1. Introduction

However, it is necessary to consider the “health” of the financial system, not only taking into consideration financial indicators but shifting the research view to economic indicators as factors depending on and, at the same time, affecting macroeconomic factors.

When a financial system malfunctions, a country’s economy can suffer significantly. There is also an inverse relationship—the financial system of any country is very sensitive to the state of the macroeconomic performance (

Ariffin, 2012;

Bucevska & Hadzi Misheva, 2017;

Climent-Serrano, 2019;

Dibar & Sridevi, 2021;

Tanasković & Jandrić, 2015). The sectors of the economy also react to and, simultaneously, affect the risks and state of the financial system (

Cernisevs & Popova, 2022;

Melnyk et al., 2025;

Onyshchenko et al., 2025;

Popova & Cernisevs, 2023;

Saksonova & Papiashvili, 2021;

Saksonova & Vilerts, 2015). There are numerous risks which should be considered in the financial sector (

Cernisevs et al., 2023). This article considers only one factor of instability of the financial system—non-performing loans (NPLs). NPLs serve as one of the visible manifestations of the deteriorating quality of credits and increased systemic risk within the banking sector. NPLs are widely discussed by the scientific community (

Anastasiou et al., 2019;

Boudriga et al., 2009;

Irani et al., 2022;

Saliba et al., 2023;

Vouldis & Louzis, 2018).

NPLs not only affect bank profitability and capital adequacy but also lower credit availability and slow economic growth and development. In emerging economies like Kazakhstan, banking systems have the leading role in redirecting the financial resources into the real sectors of the economy; they are subjected to serious risks (

Popova et al., 2024,

2025). Therefore, the impact of macroeconomic factors on loan performance becomes particularly visible.

The goal of this research is to determine the impact of macroeconomic factors on NPLs with the mediation effect of foreign factors, saving factors, and social factors in Kazakhstan. The factors for analysis were chosen on the basis of a substantial literature review (the methodology is presented in

Section 2.1).

As we see, scientists pay great attention to the impact of macroeconomic indicators on NPLs. Therefore, the topic is not absolutely novel. However, researchers traditionally choose a wide range of indicators for the application of statistical analysis. The authors of this article have decided to concentrate on a rather small number of indicators to have a more exact and brighter vision of the factors’ interconnectedness. We tried to choose the minimum set of indicators capable of shaping the repayment capacity of borrowers and the overall confidence in the financial system, which we supposed to be the leading factors of credit deterioration. The chosen indicators reflect macroeconomic volatility, foreign financial pressures, the savings behavior of the population, and deposit dynamics and social inequality indicators, and this paper analyzes their effect on “bad loans” (NPLs) in the Kazakh banking sector.

The authors believe that this impact has not been investigated fully.

First of all, the authors have not found any articles considering the economies of central Asia in accordance with the inclusion criteria. There are analyses of European and Asian countries, BRICS countries, the US, Turkey and South American countries, and African countries. Nevertheless, the post-Soviet central Asian countries were not analyzed, though they are rich in resources, have well-developed mining and manufacturing industries, and are engaged in intensive financing of the real sector of the economy via the banking system. Therefore, we suppose that this unique combination of features should be studied separately. Certainly, articles not corresponding to the inclusion criteria can be found, for example, (

Zaitenova & Baibulekova, 2016); however, they are excluded from the study. We have chosen the Republic of Kazakhstan, since this country is a typical representative of post-Soviet countries with a resource-based economy and developed banking system redirecting financial flows to real-economy sectors. The economies and banking systems of Kazakhstan and other central Asian countries (Uzbekistan, Turkmenistan, Tajikistan, and Kyrgyzstan) have many similarities, which appear to be due to historical, political, and geographical factors. All central Asian countries are at the stage of creating market economies (

Kaser, 1997;

Pomfret, 2021), although in most of them, the state continues to play a significant role, especially in the strategic sectors of the economy. The economies of these countries are resource-based, and they rely heavily on the export of natural resources. This dependence on raw-material exports affects the stability of national currencies and the banking sector (

Yadav, 2016). Nevertheless, the development of digital banking services (mobile banking, online payments, e-wallets, fintech startups) is one of the priority tasks in these countries. There is growing interest in digitalization and financial technologies, and countries are actively developing their own electronic solutions (

Begimkulov, 2025;

Ure, 2021). Kazakhstan is one of the regional leaders in this area (e.g., the KASPI.kz platform).

In these countries, SMEs are actively supported through both banking and non-banking sectors (

Prêtet & Klang, 2019); therefore, the microfinance sector is well developed.

Central Asian countries depend on foreign trade and external investments, and their banking systems rely on international reserves, foreign investments, and loans from international organizations (

Dosmagambet et al., 2018). Consequently, these countries have currency restrictions or regulations. Central banks play a key role in monetary policy, exchange rate regulation, and supervision. In addition, banking systems in these countries have faced challenges such as poor credit portfolio quality and overdue debt, which require strong regulation (

Čihák & Demirgüç-Kunt, 2013).

