1. Introduction

This paper addresses the definitional and evaluative ambiguity surrounding the term “green fintech”. While the term is increasingly invoked in academic, regulatory, and market discourse, its scope and meaning remain unclear. Green fintech is often conflated with broader categories such as “green finance” or “sustainable finance”. This occurs despite significant differences in technological foundation, operational mechanisms, and intended outcomes. This paper offers a precise definition of green fintech and proposes a six-step litmus test to evaluate whether initiatives that self-identify as such satisfy the environmental, technological, and regulatory criteria needed to support sustainability claims.

Financial technology (“fintech”) encompasses a wide array of innovations, including blockchain, mobile banking, algorithmic credit scoring, and digital platforms for trading or investment (

Broby, 2021). These technologies have transformed the efficiency, accessibility, and transparency of financial services. In environmental contexts, this transformation is increasingly viewed as an enabler of sustainability (

Marín-Rodríguez et al., 2024). Green fintech, as the term suggests, encompasses the integration of these digital tools into environmentally focused finance. However, the lack of consensus undermines its conceptual clarity and exposes it to potential misuse.

In the academic literature, we found two explicit definitions.

Kwong et al. (

2023) describe green fintech as the synergy between financial technology and green finance, aimed at promoting environmental sustainability through innovative financial solutions. They also highlight the need for a better definition. Similarly,

Kabaklarlı (

2022) defines green fintech as the application of emerging financial services, such as big data, AI, and blockchain, to support environmental goals, particularly emphasizing its role in addressing the ecological footprint of digital finance.

In support of the scholarly framing, we reviewed twenty publicly available definitions of green fintech sourced from government organizations, top web searches, and non-governmental organizations. Our definition emerges from a synthesis of these sources and the key peer-reviewed articles (see

Appendix A).

This follows an interpretive content analysis approach. It ensures conceptual breadth and institutional credibility. The comparative analysis of these sources allowed us to identify recurring dimensions that informed the structured definition we now propose:

Definition 1. Green fintech is the implementation of climate objectives through the medium of financial technology. Utilizing the internet, it involves the integration of technology into finance for the allocation, oversight, and deployment of capital based on green criteria. It enhances the efficiency, accessibility, and scalability of sustainable financial activities, and conforms to regulatory or audit-based verification mechanisms.

This definition contributes to measurable environmental outcomes. It also avoids the word innovation as many of the technologies are now well established. To operationalize the definition, we introduce a litmus test in

Section 4. This test serves as a diagnostic framework to distinguish between legitimate fintech solutions and those that engage in greenwashing. This is the practice of making misleading or unverifiable environmental claims to benefit from market or regulatory incentives.

Greenwashing has become increasingly prevalent as investors, regulators, and the public demand greater accountability in the transition to a low-carbon economy. The term refers to the misrepresentation of financial products or technologies as environmentally beneficial without credible evidence. In the context of green fintech, greenwashing can occur when digital platforms, carbon token systems, or AI-driven ESG tools claim environmental benefits that are neither measurable nor aligned with verified standards. Without defined criteria, green fintech risks becoming a rhetorical device rather than a meaningful classification. Addressing this requires definitional rigor and a systematic evaluative tool.

The proposed framework is grounded in foundational theories from finance, sustainability, and innovation studies. From a financial perspective, the framework builds on capital allocation theory, which holds that financial markets channel resources based on risk-adjusted returns and informational efficiency. In this context, green fintech mechanisms such as ESG scoring or carbon tracking serve to reduce information asymmetries around environmental performance (

Healy & Palepu, 2001). From the sustainability literature, the framework draws on the theory of environmental externalities and the role of finance in internalizing social costs through pricing mechanisms (

Pigou, 1920;

Stiglitz, 1989;

Othman, 2025). The objective is to ensure that fintech contributes to allocative efficiency not only in financial returns but also in environmental outcomes.

The motivation for this study is both conceptual and practical. On the one hand, financial systems are increasingly expected to contribute to global climate goals, such as those outlined in the Paris Agreement. On the other, the rapid evolution of fintech has outpaced the development of sustainable governance and assurance mechanisms. As noted by

Muganyi et al. (

2022), empirical evidence on the relationship between fintech and environmental or developmental outcomes remains limited. While technologies such as blockchain and AI offer clear operational efficiencies, their environmental impact is contingent on how they are used. For example,

Kakar et al. (

2025) suggest that fintech tools can support biodiversity financing, but, without definitional and methodological consistency, such claims are difficult to assess.

The paper contributes to both definitional clarity and evaluative practice in the green fintech domain. It addresses a gap between high-level sustainability taxonomies and the specific characteristics of fintech applications. While regulatory and academic efforts have articulated broad environmental standards, they often lack operational tools for assessing whether digitally enabled finance initiatives meet these criteria. The litmus test presented here formalizes this process by linking definitional clarity with diagnostic assessment. The intended users of the framework include regulators, ESG auditors, fintech developers, and institutional investors.

The paper therefore fills a gap in the literature by (1) clarifying the meaning of green fintech, (2) proposing a litmus test for evaluation, and (3) demonstrating the test through a comparative analysis of two real-world cases. One is a regulated tokenized green bond issued by the Hong Kong government; the other is the Klima Protocol (formerly KlimaDAO), a decentralized platform that tokenizes carbon credits (supposedly without clear environmental verification).

1 2. Conceptual Foundations

Green fintech arises from the imperative to align financial systems with environmental objectives. Scientific consensus confirms that global warming is accelerating due to anthropogenic greenhouse gas (GHG) emissions (

L. Wang et al., 2023;

Wiedmann & Minx, 2008). Addressing this challenge requires systemic reallocation of capital towards low-carbon solutions (

Qin et al., 2024). Green fintech offer tools to support this transition by enabling quantification, verification, and accountability in environmental performance. A widely used operational metric, in this respect, is the carbon footprint. This attributes GHG emissions to firms and can be stated by enterprise value. This enables comparative assessments of environmental efficiency across firms and sectors. The formula can be represented as

Technologies such as blockchain can support the credibility of such measures by providing immutable, transparent records of emission data and financial transactions. In this regard, green fintech serves as a mechanism for establishing trust in sustainability-linked finance initiatives. It not only enables more accurate measurement but also supports accountability by linking fintech usage to verifiable environmental outcomes.

Institutional actors have increasingly acknowledged the potential of finance in addressing environmental risks. According to the Green Finance Institute, approximately USD 1.1 trillion has already been allocated to low-carbon energy, with an annual USD 1.7 trillion investment needed to meet the net-zero goals by 2050 (

Holmes, 2023). The UN Task Force on Digital Financing of the Sustainable Development Goals similarly highlights the importance of leveraging digital infrastructure to mobilize climate-aligned capital.

