Abstract

This research investigates the dynamic spillover effects among green bond markets and the impact of investor sentiment on these spillovers. We employ different research methods, including a time-varying parameter vector autoregression, an exponential general autoregressive conditional heteroscedasticity, and a generalized autoregressive conditional heteroskedasticity-mixed data sampling model. Our sample is for twelve international green bond markets from 3 January 2022 to 31 December 2024. Our results evidence the strong correlation between twelve green bond markets, with the United States and China being the net risk receivers and Sweden being the largest net shock transmitter. We also find the varied impact of direct and indirect investor sentiment on the net total directional spillovers. Our research offers fresh contributions to the existing literature in different ways. On the one hand, it adds to the green finance literature by clarifying the dynamic spillovers among leading international green bond markets. On the other hand, it extends behavioral finance research by including direct and indirect investor sentiment in the spillovers of domestic and foreign green bond markets. Our study is also significant to related stakeholders, including investors in their portfolio rebalancing and policymakers in stabilizing green bond markets.

1. Introduction

Since the global financial crisis, financial markets have revealed a high level of interconnection, information transmission (Q. Wang & Li, 2024), and integration that induce spillover effects and contagion (Abad et al., 2014). As a complex network (Deng et al., 2022), financial markets significantly facilitate investment performance (Mzoughi et al., 2022). Thus, it is crucial for investors and regulators to understand profoundly how financial markets correlate with each other (Asgharian & Nossman, 2011) and what factors are behind their correlations to diversify, price, and allocate internationally financial assets (Skintzi & Refenes, 2006; Vukovic et al., 2021), regulate autonomous monetary policy, and finance fiscal deficits (Abad et al., 2010). Consequently, the interdependence between different financial markets has long been an interesting topic to finance scholars (Skintzi & Refenes, 2006) after the initial analysis (Engle et al., 1990) on spillover effects among foreign exchange markets (Christiansen, 2007). The research stream in this area has witnessed the two main co-movements dominated in equity and bond markets. Nevertheless, it is noteworthy that although the market capitalization of international bond markets outweighs that of international equity markets, the literature on bond market linkages is underexplored compared to equity markets (Abad et al., 2010). This research strand is even scarcer regarding the spillover effects between green bond markets.

With the world’s cry for sustainable development (Tiwari et al., 2023), green bonds emerge as a bright spot for sustainable finance among financial instruments. Extant studies have evidenced the multifaceted dedication of green bonds to the sustainability of firms and the environment. Specifically, for firms, the issuance of green bonds lowers the cost of capital (Q. Li et al., 2022; R. Zhang et al., 2021), fosters green innovation (Ren et al., 2024; X. Wu et al., 2022), improves green total factor productivity (Y. Li et al., 2023; S. Liu & Li, 2024), enhances corporate ESG performance (J. Zheng et al., 2023), promotes green investment (He et al., 2024), and increases trade credit (Gan et al., 2024). For an overall sustainable environment, green bonds serve as a genuinely essential funding source for environmental projects by financing green energy resources (Tu & Rasoulinezhad, 2022), facilitating investment efficiency of renewable energy (Cheng et al., 2024; Zhao et al., 2023), reducing carbon emissions (M. Zhang et al., 2023), and unblocking green finance obstacles and sustainability tools (Ning et al., 2023).

Given the evident roles of green bonds, sustainability scholars have investigated the co-movement, connectedness, and spillover effects of green bond markets with other sub-markets. However, the correlation of this market to other financial markets is limited to stock (Mensi et al., 2022b; Park et al., 2020), conventional bond (Gao et al., 2021), commodities (Naeem et al., 2021a; Yousaf et al., 2024), currency (Reboredo & Ugolini, 2020), and clean energy markets (Jiang & Jia, 2022; N. Liu et al., 2021). To the best of our knowledge, there are three studies (Long et al., 2022; Rehman et al., 2023; Q. Wang & Li, 2024) examining the risk spillover effects between green bond markets. Since the first introduction of green bonds in 2007 by the European Investment Bank, they have been a potential channel in financing low-carbon activities by benefiting carbon emission goals through scale, structure, and technology (Lee & Kim, 2019). As a result, green bonds have been traded widely, and these markets have witnessed sharp growth over the decade by contributing more than 63% to the global sustainable debt market (Climate Bonds Initiative, 2023). Hence, employing only the U.S., European, and Chinese green bond markets to document the spillovers may lack representativeness. This research gap leads us to the question: What spillover effects exist among different green bond markets? To answer this question, we utilize twelve leading international green bond markets with the objective of identifying and analyzing the spillover effects among green bond markets in various countries.

Additionally, as a crucial factor reflecting investors’ psychology, investor sentiment directs investors to invest in sustainability (Piñeiro-Chousa et al., 2021). It is also argued that the core of demand and supply imbalances in green bond markets lies in investors’ choices shaped by investor sentiment (Barua & Chiesa, 2019; R. Wu & Liu, 2023). Therefore, we come to another research question: What is the role of investor sentiment in the dynamic spillovers of different green bond markets? To address this question, we include direct and indirect proxies of investor sentiment as explanatory variables in the explained factor of net total directional spillovers of each green bond market. The answer to this question helps us to achieve an objective of identifying the impact of investors’ outlook (as a direct proxy) and investors’ trading activity (as an indirect measure) on spillovers of various green bond markets. Still, on the way to finding the role of investor sentiment in green bond markets’ spillovers, we see that as the capital flow liberalization, investors tend to hedge their portfolios by international diversification (Asgharian & Nossman, 2011; Delroy & David, 2005; Skintzi & Refenes, 2006); it means that investors in one country may invest in green bond markets in different countries. Thus, we raise the third question: Does foreign investor sentiment play a role in spillovers of domestic green bond markets? For this question, our objective is to clarify the impact of investors’ outlook and trading behavior in one country on the spillover effects of the green bond market in another country.

Our study is significant to the existing literature of green and behavioral finance. First, most of current green finance research focuses on the correlation between green bonds and other financial markets, including stock, commodity, clean energy, and conventional bond markets; our study pioneers quantify the dynamic spillover effects among diversified international green bond markets from Asia (China, Japan, Australia, and New Zealand), America (Canada and the U.S.), and Europe (the European Union (EU), the United Kingdom (UK), Switzerland, Denmark, Norway, and Sweden). Our research covers most of the leading international green bond markets whose indices are available to date, except for Singapore and Hong Kong, due to the unavailability of CCI data. Hence, our empirical results add to the green finance branch with more representativeness of dynamic spillovers among the most traded green bond markets. Second, the extant literature of behavioral finance sheds light on the impact of investor sentiment on green bond market performance, measured by its return and volatility. This study is the first attempt to identify the impact of investor sentiment on the total net directional spillovers of leading international green bond markets. Hence, touching on investor sentiment, our research directly points out the role of the demand side in the spillover effects of these green bond markets and reveals its role in channeling financial contagion. Furthermore, while existing research on investor sentiment uses a single and mainly direct way to measure it, we take both direct and indirect proxies into account. If direct investor sentiment describes investors’ thoughts, an indirect one indicates their real choices through trading activities in financial markets; therefore, our research brings a broader aspect of how investor sentiment impacts green bond market performance. Finally, extant behavioral research documents the role of foreign investor sentiment in domestic conventional financial markets; we differ from them by shedding light on how direct and indirect sentiment of foreign investors impacts the net risk position of green bond markets.

Our research results are also valuable to green bond markets’ participants, including investors and policymakers. To investors, understanding the total risk spillovers and net risk positions of different green bond markets enables them to price, diversify, and rebalance their local and international portfolios. To green bond market regulators, our results of risk spillovers among various green bond markets suggest that they should include contagion and behavior of strongly correlated markets when stabilizing their green bond markets. Additionally, our findings of how the sentiment of domestic and foreign investors impacts the net spillovers of green bond markets imply that policymakers should put these factors on the table to regulate their green bond markets.

The remainder of the paper is as follows: Section 2 discusses the relevant literature. Section 3 presents theoretical background and proposes research hypotheses. Section 4 details the data, their sources, and the methods used to test the models. Research results and their discussions appear in Section 5 and Section 6. Section 7 concludes the study with a summary of the findings and their implications for future studies.

