Effects of Civil Wars on the Financial Soundness of Banks: Evidence from Sudan Using Altman’s Models and Stress Testing

Abstract

1. Introduction

2. Literature Review

- How accurately do Altman’s Z-score models predict the financial stability of Sudanese commercial banks, using audited financial ratios from 2016 to 2022?

- Which model (Model 3 or Model 4) demonstrates stronger predictive validity under Sudan’s conditions?

- How do conflict-driven stress scenarios affect liquidity, capital adequacy, and credit risk among Sudanese commercial banks?

2.1. Altman’s Z-Score Models and Bankruptcy Prediction

- X1 (liquidity): This ratio indicates a bank’s liquidity, efficiency, and overall financial soundness through comparison with its total assets (including both short- and long-term assets). The liquidity ratio reflects a bank’s liquidity and its capacity to pay short-term debts to creditors.

- X2 (retained earnings): This ratio reflects a bank’s cumulative profitability, assessing profits that have been held for many years from net earnings and not distributed to shareholders.

- X3 (profitability): This ratio measures a bank’s operational efficiency and profitability, independent of its financing and tax structures.

- A higher X3 value reflects better asset productivity, implying that the bank is generating more earnings from its asset base, which is a positive sign for creditors and investors, according to Rashid et al. (2023).

- X4 (leverage): This ratio measures a bank’s financial leverage and solvency by comparing its equity to its liabilities. A high X4 value suggests strong equity relative to liabilities, indicating that the bank has a solid buffer to absorb potential losses, thereby lowering its risk of bankruptcy. A robust X4 ratio demonstrates that the bank has sufficient equity to cover its liabilities, enhancing its creditworthiness and financial stability according to Rashid et al. (2023). Overall, higher values generally indicate a healthier financial position and a lower risk of bankruptcy.

2.2. Stress Testing in Conflict-Prone Economies

2.3. Literature Gaps and Contribution of the Study

3. Research Methodology

3.1. Justification and Model Selection

3.2. Conceptual Link Between Variables and Altman Models

- Liquidity (X1): It equals the ratio of working capital to total assets—measures a bank’s ability to meet its short-term obligations.

- Retained earnings (X2): Expresses retained earnings as a share of total assets, reflecting the extent of self-financing and the historical buildup of profits.

- Profitability (X3): A measure derived from EBIT over total assets, capturing the efficiency of asset use in producing operating earnings.

- Leverage (X4): Calculated as equity divided by total liabilities, this indicator assesses financial stability and capital sufficiency.

3.3. Data Collection and Sample Description

- Audited annual reports of Sudanese commercial banks, as published by the Central Bank of Sudan (2016–2022);

- Macroeconomic indicators and financial soundness measures from international databases and statistical bulletins.

3.4. Stress Testing Design and Intensity Levels

3.4.1. Stress Testing Framework and Hypotheses

3.4.2. Explanation of Stress Testing and Intensity Levels

3.5. Financial Indicators and Measurement Tools

3.6. Integration of Altman Models and Stress Testing

4. Application of Altman’s Z-Score Models and Stress Testing

4.1. Macroeconomic Context of Sudan (2016–2022)

4.2. Conceptual Framework for Altman Z-Score Analysis

4.3. Stress Testing Scenarios and Hypotheses

4.3.1. Low-Conflict Scenario (16.4% Stress Level)

4.3.2. High-Conflict Scenario (25% Stress Level)

5. Results and Discussion

5.1. Altman Z-Score Analysis (2016–2022)

5.1.1. Altman Z′-Score Analysis

5.1.2. Altman Z″-Score Analysis

5.1.3. Relationship Between Z-Score Results and Financial Components

- Liquidity (X1) demonstrated a near-perfect positive correlation with both the Z′- and Z″-scores. This indicates that liquidity is the most significant determinant of financial soundness in this context. The banks’ Z-scores increased as liquidity improved, suggesting enhanced capacity to absorb shocks and maintain stability. This finding supports Altman et al. (2017), who emphasized the role of working capital in bank stability during crises.

- Retained earnings (X2) and profitability (X3) showed moderate-to-strong positive correlations (approximately 0.49 and 0.54, respectively), suggesting that internal capital generation and operational efficiency significantly contribute to financial health. These results align with Mennawi (2020), who found that internal funding sources were crucial for bank resilience in constrained environments such as Sudan.