2 However, definitional ambiguity remains a significant barrier. As noted by

Berensmann and Lindenberg (

2016), the lack of standardized terminology and criteria allows unverified claims to be made, thereby creating the conditions for what we earlier defined as greenwashing.

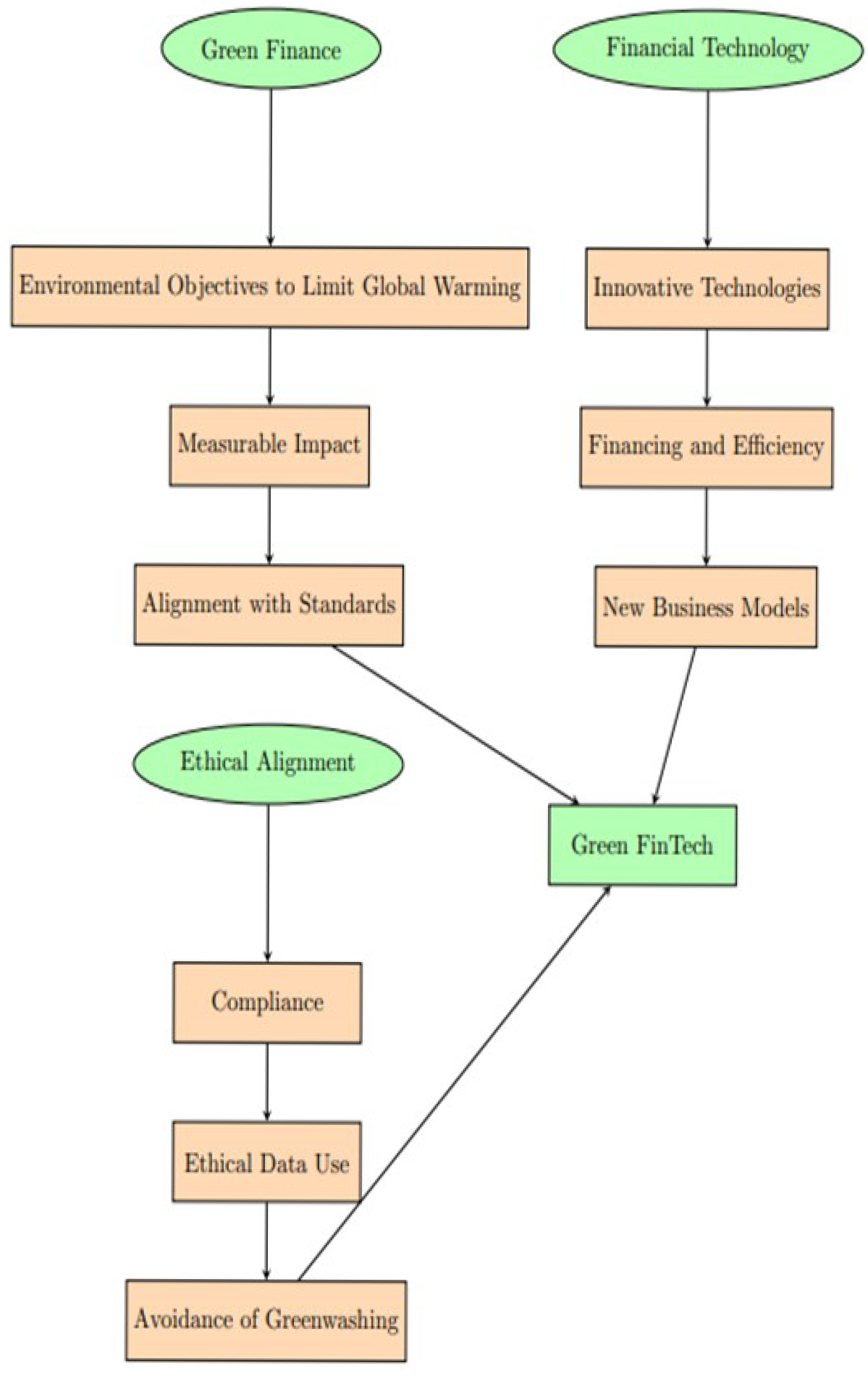

Figure 1 outlines a conceptual framework that synthesizes green finance, financial technology, and ethical alignment into a coherent definition of green fintech. Beyond serving as definitional anchors, these three pillars interact in ways that reinforce the transformative potential of green fintech. Green finance defines the objective, ethical alignment provides the normative rationale, and financial technology represents the operational mechanism through which environmental outcomes are pursued. In this respect, green finance provides the environmental targets and metrics that fintech tools operationalize, such as through algorithmic scoring of ESG risks or the tokenization of carbon credits. Financial technology enables scalability and accessibility, making green products viable for retail and institutional segments alike. Ethical alignment, often overlooked in early-stage innovation, ensures these solutions do not compromise transparency or integrity, particularly in contexts where data privacy and regulatory arbitrage can undermine trust. Together, the framework captures how green fintech is not merely the digitalization of sustainable finance. Rather, it is an integrated system that promotes environmental outcomes and risks through verifiable, efficient, and ethically governed technological innovation (

Mandić et al., 2025).

We argue that greenwashing undermines both market credibility and environmental impact. As introduced in the preceding section, we define greenwashing in the context of green fintech as the strategic misrepresentation of products or services as environmentally sustainable without verifiable evidence of their environmental impact. This risk is particularly acute in fintech contexts, where innovation often outpaces regulatory oversight and where environmental claims may lack auditability. To address this challenge, we formulate the following hypothesis:

H1: The lack of standardized definitional frameworks contributes significantly to greenwashing in green fintech products and/or services.

To examine this, we propose a six-step evaluative framework to classify fintech initiatives based on their alignment with environmental outcomes, technological innovation, and regulatory standards. As shown in later sections, this framework allows for the systematic assessment of both compliance and credibility. While green fintech encompasses innovations such as tokenized green bonds, decentralized ESG scoring, and real-time carbon tracking, the legitimacy of these approaches depends on the whole picture: in other words, how they are governed, verified, and implemented. The resultant litmus test operationalizes this evaluative logic.

3. Literature Review

We structure our review around the three core dimensions of the proposed framework. First, environmental impact is grounded in the sustainability finance literature and green finance metrics (

Alsedrah, 2024;

Q. Li et al., 2022). Second, technological innovation draws on digital finance and fintech applications to ESG objectives (

Shi & Yang, 2025). Third, regulatory alignment builds on evolving sustainable finance taxonomies and green finance standards across jurisdictions. These pillars provide the theoretical basis for each corresponding step in the litmus test.

