On the Disruptive Innovation Strategy of Renewable Energy Technology Diffusion: An Agent-Based Model

Abstract

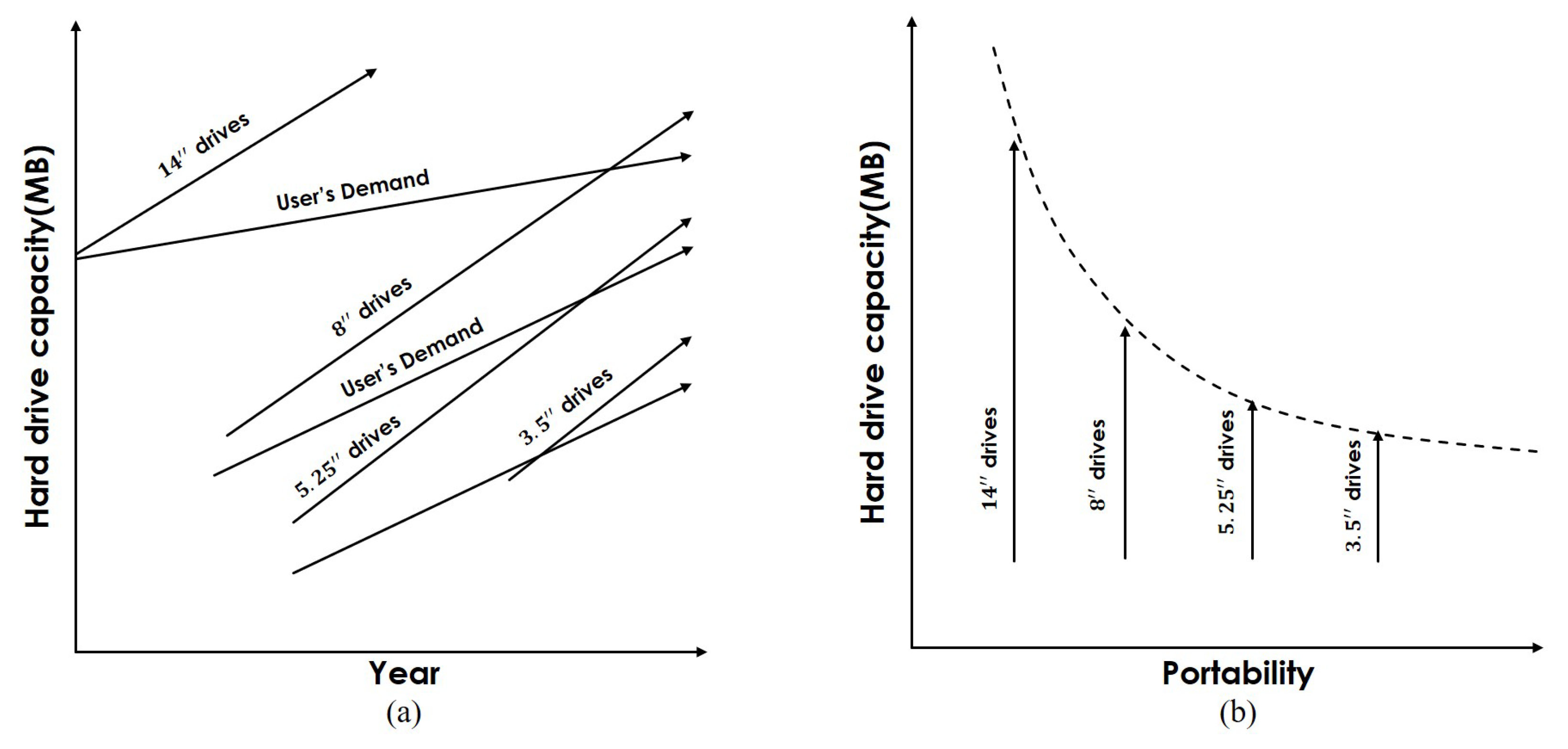

:1. Introduction

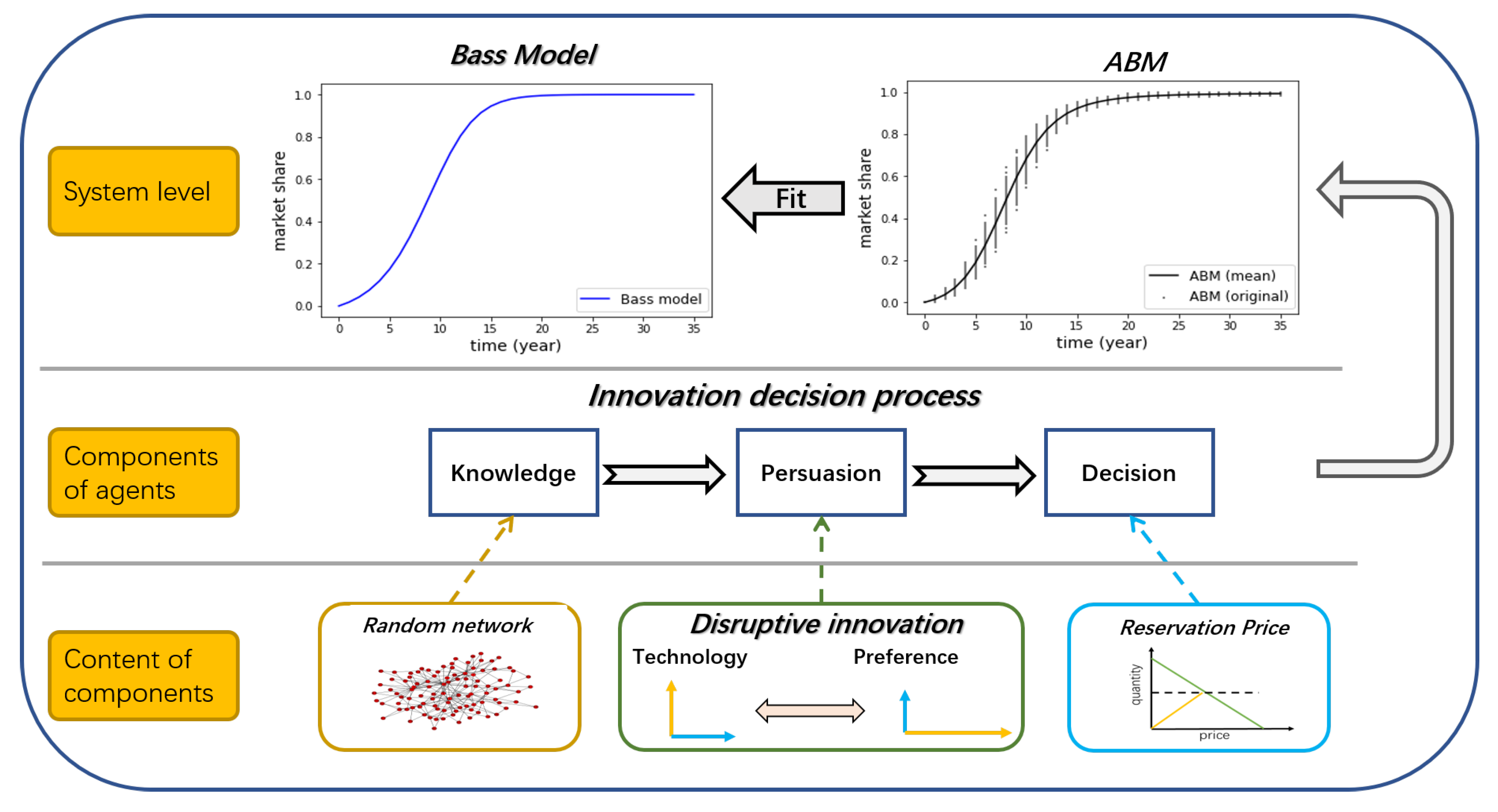

2. Materials and Methods

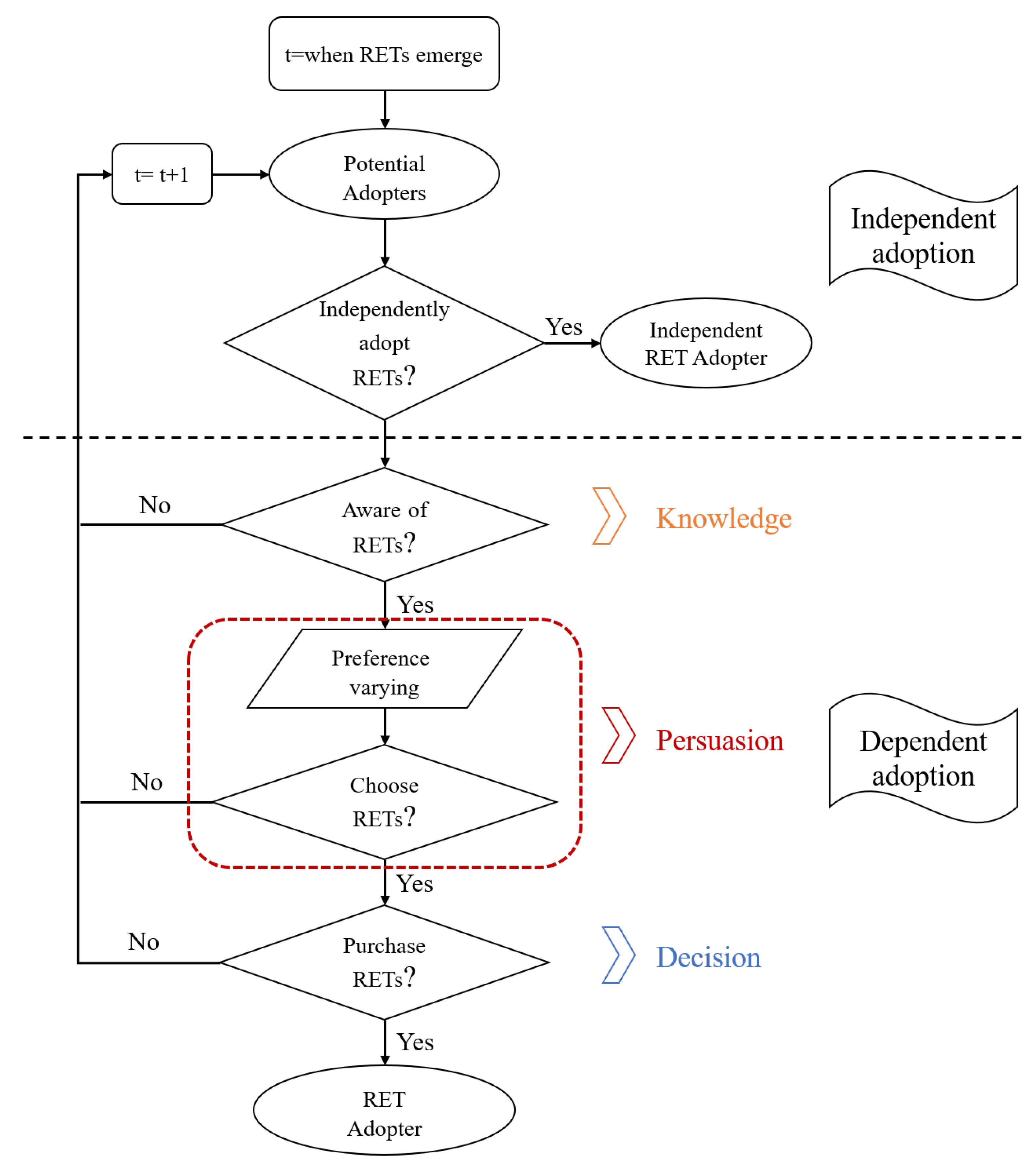

2.1. Framework of the Model

2.2. Model Dynamics

3. Results

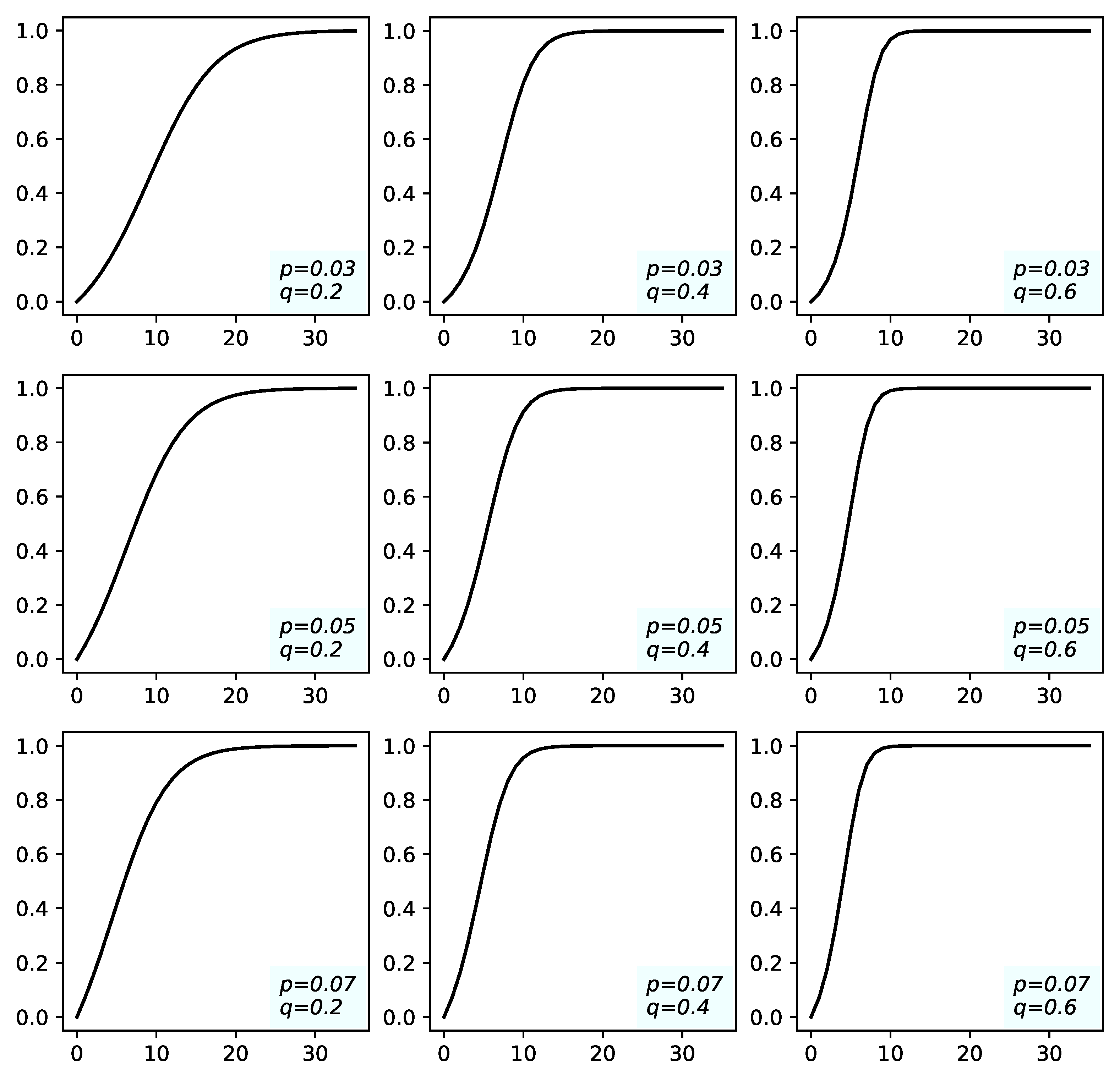

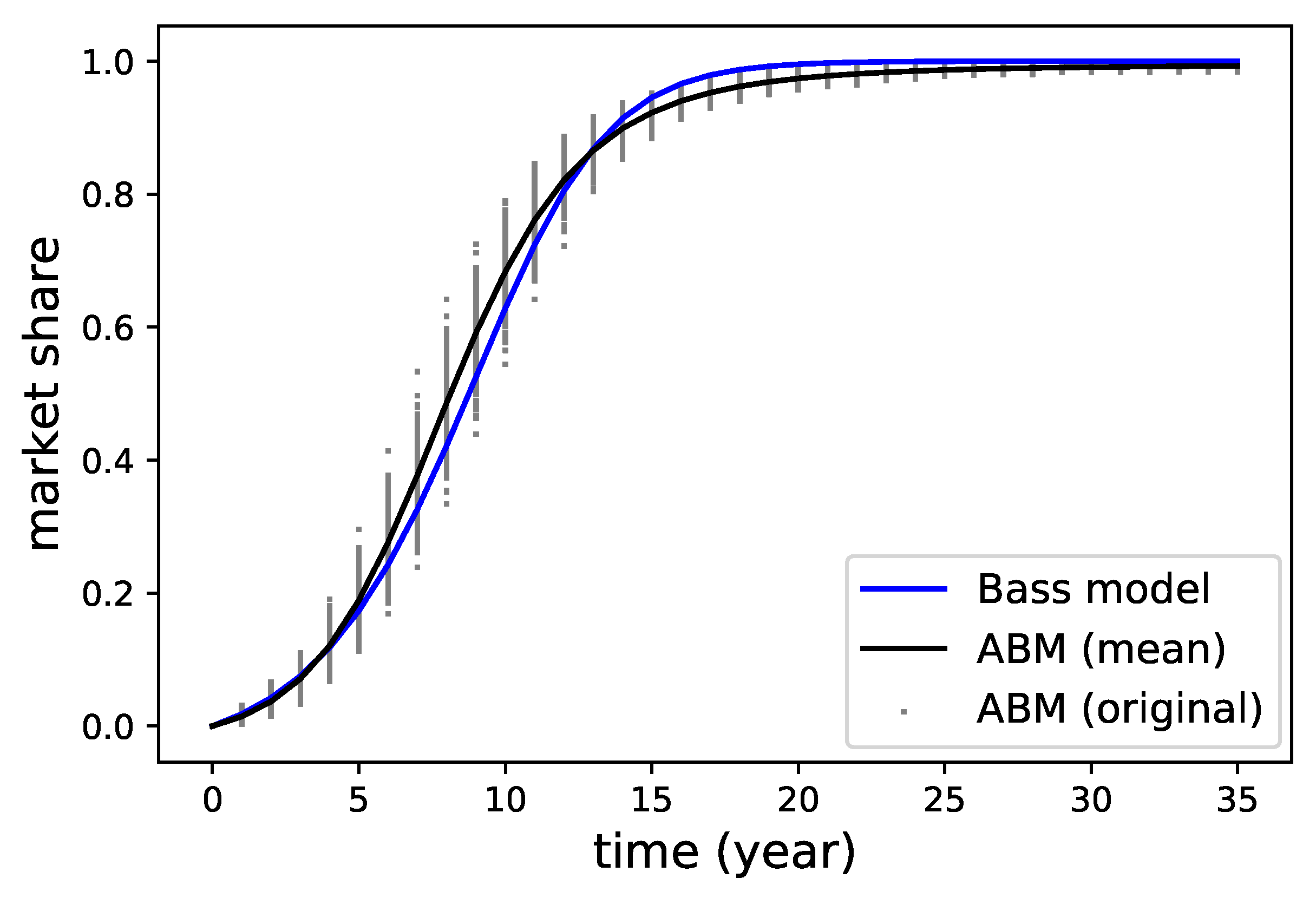

3.1. One-Dimensional Competition

3.2. Two-Dimensional Competition

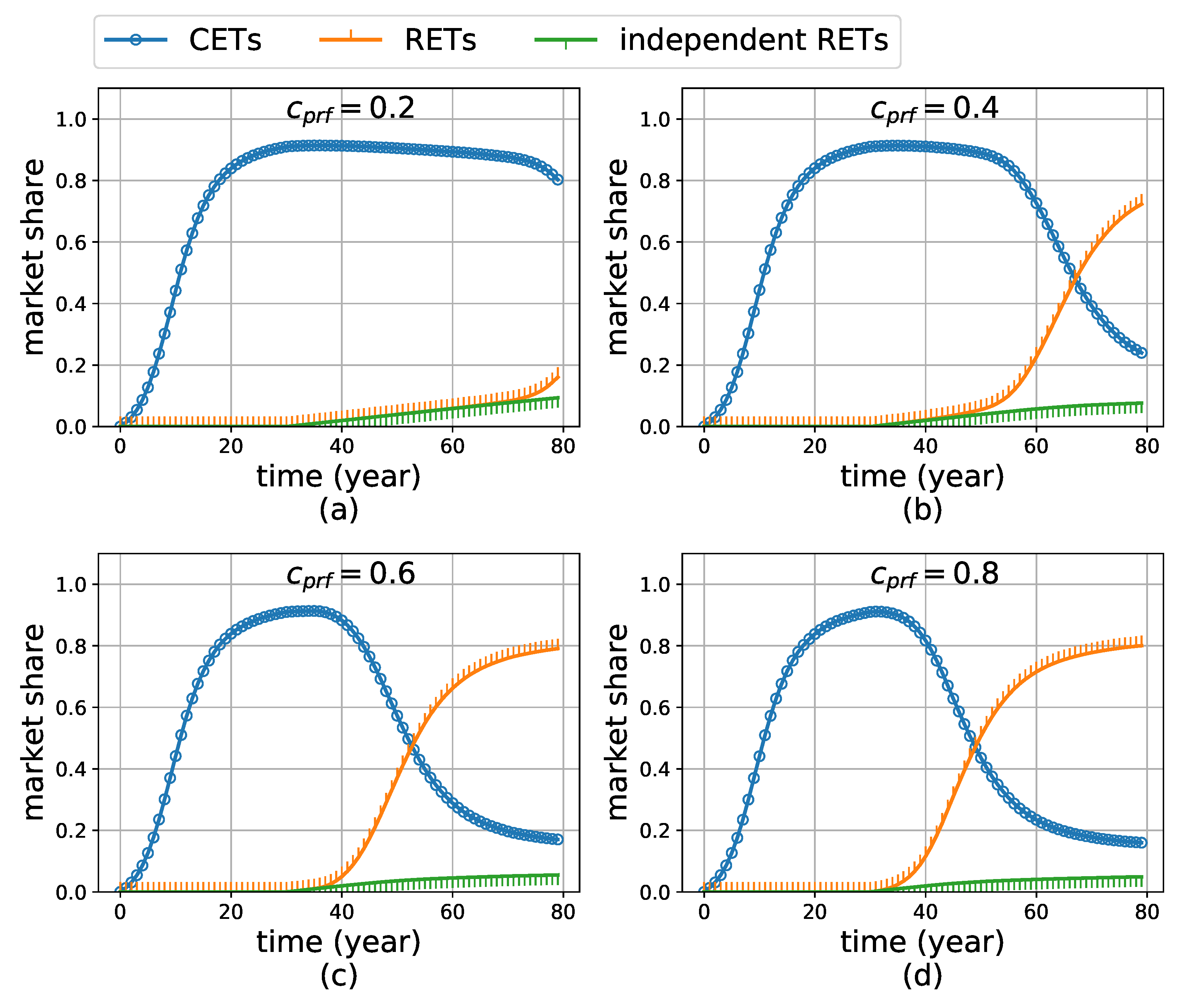

3.2.1. The Impact of Price Variation

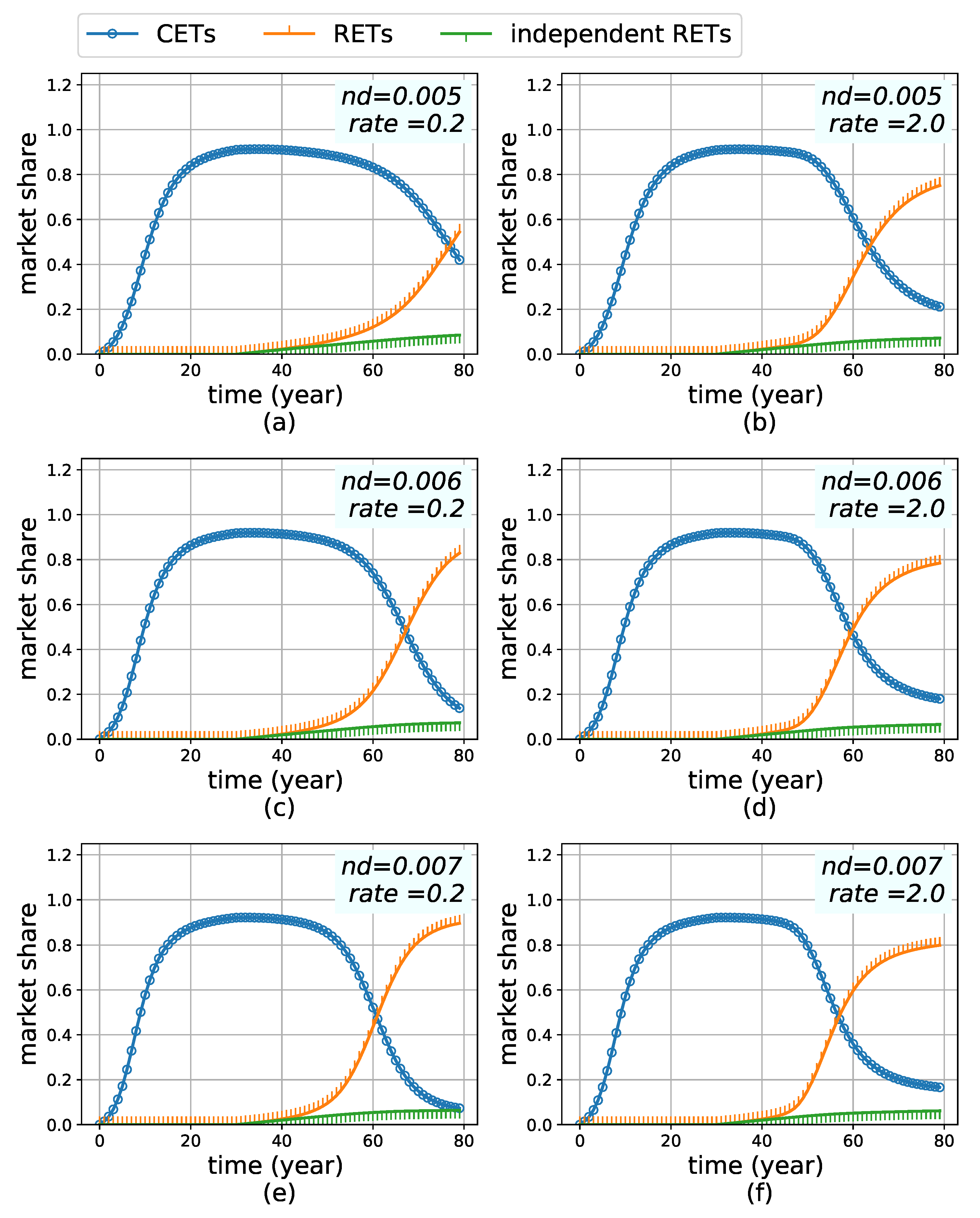

3.2.2. Impact of Preference Changing

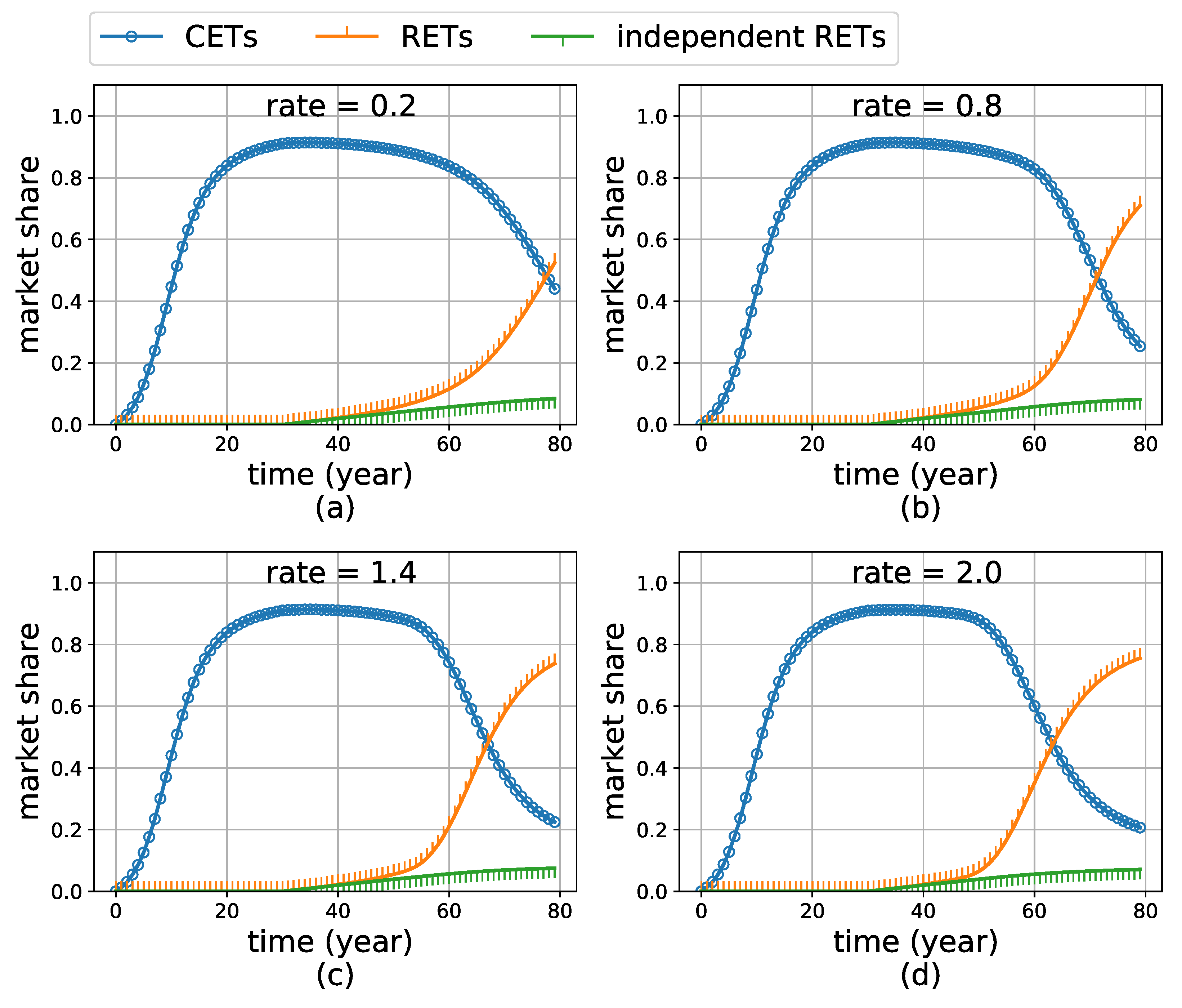

3.2.3. The Impact of RET Improvement Rate

