The Mutual Impact of Demand Response Programs and Renewable Energies: A Survey

Abstract

:1. Introduction

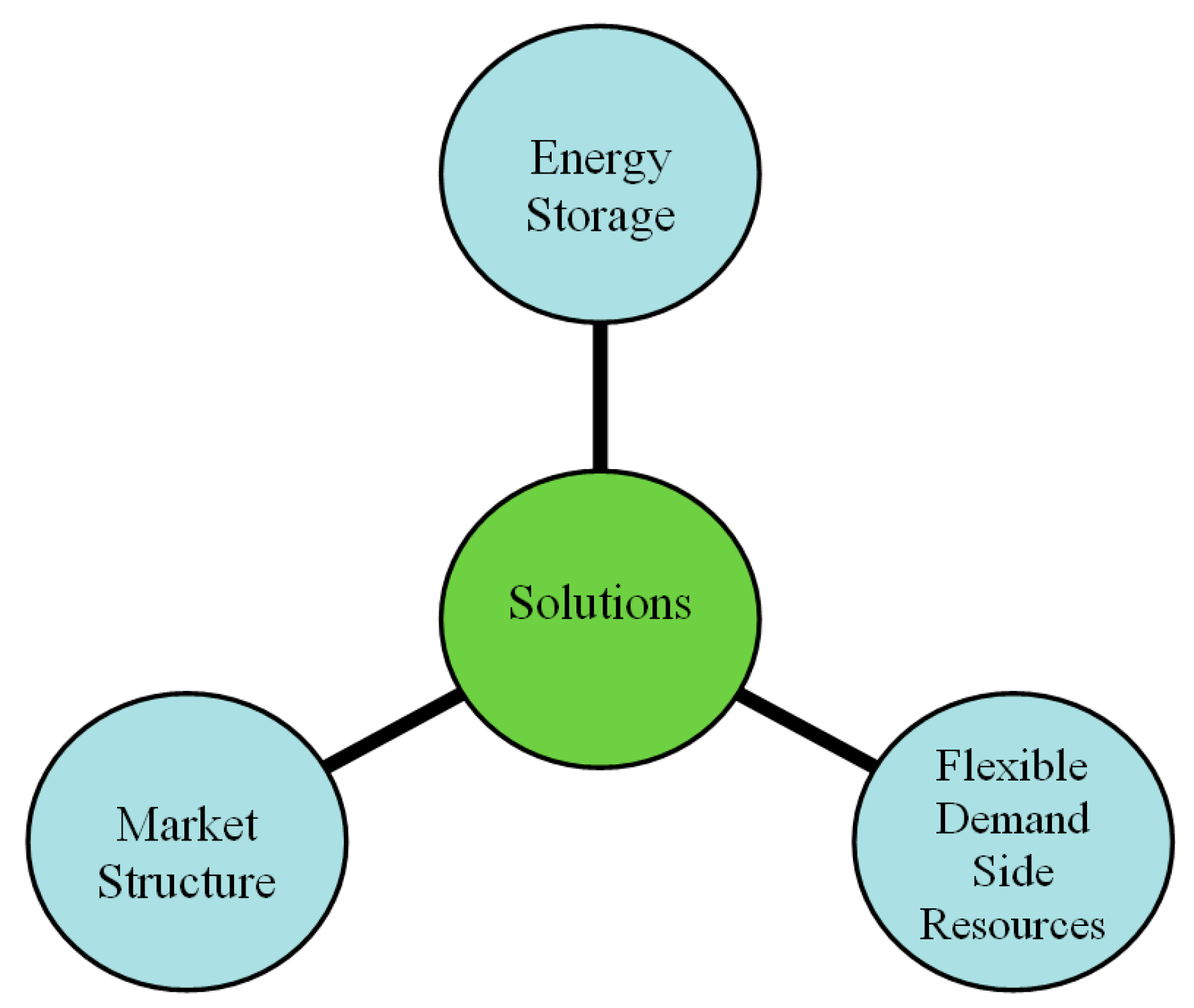

2. Classification of the Solutions for System Operators

- (1)

- Integration of renewable energies with energy storage systems (ESSs).

- (2)

- Utilizing additional reserve at electricity markets and developing market rules and structures.

- (3)

- Utilizing demand side sources.

