Monetary Policy and Fiscal Conditions: Interest Rates, Nominal Growth Rates, Tax Revenues, and Government Expenditures

Abstract

1. Introduction

- (1)

- The relationship between government revenue, nominal GDP, and the inflation rate.

- (2)

- The relationship between government expenditure, nominal GDP, and the inflation rate.

- (3)

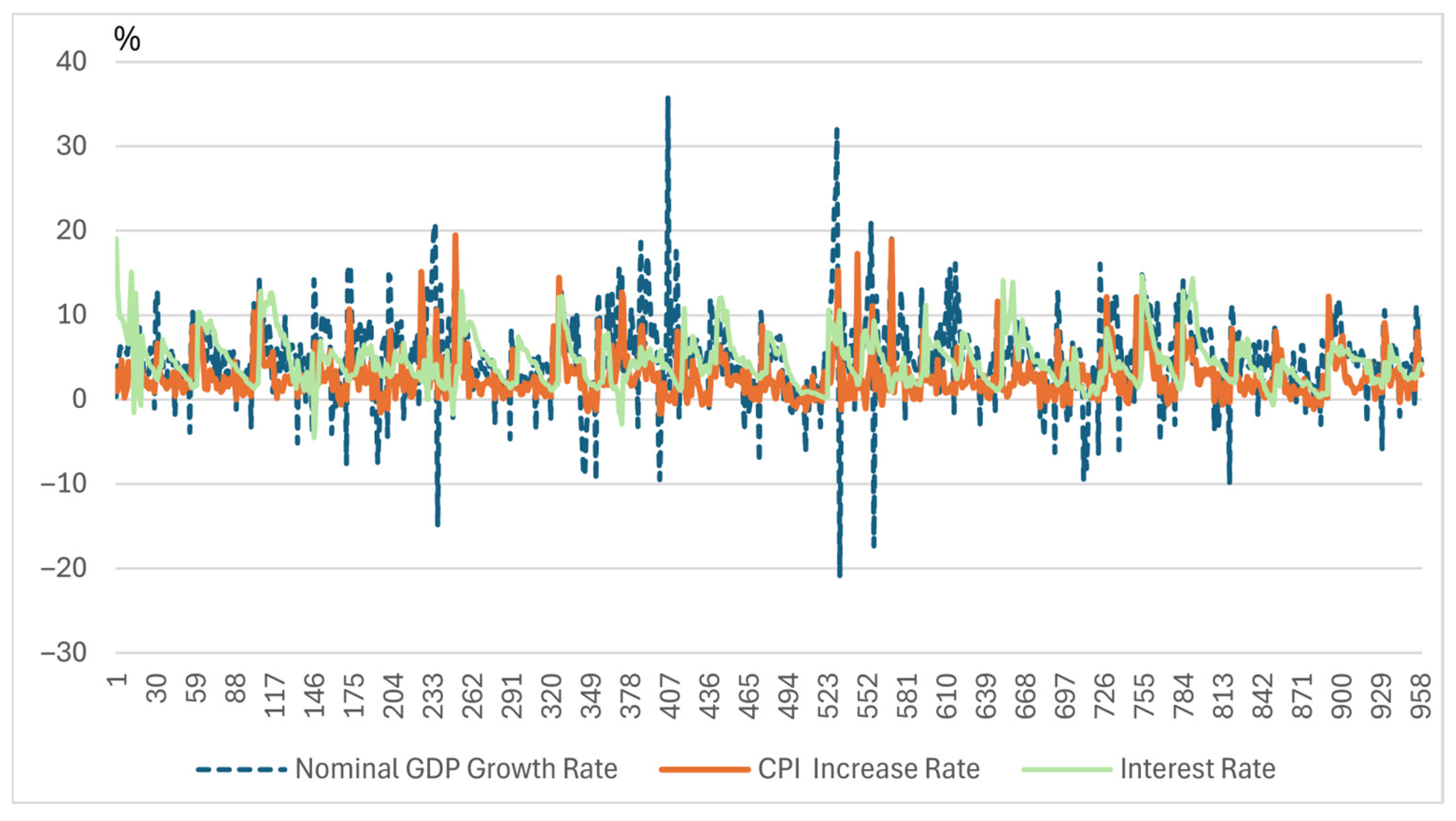

- The relationship between the interest rate and the nominal growth rate .

2. Literature Review

3. Relationship Between Budget Situation and Monetary Policy

3.1. Relations of Budget Data and Nominal GDP

3.2. Relations Between Fiscal Stability and Monetary Policy

4. Dataset

4.1. Data Checks and Exclusions

4.2. Descriptive Statistics

- PPP (Purchasing Power Parity) GDP per capita (2021 international dollars): mean $49,645; minimum $15,035; maximum $142,311, indicating the sample is concentrated in advanced economies.

- CPI inflation: mean 2.7%; minimum −1.7%; maximum 19.4%.

- Nominal GDP growth: mean 5.1%.

- Nominal interest rate: mean 4.4%; the pooled sample therefore exhibits a negative average .

