1. Introduction

Global warming has become an unequivocal problem where the main cause is considered to be anthropogenic greenhouse gas (GHG) emissions [

1]. Means to mitigate GHG emissions such as the implementation of renewable energy (RE) sources, stopping deforestation and increasing power generation efficiencies have been presented [

2]. New and efficient RE technologies such as wind and solar power are being implemented in large quantities on a global scale. To demonstrate the rapid growth of the global RE capacity, wind power rose from 17,333 MW to 369,608 MW from 2000 to 2014 and solar energy capacity increased from 805 MW to 175,305 MW during the same period [

3].

These new energy sources entail problems linked to their power output as it is highly intermittent and cannot meet steady energy demand [

4]. One solution to this problem is to use hydrogen as an energy carrier where hydrogen can be produced on site by water electrolysis, and compressed, stored and re-electrified via fuel cells during low production days or used for mobility purposes [

5].

Compared to conventional fuels hydrogen is a strong competitor. For example, hydrogen has more energy content per unit mass but at the same time occupies more space at atmospheric temperature which makes a high pressure or liquefied storage vital [

4,

6,

7,

8,

9,

10,

11,

12]. Hydrogen can be produced from variable sources and by different processes such as coal gasification, partial oxidation of hydrocarbons, steam reforming of natural gas and water electrolysis [

13,

14,

15]. Water electrolysis is the only method that does not entail GHG emissions, making it the perfect method to link to the rapidly increasing RE capacity. Despite the advantages of hydrogen, large scale implementation has been slow to be developed, due to high capital and running costs [

16].

The term “hydrogen economy” has a relatively broad meaning [

17] and can be traced to the early 1970’s where the term was first used publicly in the work of Bockris [

18,

19], who referred to the hydrogen economy as the concept of using hydrogen as the energy medium between future energy generation sites and consumers where the hydrogen could be used as a fuel or to produce electricity. Since then the term has widely been used in relation to the part hydrogen plays in the car industry and as an energy carrier linked to renewable energy sources aimed to balance intermittent energy production [

5,

20]. Therefore, the term has been referred to as many “economies” instead of one “economy” [

17].

Although hydrogen has been considered a viable option as an energy carrier for stationary applications, the main application of hydrogen has been linked to the car industry where hydrogen could replace conventional fossil fuels, thus reducing GHG emissions [

7,

9,

21]. During the first decade of this century hydrogen “hype” linked to the car industry peaked [

22]. However, despite the cooling down of hydrogen hype, car manufacturers have reached a point where hydrogen driven vehicles are ready for deployment.

Hydrogen production via water electrolysis is expensive due to the high investment and running costs which make an economic assessment of such systems important. Life cycle cost (LCC) analysis has been the method to study the cost due to its capability of capturing all upstream costs associated with the overall lifetime of the selected system [

12]. Hydrogen systems are often considered as a replacement or addition to conventional energy sources at remote locations where diesel generators are used extensively with relevant emissions and diesel cost. Therefore, as a means to compare different systems at different locations the levelized cost of hydrogen (LCOH) method has been implemented in order to evaluate the LCC in terms of cost per energy unit (kWh) or in terms of hydrogen mass (kg) [

12,

23,

24,

25].

The literature reveals many studies that assess the economic feasibility of energy systems that include hydrogen as an energy carrier, especially for remote locations [

26,

27,

28,

29]. The key similarity among the results of those studies is that further reduction in hydrogen component cost is needed to achieve economic competitiveness. Thus, new pilot projects and research on their results are needed for the hydrogen systems to become economically competitive. Furthermore, although there is an abundance of feasibility studies for hydrogen energy systems there is a certain lack of economic assessments of real demonstration and pilot projects despite the fact that a number of hydrogen systems have been installed [

30].