While the green finance literature provides ample discussion on ESG instruments and fintech innovation, no existing study to our knowledge integrates a structured evaluative framework grounded in definitional precision. Most research treats fintech and green finance separately or assumes inherent synergies, thus neglecting critical criteria for credibility and governance.

The academic literature on green finance and green fintech is growing rapidly yet remains conceptually fragmented (

Puschmann & Khmarskyi, 2024). The existing studies address sustainability-aligned investment, digital transformation in finance, and the growing market for green bonds and ESG-labeled funds. However, no one to our knowledge has provided a unified definition of green fintech, or a method for evaluating whether fintech applications meet substantive environmental objectives. This lack of definitional clarity leads to the interchangeability of terms such as “green finance”, “sustainable fintech”, and “ESG innovation” despite their differing theoretical and operational scopes (

Berensmann & Lindenberg, 2019;

Georgeson et al., 2017).

As shown in

Table 1, the current literature on green fintech demonstrates thematic clustering around ESG integration, tokenized finance, and regulatory dimensions yet lacks consistent verification standards, evaluative taxonomies, and fintech-specific benchmarks.

S. Wang et al. (

2025) support the view that definitional ambiguity enables greenwashing. As

Berensmann and Lindenberg (

2016) observe, vague taxonomies allow institutions to make sustainability claims that are unsubstantiated or unverifiable. Moreover, studies often describe the potential of digital technologies in supporting environmental goals (

Puschmann et al., 2020). That said, they often treat these tools as inherently beneficial without critically assessing their actual application or effectiveness.

A key strand of the literature focuses on the mobilization of capital for the green transition.

Kemp and Never (

2017) characterize this transition as the phased deployment of low-carbon technologies supported by long-term financial strategies. Green financial instruments, particularly green bonds and Socially Responsible Investment (SRI) funds, are widely used to allocate resources toward sustainable investments (

Bhutta et al., 2022;

Kempf & Osthoff, 2008). However, questions remain about the true environmental performance of such instruments. For instance,

Nitsche and Schröder (

2018) raise concerns that many SRI-labeled funds fail to meet the impact claims on which they are marketed.

To assess the environmental effectiveness of such financial mechanisms, the literature increasingly draws on Integrated Assessment Models (IAMs) (

Gopal & Pitts, 2025). IAMs provide a systematic framework for evaluating the economic and environmental trade-offs of climate-aligned investments. Among these, the Dynamic Integrated Model of Climate and the Economy (DICE) developed by

Nordhaus (

2018) is one of the most widely used. The DICE quantifies climate damages over time by linking GHG emissions with projected temperature increases and economic losses. This is represented as

where

represents estimated economic damages at time

t, and

r is the discount rate.

IAMs, and particularly the DICE, support analysis of whether green fintech can achieve meaningful reductions in emissions (

Daah et al., 2024). The model’s estimation of the social cost of carbon provides a quantitative basis for pricing emissions in traded markets, ensuring alignment between digital innovation and environmental performance. That said, despite their analytical promise, IAMs are largely absent from the empirical green fintech literature. Most studies remain qualitative or descriptive. As a result, there is little evidence on how fintech applications influence climate outcomes beyond narrative claims. This is a critical gap, particularly in light of growing interest in tokenized green bonds, decentralized ESG platforms, and algorithmic sustainability rankings.

Beyond modeling, the literature also explores institutional mechanisms that support the financing of green innovation. Public–Private Partnerships (PPPs), for instance, are highlighted as a key vehicle for green fintech development.

Sun et al. (

2021) and

Kościelniak and Górka (

2016) suggest that PPPs can leverage private innovation and capital while maintaining public oversight. Fintech tools, such as blockchain for fund traceability or AI for risk assessment, enhance the governance of PPP-led sustainability projects.

Impact investing also features prominently in the literature.

Barber et al. (

2021) note that financial technologies enable more granular screening of ESG criteria, allowing capital to be directed toward businesses with verifiable sustainability outcomes. However, much like SRI funds, the degree to which these investments avoid greenwashing remains uncertain without structured evaluative tools. Green fintech can be used to enable this approach.

The literature also has a strong strand focused on enhancing transparency and accountability (

Rerung et al., 2024). Artificial intelligence, blockchain, and other financial technologies are playing an increasingly important role in the drive toward a green future. They offer new ways to track, verify, and report on environmental data, making it easier to align their operations with sustainability goals. By improving the integrity of environmental data and increasing stakeholder trust, these technologies are reshaping finance.

AI can analyze large datasets quickly and accurately, identifying trends and patterns that are not immediately apparent. This capability, according to

Mohammed et al. (

2024), is particularly useful in promoting eco-friendly investments and avoiding greenwashing, as well as for monitoring environmental metrics, such as carbon emissions, water usage, and energy efficiency (

Zhong et al., 2024;

Yang & Broby, 2020). Through AI-powered algorithms, companies can track their environmental impact in real time, allowing for more immediate corrective actions and greater accountability. Additionally, as observed by

Bhatti et al. (

2023), AI can assist in reducing carbon emissions: for example, in the use of predictive modeling to help firms understand the long-term consequences of their actions on the environment, which supports better decision-making for sustainable investments.

As highlighted by

Bouafia et al. (

2024), blockchain, with its decentralized and immutable ledger, offers a powerful tool for increasing transparency.

Adigun et al. (

2024) provide a good overview on how it can be used to enhance carbon markets with fintech. It ensures that environmental data, such as carbon offsets or green bonds, are recorded and verified without tampering. Blockchain can also streamline the process of verifying corporate claims about sustainability as it creates a trusted shared record that all stakeholders can access. For instance, companies can use blockchain to certify that their supply chains are free of environmentally harmful practices, such as deforestation or excessive resource extraction, enhancing accountability across the entire production process.

Egger and Keuschnigg (

2015) also suggest that innovations can be applied to more traditional financial technologies for green purposes. In a fintech context, this includes innovations in digital banking services. Many green fintech applications rely on tracking environmental impacts, like carbon footprints. However, ambiguity surrounds the use of customer data, particularly in terms of transparency, privacy, and ethical considerations. Defining the appropriate balance between data use and green goals remains an unresolved issue.

Other fintech applications, such as green bonds (see

Section 4.2.1) and tokenized carbon credits (see

Section 4.2.2), enable financing of environmental projects and/or carbon mitigation (

Tao et al., 2022). They provide both investors and regulators with greater confidence in how resources are being allocated.

