Biological Assets in Agricultural Accounting: A Systematic Review of the Application of IAS 41

Abstract

1. Introduction

2. Theoretical Framework

2.1. Biological Assets: Concept, Classification, and Characteristics

2.1.1. Concept

2.1.2. Classification

- Consumable biological assets: These are those that are to be harvested as agricultural products or sold as biological assets, such as cattle for meat, annual crops, etc.

- Biological production assets: These are those that are used to produce other products, such as dairy cattle, fruit trees, timber trees, etc.

2.1.3. Characteristics

- Biological cycle: Biological assets undergo a biological transformation throughout their life cycle, which alters their substance and generates changes in the value of the asset.

- Age: The age of the biological asset is a determining factor in its valorization since biological changes vary according to the stage of the life cycle.

- Genetic quality: The genetic quality of the biological asset influences its growth and production potential, which is reflected in its fair value.

- Climatic conditions: Climatic factors such as temperature, rainfall, etc. affect the development and growth of biological assets, impacting their valorization.

- Other factors: In addition, IAS 41 mentions that the valuation of biological assets is influenced by various external factors that cause unpredictable changes in them.

2.2. Accounting Valuation and Fair Value in the Agricultural Sector

2.2.1. Fair Value Minus Costs to Sell

2.2.2. Discounted Cash Flow Model

2.2.3. Accrued Cost Model (Cost Model)

2.3. Relationship Between Valuation of Biological Assets and Business Profitability

2.3.1. Impact on Financial Statements

2.3.2. Recognition of Changes in Fair Value

2.3.3. Disclosure and Business Value Creation

2.3.4. Effect of Valuation Methods on Profitability

2.3.5. Biological Transformation and Accounting Limitations

2.3.6. Need for Suitable Measurement Models

2.4. Challenges and Perspectives in the Implementation of IAS 41

3. Materials and Methods

3.1. Approach and Review Strategy

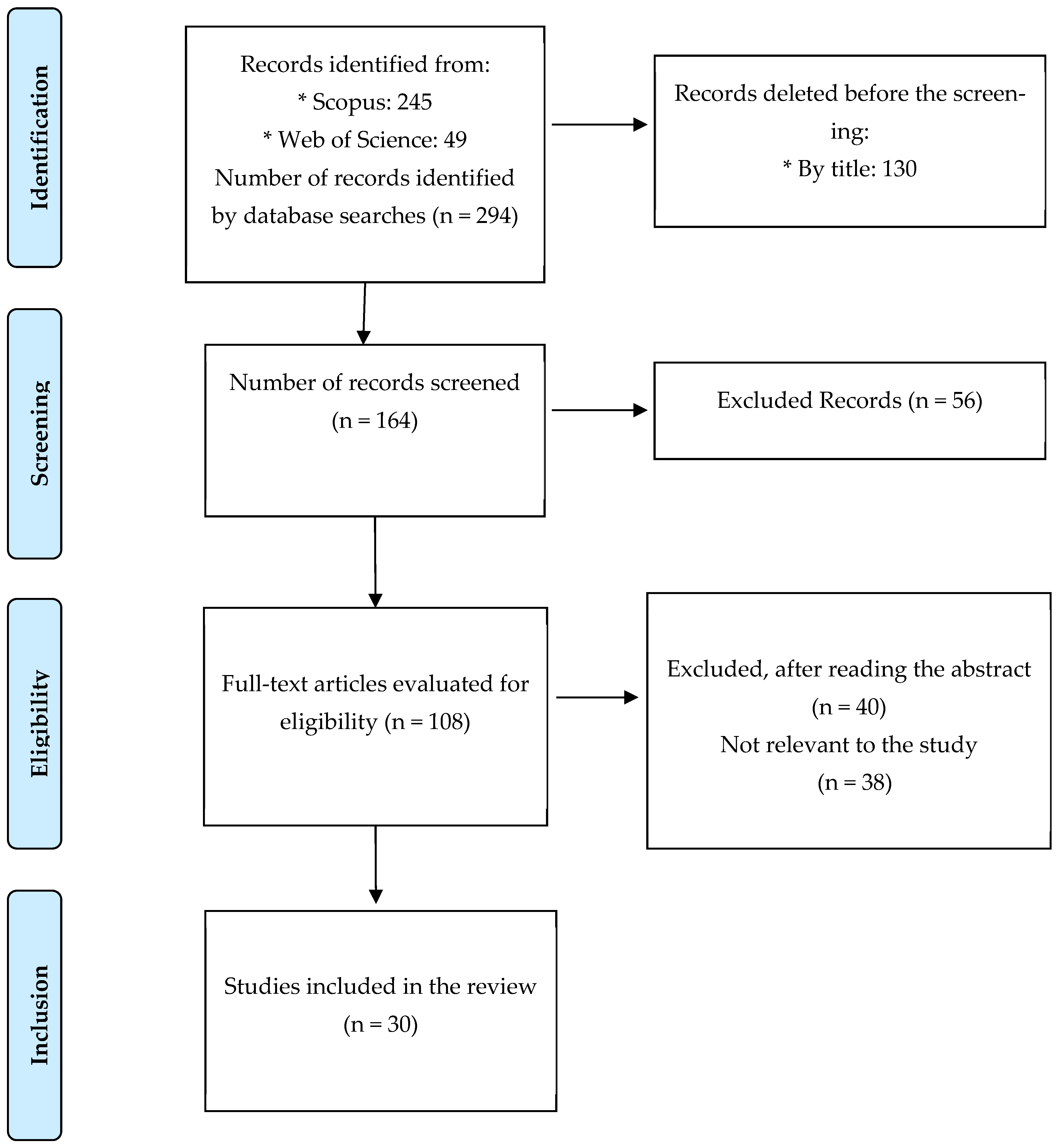

3.2. Procedure for Systematization and Selection of Studies

3.3. PRISMA Flow Chart

3.4. Research Questions and Analytical Approach

- Q1: How does the correct valuation of biological assets influence the quality of financial and strategic decision-making in the agricultural sector?