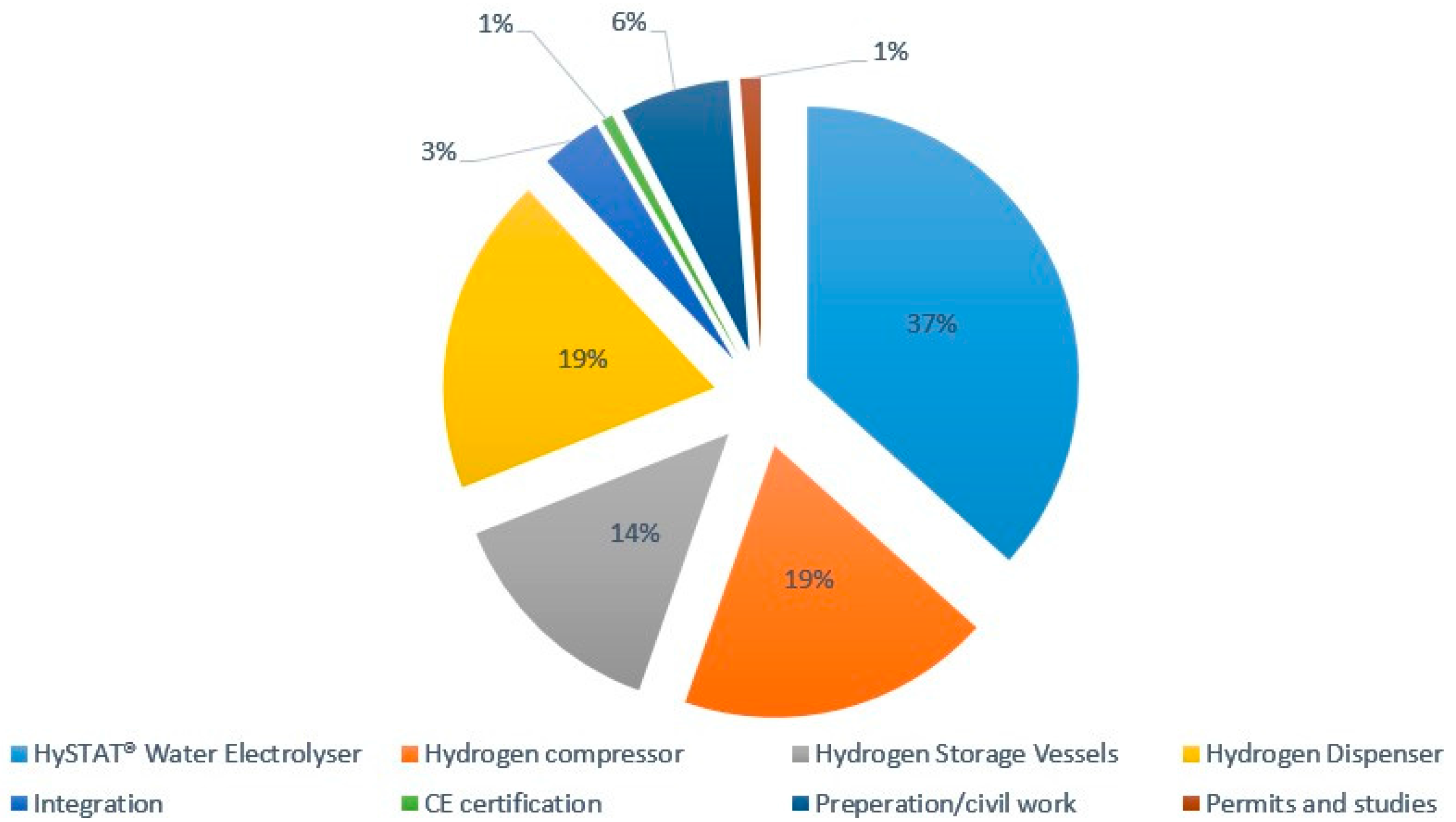

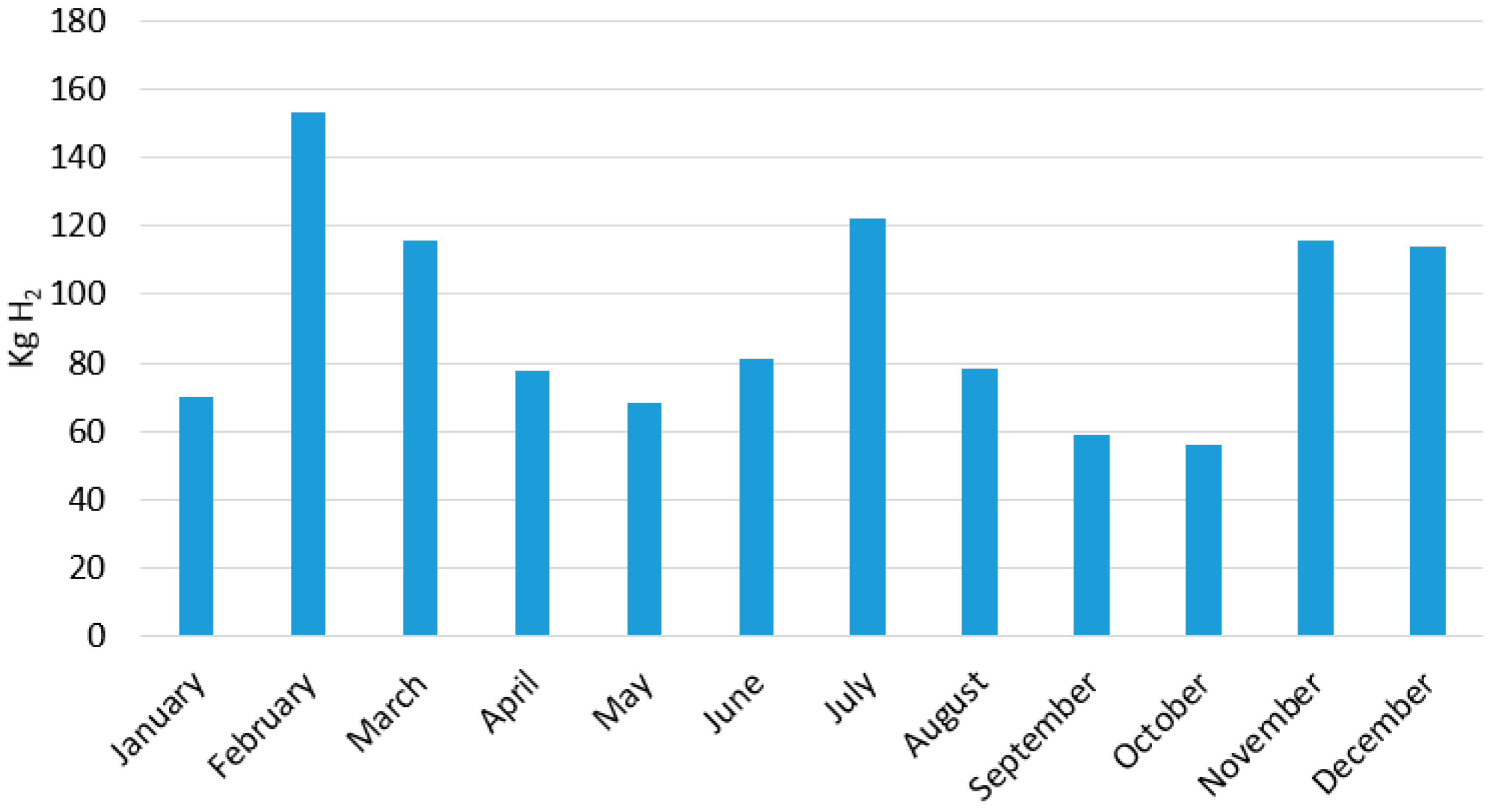

The aim of this study was to evaluate the well-to-tank (WTT) LCOH of a hydrogen refueling station (HRS) located in Halle, Belgium, compare the cost-level to previous benchmarks, and identify the most critical cost factors. In addition, a sensitivity analysis for different uncertain components is provided to evaluate further under which conditions certain target cost levels could be met. The LCC model provides a holistic approach based on the existing literature. The main findings are that capital costs should be pushed down in the future to reach more competitive cost levels, which in the current assessment are only reached under the most favorable future running cost development.