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| Variable | Meaning |

| the probability that a potential adopter independently adopts CETs. | |

| the probability that a potential adopter independently adopts RETs. | |

| the probability that a potential adopter becomes aware of CETs. | |

| the probability that a potential adopter becomes aware of RETs. | |

| the probability that a neighboring adopter of CETs successfully influences the potential adopter of CETs. | |

| the probability that a neighboring adopter of RETs successfully influences the potential adopter of RETs. | |

| the number of neighboring adopters of CETs. | |

| the number of neighboring adopters of RETs. | |

| the preference of agent i. | |

| the weight that agent i assigns to a technology’s conventional dimension. | |

| the weight that agent i assigns to a technology’s non-conventional dimension. | |

| the initial weight agent i assign to RETs’ non-conventional dimension. | |

| a coefficient adjusting the degree of the influence on preference changing | |

| the performance of CETs. | |

| the performance of CETs in terms of the conventional dimension. | |

| the performance of CETs in terms of the non-conventional dimension. | |

| the initial performance of CETs when they enter the market at first. | |

| the constant that adjusts the speed of technology progress. | |

| the maximal cumulative adopters of CETs at year t. | |

| M | the total number of potential adopters in a market. |

| the performance of RETs. | |

| the performance of RETs in terms of the conventional dimension. | |

