, 38, 3297–3308. [Google Scholar] [CrossRef]

- Amillo, A.; Huld, T.; Müller, R. A new database of global and direct solar radiation using the eastern meteosat satellite, models and validation. Remote Sensing 2014, 6, 8165–8189. [Google Scholar] [CrossRef] [Green Version]

- Hempel, S.; Schweinsberg, C.; Schmidt, J.; Tröster, E.; Ackermann, T. Smart Network Control with Coordinated PV Infeed. Available online: http://regridintegrationindia.org/wp-content/uploads/sites/3/2017/09/7A_5_GIZ17_xxx_paper_Eckehard_Troester.pdf (accessed on 29 July 2018).

- Darghouth, N.R.; Barbose, G.; Wiser, R.H. Customer-economics of residential photovoltaic systems (Part 1): The impact of high renewable energy penetrations on electricity bill savings with net metering. Energy Policy 2014, 67, 290–300. [Google Scholar] [CrossRef]

- Holdermann, C.; Kissel, J.; Beigel, J. Distributed photovoltaic generation in Brazil: An economic viability analysis of small-scale photovoltaic systems in the residential and commercial sectors. Energy Policy 2014, 67, 612–617. [Google Scholar] [CrossRef]

- Kroics, K.; Zemite, L.; Gaigals, G. Analysis of advanced inverter topology for renewable energy generation and energy storage integration into AC grid. In Proceedings of the 16th International Scientific Conference Engineering for Rural Development, Jelgava, Latvia, 24–26 May 2017. [Google Scholar]

- Gajowniczek, K.; Nafkha, R.; Ząbkowski, T. Electricity peak demand classification with artificial neural networks. In Proceedings of the 2017 Federated Conference on Computer Science and Information Systems (FedCSIS), Prague, Czech Republic, 3–6 September 2017. [Google Scholar]

- Ząbkowski, T.; Gajowniczek, K.; Szupiluk, R. Grade analysis for energy usage patterns segmentation based on smart meter data. In Proceedings of the 2015 IEEE 2nd International Conference on Cybernetics (CYBCONF), Gdynia, Poland, 24–26 June 2015. [Google Scholar]

- Sauhats, A.; Petričenko, Ļ; Berjozkina, S. Stochastic Planning of Distribution Lines. In Proceedings of the 2016 13th International Conference on the European Energy Market (EEM 2016), Porto, Portugal, 6–9 June 2016. [Google Scholar]

- Moshkin, I.; Sauhats, A. Solving district heating problems by using cooperative game theory methods. In Proceedings of the 16th International Conference on Environment and Electrical Engineering (EEEIC 2016), Florence, Italy, 6–8 June 2016. [Google Scholar]

- Singh, S.; Yassine, A. Big Data Mining of Energy Time Series for Behavioral Analytics and Energy Consumption Forecasting. Energies 2018, 11, 452. [Google Scholar] [CrossRef] [Green Version]

- Aggarwal, S.K.; Saini, L.M.; Kumar, A. Electricity price forecasting in deregulated markets: A review and evaluation. Int. J. Electr. Power Energy Syst. 2009, 31, 13–22. [Google Scholar] [CrossRef]

- Singh, N.; Mohanty, S.R. A Review of Price Forecasting Problem and Techniques in Deregulate ElectricityMarkets. J. Power Energy Eng. 2015, 3, 1–19. [Google Scholar] [CrossRef]

- Pandey, N.; Upadhyay, K.G. Different price forecasting techniques and their application in deregulated electricity market: A comprehensive study. In Proceedings of the 2016 International Conference on Emerging Trends in Electrical Electronics & Sustainable Energy Systems (ICETEESES), Sultanpur, India, 11–12 March 2016. [Google Scholar]

- Petrichenko, R.; Baltputnis, K.; Sauhats, A.; Sobolevsky, D. District Heating Demand Short-Term Forecasting. In Proceedings of the 17th International Conference on Enviroment and Electrical Engineering (IEEE EEEIC 2017), Italy, Milan, 6–9 June 2017. [Google Scholar]