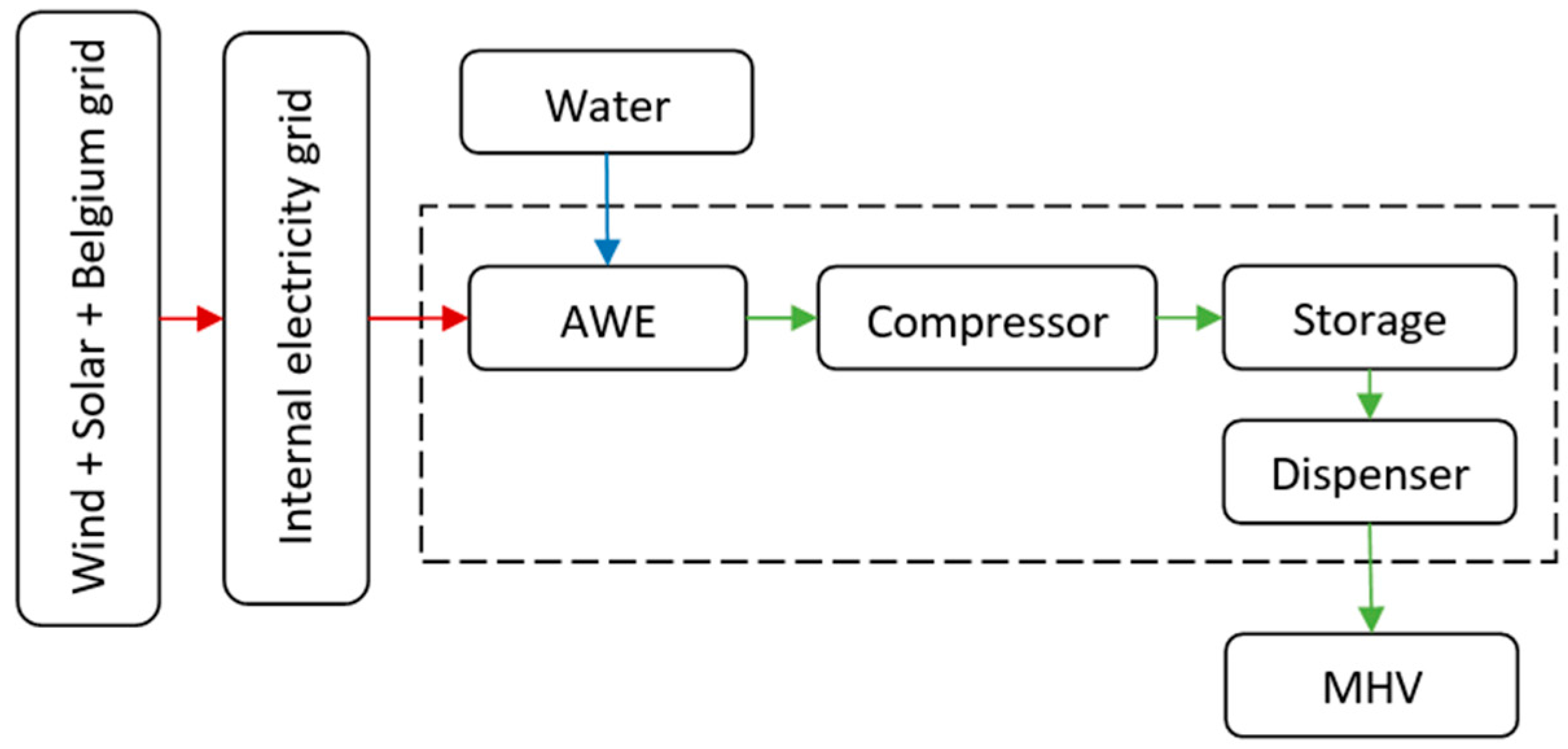

The case study project was co-funded by the European Commission. The 7th Framework Programme for the Fuel Cell and Hydrogen Joint Undertaking (FCH JU) initiative and has been given the acronym Don Quichote (DQ). The DQ project was initiated in 2012 and is a 5-year project consisting of three phases. The first phase, analyzed in this paper, was the evaluation of an existing hydrogen refueling station based on an alkaline water electrolyzer (WE), diaphragm compressor (450 bar) and steel hydrogen storage (50 kg). Phase 2 is aimed to implement a state-of-the-art proton exchange membrane (PEM) WE and a fuel cell (FC) for the re-electrification of the hydrogen and a (40 kg) composite storage tank. The aim of the DQ project is obviously to benchmark the new PEM WE system against the mature alkaline WE technology. Phase 3 includes the addition of a state-of-the-art electrochemical compressor that will be benchmarked against the existing diaphragm compressor. The focus of this study is only on phase 1 of the project and can act as a benchmark for phase 2.

The structure of this paper is split, as follows: the research methods are explained in

Section 2 and a detailed description of the research process is given in

Section 3. The results are presented in

Section 4, including the main LCC results along with a sensitivity analysis. Implications and further discussion are provided in

Section 5 and finally the main results are concluded in

Section 6.

