1. Introduction

Financial technologies, commonly referred to as fintech, have rapidly transformed the global economic environment. This transformation has fundamentally changed the perception, accessibility, and delivery of financial products and services. The intersection of fintech with core areas of investment and risk—foundational pillars in business, finance, and management studies—is becoming more prevalent as its influence continues to expand. The proliferation of fintech has given rise to intricate dynamics that are not only technological but also deeply financial and managerial. This trend has raised critical questions regarding strategic decision-making, transparency, and stability.

However, current research remains fragmented, often examining the above dimensions separately. For instance, recent research has highlighted various emerging uncertainties in the digital finance sector; however, it does not account for potential economic and financial repercussions (

R. Jain et al., 2023).

Foglia et al. (

2024) initiated additional investigations into the relationship between market dynamics and innovations in financial instruments; however, their contextual scope and generalizability are limited.

Ashta and Herrmann (

2021) conducted additional research on the role of advanced technologies in transforming financial practices. Nevertheless, this work focuses on sector-specific perspectives and does not fully address the cross-cutting implications or broader patterns. The current literature lacks a comprehensive and integrated examination of the interconnections between economic environments, financial exposure, and technological advancements.

The difference reveals the necessity for expanded research into wider consequences and relationships. To investigate the relationships between fintech and various risk issues in investment contexts, this investigation aims to conduct a systematic literature review. Two primary research questions serve as the foundation for this inquiry: (1) What is the current state of the literature regarding the risks associated with fintech in the context of investment? (2) What conclusions can be derived to guide future scholarly research and exploration? In turn, the objective of this investigation is to unveil existing patterns, gaps, and directions in the development of emerging research fields.

2. Literature Review: A Sketch of Fintech, Investment, and Risk

2.1. Conceptualizing Fintech

Fintech has emerged in recent decades, manifesting the financial sector’s increased reliance on digital innovations. As a complex and continually evolving domain, the understanding of fintech varies among academics and experts, reflecting diverse and multidimensional perspectives.

Digital advancements in engineering, computing, and analytics are the foundation of fintech. Emerging primarily from start-ups, fintech solutions use integrated information systems and technologies such as artificial intelligence (AI), machine learning (ML), biometric security, and distributed ledgers to deliver intelligent and flexible financial services Digital infrastructure provides platforms that support algorithm-based transactions, automated investing, direct peer-to-peer exchanges, and real-time execution, improving service accessibility and responsiveness across user groups. The incorporation of blockchain and predictive analytics enables personalized, data-driven financial products that meet increasing systemic complexity and evolving customer expectations (

Ha et al., 2025). Overall, fintech’s technological foundation and strategic adaptability position it as a driving force in transforming financial systems and business operations across economic sectors, reinforcing its role in advancing a more efficient, secure, and inclusive financial ecosystem.

Governmental bodies provide their perspectives on this phenomenon. The Financial Stability Board of the European Union characterizes fintech as “technology-enabled innovation in financial services that could result in new business models, applications, processes, or products, with an associated material effect on financial markets and institutions.” (

FSB, 2019). This perspective highlights fintech’s ability to transform financial mechanisms across both individual and systemic levels. On the other hand, the United States House of Representatives sees fintech’s development as revolutionary, representing technological applications that radically transform individual and commercial financial practices through improved accessibility, precision, and efficiency, e.g., how loans employ advanced analytics enabling responsible service access for citizens and enterprises with rapid transactions and protected exchanges for individual and corporate clients (

USHR, 2019). These institutional viewpoints provide scholars with grounds for emphasizing technological underpinnings and the disruptive potential of fintech.

2.2. Fintech’s Roles and Applications

The roles and applications of fintech can be approached and demonstrated from various angles. For example, fintech is more than just augmenting individual services—it encompasses the structure of core financial activities.

H. Zhang et al. (

2024) highlight that digital technologies are now embedded across various functions, including payments, lending, investment management, and fund transfers. Institutions leverage these tools to streamline information exchange, improve decision-making under uncertainty, and manage financial exposure with greater precision.

The diffusion of fintech into mainstream finance has been shaped not only by technological progress but also by shifts in business models and organizational strategy. Fintech facilitates operational enhancements, cost efficiencies, and improved client experiences, prompting established institutions to reassess legacy systems.

Choudhary and Thenmozhi (

2024) argue that the growth of fintech is catalyzed by regulatory adaptations, shifting consumer behavior, and partnerships between traditional banks and digital start-ups. These factors collectively enable more responsive, agile financial service ecosystems.

Start-up organizations are crucial for driving fintech’s industrial momentum and have played a pivotal role in accelerating fintech’s evolution, often introducing innovative frameworks for service delivery and institutional collaboration.

Haddad and Hornuf (

2023) found that entrepreneurial ventures in the fintech area improve incumbents’ performance metrics by driving adaptation, encouraging innovation, and reducing system-wide vulnerabilities. These shifts reflect a dynamic in which competition and collaboration coexist, thereby strengthening the resilience and flexibility of financial systems.

Moreover, fintech operates within a multifaceted ecosystem that interacts with both traditional assets and emerging financial instruments.

Abdullah et al. (

2024) suggest that fintech’s capacity to enhance information transparency, provide personalized financial solutions, and integrate AI-based analytics contributes to its influence on capital allocation decisions and financial market structure. These innovations reshape how risk is understood and acted upon by both financial professionals and technology providers.

2.3. Investment in the Fintech Age

The proliferation of fintech has transformed investment activity, traditionally grounded in risk–return evaluation and strategic capital allocation. The emergence of digital investment platforms, algorithmic portfolio management, and tokenized assets has introduced new mechanisms for accessing and managing investment opportunities. These advancements have reconfigured investor behavior and influenced portfolio diversification strategies.

At the same time, integrating fintech into investment practices introduces complex challenges.

Yousef (

2024) observed that fintech-enabled assets—especially those that are decentralized or algorithm-driven—expose investors to risks related to cybersecurity, regulatory ambiguity, and operational instability. These uncertainties necessitate an enhanced evaluation of traditional asset evaluation techniques and require more dynamic, context-specific risk assessments.

As

Imerman and Fabozzi (

2020) contend, successful investment in fintech-related markets hinges on the ability to account for both the disruptive nature of innovation and its associated volatility. Investors must assess technological developments not only as drivers of potential returns but also as sources of systemic and operational risk. This dual assessment requires forward-looking tools and real-time data capabilities to adjust strategies in response to rapidly changing market conditions.

In addition, fintech’s impact on investment extends to the structural level, affecting how capital is distributed across sectors and geographic regions. By lowering barriers to entry and reducing transaction costs, fintech democratizes access to investment opportunities while also creating new dependencies on platform integrity, data accuracy, and digital literacy. These systemic changes not only reshape traditional investment pathways but also redefine the dynamics of financial risk and oversight. As fintech ecosystems grow, they introduce the opportunity for both innovation and challenges in relation to regulatory coherence, ethical standards, and systemic stability (

Jourdan et al., 2023).

2.4. Emerging Risk Dimensions in Fintech

Fintech has introduced a new risk landscape characterized by increased speed, connectivity, and automation. Traditional models of financial risk, often based on historical data and static assessments, are increasingly insufficient to evaluate threats in digital financial ecosystems. Novel risk dimensions—such as algorithmic error, cyberattack vulnerability, and regulatory fragmentation—are part of factors that are increasingly considered integral to modern risk evaluation frameworks.

The growing reliance on digital platforms also raises concerns about systemic interdependence. As fintech applications become more complex and interconnected, the risk of cascading failures or unanticipated feedback loops becomes more pronounced. This reality demands a more integrated, cross-platform approach to risk oversights, incorporating both technical and behavioral data to monitor vulnerabilities in real time (

Gao, 2022).

Xia et al. (

2024) argue that advanced computational tools, including machine learning and natural language processing, offer significant improvements in identifying subtle indicators of platform instability and user behavior anomalies. Their study illustrates how these techniques can enhance investor awareness in peer-to-peer lending environments by revealing credit risk and platform trustworthiness that conventional models may not detect. They suggest that regulators and institutions should develop more adaptable frameworks to address these new conditions. Risk management in fintech contexts now requires hybrid models that blend algorithmic insights with human oversight to ensure transparency, accountability, and resilience.