| the performance of RETs in terms of the non-conventional dimension. | |

| the initial performance of RETs. | |

| the speed of the technological progress of RETs. | |

| the maximum cumulative adopters of RETs within t years. | |

| the probability that consumer i decides to purchase a CET. | |

| the probability that consumer i decides to purchase a RET. | |

| the reservation price of consumers willing to pay for CETs. | |

| the reservation price of consumers willing to pay for RETs. | |

| the actual price of CETs. | |

| the actual price of RETs. | |

| the utility of CETs that a consumer perceives. | |

| the utility of RETs that a consumer perceives. | |

| d | the deviation between the utility a consumer perceives and the reservation price the consumer is willing to pay. |

| the unit price of . | |

| the unit price of . |

References

- Wu, J.; Fan, Y.; Xia, Y. How can China achieve its nationally determined contribution targets combining emissions trading scheme and renewable energy policies? Energies 2017, 10, 1166. [Google Scholar] [CrossRef]

- Li, Y.; Yang, Z.; Li, G.; Zhao, D.; Tian, W. Optimal scheduling of an isolated microgrid with battery storage considering load and renewable generation uncertainties. IEEE Trans. Ind. Electron. 2019, 66, 1565–1575. [Google Scholar] [CrossRef]

- Li, Y.; Yang, Z.; Li, G.; Mu, Y.; Zhao, D.; Chen, C.; Shen, B. Optimal scheduling of isolated microgrid with an electric vehicle battery swapping station in multi-stakeholder scenarios: A bi-level programming approach via real-time pricing. Appl. Energy 2018, 232, 54–68. [Google Scholar] [CrossRef]

- Verdolini, E.; Vona, F.; Popp, D. Bridging the gap: Do fast-reacting fossil technologies facilitate renewable energy diffusion? Energy Policy 2018, 116, 242–256. [Google Scholar] [CrossRef] [Green Version]

- Bergek, A.; Mignon, I. Motives to adopt renewable energy technologies: Evidence from Sweden. Energy Policy 2017, 106, 547–559. [Google Scholar] [CrossRef]

- Negro, S.O.; Alkemade, F.; Hekkert, M.P. Why does renewable energy diffuse so slowly? A review of innovation system problems. Renew. Sustain. Energy Rev. 2012, 16, 3836–3846. [Google Scholar] [CrossRef]

- System Advisor Model (SAM). Available online: https://sam.nrel.gov/ (accessed on 20 October 2018).