5. Estimation

5.1. Model Selection

5.2. Estimation Results

5.3. Effects of Nominal GDP Growth (Models 1–7)

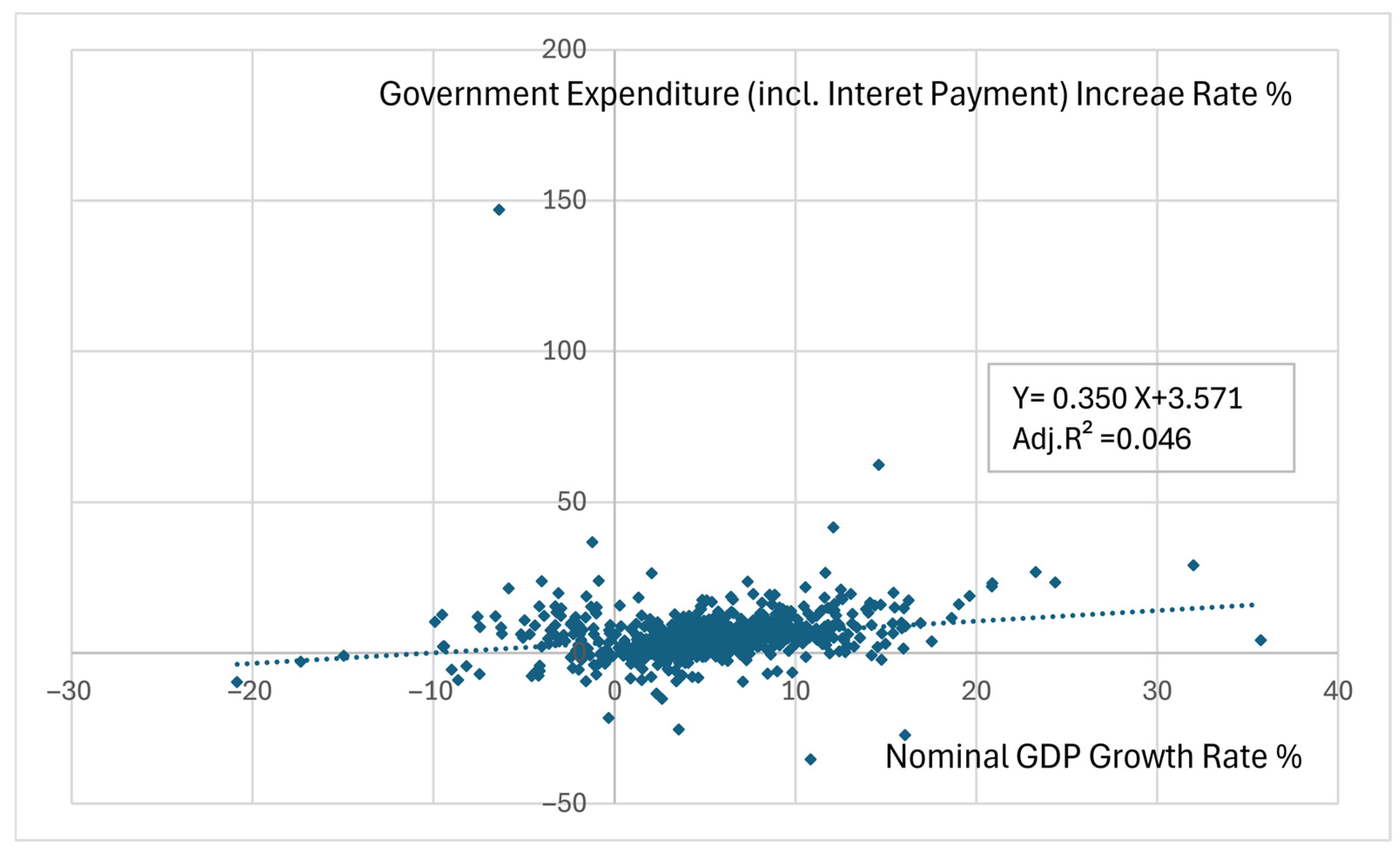

- Model (1): A one percentage point increase in nominal GDP growth is associated with a 0.564 percentage point increase in government expenditure growth .

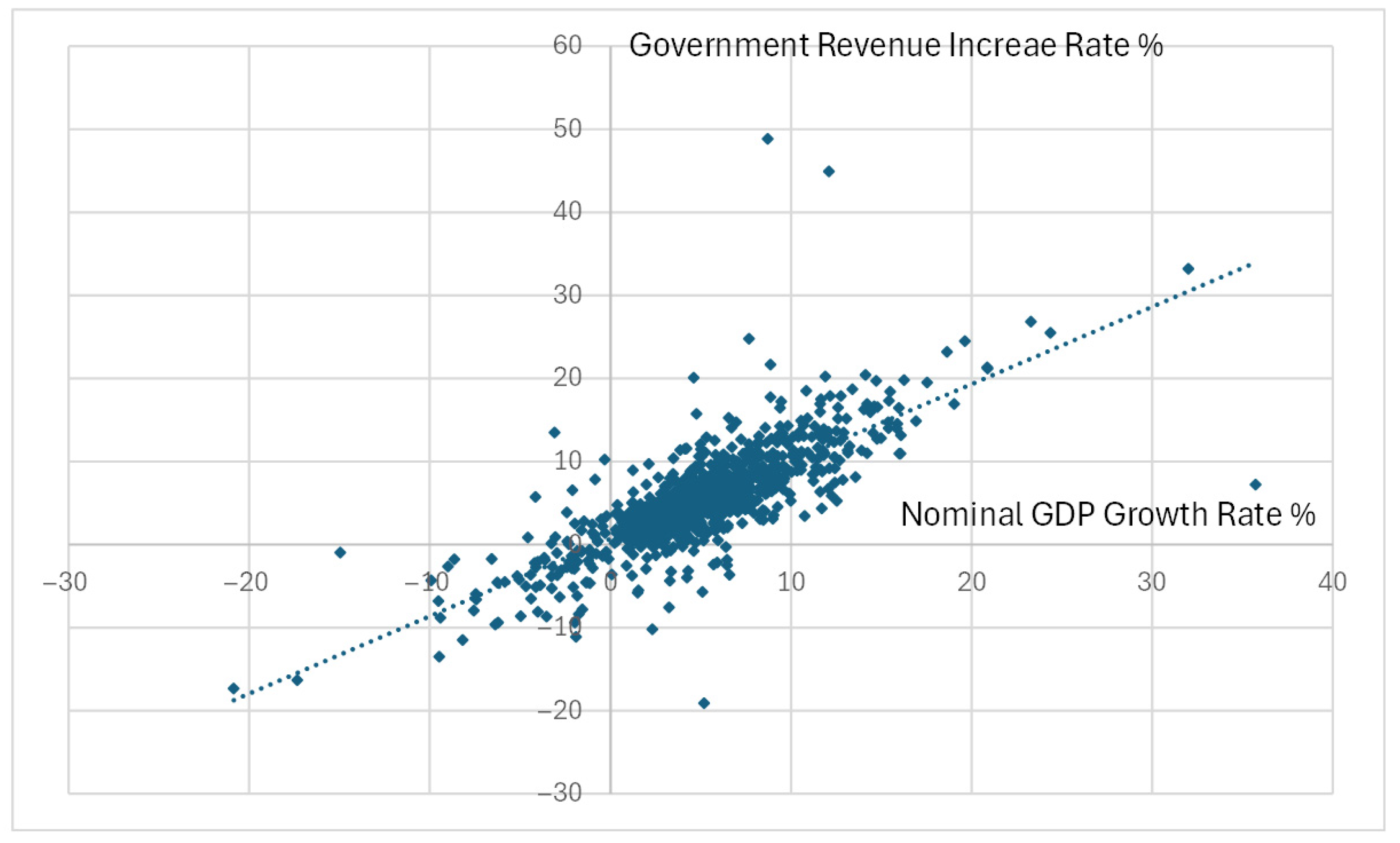

- Model (2): A one percentage point increase in nominal GDP growth corresponds to 0.770 percentage point increase in government revenue growth . The estimated coefficient of 0.770 is consistent with the interpretation that many countries adjust tax parameters to limit bracket creep induced by inflation.

- Model (3): A one percentage point increase in nominal GDP growth reduces the gap between government expenditure growth and government revenue growth by 0.206 percentage points, consistent with Models (1) and (2) and implying that higher nominal growth reduces the budget deficit3.

- Model (4): Nominal GDP growth tends to reduce the nominal interest rate, but the estimated effect is small (0.009) and not statistically significant4.

- Model (5): Nominal GDP growth improves the primary balance ratio , consistent with the inference from Model (3).