5. Discussion

The main goal of this study was to evaluate the LCOH for a decentralized HRS in Belgium. The cost model was derived from mature and state of the art literature and the calculations were based on a comprehensive field data collection to ascertain as realistic costs as possible. The results can also be used as benchmarks for the next phase of the DQ project, where a new state of the art PEM WE and FC have been added to the current HRS.

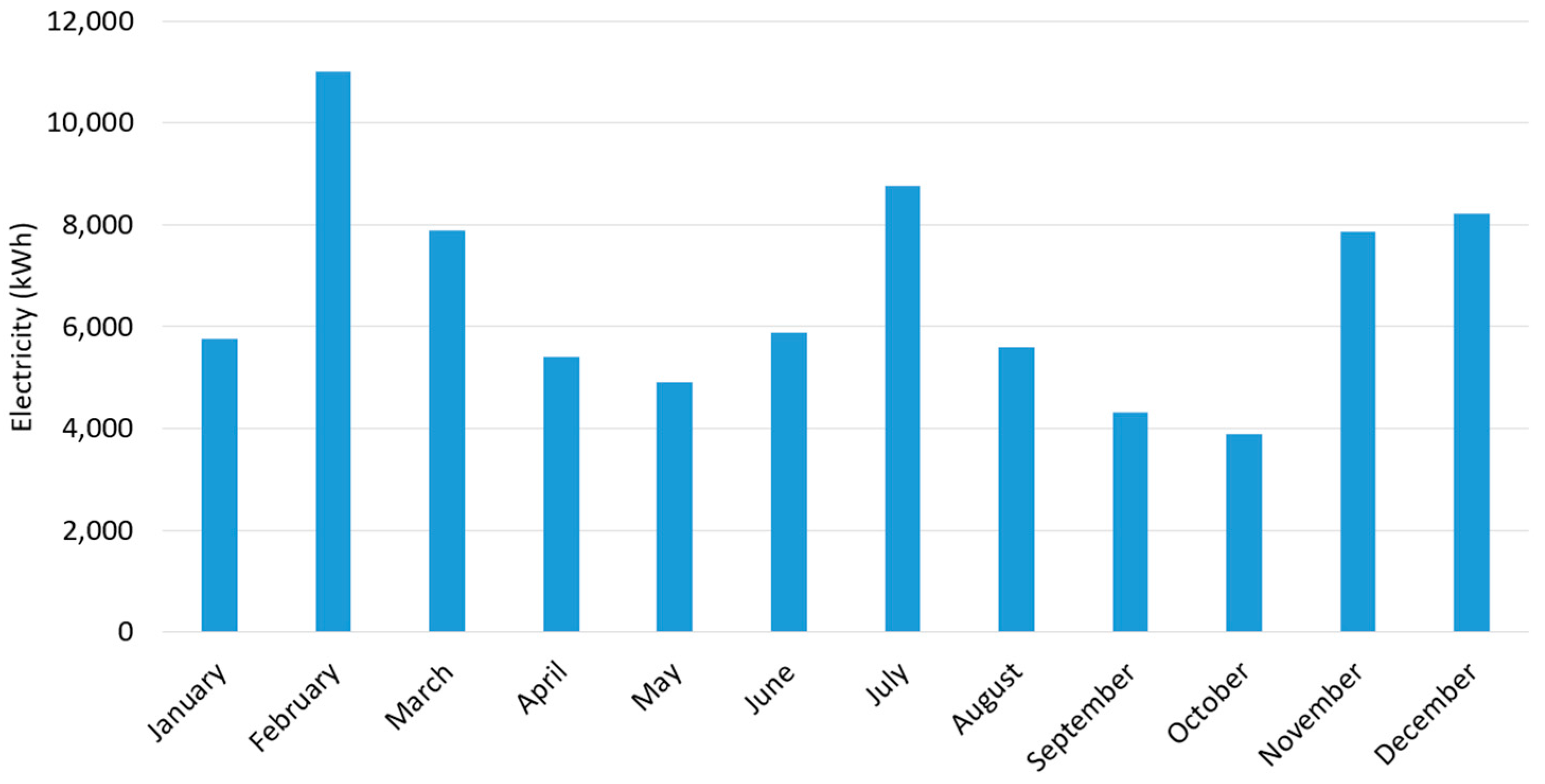

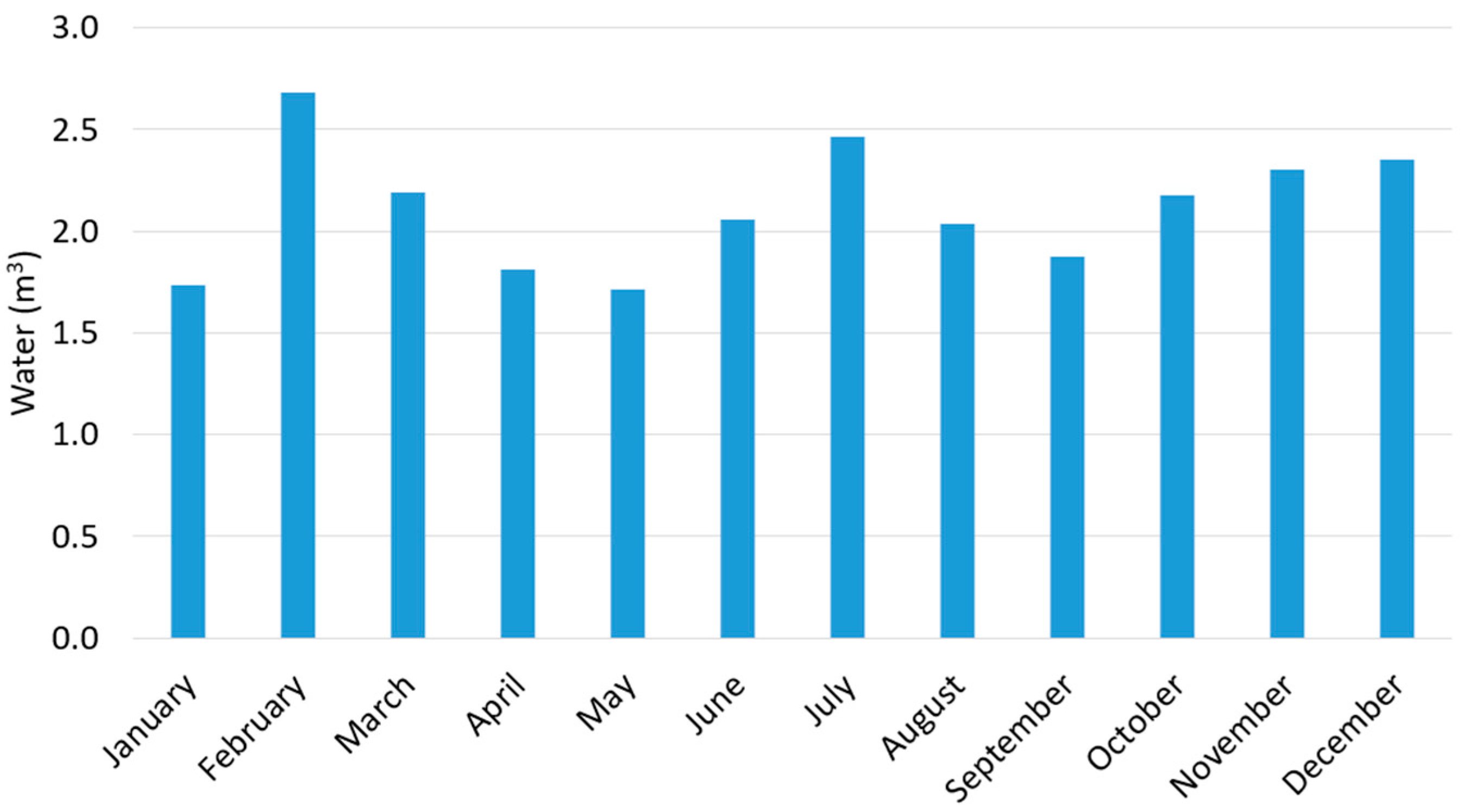

The main limitations of the study are related to assumptions of the price of electricity and the utilization of the HRS. The assumption of the price of electricity was based on an average value, both for the high and low values, which is a simplification of a highly dynamic relationship. These assumptions might lead to estimation errors as well, especially if actual operating hours tend to be during peak hours when the cost of electricity is high or at other times resulting in lower electricity costs. A further analysis of this relationship is an area of further study.

No consumer tax or other fees were applied to the LCOH, which would reflect real consumer costs similar to some of the results in the study by Linnemann & Steinberger-Wilckens [

36]. There was no salvage value assumed nor any end of life costs due to uncertainty of the status of the components after the lifetimes analyzed.