Reza-Gharehbagh et al. (

2022) suggest that digital platforms can be used to aggregate and analyze data on green investments. This allows for more rigorous scrutiny, ensuring that companies are held to account for their environmental commitments.

Regulatory uncertainty further complicates the landscape of green fintech (

Andreeva et al., 2018). Regulations for green finance and fintech vary significantly across jurisdictions, meaning that what qualifies as green fintech in one region might not be recognized as such elsewhere. Additionally, emerging regulations, like the EU’s Green Taxonomy, may not be harmonized globally (

O’Reilly et al., 2024), This creates challenges for fintech companies navigating this space. There is also an inherent tension between financial innovation and environmental goals. The ambiguity here lies in whether green fintech should prioritize financial returns or environmental impact, and how these dual objectives can be balanced within regulation.

There are economic trade-offs that contribute to the ambiguity of green fintech. Some fintech companies focus on financial inclusion for underserved communities (

Liu et al., 2022). These initiatives do not always align with strict environmental sustainability goals, so there is an outstanding question as to whether they are classified as green fintech or simply fintech. Because of this, balancing financial inclusion within the definition presents challenges. These ambiguities need to be resolved, possibly by empirical research. This supports the need to establish a clearer framework for defining green fintech.

A core rationale underpinning our definition of green fintech is its functional contribution to climate mitigation. Unlike broader categories such as ESG investing or sustainable finance, green fintech, as conceptualized in this paper, requires the demonstrable use of financial technologies to support verifiable environmental outcomes. This distinction is essential to avoiding definitional ambiguity and reducing the risk of greenwashing in climate-aligned financial initiatives. In this respect, green fintech offers a suite of tools for quantifying, disclosing, and tracking environmental impact. These tools enable investors, regulators, and institutions to align capital flows with climate objectives in ways that are both transparent and scalable. Importantly, they help to translate sustainability pledges into measurable outcomes.

One key area of application is the measurement of greenhouse gas (GHG) emissions (

M. Li et al., 2025). Metrics such as carbon intensity, carbon footprint, and owned GHG emissions allow stakeholders to assess carbon efficiency relative to financial performance. For example, the owned GHG emission metric quantifies the direct emissions for which a firm is responsible, normalized by its revenue. This provides an indicator of environmental impact per unit of economic output, facilitating both cross-company comparison and longitudinal tracking. The formula is as follows:

where

is the weighting factor for each company.

GHG emissions refers to the total greenhouse gas emissions of the company.

Revenue is the total revenue generated by the company.

They suggest that carbon intensity can be measured through an index method. Again, green fintech can assist with this. This metric compares GHG emissions to financial metrics such as “enterprise value including cash” (EVIC) and corporate sales. These measure emissions relative to a company’s operational or financial scale. The formulae are

where

is the weighting factor for each company.

EVIC stands for enterprise value including cash.

Sales refers to the total sales revenue of the company.

Green fintech platforms that incorporate such metrics into their design, through dashboards, automated ESG scoring, or real-time emission monitoring, are particularly useful. They deliver measurable objectives, data-driven impact, and transparency. However, for these tools to contribute meaningfully to climate mitigation, they must also be embedded in regulatory-compliant structures and supported by verifiable third-party reporting. The literature identifies a wide range of digital solutions, including ESG analytics and green lending platforms. Yet, it offers limited insight into the definitional boundaries or evaluative standards that would allow stakeholders to differentiate between credible green fintech initiatives and superficial applications.

In summary, the literature suggests that the presence of financial technology alone is insufficient to establish environmental credibility. Platforms that track emissions or promote sustainability claims, yet lack verifiable methodologies or integration into regulatory and investment decisions, risk functioning as superficial compliance mechanisms. This reinforces the central premise of this paper that the legitimacy of green fintech hinges not merely on the definition. A meaningful framework, such as the one we propose, must therefore link environmental metrics to specific financial technologies within a structure that ensures transparency, auditability, and accountability. Only under such conditions can green fintech function as a credible instrument of climate-aligned finance. Otherwise, it becomes a technologically enhanced extension of conventional finance and potentially subject to greenwashing.

4. Conceptual Framework

To address the ambiguities surrounding the term green fintech, we now present our proposed conceptual framework. This is grounded in diagnostic logic across three foundational dimensions: (1) environmental impact, (2) financial technology innovation, and (3) regulatory alignment.

The methodology employed is conceptual and diagnostic. It aims not to test causal relationships but to construct and apply an evaluative approach for determining whether fintech-labeled initiatives credibly meet the threshold for being classified as green fintech. The resultant litmus test translates the conceptual foundation into a series of criteria that can be applied to real-world cases.

The first dimension, “environmental impact”, requires that any green fintech solution demonstrate a tangible and measurable contribution to environmental objectives. These may include emission reduction, energy efficiency improvements, or resource optimization. The contribution must be traceable through standardized metrics, such as carbon savings, GHG intensity, or climate-adjusted return measures. Crucially, these outcomes should align with global frameworks such as the Paris Agreement or the UN Sustainable Development Goals (SDGs), ensuring definitional coherence across jurisdictions.

The second dimension, “technology-driven innovation”, focuses on the nature of the financial technology employed. Qualifying initiatives must embed innovative digital tools, such as blockchain, AI, or internet of things (IoT). Innovation is not limited to infrastructure but includes the deployment of new business models such as tokenized bonds, decentralized carbon markets, or ESG-integrated platforms for impact investing. These features distinguish green fintech from traditional green finance by expanding the capacity of the financial system to mobilize and verify capital flows toward sustainable outcomes.

The third dimension, “regulatory and ethical alignment”, requires compliance with both financial and environmental governance standards. This includes conformity with reporting obligations, auditability by third parties, and transparency in sustainability claims. To mitigate greenwashing, fintech products must undergo independent verification or certification of their environmental performance. Additionally, given the data-driven nature of many green fintech applications, solutions must respect data protection regulations and uphold ethical standards in the use of consumer or transaction-level data.

Together, these three dimensions form the basis of the litmus test presented in the next section.