Kazakhstan stands out in this context with a higher level of economic development, liberalization, and digitalization of the banking sector, making it a relative leader in the region. Our choice of this country is based on these factors.

Another novelty is the approach to testing the indicators. We did not test the direct impact of these indicators, but they were considered as mediators for economic factors. We believe it can show a more complex structure of interconnections of factors when they interplay and change the final effect on NPLs.

One more novelty is the application of the PLS-SEM method for investigating the relationships between variables. The detailed explanation of the method and its advantages are shown in

Section 2.2. The employment of this method is a good contribution to other statistical tools applied to this topic study, for example, autoregressive (AR), moving average (MA), and autoregressive integrated moving average (ARIMA) models.

We hope this study will contribute to the topic, and it will be interesting for the scientific community as well as for the practitioners from the industry interested in managing the financial flows, including loans.

2. Methodology

2.1. Literature Review

The goal of the study is to analyze the impact of macro indicators on NPLs. The preliminary literature review is a mandatory part of the study. The obtained results of the literature review are shown in Introduction section of this article. The literature review was completed according the methodology described in several research studies (

Butler et al., 2021;

Popova & Popovs, 2023;

Popova, 2020;

Wee & Banister, 2016).

There are certain stages in the literature review. It is necessary to determine the study goal, the corresponding keywords for the literature search, and inclusion and exclusion criteria, which are all part of the first research stage. The following are the requirements for inclusion: only English-language full-text publications that are accessible online and listed in the Scopus database. Items were excluded if they were books, not English-language full-text articles, or book chapters.

Scopus was chosen as a research database since it is one of the top databases with a large number of peer-reviewed social science studies. The wide selection of articles makes it possible to select the full collection of peer-reviewed papers in accordance with the stated objective. Even though Web of Science is a widely used scientific database, it does not offer as many articles in the social sciences as the Scopus database (

Falagas et al., 2008;

Mongeon & Paul-Hus, 2016;

Vujković et al., 2022). The articles in Scopus and the social science research displayed in the Web of Science database interact.

The authors therefore made the decision to exclusively use the Scopus database because it enables the accomplishment of the objectives.