3. Material and Method

Two bibliometric tools, including VOSviewer and Bibliometrix, are used to unveil insights from bibliometric data. VOSviewer (1.6.20) is a system designed to provide a graphical representation of connections between literary works demonstrating scholarly efforts. Biliometrix (2024) is used to demonstrate the knowledge structure of the included literature visually (

Aria & Cuccurullo, 2017), as an analytical tool for mapping scientific data. It enables the structured analysis of the scholarly literature, the examination of citation dynamics, and the development of graphical depictions of intellectual landscapes.

PRISMA, short for Preferred Reporting Items for Systematic Reviews and Meta-Analyses, is a broadly employed guideline for conducting systematic reviews of the literature and has been used in studies in finance, management, and technology (

Arjun & Subramanian, 2024;

Choudhary & Thenmozhi, 2024). Adhering to the PRISMA framework, this study employed a structured, multi-phase methodology that comprises phases of identification, screening, and inclusion (

Galletta et al., 2024;

A. Jain et al., 2024).

The theoretical foundation of the methodology integrates two core components: bibliometric thresholds and clustering logic. Both of these are essential for structuring, filtering, and interpreting research data. Bibliometric thresholds function as selection mechanisms that guide what is included in the analysis. PRISMA emphasizes the importance of predefined criteria—such as publication year, language, and document type—to ensure transparency and enable replication (

Moher et al., 2009). Similarly, VOSviewer determines inclusion thresholds by assessing the strength of relationships between elements, which are calculated based on the co-occurrence frequency relative to individual appearances. Users can adjust these parameters to manage the scope of the data and the detail of groupings, although filtering out low-frequency items may risk not including relevant insights (VOSviewer manual). Bibliometrix and its graphic interface, Biblioshiny, also allows users to apply thresholds that retain only frequently occurring items and stronger links, helping to reduce noise and enhance the reliability and clarity of visual and network analyses (

Aria & Cuccurullo, 2017).

Complementing this, clustering logic defines how these tools organize data into meaningful structures. While PRISMA does not perform computational clustering, it provides a systematic, rule-based selection process based on transparent, sequential phases (

Page et al., 2021). In contrast, VOSviewer uses an algorithm optimized for large-scale data to group items based on co-occurrence strength, arranging them spatially so that similar topics are visually and thematically aligned (

van Eck & Waltman, 2017). Bibliometrix and Biblioshiny extend this approach by offering multiple clustering algorithms, grounded in graph theory and statistical modeling, enabling flexible analysis from different perspectives (Bibliometrix manual).

In the PRISMA identification phase, the relevant literature was retrieved using the Scopus database, which was selected for its comprehensive coverage of peer-reviewed journals and its strong reputation in emerging technology research (

R. Jain et al., 2023). Scopus is also widely recognized for its inclusion of high-impact publications not commonly found in other databases (

Vieira & Gomes, 2009).

Truncation, such as “invest*,” encompasses similar phrases (e.g., investment, investing, investor, etc.) for comprehensive coverage. The inclusion of the formal term “financial technology” and its commonly used abbreviation “fintech” reflects variances in terminology. Collectively, these methods enhance the retrieval of the relevant literature based on the review’s core.

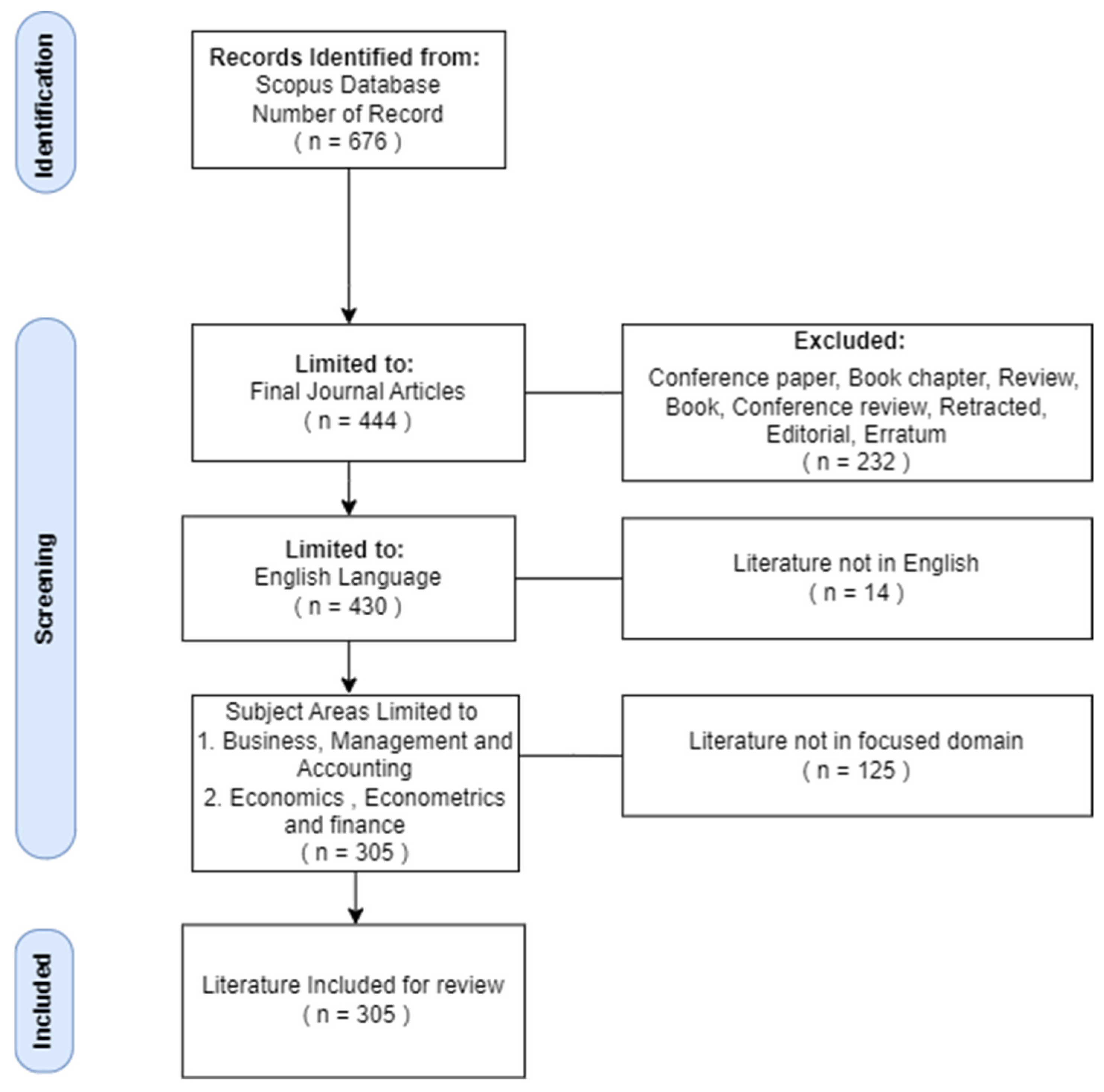

A total of 676 records were initially identified using the keyword combination invest OR investment OR invest* AND fintech OR “financial technology” AND risk OR risk*. These keywords were searched across article titles, abstracts, and keyword fields to ensure inclusive retrieval of pertinent works.

In the screening phase, several filtering criteria were sequentially applied to refine the dataset. First, only journal articles were retained, excluding 232 items such as conference papers, book chapters, reviews, editorials, and errata, and thereby reducing the pool to 444 records. Second, the language was restricted to English, which led to the exclusion of 14 non-English articles, resulting in 430 eligible publications.

The final screening step focused on the relevance of the subject area. Since this research aimed to examine fintech investment risk from a business and management perspective—rather than from a technical or engineering viewpoint—the subject areas were limited to “Business, Management and Accounting” and “Economics, Econometrics and Finance”. This thematic refinement excluded 125 articles that did not align with the research’s disciplinary focus, leaving 305 articles for inclusion.

Overall, the inclusion phase concluded with 305 articles selected for in-depth review, spanning a period of publication from 2013 to 2024, thereby covering over a decade of scholarly contributions at the intersection of investment, fintech, and risk. This rigorous process is visually summarized in

Figure 1, which presents the PRISMA flowchart.

4. Findings

4.1. General Information on the Included Literature

The included articles spanned over a decade, from 2013 to 2024, and were obtained from 175 sources and 305 documents. A summary of statistics is provided in

Table 1.