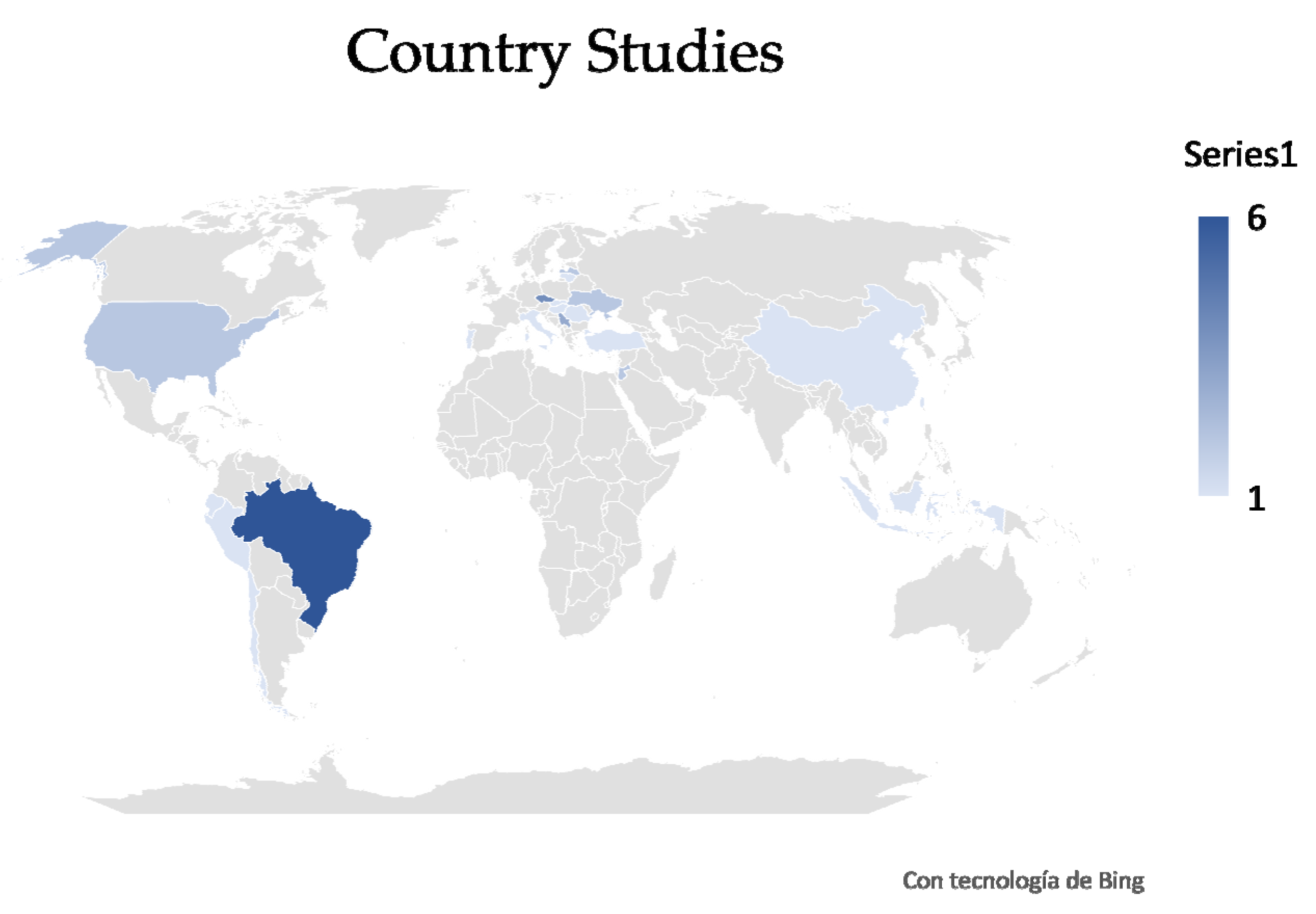

- Q2: In which countries are studies on the valuation of biological assets mainly concentrated?

- Q3: What are the differences between the methodologies used for the valuation of biological assets, and how do these divergences affect the comparability of financial reports between different regions or companies?

- Q4: What are the main challenges organizations face in applying for IAS 41 in practice?