5.1.4. Conclusion for Altman’s Z-Scores Analysis (2016–2022)

5.1.5. Summary of Altman’s Z-Score Findings

5.2. Stress Testing Analysis (2022–2028)

5.2.1. Baseline Assessment of Financial Indicators Prior to Conflict

5.2.2. Stress Test Modeling Framework

5.2.3. Low-Conflict Scenario (16.4% Stress Level)

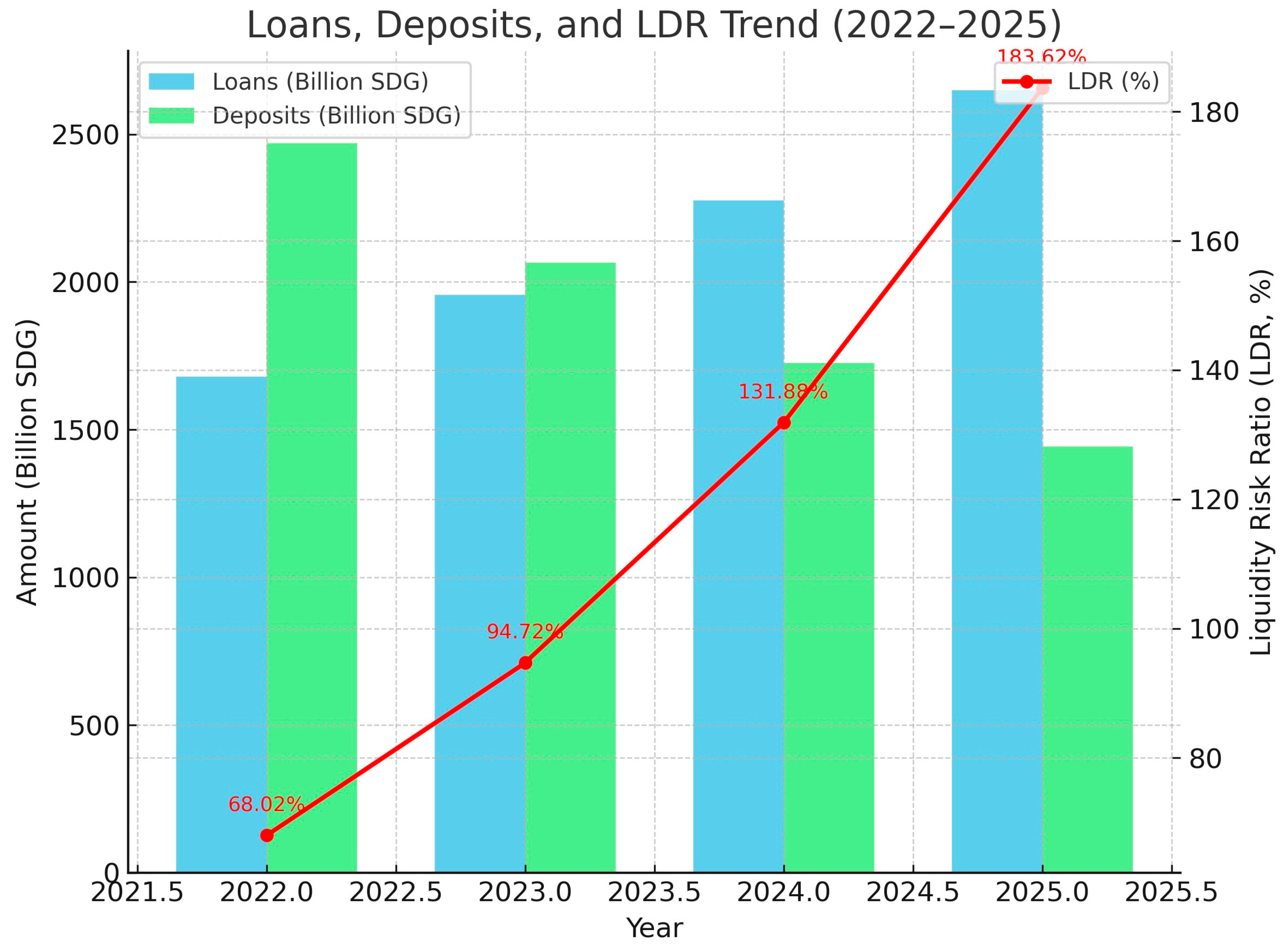

Liquidity Risk Analysis

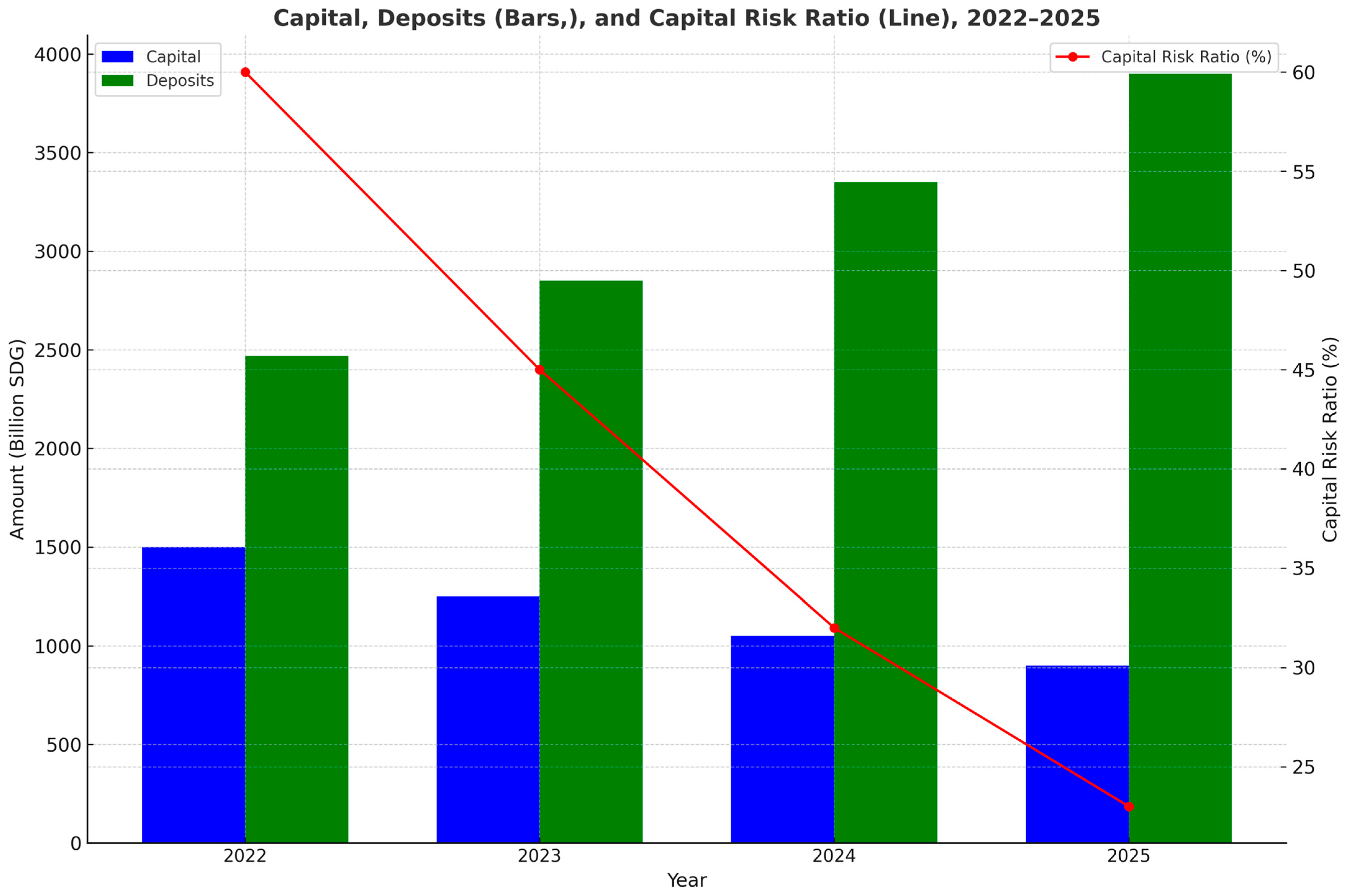

Capital Risk Analysis

Credit Risk Analysis

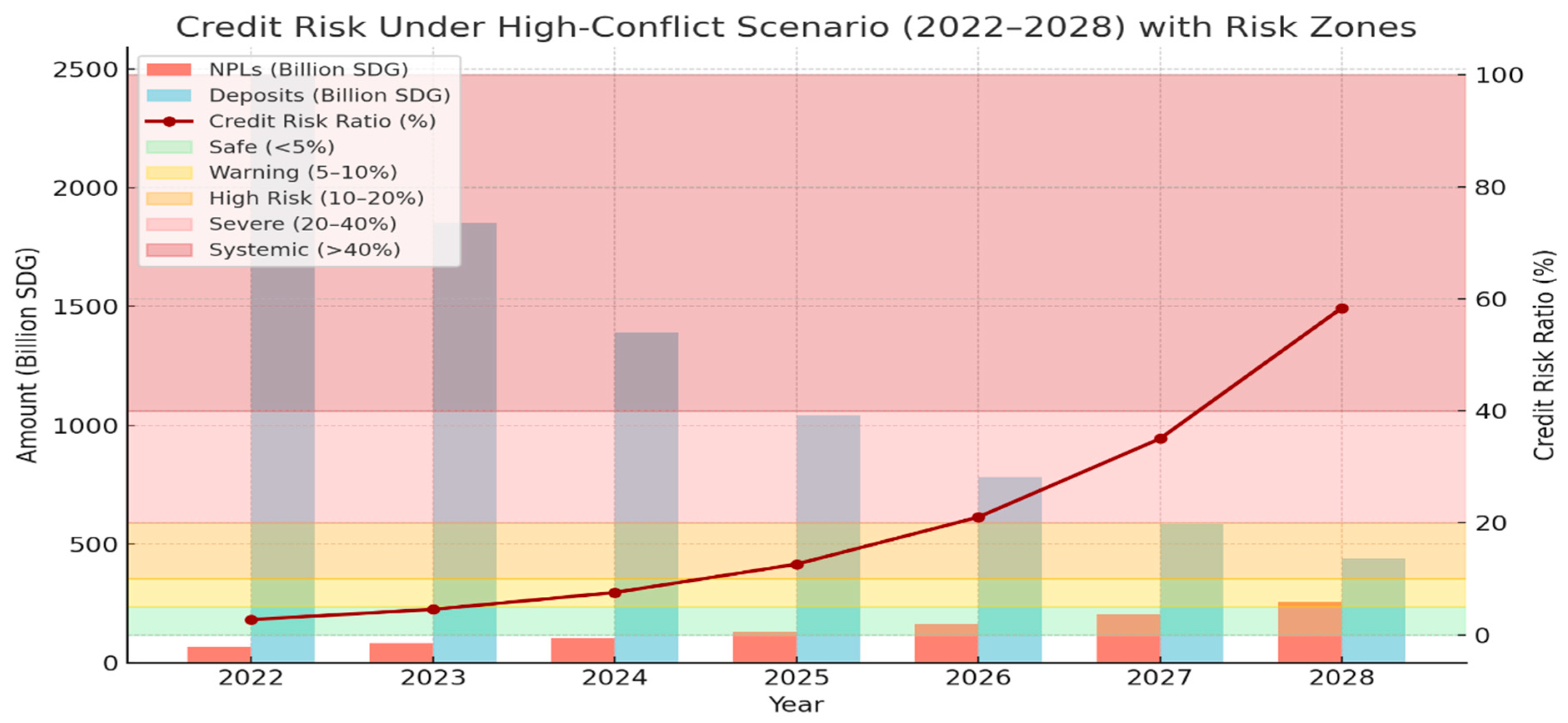

5.2.4. High-Conflict Scenario (25% Stress Level)

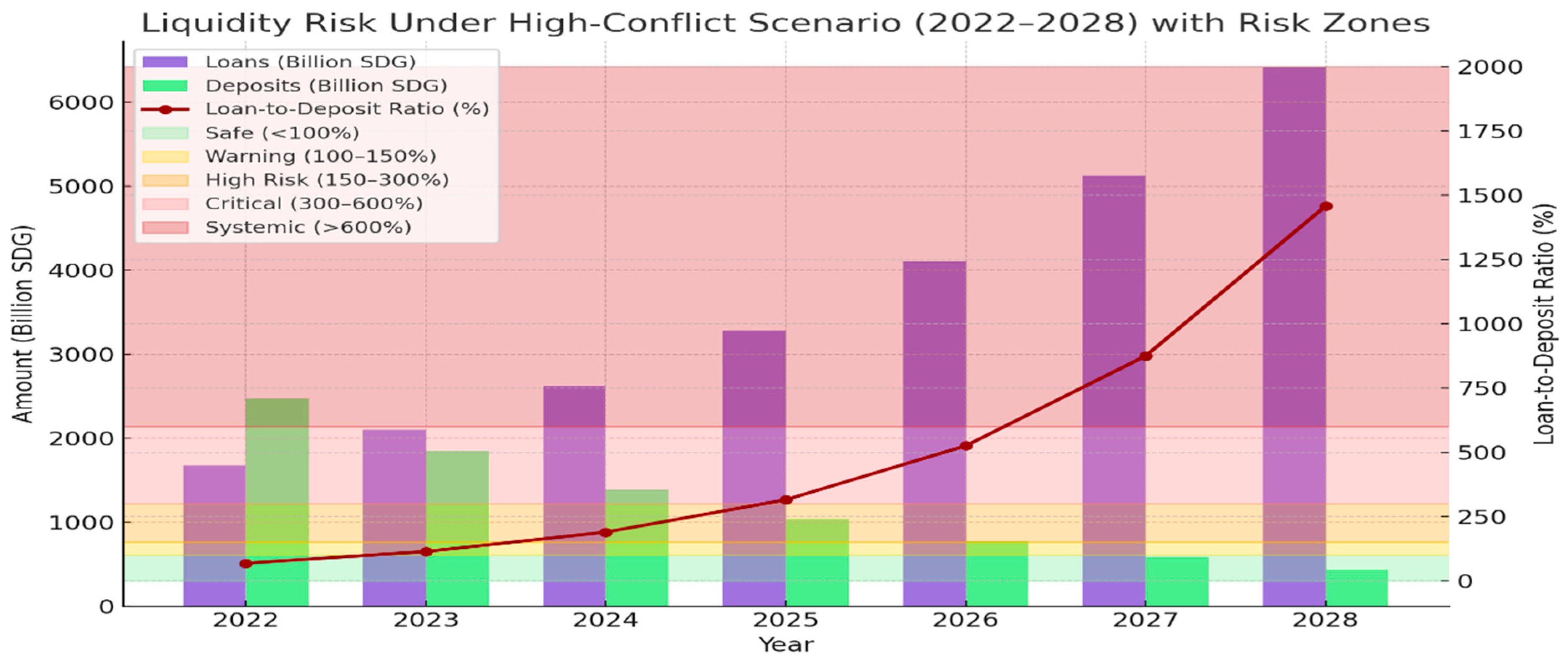

Liquidity Risk Analysis

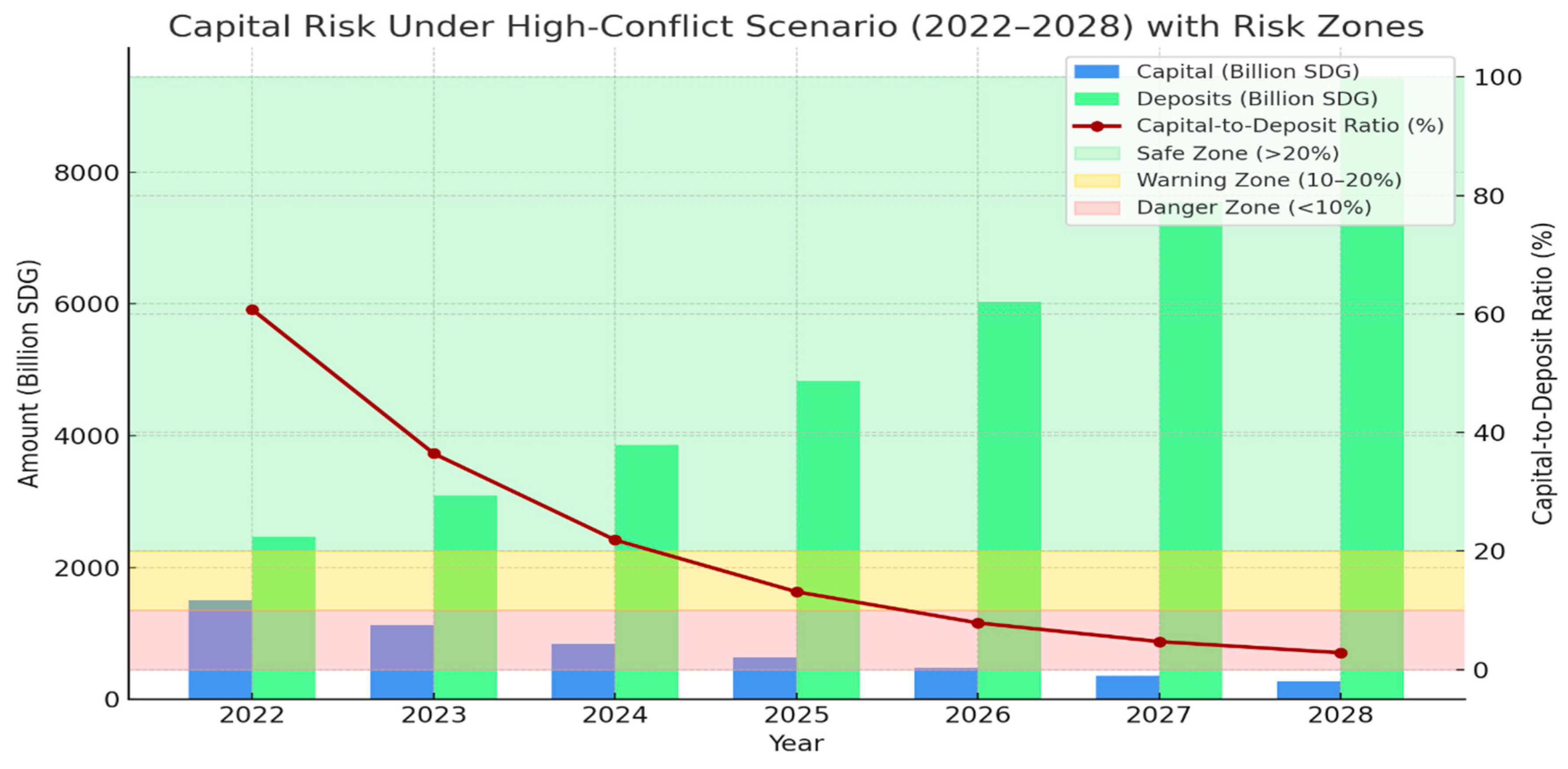

Capital Risk Analysis

Credit Risk Analysis

5.2.5. Conclusion for Stress Testing Analysis (2022–2028)

5.2.6. Summary of Stress Testing Findings

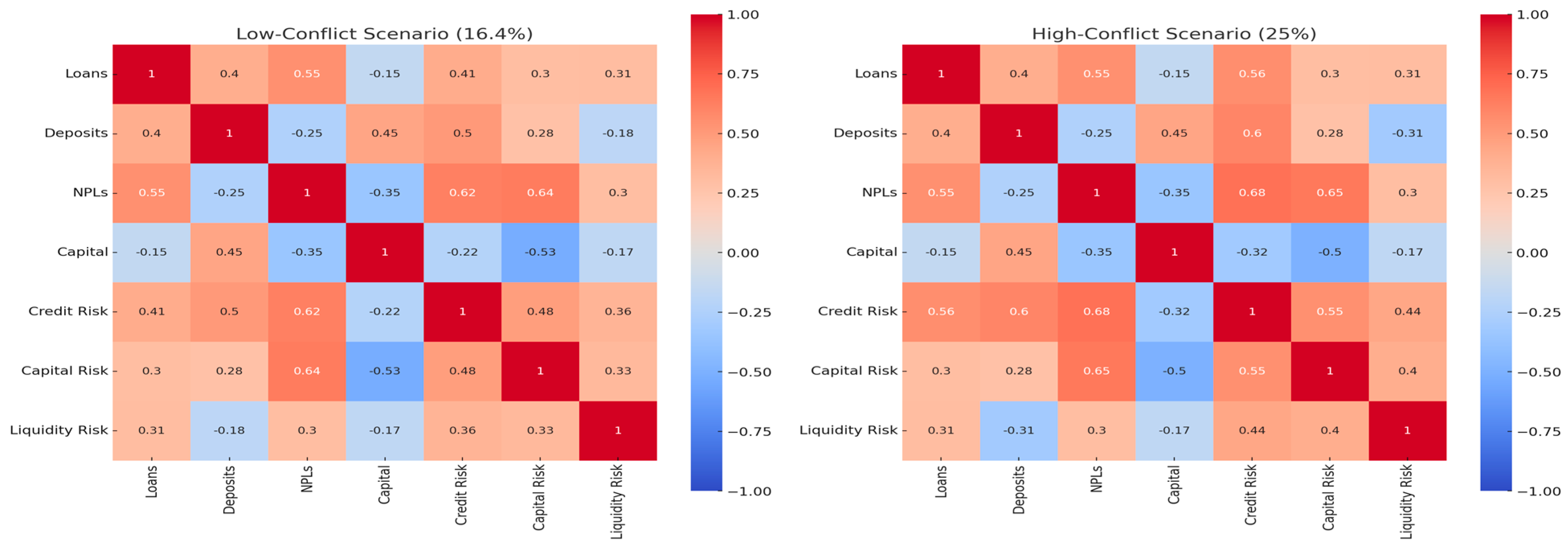

5.3. Correlation of Risk Factors Across Conflict Scenarios

Correlation Matrix by Conflict Scenario (Low- vs. High-Conflict Levels)

6. Findings, Limitations, and Recommendations

6.1. Summary of Key Findings

- Validation of Altman Z-score models—Both Models 3 and 4 accurately captured shifts in financial stability and distress signals in Sudanese banks, reinforcing their applicability in emerging markets under political instability.

- Liquidity as a primary determinant—Strong positive correlations between liquidity and the Z-scores underscore the centrality of liquidity management for resilience.