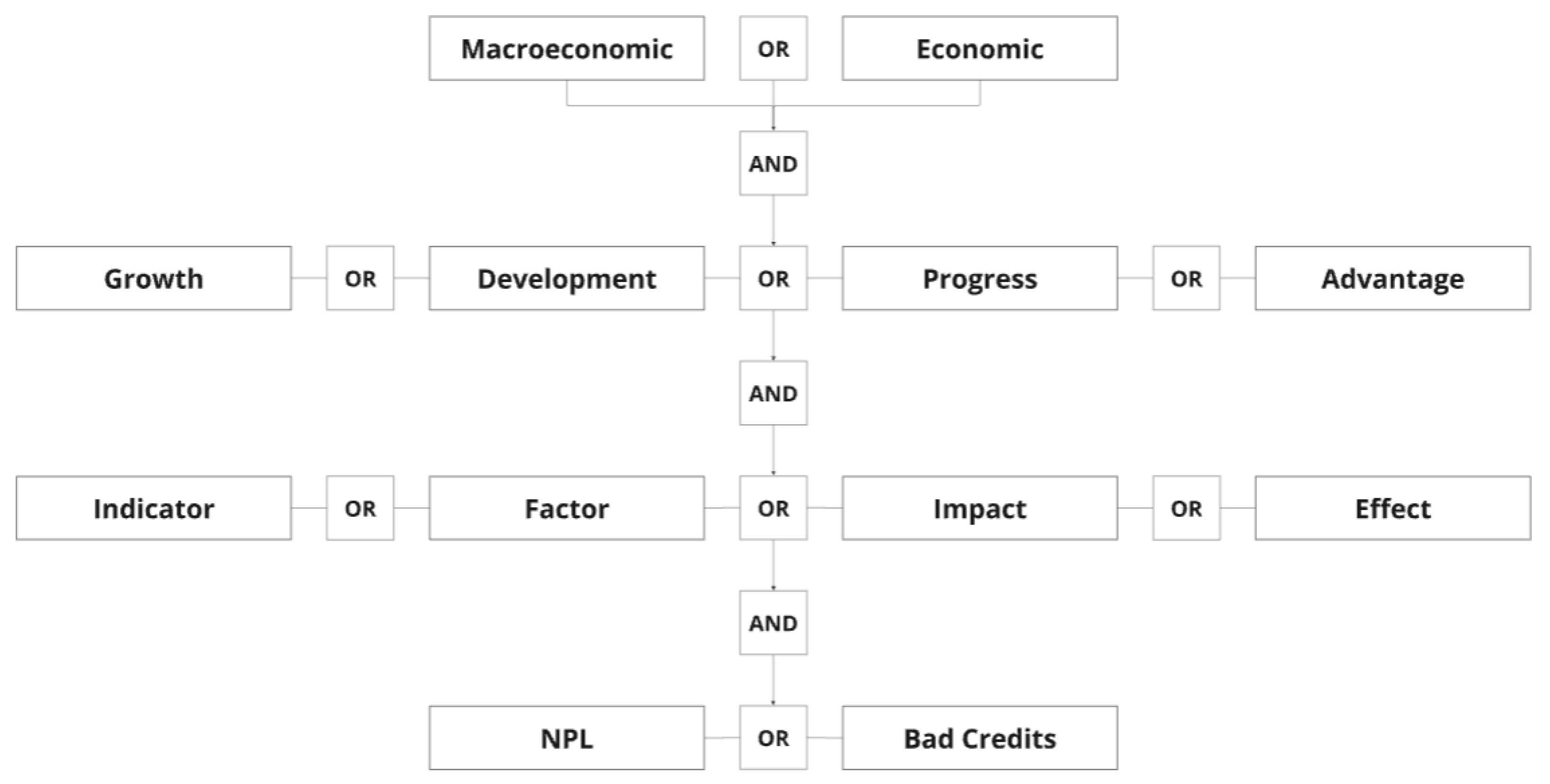

The next step involves using the identified keywords to conduct a search in the Scopus Database using the Boolean approach. The concept of search is demonstrated in

Figure 1.

At the first stage, duplicate publications, books, book chapters, articles that are not in English, or that are not accessible online are all eliminated as part of the primary selection process.

The abstracts of the chosen papers are screened for relevance to the research goal in the third stage. Articles that are thought to be unrelated to the research are excluded.

Then, the authors read the full-text articles, excluding the ones not related to the research goal.

Next, the snowballing search was applied. The authors checked the references of the previously selected articles, and from the list of references in the articles, among those that seemed to be the most corresponding to the study goal, we chose articles for further study. These articles also satisfied the set inclusion criteria; however, there was one exception—at this stage, we also included the book chapters and articles not indexed in Scopus.

Then, qualitative analysis was used to analyze the selected articles.

2.2. Research Design

This paper uses Partial Least Squares Structural Equation Modeling (PLS-SEM) to explore the structural relationships between macroeconomic, financial, foreign, and social determinants and the level of non-performing loans (NPLs) in Kazakhstan’s banking sector. PLS-SEM is particularly suited for exploratory modeling with small to medium samples and when the goal is prediction and theory development (

Hair et al., 2017).

CB-SEM is traditionally employed for verification, confirming the existing results and supporting the correct selection of factors. It is one of the methods that uses constructs (latent variables) as common factors (

Hair et al., 2017). In contrast, PLS uses composite variables comprising the linear combination of measures (indicators) (

Hair et al., 2017).

PLS-SEM is traditionally used for a causal-predictive analysis of the variance in the independent constructs. Practically, it is a combination of regression of path and components analysis; it is used for predicting how the specific construct (latent variable) will behave (

W. Chin et al., 2020;

Hair et al., 2021;

Mateos-Aparicio, 2011;

Ringle et al., 2020;

Schlägel & Sarstedt, 2016). Moreover, PLS-SEM allows applying moderating and mediating factors via the calculation of direct and indirect relationships (

Ringle et al., 2020). Therefore, this method is used by many researchers (

Onyshchenko et al., 2025;

Shujahat et al., 2018;

Valaei et al., 2017;

Wang et al., 2016).

The authors developed the set of hypotheses focused on proving the relationships between macroeconomic indicators and bad credits. The macroeconomic indicators traditionally used for predicting the NPLs were taken: real GDP, GDP growth rate, and inflation. The usage of these macroeconomic indicators was proven for other world regions (see

Table 1), and the authors assume that the same indicators can be taken for the Kazakhstan economy. The same refers to all other indicators used for the formation of latent variables: we formed them using the indicators, and these were investigated by scholars for other world regions.

However, the goal of the article is to determine the impact of macroeconomic factors; we assumed that this impact can be affected by other factors, and we decided to consider the mediation effect of some factors that we considered to be of primary importance for NPLs. We tried to reduce the number of latent variables to avoid multicollinearity and to achieve more evident results.

Then, we have taken separate factors reflecting the foreign influence on the Kazakhstan economy. Kazakhstan is a resource-based economy, and it depends heavily on the foreign sector. Therefore, it is logical to consider foreign factors and their impact on NPLs. Saving behavior is very important for the formation of loans. Therefore, the authors use the latent variable saving factors for determining the mediation effect on NPLs. Then, we assume that NPLs are connected not only to the intentional misbehavior of people; the most evident case of the appearance of NPLs is social factors that impact the individuals’ behavior. Therefore, this latent variable was also included in the study.

