Integration of Blockchain in Accounting and ESG Reporting: A Systematic Review from an Oracle-Based Perspective

Abstract

1. Introduction

- Does the academic literature on blockchain and accounting’s integration consider the roles and limitations of oracles?

- What characteristics of the literature are associated with greater attention to oracles and the oracle problem in blockchain-based accounting research?

- Under the rationale that neglecting oracles’ integration constitutes a theoretical bias, what portion of the literature exhibits such a bias?

- What types of oracles have been proposed for use in the accounting field?

- Which blockchain-based accounting integration shows the most robust or advanced research on the roles of oracles?

2. Literature Background

2.1. Blockchain, Smart Contracts, and Oracles

2.2. Blockchain in Accounting

2.2.1. Triple-Entry Accounting

2.2.2. Real-Time Accounting/Auditing and Continuous Auditing

2.2.3. Governance, Trust, and Accountability

2.2.4. ESG Reporting

2.2.5. Blockchain’s Adoption and Its Impact on Accounting Professions

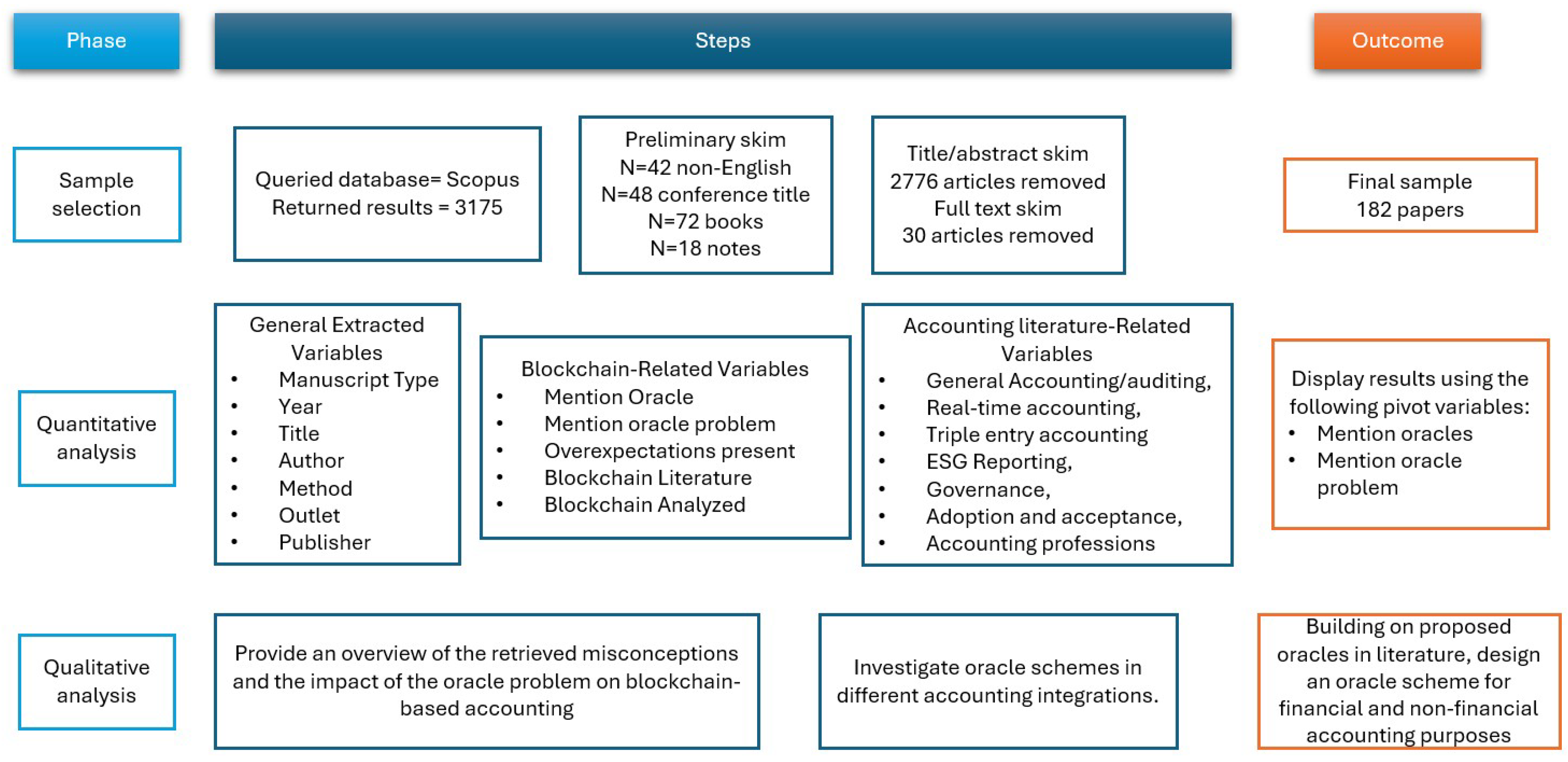

3. Methodology

3.1. Database and Article Selection Process

3.2. Data Extraction

4. Findings

4.1. The Oracle Problem in Accounting and Auditing

4.2. Oracle Ecosystems in Accounting and Auditing

4.3. Oracle Ecosystems in ESG Reporting

5. Discussion

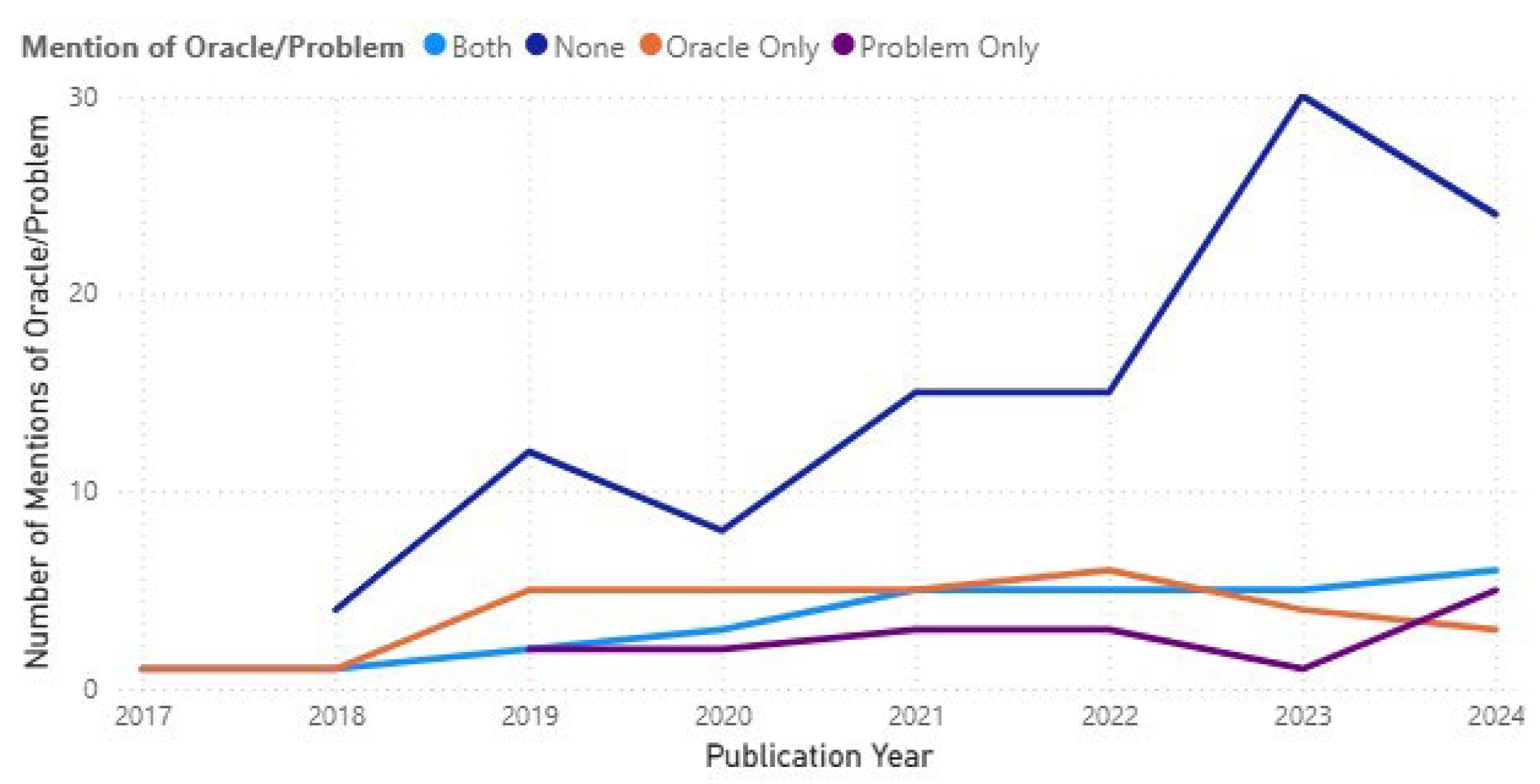

5.1. Theoretical Implications of Oracle Mentions in the Accounting Literature

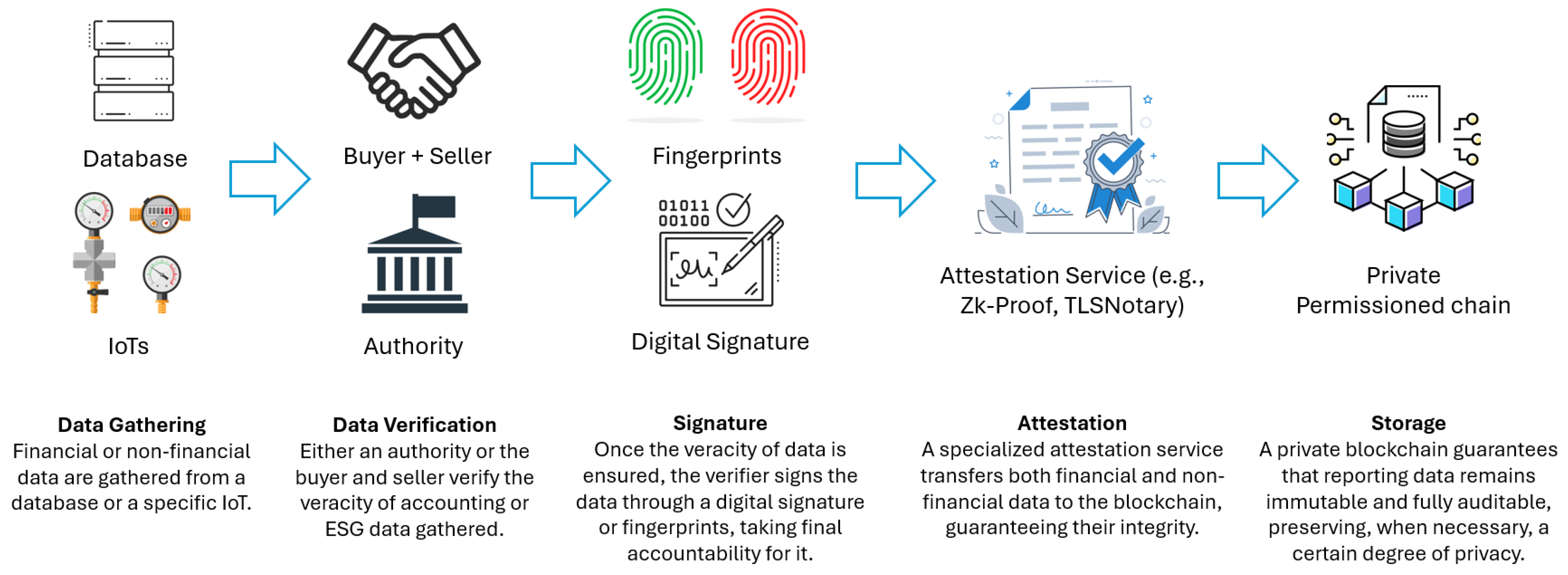

5.2. Theoretical Implications of Oracle Designs for Reporting Purposes

5.3. Implications for Developers, Accounting Professionals, and Standard Setters

6. Conclusions

- (1)

- While oracles were mentioned in 33% of the retrieved sample, they are rarely explained in technical depth or integrated meaningfully into proposed blockchain architectures for accounting use cases.

- (2)

- References to oracles and their implementation appear predominantly in empirical studies that focus on specific blockchain platforms.

- (3)

- Roughly 25% of the sample exhibited overexpectations about blockchain capabilities. However, only 6% of the papers included any discussion of oracles that had overexpectations, suggesting that attention to the oracle layer significantly reduces the likelihood of unrealistic claims.

- (4)

- In accounting applications, the most common oracle schemes involve either a trusted authority that is responsible for data verification or bilateral validation by transacting parties. More advanced proposals include distributed validation by multiple nodes or cryptographic attestation services. For non-financial reporting, several studies have proposed the use of IoT devices or coordinated IoT systems as data providers.

- (5)