- Distinct leverage effects in Islamic banking—Positive leverage–Z-score correlations suggest that equity-based financing instruments, such as Mudarabah and Musharakah, mitigate traditional leverage risk.

- Conflict duration–risk escalation nexus—A longer conflict duration was shown to correlate with liquidity depletion, capital erosion, and rising credit risk, especially beyond 2028 under the high-conflict scenario.

- Stress testing alignment with historical patterns—Scenario analysis confirmed that even moderate conflicts can rapidly destabilize liquidity, capital, and asset quality.

6.2. Limitations

- Data Availability and Reliability: Publicly reported financial data may be incomplete or delayed, particularly under conflict conditions.

- Model Scope and Assumptions: Altman’s Z-Score models are accounting-based and may not fully capture forward-looking risks or off-balance-sheet exposures.

- Sectoral Concentration in Islamic Banking: Positive leverage–Z-score correlations may not generalize across banks with concentrated sectoral exposures.

- Political and Macroeconomic Uncertainties: Projections beyond 2028 assume relative macroeconomic stability; unexpected global shocks could affect outcomes.

6.3. Future Research Directions:

- Integrate market-based risk measures (e.g., CDS spreads, interbank rates).

- Conduct bank-level behavioral analysis to capture governance and decision-making effects.

- Expand comparative studies to other fragile and conflict-affected states.