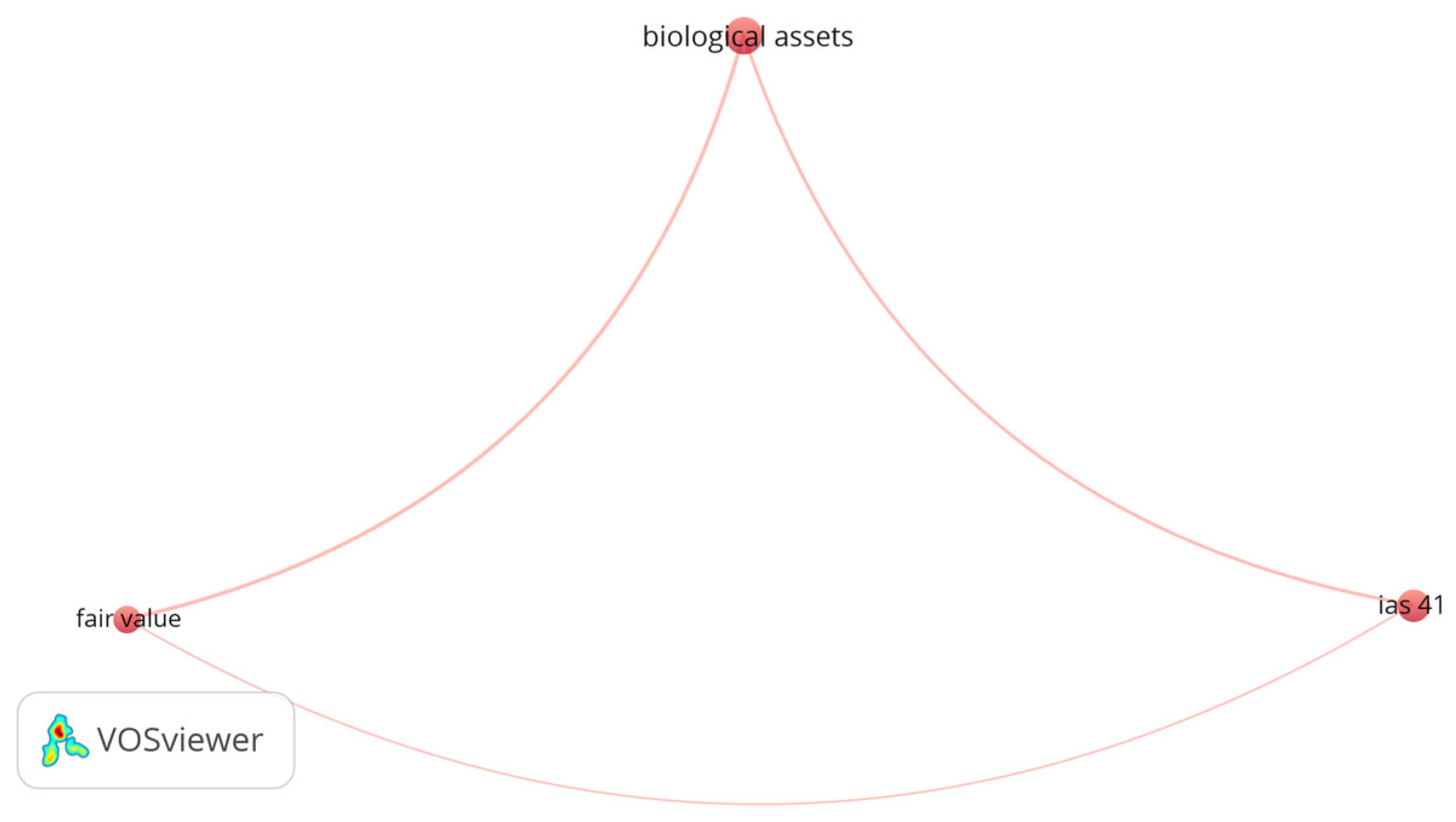

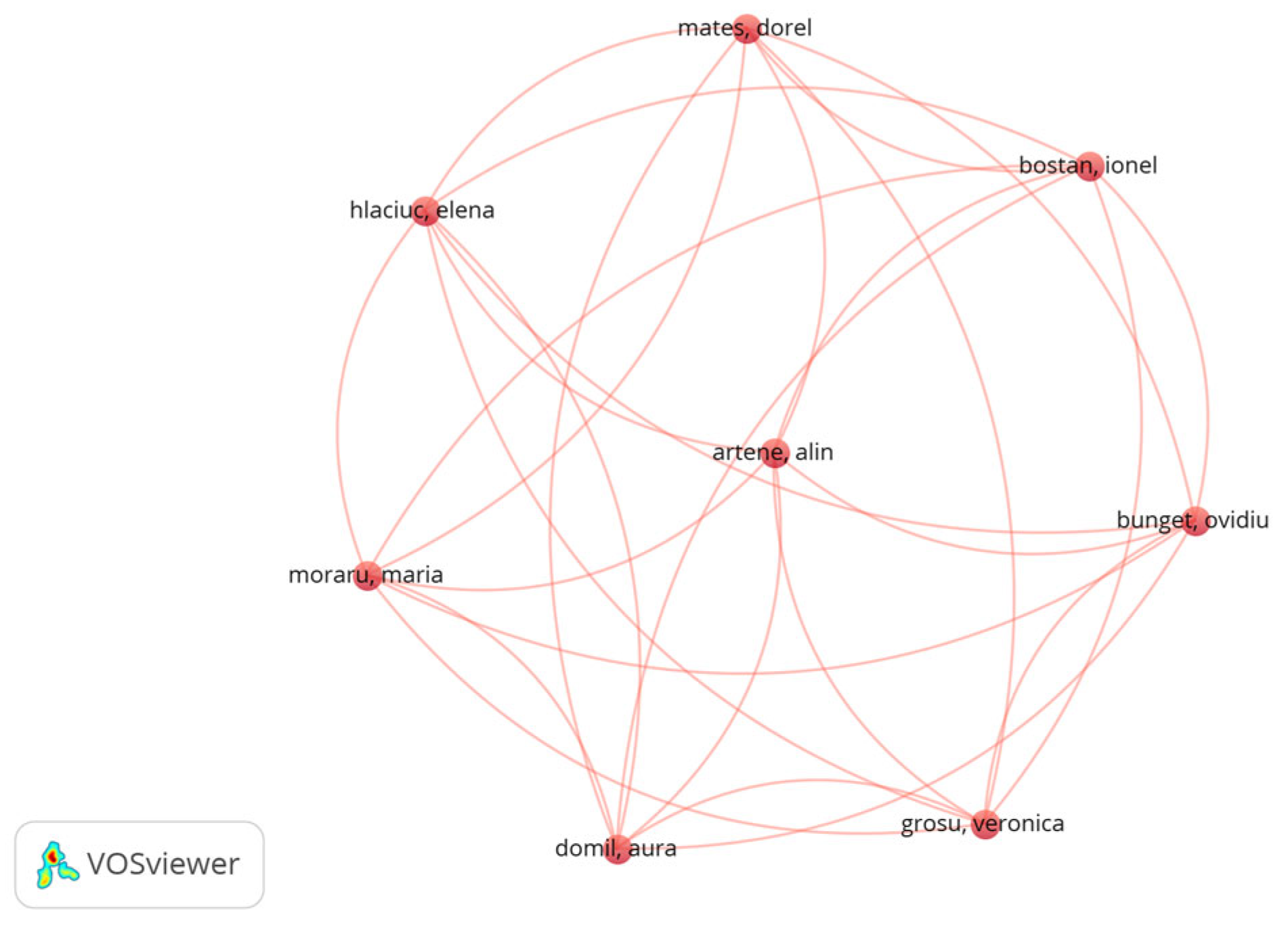

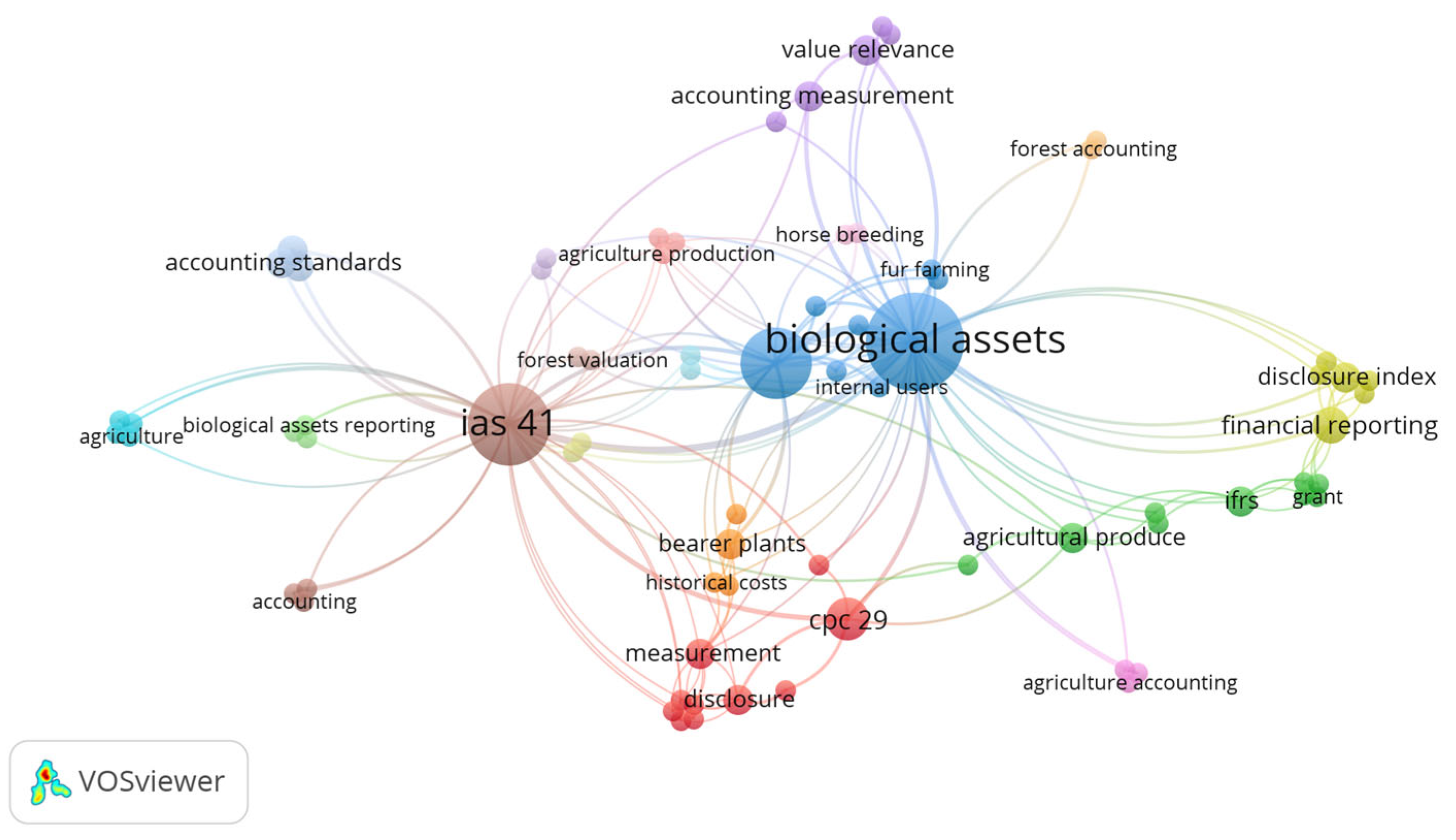

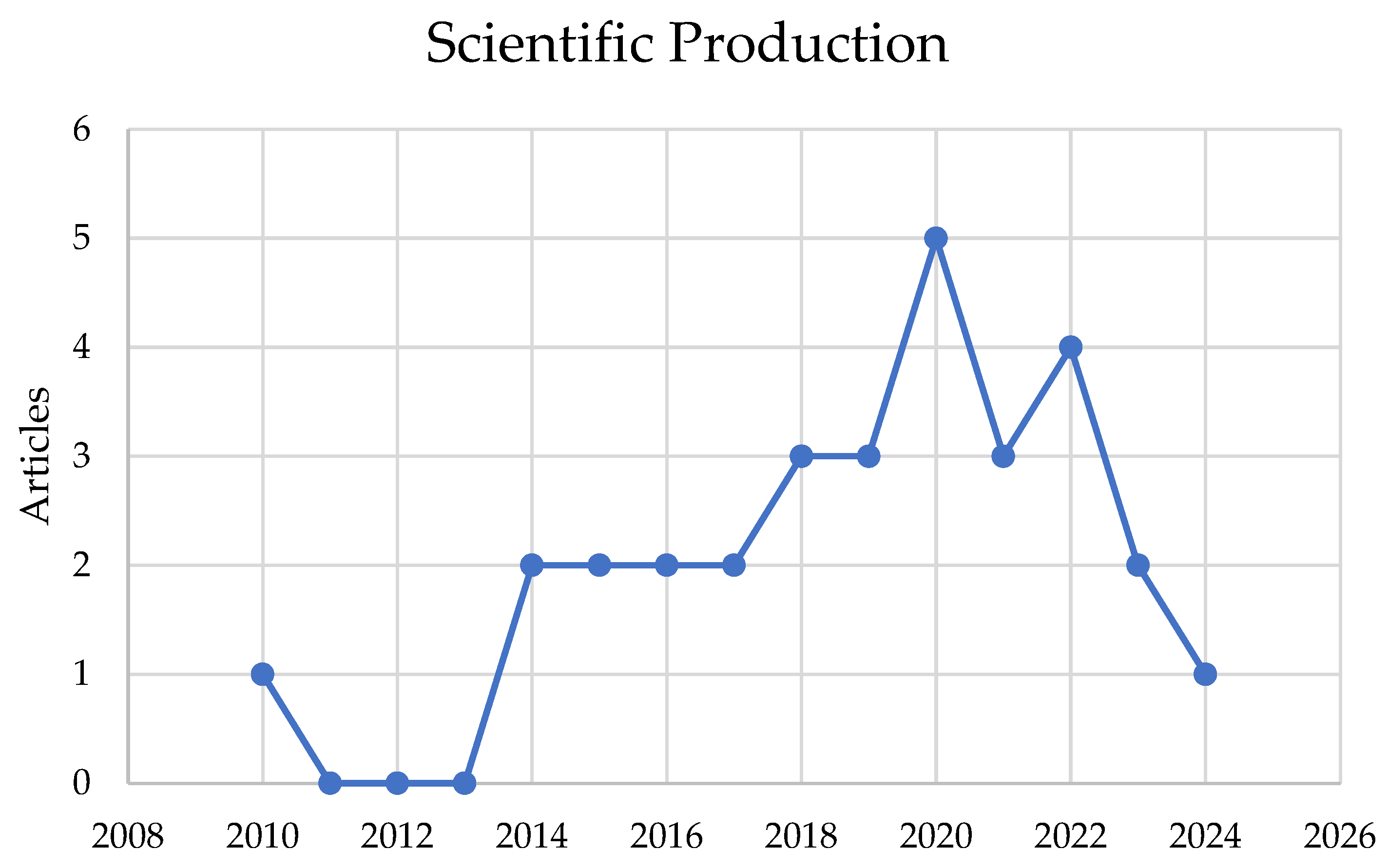

4. Results

5. Discussion

5.1. Q1: How Does the Correct Valuation of Biological Assets Influence the Quality of Financial and Strategic Decision-Making in the Agricultural Sector?

5.2. Q2: In Which Countries Are Studies on the Valuation of Biological Assets Mainly Concentrated?

5.3. Q3: What Are the Differences Between the Methodologies Used for the Valuation of Biological Assets, and How Do These Divergences Affect the Comparability of Financial Reports Between Different Regions or Companies?

5.4. Q4: What Are the Main Challenges Organizations Face in Applying for IAS 41 in Practice?

6. Conclusions

6.1. Conclusions of the Study

6.2. Limitations of the Study

6.3. Future Lines of Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Acuña, E., Pinto, A., Cancino, J., & Sandoval, S. (2020). Fair value of standing timber in the context of IAS 41 implementation: A case study. Ciência Florestal, 30(4), 1217–1229. [Google Scholar] [CrossRef]

- Alana, C., Chacón, B., Martins, V., & Ramos, D. (2022). Earnings management and disclosure level of CPC 29 biological asset and agricultural product: An analysis with Brazilian companies. Custos e Agronegócio, 18(1), 39–61. [Google Scholar]