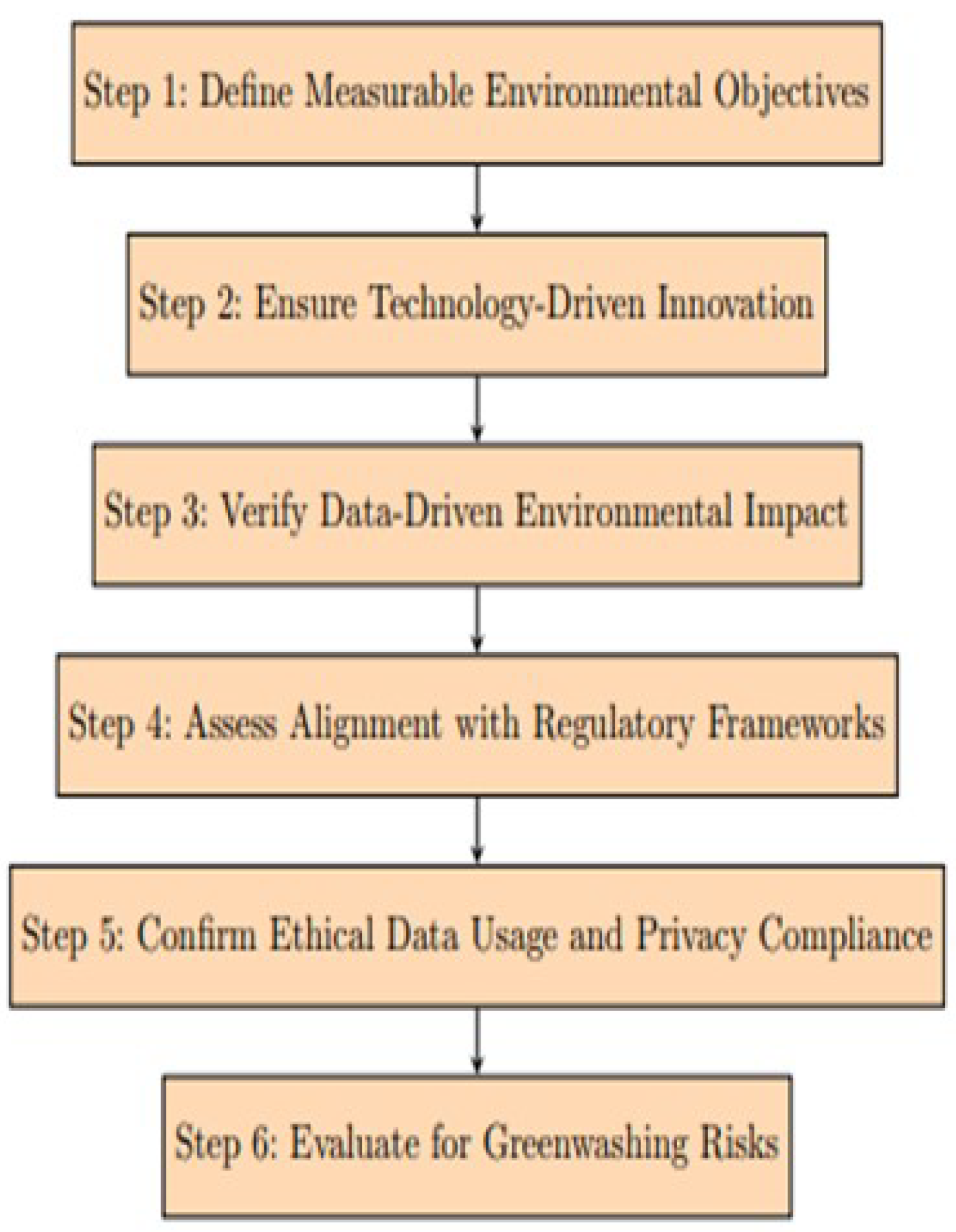

Figure 2 summarizes the framework’s conceptual logic, illustrating how definitional clarity is constructed from the integration of environmental, technological, and regulatory subcomponents. The litmus test translates this framework into operational criteria that enable the classification and evaluation of green fintech initiatives in empirical settings.

4.1. The Litmus Test

We now present the step-by-step litmus test that we suggest can help to determine whether a financial technology qualifies as green fintech. Our process ensures that the solution is not merely labeled as “green” but methodically meets the criteria for environmental sustainability, technological innovation, and regulatory compliance.

The litmus test we propose serves a dual purpose. Conceptually, it functions as a classification mechanism for identifying legitimate green fintech initiatives. Analytically, it allows us to evaluate whether the absence of standardized definitions correlates with an increased risk of greenwashing. In this way, the framework also provides a means to assess the validity of our hypothesis.

By applying the litmus test to contrasting cases, namely a well-documented standardized tokenized green bond and a less clearly defined decentralized carbon platform, we illustrate how definitional clarity affects the credibility and verifiability of green claims. This comparative approach underscores the operational relevance of definitional precision in mitigating the risk of greenwashing.

The test assesses whether the technology contributes to measurable environmental outcomes, such as reducing carbon emissions or improving energy efficiency. It also ensures that leveraging innovative financial technologies is captured. Additionally, it ensures the solution that green fintech companies adhere to relevant regulatory frameworks and ethical data usage standards.

The litmus test is presented in

Figure 2. It is structured into six key steps: defining measurable environmental objectives, ensuring technology-driven innovation, verifying data-driven environmental impact, assessing regulatory compliance, confirming ethical data handling, and evaluating for greenwashing risks. Each step serves as a checkpoint to validate the legitimacy and sustainability of the financial technology under review. The steps themselves are as follows:

Define measurable environmental objectives, whereby the key question to address is whether the financial technology aims to achieve specific and measurable environmental outcomes. The solution must target concrete environmental goals, such as reducing carbon emissions, increasing renewable energy usage, or improving resource efficiency. These objectives should align with global standards, such as those outlined in the Paris Agreement or the UN Sustainable Development Goals (SDGs). The test for this step involves determining whether there are clear metrics, such as carbon savings or energy efficiency improvements—that can be tracked and verified.

Ensure technology-driven innovation, where the question is whether the solution leverages innovative financial technologies. The technology involved must enhance transparency, efficiency, or accessibility in the financing of green projects or the management of green investments. Examples of such technologies include blockchain, which can provide immutability, AI for ESG reporting, or digital platforms for tracking carbon footprints. To pass this step, the solution must show measurable improvement in existing financial systems, such as by enabling peer-to-peer energy trading or crowdfunding for sustainable projects.

Verify data-driven environmental impact, which involves assessing whether the environmental impact of the solution is measurable and verifiable through data. The technology should be capable of producing data-driven outcomes that demonstrate real contributions to sustainability. Quantifiable metrics, such as carbon footprint tracking, energy savings, or emission reductions, should be used to verify the environmental impact. The test for this step is whether the solution can provide data-supported evidence that is independently verifiable.

Assess alignment with policy structure, where the financial technology solution is examined for compliance with relevant financial and environmental regulations. The solution must adhere to both financial and regulatory standards, including reporting and disclosure requirements. Regulatory compliance ensures that the solution can be audited or certified by third parties. To pass this step, the solution must meet the necessary standards for financial and environmental compliance, and it must be certifiable or auditable by regulatory bodies.