- Develop scenario expansions incorporating technological and cross-border contagion risks.

- Assess the impact of post-conflict regulatory reforms, including Basel III implementation.

6.4. Recommendations

- Prioritize Conflict Resolution for Financial Recovery: Sustainable stability in Sudan’s banking sector critically depends on ending the civil conflict. Post-conflict priorities should include restoring liquidity flows, recapitalizing banks, and re-establishing effective central bank oversight.

- Strengthen Prudential Regulation and Supervision: The Central Bank of Sudan should enforce capital adequacy and liquidity requirements more rigorously. Dynamic bank risk profiling and regular conflict-sensitive stress tests should be institutionalized to anticipate and mitigate systemic risk.

- Mandate Crisis Preparedness and Contingency Planning: Banks should maintain contingency reserves and crisis management plans to address conflict-driven risks such as sudden liquidity shocks, capital flight, and surges in non-performing loans (NPLs). Stress-testing exercises should be updated regularly to incorporate emerging conflict scenarios.

- Leverage Predictive Analytics in Supervisory Frameworks: Embedding Altman’s Z-Score models, along with scenario-based stress testing, into regulatory monitoring enhances early-warning capabilities. Predictive analytics can guide targeted interventions before systemic vulnerabilities crystallize.

- Institutional Capacity Building and Governance Enhancement: Collaboration between regulators, policymakers, and international partners is essential to improve technical expertise, governance practices, and risk management capabilities. Training programs should focus on conflict-sensitive financial oversight, liquidity risk management, and crisis response.

- Implement Basel III Standards and Risk-Based Supervision: Counter-cyclical capital buffers, liquidity coverage ratios, and enhanced risk-based supervision can reduce interbank contagion and strengthen systemic resilience. The Basel III framework should be adapted to Sudan’s unique economic and Islamic banking context, including allowances for equity-based financing instruments.

- Monitor Conflict Duration–Risk Nexus Continuously: Given the direct relationship between conflict duration and systemic fragility, regulators should continuously monitor macroeconomic and conflict indicators to adjust stress-test assumptions. Scenario planning should consider both moderate (16.4%) and severe (25%) stress levels, reflecting empirical evidence from the IMF and other conflict-affected states.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- ACAPS. (2023). Implications of financial blockages in Sudan. Available online: https://www.acaps.org/fileadmin/Data_Product/Main_media/20230811_ACAPS_thematic_report_in_Sudan_implication_of_financial_blockages.pdf (accessed on 20 March 2025).