4.2. Publication Time Trend: Overall Annual Production and Citation

Publication trends are indicated by annual production and citation counts over the years, as shown in

Figure 2, where research output (blue bars) and citations (red curve) are displayed. The x-axis represents years, with annual production on the left and annual citations on the right y-axis. Both metrics exhibit an upward trend, reflecting an increase in research activity and impact. Initially, both production and citations remained relatively low. A steady rise in publications began in 2017, accelerating sharply in 2020 before reaching peak levels. Citations follow a similar trajectory but with fluctuations, remaining low until 2018 before rising sharply, particularly in 2020 and 2021, as prior research gained recognition. In the most recent period, citations have declined slightly despite high production, likely due to delayed referencing or shifting research focuses. The rise in production may suggest increased research interest, funding, or advancements, while citations typically lag due to the time required for referencing. Overall, research output and impact have significantly expanded over the past decade, both in terms of production and citations.

The most influential documents are demonstrated by ranked total citations (TCs) and total citations per year (TCY). Each entry provides essential details, including the title, author(s), publication year, journal name, and citation metrics, which reflect the scholarly impact of these works, as shown in

Table 2. The prevalence of references in these works highlights their academic importance. The most-cited publications typically represent fundamental research that has influenced ongoing scholarly conversations and applications.

We gained insights into the development trajectory of fintech and the key intellectual contributions that have shaped its progression by identifying the most-cited works. Recent fintech research has included topics such as AI, cryptocurrencies, digital finance, Industry 4.0, and robo-advisors. The high growth in citation rates suggests that these topics are gaining attention, shaping both academic discussions and industry practices in finance. Additionally, discussions address various issues surrounding risk, such as data security, risk spillovers, diversification, and consumer trust. This indicates a growing concern about managing uncertainties in digital finance. Moreover, investment-related concepts, including portfolio strategies, investor behavior, financial inclusion, and alternative assets like Bitcoin, showcase the intersection of technology, financial decision-making, and market dynamics. Overall, this table reveals that research at the intersection of technology, risk, and investment is driving academic influence, with AI and FinTech leading innovations while also raising critical concerns about financial security and market stability.

Specifically,

Gomber et al.’s (

2018) publication “On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services” stands as the preeminent reference. Published in the

Journal of Management Information Systems, this work has accumulated 853 citations—averaging 121 citations annually. Their study demonstrates that technological advancement propels change throughout banking sectors, accelerating the development of operational frameworks and improving client interactions. Also,

Milian et al. (

2019) contributed “Fintechs: A Literature Review and Research Agenda,” which has obtained 256 citations (42.67 annually). Through systematic analysis, these researchers have developed a comprehensive categorization of fintech developments—including payment technologies, blockchain applications, and financial service risk factors. Their investigation particularly emphasizes how disruptive innovations reconfigure established paradigms within these domains, providing a structured framework for understanding the rapidly evolving fintech landscape.

In summary, a broader interpretation of the trend of recent publications suggests a surge in scholarly attention, which points to the fintech sector’s rapid evolution and the growing need for academic inquiry into emerging challenges and innovations. The field’s dynamic nature implies that contemporary and future research will continue to gain scholarly relevance and practical significance.

4.3. Sources: The Most Productive Journals with the Highest Impact

Journals are analyzed based on their productivity and impact via several metrics: Total Publications (TPs), total citations (TCs), Total Cited Publications (TCPs), TC/TP (average citations per publication), and TC/TCP (average citations per cited article). TP reflects publication volume, TC measures overall impact, and TCP represents the number of papers cited, while TC/TP and TC/TCP highlight their average impact and depth of influence, respectively, as shown in

Table 3.

Financial Innovation leads the publication count with 10 articles, earning 242 citations and 32 cited works. It provides a key source for advancing financial innovation research and addressing practical financial challenges. In contrast,

Technological Forecasting and Social Change has the highest academic influence, accumulating 366 citations and achieving top averages in citations per article (52.29) and per cited paper (14.64). The

Journal of International Financial Markets, Institutions and Money also ranks high in citation averages, despite having fewer publications. These findings suggest that while some journals excel in publishing volume, others exert considerable influence through citation strength.

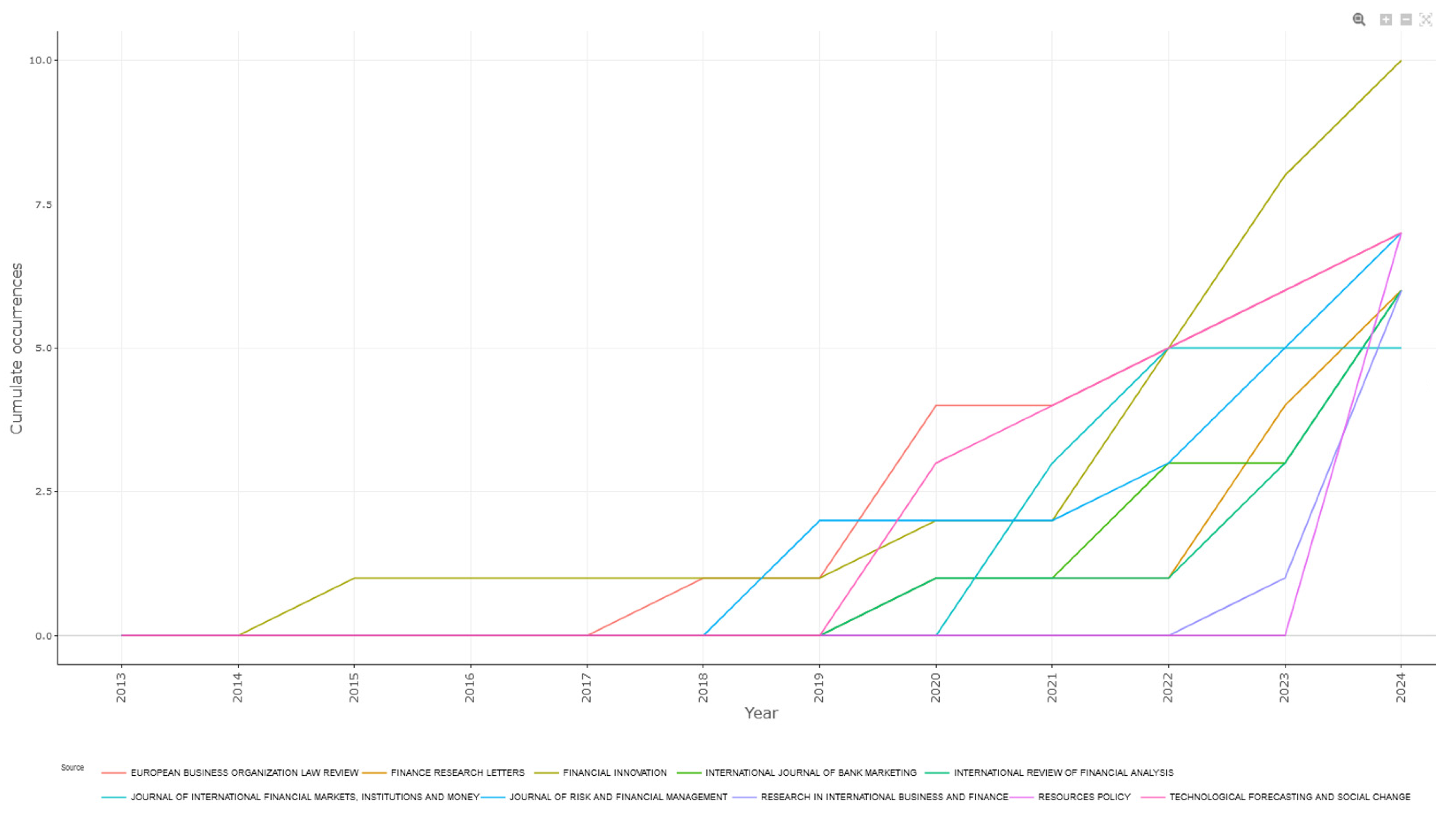

Regarding production over time, a line chart tracks the cumulative number of articles published by various journals, as shown in

Figure 3. The shape of the curve shows the growth pattern of article publication in that journal over time. A steep incline indicates a burst of publications in that period, while a flat line implies no new articles added. The chart illustrates how selected journals have contributed to the literature over time. Financial Innovation (olive) achieves the highest cumulative output by examining innovations across technological advancements and connecting researchers with practitioners, thereby advancing knowledge of new instruments, technologies, and financial artifacts. The Journal of Risk and Financial Management (blue) demonstrates transformative acceleration in examining finance, economics, and risk through a technological lens, highlighting innovation while supporting research on facets of financial and risk decision-making. Technological Forecasting and Social Change (magenta) has shown a marked increase in publications recently, highlighting forward-looking methodologies that analyze the interconnections between social dynamics, environmental concerns, and technological developments, such as planning instruments. Research Policy (purple) exhibits a sharp upward trend, highlighting its focus on innovation, technology, and research, which interact with organizational processes to generate insights into policy development and management practices.