- Al-mulla, M., & Bradbury, M. (2022). Auditor, client and investor consequences of the enhanced auditor’s report. International Journal of Auditing, 26(2), 134–150. [Google Scholar] [CrossRef]

- Altarawneh, M. (2023). How company characteristics influence measurement practices and disclosure level prescribed within IAS 41. Journal of Risk and Financial Management, 16(6), 288. [Google Scholar] [CrossRef]

- Arbidane, I., & Mietule, I. (2018). Problems and solutions of accounting and evaluation of biological assets in Latvia. Entrepreneurship and Sustainability Issues, 6(1), 10–22. [Google Scholar] [CrossRef] [PubMed]

- Arévalo, E., Pulido, D., & Rangel, A. (2018). La amortización contable de los activos biológicos. Revista Finnova, 3(5), 15–22. [Google Scholar] [CrossRef]

- Bispo, T., & Lopes, A. (2022). Exploring the value relevance of biological assets and bearer plants: An analysis with IAS 41 Revision. Custos e Agronegócio, 18(1), 61–85. [Google Scholar]

- Bohušová, H., & Svoboda, P. (2017). Will the amendments to the IAS 16 and IAS 41 influence the value of biological assets? Available online: https://repozitar.mendelu.cz/xmlui/handle/20.500.12698/1302 (accessed on 20 February 2025).

- Bozzolan, S., Laghi, E., & Mattei, M. (2016). Amendments to the IAS 41 and IAS 16—Implications for accounting of bearer plants. Agricultural Economics (Zemědělská Ekonomika), 62(4), 160–166. [Google Scholar] [CrossRef]