2.1. Using Energy Storage Technologies

2.2. Improving Market Structure

2.3. Using Flexible Demand Side Resources

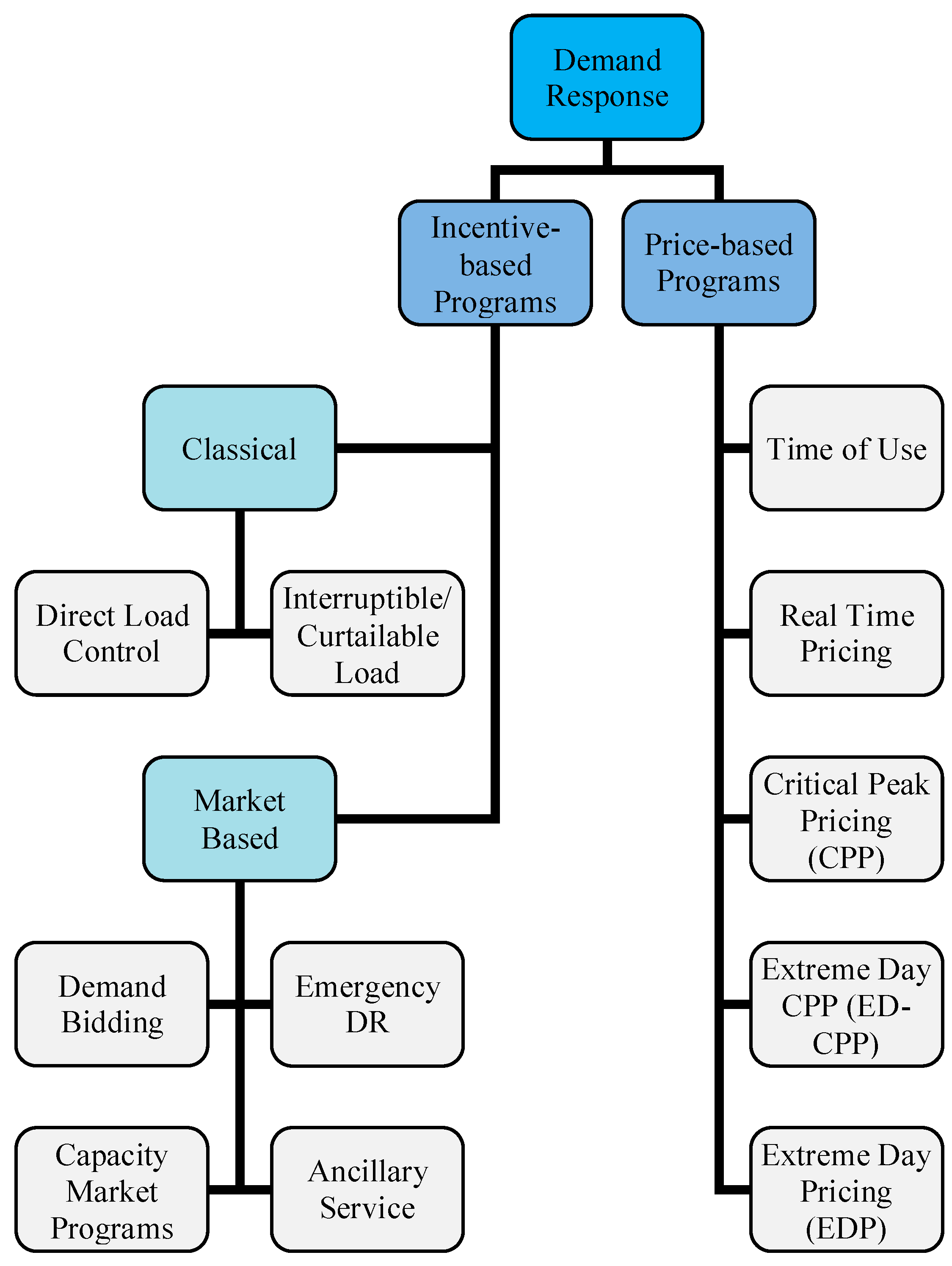

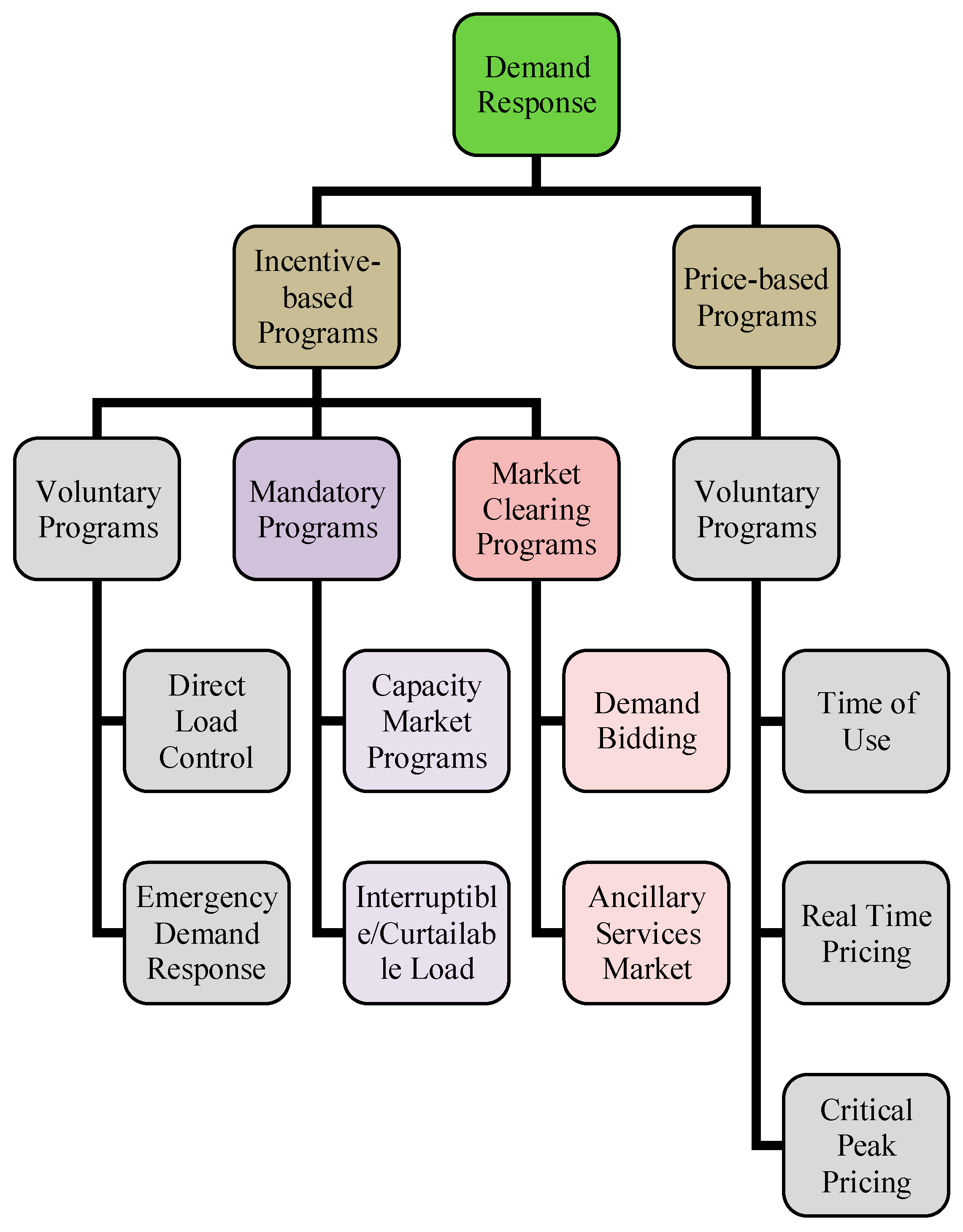

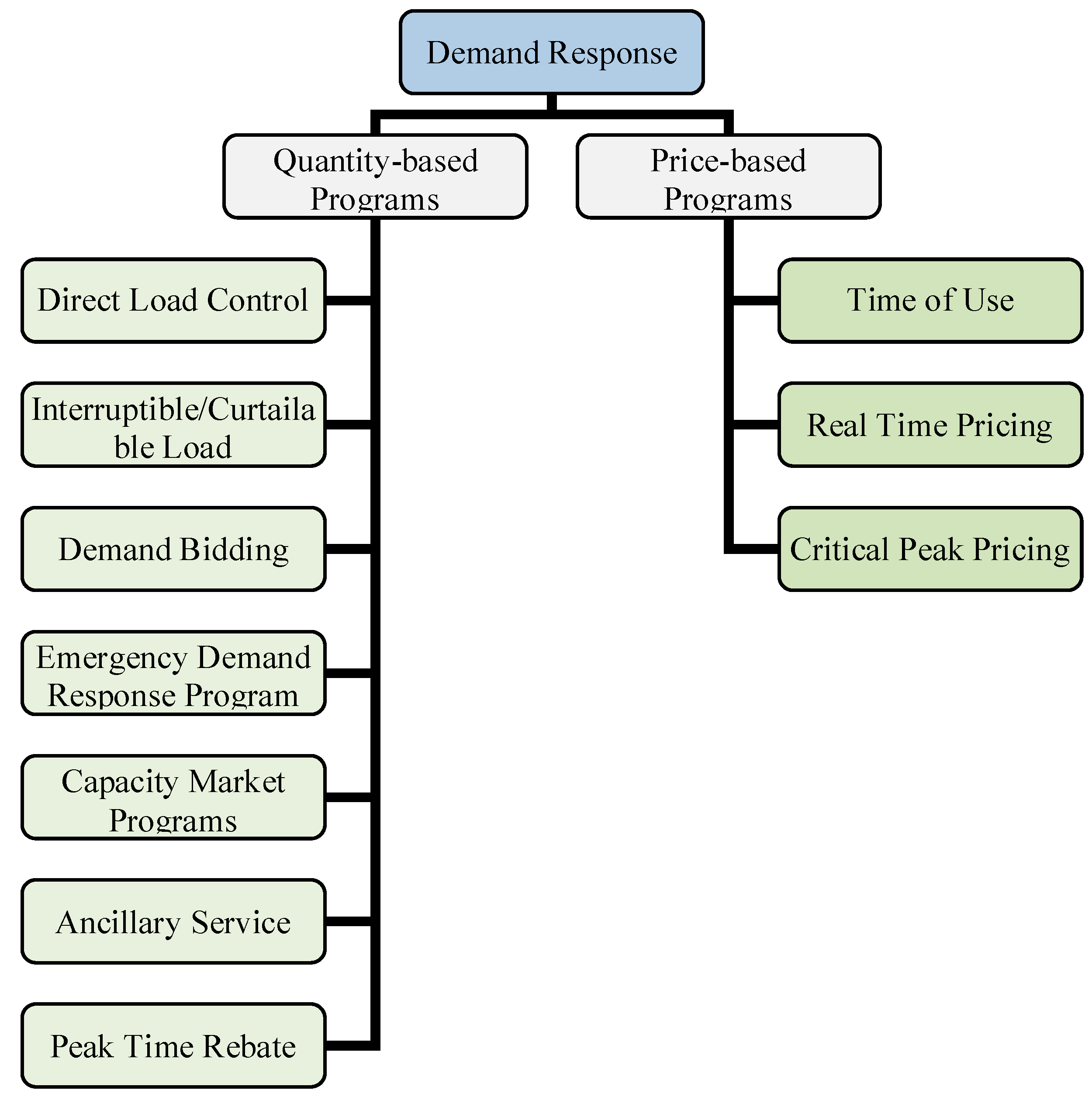

3. Models of Responsive Loads

4. Various Electricity Market Designs Enabling Demand Response and Renewable Energy Systems

4.1. Spot Markets

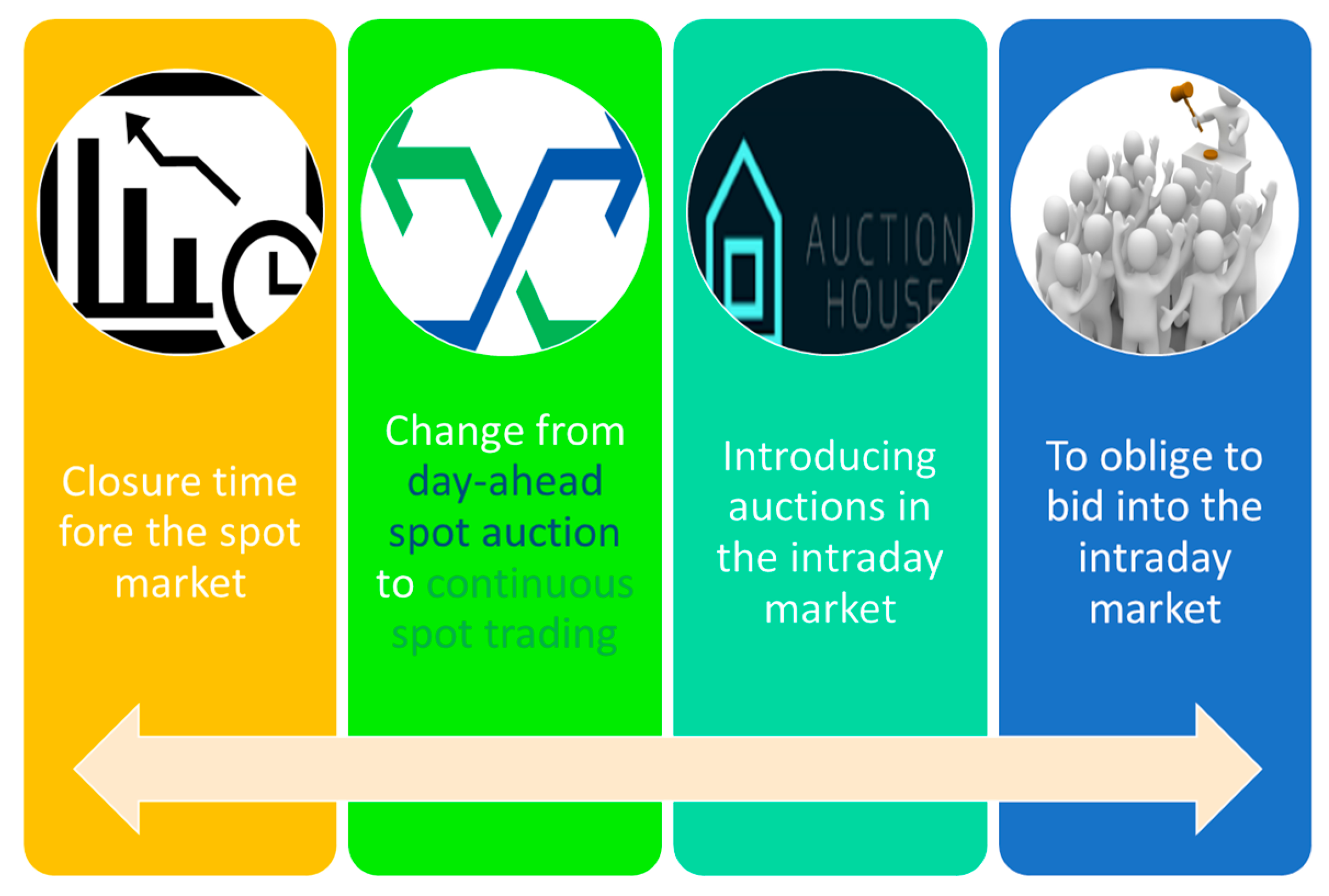

4.2. Intraday Markets

4.3. Balancing Markets and Reserve Markets

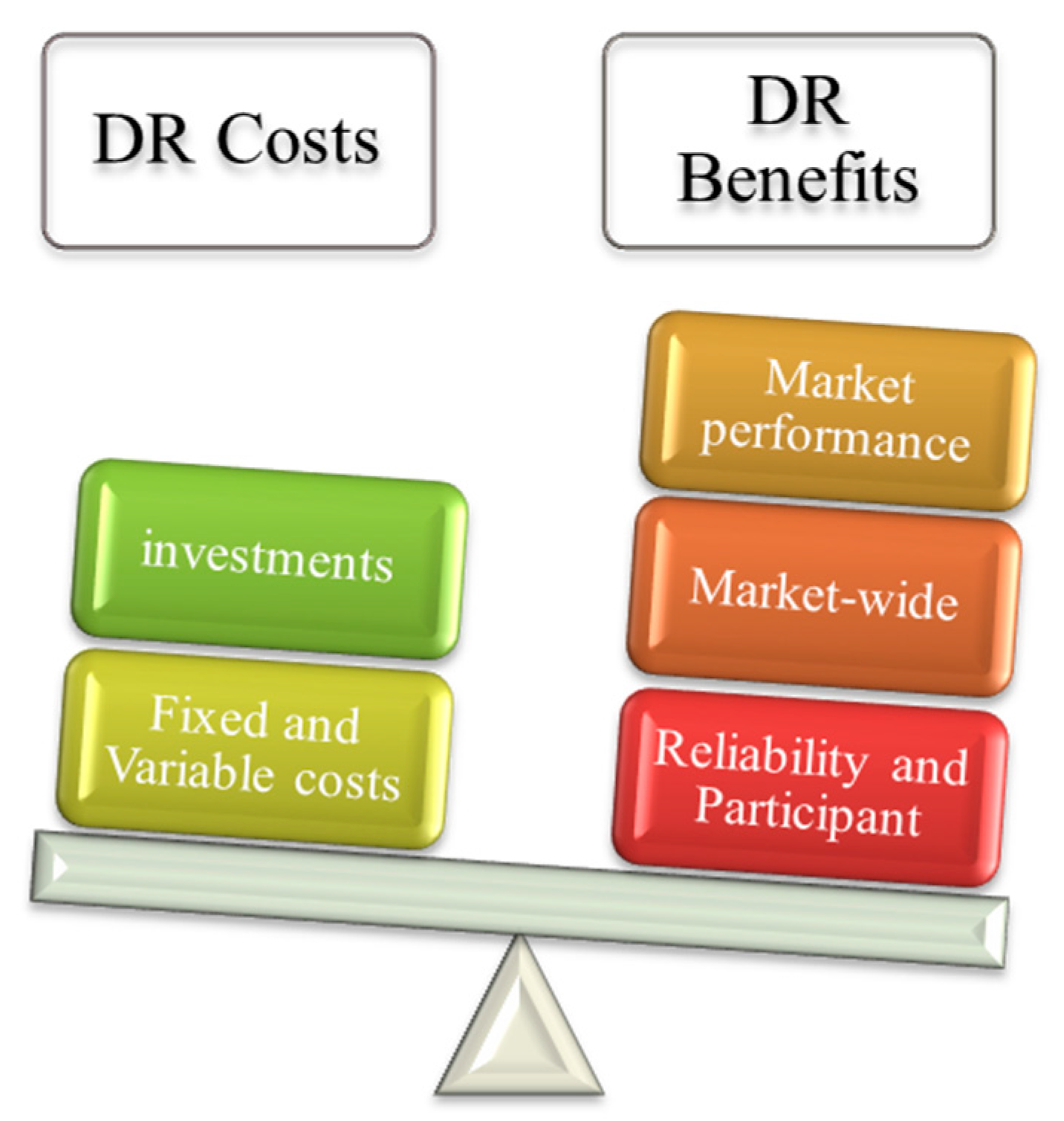

5. Various Demand Response Costs and Benefits

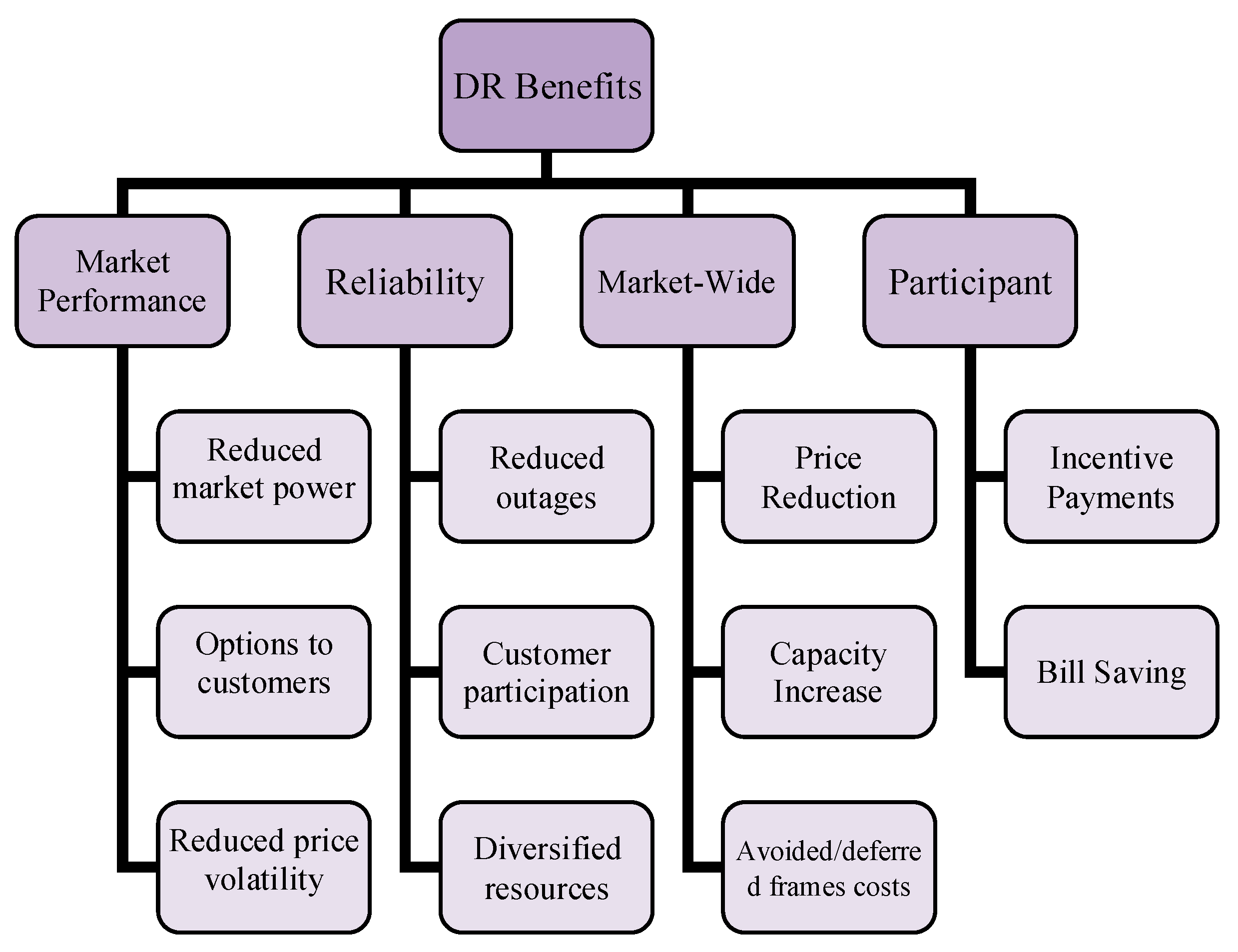

5.1. Benefit of DR

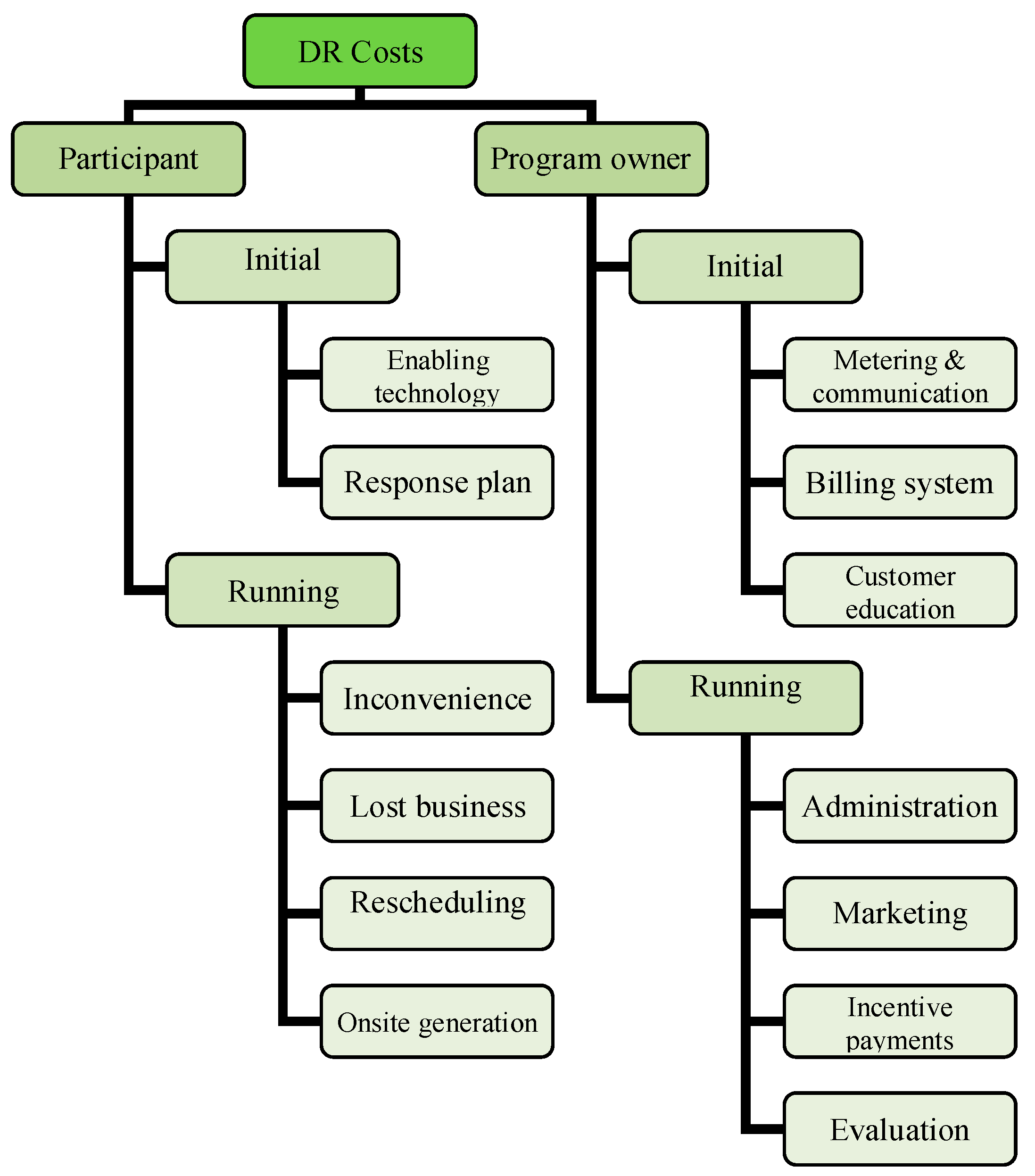