4.4. Authors: Most Influential Authors, Production over Time, and Country of Origin

4.4.1. Most Influential Authors

Table 4 highlights the most active contributors to a specific research field, focusing on individual authors and countries. Three key metrics are employed: Total Publications (TPs), which represent the number of papers produced; total citations (TCs), measuring the frequency with which the work has been referenced; and average citations per publication (AC), indicating the typical impact of each published item. These indicators collectively assess both productivity and scholarly influence.

The most productive authors are Hassan MK, Wang Y, and Wang L, each of whom has publications. Hassan MK also stands out with 45 citations and an average citation rate of 11.25 per paper. Regarding total citations, Banna H (175), Rupeika-Apoga R (139), and Taneja S (132) lead the list. When considering the average impact per publication, Herrmann H (64), Huang W (59), and Banna H (58.33) rank highest, highlighting their strong influence despite having fewer published works.

The top countries table shows China as the most productive country, contributing 436 publications. In contrast, the United States demonstrates the greatest scholarly impact with 1357 citations and the highest average citations per article (AC = 5.45). France (AC = 4.14) and the United Kingdom (AC = 2.48) also rank prominently in terms of citation quality, demonstrating a strong global research influence.

4.4.2. Authors’ Production over Time

To illustrate scholars’ long-term productivity,

Figure 4 displays the publication activity of key authors over recent years, with each horizontal line representing an author and dots indicating the years in which they published. The dot size reflects the number of articles published in a year, while darker shades indicate higher citation rates per year, highlighting the influence of the publications.

Authors such as Hassan MK, Wang L, and Wang Y demonstrate steady research engagement, producing several works with considerable academic impact. Their consistent contributions reflect a strong and influential presence within the field, marked by both output volume and notable citation performance. Larger, darker dots highlight Banna H, indicating a strong impact. The recognition of authors such as Rupeika-Apoga, Tan C, and Taneja S steadily increased.

The figure illustrates the increasing frequency and visibility of authors’ contributions, reflecting the expanding scope and ongoing interest in this research field. It highlights how diverse authors’ contributions continue to grow, showcasing the sustained relevance of this area over time.

4.4.3. Author Country and Publication Preferences

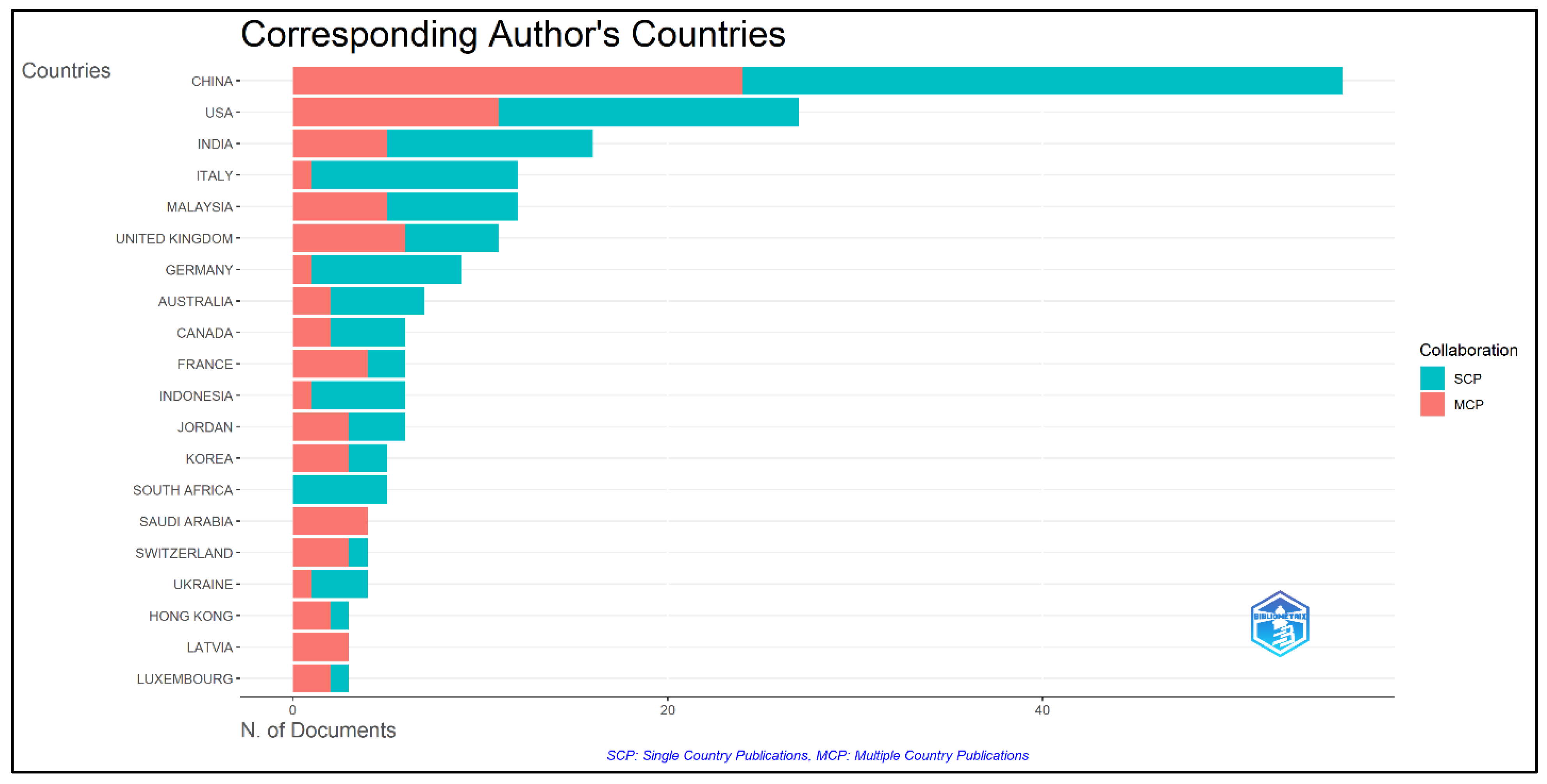

Figure 5 compares domestic and international research publications across countries. It shows the most active countries based on the corresponding authors and the number of papers published. It also displays the ratios of multi-country publications (MCP, orange) versus single-country publications (SCP, blue). China dominates both categories, followed by the USA and India. Research collaboration patterns vary significantly: South Africa publishes almost exclusively domestically, while Saudi Arabia shows international partnerships. Countries such as Germany, Australia, and Indonesia tend to favor internal collaboration. The visualization illustrates how research ecosystems vary globally—some nations prioritize self-contained academic communities, while others integrate into international networks. Major research powers maintain balanced approaches by developing both domestic capabilities and global partnerships. Smaller academic communities have limited overall output.

4.5. Co-Citation Analysis

Co-citation represents the association between two pieces of literature that are referenced jointly. A higher frequency of joint citations indicates a closer intellectual association. This technique aids in identifying conceptual relationships among studies, shedding light on significant contributions, prevailing topics, and the progression of knowledge within a domain (

van Eck & Waltman, 2014). By analyzing co-cited items, it reveals thematic groupings and provides a deeper understanding of research trends, the core literature, and new developments in a given field, such as innovation (

Sumakaris et al., 2020) or lending (

Rabbani et al., 2022). The analyses below show co-citation from various facets, including references, sources, and authors.

4.5.1. Co-Citation of References

Co-citation of references tracks how often specific publications are cited together, revealing foundational works and thematic linkages in a field. It helps map key intellectual contributions and understand how scholarly conversations evolve. Identifying frequently co-cited references highlights influential theories, methods, or debates shaping the structure of the research landscape.

The co-citation of references is shown in

Figure 6. The core of network analysis shows that the red cluster examines how fintech changes banking systems and financial services, including research on gig economy funding, long-term finance and market instability, and fintech business models (

Demirgüç-Kunt et al., 2017;

Buchak, 2024;

Lee & Shin, 2018). The blue cluster is located above and addresses macroeconomic and regulatory perspectives, highlighting the role of digital finance, such as financial inclusion, stability, and systemic risk (

Ozili, 2018;

Goldstein et al., 2019). The green cluster is on the left side of the network and explores user behavior in adopting fintech, drawing on established models such as the Theory of Planned Behavior and the extended Technology Acceptance Model (

Ajzen, 1991;

Venkatesh & Davis, 2000). Located on the far right, the yellow cluster focuses on governance and institutional frameworks, using examples like fintech’s role in expanding access to finance and its regulation through mechanisms such as crowdfunding and digital lending platforms (

Bollaert et al., 2021).

