Expected Credit Spreads and Market Choice: Evidence from Japanese Bond Issuers

Abstract

1. Introduction

2. The Related Literature

2.1. Theoretical Underpinning

2.2. The Empirical Literature

2.3. Hypothesis Development

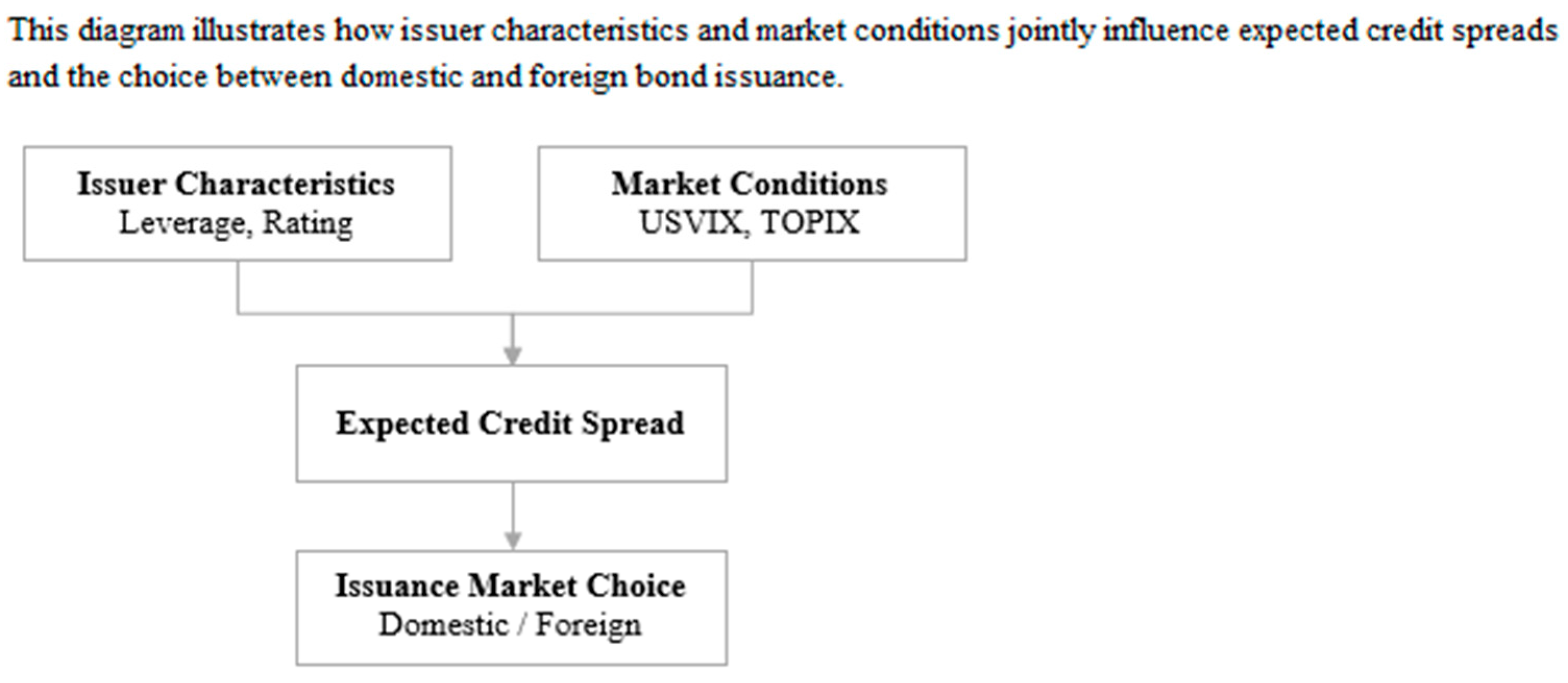

3. Methodology

3.1. Econometric Framework

- Step 1: Credit Spread Determination

- Step 2: Market Choice Model

3.2. Data and Variable Construction

4. Results and Analysis

4.1. Results

4.2. Robustness

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BOJ | Bank of Japan |

| CBOE | Chicago Board Options Exchange |

| CS | Credit Spread Index |

| JGB | Japanese Government Bonds |

| JPVIX | Japan Volatility Index |

| QE3 | Quantitative Easing 3 |

| S&P 500 | Standard & Poor’s 500 Composite Stock Price Index |

| SMEs | Small and Medium-Sized Enterprises |

| TOPIX | Tokyo Stock Price Index |

| UST | U.S. Treasuries |

| USVIX | U.S. Volatility Index |

| VIX | Volatility Index |

References

- Ahwireng-Obeng, A. S., & Ahwireng-Obeng, F. (2022). Corporate bond issuance behaviour in African emerging markets. Journal of African Business, 23, 126–145. [Google Scholar] [CrossRef]

- Anderson, G., & Cesa-Bianchi, A. (2024). Crossing the credit channel: Credit spreads and firm heterogeneity. American Economic Journal: Macroeconomics, 16, 417–446. [Google Scholar] [CrossRef]

- Badoer, D. C., & James, C. M. (2016). The determinants of long-term corporate debt issuances. The Journal of Finance, 71(1), 457–492. [Google Scholar] [CrossRef]

- Bank of Japan. (2025). Developments in the functioning of the JGB markets. BOJ Review, 3. Available online: https://www.boj.or.jp/en/research/wps_rev/rev_2025/rev25e03.htm:2025-E (accessed on 5 August 2025).

- Bhattacharyay, B. N. (2013). Determinants of bond market development in Asia. Journal of Asian Economics, 24, 124–137. [Google Scholar] [CrossRef]