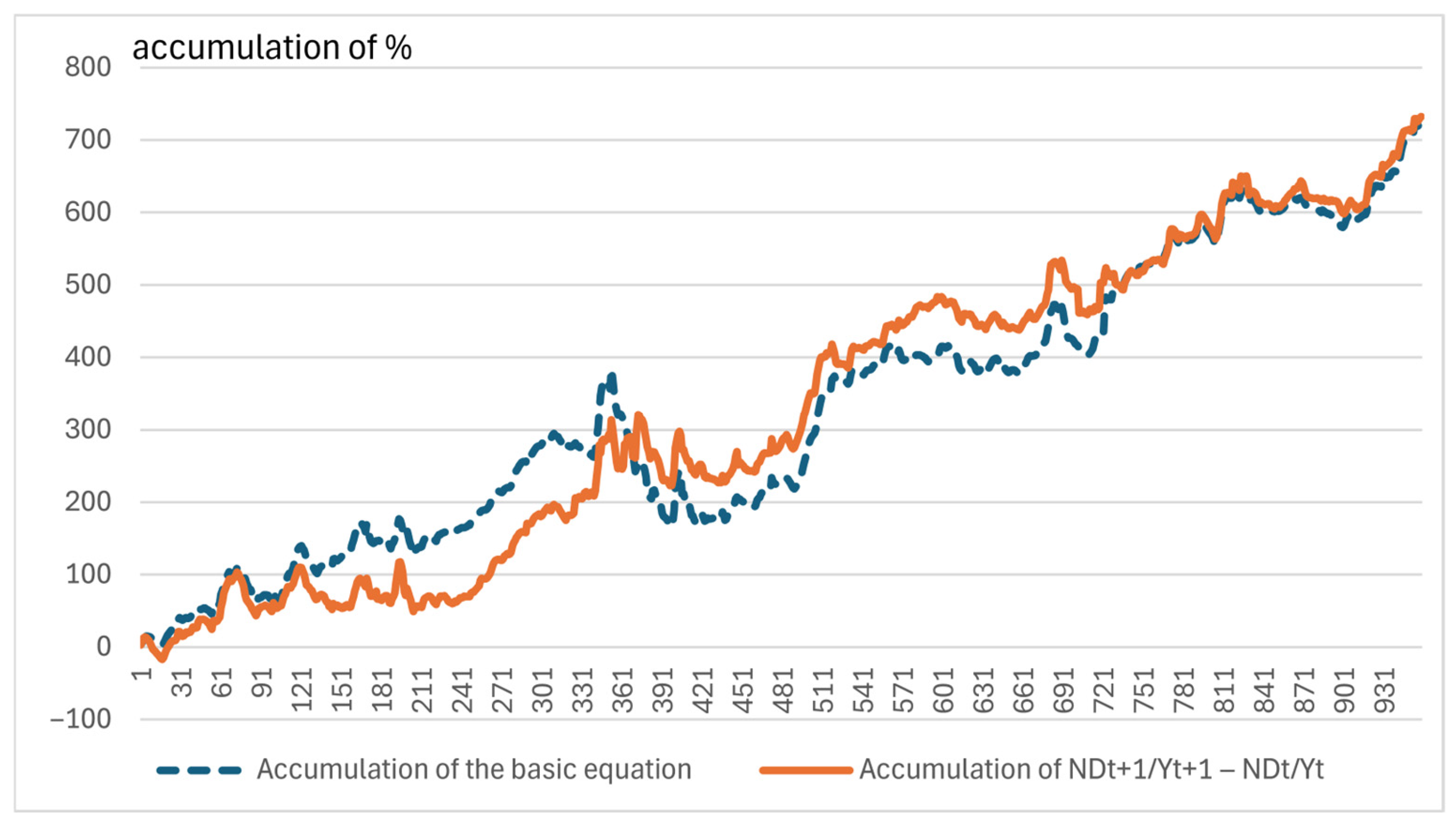

- Model (6): Nominal GDP growth mitigates the term, meaning nominal growth exceeds interest rates as we discussed before5.

- Model (7): Consolidating the components in Models (5) and (6), nominal GDP growth reduces , a reduction in .

5.4. Effects of CPI Growth (Models 1–7)

- Model (1): A one percentage point increase in CPI is linked to a 0.964 percentage point increase in government expenditure growth, indicating that a one percent rise in prices is nearly matched by a one percent increase in government spending.

- Model (2): A one percentage point increase in CPI is positively related to a 0.793 percentage point increase in government revenue growth.

- Model (3): A one percentage point increase in CPI is associated with a 0.171 percentage point increase in the expenditure minus revenue growth differential, implying increase in the budget deficit; however, this coefficient is very small and statistically insignificant.

- Model (4): A one percentage point increase in CPI raises the nominal interest rate by 0.064 percentage points, consistent with a Fisher-type effect; the coefficient is small and statistically insignificant in the short run and may be more relevant over longer horizons6.

- Model (5): CPI growth is estimated to deteriorate the primary balance ratio , and this coefficient is statistically insignificant at the 5% level, aligning with the (weak) findings of Model (3).

- Model (6): CPI growth mitigates the .

- Model (7): CPI growth’s net effect on is statistically insignificant; components increase and decrease different parts of the equation, resulting in an ambiguous net effect in this specification.