- The few studies offering more advanced oracle designs are largely found in ESG reporting contexts. However, practical implementations remain underdeveloped.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Understanding the Bitcoin Network and Blockchains

Appendix B. Features and Limitations of Blockchains and the Need for Oracles

| Blockchain Features and Limitations | Overexpectations | Search String/Marker | Reference |

|---|---|---|---|

| Blockchain decentralization is guaranteed by miners or stakers who compete with each other, investing in mining equipment or stakes in return for cryptocurrencies. Multiple nodes do not imply decentralization and do not verify arbitrary data. | Blockchain systems are inherently decentralized and trustworthy simply because they involve multiple nodes. | “multiple nodes ensure data reliability” “data is verified by distributed nodes” | (Antonopoulos, 2016, 2017; Gates, 2017; Antonopoulos & Woods, 2018) |

| The Bitcoin ledger keeps track of cryptocurrency owners by adding updated data to the ledger; it does not directly trace them around the network. Therefore, it cannot directly trace real-world assets. | Blockchain can trace individuals or real-world assets across the network automatically. | “blockchain can trace real-world assets” “ledger provides full asset traceability” | (Brühl, 2017; Kumar et al., 2020; Caldarelli et al., 2023) |

| To implement blockchains in applications aside from the simple exchange of currencies, smart contracts need to be implemented. These, like any computer program, may contain bugs and do not imply automation. | Smart contracts guarantee trustless and error-free automation. | “self-executing and self-enforcing contracts” “blockchain enables automatic processes.” | (Frankenreiter, 2019; Harris, 2019; Tasca & Tessone, 2019; Mühlberger et al., 2020) |

| For applications that require real-world data, oracles are introduced, whose security is unrelated to that of the chain. Therefore, a direct reduction in intermediaries is not achieved through the implementation of blockchain, as new ones (oracles) are introduced. | Blockchain eliminates all intermediaries. | “blockchain removes the need for third parties” “blockchain provides full decentralization across layers” | (Buck, 2017; Egberts, 2017; Caldarelli, 2020b; HacKen, 2020; B. Liu et al., 2021) |

| Blockchains store a limited quantity of data; for Bitcoin, a 32-byte hash was already considered excessive. Although other chains allow a higher quantity of data, the associated price is considerably higher. | Blockchain can store all kinds of documents and data directly on-chain. | “all accounting data is saved on-chain” “immutable storage of all data on-chain” | (bchworldorder, 2018; Strehle & Steinmetz, 2020; BitMex-Research, 2022) |