- Al-Shboul, M., Maghyereh, A., Hassan, A., & Molyneux, P. (2020). Political risk and bank stability in the Middle East and North Africa region. Pacific-Basin Finance Journal, 60, 101291. [Google Scholar] [CrossRef]

- Alyousef, O. (2022). The effect of the Syrian crisis on the profitability of the country’s private banking sector. BAU Journal—Creative Sustainable Development, 4(1), 7. [Google Scholar] [CrossRef]

- Altman, E. I., Iwanicz-Drozdowska, M., Laitinen, E. K., & Suvas, A. (2017). Financial distress prediction in an international context: A review and empirical analysis of Altman’s Z-score model. Journal of International Financial Management & Accounting, 28(2), 131–171. [Google Scholar] [CrossRef]

- Arzhevitin, S., Bortnikov, G., Bublyk, Y., & Lyubich, O. (2023). Impact of martial state on the performance of the Ukrainian banking sector. Financial and Credit Activity: Problems of Theory and Practice, 1(48), 23–41. [Google Scholar] [CrossRef]

- Ashraf, S., Félix, E., & Serrasqueiro, Z. (2019). Do traditional financial distress prediction models predict the early warning signs of financial distress? Journal of Risk and Financial Management, 12, 55. [Google Scholar] [CrossRef]

- Badea, I., & Matei, G. (2016). The Z-Score model for predicting periods of financial instability. Z-Score estimation for the banks listed on bucharest stock exchange. (Finance—Challenges of the Future), University of Craiova, Faculty of Economics and Business Administration, 1(18), 24–35. Available online: https://ideas.repec.org/a/aio/fpvfcf/v1y2016i18p24-35.html (accessed on 1 November 2024).

- Beck, T., Iqbal, Z., & Mutlu, R. (2020). Do Islamic banks contribute to risk sharing? In Z. Iqbal (Ed.), Handbook of analytical studies in Islamic finance and economics (pp. 293–318). De Gruyter. [Google Scholar] [CrossRef]

- Boanta, R., Petre, B., & Simon, A. (2020). Insolvency risk. Application of Altman z-score to the auto parts sector in Romania. International Journal of Innovation and Economic Development, 6(1), 7–18. [Google Scholar] [CrossRef]

- Bondar, R. B., & Mudzakar, M. K. (2023). Bankruptcy prediction model: Altman (Z-Score), Springate (S-Score), Zmijewski (X-Score) and Grove (G-Score) models in companies listed at the LQ 45 stock index. Journal Ekonomi, Bisnis & Entrepreneurship (e-Journal), 17(2), 279–295. [Google Scholar] [CrossRef]

- Central Bank of Sudan. (2022). Operating banks in Sudan. Available online: https://cbos.gov.sd/en/content/operating-banks-sudan (accessed on 6 April 2025).

- Cındık, M., & Armutlulu, I. H. (2021). A revision of Altman Z-Score model and a comparative analysis of Turkish companies’ financial distress prediction. National Accounting Review, 3(2), 237–255. [Google Scholar] [CrossRef]

- Compaoré, A., Mlachila, M., Ouedraogo, R., & Sourouema, S. (2020). The impact of conflict and political instability on banking crises in developing countries. MF Working Papers. International Monetary Fund. [Google Scholar] [CrossRef]

- Diwani, M. M. (2022). How competitive is the Syrian banking sector? Empirical evidence from ‘pre/post’ war Syria. Pacific Economic Review, 28(2), 347–389. [Google Scholar] [CrossRef]

- Elhussein, N., & Eldawaha, A. (2024). Are the Sudanese banks financially sound? International Journal of Financial Research, 15(1), 19. [Google Scholar] [CrossRef]

- Elia, J., Toros, E., Sawaya, C., & Balouza, M. (2021). Using Altman z-score to predict financial distress: Evidence from Lebanese alpha banks. Management Studies and Economic Systems (MSES), 6(1/2), 47–57. [Google Scholar] [CrossRef]

- Gazi, M. A. I., Karim, R., Senathirajah, A. R. S., Ullah, A. K. M. M., Afrin, K. H., & Nahiduzzaman, M. (2024). Bank-specific and macroeconomic determinants of profitability of Islamic Shariah-based banks: Evidence from new economic horizon using panel data. Economies, 12(3), 66. [Google Scholar] [CrossRef]

- Gerged, A. M., Marie, M., & Elbendary, I. (2022). Estimating the risk of financial distress using a multi-layered governance criterion: Insights from Middle Eastern and North African banks. Journal of Risk and Financial Management, 15(5), 588. [Google Scholar] [CrossRef]

- Huddleston, R. J., & Wood, D. (2021). Functional markets in Yemen’s war economy. Journal of Illicit Economies and Development, 2(2), 204–221. [Google Scholar] [CrossRef]

- International Monetary Fund. (2017). World economic outlook: Conflict and fragility. International Monetary Fund. Available online: https://www.imf.org/en/Publications/WEO/Issues/2017/09/19/world-economic-outlook-october-2017 (accessed on 12 June 2025).

- International Monetary Fund. (2020). Global financial stability report: Markets in the time of COVID-19 (IMF Global Financial Stability Report No. 2020/001). International Monetary Fund. [Google Scholar] [CrossRef]

- International Monetary Fund. (2021). Sudan: Selected issues. International Monetary Fund. Available online: https://www.imf.org/en/Countries/SDN (accessed on 16 March 2025).

- International Monetary Fund. (2022). Global financial stability report, April 2022: Shockwaves from the war in Ukraine test the financial system’s resilience (Global Financial Stability Report No. 2022/001). International Monetary Fund. [Google Scholar] [CrossRef]

- International Monetary Fund. (2024). Republic of Sudan: 2023 article IV consultation and review. International Monetary Fund. Available online: https://www.imf.org/en/Publications/Search?series=Country%20Report (accessed on 10 April 2025).