5.5. Brief Summary

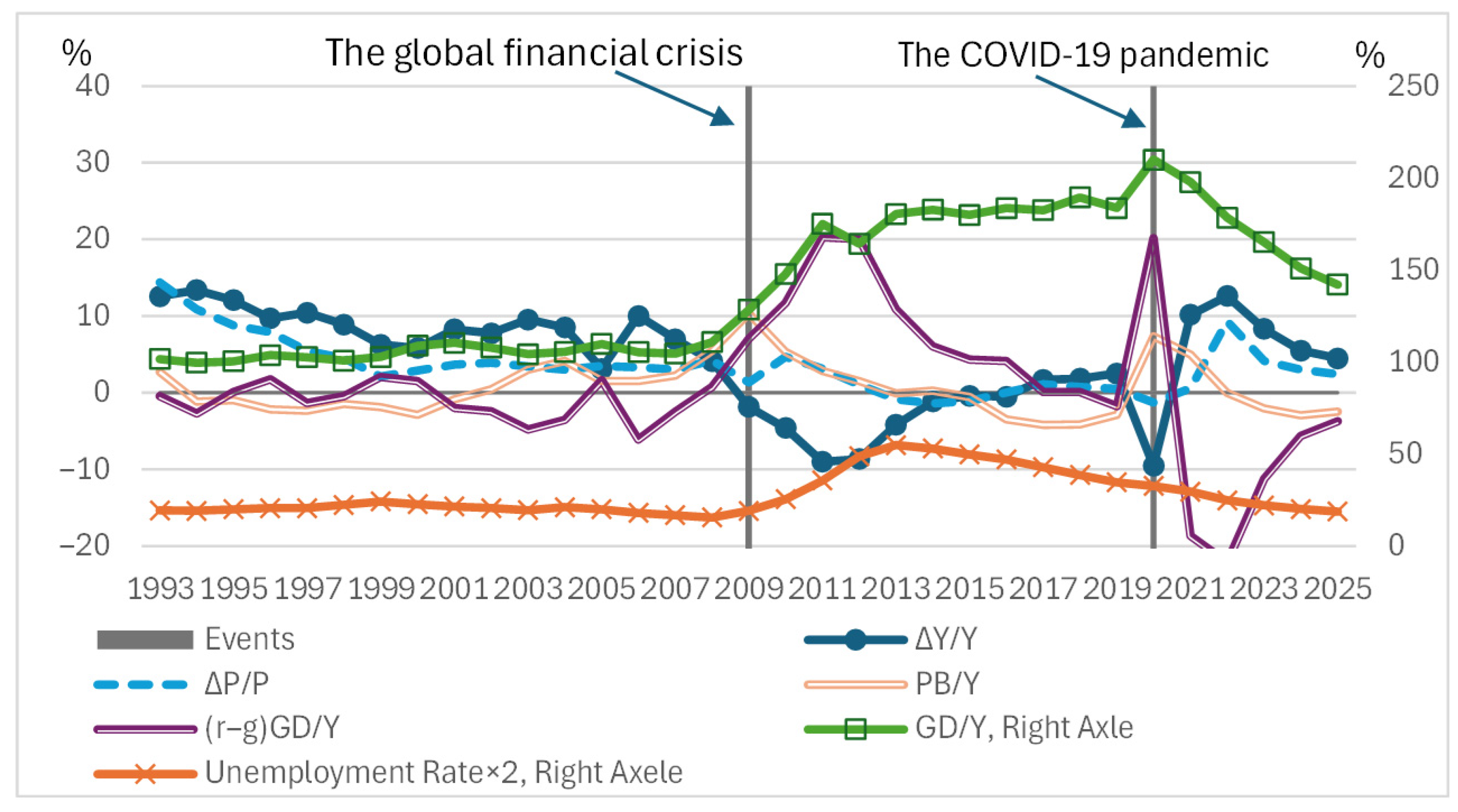

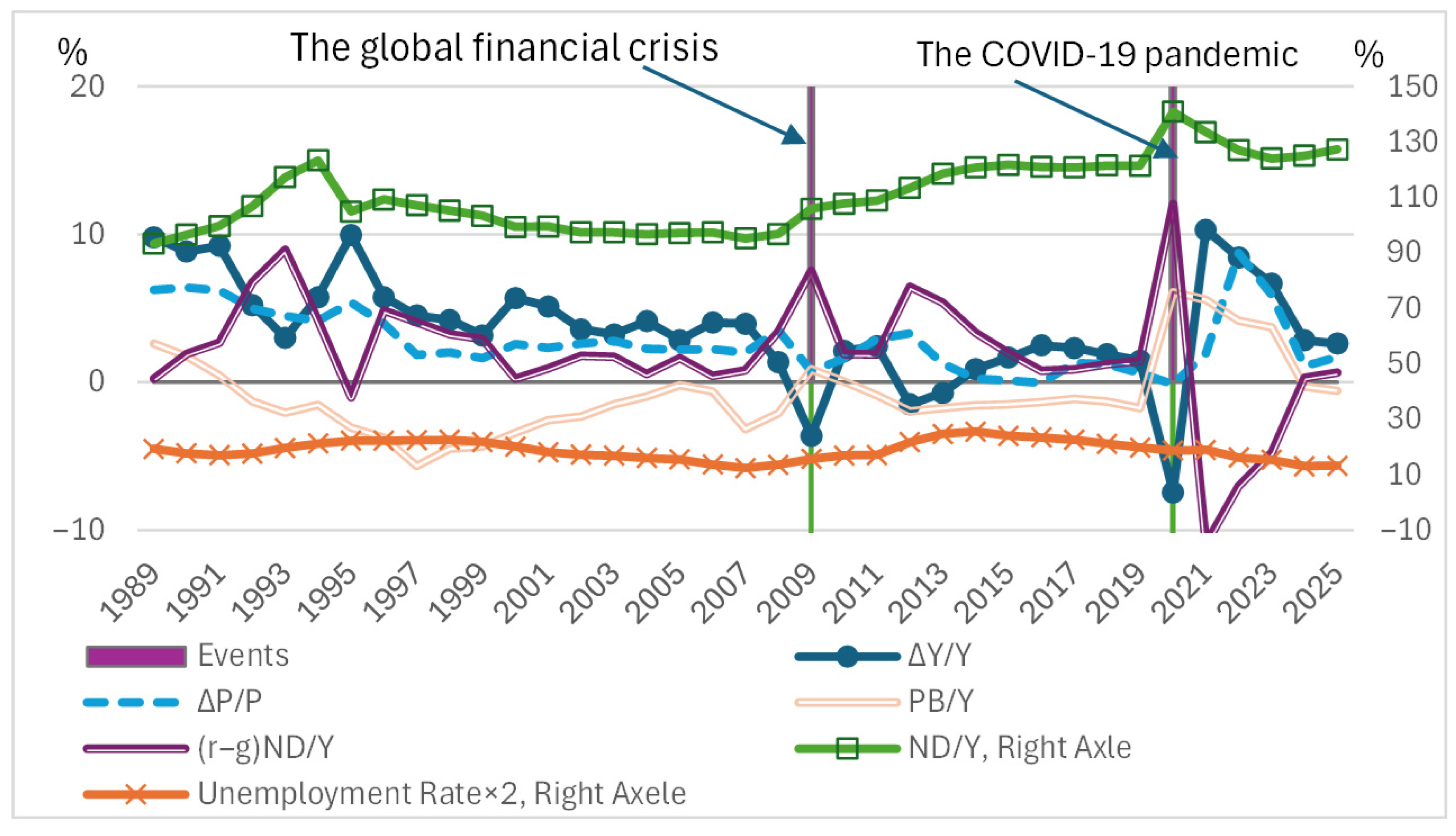

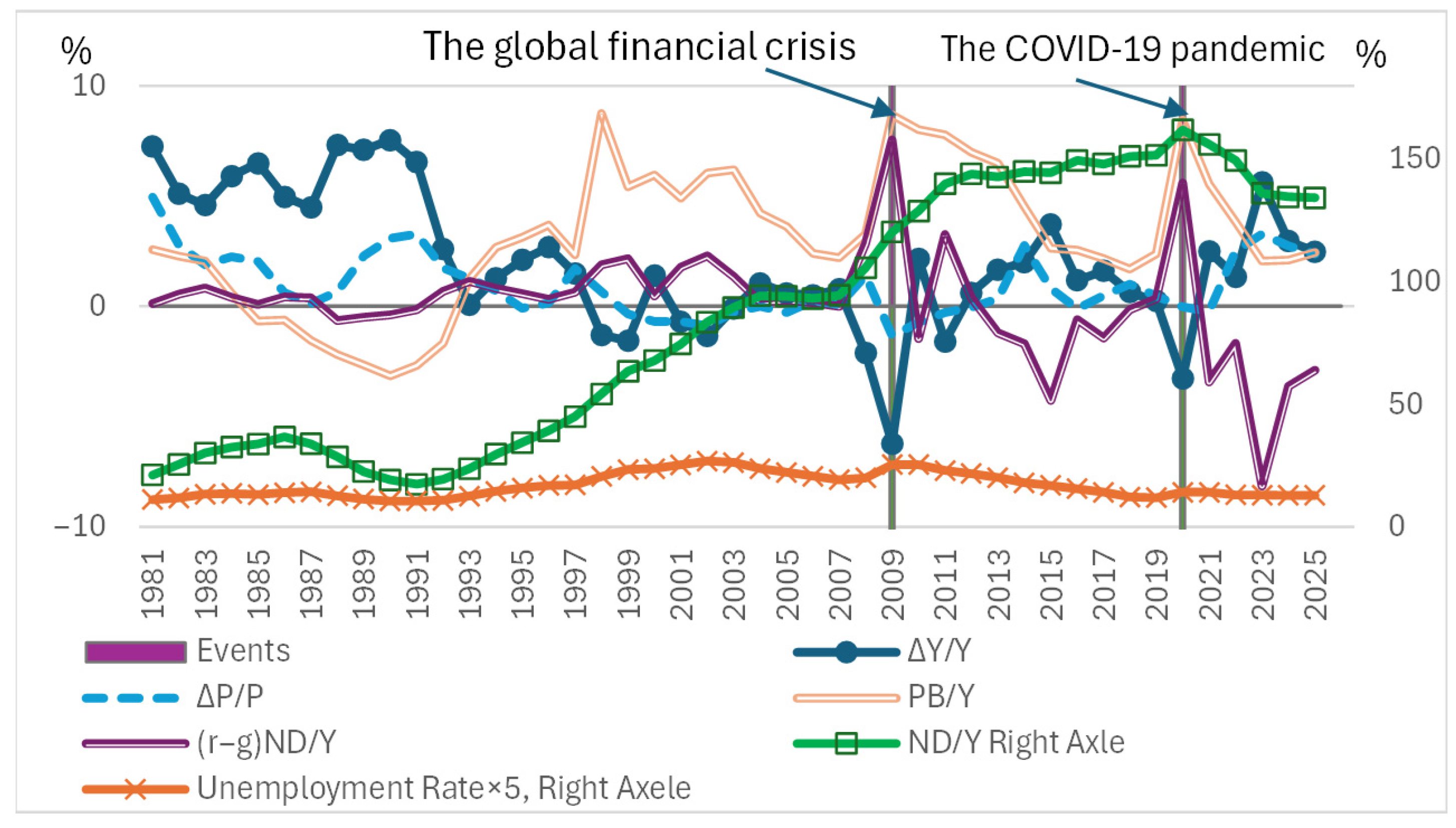