- Budrionytė, R., & Gaižauskas, L. (2018). Historical cost vs. fair value in forest accounting: The case of Lithuania. Entrepreneurship and Sustainability Issues, 6(1), 60–76. [Google Scholar] [CrossRef]

- Buyukarikan, U. (2019). Agricultural practices of apple and apple nursery production according to Turkish IAS 41 accounting standard in an agricultural enterprise. Custos e Agronegócio, 15(2), 465–488. [Google Scholar]

- Cavalheiro, R., Gimenes, R., Binotto, E., & Fietz, C. (2019). Fair value of biological assets: An interdisciplinary methodological proposal. Revista de Administração Contemporânea, 23(4), 543–563. [Google Scholar] [CrossRef]

- Dékán, T., & Kiss, Á. (2015). Measurement of agricultural activities according to the international financial reporting standards. Procedia Economics and Finance, 32, 777–783. [Google Scholar] [CrossRef]

- Fernandes, E., Fernandes, F., & Gonzaga, T. (2016). Biological assets mensuration and IAS 41 observance in South America. Custos e Agronegócio, 12(2), 333–351. [Google Scholar]

- Fiandrino, S., di Trana, M., Tonelli, A., & Lucchese, A. (2022). The multi-faceted dimensions for the disclosure quality of non-financial information in revising directive 2014/95/EU. Journal of Applied Accounting Research, 23(1), 274–300. [Google Scholar] [CrossRef]

- Garcia, R., & Cano, A. (2021). Accounting treatments of biological assets and agricultural products. Available online: https://rid.unam.edu.ar/handle/20.500.12219/3566 (accessed on 20 February 2025).