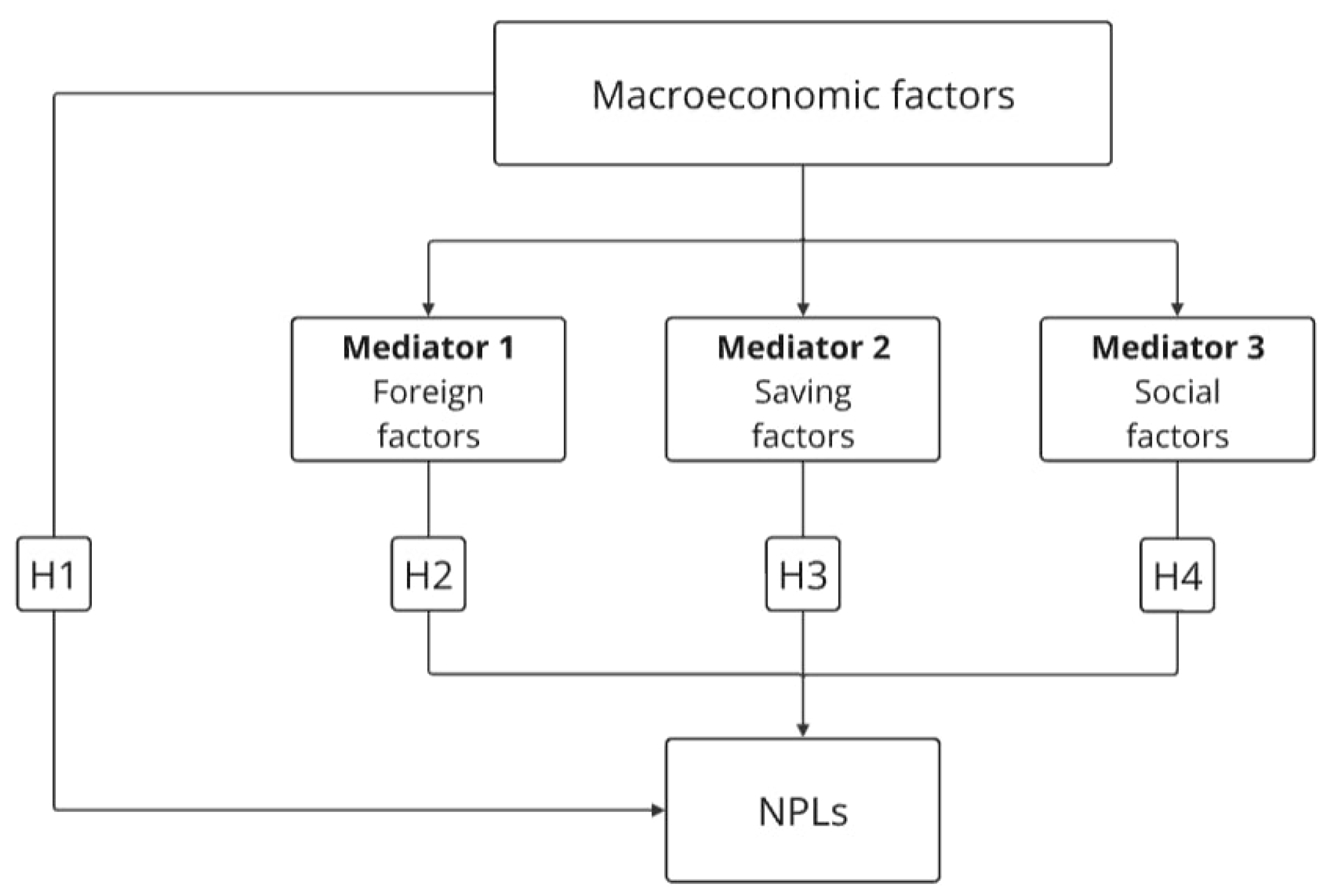

The developed hypotheses consider the mediation effect of foreign, saving and social factors.

H1. Macroeconomic indicators have a direct impact on NPLs with an inverse relation.

H2. Macroeconomic indicators have an impact on NPLs with an inverse relation with the mediation of foreign factors.

H3. Macroeconomic indicators have an impact on NPLs with an inverse relation with the mediation of saving factors.

H4. Macroeconomic indicators have an impact on NPLs with a direct relation with the mediation of social factors.

The conceptual model, presented in

Figure 2, was developed to visualize the hypotheses.

The methodological framework is grounded in the developed conceptual model.

2.3. Data Sources and Indicators

The model is constructed on the basis of five latent variables. The latent variables in their turn use the publicly available macroeconomic data for the Republic of Kazakhstan for 20 years—from 2004 to 2024 (

Bureau of National Statistics, n.d.;

Ministry of Finance, n.d.;

National Bank of Kazakhstan, n.d.). The 20-year period allows enough inputs for statistical analysis, which is the final purpose of the data selection; another criterion of this choice is data availability. The earlier information is not fully available for all the indicators that were used in the study. The data were used as a time series without any exclusion due to positive or negative shocks in the economy of Kazakhstan. The data were standardized before application to analysis (see

Appendix A).

The following indicators were initially used for constructing the model (see

Table 2).

The model was constructed and evaluated in SmartPLS 4.0 software. In the first stage, the outer model was estimated. The quality of the outer model affects the quality of the latent variables. The latent variables meeting all requirements and all estimation criteria allow the researcher to determine further relationships in the structural model with maximum accuracy.