4.5.2. Co-Citation of Sources

Co-citation of sources reveals how academic sources align across areas by examining how sources, such as journals, are cited together. It provides insight into subject overlaps, journal influence, and thematic proximity. Such clustering helps researchers navigate related outlets and understand how different publication pathways contribute to a shared scholarly domain, as presented in

Figure 7.

The red cluster, which is on the left, centers on applied banking and management. Prominent journals like the

International Journal of Bank and

Management Science exemplify this cluster’s focus on practical applications, risk management, and operational aspects of financial institutions. These publications typically address real-world banking practices and managerial decision-making in financial contexts (

Hong et al., 2024;

Le et al., 2024).

The blue cluster at the center-left represents research in financial economics. Prominent publications such as the

Journal of Financial Economics and

Finance Research Letters illustrate this cluster’s emphasis on theoretical and empirical understanding of financial markets, corporate finance, and investment strategies. This cluster forms the intellectual core connecting applied and theoretical finance research traditions (

Y. Zhang et al., 2023;

Reher & Sokolinski, 2024).

The green cluster, on the right, encompasses publications with quantitative foundations. Prominent ones include, e.g.,

The Review of Financial Studies balances theoretical and empirical contributions at the finance–economics interface, while

Energy Economy specializes in energy markets and financial modeling. These journals provide advanced theoretical frameworks that strengthen financial research through analytical discussions of financial theory and specialized applications (

Goldstein et al., 2019).

In summary, the network structure illustrates the landscape of financial research, which also draws from advanced quantitative methods, creating a continuous knowledge flow across the finance and economics landscape.

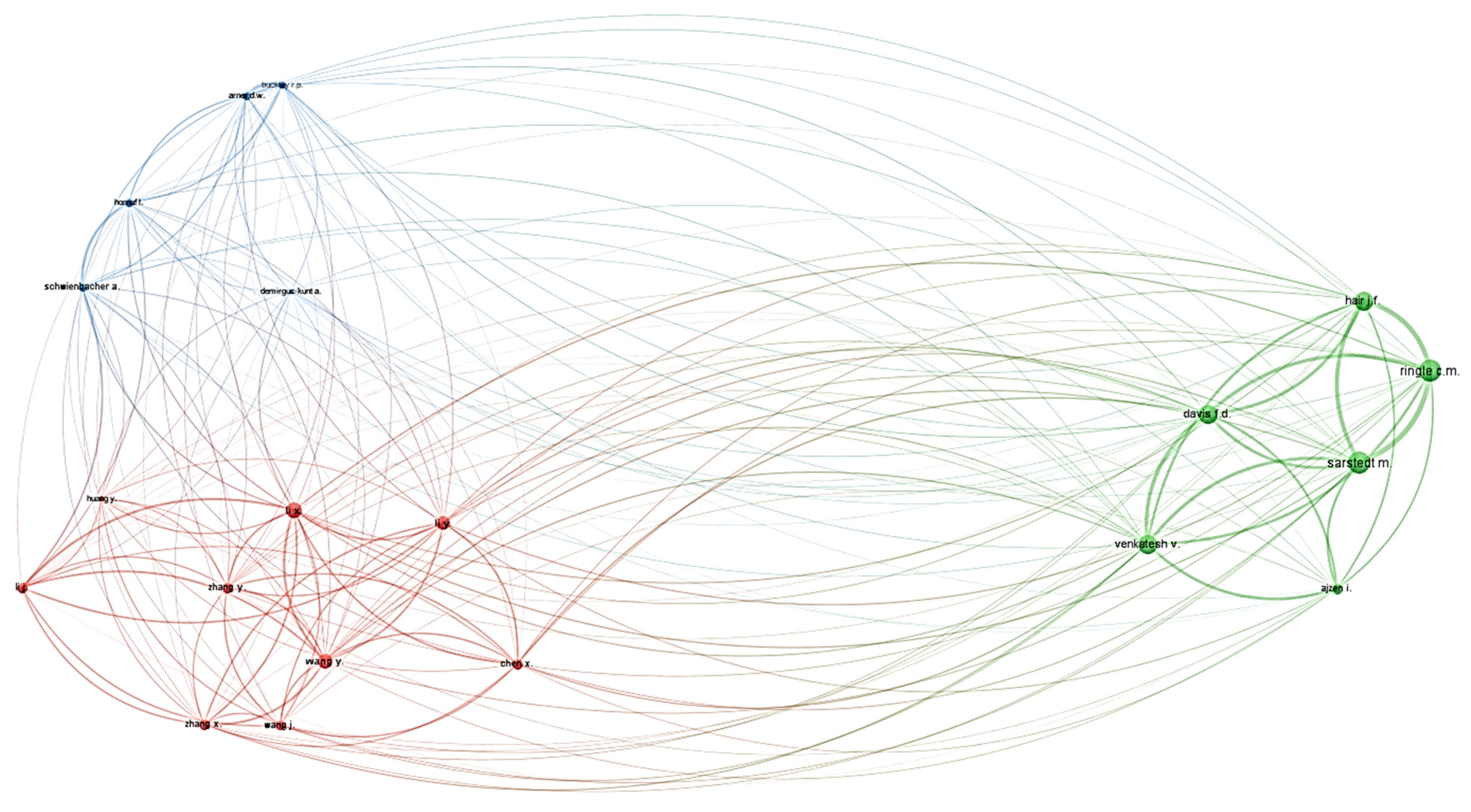

4.5.3. Co-Citation of Authors

Author co-citation reveals connections between scholars based on shared citations and the relationships presented in their work. It highlights communities of thought, aligned perspectives, and core contributors in a research area. This view helps trace schools of thought or understand intellectual networks within a discipline.

The network consists of blue, green, and red clusters, as demonstrated in

Figure 8. The blue cluster on the upper left represents researchers who focus primarily on fintech regulation, crowdfunding, and financial inclusion. For example, strong co-citation patterns may be indicated by their influential collaborative work on digital financial regulation, financial inclusion, and sustainable development through the implementation of digital infrastructure (

Arner et al., 2020;

Buckley et al., 2020).

The green cluster is on the right side and represents the theoretical backbone of the field, such as technology acceptance frameworks that enable rigorous empirical research in financial technology adoption and research methodologies. For instance, scholars like Venkatesh, Ajzen, and Davis exhibit this association (

Davis et al., 1994).

The red cluster, positioned at the lower left side, comprises researchers forming regional networks focused on information systems and financial applications, e.g., the patterns that reveal collaborative relationships addressing technology implementation in developing financial markets (

Ding et al., 2021).

In summary, the visualization below organizes research around methodological foundations, regional research networks, and specialized domains. Scholars working with research frameworks maintain intellectual links across the field, demonstrating how various approaches serve as connecting elements throughout fintech research domains.

4.6. Keyword Analysis

A co-occurrence map generated by VOSviewer visualizes how keywords jointly indicate connections present in the literature, as shown in

Figure 9. Node size reflects keyword frequency, while the thickness of connecting lines indicates the strength of their co-occurrence. The map organizes related terms into color-coded clusters, each representing a distinct thematic area within the broader research context. At the center of the map is “fintech,” the most frequent and connected term, highlighting its central role across various themes, including digital finance, investment, AI, and risk. The graph illustrates fintech’s ties to innovation and digital services, its influence on investment performance and market behavior, and its connection to risk concerns, including credit, regulation, and financial stability. Out of 1393 candidates, the minimum occurrence of keywords is five, focusing only on the most prominent ones, resulting in 33 included key terms.

Five major clusters emerge in various colors in the co-occurrence network: red, blue, green, purple, and yellow.

The red cluster includes the behavioral dimension of fintech, particularly users’ perceptions and adoption of digital platforms such as mobile banking (

Shukla et al., 2024) and robo-advisors (

Hasanah et al., 2024). Concepts like trust, financial literacy, and security are central here, especially in the context of external stressors such as the pandemic (

Nigmonov et al., 2024). These themes underscore the role of psychological and experiential factors in shaping investment decisions and fintech engagement, such as perceived value (

Xie et al., 2021), while also pointing to the inherent consideration of perceived risk that influences user behavior (

Jangir et al., 2023).