- Chetty, R., Friedman, J. N., Stepner, M., & Opportunity Insights Team. (2024). The economic impacts of COVID-19: Evidence from a new public database built using private sector data. The Quarterly Journal of Economics, 139, 829–889. [Google Scholar] [CrossRef] [PubMed]

- Collin-Dufresn, P., Goldstein, R. S., & Martin, J. S. (2001). The determinants of credit spread changes. The Journal of Finance, 56, 2177–2207. [Google Scholar] [CrossRef]

- Duca, M. L., Nicoletti, G., & Martinez, A. V. (2016). Global corporate bond issuance: What role for US quantitative easing? Journal of International Money and Finance, 60, 114–150. [Google Scholar] [CrossRef]

- Fatmawatie, N., Endri, E., & Husein, D. (2024). Macroeconomic factors and government bond yield in Indonesia. Public and Municipal Finance, 13, 95–105. [Google Scholar] [CrossRef]

- Feyen, E., Ghosh, S., Kibuuka, K., & Farazi, S. (2015). Global liquidity and external bond issuance in emerging markets and developing economies (Working Paper No. 7363). World Bank. [Google Scholar] [CrossRef]

- Huang, J. Z., Nozawa, Y., & Shi, Z. (2025). The global credit spread puzzle. The Journal of Finance, 80, 101–162. [Google Scholar] [CrossRef]

- Mertzanis, C., & Tebourbi, I. (2025). Geopolitical risk and global green bond market growth. European Financial Management, 31, 26–71. [Google Scholar] [CrossRef]

- Miller, D. P., & Puthenpurackal, J. J. (2005). Security fungibility and the cost of capital: Evidence from global bonds. Journal of Financial and Quantitative Analysis, 40, 849–872. [Google Scholar] [CrossRef]

- Mizen, P., & Tsoukas, S. (2014). What promotes greater use of the corporate bond market? A study of the issuance behaviour of firms in Asia. Oxford Economic Papers, 66, 227–253. [Google Scholar] [CrossRef]

- Ochi, K., & Osada, M. (2024). Market functioning in the Japanese corporate bond market (Bank of Japan Working Paper Series No. 24-E-05). Bank of Japan. Available online: https://www.boj.or.jp/en/research/wps_rev/wps_2024/data/wp24e05.pdf (accessed on 5 August 2025).