The loadings of all indicators were estimated, and the indicators with loadings below 0.5 were excluded due to not significantly contributing to the model. The obtained model demonstrates very good loadings and

p-values. The loadings are above 0.8, demonstrating the highly satisfactory quality of the constructs, and all

p-values are less than 0.001 (see

Table 2) (

Hair et al., 2012,

2019). Then, the model was tested for reliability, convergent validity and discriminant validity. The obtained values were estimated in accordance with the criteria established for the PLS-SEM outer model assessments (

Cernisevs et al., 2023;

Hair et al., 2014;

Henseler et al., 2015;

Popova & Zagulova, 2022a,

2022b;

Wong, 2013).

The model’s stability and convergence were estimated via the iterations number needed to finish the assessment with the maximum threshold of 300 iterations (

Hair et al., 2021;

Ringle et al., 2020).

Multicollinearity is measured via the Variation Inflation Factor (VIF). Usually, the threshold set for the models is 3; however, for some macroeconomic indicators, the threshold can be set at the level of 10 (

Mooi & Sarstedt, 2011;

Popova & Popovs, 2022).

The Average Variance Extracted (AVE) is used to estimate the convergent validity; the criteria of acceptance is having an AVE above 0.5, which means the explanation of more than 50% of the indicators’ variance. The ρA measure is used for internal consistency, which is considered as an “approximately exact reliability measure of the PLS-SEM composites” (

Wang et al., 2016). Another criterion, which is supposed to be the most mild and “liberal” one for measuring reliability of the model, is the Composite Reliability (CR) (

Garson, 2016). This study has exploratory purposes, and in this type of research, it is common to accept CR as more than or equal to 0.6 (

W. W. Chin, 1998;

Garson, 2016;

Höck & Ringle, 2006). Some authors suppose that the CR should be ≥0.7 (

Mateos-Aparicio, 2011) or even ≥0.8 (

Daskalakis & Mantas, 2008;

Wong, 2013). Usually, such values are used for the confirmation of existing theories. However, in this study, the CR is more than 0.799, so it satisfies the highest criteria. It is highly important to support the uniqueness of the variables. The measurement of Cronbach’s alpha is assumed by some authors to be a “conservative measure” (

W. W. Chin, 1998;

Garson, 2016;

Rahi, 2017;

Sanmukhiya, 2020).

Discriminant validity shows the degree of independence of the variables. The strictest criteria applied to the variables is the heterotrait–monotrait ratio of correlations (HTMT) measure. According to (

Hair et al., 2019,

2021;

Henseler et al., 2015), it should be <0.85 if the variables are different and <0.90 if the variables are closely interrelated. The authors also used the Fornell–Larcker criterion and cross-loadings (

Henseler et al., 2015) for measuring discriminant validity, which are more “liberal” and seem to be applicable to this research.

The second step is the estimation of the internal or structural model.

The model tests the direct impact of macroeconomic factors on NPLs as well as the impact of these factors with the mediation of social, saving and foreign factors. Due to the goals of the study, the authors measured the total effect without division on direct and indirect impacts. It was decided that the principal interest is in discovering the impact of macroeconomic factors but not mediators.

The Standardized Path Coefficients (β) traditionally accepted are in the range from −1 to +1; the obtained betas are in this acceptable range.

F2 values (Effect Sizes) can be weak, moderate and strong within the determined paths. Weak are f

2 ≥ 0.02, moderate are f

2 ≥ 0.15, and strong are f

2 ≥ 0.35 (

Cohen, 1988). The higher the f

2 values, the greater impact the exogenous variable has on the endogenous variable.

The model fit is determined by means of Standardized Root Mean Square Residual (SRMR), which demonstrates the level of discrepancy between the actual and estimated correlation matrix. According to (

Henseler et al., 2015), a good fit with low discrepancy will have an SRMR value less than 0.08, demonstrating minimal discrepancy.

3. Results

3.1. Outer Model Evaluation

The first step is estimation of the outer model quality to create the basis for an accurate assessment of the structural model.

The measures of validity and reliability are made on the basis of the Average Variance Extracted (AVE), Composite Reliability (CR) and Cronbach’s alpha (see

Table 4).

As we see, all the measures demonstrate the highest level of reliability and validity, and the quality of constructs is high, promising the good quality of the structural model. Even Cronbach’ alpha demonstrates the very high quality of model. All values are significantly above the determined thresholds.

The multicollinearity (VIF) was checked, and the values were not higher than 3.3, which demonstrates the absence of multicollinearity among the indicators. The indicators do not demonstrate a high level of correlation, and it means that the impact of each indicator can be determined separately, increasing the quality of the model and its reliability.

The discriminant validity was measured using all measures available in SmartPLS software. The authors used the Fornell–Larcker criterion and cross-loadings to state that the discriminant validity is satisfactory. Certainly, some indicators are interconnected logically, since they describe the economic development of the country, and they sometimes can show the similar dependencies, as demonstrated in (

Popova & Popovs, 2022). These close relationships of variables are reflected by the HTMT ratio (see

Table 5).