2. Literature Review

We conduct our literature review based on three aspects. First, we summarize the previous research results on the spillovers between green bonds and conventional assets to see what kinds of conventional instruments have been in the list of this association and what the findings have been. Second, we focus on research examining the spillovers between green bonds and other green finance assets to reveal the gap we need to fill. Third, because one of our objectives is to investigate the role of investor sentiment in the spillovers of domestic and foreign green bond markets, we review related studies to see if we can add more to this research branch.

The existing literature has paid great attention to the spillover effects between green bond markets and conventional financial markets, ranging from equity, commodities, clean energy, and traditional bond markets. For the correlation between green bonds and equity markets, (Park et al., 2020) document the asymmetric volatility spillover effects between green bonds (proxied by the Standard & Poor’s (S&P) Green Bond Select Index) and equity markets (proxied by the S&P 500 Index). (Mensi et al., 2022a) find a strong connectedness between eight green finance markets, including green bonds and stock markets, with a global scope. (Billah et al., 2024) investigate the spillovers between green bonds and Islamic banking stocks in eleven country-based Islamic bank markets. They show time-varying spillover effects between these two markets, and the interrelation is low in both the medium and long terms.

For the spillovers between green bonds and commodities markets, (Naeem et al., 2021a) indicate that gold and silver exhibit the strongest correlation with green bonds. In another research focusing on energy commodities, including crude oil, natural gas, heating oil, gasoline, and coal, (Naeem et al., 2021b) show various dependent tails among these markets; specifically, green bonds and natural gas reveal extremely positive tail dependence, whereas that of green bonds and other commodities is highly negative. (Deng et al., 2022) shed light on fossil energy markets, including crude oil and coal. They find the weak interdependence between green bonds and fossil energy markets. Additionally, coal transmits greater shocks to green bonds than crude oil. (Y. H. Su et al., 2023) show the transmission of risk and contagion between oil prices and green bonds. (K. H. Wang et al., 2023) investigate the connectedness among green bonds and energy prices (including oil, natural gas, coal, and carbon futures) using quantile regression. Their results are that these spillovers reach higher points in extreme quantiles than in median and lower ones. (Yousaf et al., 2024) investigate the dynamic co-movement of nine green bond indices of different sectors with crude oil futures. The authors see a strong and short-lived correlation between these green bond indices, while the correlation between green bonds and crude oil is relatively weak.

Green bonds also have a strong connectedness with clean energy markets. (N. Liu et al., 2021) find asymmetric spillovers, positive time-varying averages, and tail dependence between green bonds and various clean energy market indices, including the Wilder Hill Clean Energy Index, S&P Global Clean Energy Index, European Renewable Energy Index, ISE Global Wind Energy Index, MAC Global Solar Energy Stock Index, and S&P Renewable Energy and Clean Technology Index. (Jiang & Jia, 2022; Mzoughi et al., 2022; H. Zheng et al., 2025) also indicate the asymmetric and time-varying spillovers from green bonds to clean energy markets.

In addition to the connectedness with a single financial market, researchers explore the spillovers of green bond markets with multiple financial markets simultaneously. (Reboredo, 2018) investigated the co-movement of green bonds and other sub-financial markets, including fixed-income (corporate and government bonds), stock, and energy commodity markets. They find that green bonds are substantially affected by conventional bonds while weakly correlated with stock and energy markets. (Reboredo & Ugolini, 2020) extend (Reboredo, 2018) by adding a currency market to these spillovers. Their results show that green bonds strongly connect with currency and government bond markets. (Gao et al., 2021) explore the risk spillovers and net connectedness between China’s green bonds, stocks, conventional bonds, commodities, foreign exchange, and money markets. Their results document the two-way spillovers between green bond and traditional bond markets and one-way spillovers from stock and commodities markets, while the other markets show no significant correlation. (Guo & Zhou, 2021) compare the risk spillovers between green bonds, government bonds, stocks, foreign exchange, and crude oil in the U.S. and China. The authors document significant, time-varying, and quantile-dependent correlations between the two countries’ green bonds and other markets.

Additionally, there is consistency between the behaviors of green bonds in the U.S. and China, implying a small cross-country difference. (T. Su et al., 2022) explore risk transmission between green bonds, conventional bonds, and stocks in China. The results show that green and traditional bonds have strong pairwise correlations in return and volatility, while stocks generate the most extreme spillovers. (Mensi et al., 2022a) find the dynamic and crisis-sensitive spillovers between green bonds, crude oil, and G7 stock markets. (Mensi et al., 2023) investigate the frequency of spillovers between green bonds and different markets, including Brent oil, stocks, gold, silver, option, and currency in the U.S. They evidence that in the short-run, the green bond market is the net spillover transmitter but is the net spillover receiver in the long-run. (G. Chen et al., 2023) show weak risk spillovers from clean energy stocks, technology, gold, and traditional energy markets to green bonds. (Tiwari et al., 2023) examine the price spillovers between green bonds, Islamic stocks, traditional stocks, conventional corporate bonds, and energy markets. They document a negative spillover from green bonds to Islamic stocks in the long term, and the dependence between green bonds and other sub-financial markets is more significant in lower quantiles. (Dai et al., 2023) indicate asymmetric and time-varying spillovers across quantiles between green bonds, carbon emission stock, and crude oil markets. Reviewing research papers on the spillover effects between green bonds and traditional instruments, we observe two main issues. First, although the first introduction of green bonds was in 2007 and green bond markets have witnessed substantial development over the last decades, their spillovers with conventional assets have just gained popularity since 2020 in the academic community. Second, despite correlating with various traditional instruments, the spillovers occur primarily in a single or pair of countries, which yields limited evidence on the financial contagion across countries.

Regarding the spillover effects between green bonds and other green finance assets, scholars mostly link to green equities. For instance, (Pham, 2021) explores the frequency of connectedness between green bonds and green equities (including clean energy stocks, green transportation stocks, green building stocks, and clean water stocks). They find that green bonds demonstrate a weak correlation with green equity in normal market conditions, but in extreme conditions, the connectedness is relatively strong. Overall, these spillovers reveal short spans regardless of market conditions. (Chatziantoniou et al., 2022) also document the time and frequency connectedness between green bonds and green equities, including green stocks (MSCI Global Environment Price Index), clean energy (S&P Global Clean Energy Price Index), and sustainability (Dow Jones Sustainable World Index). Their results show that green bonds and clean energy are mainly shock receivers, while green stocks and sustainability are the shock transmitters across different horizons. (Tiwari et al., 2023) reveal a relatively weak interdependence between green bonds and green stocks (proxied by the MSCI Global Environment Price Index, including green building, alternative energy, sustainable water, clean technology, or pollution prevention). (R. Wu & Liu, 2023) examine the dynamic spillovers among seven green finance markets, including clean energy stock, green transportation stock, green building stock, clean water stock, ESG stock, green bonds, and carbon markets. They show that green bonds are mainly receivers and tend to connect more with other assets after the COVID-19 pandemic.

Currently, there are two studies that come closest to our research, including (Long et al., 2022; Q. Wang & Li, 2024). (Long et al., 2022) examine the dynamic spillovers between uncertainties and green bond markets. Their research also shed light on the spillovers between three green bond markets: the U.S., the EU, and China. They evidence the dominant role of the U.S. green bond market by mainly transmitting risk to other markets, while China is mostly the receiver in the system. (Q. Wang & Li, 2024) investigate the risk spillovers between U.S. and Chinese green bond markets for the period from 12 May 2015, to 13 June 2023. Using a threshold time-varying Copula-GARCHSK framework, they point out that these two green bond markets produce asymmetric bidirectional risk spillover effects with the tendency of the Chinese green bond market to transmit risks to that of the U.S. This research reveals several gaps for us. First, given the crucial role of green bonds and other green finance assets in channeling funds for sustainable development, the research on their spillover effects is still limited. Second, the spillovers of green bonds are mainly limited to green equities at the global stage rather than across markets. Third, we credit two papers shedding light on the risk spillover effects among green bond markets; however, they only focus on dominant markets, including the U.S., EU, and China, whose findings are not representative of the spillovers across international green bond markets.

