Modeling the Risk of Commercial Failure for Hydraulic Fracturing Projects Due to Reservoir Heterogeneity

Abstract

:1. Introduction

2. Theoretical Background

2.1. Heterogeniety Impact Factor Determination

2.2. Cumulative Gas Production Calculation

- (1)

- for HIF < 1: and

- (2)

- for HIF > 1: and

2.3. Economic Evaluation

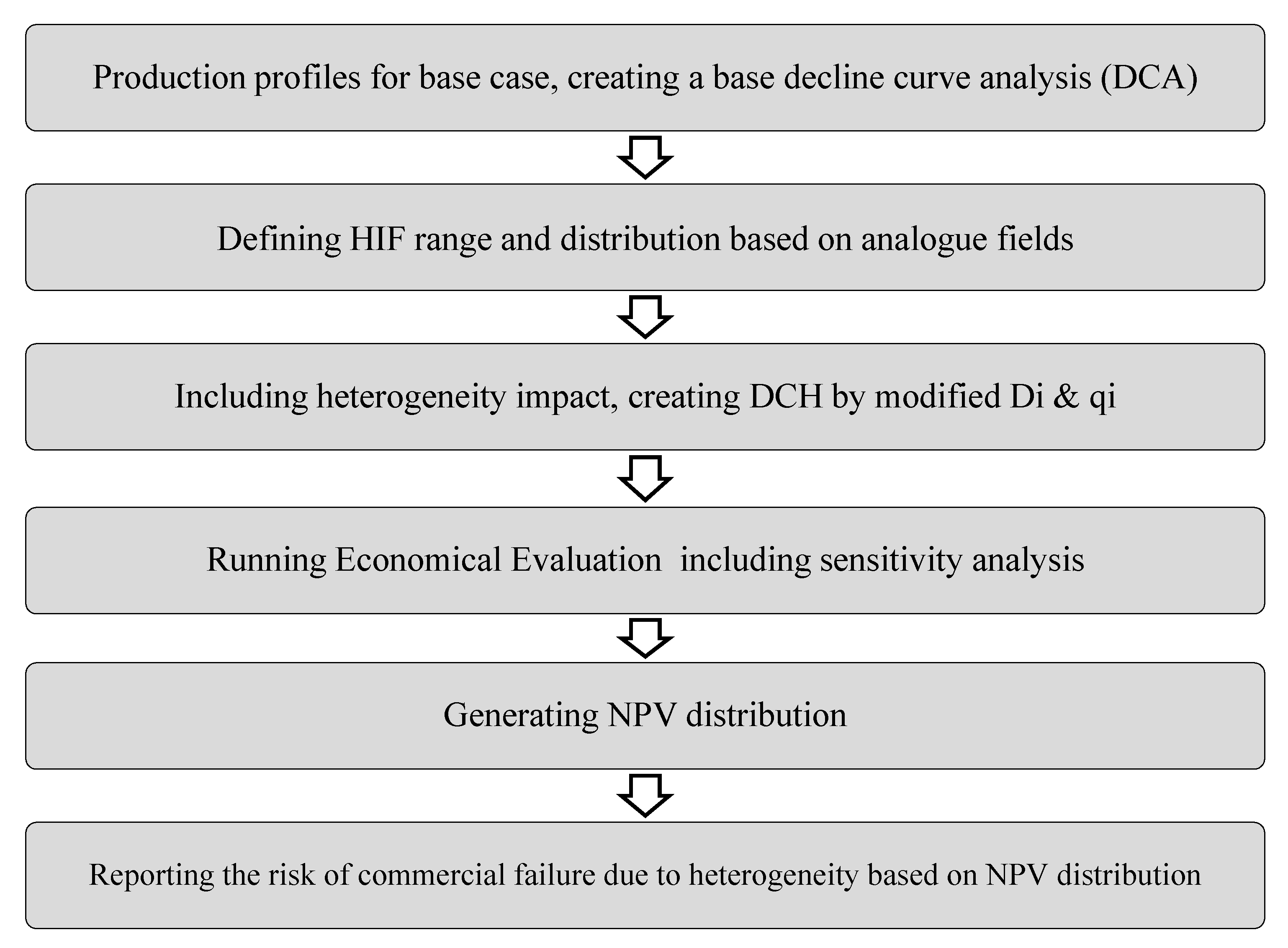

2.4. Definition of Risk Due to Heterogeneity

- (1)

- Set a value for HIF; i.e., for any HIF an individual NPV history is achieved.

- (2)

- Calculate the modified flow rate and the decline constant considering the set HIF value.

- (3)

- Quantify the annual cumulative gas production from Equation (5) based on the difference of gas production values from to successive time intervals of n and n + 1.

- (4)

- Multiply the value obtained in step 3 by the gas price to calculate the annual revenue.

- (5)

- Discount the annual revenue for OPEX and discount rate on an annual base.

- (6)

- Subtract the discounted income resulted in step 6 from CAPEX.