The blue cluster addresses systemic and policy-related themes. It positions fintech as a catalyst for financial inclusion, especially in underserved or resource-constrained environments (

Panait et al., 2024). Topics include banking access (

Yiadom et al., 2023), sustainability (

Gopal & Pitts, 2024), and economic stability (

Ullah et al., 2023). The underlying narrative suggests that fintech innovations can extend the reach of financial systems, reduce inequality, and enhance macro-level stability, thereby mitigating long-term financial risks and fostering inclusive investment opportunities.

Focusing on technological and computational aspects, the green cluster revolves around the application of artificial intelligence and data analytics in financial decision-making. Key terms include relevant concepts like credit risk (

Siering, 2023), risk analysis (

Wang et al., 2022), stock market performance (

Arenas et al., 2024), and profitability (

Mirza et al., 2023). This cluster encapsulates how fintech tools can enhance investment strategies and risk prediction through advanced algorithms, thereby enabling more precise financial forecasting and efficient risk assessment and management.

The purple cluster highlights the emergence of peer-to-peer lending and crowdfunding as an application of novel decentralized finance tools. These mechanisms disrupt traditional financial intermediaries, democratize access to capital, and create new investment vehicles (

Miglietta et al., 2019;

Anderloni et al., 2024).

The yellow cluster primarily focuses on blockchain technology, digital currencies like Bitcoin, and the emerging regulatory frameworks surrounding them. These crypto-based innovations offer alternative investment assets and new modes of transaction, but also have heightened exposure to volatility, with uncertainties in regulation. The themes in this cluster reveal how fintech intersects with decentralization, investment diversification, and policy concerns in managing emerging investment instruments (

Chen et al., 2023;

Khaki et al., 2024).

4.7. Three-Point Plot

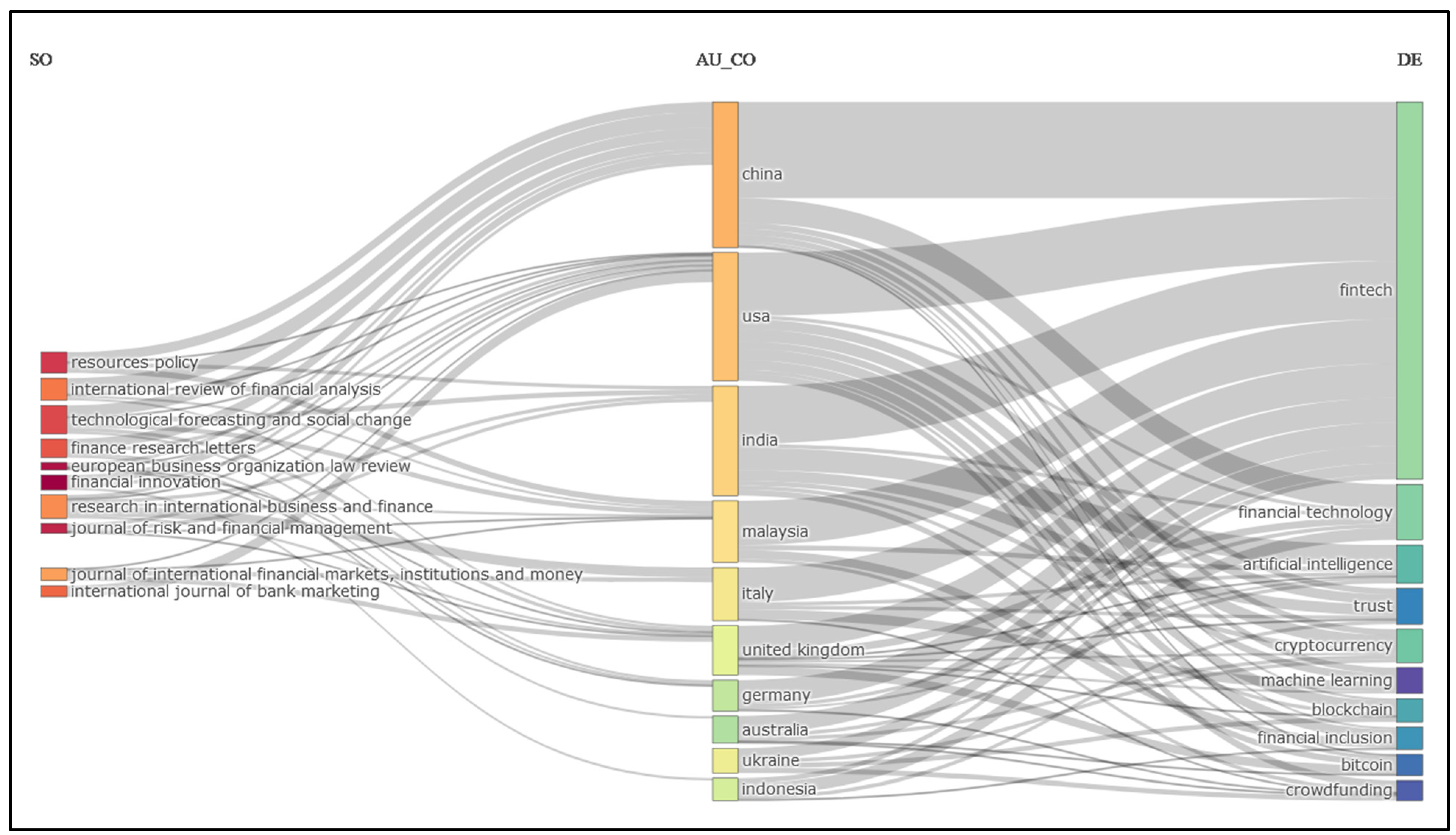

The Three-point diagram provides a clear overview of academic research by including the flows of focused value metrics in the literature, as shown in

Figure 10. It connects three elements: source journals (left, SO), the countries where authors are from (middle, AU_CO), and research keywords (right, DE). The curved lines represent the flow and volume of publications between these elements. These flows illustrate how research is produced in various countries, published in specific journals, and focused on particular topics. This structure highlights the distribution of academic output across regions, publication venues, and research themes. The diagram reveals that China, the USA, and India are the leading contributors to this field, followed by countries such as Malaysia, Italy, the United Kingdom, Germany, Australia, Ukraine, and Indonesia. China demonstrates engagement across multiple journals and themes, including fintech, artificial intelligence, and machine learning. The USA contributes significantly with a diversified focus on blockchain, trust, and financial inclusion. India shows vigorous research activity in fintech and AI, reflecting its growing focus on digital innovation. These patterns suggest that countries prioritize different areas based on their research strengths and national interests. Regarding publication outlets, journals like

Technological Forecasting and Social Change, Research in International Business and Finance, and International Review of Financial Analysis serve as platforms for disseminating research. These journals are central in connecting authors to essential themes, making them strategic choices for researchers seeking visibility and impact. The frequent appearance of keywords such as fintech, artificial intelligence, and trust indicates high levels of academic interest, while less common topics like blockchain, financial inclusion, and crowdfunding may present opportunities for further exploration. Overall, the diagram shows which countries produce the most research, which journals are most used, and which topics are the most studied. This information is helpful for scholars selecting research topics or journals, institutions aiming to build collaborations, and policymakers interested in national research trends. The figure provides a practical way to understand how research in fintech is developing globally and where future contributions may be most valuable.