The effects are moderate and strong, and the impact of exogenous variables on endogenous ones ranges from medium to strong.

Further, it was established that 11 of the 300 iterations allowed finishing the assessment.

Therefore, it is possible to conclude that the outer model is of high quality, while the constructs (latent variables) can provide an accurate estimation of the structural model for testing hypotheses and achieving the set goal.

3.2. Structural (Inner) Model Results

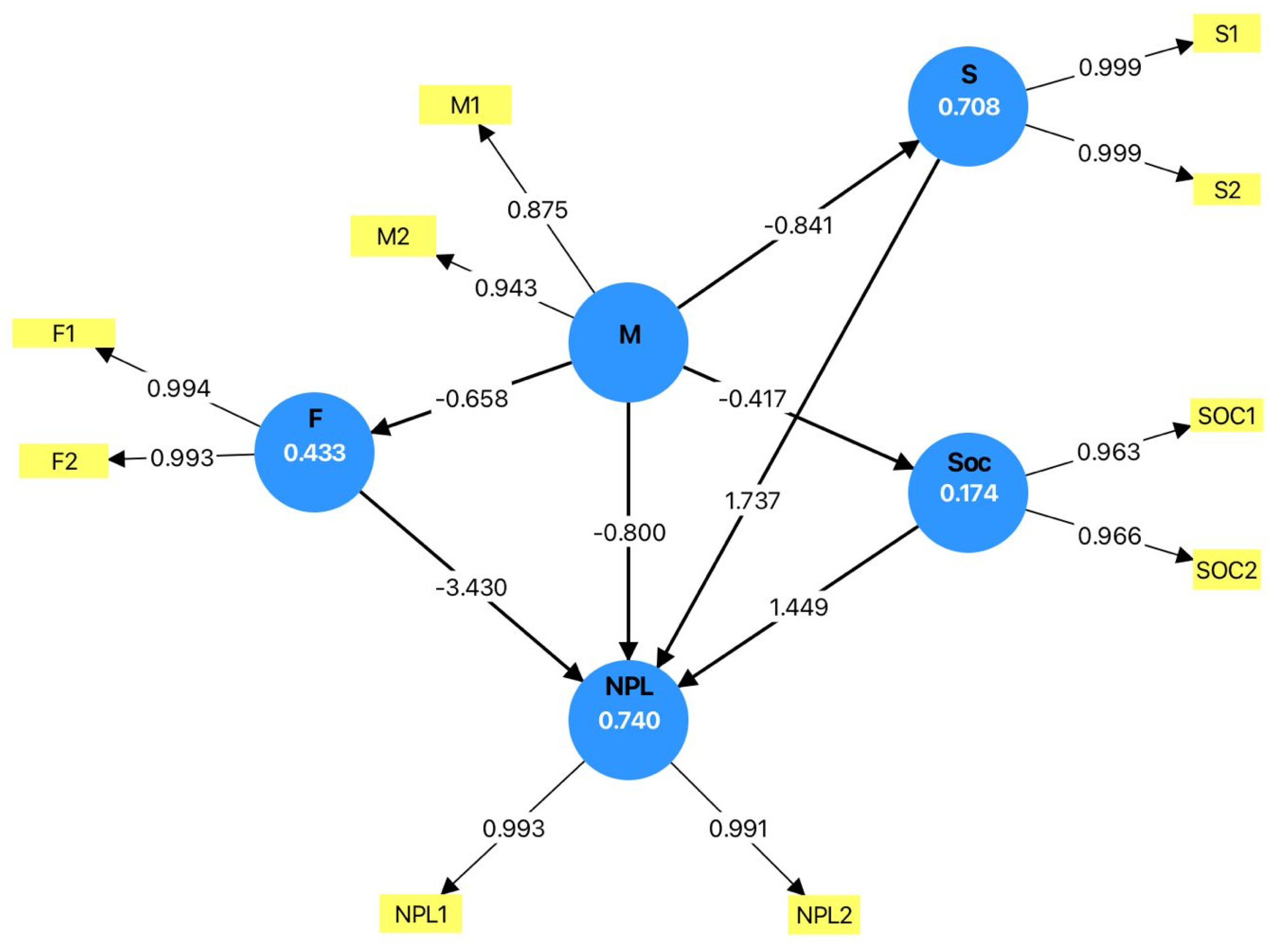

The constructed model is shown in

Figure 3.

The model comprises five latent variables:

According to the developed conceptual model of the research, the latent variables are used for constructing the following relationships:

Direct impact of macroeconomic factors on NPLs;

Impact of macroeconomic factors on NPLs with foreign factors variable as a mediator;

Impact of macroeconomic factors on NPLs with savings factors variable as a mediator;

Impact of macroeconomic factors on NPLs with social factors variable as a mediator.

Therefore, the model corresponds to the set hypotheses and research design.