- García, V., Bonilla-Jurado, D., & Villacís, R. (2023). Accounting procedure for fixed assets in the municipal government of Chimbo Canton, Bolivar Province. Revista de Investigación Sigma, 10(1), 1–10. [Google Scholar]

- Giertliová, B., Dobšinská, Z., & Šulek, R. (2017). Comparison of the forest accounting system in Slovakia and IAS 41. Austrian Journal of Forest Science, 134, 1–22. Available online: https://www.forestscience.at/content/dam/holz/forest-science/2017/heft1a/CB1701A_Article01.pdf (accessed on 20 February 2025).

- Grege, E. (2010). Challenges in accounting the forests—A Latvian case study. Annals of Forest Research, 53(1), 51–58. [Google Scholar]

- Hernández, J., & Tolentino, H. (2024). Measurement and disclosure criteria for biological assets for Chilean and Peruvian companies. Cuadernos de Administración, 40(80), e2113663. [Google Scholar] [CrossRef]

- Herrera, A., Herrera, A., & Chávez, G. (2021). NIC 41 y su incidencia en el precio por caja de banano ecuatoriano, período 2019–2020. Universidad y Sociedad, 13(3), 100–109. [Google Scholar]

- Huffman, A. (2018). Asset use and the relevance of fair value measurement: Evidence from IAS 41. Review of Accounting Studies, 23(4), 1274–1314. [Google Scholar] [CrossRef]

- Ika, S., Farida, F., Asih, S., Okfitasari, A., & Widagdo, A. (2024). The impact of biological asset disclosures and economic sustainability on firm value: Evidence from agricultural companies in Indonesia. IOP Conference Series: Earth and Environmental Science, 1297(1), 012069. [Google Scholar] [CrossRef]

- Jana, H., & Marta, S. (2014). The fair value model for the measurement of biological assets and agricultural produce in the Czech Republic. Procedia Economics and Finance, 12, 213–220. [Google Scholar] [CrossRef]

- Jeriji, M., & Nasfi, A. (2022). The value relevance of mandatory sustainability reporting assurance. South African Journal of Accounting Research Best Paper Prize, 37, 122–138. [Google Scholar] [CrossRef]

- Jordão, F., & Menezes, R. (2021). Effect of the fair value of biological assets on the cost debt: An international study. Custos e Agronegócio, 17(4), 389–411. [Google Scholar]

- Killi, M., & Kefe, İ. (2024). Bibliometric network mapping of farm accounting studies using a comprehensive dataset. Data in Brief, 54, 110288. [Google Scholar] [CrossRef] [PubMed]

- Klychova, G., Kulikova, L., Mavlieva, L., & Klychova, A. (2014). Organization of Accounting in Fur Farming according to IAS. Mediterranean Journal of Social Sciences, 5(24), 84–91. [Google Scholar] [CrossRef]

- Komoldinov, I. (2024a). Analysis of current accounting practices and challenges in agricultural enterprises. Web of Humanities: Journal of Social Science and Humanitarian Research, 2(12), 25–35. [Google Scholar][Green Version]

- Komoldinov, I. (2024b). Methodological steps for implementing international standards in agricultural accounting. Web of Humanities: Journal of Social Science and Humanitarian Research, 2(11), 128–135. [Google Scholar][Green Version]

- Kurniawan, R., Mulawarman, A. D., & Kamayanti, A. (2014). Biological assets valuation reconstruction: A critical study of IAS 41 on agricultural accounting in Indonesian farmers. Procedia—Social and Behavioral Sciences, 164, 68–75. [Google Scholar] [CrossRef]

- Leitner, S., & Lehner, O. (2023). AI-powered information and Big Data: Current regulations and ways forward in IFRS reporting. Journal of Applied Accounting Research, 24(2), 282–298. [Google Scholar] [CrossRef]

- López-Solís, O., Luzuriaga-Jaramillo, A., Bedoya-Jara, M., Naranjo-Santamaría, J., Bonilla-Jurado, D., & Acosta-Vargas, P. (2025). Effect of generative artificial intelligence on strategic decision-making in entrepreneurial business initiatives: A systematic literature review. Administrative Sciences, 15(2), 66. [Google Scholar] [CrossRef]

- Maksymiv, Y., Yakubiv, V., Pylypiv, N., Piatnychuk, I., Hryhoruk, I., & Hokh, V. (2022). Biological assets in accounting of socially responsible activities of agricultural enterprises. Custos e Agronegócio, 18(2), 458–477. [Google Scholar]

- Mates, D., Grosu, V., Hlaciuc, E., Bostan, I., Bunget, O., Domil, A., Moraru, M., & Artene, A. (2015). Biological assets and the agricultural products in the context of the implementation of the IAS 41: A case study of the Romanian agro-food system. Archives of Biological Sciences, 67(2), 705–714. [Google Scholar] [CrossRef]

- Menezes, R., & Ciampaglia, P. (2023). IAS 41 and biological assets in Brazil. Revista Catarinense Da Ciência Contábil, 22, e3365. [Google Scholar] [CrossRef]

- Mirović, V., Milenković, N., Jakšić, D., Mijié, K., Andrašić, J., & Kalaš, B. (2019). Quality of biological assets disclosures of agricultural companies according to international accounting regulations. Custos e Agronegócio, 15(4), 43–58. [Google Scholar]