5.2. Cost of DR

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Heydarian-Forushani, E.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Shafie-khah, M.; Catalao, J.P. Investigating the effects of flexible load in the grid integration of wind power. In Proceedings of the 2014 IEEE PES T&D Conference and Exposition, Chicago, IL, USA, 14–17 April 2014; pp. 1–5. [Google Scholar]

- Chen, R.; Botterud, A.; Sun, H.; Wang, Y. A bilateral reserve market for variable generation: Concept and implementation. In Proceedings of the Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016; pp. 1–5. [Google Scholar]

- Albadi, M.H.; El-Saadany, E.F. A summary of demand response in electricity markets. Electr. Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Aghaei, J.; Alizadeh, M.-I. Demand response in smart electricity grids equipped with renewable energy sources: A review. Renew. Sustain. Energy Rev. 2013, 18, 64–72. [Google Scholar] [CrossRef]

- Lund, P.D.; Lindgren, J.; Mikkola, J.; Salpakari, J. Review of energy system flexibility measures to enable high levels of variable renewable electricity. Renew. Sustain. Energy Rev. 2015, 45, 785–807. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, C.; Ding, Y.; Xydis, G.; Wang, J.; Østergaard, J. Review of real-time electricity markets for integrating distributed energy resources and demand response. Appl. Energy 2015, 138, 695–706. [Google Scholar] [CrossRef]

- Wang, F.; Xu, H.; Xu, T.; Li, K.; Shafie-khah, M.; Catalão, J.P. The values of market-based demand response on improving power system reliability under extreme circumstances. Appl. Energy 2017, 193, 220–231. [Google Scholar] [CrossRef]

- Chen, H.; Cong, T.N.; Yang, W.; Tan, C.; Li, Y.; Ding, Y. Progress in electrical energy storage system: A critical review. Prog. Nat. Sci. 2009, 19, 291–312. [Google Scholar] [CrossRef]

- Zhou, D.; Zhao, C.-Y.; Tian, Y. Review on thermal energy storage with phase change materials (PCMs) in building applications. Appl. Energy 2012, 92, 593–605. [Google Scholar] [CrossRef] [Green Version]