- Angeletos, G.M.; Laibson, D.; Repetto, A.; Tobacman, J.; Weinberg, S. The hyperbolic consumption model: Calibration, simulation, and empirical evaluation. J. Econ. Perspect. 2001, 15, 47–68. [Google Scholar] [CrossRef]

- Rubinstein, A. “Economics and Psychology”? The Case of Hyperbolic Discounting. Int. Econ. Rev. 2003, 44, 1207–1216. [Google Scholar] [CrossRef]

- Cannistraro, M.; Mainardi, E.; Bottarelli, M. Testing a Dual-Source Heat Pump. Math. Model. Eng. Prob. 2018, 5, 205–210. [Google Scholar] [CrossRef]

- Piccolo, A.; Siclari, R.; Rando, F.; Cannistraro, M. Comparative performance of thermoacoustic heat exchangers with different pore geometries in oscillatory flow. implementation of experimental techniques. Appl. Sci. 2017, 7, 784. [Google Scholar] [CrossRef]

- Cannistraro, M.; Castelluccio, M.E.; Germanò, D. New sol-gel deposition technique in the Smart-Windows– Computation of possible applications of Smart-Windows in buildings. J. Build. Eng. 2018, 19, 295–301. [Google Scholar] [CrossRef]

- Bower, J.L.; Christensen, C.M. Disruptive technologies: Catching the wave. Harv. Bus. Rev. 1995, 73, 43–53. [Google Scholar]

- Adner, R. When are technologies disruptive? A demand-based view of the emergence of competition. Strateg. Manag. J. 2002, 23, 667–688. [Google Scholar] [CrossRef]

- Christensen, C. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail; Harvard Business Review Press: Cambridge, MA, USA, 2013. [Google Scholar]

- Hardman, S.; Steinberger-Wilckens, R.; van der Horst, D. Disruptive innovations: The case for hydrogen fuel cells and battery electric vehicles. Int. J. Hydrogen Energy 2013, 38, 15438–15451. [Google Scholar] [CrossRef]

- Dijk, M.; Wells, P.; Kemp, R. Will the momentum of the electric car last? Testing an hypothesis on disruptive innovation. Technol. Forecast. Soc. Chang. 2016, 105, 77–88. [Google Scholar] [CrossRef]

- SolarCity. Available online: https://www.tesla.com/solarroof (accessed on 20 October 2018).

- Ilieva, I.; Gabriel, S. Electricity retailers’ behavior in a highly competitive Nordic electricity market. J. Energy Mark. 2014, 7, 4. [Google Scholar] [CrossRef]

- Lilliestam, J.; Patt, A. Barriers, risks and policies for renewables in the Gulf States. Energies 2015, 8, 8263–8285. [Google Scholar] [CrossRef]

- Lee, D.H.; Park, S.Y.; Kim, J.W.; Lee, S.K. Analysis on the feedback effect for the diffusion of innovative technologies focusing on the green car. Technol. Forecast. Soc. Chang. 2013, 80, 498–509. [Google Scholar] [CrossRef]

- Marinakis, Y.D. Forecasting technology diffusion with the Richards model. Technol. Forecast. Soc. Chang. 2012, 79, 172–179. [Google Scholar] [CrossRef]

- Gunduc, S. A Case Study of Diffusion of Innovation under Competition. Acta Phys. Pol. A 2018, 133, 1465–1469. [Google Scholar] [CrossRef]

- Jin, W.; Zhang, Z. On the mechanism of international technology diffusion for energy technological progress. Resour. Energy Econ. 2016, 46, 39–61. [Google Scholar] [CrossRef] [Green Version]

- Olivella-Rosell, P.; Villafafila-Robles, R.; Sumper, A.; Bergas-Jané, J. Probabilistic agent-based model of electric vehicle charging demand to analyse the impact on distribution networks. Energies 2015, 8, 4160–4187. [Google Scholar] [CrossRef] [Green Version]

- Shafiei, E.; Thorkelsson, H.; Ásgeirsson, E.I.; Davidsdottir, B.; Raberto, M.; Stefansson, H. An agent-based modeling approach to predict the evolution of market share of electric vehicles: A case study from Iceland. Technol. Forecast. Soc. Chang. 2012, 79, 1638–1653. [Google Scholar] [CrossRef]

- Stummer, C.; Kiesling, E.; Günther, M.; Vetschera, R. Innovation diffusion of repeat purchase products in a competitive market: An agent-based simulation approach. Eur. J. Oper. Res. 2015, 245, 157–167. [Google Scholar] [CrossRef]

- Palmer, J.; Sorda, G.; Madlener, R. Modeling the diffusion of residential photovoltaic systems in italy: An agent-based simulation. Technol. Forecast. Soc. Chang. 2015, 99, 106–131. [Google Scholar] [CrossRef]

- Robinson, S.A.; Rai, V. Determinants of spatio-temporal patterns of energy technology adoption: An agent-based modeling approach. Appl. Energy 2015, 151, 273–284. [Google Scholar] [CrossRef] [Green Version]

- Kangur, A.; Jager, W.; Verbrugge, R.; Bockarjova, M. An agent-based model for diffusion of electric vehicles. J. Environ. Psychol. 2017, 52, 166–182. [Google Scholar] [CrossRef]

- Desmarchelier, B.; Fang, E.S. National culture and innovation diffusion. Exploratory insights from agent-based modeling. Technol. Forecast. Soc. Chang. 2016, 105, 121–128. [Google Scholar] [CrossRef]

- Goldenberg, J.; Libai, B.; Muller, E. Using complex systems analysis to advance marketing theory development: Modeling heterogeneity effects on new product growth through stochastic cellular automata. Acad. Mark. Sci. Rev. 2001, 2001, 9. [Google Scholar]

- Kononovicius, A.; Daniunas, V. Agent-based and macroscopic modeling of the complex socio-economic systems. Soc. Technol. 2013, 3. [Google Scholar] [CrossRef]

- Wilensky, U. NetLogo. Center for Connected Learning and Computer-Based Modeling. 1999. Available online: http://ccl.northwestern.edu/netlogo/ (accessed on 7 June 2018).