6. Case Studies

- (1)

- Greece

- (2)

- Italy

- (3)

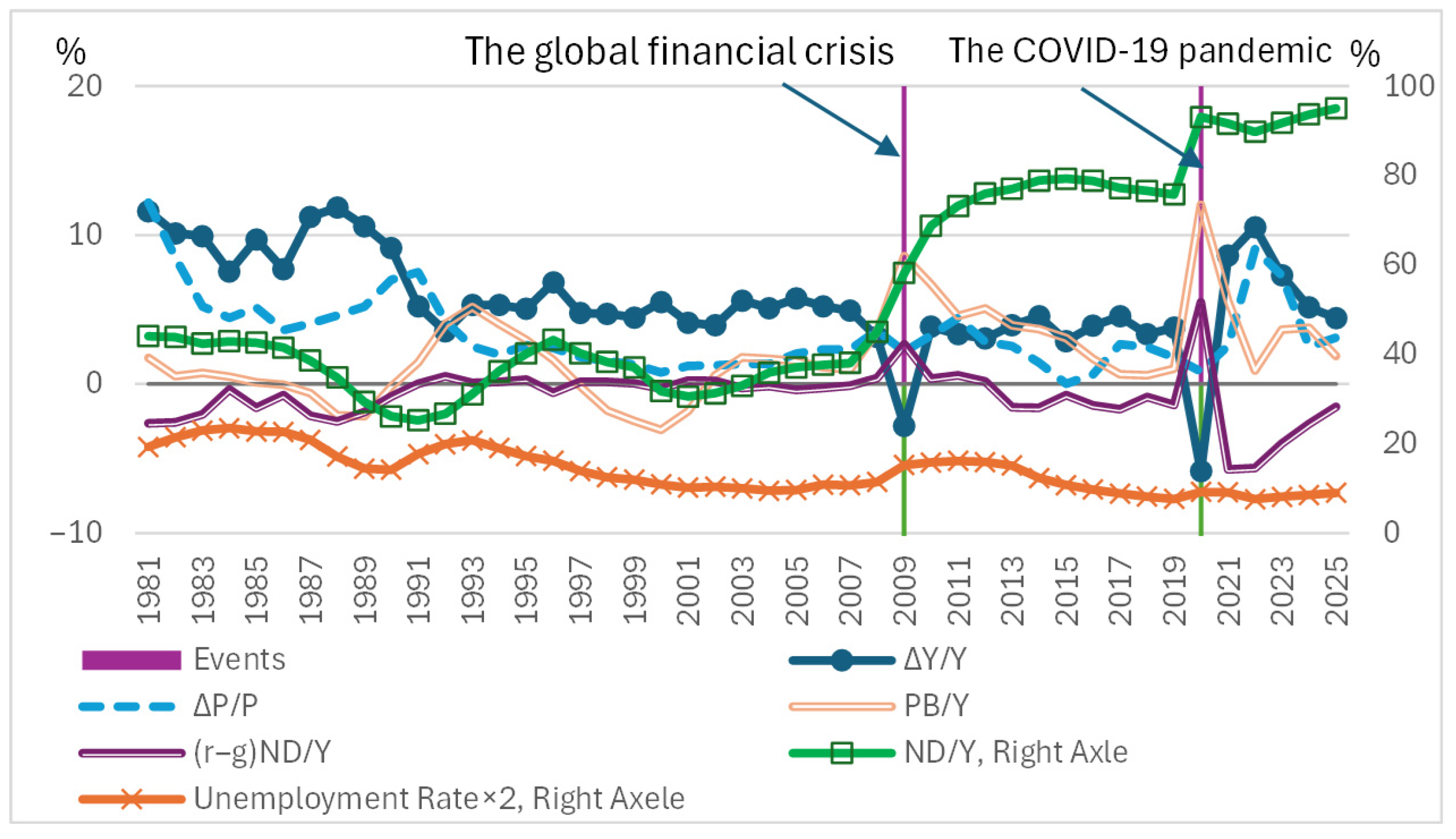

- Japan

- (4)