- Okimoto, T., & Takaoka, S. (2024). Sustainability and credit spreads in Japan. International Review of Financial Analysis, 91, 103052. [Google Scholar] [CrossRef]

- Tawatnuntachai, O., & Yaman, D. (2007). Why do firms issue global bonds? Managerial Finance, 34, 23–40. [Google Scholar] [CrossRef]

- Wang, Q., Zhou, Y., Luo, L., & Ji, J. (2019). Research on the factors affecting the risk premium of China’s green bond issuance. Sustainability, 11, 6394. [Google Scholar] [CrossRef]

- Wang, X., Luo, Y., & Zhu, Z. (2023). Capital account liberalization and international corporate bond issuance: Transaction-level evidence from China. China and World Economy, 31, 156–178. [Google Scholar] [CrossRef]

- Zhu, Y. (2013). Determinants of long-term debt issuing decisions: An alternative approach. Australian Journal of Management, 38, 429–439. [Google Scholar] [CrossRef]

| Variable Name | Description | Type | Source/Notes |

|---|---|---|---|

| CS | Credit spread at issuance (corporate bond yield minus matched government bond yield) | Dependent (Step 1) | Calculated from bond issuance data and government bond yields |

| Foreign Dummy | Indicator for foreign bond issuance (1 = foreign, 0 = domestic) | Independent | Categorical variable identifies issuance location |

| Credit rating | Firm’s credit rating (converted to numeric scale: 1 = highest, 10 = lowest) | Independent | Moody’s ratings, investment-grade only |

| Leverage | Firm’s leverage ratio (total liabilities/total assets) | Independent | Firm-level financial data from EOL database |

| JPVIX | Japan Volatility Index | Market control | Proxy for domestic market uncertainty |

| USVIX | U.S. Volatility Index | Market control | Proxy for global market uncertainty |

| TOPIX | Tokyo Stock Price Index | Market control | Proxy for domestic equity market conditions |

| S&P 500 | Standard & Poor’s 500 Index | Market control | Proxy for foreign equity market conditions |

| Prob(Foreign Issue) | Probability of foreign bond issuance | Dependent (Step 2) | Modeled using fixed-effects logit regression |

| ^CS | Expected credit spread (predicted from Step 1 regression) | Independent (Step 2) | Used in Step 2 to model market choice |

| JGB | Yield on matched Japanese Government Bond | Market control | Used to calculate domestic credit spread |

| UST | Yield on matched U.S. Treasury Bond | Market control | Used to calculate foreign credit spread |

| Maturity year | Bond maturity in years | Control variable | Bond-level data |

| Interest rate | Coupon rate of the bond | Control variable | Bond-level data |

| Obs | Mean | Std. Dev | Min | Max | Unit/Notes | |

|---|---|---|---|---|---|---|

| CS | 465 | 0.325 | 0.358 | −0.001 | 2.410 | Credit spread index |

| Foreign Dummy | 471 | 0.312 | 0.464 | 0.000 | 1.000 | Dummy Variable |

| Leverage rate | 471 | 0.825 | 0.120 | 0.233 | 0.967 | Ratio |

| Credit rating | 471 | 4.548 | 1.104 | 2.000 | 10.000 | Rating scale (1–10) |

| Issuance (JPY) | 324 | 26,795.68 | 19,622.70 | 5000 | 120,000 | Millions of Yen |

| Issuance (USD) | 147 | 895.995 | 493.509 | 53 | 2500 | Millions of USD |

| Interest rate | 471 | 1.140 | 1.106 | 0.001 | 5.000 | % |

| Maturity year | 471 | 7.531 | 5.901 | 2.000 | 40.000 | Year |

| JGB | 471 | 0.301 | 0.467 | −0.376 | 2.128 | Yield spread (bps) |

| UST | 442 | 1.778 | 0.829 | 0.240 | 4.520 | Yield spread (bps) |

| TOPIX | 471 | 1237.612 | 337.209 | 716.840 | 1911.070 | Index level |

| SP500 | 471 | 1907.950 | 556.850 | 1064.880 | 3096.630 | Index level |

| JPVIX | 471 | 21.797 | 4.897 | 13.880 | 36.600 | VIX |

| USVIX | 471 | 16.317 | 4.917 | 9.510 | 37.810 | VIX |

| Foreign Dummy | CS | Leverage Rate | Credit Rating | JGB | UST | TOPIX | SP500 | JPVIX | USVIX | |