Appendix C

References

- Abdennadher, S., Grassa, R., Abdulla, H., & Alfalasi, A. (2022). The effects of blockchain technology on the accounting and assurance profession in the UAE: An exploratory study. Journal of Financial Reporting and Accounting, 20(1), 53–71. [Google Scholar] [CrossRef]

- Abdulla, H., Alfalasi, A., & Grassa, R. (2022). Would blockchain disrupt the accounting and auditing professions? An exploratory study in the UAE. In Contemporary research in accounting and finance: Case studies from the MENA region (pp. 295–310). Springer Nature. [Google Scholar] [CrossRef]

- Abu Afifa, M. M., Vo Van, H., & Le Hoang Van, T. (2023). Blockchain adoption in accounting by an extended UTAUT model: Empirical evidence from an emerging economy. Journal of Financial Reporting and Accounting, 21(1), 5–44. [Google Scholar] [CrossRef]

- Akter, M., Kummer, T.-F., & Yigitbasioglu, O. (2024). Looking beyond the hype: The challenges of blockchain adoption in accounting. International Journal of Accounting Information Systems, 53, 100681. [Google Scholar] [CrossRef]

- Albizri, A., & Appelbaum, D. (2021). Trust but verify: The oracle paradox of blockchain smart contracts. Journal of Information Systems, 35(2), 1–16. [Google Scholar] [CrossRef]

- Al-Breiki, H., Rehman, M. H. U., Salah, K., & Svetinovic, D. (2020). Trustworthy blockchain oracles: Review, comparison, and open research challenges. IEEE Access, 8, 85675–85685. [Google Scholar] [CrossRef]

- Alex, B.-S., Teresa, C.-J. M., Liz, V.-C., & Mariuxi, P.-C. (2022, June 22–25). Blockchain application in accounting and auditing: A bibliometric and systemic analysis. 2022 17th Iberian Conference on Information Systems and Technologies (CISTI) (pp. 1–6), Madrid, Spain. [Google Scholar] [CrossRef]

- Alharby, M., & van Moorsel, A. (2017). Blockchain based smart contracts: A systematic mapping study. In Computer science & information technology (CS & IT) (pp. 125–140). Academy & Industry Research Collaboration Center (AIRCC). [Google Scholar] [CrossRef]

- Alkhwaldi, A. F., Alidarous, M. M., & Alharasis, E. E. (2024). Antecedents and outcomes of innovative blockchain usage in accounting and auditing profession: An extended UTAUT model. Journal of Organizational Change Management, 37(5), 1102–1132. [Google Scholar] [CrossRef]

- Alles, M., & Gray, G. L. (2023). Hope or hype? Blockchain and accounting. International Journal of Digital Accounting Research, 23, 19–45. [Google Scholar] [CrossRef]

- Alrfai, M. M., Rahahle, M., & Yassine, F. A. (2024). Artificial intelligence and economic sustainability in the era of Industrial Revolution 5.0 (A. M. A. Musleh Al-Sartawi, & A. I. Nour, Eds.; Vol. 528). Studies in Systems, Decision and Control. Springer Nature. [Google Scholar] [CrossRef]

- Androulaki, E., Barger, A., Bortnikov, V., Cachin, C., Christidis, K., De Caro, A., Enyeart, D., Ferris, C., Laventman, G., Manevich, Y., Muralidharan, S., Murthy, C., Nguyen, B., Sethi, M., Singh, G., Smith, K., Sorniotti, A., Stathakopoulou, C., Vukolić, M., … Yellick, J. (2018, April 23–26). Hyperledger fabric. Thirteenth EuroSys Conference (pp. 1–15), New York, NY, USA. [Google Scholar] [CrossRef]

- Antonopoulos, A. M. (2016). The internet of money: A collection of talks by andreas antonopoulos (1st ed.). Merkle Bloom LLC. [Google Scholar]

- Antonopoulos, A. M. (2017). Mastering bitcoin: Programming the open blockchain (2nd ed.). O’Reilly. [Google Scholar]

- Antonopoulos, A. M. (2018). The internet of money—Volume two. Merkle Bloom LLC. [Google Scholar]

- Antonopoulos, A. M., & Woods, G. (2018). Mastering ethereum—Building smart contracts and DAPPS (1st ed.). O’Reilly. [Google Scholar]

- Anwar, S., Shukla, V. K., Rao, S. S., Sharma, B. K., & Sharma, P. (2019, November 20–21). Framework for financial auditing process through blockchain technology, using identity based cryptography. ITT 2019—Information Technology Trends: Emerging Technologies Blockchain and IoT (pp. 99–103), Ras Al Khaimah, United Arab Emirates. [Google Scholar] [CrossRef]

- Atik, A., & Kelten, G. (2021). Blockchain technology and its potential effects on accounting: A systematic literature review. Istanbul Business Research, 50, 495–515. [Google Scholar] [CrossRef]

- Augusto, A., Belchior, R., Kocsis, I., Gönczy, L., Vasconcelos, A., & Correia, M. (2023, May 1–5). CBDC bridging between hyperledger fabric and permissioned EVM-based blockchains. 2023 IEEE International Conference on Blockchain and Cryptocurrency (ICBC) (pp. 1–9), Dubai, United Arab Emirates. [Google Scholar] [CrossRef]

- Autore, D., Chen, H., Clarke, N., & Lin, J. (2024). Blockchain and earnings management: Evidence from the supply chain. The British Accounting Review, 56(4), 101357. [Google Scholar] [CrossRef]

- Barandi, S., Lawson-Body, A., Lawson-Body, L., & Willoughby, L. (2020). Impact of blockchain technology on the continuous auditing: Mediating role of transaction cost theory. Issues In Information Systems, 106(2), 391–396. [Google Scholar] [CrossRef]

- bchworldorder. (2018). A few months after the counterparty developers started using OP_RETURN, bitcoin developers decreased the size of OP_RETURN from 80 bytes to 40 bytes. The sudden decrease in the size of the OP_RETURN function stopped networks launched on top of bitcoin from operating properly. btc. Reddit.com. Available online: https://www.reddit.com/r/btc/comments/80ycim/a_few_months_after_the_counterparty_developers/ (accessed on 19 January 2023).

- Belchior, R., Süßenguth, J., Feng, Q., Hardjono, T., Vasconcelos, A., & Correia, M. (2023). A brief history of blockchain interoperability. Authorea Preprints. [Google Scholar] [CrossRef]

- Bistarelli, S., Mercanti, I., & Santini, F. (2019). An analysis of non-standard transactions. Frontiers in Blockchain, 2, 7. [Google Scholar] [CrossRef]

- BitMex-Research. (2022). The OP_Return wars of 2014—Dapps vs bitcoin transactions. blog.bitmex.com. Available online: https://blog.bitmex.com/dapps-or-only-bitcoin-transactions-the-2014-debate/ (accessed on 12 January 2023).

- Bonsón, E., & Bednárová, M. (2019). Blockchain and its implications for accounting and auditing. Meditari Accountancy Research, 27(5), 725–740. [Google Scholar] [CrossRef]

- Bora, I., Duan, H. K., Vasarhelyi, M. A., Zhang, C., & Dai, J. (2021). The transformation of government accountability and reporting. Journal of Emerging Technologies in Accounting, 18(2), 1–21. [Google Scholar] [CrossRef]

- Borrero, J. D. (2019). Agri-food supply chain traceability for fruit and vegetable cooperatives using Blockchain technology. CIRIEC-Espana Revista de Economia Publica, Social y Cooperativa, 95, 71–94. [Google Scholar] [CrossRef]

- Brühl, V. (2017). Bitcoins, blockchain, and distributed ledgers. Wirtschaftsdienst, 97(2), 135–142. [Google Scholar] [CrossRef][Green Version]

- Buck, J. (2017). Blockchain oracles explained. Available online: https://cointelegraph.com/explained/blockchain-oracles-explained (accessed on 1 March 2020).