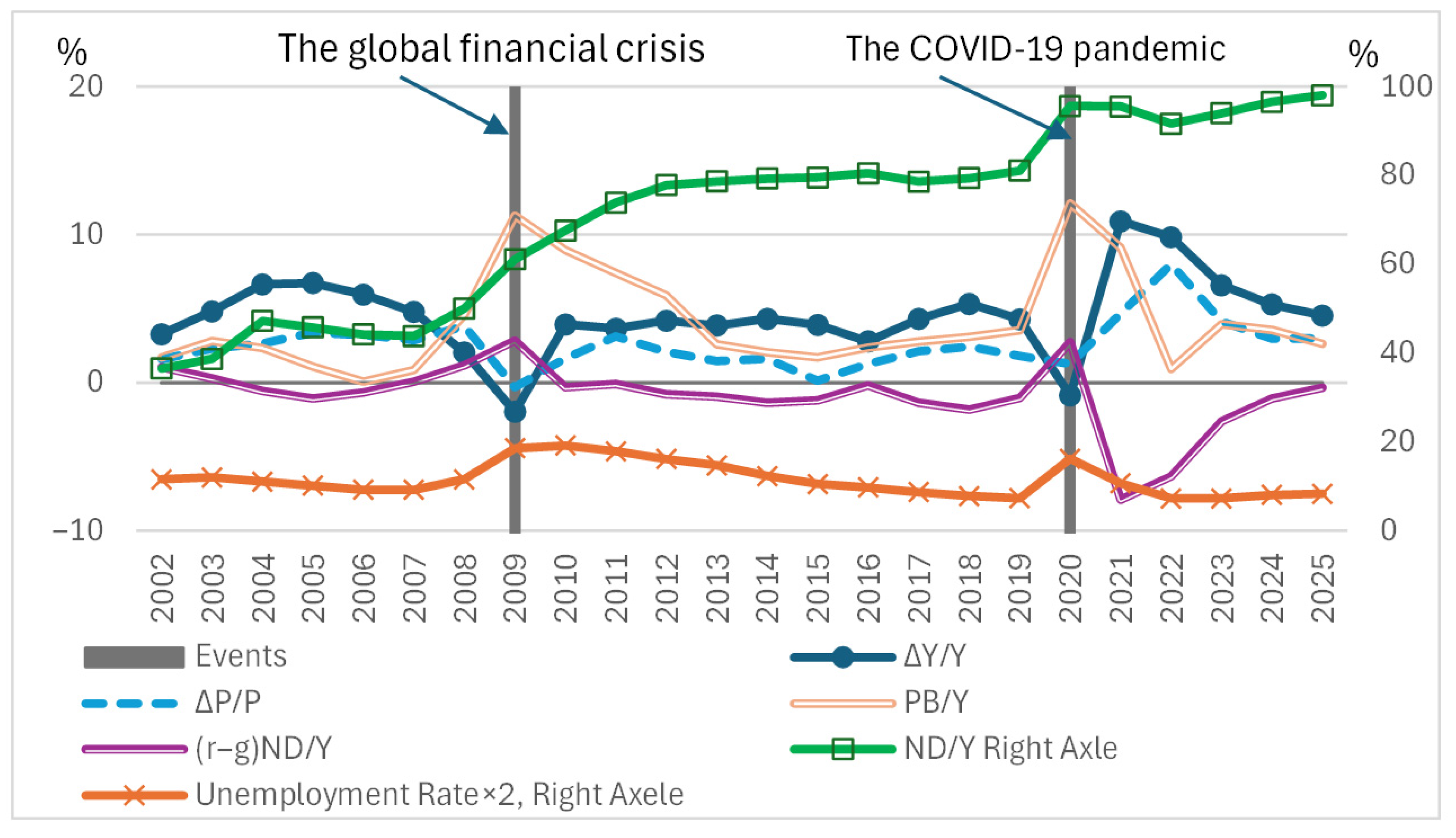

- the United Kingdom and the United States

7. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. For Dataset Cleaning and Exclusions

| 1 | We refrain from simultaneously including the GDP growth rate and the consumer price inflation rate in the models, since nominal GDP growth equals the sum of real GDP growth and the GDP deflator growth, and nominal GDP growth is correlated with the CPI inflation rate. Although the correlation coefficient between the two variables (0.5196) indicates that multicollinearity is not statistically significant, we exclude their joint estimation in light of the theoretical interdependence between them. |

| 2 | Year-specific effects are excluded because the estimation employs a two-way fixed model. For example, the global financial crisis of 2009 lowered nominal GDP growth rates, weakened fiscal positions, and thereby induced a correlation between nominal GDP and fiscal variables. This correlation, however, is absorbed by the year-specific effect. Accordingly, the estimated relationship between nominal GDP and fiscal positions can be interpreted as relatively unbiased with respect to time-specific shocks. |