- Ociпчyк, Д., Чижeвcькa, Л., Пeтpишин, Л., Пpиймaк, C., Лoбoдa, H., & Aнтoщeнкoвa, B. (2024). Biдoбpaжehhя дepжabhиx гpahtib у зbithocti aгpoпiдпpиєmctb ЗA mcφз. Financial and Credit Activity Problems of Theory and Practice, 4(57), 143–154. [Google Scholar] [CrossRef]

- Oreida, A. (2022). IAS 41 and its impact on the valuation of biological assets of companies dedicated to agricultural activity. Revista Frecosapiens, 5(1), 1–10. [Google Scholar]

- Paliuliené, L., & Knyviené, I. (2024). The impact of the choice of asset valuation techniques on the valuation of agricultural entities: A case study. Applied Research in Studies and Practice, 20(1), 251–258. [Google Scholar]

- Peštović, K., Medved, I., Rađo, D., Jakšić, D., & Saković, D. (2022). The impact of accounting regulation basis to the mandatory biological assets reporting: Evidence from the Serbian agricultural production companies. Custos e Agronegócio, 18(3), 94–109. [Google Scholar]

- Pinzón, Y., & Suárez, B. (2017). Métodos de valoración de los activos biológicos aplicando la NIC 41 en las empresas bananeras, un análisis a la norma y su afectación en el cálculo del pago de impuesto a la renta. Available online: https://repositorio.uees.edu.ec/items/35f7dfac-dac1-4013-86db-03f4f3947949 (accessed on 20 February 2025).

- Pires, A., Lemos, S., & Lemos, D. (2021). Assessment of biological assets in agribusiness. Custos e Agronegócio, 17(3), 85–107. [Google Scholar]

- Queiroz, R., Miranda, L., Hideo, V., Flores, E., & Martins, E. (2020). Analysis of the usefulness of fair value measurement of forest assets under the perspective of preparers of the financial statements. Custos e Agronegócio, 16(1), 47–79. [Google Scholar]

- Rabassi, R., Batalha, M., & Albuquerque, A. (2020). Valuation of biological assets at fair value: Impacts on decision-making in agro-industrial companies. Custos e Agronegócio, 16(1), 2–25. [Google Scholar]

- Rezende, A., da Silva, J., Dalmácio, F., & Rodrigues, I. (2022). Relevância do valor justo em ativos biológicos: Uma análise experimental da percepção do mercado versus a percepção acadêmica. Organizações Rurais & Agroindustriais, 24, e1888. [Google Scholar]

- Ríos, K., Carvajal, H., Prado, E., & Espinoza, M. (2024). Activos biológicos de una camaronera: NIC 41 y su aplicación en el ámbito contable tributario. Multidisciplinary Latin American Journal (MLAJ), 2(2), 107–123. [Google Scholar] [CrossRef]

- Rojo, M., Bonilla Jurado, D., & Masaquiza, C. (2018). The development of new products and their impact on production: Case Study. Universidad y Sociedad, 10(1), 134–142. [Google Scholar]

- Rosas, C., Urbina, M., Miranda, M., Chapoñan, E., & Cubas, J. (2022). Glosario bilingüe contable. Available online: https://colloquiumbiblioteca.com/index.php/web/article/view/105 (accessed on 20 February 2025).

- Sakovié, D., Peštović, K., Tica, T., & Rado, D. (2020). The impact of quality of biological assets and properties disclosures on agricultural company’s performance. Custos e Agronegócio, 20(1), 91–110. [Google Scholar]

- Suttipun, M. (2021). External auditor and KAMs reporting in alternative capital market of Thailand. Meditari Accountancy Research, 30(1), 74–93. [Google Scholar] [CrossRef]

- Tanaka, G., & Castillo, C. (2023). Implementation of IAS 41 (Agriculture): The case of a Peruvian SME. Contabilidad y Negocios, 18(35), 14–38. [Google Scholar] [CrossRef]

- van Biljon, M., & Wingard, C. (2020). An agricultural sector assessment of biological asset valuation challenges with inputs considered from valuers. International Journal of Financial, Accounting, and Management, 2(3), 243–258. [Google Scholar] [CrossRef]

- Wegrzynska, M., & Nowotarska, A. (2021). Measuring and valuation of biological assets: A research study. European Research Studies Journal, 24(2), 191–229. [Google Scholar] [CrossRef]

- Wen-hsin Hsu, A., Liu, S., Sami, S., & Wan, T. H. (2019). IAS 41 and stock price informativeness. Asia-Pacific Journal of Accounting & Economics, 26(1–2), 64–89. [Google Scholar] [CrossRef]

- Xie, B., Liu, M., Randhir, T., Yi, Y., & Hu, X. (2020). Are the biological assets measured by historical cost value-related? Custos e Agronegócio, 16(1), 122–150. [Google Scholar]

- Zlati, M., & Mirica, C. (2021). Biological assets accounting in the agricultural sector. European Journal of Accounting, Finance & Business, 9(1), 1–7. [Google Scholar] [CrossRef]

| Inclusion Criteria | Exclusion Criteria |

|---|---|

| Articles published between 2010 and 2025 | Publications prior to 2010 |

| Peer-reviewed studies | Non-peer-reviewed documents (notes, technical bulletins, blog posts, etc.) |

| Publications indexed in Scopus or Web of Science (WoS) | Publications in journals without recognized indexing or without evidence of scientific review |

| Studies published in high-impact scientific journals (quartiles Q1, Q2, Q3, and Q4 preferred) | Studies published in low-impact journals (no assigned quartile) |

| Articles available in multiple languages or with official translation available | Articles without accessible translation |

| Research focused on the valuation of biological assets in accordance with IAS 41 | Studies focused on other types of assets (intangibles, machinery, financial, etc.) |