Confirm ethical data usage and privacy compliance, addressing whether the solution handles data in an ethical and secure manner. Any use of consumer data, such as carbon footprint tracking, must comply with data privacy regulations, including the General Data Protection Regulation (GDPR). Ethical data usage is critical for building trust and ensuring transparency. The test for this step is whether the solution has clear protocols for data privacy and security, and whether it aligns with data protection laws.

Evaluate greenwashing risks, focusing on determining whether the claims of environmental impact can be independently verified to avoid greenwashing. The solution must provide clear and verifiable evidence of its environmental impact, which should be supported by independent certification when necessary. The test for this step is whether third-party certification or auditing is in place to validate the claims made by the technology.

We believe this litmus test ensures that any financial technology solution aiming to be classified as green fintech meets high standards of environmental sustainability, technological innovation, and compliance. By adhering to these steps, stakeholders can ensure that such solutions genuinely contribute to sustainability goals and avoid the risks of greenwashing.

To support future empirical validation, we propose a preliminary scoring rubric detailed in

Table 2. This rubric applies a 0–2 scale across each of the six evaluative dimensions. A cumulative threshold of 10 or more (out of a maximum of 12) may serve as a provisional benchmark for classifying an initiative as credible green fintech, subject to independent verification. Each of the six dimensions of the litmus test can be evaluated on a 0–2 scale:

0 = Absent or Not Evident: No meaningful demonstration of the criterion.

1 = Partial or Ambiguous Evidence: Criterion is addressed but lacks clarity, rigor, or independent validation.

2 = Fully Satisfied: Clear documented evidence supports full alignment with the criterion.

A total score of 10 or higher (out of 12) suggests a high alignment with green fintech classification standards. Subsequent research should test the rubric using case-based scoring exercises and stakeholder interviews. Methodologies such as the Delphi method proposed by

Okoli and Pawlowski (

2004) could provide construct validity and enhance framework robustness. The rubric also enables future extension through weighting schemes or regional regulatory adaptation.

We define thresholds for acceptability indicators for each dimension as follows: In the context of environmental objectives, ‘sufficient’ denotes the presence of clearly stated measurable targets (such as emissions saved per dollar invested, or contribution to a recognized climate goal) that can be traced to external verification or statutory standards (e.g., ICMA Green Bond Principles). In terms of technological innovation, ‘sufficient’ reflects the application of digital tools (such as blockchain, smart contracts, or AI) that enable enhanced transparency, data integrity, or automated verification, as evidenced in official technical documentation. Similar thresholds apply across the remaining dimensions, with scores of ‘2’ indicating that the initiative meets established standards or best practices, ‘1’ representing partial or ambiguous evidence, and ‘0’ denoting absence. These thresholds and indicators are applied consistently across the case studies, providing an objective and reproducible basis for evaluation.

While the litmus test offers a structured conceptual framework, it has not yet undergone empirical validation through stakeholder engagement, field piloting, or statistical reliability testing. This limitation is acknowledged. The framework is intended as a first-order diagnostic tool, grounded in normative and regulatory reasoning. However, its practical utility must be assessed through subsequent empirical work.

To formalize the evaluation process and enhance its transparency, we now express it as a structured formula. Each initiative is assessed across six dimensions, with each dimension receiving a score

, where 0 denotes an absent criterion, 1 denotes partial evidence, and 2 denotes full evidence. The total “green fintech” score,

, is defined as

where the six dimensions are

: Environmental Objectives (measurable climate or sustainability outcomes).

: Technological Innovation (integration of digital technologies such as blockchain or AI).

: Data-Driven Impact (availability of verifiable metrics for environmental benefits).

: Regulatory Compliance (conformance with relevant financial and environmental standards).

: Ethical Data Use (alignment with data privacy and ethical usage standards).

: Greenwashing Risk Mitigation (third-party verification and auditability).

An initiative is classified as credible green fintech if and only if

This formalization allows for transparency, reproducibility, and comparability across cases. By anchoring the assessment in a defined scale and making the supporting evidence explicit (

Appendix B), the approach ensures that the evaluative logic can be traced, audited, and replicated across different green fintech initiatives.

The limitation of this approach is that there is some degree of subjective evaluation in the quantitative scoring. While the litmus test offers a classification framework for practitioners and regulators, the DICE supports ex ante evaluation of fintech initiatives by quantifying environmental and economic trade-offs. Used in tandem, they provide a holistic means of evaluating both the legitimacy and effectiveness of green fintech solutions

In summary, the litmus test establishes a structured means of evaluating definitional adequacy in green fintech. The six steps not only provide guidance for practitioners and policymakers but also operationalize our conceptual framework. By assessing whether initiatives satisfy all criteria, we can identify where definitional gaps persist. In this way, the framework serves as both a diagnostic and classificatory tool. It allows users to examine whether the absence of standardization is indeed associated with a heightened risk of greenwashing.

4.2. Testing the Litmus Test for Greenwashing Risk

This section evaluates the hypothesis by applying the litmus test to two contrasting cases: the Hong Kong Special Administrative Region’s (HKSAR) tokenized green bond issuance and the Klima Protocol, a decentralized blockchain-based carbon credit platform. The comparative analysis illustrates how definitional rigor, regulatory adoption, and verifiability reduce the risk of greenwashing in green fintech initiatives.

The two cases were selected based on a purposive sampling strategy. The first, Hong Kong’s tokenized green bond, represents a regulated state-sponsored instrument that publicly claims compliance with global green finance standards. The second, the Klima Protocol, was chosen due to its decentralized structure and minimal formal oversight. This contrast allows the framework to be tested across institutional extremes.

In presenting this comparison, we demonstrate that the successful application of the litmus test depends not only on regulatory frameworks and measurable goals but also on the availability of technological infrastructure.

Table 3 maps core digital technologies to specific steps in the evaluative process. This illustrates the role of technology in supporting verifiability, innovation, and greenwashing mitigation.

The first case pertains to green bonds. These are often positioned as exemplary instruments of sustainable finance. However, the increasing integration of fintech into these instruments introduces a risk. Digital labeling may obscure weak environmental performance behind technological novelty. The Hong Kong tokenized green bond provides a high-profile test of whether digital issuance mechanisms enhance or merely mask environmental accountability.

In contrast, the second case, the Klima Protocol, claims to democratize carbon markets through decentralized finance. That said, its operational structure raises questions about credit quality, verification, and regulatory oversight.

4.2.1. Hong Kong Tokenized Green Bond

In February 2023, the HKSAR Government issued a tokenized green bond under its green bond program.