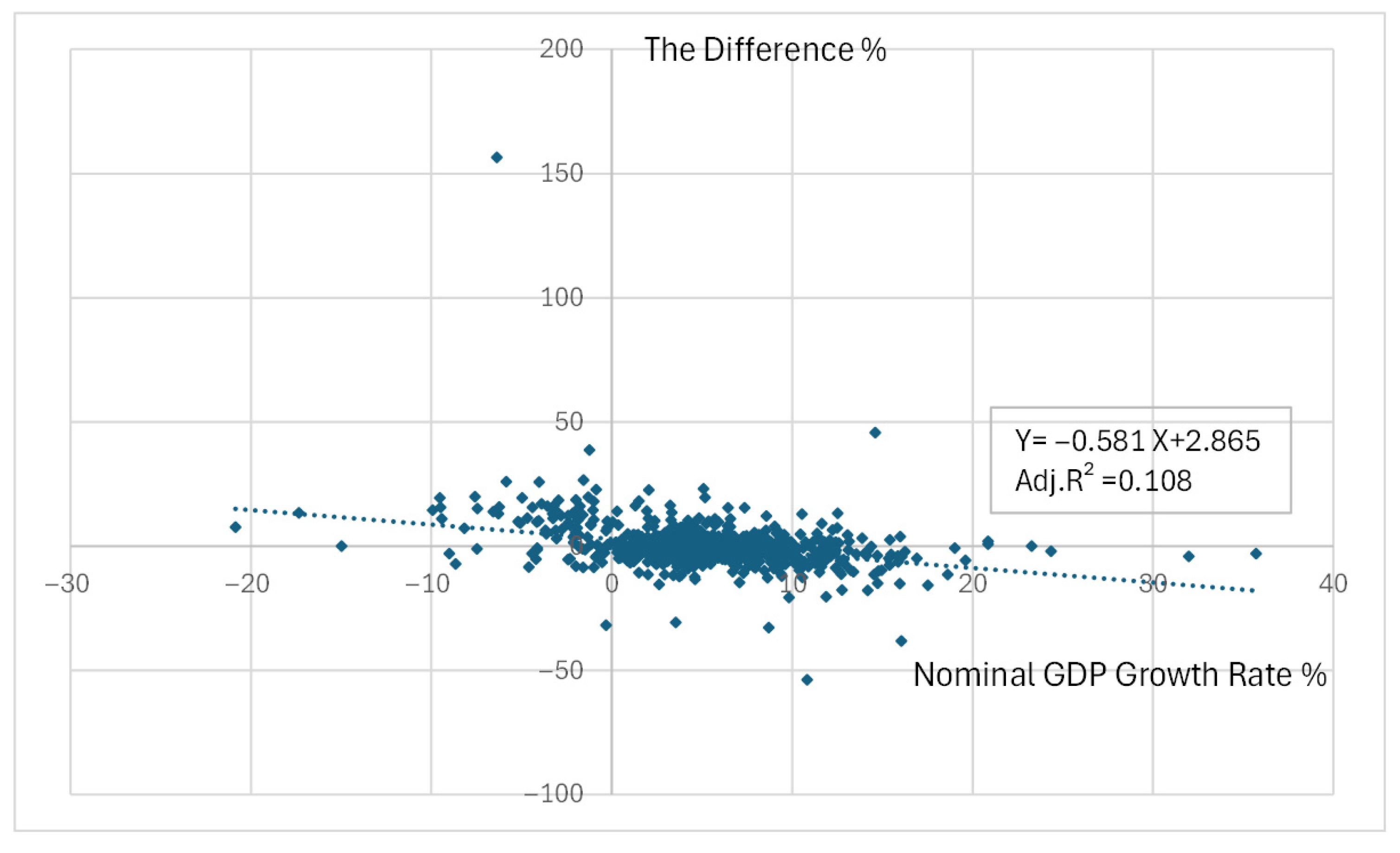

| 3 | The coefficients reported in Table 2 differ from the simple OLS slopes shown in Figure 3, Figure 4 and Figure 5 because Figure 3, Figure 4 and Figure 5 employ expenditure measures that include interest payments and are estimated using pooled OLS, whereas Table 2 presents for a two-way fixed-effect estimates. |

| 4 | The interest rate used here is computed as interest payments divided by the previous year’s government debt, representing an average rate on government bonds issued in prior years. Therefore, this rate is not immediately affected by changes in nominal growth or inflation. |

| 5 | The term (r − g) is largely driven by g, which makes the estimation results intuitive; however, this also distorts the coefficient and its p-value. That said, the coefficient on r in Model (4) is small, confirming that increases in g do not lead to a substantial rise in r. |

| 6 | See also note 4. |

| 7 | The interest rate paid by the government did not surge, it remained around 4.5% in 2009 and 2010. This is because the rate reflects average yields on previously issued bonds. |

| 8 | |

| 9 | Net debt data for Greece are unavailable; therefore, gross debt (GD) is used instead. |

| 10 | For nominal GDP: OECD Data Explorer, Annual GDP and components—expenditure approach, Euro area (20 countries). For monetary base: European Central Bank, ECB Data Portal, Base money, Euro area, (ILM.M.U2.C.LT00001.Z5.EUR). |

| 11 | The Japanese government holds substantial foreign assets, whose value increases when the yen depreciates. The effect of nominal GDP growth on net debt may be overstated, because nominal GDP growth decrease yen rate through inflation. |

| 12 | If asset bubbles occur and burst, the results appear in movements of nominal GDP growth, which affect fiscal conditions. |

References

- Amadeo, K. (2019). The balance—Greek debt crisis: Summary, causes, timeline, outlook. Available online: https://www.thebalancemoney.com/what-is-the-greece-debt-crisis-3305525 (accessed on 20 December 2025).

- Auerbach, A. J., & Gorodnichenko, Y. (2012). Measuring the output responses to fiscal policy. American Economic Journal: Economic Policy, 4(2), 1–27. [Google Scholar] [CrossRef]

- Bernheim, B. D. (1987). Ricardian equivalence: An evaluation of theory and evidence. NBER Macroeconomics Annual, 2, 263–304. [Google Scholar] [CrossRef]

- Blanchard, O. (2023). Fiscal policy under low interest rates. The MIT Press. [Google Scholar]

- Checherita-Westphal, C. D., & Semeano, J. D. (2020). Interest rate-growth differentials on government debt: An empirical investigation for the euro area. European Central Bank. [Google Scholar]

- Cochrane, J. H. (2010). Understanding policy in the great recession: Some unpleasant fiscal arithmetic. NBER working paper 16087. Available online: https://www.nber.org/papers/w16087 (accessed on 20 December 2025).

- Cohen, J., & Bastien, D. (2023). The ECB at 25 years—Chronicle of a stormy youth markets and strategies. CPRAM. Available online: https://cpram.com/fra/en/individual/publications/experts/article/the-ecb-at-25-years-chronicle-of-a-stormy-youth (accessed on 20 December 2025).

- Fisher, I. (1933). The debt-deflation theory of great depressions. Econometrica, 1(4), 337–357. [Google Scholar] [CrossRef]

- Greenlaw, D., Hamilton, J. D., Hooper, P., & Mishkin, F. S. (2013). Crunch time: Fiscal crises and the role of monetary policy. Working paper 19297. National Bureau of Economic Research. [Google Scholar]

- Heimberger, P. (2023). Public debt and r-g risks in advanced economies: Eurozone versus stand-alone. Journal of International Money and Finance, 136, 102877. [Google Scholar] [CrossRef]

- Heylen, F., Mareels, M., & Van Langenhove, C. (2024). Long-run perspectives on r − g in OECD countries: An empirical analysis. Journal of International Money and Finance, 145, 103093. [Google Scholar] [CrossRef]

- Mauro, M. P., & Zhou, J. (2020). r minus g negative: Can we sleep more soundly? International Monetary Fund. [Google Scholar]

- McCallum, B., & Nelson, E. (2016). Monetary and fiscal theories and of price level: The irreconcilable differences. Working paper 2006-010. Federal Reserve Bank. [Google Scholar]

- McCandless, G. T., Jr., & Weber, W. E. (1995). Some monetary facts. Quarterly Review, 19(3), 2–11. [Google Scholar] [CrossRef]

- Sloley, C. (2012). A dove and a hawk: How do Trichet and Draghi compare? Citywire. [Google Scholar]