The yellow rectangles demonstrate the indicators, which participated in the construction of the latent variables. The latent variables are shown as blue circles. The arrows from blue circles to yellow rectangles show the values of loadings of each indicator, and these values should not be lower than 0.5. As we can see, all loadings’ values are very high, demonstrating the strong relationship of indicators with the latent variables and importance of them as a part of latent variables. The values inside the blue circles mean the determination coefficient R2. These values are very high for the saving factor (0.708) and NPLs (0.740), demonstrating that 71% and 74% are explained by the chosen indicator, respectively. The determination coefficient for the latent variable foreign factors is 0.433, which means that 43.3% of variable is explained by the chosen indicators. Nevertheless, R2 is very low for the variable social factors, explaining only 17.4% of the variable.

The structural model was calculated via bootstrapping algorithm application. The values on the arrows show betas. The possible explanation of betas will be provided in the Discussion section.

The constructed model allows testing the set hypotheses. The relationships within the model were estimated, and these are presented in

Table 6.

The structural model demonstrated several significant and policy-relevant relationships (see

Table 7).

As we see, macroeconomic factors have strong negative relationships with all of the independent variables. However, theses relationship in this paper are not important, since the goal of the study does not include the determination of these relations, and they only serve for calculating the total effect on NPLs.

What is interesting for this study is the relations between macroeconomic factors and NPLs directly and with the mediating role of other latent variables.

As a result, two hypotheses out of the four were not rejected, while two were fully rejected. The main findings of the study are presented in

Table 8.

4. Discussion

The authors propose the discussion of the research results, based on the developed PLS SEM model, presented within this paper to the scientific community. The research results show that Kazakhstan’s economy behaves like other economies in relation to the macroeconomics influence on the NPLs. The development of the national economy has a significant inverse relationship with NPLs: β = −0.800, T-statistics 9.729, p value < 0.001. Despite the fact that the dependencies between Kazakhstan’s economy and NPLs was not widely assessed within the academic articles, which was one of the motivations to conduct this research, we assume that in relation to the macroeconomic influence on NPLs, it is possible to rely on the results of other countries’ assessments by the academic society.

In addition to the above, the research shows the negative relations of macroeconomic factors on NPLs with the mediation of foreign factors (β = −4.088, T-statistics 2.524, p value 0.012). That proves that foreign factors work as a mediator and enforce the effect of the macroeconomic factors on NPLs. The mediator increases the impact of the independent variable. The amount of NPLs increases dramatically when economic growth is coupled with a rise in the proportion of foreign currency loans or a decline in the value of the national currency.

On the other hand, unsupported hypotheses are manifested differently. The research shows that the impact of macroeconomic factors on NPLs with saving factors as a mediating variable is positive, as the total effect results show, but this impact is insignificant. The other results of the research show that saving factors’ impact on NPLs is significant, but when they are used as a mediator for the macroeconomic factors, the significance of the effect disappears.

The authors propose to the academic society to discuss the saving and social factors’ neutralizing effect in relation to the macroeconomic factors and non-performing loans. We would like to propose our explanation of this effect.

Economic growth usually leads to inflation, which in a stable situation is not more than 3–5%, and to an increase in expenditures of households and businesses, while their savings do not rise significantly. At the same time, the financial system’s capacity to lend money may be limited in a period of rapid growth of the economy, which naturally increases the price of lending—the interest rate. In this situation, the demand for credit decreases and citizens’ habits switch to savings, increasing household and business deposits in commercial banks.

In view of the above, we may assume that saving factors can offset or weaken the effect of economic growth on NPLs; despite the fact that economic growth usually reduces NPLs, the increase in savings and the decrease in borrowing may reduce the negative effect.

Similarly, social factors like the Gini index and quintile coefficient, representing income inequality, may act as a balancing force. Nevertheless, the growing economy and the increase in income inequality may reduce the ability of a large group of citizens to cover their loans. This may create pressure in the opposite direction, which potentially may increase NPLs and weaken the improving beneficial effect of macroeconomic factors.

Therefore, the authors propose as the explanation, that savings and social factors in Kazakhstan may have neutralizing influences due to a switch of the households’ and businesses’ habits from borrowing to savings and an increase in income inequality.

It is very important to understand the mediation effects of various factors on NPLs. The policy-makers traditionally try to provide resilience for the financial sector using financial tools only. However, this paper, in line with the studies of other scholars, shows that it is absolutely necessary to consider other factors related to the national economy, and mediation effects allow changing the situation significantly without having any direct impact on the financial sector. It provides the governments of developing countries with certain flexibility regarding the resilience of the financial sector.

4.1. Implications

The obtained results have serious implications on practice. They can be applied to regulating the processes within the financial system of Kazakhstan. The obtained results are significant for policy-makers, financial regulators, and banking institutions in Kazakhstan and potentially in similar economies. According to the research findings, macroeconomic stability reduces NPLs, and any improvements in macroeconomic conditions lead to a decrease in NPLs. Therefore, the focus on maintaining macroeconomic stability can serve as a key strategy to improve the health of the financial system. A stable economic system can reduce credit risk and enhance loan repayment capacity. Policy-makers in Kazakhstan can use these findings to prioritize sustained economic growth and macroeconomic discipline as tools to reduce credit risk in the banking sector.