- O’Dwyer, C.; Ryan, L.; Flynn, D. Efficient Large-Scale Energy Storage Dispatch: Challenges in Future High Renewables Systems. IEEE Trans. Power Syst. 2017, 32, 3439–3450. [Google Scholar] [CrossRef]

- Lund, H.; Salgi, G. The role of compressed air energy storage (CAES) in future sustainable energy systems. Energy Convers. Manag. 2009, 50, 1172–1179. [Google Scholar] [CrossRef]

- Wang, Y.; Dvorkin, Y.; Fernandez-Blanco, R.; Xu, B.; Qiu, T.; Kirschen, D. Look-Ahead Bidding Strategy for Energy Storage. IEEE Trans. Sustain. Energy 2017, 8, 1106–1117. [Google Scholar] [CrossRef]

- Pandžić, H.; Wang, Y.; Qiu, T.; Dvorkin, Y.; Kirschen, D.S. Near-optimal method for siting and sizing of distributed storage in a transmission network. IEEE Trans. Power Syst. 2015, 30, 2288–2300. [Google Scholar] [CrossRef]

- Nikolova, S.; Causevski, A.; Al-Salaymeh, A. Optimal operation of conventional power plants in power system with integrated renewable energy sources. Energy Convers. Manag. 2013, 65, 697–703. [Google Scholar] [CrossRef]

- Ye, B.; Zhang, K.; Jiang, J.; Miao, L.; Li, J. Toward a 90% renewable energy future: A case study of an island in the South China Sea. Energy Convers. Manag. 2017, 142, 28–41. [Google Scholar] [CrossRef]

- Ye, B.; Yang, P.; Jiang, J.; Miao, L. Feasibility and economic analysis of a renewable energy powered special town in China. Resour. Conserv. Recycl. 2017, 121, 40–50. [Google Scholar] [CrossRef]

- Oren, S.S. Generation adequacy via call options obligations: Safe passage to the promised land. Electr. J. 2005, 18, 28–42. [Google Scholar] [CrossRef]

- Heo, D.-Y.; Tesfatsion, L. Standardized contracts with swing for the market-supported procurement of energy and reserve: Illustrative examples. In Proceedings of the Power and Energy Society General Meeting (PESGM), Denver, CO, USA, 26–30 July 2015; pp. 1–30. [Google Scholar]

- Fattler, S.; Pellinger, C. The value of flexibility and the effect of an integrated European Intraday-Market. In Proceedings of the 2016 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–5. [Google Scholar]

- Hansen, J.; Somani, A.; Sun, Y.; Zhang, Y. Auction design for power markets based on standardized contracts for energy and reserves. In Proceedings of the Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016; pp. 1–5. [Google Scholar]

- Gil, E.; Aravena, I. Evaluating the capacity value of wind power considering transmission and operational constraints. Energy Convers. Manag. 2014, 78, 948–955. [Google Scholar] [CrossRef]

- Tabone, M.D.; Callaway, D.S. Modeling variability and uncertainty of photovoltaic generation: A hidden state spatial statistical approach. IEEE Trans. Power Syst. 2015, 30, 2965–2973. [Google Scholar] [CrossRef]

- Alhaider, M.; Fan, L.; Miao, Z. Benders Decomposition for stochastic programming-based PV/Battery/HVAC planning. In Proceedings of the Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016; pp. 1–5. [Google Scholar]

- Wang, D.; Guan, X.; Wu, J.; Li, P.; Zan, P.; Xu, H. Integrated energy exchange scheduling for multimicrogrid system with electric vehicles. IEEE Trans. Smart Grid 2016, 7, 1762–1774. [Google Scholar] [CrossRef]

- Wang, D.; Coignard, J.; Zeng, T.; Zhang, C.; Saxena, S. Quantifying electric vehicle battery degradation from driving vs. vehicle-to-grid services. J. Power Sources 2016, 332, 193–203. [Google Scholar] [CrossRef]

- Wang, D.; Gao, J.; Li, P.; Wang, B.; Zhang, C.; Saxena, S. Modeling of plug-in electric vehicle travel patterns and charging load based on trip chain generation. J. Power Sources 2017, 359, 468–479. [Google Scholar] [CrossRef]

- Chen, W.; Yan, H.; Pei, X.; Wu, B. Probabilistic load flow calculation in distribution system considering the stochastic characteristic of wind power and electric vehicle charging load. In Proceedings of the 2016 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Xi’an, China, 25–28 October 2016; pp. 1861–1866. [Google Scholar]

- Amid, P.; Crawford, C. Cumulant-based probabilistic load flow analysis of wind power and electric vehicles. In Proceedings of the 2016 International Conference on Probabilistic Methods Applied to Power Systems (PMAPS), Beijing, China, 16–20 October 2016; pp. 1–6. [Google Scholar]

- Zhang, Q.; Ju, F.; Zhang, S.; Deng, W.; Wu, J.; Gao, C. Power Management for Hybrid Energy Storage System of Electric Vehicles Considering Inaccurate Terrain Information. IEEE Trans. Autom. Sci. Eng. 2017, 14, 608–618. [Google Scholar] [CrossRef]

- Heydarian-Forushani, E.; Golshan, M.E.H.; Shafie-khah, M.; Catalão, J.P.S. Impacts of stochastic demand response resource scheduling on large scale wind power integration. In Proceedings of the 2015 Australasian Universities Power Engineering Conference (AUPEC), Wollongong, Australia, 27–30 September 2015; pp. 1–6. [Google Scholar]

- Wang, D.; Kalathil, D.; Poolla, K.; Guan, X. Coordination of wind power and flexible load through demand response options. In Proceedings of the 2015 IEEE 54th Annual Conference on Decision and Control (CDC), Osaka, Japan, 15–18 December 2015; pp. 7226–7231. [Google Scholar]

- Tomiyama, K.; Kawano, Y.; Hashimoto, T.; Ohtsuka, T. Real-time price optimization for load frequency control in electric power systems with wind farms. In Proceedings of the 2016 SICE International Symposium on Control Systems (ISCS), Nagoya, Japan, 7–10 March 2016; pp. 1–6. [Google Scholar]

- Wei, M.; Zhong, J. Scenario-based real-time demand response considering wind power and price uncertainty. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar]

- Parvania, M.; Fotuhi-Firuzabad, M. Integrating load reduction into wholesale energy market with application to wind power integration. IEEE Syst. J. 2012, 6, 35–45. [Google Scholar] [CrossRef]

- Yousefi, A.; Iu, H.H.-C.; Fernando, T.; Trinh, H. An approach for wind power integration using demand side resources. IEEE Trans. Sustain. Energy 2013, 4, 917–924. [Google Scholar] [CrossRef]

- Heydarian-Forushani, E.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Shafie-khah, M.; Catalão, J.P.S. A stochastic framework for the grid integration of wind power using flexible load approach. Energy Convers. Manag. 2014, 88, 985–998. [Google Scholar] [CrossRef]

- IEA. Strategic Plan for the IEA Demand-Side Management Program 2014–2020. Available online: http://www.iea.org. (accessed on 29 January 2017).