- (7)

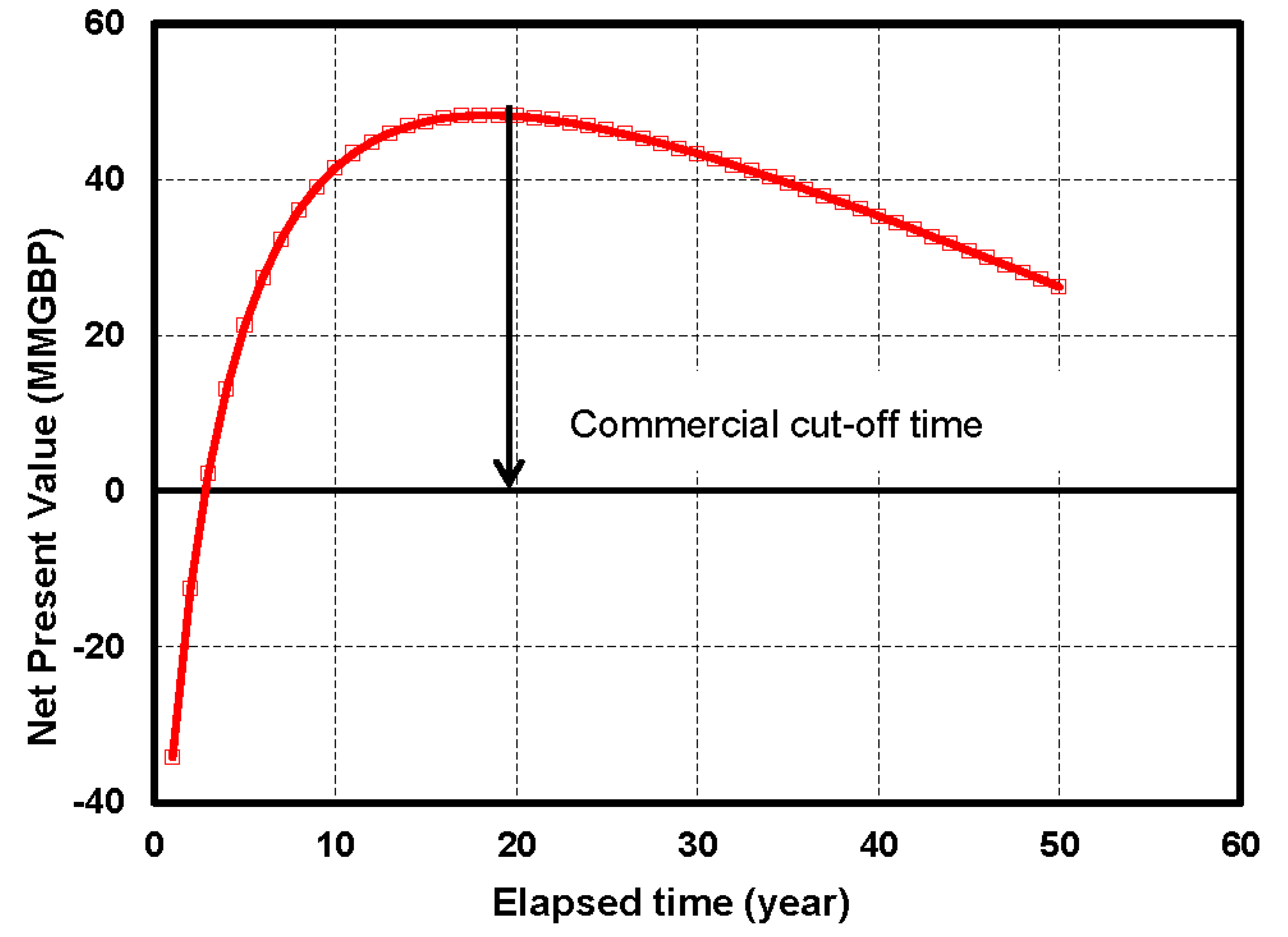

- Repeat the above steps for subsequent years of production and construct the NPV versus time plot.