- Issa, J. S., Abbaszadeh, M. R., & Salehi, M. (2022). The impact of Islamic banking corporate governance on green banking. Administrative Sciences, 12(4), 190. [Google Scholar] [CrossRef]

- Malik, A., & Awadallah, B. (2013). The economics of the Arab Spring. World Development, 45, 296–315. [Google Scholar] [CrossRef]

- Mennawi, A. N. A. A. (2020). The impact of liquidity, credit, and financial leverage risks on financial performance of Islamic banks: The case of Sudanese banking sector. International Journal of Applied Economics, Finance and Accounting, 8(2), 73–83. [Google Scholar] [CrossRef]

- Mousavi, M., & Ouenniche, J. (2014). The impact of Mena conflicts (the Arab spring) on global financial market. Journal of Developing Areas, Tennessee State University, College of Business, 48(4), 21–40. Available online: https://ideas.repec.org/a/jda/journl/vol.48year2014issue4pp21-40.html (accessed on 6 July 2025). [CrossRef]

- Mustafa, O. A. O. (2019). The conflict between liquidity and profitability and its impact on banking finance: An empirical investigation from Sudan (2000–2018). Global Academic Journal of Economics and Business, 1(1), 27–32. [Google Scholar]

- Mustafa, O. A. O. (2020). Impact of liquidity shortage risk on financial performance of Sudanese Islamic banks. International Journal of Islamic Economics and Finance, 3(2), 251–280. [Google Scholar] [CrossRef]

- Mustafa, O. A. O. (2023). Sudanese banking sector and stress testing. Applied Economics and Finance, 10(3), 11–21. [Google Scholar] [CrossRef]

- Nath, S., Biswas, B., Rashid, M., & Biswas, M. (2020). Financial distress prediction through Altman Z-Score model: A case study of state-owned commercial banks of Bangladesh. Indian Journal of Commerce & Management Studies, 11(3), 60–67. [Google Scholar] [CrossRef]

- Novta, N., & Pugacheva, E. (2020). The macroeconomic costs of conflict. MF Working Paper. International Monetary Fund. [Google Scholar] [CrossRef]

- OECD. (2022). Impacts of the Russian invasion of Ukraine on financial market conditions and resilience: Assessment of global financial markets. OECD Publishing. [Google Scholar]

- Ong, L., & Jobst, A. (2020). Stress testing in conflict-affected countries (IMF Technical Note). International Monetary Fund. [Google Scholar]

- Pagratis, S., Topaloglou, N., & Tsionas, M. (2017). System stress testing of bank liquidity risk. Journal of International Money and Finance, 37, 22–40. [Google Scholar] [CrossRef]

- Rashid, F., Khan, R. A., & Qureshi, I. H. (2023). A comprehensive review of the Altman Z-Score model across industries [Online]. SSRN. [Google Scholar] [CrossRef]

- Rother, B., Pierre, G., Lombardo, D., Herrala, R., Toffano, P., Roos, E., Auclair, A., & Manasseh, K. (2016). The economic impact of conflicts and the refugee crisis in the Middle East and North Africa (Staff Discussion Notes No. 2016/008). International Monetary Fund. [Google Scholar] [CrossRef]

- Rupin, P. (2000). The political economy of war and peace in Afghanistan. World Development, 28(10), 1789–1803. [Google Scholar] [CrossRef]

- Sahyouni, A., & Wang, M. (2019). Liquidity creation and bank performance of Syrian banks before and during the Syrian war. International Journal of Financial Studies, 7(3), 40. [Google Scholar] [CrossRef]

- Shrestha, S., Mahat, D., Neupane, D., Karki, T., & Acharya, S. (2025). Financial distress determinants in emerging markets: Evidence from Nepalese financial institutions. International Journal of Education, Management, and Technology, 3(2), 473–490. [Google Scholar] [CrossRef]

- Weinstein, J. M., & Imai, K. (2000). Measuring the economic impact of civil war. CID Working Paper No. 51. CID. Available online: http://www.cid.harvard.edu/cidwp/051.pdf (accessed on 9 May 2025).

| Model | Altman Z′-Score Analysis (2016–2022) | |||||

|---|---|---|---|---|---|---|

| Year | X1 (Liquidity) | X2 (Retained Earnings) | X3 (Profitability) | X4 (Leverage) | Z’-Score Categories | Financial Zone |

| 2016 | 0.26 | 0.012 | 0.023 | 0.125 | 2.05 | Distress |

| 2017 | 0.36 | 0.025 | 0.035 | 0.15 | 2.84 | Safe |

| 2018 | 0.53 | 0.03 | 0.047 | 0.175 | 4.12 | Safe |

| 2019 | 0.62 | 0.035 | 0.053 | 0.215 | 4.76 | Safe |

| 2020 | 0.67 | 0.045 | 0.042 | 0.175 | 5.01 | Safe |

| 2021 | 0.25 | 0.038 | 0.027 | 0.125 | 2.08 | Distress |

| 2022 | 0.64 | 0.023 | 0.018 | 0.075 | 4.47 | Secure |

| Model | Altman Z″-Score Analysis (2016–2022) | |||||

|---|---|---|---|---|---|---|

| Year | X1 | X2 | X3 | X4 | Z″-Score Categories | Financial Zone |

| 2016 | 0.26 | 0.012 | 0.023 | 0.125 | 5.3 | Grey |

| 2017 | 0.36 | 0.025 | 0.035 | 0.15 | 6.09 | Safe |

| 2018 | 0.53 | 0.03 | 0.047 | 0.175 | 7.37 | Safe |

| 2019 | 0.62 | 0.035 | 0.053 | 0.215 | 8.01 | Safe |

| 2020 | 0.67 | 0.045 | 0.042 | 0.175 | 8.25 | Safe |

| 2021 | 0.25 | 0.038 | 0.027 | 0.125 | 5.33 | Grey |

| 2022 | 0.64 | 0.023 | 0.018 | 0.075 | 7.72 | Secure |

| Year | Loans (Billion SDG) ↑ | Deposits (Billion SDG) ↓ | Liquidity Risk Ratio (LDR) After Stress Test | Liquidity Risk Status |

|---|---|---|---|---|

| 2022 | 1680 | 2470 | 68.02% (pre-stress) | Safe |

| 2023 | 1955.85 | 2064.92 | 94.72% | Tight liquidity |

| 2024 | 2276.56 | 1726.27 | 131.88% | High risk of illiquidity |

| 2025 | 2649.92 | 1443.16 | 183.62% | Critical—liquidity crisis |

| Year | Capital (Billion SDG) ↓ | Deposits (Billion SDG) ↑ | Capital Risk Ratio After Stress Test | Capital Adequacy Status |