4.8. Thematic Map

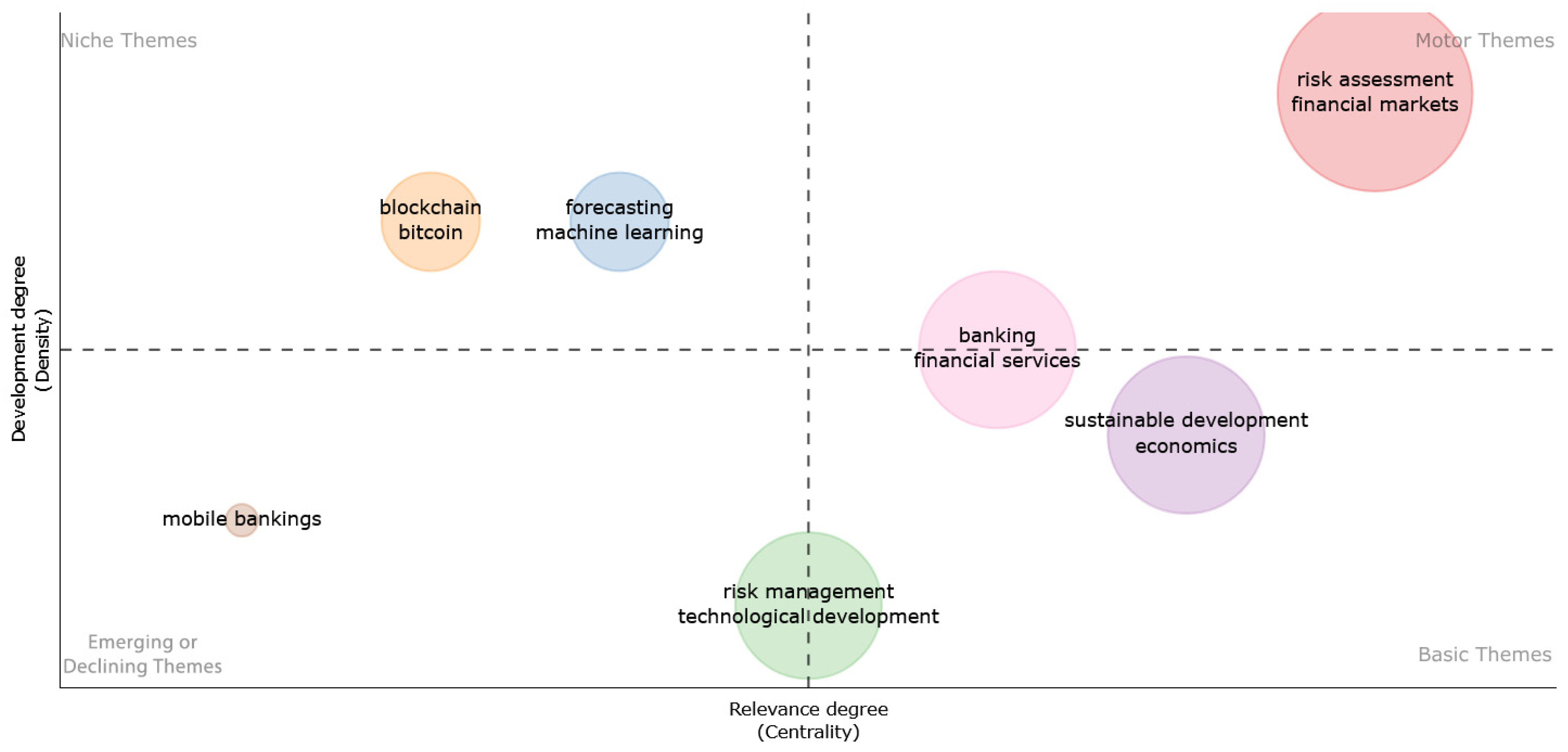

Thematic analysis uncovers themes from the main body of knowledge in the literature and is employed in the topics of technology and risk in financial domains (

Nasir et al., 2021). Thematic maps offer a structured visualization through two key dimensions: centrality and density. Centrality measures how relevant and interconnected a theme is within the broader research field, while density reflects the theme’s internal structure, development, and cohesion. These dimensions evaluate a theme’s strategic importance and conceptual maturity by placing it within one of four quadrants: motor, basic, niche, and emerging or declining. This classification provides a clear overview of a discipline’s knowledge structure: motor themes are central and well-developed, guiding the field’s evolution. Basic themes are broadly connected but conceptually immature, acting as foundational pillars. Niche themes are highly developed yet isolated topics, reflecting specialized research areas. Emerging or declining themes are underdeveloped and loosely connected, indicating nascent interest, fading relevance, or fragmented research. Positioning key concepts within these quadrants helps illustrate their scholarly significance and development stage, offering researchers a comprehensive map of thematic maturity, relevance, and evolving research trends (

Callon et al., 1991).

Employing the above thematic analysis on the included literature, it was found that

risk assessment and

financial markets appear to be more central and developed themes in the motor themes quadrant. These topics are likely more established and thoroughly discussed in the literature, demonstrating their broad relevance and robust internal structure. They may serve as key drivers of academic discussion, connecting strongly with other themes while offering a rich conceptual base. Relatively, in the basic themes quadrant,

banking,

financial services,

sustainable development, and

economics show higher relevance but appear less conceptually developed. These topics are likely foundational and broadly referenced, but they may require further detailed exploration, as their function could support wider research. By contrast,

blockchain,

bitcoin,

forecasting, and

machine learning in the niche themes quadrant are more specialized. These themes show higher internal development but appear less connected to the broader field. Their roles may be more technical or focused, serving as sources of innovation within specific domains rather than across wider research areas. Lastly,

mobile banking,

risk management, and

technological development are included in the emerging or declining themes quadrant as they appear to be less developed and less relevant topics. These areas may be either in the early stages of research or receiving less attention, with the potential to grow if reconnected to evolving scholarly or practical concerns. The thematic map is shown in

Figure 11.

In summary, the map provides a clear overview of where academic efforts are currently focused and which areas remain underexamined. It highlights dominant topics and uncovers weaker or overlooked themes, guiding researchers toward meaningful contributions. This visual structure can support informed decisions on future research paths by highlighting strengths in the existing literature and identifying opportunities for further scholarly development.

5. Discussion and Limitations

The following discussion is built on the thematic patterns identified in the analysis, with co-occurrence diagrams offering additional context. Collectively, these findings highlight emerging research areas and future directions. While the discussion synthesizes themes holistically, it also delineates specific avenues for further investigation. These insights not only contribute to the development of conceptual frameworks but also underscore underexplored topics that warrant further inquiry.

5.1. Risks, Markets, and Banking

Research on financial risk increasingly adopts integrated frameworks, signaling a shift toward multidimensional approaches. Future studies could combine technological components, considerations of sustainability, and multi-source data to enhance market stability assessments and strengthen risk management across diverse financial sectors.

Recent quests for financial risk management have incorporated technological innovations in the banking sector to address challenges in volatility and improve resilience. Studies have examined how digital solutions influence dimensions of systemic and institutional risk. For instance,

Liu et al. (

2025) analyzed the interplay between technology adoption and risk mitigation, identifying mechanisms through which digital enhancements improve the flow of information and operational efficiency. The findings highlight variations in effectiveness across market segments and institutional structures, presenting implications for regulatory frameworks and corporate governance.

Furthermore, integrated frameworks contribute to a multidimensional evaluation of investment risks through a combination of traditional financial metrics, market factors, and accrual-based disclosures.

Haraguchi et al. (

2024) demonstrate that this approach enables more accurate municipal bond risk assessments compared to conventional single-metric analyses. The work shows how systematic consolidation of diverse information sources addresses governmental financial challenges and supports improved decision-making in markets.

5.2. Technology Systems and Development

Rapid advancements in technologies such as AI and blockchain present significant research potential. AI leverages digital capabilities to approximate human reasoning, while blockchain introduces decentralized, distributed ledger systems.

In fintech, blockchain and cryptocurrency innovations are transforming financial operations through decentralized frameworks and digital assets. AI and machine learning (ML) are currently driving progress in traditional banking and investment contexts.

Kou and Lu (

2025) examine how these technologies collectively reshape financial service delivery by improving security, enabling autonomous analysis, and enhancing performance. This study indicates that AI algorithms refine trading strategies, risk assessments, and fraud detection. Distributed ledger technology, on the other hand, ensures transparent, immutable transactions and facilitates operational processes.

Financial institutions deploy AI/ML to assess credit risks--these technologies enable precise borrower evaluations within compliance frameworks.

Allen et al. (

2023) found that algorithms handle loan applications more efficiently than traditional methods while maintaining risk standards. Their findings indicated that automated systems are more effective in identifying qualified borrowers, particularly during market surges when regulatory scrutiny and lending oversights intensify. The deployment of AI-driven fintech, in turn, improves operational efficiency while maintaining risk management protocols and ensuring regulatory adherence.

5.3. Sustainability

Sustainable finance integrates environmental, social, and governance (ESG) principles into financial decision-making. For fintech and investment, sustainability underpins responsible innovation by aligning digital finance tools with ethical standards and long-term objectives, ensuring stable capital flows while addressing environmental and social priorities (

EU, 2024).

Organizational sustainability increasingly requires the alignment of technological innovation with compliance frameworks to meet growing social and environmental imperatives. Advanced regulatory solutions enable businesses to achieve operational excellence while adhering to ESG standards.

Kanojia and Kaur (

2024) demonstrate that fintech platforms drive corporate responsibility through resource optimization, cost minimization, and enhanced transparency. Compliance-focused digital architectures reinforce governance by promoting data anonymization and stakeholder engagement. This analysis demonstrates how technological adoption supports sustainable lending and enhances risk-adjusted return metrics.