For the impact of investor sentiment on green bond market performance, (Piñeiro-Chousa et al., 2021, 2022) were pioneers in exploring this association using Twitter messages as the investor sentiment proxy. They document investor sentiment’s positive and significant impact on green bond returns. Investor sentiment constructed by text mining also widens asking yields between green and conventional bonds (Fu et al., 2024), triggering green bond volatility (Bouteska et al., 2024). In addition to investor sentiment, scholars employ investor attention to examine this nexus, and they also evidence that investor attention, measured by Google search volume and Chinese Baidu indices, plays a crucial factor in predicting green bond return and volatility (Gao et al., 2023; Pham & Cepni, 2022; Pham & Luu Duc Huynh, 2020). Researchers also investigate the role of investor sentiment in spillover effects between green bonds and other financial markets. (R. Wu & Liu, 2023) investigate the role of investor sentiment in the spillovers between green finance markets, including clean energy stock, transportation stock, building stock, clean water stock, ESG stock, green bonds, and carbon markets. They employ the Google search volume index to reflect investor sentiment, which boosts the dynamic spillovers among these markets. (Gao & Liu, 2024) explore the role of indirect investor sentiment, measured by the U.S. Chicago Board Options Exchange market volatility index (VIX), in the time and frequency spillovers between rare earth markets and oil, clean energy, gold, base metal, green bond, ESG, and agricultural markets. They show that green bonds are net shock receivers in the system, and investor sentiment is the most crucial driver of connectedness between these markets. (Man et al., 2024) on the way to investigate risk spillovers between green bonds, thermal coal, crude oil and natural gas, new energy, stock, and traditional bond markets in China, also look at the impact of investor sentiment. Measuring investor sentiment using macroeconomic factors based on Baker and Wurgler’s (2006) approach indicates time-varying, asymmetric, and heterogeneous risk spillovers among these markets, and the investor sentiment is significant to the connectedness. In this research branch, we see the absence of the investor sentiment factor in the spillovers among green bond markets. When linking investor sentiment with the performance of green finance markets, scholars favor a direct proxy of investor sentiment, leaving the question of whether direct and indirect sentiments equally impact the spillovers. Significantly, in the presence of financial contagion, international portfolio diversification, and portfolio rebalancing, investors in one country can make investments in other countries. In this regard, the question of how foreign investor sentiment impacts spillovers of green bond markets in other countries is unanswered.

To conclude our literature review section, we identify three main research gaps we aim to address. First, although spillover effects between green bonds and other sub-financial markets have drawn significant attention from scholars, the results are mixed. Significantly, despite yielding concerns about the spillovers between different green bond markets, the markets are limited to pairs (Q. Wang & Li, 2024) or three countries (Long et al., 2022). Therefore, it is noteworthy to bring various international green bond markets to examine the spillover effects to provide more comprehensive and conclusive results. Second, current research about investor sentiment and green bond markets employs a single way to measure investor sentiment, most of which is a direct proxy. Because both direct and indirect investor sentiment equally reflect investors’ psychology, it is essential to explore how they impact the spillover effects between green bond markets. Thirdly, we rarely see scholars discuss how investor sentiment in a foreign market impacts green bond markets or spillover effects between green bond markets of other countries, except (Gao & Liu, 2024), who use U.S. investor sentiment to test its role in dynamic spillovers among different global financial markets. Hence, exploring this relationship to offer valuable implications to green bond market regulators is interesting.

3. Theoretical Background and Hypothesis Development

The theoretical foundation for our research is based on the financial contagion theory. Although there has been no universal acceptance of the definition of contagion, it has been used widely since the seminal work of (King & Wadhwani, 1990; Forbes & Rigobon, 1999). Specifically, the latter authors consider contagion as “a significant increase in cross-market linkages resulting from a shock hitting one country or group of countries”. (Kaminsky et al., 2003) describe two phenomena of contagion. On the one hand, when the contagion effects are immediate, impacting time horizons of hours or days, they are fast and furious reactions. On the other hand, if the responses are time-consuming and their gradual effects cumulatively induce economic consequences, they are referred to as spillovers. (Kaminsky et al., 2003) pioneered in summarizing the mechanisms by which risks in one country can move beyond international borders, including herding, trade, and financial linkages. In herding behavior, an individual is in information cascades, observing and following preceding ones’ decision-making (Banerjee, 1992) without paying attention to his or her own information (Bikhchandani et al., 1992). Contagion through a trade linkage can result from the devaluation of one country, which may pressure other economies because of its cheaper goods internationally (Nurkse, 1944). Consequently, countries with trade linkages with devaluers tend to lose competitiveness and lower their position (Gerlach & Smetts, 1995). Financial linkage is another source of the contagion because it raises liquidity issues of international portfolios (Calvo, 1998), induces shared macroeconomic risk factors affecting long-term assets’ values (Kodres & Pritsker, 2002), and includes common creditors, such as commercial banks, among countries (Kaminsky et al., 2003).

The existing research empirically evidences the spillover effects among green bond markets (Long et al., 2022; Long et al., 2022; Rehman et al., 2023; Q. Wang & Li, 2024) and between green bonds and other green finance markets (Chatziantoniou et al., 2022; Pham, 2021; Tiwari et al., 2023; R. Wu & Liu, 2023). The possible connectedness of green bond markets can be inferred from financial contagion and international diversification that induce spillovers between conventional financial markets. On the one hand, the essence of financial contagion implies that asset trading in one market per se influences asset prices in other markets; thus, the stock prices of one market are affected by public information about its economic fundamentals and changes in stock prices elsewhere (King & Wadhwani, 1990; Pham, 2021). Additionally, countries may share macroeconomic risks, which are the underlying factors of long-term assets’ price; therefore, as informed investors rebalance their portfolios in other markets, they induce asymmetric information to uninformed investors there (Kaminsky et al., 2003). As a result, an idiosyncratic shock produces contagion across countries’ asset markets (Kodres & Pritsker, 2002). The wake-up call contagion of (Goldstein, 1998), also validates the risk spillovers among various markets. Accordingly, a crisis in a country is a wake-up call for investors to reevaluate and acquire information about other countries, leading them to the possibility of avoiding or liquidating their investments in regions sharing similar underlying factors. (Lin & Ito, 1994) also indicate that the spillovers between different markets result from informational linkages and market contagion across financial markets. On the other hand, the liberalization of capital flows promotes integration between international financial markets (Skintzi & Refenes, 2006), facilitating investors to invest in foreign financial markets. Importantly, international diversification benefits investors in hedging risks (Asgharian & Nossman, 2011) and constructing an optimal asset portfolio (Christiansen, 2007). Speculative arbitrage is a possible channel in this context. Specifically, it motivates the connectedness among green bond markets and the bond yield convergence across markets (Long et al., 2022). Consequently, investors may leave one market if there are lower yields in different markets. Thus, based on the above analysis, we propose the following hypothesis:

H1.

There are spillover effects between different green bond markets.

Lin and Ito (1994) point out that due to the market contagion, investors’ behaviors such as overreaction, speculation, and noise trading are transmissible from one market to another. Their research findings show that investor sentiment is important in the spillover effects among financial markets. W. Chen (2021) indicates that investor sentiment influences bond markets through two channels, including overinvestment and capital flows. Extant researchers also document the significant impact of investor sentiment in the spillovers between green bonds and other sub-financial markets (Gao & Liu, 2024; Man et al., 2024; R. Wu & Liu, 2023). Hence, we develop the below hypothesis:

H2.

Investor sentiment (direct and indirect) impacts the spillover effects between different green bond markets.

Because of the hedging demand shifts (Dean et al., 2010; Pham, 2021) and international diversification, investors in one country may invest in other countries. Furthermore, investors can access diversified sources of information and may rely on information from one market to infer price changes in other markets (Lin & Ito, 1994; King & Wadhwani, 1990). Empirically, several scholars also document the significant role of foreign investor sentiment in domestic financial markets’ spillovers. For example, (Pham & Luu Duc Huynh, 2020; Piñeiro-Chousa et al., 2021) use global investor sentiment measures for financial market spillovers in the EU, U.S., and China; (Gao & Liu, 2024) employ U.S. (VIX) for global financial market spillovers; and (Fernandes et al., 2016) investigate the role of EU investor sentiment in the Portugal debt market. Therefore, we develop the following hypothesis:

H3.