|---|---|---|---|---|---|---|---|---|---|---|

| Foreign Dummy | 1 | |||||||||

| CS | 0.798 | 1 | ||||||||

| Leverage rate | 0.022 | −0.051 | 1 | |||||||

| Credit rating | 0.200 | 0.317 | −0.186 | 1 | ||||||

| JGB | −0.250 | −0.183 | −0.135 | −0.329 | 1 | |||||

| UST | −0.055 | −0.120 | −0.278 | 0.094 | 0.536 | 1 | ||||

| TOPIX | 0.216 | 0.154 | −0.181 | 0.520 | −0.460 | 0.312 | 1 | |||

| SP500 | 0.213 | 0.164 | −0.209 | 0.577 | −0.548 | 0.234 | 0.924 | 1 | ||

| JPVIX | −0.080 | −0.019 | 0.107 | −0.319 | 0.308 | −0.089 | −0.407 | −0.524 | 1 | |

| USVIX | −0.131 | −0.067 | −0.033 | −0.225 | 0.275 | −0.050 | −0.471 | −0.443 | 0.437 | 1 |

| Model | ||||||

|---|---|---|---|---|---|---|

| 1 | 2 | |||||

| Variable | Coef. | SE | Sig | Coef. | SE | Sig |

| Credit Spread (CS) | ||||||

| Foreign Dummy | 0.621 | 0.100 | *** | 0.617 | 0.103 | *** |

| Leverage | 0.718 | 0.475 | −0.166 | 0.232 | ||

| Credit rating | 0.092 | 0.080 | 0.087 | 0.037 | ** | |

| TOPIX | 0.000 | 0.000 | * | |||

| S&P 500 | 0.000 | 0.000 | ||||

| JPVIX | 0.007 | 0.002 | ** | |||

| USVIX | −0.005 | 0.003 | ||||

| JGB | −0.052 | 0.038 | ||||

| UST | 0.037 | 0.033 | ||||

| Constant | −0.872 | 0.590 | 0.402 | 0.356 | ||

| Observations | 465 | 442 | ||||

| R-squared | 0.772 | 0.673 | ||||

| Year FE | Yes | Yes | ||||

| Dependent Variable: Foreign Bond Issuance Dummy | |||||||||

| Model | |||||||||

| 1 | 2-1 | 2-2 | |||||||

| Variable | Coef. | SE | Sig | Coef. | SE | Sig | Coef. | SE | Sig |

| CS | 36.005 | 9.143 | *** | 49.106 | 16.488 | *** | 49.106 | 16.488 | *** |

| Leverage | 62.002 | 54.784 | 128.72 | 62.713 | ** | 128.72 | 62.713 | ** | |

| Credit rating | −2.35 | 1.24 | * | −4.739 | 1.902 | ** | −4.739 | 1.902 | ** |

| TOPIX | 0.008 | 0.003 | ** | 0.008 | 0.003 | ** | |||

| S&P 500 | |||||||||

| JPVIX | |||||||||

| USVIX | −0.207 | 0.215 | −0.207 | 0.215 | |||||

| JGB | |||||||||

| UST | |||||||||

| Observations | 465 | 465 | 465 | ||||||

| LR chi2(3) | 365.08 | *** | 374.16 | *** | 374.16 | *** | |||

| Number of Issuers | 13 | 13 | 13 | ||||||

| Fixed Effects | Issuer-level (conditional logit) | Issuer-level (conditional logit) | Issuer-level (conditional logit) | ||||||