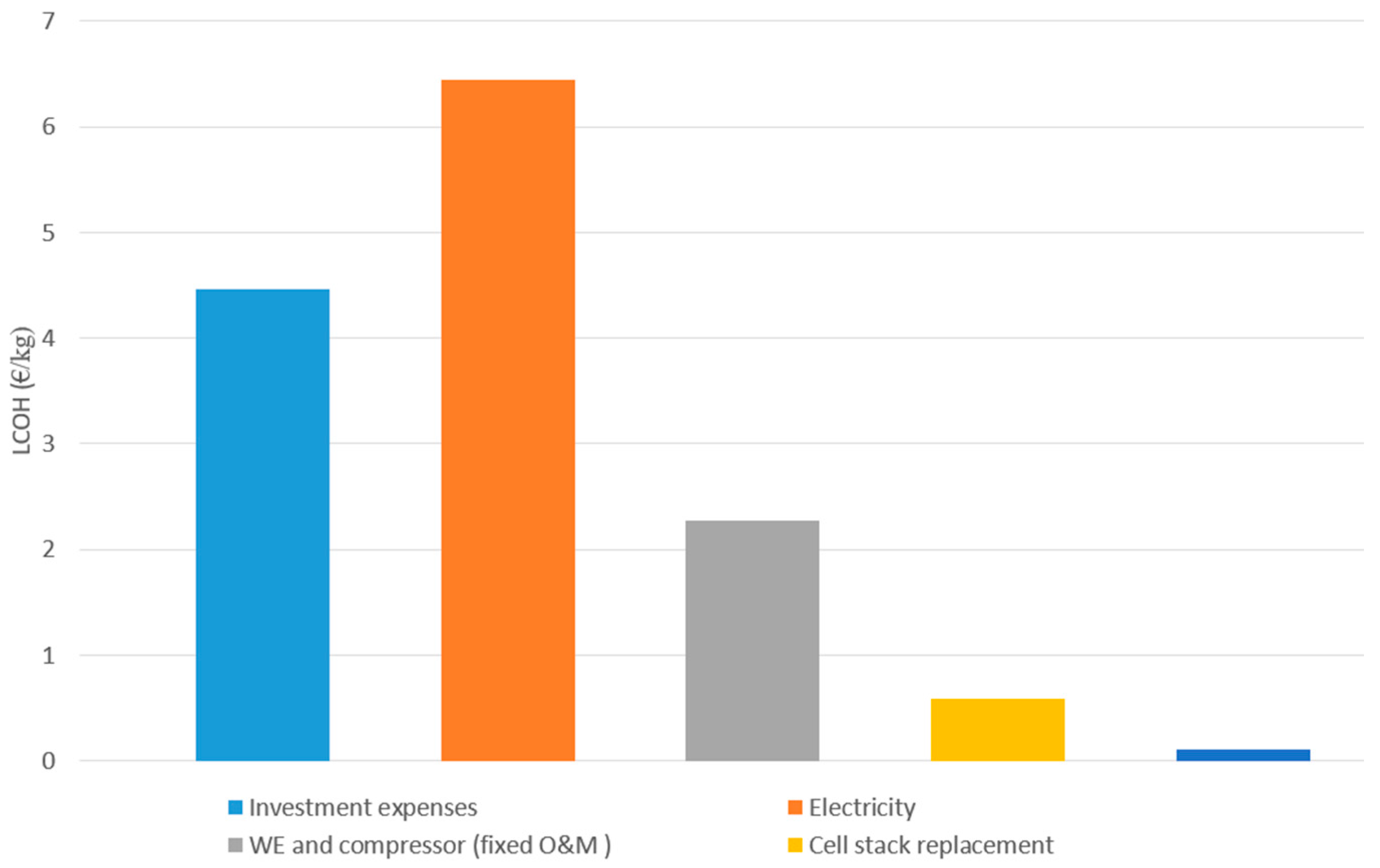

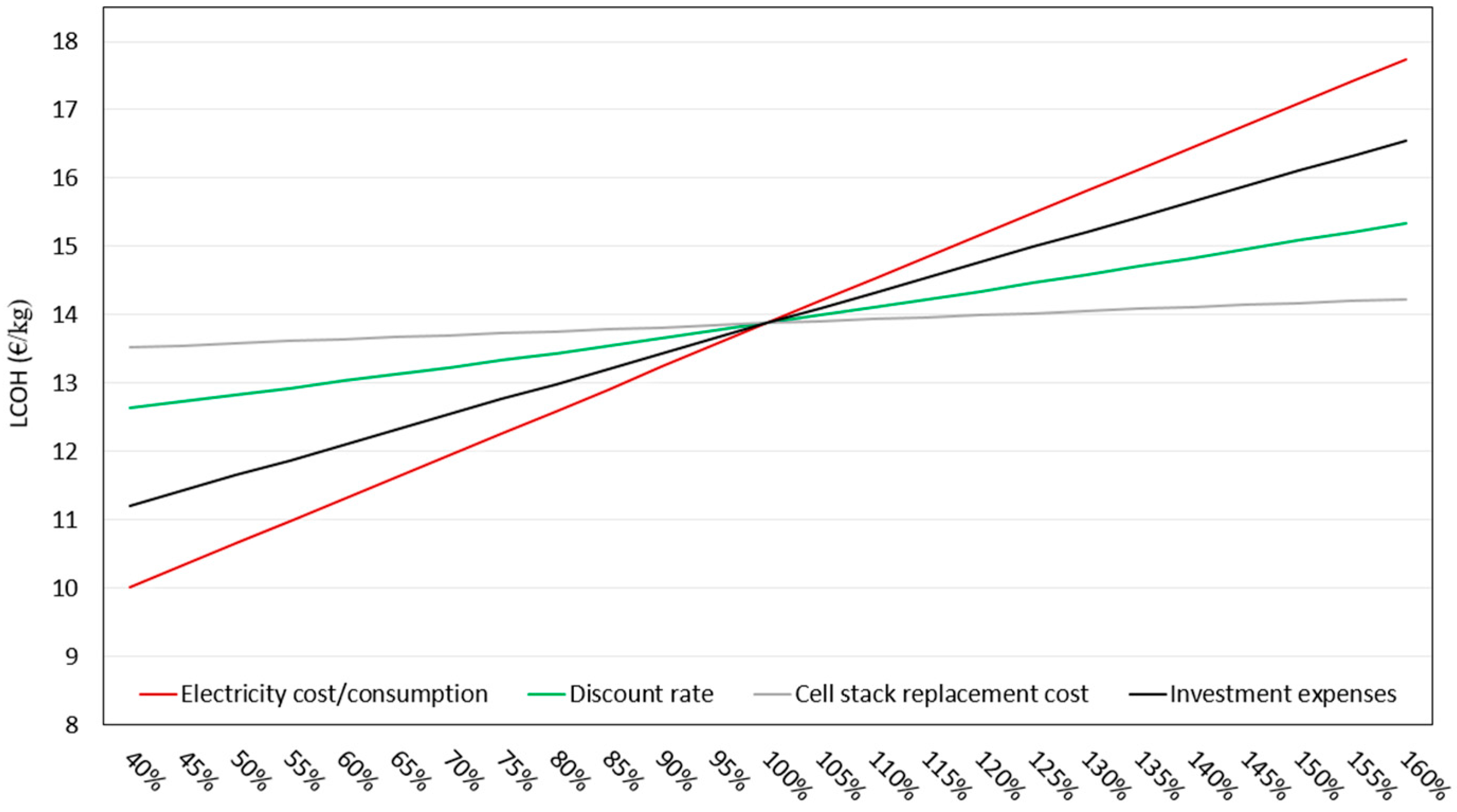

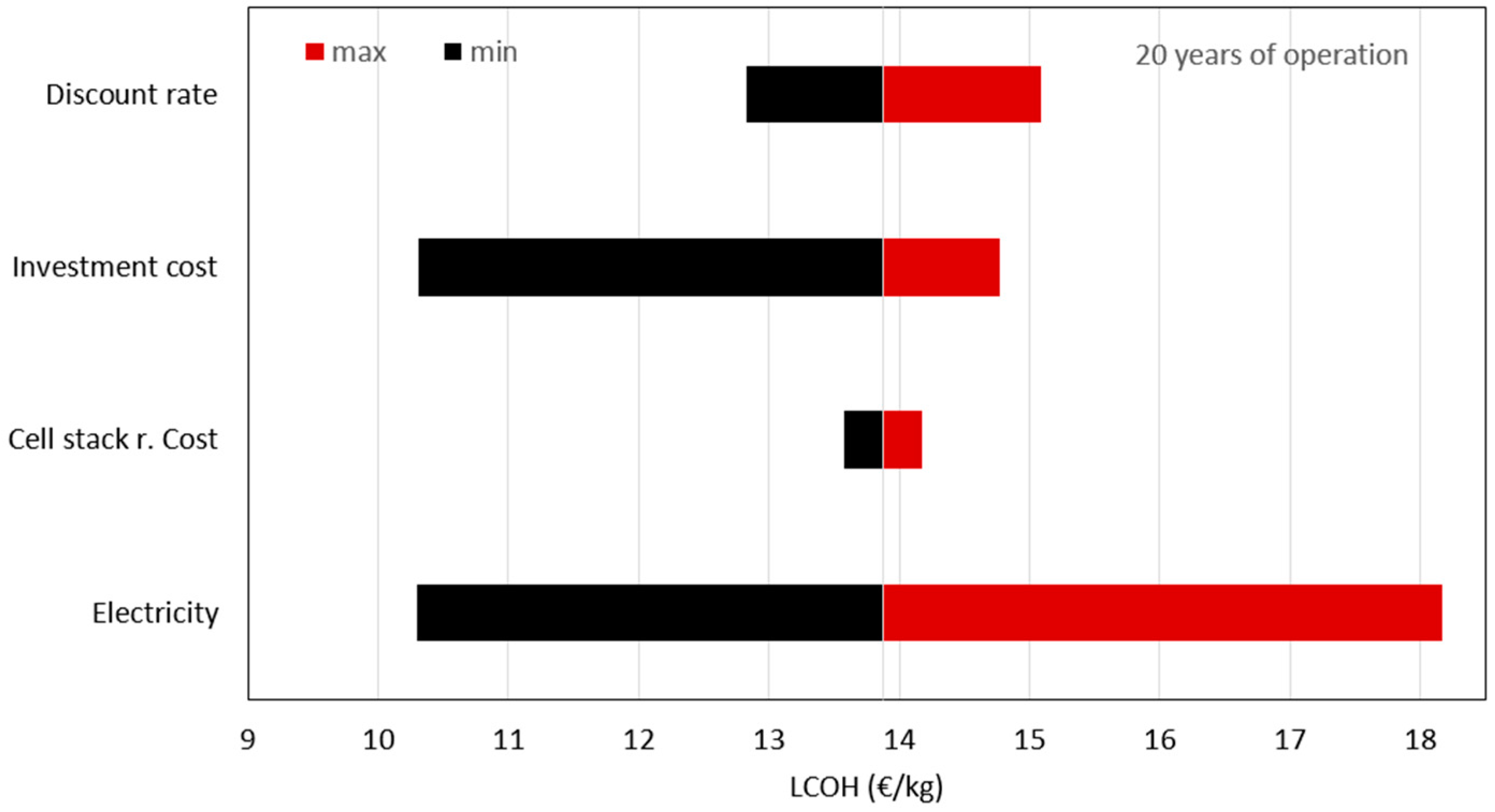

Based on the assumptions in this study the main results indicated that a LCOH of 13.9 €/kg could be reached for a 20 year lifetime with 80% utilization. Furthermore, in favorable conditions, with a reduction in investment expenses of −80% and electricity cost of 0.04 €/kWh a LCOH as low as 6.7 €/kg could be reached. Of these, a reduction in investment expenses requires subsidizing or a technological leap, but the electricity part is already a plausible scenario with the RE systems operated on the case site, and with an electricity cost of only 0.04 €/kWh the LCOH would drop down close to 6.7 €/kg.

When comparing the results with the existing literature on similar production systems [

25,

36], variations in the results are found placing the current study in between the extremes. The key factor explaining the differences seems to be the high impact on different assumptions, underlining the earlier stated need for more studies of actual operating facilities.

In comparison to the study by Linnemann and Steinberger-Wilckens [

36], where a small and a large scale hydrogen plant were analyzed, costs of approximately 27.5 €/kg and 11.4 €/kg, respectively, were presented. It is relevant to compare the cost of the smaller scale system from the reference study to the 13.9 €/kg in the current study. There is a large difference between the two which could be attributed by different assumptions. The main differences are depicted in

Table 7 but the main difference was the operating hours. It should be noted that although the dates of the studies differ, the technology is similar and the date of the cost information in the current study is from the year 2011 and therefore the validity of the comparison remains.