|---|---|---|---|---|

| 2022 | 1500 | 2470 | 60.73% (pre-stress) | Very strong |

| 2023 | 1254.00 | 2875.08 | 43.62% | Adequate but weakening |

| 2024 | 1048.34 | 3346.59 | 31.33% | Under-capitalized |

| 2025 | 876.41 | 3895.43 | 22.49% | Critically weak |

| Year | NPLs (Billion SDG) ↑ | Deposits (Billion SDG) ↓ | Credit Risk Ratio | Credit Risk Status |

|---|---|---|---|---|

| 2022 | 67.26 | 2470 | 2.72% (pre-stress) | Safe, low risk |

| 2023 | 78.29 | 2064.92 | 3.79% | Critical |

| 2024 | 91.13 | 1726.27 | 5.28% | Insolvency warning |

| 2025 | 106.08 | 1443.16 | 7.35% | Systemic failure |

| Year | Loans (Billion SDG) ↑ | Deposits (Billion SDG) ↓ | Loan-to-Deposit Ratio (LDR) | Liquidity Risk Status |

|---|---|---|---|---|

| 2022 | 1680 | 2470 | 68.02% (pre-stress) | Stable/liquid |

| 2023 | 2100 | 1852.5 | 113.36% | Warning zone—tight funding |

| 2024 | 2625 | 1389.38 | 188.93% | High risk—liquidity stress |

| 2025 | 3281.25 | 1042.04 | 314.89% | Critical liquidity crisis |

| 2026 | 4101.56 | 781.53 | 524.81% | Systemic stress |

| 2027 | 5126.95 | 586.15 | 874.68% | Near collapse—panic levels |

| 2028 | 6408.69 | 439.61 | 1457.81% | Total breakdown |

| Year | Capital (Billion SDG) ↓ | Deposits (Billion SDG) ↑ | Capital-to-Deposit Ratio (%) | Capital Adequacy Status |

|---|---|---|---|---|

| 2022 | 1500 | 2470 | 60.73% (pre-stress) | Safe zone |

| 2023 | 1125 | 3087.50 | 36.44% | Safe zone |

| 2024 | 843.75 | 3859.38 | 21.86% | Safe zone |

| 2025 | 632.81 | 4824.22 | 13.12% | Warning zone |

| 2026 | 474.61 | 6030.28 | 7.87% | Danger zone |

| 2027 | 355.96 | 7537.85 | 4.72% | Danger zone |

| 2028 | 266.97 | 9422.31 | 2.83% | Danger zone |

| Year | NPLs (Billion SDG) ↑ | Deposits (Billion SDG) ↓ | Credit Risk Ratio (%) | Credit Risk Status |

|---|---|---|---|---|

| 2022 | 67.26 | 2470 | 2.72% (pre-stress) | Safe |

| 2023 | 84.08 | 1852.5 | 4.54% | Rising risk |

| 2024 | 105.09 | 1389.38 | 7.56% | Concerning |

| 2025 | 131.36 | 1042.04 | 12.61% | High risk |

| 2026 | 164.20 | 781.53 | 21.01% | Critical |

| 2027 | 205.25 | 586.15 | 35.02% | Severe |

| 2028 | 256.56 | 439.61 | 58.36% | Systemic |

| Risk Factor | Loans | Deposits | NPLs | Capital | Credit Risk | Capital Risk | Liquidity Risk |

|---|---|---|---|---|---|---|---|

| Loans | 1.00 | +0.40 | +0.55 | −0.15 | +0.41(L)/+0.56(H) | +0.30 | +0.31 |

| Deposits | +0.40 | 1.00 | −0.25 | +0.45 | +0.50(L)/+0.60(H) | +0.28 | −0.18(L)/−0.31(H) |

| Non-Performing Loans | +0.55 | −0.25 | 1.00 | −0.35 | +0.62(L)/+0.68(H) | +0.64(L)/+0.65(H) | +0.30 |

| Capital | −0.15 | +0.45 | −0.35 | 1.00 | −0.22(L)/−0.32(H) | −0.53(L)/−0.50 | −0.17 |

| Credit Risk | +0.41(L)/ +0.56(H) | +0.50(L)/ +0.60(H) | +0.62(L)/ +0.68(H) | −0.22(L)/ −0.32(H) | 1.00 | +0.59(L)/+0.61(H) | +0.35(L)/+0.48(H) |

| Capital Risk | +0.30 | +0.28 | +0.64(L)/ +0.65(H) | −0.53(L)/ −0.50 | +0.59(L)/+0.61 | 1.00 | +0.44(L)/+0.47 |

| Liquidity Risk | +0.31 | −0.18(L)/ −0.31 | +0.30 | −0.17 | +0.35(L)/+0.48(H) | +0.44(L)/+0.47(H) | 1.00 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abuelgasim, M.; Toumi, S. Effects of Civil Wars on the Financial Soundness of Banks: Evidence from Sudan Using Altman’s Models and Stress Testing. J. Risk Financial Manag. 2025, 18, 476. https://doi.org/10.3390/jrfm18090476

Abuelgasim M, Toumi S. Effects of Civil Wars on the Financial Soundness of Banks: Evidence from Sudan Using Altman’s Models and Stress Testing. Journal of Risk and Financial Management. 2025; 18(9):476. https://doi.org/10.3390/jrfm18090476

Chicago/Turabian StyleAbuelgasim, Mudathir, and Said Toumi. 2025. "Effects of Civil Wars on the Financial Soundness of Banks: Evidence from Sudan Using Altman’s Models and Stress Testing" Journal of Risk and Financial Management 18, no. 9: 476. https://doi.org/10.3390/jrfm18090476

APA StyleAbuelgasim, M., & Toumi, S. (2025). Effects of Civil Wars on the Financial Soundness of Banks: Evidence from Sudan Using Altman’s Models and Stress Testing. Journal of Risk and Financial Management, 18(9), 476. https://doi.org/10.3390/jrfm18090476