- Buterin, V. (2013). Ethereum: A next-generation smart contract and decentralized application platform. Available online: https://cryptorating.eu/whitepapers/Ethereum/Ethereum_white_paper.pdf (accessed on 12 April 2020).

- Byström, H. (2019). Blockchains, real-time accounting, and the future of credit risk modeling. Ledger, 4, 40–47. [Google Scholar] [CrossRef]

- Cai, C. W. (2021). Triple-entry accounting with blockchain: How far have we come? Accounting and Finance, 61(1), 71–93. [Google Scholar] [CrossRef]

- Caldarelli, G. (2020a, November 25–27). Real-world blockchain applications under the lens of the oracle problem. A systematic literature review. 2020 IEEE International Conference on Technology Management, Operations and Decisions, ICTMOD 2020 (pp. 1–6), Marrakech, Morocco. [Google Scholar] [CrossRef]

- Caldarelli, G. (2020b). Understanding the blockchain oracle problem: A call for action. Information, 11(11), 509. [Google Scholar] [CrossRef]

- Caldarelli, G. (2021). Blockchain oracles and the oracle problem: A practical handbook to discover the world of blockchain, smart contracts, and oracles—Exploring the limits of trust decentralization (1st ed.). Amazon Publishing. [Google Scholar]

- Caldarelli, G. (2023). Before ethereum. The origin and evolution of blockchain oracles. IEEE Access, 11, 50899–50917. [Google Scholar] [CrossRef]

- Caldarelli, G. (2024). Expert perspectives on blockchain in the circular economy: A delphi study with industry specialists. Journal of Cleaner Production, 465, 142781. [Google Scholar] [CrossRef]

- Caldarelli, G., & Ellul, J. (2021). The blockchain oracle problem in decentralized finance—A multivocal approach. Applied Sciences, 11(16), 7572. [Google Scholar] [CrossRef]

- Caldarelli, G., Rossignoli, C., & Zardini, A. (2020). Overcoming the blockchain oracle problem in the traceability of non-fungible products. Sustainability, 12(6), 2391. [Google Scholar] [CrossRef]

- Caldarelli, G., Rossignoli, C., & Zardini, A. (2023, October 20–22). Oracle trust models for blockchain-based applications. An early standardization. 2023 IEEE International Conference on Technology Management, Operations and Decisions (ICTMOD) (pp. 1–6), Glasgow, UK. [Google Scholar] [CrossRef]

- Caro, M. P., Ali, M. S., Vecchio, M., & Giaffreda, R. (2018, May 8–9). Blockchain-based traceability in agri-food supply chain management: A practical implementation. 2018 IoT Vertical and Topical Summit on Agriculture—Tuscany (IOT Tuscany) (pp. 1–4), Tuscany, Italy. [Google Scholar] [CrossRef]

- Casey, M. J., & Vigna, P. (2018). The truth machine: The blockchain and the future of everything (HarperCollins Ed.; 1st ed.). HarperCollins Publisher. [Google Scholar]

- Chen, W., Wu, W., Ouyang, Z., Fu, Y., Li, M., & Huang, G. Q. (2024). Event-based data authenticity analytics for IoT and blockchain-enabled ESG disclosure. Computers & Industrial Engineering, 190, 109992. [Google Scholar] [CrossRef]

- Coyne, J. G., & McMickle, P. L. (2017). Can blockchains serve an accounting purpose? Journal of Emerging Technologies in Accounting, 14(2), 101–111. [Google Scholar] [CrossRef]

- Crooks, N. (2023). What is the blockchain trilemma? The Block. Available online: https://www.theblock.co/learn/249536/what-is-the-blockchain-trilemma (accessed on 24 February 2024).

- Crosby, M., Pattanayak, P., Verma, S., & Kalyanaraman, V. (2016). Blockchain technology beyond bitcoin. Applied Innovation Review, 2, 71. [Google Scholar]

- Curran, B. (2018). What are oracles? Smart contracts, chainlink & the oracle problem. Available online: https://blockonomi.com/oracles-guide (accessed on 12 April 2019).

- Dai, J., He, N., & Yu, H. (2019). Utilizing blockchain and smart contracts to enable audit 4.0: From the perspective of accountability audit of air pollution control in China. Journal of Emerging Technologies in Accounting, 16(2), 23–41. [Google Scholar] [CrossRef]

- Dai, J., & Vasarhelyi, M. A. (2017). Toward blockchain-based accounting and assurance. Journal of Information Systems, 31(3), 5–21. [Google Scholar] [CrossRef]

- Damjan, M. (2018). The interface between blockchain and the real world. Ragion Pratica, 2018(2), 379–406. [Google Scholar] [CrossRef]

- Dario, C., Sabrina, L., Landriault, E., & De Vega, P. (2021). DLT to boost efficiency for Financial Intermediaries. An application in ESG reporting activities. Technology Analysis and Strategic Management, 37(4), 373–386. [Google Scholar] [CrossRef]

- Dickinson, A. (2020, November). Blockchain for invoice reconciliation and dispute resolution|IBM. ibm.com. Available online: https://www.ibm.com/products/blog/blockchain-for-invoice-reconciliation-and-dispute-resolution (accessed on 23 July 2025).

- Douceur, J. R. (2002). The Sybil Attack. In Peer-to-peer systems (pp. 251–260). MIT Faculty Club. [Google Scholar] [CrossRef]

- Dyball, M. C., & Seethamraju, R. (2021). The impact of client use of blockchain technology on audit risk and audit approach—An exploratory study. International Journal of Auditing, 25(2), 602–615. [Google Scholar] [CrossRef]

- Egberts, A. (2017). The oracle problem—An analysis of how blockchain oracles undermine the advantages of decentralized ledger systems. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Eskandari, S., Salehi, M., Gu, W. C., & Clark, J. (2021). SoK: Oracles from the ground truth to market manipulation. In Proceedings of the 3rd ACM Conference on Advances in Financial Technologies (pp. 127–141). ACM. [Google Scholar] [CrossRef]

- EY. (2016). Building blocks of the future. EY.com. Available online: https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gl/insights/assurance/documents/ey-reporting-building-blocks-of-the-future.pdf (accessed on 19 October 2024).

- Faccia, A., Moşteanu, N. R., & Cavaliere, L. P. L. (2020, September 16–18). Blockchain hash, the missing axis of the accounts to settle the triple entry bookkeeping system. 2020 12th International Conference on Information Management and Engineering (pp. 18–23), Amsterdam, The Netherlands. [Google Scholar] [CrossRef]

- Faccia, A., Sawan, N., Eltweri, A., & Beebeejaun, Z. (2021, November 12–14). Financial big data security and privacy in X-accounting. A step further to implement the triple-entry accounting. 6th International Conference on Information Systems Engineering (pp. 7–12), Shanghai, China. [Google Scholar] [CrossRef]

- Fang, B., Liu, X., Ma, C., & Zhuo, Y. (2023). Blockchain technology adoption and accounting information quality. Accounting and Finance, 63(4), 4125–4156. [Google Scholar] [CrossRef]

- Frankenreiter, J. (2019). The limits of smart contracts. Journal of Institutional and Theoretical Economics JITE, 175(1), 149–162. [Google Scholar] [CrossRef]

- Fullana, O., & Ruiz, J. (2021). Accounting information systems in the blockchain era. International Journal of Intellectual Property Management, 11(1), 63–80. [Google Scholar] [CrossRef]

- Gaggioli, A., Eskandari, S., Cipresso, P., & Lozza, E. (2019). The middleman is dead, long live the middleman: The “Trust Factor” and the psycho-social implications of blockchain. Frontiers in Blockchain, 2, 20. [Google Scholar] [CrossRef]