In another study, Greiner et al. [

25] provide a method of assessment for a wind-hydrogen system on a Norwegian island, presenting both a chronological simulation and cost calculations. In contrast to the current study and the reference study above there is a large gap between the results. Greiner et al. [

25] presented a LCOH of 2.8 €/kg and 6.2 €/kg for grid-connected and stand-alone systems. Different assumptions (refer to

Table 7) are the main reasons for the vast difference where the largest factors might be the scale of the system and potentially the electricity costs. The study by Greiner et al. [

25] utilizes electricity from an onsite wind turbine and therefore the electricity cost is only connected to the wind turbine cost and production capacity. They also assume hydrogen demand of 450 kg/day. It is appropriate to compare the grid connected system to the current study whereas both systems have renewables that inject electricity into the local grid, bearing in mind that Greiner et al. [

25] include the sold sale/purchase cost of market price electricity. In this way, in the case of the lowest electricity cost in the current study the LCOH could reach 10.3 €/kg with an electricity cost of 0.04 €/kWh. The assumption of the lower electricity cost is somewhat unrealistic where this value could only be reached when injecting electricity into the public grid, which then affects the results to some extent. The actual price would presumably fluctuate, but just how much is an area for further study. It should be noted that the investment expenses in the current study include more realistic costs than the comparison studies, and hence a potentially higher LCOH.