3 A second issuance followed in 2024, valued at HKD 6 billion and denominated in four currencies.

4 Issued in a digitally native format, the bond was fully integrated with blockchain infrastructure for tokenization, settlement, and disclosure.

We apply the litmus test as follows:

Measurable Environmental Objectives: The bond finances projects aligned with quantified decarbonization goals, including renewable energy and efficiency initiatives.

Technology-Driven Innovation: Blockchain is used for tokenization, digital settlement, and documentation—representing a substantive innovation in green bond infrastructure.

Data-Driven Environmental Impact: Investors have access to real-time allocation reports and verified impact metrics, improving environmental transparency.

Regulatory Alignment: The issuance complies with both local and international green finance frameworks, including the ICMA Green Bond Principles and the Climate Bond Taxonomy.

Ethical Data Use and Privacy Compliance: The blockchain system ensures secure, auditable, and transparent data usage without compromising user confidentiality.

Greenwashing Mitigation: The use of third-party verification, immutable documentation, and international standards minimizes the risk of misrepresentation.

This case satisfies all six litmus test criteria. It demonstrates how definitional precision, technological verifiability, and alignment with regulatory norms can jointly mitigate greenwashing risk. The case supports our hypothesis by showing that initiatives grounded in established frameworks and metrics are less prone to sustainability misrepresentation.

4.2.2. Klima Protocol

The Klima Protocol is a decentralized autonomous organization that issues a token backed by tokenized carbon credits.

5 The platform claims to deepen carbon markets by creating on-chain incentives to lock up verified emission offsets. However, it operates without regulatory supervision and has faced scrutiny regarding the legitimacy of the credits it uses, many of which are drawn from outdated or low-quality offset registries.

We apply the litmus test as follows:

Measurable Environmental Objectives: The platform lacks clear independently defined environmental targets. Its impact is derived from the financial manipulation of existing credits rather than new emission reductions.

Technology-Driven Innovation: The Klima Protocol uses smart contracts, treasury management, and decentralized governance—clearly qualifying as fintech-driven.

Data-Driven Environmental Impact: There is limited evidence of verifiable environmental improvements. Carbon credits are pooled and reissued without robust disclosure of provenance or additionality.

Regulatory Alignment: The project operates entirely outside regulated financial or environmental markets and does not align with recognized taxonomies or standards.

Ethical Data Use and Privacy Compliance: Governance is anonymous and decentralized. There is no evidence of formal compliance with data governance standards.

Greenwashing Mitigation: Due to speculative token dynamics and unverified environmental claims, the platform has high exposure to greenwashing risk.

Unlike the Hong Kong case, the Klima Protocol is non-compliant with most of the litmus test criteria. It demonstrates how fintech platforms can exploit sustainability narratives without satisfying regulatory, environmental, or evidentiary standards. This contrast provides a counter case for our hypothesis where initiatives that lack standardized definitions and verification mechanisms are more likely to result in greenwashing.

4.2.3. Comparative Evaluation

Table 4 presents a comparative analysis. This reinforces the central claim of the paper, namely that definitional rigor, verifiability, and alignment with recognized standards are essential in distinguishing credible green fintech initiatives from those that merely adopt the label. The Hong Kong bond issuance is compliant with all six steps of the litmus test, demonstrating its status as a legitimate green fintech innovation. The Klima Protocol, by contrast, is non-compliant with most criteria, illustrating how the absence of precision can lead to unsubstantiated environmental claims.

Together, these cases demonstrate that the litmus test is not only conceptually robust but also practically useful as a tool to identify greenwashing in fintech products. Thus, the analysis offers empirical support for our hypothesis and reinforces the value of applying structured evaluation to emerging sustainability-focused technologies in finance.

4.3. Applying the Litmus Test

We apply the proposed litmus test to the Hong Kong tokenized green bond and the Klima Protocol. This allows an empirical illustration of how the framework operates across its six dimensions. Each dimension is scored from 0 to 2, yielding a total potential score of 12. The results, presented in

Table 5, draw on publicly available documents listed in

Appendix B.

This application demonstrates the framework’s discriminating ability. The HKSAR tokenized green bond satisfies all the dimensions, yielding the maximum score (12) and aligning with recognized green finance standards. The Klima Protocol, by contrast, scores only 3, reflecting its lack of formal environmental metrics, verification processes, and regulatory alignment despite its technological innovation. These results underscore the utility of the litmus test in differentiating credible green fintech instruments from those prone to greenwashing. Importantly, these scores are illustrative, based on publicly available data listed in

Appendix B, and intended as a foundation for future empirical testing and calibration.

5. Discussion

The two presented cases highlight the importance of definitional clarity and evaluative mechanisms in shaping credible green fintech initiatives. In this discussion, we extend these arguments by considering how the current applications of financial technology address, or fail to address, the identified gaps in sustainability measurement, standardization, and access.

A significant limitation in green fintech is the uneven alignment between innovation and regulation. While fintech platforms offer promising tools for environmental accountability—such as real-time carbon tracking, smart contracts, and automated ESG scoring—there is limited consistency in how these tools are governed. For example, few jurisdictions mandate uniform disclosure or third-party verification for sustainability claims made by fintech products. This regulatory gap enables greenwashing as fintech solutions often operate outside the taxonomies used in traditional sustainable finance.

The technologies themselves are evolving rapidly. Blockchain, artificial intelligence (AI), and big data analytics support traceability, automate ESG reporting, and enable more granular assessments of environmental impact. These tools expand the potential for evidence-based climate finance. However, the extent to which they are used systematically, and in ways that align with global standards such as the EU Green Taxonomy or the Paris Agreement, remains under-examined.

The accessibility of green fintech is another underexplored issue. While technologies such as crowdfunding and decentralized platforms increase investor participation, they also raise concerns about the quality and verifiability of claims. Lower barriers to entry may democratize finance but also amplify the risk of poorly defined or weakly monitored initiatives gaining traction. The litmus test proposed in this paper could be extended to assess not only institutional offerings but also retail-oriented platforms where regulation is less mature.

Additionally, green fintech raises important distributional questions. Most green fintech tools are designed around high-quality data, digital infrastructure, and technical expertise, features that are unevenly distributed across jurisdictions and populations. As such, there is a risk that the benefits of green fintech will remain concentrated in advanced economies, reinforcing global disparities in access to sustainable capital. Research into digital exclusion, interoperability, and cross-border standardization is essential to address these asymmetries.