- Garanina, T., Ranta, M., & Dumay, J. (2022). Blockchain in accounting research: Current trends and emerging topics. Accounting, Auditing and Accountability Journal, 35(7), 1507–1533. [Google Scholar] [CrossRef]

- Garaus, M., & Treiblmaier, H. (2021). The influence of blockchain-based food traceability on retailer choice: The mediating role of trust. Food Control, 129, 108082. [Google Scholar] [CrossRef]

- Gates, M. (2017). Blockchain: Ultimate guide to understanding blockchain, bitcoin, cryptocurrencies, smart contracts and the future of money. Wise Fox Publishing. [Google Scholar]

- Gauthier, M. P., & Brender, N. (2021). How do the current auditing standards fit the emergent use of blockchain? Managerial Auditing Journal, 36(3), 365–385. [Google Scholar] [CrossRef]

- Goel, V., & Mishra, A. (2023, November 23–24). Importance of blockchain technology in accounting in current era. 2023 3rd International Conference on Advancement in Electronics and Communication Engineering, AECE 2023 (pp. 1057–1059), Ghaziabad, India. [Google Scholar] [CrossRef]

- Grant, M. J., & Booth, A. (2009). A typology of reviews: An analysis of 14 review types and associated methodologies. Health Information and Libraries Journal, 26(2), 91–108. [Google Scholar] [CrossRef]

- Grigg, I. (2024). Triple entry accounting. Journal of Risk and Financial Management, 17(2), 76. [Google Scholar] [CrossRef]

- HacKen. (2020). Biggest DeFi hacks of 2020 report. HACKEN. Available online: https://hacken.io/discover/biggest-defi-hacks-of-2020-report/ (accessed on 2 March 2021).

- Han, H., Shiwakoti, R. K., Jarvis, R., Mordi, C., & Botchie, D. (2023). Accounting and auditing with blockchain technology and artificial Intelligence: A literature review. International Journal of Accounting Information Systems, 48, 100598. [Google Scholar] [CrossRef]

- Harris, C. G. (2019, May 14–17). The risks and challenges of implementing ethereum smart contracts. ICBC 2019—IEEE International Conference on Blockchain and Cryptocurrency (pp. 104–107), Seoul, Republic of Korea. [Google Scholar] [CrossRef]

- He, J. (2021). Research on the application of blockchain technology in financial statement auditing. Journal of Physics: Conference Series, 1992(2), 022008. [Google Scholar] [CrossRef]

- Hearn, M. (2011). Contracts. BitcoinWiki. Available online: https://en.bitcoin.it/w/index.php?title=Contract&oldid=13637 (accessed on 2 December 2022).

- Heiss, J., Oegel, T., Shakeri, M., & Tai, S. (2024). Verifiable carbon accounting in supply chains. IEEE Transactions on Services Computing, 17(4), 1861–1874. [Google Scholar] [CrossRef]

- Hughes, A., Park, A., Kietzmann, J., & Archer-Brown, C. (2019). Beyond bitcoin: What blockchain and distributed ledger technologies mean for firms. Business Horizons, 62(3), 273–281. [Google Scholar] [CrossRef]

- Huilgolkar, H. (2021). Razor network: A decentralized oracle platform. Available online: https://razor.network/whitepaper.pdf (accessed on 18 February 2021).

- Ijiri, Y. (1986). A framework for triple-entry bookkeeping. The Accounting Review, 61(4), 745–759. [Google Scholar]

- Ingle, C., Samudre, A., Bhavsar, P., & Vidap, P. S. (2019, December 13–15). Audit and compliance in service management using blockchain. 2019 IEEE 16th India Council International Conference, INDICON 2019—Symposium Proceedings (pp. 1–4), Rajkot, India. [Google Scholar] [CrossRef]

- Johri, S., Mehta, K., Suhashini, J., Shukla, P. K., Podile, V., & Singh, D. P. (2022, April 28–29). The impact of block chain in accounting and auditing domain—A critical approach for enhanced efficiency and transparency. 2022 2nd International Conference on Advance Computing and Innovative Technologies in Engineering, ICACITE 2022 (pp. 1628–1632), Greater Noida, India. [Google Scholar] [CrossRef]

- Kafshdar Goharshady, A., Behrouz, A., & Chatteriee, K. (2018, July 30–August 3). Secure credit reporting on the blockchain. Proceedings—IEEE 2018 International Congress on Cybermatics: 2018 IEEE Conferences on Internet of Things, Green Computing and Communications, Cyber, Physical and Social Computing, Smart Data, Blockchain, Computer and Information Technology, IThings/Green (pp. 1343–1348), Halifax, NS, Canada. [Google Scholar] [CrossRef]

- Kao, J. H., & Tsay, R. S. (2023, July 20–21). Preventing financial statement fraud with blockchain-based verifiable accounting system. International Conference on Electrical, Computer, Communications and Mechatronics Engineering, ICECCME 2023 (pp. 1–5). Online. [Google Scholar] [CrossRef]

- Karajovic, M., Kim, H. M., & Laskowski, M. (2019). Thinking outside the block: Projected phases of blockchain integration in the accounting industry. Australian Accounting Review, 29(2), 319–330. [Google Scholar] [CrossRef]

- Karim, R. (2024). Blockchain and the future of accountancy: A review on policies and regulations. In Digital transformation in accounting and auditing (pp. 237–261). Springer International Publishing. [Google Scholar] [CrossRef]

- Koutmos, D. (2023). Network activity and ethereum gas prices. Journal of Risk and Financial Management, 16(10), 431. [Google Scholar] [CrossRef]

- Kumar, A., Liu, R., & Shan, Z. (2020). Is blockchain a silver bullet for supply chain management? Technical challenges and research opportunities. Decision Sciences, 51(1), 8–37. [Google Scholar] [CrossRef]

- Lazarov, I., Botha, Q., Costa, N. O., & Hackel, J. (2022). Reporting of cross-border transactions for tax purposes via DLT. In Communications in computer and information science: Vol. 1633 CCIS. Springer International Publishing. [Google Scholar] [CrossRef]

- Li, C. (2023, October 20–23). Application research on blockchain technology in accounting system. 2023 International Conference on Evolutionary Algorithms and Soft Computing Techniques, EASCT 2023 (pp. 1–6), Bengaluru, India. [Google Scholar] [CrossRef]

- Lindawati, A. S. L., Handoko, B. L., & Heykal, M. (2023, November 7–8). Model of blockchain adoption in financial audit profession. 2023 IEEE 9th International Conference on Computing, Engineering and Design, ICCED 2023 (pp. 1–6), Kuala Lumpur, Malaysia. [Google Scholar] [CrossRef]

- Liu, B., Szalachowski, P., & Zhou, J. (2021, August 23–26). A first look into defi oracles. 2021 IEEE International Conference on Decentralized Applications and Infrastructures (DAPPS) (pp. 39–48). Online. [Google Scholar] [CrossRef]

- Liu, L., Ma, Z., Zhou, Y., Fan, M., & Han, M. (2024). Trust in ESG reporting: The intelligent veri-green solution for incentivized verification. Blockchain: Research and Applications, 5(2), 100189. [Google Scholar] [CrossRef]

- Liu, R. (2020, October 16–18). A preliminary study of the impact of blockchain technology on internal auditing. 2020 2nd International Conference on Applied Machine Learning, ICAML 2020 (pp. 286–293), Changsha, China. [Google Scholar] [CrossRef]

- Lobanchykova, N., Vakaliuk, T., Zakharov, D., Levkivskyi, V., & Osadchyi, V. (2024, April 4). Features of using blockchain technology in accounting. DECaT-2024 Digital Economy Concepts and Technologies Workshop 2024 (Vol. 3665, pp. 48–60), Kyiv, Ukraine. [Google Scholar]

- Low, K. F. K. K., & Mik, E. (2020). Pause the blockchain legal revolution. International and Comparative Law Quarterly, 69(1), 135–175. [Google Scholar] [CrossRef]