3. Results and Discussion

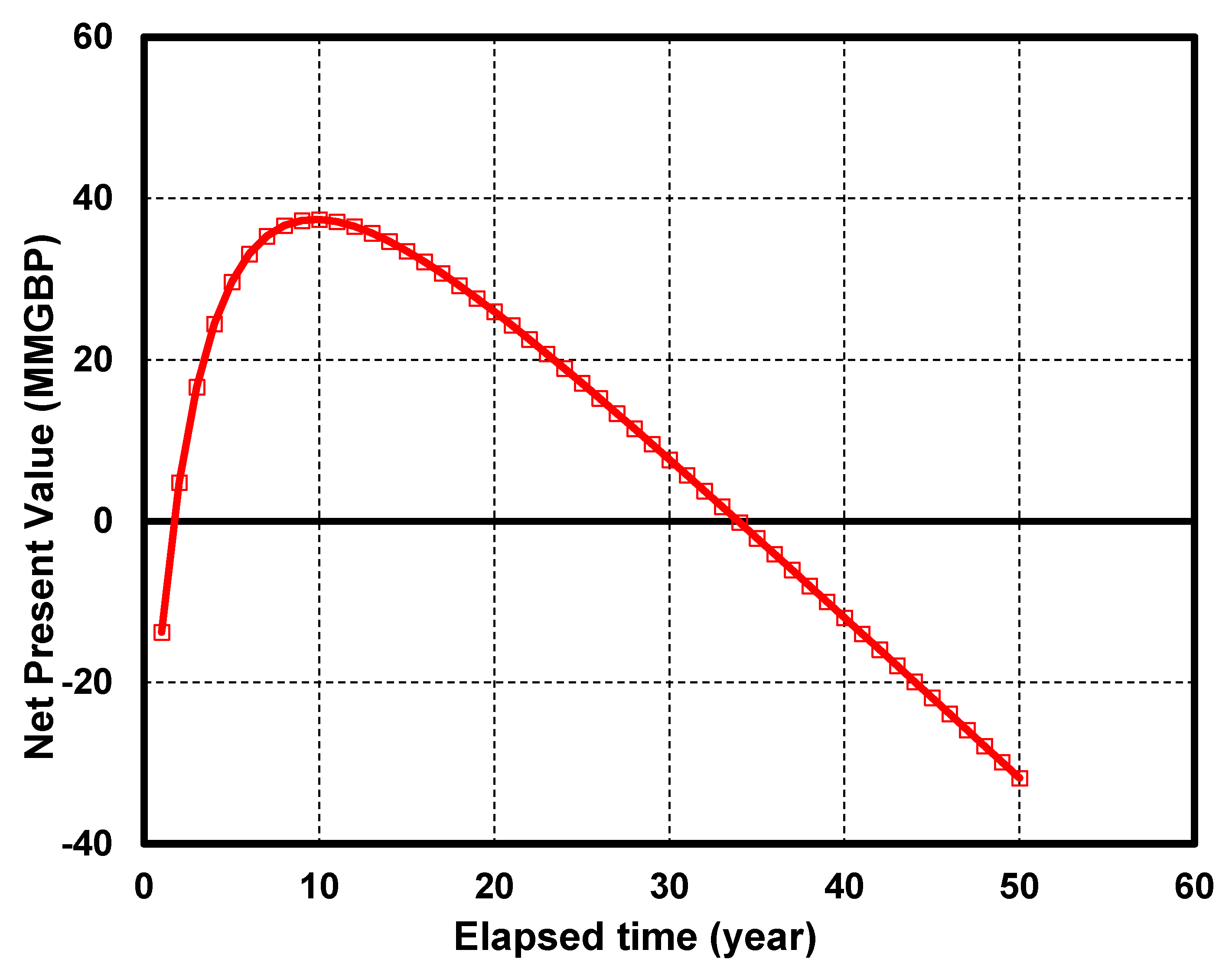

3.1. Economical Model

3.1.1. Assumption of Model Variables

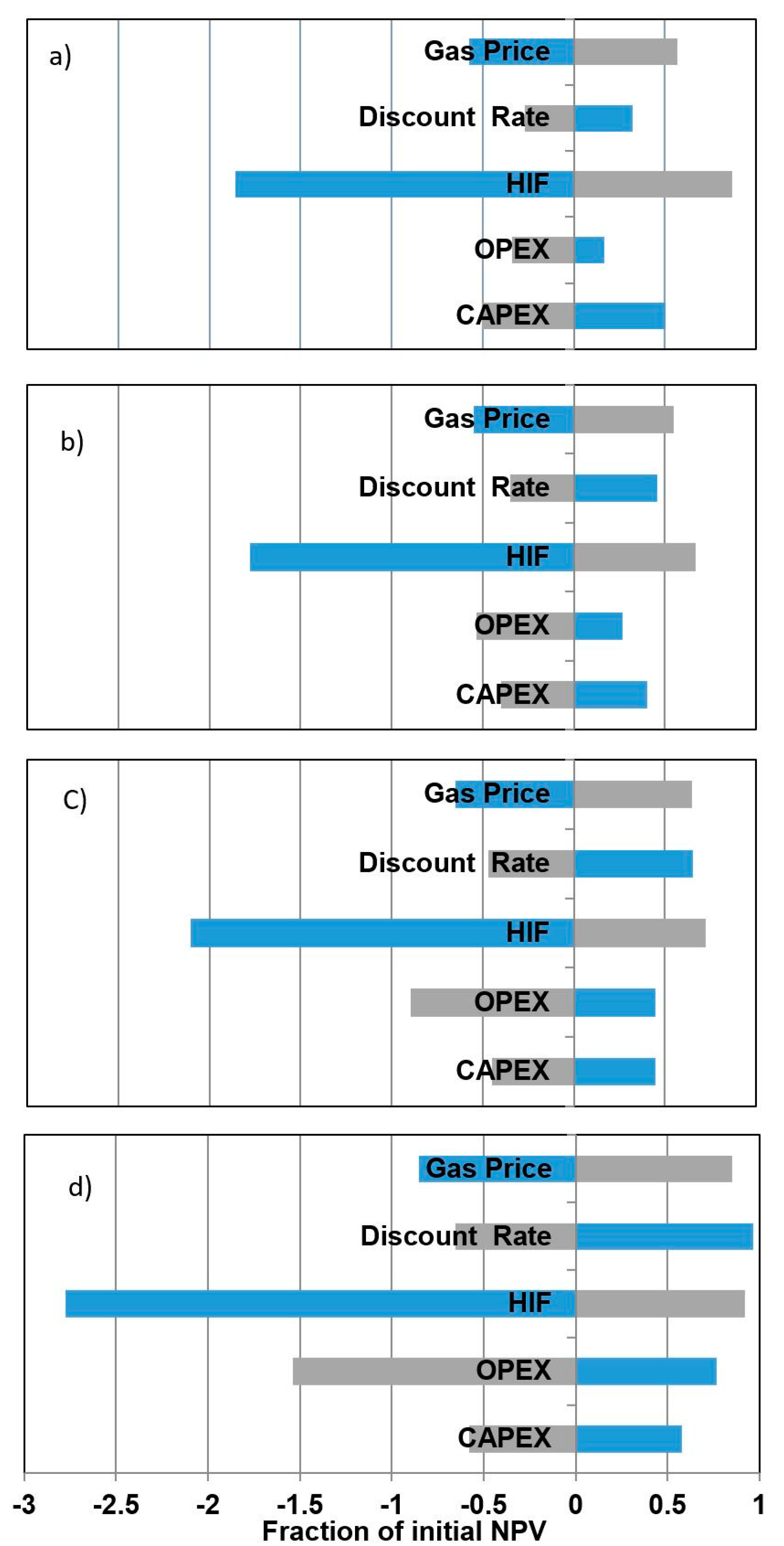

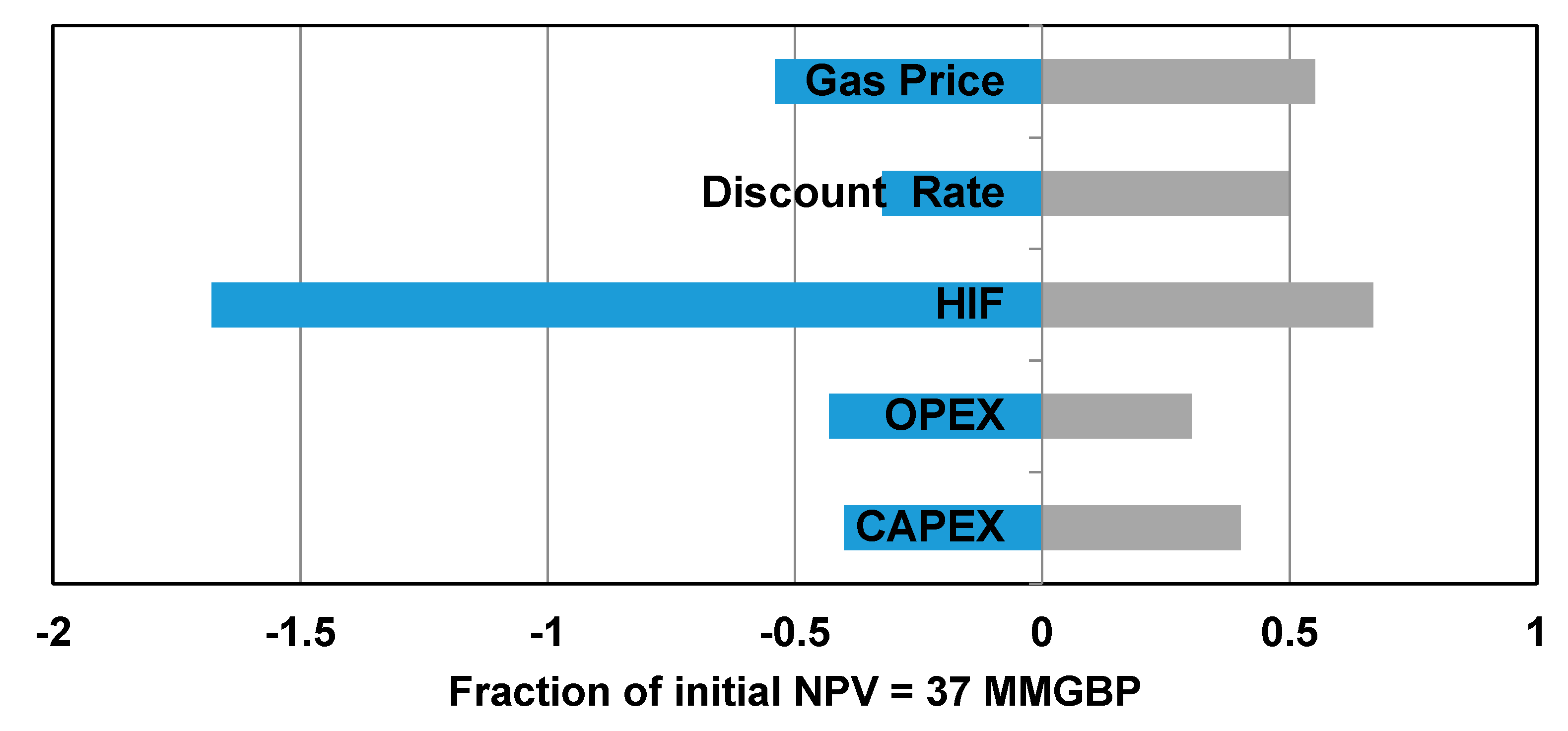

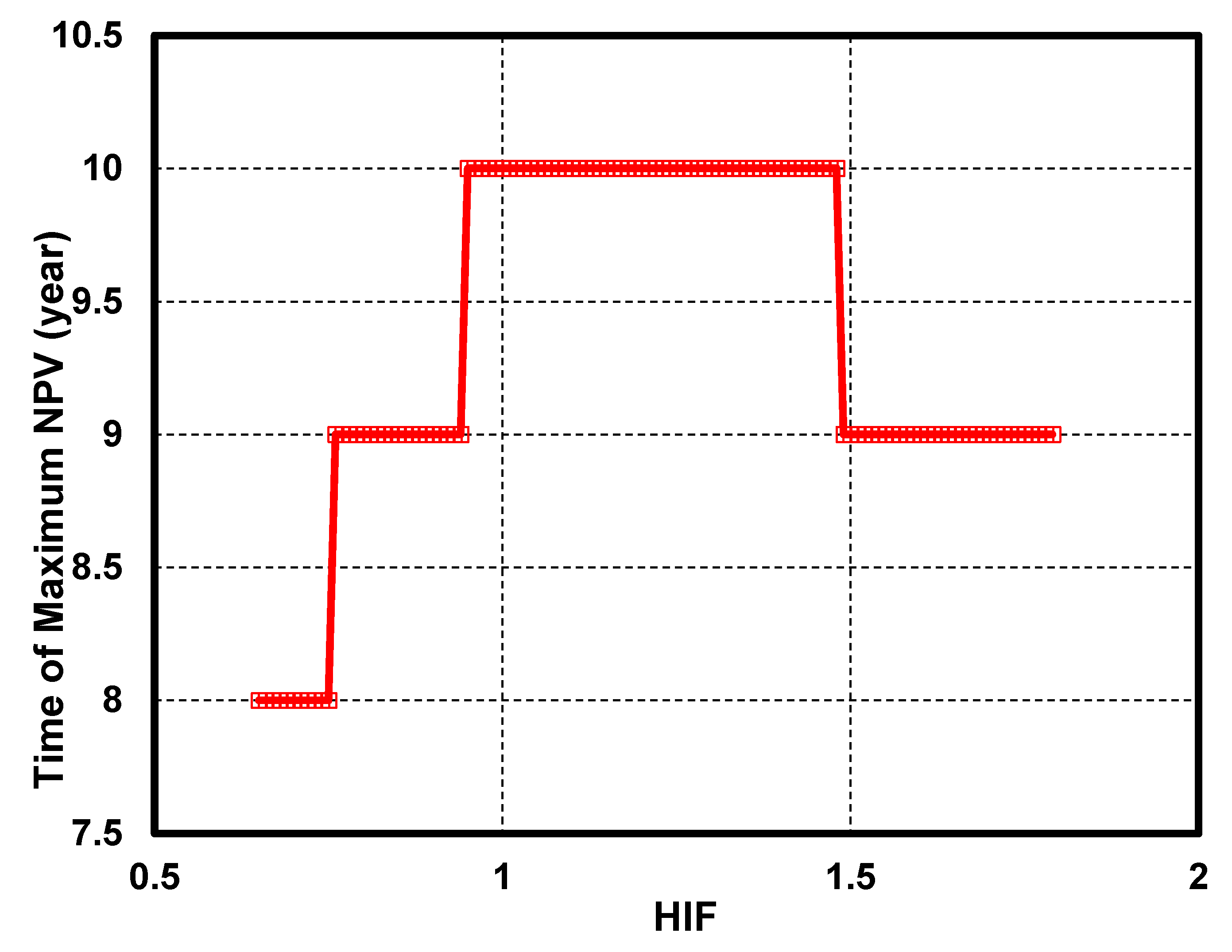

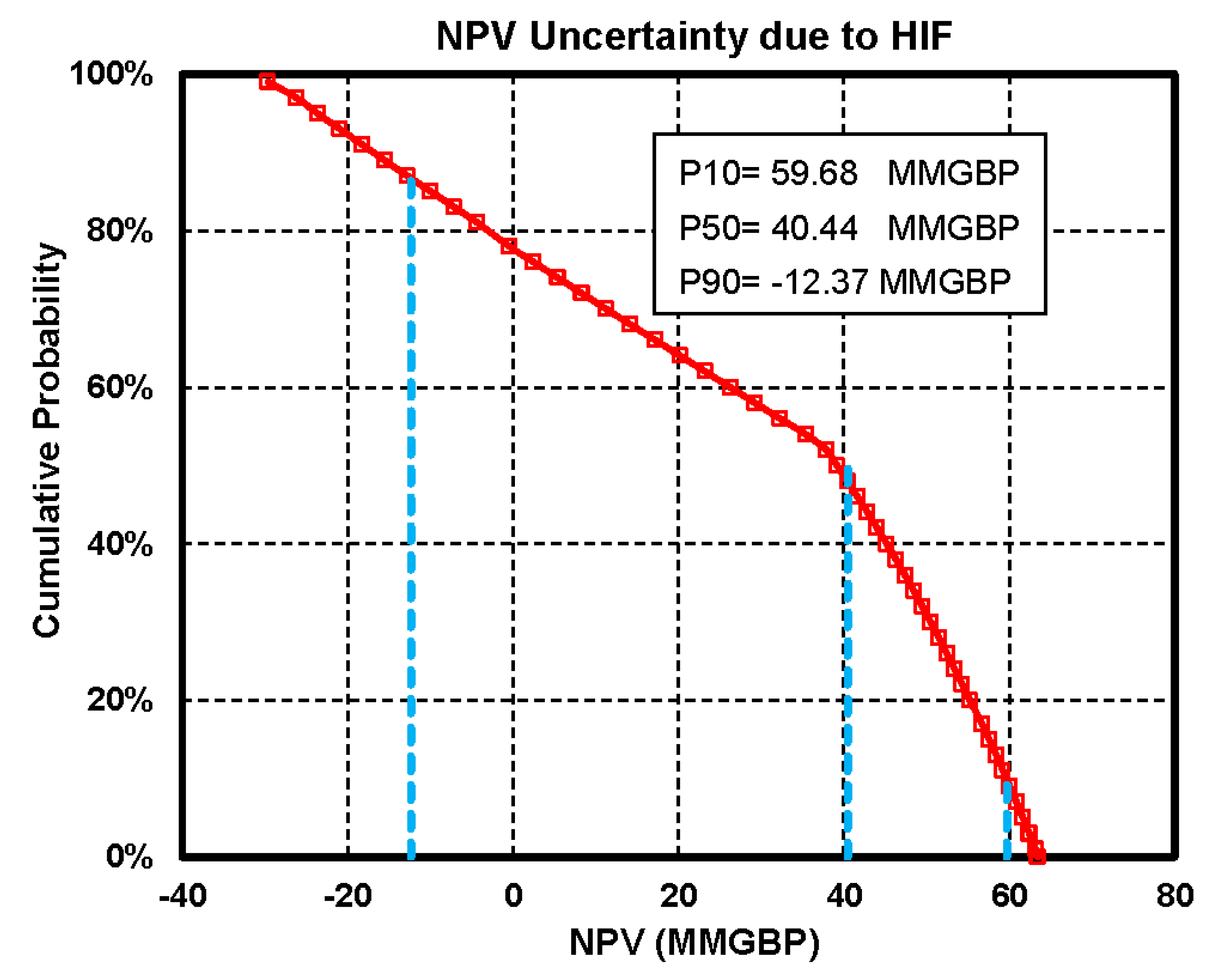

3.1.2. Sensitivity Analysis

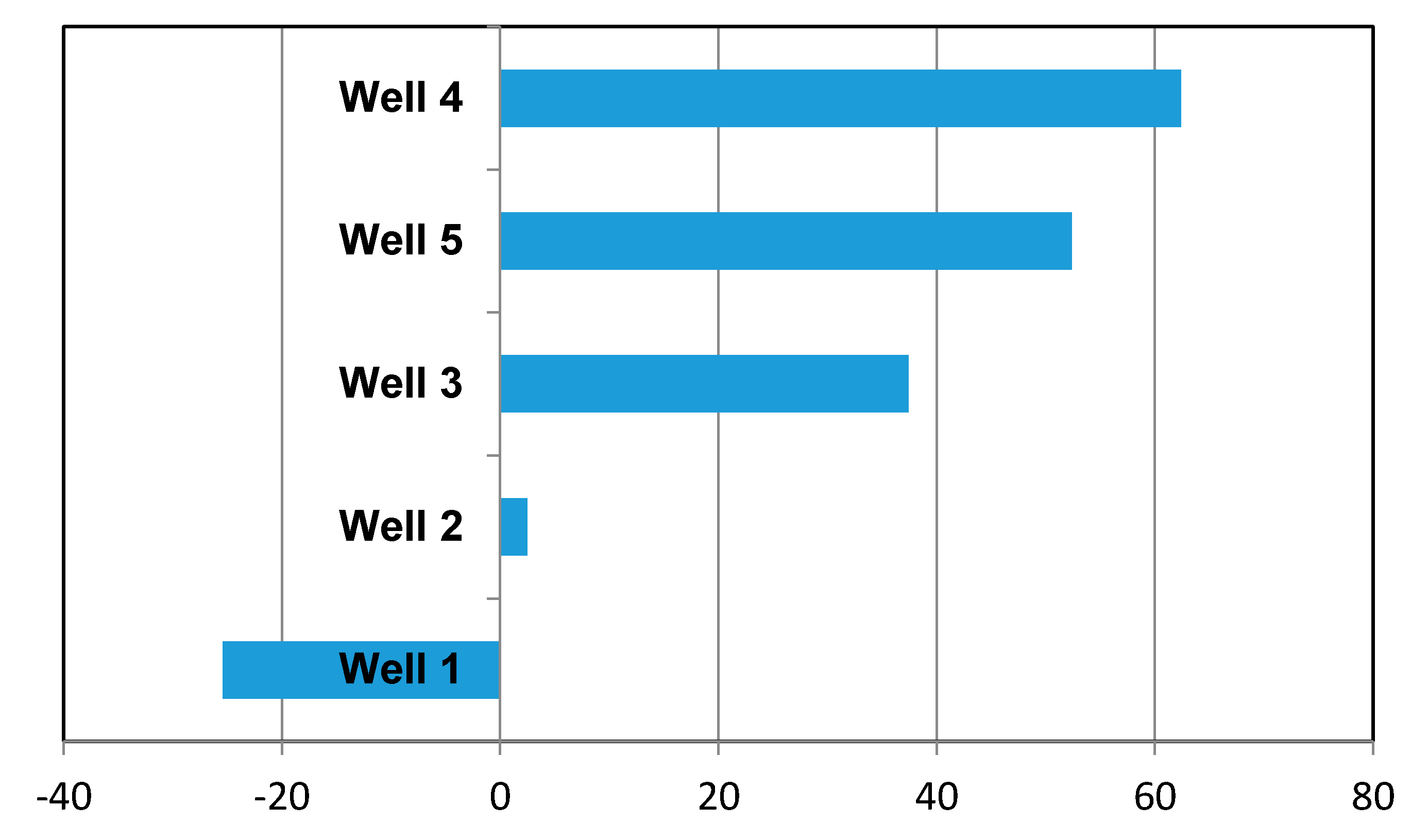

3.2. Single Field Case Study

3.2.1. Field Description

3.2.2. Modelling

3.3. Validation

4. Conclusions

Author Contributions