Foreign investor sentiment (direct and indirect) impacts the spillover effects of green bond markets.

4. Research Design

The research design section introduces the data and variables used in our research and the research models to test the proposed hypotheses.

4.1. Data and Variables

In our research, we employ green bond market indices denominated by twelve currencies of twelve countries, including China, Japan, Canada, the U.S., Australia, New Zealand, the EU, the UK, Switzerland, Denmark, Norway, and Sweden, to proxy for green bond markets of these countries. Currently, green bond indices of fourteen currencies are available; nevertheless, due to the unavailability of CCI data, we exclude these two countries from our research sample as a direct investor sentiment proxy of Singapore and Hong Kong. With the increasing importance of green bond markets, different global green bond indices have been constructed, such as S&P Green Bond Indices, Bloomberg Barclays MSCI Green Bond Indices, and J.P. Morgan EM Green Bond. Each of them has its methodologies and criteria to create the indices. However, they share similar dynamics and correlations (Reboredo, 2018; Reboredo & Ugolini, 2020). Hence, our study employs the green bond market indices provided by the Bloomberg database as current research in this area.

Previous scholars employed various measures, from direct to indirect ways, to reflect the investor sentiment variable. Amongst them, an indirect proxy proposed by (Baker & Wurgler, 2006) is widely used for research about investor sentiment; however, it has several drawbacks that we cannot employ in our study. On the one hand, it is a composite index based on the first principal component approach of six U.S. macroeconomic factors. Hence, it is not a given database and requires recomputing as needed. Importantly, it is challenging to build this index to various markets for our research due to the nature of the market and the data availability mismatch between countries.

On the other hand, (Huang et al., 2015) point out that the first principal component framework is inefficient due to its approximation errors and even eliminates the effects of variables as orthogonalized (Keiber & Samyschew, 2019). Additionally, (Bethke et al., 2017; W. Wang & Duxbury, 2021) evidence that without a first principal analysis, investor sentiment still casts a significant impact on stock returns. Consequently, for the consistent data set, our research employs CCI as the direct investor sentiment following (Anand et al., 2021; Karahan & Soykök, 2022; J. Li & Yang, 2024; Shi et al., 2022; W. Wang & Duxbury, 2021), and turnover ratio as the indirect investor sentiment following (Baker & Stein, 2004; W. Wang et al., 2022).

Each green bond index has different launching dates; therefore, to obtain a consistent research sample, our research covers the period from 3 January 2022 to 31 December 2024. To this end, Table 1A presents an overview of green bond indices. Accordingly, we employ daily data of twelve green bond indices for twelve countries. Most of these data are from the Bloomberg database, except for the Chinese green bond index from FTSE Russell. Following existing research about green bond market spillovers, we use the daily returns of these green bond indices.

Table 1.

(A) Green bond indices. (B) Direct investor sentiment. (C) Indirect investor sentiment.

Table 1B provides information on the data of direct investor sentiment. The data of CCI is only available monthly and extracted from

Table 1C reports information on the data of indirect investor sentiment. The data for the turnover ratio is daily from Bloomberg.

4.2. Regression Model

To test our hypotheses, our regression models cover three sub-sections. To estimate daily dynamic spillover effects among green bond markets, we employ the TVP-VAR model, which helps us to extract average, total, and net directional spillover indices of the twelve green bond markets. Next, to investigate the impact of direct and indirect investor sentiment on the net spillovers, we utilize the E-GARCH model. Notably, between the two proxies of investor sentiment, CCI data is monthly, which is not consistent with the daily data of spillovers. Thus, to conduct the E-GARCH estimation, we follow (Bethke et al., 2017) to interpolate the CCI variable from monthly to daily frequency. Lastly, given the results from the E-GARCH regression, we apply the GARCH-MIDAS model, which addresses the data frequency mismatch between variables, as a robustness test to confirm our findings.

4.2.1. TVP-VAR Model

To quantify the dynamic spillover effects between twelve green bond markets, we apply the TVP-VAR model redefined by (Antonakakis et al., 2018; Gabauer & Antonakakis, 2017), which is the extension of the VAR-based connectedness methodology developed by (Diebold & Yilmaz, 2009, 2012, 2014). In the original connectedness methodology of (Diebold & Yilmaz, 2009, 2012, 2014), the various versions of connectedness are based on forecast error variance decomposition from vector autoregressions. To estimate the model, it is crucial to represent the dynamic and time-varying spillovers among factors. Hence, two important issues are choosing the predictive horizon and the rolling estimation window (Diebold & Yilmaz, 2014). To address the problem, these authors tailor the horizon to 12 days and offer a flexible choice of window width. (Gabauer & Antonakakis, 2017; Antonakakis et al., 2018) propose an extended version called the TVP-VAR-based measure of connectedness and provide an empirical comparison between the two approaches. They document that while spillover indices measured by the TVP-VAR immediately adjust to shocks, those of the VAR-based procedure overreact to events in an inappropriately small rolling-window size and smooth out the shocks in an inappropriately large rolling-window size. Even at the rolling-window size that produces consistent dynamic spillovers, the original model reveals a sensitivity to extreme outliers. Among existing models estimating spillover effects, the TVP-VAR approach is state-of-the-art and reveals significant strengths. Accordingly, the TVP-VAR model overcomes the drawbacks of the original connectedness approach by allowing the variation of estimating variances using stochastic volatility Kalman Filter parameters with missing factors proposed by (Koop et al., 1996). Hence, it allows time-varying variances to capture evolving associations among variables. Furthermore, the traditional rolling-window VAR model requires an appropriate selection of window sizes, while this method avoids the arbitrary selection of rolling window size, observation loss, and outliner sensitivity (R. Wu & Liu, 2023). Consequently, its flexibility in choosing a rolling window eliminates the bias of a poor window choice. Notably, the TVP-VAR estimation reports net shock receivers and transmitters, supporting investors and regulators in their investment decisions and market regulation.

According to the Bayesian Information Criterion, a stationary TVP-VAR (1) model is as follows:

where and are N × 1 conditional volatilities and dimensional error disturbance vectors with an N × N time varying variance-covariance matrix, and are N × Np dimensional time-varying coefficient and dimensional error disturbance vector with a variance-covariance matrix, and relies on their own lagged values and an N × Np dimensional error matrix.

A TVP-vector moving average (VMA) representation inferred from the TVP-VAR (1) is as follows:

where is an N × N dimensional coefficient matrix.

The TVP-VMA form is fundamental to the original connectedness measurement using the generalized impulse response function and the generalized forecast error variance decomposition (GFEVD) of (Koop et al., 1996; Pesaran & Shin, 1998). For the TVP-VAR model, we pay great attention to the GFEVD forecasting variable based on the shocks on a variable in the H-step error variance. Its formula is as follows:

where is the H-step ahead GFEVD and is a dummy variable obtaining the value of 1 on the i-th position, and zero otherwise. is normalized as .

Based on the GFEVD, we build up the total spillover index representing the average interconnectedness of the network, which is as follows:

First, we quantify the spillovers of variable to all others in the system, total directional connectedness to others (TO) index is as follows:

Second, we measure the spillovers of all variables to variables in the system, total directional connectedness from others (FROM) index is as follows:

Third, to obtain net total directional spillovers (NET index) we estimate the difference between total directional connectedness to others and total directional connectedness from others, which is as follows:

The NET index’s positive sign indicates the variable’s net transmitter position in the system, while the negative sign reflects the net information receiver status .

4.2.2. E-GARCH Model

To investigate the impact of investor sentiment on the constructed spillover indices, which may bear conditional heteroscedasticity (R. Wu & Liu, 2023), we employ the EGARCH model of (Nelson, 1991). EGARCH is widely used in the finance literature because of its suitability for financial data as compared to other GARCH-family models, such as GARCH and GJR-GARCH methodologies (W. Wang et al., 2022). Additionally, the EGARCH model allows the spillovers of mean and volatility, efficiently capturing the potential sentiment asymmetries on our spillover metrics (Hadad & Kedar-Levy, 2024; Skintzi & Refenes, 2006).