- Luo, Y., Shen, J., Liang, H., Sun, L., & Dong, L. (2024). Supporting building life cycle carbon monitoring, reporting and verification: A traceable and immutable blockchain-empowered information management system and application in Hong Kong. Resources, Conservation and Recycling, 208, 107736. [Google Scholar] [CrossRef]

- Maiti, M., Kotliarov, I., & Lipatnikov, V. (2021). A future triple entry accounting framework using blockchain technology. Blockchain: Research and Applications, 2(4), 100037. [Google Scholar] [CrossRef]

- Majeed, R. H., & Taha, A. A. D. (2024). A survey study of Iraqi auditors’ adoption of blockchain technology. Asian Review of Accounting, 32(3), 521–546. [Google Scholar] [CrossRef]

- Massaro, M., Dal Mas, F., Chiappetta Jabbour, C. J., & Bagnoli, C. (2020). Crypto-economy and new sustainable business models: Reflections and projections using a case study analysis. Corporate Social Responsibility and Environmental Management, 27(5), 2150–2160. [Google Scholar] [CrossRef]

- Matringe, N., & Power, M. (2024). Memories lost: A history of accounting records as forms of projection. Accounting, Organizations and Society, 112, 101514. [Google Scholar] [CrossRef]

- McBurney, P. (2022). Blockchain boost for sustainability. AbMagazine. Available online: https://abmagazine.accaglobal.com/global/articles/2022/mar/business/blockchain-boost-for-sustainability.html (accessed on 20 August 2023).

- McCallig, J., Robb, A., & Rohde, F. (2019). Establishing the representational faithfulness of financial accounting information using multiparty security, network analysis and a blockchain. International Journal of Accounting Information Systems, 33, 47–58. [Google Scholar] [CrossRef]

- Mercanti, I., Bistarelli, S., & Santini, F. (2018, June 20–22). An analysis of non-standard bitcoin transactions. 2018 Crypto Valley Conference on Blockchain Technology, CVCBT 2018 (pp. 93–96), Zug, Switzerland. [Google Scholar] [CrossRef]

- Miles, M. B., & Huberman, M. A. (1994). Qualitative data analysis (2nd ed.). Sage Publications Ltd. [Google Scholar]

- Mingming, T. (2020, July 18–19). Research on the application of blockchain technology in accounting information system. 2020 International Conference on Virtual Reality and Intelligent Systems, ICVRIS 2020 (pp. 330–334), Zhangjiajie, China. [Google Scholar] [CrossRef]

- Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G. (2009). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Medicine, 6(7), e1000097. [Google Scholar] [CrossRef]

- Mühlberger, R., Bachhofner, S., Ferrer, E. C., Di Ciccio, C., Weber, I., Wöhrer, M., & Zdun, U. (2020). Foundational oracle patterns: Connecting blockchain to the off-chain world. Lecture Notes in Business Information Processing, 393, 35–51. [Google Scholar] [CrossRef]

- Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 11 June 2019).

- O’Leary, D. E. (2018). Open information enterprise transactions: Business intelligence and wash and spoof transactions in blockchain and Social commerce. Intelligent Systems in Accounting, Finance and Management, 25, 148–158. [Google Scholar] [CrossRef]

- Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., Brennan, S. E., Chou, R., Glanville, J., Grimshaw, J. M., Hróbjartsson, A., Lalu, M. M., Li, T., Loder, E. W., Mayo-Wilson, E., McDonald, S., … Moher, D. (2021). The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ, 372, n71. [Google Scholar] [CrossRef] [PubMed]

- Pan, L., Vaughan, O., & Wright, C. S. (2023). A private and efficient triple-entry accounting protocol on bitcoin. Journal of Risk and Financial Management, 16(9), 400. [Google Scholar] [CrossRef]

- Pasdar, A., Dong, Z., & Lee, Y. C. (2021). Blockchain oracle design patterns. arXiv, arXiv:2106.09349. [Google Scholar] [CrossRef]

- Pawczuk, L., Massey, R., & Holdowsky, J. (2019). Deloitte’s 2019 global blockchain survey—Blockchain gets down to business. Deloitte Insights, 2–48. Available online: https://www.deloitte.com/za/en/Industries/technology/analysis/blockchain-gets-down-to-business.html (accessed on 22 September 2024).

- Powell, W., Foth, M., Cao, S., & Natanelov, V. (2022). Garbage in garbage out: The precarious link between IoT and blockchain in food supply chains. Journal of Industrial Information Integration, 25, 100261. [Google Scholar] [CrossRef]

- PWC. (2019). Two practical cases of blockchain for tax compliance. Pwc.nl. Available online: https://www.pwc.nl/nl/tax/assets/documents/pwc-two-practical-cases-of-blockchain-for-tax-compliance.pdf (accessed on 23 April 2025).

- Ramassa, P., & Leoni, G. (2022). Standard setting in times of technological change: Accounting for cryptocurrency holdings. Accounting, Auditing and Accountability Journal, 35(7), 1598–1624. [Google Scholar] [CrossRef]

- Rauchs, M., Glidden, A., Gordon, B., Pieters, G. C., Recanatini, M., Rostand, F., Vagneur, K., & Zhang, B. Z. (2018). Distributed ledger technology systems: A conceptual framework. SSRN Electronic Journal. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3230013 (accessed on 26 August 2025).

- Rîndaşu, S. M. (2019). Blockchain in accounting: Trick or treat? Quality-Access to Success, 20(170), 143–147. [Google Scholar]

- Rooney, H., Aiken, B., & Rooney, M. (2017). Q&A. Is internal audit ready for blockchain? Technology Innovation Management Review, 7(10), 41–44. [Google Scholar] [CrossRef]

- Roszkowska, P. (2021). Fintech in financial reporting and audit for fraud prevention and safeguarding equity investments. Journal of Accounting & Organizational Change, 17(2), 164–196. [Google Scholar] [CrossRef]

- Rozario, A. M., & Thomas, C. (2019). Reengineering the audit with blockchain and smart contracts. Journal of Emerging Technologies in Accounting, 16(1), 21–35. [Google Scholar] [CrossRef]

- Rozario, A. M., & Vasarhelyi, M. A. (2018). Auditing with smart contracts. International Journal of Digital Accounting Research, 18, 1–27. [Google Scholar] [CrossRef]

- Sargent, C. S. (2022). Replacing financial audits with blockchain: The verification issue. Journal of Computer Information Systems, 62(6), 1145–1153. [Google Scholar] [CrossRef]

- Sarwar, M. I., Iqbal, M. W., Alyas, T., Namoun, A., Alrehaili, A., Tufail, A., & Tabassum, N. (2021). Data vaults for blockchain-empowered accounting information systems. IEEE Access, 9, 117306–117324. [Google Scholar] [CrossRef]

- Saxena, A., Singh, R., Gehlot, A., Akram, S. V., Twala, B., Singh, A., Montero, E. C., & Priyadarshi, N. (2023). Technologies empowered Environmental, Social, And Governance (ESG): An industry 4.0 landscape. Sustainability, 15(1), 309. [Google Scholar] [CrossRef]

- Schmitz, J., & Leoni, G. (2019). Accounting and auditing at the time of blockchain technology: A research agenda. Australian Accounting Review, 29(2), 331–342. [Google Scholar] [CrossRef]

- Seidenfad, K., Greiner, M., Biermann, J., & Lechner, U. (2024, January 8–11). Blockchain-based monitoring, reporting and verification of GHG emissions on the network edge—A system integration study in the Artisan coffee industry. 2024 IEEE/SICE International Symposium on System Integration, SII 2024 (pp. 1227–1228), Ha Long, Vietnam. [Google Scholar] [CrossRef]