Conflicts of Interest

References

- Arthur, J.D.; Bohm, B.K.; Coughlin, B.J.; Layne, M.A.; Cornue, D. Evaluating the Environmental Implications of Hydraulic Fracturing in Shale Gas Reservoirs. In Proceedings of the SPE Americas E&P Environmental and Safety Conference, San Antonio, TX, USA, 23–25 March 2009. [Google Scholar]

- Phatak, A.; Kresse, O.; Nevvonen, O.V.; Abad, C.; Cohen, C.-E.; Lafitte, V.; Abivin, P.; Weng, X.; England, K.W. Optimum Fluid and Proppant Selection for Hydraulic Fracturing in Shale Gas Reservoirs: A Parametric Study Based on Fracturing-to-Production Simulations. In Proceedings of the SPE Hydraulic Fracturing Technology Conference, The Woodlands, TX, USA, 4–6 February 2013. [Google Scholar]

- Denney, D. Evaluating Implications of Hydraulic Fracturing in Shale-Gas Reservoirs. Petroleum Technol. 2009, 61, 53–54. [Google Scholar] [CrossRef]

- Tan, P.; Jin, Y.; Han, K.; Hou, B.; Chen, M.; Guo, X.; Gao, J. Analysis of hydraulic fracture initiation and vertical propagation behavior in laminated shale formation. Fuel 2017, 206, 482–493. [Google Scholar] [CrossRef]

- Xu, C.; Li, P.; Lu, D. Production performance of horizontal wells with dendritic-like hydraulic fractures in tight gas reservoirs. J. Pet. Sci. Eng. 2017, 148, 64–72. [Google Scholar] [CrossRef]

- Lai, F.; Li, Z.; Wang, Y. Impact of water blocking in fractures on the performance of hydraulically fractured horizontal wells in tight gas reservoir. J. Pet. Sci. Eng. 2017, 156, 134–141. [Google Scholar] [CrossRef]