Following (Hadad & Kedar-Levy, 2024; W. Wang et al., 2022; W. Wang & Duxbury, 2021), we have an EGARCH model as below using the total net directional spillover indices as dependent variables:

where are the net spillover indices for each market, is a constant term, and is an error term. The conditional variance model is as follows:

where is the conditional variance of spillovers, is the direct or indirect investor sentiment proxy. , , and are constant, symmetric, and asymmetric effects of the general autoregressive model. captures the conditional volatility’s persistence. presents our matter of interest by reflecting on the impact of investor sentiment on the spillover indices.

We estimate the EGARCH model separately for each country and each investor sentiment proxy. Importantly, as direct investor sentiment (CCI) is monthly data, to be consistent with the daily data of the dependent variable, we follow (Bethke et al., 2017) to interpolate it.

4.2.3. GARCH-MIDAS Model

Our research contains monthly CCI data, which has lower frequency data than daily spillovers of green bond returns. Two fundamental concerns regarding including lower-frequency data in our research are combining data sampled at different frequencies without losing data information and directly investigating the macro-spillover nexus without processing different steps (Engle et al., 2013). In the existing literature, (Ghysels et al., 2005) introduce a MIDAS approach mixing daily and monthly data to examine the trade-off between conditional variance and conditional mean of stock market return. Although the MIDAS model is powerful and flexible in forecasting market return variance by covering data frequency mismatch (Ghysels et al., 2005), it does not mention the determinants of this conditional variance. (Engle & Rangel, 2008) propose a spline-GARCH model to identify the impact of low-frequency macroeconomic factors on high-frequency equity return. In this approach, the authors separate the volatility process into two components: high- and low-frequency. To smoothen out a low-frequency component, they insert a trend in the standard GARCH (1,1), which links it to slowly varying macroeconomic factors. They measure this trend approximately by applying a nonparametric approach of exponential quadratic spline. Consequently, this slow-moving trend features low-frequency volatility. Given the complexity of the spline-GARCH model, (Engle et al., 2013) develop a GARCH-MIDAS estimator combining compelling insights of MIDAS and spline-GARCH. Significantly, it does not limit its implication to macroeconomic variables but is flexible to other economic factors.

Therefore, in addition to following (Bethke et al., 2017) to interpolate its monthly to daily data in the EGARCH model, we take advantage of the GARCH-MIDAS model developed by (Engle et al., 2013) to address the common data frequency mismatch between variables. The GARCH-MIDAS is superior to individual GARCH and MIDAS models in three aspects, which smooth out the genuine dynamics of our direct investor sentiment variable. First, the mixed-frequency integration of this approach means that we do not need to interpolate our monthly data of CCI. The most significant importance of this integration is helping our research to restore the native essence of this data (H. Zheng et al., 2025). Second, it incorporates the GARCH component based on daily bond returns, and the MIDAS polynomial links macroeconomic variables to the long-term component (Engle et al., 2013). Therefore, it can capture both short-term and long-term volatility. Third, the daily net directional spillovers exhibit the conditional heteroscedasticity, while it is not the case for lower frequency data. The GARCH-MIDAS model combined framework deals with conditional heteroscedasticity of spillovers (R. Wu & Liu, 2023).

In the original GARCH-MIDAS mode, we have the following:

where with is the available information on day i − 1; is the short-term component; is the long-term component; and is unconditional mean. The short-term factor, , follows the GARCH (1,1) model as follows:

where and are ARCH and GARCH components, respectively, with > 0, > 0, and + < 1.

Regarding the long-term factor, , it is a varying function of the exogenous variable, which is investor sentiment in our research as follows:

where represents CCI or the turnover ratio and are the beta weights, defined as follows:

Again, we individually estimate the GARCH-MIDAS model for each market and investor sentiment measure. Following (Engle et al., 2013), we set the lag order of the low frequency variable, CCI, to be 12 months (one year).

5. Empirical Analysis

This section contains our research analysis results. First, we report descriptive statistics of our research variables. Next, we discuss the empirical findings of spillover effects among green bond markets. Furthermore, we present the results of the role of domestic investor sentiment in these spillovers. Finally, we present the relationship between foreign investor sentiment and the dynamic spillover effects of these green bond markets.

5.1. Descriptive Statistics

Table 2A provides descriptive statistics of twelve green bond indices in our research. It shows that all markets have negative average returns, except for China, and the Chinese green bond market also exhibits the lowest volatility measured by the standard deviation values. Most skewness values are more significant than zero, implying that these markets are right-skewed. The table’s Kurtosis values indicate that the green bond indices have fat tails. The Jarque–Bera test indicates that each market is far from the normal distribution at a 1% significance level. The standard Augmented Dickey–Fuller (ADF) statistics reveal that the green bond indices are all significantly stationary.

Table 2.

(A) Descriptive statistics of green bond indices. (B) Descriptive statistics of direct investor sentiment. (C) Descriptive statistics of indirect investor sentiment.

Table 2B presents our research’s descriptive statistics of CCI as the direct investor sentiment proxy. It shows that these green bond markets have relatively similar average values of CCI with low volatility measured by the standard deviation. Most skewness values are less than or close to zero, implying that these markets are left-skewed. The table’s Kurtosis values indicate that the green bond indices are leptokurtic. The Jarque–Bera test indicates that each market deviates from the normal distribution at a 1% significance level. The standard Augmented Dickey–Fuller (ADF) statistics reveal that the direct investor sentiment proxies are all significantly stationary.

Table 2C provides descriptive statistics of the turnover ratio as an indirect investor sentiment proxy in our research. It shows that most markets have a favorable average turnover ratio with medium volatility reflected by the standard deviation. The skewness values imply the mixed asymmetries in our data in that half of the markets are right-skewed (those have positive skewness values), and the others are left-skewed. The table’s Kurtosis values indicate that the turnover ratios have fat tails. The Jarque–Bera test indicates that each market is far from the normal distribution at a 1% significance level. The standard Augmented Dickey–Fuller (ADF) statistics reveal that the indirect investor sentiment measures are all significantly stationary.

5.2. Dynamic Spillovers Among Green Bond Markets

Table 3 reports the average results of the dynamic spillover matrix among green bond markets. Each row shows the average FROM index of various markets to a country, whose sum is in the FROM column, and TSI is the mean of these FROM values. Meanwhile, each column points out the average TO index of a market to another country in the system, whose sum is in the TO row, and the NET row is the difference between these TO and FROM indices.

Table 3.

Averaged joint connectedness.

Overall, the mean TSI is 83.35%, which indicates strong spillover effects for the entire sample. Among these markets, the U.S. and China have negative NET values, −29.65% and −8.75%, respectively, revealing that these two markets are net shock receivers in the system and the others are net transmitters. For individual markets, Chinese green bonds absorb shocks mostly from themselves (88.95%); when considering shocks from other markets, they receive mainly from Canada (1.2%), while Canada receives the most from New Zealand (9.51%). New Zealand and Norway are the biggest shock transmitters to Japan, with both FROM values being 9.5%. Denmark and Switzerland transfer risks to each other in the same amount, which is 9.5%. The Swedish green bond market appears to be the most influential by sending large shocks to different markets, including the U.S. (8.55%), the EU, and the UK (9.47%), New Zealand (9.48%), and Norway (9.5%), while it only receives a shock from Norway with 9.48%.

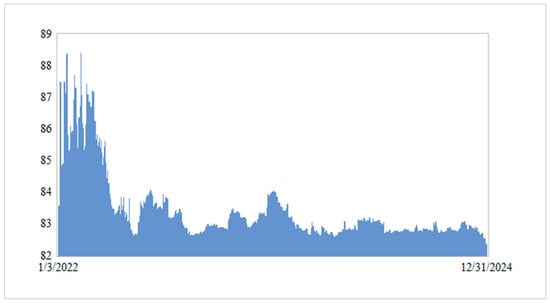

Figure 1 illustrates the visual dynamic of total spillovers among green bond markets (TSI). The total spillovers are much higher in the early period of the research, strongly fluctuating around 83% and 88.5%; nevertheless, they are more stable and range from 82% to 84%, with an average value of 83.35%, as reported in Table 3. The sizeable total spillover effects imply strong information transmission and risk contagion across green bond markets (R. Wu & Liu, 2023).