The external (foreign) factors like exchange rate stability and public debt levels amplify the impact of macroeconomic factors on NPLs due to the intensification of inverse relationships between macroeconomic indicators and NPLs. The level of non-performing loans (NPLs) rises significantly when economic expansion coincides with an increase in foreign currency-denominated loans or a depreciation of the local currency. Therefore, the financial regulators and banks can mitigate the risks within the national financial system by monitoring and managing the exposure to foreign economic shocks. Managing external vulnerabilities, for example, minimizing excessive foreign currency lending and maintaining a balanced public debt profile, can further mitigate the risk of rising NPLs.

Savings behavior, such as households’ deposits or accounts balance, does not mediate the relationship between macroeconomic indicators and NPLs. Moreover, the inverse effect of macroeconomic factors on NPLs is levelled off by these saving factors. Therefore, the policy-makers should keep in mind that while promoting savings is important for financial stability, it may not directly buffer the impact of macroeconomic downturns on NPLs. Therefore, policies focused on savings alone may be insufficient to reduce credit risk during economic slumps. In this way, the rejected hypotheses are even more important for understanding how to manage the simultaneous stability of economic growth and saving factors.

Social factors (e.g., unemployment, income inequality, etc.) do not significantly mediate the relationship between macroeconomic conditions and NPLs when considered alongside macroeconomic variables. A growing economy combined with rising income inequality can undermine the ability of a significant portion of the population to meet their loan obligations. This could create a counteracting pressure that offsets the positive impact of macroeconomic improvements, potentially leading to higher NPLs and weakening the overall beneficial effect of favorable macroeconomic conditions. Therefore, the policy-makers should consider not only development of national economy as a means of stabilizing the financial system but also think about indicators of income inequality and poverty within the country.

These results suggest that macroeconomic indicators should be included in Kazakhstan’s policies aimed at maintaining financial stability. Regulators could improve their stress testing models by considering how sensitive the financial system is to foreign factors. They should also consider stricter rules for foreign currency loans, especially when the tenge is losing value. In addition, tools like countercyclical capital buffers can be adjusted based on how fast the economy is growing and how exposed it is to external risks. This would help banks handle financial shocks better and support long-term stability in the lending market.

International best practices and regulatory models can be applied to Kazakhstan with confidence, and the country can be included in broader comparative analyses or regional policy frameworks.

4.2. Areas for Further Research

The study opens up questions about the role of saving and social factors in credit risk dynamics. Future research could explore non-linear relationships, time-lagged effects, or the sector-specific impacts of these factors. Additionally, qualitative studies could help uncover deeper mechanisms behind these statistical relationships.

4.3. Limitations of the Research

The research limitations are determined by the type of investigation.

First of all, the authors consider Kazakhstan as a representative of post-soviet central Asian countries; however, it does not consider other post-soviet central Asian countries—Uzbekistan, Turkmenistan, Tajikistan, or Kyrgyzstan. The choice of the same variables but for another country can change the results of the study.

The choice of latent variables and indicators for the analysis was restricted purposefully; however, it is also a limitation of the study. The choice of other variables can change the results of the study.

The type of implemented analysis—PLS-SEM—predetermines the certain statistical analyses; however, it could be possible to employ other types of statistical analyses.

5. Conclusions

The article is devoted to the relationship between various macro indicators and NPLs. The authors do not use isolated indicators but rather combine them in complex latent variables, which then participate in PLS-SEM.

Hypotheses Testing

H1, “Macroeconomic indicators have a direct impact on NPLs with an inverse relation,” was confirmed. Any increase in the national economy results in a decrease in NPLs. This finding is similar to other researches devoted to this topic, although we used complex latent variables containing several macro indicators.

The test of the direct impact of latent variables (foreign factors, social factors and saving factors) on NPLs was beyond the framework of this study; however, in the process of testing other hypotheses, we obtained results which allow concluding that the Kazakh financial system has completely the same dependencies as other countries, and it can be considered not individually but rather in line with other countries.

H2, “Macroeconomic indicators have an impact on NPLs with an inverse relation with the mediation of foreign factors,” was confirmed. The mediating effect of foreign factors strengthens the negative relationships between macro factors and NPLs.

H3, “Macroeconomic indicators have an impact on NPLs with an inverse relation with the mediation of saving factors,” was not confirmed. The effect of saving factors levels off, balancing the inverse impact of macro factors. Separately, these variables have significant relations with NPLs, but when they act together, the total effect is insignificant.

H4, “Macroeconomic indicators have an impact on NPLs with a direct relation with the mediation of social factors,” was not confirmed, either. The situation is similar to the H3 situation—separately, the impacts are significant, but together, the mediator makes impact of macro factors insignificant.

The findings of the study are quite interesting for scientific discussion, since they allow various speculations. The authors have proposed their interpretations of results as a point for such discussion. Moreover, the evident implications of the research results will contribute to the development of the banking sector in Kazakhstan with the simultaneous stabilization of the situation within the industry.