- International Energy Agency. The Power to Choose—Demand Response in Liberalized Electricity Markets; OECD: Paris, France, 2003. [Google Scholar]

- Aalami, H.A.; Moghaddam, M.P.; Yousefi, G.R. Demand response modeling considering Interruptible/Curtailable loads and capacity market programs. Appl. Energy 2010, 87, 243–250. [Google Scholar] [CrossRef]

- Asensio, M.; Contreras, J. Risk-constrained optimal bidding strategy for pairing of wind and demand response resources. IEEE Trans. Smart Grid 2017, 8, 200–208. [Google Scholar] [CrossRef]

- Estimating Demand Response Load Impacts: Evaluation of Baseline Loadmodels for Non-Residential Buildings in California. Available online: http://goo.gl/bKUIcm (accessed on 29 January 2017).

- Hirth, L.; Ueckerdt, F.; Edenhofer, O. Integration costs revisited–An economic framework for wind and solar variability. Renew. Energy 2015, 74, 925–939. [Google Scholar] [CrossRef]

- Spiecker, S.; Weber, C. The future of the European electricity system and the impact of fluctuating renewable energy—A scenario analysis. Energy Policy 2014, 65, 185–197. [Google Scholar] [CrossRef]

- Ketter, W.; Collins, J.; Weerdt, M. The 2016 power trading agent competition. In Proceedings of the PES Innovative Smart Grid Technologies Conference Europe (ISGT-Europe), Ljubljana, Slovenia, 9–12 October 2016; pp. 1–6. [Google Scholar]

- Vandezande, L.; Meeus, L.; Belmans, R.; Saguan, M.; Glachant, J.-M. Well-functioning balancing markets: A prerequisite for wind power integration. Energy Policy 2010, 38, 3146–3154. [Google Scholar] [CrossRef]

- Weber, C. Adequate intraday market design to enable the integration of wind energy into the European power systems. Energy Policy 2010, 38, 3155–3163. [Google Scholar] [CrossRef]

- Maupas, F. Analyse de L’impact économique de L’aléa éolien sur la Gestion de L’équilibre Production Consommation d’un Système électrique. Ph.D. Thesis, University of Paris XI, Paris, France, 2008. [Google Scholar]

- Shafie-khah, M.; Shoreh, M.H.; Siano, P.; Neyestani, N.; Yazdani-Damavandi, M.; Catalão, J.P.S. Oligopolistic behavior of wind power producer in electricity markets including Demand Response Resources. In Proceedings of the Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016; pp. 1–5. [Google Scholar]

- Shafie-khah, M.; Fitiwi, D.Z.; Catalão, J.P.S.; Heydarian-Forushani, E.; Golshan, M.E.H. Simultaneous participation of Demand Response aggregators in ancillary services and Demand Response eXchange markets. In Proceedings of the 2016 IEEE/PES Transmission and Distribution Conference and Exposition (T&D), Dallas, TX, USA, 3–5 May 2016; pp. 1–5. [Google Scholar]

- Skiba, L.; Maaz, A.; Moser, A. Agent-based price simulation of the day-ahead-spot-market and markets for control reserve power. In Proceedings of the 2016 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–5. [Google Scholar]

- Feng-min, Y.; Shan, L.; Wen-hao, N. Spot market coping with supply disruption under supply chains competition. In Proceedings of the 2016 Chinese Control and Decision Conference (CCDC), Yinchuan, China, 28–30 May 2016; pp. 6003–6008. [Google Scholar]

- Wollega, E.D.; Ghosh, S.; Squillante, M.S. Bi-level stochastic approximation for joint optimization of hydroelectric dispatch and spot-market operations. In Proceedings of the Winter Simulation Conference (WSC), Washington, DC, USA, 11–14 December 2016; pp. 1769–1780. [Google Scholar]

- Kazemi, M.; Mohammadi-Ivatloo, B.; Ehsan, M. Risk-constrained strategic bidding of GenCos considering demand response. IEEE Trans. Power Syst. 2015, 30, 376–384. [Google Scholar] [CrossRef]

- Hajibandeh, N.; Sheikh-El-Eslami, M.K.; Aminnejad, S.; Shafie-Khah, M. Resemblance measurement of electricity market behavior based on a data distribution model. Int. J. Electr. Power Energy Syst. 2016, 78, 547–554. [Google Scholar] [CrossRef]

- Wu, H.; Shahidehpour, M.; Alabdulwahab, A.; Abusorrah, A. Demand Response Exchange in the Stochastic Day-Ahead Scheduling With Variable Renewable Generation. IEEE Trans. Sustain. Energy 2015, 6, 516–525. [Google Scholar] [CrossRef]

- Nasrolahpour, E.; Ghasemi, H. A stochastic security constrained unit commitment model for reconfigurable networks with high wind power penetration. Electr. Power Syst. Res. 2015, 121, 341–350. [Google Scholar] [CrossRef]

- Pei, W.; Du, Y.; Deng, W.; Sheng, K.; Xiao, H.; Qu, H. Optimal Bidding Strategy and Intramarket Mechanism of Microgrid Aggregator in Real-Time Balancing Market. IEEE Trans. Ind. Inform. 2016, 12, 587–596. [Google Scholar] [CrossRef]

- Jafari, A.M.; Zareipour, H.; Schellenberg, A.; Amjady, N. The Value of Intra-Day Markets in Power Systems with High Wind Power Penetration. IEEE Trans. Power Syst. 2014, 29, 1121–1132. [Google Scholar] [CrossRef]

- Hu, Y.; Morales, J.M.; Pineda, S.; Sánchez, M.J.; Solana, P. Dynamic multi-stage dispatch of isolated wind–diesel power systems. Energy Convers. Manag. 2015, 103, 605–615. [Google Scholar] [CrossRef]

- Zugno, M.; Conejo, A.J. A robust optimization approach to energy and reserve dispatch in electricity markets. Eur. J. Oper. Res. 2015, 247, 659–671. [Google Scholar] [CrossRef]

- Wang, Q.; Guan, Y.; Wang, J. A Chance-Constrained Two-Stage Stochastic Program for Unit Commitment with Uncertain Wind Power Output. IEEE Trans. Power Syst. 2012, 27, 206–215. [Google Scholar] [CrossRef]

- Beraldi, P.; Conforti, D.; Violi, A. A two-stage stochastic programming model for electric energy producers. Comput. Oper. Res. 2008, 35, 3360–3370. [Google Scholar] [CrossRef]