Figure 1.

Dynamic total spillovers among green bond markets.

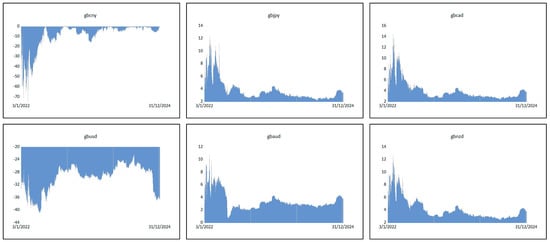

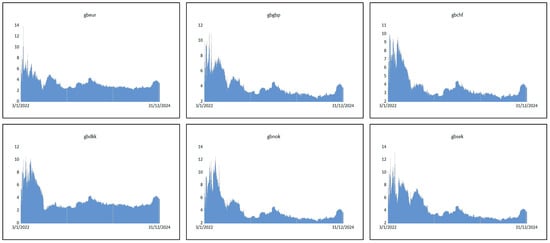

In addition to the visual TSI and the average results of the dynamic shown in Table 2, we plot the dynamic net total directional spillovers (NET) of each green bond market in Figure 2. In these graphs, markets with positive spillovers are net information transmitters, while those with negative ones are net risk receivers in the system. Our graphs in Figure 2 again confirm our results in Table 2 about the net information receiver position of the U.S. and Chinese green bond markets, with the U.S. being dominant because of its higher NET values. Furthermore, each NET plot also casts a similar pattern with the TSI by having higher NET values at the beginning of the research period and less fluctuation thereafter. Among information-transmitting markets, Australia, the EU, the UK, Switzerland, and Denmark represent the most information emissions, as their net total directional spillovers are larger than other markets in the system.

Figure 2.

Dynamic net total spillovers of each green bond market.

5.3. The Impact of Domestic Investor Sentiment on Dynamic Spillovers

Given the dynamic spillover effects of the twelve green bond markets documented above, we test the second hypothesis about the impact of investor sentiment on the spillover effects of these green bond markets. Table 4 reports our research results on the role of direct investor sentiment (CCI) in these spillovers using EGARCH (Panel A) and GARCH-MIDAS (Panel B) models to address the data frequency mismatch between daily spillover indices and monthly CCI. Following (Anderson & Burnham, 2004; W. Wang & Duxbury, 2021), we report the log-likelihood function (LLF) and Akaike’s Information Criterion (AIC) for each regression.

Table 4.

Impact of direct investor sentiment on net total directional spillovers.

The sign and significance of the estimated coefficients from the EGARCH model in Table 4 show the mixed impact of direct investor sentiment on the net total spillovers of twelve green bond markets. On the one hand, direct investor sentiment has a significant and positive association with the net return spillovers in Japan (0.66), Canada (0.76), the U.S. (0.82), Australia (10.79), the EU (3.24), Norway (3.54), and Sweden (5.49). On the other hand, it yields significantly negative impacts on the net return spillovers of China (−3.07), New Zealand (−6.38), the UK (−1.96), Switzerland (−4.41), and Denmark (−5.26). Among these countries, investor sentiment mainly affects the return connectedness of Australia, New Zealand, and Sweden as measured by the magnitude of the coefficients, which are 10.79, 6.38, and 5.49, respectively. Meanwhile, Japan, Canada, and the U.S. receive less effect from the direct investor sentiment because the reported coefficients are lower than one percent.

CCI reflects consumers’ outlook through saving and consumption behaviors; thus, a higher CCI indicates a better investor sentiment (J. Li & Yang, 2024; Shi et al., 2022). Hence, in some green bond markets, a positive nexus between the direct investor sentiment and the return spillovers implies that as investors feel more confident about the financial markets, they tend to invest more in green assets, which leverages the green asset integration. However, in other countries where investor sentiment slows down the return connectedness, it may result in investors being pessimistic about the market and appearing to avoid risky assets like green bonds (Nykvist & Maltais, 2022; Pham, 2016).

In the GARCH-MIDAS model results reported in Panel B of Table 4, the sum of ARCH and GARCH components is less than 1, α + β < 1, implying that the model has no misspecifications as mentioned in Equation (12). Our parameter of interest is the MIDAS slope coefficient θ, which indicates the role of direct investor sentiment in the return connectedness of these green bond markets. The slope coefficients are all significant and consistent with the coefficients estimated in the EGARCH model. Therefore, the impact of direct investor sentiment on the return spillovers is constant even when the difference in data frequency is considered.

Table 5 shows the results on the role of indirect investor sentiment and turnover ratio in the spillover effects of green bond markets using the EGARCH model. Because the data frequency of spillover indices and turnover ratio are consistent, we do not perform the GARCH-MIDAS model for this relationship. In Table 5, the coefficients of the indirect investor sentiment are all positive and significant, meaning that the indirect sentiment is crucial to facilitating the return spillovers of these green bond markets. This sentiment primarily impacts the U.S., China, and Norway’s coefficient magnitude. Specifically, a 1 percent rise in the turnover ratio increases the spillover indices of these countries by 0.09, 0.07, and 0.04, respectively. Nevertheless, the indirect one casts a mild effect compared to the impact of direct investor sentiment because their estimated coefficients are all less than one percent.

Table 5.

Impact of indirect investor sentiment on net total directional spillovers.

5.4. The Impact of Foreign Investor Sentiment on Dynamic Spillovers

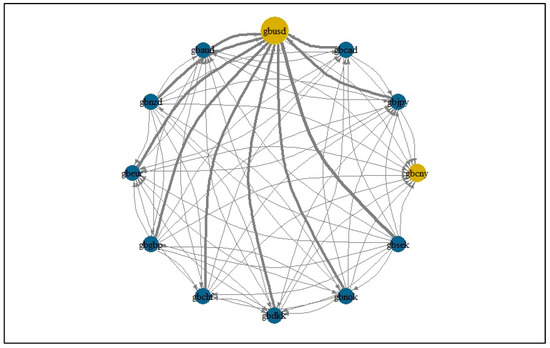

We plot the return connectedness networks of twelve green bond markets in Figure 3. In this diagram, each node represents an individual green bond market, and the nodes’ size reveals the market’s importance, while their colors tell whether the market is a net shock transmitter or receiver. Each edge shows the directional spillover effect between markets, with a thick one indicating a strong connection. Importantly, arrows going with edges point out the information transmitting or receiving position of a market. From Figure 3, we easily see that the U.S. and China are the net risk receivers, with the U.S. being the largest receiving market, again confirming our above analysis. In this section, we base the spillover network diagram to test our third hypothesis on how foreign investor sentiment impacts domestic spillovers. As the U.S. and China are the net shock absorbers in the system, we are interested in exploring whether the investor sentiments of shock-transmitting markets drive the return connectedness of these two countries. It is interesting to know that these two net shock receivers represent developed (U.S.) and emerging (China) countries (Guo & Zhou, 2021). To this end, in this section, we present the testing results of this hypothesis for U.S. and Chinese green bond markets.

Figure 3.

Spillover network diagram among green bond markets.

5.4.1. The Impact of Foreign Investor Sentiment on U.S. Dynamic Spillovers

From directional edges in the network diagram of Figure 3, we identify all other green bond markets (except for China) that send shocks to the U.S.; hence, we consider these transmitters foreign markets to the U.S. and employ their investor sentiment proxies. Table 6 reports the research results of the role of foreign direct investor sentiment in the net total directional spillovers of U.S. green bond markets using the EGARCH model (Panel A) and GARCH-MIDAS model (Panel B).

Table 6.

Impact of foreign direct investor sentiment on U.S. net total directional spillovers.

In Panel A of Table 6, all the estimated coefficients are positive at high significance levels, indicating that foreign direct investor sentiment increases the return connectedness of the U.S. green bond market. Notably, most of these parameters have larger magnitudes than those for domestic direct investor sentiment, revealing that foreign direct investor sentiment is an important driver of U.S. return spillovers. Among ten foreign markets, Switzerland, Denmark, and the EU’s direct investor sentiment yield the most considerable impact on the return connectedness of the U.S. green bond market. Specifically, a one percent rise in these direct sentiments increases the U.S. green bond return spillovers by 51.25 percent, 45.43 percent, and 21.78 percent, respectively.