- Wray, L. R. (2025). Understanding modern money theory: Money and credit in capitalist economies. Edward Elger. [Google Scholar]

| Purchasing Power Parity GDP per Capita | Nominal GDP Growth Rate % | Consumer Price Index Increase Rate % | Government Revenue Increase Rate % | Government Revenue % of GDP | Government Expenditure (Incl. Interest Paymanet) Increase Rate % | Government Expenditure (Excl. Interest Paymanet) Increase Rate % | Government Expenditure Excl. Interest Payment % of GDP | |

| PPPy | ΔY/Y | ΔP/P | ΔT/T | T/Y | ΔER/ER | ΔE/E | E/Y | |

| Mean | 49,645 | 5.1 | 2.7 | 5.4 | 39.9 | 5.3 | 5.4 | 40.8 |

| Standard Deviation | 19,375 | 4.8 | 2.6 | 5.8 | 7.4 | 7.7 | 7.9 | 7.5 |

| Minimum | 15,035 | −20.9 | −1.7 | −19.1 | 19.1 | −35.2 | −35.9 | 18.8 |

| Median | 46,254 | 4.8 | 2.2 | 5.0 | 40.0 | 4.7 | 4.8 | 41.1 |

| Maximum | 142,311 | 35.7 | 19.4 | 48.9 | 59.0 | 146.9 | 147.0 | 64.7 |

| Skewness | 2.2 | 0.2 | 2.1 | 0.9 | −0.3 | 6.9 | 6.4 | −0.2 |

| Kurtosis | 10.2 | 8.0 | 10.0 | 10.1 | 2.8 | 125.2 | 113.2 | 3.4 |

| The Difference % | Budget Balance % of GDP | Primary Balance % of GDP | Net Debt % of GDP | Interest Rate % | (r − g)ND/Y | The Basic Equation | The Difference of Net Debt to GDP Ratio % | |

| ΔER/ER −ΔT/T | B/Y | PB (=E − T)/Y | ND/Y | r | (r − g)ND/Y | PB/Y + (r − g)ND/Y | NDt+1/Yt+1 − Nt/Yt | |

| Mean | −0.1 | −3.0 | 0.9 | 52.5 | 4.4 | −0.2 | 0.8 | 0.8 |

| Standard Deviation | 8.4 | 3.7 | 3.4 | 38.5 | 2.9 | 3.1 | 4.9 | 5.6 |

| Minimum | −53.7 | −37.6 | −15.5 | −32.8 | −4.5 | −26.9 | −27.2 | −32.2 |

| Median | −0.8 | −2.6 | 0.6 | 45.3 | 4.1 | 0.0 | 0.3 | 0.3 |

| Maximum | 156.5 | 12.5 | 36.6 | 209.9 | 19.0 | 20.3 | 36.7 | 37.2 |

| Skewness | 6.8 | −1.8 | 2.2 | 0.9 | 1.0 | −0.5 | 1.0 | 0.9 |

| Kurtosis | 131.7 | 15.1 | 20.9 | 4.0 | 4.6 | 19.7 | 11.9 | 11.3 |

| Model | Explained Variables | Explanatory Variables | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Nominal GDP Growth Rate | sigma_u | sigma_e | Within R-Square | R-Square Overall | obs | Prob > F* | Applied Model | |||

| (1) | Government Expenditure (excl Intrest Payments) Growth Rate | ΔE/E | 0.564 | 1.039 | 6.944 | 0.259 | 0.277 | 959 | 0.000 | Two way FE |

| p-value | 0.001 | |||||||||

| (2) | Government Revenue Growth Rate | ΔT/T | 0.770 | 0.784 | 3.555 | 0.614 | 0.633 | 959 | 0.000 | Two way FE |

| p-value | 0.000 | |||||||||

| (3) | difference | ΔE/E − ΔT/T | −0.206 | 0.791 | 7.111 | 0.356 | 0.354 | 959 | 0.000 | Two way FE |

| p-value | 0.043 | |||||||||

| (4) | Interest Rate | r | −0.009 | 1.728 | 1.529 | 0.659 | 0.459 | 959 | 0.000 | Two way FE |

| p-value | 0.766 | |||||||||

| (5) | Primary Balance (E-T) % of GDP | PB/Y | −0.134 | 1.245 | 2.612 | 0.388 | 0.345 | 959 | 0.000 | Two way FE |

| p-value | 0.002 | |||||||||

| (6) | (r − g)ND/Y | (r − g)ND/Y | −0.430 | 0.945 | 1.975 | 0.581 | 0.536 | 959 | 0.000 | Two way FE |

| p-value | 0.000 | |||||||||

| (7) | The model | PB/Y + (r − g)ND/Y | −0.549 | 1.400 | 3.280 | 0.545 | 0.510 | 959 | 0.000 | Two way FE |

| p-value | 0.000 | |||||||||

| Consumer Pice Increase Rate | sigma_u | sigma_e | Within R-Square | R-Square Overall | obs | Prob > F* | Applopriate Model | |||

| (1) | Government Expenditure (excl Intrest Payments) Growth Rate | ΔE/E | 0.964 | 1.361 | 7.007 | 0.245 | 0.524 | 959 | 0.000 | Two way FE |

| p-value | 0.000 | |||||||||

| (2) | Government Revenue Growth Rate | ΔT/T | 0.793 | 1.519 | 4.133 | 0.479 | 0.462 | 959 | 0.000 | Two way FE |

| p-value | 0.000 | |||||||||

| (3) | difference | ΔE/E − ΔT/T | 0.171 | 0.805 | 7.136 | 0.352 | 0.379 | 959 | 0.000 | Two way FE |

| p-value | 0.218 | |||||||||

| (4) | Interest Rate | r | 0.064 | 1.702 | 1.526 | 0.659 | 0.471 | 959 | 0.000 | Two way FE |

| p-value | 0.427 | |||||||||

| (5) | Primary Balance % of GDP | PB/Y | 0.135 | 1.216 | 2.638 | 0.375 | 0.332 | 959 | 0.000 | Two way FE |

| p-value | 0.122 | |||||||||

| (6) | (r-g)D/Y | (r − g)ND/Y | −0.199 | 0.945 | 2.384 | 0.390 | 0.364 | 959 | 0.000 | Two way FE |

| p-value | 0.010 | |||||||||

| (7) | The model | PB/Y + (r − g)ND/Y | −0.083 | 1.299 | 3.715 | 0.452 | 0.392 | 959 | 0.000 | Two way FE |

| p-value | 0.484 | |||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Harada, Y.; Suzuki, M. Monetary Policy and Fiscal Conditions: Interest Rates, Nominal Growth Rates, Tax Revenues, and Government Expenditures. J. Risk Financial Manag. 2026, 19, 75. https://doi.org/10.3390/jrfm19010075

Harada Y, Suzuki M. Monetary Policy and Fiscal Conditions: Interest Rates, Nominal Growth Rates, Tax Revenues, and Government Expenditures. Journal of Risk and Financial Management. 2026; 19(1):75. https://doi.org/10.3390/jrfm19010075

Chicago/Turabian StyleHarada, Yutaka, and Makoto Suzuki. 2026. "Monetary Policy and Fiscal Conditions: Interest Rates, Nominal Growth Rates, Tax Revenues, and Government Expenditures" Journal of Risk and Financial Management 19, no. 1: 75. https://doi.org/10.3390/jrfm19010075

APA StyleHarada, Y., & Suzuki, M. (2026). Monetary Policy and Fiscal Conditions: Interest Rates, Nominal Growth Rates, Tax Revenues, and Government Expenditures. Journal of Risk and Financial Management, 19(1), 75. https://doi.org/10.3390/jrfm19010075