- Sheldon, M. D. (2018). Using blockchain to aggregate and share misconduct issues across the accounting profession. Current Issues in Auditing, 12(2), A27–A35. [Google Scholar] [CrossRef]

- Sheldon, M. D. (2021a). Auditing the blockchain oracle problem. Journal of Information Systems, 35(1), 121–133. [Google Scholar] [CrossRef]

- Sheldon, M. D. (2021b). Preparing auditors for the blockchain oracle problem. Current Issues in Auditing, 15(2), P27–P39. [Google Scholar] [CrossRef]

- Shogenov, B. A., & Mirzoyeva, A. R. (2023). Blockchain—As an element of digitization of accounting and audit. Ekonomika I Upravlenie: Problemy, Resheniya, 11/5(140), 170–176. [Google Scholar] [CrossRef]

- Silva, R., Inácio, H., & Marques, R. P. (2022). Blockchain implications for auditing: A systematic literature review and bibliometric analysis. International Journal of Digital Accounting Research, 22, 163–192. [Google Scholar] [CrossRef]

- Singh, M., Joshi, M., Sharma, S., & Rana, T. (2023). How blockchain is transforming accounting, auditing and finance: A systematic review. In Handbook of big data and analytics in accounting and auditing (pp. 535–560). Springer Nature. [Google Scholar] [CrossRef]

- Song, J. (2018). The truth about smart contracts. Available online: https://medium.com/@jimmysong/the-truth-about-smart-contracts-ae825271811f (accessed on 2 March 2020).

- Spanò, R., Massaro, M., Ferri, L., Dumay, J., & Schmitz, J. (2022). Blockchain in accounting, accountability and assurance: An overview. Accounting, Auditing & Accountability Journal, 35(7), 1493–1506. [Google Scholar] [CrossRef]

- Strehle, E., & Steinmetz, F. (2020). Dominating OP returns: The impact of omni and veriblock on bitcoin. Journal of Grid Computing, 18(4), 575–592. [Google Scholar] [CrossRef]

- Subramoniam, R., Parameswaran, A., Ramanan, R., Sreekumar, R., & Cherian, S. (2022, November 7–11). Generating trust using product genome mapping: A cure for ESG communication. 2022 IEEE 1st Global Emerging Technology Blockchain Forum: Blockchain and Beyond, IGETblockchain 2022, Irvine, CA, USA. [Google Scholar] [CrossRef]

- Sunde, T. V., & Wright, C. S. (2023). Implementing triple entry accounting as an audit tool—An extension to modern accounting systems. Journal of Risk and Financial Management, 16(11), 478. [Google Scholar] [CrossRef]

- Szabo, N. (1994). Smart contracts. Personal Blog. Available online: https://www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/smart.contracts.html (accessed on 8 February 2023).

- Sztorc, P. (2017). The oracle problem. Available online: https://www.infoq.com/presentations/blockchain-oracle-problems (accessed on 3 March 2020).

- Tan, B. S., & Low, K. Y. (2019). Blockchain as the database engine in the accounting system. Australian Accounting Review, 29(2), 312–318. [Google Scholar] [CrossRef]

- Tang, Q., & Tang, L. M. (2019). Toward a distributed carbon ledger for carbon emissions trading and accounting for corporate carbon management. Journal of Emerging Technologies in Accounting, 16(1), 37–46. [Google Scholar] [CrossRef]

- Tang, Y. (2021). Frontier computing (J.-W. Chang, N. Yen, & J. C. Hung, Eds.; Vol. 747). Lecture Notes in Electrical Engineering. Springer. [Google Scholar] [CrossRef]

- Tanveer, U., Ishaq, S., & Hoang, T. G. (2025). Tokenized assets in a decentralized economy: Balancing efficiency, value, and risks. International Journal of Production Economics, 282, 109554. [Google Scholar] [CrossRef]

- Tasca, P., & Tessone, C. J. (2019). A taxonomy of blockchain technologies: Principles of identification and classification. Ledger, 4, 1–39. [Google Scholar] [CrossRef]

- Thies, S., Kureljusic, M., Karger, E., & Kramer, T. (2023). Blockchain-based triple-entry accounting: A systematic literature review and future research agenda. Journal of Information Systems, 37(3), 101–118. [Google Scholar] [CrossRef]

- Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14, 207–222. [Google Scholar] [CrossRef]

- Wang, K., Zhang, Y., & Chang, E. (2020). A conceptual model for blockchain-based auditing information system. ACM International Conference Proceeding Series, 101–107. [Google Scholar] [CrossRef]

- Webster, J., & Watson, R. T. (2002). Analyzing the past to prepare for the future: Writing a literature review. MIS Quarterly, 26(2), xiii–xxiii. [Google Scholar]

- Wu, J., Xiong, F., & Li, C. (2019). Application of internet of things and blockchain technologies to improve accounting information quality. IEEE Access, 7, 100090–100098. [Google Scholar] [CrossRef]

- Wu, W., Chen, W., Fu, Y., Jiang, Y., & Huang, G. Q. (2022a). Unsupervised neural network-enabled spatial-temporal analytics for data authenticity under environmental smart reporting system. Computers in Industry, 141, 103700. [Google Scholar] [CrossRef]

- Wu, W., Fu, Y., Wang, Z., Liu, X., Niu, Y., Li, B., & Huang, G. Q. (2022b). Consortium blockchain-enabled smart ESG reporting platform with token-based incentives for corporate crowdsensing. Computers & Industrial Engineering, 172, 108456. [Google Scholar] [CrossRef]

- Yang, X. (2020). On the credibility guarantee mechanism of accounting information system: Based on block-chain technology. ACM International Conference Proceeding Series, 8, 53–58. [Google Scholar] [CrossRef]

- Yermack, D. (2017). Corporate governance and blockchains. Review of Finance, 21(1), 7–31. [Google Scholar] [CrossRef]

- Yoana, C. (2024, April). EY launches opschain contract manager for business agreements. Erp.Today. Available online: https://erp.today/ey-launches-opschain-contract-manager-for-secure-private-business-agreements/ (accessed on 23 July 2025).

- Yu, T., Lin, Z., & Tang, Q. (2018). Blockchain: The introduction and its application in financial accounting. Journal of Corporate Accounting and Finance, 29(4), 37–47. [Google Scholar] [CrossRef]

- Zhang, W., & Zhu, M. (2022). Environmental accounting system model based on artificial intelligence blockchain and embedded sensors. Computational Intelligence and Neuroscience, 2022, 1–11. [Google Scholar] [CrossRef]

- Zhao, Y., Zhang, W., & Huang, R. (2022, February 24–26). The mechanism of blockchain technology influencing management accounting. 2022 3rd Asia Service Sciences and Software Engineering Conference (pp. 21–29), Macau, China. [Google Scholar] [CrossRef]

- Zheng, R. (2021). Applications research of blockchain technology in accounting system. Journal of Physics: Conference Series, 1955(1), 012068. [Google Scholar] [CrossRef]

- Zheng, Z., Xie, S., Dai, H., Chen, X., & Wang, H. (2017, June 25–30). An overview of blockchain technology: Architecture, consensus, and future trends. 2017 IEEE International Congress on Big Data (BigData Congress) (pp. 557–564), Honolulu, HI, USA. [Google Scholar] [CrossRef]