| Studies that analyze the financial-accounting impact, especially in relation to financial information and profitability in companies in the agricultural sector | Research without a financial or accounting focus or without an agribusiness relationship |

| Publications with an empirical or theoretical approach or systematic reviews with clearly defined methodology | Opinions, editorials, narrative essays, or other texts without methodological support |

| Articles with access to full text and sufficient data for analysis | Publications with restricted access or only available as a summary |

| N° | Author(s) | Sector | Valuation Method | Relationship to IAS 41 |

|---|---|---|---|---|

| 1 | (Grege, 2010) | Forestry | Fair value | Application in forest accounting, to combat challenges that affect the valuation of forest assets at fair value |

| 2 | (Kurniawan et al., 2014) | Agricultural | Fair Value and the Cost Model | Criticizes the application of the rule for lack of adjustment to sociocultural conditions |

| 3 | (Jana & Marta, 2014) | Agricultural products | Fair value | Compares current practices with the proposed draft IAS 41 for carrier plants |

| 4 | (Mates et al., 2015) | Agricultural production-agribusiness | Fair Value and the Cost Model | Analyzes the difficulties and controversies in the implementation of the standard in the agricultural sector |

| 5 | (Dékán & Kiss, 2015) | Agricultural | Fair Value and the Cost Model | Partial application, depending on reliability |

| 6 | (Fernandes et al., 2016) | Agricultural | Historical cost, discounted cash flow, and active market information | Flexible application according to data reliability |

| 7 | (Bozzolan et al., 2016) | Carrier plants | Fair value | Implications of carrier plants such as NIC 16 instead of NIC 41 |

| 8 | (Bohušová & Svoboda, 2017) | Agricultural | Fair Value and the Cost Model | IFRS Alignment for SMEs |

| 9 | (Giertliová et al., 2017) | Forestry | Fair value | Challenges in Slovakia with NIC 41 |

| 10 | (Huffman, 2018) | Plants and animals | Fair Value and the Cost Model | IAS 41 applied according to the purpose of the asset |

| 11 | (Arbidane & Mietule, 2018) | Agricultural | Fair Value and the Cost Model | Legislative Alignment Assessment |

| 12 | (Budrionytė & Gaižauskas, 2018) | Forest | Historical cost and fair value | Difficulties due to lack of active market |

| 13 | (Wen-hsin Hsu et al., 2019) | Plants and animals | Fair value | Relationship between IAS 41 and transparency |

| 14 | (Buyukarikan, 2019) | Apple trees | Fair value for costs of production and present value | Adaptation to specific crop |

| 15 | (Mirović et al., 2019) | Agricultural | Fair Value and Historical Cost | Assessment of disclosure under IAS 41 |

| 16 | (Xie et al., 2020) | Agricultural | Historical cost model | Comparison with CAS5 standard |

| 17 | (Rabassi et al., 2020) | Sugar cane | Fair value and judgment criteria | Impact on business decisions |

| 18 | (Queiroz et al., 2020) | Long-cycle forestry (Forests) | Discounted cash flow and mixed methods | Posting of changes in net assets |

| 19 | (Sakovié et al., 2020) | Agricultural | Fair Value and Historical Cost | NIC Disclosure Quality for SMBs |

| 20 | (Acuña et al., 2020) | Forestry (Wood) | CDF and Cost Approach | IFRS and IAS 41 support |

| 21 | (Pires et al., 2021) | Agro-industrial | Discounted cash flow and historical cost | Degree of compliance with the standard in companies |

| 22 | (Herrera et al., 2021) | Banana | Fair value and costs of sale | Impact on pricing and accounting practices |

| 23 | (Jordão & Menezes, 2021) | Plants and animals | Fair value | Influence on the perception of the cost of debt |

| 24 | (Maksymiv et al., 2022) | Agricultural and organic production | Fair Value and Historical Cost | Recommendation for improved reporting and disclosure of information on biological assets |

| 25 | (Alana et al., 2022) | Agricultural | Discounted cash flow and historical cost | Use of CPC 29 (equivalent to IAS 41) |

| 26 | (Bispo & Lopes, 2022) | Agricultural | Fair value of assets and cost models | Changes by revision 2016 |

| 27 | (Peštović et al., 2022) | Agricultural | Fair value and costs of sale | Comparison of dissemination quality |

| 28 | (Altarawneh, 2023) | Agricultural | Fair Value and Historical Cost | Influence of business characteristics |

| 29 | (Tanaka & Castillo, 2023) | Forest | Discounted cash flow | Application vs. local cost model |

| 30 | (Ociпчyк et al., 2024) | Plants and animals | Fair value and costs of sale | Joint application IAS 41 and IAS 20 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Campos-Llerena, P.; Arias-Pérez, M.; Toscano-Morales, C.; Barreno-Córdova, C. Biological Assets in Agricultural Accounting: A Systematic Review of the Application of IAS 41. J. Risk Financial Manag. 2025, 18, 380. https://doi.org/10.3390/jrfm18070380

Campos-Llerena P, Arias-Pérez M, Toscano-Morales C, Barreno-Córdova C. Biological Assets in Agricultural Accounting: A Systematic Review of the Application of IAS 41. Journal of Risk and Financial Management. 2025; 18(7):380. https://doi.org/10.3390/jrfm18070380

Chicago/Turabian StyleCampos-Llerena, Priscila, Mauricio Arias-Pérez, Cecilia Toscano-Morales, and Carlos Barreno-Córdova. 2025. "Biological Assets in Agricultural Accounting: A Systematic Review of the Application of IAS 41" Journal of Risk and Financial Management 18, no. 7: 380. https://doi.org/10.3390/jrfm18070380

APA StyleCampos-Llerena, P., Arias-Pérez, M., Toscano-Morales, C., & Barreno-Córdova, C. (2025). Biological Assets in Agricultural Accounting: A Systematic Review of the Application of IAS 41. Journal of Risk and Financial Management, 18(7), 380. https://doi.org/10.3390/jrfm18070380