- Yao, M.; Zhao, M.; Xiao, H.; Wang, D. Research on mid-long term load forecasting based on combination forecasting mode. In Proceedings of the 2015 IEEE/ACIS 16th International Conference on Software Engineering, Artificial Intelligence, Networking and Parallel/Distributed Computing (SNPD), Takamatsu, Japan, 1–3 June 2015. [Google Scholar]

- Agarwal, A.; Ojha, A.; Tewari, S.C.; Tripathi, M.M. Hourly load and price forecasting using ANN and fourier analysis. In Proceedings of the 2014 6th IEEE Power India International Conference (PIICON), Delhi, India, 5–7 December 2014. [Google Scholar]

- Ariyo, A.A.; Adewumi, A.O.; Ayo, C.K. Stock Price Prediction Using the ARIMA Model. In Proceedings of the 2014 UKSim-AMSS 16th International Conference on Computer Modelling and Simulation, Cambridge, UK, 26–28 March 2014. [Google Scholar]

- Sauhats, A.; Čuvičins, V.; Bočkarjova, G.; Žalostība, D.; Antonovs, D.; Petričenko, R. Detection and Management of Large Scale Disturbances in Power System. In Critical Information Infrastructures Security. Lecture Notes in Computer Science: Vol.8985; Springer International Publishing: Limassol, Cyprus, 2016; pp. 147–152. [Google Scholar]

- Energy Prices Forecast. Available online: https://blog.energybrainpool.com/en/trends-in-the-development-of-electricity-prices-eu-energy-outlook-2050/ (accessed on 5 October 2018).

- AS “Sadales Tīkls” Electricity Distribution Differential Tariffs. Available online: https://www.sadalestikls.lv/uploads/2018/01/ST_tarifi_ENG.pdf (accessed on 5 October 2018).

- Electricity Price Components. Available online: http://www.eptirgotajs.lv/no-2018-gada-sagaidama-oik-samazinasanas/#/ [on Latvian] (accessed on 5 October 2018).

- Bank Interest Rates. Available online: https://www.bank.lv/statistika/dati-statistika/procentu-likmju-statistikas-raditaji/galvenas-procentu-likmes [in Latvian] (accessed on 5 October 2018).

| Name of the Parameter; Measuring Unit | Value |

|---|---|

| Number of phases | 3 |

| Payment for the trading service, €/kWh | 0.00564 |

| FV component, €/year | 115.11 |

| VP component, €/kWh | 0.07104 |

| Planning time, years | 25 |

| Loan interest rate, % | 2.6 |

| Discount rate, % | 2.0 |

| Scenario | According to MC | Loan | Sum of Annual Mean Costs, € | NPV, € | PP, Years | LCOE, €/kWh | LCOE Changes in Respect to the Base Case, % |

|---|---|---|---|---|---|---|---|

| Base case | Accounting | - | 37420.72 | - | - | 0.16 | 0.00% |

| NBS | Billing | present | 16446.07 | 7468.60 | 11 | 0.11 | −33.40% |

| Billing | absent | 11852.97 | 8 | 0.10 | −38.13% |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sauhats, A.; Zemite, L.; Petrichenko, L.; Moshkin, I.; Jasevics, A. Estimating the Economic Impacts of Net Metering Schemes for Residential PV Systems with Profiling of Power Demand, Generation, and Market Prices. Energies 2018, 11, 3222. https://doi.org/10.3390/en11113222

Sauhats A, Zemite L, Petrichenko L, Moshkin I, Jasevics A. Estimating the Economic Impacts of Net Metering Schemes for Residential PV Systems with Profiling of Power Demand, Generation, and Market Prices. Energies. 2018; 11(11):3222. https://doi.org/10.3390/en11113222

Chicago/Turabian StyleSauhats, Antans, Laila Zemite, Lubov Petrichenko, Igor Moshkin, and Aivo Jasevics. 2018. "Estimating the Economic Impacts of Net Metering Schemes for Residential PV Systems with Profiling of Power Demand, Generation, and Market Prices" Energies 11, no. 11: 3222. https://doi.org/10.3390/en11113222

APA StyleSauhats, A., Zemite, L., Petrichenko, L., Moshkin, I., & Jasevics, A. (2018). Estimating the Economic Impacts of Net Metering Schemes for Residential PV Systems with Profiling of Power Demand, Generation, and Market Prices. Energies, 11(11), 3222. https://doi.org/10.3390/en11113222