- Yazdani-Damavandi, M.; Neyestani, N.; Shafie-khah, M.; Contreras, J.; Catalao, J.P. Strategic Behavior of Multi-Energy Players in Electricity Markets as Aggregators of Demand Side Resources using a Bi-level Approach. IEEE Trans. Power Syst. 2017. [Google Scholar] [CrossRef]

- Damavandi, M.Y.; Moghaddam, M.P.; Haghifam, M.-R.; Shafie-khah, M.; Catalão, J.P. Modeling Reserve Ancillary Service as Virtual Energy Carrier in Multi-Energy Systems. In Proceedings of the 6th Doctoral Conference on Computing, Electrical and Industrial Systems, Lisbon, Portugal, 13–15 April 2015; pp. 431–439. [Google Scholar]

- Heydarian-Forushani, E.; Shafie-Khah, M.; Damavandi, M.Y.; Catalão, J.P. Optimal Participation of DR Aggregators in Day-Ahead Energy and Demand Response Exchange Markets. In Proceedings of the 5th Doctoral Conference on Computing, Electrical and Industrial Systems, Lisbon, Portugal, 7–9 April 2014; pp. 353–360. [Google Scholar]

- Martinez-Mares, A.; Fuerte-Esquivel, C.R. A robust optimization approach for the interdependency analysis of integrated energy systems considering wind power uncertainty. IEEE Trans. Power Syst. 2013, 28, 3964–3976. [Google Scholar] [CrossRef]

- Zhang, H.; Li, P. Chance constrained programming for optimal power flow under uncertainty. IEEE Trans. Power Syst. 2011, 26, 2417–2424. [Google Scholar] [CrossRef]

- Summers, T.; Warrington, J.; Morari, M.; Lygeros, J. Stochastic optimal power flow based on convex approximations of chance constraints. In Proceedings of the Power Systems Computation Conference (PSCC), Wroclaw, Poland, 18–22 August 2014; pp. 1–7. [Google Scholar]

- Wu, H.; Shahidehpour, M.; Li, Z.; Tian, W. Chance-constrained day-ahead scheduling in stochastic power system operation. IEEE Trans. Power Syst. 2014, 29, 1583–1591. [Google Scholar] [CrossRef]

- Heydarian-Forushani, E.; Golshan, M.E.H.; Moghaddam, M.P.; Shafie-khah, M.; Catalão, J.P.S. Robust scheduling of variable wind generation by coordination of bulk energy storages and demand response. Energy Convers. Manag. 2015, 106, 941–950. [Google Scholar] [CrossRef]

- Jingmeng, B.; Zeng, B.; Zhang, J.; Dunnan, L.; Ming, Z. Benefits comprehensive evaluation of demand response in SDN based on distant Grey Relational Analysis-Technique for Order Preference by Similarity to Ideal Solution. In Proceedings of the 2016 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Xi’an, China, 25–28 October 2016; pp. 843–851. [Google Scholar]

- Gheydi, M.; Farhadi, P.; Ghafari, R. The effect of demand response on operation of smart home energy system with renewable energy resources. In Proceedings of the 2016 International Symposium on Fundamentals of Electrical Engineering (ISFEE), Bucharest, Romania, 30 June–2 July 2016; pp. 1–6. [Google Scholar]

- Nguyen, D.T.; Nguyen, H.T.; Le, L.B. Dynamic Pricing Design for Demand Response Integration in Power Distribution Networks. IEEE Trans. Power Syst. 2016, 31, 3457–3472. [Google Scholar] [CrossRef]

- Dietrich, K.; Latorre, J.M.; Olmos, L.; Ramos, A. Demand response in an isolated system with high wind integration. IEEE Trans. Power Syst. 2012, 27, 20–29. [Google Scholar] [CrossRef]

- Vardakas, J.S.; Zorba, N.; Verikoukis, C.V. A survey on demand response programs in smart grids: Pricing methods and optimization algorithms. IEEE Commun. Surv. Tutor. 2015, 17, 152–178. [Google Scholar] [CrossRef]

- Soleymani, S.; Hajibandeh, N.; Shafie-khah, M.; Siano, P.; Lujano-Rojas, J.M.; Catalão, J.P.S. Impacts of Demand Response on oligopolistic behavior of electricity market players in the day-ahead energy market. In Proceedings of the Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016; pp. 1–5. [Google Scholar]

- Qdr, Q. Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them, A Report to the United States Congress; U.S. Department of Energy: Washington, DC, USA, February 2006.

- Kreuder, L.; Gruber, A.; von Roon, S. Quantifying the costs of Demand Response for industrial businesses. In Proceedings of the 39th Annual Conference of the IEEE Industrial Electronics Society, IECON 2013, Vienna, Austria, 10–13 November 2013; pp. 8046–8051. [Google Scholar]

- Von Scheven, A.; Prelle, M. Lastmanagementpotenziale in der stromintensiven Industrie zur Maximierung des Anteils regenerativer Energien im bezogenen Strommix. In VDE-Kongress 2012; VDE VERLAG GmbH: Stuttgart, Deutschland, 2012. [Google Scholar]

- Gils, H.C. Balancing of Intermittent Renewable Power Generation by Demand Response and Thermal Energy Storage. Ph.D. Thesis, University of Stuttgart, Baden-Württemberg, Germany, 2015. [Google Scholar]

- Paulus, M.; Borggrefe, F. The potential of demand-side management in energy-intensive industries for electricity markets in Germany. Appl. Energy 2011, 88, 432–441. [Google Scholar] [CrossRef]

- Graeber, D.; Kleine, A. The combination of forecasts in the trading of electricity from renewable energy sources. J. Bus. Econ. 2013, 83, 409–435. [Google Scholar] [CrossRef]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hajibandeh, N.; Ehsan, M.; Soleymani, S.; Shafie-khah, M.; Catalão, J.P.S. The Mutual Impact of Demand Response Programs and Renewable Energies: A Survey. Energies 2017, 10, 1353. https://doi.org/10.3390/en10091353

Hajibandeh N, Ehsan M, Soleymani S, Shafie-khah M, Catalão JPS. The Mutual Impact of Demand Response Programs and Renewable Energies: A Survey. Energies. 2017; 10(9):1353. https://doi.org/10.3390/en10091353

Chicago/Turabian StyleHajibandeh, Neda, Mehdi Ehsan, Soodabeh Soleymani, Miadreza Shafie-khah, and João P. S. Catalão. 2017. "The Mutual Impact of Demand Response Programs and Renewable Energies: A Survey" Energies 10, no. 9: 1353. https://doi.org/10.3390/en10091353

APA StyleHajibandeh, N., Ehsan, M., Soleymani, S., Shafie-khah, M., & Catalão, J. P. S. (2017). The Mutual Impact of Demand Response Programs and Renewable Energies: A Survey. Energies, 10(9), 1353. https://doi.org/10.3390/en10091353