- Murtaza, M.; Al Naeim, S.; Waleed, A. Design and Evaluation of Hydraulic Fracturing in Tight Gas Reservoirs. In Proceedings of the SPE Saudi Arabia Section Technical Symposium and Exhibition, Al-Khobar, Saudi Arabia, 19–22 May 2013. [Google Scholar]

- Vos, B.; Shaoul, J.R.; de Koning, K.J. Southern North Sea Tight-Gas Field Development Planning Using Hydraulic Fracturing. In Proceedings of the EUROPEC/EAGE Conference and Exhibition, Amsterdam, The Netherlands, 8–11 June 2009. [Google Scholar]

- Antoci, J.C.; Anaya, L.A. First Massive Hydraulic Fracturing Treatment in Argentina. In Proceedings of the SPE Latin American and Caribbean Petroleum Engineering Conference, Buenos Aires, Argentina, 25–28 March 2001. [Google Scholar]

- Shaoul, J.R.; Ross, M.J.; Spitzer, W.J.; Wheaton, S.R.; Mayland, P.J.; Singh, A.P. Massive Hydraulic Fracturing Unlocks Deep Tight Gas Reserves in India. In Proceedings of the European Formation Damage Conference, Scheveningen, The Netherlands, 30 May–1 June 2007. [Google Scholar]

- Parvizi, H.; Rezaei-Gomari, S.; Nabhani, F.; Dastkhan, Z.; Feng, W.C. A Practical Workflow for Offshore Hydraulic Fracturing Modelling: Focusing on Southern North Sea. In Proceedings of the EUROPEC 2015, Madrid, Spain, 1–4 June 2015. [Google Scholar]

- Al-zarouni, A.Y.A.A.; Ghedan, S.G. Paving the Road for the First Hydraulic Fracturing in Tight Gas Reservoirs in Offshore Abu Dhabi. In Proceedings of the SPE Middle East Unconventional Gas Conference and Exhibition, Abu Dhabi, UAE, 23–25 January 2012. [Google Scholar]

- Rodgerson, J.L. Impact of Natural Fractures in Hydraulic Fracturing of Tight Gas Sands. In Proceedings of the SPE Permian Basin Oil and Gas Recovery Conference, Midland, TX, USA, 21–23 March 2000. [Google Scholar]

- Maxwell, S.C. Assessing the Impact of Microseismic Location Uncertainties on Interpreted Hydraulic Fracture Geometries. In Proceedings of the SPE Annual Technical Conference and Exhibition, New Orleans, LA, USA, 4–7 October 2009. [Google Scholar]

- Bahrami, H.; Rezaee, R.; Clennell, B. Water blocking damage in hydraulically fractured tight sand gas reservoirs: An example from Perth Basin, Western Australia. J. Pet. Sci. Eng. 2012, 88, 100–106. [Google Scholar] [CrossRef]

- Parvizi, H.; Rezaei-Gomari, S.; Nabhani, F.; Turner, A.; Feng, W.C. Hydraulic Fracturing Performance Evaluation in Tight Sand Gas Reservoirs with High Perm Streaks and Natural Fractures. In Proceedings of the EUROPEC 2015, Madrid, Spain, 1–4 June 2015. [Google Scholar]

- Westwood, R.F.; Toon, S.M.; Cassidy, N.J. A sensitivity analysis of the effect of pumping parameters on hydraulic fracture networks and local stresses during shale gas operations. Fuel 2017, 203, 843–852. [Google Scholar] [CrossRef]

- Wilson, A. Hydraulic-Fracture Design: Optimization under Uncertainty. J. Pet. Technol. 2015, 67. [Google Scholar] [CrossRef]

- Bai, M. Risk and Uncertainties in Determining Fracture Gradient and Closure Pressure. In Proceedings of the 45th U.S. Rock Mechanics/Geomechanics Symposium, San Francisco, CA, USA, 26–29 June 2011. [Google Scholar]

- Durant, B.; Abualfaraj, N.; Olson, M.S.; Gurian, P.L. Assessing dermal exposure risk to workers from flowback water during shale gas hydraulic fracturing activity. J. Nat. Gas Sci. Eng. 2016, 34, 969–978. [Google Scholar] [CrossRef]

- Harding, N.R. Application of Stochastic Prospect Analysis for Shale Gas Reservoirs. In Proceedings of the SPE Russian Oil and Gas Technical Conference and Exhibition, Moscow, Russia, 28–30 October 2008. [Google Scholar]

- Willigers, B.J.; Bratvold, R.B.; Bickel, J.E. Maximizing the Value of Unconventional Reservoirs by Choosing the Optimal Appraisal Strategy. SPE Reserv. Eval. Eng. 2017, 20. [Google Scholar] [CrossRef]

- Williams-kovacs, J.; Clarkson, C.R. Using Stochastic Simulation to Quantify Risk and Uncertainty in Shale Gas Prospecting and Development. In Proceedings of the Canadian Unconventional Resources Conference, Calgary, AB, Canada, 15–17 November 2011. [Google Scholar]

- Liang, B.; Khan, S.; Puspita, S.D.; Tran, T.; Du, S.; Blair, E.; Rives, S. Improving Unconventional Reservoir Factory-Model Development by an Integrated Workflow with Earth Model, Hydraulic Fracturing, Reservoir Simulation and Uncertainty Analysis. In Proceedings of the Unconventional Resources Technology Conference (URTEC), San Antonio, TX, USA, 1–3 August 2016. [Google Scholar]

- Thiele, M.R.; Batycky, R.P. Evolve: A Linear Workflow for Quantifying Reservoir Uncertainty. In Proceedings of the SPE Annual Technical Conference and Exhibition, Dubai, UAE, 26–28 September 2016. [Google Scholar]