The convergence of sustainability and technology introduces complex interactions that influence institutional practices, market performance, and systemic stability. These dynamics embrace critical considerations for risk assessment and investment strategies. For example,

Ma et al. (

2025) employed analytical methods to investigate market behavior under varying economic conditions, identifying asymmetric impacts among market segments and temporal variations in risk transmission. Their findings illustrate how sustainability and technological factors jointly shape financial stability during both stable and volatile periods.

5.4. Perceptions and Human Traits

Although users perceive risks in financial transactions, these concerns are significantly alleviated as AI and ML automate credit evaluations that were traditionally dependent on human judgment. Algorithm-driven risk assessment minimizes uncertainty in passive lending and maintains transparency for active investors.

Balyuk and Davydenko (

2024) trace the evolution of digital lending platforms from manual auction systems to algorithmically managed intermediaries. Their findings indicate that technological integration improves efficiency while preserving investor oversight tailored to different levels of expertise.

Customer-perceived value remains a critical driver for business success. AI/ML enhances perceived value in digital finance by delivering personalized services that optimize user experience and strengthen institutional risk management.

Kanaparthi (

2024) developed an AI framework using multiple ML classifiers, notably Random Forest, to improve credit risk detection. This research demonstrates how AI-based personalization creates superior value propositions by aligning financial products with individual needs while maintaining robust risk protocols.

Additionally, personal traits present a promising research direction. Trust, perceived risk, and perceived value act as key determinants of investment behavior on peer-to-peer (P2P) lending platforms.

Shtudiner et al. (

2025) reveal that P2P investors exhibit distinct behavioral profiles, including a higher risk tolerance and a greater willingness to delay returns compared to non-users. These insights underscore the importance of balanced regulatory frameworks that not only encourage innovation but also safeguard investors, while fostering collaborations and leveraging behavioral findings across similar peer-based fintech services.

5.5. Inclusion

Financial inclusion broadens access to financial services and indicates a critical research area.

Ha et al. (

2025) argue that inclusion-driven transformation reshapes traditional finance through interconnected mechanisms, including innovative delivery models, market restructuring, and multi-stakeholder collaboration. Although it introduces regulatory challenges, data privacy concerns, and potential risks of discrimination, fintech ultimately democratizes access to financial services.

Fintech enhances financial inclusion by using mobile banking platforms as part of technological innovation strategies. These research streams identify digital finance as a key mechanism for addressing exclusion barriers in developing economies.

Del Sarto and Ozili (

2025) show that peer-to-peer lending, blockchain, and digital payment systems support underserved users, while digitized financial architectures overcome infrastructure limitations and increase service availability. In addition, technological financial solutions reduce socioeconomic disparities by improving access to credit. Comprehensive digital frameworks also integrate remote communities into mainstream economic activity and meet broader development goals.

5.6. Summary of Literature Status and Future Directions

The current literature demonstrates a strong convergence between technological innovation and investment risks, as emerging technologies such as artificial intelligence, blockchain, and sustainability frameworks are increasingly embedded into comprehensive risk models. These advancements are transforming traditional assessment methods, moving beyond purely financial metrics to incorporate sustainability as a fundamental criterion in investment decisions. In parallel, behavioral factors—particularly trust and risk tolerance—have become critical determinants of the adoption of fintech platforms and continued usage, reflecting the interplay between technology, human perception, and risk behavior. Based on these insights, future research could explore the building of holistic frameworks that integrate technological capabilities with sustainability metrics and behavioral dimensions across both banking and capital market sectors. Such efforts could guide efforts to enhance the robustness of security, privacy, and transparency mechanisms while simultaneously enabling broader digital inclusion. This approach is essential to expand market access to underserved populations while reinforcing protective measures against systemic and operational risks that may emerge as fintech ecosystems continue to evolve.

5.7. Integrated Implications for Practitioners

Our research underscores several critical implications for practitioners, presenting significant opportunities to transform financial ecosystems. For managers, adopting advanced technologies that strengthen risk detection and integrate sustainability objectives enables operational efficiency and long-term resilience. Investors benefit from multidimensional frameworks that consolidate diverse data sources, while the results may require portfolio recalibration to account for behavioral variations and market asymmetries affecting different user groups. Regulators can assume adaptive governance roles that balance innovation with stability, fostering industry collaboration while mitigating emerging risks. These findings demonstrate the importance of cross-disciplinary coordination for risk monitoring and the deployment of strategies that simultaneously drive innovation and deliver value to stakeholders.

5.8. Research Limitations

Despite its contributions, this study faces several limitations, as outlined below, and opens avenues for future research. The timeframe, database selection, and keyword constraints restricted the analytical scope; therefore, broader coverage, more diverse data sources, and flexible parameters could yield richer insights. Future studies should also integrate varied theories, frameworks, and methodologies to strengthen thematic depth. Additionally, limiting the review to English-language publications excludes valuable non-English contributions, reducing cross-cultural perspectives, while the underrepresentation of emerging economies also restricts this study’s global applicability. Furthermore, reliance on bibliometric methods may overlook specialized studies with low citation visibility. Overcoming these limitations will require incorporating multilingual sources, fostering international collaborations, and combining bibliometric techniques with complementary methodologies to provide a more holistic understanding of fintech, investment, and risk in global markets.

6. Conclusions

Fintech is rooted in digital innovation and has become a significant force reshaping the financial sector through more flexible, efficient, and data-based services. While fintech shows importance in its intersection with investment and risk in financial ecosystems, existing research remains fragmented, examining various dimensions in isolation and lacking an integrated view of the landscape. To conclude, our study addresses this gap through a systematic literature review, examining the repercussions of fintech, investment, and risk, identifying areas for future scholarship and practice. Fintech services, emerging from entrepreneurial innovation, enhance core financial operations by improving efficiency, decision-making, and risk management. Meanwhile, governments and regulators are increasingly recognizing fintech as both a catalyst of innovation and an institutional transformer. This expansion is supported by evolving consumer expectations, business models, regulatory frameworks, and growing collaboration between traditional institutions and fintech entrants. In investment sectors, fintech introduces automated tools and digital platforms that expand market access and reshape investor behavior; however, these developments simultaneously generate new vulnerabilities, particularly concerning digital security, operational stability, and regulatory ambiguity, thereby necessitating adaptive assessment methodologies. Although fintech democratizes financial market participation, it concurrently increases reliance on digital infrastructure and data integrity. Consequently, the efficiency gained from adopting fintech exposes financial systems to novel risks that conventional risk management frameworks cannot adequately address, thereby requiring a thorough evaluation of both opportunities and emerging threats to ensure the sustainable evolution of the financial system.

Bibliometric analysis was conducted to examine the scope of this study through a systematic review methodology, employing specialized analytical tools to investigate scholarly output spanning over a decade. The investigation revealed substantial growth in research production and academic influence, with notable acceleration occurring in recent years. The geographic distribution revealed varying patterns of scholarly contributions across different regions, with journal analysis indicating diverse levels of academic impact among publishing sources. Further analyses yielded additional findings: Co-citation mapping revealed distinct intellectual clusters encompassing fintech’s banking transformation, macroeconomic regulatory frameworks, user adoption patterns, and governance structures. A three-point plot visually showed the flow of valued metrics and their relationships. Keyword analysis positioned fintech as the central concept, connecting varying relevant elements shown in network graphics. A thematic map helps scholars understand the structure of existing research, identify gaps, and guide future directions for study.

Fintech has a significant impact by transforming financial systems and altering the way value is created, exchanged, and managed. This disruption influences a wide array of stakeholders: individuals gain access to customized services and more investment options but face heightened exposure to digital threats and opaque risks; corporations improve their operational efficiency and strategic agility, and work with emerging dependencies and systemic complexity; governments must recalibrate policies to safeguard stability without impeding progress; and society at large navigates decentralized financial structures and shifting market norms. Collectively, these developments demand coordinated, forward-looking responses to ensure sustainable and equitable growth.

This research culminates in several areas that warrant further discussion. For example, behavioral user perspectives emphasize trust and digital literacy, whereas systemic policy considerations focus on financial inclusion and stability. Future research directions should emphasize the integration of sustainability considerations with technological advancements, exploring AI’s potential for enhanced risk management, and investigating the transformative role of fintech in promoting financial inclusion. These developments are particularly beneficial for developing economies, where digital payment systems address infrastructure gaps and reduce socioeconomic disparities, suggesting a continued evolution in how technology reshapes traditional financial services and expands access to underserved populations through mobile banking and blockchain innovations. It is hoped that this work provides a foundation and provides directions for future research.