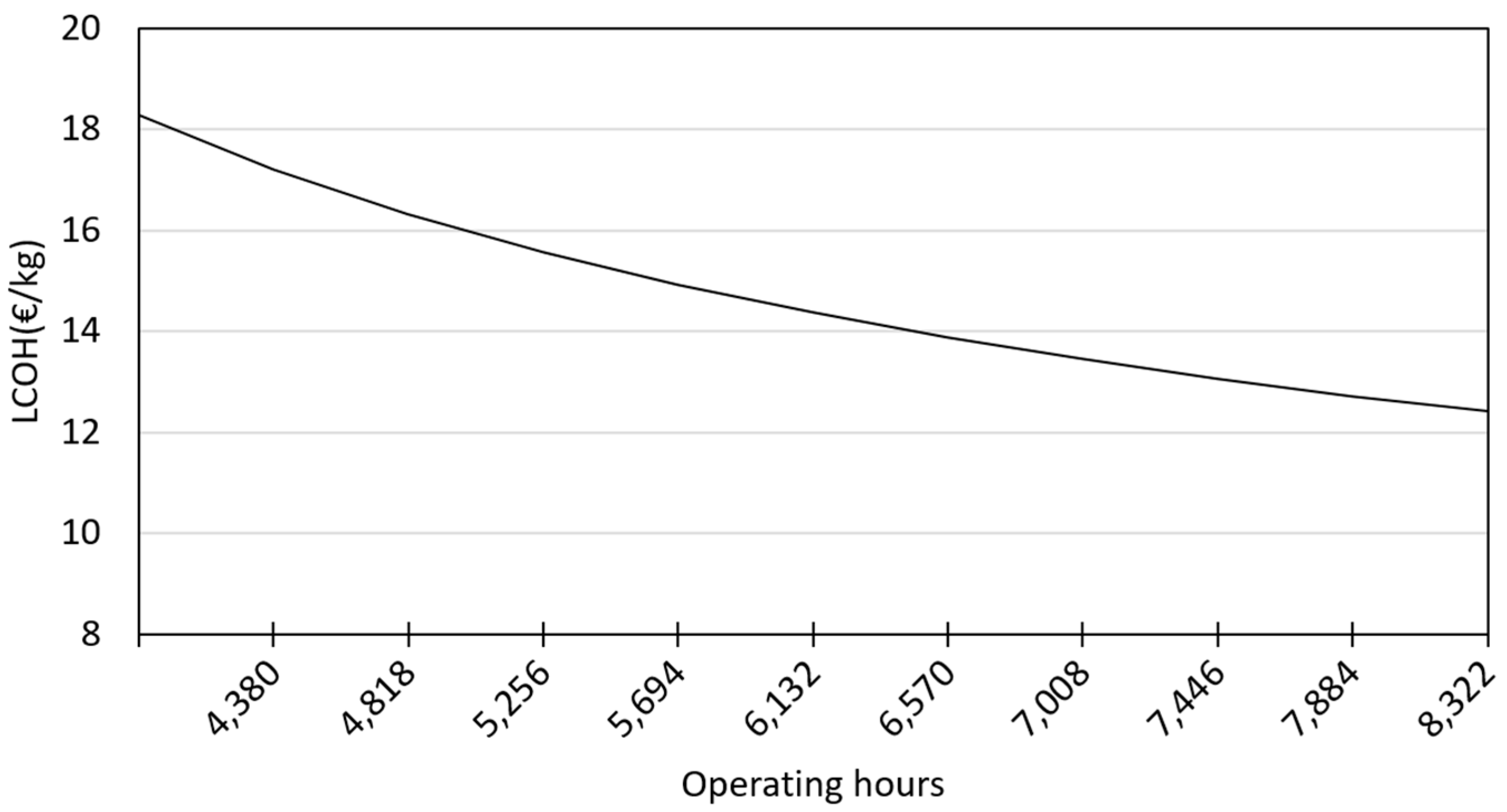

Based on the above it becomes evident that the main factor in keeping the LCOH as low as possible is maintaining operating hours at the maximum level as the LCOH could drop to approximately 12 €/kg at 95% utilization, as depicted in

Figure 10. The second largest cost factor, which is consistent with the literature [

6,

16,

40], is the electricity cost, as demonstrated in this study with the sensitivity analysis. Investment expenses together with replacement costs form the third important category.

The cost figures used in this study date back to the year 2011 and represent relatively high costs as DQ is a small-scale demonstration project. A larger scale commercial system could yield lower initial and running costs where WE costs tend to follow a non-linear cost curve [

4,

11]. The sensitivity analysis in

Section 4.2 depicts the underlying potential in reducing these costs.

6. Conclusions

The main results showed that a LCOH of 13.9 €/kg could be reached if the operational hours are maximized. However, as seen in the sensitivity analysis, by reducing the electricity cost down to 0.04 €/kWh, the investment expenses down by −80% of the total cost and maintaining 80% operating hours a LCOH of 6.7 €/kg could be reached.

The results indicated that the critical cost factors are the electricity and investment expenses as they have the largest impact on the LCOH. As hydrogen production is evidently capital intensive and requires cheap and environmentally friendly electricity, combining the large quantity of renewables installed every year and green policies is critical to achieve the cost levels required. However, a system such as the studied DQ could, together with selected RE technologies, provide an option for a comprehensive off the grid solution even before the aimed cost competitiveness is achieved. Demand for reliable low-carbon off the grid solutions with high self-sufficiency is growing fast, and the cost requirement for competitiveness is less demanding.

Although the model and the results in this study were solely based on phase 1 of the DQ project, this study takes a small but yet important step towards the hydrogen economy by demonstrating the realistic cost of small scale hydrogen production and provides a benchmark for new hydrogen technologies.