- Zhong, M., & Fan, T. (2021). Research on the integration of corporate financial accounting and management accounting under big data and block chain. Journal of Physics: Conference Series, 1827(1), 012202. [Google Scholar] [CrossRef]

| Category | Definition | Illustrative Keywords/Coding Examples |

|---|---|---|

| Article Type | Classifies the methodological nature of the study (e.g., theoretical, empirical, review) | Theoretical; empirical; qualitative study; quantitative analysis; systematic review; case study |

| Blockchain Literature Breadth | Indicates whether the article treats blockchain as a singular, generic concept or distinguishes between different types of blockchain systems | General: generalized use without specifying type; Moderate: public/private, permissioned, etc.; Extensive: differentiation between specific chains and implementations |

| Blockchain Specification | Captures whether the article refers to a specific blockchain platform, such as Ethereum, Hyperledger, or private blockchains, for accounting or reporting purposes | Mentions Ethereum, Hyperledger, Tezos, etc., in an applied context; not applicable when the paper is a review. |

| Oracle Mention | Describes whether and how the article discusses the concept of oracles or the oracle problem | Direct mention: “oracle problem,” “oracle mechanism”; Indirect: “sensors”, “RFID”, “unverifiable source” |

| Overexpectations Present | Identifies whether the article includes overstated claims about blockchain’s capabilities (based on the predefined expectations listed in Appendix B Table A1) | Immutable truth; blockchain eliminates fraud; no need for auditors; fully automated trust; no human intervention |

| Main Topics Discussed | Classifies the dominant themes of the paper within the accounting and reporting field | ESG reporting; triple-entry accounting; real-time accounting; auditing; financial reporting; governance impact |

| Theme | Mentioned Oracle | Mentioned Oracle Problem | Mentioned Both | None | Total |

|---|---|---|---|---|---|

| General A&A | 17 | 12 | 17 | 63 | 109 |

| ESG Reporting | 9 | 0 | 9 | 7 | 25 |

| Governance and Trust | 1 | 3 | 0 | 6 | 10 |

| Accounting Professions | 3 | 7 | 5 | 20 | 35 |

| Adoption and Acceptance | 0 | 3 | 1 | 22 | 26 |

| Triple-Entry Accounting | 7 | 3 | 0 | 18 | 28 |

| Real-Time Accounting | 4 | 2 | 0 | 19 | 25 |

| Overexpectations in Blockchain-Based Accounting | References | Clarification | References |

|---|---|---|---|

| The blockchain encryption mechanism ensures the reliability and authenticity of accounting information. | (Matringe & Power, 2024; Y. Tang, 2021; R. Zheng, 2021) | Blockchain guarantees immutability to a certain extent but not truthfulness. Oracles can verify truthfulness only if a specific design is implemented. | (Gauthier & Brender, 2021; Autore et al., 2024; Lobanchykova et al., 2024; Al-Breiki et al., 2020) |

| If a node has false information, all the information reported on this node will be rejected by other nodes. | (Zhong & Fan, 2021; Yang, 2020; Fang et al., 2023; Li, 2023; Johri et al., 2022) | Nodes are unaware of the true validity of the transaction; they simply verify whether the input is unspent. Arbitrary data inserted by oracles are not verified for validity. | (Sargent, 2022; Coyne & McMickle, 2017; Damjan, 2018; Caldarelli, 2020b) |

| Smart contracts can automatically monitor transactions and predict fraud. | (Thies et al., 2023; Dai & Vasarhelyi, 2017; Alrfai et al., 2024; Zhao et al., 2022) | Smart contracts cannot provide more automation than any other regular computer program. Oracles can perform off-chain computations, but they are not infallible. | (Antonopoulos & Woods, 2018; Song, 2018; Frankenreiter, 2019; Mühlberger et al., 2020; Caldarelli, 2021) |

| Blockchain can reduce intermediaries and eliminate the work of auditors. | (Abu Afifa et al., 2023; Yu et al., 2018; He, 2021; Lindawati et al., 2023) | Auditors are essential for evaluating the reliability of third-party oracles and cannot be eliminated. | (Alles & Gray, 2023; Tan & Low, 2019; Sheldon, 2021a, 2021b; Fang et al., 2023) |

| Blockchains can be leveraged as a decentralized database for accounting transactions. | (R. Zheng, 2021; Byström, 2019) | Blockchains have extremely limited data storage. Storing large quantities of data can be expensive and is often opposed. | (Mercanti et al., 2018; BitMex-Research, 2022; Bistarelli et al., 2019) |

| Oracle Mechanism | Accounting Application | Reference |

|---|---|---|

| Buyers and sellers sign the transaction and take responsibility for the veracity of data. | TEA | (Kao & Tsay, 2023; Pan et al., 2023) |

| A fingerprint is associated with the transactions in the double-entry ledger, and both fingerprints are inserted into the third-entry ledger. | TEA, general accounting, and auditing | (Sunde & Wright, 2023; Kafshdar Goharshady et al., 2018) |

| Use IoT to put data on the chain. | General accounting and auditing, real-time accounting | (Faccia et al., 2020, 2021; Maiti et al., 2021; J. Wu et al., 2019; Mingming, 2020) |

| An authority signs the transaction and takes responsibility for its veracity. | General accounting and auditing, credit risk reporting, tax reporting | (Rozario & Thomas, 2019; Kafshdar Goharshady et al., 2018; Sarwar et al., 2021; Anwar et al., 2019) |

| Data are scattered among peers, and multi-party security is used to mimic a trusted party. | Real-time accounting | (McCallig et al., 2019) |

| Auditors are oracles. | Accounting professions | (Sheldon, 2021a, 2021b) |

| Oracle Mechanism | References |

|---|---|

| System of IoTs, continuous data gathering, and multiple checks with complex algorithms to ensure IoTs’ reliability, eliminate outliers, and ensure data veracity. | (Chen et al., 2024; W. Wu et al., 2022a, 2022b) |

| An attestation service guarantees that non-financial data come from the designated source. | (Heiss et al., 2024) |

| Companies or authorized stakeholders are oracles and retain full responsibility for the uploaded data. | (Q. Tang & Tang, 2019; Luo et al., 2024) |

| Research Question | Answer |

|---|---|

| Does the academic literature on blockchain and accounting’s integration consider the roles and limitations of oracles? | Of the papers in the final sample, 32% included content on oracles, and 17% mentioned the limitations of oracles. However, only 12% provided information on how to design oracles for accounting purposes. |

| What characteristics of the literature are associated with greater attention to oracles and the oracle problem in blockchain-based accounting research? | The accounting literature on oracles is primarily empirical, focused on specific chains, and addresses topics such as general accounting and auditing implementations and ESG reporting. |

| Under the rationale that neglecting the integration of an oracle constitutes a theoretical bias, what portion of the literature exhibits such a bias? | Of the total sample, 25% included overexpectations about blockchain’s potential; however, of the articles that mentioned the oracle problem, only 6% included overexpectations. |

| What types of oracles are proposed in the accounting field? | The oracle role is expected to be performed by the following:

|

| Which blockchain-based accounting integration shows more robust or advanced research on the role of oracles? | The ESG reporting literature shows advanced oracle mechanisms, although only in a few papers. Practical implementations are considered feasible. Oracles have not been studied from the viewpoint of accounting professionals, but they should be prepared to audit price oracles. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Caldarelli, G. Integration of Blockchain in Accounting and ESG Reporting: A Systematic Review from an Oracle-Based Perspective. J. Risk Financial Manag. 2025, 18, 491. https://doi.org/10.3390/jrfm18090491

Caldarelli G. Integration of Blockchain in Accounting and ESG Reporting: A Systematic Review from an Oracle-Based Perspective. Journal of Risk and Financial Management. 2025; 18(9):491. https://doi.org/10.3390/jrfm18090491

Chicago/Turabian StyleCaldarelli, Giulio. 2025. "Integration of Blockchain in Accounting and ESG Reporting: A Systematic Review from an Oracle-Based Perspective" Journal of Risk and Financial Management 18, no. 9: 491. https://doi.org/10.3390/jrfm18090491

APA StyleCaldarelli, G. (2025). Integration of Blockchain in Accounting and ESG Reporting: A Systematic Review from an Oracle-Based Perspective. Journal of Risk and Financial Management, 18(9), 491. https://doi.org/10.3390/jrfm18090491