- Hosseini, B.K.; Chalaturnyk, R.J. Streamline-Based Reservoir Geomechanics Coupling Strategies for Full Field Simulations. In Proceedings of the 14th European Conference on the Mathematics of Oil Recovery, Catania, Italy, 8–11 September 2014. [Google Scholar]

- Thiele, T.M.R.; Batycky, R.P. Using Streamline-Derived Injection Efficiencies for Improved Waterflood Management. SPE Reserv. Eval. Eng. 2006, 9, 187–196. [Google Scholar] [CrossRef]

- Jesmani, M.; Hosseini, B.K.; Chalaturnyk, R.J. Use of Streamlines in Development and Application of a Linearized Reduced-Order Reservoir Model. In Proceedings of the 9th International Geostatistics Congress, Oslo, Norway, 11–15 June 2012. [Google Scholar]

- Hosseini, B.K.; Chalaturnyk, R.J. A Domain Splitting-Based Analytical Approach for Assessing Hydro-thermo-geomechanical Responses of Heavy Oil Reservoirs. SPE J. 2016, 22. [Google Scholar] [CrossRef]

- Parvizi, H.; Rezaei-Gomari, S.; Nabhani, F. Robust and Flexible Hydrocarbon Production Forecasting Considering the Heterogeneity Impact for Hydraulically Fractured Wells. Energy Fuels 2017, 31, 8481–8488. [Google Scholar] [CrossRef]

- Parvizi, H.; Rezaei-Gomari, S.; Nabhani, F.; Turner, A. Evaluation of heterogeneity impact on hydraulic fracturing performance. J. Pet. Sci. Eng. 2017, 154, 344–353. [Google Scholar] [CrossRef]

- Jonsbråten, T.W. Oil field optimization under price uncertainty. J. Oper. Res. Soc. 1998, 49, 811–818. [Google Scholar] [CrossRef]

- Goel, V.; Grossmann, I.E. A stochastic programming approach to planning of offshore gas field developments under uncertainty in reserves. Comput. Chem. Eng. 2004, 28, 1409–1429. [Google Scholar] [CrossRef]

- Ozdogan, U.; Horne, R.N. Optimization of Well Placement under Time-Dependent Uncertainty. SPE Reserv. Eval. Eng. 2006, 9. [Google Scholar] [CrossRef]

- PremierOil, Proposed acquisition of the EPUK Group Circular to Shareholders and Notice of General Meeting. Available online: http://www.premier-oil.com/premieroil/dlibrary/panda/Eva-FINAL-CIRCULAR.pdf (accessed on 20 July 2017).

| Input Parameter | Low Value | Mid Value | High Value | Unit |

|---|---|---|---|---|

| Capital Expenditure (CAPEX) | 30 | 45 | 60 | MMGBP |

| Operational Expenditure (OPEX) | 1 | 2 | 4 | MMGBP/Year |

| HIF | 0.35 | 1 | 1.75 | - |

| I (discount rate) | 0.05 | 0.1 | 0.15 | Yearly |

| GBPg (gas price) | 4 | 5 | 6 | GBP/MSCF |

| Parameters | Maximum NPV [MMGBP] | ||

|---|---|---|---|

| Low Value | Mid Value | High Value | |

| HIF | −25.4 | 37.4 | 62.4 |

| GBP_g (gas price) | 17.2 | 37.4 | 58 |

| I (Discount Rate) | 25.3 | 37.4 | 56 |

| CAPEX | 22.4 | 37.4 | 52.4 |

| OPEX | 21.3 | 37.4 | 48.7 |

| INPUT Parameter | Value | Unit |

|---|---|---|

| CAPEX per well | 45 | MMGBP |

| OPEX per well in this field | 2 | MMGBP |

| qi | 25,000 | MSCF/d |

| GBP_g (gas price) | 5 | GBP/MSCF |

| I (Discount rate) | 0.1 | Yearly |

| D | 4.2 | % Monthly |

| Well No | HIF |

|---|---|

| 1 | 0.35 |

| 2 | 0.65 |

| 3 | 1 |

| 4 | 1.75 |

| 5 | 1.4 |

| Well No | HIF | qmi | Dmi | b |

|---|---|---|---|---|

| 1 | 0.35 | 8750 | 4.2 | 0.7 |

| 2 | 0.65 | 16,250 | 4.2 | 0.7 |

| 3 | 1 | 25,000 | 4.2 | 0.7 |

| 4 | 1.75 | 43,750 | 7.35 | 0.7 |

| 5 | 1.4 | 35,000 | 1.95 | 0.7 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Parvizi, H.; Rezaei Gomari, S.; Nabhani, F.; Dehghan Monfared, A. Modeling the Risk of Commercial Failure for Hydraulic Fracturing Projects Due to Reservoir Heterogeneity. Energies 2018, 11, 218. https://doi.org/10.3390/en11010218

Parvizi H, Rezaei Gomari S, Nabhani F, Dehghan Monfared A. Modeling the Risk of Commercial Failure for Hydraulic Fracturing Projects Due to Reservoir Heterogeneity. Energies. 2018; 11(1):218. https://doi.org/10.3390/en11010218

Chicago/Turabian StyleParvizi, Hadi, Sina Rezaei Gomari, Farhad Nabhani, and Abolfazl Dehghan Monfared. 2018. "Modeling the Risk of Commercial Failure for Hydraulic Fracturing Projects Due to Reservoir Heterogeneity" Energies 11, no. 1: 218. https://doi.org/10.3390/en11010218

APA StyleParvizi, H., Rezaei Gomari, S., Nabhani, F., & Dehghan Monfared, A. (2018). Modeling the Risk of Commercial Failure for Hydraulic Fracturing Projects Due to Reservoir Heterogeneity. Energies, 11(1), 218. https://doi.org/10.3390/en11010218