The integration of economic modeling, such as the DICE, offers a promising pathway for linking fintech innovation with rigorous environmental valuation. Yet, the current fintech platforms rarely draw on such models in a systematic way. Future applications could embed dynamic carbon pricing, the social cost of carbon adjustments, or climate risk projections into fintech product design, thereby enhancing the alignment between financial innovation and climate objectives.

The litmus test proposed in this paper offers a structured basis for addressing inconsistencies in the classification and verification of green fintech initiatives. From a policy perspective, several implications follow.

First, there is a strong case for integrating structured evaluative criteria into existing regulatory taxonomies. Institutions such as the European Commission, the ASEAN Taxonomy Board, and national fintech regulators could incorporate criteria aligned with the six-step test into sustainable finance classification frameworks. This would help to ensure that digital financial products claiming environmental benefits are assessed on a consistent and transparent basis, thereby reducing definitional fragmentation and regulatory arbitrage.

Second, mandatory disclosure of verifiability metrics should be a condition for accessing sustainability-linked incentives or regulatory relief. Green fintech initiatives should be required to report on measurable environmental impacts, including methodologies for carbon reduction estimates, third-party verification mechanisms, and alignment with recognized benchmarks. Without such disclosures, fintech products risk functioning as self-declared green instruments, undermining market credibility and public trust.

Third, the development of ESG audit standards tailored to fintech applications should be prioritized. The existing ESG audit frameworks are generally designed for traditional financial institutions and do not account for the specific risks associated with decentralized platforms, automated scoring tools, or blockchain-based asset issuance. A dedicated fintech ESG audit regime could help to evaluate the environmental claims of algorithm-driven or tokenized systems, particularly those operating outside conventional reporting frameworks.

These regulatory measures, if adopted, would help to ensure that green fintech evolves in a direction that supports environmental integrity, policy alignment, and market accountability. They also offer a pathway for operationalizing the evaluative framework proposed in this study.

In sum, while green fintech introduces tools that can improve environmental transparency and extend sustainable finance, its credibility depends on consistent definitions, verifiable outcomes, and inclusive design. Addressing the gaps in regulatory compliance, access, and modeling integration is necessary if green fintech is to move from a promising concept to a credible instrument in the climate transition.

5.1. Ethical Foundations and the Role of Verifiability

Ethical alignment is a foundational dimension in the proposed framework for evaluating green fintech, yet it remains underdeveloped in both practice and policy. While digital financial innovations often emphasize technological efficiency, the legitimacy of sustainability claims depends equally on their verifiability and ethical coherence. This includes not only compliance with regulatory standards but also a normative commitment to transparency, accountability, and public trust.

The importance of verifiability in ESG disclosures has been highlighted in the work of

Hart and Zingales (

2017) who argue that firms should pursue shareholder welfare, broadly conceived, rather than simply maximizing market value. In their view, where externalities such as climate change are present and where regulation is incomplete, corporate behavior should reflect societal preferences. Unverified or misleading claims about environmental impact undermine this form of legitimacy, particularly when made by financial platforms that benefit from regulatory ambiguity.

Similarly,

Bénabou and Tirole (

2010) critique the prevalence of reputational signaling in corporate social responsibility (CSR) and ESG communications. They caution that, without credible enforcement or disclosure requirements, such claims risk becoming what they term “cheap talk”—symbolic gestures that lack substantive commitment. In the context of green fintech, this concern is amplified by the use of opaque algorithms, decentralized governance structures, and tokenized asset offerings, many of which lack third-party certification or audit trails.

Addressing these concerns requires more than regulatory compliance. It requires a systematic commitment to ethical data use, verifiable environmental performance, and institutional accountability. This paper’s litmus test operationalizes these principles by making verifiability a necessary criterion for classifying a financial technology as “green fintech”. It distinguishes between technological enhancement and ethical legitimacy, recognizing that innovation alone does not guarantee alignment with sustainability objectives.

Without structured ethical safeguards, fintech solutions risk reinforcing superficial compliance or opportunistic branding. To prevent this, policymakers should embed normative standards for transparency, auditability, and independent verification into ESG frameworks, particularly as they relate to digital finance. Ethical alignment, properly defined, is not peripheral but central to the credibility of green fintech.

5.2. Limitations and Future Directions

While the litmus test is grounded in clearly defined constructs, it has not yet been empirically field-tested or validated through structured stakeholder engagement. This represents an important limitation of the current study. The framework’s utility in regulatory, investment, or auditing contexts remains theoretical and requires practical application pilots with green fintech providers, third-party verifiers, and relevant supervisory authorities.

We have suggested that definitional ambiguity contributes to greenwashing risk. That said, we did not empirically test this relationship through matched controls or quantifiable misrepresentation outcomes. The findings are therefore illustrative. Future studies could compare initiatives with and without formal definitions across metrics such as regulatory sanction, ESG rating volatility, or investor disputes to examine this relationship systematically.

6. Conclusions

This paper addresses the definitional ambiguity surrounding the term green fintech and proposes a structured means to evaluate whether financial technologies labeled as green genuinely contribute to environmental sustainability. It provides a precise definition: green fintech is the implementation of climate objectives through the medium of financial technology. This definition emphasizes measurable environmental outcomes, technological innovation, and regulatory compliance that conform to regulatory or audit-based standards.

The core contribution lies in clarifying how green fintech differs from adjacent categories such as green finance, and in proposing a six-step litmus test that can be used to assess definitional rigor, reduce misrepresentation, and strengthen verifiability. By applying the framework to contrasting real-world cases, we illustrate both the risks of definitional ambiguity and the potential for structured criteria to support regulatory alignment and investor confidence.

The framework’s diagnostic structure enables future empirical work and provides a basis for policy tools, such as classification systems or ESG assurance protocols tailored to fintech. However, as acknowledged, the framework requires further validation, including scoring calibration and stakeholder engagement. Addressing this will be essential for its integration into regulatory practice. In sum, this study offers both a conceptual clarification and a testable evaluative method, with the aim of supporting more transparent and accountable green fintech innovation.

Looking forward, the development of interoperable taxonomies and mandatory disclosure standards remains essential. Policymakers need to design regulatory frameworks that link innovation to demonstrable climate outcomes. Integrating climate risk models such as the DICE into financial assessment and strengthening ESG reporting practices can improve the credibility of reporting. Regulatory bodies and international standard-setting organizations should consider integrating evaluative tools such as the litmus test into guidance on fintech innovation.

We conclude by pointing out that technology alone does not deliver sustainability. Its effectiveness depends on the institutional context in which it operates. By grounding the green fintech definition in measurable environmental evidence and applying systematic evaluative criteria, technology can contribute meaningfully to a low-carbon transition and support a more transparent, accountable financial system.