In the GARCH-MIDAS model results presented in Panel B of Table 6, all the MIDAS slopes θ are also favorable at a high significance level. After addressing the data frequency mismatch between CCI and the spillover index, the estimation validates the significant impact of foreign direct investor sentiment on U.S. return spillovers.

Table 7 shows the role of foreign indirect investor sentiment in the return spillovers of the U.S. green bond market using the EGARCH model. All the coefficients are positive and significant, indicating the crucial influence of the foreign turnover ratio on U.S. net spillovers. In the foreign indirect sentiment, the spillovers are driven mainly by Australia, Norway, and Japan because a one percent increase in these sentiments raises the U.S. spillover index by 0.43 percent, 0.32 percent, and 0.27 percent, respectively.

Table 7.

Impact of foreign indirect investor sentiment on U.S. net total directional spillovers.

5.4.2. The Impact of Foreign Investor Sentiment on Chinese Dynamic Spillovers

Table 8 estimates how foreign direct investor sentiment affects Chinese green bond return spillovers from the EGARCH model (Panel A) and the GARCH-MIDAS model (Panel B). Because Figure 3 shows eleven markets that transmit information to China, we report this relationship in terms of the direct sentiment of these eleven countries.

Table 8.

Impact of foreign direct investor sentiment on Chinese net total directional spillovers.

The EGARCH coefficients shown in Panel A are all positive at high levels of significance, implying the co-movement between foreign direct sentiments and Chinese return spillovers. Among these foreign countries, the direct investor sentiments of Denmark, Japan, and Norway cast the most significant impact on China’s return connectedness because a one percent increase in these sentiment indices induces 56.42 percent, 48.61 percent, and 34.48 percent, respectively, in the rise of the net spillover index of the Chinese green bond market. Compared to the impact of foreign direct investor sentiment on U.S. spillovers, those on Chinese spillovers have similar patterns in large magnitudes and positive signs and are most affected by European countries like Switzerland, Denmark, and Norway.

Regarding the results from the GARCH-MIDAS model, the coefficients θ of all foreign direct sentiments are also positive and significant, validating the role of CCI of other countries in the spillover effects of Chinese green bond markets.

Table 9 provides the EGARCH estimation on the association between foreign indirect sentiments and return spillovers of the Chinese green bond market. These coefficients are all positive and highly significant, meaning that the turnover ratio of foreign markets also plays an important role in promoting China’s green bond connectedness. Among these foreign indirect sentiments, the U.S. and Japan are mainly influential to the return spillovers of Chinese green bonds in coefficient magnitudes of 0.46 percent and 0.35 percent, respectively.

Table 9.

Impact of foreign indirect investor sentiment on Chinese net total directional spillovers.

6. Results Discussion

In this section, we discuss the above findings about the dynamic spillover effects among twelve green bond markets and the role of investor sentiment in these spillovers.

6.1. Dynamic Spillovers Among Green Bond Markets

We observe three shock contagion patterns from the results of the TVP-VAR model shown in Table 3 and Figure 2 on the spillovers among twelve international green bond markets. First, the spillover from other markets received by the U.S. green bond market is 84.57%, while the spillover it sends to others is 54.92%, meaning that it is a primary net receiver of shock with the average NET index of −29.65. This finding is not consistent with current research, including (Long et al., 2022; Rehman et al., 2023; Q. Wang & Li, 2024), documenting the risk transmitting position of the U.S. green bond market. It is also contrary to the fact that its green bond market is dominant in issuing volume and priced deals (Climate Bonds Initiative, 2024). Furthermore, the U.S. has been influential in global development and money supply because of its significantly sizable economy (Q. Wang & Li, 2024). Hence, its green bond market should transmit shocks to others rather than absorb them. Two possible explanations exist for the net risk-receiving position of the U.S. green bond markets. On the one hand, because the U.S. dollar is one of the most prominent currencies dominating the international green bond market (Climate Bonds Initiative, 2024), green bonds issued in other countries may be denominated in the U.S. dollar. In the context of financial and trade linkages with the U.S., as volatility in other countries appears, it hits the U.S. and makes it a shock absorber. On the other hand, by rebalancing the portfolio, investors may move their investment to the U.S. green bond market. Fund reallocation can inject foreign risk into the market, and the risk is even higher if foreign green bonds underperform.

Secondly, China absorbs the highest shock among the twelve green bond markets by itself, at 88.95%. This figure evidences its strong independence in the system. Interestingly, both the U.S. and Chinese green bond markets send relatively low shocks to each other. Specifically, the U.S. transmits 0.93% risk to China while receiving only 0.59% of its risk, which presents the weak correlation between these markets. This result is different from (Q. Wang & Li, 2024) who show the intensive risk spillovers from the U.S. to the Chinese green bond market. Despite high independence, China is also a net shock receiver like the U.S., with the net risk absorption of 8.75%. This position of the Chinese green bond market may result from its low-risk protection mechanisms (Q. Wang & Li, 2024). Additionally, its green bond market is still immature regarding development history and issuing volume compared to other developed green bond markets (Long et al., 2022). Consequently, it lacks influential power over other green bond markets in the system.

Thirdly, except for the U.S. and China being net shock receivers, the rest of the international green bond markets are net risk transmitters. They share close NET indices, fluctuating from 3.39% to 4.31%, with the largest net risk sender being Sweden. These green bond market pairs also feature similar bidirectional spillovers, indicating relatively small net effects.

6.2. The Impact of Investor Sentiment on Dynamic Spillovers

Our estimation of the impact of domestic investor sentiment on the net spillovers of green bond markets in Table 4 and Table 5 documents mixed findings for direct and indirect measures. Direct sentiment, proxied by the consumer confidence index, significantly intensifies net-risk absorption in the U.S., the UK, Switzerland, Denmark, and New Zealand, with the latter two facing the most significant effects. Meanwhile, the direct sentiment of local investors widens the net-risk transmission to the others, particularly Sweden. The varied impact of this sentiment measure on the net total directional spillovers is understandable because of the different maturity and development in their green bond markets (Long et al., 2022). Nevertheless, this finding implies that direct investor sentiment can serve as a channel of risk spillovers among green bond markets. Based on their economic outlook, domestic investors may rebalance their local and international portfolios, triggering asymmetric information to investors in other markets (Kaminsky et al., 2003). Consequently, financial contagion occurs with the capital movements among green bond markets.

Regarding the indirect sentiment of domestic investors, measured by the market turnover ratio, although it shows a significantly positive relationship with the net total directional spillovers across twelve green bond markets, its impact is mild. Specifically, the coefficients of turnover ratio on the net spillovers are all less than 0.1%; compared to the role of direct investor sentiment, the indirect one is vague in explaining the spillovers. However, the low market turnover ratio can explain this small effect because, as reported in Table 2C, the average values of the ratio for the twelve green bond markets are only from −0.31% to 1.54%, suggesting that they are not conducive to active trading and high liquid markets. Thus, the trading behavior of domestic investors in these financial markets is not enough to reflect the net risk spillovers.

Because the U.S. and China are net risk absorbers in the system, how the sentiment of foreign investors impacts their risk-receiving position is crucial. Our results document that the U.S. green bond market is most affected by the sentiment of investors in Switzerland and Denmark. In contrast, the Chinese market is mainly influenced by investors in Japan, which shares a similar Asian culture. Although indirect proxies cast lower effects, all foreign investors’ direct and indirect sentiments evidence a significantly positive relationship with these green markets’ total net directional spillovers. This finding indicates that higher levels of confidence of foreign investors and more active trading in foreign markets send more shocks to the U.S. and Chinese green bond markets. It is also consistent with our previous analysis of how these countries are net shock absorbers and provides more validation to our argument that investor sentiment plays a possible mechanism for financial contagion in different green bond markets.