| Model | |||||||||

| 2-3 | 2-4 | 2-5 | |||||||

| Variable | Coef. | SE | Sig | Coef. | SE | Sig | Coef. | SE | Sig |

| CS | 35.051 | 9.019 | *** | 45.217 | 14.181 | *** | 48.878 | 15.552 | *** |

| Leverage | 68.909 | 55.363 | 115.401 | 50.357 | ** | 122.548 | 57.203 | ** | |

| Credit rating | −2.705 | 1.411 | * | −4.152 | 1.609 | *** | −3.23 | 1.608 | ** |

| TOPIX | 0.009 | 0.007 | |||||||

| S&P 500 | −0.001 | 0.003 | |||||||

| JPVIX | −0.31 | 0.15 | ** | ||||||

| USVIX | −0.275 | 0.217 | |||||||

| JGB | −2.229 | 3.712 | |||||||

| UST | 1.445 | 1.197 | |||||||

| Observations | 442 | 465 | 465 | ||||||

| LR chi2(3) | 352.77 | *** | 373.29 | *** | 372.19 | *** | |||

| Number of Issuers | 13 | 13 | 13 | ||||||

| Fixed Effects | Issuer-level (conditional logit) | Issuer-level (conditional logit) | Issuer-level (conditional logit) | ||||||

| Model | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | 1 | 2 | 3-1 | 3-2 | 3-3 | 3-4 | 4 | ||||||

| Credit Spread (CS) | |||||||||||||

| Leverage rate | 1.542 | 0.785 | 0.985 | ** | 0.581 | 0.961 | * | 1.008 | * | 0.856 | |||

| Credit rating | 0.064 | 0.097 | 0.084 | 0.094 | 0.083 | 0.09 | 0.085 | ||||||

| Foreign Dummy (Foreign) | 0.577 | * | 0.555 | *** | 0.534 | *** | 1.026 | *** | 1.087 | *** | 0.160 | ||

| Foreign × Credit rating | −0.017 | ||||||||||||

| Foreign × Leverage rate | 0.147 | ||||||||||||

| Foreign × JGB | 0.405 | *** | |||||||||||

| Foreign × UST | 0.051 | ||||||||||||

| Foreign × TOPIX | −0.003 | ** | |||||||||||

| Foreign × S&P 500 | 0.000 | *** | |||||||||||

| Foreign × JPVIX | 0.019 | *** | |||||||||||

| Foreign × USVIX | 0.003 | ||||||||||||

| Constant | −1.2389 | −0.951 | −1.05 | * | −0.772 | −1.026 | −1.094 | * | −0.932 | ||||

| Observations | 465 | 465 | 465 | 442 | 465 | 465 | 465 | ||||||

| R-squared | 0.329 | 0.77 | 0.717 | 0.774 | 0.787 | 0.794 | 0.792 | ||||||

| F-statistic | 1.46 | 12.01 | *** | 20.12 | *** | 18.17 | *** | 16.83 | *** | 18.99 | *** | 13.25 | *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shiiyama, I. Expected Credit Spreads and Market Choice: Evidence from Japanese Bond Issuers. J. Risk Financial Manag. 2025, 18, 490. https://doi.org/10.3390/jrfm18090490

Shiiyama I. Expected Credit Spreads and Market Choice: Evidence from Japanese Bond Issuers. Journal of Risk and Financial Management. 2025; 18(9):490. https://doi.org/10.3390/jrfm18090490

Chicago/Turabian StyleShiiyama, Ikuko. 2025. "Expected Credit Spreads and Market Choice: Evidence from Japanese Bond Issuers" Journal of Risk and Financial Management 18, no. 9: 490. https://doi.org/10.3390/jrfm18090490

APA StyleShiiyama, I. (2025). Expected Credit Spreads and Market Choice: Evidence from Japanese Bond Issuers. Journal of Risk and Financial Management, 18(9), 490. https://doi.org/10.3390/jrfm18090490