- Rogers, E.M. Diffusion of Innovations; Simon and Schuster: New York City, NY, USA, 2010. [Google Scholar]

- Bass, F.M. A new product growth for model consumer durables. Manag. Sci. 1969, 15, 215–227. [Google Scholar] [CrossRef]

- NetLogo Nw Extension. Available online: https://ccl.northwestern.edu/netlogo/docs/nw.html (accessed on 1 November 2018).

- Kiesling, E.; Günther, M.; Stummer, C.; Wakolbinger, L.M. Agent-based simulation of innovation diffusion: A review. Cent. Eur. J. Oper. Res. 2012, 20, 183–230. [Google Scholar] [CrossRef]

- Van den Bulte, C.; Stremersch, S. Social contagion and income heterogeneity in new product diffusion: A meta-analytic test. Mark. Sci. 2004, 23, 530–544. [Google Scholar] [CrossRef]

- North, M.J.; Macal, C.M. Managing Business Complexity: Discovering Strategic Solutions with Agent-Based Modeling and Simulation; Oxford University Press: Oxford, UK, 2007. [Google Scholar]

- Jager, W. Stimulating the diffusion of photovoltaic systems: A behavioural perspective. Energy Policy 2006, 34, 1935–1943. [Google Scholar] [CrossRef]

- Rai, V.; Reeves, D.C.; Margolis, R. Overcoming barriers and uncertainties in the adoption of residential solar PV. Renew. Energy 2016, 89, 498–505. [Google Scholar] [CrossRef]

- Srinivasan, V.; Mason, C.H. Nonlinear least squares estimation of new product diffusion models. Mark. Sci. 1986, 5, 169–178. [Google Scholar] [CrossRef]

- Chandrasekaran, D.; Tellis, G.J. A critical review of marketing research on diffusion of new products. In Review of Marketing Research; Emerald Group Publishing Limited: Bingley, UK, 2007; pp. 39–80. [Google Scholar]

- Oecd Renewable Energy Data. Available online: https://data.oecd.org/energy/renewable-energy.htm (accessed on 20 October 2018).

- Sultan, F.; Farley, J.U.; Lehmann, D.R. A meta-analysis of applications of diffusion models. J. Mark. Res. 1990, 27, 70–77. [Google Scholar] [CrossRef]

- Barabási, A.L. Network Science; Cambridge University Press: Cambridge, UK, 2016. [Google Scholar]

- Rand, W.; Rust, R.T. Agent-based modeling in marketing: Guidelines for rigor. Int. J. Res. Mark. 2011, 28, 181–193. [Google Scholar] [CrossRef]

- Antonopoulos, C. Diffusion of Energy Efficient Technology in Commercial Buildings: An Analysis of the Commercial Building Partnerships Program. Ph.D. Thesis, Portland State University, Portland, OR, USA, 2013. [Google Scholar]

- Building a Better World with Smart Homes + Solar Energy & Battery Storage. Available online: https://www.sunrun.com/go-solar-center/solar-articles/building-a-better-world-with-smart-homes-solar-energy-battery-storage (accessed on 20 October 2018).

- 5 Trends for the Smart Energy Home of the Future. Available online: https://www.greentechmedia.com/articles/read/5-trends-for-the-smart-energy-home-of-the-future#gs.5An9N=o (accessed on 20 October 2018).

- Where Nokia Went Wrong. Available online: https://www.newyorker.com/business/currency/where-nokia-went-wrong (accessed on 20 October 2018).

| Parameter Name | Value | Remark |

|---|---|---|

| M | 1000 | The absolute number of agents is not important when potential adopters are treated as 1. |

| 0.005 | Network density () is set according to the calibration. This is consistent with [47], which found that the networks in the real world are normally sparse. | |

| 0.01 | Set according to the calibration. The value is located in the range of previous literature [36,48]. | |

| 0.01 | Controlled for the current experiment. | |

| 0.26 | Set according to the calibration. The value is located in the range of previous literature [36,48]. | |

| 0.26 | Controlled for the current experiment. | |

| 0.01 | Assume that CETs start with a very low performance, which intends to mimic a complete maturation process of CETs. | |

| 2.6 | Set according to the calibration. This value indicates that this technology becomes fully mature after 38.9% of the consumers have adopted, according to Equation (8). | |

| Controlled for the current experiment. Indicating that the emergent technology appears with the same performance as the incumbent technology. | ||

| 2.6 | Controlled for the current experiment. | |

| 1 | The unit price of a technology’s conventional dimension. The number “1” is a convenient benchmark. |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zeng, Y.; Dong, P.; Shi, Y.; Li, Y. On the Disruptive Innovation Strategy of Renewable Energy Technology Diffusion: An Agent-Based Model. Energies 2018, 11, 3217. https://doi.org/10.3390/en11113217

Zeng Y, Dong P, Shi Y, Li Y. On the Disruptive Innovation Strategy of Renewable Energy Technology Diffusion: An Agent-Based Model. Energies. 2018; 11(11):3217. https://doi.org/10.3390/en11113217

Chicago/Turabian StyleZeng, Yongchao, Peiwu Dong, Yingying Shi, and Yang Li. 2018. "On the Disruptive Innovation Strategy of Renewable Energy Technology Diffusion: An Agent-Based Model" Energies 11, no. 11: 3217. https://doi.org/10.3390/en11113217