7. Conclusions and Implications

As a crucial instrument for sustainable finance, green bonds have gained considerable attention from finance scholars investigating their multifaceted aspects, ranging from their impact on firms, countries, and sustainability to factors behind their development. With capital flow liberalization, researchers focus on how green bonds correlate with other financial assets such as stocks, conventional bonds, and commodities. Nevertheless, there is an absence of connectedness between green bonds in different countries. Recognizing the increasing importance of green bonds to sustainable development and the potential contagion among various markets, we aim to identify the dynamic spillover effects between green bond markets. Interestingly, in addition to exploring these return spillovers, we employ investors’ sentiments as the core factor of green bond demand to investigate whether they yield an impact on these spillovers.

To conduct our research, we employ the TVP VAR model to reveal the dynamic spillovers between twelve green bond markets, including China, Japan, Canada, the U.S., Australia, New Zealand, the EU, the UK, Switzerland, Denmark, Norway, and Sweden, for the period from 3 January 2022 to 31 December 2024. After extracting the spillover indices of these green bond markets, we employ the EGARCH model to examine the effects of direct (measured by CCI) and indirect (measured by turnover ratio) investor sentiment in individual markets’ net total directional spillovers. Because CCI has a lower data frequency than the spillover index, we use the GARCH-MIDAS model to address the data frequency mismatch. Additionally, from the research results, we find that the U.S., as a representative of developed countries, and China, as a representative of emerging markets, are net information receivers; we perform the same research methodologies to examine whether the investor sentiment of shock-transmitting countries affects the spillover effects of these receiving markets.

Our research findings are threefold. First, we see the strong return connectedness between the twelve green bond markets, with the U.S. and China are net risk receivers. Second, both direct and indirect investor sentiment play significant roles in the net spillovers of these green bond markets. Third, direct and indirect sentiments of foreign investors increase the net-risk absorption of the U.S. and China.

Our research results are significant to the sustainable and behavioral finance literature. On the one hand, we are among the first to attempt to identify the dynamic spillover effects of the most influential international green bond markets, serving as more conclusive and comprehensive findings for the spillovers between different green bond markets. On the other hand, we are pioneering in including the investors’ psychological factors, referring to investor sentiment, to examine their roles in the spillover effects of various green bond markets. Importantly, we focus on both direct and indirect proxies of investor sentiment rather than being partial to a single measure of the sentiment. Additionally, we shed light on the impact of investor sentiment on foreign green bond markets and the spillover effects of a country.

Our research offers valuable implications to green bond regulators. First, knowing the strong interdependence of various international green bond markets, green bond market regulators should consider the cross-market and risk contagion effects when constructing policies to develop their green bond markets, especially in the U.S. and China because they are the net shock receivers in the system. In that way, green bond regulators should construct official and consistent measurements of green bond market performance regarding return, volatility, and liquidity across markets. This way can help regulators of different green bond markets put their market performance and stability on a common standard in the context of contagion. Furthermore, when understanding the shock transmitting and receiving position, regulators should regularly evaluate the performance of their strongly correlated markets to avoid potential threats to their green bond markets. Second, with the persistent impacts of both direct and indirect investor sentiment proxies, green bond regulators may have various lenses when assessing the factors driving different countries’ green bond return connectedness. Hence, policymakers should consider investor sentiment a mechanism of risk spillovers and include it in regulatory frameworks to stabilize green bond markets. Currently, there is no universal acceptance in measuring investor sentiment; therefore, researchers struggle with finding proper proxies for it. Given the crucial role of investor sentiment in green bond spillovers and conventional instruments’ performance, it is high time for regulators to construct an official and consistent investor sentiment indicator. Third, realizing the significant impact of foreign investor sentiments on green bond spillovers across markets adds to the regulatory strategies of local authorities. When regulating domestic green bond markets, they must consider foreign investors’ sentiments, including direct and indirect measures. Thus, achieving comprehensive green bond market regulations requires international cooperation among countries’ regulators to build consistent investor sentiment measures and stability mechanisms at all levels.

In addition to policymakers, our research results bring important investment strategies to green bond investors. First, our study shows that the U.S. is the leading net risk receiver with a relatively high amount of 29.65% on average. Therefore, when investors hold the U.S. green bonds, they should constantly track the changes or shocks in other markets to adjust their portfolio for hedging purposes promptly. Second, despite net risk receiving, the Chinese green bond market is significantly independent; given its most significant self-risk absorption of 88.95% on average, investors can consider it a hedging heaven and diversification opportunity. Third, except for the U.S. and China, the rest of the green bond markets are net risk transmitters, and their net bidirectional effects are all low. Hence, investors can view them as a safe place for asset allocation. Finally, we document the significant role of direct and indirect sentiment of local and foreign investors in green bond spillovers. These findings will help investors understand how their outlook and trading behavior impact green bond market performance from different geographical and ideological perspectives. Thus, they can use their sentiment to predict green bond performance in local and foreign markets. Consequently, they can construct effective trading and diversification strategies to minimize investment risks and maximize potential profits.

In addition to its contributions, our study has several limitations. One of the most significant weaknesses of our research is not including two dynamic green bond markets in Asia, namely Singapore and Hong Kong, due to the unavailability of data on direct investor sentiment. This exclusion prevents us from conducting two aspects of our research. On the one hand, in addition to individual markets, we intended to group green bond markets based on regions (Asia, Europe, and America) and regress our models for regional purposes. On the other hand, because these two markets are China’s neighbors, given its net-risk receiving situation, adding Singapore and Hong Kong may yield more comprehensive findings in this spillover, together with the role of direct and indirect investor sentiment. Consequently, our research results may lack representativeness, particularly for Asian green bond markets. Another limitation of our paper is that it does not explore the time and frequency spillovers of these green bond markets with the role of investor sentiment. Hence, other researchers can consider the following recommendations to improve our research. First, they can estimate the net pairwise directional spillover index to see the bilateral spillovers and explore the role of investor sentiment in these spillover indices. Second, they can examine the time-frequency spillovers and include investor sentiment. Third, they can employ other methods like Copula to investigate risk spillovers among green bond markets.

Author Contributions

Conceptualization, T.D.L.; methodology, T.D.L.; software, T.D.L.; validation, A.H. and T.L.; formal analysis, T.D.L.; investigation, T.D.L.; resources, A.H.; data curation, T.D.L.; writing—original draft preparation, T.D.L.; writing—review and editing, T.D.L., A.H. and T.L.; visualization, T.D.L.; supervision, A.H. and T.L.; project administration, T.L.; funding acquisition, NA. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abad, P., Chuliá, H., & Gómez-Puig, M. (2010). EMU and European government bond market integration. Journal of Banking and Finance, 34(12), 2851–2860. [Google Scholar] [CrossRef]

- Abad, P., Chuliá, H., & Gómez-Puig, M. (2014). Time-varying integration in European government bond markets. European Financial Management, 20(2), 270–290. [Google Scholar] [CrossRef]

- Anand, A., Basu, S., Pathak, J., & Thampy, A. (2021). The impact of sentiment on emerging stock markets. International Review of Economics and Finance, 75, 161–177. [Google Scholar] [CrossRef]

- Anderson, D., & Burnham, K. (2004). Model selection and multi-model inference: A practical information—Theory approach: Vol. 63.2020 (10th ed.). Springer. [Google Scholar]

- Antonakakis, N., Gabauer, D., Gupta, R., & Plakandaras, V. (2018). Dynamic connectedness of uncertainty across developed economies: A time-varying approach. Economics Letters, 166, 63–75. [Google Scholar] [CrossRef]

- Asgharian, H., & Nossman, M. (2011). Risk contagion among international stock markets. Journal of International Money and Finance, 30(1), 22–38. [Google Scholar] [CrossRef]

- Baker, M., & Stein, J. C. (2004). Market liquidity as a sentiment indicator. Journal of Financial Markets, 7(3), 271–299. [Google Scholar] [CrossRef]

- Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross-section of stock returns. Journal of Finance, 61(4), 1645–1680. [Google Scholar] [CrossRef]

- Banerjee, A. V. (1992). A simple model of herd behavior. The Quarterly Journal of Economics, 107(3), 797–817. [Google Scholar] [CrossRef]

- Barua, S., & Chiesa, M. (2019). Sustainable financing practices through green bonds: What affects the funding size? Business Strategy and the Environment, 28(6), 1131–1147. [Google Scholar] [CrossRef]